At Eide Bailly, we’re a business advisory and accounting firm, helping our clients embrace opportunities and bring innovation to an evolving business landscape. For years, we’ve worked closely with Arizona business owners and nonprofits whether they’re navigating compliance requirements, investing in technology or wondering what’s next. With specialty services like data analytics, cybersecurity, forensics, wealth planning, planned giving and more, we have the resources to help make even the biggest goals a reality.

The Arizona Tax Credit Giving Guide and AZTaxCreditGuide.com are published by Frontdoors Media, a local company dedicated to local philanthropy. Arizona is a special place as it’s one of the best in the country when it comes to tax credits for charitable giving.

The Arizona Charitable Tax Credit program is a unique opportunity for taxpayers. You have the power to decide where the state tax dollars you owe go — and, for most people, it doesn’t cost a thing.

So what’s the catch? There isn’t one, just a tax credit limit for each of the four categories listed here. A married couple filing jointly can get credit for up to $800 donated to a Qualified Charitable Organization (QCO). And QCO is just one of four credits available to benefit qualified Arizona nonprofits and schools! Each credit is separate — so you can claim the maximum amount in all four categories. And, since there are so many organizations that qualify as a QCO, we’ve organized them into types this year so you can find an area that speaks to your heart.

Read on for details about how this program works as well as a directory of nonprofits, foster care organizations, schools and school tuition organizations that have partnered with us for the 2022-2023 tax season. They are all vetted and qualify per the Arizona Department of Revenue (azdor.gov/tax-credits).

We invite you to choose the organizations you want to support and take this special issue to your next appointment with your tax adviser. The worksheet on the last page is a great tool as well and includes a checklist of the Arizona tax forms needed to claim your credits. Our hope is to see tax credit giving increase across all four categories. We believe that Arizona nonprofits and schools need a hand up now more than ever and invite you to join us in that effort.

With thanks,

Andrea & Karen

Andrea Tyler Evans | PUBLISHER Karen Werner | EDITOR IN CHIEF

.

.

Executive Council Charities (15) Valley of the Sun United Way (15)

Ability360 (47)

Amanda Hope Rainbow Angels (18) A New Leaf (20)

Arizona Burn Foundation (28)

Arizona Cancer Foundation for Children (18)

Arizona Food Bank Network (26)

Arizona Justice Project (38)

Arizona Legal Women and Youth Services (ALWAYS) (21)

Assistance League of East Valley (53)

Assistance League of Phoenix (53)

Aster Aging (34)

Autism Society of Greater Phoenix (47)

Back to School

Clothing Drive (54) Beacon Group (48) Benevilla (35)

Big Brothers Big Sisters of Central Arizona (54)

Boy Scouts of America Grand Canyon Council (55)

Boys & Girls Clubs of Greater Scottsdale (55)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Boys & Girls Clubs of the Valley (56)

Brain Injury Alliance of Arizona (38)

Brighter Way Institute (28) Cancer Support Community Arizona (19) Care 4 the Caregivers (48)

Central Arizona Shelter Services (CASS) (33) Children’s Cancer Network (19)

Civitan Foundation, Inc. (49) Control Alt Delete LLC (21) Cortney’s Place (49) Creighton Community Foundation, Inc (39)

Delta Dental of Arizona Foundation (29) Devereux Advanced Behavioral Health Arizona (39)

Diana Gregory Outreach Services (35)

Dress for Success Phoenix (40)

Duet: Partners In Health & Aging (36) Esperança (29) Family Promise of Greater Phoenix (23)

Foothills Caring Corps (36) Foster Your Future (23, 40)

Foundation for Blind Children (50)

Fresh Start Women’s Foundation (41) FSL (41)

Future for KIDS (56)

Gabriel’s Angels (57) Genesis City (57) Gesher Disability Resources (50) Habitat for Humanity Central Arizona (33) HonorHealth Desert Mission (42) Human Services Campus, Inc (42) Hunkapi Programs (52) Jewish Family & Children’s Service (30, 37, 43)

Junior League of Phoenix Foundation (24)

Kids in Focus (58) Legacy Connection (58) Live & Learn (43)

Maggie’s Place Inc. (34) Midwest Food Bank (26) Miracle League of Arizona (51)

Mission of Mercy Arizona Health Partnership Fund (30)

National Kidney Foundation of Arizona (31) New Life Center (22) New Pathways for Youth (59) notMYkid, Inc. (59) NourishPHX (44) Oakwood Creative Care (37) one·n·ten (60) Paz de Cristo (44)

Phoenix Indian Center (45)

Power Paws Assistance Dogs, Inc. (51)

Pregnancy Care Center of Chandler Inc. (24)

Ronald McDonald House Charities® of Central and Northern Arizona (25)

Rosie’s House: A Music Academy for Children (60) Ryan House (31) Sojourner Center (22) St. Mary’s Food Bank (27) St. Vincent de Paul (25)

The ALS Association Arizona Chapter (27) The Be Kind People Project® (61) The Joy Bus (20)

The Salvation Army (45) U.S.VETS | Phoenix (46)

UCP of Central Arizona (32)

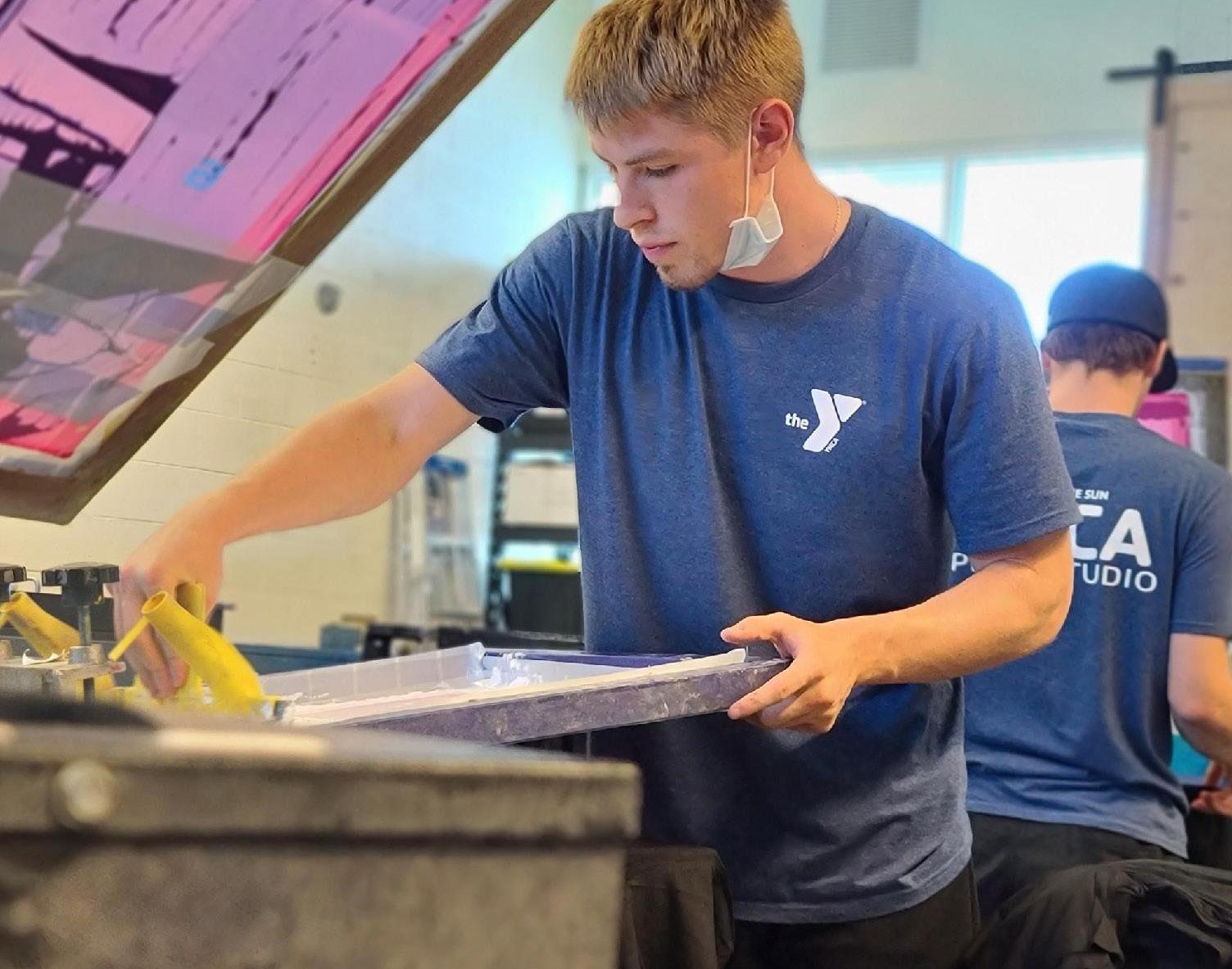

Valley of the Sun YMCA –Valley YMCA Cares (61) Valleywise (32)

WHEAT (46)

Whispering Hope Ranch Foundation (52)

Agape Adoption Agency of AZ (65)

Arizona Association for Foster and Adoptive Parents (65)

Arizona Friends of Foster Children Foundation (66) Arizona Helping Hands (66)

Arizona Sunshine Angels (67)

Boost A Foster Family, Inc. (67) Catholic Charities Community Services (68) Center for the Rights of Abused Children (68)

Arizona School for the Arts (74)

BASIS Charter Schools (74)

. . . . . . . . . . . . . 63

Child Crisis Arizona (69)

Florence Crittenton Services of Arizona (69)

Free Arts for Abused Children of Arizona (70)

Hope & A Future (70) OCJ Kids (71) Onward Hope, Inc. (71)

. . . . . . . . . . . . . . . . . . . . . . . . . . 73

Genesis Academy (75)

All Saints’ Episcopal Day School (78)

Arizona Private Education Scholarship Fund (78)

Brophy Community Foundation (79) Catholic Education Arizona (79)

.

. . . . . . . . . . . . . . . . . . . 77

New Way Academy (80) Xavier College Preparatory (80)

Frontdoors Media celebrates the people and groups that give generously and work to build the future of our community. It’s the premier source of information — and inspiration — for those who strive to make the Valley of the Sun a better place to live. We invite you to sign up for our weekly e-newsletter, The Knock, at FrontdoorsMedia .com and become a Frontdoors reader!

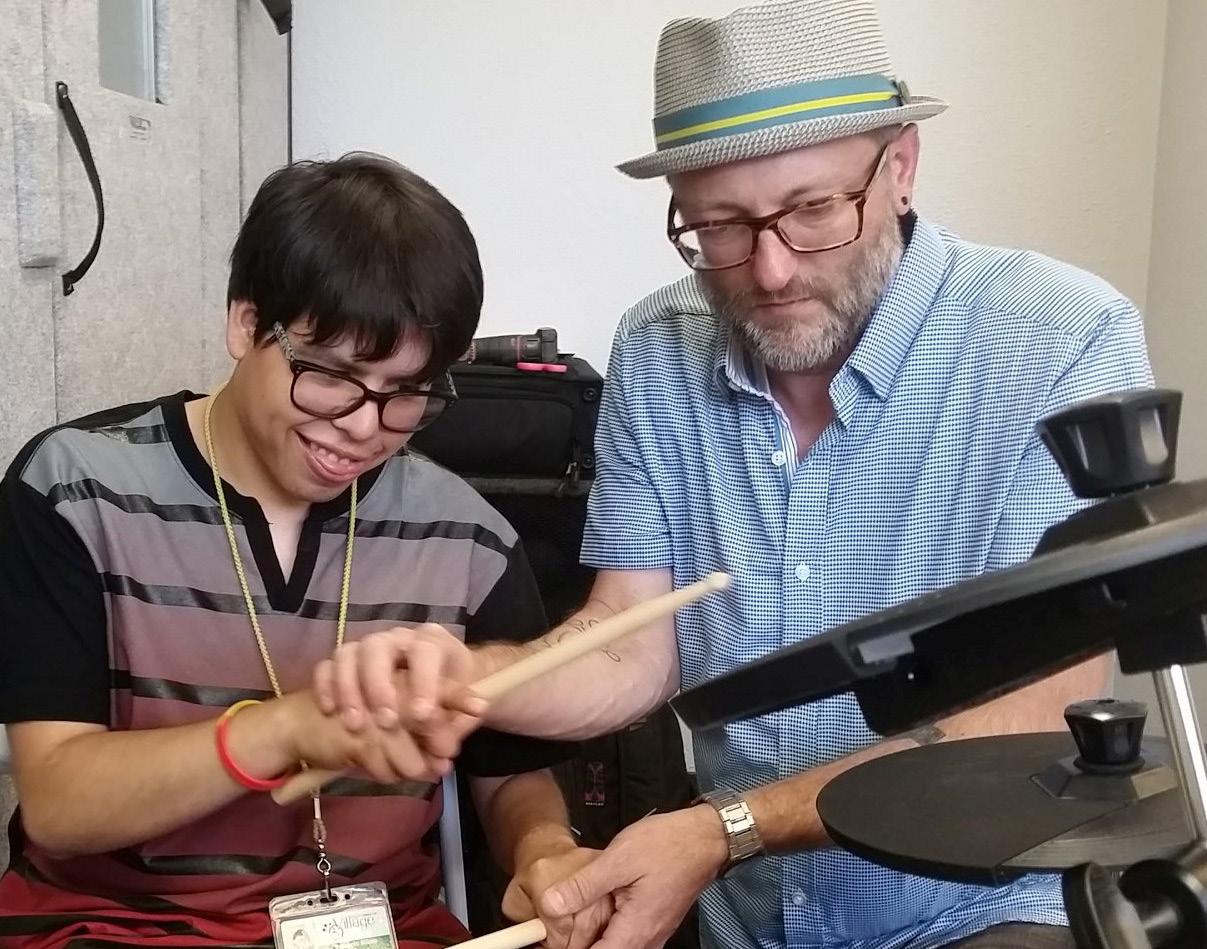

Photo courtesy of St. Vincent de Paul

Photo courtesy of St. Vincent de Paul

By Tom Evans

By Tom Evans

Tax credit contributions continue to be the fuel that powers many Arizona nonprofits — donations that provide revenue to nonprofits while giving donors a break on state income taxes.

The State of Arizona allows taxpayers to receive a dollar-for-dollar credit on their state income taxes when they donate to qualified organizations in these categories:

ARIZONA QUALIFYING CHARITABLE ORGANIZATIONS, which provide basic needs to qualifying low-income families and individuals, the chronically ill and disabled. Limits are $400 for individuals and $800 for married couples.

QUALIFYING FOSTER CARE ORGANIZATIONS, with limits of $500 for individuals and $1,000 for married couples.

PUBLIC SCHOOL TAX CREDIT ORGANIZATIONS, with limits of $200 and $400.

PRIVATE SCHOOL TUITION ORGANIZATIONS FOR INDIVIDUALS, with limits of $623 for individuals and $1,245 for married couples. These limits have been increased for 2022 and can be combined with the “Switcher” tax credit if maxed.

CERTIFIED SCHOOL TUITION ORGANIZATIONS (also known as the “Switcher” Individual Tax Credit): These organizations may receive your contribution if you’ve already maxed out the Private School Tuition Organization credit first — for which limits increased to $620 individually and $1,238 for married couples. Contributions can be made directly or by the shareholder when paid by an S-Corporation.

SCHOOL TUITION

FOR CORPORATIONS: C-Corporations, S-Corporations, LLCs and insurance companies can qualify for two types of credits. The Low-Income Tax Credit supports low-income students in private schools, and the Disabled/Displaced Tax Credit supports disabled students and students in (or who have been in) foster care. Because there are statewide caps for both credits ($142 million and $6 million, respectively), applications for approval are made by the Private School Tuition Organization to the Arizona Department of Revenue on behalf of the donor. The corporate tax credits can be beneficial for many people who own their own companies.

Brenda Blunt, a partner with Eide Bailly LLP, said one change this year is a new program from the Arizona Department of Education called the Empowerment Scholarship Account program, or “ESA” funding.

“Families can apply for funding under this program to pay for private school tuition and other education expenses up to certain limits,” she said. “We have received calls from clients expressing confusion about the new program. It is important to know that the program does not allow families to receive both ESA funds and STO funds, but families receiving ESA funds can still contribute to STOs and qualify for the credit.”

It’s true — you can give to a qualified charity or tuition organization instead of giving it to the state government for taxes. And over time, these contributions have become increasingly popular for residents and beneficial for nonprofits.

“Some people hesitate to donate to these programs because they are not sure what their Arizona tax liability will be for 2022 and because

the combined tax credits cannot exceed any given taxpayer’s Arizona tax liability for the current year,” Blunt said. “It is important to know that contributions paid within the credit thresholds this year, but your Arizona tax liability can carry forward for five years, so are not lost. They can benefit future years. Contributions paid over the thresholds are not eligible for the credit, but can be taken as a charitable contribution deduction, so it is still a tax benefit.”

It is worth noting that recent changes in the tax law allow limited deductions for charitable contributions at the federal and Arizona levels, even when a taxpayer takes the standard deduction. “So there are lots of ways to use these programs to help vulnerable Arizona families and still help yourself come tax time,” Blunt said.

“These contributions have become increasingly popular for residents and beneficial for nonprofits.”Photo courtesy of The Center for the Rights of Abused Children

Gerald Wissink, president & CEO of BHHS Legacy Foundation, said tax credit contributions have a tremendous impact on specific programs, including ones his foundation supports.

“Tax credit contributions help us support Legacy Connection’s Backpack Buddies program,” he said. “This program provides back-to-school supplies and clothing that Title I children need when they go to school, enhancing their confidence and ability to focus on education. One in four students in this state lives in poverty. Thanks to tax credit donations, we can make a powerful difference in their lives.”

Nancy Padberg, president & CEO of Catholic Education Arizona, said that STO contributions have a huge effect on thousands of Arizona children.

“Choosing the education model that best meets

a child’s needs should not depend on one’s ability to pay tuition,” she said. “The State of Arizona allows taxpayers to support private education through their individual tax credits, allowing them to change lives, serve society and transform culture.”

Wissink said these contributions are an important way for Arizonans to support their favorite charitable causes, whether during difficult times or smooth sailing.

“This is a chance for our community to invest in Arizona’s future,” Wissink said. “Thanks to the Arizona Charitable Tax Credit, you can decrease your Arizona tax bill — or increase your refund — by $400 or $800. That means your gift ends up costing you nothing. It is a simple but powerful way to reach out and impact our community.”

For a complete list of qualifying charitable organizations and qualifying foster care organizations, see azdor.gov/tax-credits/contributions-qcos-and-qfcos. Organizations are added on an ongoing basis, so it may be worth your time to check back before year-end and again before April 18, 2023 — the last day 2022 tax credit contributions can be made.

Some charities under the Arizona Qualified Charity Tax Credit have a slightly different designation as “umbrella organizations.” They are eligible for contributions of $400 per person and $800 per couple as well, but are listed differently on the State of Arizona’s website.

For example, Executive Council Charities, Valley of the Sun United Way and other United Way organizations across the state are considered “umbrella organizations” because they may receive tax credit contributions and distribute them to other nonprofit partners in the community.

Use the Tax Credit Worksheet on the last page to take notes and record the Umbrella tax code for the charities you choose. You can choose more than one!

Our mission is to support charity organizations focused on helping youth in our community overcome adversity and reach their full potential as productive, caring and responsible citizens.

Support Arizona Youth (SAY) is the annual campaign for Executive Council Charities (ECC), an umbrella organization for the Arizona Charitable Tax Credit. Through SAY, donors can take advantage of the tax credit for both qualified and foster care charities and choose “Highest Need,” to have the most significant impact among our 60 featured charities, or indicate a preference for any specific qualified charity. Not only are 100 percent of the funds forwarded to benefit vital programs at these charities, but ECC also covers all credit card processing fees.

ec70phx.com

Tax Code 20726

Valley of the Sun United Way is creating a better future for everyone in our community. A community where every child, family and individual is healthy, has a safe place to live and has every opportunity to succeed in school, in work and in life.

Your gift supports our efforts to create Mighty Change, through a five-year plan for meaningful and lasting change in Maricopa County by 2026. This communitydeveloped and community-led plan tackles the Valley’s greatest issues and provides support to our neighbors who need it most. We’re working alongside donors, businesses, schools and more than 230 local nonprofits to meet Bold Goals focused on decreasing homelessness, closing education gaps and increasing access to health care and better-paying jobs. Together, we will make our community a better place for us all.

vsuw.org

Tax Code: 20726

Per the Arizona Department of Revenue, a QCO provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families (TANF) benefits, are low-income residents of Arizona, or are individuals who have a chronic illness or physical disability.

A QCO must meet ALL of the following provisions:

• Is exempt from federal income taxes under Section 501(c)(3), or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

• Provides services that meet immediate basic needs.

• Serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150 percent of the federal poverty level, or are chronically ill or physically disabled individuals.

• Spends at least 50% of its budget on qualified services to qualified Arizona residents.

• Affirms that it will continue spending at least 50% of its budget on qualified services to qualified Arizona residents.

The QCO organizations listed in the Arizona Tax Credit Giving Guide have chosen the following categories to best describe the programs they offer the community:

- CANCER SUPPORT [ pg. 18 ]

- DOMESTIC VIOLENCE [ pg. 20 ]

- FAMILY ASSISTANCE [ pg. 23 ]

- FOOD BANK [ pg. 26 ]

- HEALTHCARE [ pg. 27 ]

- HOUSING SUPPORT [ pg. 33 ]

- SENIOR SERVICES [ pg. 34 ]

- SOCIAL SERVICES [ pg. 38 ]

- SPECIAL NEEDS [ pg. 47 ]

- THERAPEUTIC SERVICES [ pg. 52 ]

- YOUTH DEVELOPMENT [ pg. 53 ]

REMINDER!

Use the Tax Credit Worksheet on the last page to take notes and record the QCO code for the charities you choose. You can choose more than one!

Amanda Hope Rainbow Angels is a nonprofit, support and educational organization designated by the IRS as a tax-deductible, tax-exempt organization, founded in 2012 in celebration of Amanda Hope’s life.

Our programs have expanded exponentially to meet the increasing need to serve children facing cancer diagnoses (or life-threatening illnesses) and their families. We serve 2,000 families per year through these services and programs: major distractions, adaptive apparel, FREE counseling and financial assistance.

amandahope.org

Tax Code 20854

Our mission is to provide social, emotional and financial support directly to families managing the health and well-being of a loved one diagnosed with pediatric cancer.

At the Arizona Cancer Foundation for Children (ACFC), we strive to give cancer warriors and their families sunshine through their toughest times. 76% of the families we serve are currently experiencing financial insecurity or live in extreme poverty. Our programs include K-9 therapy, sunshine experiences, financial aid, and counseling services for those in our community and throughout the state of Arizona.

azcancerfoundation.org

Tax Code 20873

Cancer Support Community Arizona’s mission is to ensure that all people impacted by cancer are empowered by knowledge, strengthened by action, and sustained by community.

Our programs are free for anyone impacted by cancer and include support groups, healthy lifestyle programs, education presentations, social connections and embedded hospital navigators who connect cancer patients to resources such as financial assistance with out-of-pocket medical expenses.

Our bilingual services are crucial because, while cancer patients typically receive state-of-the-art medical treatment, effective cancer care also requires psychological and social services to help overcome emotional issues associated with a cancer diagnosis.

cscaz.org

Tax Code 20821

Children’s Cancer Network supports children and families throughout their cancer journey with programs designed to provide financial assistance, offer psychosocial support and encourage healthy lifestyles.

While coping with the stress and uncertainty that comes with the initial diagnosis and the roller coaster of emotions and events that follow throughout treatment and into survivorship, CCN strives to lessen the burden with such programs as gas and food cards; adopt-a-family programs; counseling and family-centered psychosocial support; school re-entry support; wigs and more. New this year, CCN’s Let’s Move Activity Center and programming provides opportunities to connect, move and heal to optimize physical, emotional and social outcomes. CCN works to ensure that no family fights alone.

childrenscancernetwork.org

Tax Code 20176

The Joy Bus mission is to relieve the daily struggles of homebound cancer patients with a fresh and healthy meal delivered by a friendly face.

Many people are left to fend for themselves after a cancer diagnosis. The Joy Bus eases that burden by providing healthy meals specified to meet cancer patients’ needs from fresh, organic, non-GMO produce. Tucked into each hand-decorated bag is an information sheet on the nutritional power of the ingredients used and how they will support the fight against cancer. More than a meal, The Joy Bus provides wellness checks for people with cancer and weekly opportunities to personally support a person dealing with some of the most challenging days of their life. thejoybus.charity

Tax Code 22214

A New Leaf provides life-saving shelter, advocacy and support for families, children and adults facing domestic violence in our community. Our mission is “Helping Families, Changing Lives.”

Your tax credit donation will directly provide immediate safety and secure shelter to a survivor of domestic violence, saving their life and giving them a chance to start over. All contributions will support A New Leaf’s domestic violence shelters, counseling services for survivors of abuse, ongoing court advocacy and emotional support, and much more. By contributing, you will ensure that no survivor is alone on their journey.

TurnaNewLeaf.org

Tax Code 20075

ALWAYS provides free legal representation and pro se assistance to youth under 25 impacted by crime, homelessness or foster care, and trafficking survivors of all ages. Our mission is to help our clients and their families achieve safety, stability and opportunity.

Tax credit contributions are crucial to sustaining ALWAYS’ programs so trafficking survivors, neglected and abandoned children, refugees and other marginalized individuals can obtain the no-cost legal resources they need to secure employment, housing, divorce from their abusers, custody of their children, and more. ALWAYS also guides its clients through the criminal history repair process, particularly with seeking good cause exceptions for fingerprint clearance cards. It is not uncommon for a client to have more than one open case with ALWAYS, and the organization constantly sees how homelessness, foster care, trafficking and abuse intersect.

alwaysaz.org

Tax Code 20888

Control Alt Delete is 100 percent volunteer-run and helps people escape domestic violence by providing one-time assistance to remove the barriers keeping them in unsafe and dangerous situations.

One dollar of every dollar donated goes directly toward helping people escape domestic violence in our volunteer-run agency. Your support will help with fuel and transportation, up to two nights in a hotel, food and necessities and/or safety items such as new locks so an abuser can’t just use their key to walk into a survivor’s home. Your support will save lives and help create a Society of Survivors.

dvcontrolaltdelete.org

Tax Code 22198

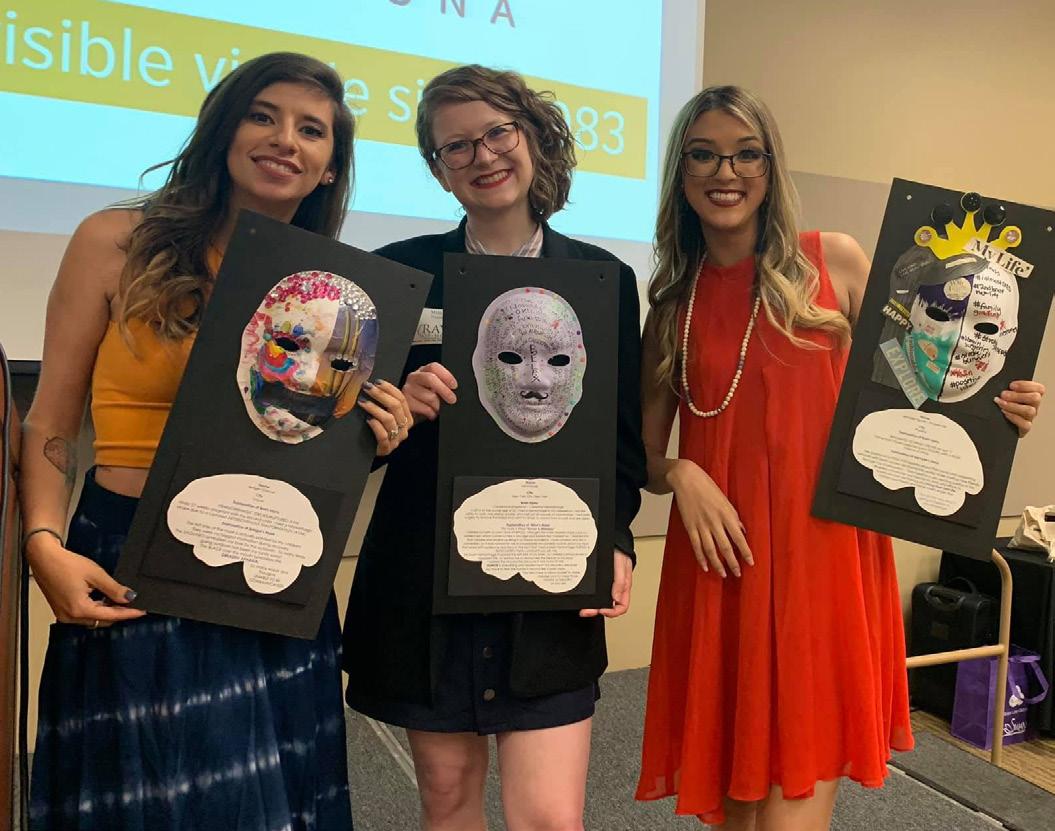

For 30 years, New Life Center has remained dedicated to its mission of helping to eliminate domestic and sexual violence through support services, education and expertise.

New Life Center believes every family has the right to live free from violence. As the largest domestic violence shelter in Arizona, New Life Center provided over 17,000 safe bed nights for survivors and their families and served over 1,000 individuals through our residential and outreach programs in 2021. More than 70 percent of New Life Center’s shelter population is children.

We are grateful to provide a safe place for families to live, heal and grow while on their path to a life free from violence. From basic needs to legal advocacy, therapeutic support and beyond, New Life Center is here — because of donors like you!

newlifectr.org

Tax Code 20559

Overcoming the impact of domestic violence, one life at a time.

Sojourner Center serves 1,000+ survivors of domestic and sexual violence and human trafficking living in Maricopa County annually, regardless of race, color, religion, age, sex, national original, disability status, genetics, protected veteran status, sexual orientation, gender identity or expression. Your tax dollars will support our emergency shelter, transitional housing, 24-hour crisis hotline, pet companion shelter, children and youth services, child development center, community-based services, workforce development and lay legal services for our participants to become independent and successful away from their abuser.

sojournercenter.org

Tax Code 20544

Praise God for Family Promise, providing “love immersion”-style shelter for children, their parents and pets in the Valley and quickly moving them toward self-sufficiency.

Our rigorous Emergency Shelter Program rescues children, their families, and pets from homelessness. We provide shelter, food, basic needs and social services. Our sites in Glendale, Mesa and Scottsdale provide 60 days of homelike comfort with work expectations. Shelter uniquely happens within an interfaith network whose volunteers provide food and lodging at no cost to families or Family Promise. As a result, your investment in Family Promise is nearly tripled through in-kind services via community partners

familypromiseAZ.org

Tax Code 20453

Foster Your Future supports independence and success with aged-out foster young adults. The rate of homelessness, incarceration and instability reduces with long-term financial support, teaching life skills while requiring employment/education.

There are times when a person should be given a chance to succeed, even though they have very little means or support to follow their desired vocational or educational path leading to becoming an independent, successful and contributing citizen. FYF has task-driven programs, including educational/vocational support with tuition/ computers/books/housing, driver training, financial literacy, and life skills. One hundred percent of donations go directly to the programs. There are no salaries or overhead as costs are covered by the founders. With a one-year commitment/drug-free/working or in school full time, the young adult works with a volunteer who mentors them in all life skills challenges.

FosterYourFuture.Org

Tax Code 22210

The Junior League of Phoenix Foundation (JLPF) supports the local Phoenix community through the programs of The Junior League of Phoenix, Inc. (JLP).

Over the past 16 years, the JLPF has worked to ensure that the children of our community can grow, thrive and learn with JLP programs like R.O.C.K.E.T.S. and Kids in the Kitchen. JLPF tax credit dollars support our partnership with St. Vincent de Paul and Harvest Compassion Center to help allay food insecurity. Each year, we work with the leadership of the JLP to ensure that the tax credit contributions we collect make an impact on the families that need them the most by going directly to organizations that meet our charitable qualifications. foundationjlp.org

Tax Code 20952

FREE, compassionate care before, during and after pregnancy.

The Pregnancy Care Center’s mission is to provide FREE pregnancy tests, options counseling, referrals, resources and ultrasounds to families in unplanned pregnancy. Being unemployed, uninsured or undocumented can be scary, and the need for services in an unplanned pregnancy has never been so great. Clients at PCC are invited to return to Learn & Earn or Fatherhood programs, where parents-to-be are educated on prenatal and life skills while earning baby bucks. Baby and “Dad” bucks can be used to purchase diapers and new items donated to the boutique. pccchandler.com

Tax Code 20562

Ronald McDonald House Charities of Central and Northern Arizona is a comforting “home-away-fromhome” for families who travel to the Valley for critical medical care for their children.

Our three Valley Houses provide families with the comfort, hope and togetherness they need to face their biggest challenges — the illness or injury of their child. When families travel far from home for the critical medical care their children need and deserve, we are here to fill in the gaps. While doctors take care of their patients, we take care of their families. That includes community spaces for families to encourage and support one another, nightly meals prepared by our dedicated Dinnertime Hero volunteers and a place to rest and rejuvenate so they can give their best to their children.

rmhccnaz.org

Tax Code 20400

St. Vincent de Paul harnesses the power of the community to feed, clothe, house and heal neighbors in need.

Tax credit gifts help to fund food, medicine, clothing, shelter, and a whole host of wrap-around services to help individuals and families experiencing poverty and homelessness. Regardless of need, immediate assistance is provided with care and compassion, while we work with individuals to seek lasting solutions. As one of the oldest and most trusted human services organizations in Arizona, St. Vincent de Paul stretches every dollar to ensure that every gift is honored and the most good is accomplished.

stvincentdepaul.net

Tax Code 20540

Developing solutions to the problem of hunger through food banking, public policy and innovation.

Your tax credit eligible contributions ensure a strong emergency food network by supporting our five regional food bank members and their nearly 1,000 agencies. AzFBN also works to end hunger through programs designed for children, seniors and other at-risk populations. About 1 million Arizonans face food insecurity. Your gifts help these Arizonans by connecting them to their local food pantry and other nutrition programs, supporting our food rescue and transportation operations, expanding our efforts to raise awareness about hunger and furthering our innovative solutions to hunger.

azfoodbanks.org

Tax Code 20527

As a faith-based organization, Midwest Food Bank’s mission is to share the love of Christ by alleviating hunger and malnutrition locally and throughout the world and providing disaster relief, all without discrimination.

The Arizona Division of Midwest Food Bank, NFP provides food and supplies, all without cost, to nearly 300 nonprofits across the state, who then distribute it to people in need. Midwest Food Bank provides weekend backpack meals to students, snack packs for homeless individuals and protein-rich rice meals for disaster relief. Every $1 contribution yields $30 worth of food and supplies for those facing food insecurity. And over 99 cents of every $1 you donate will go directly toward providing food to people in need.

arizona.midwestfoodbank.org

Tax Code 20927

Arizona’s largest food bank is also the World’s First Food Bank. St. Mary’s Food Bank is here to help alleviate food insecurity throughout most of Arizona.

During times of need, St. Mary’s Food Bank is here to help. Through direct distribution, mobile and community food pantries, school programs and a network of more than 700 nonprofit partners, St. Mary’s distributes more than 300,000 pounds of food EVERY DAY. With rising rent, gas and food costs, struggling families need extra help. This holiday season will likely be our biggest ever, and your donations will go FAR! For every $1 donated, St. Mary’s Food Bank can provide seven nutritious meals for families in need. In addition, St. Mary’s Food Bank promotes selfsufficiency through job training and placement services.

StMarysFoodBank.org

Tax Code 20208

We uphold our vision of creating a world without ALS by advocating for and empowering people affected by ALS throughout Arizona to live their lives to the fullest.

By supporting The ALS Association Arizona Chapter, you allow us to continue providing free, local programs and services that help patients and families manage this disease with dignity and hope. Our Durable Medical Equipment Program is a vital resource that our families often rely on to properly care for their loved ones. The medical equipment we provide to patients can cost upwards of $30,000, but due to generous donations, our families receive the equipment at no charge.

alsaz.org

Tax Code 20994

To improve the quality of life for burn survivors and their families in Arizona while promoting burn prevention and fire-safety advocacy and education. ABF has been serving Arizona since 1967, providing education, emotional support, financial assistance and leadership development programs to help those who’ve encountered the devastating effects of burn injuries. ABF supports burn survivors and their families from the time of their injuries through the rest of their lives. We bring them through recovery until they no longer identify as a victim but instead as a human of intrinsic value and worth.

azburn.org

Tax Code 20667

Brighter Way strives to provide comprehensive oral health care to vulnerable adults, children, veterans, those experiencing homelessness, and individuals with special needs in Maricopa County. Brighter Way, an Arizona nonprofit, transforms the lives of those most vulnerable in our community by utilizing entrepreneurial models and mobilizing collaborations to increase access to a full range of oral health services. Since its inception, Brighter Way has provided 1,387,087 services to 163,616 low-income patients with an estimated market value of $187,950,202! Our Downtown Dental Center offers restorative services to veterans, adults and homeless individuals. Parsons Center for Pediatric Dentistry & Orthodontics and Mobile Dental Center help impoverished children. The Boys & Girls Club Clinic reaches low-income children and families. Tax Credit donations will help establish dental homes for our patients.

brighterwaydental.org

Tax Code 20880

Delta Dental of Arizona Foundation works to improve lives by promoting optimal oral health.

Delta Dental of Arizona Foundation funds nonprofit organizations across the state that provide oral health education, dental treatment and nutritional services to underserved and underinsured communities. These include free or sliding fee scale community dental clinics like St. Vincent de Paul, Valleywise Health, United Community Health Center, Sunset Community Health Center, Mountain Park Health Center, North Country Health Care and others. Educational programs supported include Esperança, Children’s Museum of Phoenix, Great Arizona Puppet Theater and mobile- or school-based dental programs such as Tooth BUDDS, Coconino County Cooperative, Arizona Dental Foundation Team Smile program, Desert Senita Dental Center, and Live & Learn. deltadentalaz.com/foundation

Tax Code 20261

Esperança builds optimal social, mental, and physical health in under-resourced communities across the globe.

Esperança’s Health & Wellness program began in 2000, and is uniquely positioned as a leader in providing health education and resources to Arizona’s most at-risk and underserved Latino youth, adults and seniors, creating true social change. Our bilingual and bicultural community health educators come from the communities they serve. Classes take place in community centers, clinics, schools and low-income housing facilities to ensure maximum participation by eliminating unnecessary travel. Our programs range from diabetes prevention and management, oral health, nutrition, mental health and a meal delivery service that supports 200 seniors weekly.

esperanca.org

Tax Code 22188

As one of Maricopa County’s largest integrated behavioral and primary healthcare providers serving all faiths and backgrounds, Jewish Family & Children’s Service understands the link between mental and physical health.

Through our four healthcare clinics across the Valley, we offer primary care ranging from pediatrics to geriatrics, behavioral counseling and therapy for mental health and virtual care options. Our goal: better health outcomes with fewer visits. And because we accept all Arizona Health Care Cost Containment Systems (AHCCCS) plans serving adults, children, and families, Valley residents in this program have the same access to quality care as individuals on more comprehensive healthcare plans. jfcsaz.org/taxcredit

Tax Code 20255

Mission of Mercy Arizona (MOM) restores dignity and heals through love by providing free primary healthcare, medication and patient education to working poor and uninsured Arizonans.

Over the past 25 years, Mission of Mercy Arizona has served over 57,000 unique patients, providing 300,000 free medical visits and 500,000 free prescription medications. Serving in high need areas throughout Maricopa County, MOM now operates 6 regular weekly and bi-weekly clinics. Our clinics are 98% volunteer staffed with licensed medical doctors, nurses and other professionals, and serve up to 60 patients per day on more than 200 clinic days per year. Patients are never asked to prove their poverty in order to get the healthcare they seek!

momaz.org

Tax Code 20941

Our mission is a commitment to preventing kidney disease through awareness, education and research and improving the quality of life for Arizonans with kidney disease.

Since 1963, NKF AZ has been the agency of last resort for thousands of friends, neighbors and families in our kidney community. The heart of the foundation is its direct emergency aid services, provided to kidney patients in need. These include rides to dialysis, help with critical medication, dental work and more. Path to Wellness, the foundation’s free community health screenings, help identify kidney disease early; the Erma Bombeck Donor Awareness Project educates on the importance of kidney donation; and Camp Kidney provides a free weekend of medically supervised magic for kids living with kidney disease. NKF AZ proudly celebrates 60 years of service to the Arizona kidney community in 2023.

azkidney.org

Tax Code 20663

Our world-class care and programs embrace all children and their families as they navigate life-limiting or end-of-life journeys through palliative and respite care that addresses emotional, spiritual, and social needs.

The Support-A-Stay Program at Ryan House provides 24-hour respite stays for children with life-limiting and terminal conditions. Respite is a gift of time; short-term overnight stays that help a family take breaks from the stress of 24/7 home care. Through the Support-AStay Program, we provide professional nursing care, expert Child-Life care, life-enhancing therapeutic/ expressive activities and experiences and food and nourishment along with anticipatory grief, legacy work and bereavement support, in our 12,500-square foot, home-like medical facility.

ryanhouse.org

Tax Code 20088

UCP of Central Arizona helps people with disabilities in all stages of life overcome their challenges to live their lives to the maximum potential.

We perform miracles daily through our remarkable dedication and commitment over the years. A child says, “I love you.” for the first time. An adult cooks his first meal. We champion small steps of independence. We are a safe place for families with disabilities to come and be understood, accepted and find purpose. Our programs focus on transformative treatments with an individualized purpose of empowering individuals to reach their full potential. When you donate to UCP of Central Arizona, you are giving people with disabilities the tools needed to participate in a world that is rightfully theirs.

ucpofcentalaz.org

Tax Code 20473

Valleywise Health Foundation is the nonprofit partner to Valleywise Health, Arizona’s public teaching health system. We are ALL IN to transform care to improve community health.

Valleywise is home to the Arizona Burn Center, one of Arizona’s largest physician training programs, and is the largest provider of inpatient psychiatric care in Arizona. Unlike other health systems, more than 70 percent of Valleywise patients are financially vulnerable. Funds raised support critical patient needs and programs, including burn survivorship care, behavioral health services, and teaching tomorrow’s healthcare professionals. To support the public community health provider for our vulnerable neighbors, donors help Valleywise Health achieve its mission — exceptional care, without exception, for every patient, every time.

valleywisehealthfoundation.org

Tax Code 20047

CASS’ mission is to prevent and end homelessness among individuals and families while advancing compassionate community solutions.

Founded in 1984, CASS is Arizona’s largest and longest-serving homeless emergency shelter provider. Our adult and family shelters operate at full capacity, 365 days a year. CASS provides shelter, case management, housing support, and homelessness prevention services to a truly vulnerable community around the state and beyond. With your support, CASS will be expanding services to include a senior emergency shelter and a shelter for individuals with serious mental illness, ultimately sheltering nearly 1,000 people nightly.

cassaz.org

Tax Code 20328

When you support Habitat, you’re investing in your Arizona community. Known mostly for building new, affordable homes with working families, Habitat also serves veterans, single moms and Arizona seniors through affordable home repairs. Programs include New Builds, Home Preservation, Neighborhood Revitalization, Construction in Training and more!

Invest in your community by supporting Habitat and give Arizona a hand up!

habitatcaz.org

Tax Code 20434

Habitat brings people together to build homes, communities and hope!

Maggie’s Place welcomes pregnant and parenting women and their children into a safe and loving community, providing life-changing programs and ongoing services to help them to become selfsufficient.

Generous investments to Maggie’s Place through the Arizona Charitable Tax Credit program will provide housing, programming and aftercare services to the more than 1,100 women and 750 babies that Maggie’s Place serves.

maggiesplace.org

Tax Code 20492

Aster Aging’s mission is to empower and support East Valley older adults to remain independent and engaged in our communities.

Since 1979, Aster Aging has been dedicated to serving our community. We provide a full continuum of services aimed at independence with dignity as seniors navigate the challenging journey of aging. We accomplish this through four core programs: Our Senior Centers provide hot lunches along with a variety of social engagement and health activities; Meals on Wheels delivers nutritious meals and essential wellness checks; In-Home Support assists individuals with companionship, respite care, assisted transportation, personal care and housekeeping; and Outreach & Social Services works with older adults in navigating and accessing needed social services, benefits and health resources.

asteraz.org

Tax Code 20426

Started by and for our community in 1981, Benevilla enriches the lives of West Valley residents by serving older adults, adults with disabilities, children and the families who care for them.

Benevilla promotes health and independence by providing supportive services to community neighbors while recognizing that caring for the needs of older adults reaches beyond the individual to the entire family. Our programming includes Life Enrichment Adult Day Programs with specialized programming for those unable to care for themselves (memory loss, Parkinson’s, stroke survivors) while providing much-needed respite for family caregivers, free home services allowing homebound adults to remain independent in their own homes (assisted transportation, grocery shopping, phone pals and more), caregiver support groups and resources, preschool and childcare, Benefitness Adaptive Gym, and family resource services. benevilla.org

Tax Code 20493

Diana Gregory Outreach Services enriches lives through healthy eating by providing access to fresh produce to vulnerable and underserved veterans, seniors and grandparents raising grandchildren.

More than 100,000 seniors in Maricopa County over the age of 65 live 100-150 percent below the poverty level. The Nourishing Seniors program provides interactive workshops that provide nutritious fruits and vegetables and teach healthy eating and exercise. Meanwhile, more than 20,000 veterans in Maricopa County are seniors over the age of 65 living in poverty. One in four veterans struggles with diabetes and cardiovascular disease. The Veggies for Veterans program provides veterans access to fresh fruits, vegetables and nutrition education. Help us combat food insecurity. We want to ensure no senior or veteran goes to bed hungry. dianagregory.com

Tax Code 21050

Duet promotes health and well-being through vitally needed, free-of-charge services to homebound adults, family caregivers, faith communities and grandparents raising grandchildren.

Too often, older adults feel isolated as they deal with the most overwhelming experiences of their lives. Duet’s free-of-charge services deliver compassion, dignity and hope to individuals and families throughout our community. From pairing volunteers with homebound adults who can no longer drive, to training faith community nurses, to caring for family caregivers and grandparents raising grandchildren through support groups, guidance, respite and educational workshops, Duet is here to provide the compassionate help you need. Volunteer. Donate. Ask for help. Together, we are partners in health and aging. duetaz.org

Tax Code 20552

Foothills Caring Corps is dedicated to promoting independence and enhancing the quality of life for older adults and persons with disabling conditions residing throughout the Foothills community.

Join us in partnering with people who care to help Neighbors in need! Our Neighbors are older adults aging in place and persons with disabling conditions residing within our 256-square-mile service area. Our volunteers provide essential services such as home-delivered meals, transportation to critical medical appointments, van program outings, educational community activities and a wide variety of individualized supportive services. Our goal is to improve Neighbors’ lives by addressing socialization, health, wellness and mobility to promote physical, mental and emotional health and well-being. foothillscaringcorps.com

Tax Code 20612

One of the largest providers of behavioral health, healthcare and social services in Arizona, Jewish Family & Children’s Service is passionate about helping older adults remain independent and engaged, no matter their faith or background.

We meet older adults where they are. For those who have difficulty leaving the home, we provide counseling and access to resources that help with daily living. For those looking for social interaction, we offer virtual and in-person classes and activities. And for those experiencing changes in their thinking or memory, we invite them and their care partner to our Memory Café, where activities are designed to engage the mind and body and promote relaxation, connection and fun.

jfcsaz.org/taxcredit

Tax Code 20255

Oakwood Creative Care’s mission is to enhance the quality of life and spark joy for aging adults with dementia, Alzheimer’s and other cognitive and physical challenges.

Through tax credit contributions, OCC is able to provide scholarships to low-income families and veterans to attend one of our three Day Clubs found in the East Valley. After diagnosis, families are often encouraged to place their loved ones in a facility with minimal support or hope. OCC’s clubs allow seniors to remain at home for as long as possible by providing a safe and engaging space for caregivers to entrust their loved ones during the day. OCC’s clubs offer enriching creative, wellness and expressive classes where seniors can come to find new interests, talents, friendships and, most importantly, joy!

oakwoodcreativecare.org

Tax Code 20560

The mission of the Arizona Justice Project is to seek justice for the innocent, the wrongfully imprisoned and those who have suffered manifest injustice under Arizona’s criminal justice system.

The Arizona Justice Project is dedicated to identifying and exonerating the innocent in Arizona prisons and correcting cases of manifest injustice. Cases are carefully selected after a thorough vetting process and in-depth investigation of each case. AJP’s services are provided pro bono to incarcerated clients with no money and no right to an attorney. Along with legal services, AJP also offers clients social work and re-entry services to assist them with transitioning back into society. AJP is the only nonprofit organization in the state dedicated to this work.

azjusticeproject.org

Tax Code 22242

Brain Injury Alliance of Arizona’s mission is to improve the quality of life for individuals impacted by brain injury by providing advocacy, education, information, and support, while promoting brain injury prevention.

At Brain Injury Alliance of Arizona, we envision a world where all individuals impacted by brain injury thrive in their community. As thousands of brain health challenges and brain injuries are experienced annually, we are committed to serving survivors and their family members along every step of the recovery journey. With a database of thousands of vetted neuro resources, we provide peer support and post-hospital care coordination at no charge. We also host dozens of trainings, support groups, social events, and educational conferences to meet the needs of survivors of all ages with all types of brain trauma or injury.

BIAAZ.org

Tax Code 22360

We work in and around Creighton neighborhoods and schools, with youth and adults, to cultivate a sense of school-centered identity, foster neighborhood interaction, and increase social capacity to improve adult supportive relationships surrounding developing children.

Fresh in the Neighborhood, a CCF program, is about feeding our families, not just today but also tomorrow. A single $5 donation will feed one family member for a week. A donation of $20 provides an entire family food box with a week’s worth of meals for four. Larger gifts will help fund food boxes, support the construction of our community food site and experience center, and transform our community over the long run, with a beautiful outdoor space for coming together to alleviate hunger, increase nutrition and improve community health. We hope you’ll help us grow a community that thrives together.

creightoncommunityfoundation.org

Tax Code 20846

Devereux Advanced Behavioral Health Arizona is a nonprofit and Qualifying Charitable Organization whose mission is changing lives by unlocking and nurturing human potential for individuals with emotional, behavioral or cognitive differences.

Tax credit donations from our generous friends help support the more than 5,000 at-risk youth we serve every year in Arizona with one of our award-winning programs and services, including Integrated Outpatient Clinic for Adolescents, Autism, Brief Intervention, Outpatient Counseling, Respite, Residential Treatment and Therapeutic Foster Care. Through the generosity of donors like you, we can offer back-to-school supplies, holiday gifts and basic essential hygiene items to traumatized youth.

DevereuxAZ.com

Tax Code 20538

SOCIAL

Dress for Success Phoenix’s mission is to empower women to achieve economic independence through a network of support, professional attire, and the development tools needed to help them thrive in work and in life.

Dress for Success Phoenix delivers programs to help women succeed in every phase of their personal or professional journey, whether they are a job seeker, an employed professional or someone ready to be a leader in their community. Dress for Success Phoenix offers extensive job readiness and career training programs to ensure women are getting hired, being promoted, receiving well-earned raises, networking with other professional women, and gaining control of their finances. Since 2009, the organization has assisted more than 19,000 women throughout the metroPhoenix area.

phoenix.dressforsuccess.org

Tax Code 20168

Foster Your Future supports independence and success with aged out foster young adults. The rist of homelessness, incarceration and instability reduces with long-term, financial support, teaching life-skills, while requiring employment/education.

Foster Your Future Supports the Aged out Foster Young Adults 18 years and older. Mission Statement: There are times when a person should be given a chance to succeed even though they have very little means or support to follow their desired vocational or educational path leading to becoming an independent, successful and contributing citizen. FYF has task driven programs including educational/vocational support in regard to tuition/computers/books/housing, drivers training, financial literacy, and life skills. 100% of donations go directly to the programs. There are no salaries or overhead as this and other administrative costs are all covered by the founders. With a one year commitment/drug free/working or in school full time the young adult then works with a volunteer that mentors them in all life skills challenges.

FosterYourFuture.Org

Tax Code 22210

Fresh Start’s mission is to provide access and resources that help women achieve self-sufficiency and use their strength to thrive.

A pillar in the Phoenix community for 30 years, Fresh Start envisions and works toward a future of unlimited opportunities for women. We empower women to succeed by providing a wide range of comprehensive, wrap-around services. Our work — centered around helping women achieve economic self-sufficiency and personal empowerment — focuses on five key areas of service: Family Stability, Health and Well-Being, Financial Management, Education and Training, and Career. Fresh Start has served tens of thousands of women aged 18 and older, supporting them as they transform their lives and, in turn, transform the lives of their children, families and the community.

freshstartwomen.org

Tax Code 20525

Since 1974, FSL has been caring for Arizonans with a mission of providing home and community-based services and developing energy-efficient, affordable housing to promote health, independence and dignity for all.

FSL develops single-family homes, multi-family affordable housing communities, and residential behavioral health group homes. We operate food pantries in Phoenix, Peoria and Wickenburg. Additionally, we serve nearly 900 congregate and home-delivered meals to Arizonans each day. We provide home and community-based services to enhance independence for Arizonans of all ages, including adult day health and Medicare-certified home health services. We educate clients and family caregivers to empower them to maintain and enhance independence for themselves, their loved ones and their clients.

fsl.org

Tax Code 20199

For more than 95 years, Desert Mission has served the most vulnerable members of our community. Today, as part of the HonorHealth system, we’re still breaking down barriers to self-sufficiency.

With the help of a generous community, Desert Mission offers three major programs:

Food Bank — For struggling families, finding high-quality food for their children is a daily concern. Help us make fresh, nutritious food available at the 4th Street Market or through our mobile food pantry.

Lincoln Learning Center — This accredited early childhood learning center provides a solid foundation for future academic success for children, regardless of their socioeconomic background.

Adult Day Healthcare — A safe, engaging place for seniors, most with some form of dementia. Arts, music, meals and group activities give these older adults energy and purpose (see left).

DesertMission.com

Tax Code 20516

The Human Services Campus, Inc. (HSC) is a unique model in the U.S. for serving single adults experiencing homelessness. Our mission is “Using the Power of Collaboration to End Homelessness.”

Tax credit gifts help provide services 365 days a year to the most vulnerable in our community. HSC serves over 1,800 people daily. Services include client intake and assessments, reunification with family/friends, postal services, navigation to housing, street outreach, and connections to dozens of life-changing services. In response to the rapid increase of unsheltered individuals living on the streets surrounding the Campus, HSC opened Respiro, a 100-bed “sprung structure” emergency shelter. Our goal is to reduce the time people experience unsheltered homelessness and ultimately acquire a place to call home. hsc-az.org

Tax Code 20970

As one of Arizona’s largest providers of behavioral health, healthcare and social services, Jewish Family & Children’s Service has been helping families and individuals overcome life’s challenges, no matter their faith or background.

Our team of therapists, counselors and social workers specializes in working with children, teens and adults who are coping with hardships such as trauma, domestic violence, mental illness and substance abuse.

jfcsaz.org/taxcredit

Tax Code 20255

Live & Learn’s mission is to empower Maricopa County women to break the cycle of generational poverty because, when women thrive, they strengthen their families and the community.

Thirty-three percent of Maricopa County mothers are raising their families in poverty, struggling to provide for their children. Your tax credit donation supports our Economic Empowerment Program, which gives women a structured pathway to financial self-sufficiency. We serve women whose lives have been shaped by poverty, homelessness and domestic violence. While in our program, women earn postsecondary certifications, begin good-wage jobs in high-demand fields and end their reliance on government assistance. Their hard work unlocks their potential and gives their children a brighter future.

LiveandLearnAZ.org

Tax Code 20761

NourishPHX is the trusted community hub serving vulnerable individuals and families by offering resources to satisfy immediate needs and provide pathways to self-sufficiency.

The charitable tax credit helps NourishPHX provide support to more than 14,000 households each year with food resources, a free clothing closet, our job and resource center, SNAP (food stamps) outreach and a variety of programming with other organizations. With one in six people living in poverty in Phoenix, we need your help to assist more families. Tours and volunteers welcomed.

nourishphx.org

Tax Code 20385

Paz de Cristo’s mission is to feed, clothe and empower those struggling with poverty, hunger and homelessness in the Phoenix East Valley.

Paz de Cristo was established in 1988 as an outreach program for those struggling with hunger, poverty and homelessness. Through our comprehensive, basic needs programming, including nightly hot meal service, our weekly Food Box distribution program, clothing program and empowerment services, Paz de Cristo serves approximately 15,000 unique individuals throughout the year.

pazdecristo.org

Tax Code 20275

Phoenix Indian Center serves the American Indian community with culturally relevant youth services, language and cultural revitalization programs, education and workforce development.

Tax credit contributions support important programs like community education workshops, civic engagement outreach, substance abuse and suicide prevention, family skill building, culture and language revitalization, workforce services for teenagers and adults, and youth leadership events and workshops. Additionally, funds are utilized to aid our work in providing basic needs to families who lack sufficient resources due to longstanding impacts of COVID-19 and other life circumstances. Our center was established in 1947, and is the oldest, urban American Indian center in the country.

PhxIndCenter.org

Tax Code 20394

The Salvation Army has been helping Arizonans in need overcome poverty, addiction and economic hardships through a range of social services for nearly 130 years.

Your generous tax credit contributions help The Salvation Army provide food for the hungry, emergency shelter and clothing for the homeless, rent and utilities assistance, disaster and heat relief, holiday joy, senior activity and outreach, adult rehabilitation, skills training, opportunities for underprivileged children, and emotional and spiritual support — “Doing the Most Good” for nearly 450,000 people annually through more than 50 centers of operation throughout Arizona. In 2021, The Salvation Army was ranked #2 on the list of “America’s Favorite Charities” by The Chronicle of Philanthropy.

SalvationArmySouthwest.org

Tax Code 20671

U.S.VETS – Phoenix is on a mission to end veteran homelessness through services designed to help provide housing, mental health support and more.

The U.S.VETS - Phoenix programs benefiting from tax credit contributions are our housing-first model that offers veterans experiencing homelessness a place to stay while they work toward self-sufficiency, employment and permanent housing. In addition, it will help support our new veteran’s homes, MD Hawkins and Ashley’s Place opening winter 2022.

usvets.org/locations/phoenix

Tax Code 20756

Since 1979, the WHEAT organization has been working to end hunger and poverty at the root. Our mission is to educate, advocate, engage and empower individuals in the fight against hunger and poverty.

Our programs include the Clothes Silo, a clothing boutique empowering economically disadvantaged women through the provision of free workwear and offering on-the-job training; the Fair Trade Store, an ethical retail shop creating opportunities for artisans in 30+ countries to earn an income by bringing their stories and handmade products to the valley.

hungerhurts.org

Tax Code 20391

Ability360 Sports and Fitness Center is a 45,000-square-foot, state-of-the-art facility built with purpose and intention for people of all ages with disabilities and their families.

Ability360 continues a tradition of providing empowering programs for people with all disabilities. We offer and promote programs to enable people with disabilities to take personal responsibility so that they can achieve or continue independent lifestyles within the community. The Sports & Fitness Center offers a wide variety of amenities to help our members achieve health and fitness goals, including a fitness center with accessible weight machines, an aquatic area equipped with lifts and elevators, accessible locker rooms and more. Providing muchneeded scholarships to members of all ages during these trying times will enable us to continue our mission.

ability360.org

Tax Code 20090

The Autism Society of Greater Phoenix’s mission is to create connections, empowering everyone in the Autism community with the resources needed to live fully.

Our vision is to create a world where everyone in the Autism community is connected to the support they need when they need it. We offer programs for children, teens and adults. Each program is designed to support social, communication and job skills. Our BE SAFE Interactive Screenings teach youth how to interact with law enforcement safely. Families are the focus of training programs like Autism 101, Transition 101 and Safety 101. We offer meetups for caregivers and Autistic adults and support groups in English and Spanish. Our meetings provide valuable information and give our community a chance to connect and share resources.

PHXAutism.org

Tax Code 20728

Beacon Group creates meaningful employment opportunities for people with disabilities across Arizona.

One in ten Arizonans identifies as a person with a disability. Nationally, only 35 percent of people with disabilities are currently employed. People with disabilities want to work and feel the satisfaction of earning a paycheck for that work. Tax credit contributions support a variety of programs at Beacon Group, including vocational training programs that prepare people with disabilities for employment as well the job development, placement and retention programs that actually find and place individuals into employment. These contributions directly support Beacon Group in finding jobs for people with disabilities. beacongroup.org

Tax Code 20348

Our mission is to support caregivers raising a child with a disability to create a brighter future.

In order for children with disabilities to thrive, their primary caregiver must be seen and supported. We remove isolation by providing access to the community. We help overcome stress by providing therapy, support groups, life coaching, fitness routines and guided meditations. We empower them by giving them tools to help navigate different systems of care and strategies to help make parenting a child with a disability easier. Then we teach other organizations in the disability community how they can strengthen their families.

We are transforming the myopic way disability has been treated into a multifaceted approach. care4thecaregivers.org

Tax Code 22358

Since 1968, Civitan Foundation, Inc. has focused on enriching the lives of children and adults with intellectual and developmental disabilities through innovative and person-centered learning experiences that promote self-esteem, self-expression, community integration and independence.

Across Arizona, Civitan Foundation, Inc. provides high-quality programs for individuals with intellectual and developmental disabilities that promote opportunities for greater independence, inclusivity and an enhanced quality of life. Since the founding of Camp Civitan, Civitan Foundation, Inc. has continually developed dynamic programs and services to meet the needs of our members and their families. Your tax credit donation invests in these programs and services, providing specialized education, healthy living, life skills, socialization, job training, employment and family support for the disability community.

civitanfoundationaz.org

Tax Code 20532

Cortney’s Place, a family-founded nonprofit organization, provides an inclusive, stimulating and meaningful community-based day program for adults with Intellectual and Developmental Disabilities.

Cortney’s Place strives to encourage, support and engage individuals with Intellectual and Developmental Disabilities (IDD). We provide adults with IDD experiences any other adult would have, including specialized programs and services necessary to enhance their lives. The targeted program curriculum includes art classes, music therapy, hydrotherapy, culinary/nutritional education, fitness and wellness; all of which give individuals the opportunity to thrive in an environment that celebrates their abilities and allows them to use and grow their cognitive, fine and gross motor skills. Your tax credit contribution can be powerful in supporting the amazing work we do at Cortney’s Place.

cortneysplace.org

Tax Code 20130

Our mission is to provide education, tools and services that enable all people with vision loss to achieve greater independence.

FBC serves people of all ages with visual impairments. Our youngest client could be born today and participate in our Early Intervention Program. They would then transition to our preschool, where we teach students how to read braille and be successful in school. FBC students grow up, go to college and go to work. FBC graduates are business owners, entrepreneurs, lawyers, doctors, engineers, election officials and teachers, proving there is no limit to what our clients can achieve. Our vision for the world is that vision loss is a diagnosis, not a disability. We move toward that by working with more than 2,000 clients each year.

SeeItOurWay.org

Tax Code 20676

Founded in 1985, Gesher Disability Resources serves children and adults affected by a disability through inclusion assistance in the classroom, resource referral, residential support and social groups.

Tax credit donations to Gesher enhance ALL programs and services offered by the agency. Most member events have been available in a hybrid format, allowing participation according to preference, ability and how the individual feels that day. Educational services were provided directly to over 100 students this past school year with fees subsidized by tax credit dollars. New programming included Gesher Get Together for adults only from the disability community, Camp Gesher for students to avoid summer learning loss, and a Disability Toolkit to help families navigate disability services in Arizona.

gesherdr.org

Tax Code 20748

The Miracle League of Arizona’s mission is to provide individuals with special needs a safe, fun and successful baseball experience, regardless of any mental, physical or health-related challenges.

As participation in our league is free, tax credit contributions help ensure each player gets a major league experience at the Miracle League. Players are outfitted with personalized jerseys with their name and number on the back, get their own walk-up music, are announced over the PA system, and even get their name and photo up on a giant video board. Gifts to the organization help defray those costs, as well as the expenses of adaptive baseball equipment, volunteer training, insurance and registration. Your support allows more than 250 individuals with special needs to get out and play ball!

MiracleLeagueAz.com

Tax Code 20258

.

Power Paws trains service dogs for disabled children and adults with Mobility challenges, Type I diabetes, PTSD or facilities serving survivors of domestic or sexual abuse.

Your tax credit donation lowers the cost of training an assistance dog by 70 percent for those faced with the financial burden of healthcare for the rest of their lives. For each dog placed into service, we provide ongoing training to the client and canine at no additional cost for the life of the canine.

Power Paws is one of two agencies in Arizona accredited by Assistance Dogs International to train service dogs.

azpowerpaws.org

Tax Code 20712

Whispering Hope Ranch Foundation’s mission is to provide hope and healing to children with special needs through the wonders of camp, the beauty of nature and the human-animal connection.

There are more than 325,000 Arizona children with special healthcare needs and one camp facility designed and built from the ground up expressly for them—Whispering Hope Ranch. Nestled in the cool pines of Payson and serving children throughout the State with any developmental, medical or emotional disability, Whispering Hope Ranch is more than a camp. It’s a place of possibilities, acceptance and community. A week at camp can be powerful for children with special needs, giving them tools to cope with everyday stress, a sense of independence and accomplishment, and improved medical compliance.

whisperinghoperanch.org

Tax Code 20322

Hunkapi Programs is an established Arizona nonprofit offering equestrian-based behavioral health and related services to more than 300 children, youth and adults weekly on our 10-acre Scottsdale farm.

Hunkapi offers a wide range of programs and services, including a contractual relationship with several Maricopa County mental health organizations serving children ages 3-18. In addition, we provide a unique program for First Responders recovering from PTSD, using equine therapy as a basis for treatment. In collaboration with Mayo Scottsdale and the Arizona ALS Society, Hunkapi has developed a program to improve the quality of life for recently diagnosed ALS patients and their caregivers. We also work in partnership with Homeward Bound to treat families who have faced the trauma of experiencing homelessness.

hunkapi.org

Tax Code 21993

Assistance League of East Valley improves the lives of children through philanthropic programs that fulfill basic needs, foster self-esteem and enhance quality of life.

Assistance League of East Valley® puts commitment into action through our Philanthropic Programs — WE CARE!

This year, Assistance League of East Valley celebrates over 25 years of philanthropic work in the East Valley. Our signature program, Operation School Bell, provided new school clothing to more than 10,000 area children last year. We also work with community agencies to assist homeless teens and adults in need. We are an all-volunteer organization. Your tax credit donations will help us continue our work providing new school clothing, shoes, assault survivor kits and scholarships in our community. One hundred percent of every tax dollar credit is used for our philanthropic programs.

assistanceleagueeastvalley.org

Tax Code 20222

Assistance League of Phoenix improves the lives of children through programs that provide basic needs, foster self-esteem, and enhance quality of life.

Assistance League of Phoenix has been helping the most vulnerable in our community for more than 60 years. Our signature program, Operation School Bell, provides new wardrobe packages to more than 10,000 children grades K-8 living in poverty each year. Our Delivering Dreams Buses travel across the Valley, serving 130 high-need Title I schools to bring the program directly to children in need. We also serve homeless youth, refugees and children living in foster care. Your donation provides wardrobe packages to children in our community. Through a generous grant from BHHS Legacy Foundation, tax credit donations are matched — doubling your impact.

alphx.org

Tax Code 20533

Back to School Clothing Drive breaks down barriers to educational equality by providing new school clothes, shoes, backpacks, school supplies and personal hygiene items to low-income children throughout Arizona.

The feeling of not fitting in at school isn’t just bad for self-esteem, it’s also an indicator of future educational success. Your tax credit donation helps Back to School Clothing Drive give low-income students new clothes, shoes and backpacks filled with school supplies so they can go to school feeling great and ready to learn! We have served Arizona’s families for 55 years and more than 25,000 students are impacted annually by one of our programs. Thank you for helping us help them!

btscd.com

Tax Code 20462

For more than 65 years, BBBSAZ has operated under the belief that every child has the inherent ability to succeed and thrive in life.

Each time a gift is made to Big Brothers Big Sisters, potential is ignited within our community. Big Brothers Big Sisters makes meaningful, professionally supported matches between adult volunteers (“Bigs”) and children (“Littles”), ages 6 through 18, in Maricopa County and Pinal County. We develop positive relationships that have a direct and lasting effect on the lives of young people and the community. When you give to BBBSAZ, you join a network of thousands who believe in the power of potential.

bbbsaz.org

Tax Code 20332

The Boy Scouts of America’s Grand Canyon Council benefits its members, their communities, and the future by helping youth build character, learn about the world and grow into inspired leaders.

In Scouting, every new adventure, every campout, and every badge is a chance to learn new skills and gain new experiences. Scouts and their families are welcomed into an inclusive community that encourages them to try new hobbies, serve their community, and explore the outdoors while learning about the world around them. Through these experiences, Scouts gain knowledge and skills; create and strengthen relationships with family, friends, and communities; and learn to lead values-based lives that build their character and leadership abilities. Contributions support at risk youth and gives them opportunities through Scouting that don’t exist anywhere else.

grandcanyonbsa.org/support-scouting

Tax Code 20437

To enable all young people, especially those who need us most, to reach their full potential as productive, caring, responsible citizens.

Boys & Girls Clubs of Greater Scottsdale provides unrivaled programming and a vital source of stability that helps kids avoid risky behaviors and overcome challenges. Arizona tax credit funds provide a safe place for hundreds of youth who need us most to have fun, build relationships, learn new things, and be supported. But we do more than that. We provide homework help, art, tech, science, exercise, mentoring, hopes and dreams, and on and on. We do whatever it takes to help kids succeed.

bgcs.org

Tax Code 20091

Boys & Girls Clubs of the Valley empowers young people, especially those who need us most, to reach their full potential as productive, caring, responsible members of the community.

Boys & Girls Clubs of the Valley offers affordable afterschool and summer programs for young people in grades K-12. At 25+ Clubs across the Valley, BGCAZ provides award-winning programs designed to change young people’s lives. BGCAZ also operates the Mesa Arts Academy, a charter school offering a rigorous K-8 academic program emphasizing the arts and technology. By integrating the arts and technology into our educational program, we create a more hands-on learning environment that better fits the learning styles of our diverse population of students.

BGCAZ.org

Tax Code 20331

Future for KIDS provides mentor-driven out-ofschooltime programs and camps that focus on academics, athletics and ethics to improve the lives of youth facing adversity.

For more than 30 years, we have been standing alongside kids and their families to provide the extra support needed to navigate life’s challenges. Through the power of volunteers and community support, we work daily to improve the lives of youth facing adversity through strong programs and camps focusing on academics, athletics, and ethics.

futureforkids.org

Tax Code 20196

The mission of Gabriel’s Angels is to inspire confidence, compassion and best behaviors in at-risk children through pet therapy.

Our work is driven by a passionate belief that the unconditional love of a pet can heal a child. With Arizona ranking 44th in the nation in child welfare, we know that our Pet Therapy visits to at-risk children in places like Title I schools, crisis nurseries, homeless shelters and group homes have a positive impact and enhance children’s social and emotional development. This year, we expect to serve 2,300 children with 125 Pet Therapy teams at 75 partner agencies in Arizona. For every $50 of your tax credit donation, an at-risk child can experience pet therapy for a year.

gabrielsangels.org