For over 45 years, the Arizona Community Foundation has supported nonprofits and students across our state by mobilizing the collective passion and generosity of thousands of Arizonans.

We are glad you feel inspired to give back to the organizations and institutions that work tirelessly to serve our communities. When you are ready to take the next step in your personal charitable giving journey, we are here to help you achieve your goals.

check out the “Maximize the Tax Credit Opportunity” on PAGE 6 for a quick review of the four credits available.

start with the article on PAGE 7.

to use the TAX CREDIT WORKSHEET as you are reviewing the list of organizations throughout the publication. YES, THERE ARE

Check out the list of categories on PAGE 16 to help you find an organization that connects.

We recommend taking this publication and your worksheet with you when you meet with your tax adviser!

s)

Check

published by FRONTDOORS MEDIA

EDITOR

Karen Werner

CONTRIBUTING EDITOR

Tom Evans

SENIOR ACCOUNT EXECUTIVE

Lindsay Green

PUBLISHER

Andrea Tyler Evans

CREATIVE DIRECTOR

Neill Fox

DESIGNER

Cheyenne Brumlow

How do I get a copy?

Need a print copy of the Arizona Tax Credit Giving Guide 2024-25?

Order a copy to be mailed to you at: frontdoorsmedia.com/payment

Be in the know

FOLLOW FRONTDOORS MEDIA

GENERAL INFORMATION & PRESS RELEASES

info@frontdoorsmedia.com

3104 East Camelback Road, Suite 967 Phoenix, AZ 85016

480-622-4522 | frontdoorsmedia.com

Frontdoors Media celebrates the people and groups that give generously and work to build the future of our community. It’s the premier source of information — and inspiration — for those who strive to make the Valley of the Sun a better place to live. We invite you to sign up for our weekly e-newsletter, The Knock, at FrontdoorsMedia.com and become a Frontdoors reader!

Our roots are in ink and paper, but our work goes far beyond the traditional. We’re strategists, creatives, campaign developers and producers. From concept to implementation, we provide innovative marketing solutions that go above and beyond.

Welcome to the Arizona Tax Credit Giving Guide and

At Frontdoors Media, we’re proud to be your go-to source for all things philanthropy in our community. As tax season nears, many of you are considering how best to optimize your tax situation while making a positive difference in Arizona. Luckily, our state offers some of the most generous charitable tax credit programs in the country, allowing you to direct your tax dollars to the causes that matter most to you — at no extra cost.

With options like the Qualified Charitable Organization (QCO) tax credit, where a married couple can claim up to $938, you have the opportunity to support nonprofits, foster care organizations, schools and tuition organizations across the state. And the best part? Each credit is separate, so you can maximize your giving across multiple categories.

We’ve organized the qualified organizations into easy-to-read sections, and all are vetted and approved by the Arizona Department of Revenue. Take this guide to your next tax appointment, and use the worksheet on the back cover as a handy checklist for claiming your credits.

Now more than ever, Arizona nonprofits and schools need our support. Let’s work together to make a meaningful difference in our community.

Thank you for being a part of this effort!

Andrea & Karen

Andrea Tyler Evans, Publisher Karen Werner, Editor in Chief

Tax Credit Contributions Continue to Boost Arizona Nonprofits

Executive Council Charities (15)

Valley of the Sun United Way (15) FEATURE STORY

Ability360 (40)

ACCEL (49)

Advance Community (formerly Esperança) (36)

ALS Arizona (26)

Amanda Hope Rainbow Angels (18)

Area Agency on Aging, Region One (37)

Arizona Burn Foundation (40)

Arizona Cancer Foundation for Children (18)

Arizona Foundation for Cancer (19)

Arizona Justice Project (35)

Arizona Legal Women and Youth Services (ALWAYS) (35)

Aster Aging (37)

Autism Society of Greater Phoenix (49) Benevilla (38)

Big Brothers Big Sisters of Central Arizona (54)

Boys & Girls Clubs of Greater Scottsdale (55)

Boys & Girls Clubs of the Valley (55)

Central Arizona Shelter Services (CASS) (32)

Chicanos Por La Causa (41)

Children’s Cancer Network (19)

Circle the City (27)

Civitan Foundation, Inc. (50)

Copa Health (27)

Cortney’s Place (50)

Dress for Success Phoenix (41)

Duet: Partners In Health & Aging (38)

Families Raising Hope (20)

Family Promise –Greater Phoenix (42)

Fresh Start Women’s Foundation (42)

Gabriel’s Angels (56)

Gesher Disability Resources (51)

Habitat for Humanity Central Arizona (32)

Healing Arizona Veterans (54)

Helping Hands for Single Moms (22)

HonorHealth Desert

Mission (28)

Hope’s Crossing (43)

House of Refuge (33)

Hushabye Nursery (28)

ICAN (56)

Jewish Family & Children’s Service (20), (23), (29), (39), (43), (57)

Keys to Change (33)

Lions Camp Tatiyee (51)

Maggie’s Place (34), (44)

Make Way for Books (57)

MASD dba Arizona

Disabled Sports (52)

Midwest Food Bank, Arizona Division (25)

Military Assistance Mission (23)

Miracle League of Arizona (52)

Mission of Mercy

Arizona Health

Partnership Fund (29)

Mother’s Grace (24)

National Kidney Foundation of Arizona (30)

A New Leaf (21), (34)

New Life Center (21)

New Pathways for Youth (58)

NourishPHX (44)

one•n•ten (58)

Pawsitive Friendships (59)

Paz de Cristo Community Center (25)

Phoenix Children’s Foundation (30)

Phoenix Conservatory of Music (59)

Phoenix Indian Center (45)

Phoenix Rescue Mission (45)

Power Paws Assistance Dogs, Inc. (53)

Pregnancy Care Center of Chandler (24)

Recovery Empowerment Network (36)

Ronald McDonald House

Charities of Central and Northern Arizona (46)

Ryan House (31)

The Salvation Army

Metro Phoenix (46)

Society of St. Vincent de Paul (26), (47)

Sojourner Center (22)

St. Joseph the Worker (48) STARS (47)

Valley of the Sun YMCA - Valley YMCA

Cares (39), (60)

Valleywise Health Foundation (31)

WHEAT (48)

Agape Adoption Agency of AZ (63)

Aid to Adoption of Special Kids (AASK) (63)

Arizona Friends of Foster Children Foundation (64)

Arizona Helping Hands is now The Foster Alliance (64)

Arizona Sunshine Angels (65)

Catholic Charities

Community Services (65)

Center for the Rights of Abused Children (66)

PUBLIC & CHARTER SCHOOLS

BASIS Charter Schools (71)

TUITION ORGANIZATIONS

PRIVATE SCHOOLS

Child Crisis Arizona (66)

Florence Crittenton (67)

Hope & A Future (67)

Rise Family Services (68)

Voices for CASA Children (68)

All Saints’ Episcopal Day School (74) New Way Academy (74)

SCHOOL TUITION ORGANIZATIONS

Academic Opportunity of Arizona (75) Brophy Community Foundation (75)

Catholic Education Arizona (76) School Tuition Organization 4 Kidz (STO4KIDZ) (76)

By Tom Evans

Tax credit contributions — donations that provide revenue to nonprofits while giving donors a break on state income taxes — continue to be the fuel that powers many Arizona nonprofits and helps them achieve their missions.

Tax credit contributions continue to be a vital funding source for many Arizona nonprofits — and an excellent way for Arizona residents to make a tangible difference in their communities.

Arizona law allows taxpayers to donate to a qualified charity or tuition organization and get a dollar-fordollar reduction on state income taxes. Over time, these contributions have become increasingly popular for residents and beneficial for nonprofits.

The State of Arizona allows these tax credits when donors give to qualified organizations in these categories:

• Arizona Qualifying Charitable Organizations, which provide basic needs to qualifying low-income families and individuals, the chronically ill and disabled. Limits are $470 for individuals and $938 for married couples for tax year 2024 and $495 for individuals and $987 for married couples for the 2025 tax year.

• Qualifying Foster Care Organizations, with limits of $587 for individuals and $1,173 for married couples for tax year 2024 and $618 for individuals and $1,234 for married couples for the 2025 tax year.

• Public School Tax Credit Organizations, with limits of $200 for individuals and $400 for married couples.

• Private School Tuition Organizations for Individuals, with limits of $731 for individuals and $1,459 for married couples for the 2024 tax year and $769 for individuals and $1,535 for married couples for the 2025 tax year.

• Certified School Tuition Organizations (also known as the “Switcher” Individual Tax Credit, this credit is only available if you’ve already maxed out the Private School Tuition Organization credit). Limits are $728 for individuals and $1,451 for married couples in 2024, and $766 for individuals and $1,527 for married couples in 2025.

• Private School Tuition Organizations for Corporations: C-Corporations, S-Corporations, LLCs and insurance companies can qualify for two types of credits. The first one is the Corporate Contributions to School Tuition Organizations, which supports low-income students in private schools. The full name of the second credit is Corporate Contributions to School Tuition Organizations for Displaced Students or Students with Disabilities.

Arizona law allows contributions to be counted for the 2024 tax year all the way up to April 15, 2025.

Brenda Blunt, a partner with Eide Bailly LLP, said that other than the dollar amounts, there have been no major changes this tax year to what’s become an increasingly popular way to give back.

“It remains a great way to support schools, access to private schools and charities serving our neediest populations in a tax-efficient way,” she said. “I work with a number of private schools that have been able to attract a greater diversity of students, enriching the education process of all their students. I also work with numerous charities that are able to expand their programs to help people enjoy a full and productive life because of the tax credit dollars they attract.”

Lorraine Tallman, the founder & CEO of Amanda Hope Rainbow Angels, said the tax credit contributions have a personal meaning for her. She founded the charity in memory of her daughter Amanda, who died of leukemia in 2012. Today, the nonprofit provides support services for families impacted by childhood cancer and other life-threatening diseases.

“As a mom of a cancer warrior, I personally know the financial devastation and the mental duress on the entire family,” she said. “Arizona tax credit dollars allow us to provide free counseling programs and financial assistance to the everyday ‘here-and-now needs’ our families face daily. Priceless.”

For a complete list of qualifying charitable organizations and qualifying foster care organizations, visit azdor.gov/tax-credits/contributions-qcos-andqfcos. Organizations are also added on an ongoing basis, so it may be worth your time to check back before year-end and again before April 15, 2025 — the last day 2024 tax credit contributions can be made.

Some charities under the Arizona Qualified Charity Tax Credit have a slightly different designation as “umbrella organizations.” They are eligible for the same contribution limits ($470 for individuals, $938 for couples), but are listed differently on the State of Arizona’s website.

For example, Executive Council Charities, Valley of the Sun United Way and other United Way organizations across the state are considered “umbrella organizations” because they may receive tax credit contributions and distribute them to other nonprofit partners in the community.

Use the Tax Credit Worksheet on the back cover to take notes and record the Umbrella tax code for the charities you choose. You can choose more than one!

Food access is a key issue holding children back from a successful future. At Valley of the Sun United Way, we will never stop supporting our community until this issue—and other key issues in education, housing & homelessness, health, and workforce development—are solved. See how you can help at vsuw.org.

Our mission is to support charity organizations focused on helping youth in our community overcome adversity and reach their full potential as productive, caring and responsible citizens.

Support Arizona Youth (SAY) is the annual campaign for Executive Council Charities (ECC), an umbrella organization for the Arizona charitable tax credit. Through SAY, donors can take advantage of the tax credit for both qualified and foster care charities, or indicate a preference for any specific qualified charity. Not only are 100 percent of the funds forwarded to benefit vital programs at these charities, but ECC also covers all credit card processing fees.

ec70phx.com

Tax Code 20726

Valley of the Sun United Way is creating a better future for everyone in our community. A community where every child, family and individual is healthy, has a safe place to live and has every opportunity to succeed in school, in work and in life.

Your gift supports our community-wide efforts to create Mighty Change in Maricopa County through our MC2026 plan that tackles some of the Valley’s most urgent issues. This community-developed and community-driven plan is supported by our donors and implemented alongside our more than 300 local MC2026 Coalition partners, including businesses, schools, nonprofits and other community organizations. Together, we will meet Bold Goals focused on closing education gaps, preventing homelessness and increasing access to health care and better-paying jobs to create a more equitable and thriving community for everyone. Join us today!

vsuw.org

Tax Code: 20726

Per the Arizona Department of Revenue, a QCO provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families (TANF) benefits, are lowincome residents of Arizona, or are individuals who have a chronic illness or physical disability.

A QCO must meet ALL of the following provisions:

• Is exempt from federal income taxes under Section 501(c)(3), or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

• Provides services that meet immediate basic needs.

• Serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150 percent of the federal poverty level, or are chronically ill or physically disabled individuals.

• Spends at least 50% of its budget on qualified services to qualified Arizona residents.

• Affirms that it will continue spending at least 50% of its budget on qualified services to qualified Arizona residents.

The QCO organizations listed in the Arizona Tax Credit Giving Guide have chosen the following categories to best describe the programs they offer the community:

- CANCER SUPPORT [ pg. 18 ]

- DOMESTIC VIOLENCE [ pg. 20 ]

- FAMILY ASSISTANCE [ pg. 22 ]

- FOOD BANK [ pg. 25 ]

- HEALTHCARE [ pg. 26 ]

- HOUSING SUPPORT [ pg. 32 ]

- LEGAL SERVICES [ pg. 35 ]

- MENTAL HEALTH SERVICES [ pg. 36 ]

- SENIOR SERVICES [ pg. 36 ]

- SOCIAL SERVICES [ pg. 40 ]

- SPECIAL NEEDS [ pg. 49 ]

- VETERAN SERVICES [ pg. 54 ]

- YOUTH DEVELOPMENT [ pg. 54 ]

REMINDER!

Use the Tax Credit Worksheet on the back cover to take notes and record the QCO code for the charities you choose. You can choose more than one!

$470 per Individual

$938 per Married Couple

Arizona Department of Revenue Form 321 Required

Our mission is to bring dignity and comfort into the harsh world of childhood cancer and other life-threatening diseases.

Your tax credit contributions help Amanda Hope provide essential support services for families with a child battling cancer or another life-threatening illness. This includes our Comfycozy’s for Chemo adaptive apparel, which helps young warriors feel comfortable and remain clothed during treatment, our free Comfort and Care counseling services, and our Financial Assistance program, which is vital for families in need. You also help fund Major Distraction events like Meals of Hope, craft days, family events, teen nights and more! amandahope.org

Tax Code 20854

The mission of Arizona Cancer Foundation for Children is to provide social, emotional and financial support to families managing the health and well-being of a child diagnosed with cancer.

Arizona Cancer Foundation for Children offers a nurturing environment where kids with cancer can simply be kids. Since its founding, ACFC has supported over 10,000 individuals across the state who have been affected by pediatric cancer, providing crucial resources to those who might otherwise face isolation. ACFC assists families in need with financial aid, while also supplying food and essential household items to those struggling with food insecurity and economic hardship. Families benefit from various services, including counseling, K9 therapy, community events, toys for children and access to a facility with an art studio, play areas, education center, teen room, kitchen and food pantry.

azcancerfoundation.org

Tax Code 20873

Arizona Foundation for Cancer is dedicated to promoting health, healing and survivorship through programs and services as patients navigate their cancer journey.

Arizona Foundation for Cancer provides services such as education, integrative therapies, breast prostheses, wigs and head coverings, support groups, nutrition counseling and gas cards, to name a few. Our programs and services are designed to help reduce stress, reduce pain, improve self-image and promote wellness.

azforcancer.org

Tax Code 22419

Children’s Cancer Network supports children and families throughout their cancer journey with programs that provide financial assistance, psychosocial support and encourage healthy lifestyles and create an awareness of issues related to childhood cancer.

Children’s Cancer Network programs provide vital support to children with cancer and their families, offering emotional, financial and educational resources. These programs help families navigate the challenges of cancer treatment by providing assistance such as gas cards, meal vouchers, counseling and emergency funds. Through peer support groups, family events and educational workshops, CCN fosters a sense of community, reduces isolation and empowers families to cope with the emotional and practical demands of childhood cancer.

childrenscancernetwork.org

Tax Code 20176

The mission of Families Raising Hope is to assist cancer patients and their families with the financial burden that cancer treatments pose so that they can focus on their health, healing and recovery.

The costs associated with cancer treatment can escalate rapidly, placing significant financial strain on patients and their families. From doctor visits and missed workdays to travel expenses, overnight stays and medication costs, these expenses can make it challenging to manage essential living expenses like rent or mortgages, car payments, utility bills, groceries and gas. FRH is dedicated to easing the financial burden of cancer treatment for Arizona patients of all ages. Our focus lies in providing support for essential living expenses during their treatment journey. By offering assistance with these vital costs, we aim to empower patients to focus on what truly matters: their health, healing and recovery.

familiesraisinghope.org

Tax Code 22575

At Jewish Family & Children’s Service, we believe everyone has the right to live without fear and with the dignity and respect they deserve.

JFCS Shelter Without Walls program provides crisis and support services for survivors of intimate partner and domestic violence who are not in a shelter but wish to live independently and need assistance to do so safely. Services include step-by-step safety planning, shelter referrals, support and education groups and lay legal advocacy. Individuals of all ages, faiths and backgrounds are welcome.

jfcsaz.org

Tax Code 20255

A New Leaf provides lifesaving shelter and support to families experiencing domestic violence, homelessness and other crisis situations. Our mission is “Helping families, changing lives.”

Your generous tax credit donation will provide safe shelter, legal support and trauma counseling to survivors of domestic violence in your local community. All contributions will be used to serve survivors at A New Leaf’s lifesaving domestic violence shelters across the Valley. By making a tax credit donation, you will be providing lifesaving support to families fleeing abuse.

Thank you for your kindness!

TurnaNewLeaf.org

Tax Code 20075

New Life Center has intentionally evolved into a statewide leader in emergency shelter and outreach support, all while remaining rooted in our mission of eliminating domestic and sexual violence through support services, education and expertise.

New Life Center proudly serves as one of Arizona’s largest emergency shelters for survivors of domestic violence, sexual violence and human trafficking. With your support, New Life Center can welcome women, men and families that were quite literally forced to run for their lives, often arriving with nothing more than the clothes they were wearing when they escaped. Your generosity allows us to offer immediate safety, critical resources and care to approximately 350 adult and child survivors escaping from various forms of violence each year. Together we are creating safe, stable communities where all have a safe place to call home.

newlifectr.org

Tax Code 20559

Sojourner Center’s mission is overcoming the impact of domestic violence, sexual violence and human trafficking, one life at a time.

Domestic violence remains a pervasive issue in Arizona, affecting countless individuals and families across the state. Sojourner Center has evolved into a national leader in its field and serves survivors of domestic violence, sexual assault and human trafficking. Our programs encompass a wide range of vital services, including petfriendly shelter and safe housing that ensure survivors can escape dangerous situations without leaving their beloved pets behind. Our trauma-informed services and programs are thoughtfully crafted to empower survivors in cultivating resilience and strength, enabling them to establish and sustain lives free from violence.

sojournercenter.org

Tax Code 20544

Assisting low-income single-mom families as the mother attains post-secondary education, financial independence and a positive family legacy.

Helping Hands for Single Moms empowers families to achieve financial self-sufficiency through post-secondary education. In 2025, 53 more single moms will graduate and attain a livable wage job, while 88 others will move one step closer to that goal. Next year, we will provide over $1 million in financial assistance and supportive services to the families. All donations help hard-working single moms making great sacrifices for their children.

Your support makes a lasting difference!

If you are (or know of) a single mom college student who could benefit from our scholarship, please share this link.

helpinghandsforsinglemoms.org

Tax Code 20193

At Jewish Family & Children’s Service, we support families by providing behavioral health, healthcare and social services to all those in need.

JFCS partners with the Arizona Department of Child Safety to assist families by providing counseling and other resources, assessing the risk of violence or abuse in the home and offering parent coaching and support. Together, we help families work towards their goals.

jfcsaz.org

Tax Code 20255

Military Assistance Mission provides financial assistance and morale aid to Arizona military, their families and our wounded heroes.

Military Assistance Mission is a nonprofit that offers a financial assistance program that covers food, rent, mortgage, auto payments, utilities and auto insurance. MAM’s education assistance programs help service members and spouses with school expenses like textbooks, invoices, dorm/school living and parking fees. Additionally, MAM organizes morale-boosting family events, such as baby showers, holiday programs and tickets to sporting events.

azmam.org

Tax Code 20118

FAMILY ASSISTANCE

FAMILY ASSISTANCE

Mother’s Grace helps mothers and families suffering from adversity with emotional, spiritual and financial support.

Mother’s Grace pays for rent, utilities, car and insurance payments, medical bills and provides gift cards for food and gas for our recipients based on their immediate needs.

mothers-grace.org

Tax Code 22563

We provide FREE, compassionate care before, during and after pregnancy.

Pregnancy Care Center of Chandler demonstrates God’s love by providing compassionate care through free services such as pregnancy tests, ultrasounds and counseling. Client advocates present reliable resources as they educate on parenting, adoption and abortion options. Prenatal and parenting classes are provided through the Learn & Earn program, and parents who attend are rewarded with baby bucks that can be used at our fully stocked Baby Boutique filled with donated diapers, wipes, new baby clothes, bottles, pacifiers and more. The Fatherhood Program champions the father’s voice and aims to inspire men to be involved, responsible fathers. PCC recognizes the client’s story does not end with us, so we rely on community resources to refer for additional medical services, aiming for healthy moms giving birth to healthy babies.

pccchandler.com

Tax Code 20562

As a faith-based organization, Midwest Food Bank aims to share the love of Christ by alleviating hunger and malnutrition locally and throughout the world and providing disaster relief, all without discrimination.

The Arizona Division of Midwest Food Bank distributes over $50 million in food and supplies annually. Midwest Food Bank provides weekend backpack meals to students, snack packs for homeless individuals and protein-rich meals for disaster relief. Every dollar contribution yields $30 worth of food and supplies for those facing food insecurity. And over 99 cents of every dollar you donate will go directly toward providing food to people in need.

arizona.midwestfoodbank.org

Tax Code 20927

Paz de Cristo Community Center is more than a meal; we feed, clothe and empower our neighbors in need.

Arizona Tax Credit contributions to Paz de Cristo Community Center directly support our programs for those experiencing homelessness and poverty. These funds fuel the ongoing support of our nightly meals, food pantry, access to healthy food, clothing distribution, showers and essential document services. By donating, you’re helping us provide immediate relief and support to our community’s most vulnerable members.

pazdecristo.org

Tax Code 20275

Tax Code 20540 FOOD BANK

St. Vincent de Paul harnesses the power of our community to feed, clothe, house and heal all who are in need — whether in body or in spirit.

We believe in the intrinsic value of every person — to serve and be served. Our dining rooms and food boxes are more than just meals. Families gain access to supportive programs and referrals to community resources. When people are at their lowest point and have lost their housing, St. Vincent de Paul is there to offer not only a bed, but a path to find home again. With your support, St. Vincent de Paul is helping seniors, families and children in need in our community with food, housing, affordable healthcare and much more.

stvincentdepaul.net

Advocating for a cure and supporting individuals with ALS to embrace life to the fullest.

ALS Arizona symbolizes the hopes of people everywhere that Amyotrophic Lateral Sclerosis will one day be a disease of the past, conquered by the dedication of thousands who have worked ceaselessly to understand and eradicate it. Until that day comes, ALS Arizona relentlessly pursues its mission to help people living with ALS and to leave no stone unturned in the search for a cure for this progressive neurodegenerative disease. ALS is relentless, but so are WE!

alsaz.org

Tax Code 20693

We started with a simple but urgent idea: to deliver healthcare solutions that compassionately address the needs of all individuals facing homelessness in Maricopa County.

Circle the City is a 501c3 nonprofit and the only Federally Qualified Healthcare Center in Arizona exclusively serving individuals facing homelessness. We operate two medical respite centers, two outpatient healthcare clinics, five mobile medical units and three street medicine teams.

Our Medical Respite Centers allow patients a safe place to heal and recover from an illness. 77 percent who complete their plan of care are discharged to somewhere other than the street or a shelter.

circlethecity.org

Tax Code 20693

Copa Health provides services for individuals with intellectual and developmental disabilities, mental health conditions and complex care needs.

At Copa Health, we believe housing and healthcare must coexist to drive whole-person care and see the positive outcomes we expect to deliver for the individuals and communities we serve. Our current projects focus on developing solutions for adults and youth with disabilities and mental health designations experiencing homelessness, eliminating barriers to engagement, stabilization and permanent housing.

Copa is collaborating with other healthcare organizations, governments and individuals to create transitional housing for those with serious mental illness, a youth facility for young people who might otherwise be homeless and lowincome housing with wraparound services for individuals served by Copa Health as well as community members.

copahealth.org

Tax Code 22338

For more than 95 years, Desert Mission has served the most vulnerable members of our community.

With the help of a generous community, today’s Desert Mission offers three major programs:

• Food Bank — Families visit the food bank and talk with an intake staff member. Based on individual needs, a healthy food box is prepared for take-home the same day.

• Lincoln Learning Center — This accredited early childhood learning center provides a solid foundation for kindergarten and life.

• Adult Day Health Care — Older adults, many with dementia, benefit from a safe, supervised, enriching program.

honorhealthfoundation.org

Tax Code 20516

We embrace substance-exposed babies and their caregivers with compassionate, evidence-based care that changes the course of their entire lives.

We encourage parent involvement in treating infants born exposed to substances by providing compassionate, nonjudgmental care, empowering the family to realize a healthier, more productive life. Families work with peer mentors and therapists and learn to support their newborn throughout the withdrawal process and, if necessary, create a child services case plan to avoid removal or work toward reunification of the child. Detailed case management includes treatment, safety plans, advocacy, legal referral and documentation assistance. Every dollar helps support this work that is critical in Arizona communities.

hushabyenursery.org

Tax Code 22019

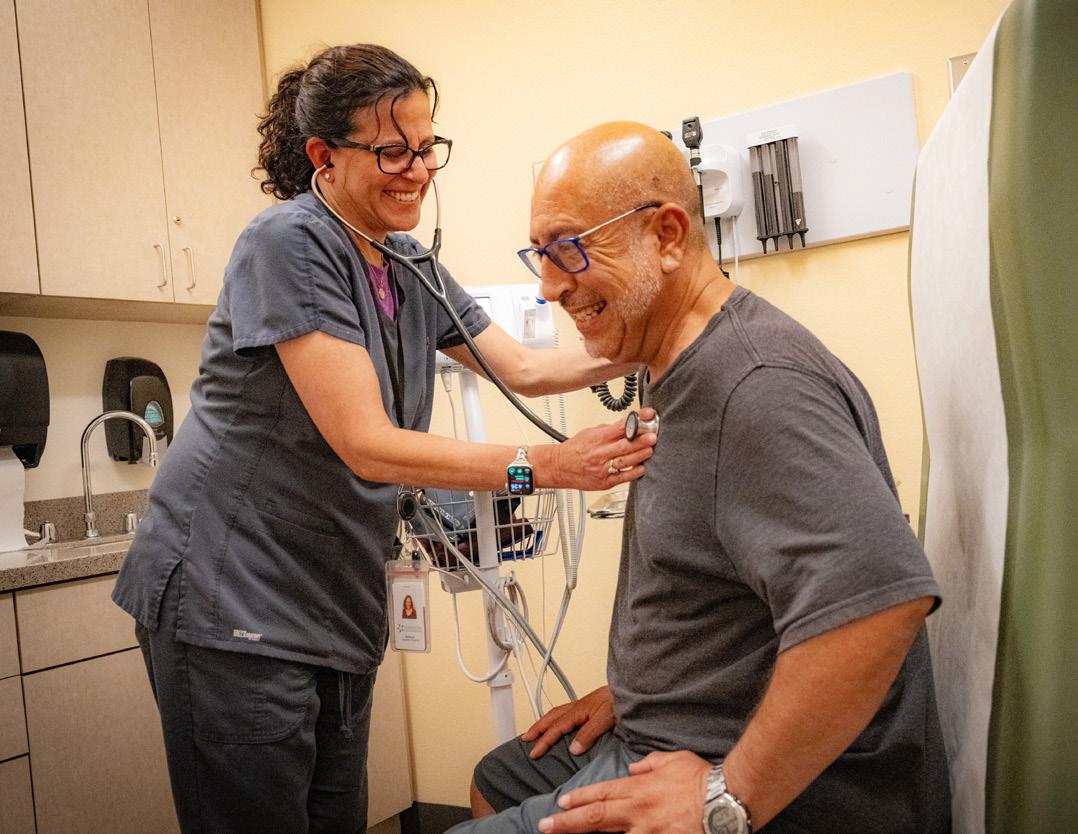

As one of Maricopa County’s largest integrated healthcare providers, Jewish Family & Children’s Service understands the link between mental and physical health.

Three of our healthcare centers offer comprehensive behavioral health and primary care services for individuals of all ages, faiths and backgrounds. Behavioral healthcare services, available at all our centers, include psychiatric care, medication management, substance abuse counseling and individual and group therapy. Our primary care services include treatment for colds and flu, acute pain and injuries, high blood pressure management and annual wellness exams.

jfcsaz.org

Tax Code 20255

Mission of Mercy’s mobile medical program restores dignity and provides healing through love to uninsured families through access to free healthcare, prescription medications and education at clinics across the Valley.

Since 1997, Mission of Mercy has provided free primary care services to uninsured patients with acute and chronic conditions. More than 90% of our patients have at least one chronic condition like type 2 diabetes or hypertension. Without regular medical care, they face life-threatening complications and poor quality of life. With six locations across Maricopa County, MOM utilizes the skills of volunteer physicians, nurses, pharmacists and specialists to deliver compassionate healthcare to the underserved. The Arizona medical program has provided 304,451 free medical visits and 567,581 prescription medications to 58,014 unduplicated patients over 27 years of service.

healingaz.org

Tax Code 20941

Our mission is to provide awareness, assistance and hope to Arizonans at-risk and impacted by kidney disease.

Since 1963, NKF AZ has been the agency of last resort for thousands of friends, neighbors and families in our kidney community. The heart of the foundation is its direct emergency aid services. These include rides to dialysis, help with critical medication, dental work and more. Path to Wellness, the foundation’s free community health screening, helps identify kidney disease early. The Erma Bombeck Donor Awareness Project educates people on the importance of kidney donation and Camp Kidney provides a free weekend of medically supervised magic for kids with kidney disease. NKF AZ proudly celebrated its 60th year serving the Arizona Kidney Community in 2023.

azkidney.org

Tax Code 20663

Phoenix Children’s Foundation supports Phoenix Children’s mission to advance hope, healing and world-class healthcare for children and their families in Arizona and beyond.

Phoenix Children’s has expanded from a single hospital into a nationally recognized pediatric health system providing world-class care to all patients who seek treatment — regardless of their ability to pay. Not only is it the only Level 1 Pediatric Trauma Center in Arizona, but one of only 59 nationwide. Through expansion efforts in the West and East Valley, Phoenix Children’s continues to serve Arizona families and beyond. One in four Arizona children has received care from a Phoenix Children’s provider, and Phoenix Children’s provides care to nearly 200,000 patient annually.

phoenixchildrensfoundation.org

Tax Code 20551

HEALTHCARE

Ryan House enriches the quality of life and creates cherished memories for children and their families, providing a much-needed break from 24/7 caregiving as they navigate life-limiting or end-of-life journeys.

The Support-A-Stay Program at Ryan House provides 24hour respite stays for children with life-limiting and terminal conditions. Respite is a gift of time; short-term overnight stays that help a family take breaks from the stress of 24/7 home care. Through the Support-A-Stay Program, we provide professional nursing care, expert Child-Life care, life-enhancing therapeutic/expressive activities and experiences, food and nourishment along with anticipatory grief, legacy work and bereavement support in our 12,500-square-foot, home-like medical facility.

ryanhouse.org

Tax Code 20088

Valleywise Health Foundation is the Phoenix-based nonprofit dedicated to providing financial support for critical patient and program needs at Arizona’s only public teaching health system, Valleywise Health.

At Valleywise Health, over 70 percent of our patients are financially vulnerable. By making a tax credit donation to Valleywise Health Foundation, you’re playing a vital role in transforming the health and well-being of our community. Your generous support enables Valleywise Health to fulfill its mission to provide exceptional healthcare, without exception, every patient, every time — regardless of a patient’s ability to pay.

Your contribution directly funds essential programs, innovative research, educational resources and critical patient services like burn survivorship care, evidencebased behavioral health programs and the training of tomorrow’s healthcare professionals.

valleywisehealthfoundation.org

Tax Code 20047

HEALTHCARE

HOUSING SUPPORT

HOUSING SUPPORT

Our mission is to prevent and end homelessness among individuals and families while advancing compassionate community solutions.

Your tax credit contribution provides shelter and supportive services to those experiencing homelessness in Arizona. Founded in 1984, CASS is Arizona’s largest and longest-serving homeless emergency shelter provider. To celebrate its 40th anniversary of delivering solutions to end homelessness, CASS will open its apartment-style senior shelter, The Haven, at the end of 2024. With this new addition, our adult and family shelters house more than 900 people each night, 365 days a year. Give today to support nightly shelter, case management and housing support for Arizona’s most vulnerable neighbors.

cassaz.org

Tax Code 20328

Bringing people together to build homes, communities and hope.

When you support Habitat for Humanity Central Arizona, you’re helping Arizona seniors, veterans and single parents in need of affordable housing and helping to build a stronger Arizona. Driven by the vision that everyone needs a decent place to live, Habitat for Humanity’s model showcases the power of collaboration. By offering a hand up, rather than a handout, they provide homes that represent more than just structures; they embody hope and opportunity. Donate to Habitat and Let’s Give Arizona a Hand Up!

habitatcaz.org

Tax Code 20434

House of Refuge provides transitional housing in a neighborhood setting for homeless families. Since 1996, our nonprofit charitable organization has been dedicated to rescuing homeless families through dignified transitional housing and crucial on-site supportive services in a peaceful neighborhood setting. Those services included housing for a year, case management, education and employment services, helping hands donation center, community center for kids and a teen center for teens.

houseofrefuge.org

Tax Code 86-0662244

Keys to Change uses the power of collaboration to create solutions to end homelessness for individuals across Maricopa County.

Your donations to Keys to Change will support individuals experiencing homelessness in finding permanent solutions to end their homelessness. Tax credit contributions allow us to respond to critical needs such as shelter and food and provide assistance in finding permanent housing. Funds support collaborative efforts for wraparound care such as medical, dental and behavioral healthcare, obtaining identification and social service benefits, employment resources, reuniting with friends or family and more. Your contributions can make our vision a reality: a community without homelessness.

keystochangeaz.org

Tax Code 20970

HOUSING SUPPORT

HOUSING SUPPORT

Since we opened our doors in 2000, Maggie’s Place has provided over 1,200 homeless, pregnant and parenting women and 700 babies with a safe and nurturing environment.

Today, we manage and operate five residential homes throughout Maricopa County that serve over 100 women each year. Your tax-deductible contribution directly supports our shelter operations, which provide a safe and nurturing environment, access to resources, supplies and ongoing support, helping women break the cycle of generational trauma so they can build a meaningful, independent life for themselves and their families.

maggiesplace.org

Tax Code 20492

A New Leaf provides lifesaving shelter and support to families experiencing homelessness, domestic violence and other crisis situations. Our mission is “Helping families, changing lives.”

Your generous tax credit donation will provide food, immediate shelter and long-term support to a family experiencing homelessness in your local community. All contributions will be used to serve families in need at | A New Leaf’s life-changing homeless shelters and domestic violence shelters across the Valley. By making a tax credit donation, you will be helping a family to overcome homelessness and find stability. Thank you for your kindness!

TurnaNewLeaf.org

Tax Code 20075

We seek justice for the innocent, the wrongfully imprisoned and those who have suffered manifest injustice under Arizona’s criminal justice system.

The Arizona Justice Project is the only nonprofit organization in Arizona dedicated to helping those who have been wrongfully convicted or who have suffered manifest injustice regain their freedom. Over the past 26 years, the AJP has helped 50 individuals regain their freedom and has been involved in several court cases that have had a positive impact for numerous incarcerated individuals. Many of these individuals spent decades in prison, away from their families and communities. Along with providing free post-conviction legal representation, AJP also assists clients with reentry, providing support for housing, work, education, access to healthcare and other benefits.

azjusticeproject.org

Tax Code 20725

ALWAYS provides free wraparound legal services to trafficking survivors of all ages and people under 25 impacted by crime, homelessness and foster care.

Donations make ALWAYS’ family law, immigration law, and criminal history repair services possible for trafficking survivors of all ages and young people seeking to overcome adversity and achieve safety and opportunity. Family law support includes representation and other assistance with orders of protection, divorces, child custody, and child support. The ALWAYS team also handles immigration matters, including T-Visas for trafficking victims, U-Visas for survivors of crime, Special Immigrant Juvenile Status for abused and abandoned youth, “green cards,” and citizenship. Many trafficking survivors have convictions keeping them from pursuing education and certain professions; ALWAYS helps eliminate these barriers through Good Cause Exceptions, set-asides, and expungement.

alwaysaz.org

Tax Code 20888

SENIOR SERVICES

To provide recovery and healing opportunities in our community by sharing our journey.

Recovery Empowerment Network is an organization dedicated to supporting individuals in their recovery journeys through a variety of services and programs. REN focuses on providing meaningful and enriching recovery support by offering resources that foster personal growth, well-being and community involvement. Their services include educational workshops, counseling and community-building activities aimed at empowering members to achieve and sustain recovery. REN is committed to creating a safe and supportive environment for all participants, emphasizing the importance of ethical behavior and adherence to guidelines to maintain a positive and effective recovery community.

renaz.org

Tax Code 20273

Advance is creating new possibilities and promising futures by building optimal health in under-resourced communities in Arizona.

Through our Stove to Table program, Advance provides culturally appropriate meals and nutrition education to older adults living in low-income senior housing across Maricopa County. The goal of our program is to help them maintain healthy, independent lifestyles for as long as possible. Every Tuesday and Wednesday, we deliver over 200 fresh, nutritious meals directly from our kitchen to their doors. Our dedicated staff and wonderful volunteers prepare, package and deliver these meals using locally sourced ingredients, including produce from our own garden. Through your support, we are able to serve over 10,000 older adults annually!

advancecommunity.org

Tax Code 22188

The Area Agency on Aging, a private nonprofit organization, serves older adults, caregivers, persons with disabilities and many other special populations in Maricopa County through 58 unique programs and services.

Over the past five decades, the Agency has delivered more than 39 million meals to isolated older adults, offered family caregivers over 11 million hours of respite, provided 4.3 million hours of home care and responded to over 1 million calls to its 24-hour Senior HELP LINE. Your contribution will help the Agency continue to impact the community and respond to unmet needs by providing critical assistance and support to more than 110,000 individuals annually.

aaaphx.org

Tax Code 20044

Aster Aging’s mission is to empower and support East Valley older adults and their families to remain independent and engaged in our communities.

Aster Aging is a nonprofit organization dedicated to serving our local communities for over 45 years. Our vision is to be a leader in providing direct services and mobilizing resources that support our older adult community’s changing needs. We offer a full continuum of programs aimed at independence with dignity as older adults and families navigate the journey of aging. Your contribution makes the difference for thousands of older adults in the East Valley through the support of critical programs, including Meals on Wheels, In-Home Supports, Senior Centers, social services and much more.

asteraz.org

Tax Code 20426

SENIOR

Benevilla enriches lives by serving older adults, adults with disabilities, children and the families that care for them by promoting health and independence.

Benevilla provides supportive services to community neighbors while recognizing that caring for the needs of older adults reaches beyond the individual to the entire family. Our services include Life Enrichment Adult Day centers with specialized programming for those unable to care for themselves (memory loss, Parkinson’s, stroke survivors) while providing much-needed respite for family caregivers, free home services allowing homebound older adults to remain independent in their own homes (assisted transportation, grocery shopping, friendly visitors and more), caregiver support groups and resources, preschool and childcare and Benefitness Adaptive Gym. With your support, we serve more than 5,500 individuals annually.

benevilla.org

Tax Code 20493

Duet promotes health and well-being through vitally needed free-of-charge services to homebound adults, family caregivers and grandparents raising grandchildren. Your generosity transforms lives. With Duet’s free-of-charge services, you bring compassion, dignity and hope to older adults facing isolation and overwhelming challenges. Your donations help aging adults maintain their independence, access vitally needed services and stay connected by being paired with dedicated volunteers. Your tax credit donations also support family caregivers and guide grandparents raising grandchildren, creating a stronger, healthier community. Your contributions provide bilingual personalized guidance, in-person and virtual support groups, and educational events, enriching lives every day. Volunteer, donate or ask for help. Together, we are partners in health and aging, making a lasting impact.

duetaz.org

Tax Code 74-2370522

At Jewish Family & Children’s Service, we’re passionate about helping older adults remain independent and engaged, no matter their faith or background.

Our JFCS Senior Enrichment program offers diverse online and in-person classes that encourage seniors to engage, move forward and have fun, welcoming everyone 60 and over. Classes include art and cultural experiences, insightful lectures, immersive tours and fitness programs. JFCS also offers older adults professional counseling, case management and advocacy and referral services.

jfcsaz.org

Tax Code 20255

As an organization with more than 130 years of caring for our community, Valley of the Sun YMCA responds quickly to creatively expand our programs to meet our community when, where and how we are needed most.

With your help, we can continue to ensure the health, safety and well-being of every YMCA senior. Donations will support programs for senior outreach and wellness, including transportation to medical appointment and grocery shopping, fall prevention classes, social activities and fitness classes. And, if you choose to, you can earmark your gift to your local Y community.

valleyymca.org/valley-ymca-cares

Tax Code 20708

Ability360 offers and promotes programs designed to empower people with disabilities so that they may achieve or continue independent lifestyles within the community.

Over 40 years ago, Ability360 began offering services to people with disabilities and has become the largest Center for Independent Living in Arizona. With a focus on empowering individuals with disabilities to achieve independent lifestyles, we offer five core services: information and referral, independent living skills training, peer support, advocacy, assistance with transitioning to community living and support for youth. In addition, we offer home care services, home modifications, employment services, sports and fitness programs and much more. Your tax credit donation ensures we can continue to support the disability community throughout Arizona regardless of their financial abilities.

Ability360.org

Tax Code 20090

Our mission is to improve the quality of life for burn survivors and their families in Arizona, while promoting burn prevention advocacy and education.

Survivors rely on medical professionals, emotional support staff, families and friends. That’s why Arizona Burn Foundation offers compassionate services that bring all parties together through a comprehensive continuum of care.

Arizona Burn Foundation has been serving the Grand Canyon State and its residents since 1967, providing education, emotional support, financial assistance and leadership development programs to help those who’ve encountered the devastating effects of burn injuries. From the time of a survivor’s injury through the rest of their life, Arizona Burn Foundation supports burn survivors and their families. We bring them through recovery until they no longer identify as a victim, but instead as a human being of intrinsic value and worth.

azburn.org

Tax Code 20667

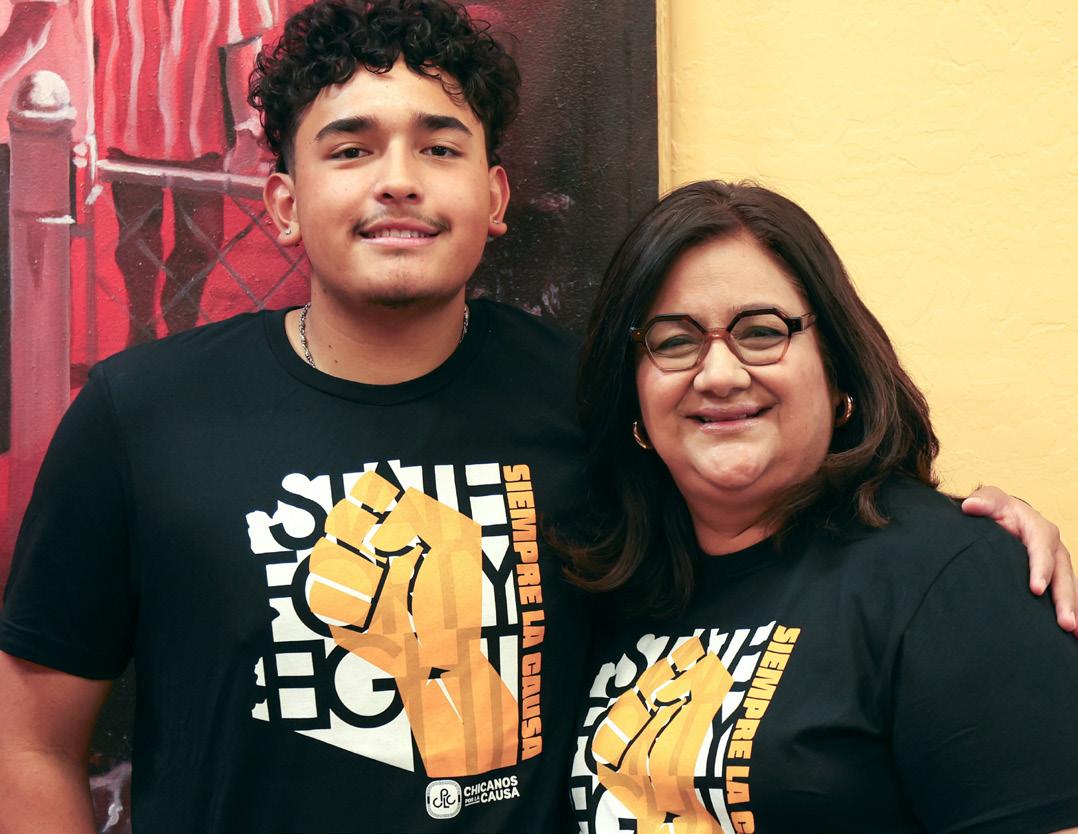

Building our better tomorrow. We drive systemic change, fighting for all people to have the power to live a life of dignity.

CPLC began with a group of student and community activists who pushed back against racial discrimination. Today, we are the largest Latino nonprofit in the country, providing services to people of all backgrounds while honoring our Mexican American roots. Our programs give individuals and families a seat at the table through five Areas of Impact: Health & Human Services, Housing, Education, Economic Development and Advocacy.

cplc.org

Tax Code 20056

Our mission is to empower women to achieve economic independence by providing a network of support, professional attire and the development tools needed to help women thrive in work and life.

From career development to coaching, networking, cohort-based learning and professional styling, Dress for Success Phoenix delivers free programs that reach women when and where they are along their personal journey. Seventy-five percent of women job seekers in our programming are employed within three months, and 85 percent of women who participate in our financial education programs increase their savings.

dfsphoenix.org

Tax Code 20168

Our mission is to provide emergency shelter and social services to help families move toward independent housing and self-sufficiency through community partnerships.

We have four Valley sites exclusively focused on sheltering families with children AND THEIR PETS. Some families endured a job loss or eviction. Others come to Arizona for a fresh start.

A tax credit is their treasured welcome mat. It ensures that our families have a loving place to start anew. It preserves our unique shelter model that features family-style dinners and private, overnight lodging in the community.

Our Shelter Support Team provides basic needs and case management that reveals pathways for a job, savings and housing — often in less than 60 days with a 70 percent success rate!

familypromiseaz.org

Tax Code 20453

A pillar in the Phoenix community for over 30 years, Fresh Start transforms lives by providing access and resources that help women achieve self-sufficiency and use their strength to thrive.

Fresh Start works toward a future of unlimited opportunities for all women. To empower women to achieve selfsufficiency, our organization’s strategic approach encompasses five key areas of service: Family Stability, Health and Well-being, Financial Management, Education and Training, and Careers. These pillars of support are the foundation for the Impact Program, a comprehensive pathway to economic independence and personal empowerment. Through access to our in-person and virtual workshops, workforce training, family law support and other resources, thousands of Arizona women aged 18 and older have transformed their lives, the lives of their children and our community for generations to come.

freshstartwomen.org

Tax Code 20525

Hope’s Crossing helps at-risk women create lives of self-sufficiency, community and hope. We guide high-potential women through a process of recovery, rehabilitation and cognitive behavioral transformation to produce productive citizens, ready to contribute to our economy.

Hope’s Crossing offers a program of emotional support geared toward creating a new belief system that promotes whole and healthy living, as well as employment support, financial coaching and housing assistance. Through our unique, comprehensive approach, we give women the tools they need for a new beginning and sustainability. Our Signature Fundamentals of Freedom Program offers a holistic approach that addresses foundational skills building, critical thinking and decision making, and finally, Leadership Development to guide women and families to thrive in life.

hopescrossing.org

Tax Code 20946

Jewish Family & Children’s Service is dedicated to strengthening the community by providing behavioral health, healthcare and social services to children, teens and adults of all ages, faiths and backgrounds.

Our wide range of social services to residents of Maricopa County includes child welfare programs, support for families in transition, programs for foster care youth, domestic violence services, and counseling and resources for older adults.

jfcsaz.org

Tax Code 20255

Since we opened our doors in 2000, Maggie’s Place has provided over 1,200 homeless, pregnant and parenting women and 700 babies with shelter across our five residential homes.

In addition to providing a safe and nurturing environment, we provide year-round access to resources, supplies and ongoing support at our Family Success Center for mothers during their time in our care and after program completion. We offer classes, workshops and support groups on parenting, infant care, career counseling and addiction recovery, along with providing groceries, formula, diapers and hygiene supplies. Your tax-deductible contribution directly supports our shelter operations, as well as all services and supplies available to women at no cost, helping them break the cycle of generational trauma to build a meaningful, independent life for themselves and their families.

maggiesplace.org

Tax Code 20492

NourishPHX is the trusted community hub serving vulnerable individuals and families by offering resources to satisfy immediate needs and provide pathways to self-sufficiency.

Your tax credit donation helps low-income families, individuals and seniors with food, clothing, SNAP Outreach and job resources. In addition to direct services, we partner and coordinate many free community classes and workshops, including topics like financial education and jewelry-making. Volunteers are always welcome.

nourishphx.org

Tax Code 20385

As the oldest American Indian Center, we serve as the hub for the advancement of our urban American Indian relatives with culturally relevant essential services, programs and initiatives. We envision a healthy and thriving urban American Indian community.

Since 1947, the Phoenix Indian Center has been a center of community engagement. Continuing with this tradition, we provide opportunities to connect and support the children, youth and families who live and work in our busy metropolitan area. In 2024, our Center provided direct assistance to over 9,500 individuals, with our outreach efforts touching the lives of more than 35,000 urban American Indian people. Your financial support demonstrates your commitment to making a tangible difference in the lives of those we serve.

PhxIndCenter.org

Tax Code 20394

We provide Christ-centered, life-transforming solutions to people facing hunger, homelessness, addiction and trauma.

When you support the work at Phoenix Rescue Mission, you are addressing short-term needs, with a long-term mentality. Our Street Outreach team drives throughout the Valley every day, meeting neighbors in need where they are and providing basic necessities and care. As we build relationships in the community, we offer a way to address deep-rooted issues through our residential programs for men, women and children. Because of incredible supporters like you, we continue to see the blessing of love, hope and transformation for our neighbors across the Valley.

phxmission.org

Tax Code 20549

Ronald McDonald House Charities® of Central and Northern Arizona is a welcoming “home-away-fromhome” for families with children facing medical challenges, providing an atmosphere of comfort, hope and courage.

One in five children live in rural communities. Yet most specialized pediatric care for life-threatening illnesses or injuries is available only in larger cities like Phoenix. Ronald McDonald House Charities® of Central and Northern Arizona offers families a comfortable, safe place to stay near their hospitalized children. Three Valley locations (two in Central Phoenix and one in Mesa) offer vulnerable and devastated families a good night’s sleep, nourishing food to keep up their strength and crucial emotional support — all at no cost to families.

rmhccnaz.org

Tax Code 20400

The Salvation Army has been helping our neighbors in need in Maricopa County overcome poverty, addiction and economic hardships through a range of social services for 130 years.

Your generous tax credit contributions provide food for the hungry, shelter and clothing for the homeless, rent and utilities assistance, disaster and heat relief, holiday joy, senior activity and outreach, adult rehabilitation, skills training, opportunities for under-resourced children and emotional and spiritual support — “Doing the Most Good” for over 310,000 people annually through nearly 20 centers of operation in Maricopa County. The Salvation Army ranks #6 on Forbes’ latest list of America’s Top 100 Charities.

salvationarmyphoenix.org

Tax Code 20671

St. Vincent de Paul harnesses the power of our community to feed, clothe, house and heal all who are in need — whether in body or in spirit.

We believe in the intrinsic value of every person — to serve and be served. Our dining rooms and food boxes are more than just meals. Families gain access to supportive programs and referrals to community resources. When people are at their lowest point and have lost their housing, St. Vincent de Paul is there to offer not only a bed, but a path to find home again. With your support, St. Vincent de Paul is helping seniors, families and children in need in our community with food, housing, affordable healthcare and much more. stvincentdepaul.net

Tax Code 20540

STARS has been serving the intellectually and cognitively disabled throughout the Valley for over 51 years. Our mission is to change lives through opportunity by providing job training, life skills and a community in which these individuals can thrive.

All STARS programs benefit from tax credit contributions, including our Competitive Integrated Employment, our Community-Based Employment, our CommunityWork center-based work, and our Day Training for Adults.

starsaz.org

Tax Code 20117

St. Joseph the Worker is dedicated to helping homeless, low-income and other disadvantaged individuals achieve self-sufficiency by providing the resources and support necessary to secure quality employment and stable housing.

SJW’s Employment Without Barriers Program offers personalized, one-on-one support tailored to each client’s unique needs. This includes job leads, application guidance, resume help, interview prep, professional clothing, hygiene products and transportation vouchers. We also provide essential resources like uniforms, work gear, tools, certifications and transportation assistance to help clients smoothly transition to their first paycheck. Workforce Villages is a free 90-day transitional housing program for employed clients experiencing housing insecurity. Through this program, clients save, on average, $5,000 to cover rent and security deposits, allowing them to secure their own housing.

sjwjobs.org

Tax Code 20248

Since 1979, the WHEAT organization has been working to end hunger and poverty at the root. The mission of WHEAT is to educate, advocate, engage and empower individuals in the fight against hunger and poverty.

Our major programs include the Clothes Silo, a clothing boutique empowering economically disadvantaged women through the provision of free workwear and offering on-the-job training, as well as the Fair Trade Store, a retail shop partnering with artisans and small-scale farmers around the globe to help break the cycle of poverty through fair and ethical trade.

hungerhurts.org

Tax Code 20391

We serve all people who have disabilities to learn, work and live successfully with dignity and independence. When you support ACCEL, you empower people who have disabilities to develop their unique gifts. Your tax credit contribution directly benefits our educational, behavioral, therapeutic and vocational programs that help children and adults with developmental disabilities, behavior disorders and intellectual disabilities. Together, we can create a more inclusive Arizona where everyone is celebrated for their abilities. Join us in transforming lives and building a brighter future for our disabled community.

accel.org

Tax Code 20317 SPECIAL

Our mission is to create connections, empowering everyone in the Autism community with the resources needed to live fully.

When you support the Autism Society of Greater Phoenix, you are helping Autistic individuals and their families across Arizona. We have proudly served the Valley since 1973. We are families helping families. Our vision is to create a world where everyone in the Autism community is connected to the support they need, when they need it. We offer programs for children, teens and adults. Each program is designed to support social, communication and job skills. Our events provide valuable information and give our community a chance to connect and share resources. We invite you to join our mission and empower your community.

phxautism.org

Tax Code 20728

SPECIAL NEEDS

SPECIAL NEEDS

Established in 1968, Civitan Foundation, Inc. is a Multi-Service Life Programming Agency that enriches the lives of children and adults with intellectual and development disabilities (IDDs).

With an innovative and visionary approach, Civitan serves as a centralized resource for a broad range of essential services and life-enhancing programs. The organization provides educational day programming, Camp Civitan week-long summer and monthly year-round weekend camp adventures, life skills training, job training, paid employment, recreation, family respite, home-based services and transportation. The diverse range of curriculum continually evolves to serve member interests and goals.

Civitan creates unparalleled and life-enhancing opportunities for Arizonans with IDDs that are safe, accessible and affordable.

civitanfoundationaz.org

Tax Code 20532

Cortney’s Place is a family-founded nonprofit providing an inclusive, stimulating and meaningful communitybased day program for adults with intellectual and developmental disabilities.

Cortney’s Place aims to encourage, support and engage adults with developmental disabilities. Our focus is providing participants with fulfilling opportunities that enable them to live an active, enriched life through a monthly curriculum combining therapies, purposeful classes and community outings. Our year-round programming includes hydrotherapy, healthy cooking, art, science, life skills, adaptive fitness, music therapy and technology learning groups. Our programming gives a foundation for individuals to improve self-esteem, acquire social skills and gain independence. Cortney’s Place provides a safe, inclusive, positive and supportive environment. Your tax credit contribution helps support the amazing work we do at Cortney’s Place.

CortneysPlace.org

Tax Code 20130

SPECIAL

Founded in 1985, Gesher Disability Resources serves children and adults affected by a disability through inclusion assistance in the classroom, resource referral, residential support and social groups.

Gesher programs offer tools that break down barriers caused by stigma and isolation within the Intellectual & Developmental Disability (IDD) community, making participation in social activities like bowling, swimming, zoo visits and other special events integral to their well-being. Every month, Gesher offers activities focused on inclusivity and fun for all. Expansion of Gesher’s residential program is a priority this year since members of the IDD community have difficulty accessing safe, secure, affordable housing. Gesher also offers educational support for students with learning challenges attending private schools that lack the bandwidth to provide individualized learning. Over 4,000 Arizonans are impacted by Gesher programming each year. gesherdr.org

Tax Code 20748

Lions Camp Tatiyee provides life-changing summer camp experiences to special needs youth from across Arizona free of charge, helping to promote their emotional health, independence, self-esteem and confidence.

You can help provide a life-changing summer camp experience for a child with special needs by making a tax credit contribution to Lions Camp Tatiyee. The camp serves children across Arizona with learning, developmental, physical, hearing and vision-related disabilities. Offering our programming entirely free of charge, we conduct eight one-week sessions each summer season according to the ages and disabilities of the children we serve, providing adventure programming, educational curriculum and empowerment activities. From go-kart racing to science to archery to arts and crafts — Lions Camp Tatiyee makes all summer camp activities accessible to the special needs community!

CampTatiyee.org

Tax Code 20677

SPECIAL

SPECIAL

SPECIAL

Providing sports and recreation opportunities for individuals with physical and developmental disabilities and visual impairments.

Our vision is a community that creates opportunities that empower individuals of all abilities through sports and recreation. Recognizing the importance of recreation and competitive opportunities that contribute to quality of life, the primary mission of AzDS is to provide a variety of programs and activities to individuals with disabilities. AzDS offers two different types of programs that include adaptive opportunities for individuals with developmental disabilities through the Team Mesa programs, as well as adaptive opportunities for individuals with physical disabilities through the Arizona Heat Physically Challenged programs. Our goal is to let no one sit on the sidelines!

arizonadisabledsports.com

Tax Code 20139

Providing a safe, fun and successful baseball experience to individuals with special needs.

Tax credit contributions help defray the costs of uniforms, walk-up songs, baseball cards, awards and more for our 400+ players with special needs. This support allows us to continue to offer our services at no cost to the family.

MiracleLeagueAz.com

Tax Code 20258

SPECIAL NEEDS

We assist individuals with special needs in developing their skills through adaptive activities and interaction with pets.

Pawsitive Friendships is an organization that assists individuals with special needs by incorporating pets into adaptive activities. Our approach extends beyond just providing companionship and instead focuses on personal development, building confidence and creating new opportunities by utilizing the unique bond between people and pets.

Our program helps improve skill development in various areas, such as motor skills, emotional regulation, social participation, executive functioning, planning, communication and more. Pets play a crucial role in catalyzing these improvements.

pawsitivefriendships.org

Tax Code 20861

Since 2001, Power Paws has provided trained service dogs for disabled children and adults.

One hundred percent of your tax credit donation will go toward training assistance dogs for disabled children or adults. There is no cure for the children and adults Power Paws serves.

azpowerpaws.org

Tax Code 20712

SPECIAL NEEDS

YOUTH DEVELOPMENT

Healing Arizona Veterans sponsors treatment for military veterans with wartime Traumatic Brain Injury (TBI) and Post Traumatic Stress Disorder (PTSD). Treatment utilizes Hyperbaric Oxygen Therapy (HBOT) at private facilities.

Healing Arizona Veterans uses donations to sponsor the treatment of military veterans suffering from wartime TBI and PTSD. The treatment utilizes Hyperbaric Oxygen Therapy at private facilities. These veterans’ evaluations and treatments are covered by HAV, a grassroots all-volunteer nonprofit. HAV receives donations to cover the costs of this critical, life-changing care at a time when veterans need it most but can least afford it. Qualified veterans receive treatment at private facilities across Arizona.

healingarizonaveterans.org

Tax Code 22353

To create and support one-to-one mentoring relationships that ignite the power and promise of youth. For nearly 70 years, BBBSAZ has operated under the belief that every child has the inherent ability to succeed and thrive in life.

Each time a gift is made to Big Brother Big Sisters of Central Arizona (BBBSAZ), potential is ignited within our community. Big Brothers Big Sisters makes meaningful, professionally supported matches between adult volunteers (“Bigs”) and youth (“Littles “) aged 6 through 18 in Maricopa County and Pinal County. We develop constructive relationships that have a direct and lasting effect on the lives of young people and the community. Dedicated mentors can help their mentees make positive choices and lay out plans for their futures. When you give to BBBSAZ, you join a network of thousands who believe in empowering potential.

bbbsaz.org

Tax Code 20332

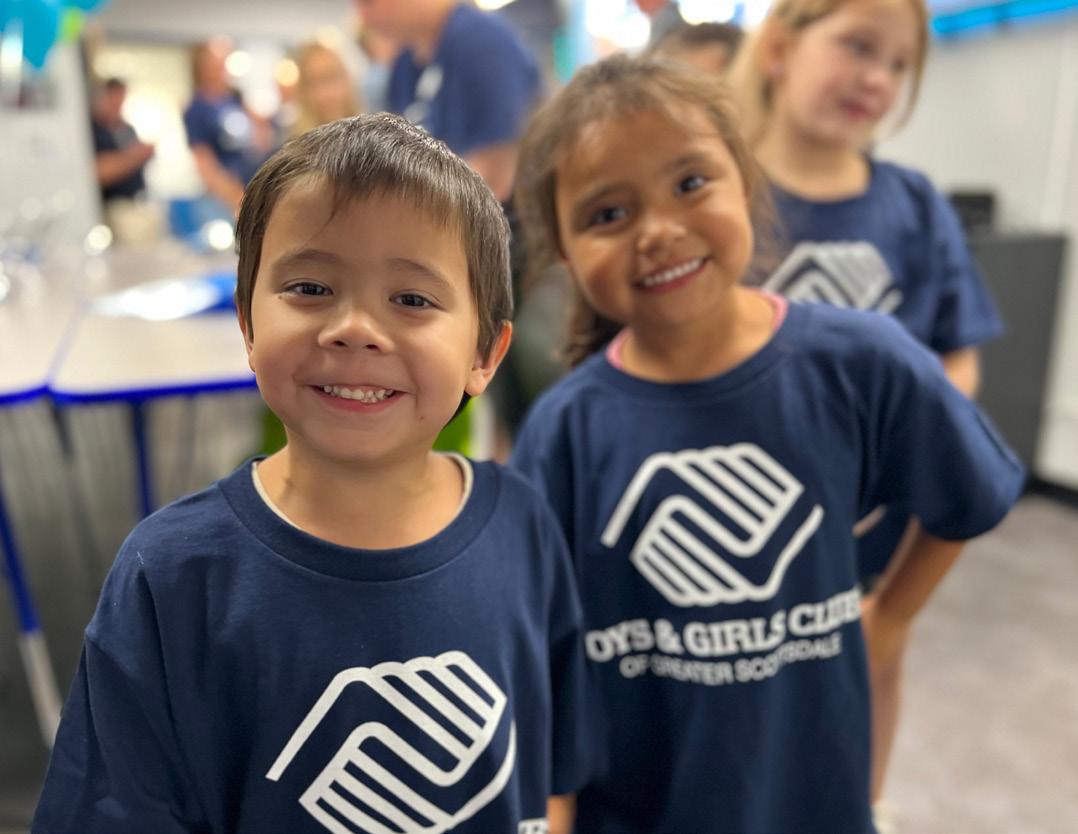

To enable all young people, especially those who need us most, to reach their full potential as productive, caring, responsible citizens.

At Boys & Girls Clubs of Greater Scottsdale, we provide a safe place with caring mentors and worldclass programs for youth who need us most when school is out. Research shows that when compared to their peers, Club members have a higher interest in pursuing STEM careers, volunteer more in their local communities and are more physically active. No matter the circumstances that bring a child to us, our youth development professionals help them set and achieve personal, academic and creative goals. We work to prove that every kid has what it takes to succeed.

bgcs.org

Tax Code 20091

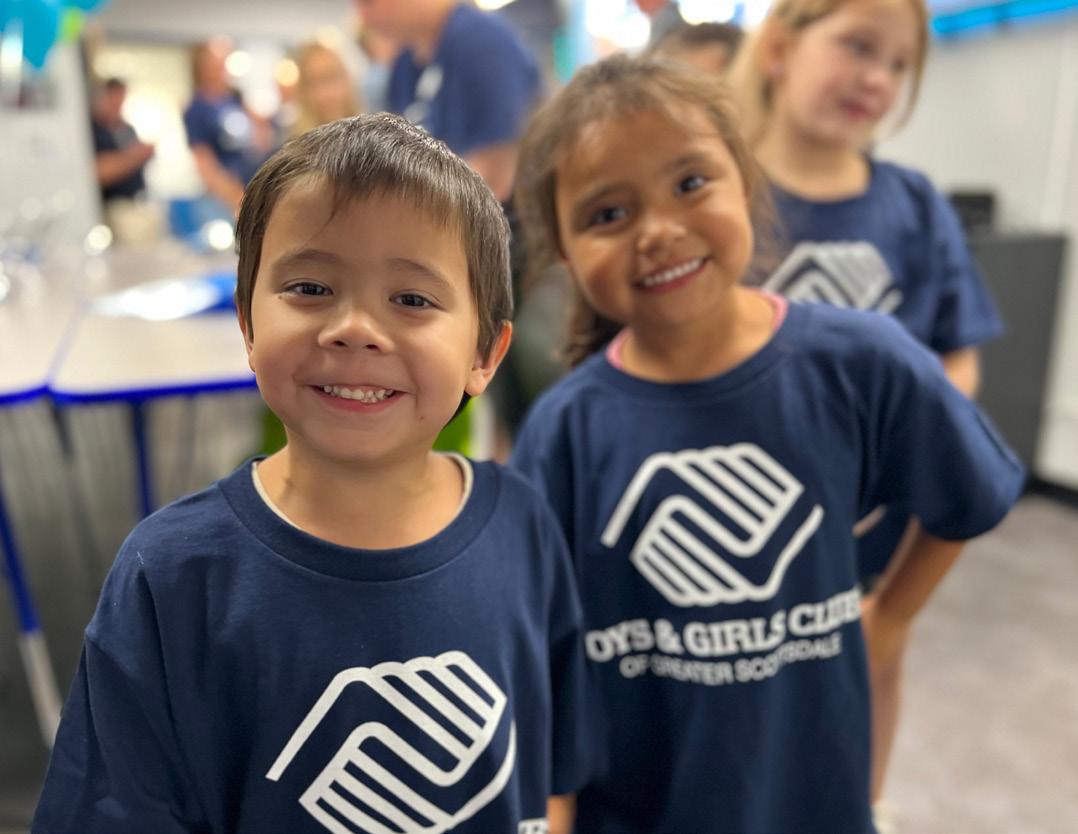

Boys & Girls Clubs of the Valley offers affordable after-school and summer programs for 12,000+ young people in grades K-12. At 31+ Clubs across the Valley and in greater Arizona, BGCAZ provides award-winning programs designed to change the lives of young people.

For thousands of Valley kids, their Boys & Girls Club is a safe refuge where they can learn, play, grow and learn to be a strong, resilient adult. Please help ensure quality services and life-changing programs for kids in need by giving your gift today.

Your generosity impacts more than 12,000 kids with proven programs that offer safe spaces where they can go when they are out of school and enjoy positive role models, fun sports, healthy meals and academic success. bgcaz.org

Tax Code 20331

Nurturing youth and their well-being by connecting them with the healing power of pets and compassionate adults.

Gabriel’s Angels provides resilience-building pet therapy programs to kids and teens ages 5-18 at schools, shelters and other youth-serving organizations throughout Arizona. Thanks to the generous support of our community, services are provided free of charge to ensure that youth receive the support they need regardless of their families’ economic circumstances. With the unconditional love of therapy pets to help guide the way, youth enjoy learning the nuances of teamwork, forming healthy relationships, regulating emotions, practicing attunement, treating others with kindness, celebrating differences and respecting others.

gabrielsangels.org

Tax Code 20449

At ICAN, we provide access to out-of-school time opportunities that empower all youth and their families to pursue what is most meaningful to them.

Our award-winning, year-round youth development programming enriches the lives of children and their families and sets them up for success in their futures. ICAN focuses on three key areas that work together to empower our youth: life skills development, educational enrichment and workforce readiness. When we support children’s growth, we leave a lifelong impact on their well-being and set the foundation for a healthy, prosperous future. When children and families prosper, so do our communities. By leading the way for every family to access life-changing childcare, we’re building stronger communities across Arizona.

icanaz.org

Tax Code 20031

As one of the largest providers of healthcare and social services in Maricopa County, Jewish Family & Children’s Service supports children and teens across the community, no matter their faith or background. Our healthcare centers provide behavioral health and primary care services to thousands of children and teens each year. At JFCS, we also partner with the Arizona Department of Child Safety to support families through counseling and provide programs for foster youth to achieve their educational and vocational goals.

jfcsaz.org

Tax Code 20255

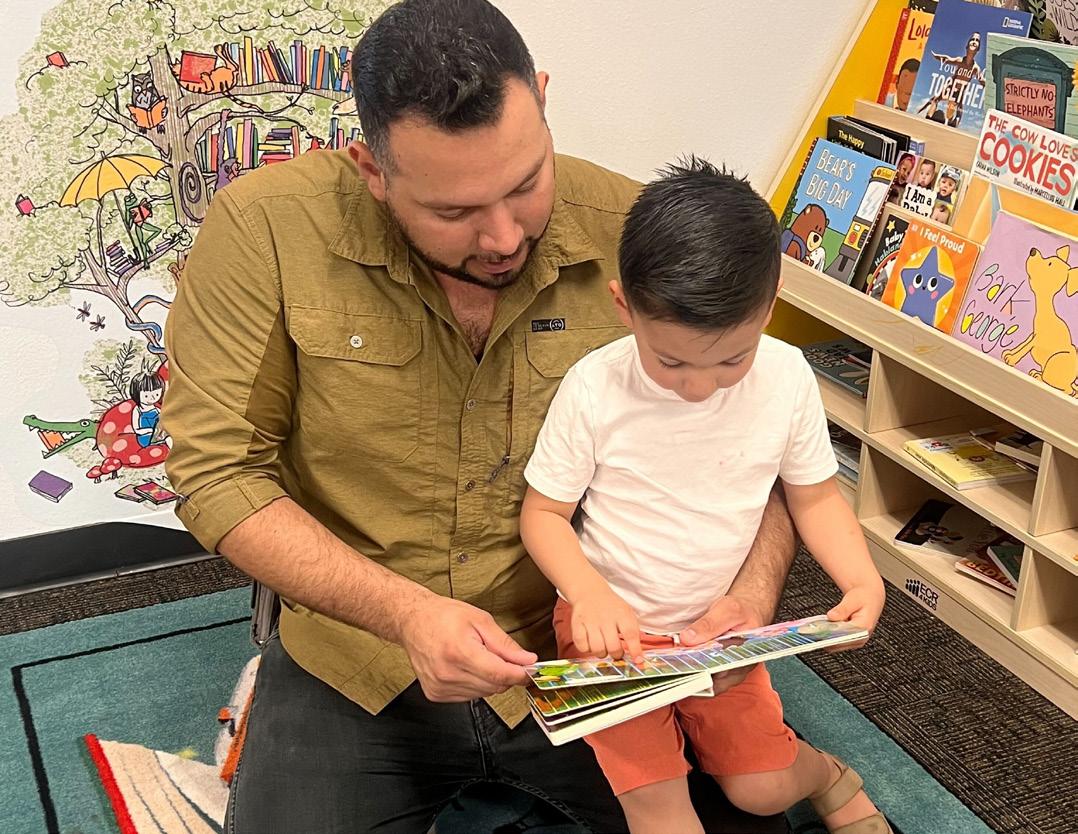

Make Way for Books empowers parents, caregivers and educators in under-resourced communities throughout the state with the tools they need to nurture each child’s development, learning and love of reading.

Education is a powerful tool to advance our community. When you support Make Way for Books, you are helping Arizona’s kids build foundational language and literacy skills to ensure lifelong learning. We proudly serve over 30,000 children (birth to 5), parents and educators annually through our free language and literacy programs. Your contribution comes with a tax credit, so you can significantly impact children’s education while reducing your tax burden. Partner with us today, and let’s ensure all of Arizona’s kids are set up for success! makewayforbooks.org

Tax Code 20166

Our Mission: Transforming the lives of youth by providing the support, stability and skills they need to flourish in the community and in their families.

New Pathways for Youth serves teens who have experienced extreme poverty and adversity by providing 1:1 mentoring with a dedicated adult and a proven path for personal growth that includes tailored goal setting and connection to vital resources, all within a supportive peer group. Your contribution enables us to provide youth with college and career readiness programs, scholarship opportunities, trauma-informed personal development workshops, engaging community outings, and seasonal youth-focused events. As a result, 90 percent of NPFY’s Youth graduate from high school, and 80 percent pursue post-secondary education, which is key for breaking the cycle of poverty.

npfy.org

Tax Code 20267

one·n·ten serves LGBTQ+ youth and young adults ages 11-24. We enhance their lives by providing empowering social and service programs that promote self-expression, self acceptance, leadership development and healthy life choices.

With your support, LGBTQ+ youth and young adults acquire skills for self-sufficiency, well-being and resilience. Signature programs include Youth Center, Satellite Groups, Identity-Specific, Workforce Development, Housing Solution, Camp OUTdoors and Health & Wellness. Lesbian, gay, bisexual, transgender, queer and questioning (LGBTQ+) young people may feel unsafe and unwelcome in youth programs developed for the general population. By affirming self-identified gender identities and sexual orientations, one·n·ten maintains a supportive environment where LGBTQ+ youth feel comfortable learning alongside their peers.

onenten.org

Tax Code 20190

We assist individuals with special needs in developing their skills through adaptive activities and interaction with pets.