Retail without borders

CEO of Central Food Group Stephane Coum on how the Thai supermarket giant is creating a seamless shopping experience for consumers

Already a massive consumer market for global suppliers, China is becoming even more competitive as a producer and exporter – and it's beginning to shake up the Asia trade

Opportunities abound but innovation key

Asia Fruit Logistica is back! And it’s bigger than ever... brimming with fresh insights, innovations and business opportunities. In this edition, we bring you the most comprehensive preview to the premier event on Asia’s fresh produce trade calendar (see p72-119) – and a publication jam-packed with exciting industry news and developments. China – once again the largestsingle exhibiting country at Asia Fruit Logistica – remains the driving force in Asia’s fresh produce business. Already a massive consumer market for global suppliers, China is becoming even more competitive as a producer and exporter – and it's beginning to shake up the Asia trade (see market focus, p24-46). Historically, China’s inroads into export markets were driven primarily by price. Now advances in quality, growing technology and diversification into newer fruit varieties are powering a new era of expansion. China’s efforts to embrace protected fruit varieties will only accelerate this growth and development in future, as an insightful report from Bloom Fresh's David Smith details (p40-41). While all this has far-reaching implications for global suppliers to Asia, market opportunities still abound across the region. Despite the downturn in China’s economy, consumers’ appetite and enthusiasm for fresh produce have not diminished. On the contrary, new trends in consumption are emerging all the time, as Trendforsee’s Clark Xiao outlines (p32). Marketers must stay abreast and tailor their brand strategies to capitalise. Innovation is key to realising the market opportunities in Asia, and there are plenty of cutting-edge developments covered in this edition. Take in the range of exciting brands and varieties profiled across our features. Read about the landmark investments in ports and logistics infrastructure, the groundbreaking grading and packaging technologies, and the breakthroughs in breeding. It underlines the magnitude of the market potential. There’s so much to share, discover and discuss, and Asiafruit creates the forum at Asiafruit Knowledge Centre, our brand-new, all-in-one content hub at Asia Fruit Logistica. We look forward to seeing you there.. A

John Hey, Editor

Stephane Coum, CEO of

BRIEFINGS FEATURES DISPATCHES

Events

fruitnet.com/freshproduceindia Fresh Produce India attracted record numbers as it returned to Mumbai on 21-22 March for the first time since 2019. View the photo gallery online.

Photo Blog

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

News

fruitnet.com/asiafruit Asiafruit's news website provides regular updates on all the top stories from Asia's fresh fruit and vegetable business.

Asiafruit in Chinese

asiafruitchina.net

Visit Asiafruit's Chinese-language portal for all the latest news in Mandarin. Sign up to our newsletter, Asiafruit News and find us on WeChat. Our WeChat ID is asiafruit.

Expand your network of professional contacts and join the fresh produce conversation by visiting the Asiafruit LinkedIn account. LinkedIn

linkedin.com/showcase/asiafruitmagazine

x.com/asiafruit Keep up to date with news, opinions and developments from around the Asia's fresh produce trade by following our dedicated X account. X

Asiafruit App

desktop.asiafruitmagazine.com

Download the new Asiafruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed on the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

Fruitbox

https://bit.ly/3eHjlS0

Download Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts.

EDITORIAL

editor

John Hey

+61 3 9040 1602 john@fruitnet.com

digital editor

Liam O'Callaghan

+61 3 9040 1605 liam@fruitnet.com

staff journalist

Bree Caggiati

+61 3 9040 1606 bree@fruitnet.com

china editor

Yuxin Yang +61 3 9040 1604 yuxin@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

senior designer

Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive

Poppy Bowe

+44 20 7501 3719 poppy@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions

+44 20 7501 0311 subscriptions@fruitnet.com

ADVERTISING

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

europe & middle east

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

greater china, thailand & philippines

Jennifer Zhang +86 21 6136 6010 jennifer@fruitnet.com

uk, ireland, belgium, greece, turkey & south-east europe

Giorgio Mancino

+44 20 7501 3716 giorgio@fruitnet.com

us & canada

Jeff Long +1 805 966 0815 jeff@fruitnet.com

south africa

Fred Meintjes +27 28 754 1418 fredmeintjes@fruitnet.com

italy

Giordano Giardi +39 059 786 3839 giordano@fruitnet.com

MANAGEMENT

commercial director

Ulrike Niggemann +49 211 99 10 425 ulrike@fruitnet.com

managing director Chris White +44 20 7501 3710 chris@fruitnet.com

CONTRIBUTORS

David Smith bloom fresh china David details China's shifting position towards protected varieties over the years through considerable government investment, research, and strategic agricultural innovation. china–p40-41

Dan Lepard food writer Dan shares his experience working alongside conservationists aiming to repopulate near-extinct Citrus Taiwanica trees and use the fruit in the citrus peel market. citrus–p144-145

Jeff Long fruitnet

North America

correspondent Jeff reports on the extreme heat hitting San Joaquin Valley table grape growers, which is affecting supply and FOB prices across the US. grapes–p120-122

Winnie Wang asiafruit china

Winnie reports from Taiwan with a look at market trends covering both fruit imports and exports. Exports are back on track after the industry developed markets beyond mainland China. taiwan–p166-171

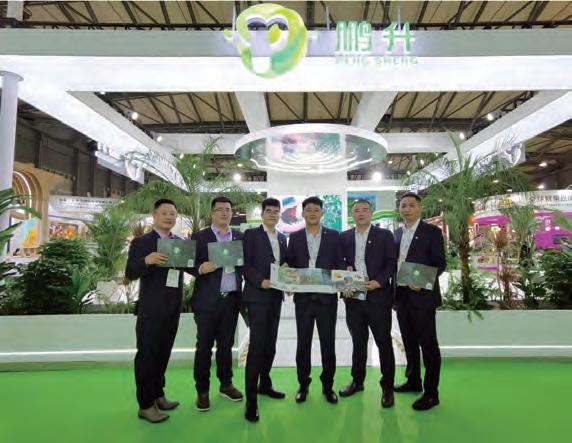

let’s grow together

New varietiesgrapehold key to growth

Leading analysts and key industry players at Fruitnet Grape Congress in Puglia say they see huge market potential thanks to new and better varieties.

by Mike Knowles

Grape suppliers must continue to invest in better-tasting and more climate-resilient varieties if they are to retain their share of the market.

But they also need to avoid presenting consumers with too many different types of grape if they are to improve sales.

Those were among the key messages delivered

to around 250 delegates from 16 different countries who attended the Fruitnet Grape Congress in Puglia, Italy, on 4 July.

“Consumers do really like grapes, and in the last four turbulent years we have seen that demand especially in Europe is robust,” said

leading analyst Cindy van Rijswick of Rabobank Research Food & Agribusiness during her opening keynote presentation.

“But the industry must not fall asleep. It needs to pay attention to the fact that costs and risks for growers are a lot higher now.”

Market prices over the past year or so have been reasonably good, Van Rijswick noted, but she also indicated that much of the recent consumer price inflation had been accompanied by significantly higher costs and supply chain risks.

“The industry must not sleep. It needs to pay attention to the fact that costs and risks for growers are a lot higher now”

Nevertheless, she said, the introduction of some really innovative, great-tasting grapes with improved shelf-life had kept consumers and trade buyers keen.

“New varieties have really tapped into opportunities with consumers,” she explained. “But the industry needs more new varieties that can cope with drought and other weather extremes resulting from climate change. The products need to be a win-win for the whole supply chain to be successful.”

MORE CONSISTENCY

For Josefina Mena (pictured opposite, centre), commercial manager of Spanish company Moyca, the challenge today is indeed to identify which of those varieties will tick all of the boxes when it comes to consumer demands, retail requirements, and grower returns.

“We were previously working with more than 50 varieties, but now we are trying to reduce that and work out which are the best,” she revealed. “In the beginning, it wasn’t easy to introduce new varieties and flavours because they didn’t want to pay the extra money that they cost. But the northern European markets helped us. And now breeders are giving us more consistency, better crunch, better shelf-life.”

Over the past few decades, the major market trend as new suppliers in Spain and Latin America entered the grape business has been the replacement of seeded with seedless varieties.

For John Pandol (pictured opposite, on the right) of Californiabased Pandol Bros, the recent varietal proliferation has been very positive because it has enabled certain suppliers to deliver a much better eating experience, better sales for vendors, and more sustainable business for the growers and exporters themselves.

“We’ve never had more varieties and sources, and we’ve never had

more disruption,” he told delegates. “It’s a very good and sound thing to have more sources and more product available. In California, Thompson and Red Globe used to be 70 per cent of our production. Today, our biggest varieties are probably only 40 per cent.”

Both Pandol and Mena agreed that the grape supply base was undergoing a period of consolidation. “There are so many more varieties,” said Pandol. “And look at the pile of failed ones. It’s about trial and failure.”

So could the sector see the overall number of grape varieties level out, or even fall? Pandol suggested each supplier and each production region would eventually reach an optimum number of varieties.

“In our case, with a five-month season, we have three to four red and white, maybe three blacks, and then maybe a speciality. For us, the ideal number is maybe up to 18.” A

Pink Lady partners with Goodfarmer

Following a series of successful export trials in recent years, the Pink Lady apple brand has officially launched into the China market with Goodfarmer Group gaining exclusive marketing rights for the next ten years across Greater China.

To mark the occasion,

Goodfarmer held a launch event at the Shanghai Waigaoqiao Sheraton Hotel on 20 July.

Global Pink Lady production sits at over 700,000 tonnes, making it one of the world’s leading apple brands. Apple & Pear Australia (Apal), the brand’s owner and marketer, expects the cooperation

Ecuador bananas surge in Korea

Korea was the fastest-growing market for exports of Ecuadorean bananas in the first half of 2024, according to the latest trade data shared by industry associations Aebe and Acorbanec.

Shipments to the Asian country grew 271 per cent to 2.2m boxes between January and June of this year compared to the same period in 2023. Exporters have been able to take advantage of the elimination of tariffs –which came into effect in January – and production problems in the Philippines. In all, Ecuador shipped almost 189m boxes in the first half of the year, around 1 per cent fewer than in the same period of 2023.

between Goodfarmer to drive significant growth in China and meet consumer demand for highquality apples.

“We must tailor a precise strategy for the Chinese market because the competition here is very fierce,” said Philip Turnbull group chief executive of Apal.

“Most apples on the market today have similar tastes and are usually very sweet. The message we want to convey to Chinese consumers is that not all apples are sweet. The sweet and sour taste of Pink Lady will surprise them and is a completely different experience. Therefore, our strategy will also reflect this.”

Goodfarmer will support the development of Pink Lady in the Chinese market from three aspects: channel expansion, brand building and marketing promotion.

CA stonefruit to

Vietnam

Vietnam has granted market access for California peaches and nectarines, according to the United States Department of Agriculture (USDA). Eliminating the phytosanitary barriers keeping California stonefruit out of the Vietnamese market took multiple rounds of negotiations over several years. “This market access is a big win for California’s nectarine and peach producers,” said USDA’s Jenny Lester Moffitt, undersecretary for marketing and regulatory programs. The California Fresh Fruit Association acknowledged there will be strict protocols in place, but it said California stonefruit shippers had already demonstrated a commitment to meeting Vietnam’s requirements.

Camposol and Ninjacart bring Peruvian blueberries to India

Blueberry producer partners with Walmart-backed agri-tech start-up to distribute fruit to more than 100,000 Indian retail outlets in over 100 cities.

by Carl Collen

Leading Peruvian blueberry producer Camposol has announced it has joined forces with Ninjacart to bring high-quality blueberries to Indian consumers.

The partnership between the two companies was formalised with an MoU signed on 17 July during an event in India.

The collaboration aims to facilitate Camposol’s market entry through a curated strategy, utilising Ninjacart’s expertise and data systems to drive accelerated growth.

“Leveraging Ninjacart’s extensive network of over 100,000 retailers, the partnership ensures a reliable and consistent supply of high-quality blueberries, benefiting consumers and retailers alike,” the two companies shared in a statement.

“Additionally, the alliance enhances Camposol’s operational stability in India through datadriven insights based on volume, facilitating faster market access to additional cities and consumers. Ninjacart also guarantees endto-end traceability, bolstering transparency in the safety and origin of premium blueberries for consumers.”

According to the companies, the collaboration will not only strengthen the availability of blueberries in India but also, aims to foster stronger bilateral agricultural ties between Peru and India.

“Ninjacart’s strong presence and deep understanding of the Indian consumer will be invaluable in establishing Camposol as a leading supplier of blueberries in India,” says Sergio Torres, senior vice-president for commercial operations at Camposol.

“Together, we are poised to redefine accessibility and perception of blueberries, ensuring that consumers across the country have access to fresh, high-quality produce.”

Sharath Loganathan, co-founder and head of international business of Ninjacart, says the start-up was “thrilled” to announce its partnership with Camposol.

“As the largest Peruvian exporter of blueberries, Camposol’s vertically integrated operations ensure top-quality produce is

BELOW—The two companies signed an MoU on 17 July during an event in India

delivered efficiently across their operations,” he says.

“Our strong connections with kirana stores, supermarkets, modern trade outlets, e-commerce/ quick commerce platforms, and Horeca partners enable global brands to seamlessly reach premium customers.”

In recent years, blueberries have shown significant double-digit growth in India, however, a notable supply gap remains between imported seasonal consumption and domestic production.

This gap is primarily due to limited international exporter access to Indian consumers, who also predominantly shop at traditional mom-and-pop stores, according to Camposol and Ninjacart.

“This strategic alliance aims to enhance awareness and adoption, driving growth in the segment,” say the groups. “The collaboration ensures a steady and reliable supply, meeting the rising demand among Indian consumers.”

Ninjacart aims to leverage its efficient supply chain to minimise wastage and deliver competitively-priced blueberries across major e-commerce platforms and city-level retailers. A

APPOINTMENTS

Berries Australia has announced the appointment of Jesse White as the organisation’s general manager – Asia. White joins with extensive experience across horticulture international trade, market entry, and business development including a stint living and working in China where he developed crucial on-theground experience. He is also fluent in Mandarin.

Vanguard Group International has announced the promotion of Ignacio Ugarte to the position of commercial director for export grapes. The group said he successfully led the sales of fresh fruit, both from its own production and from third-party producers in Peru, Chile, and Argentina, to markets in Japan, Korea, Indonesia, Vietnam, and Malaysia.

Patrick Vizzone (pictured), a global financier, investor and agri-food tech founder, has been appointed an honorary professor of sustainable innovation and entrepreneurship at Alliance Manchester Business School (AMBS) at the University of Manchester. “This appointment is such an incredible honour and privilege,” Vizzone commented. “AMBS’s commitment to turning theory into practice resonates deeply with my personal and professional values.”

PBNW names new president

Pear Bureau Northwest (PBNW) has announced CarrieAnn Arias as the organisation’s new president and chief executive, effective 1 July.

Arias served as founder and chief executive of TableSpark, vice-president of marketing at Naturipe Farms and vice-president of marketing at Dole Food Company, leading teams, driving market growth, and cultivating strong relationships within the industry.

“I am thrilled to join the Pear Bureau and lead this incredible team,” she said. “Together, we will continue to build on the Bureau’s strong foundation and drive

our mission of promoting pears in the US and around the world.”

Arias takes over the duties as president and chief executive following the departure of Kevin Moffitt, who held the role since 2001.

“I am committed to fostering a culture of innovation, collaboration, and excellence as we work to achieve our strategic goals,” Arias said.

PBNW chairman Jordan Matson said he was very pleased to have Arias on board. “With her decades of produce marketing experience. I believe she is going to do a great job of furthering the mission to increase fresh pear consumption among consumers worldwide and continue to increase grower returns.”

Following the appointment, Arias thanked the board of directors for their faith in her.

“I look forward to leading the dedicated PBNW team as we begin this new chapter together,” she said.

New Australian minister for agriculture

Australia’s Prime Minister, Anthony Albanese has appointed Tasmanian MP Julie Collins as the country’s new agriculture minister, replacing Murray Watt

The assistant minister for agriculture has also been replaced by Queensland senator Anthony Chisholm. Collins said she welcomed the “great honour” to serve as the new minister for agriculture, fisheries and forestry and thanked the Prime Minister for the new challenge.

“Agriculture plays a vital role in our country, and our national economy continues to rely on a strong and diverse sector,” she said in a statement.

Peak industry bodies from across Australia welcomed Collins to the new role and said they were looking forward to working with Collins on some of the challenges facing industry.

They bodies also thanked Watt for his time as minister.

Tops CEO sees bright future for bricks and clicks

Stephane Coum, chief executive of leading Thai supermarket retailer Central Food Group, talks exclusively to Asiafruit about the rebound in physical retail post-Covid and the shift to omnichannel.

by John Hey

CEO of Central Food Group Stephane Coum has an impressive track record in the global retail industry spanning more than 30 years. The Frenchman’s journey in retail started out in his hometown in Brittany working in his local Leclerc hypermarket store at weekends.

After attending business school and working for a period in the automotive sector, Coum returned to retail to train as a store manager in 1996 at Stoc Supermarket, which was bought out by Carrefour in 2000. Having served in several store management positions for Carrefour in France, he began his international journey with a move to Turkey. He was later promoted to regional manager in Shanghai for Carrefour, before stints in Malaysia and Singapore. His most recent role before joining Tops/Central Food was director of operations for Carrefour Italia.

Coum was appointed chief executive of Central Food Group in September 2019 with a particular focus on driving the group’s digital strategy. He wasted no time in implementing organisational changes. When he arrived, CFG was an aggregation of companies, but Coum sought to create a more open, unified structure. He also led a focus on building the retailer’s online channels.

Both moves helped the company to navigate the turmoil that ensued in 2020 with the onset of the Covid-19 pandemic. Looking back on what was a tumultuous time for physical retail in general, Coum is philosophical.

“When Covid hit, a lot of retail experts suggested offline was dead, that brick-and-mortar retail was finished, but our customers across Thailand want to socialise and they want to see products physically,”

“Thailand is the sixth country worldwide in terms of plastic pollution, so it’s our duty to take a stand on this issue”

he said. “What we’ve seen since the pandemic is that omnichannel –the seamless shopping experience across all channels: in-store, online and mobile – is the most important.”

Thailand’s economy – and in turn its retail market – took a major hit during Covid, largely due to the serious impacts on its tourism trade.

“Thailand has a 60m-plus population, plus 40m tourists, so during Covid, we immediately lost around 40 per cent of our potential customers,” Coum explains. “But our sales recovered in 2023 thanks to the tourists who came back to Thailand. Online has remained resilient after Covid, but the

physical stores have continued to be very efficient.”

FOUR RETAIL CLUSTERS

Brick-and-mortar stores are very much the backbone of the Central Food Retail business, which operates in four key ‘clusters’.

Tops Food Hall, its brand of high-end food halls spanning 2,000m2-4,000m2, numbers around 20 stores and contributes some 20 per cent of its total sales.

Tops Supermarket has around 160 stores in 46 provinces across Thailand. Coum says this makes the group the “clear leader” in Thailand’s supermarket sector with a 40 per cent market share. Its supermarket stores cater to the upper and premium mass market, targeting A, B and C+ customer profiles. Tops Premium features a larger premium and imported food assortment versus the standard Tops Supermarket.

The other major format is its convenience stores, which were all converted to the Tops Daily brand in 2023 following Central Food’s buyout of FamilyMart. “I decided to create one brand to give us much more visibility to our customers,” Coum explains. Today, the company has some 511 Tops Daily convenience stores and minimarts across the country.

OMNICHANNEL SHIFT

But it is the growth of omnichannel – the rise of online platforms and the integration of these with its physical stores – that has defined Central Food’s direction of late, Coum notes.

Tops Online, Top’s own online business, has been growing over the past six years, particularly during the pandemic, he says. Omnichannel also includes so called ‘quick commerce’, where »

OPPOSITE—CEO of Central Food Group, Stephane Coum

LEFT—Tops Food Hall accounts for some 20 per cent of Central Food’s total sales

BELOW LEFT— Central Food continues to cultivate its reputation as a destination for fresh produce shoppers

online delivery platform partners such as Grab and Foodpanda pick product from the shelves of its stores and deliver to customers.

Another pillar of online is the thirdparty Marketplace, which includes Lazada, Shopee and TikTok among others. The fourth segment is Tops’ Personal Shopper.

“We have around 500 associates who assist our customers to do their shopping. They propose new products with instant communication,” he explains.

“Customers can also make preorders of new in-season products and we deliver to their homes, or they come to pick up at our stores.”

Omnichannel now accounts for 10 per cent of Central Food’s total sales, according to Coum.

“Between Tops Online, quick commerce, Tops Marketplace and Personal Shopper, customers have the opportunity to switch from pure offline to omnichannel,” he says. “What I see with the experience of omnichannel is a

LEFT—Central Food ranges some 70 different apple varieties all year round BELOW LEFT— Shoppers have been flocking to physical stores post-Covid OPPOSITE— Central Food is boosting the number of fresh produce SKUs in its Tops Daily stores

strong bridge between offline and online. Customers who are shopping online are those who are very loyal with us offline too.”

BOOSTING THE PHYSICAL FOOTPRINT

Turning back to brick-and-mortar stores, Coum insists there is good potential for growth in Thailand.

“Our five-year plan is based on an expansion of around ten supermarkets per year, especially in the top six cities all over the country,” he says.

Smaller convenience formats are also a key focus. “We’ll accelerate the expansion of our Tops Daily. 2024 was a year of consolidation after converting all the FamilyMart stores in 2023, but we’re aiming to open between 30 and 35 stores per year from next year,” he says. “We’re increasing the number of SKUs on fresh produce in these outlets, especially on vegetables.”

PRICE-ORIENTED CONSUMER

While Tops/Central Food Group maintains its reputation as a premium supermarket retailer focused on higher end customer groups, Thailand’s sluggish economic recovery from Covid, and the cost-of-living crisis, has led the retailer to adapt.

“Have we seen some changes in consumption? Yes, people have become more price-oriented. This is why we launched a price-lock campaign a few months ago to freeze the prices of essential items in order to help the population live better,” he says. “We’re locking the prices for the next 12 months, which is quite difficult,

especially in fresh where the prices move every day.”

In keeping with this trend, Coum says private label is becoming ever-more important. “Today, private label represents more than 11 per cent of our business, versus 7 per cent five years ago, and we continue to extend our range of products to help our customers find a quality product at a more affordable price,” he says. “That includes fresh produce offerings too, where we have the My Choice brand.”

Tops/Central Food is seeking to cater to the mass market more generally, he notes. “We’re upgrading our business model with more affordable and private label products to answer the expectations of customers with a B, C or D profile.”

QUALITY AND ASSORTMENT

Economic headwinds aside, Tops/Central Food’s fresh produce offering is still characterised by quality and assortment. The retailer continues to cultivate its reputation as a ‘destination’ for fruit and vegetable shoppers.

Some 50 per cent of its fresh fruit sales are imported, sourced from a diverse range of global origins, including Australia, New Zealand, the US, France, Italy, Chile, South Africa, India, Japan, Vietnam, Korea and China. Central Food is a leader in sales of high-value categories such as apples, berries, cherries and grapes – and it offers a huge variety of products for consumers.

“We’re the best retailer in terms of assortment of apples,” Coum points out. “We offer more than 70 different varieties all year round.”

So does ranging this many varieties result in higher rates of shrinkage? Coum insists not. Shrinkage is controlled via a combination of store replenishment and ensuring product meets quality specifications when it reaches the retailer’s DC, he says, with adequate shelf-life to last several days on the shelf. The small percentage of product that goes past its sales cycle is donated to foodbank associations, Coum adds. In addition to minimising waste, Tops is moving to cut its use of plastic packaging.

“Thailand is the sixth country worldwide in terms of plastic pollution, so it’s our duty to take a stand on this issue,” says Coum. “Our team in charge of sustainability is working to find solutions. Firstly, with packaging of our private label products; and secondly working with our suppliers to convert from conventional plastic packaging to biodegradable packaging. We’re moving faster on it, especially for all our cherries and vegetables.” A

Jing Jai Farmers’ Market

Tops/Central Food continues to underline its commitment to supporting local farmers with Jing Jai Farmers’ Market. Set up in 2018, Jing Jai Market is a dedicated space in Central Food’s stores where local farmers can sell their vegetables to consumers.

“Most of the time the sellers are groups such as farmers associations, and Jing Jai helps them to increase their incomes. Since working with us, most of them have increased their revenues three-fold,” explains Central Food Group CEO, Stephane Coum. “Today, we have more than 10,000 household farmers working with us, and some of our Jing Jai products are commercialised now in stores all over Thailand.”

Coum says one of the main challenges facing farmers is the logistics of getting their product to market. Jing Jai enables them to take their product to their local Tops store or DC, where the retailer can work with them to commercialise their product in stores nationwide, he notes.

“We support them in terms of marketing, logistics and quality assurance,” says Coum.

“We have our own lab to control the quality and test for pesticides and insecticides. This enables us to ensure the product is safe for our customers, but also educate the farmers we are working with.”

New brand, same quality

Leading Southern Hemisphere supplier Citri&Co unveils its new brand, Safresco, at this year’s Asia Fruit Logistica.

by Maura Maxwell

Safresco is a new brand with some serious pedigree behind it. The citrus, grape, and avocado specialist was created in 2022 from the sale of Argentine lemon giant San Miguel Global’s fresh fruit business to Citri&Co, the vertically integrated global fruit group created by private fund Miura Partners. The deal included San Miguel's operations in South Africa and Peru and the marketing of fresh fruit from Argentina and Uruguay. A year later the Safresco brand was born.

“This year marks a milestone for the company

BELOW LEFT— Safresco is expanding its avocado and citrus production in Peru and South Africa

with the launch of our new citrus, avocado and grape brand, reaffirming our commitment to quality and sustainability,” says Safresco’s commercial manager for Asia, María del Pilar Arévalo. “With 150,000 tonnes of fruit exported from Peru, South Africa, Argentina and Uruguay, coming from 2,500ha of our own farms and another 2,000ha from associated producers, we’re consolidating our presence under the Citri&Co banner.”

Safresco finds itself in good company: other legacy names that can be found among Citri&Co’s stable of businesses include Martinavarro – one of Spain’s oldest citrus companies – and Brazilian melon giant Agricola Famosa.

Arévalo acknowledges that ditching such a well-known brand as San Miguel – with all the equity it has accrued over the years –presents its own challenges. But she is confident that the longterm strategic collaborations the company has built up with its Asian customers over the years will ease the transition.

“This year’s Asia Fruit Logistica is our first fair under the new name and we’ll be using it as an opportunity to remind our customers that we retain the same commitment to high standards of quality and adaptability as we did under the old brand,” she says. “Our goal is for Safresco to be recognised in Asia for the same quality as before.”

As well as strengthening its

presence in China’s retail sector, Arévalo sees strong potential for the company to develop the Indian and Bangladeshi markets, where the expansion of the middle class is driving demand for fresh citrus in the off-season. “In India, we are actively promoting the mandarin category in the retail sector to increase demand throughout the year,” she says.

At the same time, Safresco is working hard to consolidate its supply during the Southern Hemisphere season both through the establishment of strategic alliances with growers in South Africa and Peru and by testing new varieties to enable it to tailor its offer to the demands of its customers.

In South Africa, for example, it has 500ha of citrus trees less than five years old, and 400ha of covered production of Nadorcott and late navels, with plans to expand to 700ha. “We’re looking at a significant increase in supply as these trees mature, plus the covered production will allow us to improve quality and yield going forward,” Arévalo says.

In Peru, Safresco is investing in new table grape varieties more aligned to market demand, as well as expanding its avocado production and broadening its offer with the incorporation of pomelos, limes, Minneolas, clementines and pomegranates sourced from strategic partners.

Being part of Citri&Co also gives Safresco access to a much wider assortment of produce and it now handles significant volumes of melons, watermelons and stonefruit.

“Our extensive experience and track record in consolidated markets like Europe and the US allows us to adapt our supply model to retailers and wholesalers, adjusting to the particularities of the Asian market,” Arévalo says. A

Across three stages over three days, expert speakers provide the best combination of strategic insights and practical takeaways to help you grow your business in Asia.

Xing Ye Yuan takes new paths

Liu Yan, Xing Ye Yuan founder and chairperson, believes innovation is key to stay ahead of competition and achieve global success.

by Yuxin Yang

It has been five years since your last interview with Asiafruit. How has Xing Ye Yuan's fresh fruit business grown over this period?

Liu Yan: As distribution channels continue to evolve, there has been much change and innovative expansion in China’s fruit industry over the past five years, and with that also came a reshuffling and elimination. Throughout these five years, Xing Ye Yuan has moved forward with respect and perseverance. We have always believed that ‘survivors are the kings’, and have been learning from our peers and breaking new ground.

In 2023, we successfully completed a V-shaped recovery after the pandemic – both sales and profits exceeded pre-pandemic levels, with an annual growth rate of over 15 per cent. The Q1 2024 performance recently released is also satisfactory.

In the S2B2C (Supplier to Business to Consumer) field, our supply chain infrastructure

maintains a relatively leading position in China: 14 fruit processing centres operating at full capacity in key production areas, and a reliable production base network across the country ensuring consistent supply. On the 2C side, we have 12 fresh food logistics centres covering 186 hotspot cities, with smooth cooperation with supermarkets, e-tailers, and New Retail businesses.

Four products have achieved billion-yuan (US$140m) status: cherries, apples, Babagan (Harumi mandarin), and durians. We’ve also made significant progress with our proprietary brands.

What is most exciting is our breakthrough in international business. The performance of our international expansion team has been satisfactory; we have successfully entered markets in Singapore, Indonesia, Thailand, Vietnam, Myanmar, and others.

As an emerging player from the Chinese fruit industry, the Xing Ye Yuan team is now competing

“What is most exciting is our breakthrough in international business. We have successfully entered several new markets”

alongside major global fruit brands. We are humbled by that, and will continue to make strides and capture new territories in the dynamic Asian region.

As you said, the way fruit is distributed and sold has changed since Covid. What is the change like internally for Xing Ye Yuan?

LY: Xing Ye Yuan started as a supplier to conventional retailers, but we didn’t stop there. As we continue to further deepen our engagement in brick-and-mortar retail, our collaboration with e-retailers and New Retail has become our primary source of growth.

We have implemented a strategy that simultaneously services both online and offline channels and advances both B2B and B2C segments. The Chinese market is a vast, multi-dimensional, diverse consumer ecosystem where various retail formats coexist. They do not replace each other but rather each has its own place in the market.

Xing Ye Yuan empowers its partners throughout the supply chain with unmatched value. That is why

we cooperate well with all types of channels. Since its establishment, Xing Ye Yuan has witnessed iterations of China's fruit industry. The first two generations were building storage, acquiring customers, establishing factories, tracing origins, setting standards, and building systems. We have now entered the third generation of supply chains. This new phase focuses on innovation, quality improvement, digital intelligence, algorithms, and deep integration. It is linking a new value chain and making Xing Ye Yuan a trusted and reliable business partner for its clients. For retailers seeking breakthroughs in sales and profit, collaboration with suppliers to refine a high-quality supply chain has become the inevitable choice. ‘Supplier-retailer integration’ is becoming the mainstream trend

for the future and is our primary consideration when choosing partners.

The downturn in China's economy and weakening consumer purchasing power is a key focus for the global fruit industry. Do you think Chinese consumers are consuming less fruit, or are there new consumption trends emerging? Where can we find further growth?

LY: There is some downward pressure on fruit consumption in the China market, but the key change is not in the overall consumption volume but in the consumption structure. At first glance, the problem seems to lie on the demand side, but upon closer inspection, you can see it is still on the supply side.

Consumers' enthusiasm for

fresh fruit hasn’t diminished. Quite the opposite. Some new trends have emerged: self-care consumption has increased demand for healthy, organic, and/ or low-sugar fruit products. The demand for convenient, smallpack fruit, fresh-cuts, and mixed fruit has significantly risen among young people, single households and small families

Faced with new market requirements, if businesses remain focused on bulky and heavy ‘old products’ like largesize watermelons, basket-packed pears, and box-packed apples, their outlook will undoubtedly be difficult. We put Xing Ye Yuan on the right path by shifting focus to emerging categories like Shine Muscat grapes, cherries, blueberries, and persimmons.

Proactive innovation is key »

ABOVE—Xing Ye Yuan continues to invest in production and post-harvest infrastructure

to staying ahead of competition. We need new technologies and new business models. Only by bravely forging a new path can you see a different landscape. What has propelled Xing Ye Yuan forward over the past five years is pioneering new paths.

For the China market and for Xing Ye Yuan, maintaining a positive attitude towards external changes, seizing growth opportunities for trending products, bringing regional specialties onto the national stage, making niche products mainstream, and releasing a product’s true potential, are where new growth lies.

Premium Chinese fruit has been performing well in export in recent years. How is Xing Ye Yuan’s export business tracking?

LY: Export has been the most valued business segment for Xing Ye Yuan recently, and has shown the most outstanding performance. We have a dedicated export expansion team consisting of young talents from Fortune 500 companies. We are focusing on the Asian region. We have successfully entered markets in Singapore, India, Thailand, Vietnam, and Myanmar.

We have laid a solid foundation in these markets with the ‘traditional trio’ of Chinese fruit exports – apples, pears, and citrus – emphasising extreme costeffectiveness. Simultaneously, we have introduced a "new trio" – Shine Muscat grapes, seedless pomegranates, and Orah mandarins, along with trial sales of blueberries and strawberries. We call them "Chinese New Fruit Three Plus Two".

The market response to these products has been very positive, with high consumer repurchase rates, suggesting that they are

“Global scope, proprietary brands and Chinese fruit are the guiding principles of our global strategy”

likely to become new favourites among South-East Asian consumers.

"Global scope, proprietary brands, Chinese fruit" are the guiding principles of our global strategy. Under the umbrella brand Xing Ye Yuan, we are marketing our products in five sub-brands: Fola, Cybele, Furta, 3YY, and Prodigy. Each of these sub-brands targets different market segments and customer groups, which has quickly opened up the market. Our initial efforts have been very successful.

We firmly believe that the pursuit of ultimate quality leads to brand loyalty. Making good fruit that tastes great is key. Frankly speaking, our entry into the South-

East Asian market has been smoother than we expected. This is due to our extensive experience competing with strong players and experts in the Chinese market, where we have worked hard and honed our skills. We have achieved high quality in all aspects, including taste, appearance, cold chain, packaging, consistent standards, and consumer experience. These qualities, forged in the highly competitive Chinese market, have allowed us to quickly achieve some success in the emerging South-East Asian market.

As the founder of Xing Ye Yuan and a ‘veteran’ in the fruit industry, it is gratifying to see the vitality that Xing Ye Yuan still possesses, which has led us to boldly set out again after a 45-year industrial marathon.

Our young teams, carrying and representing Chinese fruit, are moving towards the Asian and Middle Eastern markets and pushing into Europe and the Americas. Although the road is long, we will reach our destination; if we take action, we will succeed. A

BELOW—Liu Yan, Xing Ye Yuan founder and chair

Quality drives China export charge

Sam Sin, deputy GM of Pagoda Global Fresh, says the company is putting quality first as it builds its export business supplying a range of Chinese-grown fruits.

by John Hey

Pagoda Global Fresh (PGF) is on a mission to build China’s reputation as an exporter of high-quality fruits. Back in 2019, the group acquired Haiyang Chiang Mai Thai AgriProducts Co (HYJCT), a leading exporter of Chinese apples and pears for more than 25 years. In addition to shipping to long-haul markets such as Europe, the Middle East and South America, HYJCT has a strong presence across SouthEast Asia with its JCT brand, as

well as the Wangshan brand in the Indonesia market.

But last year, PGF began exporting a full range of Chinesegrown fruits from the group’s supply sources says Sam Sin, whose family owned HYJCT, is heading up Pagoda’s export business.

“We’re targeting consumers who want good eating quality, and we’re mostly supplying the retail market,” he says. “Our product range includes blueberries, strawberries, kiwifruit, oranges,

LEFT—Pagoda Global Fresh’s Sam Sin says China will extend its dominance as a supplier to South-East Asia

mandarins, grapes and more.”

Sin says Pagoda and HYJCT share the same vision to establish China’s reputation as a high-quality fruit exporter.

“In previous years, I think the perception in the international market was that China was not always in the top tier [on quality]. But as you can see recently, the quality of Chinese products is improving a lot.”

Sin cites Driscoll’s’ berry investments in the Yunnan region as an example of the quality benchmarks being established in China’s fruit industry. “We believe that in the next three to five years, China is going to be the major supply source for South-East Asia in terms of agricultural products,” he says.

Chinese-grown grapes and mandarins have already made major inroads in markets in South-East Asia, Sin notes. Shine Muscat grapes are the most obvious example, now seen selling “all over South-East Asia”.

“If you talk with any importer in South-East Asia, I think they took at least 50 per cent fewer grapes from the US, Peru or Chile this year,” he says. “The transit time from these origins is around 25-30 days, but China can ship to Indonesia in a few days and to Vietnam in less than 24 hours.”

Sin singles out blueberries as the product seeing the fastest volume growth for export. PGF already exports strawberries from its own farms in Dandong and Nanjing, while it has a network of blueberry suppliers around China.

“We can truck fruit to Hong Kong and Thailand, and ship by sea to Singapore and Malaysia,” he says. “This makes our product much more competitive than alternative origins like Morocco. It also enables us to harvest fruit at a higher level of maturity.”

One of the challenges for blueberry exports is the lack of phytosanitary protocols for market access, he adds. “Berries was not traditionally a big category in China’s fruit industry, so the government did not establish protocols with many other countries. This will take some time.”

Pagoda packs and grades its export fruit to the same high standards required by China’s fruit import market, according to Sin. He sees China’s rise as a high-quality supplier making conditions much more competitive for global suppliers to China and SouthEast Asia in the future. Indeed, he expects China to extend its influence globally.

“I’m proud to say that in the next five or ten years, China is going to be the biggest exporter of highquality produce in the world,” Sin concludes. A

Goodfarmer Durians stand out

With the addition of fresh Malaysian durians, Goodfarmer continues to satisfy the varied and ever-growing demand for the ‘king of fruit’.

Although China’s FMCG industry is slowing and overall consumption is weak, the imported fruit market is showing surprising momentum. With rising living standards and changing consumption habits, imported fruit has become one of the most popular items in the Chinese market, injecting new impetus into the FMCG sector. Among all the imported products, durians are a clear standout, according to Gan Xingshun, durian products director of Goodfarmer Group’s fruit brand business

department.

ABOVE—

Goodfarmer Durians are sold both domestically and internationally

OPPOSITE—Gan Xingshun, durian products director at Goodfarmer

“Durian, the star of tropical fruits, is not only loved in Asia but has also gained popularity worldwide in recent years, becoming one of the most eye-catching products in the international market,” he says.

Durian consumption in China has soared over the past few years. According to a report from China’s General Administration of Customs, durian has overtaken apples to become China’s largest imported fruit by value.

QUALITY GUARANTEE

Goodfarmer stands out among the many durian brands with its excellent quality and strong brand power. Committed to providing fresh and delicious durians, Goodfarmer strictly follows international

quality standards, from planting to harvesting and marketing. Utilising advanced planting technology, scientific harvesting methods, and fast logistics distribution, it ensures durians are delivered to consumers in optimal condition. Goodfarmer Durians are sold both domestically and internationally, earning the love and trust of consumers and becoming a leader in the durian market. With brand-building as the overall goal and consumer experience guarantee as the purpose, Goodfarmer implements its “three goods and one standard” strategy, consistently achieving excellence in quality, quantity, price, and brand.

Durians come in many varieties, each with its own unique taste and flavour. After thorough field studies and in-depth research, the Goodfarmer durian team has carefully selected four varieties from Thailand and Vietnam: Kradum Thong, Monthong, Kanyao (Ri6), and Chanee. These

varieties cater to different taste preferences: Kradum Thong has strong fragrance, Monthong has rich flesh, Kanyao has smooth flavour, and Chanee is refreshing. The Thai Monthong durian, with its small pit, rich meat, and tender flavour, has quickly attracted many consumers and became one of the most popular Goodfarmer durians, earning wide recognition over the years. Meanwhile, Vietnam’s Kanyao durian (Ri6) is gaining attention and rapidly dominating the market with its price advantage. The relatively mild aroma of Vietnamese durians makes them more suitable for consumers who are sensitive to the typical durian smell. According to a report, Vietnam’s durian exports to China accounted for 35 per cent of China’s total imports in 2023, and the market share is expected to expand in the future. With the geographical advantage of bordering China, Vietnamese durians offer consumers a costeffective option with shorter transport.

Malaysian Musang King durians are considered premium among durians, known for their golden flesh, creamy texture, and strong fragrance. Compared to other varieties, Musang King durians have a perfect balance of sweetness and bitterness, a unique flavour favoured by durian lovers. Additionally, its flesh has a lower fibre content, resulting in a smoother eating texture. The approval of fresh Malaysian durians for export to China is a positive signal. Fresh Malaysian durians will likely become another dark horse in the Chinese market, capturing the high-end durian segment. As a leader in China’s fruit industry,

Goodfarmer is preparing for the inaugural shipment of Malaysian durians to China, bringing fresh flavours to consumers and introducing the Malaysian taste to households nationwide. To ensure the quality of the first batch, Goodfarmer has dispatched expert durian specialists to Malaysia. They have conducted comprehensive evaluations of the growing environment, cultivation techniques, harvesting times, and transportation methods of Malaysian durians, aiming for perfection at every step. Team members have also personally participated in the harvesting and preliminary processing to ensure each durian is picked at peak ripeness and delivered to consumers in the shortest time possible through cold chain logistics.

BRAND INNOVATION HELPS HAPPINESS

As the so-called ‘king of fruit’, durian has become a top choice for gift-giving. The Goodfarmer durian team is committed to quality and customer care, meticulously creating a variety of durian gift boxes to offer consumers diverse options. Goodfarmer is an excellent choice when customers want to send thoughtful gifts to family and friends.

With the increasing consumer demand for health and quality, the durian market is expanding, and many innovative durian products are emerging to meet different needs. Goodfarmer adheres to the principle of ‘Consumer First’, conducting in-depth market research and developing numerous innovative

durian products. These include small durian ‘gold bars’, durian ice cups, baked durian, and durian ice cream. These creative offerings are very popular in the snack market and are loved by consumers, satisfying their “durian cravings” and allowing durian enthusiasts to enjoy durian anytime and anywhere.

Frozen durian is becoming a preferred alternative to fresh durians. Goodfarmer’s dedicated fresh durians team and frozen durians team leverage their expertise to ensure consumers can enjoy delicious durians in both forms.

Goodfarmer Durians are available on various e-commerce platforms such as Meituan, JD.com, Pinduoduo, Tmall, and DingDong Maicai. The company has launched joint initiatives with major supermarkets like Freshippo, Yonghui, and Pagoda to further establish brand recognition. By utilising various channels, the Goodfarmer Durians brand continues to expand product exposure and boost awareness.

Keeping pace with the consumer

Consumer demands are ever-changing in China, and fruit brands must keep track to capitalise on market opportunities, says Clark Xiao of Trendforsee Consulting.

by John Hey

China has faced some economic headwinds of late, but its consumer market still holds huge untapped potential for fresh produce suppliers who can tailor their offerings to ever-shifting demands.

That was one of the key messages from Clark Xiao, CEO of Trendforsee Consulting, who gave a keynote talk on consumer trends in China at the Asia Fruit Logistica China Business Meet Up in Shanghai on 27-28 May.

“With the sheer size of the domestic market and the advancement of urbanisation, there’s still great potential for market development in China,” said Xiao.

“The development of tierone cities is relatively flat, but 14 provinces saw a consumption growth rate of 10 per cent for the Double 11 shopping festival last year. The mid-west and rural provinces are seeing the fastest growth in consumption.”

Xiao singled out four key trends in consumer behaviour across China.

First, he said consumers are becoming more rational and prudent in their purchasing habits. “Consumers are thinking about what they retain and what they abandon,” said Xiao. “Saving has become the consensus. They still want quality, but it must be affordable quality, and this is where

cheaper substitute products come in. Today it’s about high-quality substitutes.”

The second key trend is “spiritual enrichment”. “Chillaxing and emotional fulfilment have become the need of consumers who find themselves under pressure in their lives and at work,” he said.

Xiao pointed to the 600,000 milk tea shops that have opened up across China. Dressing in dopamine colours like red, orange and yellow has also become a big trend, he added. Marketing of fruit can tap into this thirst for spiritual satisfaction. “Fruit is not just about satisfying taste and nutritional needs,” he said. “It’s a source of emotional value and companionship.”

Appealing to the emotional needs of consumers and “personalising” products are key for fruit marketers, Xiao said. He cited examples such as the “anti-anxiety banana” and serving stove-boiled tea with fruit.

The third big trend is consumers putting their health first. “Healthy products need to be readily available at any time,” said Xiao.

Consumption of superfruits is on the rise, as underlined by the growth in sales of Zespri kiwifruit, avocados (known as ‘forest cream’) and cherries, Xiao said. Fruit marketers can build the health message into their products. “One durian holds the same nutritional value as three chickens,” he said.

Xiao also highlighted the growth in sales of fruitbased yoghurts and milkshakes. “Ambrosial has been very successful in developing fruit yoghurts,” he said. “Avocado yoghurt is also now a top-seller.”

Convenience and instant enjoyment are the fourth key trend. “Consumers are becoming impatient,” Xiao said. “They want spontaneous retail, fast retail. They’ll jump on e-commerce where they can get products instantaneously, and fruit and vegetables are the most popular-selling category on instant retail. Fruits are becoming standard as part of a healthy afternoon tea.”

Turning to more general consumer demands in fresh fruit, Xiao said safety, freshness, and high-quality products and origins were the priorities.

Overall, Xiao highlighted big opportunities for branding and business development in the fresh produce business, from field to shelf.

“To be a leader in the market, brands and products must know and understand the key consumer trends,” he said. “They need to create popular products that are tailored to these trends to build brand value.” A

BELOW LEFT—Trendforsee’s Clark Xiao speaking at the Asia Fruit Logistica China Business Meet Up in Shanghai

China grants access to fresh Malaysian durian

Access provides a significant boost for Malaysian industry and adds another supply source to China’s competitive durian market.

by Liam O’Callaghan

On 19 June, China and Malaysia signed a protocol allowing fresh Malaysian durian to be exported to China.

Malaysia secured access to China for durian pulp in 2011 and whole frozen durian in 2018 and attaining approval for fresh durian has been a long-term priority. Although the protocol has been signed, at the time of publication authorities were still working through details such as packhouse registration.

Malaysian minister of agriculture and food security, Datuk Seri Mohamad Sabu, told the Malaysian parliament at the start of July he expects the export of fresh durian to China to commence

in the third quarter of 2024.

“Only orchards and durian fruit packing facilities that apply and are registered with the Department of Agriculture, comply with myGAP (Good Agricultural Practices) standards, and receive approval from General Administration of Customs China (GACC) by meeting the conditions set out in the protocol, will be allowed to export fresh durian fruit to China,” he said.

The trade in China expects fresh Malaysian fruit to make a welcome addition to the country’s durian market.

Gan Xingshun, general manager of Goodfarmer Foods (Thailand) and Vietnamese and Thai durian products director of Goodfarmer

Group’s Product Centre believes Malaysian durians will be highly popular.

“Due to the high quality of Malaysian durians, particularly varieties like Musang King and Black Thorn, their entry into China could elevate overall market quality. However, their success will depend on various factors, including logistics costs, market access barriers, and consumer preferences,” says Gan.

He says Malaysian durian will provide consumers with more choice.

“Fresh Malaysian durians are positioned as superpremium fruit in the China market primarily targeting consumers who value quality and unique experiences. They can differentiate themselves from products from other countries by emphasising their unique varieties, such as Musang King and Black Thorn.”

Raymond Mou, head of supply chain import project at Yonghui Superstores, is cautious about predicting the impact of Malaysian durian on the market, noting the challenges of handling tree-ripened fruit.

“We welcome Malaysian durians to enter China, but in order to sell them efficiently and meaningfully to customers, thorough preparation is necessary, because tree-ripened products are quite a different species. Any company entering this field needs to have sufficient supply chain capabilities and preparations,” Mou notes.

“That is why we do not have particularly high expectations for fresh Malaysian durians yet. At present we don’t have plans to get involved in the products immediately. We would like to see how they are when they arrive in China.”

Mou says many Chinese consumers have not experienced fresh, tree-ripened Musang King durians so he does not expect growing practices to change and remove the point of differentiation.

“Generations of Malaysian growers have been ripening their durians on trees, and they will not be changing their practices for Chinese consumer habits. But handling tree-ripen durians is a challenge,” says Mou. “Even if they are willing, it will require a lot of research to know how to properly ripen Musang King. And if they are ripened post-harvest, then is there much difference left compared to Thai products?” A

LEFT—Malaysia is the latest supplier to gain access to China’s competitive fresh durian market

Loved by Consumers.

OZblu® consistently finishes on the podium when rated by consumer panels.[1]

series

BLUEBERRIES

Loved by Customers.

Customers demand more OZblu® blueberries, year-round, to complete a premium offer.

Loved by Growers.

OZblu® growers yield an average of 45 tonne per ha of *OZblu® Magica, which remains class-leading.[2]

Loved by the Planet.

OZblu® is guided by ESG and serious about climate.

US citrus giants promote high-Brix oranges

Sun Pacific and Sunkist see good potential for oranges with guaranteed sweetness in China.

by John Hey

Major US citrus growermarketers Sun Pacific and Sunkist promoted their high-Brix navel orange offerings at the Asia Fruit Logistica China Business Meet Up in Shanghai on 27-28 May.

Both companies say they see exciting potential for oranges with guaranteed high sweetness in the China market. The timing of the event towards the end of the US navel orange season presented an opportunity to sample fruit to the local trade.

Sun Pacific markets Brixsensored oranges under the PureSpect label, which provides an

While the PureSpect machine sensors Brix levels to guarantee a consistent standard, Martin says it is Sun Pacific’s farming practices that enable the company to supply high-Brix oranges. PureSpect-branded fruit has proven popular in export markets, where customers pay a premium for the fruit over other brands of navels, according to Martin.

“Over the last fifteen years, we turned the Korean market into a high-Brix market, and we turned 30-40 per cent of the business in Hong Kong to high-Brix.

“Now we see big opportunities in China because there aren’t many differentiators among navels in the market but high-Brix makes a big difference.”

LEFT—Elizabeth Martin, export sales manager of Sun Pacific

BELOW RIGHT—

PureSpectbranded oranges are Brix-sensored

Martin says Sun Pacific’s high-Brix oranges would “be selling all over China” already, if it were not for the US-China trade war of recent years, which saw China increase the import tariff on US citrus.

“China’s import duty on our oranges is now 26 per cent plus 9 per cent VAT,” she says. “It makes things tough for us.”

Nevertheless, Martin was enthused by the positive response from Chinese buyers sampling the PureSpect oranges at the China Business Meet Up. “We’ve never been in China before when we had high-Brix fruit available, so it’s great to be able to sample the fruit here,” she says. “The response has been very good, and I think we’ll have some success. We already have a potential customer who wants to try high Brix.”

Sunkist launched a high-Brix orange brand earlier this year with the Premium Sweet label. The major US citrus cooperative showcased the offering at the China Business Meet Up. The Premium Sweet brand has a distinctive black label that stands out on the orange background of the fruit.

ideal sugar to acid ratio. The brand has developed a strong following in Korea in particular, as well as in Hong Kong and Taiwan, according to Elizabeth Martin, Sun Pacific’s export sales manager. The company also offers two other high-Brix brands, Vintage Sweet and L-Sweet.

The PureSpect label originates from Korea, where the company that bears its name developed a machine for testing the Brix level of the fruit.

“Sun Pacific has the exclusive rights to the label in Korea and Hong Kong and we lease the Brixtesting machinery from PureSpect for grading our fruit,” says Martin.

The Sunkist brand is well known in China, reflecting its long history in the market, according to a company spokesperson. Sunkist promotes the brand actively in major cities throughout the country, and consumption of oranges continues to grow, the spokesperson notes. A

The rise and shine of IP protected fruits in China

China’s efforts to embrace protected varieties has had a transformative effect on the country’s fruit industry.

IDAVID SMITH

Bloom Fresh China General manager

’m no stranger to seeing insane prices for fruit in China. Throughout the year, we can see local cherries selling for well over US$70 a kilogram, US$100 square watermelons from Japan, US$40 for a single bunch of locally grown Shine Muscat grapes, and many other mindboggling prices for fruits. Being in the grape industry, the grapes catch my eye.

Shine Muscat grapes were originally bred in the late 90s and released in 2003 in Japan, where they are still prized and protected today. It didn’t take long for the variety’s popularity to soar.

Fast forward to 2006, when Chinese growers began noticing the popularity of this variety and decided to take a crack at growing it locally.

It took the better part of a decade for growers to figure out how to cultivate the variety, but between 2016 and 2022, the planted area for Shine Muscat exploded from around 40,000ha to over 400,000ha.

This rapid expansion, however, was especially unfortunate for the Japanese National Institute of Fruit Tree Science, the original breeders of the variety. Because they did not go through the formalities to receive PVR on the variety in China, they missed out on millions of dollars in royalties.

The sad part of this story is what is now happening to the growers. Because this variety has been planted so widely, the market is starting to suffer under the weight of thousands and thousands of tonnes of mediocre (and often downright bad) fruit.

While many growers still cling to the hope that they will be able to achieve high prices for these grapes, the situation is dire for most.

CHINA’S PVR JOURNEY

China’s journey with Plant Variety Rights (PVR) has been nothing short of transformative yet fraught with

its own set of challenges.

Over the past two decades, China has seen a surge in protected fruit varieties and PVR applications, reflecting the country’s commitment to agricultural innovation and its strategic role in the global market.

By 1999, China had made its first significant leap by joining the International Convention for the Protection of New Varieties of Plants (UPOV), setting a baseline of standards for legal protection.

This was followed by the introduction of specific laws in

2000 to protect plant variety rights, marking the beginning of what would be a rapid journey toward agricultural innovation.

In 2019 alone, there were over 34,000 PVR applications in China, accounting for a significant portion of global applications.

By 2023, China was not just participating, but leading in global variety registrations.

The growth has been nothing short of explosive – take citrus, for example, where the number of protected varieties increased from 80 in 2012 to 125 in 2023.

INTERNATIONAL COLLABORATION

One of the most remarkable aspects of China’s PVR journey has been the level of international collaboration involved. Research institutes from around the world— South America, North America, and Europe—are increasingly participating in China’s burgeoning PVR-related business. Private industry giants like Bloom Fresh, Driscoll’s, and Dole have made substantial investments, seeing the potential of China’s growing influence in global agriculture.

China’s focus on PVR is not just about protecting intellectual property; it’s about driving economic growth, enhancing food security, and expanding global market access. The robust IP protection framework in China has attracted significant investment from both the private sector and government, fostering innovation and boosting productivity.

CUTTING-EDGE BREEDING

China’s agricultural innovation isn’t just about quantity; it’s about the quality and type of breeding being done. Of the varieties being bred in China, 65 per cent are developed using traditional breeding practices, 25 per cent through genetic engineering, and 10 per cent using other biotechnologies. This diverse approach to breeding is not only increasing yield but also enhancing the resilience and sustainability of China’s agricultural sector.

For example, IP-protected apple varieties in China have shown a 20 per cent increase in yield compared to traditional varieties, thanks to enhanced traits like disease resistance. These advances are not only making farming more profitable but also more sustainable, as many of these new varieties require less water and fewer pesticides.

THE ROAD AHEAD: CHALLENGES AND OPPORTUNITIES

While China has made incredible strides in PVR, there’s still a long way to go. Enforcement remains a significant challenge, and the market is still adjusting to the influx of new varieties. However, the progress made so far indicates that China is heading in the right direction. The story of Shine Muscat serves as a powerful reminder of the importance of PVR protection – not just for breeders, but for the entire industry. Without proper protection, even the most promising varieties can become victims of their own success, leading to market saturation and a decline in quality.

Looking ahead, the focus must be on creating a balanced approach that not only drives innovation but also sustains long-term profitability for growers and satisfaction for consumers. With the right safeguards in place, China has the chance to set a global standard for how IP protection can enhance the entire industry.

In the end, the point of PVR protection is to make the industry more valuable. This means that growers need to be more profitable, and consumers must have a better consumption experience. Shine Muscat’s story is a lesson not just for China, but for the world.

This article is based on a presentation David Smith delivered at Asia Fruit Logistica’s China Business Meet Up on 27-28 May. A

OPPOSITE—Bloom Fresh has licensed its proprietary varieties in China BELOW—David Smith presenting at Asia Fruit Logistica’s China Business Meet Up

Building a supply chain for the future

Zespri’s head of supply chain for Greater China, Rahul Bagde, explains how the kiwifruit marketer is transforming its distribution together with VX Cold Chain.

by John Hey

Zespri has embarked on an ambitious project to build out its supply chain operations in China over the past six years. It’s a journey anchored by its partnership with integrated logistics service provider VX Cold Chain to create the state-of-theart Fresh Hub facility in Shanghai’s Lingang Free Trade Zone, which opened in April 2023.

Rahul Bagde joined Zespri back in 2018 to head up supply chain for the Greater China region, incorporating mainland China, Hong Kong and Taiwan. Bagde had a background working in supply chain for major blue-chip organisations such as Microsoft, Siemens, Phillips and San Disk, so the fresh produce industry

presented a learning curve. But it’s a journey he says he has relished, drawing on his expertise from outside the industry to help modernise and digitise Zespri’s supply chain operations.

“First of all, it’s been a good learning opportunity, because I knew nothing about the food industry before joining,” reflects Bagde. “Second, it has been wonderful to be part of a team focused on establishing our own infrastructure in China and designing the future supply chain for Zespri.”

Zespri only became an importer of record in China in 2016, and it began to keep some inventory in the market from 2017, just before Bagde joined.

“We didn’t have any infrastructure on the ground, so we were leveraging pretty much 100 per cent our distributors’ facilities,” he says. “Our goal was to create a foothold in the China market with our own operations, our own infrastructure, and to digitalise a significant part of our operations. We were on course to double our volumes within five years, so we needed to do this.”

SUPPLY CHAIN TARGETS

Bagde says Zespri set out with four key goals for its supply chain. The first was to achieve “end-to-end quality management”, he explains.

“It was about how we integrate between Zespri, our distributors, their tier-one customers and the wholesale markets, to ensure we have an end-to-end view of the quality.”

The second part focused on creating ripening infrastructure in-market. “We learned from our operations in Japan that there is a lot of value if you serve the market with ready-to-eat, ready-to-retail product,” notes Bagde.

Zespri’s third major focus was on being able to supply consumer packaging. “Emotional occasions in China are key to selling products. You look at different festivals and customise packaging to sell to the consumer,” he explains.

The fourth part was around the quality of infrastructure. “In this industry, there’s generally less appreciation of the value the right infrastructure brings to products,” Bagde says. “People look at storage

more in terms of just keeping the product, but we need to change that mindset in the industry.”

“WORLD-CLASS INFRASTRUCTURE”

When Michael Jiang took over as GM of Greater China in 2019, Zespri formed a strategic group with its two distributors (Joy Wing Mau and Goodfarmer) and key functional people to lead this strategy. “There are enough storage providers, but we needed to transition to the world-class infrastructure we see in New Zealand,” says Bagde.

Zespri partnered with VX Cold Chain to co-design that infrastructure. On what was bare land in 2021, VX built the Fresh Hub facility – VX Shanghai Lingang Park.

Zespri committed to VX with its five-year plans and assurance of supplying sizeable volumes of fruit for handling and throughput. VX in turn invested around Rmb400 (US$55m) to build the world-class infrastructure Zespri required.

“This facility marks the first time a product owner and service

OPPOSITE, ABOVE— VX Cold Chain’s Fresh Hub facility in Shanghai OPPOSITE, BELOW— Rahul Bagde (left) hosts New Zealand trade minister Todd McClay at the facility

LEFT—VX Fresh Hub is home to China’s first fully automated kiwifruit processing line

provider co-designed a facility based on the future demand of the product owner and the capabilities we required,” says Bagde.

This, he says, was one of many “firsts” with the VX Fresh Hub facility.

“It’s the first facility that has an automated storage and retrieval system. That gives you better storage and labour efficiency in terms of how pallets are stored because it’s all automated.”

The VX Fresh Hub is also home to China’s first fully automated kiwifruit processing line, which was designed specifically for Zespri by MAF Roda, according to Bagde.

“The processing line enables us to create the scale to process consumer packs for retail and create the transition from bulk to layers,” he explains. “It means customisation can happen closer to demand in the market – say if we want to change our packaging specifically for the Mid-Autumn festival in September.”

The other key ‘first’ was around the ripening infrastructure on site, which enables Zespri to service the ready-to-eat and ready-to-retail market.

“We needed to create a ripening infrastructure which was more decentralised,” he says. “That includes ripening infrastructure within the Zespri facility, as well as with our distributors.

“Firstly, this ensures the eating experience of ripened fruit is much better for our consumers,” he says. “Secondly, it boosts our sales rates from early in the season because when consumers buy the product, they’re not waiting for a week for it to ripen before they eat it.” »

Another distinctive feature of the facility is its intelligent energy consumption, which results in practically zero carbon emissions. “The daytime power for the facility is supplied by almost 16,000m2 of solar panels on the roof,” says Bagde. “It has a LEED Platinum certification from the US Green Building Council.”

EFFICIENCY GAINS

Bagde says the VX Fresh Hub has already helped to drive dramatic improvements in the efficiency of Zespri’s operations in China.

“It used to take us four or five days from receival of a charter vessel to process and deliver fruit to customers, but it’s now taking us just two-and-a-half days,” he says.

He highlights the digitalisation of many of its operational processes as another key benefit.

“When I am sitting in India, I can see on my phone what’s happening in the warehouse pretty much live. I can direct people on the ground remotely without having to be present,” he says. “My experience with Microsoft was the inspiration for this digital journey in Zespri Greater China.”

“People look at storage more in terms of just keeping the product, but we need to change that mindset in the industry”

One of the keys to efficiency gains is the sheer capacity of the VX facility, which can comfortably accommodate the discharge of specialised charter shipments. “It’s a three-storey facility with four chambers with a combined capacity 18,500 pallets, and you can actually discharge fruit at all three levels,” says Bagde. “When we bring in charters, we pretty much handle 6,000-7,000 pallets, so you need to have the scale.”

CHARTER CHANGE