EUROF RUIT

As the fresh produce business prepares for Fruit Logistica we look at some of its gamechanging new technologies

Class

Across Fruit Logistica’s various stages, you can tap into the fresh produce industry’s largest gathering of experts and innovators

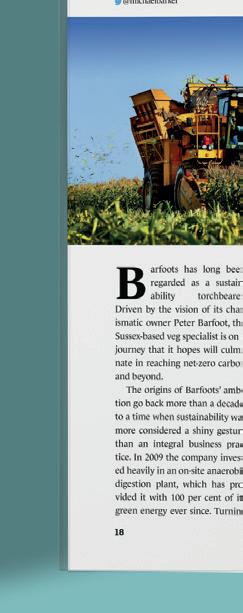

Fruit Logistica might have a fair amount of competition these days, but one of the things that continues to set it apart as a trade exhibition is an unrivalled programme of talks and discussions. I’m happy to admit that I say this from a less than entirely objective position: after all, Eurofruit publisher Fruitnet is the official media partner and thus responsible for putting together this packed agenda. Along with several of my colleagues, I myself play a key role to develop the programme, host the sessions, and chair its interviews and panel discussions. But if you look down the list of events on offer, the sheer breadth of knowledge and insight at your disposal as a Fruit Logistica visitor is the reason why we believe the show retains its position as the epicentre of intelligent thinking on the future of the global fresh produce business. Across its various stages – Fresh Produce Forum, Future Lab, Logistics Hub, Tech Stage, and Friday’s Startup Day – you can tap into the fresh produce industry’s largest gathering of experts and innovators, who will share valuable perspectives on a range of essential topics, and present you with intelligent, actionable insights. This edition of Eurofruit is designed to complement that programme, and to show you the technological innovations that will change fresh produce business forever. We look forward to meeting you all in Berlin on 7-9 February 2024. E

Events

fruitnet.com/berrycongress

The Global Berry Congress brought together leading players in the fresh berry category to connect and share in-depth experience and expertise, whilst exploring new ideas.

Photo Blog

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

linkedin.com/showcase/eurofruitmagazine

Expand your network of professional contacts and join the fresh produce conversation by visiting the eurofruit LinkedIn account.

X

x.com/eurofruit

Keep up to date with news, opinions and developments from around the European fresh produce trade by following our dedicated X account.

News

fruitnet.com/eurofruit eurofruit's news website provides regular updates on all the top stories from the European fresh fruit and vegetable business.

Eurofruit App

Ehttps://desktop.eurofruitmagazine.com

Download the new Eurofruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed of the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

Fruitnet Daily News

fruitnet.com/freenewsletter

Fruitnet Daily News is the fresh produce industry's leading source of news, information and insight. Available free to all, it is essential reading for those who need to keep track of developments and trends in the international fruit and vegetable business.

Fruitbox

https://anchor.fm/fruitbox

Listen to Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts.

SINCE 1973

EDITORIAL

managing director, fruitnet europe

Mike Knowles

+44 20 7501 3702 michael@fruitnet.com

managing editor

Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

deputy editor

Carl Collen

+44 20 7501 3703 carl@fruitnet.com

news editor

Tom Joyce

+44 20 7501 3704 tom@fruitnet.com

staff writer

Fred Searle

+44 20 7501 0301 fred@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

middleweight designer

Mai Luong

+44 20 7501 3713 mai@fruitnet.com

junior graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive Poppy Bowe

+44 20 7501 3719 poppy@fruitnet.com

MANAGEMENT

commercial director

Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White

+44 20 7501 3710 chris@fruitnet.com

ADVERTISING

sales director

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

senior sales manager

Giorgio Mancino

+44 20 7501 3716 giorgio@fruitnet.com

account manager

Josselyn Pozo Lascano

+44 20 7501 0313 josselyn@fruitnet.com

us & canada

Jeff Long

+1 805 448 8027 jeff@fruitnet.com

italy

Giordano Giardi

+39 059 786 3839 giordano@fruitnet.com

germany, austria, switzerland, middle east Heike Hagenguth

+20 100 544 5066 heike@fruitnet.com

morocco, france, tunisia Cristina Delof

+34 93 000 57 54 cristina@fruitnet.com

south africa

Fred Meintjes

+27 28 754 1418 fredmeintjes@fruitnet.com

asia pacific

Kate Riches

+61 3 9040 1601 kate@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions

+44 20 7501 0311 subscriptions@fruitnet.com

CONTRIBUTORS

Michael Barker fresh produce journal Michael visits the Global Produce and Floral Show in Anaheim, California, taking in the best the North American fresh produce industry has to offer. us–p118-122

Michael MacFarlane agriplace

Greenyard has turned to Agriplace to facilitate information sharing on quality and sustainability, and gain insight into its customer base. p&t–p137

James French tomra

James discusses how artificial intelligence is bringing a big technological shift that businesses will have to keep up with to remain competitive. p&t–p124

Richard Bright reefer trends

Richard looks at how some of the industry's biggest businesses are engaging in brand activism, and whether it is having the desired effect. dispatches–p140-141

Pineapples next for Aldi’s CSR sourcing model

A year on from the launch of its new banana sourcing strategy, Franka Rodriguez, director of global sourcing at Aldi South Group, talks exclusively to Eurofruit about the progress made and challenges encountered along the way.

by Maura Maxwell @maurafruitnetFranka, it’s been just over a year since Aldi announced its new banana sourcing strategy and its commitment to building a fairer and more transparent banana supply chain by connecting buying and corporate responsibility. Now, you are doing the same with pineapples, where workers face a similar plight to those in bananas. Has your banana strategy served as a template for pineapples? Or have you had to make many modifications based on the differences in that supply chain?

Franka Rodriguez: A major factor for the success of our new banana sourcing approach has been the involvement of our business partners in the design and implementation process from the very beginning. This meant that we searched what is most needed by suppliers and producers to support sustainable banana production, listened to their concerns, and took into account the proposed measures.

Ultimately, the key ingredient as to why this approach has been so successful and well received is the fact that this is not just a sustainability concept

or a commercial initiative – it is an approach that has been developed jointly by our buying and sustainability experts to make sure we are implementing a lasting, sustainable and effective solution to help address the key issue in the banana supply chain as reported in the media, the negative price pressure we have seen in the past years. From our perspective, the critical issue in the past was a lack of cooperation and transparency, which are issues we successfully overcame in our best practice sourcing model.

Our new banana sourcing approach clearly showed us the possibilities that are created when incorporating more responsible sourcing practices into our sourcing. This is why we believe it can serve as a template not just for other Aldi supply chains but also for other retailers to follow.

Similar to the process of designing the banana sourcing

approach, we collaborated with our key partners to understand what was most needed to promote sustainable production of pineapples. Once again, we used a multi-departmental approach to implement the most impactful

“A key challenge was the need to establish trust between all supply chain stakeholders involved”

responsible sourcing practices. We also realised that a deeper understanding of the value chain steps and costs of production were keys to mitigating a negative price pressure. This clarity enabled Aldi to develop deeper partnerships and collaboratively work on highpriority sustainability objectives.

However, there are some differences between both fresh products. In the banana sourcing approach, we had the Fairtrade index to provide industry-wide best practice costs to produce the product sustainably. For pineapples, there is no public index available. It was, therefore, even more important to work with industry partners to design an annually adjusted cost of production index. We brought in an external service provider, who was instrumental in the creation of the Fairtrade banana index, to facilitate the creation of a new index which would enable the new pricing mechanism of the new pineapple sourcing strategy.

What would you say have been the biggest challenges you have encountered so far?

FR: A key challenge we faced at the very beginning was the need

to establish trust between all supply chain stakeholders involved. Engaging with all of our strategic suppliers and further actors in the banana supply chain was essential, and we used the support of organisations like the World Banana Forum to do this. Building a direct relationship with producers in Latin America was vital to address this challenge in a way that enabled us to devise an approach that was truly sustainable. Through this engagement, we were able to establish such an approach, and to financially invest in our commitment for the creation of a real and positive impact in the banana supply chain.

With the internal business buy-in and full support for this new procedure by our management, we provided credible solutions to these concerns, which enabled us to address these challenges head-on. Now, it is our responsibility to continue listening

to our partners, to keep making sure the approach is providing them with the assistance needed for a sustainable production, and to assess how we can best scale this positive impact.

It is also essential to mention that our efforts are not enough if suppliers and local governments do not fully commit to and support sustainable food production and workers’ rights.

Most of Europe’s pineapples come from Costa Rica, »

where there have been a number of well documented cases of worker abuse. Are you sourcing bigger volumes from other suppliers since switching to your new policy?

FR: Aldi always takes its sourcing decisions carefully and considers a variety of factors to strengthen the resilience and sustainability performance of our value chains. In the fresh pineapple supply chain, Aldi is currently working on the implementation of responsible sourcing practices. We are monitoring the market to ensure that supply chain resilience and risk diversification are maximised.

to mitigate potential sustainability concerns.

Greater transparency is a key objective of Aldi’s new strategy. Can you provide examples of how you are applying this in the case of pineapples?

FR: There are no better examples than cost transparency and supply chain transparency.

Regarding cost transparency, at Aldi, we seek clarity on the true cost of production of fresh pineapples. To achieve this, we are working with our partners to get transparency on the costs

Costa Rica is one of the largest pineapple growing countries in the world, and many players in the industry have invested heavily to strengthen the country’s competitiveness. We only source our products from our strategic partners, with whom we have long-standing relationships and who are able to meet our highest sustainability standards. We want to increase transparency in the supply chain and work systematically with these partners

involved in each part of the pineapple production process. Like the banana model, regular price reviews in collaboration with our partners will be conducted to ensure the costs adequately reflect changes in market and value chain conditions.

Supply chain transparency lies at the heart of our approach to

due diligence. Aldi is working with key stakeholders to map the pineapple supply chain to better understand the route taken for the product to arrive at our stores. Armed with this information, we will be working to build stronger partnerships with supply chain partners and promote industry-wide sustainability changes.

What progress have you made in the last year with the implementation of your banana sourcing strategy?

FR: A lot has happened in the last year. We went from months of developing a blueprint for our new sourcing model to putting it into action at the start of 2023. When making our commitment public during 2022, we received a lot of praise from stakeholders who have been among our harshest critics in the past. This was reassuring and motivated us even more because we are aware that the Aldi banana price is often viewed as a reference in the industry. Now, almost one year into implementation, we receive feedback in global forums that our pricing model can be viewed as best practice.

“At Aldi we seek clarity on the true cost involved in each part of the pineapple production process”

We see stakeholders across the banana world experiencing first-hand the tangible benefits of our approach and asking other retailers to follow Aldi’s positive steps.

For our strategic partners as well as producers, the longer-term partnership we offered has provided them with increased sourcing and planning stability. This enables more investments in activities that benefit workers and the environment. After a successful implementation in 2023, preparations are taking place to ensure we can soon buy all internationally purchased bananas using this best practice model, and I am happy to report that we are on a good track here.

When you spoke to us last year, you highlighted the need for all stakeholders in the industry to work together to make the banana supply chain more sustainable. Would you say things have moved on in a meaningful way since then?

FR: What we have seen in the banana supply chain is indeed a closer, more effective collaboration »

among key stakeholders. The World Banana Forum has been instrumental in bringing all relevant stakeholders to the table, and organisations such as IDH and GIZ have not only brought retailers from different countries together in groups to join forces. These groups are also collaborating internationally towards more sustainability in the banana supply chain, first and foremost on the topic of living wages.

In addition, we have received interest from multiple groups, including competitors, on how we are implementing more responsible sourcing practices. These are generally seen as enablers for sustainability in the supply chain, and we hope that we can support other retailers in adopting these or similar measures in their banana supply chain.

Supermarkets continue to use bananas as loss leaders – just a few weeks ago, Aldi UK announced that it was cutting the price of a Nature’s pick pack of seven bananas from £0.92 to £0.88. How do you square that with arguing against a so-called “race to the bottom”? Doesn’t this make it less likely, rather than more likely, that other retailers will follow your lead in adopting a fairer pricing strategy?

FR: One of Aldi’s goals is to offer a large option of sustainable products at an affordable price. Currently, our customers are facing a challenging financial situation due to inflation, political issues and more. We always strive to absorb higher costs in the supply chain through more efficient operations and supply chain management to be able to offer the best prices to our customers.

In April of 2023, Aldi announced

the successful completion of a pilot project to understand worker-led living wage verification. Why was this project important, and what has it taught you?

FR: On our journey towards living wage bananas, we soon realised that this is only feasible when there is accurate data, both for determining potential gaps in

This was a very successful joint effort, which clearly showed the value of involving workers in this process and highlighted the key benefits of establishing such a local verification method.

What products are next in your sights?

FR: After our most recent successes, we feel confident that we will be able to roll out sustainable purchasing practices to other fresh produce categories in different continents, and we are currently evaluating our next steps.

living wages for workers as well as for verifying those payments. In our efforts to understand how living wage verification can be incorporated into existing auditing processes, we also wanted to assess additional options.

As a result, we discovered that directly affected workers, as well as worker representatives, were insufficiently involved. We, therefore, partnered with Banana Link and key strategic suppliers to develop and implement a pilot to link both these efforts. On three different banana farms in Latin America, we supported capacity building and training pilots for all local stakeholders so that worker representatives, together with farm management, could assess and verify any living wage gaps.

Unfortunately, I can’t tell you more details since we are in the very early stages of the process. Hopefully, I will be able to share a positive update regarding our new commodities next year.

Are there any other developments in your sustainability strategy relating to fresh produce?

FR: We are continuously working to strengthen environmental and human rights in our supply chains. Together with our partners, we are addressing key issues across fruit and vegetable supply chains, and our buying and sustainability teams are cooperating closely to ensure a joined-up approach on all these aspects.

In the future, we want to go beyond our current efforts and address topics related to human rights, the environment, agriculture, food waste and packaging within our fresh produce supply chains. E

ABOVE—Aldi says it will add more fresh produce lines to its sustainable sourcing stragegy

Call your citrus sales representative at 661.778.1458 or email Amanda.Meneses@wonderful.com

Produce packaging firms urge EU not to waste new opportunity

Following the European Parliament’s vote on new packaging waste management regulations, it now falls to the Council of Europe to push the proposal forward before it is enshrined in law.

by Mike Knowles @mikefruitnetLeading players in Europe’s fresh produce packaging business welcomed November’s European Parliament vote on the EU’s new Packaging and Packaging Waste Regulations (PPWR), but only after some lastminute revisions – in particular to its approach to recycling.

“The Parliament has recognised that reuse and recycling of packaging are complementary and the robust recycling systems that have existed for decades are cornerstones of EU policies for environmental sustainability,” commented Saverio Mayer, CEO of Smurfit Kappa Europe, who had earlier suggested the vote could result in more waste, not less.

“We call on the Council of Environmental Ministers to follow the Parliament in acknowledging that both reuse and recycling systems go hand in hand in the interest of a greener Europe,” he added.

A shift in favour of making greater provision for recycling of packaging, based on the kind of model already employed in Italy for example, seems to have appeased many fruit and veg packaging suppliers.

Italian packaging lobby group

Pro Food described the outcome as an opportunity to build the right

king of packaging waste system, and called it a victory for “common sense over ideology”.

In a statement it said: “This vote represented an opening of credit towards a model, the Italian one, made up of increasingly sustainable packaging production, increasingly careful uses – no overpackaging – and a system of collection, selection and recycling of packaging waste that already works, and is growing.”

ROOM FOR MORE

However, Pro Food said there was still scope to make the new rules work better. “The legislative process of the Regulation is still long, its steps are sometimes complex, and the proposal that emerged from the plenary assembly of Parliament contains points that can still be improved,” it said.

“As ProFood we will continue to defend and promote our reasons and we remain at the

disposal of the Italian Government, which will play a fundamental role.”

Other stakeholders were not so positive about the vote. Zero Waste Europe was highly critical of the PPWR proposal, describing it as “a position for the wrong century” and a “watered-down text that excluded crucial mechanisms” to achieve targets on waste.

The organisation’s Raphaëlle Catté commented: ”By favouring recycling over reuse, the new derogations in Articles 22 and 26 question the whole foundation of EU waste law, namely the waste hierarchy. Recycling will not stop the waste problem, even with robust systems. It is worrying that not

only right and far-right parties, but MEPs from all backgrounds yielded to lobbyist arguments.”

NEW DIRECTION

The European Parliament vote, which approved a position paper on new EU-wide rules designed to encourage more reuse and recycling, effectively brought EU countries closer to a major reduction in packaging waste.

MEPs approved the report in a plenary vote on 22 November, with 426 voting in favour, 125 against, and 74 abstentions. Parliament will now begin talks with national governments on the regulations’ final form, once the European Council has adopted its position.

Overall packaging reduction targets proposed in the regulation equate to 5 per cent by 2030, 10 per cent by 2035 and 15 per cent by 2040. What’s more, MEPs want to set specific targets to reduce plastic packaging – 10 per cent by 2030, 15 per cent by 2035, and 20 per cent by 2040.

In a press release issued on the European Parliament website, MEPs said they would try to clarify the requirements for packaging to be reused or refilled.

The new rules require that all packaging should be recyclable, fulfilling strict criteria to be defined through secondary legislation.

Certain temporary exemptions are foreseen, for example for wood and wax food packaging.

EU countries will be asked to ensure that 90 per cent of materials contained in packaging (plastic, wood, ferrous metals, aluminium, glass, paper and cardboard) is collected separately by 2029.

Belgian MEP Frédérique Ries, who wrote the report, welcomed the result of the vote. “Parliament is sending out a strong message in favour of a complete overhaul of the EU packaging and packaging waste market,” she commented.

“This legislation is essential for European competitiveness and innovation, and aligns environmental ambitions with industrial reality. Together with effective reuse and recycling policies, we make sure that packaging is safe for consumers, by adding a ban on harmful chemicals in food packaging, in particular PFASs.”

In 2018, packaging sales in the EU amounted to €355bn. According to Eurostat, packaging waste in the EU-27 was 84m tonnes in 2021, up from 66m tonnes in 2009.

Without intervention, it says, per-capita packaging waste in the EU is predicted to rise from 188.7kg in 2021 to 209kg by 2030. E

A new climate for innovation

Mark Piper joined Plant & Food Research in May 2023, Here, he explains how New Zealand’s primary horticultural research centre can help the fresh produce business evolve and grow.

by Mike Knowles @mikefruitnet“The potential for we er, dryer and more variable conditions will have a massive impact on food production”

As Plant & Food Research's new chief executive officer, what overall strategy will you pursue within the fruit and vegetable sector?

Mark Piper: I think the key themes for Plant & Food Research that will best support the horticulture sector into the future are: climate resilience; systems for improved production and that ensure quality from soil to the end consumer; and continuing to help our partners create the most delicious and

nutritious foods they can.

We are currently reviewing our organisational strategy and while we haven’t finalised this, the strategy will obviously focus on how we best support our sectors and our partners.

What major challenges do you see for the fresh produce business, and how can Plant & Food help address them?

MP: Weather events are one of the biggest challenges facing the world,

and the potential for we er, dryer and more variable conditions will have a massive impact on food production. We see partnerships globally as being key to help understand what could be possible under different future scenarios

One example is the fantastic relationship we have with IRTA that has focused on breeding new varieties of apples and pears specifically tailored towards a warmer climate.

During your time working for dairy

giant Fonterra, what did you learn about consumers and the way their behaviours might shape the development of the food business?

MP: There are a couple of things that stand out from my time at Fonterra. The top one is that there is no such thing as ‘a global consumer’. While people all over the world may eat the same types of food – apples, for example – they may consume them in different ways and have different expectations.

Some people love smaller apples to fit in a lunchbox. Some love a large, juicy apple. Some want ones that are perfect in pies. Some love sweet, some love sour. We are all different.

The key is firstly to understand who the consumers are for any product, and secondly to work alongside the companies that grow and supply these to create the best product for each consumer type.

What kinds of new products does Plant & Food intend to create in the next 5-10 years?

MP: Plant & Food Research will continue to create new and delicious horticultural products. You can expect to continue to see new varieties of our traditional crops, like apple, pears and hops, along with new varieties of new-to-us crops such as dragon fruit.

We are also looking at new technologies, such as controlled environment growing, as well as the open ocean aquaculture space to support sustainable fishing.

There is no shortage of opportunity and Plant & Food Research is well positioned to partner with others to help unlock a delicious and sustainable future.

What can Plant & Food do to make fresh fruit and vegetables healthier for consumers and more sustainable for the planet?

MP: Fresh fruit and vegetables are already super healthy. We have work underway on everything from reducing the nutrient additives to soil through to eliminating pesticides.

We also have work underway on increasing the concentrations of healthy compounds, like vitamins, in some of the delicious fruits and vegetables that we all consumer regularly.

Finally, what do you see as the future of Plant & Food Research itself?

MP: Plant & Food Research is a fantastic organisation with a history dating right back through to the 1920s. I see us continuing to build on that fantastic legacy and, in partnership with local and global research organisations, continuing to drive a more delicious, nutritious and sustainable future. E

Zespri forecasts record season

The industry’s focus on improving fruit quality and a strong performance in market leads to record forecast for kiwifruit growers.

by Carl Collen @carlfruitnetZespri has released its November forecast for the 2023/24 season, reporting record levels of per-tray returns for green, organic green and RubyRed, and SunGold varieties “well up” on last season.

Green was a particular standout, the New Zealand-based group stated, with the latest forecast showing green per-tray returns at a record level of NZ$9. This compared to last season’s final orchard gate return (OGR) of NZ$5.78 per tray.

For Zespri organic green, the forecast per tray was at NZ$12, up from last season’s final OGR of NZ$8.68, and for Zespri RubyRed, the OGR per tray was forecast at NZ$26.10, above last season’s final OGR of NZ$22.27.

Forecast SunGold kiwifruit returns were at NZ$12.35, well above last season’s final OGR of

NZ$9.97, and forecast returns for organic SunGold were also up at NZ$14.15.

Zespri said that the November forecast returns were up across all categories on the August forecast, mainly due to improved fruit quality this season.

Chief executive Dan Mathieson said the results reflected the ”strong and growing demand” for Zespri kiwifruit, as well as the huge effort the industry had put into improving fruit quality this year.

“It’s really pleasing to be able to deliver this positive news and to show growers that their hard work and focus on quality is being rewarded in market,” he said. “It’s particularly great following such a tough couple of years when growers have been under so much pressure while dealing with the likes of ongoing cost increases, the labour shortage, regulatory

“We’ve received positive feedback from our customers throughout the season on the improvement in fruit quality”

changes and the changing climate.

“We’ve received positive feedback from our customers throughout the season on the improvement in fruit quality – our efforts have been really appreciated by them – and they also keep telling us how they want even more of our Zespri kiwifruit next season,” Mathieson continued. “It’s great to have this confidence in our product and see this demand.

“Our job on quality isn’t done yet though and we now have a huge focus on next season – we need to maintain this focus as we look to 2024 when we are expecting to have a much larger crop and likely our biggest year on year growth in volume.

”As we have this year, it’s going to need everyone across the industry doing their part so we build on the positive changes we’ve made – as that’s crucial to returning more value back to growers,” he added. “One thing our growers can have confidence is whatever fruit we can get to market in the right condition will sell and sell well.” E

Sekoya team expands to meet increasing demand

Marianela Rodriguez and Mark W David will support the B2B network’s continued global expansion.

by Maura Maxwell @maurafruitnetThe Sekoya B2B network has recruited two new team members from the industry to meet increasing worldwide demand for its high-end blueberry varieties. Marianela Rodriguez Bejarano joined the team in October 2023 as additional business operations specialist, while Mark W David will strengthen the team as general manager in the Americas.

“We are very pleased that Marianela and Mark chose to join us. With the strong talent in our Sekoya team, we are well-equipped to execute our goals for 2024,” says general manager Holger Brandt. “Marianela and Mark both have worked in the industry for many years and bring the fundamental experience we were looking for.”

Sekoya says Rodriguez’s 14 years of management and project development experience in the fresh produce business make her a valuable asset, her insights in field production and export operations positioning the platform well in its global expansion strategy. During her career, she has managed the commercial businesses of citrus giant CPF (Consorcio de Productores de Fruta) in Peru, interacting with 55 associates/ growers and more than 100 clients.

In 2017, Rodriguez joined Spain’s SanLucar where she spearheaded projects for exotic fruits, managing the company’s procurement of seven different products.

“I am very happy and excited to start a new chapter in my professional life and be part of the Sekoya family. Although blueberries are a new product for me, I am sure my background and experience qualify me well in supporting the inspiring vision and approach that a racted me to Sekoya in the first place. I look forward to the many new insights and great experiences that lie ahead,” Rodriguez says.

In his new role of general manager North America David will lead Sekoya strategy and innovation projects as the B2B network continues its global expansion.

David brings over 15 years of sales and marketing experience in the fresh produce industry having worked for large growers in Australia and across the Americas. With most of his career focused on supplying major retailers around the globe, Sekoya says this role positions him well to drive its strategic initiatives and continued growth trajectory.

Prior to joining Sekoya, David served as director of sales for four years with United Exports (Ozblu). “I’m humbled to join the team at Sekoya,” he says. “I’ve admired the progress they have made in the premium blueberry category, especially as it relates to innovation and providing a solution for 52-week supply with the new Sekoya high chill varieties.

“I look forward to pu ing my experience in building brands and growing customer engagement to use. Our goal is to drive both consumption and category growth by ensuring customers can have the best eating blueberry experience every week of the year. I’m excited to work with the talented team at Sekoya, our grower members and retailers to achieve this.” E

Tough road ahead for berry suppliers

At the Global Berry Congress in Rotterdam, expert speakers predicted higher costs and a higher bar in terms of quality for the soft fruit sector.

by Carl Collen and Maura Maxwell @carlfruitnet @maurafruitnetThe berry business faces a tough road ahead to deliver better-quality fruit while it absorbs higher costs, attendees at this year’s Global Berry Congress heard. The annual event returned to Rotterdam in November with an overview of the international berry market and a glimpse at what the future may hold for the category.

More than 250 delegates heard Rabobank’s Cindy van Rijswick open the event with a presentation that offered a mixed forecast for the future of berries. She pointed out that while grower costs were

easing somewhat and container rates were falling, interest rates and labour expenses remained at a high level, and unpredictable or extreme weather continued to challenge the entire supply chain.

“We are seeing a slight recovery in consumer purchasing power, although this is not necessarily reflected in fruit sales,” van Rijswick explained. “We do however expect a bit of an improvement in this area in the coming months.”

Rabobank data demonstrated how consumer purchases of fresh produce had returned to pre-Covid 19 levels, a er the spike seen during the pandemic. The berry category itself was relatively flat, which she saw as no bad thing considering the maturity of the market, the relatively high price of so fruit and current negative consumer sentiment.

“Looking forward, we’re seeing a move to more consistent quality and quantity – this is what the retailers want too”

“Another factor to consider is availability,” van Rijswick outlined. ”2023 has been a year of climate extremes. This is not just a negative, as this could turn out to be an opportunity for some.”

Blueberry trends highlighted included the El Nino-affected decrease in Peruvian volumes in 2023/24 a er many years of growth, and the greater diversification of global production as the number of blueberry suppliers continues to grow.

“Another long-term trend is the price pressure on blueberries, although this actually isn’t the case in 2023/24 because of lower supply.”

For strawberries, van Rijswick said that the category was moving to a focus on higher quality and greater consistency, across many markets. In fact, for berries generally there was a notable change in varieties, with consumers adjusting to be er taste and breeders having li le choice but

to adapt their offering as a result.

“Looking forward, we’re seeing a move to more consistent quality and quantity – this is what the retailers want too,” she added. ”This will be done through improved varieties, technology and diversification.

It is also more important than ever to have a financial buffer given the many challenges the industry is faced with, including extreme weather and higher costs. But I believe there is still a lot of appetite for berries.”

2.03m

global blueberry production (tonnes) during 2022

In his presentation on the outlook for the international blueberry business Fain said global production had increased 77 per cent since 2018, reaching 2.03m tonnes in 2022. Against a background of climatic disruption, rising input costs and squeezed margins, Fain stressed the importance of continuing to focus on quality improvements in order to keep growing demand.

BLUEBERRY PRODUCTION CONTINUES TO BOOM

The opening session also included a deep dive on the blueberry business from Colin Fain of Agronometrics, who told delegates that the success of the industry in growing demand through quality improvements and effective consumer promotions had sustained its profitability through a period of huge growth.

“The benchmark on quality has gone up – there are enough decent quality blueberries on the market for consumers to start noticing the lesser quality fruit,” he said. “The quality of the punnet you sell today is your best marketing tool for the one you sell tomorrow.”

At the same time, Fain said the sector must do more to drive efficiency in production, starting with the choice of variety.

“If you haven’t got something that’s giving you a good yield you’re wasting your time,” he noted.

Another factor driving consumer demand was advances

in research on the health benefits of blueberries. To date this had focused on brain, cardiovascular and gut health and going forward funding will be made available for studies on learning and memory in school aged children, blood flow and nutrient delivery for muscle protein synthesis and the impact of blueberry consumption on hearing disorders.

With global production projected to reach a staggering 2.845m tonnes by 2026, there is no doubt the industry has its work cut out if it is to see sustainable growth. E

EasyStar®,

The star of your winter production.

Extremely easy to pick.

Light and bright color which is maintained even after the harvest. Very high productivity. In the Mediterranean region, with the right planting date and management, it’s suitable for the winter production.

#GrowEasy

Climatic and regulatory burdens take centre stage at ICOP

The organisation’s recent conference shone a spotlight on a challenging scenario faced by Europe’s fruit and vegetable producer organisations.

by Maura Maxwell @maurafruitnetSome 150 delegates from 17 countries met to discuss the challenging scenario for Europe’s produce industry at the 17th edition of the International Congress of Fruit and Vegetable Producer Organisations (ICOP), which took place in Almería on 22-24 November.

The event, organised by the Austrian consulting company gfaconsulting in cooperation with the Almerian association of Fruit and vegetable producer organisations, Coexphal, heard how climate change, cost pressures and an increasingly restrictive regulatory landscape are making life difficult for producers. “We are expected to fulfil more social expectations with fewer available resources,” said Luc Vanoirbeek from Copa-Cogeca.

The burdens placed on producers by the European Union’s new Plant Health Regulation and Packaging Regulation, and the impact of increasingly frequent incidences of heat, drought and flooding were among the most hotly debated topics of the first day by speakers including Simona Caselli from AREFLH, Juan Carlos Pérez Mesa from the University of Almería and Raquel Aguado of the Spanish federation for

wooden packaging, Fedemco.

On day two of the conference, attention turned to how the newly revised Common Agricultural Policy, already in its first year for the current 2023-27 period, is affecting the fruit and vegetable sector, especially regarding funding opportunities via the so-called Operational Programme.

In a panel discussion which also featured Adrián Torrellas Tomé from the Spanish Ministry of Agriculture, Manuel Alías Cantón from the Rural Development Fund and Kerstin Edelmann from gfa-consulting, the European Commission’s Kristine Bori noted: “The term 'common market policy' contains the word 'common' – the joint action of all those involved in the implementation of agricultural policy, at EU level, at country level and, above all, at the level of agricultural representatives, is fundamental to success”.

Using the Austrian and German produce sectors as examples, the conference heard about the specific challenges fruit and vegetable producer organisations face in applying for EU funding under the new rules.

Edelmann said the differing strategies in EU member states had brought many unexpected

problems for producer organisations. She echoed Bori’s call for cooperation between all parties.

As always, ICOP also heard about some of the latest innovations and trends in the produce sector. These included new developments in biological pest control; ways of making agriculture more resilient; the role of new genomics in plant breeding; technical innovations in solar power and data capture.

During the event, study tours were organised to the facilities of Casi, one of Spain’s biggest producer organisations in tomatoes with an annual production volume of over 230,000 tonnes, the University of Almería’s research centre and the Vicasol cooperative, which markets over 240,000 t onnes of fruit and vegetables to 34 countries worldwide. E

Water under the microscope

The GlobalGAP panel discussion at Fruit Logistica 2024 will focus on the important topic of water.

by Carl Collen @carlfruitnetIn view of the growing impact of water scarcity, the GlobalGAP Secretariat has organised a panel discussion on the responsible use of water. The discussion will be held at Fruit Logistica in Berlin and offers stakeholders an opportunity to share their perspectives, and discuss emerging solutions in fruit and vegetable production.

The event will be attended by GlobalGAP’s own experts, as well as producers, other GlobalGAP Community Members, certification bodies, as well as

an NGO working in the sector. The discussion will address both legal and environmental aspects and will examine the role of certification in the implementation and demonstration of responsible water use at farm level.

In the same vein, the new version of the group’s Sustainable Program for Irrigation and Groundwater Use (Spring Version 2) add-on, launched in September, has “furthered the GlobalGAP Secretariat’s commitment to responsible water

use”. This second version of the add-on introduced simplified implementation rules and stricter principles and criteria regarding legal compliance. It also addressed issues such as the assessment of water risks and objectives, management and use of water resources, environmental management, protection of water sources, and traceability. E

ABOVE—The responsible use of water on the farm is a crucial subject

Raising its game

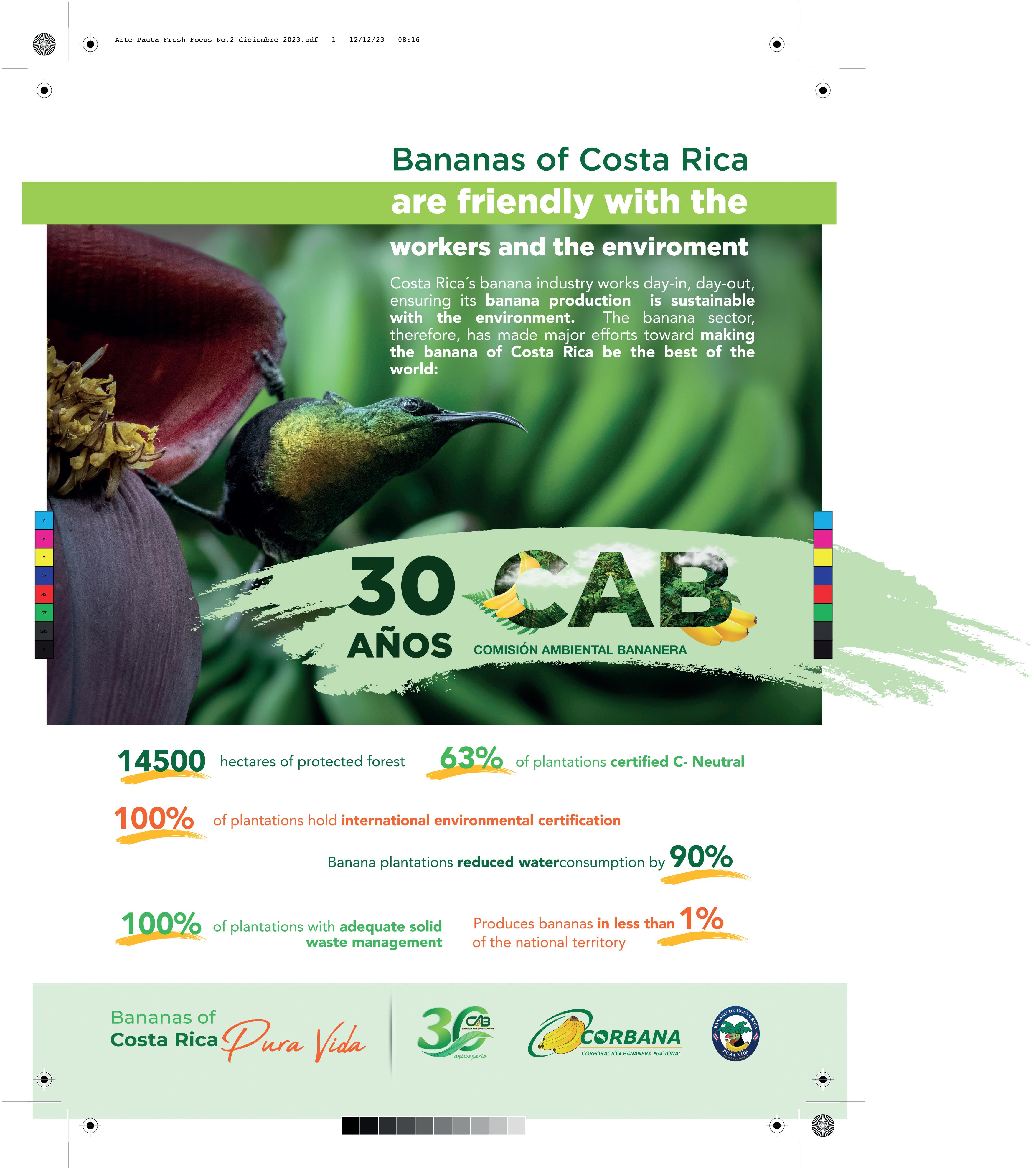

The Latin American banana industry has cleaned up its act. Now retailers have the chance to show commitment to a true shared responsibility

INNOVATION

ACP BANANAS MARKETING ECUADOR

CSR

COSTA RICA

CANARY ISLANDS

Learning to value bananas

Pressure on producers will not ease up if bananas continue to be used as a weapon in supermarket price wars.

November’s Banana Time convention in Guayaquil, organised by the Association of Ecuadorean Banana Exporters, laid bare the challenges facing the banana industry today. Climate change, disease, cost inflation, security and a seemingly endless proliferation of certifications are all placing an increasingly onerous burden on producers, all against a backdrop of stagnant retail prices.

A June 2022 report by Rabobank revealed that retail prices for bananas in the UK were still below the level seen in 1987 – despite research showing that consumers would happily pay more for their bananas and still consider the fruit to be good value. Recent years have brought a growing awareness amongst retailers – in Europe at least – of the true cost and effort that goes into producing socially and environmentally responsible bananas. A number of them have committed to support a living wage. Aldi has gone a step further with its new banana sourcing strategy, bringing together fair price purchasing and corporate responsibility into a genuinely integrated sourcing approach. It remains to be seen whether this signals a genuine sea change among the wider industry. But unless and until bananas stop being used as a weapon in supermarket price wars, it looks like the present challenges facing producers will persist

Double dose is shot in the arm in fight to curb disease

Tech startup InnoTerra says it has identified a natural, microbial treatment and a mutation of Cavendish that can combat diseases like TR4 and sigatoka.

by Mike KnowlesTwo new solutions have emerged with the potential to stop devastating diseases in their tracks, a result that could revitalise the international banana trade.

That’s according to various people involved in a new venture called Innoterra, an agritech firm with a mission to revolutionise global food supply chains and make them more sustainable using cutting-edge technology.

With its roots in the Indian banana export business, today the company has expanded to the Middle East, Philippines and China. And that investment in tech might well be about to pay off in a very big way.

The group claims to have identified two different answers

to the banana industry’s biggest existential threat, plant disease.

The first of these is a new, more resistant banana variety; and the second is a novel biofungicide made using naturally occurring microbes that can apparently prevent the spread of harmful fungal infections.

“Essentially, we have developed two tech solutions,” explains Anup Karwa, director of Innoterra’s research department InnoScience.

In recent years, it has worked to develop new, more resistant banana varieties as well as crop treatments that can protect fruit against diseases.

For banana producers and marketers around the world, the idea of not one but two lights at the end of an especially dark tunnel is a very bright prospect.

TWO-IN-ONE VACCINE

Called BanacXin, the new biofungicide is pitched as a ‘twoin-one vaccine’ that can provide farmers a means to control both fusarium tropical race 4 (TR4) and black or yellow sigatoka.

During recent trials on plantations in India and the Philippines over the past seven years, this treatment was tested on various different pathogens that are known to attack and damage banana plants.

Now, with a provisional patent and various safety certifications in place, the task ahead of Innoterra is to scale up the biofungicide’s production from its initial industrial form and make it more widely available. “We are setting up the fermentation labs, research

“This variety has the advantage of being in the mainstream of what consumers like. Most won’t see the difference”

and development, and production centre,” Karwa reveals. “We have already produced more than 10,000kg of product, which was shipped to the Philippines and then extensively evaluated by independent growers and thirdparty assessors.”

Roberto Barnett is a veteran of the Filipino banana industry who has worked for big corporations like Chiquita, Unifrutti Philippines and UGP over the past few decades. Now, he has an important new role as head of Innoterra’s production, quality and disease control departments.

For him, BanacXin is the “perfect” response to the most challenging banana diseases. That’s because it can be added to the plants using proprietary applications, a method he says is more efficient and less costly for growers.

“Normally, everyone sprays against disease using aeroplanes,” he explains. “Or you control the fungus in the soil through irrigation systems. But these systems are very costly and only the big corporations can afford them. This new, proprietary method of application does less damage to the environment and to people.”

BETTER VARIETY

Barnett is also the person responsible for identifying InnoGreen, a mutant variety of Cavendish (Williams) banana that shows what is said to be remarkable resistance to the same diseases.

“Actually, this was not the first time I saw such a mutation,” he recalls. “But we didn’t pay so much attention before. This one grows very fast and has very good distribution and separation in its leaves, which is very important when you are spraying to control disease.”

InnoGreen also appears to offer sweeter-tasing fruit. “In the Philippines, we plant highland bananas from 600m up to 1,000m elevation, and they go up to 24° Brix, which means they can be sold at a premium in Japan, whereas for lowland bananas it’s only 17°,” Barnett notes. “This green variety goes up to 20° Brix in lowland, so it’s a very good, sweet banana.”

Will consumers notice that difference in taste? Lorenzo Marconato, head of international operations at Innoterra, believes that’s unlikely. But at the same time, he argues the variety has certain advantages. “It’s going to be less costly than other

new alternatives to standard Cavendish,” he predicts. “And it has the advantage of being in the mainstream, offering easier farming and better fruit that consumers like. Most consumers won't see the difference, but the ones that are more attentive might appreciate it being sweeter.”

NEW STANDARDS

The banana business has searched for a solution to various disease threats for some time. For Karwa, the discovery of what are essentially two different forms of prevention opens the door

wider to a more resilient global production base.

During the next few months and years, Innoterra’s task will be to convince industry stakeholders, including some of the world’s biggest banana brand marketers, to accept that view and adopt its new solutions.

Those partners will want to know why choosing this particular path to disease resistance offers a better outcome than other approaches, such as gene editing.

“The review process for transgenics is hard and the timeline difficult to predict,”

Karwa suggests. “Several countries in Europe and also Japan have taken the view that gene editing is transgenic, which means gene modification, rather than mutagenesis, or natural mutation.”

One advantage, he adds, is the prospect that Innoterra’s parallel solutions might even be combined. “When co-applied with BanacXin, InnoGreen will provide an even higher efficacy,” he predicts.

Whatever the future may hold, a combination of investigation, ingenuity, and investment have put this particular team on the path to something very promising indeed.

Chiquita follows the Yelloway road

The group says its new partnership with WUR, KeyGene and MusaRadix has already made significant progress towards the goal of a more sustainable banana business.

by Mike Knowles @mikefruitnetLeading international marketer Chiquita plans to outline its vision for a more sustainable and resilient banana industry at Fruit Logistica 2024 in Berlin, Germany.

During a special session on the show’s Logistics Hub stage, the group’s sustainability director Peter Stedman and its EU director of product supply Stefano Di Paolo will join preeminent phytopathology specialist Professor Gert Kema of Wageningen University & Research

(WUR) to discuss a new long-term and collaborative approach to tackling TR4 and black sigatoka – diseases that threaten to cause serious disruption to banana supply around the globe.

The focus of the session will be on Yelloway, a new project set up in October 2023 by Chiquita, WUR, plant research company KeyGene and agri startup MusaRadix to develop new plant materials that are resistant to both pathogenic and environmental threats.

One of the project’s overall aims

BELOW—A KeyGene employee checks on the progress of Yelloway’s trial plantings

is to limit carbon emissions. Indeed, among the banana industry’s biggest challenges when it comes to disease control is the several hundred million dollars it spends each year on crop protection, as well as the knock-on effect of having to produce and employ so many plant protection products.

To address the problem, Yelloway mapped a large number of genomes to create a banana family tree, based on over 160 different types. It then produced more than 300 new varieties from that research, tested them for resistance under controlled conditions, and has now selected a first batch of candidates for field trials in the Philippines. Eventually, it hopes to identify potential successors to the most commonly marketed variety, Cavendish.

“Having been in the produce industry for over 150 years, Chiquita has witnessed the direct effects of climate change and its imminent environmental threats,” Stedman comments.

“The Yelloway initiative allows us to make a difference for the greater good, especially when it comes to food security and nutrition globally. This process will provide a long-term, sustainable solution for the banana export industry, increase banana varieties and reduce carbon emissions—we are incredibly proud of the work we’ve done.”

Tariff reduction for Mexico and Peru sparks concern among ACP Nations

Afruibana, an association of fruit producers and exporters in Côte d’Ivoire, Cameroon and Ghana, has raised fears about how postBrexit trade policy will affect ACP producers.

THOLLY WOODWARD-DAVEY Banana Link Project Coordinator

THOLLY WOODWARD-DAVEY Banana Link Project Coordinator

he UK consumes around 915,000 tonnes of bananas every year. Over 70 per cent of these bananas are grown in South and Central America, with three countries – Colombia, Costa Rica and Ecuador –dominating the trade, accounting for 57 per cent of the total supply.

As part of the European Union, Britain offered favourable trading conditions to producers in Africa, the Caribbean and the Pacific (ACP nations), who benefited from duty- and quota-free exports under economic

partnership agreements anchored in principles of human rights and sustainable development and cooperation.

However, recent tariff reductions to Peru and Mexico have called the UK government’s position into question. In July 2023, the UK signed an agreement which has seen Mexico and Peru benefit from tariff reductions that reduce costs by over a third – from £62/tonne to £40/tonne for up to 8,000 tonnes of bananas.

Concerns about how postBrexit trade policy will affect ACP producers are being raised by Afruibana – an association of fruit producers and exporters in Côte

d’Ivoire, Cameroon and Ghana. If equivalent concessions were granted to the Latin American banana giants – Ecuador, Costa Rica and Colombia –it would afford them savings of over £12m a year, says the association. The result would be disproportionate bargaining power wielded by large producers in contract negotiations with UK supermarkets, at the expense of smaller African producers.

Afruibana says this is particularly important in the UK market, where 90 per cent of bananas are sold through a handful of retailers. Currently, bananas from African and Caribbean origins represent a modest share of the UK market

Percentage of UK imports from leading source countries

Source: CIRAD/FruiTrop, Jul-Aug 2023

Source: CIRAD/FruiTrop, Jul-Aug 2023

at around 18 per cent, with the Dominican Republic, Côte d’Ivoire and Ghana leading the supply.

Similar figures are reported for the European market.

However, as the world’s most exported fruit, the importance of the banana industry as a source of stable employment in rural areas cannot be underestimated. Often, the banana plantation is the only employer around. With low levels of mechanisation, a large manual workforce is required – labour often accounts for over 40 per cent of the total costs of production. And, unlike other fruits, bananas produce fruit the whole year round, making it possible for workers to receive a reliable monthly salary.

For Afruibana, the banana industry represesnts “a pillar of African rural development”. Plantations are often located in rural areas between coastal and Sahelian nations, acting as a buffer zone of stability against the prevailing threats of violent

extremism and humanitarian crises.

In the first half of 2023 alone, over 1,814 incidents of terrorist attacks were recorded in West Africa and the Sahel, with at least 4,500 people killed. The Sahel region is recognised as one of the world’s fastest-growing humanitarian crises, where millions of people have been displaced by “indiscriminate attacks by armed groups and militias, insecurity, widespread human right violations, including gender-based violence and violence against children, and the effects of climate change”. Earlier this year, UN Special Representative Leonardo Santos Simaõ stated that tangible and long-terms solutions are required to address the situation.

Despite the difficulties they face, several banana and fruit producing companies operating in the West and Central African region are among the most highly regarded in terms of working conditions and labour rights, and among the most forward thinking when it comes

to adapting fruit production to the dual hazards of climate change and biodiversity loss.

Compagnie Frutière, the leading African banana producer, for example, is improving working conditions by taking measurable action such as increasing the number of workers on permanent contracts, decreasing the gender employment gap, and pursuing an active policy of dialogue with employees and social partners. Its commitment to reducing harm to the environment is illustrated by a reported reduction of the use of pesticides by 17 per cent in just one year (2021/22), alongside an increase in the proportion of fruit grown organically and the implementation of crop diversification methods.

In a statement to the UK parliament, Afruibana noted that across the three African banana exporting countries the sector provides more than 80,000 direct and indirect high-quality jobs, sustaining approximately half a million people in rural areas where there are often few other employment opportunities.

It further notes that: “Workers in the sector benefit from full freedom of association and active trade unions, child labour is prohibited and living wages are paid along with substantial in-kind benefits (such as housing, health, education, transportation, and others). The logistics of the sector provide an engine for all food-crop production and exports as well as a springboard agro-processing as activities such as drying and banana-related products such as flour, juice and preserves create value-addition opportunities and higher skilled jobs, particularly for women. “Contributing to the economic and social development of these economies also helps to decrease migratory pressure and support political stability in this potentially volatile region.”

OPPOSITE—The banana industry represents a pillar of African rural development

New brand tackles ‘produce devaluation’

“The world has got it wrong,” says creator of Fyffes’ new banana label, which promises support for female empowerment, education, and child nutrition.

by Mike Knowles @mikefruitnet

Fyffes, famously the first company in the world to put a branded label on its fruit, has unveiled a new consumer trademark for bananas that it says will address the widespread devaluation of fresh produce.

The new brand, called Trudi’s, is designed to tap into growing demand for responsibly sourced products, and to open consumers’ eyes to the real cost of producing the fruit.

In the UK, one of Fyffes’ most important markets, the price of bananas is estimated to have fallen by over 30 per cent in the last three decades, despite recent inflation.

“The devaluing of fresh fruit over many years has had huge

implications for the families and communities that dedicate their lives to growing it,” says Adriano Di Dia, chief marketing officer at Fyffes International.

With a tagline of ‘Good Fruit Doing Good’, Trudi’s is apparently set to tackle the issue head on. According to the company, it will offer support to people in the fruit trade in key areas of corporate social responsibility, specifically female empowerment, education and child nutrition.

“We want to become famous for being the bananas that give back, because it means a lot to the values of Fyffes, the future of the industry, but even more to those who need it most today,” Di Dia adds.

TIME TO RIGHT THAT WRONG

The launch follows the recent appointment of Impero, a strategic and creative agency based in London and Buenos Aires, which created the new brand on Fyffes’ behalf.

And the company says it is throwing plenty of its marketing budget behind Trudi’s, with a campaign designed to raise the brand’s profile and carry its message to consumers in key markets.

“I think the world has got it wrong,” says Impero founder Michael Scantlebury. “How can a fresh, delicious, natural piece of fruit that’s come from the other side of the world and arrived in our homes perfectly ripe be valued in many supermarkets far less than highly processed, fake fruit-flavoured products that won’t go off a year from now?”

The impact of that imbalance is “huge”, he adds. “Trudi’s is here to change that. And we’re super proud to be working with Fyffes International to make it happen.”

“How can a natural piece of fruit from the other side of the world be valued far less than highly processed products?”

People first

Reybanpac CEO Vicente Wong explains the company’s deep-rooted commitment to the wellbeing of its workers and the environment.

by Maura Maxwell@maurafruitnet

For more than four decades Vicente Wong has been at the helm of Reybanpac, steering the company from humble beginnings to its current position as Ecuador’s second biggest exporter. Today Reybanpac employs almost 7,000 people and more than 20m boxes of bananas are sold each year across five continents under its flagship brand, Favorita.

Throughout this time, Wong has never lost sight of the family-run company’s underlying goal. “People are the ultimate reason why we do what we do – we really pride ourselves on how we look after our workers,” he tells Fresh Focus Banana

Ecuador’s employment laws are already among the strongest

in the region – the Labour Code provides for a 40-hour work week, 15 calendar days of annual paid vacation, restrictions and sanctions for child labour, general protection of worker health and safety, minimum wages and bonuses, maternity leave, and employerprovided benefits.

equally seriously – not just because the certification schemes it must comply with to supply the main consumer markets are rigorously monitored and enforced, but because, as Wong explains, “it’s the right thing to do”.

Reybanpac has always been an early adopter of new technologies that have enabled it to fine-tune its production processes and cut its water and pesticide usage. “Productivity and efficiency are fundamental for us as a business,” says Wong. “As production costs continue to rise, the only solution is to become more efficient. In the year 2000, prior to the dollarisation of the Ecuadorean economy, it cost US$1.50 to produce a box of bananas. Now, with dollarisation it’s more than US$6. Before, with 1,800 boxes/ha you lived well. But today if you don’t get 2,700 or 2,800 boxes you’ve got a problem. Productivity is the ‘sine qua non’ of the banana industry, as well as being one of our core values.”

2om+

boxes of bananas reybanpac exports each year

Wong says the workers employed at Reybanpac’s farms and packhouses receive, on average, 34 per cent more than the monthly living wage, currently set at around US$562.50 a month.

The company takes its environmental responsibilities

Wong says recent years have ushered in a growing awareness among retailers of the cost and effort companies like Reybanpac put into making their operations as sustainable as possible.

“Before we would sell to the importer and the importer would sell to the retailer. Then the retailers took the decision to go direct to the producer. Prior to that they didn’t really know what the situation was in the producing countries,” he explains.

“Since then, they have had to make an effort to get to know all about the business, and the social and environmental aspects of banana production.

It hasn’t been easy, we’ve had to explain to them about all the investments we’ve made. But right now there is a group of supermarkets that is beginning to take into account that sourcing from producers who comply with all the CSR requirements is a way to differentiate their product.”

Retailers are also better informed about the numerous challenges facing producers today.

Wong estimates that Reybanpac has invested around US$28m in biosecurity measures to protect farms from Panama Disease TR4, which although not yet detected in Ecuador, is a constant threat to the industry. Over the past two years, Ecuador has been trialling Formosana-218, a Cavendish variant grown in Asia for many years that has some level of tolerance to the fungus, and Wong believes this could offer a partial solution until a variety with 100 per cent resistance has been developed.

Another equally devastating disease, Moko (bacterial wilt), has been silently taking root in fruit crops across the country. The bacterium attacks the plant in

different ways, causing the death of its leaves and discoloration inside the stem, as well as affecting productivity. Outbreaks of Moko have already been reported in 12 provinces.

“We’re working very hard to keep Moko in check, again through biosecurity measures,” says Wong. “Unlike TR4, which stays in the soil forever, if you detect Moko early enough you can cut the plant down, cover it in plastic and leave to biodegrade for six months, then you can start producing on that farm again.”

The increased rainfall ushered in by the current El Niño cycle is not making life any easier for producers either. Guayaquil averages around 1,200-1,600mm of rainfall a year, but with El Niño this rises to 4,000-5,000mm. Flooded plantations and increased moisture levels cause much more aggressive outbreaks of black sigatoka and other funguses, making them harder – and more expensive – to control. “We’ve learnt to live with sigatoka. The moment precipitation levels rise we ramp up control measures. But there’s no doubt that

it causes production losses,” Wong says.

A more recent scourge that the banana industry is learning to live with is the arrival of the drug cartels, lured by Ecuador’s shared border with Colombia and Peru and its shipping links to the outside world. The sector has been forced to take decisive action following the discovery of several cocaine hauls in banana containers bound for Europe, and now pays some US$100m each year in additional security measures that include the scanning of outbound containers.

Wong is clear that this is an issue that Ecuador cannot tackle on its own. “This is a demand problem, not a supply one, we didn’t create it,” he says. “It has to be treated by governments as a public health issue. Developed economies have a duty to take action to reduce consumption. Ecuador is dealing with the consequences of them not having effective policies in place to tackle this problem.”

Asked whether new president Daniel Noboa –himself heir to a banana dynasty – is a good thing for the banana industry, Wong in sanguine: “The private sector should support every government. We are here to provide employment and create wealth and should work side by side with any administration to achieve this,” he says. “As the old Chinese proverb goes, ‘it doesn’t matter what colour the cat is, only that it catches the mouse’.”

Bananas at a crossroads

The Ecuadorean banana industry faces serious challenges around security and climate change, but hopes are high in the sector following the election of President Daniel Noboa, heir to one of Ecuador’s largest banana exporters.

by Fred Searle @fredfruitnet

In more ways than one, the Ecuadorean banana industry now finds itself at a crossroads. On the one hand, this is a time of great promise: 36-yearold Daniel Noboa, the son and heir of banana magnate Alvaro Noboa, was recently elected president, raising hopes the government will prioritise the interests of the sector.

Meanwhile, banana exports are on the up, rising by 6.4 per cent year on year in January-October 2023, as trade recovers from the disruption caused by container shortages, higher freight rates, disruption to shipping services, and the war in Ukraine.

Encouragingly, the sector is also making good progress on workers’

rights and pay, recently taking steps to formalise compliance with the national living wage (see p.4445) and setting an example for other banana-producing nations to follow. On the flip side, there are major security concerns –and in some respects, the risks for producers and exporters have never been greater. The trade finds itself at the centre of Ecuador’s well-documented problems with gang violence (see p.46). Indeed, containers of bananas have been a major target for cocaine trafficking, making contamination, lost shipments, and personal safety a big concern. In addition, El Niño is making production increasingly unpredictable due to flooding and

associated pests, with Agroban president Leonidas Estrada predicting big crop losses if the damaging weather phenomenon manifests at full capacity.

And at the time of writing, there were reports from exporter association Acorbanec that European retailers are reluctant sign supply contracts that support the new ‘minimum support price’ of a box of Ecuadorean bananas, which has risen from US$6.50 in 2023 to US$6.85 in 2024.

Marianela Ubilla, president of the Association of Ecuadorean Banana Exporters (AEBE), kicked off the recent Banana Time convention in Guayaquil with words of both hope and warning.

ABOVE—

Ecuadorean banana exports were up 6.4 per cent year-on-year from January to October 2023

OPPOSITE LEFT—

Marianela Ubilla, president of AEBE

OPPOSITE

RiGHT—Leslie Media, banana production general manager of Fyffes

“This product shows an increase of 7 per cent in export volume and 18 per cent in FOB dollars compared to the same period in 2022, which shows that today more than ever, it is time for Ecuadorean bananas. However, we must remain alert.

“Our main markets are facing inflation, which could reduce the purchasing and consumption capacity of bananas in international markets. In addition, there are multiple challenges that the sector must continue to face, especially in terms of security, climate change, phytosanitary protection and the use of trade agreements.”

BUSINESS FIRST

Although by no means the biggest, Fyffes is now a major banana producer in Ecuador, having set up its own production in the country 12 years ago. Prior to that, the supplier had exported bananas from other Ecuadorean growers, but today it also grows roughly 1,200ha of its own organic bananas on the Santa Elena peninsula near Guayaquil.

Leslie Medina, Fyffes’ banana production general manager,

says he welcomes the election of Noboa, Ecuador’s youngest-ever president. At the age of 18, Noboa created his own events company before joining the family company, Noboa Corporation, and holding management positions in shipping, logistics and commercial divisions.

The new president has said he would prioritise job creation through tax incentives and credit facilities to help small businesses, as well as vowing a “firm hand” against drug gangs and promising the “militarisation of ports and borders”.

“We can expect a more business-oriented policy that facilitates investment, growth and employment,” says Medina. “In particular, it would be nice to see the government investing more in communications, road infrastructure and bridges in rural areas – to help facilitate business. This would be especially helpful during the rainy season when wet weather can block access to farms.”

WEATHER WORRIES

On this note, the growing threat of El Niño is a hot topic following forecasts in July that flooding and droughts intensified by climate change could cost South America’s economies an estimated US$300bn.

For the Ecuadorean banana sector specifically, the main fear is that heavy rainfall due to climate change can harm banana crops in three ways. Firstly, excessive rain causes physical damage to the plants, leading to breakage and premature fruit drop. Secondly, the ripening process is affected if excess water remains on the soil for more than one or two days. If this happens, the bananas cannot withstand shipping, arriving overripe at destination. And thirdly, wet weather raises the prevalence of diseases such as black sigatoka, which can lead to significant crop losses.

More than 70 per cent of Ecuadorean growers say they have already seen climate change have a major impact on their farms, and climate impacts are estimated to have reduced producers’ incomes by 15.7 per cent on average over the past two years. Banana growers in the south have been especially hard hit, and back in July it was estimated that El Niño could cause the loss of up to 50,000ha of banana plantations. This is equivalent to 1,365,000 tonnes (worth almost $600m) in lost exports.

SUPERMARKET STRATEGY

The other big talking point is price, and it will come as no great surprise that there has reportedly been kickback from European supermarkets on the

minimum price set for a box of Ecuadorean bananas in 2024.

Indeed, in June 2022 Rabobank’s fresh produce expert Cindy Van Rijswick gathered data from the UK’s Office for National Statistics to reveal that retail prices for bananas in Britain were still below the level seen in 1987 – despite inflation and despite decades of increasing costs and sustainability requirements for banana producers around the world.

“Bananas have a big problem,” Marcel Laniado of Machalabased banana producer La Nueva Pubenza told Fresh Focus Banana “They are the commodity that supermarkets all over the world compare to see who has the lowest price. They are one of the core items in the basic food basket.

“If you increase the price of bananas by just US$0.60 per box, that is a huge amount of money for the farmer. But it would only add up to a tiny increase for the consumer. The shopper wouldn’t even notice this increase. But we have a problem with supermarkets’ commercial strategy.

“In my view, the problem isn’t

the margin that each player in the supply chain is making. There are huge risks for exporters, so it is understandable that they make a 20 per cent margin, or whatever it may be. Likewise, retailers have big overheads, and they need to cover the costs of their stores. But if the retail price was increased only slightly, it would make the whole supply chain more stable and sustainable.”

PRICE POTENTIAL

Growers’ costs have increased significantly in recent years, not only due to inflation, but also due to the huge certification burden and rising wage bills. The impact

of unsustainable retail prices on Ecuadorean banana producers was highlighted in April 2022 when growers from three provinces blocked main roads to demand government action to boost prices that they said were too low to cover the cost of production.

Richard Salazar, executive director of Acorbanec, emphasised at Fruit Attraction 2023 that the matter of living wages in Ecuador cannot be discussed separately from the issue of a fair price for bananas. He said: “Retailers have the chance to show commitment to a true shared responsibility”, adding that this requires “long-term contractual engagements on the volume of products, based on fair prices… that take into account the peculiarities of each producing country”.

“Bananas have a big problem. Supermarkets all over the world compare them to see who has the lowest price”

Aldi’s commitment in August 2022 to consider the cost factors underpinning the Fairtrade Minimum Price when setting its retail prices was certainly a step in the right direction. But given all the pressures and uncertainty facing supply chains at the moment, the sector needs better long-term support from the value chain.

Fyffes’ business development manger Michaela Schneider insists that consumers would be willing to pay more for bananas, pointing to research published last year which showed that consumers in six countries – the US, Canada, the UK, Ireland, Germany and the Netherlands – think the fruit is cheap and accessible.

“When you asked them what kind of price they pay for bananas, they overestimated the price and still thought it was cheap,” she says. “Around two thirds of banana buyers are willing to spend more for a banana that is certified as being organic or Fairtrade. So, even in a challenging environment like we have at the moment, there is a potential to increase consumer prices.”

Fairer fruit

Despite past controversies, Ecuador’s banana industry has made big progress on workers’ rights, wages and female empowerment.