EUROF RUIT

PUBLISHED BY

Our second Fruit Logistica edition looks at companies that can take the fresh produce business to the next level

By dedicating an award to the tech sector, Fruit Logistica can shine an even brighter spotlight on an area of the industry that goes under the radar

Time for technology to top the podium

The Fruit Logistica Innovation Award is always one of the highlights of the week in Berlin, and its importance to the nominees should not be underestimated. Just look at the reaction among those who represented the 2023 winner – Rijk Zwaan for its Tatayoyo sweet pepper – when the result was announced at last year’s event. There was much cheering, fist pumping, and some rather eye-catching suits as the team picked up their prize. As has often been the case throughout the lifespan of the award, an innovative, exciting fresh product had won the day. And it is easy to understand why these new fruits and vegetables regularly come out on top. They are the focal point of the industry, after all. But there is so much more to the business than just the end product, which is why I am delighted to see the introduction of a new, separate category this year, FLIA Technology. By dedicating an award to the tech sector, Fruit Logistica can shine an even brighter spotlight on creativity and craftsmanship in an area of the industry that perhaps goes under the radar at times. It is important to remember that, while the glamour may be in the fresh produce, the nuts and bolts – or indeed the sorters, scanners, shelf-life extenders and software –are no less crucial. E

Carl Collen, Deputy Editor

SINCE

EDITORIAL

managing director, fruitnet europe

Mike Knowles

+44 20 7501 3702 michael@fruitnet.com

managing editor

Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

deputy editor

Carl Collen

+44 20 7501 3703 carl@fruitnet.com

news editor

Tom Joyce

+44 20 7501 3704 tom@fruitnet.com

staff writer

Fred Searle

+44 20 7501 0301 fred@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

middleweight designer

Mai Luong

+44 20 7501 3713 mai@fruitnet.com

junior graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive Poppy Bowe

+44 20 7501 3719 poppy@fruitnet.com

MANAGEMENT

commercial director

Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White

+44 20 7501 3710 chris@fruitnet.com

ADVERTISING

sales director

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

senior sales manager

Giorgio Mancino

+44 20 7501 3716 giorgio@fruitnet.com

account manager

Josselyn Pozo Lascano

+44 20 7501 0313 josselyn@fruitnet.com

us & canada

Jeff Long

+1 805 448 8027 jeff@fruitnet.com

italy

Giordano Giardi

+39 059 786 3839 giordano@fruitnet.com

germany, austria, switzerland, middle east Heike Hagenguth

+20 100 544 5066 heike@fruitnet.com

morocco, france, tunisia Cristina Delof

+34 93 000 57 54 cristina@fruitnet.com

south africa

Fred Meintjes

+27 28 754 1418 fredmeintjes@fruitnet.com

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions

+44 20 7501 0311 subscriptions@fruitnet.com

CONTRIBUTORS

Colin Fain agronometrics

Colin speaks with Michael Oates and Huang Zhang, who share their insights on the future evolution of fresh blueberry cultivation in China. berries–p36-38

Jan-Willem Schrijver coldcha

Jan-Willem says his business is seeing robust growth, as new users adopt real-time tracking technology over traditional logger methods. p&t–p74

Richard Bonn aehtr associates

Richard comments that any company that wants to secure its future must integrate sustainability into its business plan – but that it is easier said than done. sustainability–p72

Michele Dall’Olio fresh4cast

Michele discusses how new technological advances can create competitive advantages when it comes to demand planning in fresh produce. p&t–p78

Red Sea disruption will last months, experts say

European citrus, apples and Indian grapes are amongst the products caught up in the maritime disruption.

by Mike Knowles and Maura MaxwellFresh fruit and vegetable supply lines into Europe are at serious risk of delays and disruption as a result of the recent mass rerouting of shipping services away from the Red Sea.

According to several different sources, the immediate impact will be extra costs and longer journey times for suppliers that usually ship their produce via the affected route – either to or from Europe.

And for key seasonal suppliers who need to land their products in the market at a specific time,

this represents a major logistical challenge.

“For most markets east of Suez, topfruit and some root vegetables exported from northern and southern Europe will suffer disruption in the programmes,” predicts Steve Alaerts, partner at Antwerp-based Foodcareplus. “The mandatory detour route will result in up to two weeks of extra lead time, which means there will be no market arrivals for the same period.

The ripple effect of that initial blockage will lead to further disruption for the next few months at least, he tells Eurofruit. “There

ABOVE—All the major shipping lines have rerouted services away from the area

is also an export interruption in the second half of January, because ships returning from Asia are not arriving in Europe in time to load new exports, meaning that from mid-March, there will again be interruptions in arrivals at the destination markets.”

By then, Alaerts predicts, carriers will probably have restored some sailing schedules by deploying extra sailing capacity to maintain the weekly calls. But for products with shorter shelf-life, there is much less time to wait. “The situation is downright dramatic for more sensitive types of fruit and products, and programmes will have to be stopped unless they switch to airfreight.”

According to EastFruit, the suspension of shipping services comes at the height of the Egyptian orange harvest and has led to a serious crisis for the country’s citrus producers. It is also creating a deficit of oranges

for consumers in Asia – one of the most attractive export markets for Egypt. Currently, Egyptian exporters are urgently looking for alternative routes to ship their fruit, and Egyptian growers were forced to suspend harvesting oranges, fearing a collapse in prices.

Egypt is the third largest exporter of fresh oranges in the world after Spain and South Africa. In addition, it is believed that Egypt exports the most competitively priced citrus. The main orange markets for Egypt are Russia, Saudi Arabia, Bangladesh, the European Union, India, UAE, UK, China, and Malaysia.

“Given the situation in the Red Sea, more than a third of all orange exports from Egypt, the most profitable part of it, are currently blocked, impacting growers, traders, transportation companies and consumers,” says FAO economist Andriy Yarmak.

Egypt is the main supplier of fresh oranges to Southeast Asia at

this time of year. Therefore, here, too, a serious shortage of products is brewing, which, even with a strong desire, other suppliers, such as China and the US, will not be able to cover.

Moreover, China itself is a major buyer of oranges from Egypt. At the same time, the harvesting of oranges in the countries of the Southern Hemisphere will begin only in June.

“Most likely, under these conditions, Spain will increase orange shipments to Southeast Asian countries using a bypass route, and Egypt will begin to supply more oranges to the EU and Eastern European countries until the logistics situation normalises. However, no one can say yet when it will return to normal,” EastFruit says.

Spain’s Anecoop says diverting shipments via the southern tip of Africa will undoubtedly impact its exports to China and Southeast Asia during the second half of the season, from February onwards,

mainly due to the longer transits affecting the shelf-life of the fruit.

“Despite the overall fall in the Spanish citrus crop we will have more Lanes and Valencias than last year. In principle we were looking to grow our volume to South Korea and China this season but it won't be easy,” says Nacho Juárez. “The Middle East and Southeast Asia are very unpredictable markets and shipments aren’t as scheduled as in markets with strict phytosanitary protocols like China and South Korea, where a lot more planning is required.”

Anecoop also fears a knock-on impact in the European market due to the increased availability of Egyptian citrus originally bound for Asia.

Meanwhile, India’s table grape exporters say they are having to “think on their feet” and adjust their plans accordingly in the face of longer transit times to reach the European market. This creates a potentially big problem for Europe’s grape buyers, who traditionally rely on India to fill a gap in supply between the Southern and Northern Hemispheres.

“The situation is scary and terrible, and the entire trade will be badly affected,” says Nitin Agrawal, managing director of India’s largest grape exporter, Euro Fruits. “Now we face uncertain and longer transit times, a shortage of containers, fewer sailings. And our imported punnets from Italy are delayed by 30-40 days. Overall it is a complete mess.”

According to Agrawal, container freight rates were hovering around US$1,200 before the current crisis, but now they are “close to US$5,000”.

One table grape importer based in the UK told Eurofruit he agreed the next couple of months would be especially difficult for the entire industry. “In terms of India, definitely challenging, although in theory it shouldn’t be a problem with vessels diverting around the Cape of Good Hope. You just need to plan the extra cost of doing this and an additional two weeks transit time.”

However, with shipping lines changing their plans and diverting ships to other ports at a moment’s notice, the situation in the Port of Mumbai remains uncertain. “It’s not clear what will arrive and depart Mumbai on time,” the importer added. E

LatAm banana sector slams proposed new price cut by European retailers

Industry says it is “deeply concerned” about plans to cut box price by €1.30.

by Maura Maxwell @maurafruitnetRepresentatives from the Latin American banana industry have expressed their dismay about plans by European supermarkets to reduce the price of bananas by €1.30 a box.

In December, Reefer Trends reported that the retailers had based their decision on a stronger euro against the dollar this year and lower freight rates. But the specialist publication said this argument is flawed.

It noted that “at €1.08/US$1, the euro is only marginally stronger than last year, and despite blanket indications from publications such as Drewry, the freight rate on transatlantic voyages in 2024 is not materially lower than last year”.

The Latin American Task Force

for Bananas, which represents 60 per cent of banana output from Ecuador, Colombia, Guatemala, the Dominican Republic, Costa Rica, Honduras and Peru, issued a statement saying it is “deeply concerned” by the proposal.

It pointed to the “significant problems” banana farmers and exporters of the region have been experiencing since 2020, such as rising input and freight costs; the threat of TR4; drugs trafficking and the growing certification and phytosanitary burden imposed by the European Union.

“Unfortunately, supermarkets did not recognise these realities, but decided to further reduce banana prices in 2020, 2021 and 2022. These decisions, incoherent

with the objective of sustainable trade, have led us, on behalf of the region’s farmers and exporters that are affected by these unsustainable practices, to campaign tirelessly for supermarkets to assume their role within shared responsibility and therefore pay a fair price for bananas that recognises farming costs and sustainability requirements,” the cluster said.

“Faced with the unfortunate news that supermarkets once again seek to reduce the purchase price of bananas in 2024, we urge that shared responsibility not only remain under discussion, but that retailers pay a fair price for bananas.”

The cluster pointed out that the Fairtrade methodology for calculating the fair price of a banana box should be transparent, available, accepted by the European Union and that it recognise production costs increases and the requirements of sustainable agriculture.

“Supermarkets’ actions must in any case focus on their role in shared responsibility and they must avoid heading off this discussion towards third parties. The real issue here is the absence of a fair price, and that retailers take no consideration of the efforts made by each country, such as Colombia, which has dialogue mechanisms between farmers and workers to establish a living wage, or Ecuador, which has a living wage established through the constitution and the law,” the statement continued.

“Paying a fair price is essential if we are to achieve and maintain sustainable production. If supermarkets continue to evade their role within the supply chain within the framework of shared responsibility, they will continue to demonstrate the incongruity between the sustainable practices required of farmers and their own commercial practices of chasing increasingly lower prices, thereby turning sustainability into an empty statement.” E

USDA forecasts apple increase

Growth in China, South Africa and the US is expected to offset lower production in the EU and Turkey.

by Bree CagiattiAnew report from the US Department of Agriculture has forecast world apple production will increase slightly in 2023/24, rising 175,000 tonnes to 83.1m tonnes.

According to the report, this increase in the 2023/24 marketing year (12 months to 30 June 2024 for the Northern Hemisphere and 31

December 2024 for the Southern Hemisphere) is due to recovering supplies in China, South Africa, and the US, offsetting losses in the EU and Turkey.

Although China has experienced frost and temperaturerelated losses in Shandong and Gansu provinces, higher output in Shanxi, Henan, Hebei, and Liaoning

is expected to offset this and overall production is set to increase by 500,000 tonnes to 45m.

83.1m anticipated volume in tonnes of the 2023/24

South Africa production is also anticipated to rise this season to 1.2m tonnes based on good growing conditions and new supply from plantings coming into full production. Additionally, Washington State supply in the US is set to recover following last season’s weather damage and boost US production up 56,000 tonnes to 4.4m.

Indian production is expected to remain at 2.4m tonnes based on unchanged planted area and favourable weather conditions. Production in Chile is expected to lower slightly to 907,000 tonnes as its “planted area continues its long, downward trend” the report said. Meanwhile, New Zealand production is anticipated to rebound slightly by 20,000 tonnes to 463,000, as orchards continue to recover from Cyclone Gabrielle.

In contrast, EU production is expected to decline by 475,000 tonnes to 12.2m due to higher‐than‐normal fruit drop and cold temperatures. However, quality is expected to be good with output in France and Spain improving on recovery from last year’s prolonged high temperatures. Turkish production is also forecast down for the first time since the 2014/15 season to 4.9m tonnes. The decline is said to be due to low moisture during bloom and unseasonal rains during fruit maturation.

With the overall increase to production, exports are also estimated to rise. The USDA report said world apple exports are anticipated to increase 632,000 tonnes to 6.1m tonnes primarily on higher shipments from the US, Iran, and China. E

By choosing Blue Whale fruit, you are recognising 50 years of experience within the fruit industry and supporting our French growers.

Our quality produce is the result of continuous improvements honoring our commitment to the environment and sustainable farming practices hand in hand with modern technology and continuous development.

While you eat our fruit you combine this with choosing a healthy and nutritious snack.

Francis Kint is new Greenyard CEO

Kint, who was previously managing director of the frozen segment, succeeded co-chief executives Hein Deprez and Marc Zwaaneveld on 1 January 2024.

by Carl Collen @carlfruitnetGreenyard has announced that its board of directors has appointed Francis Kint as chief executive officer (CEO). Kint was the managing director of Greenyard’s frozen division, and succeeded co-CEOs Hein Deprez and Marc Zwaaneveld on 1 January this year.

The group said that Zwaaneveld would remain available in an advisory role to facilitate a smooth transition and handover. Deprez will focus on his role as executive director of the board and in this role, and as founder, will continue to ”oversee, build and drive the vision and strategic direction of Greenyard”.

The daily management and operational leadership of the organisation is now under the responsibility and direction of the new CEO, with Kint joining and leading the group executive management alongside chief financial officer Nicolas De Clercq.

“Based on the recommendations of Greenyard’s nomination and remuneration committee, under the chair of Aalt Dijkhuizen, the board of directors decided that Francis Kint is the best candidate for the position of Group CEO,” said Koen Hoffman, chairman of the board of directors. “He held leadership positions in both the fresh and long fresh segments, built expertise across the group,

holds deep understanding of the fruit and vegetable industry, and gained valuable knowledge in both the foodservice and retail channels during his career.

“Kint is the right man at the right place to accelerate the implementation of the strategic direction and to realise the full potential of Greenyard,” Hoffman outlined. “We look forward to a fruitful collaboration.

“On behalf of the board of directors, I also want to wholeheartedly thank our co-CEOs Hein Deprez and Marc Zwaaneveld for their leadership and guidance over the past years,” he continued. “This led to strong performances year on year. Driven by the vision and strategic outline that define Greenyard for 40 years, complimented with a solid structure and organisation, Greenyard is ideally positioned for further growth.”

Kint said he was ”proud and excited” to continue his journey in the Greenyard family.

“Kint is the right man to implement strategic direction and realise the full potential of Greenyard”

“This is a fantastic moment to take on the role of CEO, based on a smooth transition and supported by our board of directors, our founder Hein Deprez, and very strong teams across the world,” he said. ”The company has great ambitions for further growth and our pure-plant products respond to the needs of today’s consumers. We are in an excellent position to be a leading global actor in the consumer trend towards a healthier lifestyle and more sustainable food chains. The momentum for pure-plant food solutions is there, and we are ready to grasp it fully.” E

Gaza fruit farmer shows resolve

Founder of the first vertical strawberry farm in Palestine, Ayed Awni Aburamadan has a history of success in the face of overwhelming challenges, and he is determined to rebuild when the war is over.

by Tom Joyce @tomfruitnet

Ayed Awni Aburamadan is a Palestinian engineer who developed his family farm outside the city of Beit Hanoun in northern Gaza, producing non-traditional fruits and vegetables for the area including tropical fruits like dragon fruit.

Despite the limitations imposed by the political situation in the region, including Israel's control over movements of goods and people to and from the Gaza Strip, Aburamadan says he has remained committed to sustainable farming methods, including employing renewable energy and reusing water and agricultural waste, and he has continued to progress with innovations such as vertical

farming in order to maximise yields.

In fact, his site includes Palestine’s first vertical strawberry farm – a model of production that has apparently enabled him to reduce the amount of water, fertiliser and pesticides needed by around 90 per cent.

However, like hundreds of thousands of Gazans, Aburamadan has been forced to leave his home and farm due to the war in Gaza and head south, taking shelter in a small family home with family and friends.

“Our little place was meant for holidays only and was not equipped to host so many people for a long time,” he says. “But we managed to put up tents and build

“When the war ends, and if I’m still alive, I will go back to my farm to start again for the fi h time”

temporary cooking facilities, relying on wood, as gas and electricity were cut off.”

Fresh food quickly became scarce in grocery stores, he reveals, soon running out completely. “Factories in Gaza are not working because there is no electricity, there are no raw materials and it is not safe,” he explains. “Some people maintained their farms in the south until a couple of weeks ago, so we had fresh tomatoes, cucumbers, aubergines, potatoes, bell peppers and citrus. Now, fresh products have become scarce. Food aid is not enough for the huge number of people. Even if you have the money, you can’t find the goods.”

Aburamadan has been unable to visit his farm in the north, but he has learnt that it has sustained heavy damage. Whatever the scale, he intends to return and to rebuild.

Business has been incredibly difficult for farmers like Aburamadan, but it has also made them resolute.

“In order to establish my modern farm I needed knowledge that was not available," he says, "so I had to rely on the internet and trial and error methods to get my technical issues sorted out. I had to apply for security clearances from Israeli authorities to import some modern equipment to control the greenhouse environment. Marketing and exporting my products was also extremely expensive and difficult.

“I haven’t been able to assess the damage to the farm yet. It was also destroyed in previous years. When the war ends, and if I’m still alive, I will go back there to start again for the fifth time.” E

Mountains to climb

South Africa’s fresh produce industry must overcome a number of challenges to deliver its top-quality fresh produce to international markets

PRODUCTION

EXPORTS

LOGISTICS

SUSTAINABILITY

INNOVATION

BRANDING

MARKETING

Exporters press on as problems persist

Disruption in South African ports has left the country’s fresh produce exporters with a mountain to climb

The fresh fruit trade knows how to plan ahead. Container ships require weeks of sailing time to reach their destination, so delivery schedules are drawn up far in advance. New varieties don’t appear magically overnight; they require decades of R&D, trial and error. Orchards don’t bear fruit forever, so replacements must be planted years ahead of the required harvest. For fruit and veg suppliers, an ability to prepare is second nature. So it’s a shame that certain stakeholders – the South African government, to pluck one example out of the air – are not so agile. On our visit to the Western Cape last month, it was clear the province’s growers and exporters can cope with almost anything you throw at them: water shortages, power cuts, higher crop protection costs, stricter environmental audits, social compliance demand. You name it, they can overcome it. But the inadequacy of Cape Town’s state-run container port facilities seems, to use a logistical term, almost terminal. You might argue Transnet could have foreseen problems like gusting winds – a phenomenon that is surely as old as Table Mountain itself – and tailored its operation accordingly instead of sitting on its hands? Perhaps the adverse weather could even have been used to generate much-needed renewable energy? After all, it’s an ill wind that blows no good.

Mike Knowles Editor

Mike Knowles Editor

Everything in their power

Fruit exporters in South Africa’s Western Cape say they will do anything they can to keep costs down, maintain quality, and ensure their supply chains stay sustainable and profitable.

by Mike Knowles

Danie Viljoen is no ordinary fruit grower. As well as stonefruit, apples and pears, he now harvests something very different on the vast expanse of farmland he manages in Ceres Valley, in the heart of South Africa’s Western Cape province.

“See that?” he says, as he holds up his smartphone and points to a chart on the screen. “These are my ‘eyes on the ground’. I put 30 probes in the field, linked them to 220 irrigation valves that open and close, and I taught myself how to extract the data and visualise it. Now I can check water levels across the orchard, all from my phone.”

Like many of the country’s growers, Viljoen’s role as general manager of Graaff Fruit’s 175ha Lushof Farm has changed significantly over the past ten years.

In the second half of the last decade, the Western Cape endured its worst drought in 400 years. It was an episode so severe, the city of Cape Town almost ran out of water. As a result, growers now use any technology at their disposal to conserve water sources. For the time being at least, those reserves have mercifully been replenished.

“Our biggest challenge is water,” says Viljoen as he drives past the farm’s reservoir, which holds 1.4bn litres. Located on the edge of South Africa’s semi-arid desert region of Karoo, these orchards enjoy dry heat in the day and cool nights that enable the trees to grow sweeter fruit. But they also receive very little direct rainfall. “Everything we do is designed to preserve that. Without water, we have nothing.”

Water is not the only resource that concerns Viljoen. Like most South Africans, he now expects to run out of electricity on a regular basis. For more than a decade and

a half, in fact, the country has learned to live with frequent rolling blackouts caused by a rationing exercise known as load shedding.

It’s an extra hurdle created by chronic underinvestment in government-owned energy supplier Eskom, whose network can no longer fully meet national demand. The outages cut electricity supply from homes and businesses in different parts of the country at different times, typically for periods of up to four hours.

What load shedding has done is spark a wave of private investment in generators, solar panels, and lithium batteries. For the fruit industry, these add-ons keep orchards and packhouses in operation. At Lusfhof, for example, Graaff Fruit has spent around R20m to install generators and a solar energy system to keep its packhouse operations and irrigation systems running.

To the west near Wellington, on a major plum and nectarine production centre called Sandrivier Estate, owner Le Roux Group added an array of solar panels in December. For packhouse manager Marius Voigt, these give the farm a more reliable, cleaner energy source. “It's been up and running for about a month now,” he says. But it only solves part of the problem. The company’s coldstorage facilities need to run through the night, so it has also acquired a lithium battery to store the solar power.

“I think the country as a whole should look at this kind of renewable energy,” Voigt observes. “Obviously, it's fairly expensive to have a solar farm and a battery. But without it, it would be a disaster.

A lot of companies are picking up these costs now. We should not have to, but the other benefit is we then have green energy.”

Ian Versfeld, another farmer

based near Ceres, admits the task of shoring up electricity supply and limiting water consumption has been tough. But he also believes the experience has left many fruit producers in the Western Cape stronger and more resilient as a result. “It's quite a big investment, especially on energy costs. But everything is possible if you are geared correctly,” he explains, “It gets really expensive when you have to buy generators and batteries. But as soon as the cost comes down for all those things, it gets easier. Our farm is definitely becoming more sustainable as a result.”

PORTS IN A STORM

Even when vital resources are in short supply, you could never accuse South Africa’s fruit industry of lacking resourcefulness. On Fruitnet’s visit to the Western Cape in January, we saw an industry that was ready to supply the European market with some of the finest fresh produce on the planet. We also witnessed a determination among many of its companies to make their operations more efficient.

OPPOSITE—Fruit packhouse owners have been forced to invest in their own energy supply

“It’s fairly expensive to have a solar farm and a battery. We should not have to, but the benefit is we have green energy”

But as the industry works hard to reach those goals, complications on water and electricity are not the only challenges it faces along the way. By far the biggest source of frustration is the persistent disruption that continues to hamper the country’s ports and export shipments.

At the Port of Cape Town, most agree that a lack of investment,

expertise and effort on the part of its state-owned container terminal operator Transnet has left newly harvested fruit waiting weeks to depart. For highly perishable items with a short shelf-life, like the plums, peaches and nectarines that make up a major segment of the Western Cape’s fruit exports, this is a major problem.

Terminal will not, it seems, be fixed overnight.

ABOVE—Power generation units like this one on an orchard near Ceres have become essential investments for Western Cape fruit growers LEFT—Danie Viljoen says water is the biggest challenge when it comes to producing stonefruit

some cases, vessels were loaded in Cape Town during week 51, but only departed three weeks later. For stonefruit, that kind of delay almost certainly means financial disaster, cancelled payments, and possibly even a fee to dispose of a consignment that has no buyer.

Such problems are compounded by an apparent lack of adequate state support. One exporter suggests the government’s only real contribution to the export industry in the past few years has been to oversee a dramatic weakening of national currency the rand.

“The industry cannot afford for the ports not to function in a normal way,” says Gysbert Du Toit, marketing director of Dutoit Agri. “The only outcome I can see is privatisation, or semi-privatisation. That's the only solution.” For exporters doing their best to deliver delicate items like plums and nectarines in Europe by January, the recent Christmas period brought very little good cheer. In

Yet as Du Toit points out, even that foreign exchange advantage represents a hollow victory. “The exchange rate helps,” he explains, “but this is always a very dangerous trap. If you build a business based on a weak currency, many things are out of your control and

The fact that the situation remains beyond the industry’s own control makes it an even bigger headache. There is talk of switching to conventional reefer vessels, or paying to send fruit by airfreight, but in both cases the costs involved are significantly higher. Infrastructural failings on the part of stateowned enterprises like Cape Town Container »

the rand can strengthen back. For now at least, we are in an industry where we are export-focused and we can earn foreign currency. But there is a tipping point, because a lot of our input costs are exposed to exchange rates. You cannot say that if the rand weakens by 10 per cent, you might make 10 per cent more profit.”

There are other cost increases to contend with. Like the higher price of crop protection products that meet more stringent international

rules designed to protect the environment. As Andre Smit of industry body Hortgro explains, this casts a pall over South Africa’s ability to retain its strong position in the EU and UK markets. “Our perception is that phytosanitary measures are being used, but we don’t always think these are for biological and scientific reasons,” he suggests. “The removal of chemicals permitted to produce class-one fruit is a concern, because it is a new constraint and it pushes our

LEFT—

Gysbert Du Toit, Dutoit AgriBELOW—Robert Graaff, Graaff Fruit

OPPOSITE—Harvested fruit ready to deliver to the packhouse

“The exchange rate helps, but if you build a business based on a weak currency, things are out of your control”

costs up. We are not saying that harmful chemicals should not be phased out, but we think that the policies are anti-competitive.”

Then there’s the issue of bigger overheads associated with more demanding audits. Suppliers say they have to undergo an increasing number of checks that are required by customers who don’t want to fall foul of regulators. “We need to find ways of addressing the duplication of standards compliance and resulting inefficiencies in the supply chain,” observes Fhumulani Ratshitanga, CEO of industry body Fruit South Africa. The Sustainability Initiative South Africa (Siza) was set up 15 years ago to do just that, and has already saved fruit suppliers an estimated R66m by organising audits that cover multiple international certification schemes. But more work is needed.

SHREWD INVESTMENT

Faced with so many additional costs and a tougher market, many in the South African fruit industry believe it must find new ways to enhance the value of what it has to offer. For some, that value »

can be increased by having better structural capabilities – for example in the form of packhouses that are equipped with the latest advanced storage and grading technology.

“We are on the brink of making quite big capital investments in the packing and processing part of the business,” reveals Gysbert Du Toit. “For the previous ten years we have focused on expanding our production footprint. But now we are desperate to follow that through with investment in infrastructure. We have to invest in new technology. In the next five years, that will take a lot of our focus.”

New genetic material and better varieties also have the potential to make a big difference.

“Ten years ago, the nectarine varieties available to us would yield around 24 tonnes per hectare, but nowadays that’s higher and approaching 45 tonnes per hectare over the season,” reveals Pierre Rossouw, technical manager at stonefruit export marketer Stems. It was created in 2011 to develop new opportunities for South African stonefruit on international markets.

Those new varieties have opened up more lucrative marketing opportunities, Rossouw

says, as they have allowed growers to adjust the timing of their stonefruit campaign. “Much more is sold to Europe post-Christmas, whereas 12 years ago this was not really possible. Now, half of the volume goes to Europe after new year. As a result, we have seen growth all over Germany, Spain, and the Netherlands, which then re-exports. Russia is becoming a bigger market too, and we're growing in North America, for example in Canada.”

Graaff Fruit director Robert Graaff agrees that better varieties are essential. “It’s so expensive now to plant an orchard under nets

ABOVE—Nectarine yields have improved with the introduction of better varieties »

and do everything 100 per cent correctly, you've got to make sure that the variety is a champion,” he insists.

NEW MARKET TRENDS

Despite all of its various challenges, South Africa’s fresh fruit production and exports have seen considerable expansion in the past decade, contributing around US$3.3bn to agri-export earnings. “Fruit exports have grown from 2.5m tonnes in 2013 to over 3.5m tonnes, and the industry is expected to continue increasing its exports as new plantings coming into play,” Ratshitanga reveals.

Between 2013 and 2022, the country’s total planted area grew by 36 per cent to almost 204,000ha. Almost half of that was citrus, with topfruit (known locally as pome fruit) and subtropicals including avocados accounting for 19 per cent each. Stonefruit made up 8 per cent, with berries on 1 per cent.

Blueberry production in the country is set to continue its impressive recent expansion, after the industry increased its annual exports from 4,000 tonnes in 2016 to around 20,000 tonnes in 2023. “There has been significant growth in this commodity and, in the next ten years, big growth is expected,” Ratshitanga confirms.

The EU and UK are still the biggest markets for South African fruit, although there has been growth in sales to Asia, says Ratshitanga. She is one of the people responsible for opening new markets, or at least encouraging politicians and civil servants to do so. And Asia is the one part of the world where most of South Africa’s pending applications for market access are addressed. If it achieves its current priorities on that front, the country will eventually be able to send peaches, nectarines and

plums to China, apples and pears to India, and grapes and citrus to Japan. “As more markets open, we will see more growth,” Ratshitanga adds.

But South Africa’s membership of the Southern African Customs Union means that it cannot negotiate trade deals with other nations by itself. “This makes it difficult because we need buy-in from all of those southern African countries,” says Hortgro’s group operations manager Mariette Kotze. “We’re trying to make sure we are part of the government’s team to facilitate that process and build a supportive structure around new FTAs.” As a result, the opportunity to secure free-trade agreements with new markets remains a tricky one to grasp.

For the foreseeable future, Europe remains the primary goal for most South Africa fruit exporters. Within that market, the last decade has brought a notable shift in focus for some suppliers, from primarily UK-oriented supply to a trade that sends a much larger proportion of its export volume to mainland Europe. Part of the reason for that shift appears to be a change in consumer demand – especially for plums, peaches, and nectarines – and the arrival of better-tasting varieties.

“In 2012, 85 per cent of the nectarines we shipped went to the UK,” says Peter Wolfaardt, who along with his sister Georgie Hewitt represents the fourth generation to run Verdun Estates, a family-run stonefruit farm and packhouse near Ceres. “Last season, our volume was the same, but it made up just 35 per cent.” The company now markets its fruit through Stems.

Pierre Rossouw says a major reason for that change is that German retailers have shown much more interest. Ironically, this has coincided with UK retailers –

inspired by Aldi’s growing market share – opting to pursue a harder discount model. “Especially in the UK, customers have been slightly spoiled with not paying a lot of money for fresh produce. It's actually relatively cheap. And with all costs rising – from primary agriculture, to getting it into the market – inflation is not really coming back to the farms at the moment.”

Of course, this has implications when it comes to paying for new and more stringent sustainability requirements. And while Rossouw says those demands have tended to come from customers in the UK and Germany first, he also suggests they are not always willing to pay more to fund such improvements.

“Customers have not paid a lot for fresh produce. And with costs rising, inflation is not coming back to the farms at the moment”

“The financials are very important for sustainability and that's one of the big challenges I think we're still seeing, especially with UK supermarkets,” he says. “Germany is not a new market for us, but in terms of retail in the last several years we have focused quite a lot on retail there, and it's been really good for us. It pays a little bit more in terms of price, and it goes up more with what the market demands.”

And with margins already as tight as they are, any chance to generate a little more value is a very welcome one indeed.

PPECB retains its relevancy

Chief executive Lucien Jansen says that one of the South African fresh produce industry’s key organisations needs to stay ahead of the game.

by Carl Collen @carlfruitnet

South Africa is this year reflecting on more than 130 years of fruit exports – at a time when its reach as a fruit exporting country is expanding into new territories of the world. In the course of those 130 years, marketing organisations, export companies and farming groups have come and gone, yet one crucial cog in the wheel of South African produce exports has remained.

This is the Perishable Products Export Control Board (PPECB), which, somehow, has not only survived, but also retained its relevancy in the new, highly complex export environment.

The PPECB’s timeless relevancy in the lives of people in the produce industry is the subject of a major coffee-table publication of around 300 pages researched and written by Eurofruit’s own South African correspondent, Fred Meintjes, which was recently published by the organisation.

“South Africa is ge ing access to more countries and this involves complex protocols, the adherence to which we have a role to play in”

“It reflects the way in which the organisation has constantly reinvented itself in order to stay relevant in the fruit export sector,” says Lucien Jansen, PPECB chief executive officer. “We are now close to 100 years old, but we still touch the lives of people in every fresh produce export sector in the country.

“Perhaps our greatest contribution is that we helped to set export standards and a seal of approval which grants South African fresh produce access to the countries where they are finally offered to consumers,” he outlines. “In a world where consumers increasingly question the safety of the products that end up on their tables, the well-known PPECB stamp of approval brings comfort and assurance that South African products are safe and can be trusted.”

In the recent past the PPECB has had to extend additional assistance to the industry to ensure compliance with increasingly stricter international import requirements. “South Africa is slowly getting access to more and more countries, and this almost always involves complex protocols, the adherence to which we have a role to play in,” Jansen continues. “In our traditional markets there are new complex demands attributed to food and plant safety that

needs to be complied with.”

It is a very complex situation, where highly technical and legal details play a role. “However,’ says Jansen, “we have managed to adapt, and our diverse workforce continues to maintain the highest levels of customer service to ensure we remain relevant and of service to the industry.

“A competitive international market sees nations vying against each other for a share of the market,” he notes. “For new market entrants this is tough. Consumers suddenly have more options in terms of the availability of fresh produce. South Africa therefore needs to differentiate itself by ensuring a better quality and delivering to the right markets at the right time. Here quality inspection standards, speed to market, given all the trade barriers, and export information is critical.”

What is the PPECB?

The Perishable Products Export Control Board is an independent service provider of quality certification and cold chain management services for producers and exporters of perishable food products.

Established in 1926, the PPECB has delivered valuable services to the perishable products industry for over 90 years by enhancing the credibility of the South African export certificate and supporting the export competitiveness of South Africa’s perishable product industries.

As a national public entity, the PPECB is constituted and mandated in terms of the Perishable Products Export Control Act to perform cold chain services. The PPECB also delivers inspection and food safety services assigned by the Department of Agriculture, Forestry and Fisheries.

The presence of the PPECB in the export industry is furthermore enhanced by its recognition as an approved third country under the European Commission Regulation 543 of 2011. This agreement recognises the South African inspection systems as equivalent to that of the EU inspection bodies and therefore ensures less frequent checks at the port of import into the EU.

Together we grow and sustain your business

Our passion for excellence helps you grow your business and establish yourself as a

Sensible, sustainable steps

The South African fruit industry says its answer to the proliferation of social and enviromental certification schemes is rooted in realism and pragmatism.

by Mike Knowles@mikefruitnet

In South Africa, a land where water shortages and power cuts have underlined the finite nature of natural and man-made resources, and where ethical treatment of underprivileged people has defined the country’s very existence for as long as anyone can remember, awareness of the various environmental, social and governance factors that shape its fresh produce industry is high.

However, the South African fruit industry is also acutely aware of the need for a rational approach to environmental and social compliance, one that avoids placing unnecessary, unsustainable financial burdens on growers, suppliers and exporters.

For that reason, an independent certification body called the Sustainability Initiative South Africa (Siza) was set up 15 years ago to minimise

the number of individual audits producers had to undertake, especially if they wanted to supply major retail customers in markets like Europe. It says it has already saved the industry around R66m by removing the expense of those additional audits, which would otherwise have been required passports to entry demanded by clients in different markets.

“We maintain a hands-on approach with third-party auditors, and now recognise seven audit firms, each with a local office in South Africa,” notes Werner Van Dyk, Siza’s ethical and sustainability audit manager. This represents progress, but other complications remain. “Several customers still see social and environmental standards as different and separate, which is something we find strange when those audits and fields of discipline are combined,” Werner adds.

ABOVE & OPPOSITE—

Concern for the welfare of workers and efforts to protect the environment have made certification schemes more complicated and therefore costly

Van Dyk rejects any suggestion that producers are looking to cut corners, even if they are determined to limit the cost of compliance. For many, however, the financial burden involved in ticking the right boxes for the right buyers has risen sharply in recent years with the arrival of new rules and regulations – for example, new sustainability reporting standards implemented by the EU from the start of this year and soon to be introduced by the UK.

“We’ve seen an increase in social and environmental audits,” he explains. “Last year, we ran 732 social and 69 environmental audits. There is definitely an increase and it’s picking up quickly.” Since 2015, audits commissioned by Siza have identified over 46,000 areas where improvement or corrective action was required. An impressive 96 per cent of these have already been resolved, Van Dijk points out.

“Producers are showing their commitment to continuous improvement, and this is evaluated and proven by the third-party audit outcomes: in the past year, 61 per cent of producers achieved platinum status and 25 per cent gold. We are definitely not anticompliance, we are focused on improvement and best practice.”

A HIGHER BAR

Whereas compliance used to focus mainly on food safety, environmental standards are now a key component of most certification schemes. As Siza’s sustainability officer Victor Mouton explains, the group’s environmental standard allows buyers to keep track of their own supply chain targets. “We recently developed a net-zero guideline, a template they can use to work out best practice on water, pests, emissions, hourly wages, and worker accommodation,” he says. “The

“Several customers still see social and environmental standards as different and separate, even though the audits are combined”

overwhelming majority of producers see the benefit of this, and see the results in terms of market access. They understand the need for certification and we help them meet it.”

Van Dijk also insists that smaller growers do not necessarily need to feel at a disadvantage when it comes to achieving full compliance without incurring major overheads. “The real challenge for smaller growers lies specifically in the perception that it’s a lot more admin and requires a lot of staff,” he argues. “For the last five years, we have tried to highlight the fact that not everything has to be done on compliance like 15 years ago. You don’t need to keep huge large files and reprint them for each auditor. We help producers to develop auditing systems that suit their own business, especially online ones where everything is located in one digital hub. Digital record-keeping tools are now a more accessible means to that end.”

A faint light at the end of a blustery tunnel

Delays in South African ports have blighted the country’s fruit export business, which finds itself almost powerless to intervene.

by Mike Knowles@mikefruitnet

When writing about logistics problems and their potential resolution, the metaphor that writers usually reach for is the light at the end of the tunnel. But if fruit exporters in the Western Cape do currently see any such thing during these dark days for South African ports – by no means certain in a country where blanket power cuts are frequent – then it’s a rather faint light at best.

The story of Cape Town’s stumbling, wind-buffeted port logistics operation is already well reported. But for those that missed it, here is a mercifully brief summary: someone in the upper echelons of the South African government forgot to allocate enough budget for simple, sensible investments like cranes that don’t blow over in the city’s recurring high winds.

Antoine e Van Heerden, logistics manager at the South African Fresh Produce Exporters’ Forum, is not paid to defend state-owned operators Transnet and Transnet Port Terminals, which runs the Cape Town Container Terminal. In fact, her role is to criticise it constructively and to make recommendations for the kind of investments that might li South Africa’s ports off the very bo om rungs of the World Bank’s latest Container Port Performance Index.

So the fact that Van Heerden sees some of that symbolic light at the end of that figurative tunnel of incompetence offers a sliver of hope for those fruit exporters who spent much of their Christmas break distracted by updates on the glacial progress of their consignments out of Cape Town Container Terminal.

“What we need from Transnet is a lot of new equipment,” she tells Eurofruit. “We want to see more mobile and short cranes to help [private fresh produce logistics operator] FPT. We are also encouraged by news of a train link to the planned Belcon Maersk coldstore and warehousing depot, which is under construction, as well as plans for other facilities in Culembourg and Worcester. In short, we are happy with the progress we are seeing.”

But of course, logistics being what it is, the new

equipment won’t land in the port overnight. In fact, it may not appear for another couple of years, Van Heerden admits. “Hopefully 2025 onwards,” she suggests. “In the meantime, we will micromanage ourselves through the season.”

Fhumulani Ratshitanga, CEO of industry body Fruit South Africa, sums up the need for action: “Our fruit industry is a significant contributor to the country’s stability and development. So there is a real need for joint efforts to address the various bo lenecks faced by exporters.” How long it is before things improve remains to be seen. And with rumours of deeper financial problems at Transnet, there could be some very strong headwinds to come.

Stargrow has high hopes for 2024 Celina campaign

Company expects to substantially increase shipments of the South African-grown blush pear to the European market this season.

by Maura Maxwell @ maurafruitnet

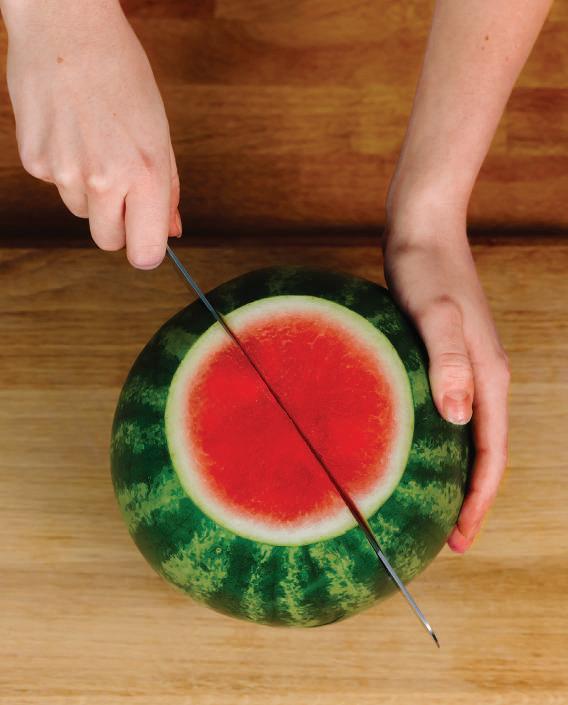

One of the key a ributes of Celina blush pears is their ability to be marketed both as a ripe and unripe variety

South Africa’s Stargrow Fruit Marketing was anticipating a strong market ahead of the arrival of the first new-season volumes of Celina blush pears in January. Sauer Kriger, who heads up the company’s trading division, said customers were reporting increased demand due to the smaller than normal Northern Hemisphere crop.

“We are already into the third week of packing Celinas and expect to enter into empty markets across the world,” he told Eurofruit. “Celina offers our customers the unique opportunity to sell the first blush pears in their respective markets every year, being the earliest commercially available blush pear variety in South Africa. With a size profile larger than other blush pears it enables us to target a wider market spread which leads to increased returns back to farm-gate for our growers.”

Over the past four seasons, Stargrow has focused on developing all of the major blush pear markets and it plans to continue to build on this momentum going into the 2024 season. One example is China, which returned very competitive prices in 2023 and is eagerly anticipating the arrival of the 2024 crop, Kriger said.

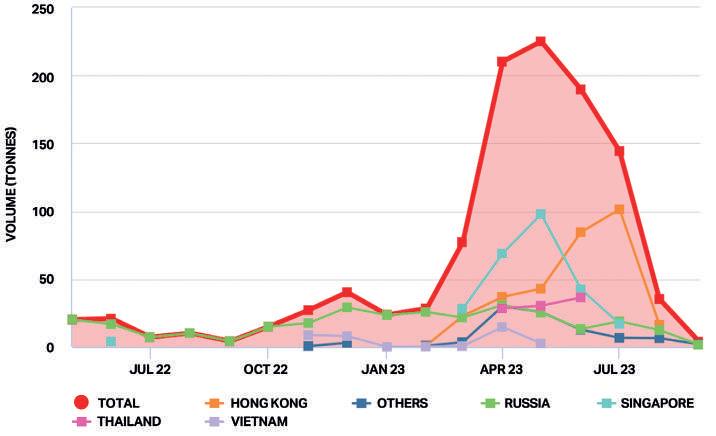

Stargrow said it expects to substantially increase volumes to this market during the 2024 season, especially in the early harvest window. Apart from the China and the European Union, other markets where Celina sales are gaining momentum include Russia, Canada, Vietnam, Indonesia, Malaysia, Singapore and Hong Kong.

Celina’s ability to be ripened has also led to an increase in uptake in the UK retail sector under the management of World Wide Fruit. “We have found the variety to be a positive addition to the pear catalogue,” said WWF’s Keith Bu erworth.

“The key a ributes are the brand name aligned to the appearance of the fruit and in particular the capability to market the fruit both as an unripe and ripe variety. This opens wider marketing opportunities, with most of the sales in the UK currently being for ripe fruit.”

TopFruit remains at the cutting edge

The visionary minds of South African fruit pioneers created a private company 40 years ago, which has since brought leading international fruit varieties to the country.

by Fred MeintjesSince its establishment in 1983 by three pioneers of the South African fruit sector, the late Dr Jim Button, Roy Jeffery, and Richard Hill, TopFruit has managed to introduce new varieties of pomefruit, stonefruit, table grapes, berries, kiwifruit and nuts to the country’s fresh produce business.

In the process, the company has established itself as the custodian of various fruit varieties, bringing innovation and value to breeders,

growers, and consumers alike, and establishing strong relationships with fruit growing sectors in other countries.

“Obviously, the proof is in the pudding and we are pleased to say that we are now seeing the results in exceptional varieties offered to the South African fruit sector,” says Liza Matthews, spokesperson for TopFruit. “Some of the successes include the Arra table grape varieties which are resistant to rain and adverse weather conditions.”

TopFruit marks 40 years

TopFruit celebrated its 40th anniversary in 2023 with the South African cultivar management company reflecting on its journey and looking to the future with great excitement. Managing director Rob Meihuizen said strategic partnerships would continue to play an important role in the success of the company.

“We remain focused on growth and innovation at the forefront of fruit industry developments, expanding our global presence, and introducing new and exciting fruit varieties and brands to consumers worldwide,” said Meihuizen. “With a diverse portfolio that includes pome fruit (apples, pears), stonefruit (peaches, nectarines, plums, apricots and cherries), table grapes, berries, and the recent addition of kiwifruit and nuts, TopFruit continues to lead the way in fruit production.”

Topfruit has managed a range of leading fruit varieties including the Pink Lady apple, which originates from the Cripps Pink variety. It has also worked with the likes of the Bradford varieties (stonefruit programme); Cripps Red/ Sundowner (today sold under the Joya trademark); Plant & Food Research’s blueberry programme in New Zealand; Bingo Gala, which is a South African apple mutation; Kiwiko BV, a joint venture to manage kiwifruit varieties globally; TopNut International’s joint venture to manage nut varieties globally, as well as a range of varieties from the Arra programme.

“We are pleased to say we are now seeing the results of exceptional varieties offered to the South African fruit sector”

In 2023 TopFruit also celebrated the first year of sales of the new branded apple, Soluna, in Asian markets. TopStar, a joint venture between TopFruit and Star Fruits, manages this new burgundy coloured apple globally. “It was a great success,” confirms Matthews. “We are working hard to establish the brand in Asia, the only market with fruit now. We will also be present at Berlin Fruit Logistica in a shared booth with Star Fruits. An extensive international evaluation programme is underway with test trees being planted all over the world.”

Another example of a leading international apple variety that TopFruit is involved with – and which is proving very successful –is the Joya branded apple. “This variety is gaining momentum because a new mutation with better colour is available and being planted in huge numbers,” she continues. “A global focus is also being worked on, bringing new possibilities to our exporters.”

Two apple varieties that were discovered in South Africa, namely Bingo Gala and Golden Joy, are also being commercialised by TopFruit globally. “Because these two varieties have a tree royalty only with no production royalty or marketing restrictions, producers are free to market it as they wish,” explains Matthews.

Bingo Gala is described as a “full cherry-red and impressive South African Gala apple mutation” and has been very well received in Asian markets, according to the group. “It is also important from a production point of view because only one or two picks are required to strip the trees,” she outlines.

Golden Joy, meanwhile, is a high-bearing, early South African Golden Delicious apple mutation, which is expected to boost the category.

“Then we also have a long association with the well-known Bradford (BQ Genetics) stonefruit varieties, which is helping to transform the South African stonefruit category,” Matthews adds. “We have exciting plums under evaluation and on offer.”

ABOVE—TopFruit’s Liza Matthews, AJ Jansen van Vuuren and André Agenbag

OPPOSITE—The Soluna variety has been a great success

Ruby Rush shines bright

Sugrafiftythree, a new early red seedless grape variety to be branded as Ruby Rush, brings new opportunities for growers locally and globally.

by Fred Meintjes

Heralded as “juicy, crunchy jewels in your mouth”, Sun World says its new Ruby Rush-branded range of early red grapes are sure to have a positive impact on the table grape world.

The results of this year’s harvest of semi-commercial vineyards in the Orange River and test block vineyards in Namibia, Berg River and Hex River are now in. And although limited in scale, the varieties have impressed growers with their early performance.

Sun World introduced the Ruby Rush brand in July 2023, featuring the Sugrafiftythree variety. The brand may expand in the future, incorporating other complementary varieties to enhance consumer recognition by ensuring a longer shelf presence throughout the year.

“Sugrafiftythree offers Sun

World growers around the world a sustainable red grape with natural colour development, better yields, lower input cost, and great postharvest attributes,” said Sun World’s Paola Barba. “Sun World licensed growers harvested Ruby Rush branded grapes this northern summer in the US, Italy, Spain, and Israel with positive results.”

“It is a sustainable red grape with natural colour development, better yields, less input cost, and great postharvest attributes”

In South Africa, JC Fölcher, the senior executive responsible for all table grape farms in the Karsten Group, says this season’s results have been very pleasing. “It is very important to note that Sugrafiftythree develops colour naturally and what we have seen this year boosts our confidence.”

He says that in the past there has not been a natural successor or potential replacement for Flame Seedless, and that the arrival of Ruby Rush is of great significance for the early regions.

GOOD RETAIL RECEPTION

The variety has also been well received by South African retailer Woolworths. “This season we received the first samples of Sugrafiftythree. the earliness of the variety is interesting, and berries remain firm postharvest,” says Frans Gelderbom, technologist fruit and Letitia Joubert, procurement manager at Woolworths. “We look forward to learning more about the variety as higher volumes become available.”

For the international table grape business, this is a significant development. Observers say there has always been a gap in the market, particularly in the early growing season, for a new range of red seedless varieties which could replace older cultivars – some of which have been around since the 1980s.

Barba also notes that the initial variety sold under the Ruby Rush brand is a ‘new generation’ red grape that is expected to be an ideal replacement for traditional early-season red seedless grapes. “For consumers, it offers a refreshing taste experience during the early season,” she says.

Volumes of Ruby Rush are set to increase globally over the next 2-5 years as the variety becomes available for growers to plant in other countries.

Europe remains a high priority for Sati

Sati says it is focused on retaining its traditional markets while opening new opportunities in the East.

by Fred Meintjes

One of the South African Table Grape industry’s (Sati) key priorities is maintaining the country’s market share and position as a preferred supplier in the UK and Europe. This is according to Sati chief executive AJ Griesel, who highlights the advantages the country has in what is an increasingly competitive market.

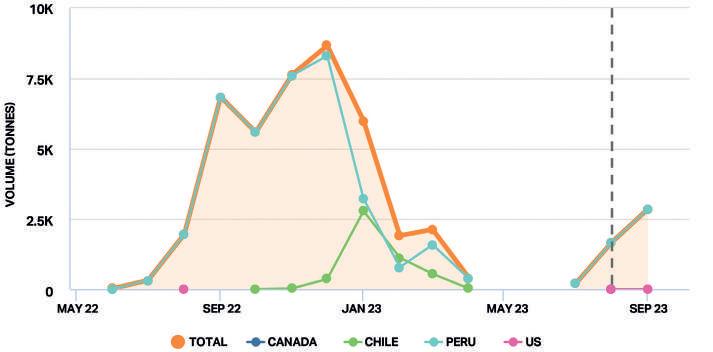

“In addition to servicing our traditional markets, Sati has prioritised increasing South Africa’s market share in eastern markets, which include China and Southeast Asian countries, and North America which includes the US and Canada,” says Griesel.

“The global market landscape remains increasingly competitive,” he continues. “Peru, Chile and to an extent India have become contenders during South Africa’s marketing window. Peru and Chile export approximately 562,500 to

585,000 tonnes per year each, and ship to the EU. Australia exports 135,000 tonnes per year and ships predominately to the Asian markets.

“However, South Africa maintains certain advantages that we believe position us as a favourable supplier to the global market,” Griesel points out. “These include established history as a preferred supplier and longstanding supplier relationships as well as family-owned businesses and focused commercial players, which offer a personal touch and the ability to tailor to a market’s specific needs.”

South Africa can also extend a marketing window of five months, with the ability to supply consumer-demanded new generation cultivars throughout this time period. Above all, the country has a reputation for producing quality products.

“South Africa maintains certain advantages that we believe position us as a favourable supplier to the global market”

EASTERN PROMISE

During the past three years, the China Market Development Campaign has promoted South African table grapes through Chinese trade and retail channels, with positive results and feedback received in the 2022/23 season.

“In conjunction with the Western Cape Department of Agriculture, Sati’s objectives for this season include expanding the market development campaign to additional eastern countries,” Griesel notes. “Opportunities in Vietnam are currently being explored, due to the market’s preference for South African grapes and potential to absorb more of South Africa’s quality product. Last year Sati engaged with local exporters and the South African ambassador to Vietnam regarding the coordination of a collaborative approach.”

Meanwhile, South Africa is currently in the final stages of applying for market access to the Philippines and is looking forward to the potential opportunities this holds for the industry, according to Griesel.

“Cultivar consolidation has ensured that growers remain aligned with global consumer market trends, and as per Sati’s latest vine census, white seedless cultivars currently dominate South Africa’s supply,” he outlines. “Our top six exported cultivars currently comprise 50 per cent of our cultivar profile. These are Crimson Seedless, Prime Seedless, and the branded varieties Sweet Globe, Sweet Celebration and Autumn Crisp.”

ABOVE—Growers are planting in line with trends

RIGHT—AJ Griesel

CREATING A PROGRESSIVE, EQUITABLE AND SUSTAINABLE TABLE GRAPE INDUSTRY

TABLE GRAPES OF OUTSTANDING QUALITY AND TASTE, WHICH ARE RESPONSIBLY GROWN IN SOUTH AFRICA TO MEET THE HIGHEST GLOBAL STANDARDS, START THE JOURNEY FROM THE FOOT OF TABLE MOUNTAIN TO REACH MARKETS AND TABLES AROUND THE WORLD.

Assisting producers to retain, grow and optimise markets is the most important function of the South African Table Grape Industry (SATI), an enabling grower association. SATI represents growers on key government and industry initiatives aimed at creating more opportunities from ownership to accessing new markets in a sustainable way.

SATI assists growers with numerous support services including Industry Information, Transformation, Research, Technical

SOUTH AFRICA – QUALITY ON ROOT

Market Access, Market Development as well as Training and Development with the objective to establish South Africa as the Preferred Country of Origin for the world’s best tasting grapes.

63 Main Road, Paarl | PO Box 2932, Paarl 7620

+27 21 863 0366

info@satgi.co.za | satgi.co.za

linkedin.com/company/satgi @sati_sa

Scan to follow us on LinkedIn

Clemengold strives for excellence

The premium mandarin brand says it must deliver consistently on its quality promise, and it is living up to this through innovation and precision farming.

by Fred MeintjesAbrand can only be as strong as its ability to consistently deliver on its quality promise. This is the opinion of Adéle Ackermann, Clemengold’s international marketing manager, who speaks exclusively with Fresh Focus South Africa about the evolution of this popular mandarin brand.

“For the premium Clemengold mandarin brand, our ability to do just that is derived from the expansive family of companies that form part of our larger group, and a legacy of excellence through continuous improvement and best practices,” she explains.

Clemengold says that superior quality means fruit that can match the specifications for inclusion in the brand, with a good return to contributing growers.

Firstfruits, the brand’s

technical advisory and continuous improvement company, works in tandem with Indigo Fruit Farms, integrating technology into its farming and packing operations, setting new benchmarks for quality and efficiency.

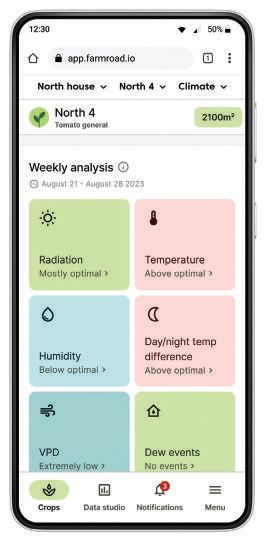

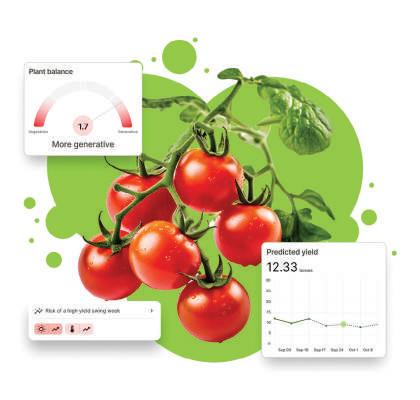

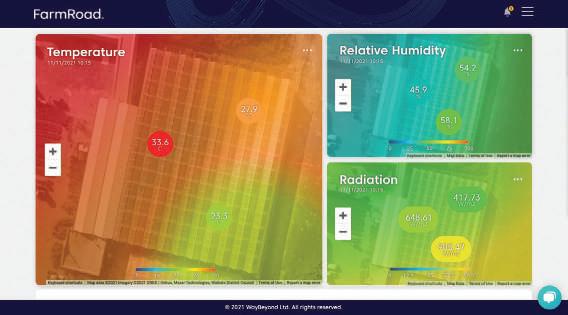

The backbone of the group’s agricultural innovation is FarmNode, a precision farming product developed by the company's software arm, Citrii Software. This technology, implemented under the guidance of Firstfruits, digitises various aspects of farming operations, which it says is “ushering in a new era of efficiency and sustainability”. The product covers several areas, including irrigation and fertigation, crop protection and manipulation, as well as packhouse practices for improved efficiency.

Jòkevan Wyk, Citrii business

analyst, says real-time data analytics provide insights into soil moisture levels, allowing for precise management of water and nutrient usage. “This not only maximises resource efficiency but also ensures optimal growing conditions, contributing to better packouts and superior fruit quality,” she explains.

Precision farming also extends to crop protection practices, where FarmNode aids growers in monitoring and controlling pests and diseases with unparalleled accuracy. “By employing targeted interventions based on real-time data and expert recommendations, Indigo has been able to minimise the use of pesticides, promoting sustainable farming practices,” van Wyk says. “FarmNode's capabilities extend to crop manipulation actions, allowing growers to make datadriven decisions regarding pruning and thinning – an approach that enhances fruit quality and increases yields, leading to better packouts.”

Clemengold’s commitment to technological excellence extends to its packhouses. “We’re proud of our packhouse teams’ ability to pack the right fruit in the right box at the right time,” says Ackermann. “This enables our commercial and marketing teams to honour supply agreements with a variety of global clients – each with their own expectations.” Automated systems, supported by data, ensure that each piece of fruit meets the highest standards of size, colour, and quality. Ackermann says the Clemengold brand has experienced a good year with “memorable and culturally relevant marketing campaigns across the globe”, and has satisfied clients and citrus lovers.

ABOVE—The Clemengold brand is internationally renowned BELOW—Clemengold focuses on continuous improvement and the implementation of best practices

Westfalia counts down to Chinese entry

There is great excitement in the South African avocado industry as access widens in Asia.

by Fred Meintjes

Following the confirmation in 2023 that China has opened to avocados from South Africa, Westfalia Fruit anticipates the first shipment will arrive in southern Chinese ports at the end of March. The company says the opening of China to South African avocados is an exciting development.

South Africa is strategically well positioned to supply the growing Chinese market with Hass, with transit times from Durban to southern ports in China, such as Hong Kong and Shanghai, only 18-22 days.

There has also been a boost for the industry with the news that Japan has also opened its doors to South African Hass avocados.

“It is indeed good news for us that

the protocol for exports of South African Hass avocados to Japan has been finalised,” says Subtrop chief executive Derek Donkin. “Widening access to easter markets allows for market diversification, providing opportunities other than the EU and UK, which currently absorb 95 per cent of South African avocado exports. These traditional markets, however, will remain important markets for South Africa.

“Tapping into growing markets in the Far East will allow for further expansion in the South African avocado industry, which has grown at a rate of 800–1,000ha per annum over the last five years,” Donkin explains. “Current plantings stand at 20,000ha.

Access to China and Japan has come at a critical time when these

new plantings are coming into production.”

Hass supply will be available over a seven-month period from April to October, and it is anticipated that production volumes in South Africa will increase in the short term as existing orchards mature and yields develop. The accessibility and predicted growth of the Chinese market will support the distribution of increased volumes in a responsible manner for the long-term benefit of the industry.

LEADING EXPORTER

Westfalia Fruit is the leading exporter of avocados in South Africa, representing half of all exports in the category, and the company says that with its

ABOVE—The opening of new markets in the Far East is a boost for the entire South African avocado business

OPPOSITE—Young avocado orchards at Westfalia Fruit Mozambique

technical experience it is ideally placed to meet the phytosanitary requirements of the Chinese market.

“Westfalia attended Asia Fruit Logistica in September 2023, with our colleagues from South Africa and South America meeting with several existing and new customers,” comments Hans Boyum, commercial director Westfalia for the Africa region. “As a global supplier we have experience of working collaboratively across continents, to leverage the efficiencies of our integrated supply chain to meet the requirements of customers and markets.”

Zac Bard, global business development executive Westfalia and chairman of the World Avocado Organization, says education and awareness will be key to developing the Chinese market. “Currently avocados are not well known or used particularly within traditional dishes,” he outlines. “Promotions developing

consumer education will no doubt vastly accelerate the growth in this relatively new avocado market. This approach has been proven in other markets across the globe. In the wider context a broader market benefits the global avocado industry from all origins.”

Over the next few months Westfalia will be welcoming several customers from China to orchards in South Africa, to experience firsthand how the fruit is grown, harvested, and managed sustainably throughout the supply chain to ensure quality and freshness.

COLD TREATMENT

Donkin says the protocol for shipment to Japan requires a cold treatment of 2°C for 19 days. “South African research has shown that Hass avocados are able to withstand this treatment, and trial shipments to the UK under this regime have been successful,” he notes. “Nonetheless, to ensure that we can deliver quality avocados, a trial shipment to Japan will be taking place in mid-2024. Hass avocados require a fairly high dry matter level to withstand the cold treatment, so shipments will only take place in the latter part of the South African season.”

Shipments to China and Japan will most probably be from the port of Durban. “South Africa is closer to the market than some other origins supplying China, meaning shorter transit times with a positive impact on fruit quality and shelf life,” Donkin adds.

Port delays drive new solutions

Logistics company GoGlobal has created new options for Southern African exporters as problems in the Port of Cape Town continue.

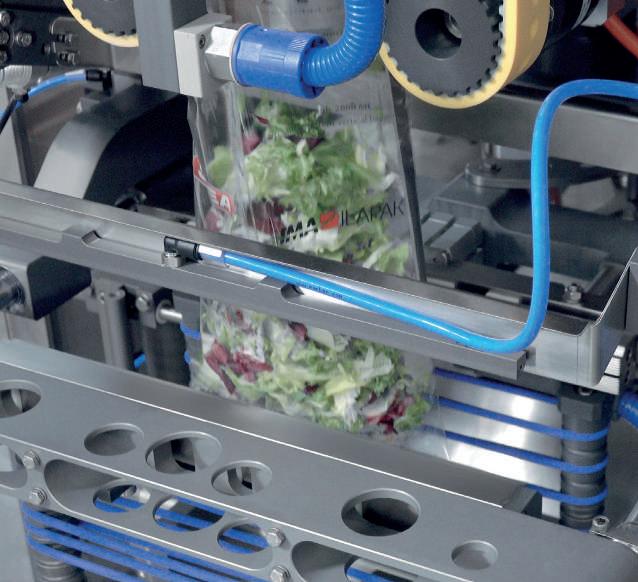

by Fred MeintjesThe early season experiment by South African logistics operator GoGlobal, in association with MSC, to ship Namibian and South African grapes through the port of Walvis Bay in Namibia has apparently been a great success. And it is indicative of the new thinking required as disruption and delays continue at the Container Terminal in Cape Town.

GoGlobal has for many years been working on holistic solutions for the South African and Namibian

export industries. These involve activities in and around the port of Durban, investigating new options via the port of Maputo, shipping fruit via Port Elizabeth in the Eastern Cape, shipping through Walvis Bay in Namibia and also working with other exporters to utilise opportunities in specialised reefer vessels.

“MSC has agreed to include Walvis Bay in their schedule to call Walvis after Cape Town,” says Delena Engelbrecht, CEO of GoGlobal. “With

their call at Port Elizabeth, along the South African Eastern coast, it allows us two opportunities to load on a weekly basis.”

Fruit loaded via Walvis has a longer shelf-life due to the shorter logistics chain, she says, noting that on average last season delays of ten days were experienced in Cape Town. “We simply had to find new solutions to get containers out without delay to the market,” Engelbrecht confirms.

With the South African pear and apple seasons now starting, pressure in the port of Cape Town will mount. “This makes the lives of logistics service providers who form the vital link for South African fruit growers to the market extremely difficult,” she continues. “We are challenged but know the important role we play to keep South African

fruit reaching markets in excellent condition.”

The operation through Walvis Bay is more expensive than getting the grapes to Cape Town for shipment. “It is around 1,600km from Aussenkehr in Southern Namibia and for exporters from the Orange River it is even further,” Engelbrecht outlines. “It is also costly to transfer containers to the Eastern Cape, but hopefully we will see the results in good arrival condition.”

An important development this season is an increased use of specialised reefer vessels. In all, only a small volume of fruit will be accommodated in this way. Vessels are only confirmed three weeks in advance and exporters still see this as an expensive option.

“An efficient container giving us

the door-to-door option is by far the preferred option. That it is why it is so important that the port of Cape Town must return to its former levels of service and efficiency,” she says. “In the meantime we are determined to offer our clients the best solutions to ensure their successful export operations.”

Africa

ABOVE—GoGlobal’s fleet ready to mobilise

Fruits brand comes alive