EUROF RUIT

BRIEFINGS

FRUIT ATTRACTION

APPLES AND PEARS

FRESH FOCUS NORTH

SOUTHERN AFRICA BERRIES

PACKAGING AND TECHNOLOGY DISPATCHES

BRIEFINGS

FRUIT ATTRACTION

APPLES AND PEARS

FRESH FOCUS NORTH

SOUTHERN AFRICA BERRIES

PACKAGING AND TECHNOLOGY DISPATCHES

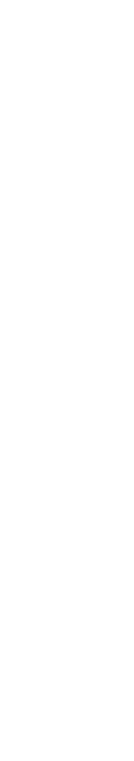

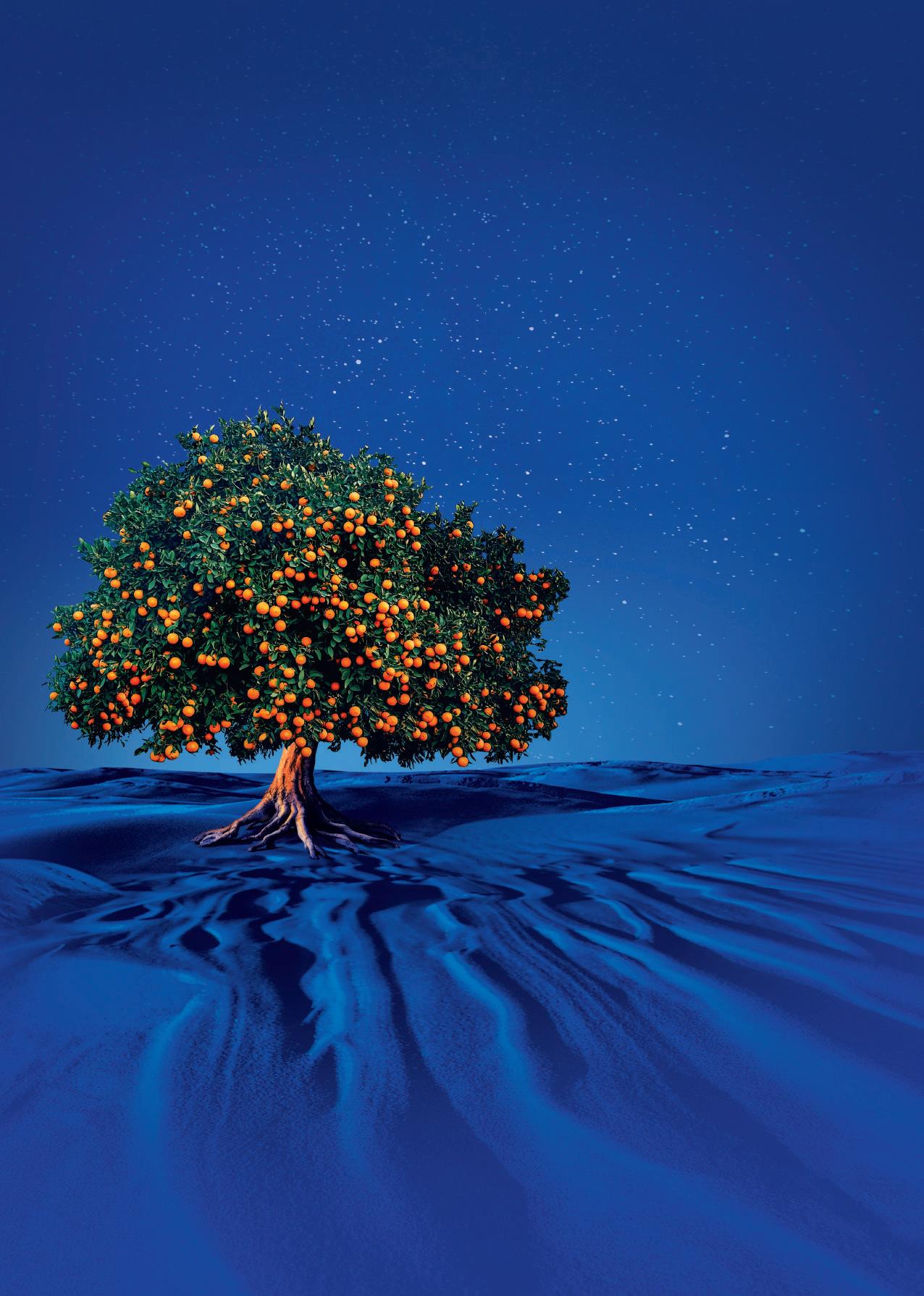

Despite some considerable challenges, Europe’s biggest fresh produce exporter continues to lead the way as a key supplier to markets around the world

Fruit

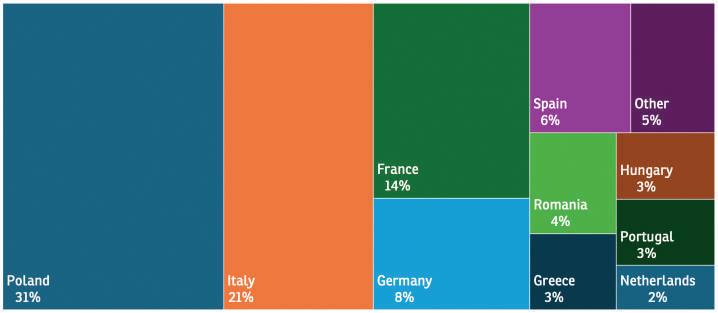

The challenges facing Spain’s agrifood sector –climate change, rising production costs, labour shortages and a loss of competitiveness against cheaper, non-EU imports to name just a few – are well documented. Yet, much like its football team, it remains the dominant force in Europe, a position driven by its favourable geography, climate, technical knowhow, efficient logistics and the resilience and resourcefulness of its growers. Last year, exports of fresh fruits and vegetables grew 6 per cent in value, despite falling by the same percentage in volume. In the words of one global supplier who took part in a recent Foods From Spain event to promote Spanish food, wine and produce in the UK, “Africa may have a labour cost advantage, but on every other metric, Spain can’t be touched”. In recent years, Spain’s role as a global trading hub for fresh produce has also developed. The number of African and Latin American countries using Spain as an entry point to serve European markets continues to grow. So let’s raise a glass and celebrate these remarkable achievements. For despite the challenges, as long as the sector continues to invest in technology, varietal development, logistics and sustainability, Spain’s future looks assured. E

Maura Maxwell, Editor

We excite consumers in every

fruitnet.com/grapecongress

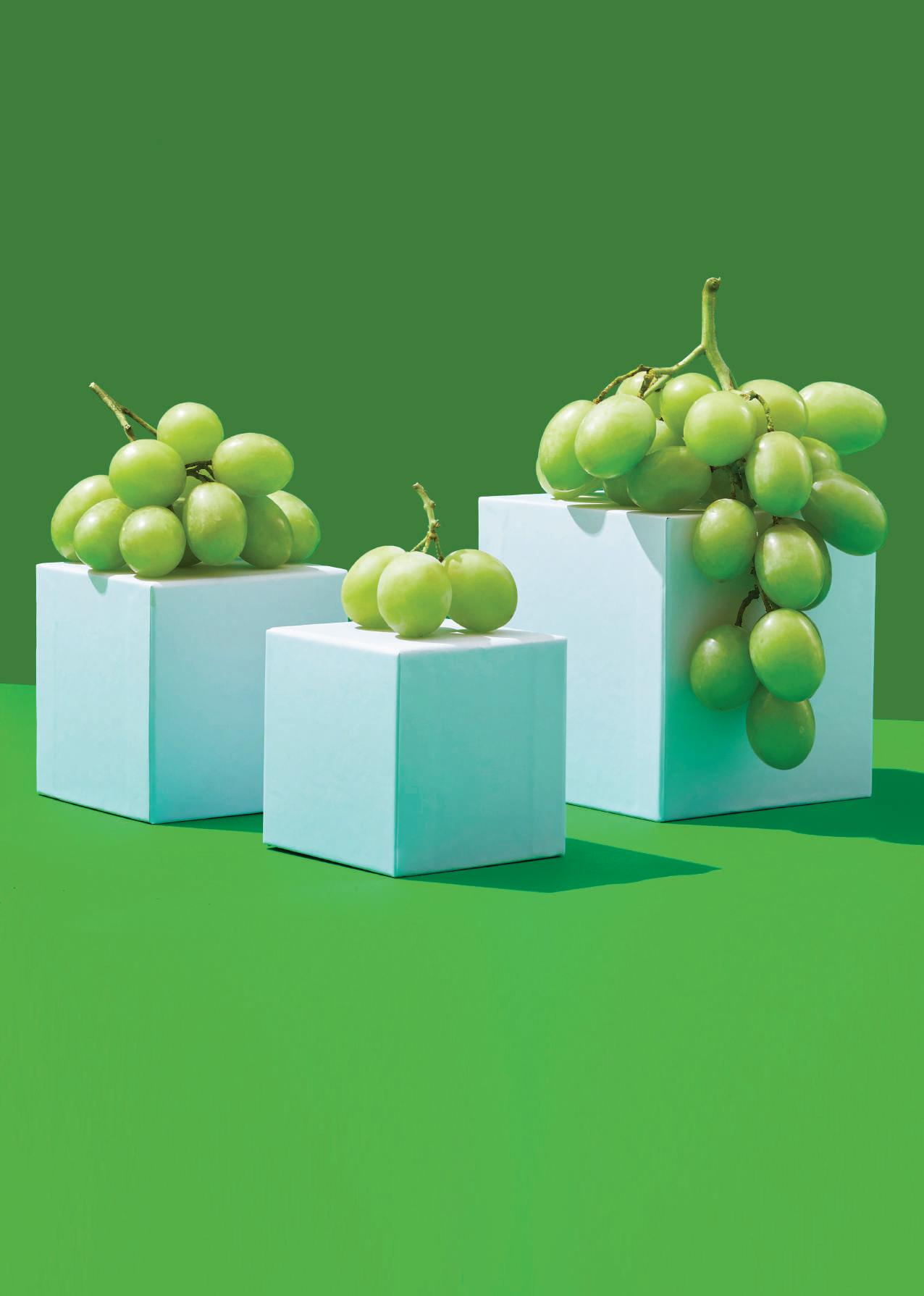

Fruitnet Grape Congress brought together leading players from the table grape category to connect and share in-depth experience and expertise, whilst exploring new ideas.

instagram.com/fruitnet

Follow Fruitnet's Instagram page for regular photos and updates from the Fruitnet team.

fruitnet.com/eurofruit eurofruit's news website provides regular updates on all the top stories from the European fresh fruit and vegetable business. News

https://desktop.eurofruitmagazine.com

Download the new Eurofruit app onto your smartphone or tablet from the App Store or Google Play. Stay informed of the latest fresh produce industry developments, and enjoy our magazines in new user-friendly digital formats.

linkedin.com/showcase/eurofruitmagazine

Expand your network of professional contacts and join the fresh produce conversation by visiting the eurofruit LinkedIn account. LinkedIn

x.com/eurofruit

Keep up to date with news, opinions and developments from around the European fresh produce trade by following our dedicated X account.

fruitnet.com/freenewsletter

Fruitnet Daily News is the fresh produce industry's leading source of news, information and insight. Available free to all, it is essential reading for those who need to keep track of developments and trends in the international fruit and vegetable business.

https://anchor.fm/fruitbox

Listen to Fruitnet's podcast series hosted by managing director Chris White in London. The Fruitbox podcast features conversations and interviews with leading industry experts. Fruitbox

Leading vertically integrated citrus grower/shipper in North America, with complete control of our fruit, from seed to store

Highest industry standards for quality

Best-in-class brands that consumers know and love

Deeply invested in innovation, sustainability, and our communities

Complete customer-centric services and expertise: Transportation, sales, marketing, merchandising, agronomy and more

SINCE 1973

managing director, fruitnet europe

Mike Knowles

+44 20 7501 3702 michael@fruitnet.com

managing editor

Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

deputy editor

Carl Collen

+44 20 7501 3703 carl@fruitnet.com

news editor

Tom Joyce

+44 20 7501 3704 tom@fruitnet.com

staff writer

Fred Searle

+44 20 7501 0301 fred@fruitnet.com

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

senior designer

Qiong Wu

+61 3 9040 1603 wobo@fruitnet.com

senior graphic designer Mai Luong

+44 20 7501 3713 mai@fruitnet.com

graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive

Poppy Bowe

+44 20 7501 3719 poppy@fruitnet.com

MANAGEMENT

commercial director

Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director

Chris White

+44 20 7501 3710 chris@fruitnet.com

sales director

Artur Wiselka

+44 20 7501 0309 artur@fruitnet.com

senior sales manager

Giorgio Mancino +44 20 7501 3716 giorgio@fruitnet.com

us & canada

Jeff Long +1 805 448 8027 jeff@fruitnet.com

italy

Giordano Giardi +39 059 786 3839 giordano@fruitnet.com

germany, austria, switzerland, middle east

Heike Hagenguth +20 100 544 5066 heike@fruitnet.com

morocco, france, tunisia Cristina Delof +34 93 000 57 54 cristina@fruitnet.com

south africa

Fred Meintjes +27 28 754 1418 fredmeintjes@fruitnet.com

asia pacific Kate Riches +61 3 9040 1601 kate@fruitnet.com

finance director

Elvan Gul +44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines +44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz +44 20 7501 3714 gunal@fruitnet.com

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

Elmé Coetzer-Boersma globalgap

Elmé comments that farm assurance solutions like those offered by GlobalGAP can simplify the certification process for producers. briefings–p10-11

Michael Barker fresh produce journal

Michael speaks with CPMA's Ron Lemaire about a range of topics relevant to Canada, such as consumption, packaging and sustainability. ff north america–s6-7

Fernando Muñoz

foods from spain Fernando highlights a new study that will assess the challenges and opportunities the Spanish fruit and vegetable industry faces. fruit attraction–p26-27

Edwin Wentink lineage logistics

Edwin says that when it comes to cutting waste amid rising demand for fresh fruit, a joined-up approach to cold chain logistics is essential.

transport & logistics–p116

ABOVE—The proposal suggests cutting the agricultural promotion policy budget over the next three years.

OPPOSITE— Communicating the benefits of fresh produce is crucial

The organisation says that the redeployment of funds could threaten the competitiveness of European fruit and vegetables.

by Carl Collen

Freshfel Europe, on behalf of the European fresh produce sector, has submitted a letter responding to the EU Commission’s proposal to drastically reduce the agricultural promotion policy budget over the next three years. The proposal will see a cut of €281.7m, resulting in a total budget reduction of over 50 per cent for the CAP policy.

The industry body said that the budgets for ‘multi programmes’, which involve multiple member states as well as the Commission’s own promotion projects in third countries, had been scrapped entirely, only leaving in place the so-called ’simple programmes’.

Freshfel expressed concern regarding the impact this would have on the EU’s fresh produce competitiveness and the continuity of essential promotion and marketing activities co-funded by the EU budget.

“While the EU decreases its promotion budget, global competitors such as the US continue to invest millions to promote American food and farm exports,” said Philippe Binard, general delegate of Freshfel Europe. “This underscores the urgent need to keep a strong EU promotion policy to maintain our competitive edge globally.”

A lacklustre promotion policy would also significantly and negatively impact the EU’s efforts to inform society and consumers about health and environmental issues relating to food and diet, it said.

The latest estimate for daily fruit and vegetable consumption is 340g per person. This is well below the WHO minimum health recommendation of 400g, driven by healthy diet considerations to address the challenges of non-communicable diseases and obesity. Furthermore, the Nordic Council has recommended reaching a minimum daily consumption of 800g of fruit and vegetables: 400g for health benefits and an additional 400g to offset negative environmental impacts.

Freshfel noted that the EU’s promotion policy and its co-funding opportunities were essential for sustaining much-needed promotion and information activities to communicate the high health benefits and the low environmental impact of fresh fruit and vegetables.

“The role of fresh produce as ’essential’ and ’public goods’ needs to be properly voiced,” it continued.

With these challenges in mind, Freshfel Europe said it was ”highly concerned” about the disproportionate decreases in the promotion policy budget, especially for multi-programme projects. The fresh produce

sector had always shown a strong and growing interest in participating in multi-programme projects across all EU member states, as demonstrated by the 52 per cent increase in applications between 2023 and 2024.

“In a time of growing geopolitical instability, with economic uncertainty impacting consumers’ purchasing power and attitudes, and the need to promote the social and environmental benefits of fresh fruit and vegetables, it is crucial for the EU’s fresh produce sector to be well supported in a more cogent, cohesive and coherent manner than has been proposed,” Binard commented.

Freshfel said that the Commission was ”once again demonstrating a lack of consistency, coherence and ambition to accompany the Green Deal strategy towards a plant-based diet”.

It was also significantly undermining its desired transition toward a more sustainable food supply chain, it said, particularly as the budget was one of the only tools that could drive consumer attitudes toward a better diet, in

alignment with the Farm to Fork strategy and Europe’s Beating Cancer Plan.

“This is a very short-term vision,” said Binard. ”This approach by the Commission ignores the indirect long-term huge financial burden on healthcare systems due to unhealthy diets. The World Economic Forum estimates that €2 is needed for each €1 spent on food to remedy the cost of an inappropriate diet.

“This budget redeployment is not only a very bad management choice in regard to the return on investment and efficiency of the promotion policy, but it will be financially very detrimental in the medium- to long-term for society.”

Freshfel called on the Commission to review its position and not to undermine the effectiveness of a popular policy of its CAP.

”With the proliferation and acceleration of multiple crises impacting the agricultural sector, a strong promotion policy remains more relevant than ever for both the internal and international markets,” it stated. E

Farm assurance solutions can simplify the certification process for fruit and vegetable producers around the world.

BELOW & OPPOSITE—

Certified goods are more attractive to the supply chain and, ultimately, the consumer

CELMÉ COETZER-BOERSMA GlobalGAP Managing director

the supply chain’s demands for transparency and assurance of responsible farming.

Smart farm assurance solutions can be the answer to tackle increasing challenges for farmers around the world.

ertification should be straightforward and streamlined and should bring recognition to the hard-working farmers that keep fresh produce on our table. It shouldn’t make their demanding jobs harder than they already are.

Fruit growers today face a daunting gauntlet of drought and climate change, tight markets, and increasingly complex government regulations. Growers are additionally expected to meet an expanding number of regulations and certifications for food safety, environmental protection, labour rights, water use, and so on, before they can gain access to an already competitive market.

As the time commitments and financial burdens that are imposed by these additional certifications become increasingly onerous, growers are asking whether less burdensome certification options exist that can truly benefit them, while still satisfying

In today’s global economy, consumers who live far from the source of the food at their local supermarket seek assurance that the food is safe to eat and that it was responsibly produced. Credible certification can provide this assurance in terms of food safety, environmental protection, water conservation, fair labour practices, and so on.

Producers certified under trusted farm assurance solutions like those offered by GlobalGAP can secure access to the supply chain and offer responsibly

produced goods, which are more desirable to the supply chain and, ultimately, to consumers. As a side benefit, many growers find that the knowledge they gain when implementing the science-backed field-tested practices embodied in these standards helps them farm more efficiently, growing betterquality products with less waste and lower input costs.

Also, certification solutions can reach beyond the supply chain directly to the consumer through consumer labels such as the GGN label. Found in supermarkets on select items produced under specific standards, the consumerfacing label brings consumers face-to-face with producers when they enter the label’s 13-digit tracking code into the label portal. Putting a face to a product gives conscientious producers the recognition they deserve for their responsible farming practices.

A scheme like GlobalGAP offers internationally recognised standard solutions to streamline and simplify the compliance process for fruit growers. Their standard for fruit and vegetable farms can be combined with additional modules focusing on specific production aspects, such as labour or water conditions. This reduces audit duplication, simplifies the process, and lowers costs to meet market demands – regardless of the producer’s situation or conditions.

Rather than implementing a heavy-handed top-down approach when developing or updating voluntary standards, GlobalGAP instead actively seeks input from all of its stakeholders, and specifically also the producers themselves, through public consultations. Producers can make specific contributions from their area of expertise, shaping standards with their valuable field-level insights.

Technical committees and focus groups lend further balance and perspective when it comes to setting the standard. And ultimately, this means solutions are crafted that will reflect the latest best practices for responsible farming.

In addition to the scientific expertise that these groups bring to the table, the process of standard

Under certain conditions, individual producers and smallholders who find certification financially prohibitive can group with other growers and receive group certification, efficiently using resources to reduce the financial burden of certification. Besides, group certification encourages collaboration and knowledge sharing among smallholders. By working together to meet certification standards, producers can learn from each other, improve their practices, and build up their capacity. This collective approach can lead to long-term sustainability and growth for smallholder farmers.

setting also involves food retailers, NGOs, agricultural suppliers, certification bodies, and industry associations. This ensures that the certification process that farmers undergo counts on robust standards and a reliable system behind it.

GlobalGAP’s core and add-on standards are driven by our stakeholders around the world. Therefore, they reflect both the needs of the market and the daily realities that are faced by producers on the ground.

Throughout the process, our farm assurance solutions are developed according to four key principles: widespread participation, scientific expertise, harmonisation, and continuous improvement. This approach ensures that we are always innovating in collaboration with stakeholders, and involving all participants in the value chain to create robust, realistic, and cost-efficient farm assurance solutions. E

GlobalGAP has released its 2023 annual report, highlighting its ongoing efforts and contributions in providing tools that support diverse sector challenges, including supply chain transparency, responsible water use, and capacity-building initiatives. These efforts aim to assist producers and communities in adopting safer and more responsible farming practices globally.

“2023 brought the farming industry closer to transformational change –with the agriculture, aquaculture, and floriculture sectors playing a growing role in global climate ambitions,” the organisation said.

“Stakeholders throughout the supply chain are looking to make vital progress on sustainability goals, including producers who must adjust their practices and provide increased transparency on their processes. At GlobalGAP we are pleased to provide our stakeholders with innovative, efficient and smart tools to combat global farming challenges.”

There are 194,777 producers in 137 countries with GlobalGAP-certified production. In total, 4.553m hectares of non-covered and covered plant production are currently GlobalGAP certified. This is calculated based on the productive area certified under the IFA plants scope (all product categories), as well as the Crops for Processing standard and the Harmonised Produce Safety Standard.

Moscow’s apparent attempts to punish Moldova for pursuing closer relations with the EU have only driven the supplier closer to Europe, and Armenia looks set to follow suit.

by Tom Joyce

In mid-July, Russia’s agricultural watchdog Rosselkhoznadzor introduced a ban on imports from 16 major Armenian fruit and vegetable suppliers, citing higher than permitted levels of pesticide residues on Armenian tomatoes and apples, according to Novaya Gazeta

With Armenia highly reliant on neighbouring Russia, which accounts for a massive 90 per cent of its produce exports, many analysts believe the continuing ban has more to do with Armenia’s apparent drift toward western markets.

Nevertheless, the countries agreed that Russian officials would visit Armenia in late August to jointly inspect production, processing, storage and shipment sites for produce destined for Russia.

The tactic is nothing new. In 2006, Russia responded to attempts by Georgia and Moldova to move closer to the EU by banning wine from the two countries, claiming they contained unsafe amounts of heavy metals and pesticides.

Moldovan fresh produce exports to Russia have dropped significantly

Earlier this year, Russia halted imports of bananas from Ecuador after the latter sold Soviet-era weapons to the US, which intended to ship them to Ukraine.

Last year, Russia banned fruit and vegetables from Moldova on health grounds, amid worsening relations with the country’s proEuropean president.

But the result has been to push Moldova further away, with companies seeking more stable markets and choosing to invest in post-harvest handling to sell fruits to EU markets when the local season ends.

Back in 2018, Moldova exported almost 70 per cent of its apricots, cherries, peaches and plums to the Russian market, according to Emerging Europe. By 2023, this figure had dropped to 18 per cent.

The Moldovan Fruit Association reports that last year the country exported 2,600 tonnes of sweet cherries to the EU. “It’s a huge amount, 12.5 times more than the year before,” says Iurie Fala, executive director of Moldova Fruct.

According to Cristina Ceban, state secretary at the Ministry of Economic Development and Digitalisation, Moldova exported nearly 74,000 tonnes of fresh plums last year, totalling US$38m. Exports to the EU were 2.6 times higher than the year before, at 60,443 tonnes, making Moldova the EU’s largest supplier of plums.

The same has largely been true for apples. In 2018, almost all Moldovan apples went to the Russian market. By 2023, this had dropped to half. E

One organic farm is understood to have been completely destroyed as a result of wildfires that spread across East Attica this summer, while grape growers are dealing with a premature start to the season.

by Tom Joyce & Mike Knowles

LEFT—

Alarge wildfire which burnt thousands of hectares of land in the region of Attica, to the north of Athens, has adversely affected some local production of vegetables.

“The East Attica wildfire was a really sad moment, mostly for production of vegetables [rather] than fruits,” said Eleni Bereti, business account manager at Cherries From Rachi Olympus.

The fires are understood to have completely destroyed an organic vegetable farm near Afidnes, known locally also as Kiourka.

“Especially from what I know, there was huge damage in the ecological farm [in the] Kiourka area. Greenhouses, storage areas, cold room, irrigation system, animal stables, workers accommodation, farm equipment, and all crops were destroyed.”

Wildfires burnt across the Attica region of central Greece from 10 August. According to the European Forest Fire Information System, the main wildfire burnt approximately 10,630ha in the East Attica regional unit.

According to Novinite, one result of the disappearance of local fruit and vegetable supplies was a sudden surge in food prices, which rose by over 30 per cent.

TOP PHOTO— Emmanouil Pavlis, Dreamstime

With traders reportedly turning to imports to meet demand, looking to Albania for watermelons, Egypt for potatoes, Turkey for tomatoes, the increase in food prices has reportedly been significant for a number of products.

With Greek grapes set for an early start to the campaign, thanks in part to the changing climate, competition on the European grape market is set to ramp up further.

Greece’s Youphoria Fruits is preparing for a smaller grape crop this year, according to general manager George Kallitsis, in part due to the premature start to the season.

“The harvest began much earlier than usual,” he told Eurofruit , “with varieties like Sugar Crisp being picked as early as 5 August, instead of the typical late August start.”

This trend has continued, he said, including for varieties such as Sweet Globe, Sweet Celebration and Jack’s Salute.

“Currently, the markets are saturated with grapes from Spain, Italy and even Egypt,” he explained. “As a result, we’ve decided to concentrate on regions where the crop is just starting. We anticipate beginning

packing at the end of next week, with distribution starting midSeptember and continuing until the end of October.”

The company’s key varieties are Sugar Crisp, Sweet Globe, Crimson Seedless and Jack’s Salute, with discussions ongoing with customers in the UK, the Netherlands, Germany and Italy.

“Simultaneously, we are monitoring the upcoming kiwifruit crop, which is expected to be similar in volume to last year,” revealed Kallitsis. “The fruit size should be a bit smaller, which is favourable, as last year’s larger sizes presented challenges, especially for retailers who prefer medium- to small-sized fruit.”

According to Kallitsis, the weather remains warmer than usual, but the company is

“The grape harvest began much earlier than usual, with varieties like Sugar Crisp being picked as early as 5 August”

hopeful of cooler conditions as September progresses, in order to ensure a smoother harvesting period.

This year, Youphoria plans to export kiwifruit to Thailand and South Korea through its existing partners, with the possibility of extending to India.

“However, the ongoing Red Sea attacks are impacting trade routes to these destinations,” said Kallitsis. “Unfortunately, Asia no longer holds the same potential for the kiwifruit business as it once did. In China, the ability to keep pace with price increases has diminished and import volumes have signifi cantly decreased in favour of local production.” E

UK innovation agency Innovate UK has announced the shortlist for its Knowledge Transfer Partnerships (KTPs) Awards 2024, with Tozer Seeds up for prize.

by Tom Joyce

“The goal of KTPs is to help companies to grow through their development and commercialisation of new products”

Having reviewed hundreds of applications for various innovative projects, the expert panel of judges for the Knowledge Transfer Partnerships (KTPs) Awards 2024 has unveiled the shortlisted finalists.

Tozer Seeds has reached the final three on the shortlist for the Best Technical Excellence Award, with the winners for each category announced in Birmingham on 27 November.

“Regardless of who wins in November, this is already a great achievement and a recognition of a really successful partnership between Tozer and Professor

Katherine Denby at the University of York,” said Jamie Claxton, director of R&D at Tozer. “The team led by Dr Viviana Rosati has done fantastic work on speed breeding and gene editing of vegetable crops. Viviana has been a great KTP associate, and we’re delighted to have her now continuing her KTP work as an employee of Tozer.”

Tozer said that KTPs helped to drive innovation through “dynamic collaborations between the business and academic worlds”.

“Their goal is to help companies to grow through their development and commercialisation of new products, processes and services, supported by an outstanding innovation ecosystem that is agile, inclusive and easy to navigate,” the company said.

“When considering the goal of the KTP scheme, we can conclude that the outcome for Tozer has been great,” explained Claxton. “That’s why we look forward to continuing our work with Innovate UK in the future.” E

Edwards said he will work to incorporate new members including large, medium and small producers.

by Maura Maxwell

Mario Edwards has been elected as the new president of the Chilean Cherry Committee. Edwards, who is currently commercial manager of Agrofruta, will serve a two-year term.

Thanking outgoing president Cristián Tagle, the committee’s executive director Claudia Soler said: “We appreciate all the work and commitment of Cristián, under which as a committee we grew and undertook successful actions.

“Together with Cristián we carried out important work to consolidate our presence in our main market, China. Today, the challenge is to continue growing, increasing consumption and facing challenges, such as phytosanitary ones, in a united manner. We welcome Mario for taking on this task to continue promoting our industry.”

Edwards has worked in the Chilean fruit production and export sector for many years and since 2019 he has been a director of the Chilean Fruit Board. He described Chile’s cherry industry as “a driving force” within the fruit sector and said his new role was a source of great pride and would present a tremendous challenge.

“All the people who work in the committee, and in Frutas de Chile, are a tremendous team that in the end make this challenge easier.

In addition, all the directors have offered me their support to be able to develop a successful work,” he said.

The upcoming 2024/25 season is challenging for the cherry sector due to the outbreak of fruit flies in Chimbarongo. Edwards said this would require individual and collective effort to resolve the problem.

“Each season is different, there are no simple recipes or solutions, but in past years we have overcome challenges that seemed quite insurmountable and we all hope that this will not be the exception,” he said.

As part of a smaller cherry production and export company, Edwards said he would try to continue to incorporate new members into the committee, which currently accounts for 80 per cent of Chilean cherry exports.

“The committee already has its history and one must represent the interests and challenges of all, which are obviously different, both large, medium and small,” he said.

“Without a doubt, the task is to continue trying to incorporate those who are not there and for partners of all sizes to feel even more involved.

“We want to advance the commitment of partners to the sustainable development of this activity, where there are many

people involved in each part of the process.”

The committee elected a total of five new directors, including a representative of a Chinese company. E

Now operational at Agrintesa is the Unitec robotic dumping machine, coupled with electronic sorter and artificial intelligence, for delicate fruits. Flat peaches and pears are sorted with Unical 10.0, emphasising versatility in specialisation.

In the collective imagination, fruit processing in water is exemplified by apples floating along a selection channel. There are fruits with a specific gravity that, despite their varying shapes and sizes, is always greater than one, so – unlike apples – they do not float.

To address this, Unitec has developed a specific immersion robot for bins, equipped with a tipping function that allows controlled and ultra-delicate emptying of those bins into water. Additionally, the combination with a mobile-bottom tank is particularly useful to ensure continuous and homogeneous feeding of fruits, whether floating or non-floating, such as pears and peaches. This system ensures that all fruits are handled uniformly, preventing damage and ensuring a continuous flow in the production process, which guarantees a constant processing capacity.

At leading supplier Agrintesa, its line dedicated to flat peaches and pears has been integrated with a Unical 10.0 sorter, with four channels equipped with advanced technologies for classification by weight, size, and colour.

Its real strength lies in the external and internal quality selection system dedicated to flat peaches, Peach Vision. This innovative system, entirely developed within Unitec’s R&D department, detects and eliminates defective and overripe fruits, ensuring that only fruits suitable for fresh consumption reach the market.

“Considering that flat peaches often lack in ripening uniformity, with Unical 10.0 we can ensure that only fruits suitable for fresh consumption reach the end distribution,” says Angelo Benedetti, president of Unitec. “Moreover, thanks to its versatility, this innovative solution can also process pears, ensuring faster amortisation times and consequently lower fixed costs. Specialisation and versatility are the keywords of this solution developed for Agrintesa, always in line with our philosophy of supporting our customers to achieve the best possible results in their handling process.”

The plant is also equipped with three different types of packing,

designed for various types of packaging such as boxes and trays, with particular attention to the handling of trays for flat nectarines, which require special care in fruit presentation. These systems allow operators to focus on specific tasks, thereby increasing productivity and significantly saving on labour costs.

Finally, there are automatic crate fillers that allow part or all of the product to be pre-sorted into boxes. This aspect makes the line extremely versatile for different handling processes, facilitating the management and packing of fruits, thus creating high efficiency in the entire process.

“All of this,” concludes Cristian Moretti, general director of Agrintesa, “helps ensure better profitability also for producers, since generating income in the field is a priority that all operators in the supply chain must aim for.”

ABOVE—Unitec’s innovative Peach Vision system detects and eliminates sub-standard fruits

With a significant contribution to apple and pear variety development under its belt, Prevar reflects on the past two decades while looking ahead to what the next 20 years will hold.

by Bree Caggiati

New Zealand-based variety development organisation, Prevar, will celebrate 20 years in business this year. The joint venture between New Zealand Apples & Pears, Plant & Food Research (Plant & Food) and Apple and Pear Australia (Apal) was created in 2004 to develop and commercialise new apple and pear varieties for licensing in New Zealand and around the world.

Prevar has developed are known as Dazzle, Rockit, PiqaBoo and Lemonade, with Sassy, Posh and Joli the latest additions to its portfolio.

In its current form, the Prevar business is centred on four core areas – consumer insights-driven innovation, a world-class breeding programme, customer-centred commercialisation, and industry and category leadership.

ABOVE—Prevar varieties Joli and Sassy

business that provides better returns for our growers, continues to support our industry and that delights consumers with the products we create.”

According to Martin, Prevar re-invests a large portion of its revenue back into R&D to stay at the forefront of innovation and product development.

“At any point in time, we have a few hundred new varieties in stages of R&D that are narrowed down. Only the best make it into full production,” he explains.

While the rest of the world was investing in larger and larger apples, Prevar took the opposite route with PremA96. The naturally small apple has become popular under the brand name Rockit through strong marketing efforts by its owner Rockit Global.

In 20 years Prevar has commercially licenced 18 varieties, entered into 36 license agreements and holds more than 183 trademark registrations across the globe. Some of the distinctive IP varieties »

“We have a lot to be proud of in our first 20 years of business,” says Prevar chief executive, Tony Martin. “There has been a lot of investment over that 20 years to be able to create a sustainable

“It’s an amazing success story where an

entrepreneur saw the opportunity to take what was a small snack apple, put it inside a tube and build a great brand story that appeals to consumers in different parts of the world,” says brand manager Amanda Lyon.

Another win for Prevar has been the development of the distinctively red pear, PiqaBoo.

“There is nothing quite like PiqaBoo anywhere in the world,” Lyon says. “It’s a special IP variety that combines the very best of Japanese, Chinese and European pears with great colour, great flavour, great texture and great storability.”

Demand and excitement for PiqaBoo continue to grow as more consumers experience the unique offering.

“We believe that these next 20 years are going to see a revolution of the pear category, and we are excited to be at the forefront of that with our Piqa series,” Lyon says.

One of Prevar’s newest apple offerings, branded as Joli, comes out of a partnership with leading New Zealand apple grower-

exporter T&G Global.

“We are really excited about this apple,” Lyon says. “It’s a bigger piece of fruit and incredibly juicy.”

With a strong portfolio of existing varieties, a significant global licensee network, an ongoing partnership with Plant & Food and a deep pipeline of selections in new product development stages, the future looks bright for Prevar and the New Zealand industry at large.

“One thing we know for sure, the next 20 years will look very different than the last,” Martin says.

For Prevar, and many other developers, the environmental impacts of long-distance shipments are becoming less viable.

“There is an exciting future ahead that’s more sustainable with fruit growing closer to the consumer,” Martin says.

“While shipping the very best premium fruit from New Zealand to global markets will continue, this will be increasingly supported by the weightless export of our intellectual property.”

Martin sees this progression as the next step for the industry, promoting growth in breeding, technology and more sustainable practices.

“The first 20 years has been all about developing a really strong portfolio of products and brands that we can take from New Zealand to the world,” Martin says. “The next 20 years gives us an opportunity to really dial up the innovation to meet the ever-changing needs of our consumers and growers.” E

Según las recomendaciones dietéticas basadas en el enfoque alimentario en España, se recomienda consumir un mínimo de 5 raciones de frutas y verduras al día.

Añade una explosión de sabor a tus comidas con deliciosas nectarinas, kiwis, melocotones y kakis. Las nectarinas ofrecen un sabor suave y agridulce, mientras que los kiwis aportan un extraordinario toque agridulce. Los melocotones son conocidos por su aromática dulzura, y el kaki, en cualquiera de sus variedades y formas de consumo, aporta un exótico sabor a miel. Incluir al menos cinco raciones de fruta y verdura fresca en tu dieta diaria es esencial para mantener un estilo de vida saludable y equilibrado, y los melocotones, nectarinas, kiwis y kakis cultivados en Europa son una opción perfecta. Disfrútalos frescos: en ensaladas, en batidos o como un aperitivo natural.

Estas frutas no solo ocupan un lugar importante en la pirámide nutricional, sino que además están llenas de nutrientes que contribuyen al bienestar general. Los productores de fruta de la Unión Europea cumplen rigurosas normativas de seguridad alimentaria y estándares de calidad como GLOBALGAP e ISO 22000, garantizando que cada bocado de estas frutas sea tanto seguro como delicioso. Con su frescura, sabor y valor nutricional excepcional, los melocotones, nectarinas, kiwis y kakis europeos constituyen una forma diversa y deliciosa de fomentar tu ingesta diaria de fruta y mantener tu salud. Siéntete seguro de “disfrutar” del día con deliciosas frutas producidas en Europa.

eufruitbasket_es eufruitbasket www.eufruitbasket.eu

Financiado por la Unión Europea. Las opiniones y puntos de vista expresados solo comprometen a su(s) autor(es) y no reflejan necesariamente los de la Unión Europea o de la Agencia Ejecutiva Europea de Investigación (REA). Ni la Unión Europea ni la autoridad otorgante pueden ser considerados responsables de ellos.

LA UNION EUROPEA APOYA CAMPAÑAS PARA PROMOVER PRODUCTOS AGRÍCOLAS DE ALTA CALIDAD

Eurofruit catches up with the Huelva-based cooperative’s managing director, Juan Báñez, ahead of Fruit Attraction.

by Maura Maxwell

What important milestones has the company achieved during this past year?

Juan Bañez: At Cuna de Platero we are committed to the continual improvement of our processes. We’re incorporating the latest AI-driven technology to allow us to be even more precise and efficient; and continue to invest in the development of new varieties that help us grow and maintain leadership in the international arena, always keeping in mind the global nature of today’s markets.

This year we’ve made significant progress in our objective of becoming ‘Your Global Berry Partner’ by offering our customers the whole range of berries throughout the year. We’ve increased our summer production by 50 per cent, mainly to meet the needs of our customers from the Iberian Peninsula. And

we have invested in new machinery exclusively for blueberries and expanded our facilities with the aim of improving our specialisation in this area and offering the highest quality to our clients.

What new developments will you share at Fruit Attraction?

JB: One of the things we will be showcasing is our commitment to regenerative agriculture, for which we have recently received Aenor certification. The aim is to regenerate the soil using natural resources, such as organic matter or compost. Healthier soil is better at retaining water and nutrients, making us more sustainable and resilient. This type of farming also captures carbon in the soil, where it is transformed into food for the plant and oxygen for the environment.

This year we also celebrate the 10th anniversary of our Food Chain Partnership with Bayer. This brings

together farmers, food processors, retailers, traders, and others along the food value chain to work together for sustainable agriculture.

The programme has really helped us improve our knowledge when it comes to environmental and social sustainability. We’ve implemented measures to save water, including the installation of humidity probes that allow us to control irrigation water; improved the health of the soil and strengthened quality control procedures amongst other things. For Cuna de Platero, sustainability

is part of each area of the company and is present in all our objectives. We work aligned with the SDGs, improving the environment and being increasingly efficient, socially, environmentally and economically. To this end, we are continually

“We launched our blueberry variety, Cupla, in 2021 and today it is is planted on almost every continent”

working on the improvement of our facilities, which are now equipped with fully automated and energy efficiency systems.

At the same time, we continue to strengthen our in-house R&D department. This year we opened a

trial farm and new laboratory that will allow us to intensify our efforts to develop new varieties, particularly in blueberries and blackberries.

This commitment to varietal research forms part of our internationalisation strategy. Our proprietary blueberry variety, Cupla. Cupla is a sweet, very juicy blueberry with a good shelf-life that produces large and extra-large berries that was bred to adapt to the local growing conditions here in Huelva. Its production cycle runs from December to the end of April, with peak volumes between mid-January and mid-March. We launched the variety in 2021 and today it is being planted on almost every continent.

Another key area of innovation is the adoption of new AI-powered tools that provide us with data and information that improve our quality processes and facilitate decision-making in different areas of

the cooperative. For example, we are designing an app to improve communication between team members, while in the field we are trialling an app that will enable us to control the handling of the fruit more precisely.

How would you sum up the 2023/24 berry campaign?

JB: This past season has been a complex one in Huelva due to the restrictions on irrigation that were imposed because of the ongoing drought. Our supply of irrigation water was cut by 25 per cent, yet despite this we managed to complete a successful campaign thanks to the muchneeded spring rains.

Now we are back to square one, praying that the rains will arrive in the autumn. It is vital that the government carry out the necessary investments to improve the province’s water infrastructure, or at the very least allow the private sector to do so. This would provide some much-needed certainty to the sector as it wouldn’t be so dependent on rainwater. E

A new study from the Spanish Economic and Commercial Office in London will assess the challenges and opportunities that the Spanish fruit and vegetable industry faces over the next five years.

TFERNANDO MUÑOZ

Foods & Wines from Spain

UK Director

he UK market is still a critical market for the Spanish industry, but we recognise that over the last 4-5 years, a number of factors that drive the market in the UK have changed. That is why the Spanish Economic and Commercial Office in London has commissioned a major independent study of the UK fresh produce market to look at what those changes have been and identify what opportunities exist for our growers and exporters in the future.

We see that the cost-of-living crisis has impacted on how consumers in the UK shop for produce, and where they shop for it. The supermarket business in the UK is still fundamental to the Spanish industry. Our companies remain very committed to meeting the high standards of supply and the increasing attention on issues surrounding sustainability that are part of this.

At the same time, we believe there are opportunities in other routes to market, including wholesale markets, the highend independent retail sector

and other customers such as delicatessens. The review will assess these opportunities. We have asked Promar International, the well-known market research and consulting company to carry out the work on our behalf.

Spain has always been an important supplier to the UK, accounting for almost 30 per cent of all fresh produce imports.

Many UK organisations have their own farms and wellestablished partners in Spain, and many Spanish companies have their own facilities and representative offices in the UK. The relationship between the two countries appears to be fundamental to the way the market in the UK operates.

We also know the UK market is

highly competitive and that many other countries want to supply it, not least our competitors in North Africa. We need to understand as much as we can about the changes taking place in the UK, inform our growers about these and what it means to them.

We benefit from having largescale production of a wide range of fruits and vegetables. While we are clearly interested in exporting to other EU markets and even further afield, we still see the UK as one of our prime export destinations for the future.

The work we have commissioned will include a combination of both consumer and business-to-business-style research with leading importers, wholesalers and retailers, as well as those operating in the foodservice and catering sectors.

The whole situation regarding Brexit has, at times, made it more difficult for the Spanish industry to supply the UK market. We are working closely with our UK counterparts on the implementation of the newly introduced border controls to help ease the situation for both our exporters and our UK customers on the issues around this. At the same time though, there are still plenty of transport links to the UK and, in some cases, we still enjoy a transit time advantage over some of our competitors.

We also know that we must reassure our customers in the UK over factors such as the cost of labour and its availability and other issues, such as the use of water. These are not things, however, that are confined just to Spanish horticulture.

We are realistic in understanding that in the future some Spanish products might well have better opportunities than for others. As an example, Spain has a very high market

share in the UK already for lettuce, stonefruit, strawberries, persimmon, aubergines, cucumbers and cherries. The market share of Spain for imports of products such as tomatoes, citrus, avocados, asparagus, grapes, grapefruit and blueberries is smaller – but in a number of cases the level of imports to the UK is still high.

The objective going forward is to build from our historically strong position. It really is about refining our portfolio of products and adapting them to meeting the needs of our customers and consumers to provide them with what they want. This can be in terms of products, varieties, logistics, methods of trading, promotional activity and the use of technology in our supply chains to help mitigate against impacts connected with climate change.

We want to find out more about how we can do even better in the UK market in the future and where the optimum opportunities exist for the Spanish industry going forward. At the end of the research process, the key findings will be shared with leading companies and industry organisations in Spain and the UK.

This dissemination work is an important part of the overall project process. The fact we are prepared to commission this type of research is a very strong indication of how important the UK market is for the Spanish horticultural sector going forward. E

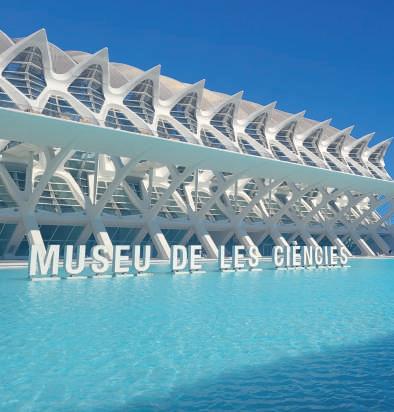

OPPOSITE—Spain accounts for almost 30 per cent of the UK’s fresh produce imports

THIS PAGE—Lettuce, persimmon, berries and cherries are among the wide variety of products that Spain supplies to the UK

Growers anticipate a more balanced market in 2024/25.

by Maura Maxwell

When it comes to fruits and vegetables, no two seasons are the same. But few sectors have experienced such intense highs and lows as the Spanish persimmon industry. A planting boom at the end of the 1990s – fuelled by growers seeking a more profitable alternative to citrus – propelled Spain up the export rankings to become the world’s leading supplier of persimmon, or kaki as it is known in Spain, accounting for around one-third of global trade.

Spanish Kaki Association, the harvest is expected to weigh in at around 340,000 tonnes, although this is subject to unforeseen weather events and the incidents of pests.

He says sizes will be smaller this year, as is the case with citrus, because there has been little rain and some hail in the main growing

However, prices suffered as the market struggled to absorb this rapid growth in volumes, a situation compounded by Russia’s decision to impose a trade ban on produce from the European Union in 2014, shutting off one of Spain’s biggest markets overnight. Most recently, a series of poor harvests, caused by a combination of adverse climatic events and the devastating impact of pests such as citrus mealybug and cotonet, have helped realign supply and demand. As the 2024 campaign gets underway, the industry appears to be entering a new period of stability.

According to Pascual Prats, president of the

region of Valencia. Quality-wise, the season is progressing well, although Prats notes that it is becoming more difficult to achieve that quality, “since we are faced with significant increases in the costs of treatments and labour”.

Rafael Perucho, head of the regulatory council that manages the PDO-certified persimmons grown in Spain’s Ribera del Xúquer valley, says he expects around

BELOW—A planting boom in the late 1990s fuelled an explosion in exports

100,000 tonnes of Rojo Brillante persimmon to be marketed under the PDO this season, similar to last year’s total.

“In terms of size and quality, one of the great virtues of this variety is that it has a constant quality, so it is practically impossible to find a campaign with poor internal quality,” he tells Eurofruit “The exponential growth we’ve experienced in the last decade has clearly slowed down, and everything points to the fact that we are entering a period of stability.”

Having said that, Perucho notes that “it’s also true to say that the productive outlook has become more insecure. Weather conditions are becoming more extreme, and the incidence of new pests is hindering the normal development of the crop. Persimmon is a complicated crop that requires work and knowledge, so we can expect production to become increasingly organised around professional growers”.

Such has been the severity of the impact of climate change and pests on the crop these past few years that the market has moved from being regularly oversupplied to undersupplied. In spite of this, Perucho says more promotional work needs to be done to increase awareness of this product, as research shows that there is still a significant lack of knowledge in many markets.

This year the PDO started developing a strategic plan to further position its Persimon

ABOVE—

Persimmon is a difficult crop to grow and manage so production is becoming increasingly concentrated around professional growers

brand on the Spanish market, which seeks to differentiate the label as the premium offering of choice in the eyes of both retailers and consumers.

While Europe remains Spain’s biggest export market, efforts to expand into other markets – notably in North and South America – have yielded some success. Last December, Spanish kakis received the green light for shipments to China, yet despite its potential both Perucho and Prats acknowledge that supplying this market is by no means easy.

“Our goal is to send our kaki directly to China, without having to go through Hong Kong, but we know this presents a great challenge, since we’re talking about many days of transit and the market is very demanding,” says Prats. “Nevertheless, China is interesting due to its size and quality requirements. We will advance step by step and see how it develops.” E

The Spanish Kaki Association is redoubling its marketing efforts this year following the successful completion in April of the third and final year of Mediterranean Combo, an EUfunded marketing campaign consisting of B2C promotions of Spanish persimmon and vegetables from the island of Crete in Spain, Germany, Greece and Hungary.

“This May saw the launch of our second European campaign, called EUFruitBasket, where we want to promote the consumption of at least five servings of fruits and vegetables in Germany and Spain,” says Pascual Prats. “The campaign features Spanish kaki, along with kiwifruit, flat peaches, nectarines and peaches from Greece.”

At the same time, the association is launching its inaugural campaign to promote persimmon consumption in any variety or form, called simply Kaki.

“With this campaign, we want to reinforce our commitment to informing and educating both consumers and professionals about the value of persimmon in all its varieties, forms of consumption and commercial brands,” Prat continues. “In a market where fruits with high nutritional benefits, such as persimmon, are increasingly appreciated, it is essential to highlight not only its properties, but also the many diverse ways it can be integrated into the daily diet.”

This integrated campaign seeks to unite all varieties of persimmon under the same identity, covering all its shapes, sizes, flavours and colours, regardless of the region or name used. “In this way, we want to ensure and clarify that the benefits of persimmon are available in more places than many imagine. As an association, this initiative is a key tool to clear up doubts, promote production and marketing, and, above all, encourage the consumption of this extraordinary fruit,” Prats continues.

Kaki Persimon®, a renewed identity with the best of all time.

The Catalan cooperative reports excellent quality for 2024 pear and stonefruit crops.

by Maura Maxwell

This year’s shorter Catalan pear crop has failed to dent Trecoop’s optimism for the 2024 summer fruit campaign. The second-tier cooperative, made up of Agraria de Montoliu and Sant Pere de Sudanell, is on course to market 12,000 tonnes of pears and 10,000 tonnes of stonefruit this season according to directors Sisco Cunillera and Ignasi González.

“Service and quality in the field

are the keys to success in producing, marketing and distributing between 22,000 and 25,000 tonnes of fruit each year,” they tell Eurofruit. “In pears, production is down by 20-25 per cent due to a lack of sufficient flowering. But the size and quality of the crop is excellent and we expect a good campaign – especially in Limonera, Williams, Conference and Alexandrina.”

In stonefruit, González notes that “we will maintain our usual output of 10,000 tonnes of peaches, nectarines, flat peaches and donut nectarines, recognised in the international market for their high quality”.

Around 70 per cent of Trecoop’s output is exported. The European Union and UK account for most of this, but the cooperative’s Alosa and 5 Boqueres brands can also be found in markets such as South Africa, South America and the Middle East, amongst others.

A tailor-made service and wide array of certifications guaranteeing the quality of its offer have enabled Trecoop to consolidate its presence in these markets over the years. This is backed by a programme of continuous support for its grower members, which includes training, service provision and financing for measures such as the installation of anti-hail nets to ensure the highest quality. E

LEFT—Trecoop exports around 70 per cent of its output

The cooperative’s peeled black garlic cloves continue to win over new customers.

by Maura Maxwell

Despite being recognised for its high quality, sales of Spanish garlic have remained relatively stagnant in recent years. In a bid to kickstart consumption, companies have introduced innovative new varieties of black and pink garlic, as well as processed products like fresh peeled garlic and garlic oil.

way of consuming black garlic and they are slowly gaining ground on the market.”

The Castilla-La Mancha-based cooperative has been selling purple garlic under its Pedroñete brand for more than 30 years and was one of the founding members of the Ajo Morado de Las Pedroñeras (Purple Garlic from Las Pedroñeras) PGI. According to Rodríguez, the brand is highly prized for its quality and the sustainable way in which the product is grown.

He notes that the recently concluded 2024 campaign has been a challenging one, in which heavy rains reduced supply. Fortunately, the resulting higher prices mitigated the impact on grower profitability.

Leading cooperative Coopaman launched its peeled black garlic clove

tub last year and says it has been well received both in Spain and in Central European markets. “This is a great value-added product that transforms any dish into a gourmet dish,” says Coopaman’s general manager, David Rodríguez. “The 85g tubs offer a convenient and practical

More generally, acreage has been shrinking steadily in recent years, as many of the older growers leave the sector altogether. Figures from ANPCA, Spain’s National Association of Garlic Producers and Marketers, show that planted area fell by 14 per cent compared to 2023, with the decline being more pronounced in purple garlic, which for the first time fell to below 40 per cent of the total cultivated area. E

ABOVE—The garlic offers added convenience to budding chefs

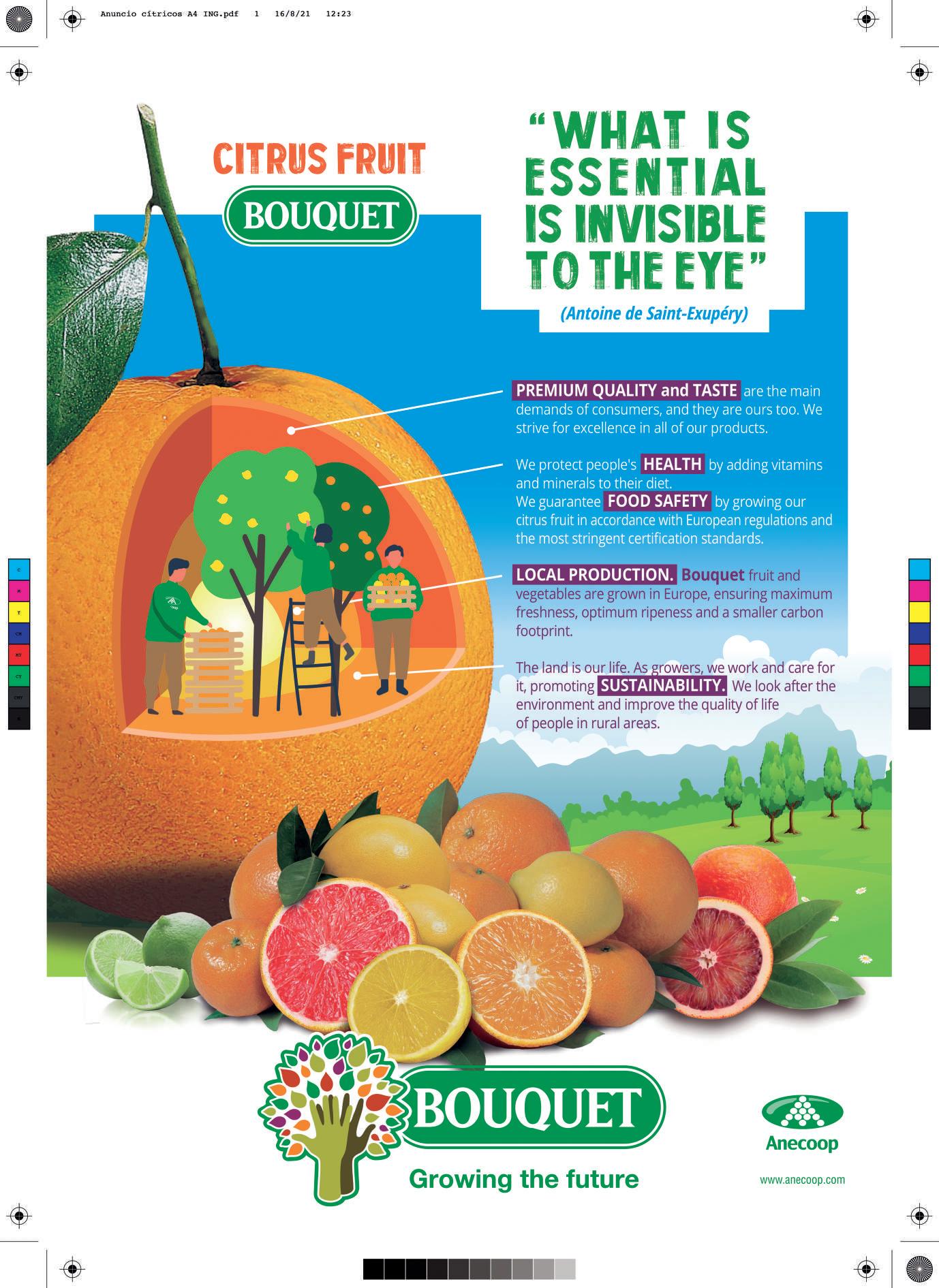

Xavi Nolla, CEO of Iberian Premium Fruits, shares his philosophy for building a successful citrus brand.

by Maura Maxwell

Iberian Premium Fruits (IPF) is a global platform focused on production and commercialisation of premium citrus fruits, resulting from the integration of three well-known players in the industry: Llusar, Naranjas Torres and V-Ros. The vertically integrated group has over 1,000ha of own production in Spain and South Africa and four packhouses, guaranteeing a yearround supply of premium citrus to its customers.

Xavi, what was behind the decision to create Iberian Premium Fruits?

Xavi Nolla: The synergies between both companies were obvious – Llusar was one of the largest specialists in premium clementines

and Torres in premium oranges, although we both worked with both products and also shared the same product philosophy: quality, excellence and customer service above all. This tradition has allowed us to specialise each warehouse in one product, making them more efficient and productive.

Following the initial merger of Llusar and Naranjas Torres, you acquired V-Ros, a specialist producer of premium clementines sold with the leaf attached. Is your strategy to incorporate new companies that give you a greater specialisation within the citrus category?

XN: The clementine with leaf is

a complementary product and V-Ros shares a similar philosophy to us. We saw this as a good opportunity to offer new products to our clients – that is our vision for growth.

Right now your production footprint spans Spain and South Africa. Do you anticipate expanding into other parts of the Northern and Southern Hemispheres?

XN: We are obsessed with the quality of the product we supply and having our own production allows us to maintain the highest quality levels. While we keep an eye on the evolution of other origins, for now we are satisfied with this. We work with Spanish-grown products for most of the campaign and when this is not possible, we complement our offer with South African so we can offer our customers the best product through 12 months of the year.

Spain’s citrus industry faces some major challenges –increased competition, climate change and water to name just three. Where, in your opinion, do you see the best opportunities for the country going forward?

XN: The Spanish citrus industry must differentiate itself through quality and proximity to market. Innovation in the development of club varieties will be a vital issue for the future of the sector, as well as the application of new technologies to optimise field resources.

What are the major projects you’ll be working on for the rest of 2024 and beyond?

XN: For IPF, the future involves consolidating the work we’ve done so far, especially by our workers, in whom I have complete confidence. As a group, our most important asset are our people. The three teams of employees that it incorporates share the same philosophy when it comes to quality, something that the market is aware of and values.

Finally, how can citrus suppliers avoid the commoditisation of the category and work towards the profitable growth of the sector?

XN: We believe it is vital to create brands that are recognised and valued by the consumer and allow suppliers to differentiate their product. Having the trust of customers and consumers is the foundation for growth. E

ABOVE LEFT—Xavi Nolla says the company’s most important asset is its people

xExprimir’s patented preservation method delivers freshness and shelf-life without compromising on taste.

by Maura Maxwell

Spain’s xExprimir has developed a new preservation process to create fresh and healthy soups with that home-cooked taste. The La Rioja-based company’s innovative range is made using a patented natural method that doesn’t involve chemical, thermal or high-pressure treatments, allowing the ingredients to retain all of their flavour and nutritional properties.

The range consists of a spring/ summer offering of cold soups with flavours like melon and tomato and jalapeño and autumn/winter hot soups such as broccoli, tomato and wakame seaweed. All are free

from preservatives, colourants and flavouring.

xExprimir came up with the preservation process for its fruit and vegetable juices before deciding to expand into soups. The company has already won plaudits in Spain and now has its sights set on conquering the international market. This year, it scooped first prize for innovation in the fresh product category at the Innoval awards at Alimentaria, and in 2023 the range was awarded the fresh produce prize at Fruit Attraction’s Innovation Hub Awards.

“We invested a lot of capital to develop our own patented production process, which is

“We invested a lot to develop our own patented production process, now registered in more than 50 countries” »

BELOW—Eduardo Cuevas, founder and director of xExprimir

now registered in more than 50 countries,” founder and director Eduardo Cuevas tells Eurofruit “The process is based on four pillars – firstly, we only use the highest quality, locally sourced fresh raw materials. These are then cleaned using a tailor-made washing and drying process. We

have developed a juice extraction method that never raises the temperature of the fruits and vegetables above 6ºC and, finally our natural preservation process means our juices and soups retain their organoleptic and nutritional properties for 10 and 14 days respectively, when stored at 1-6ºC. All this makes our products truly unique – their natural and real flavour makes them unbeatable in any taste test.”

Cuevas notes that while there are many other manufactured soups on the market, their main ingredient is often water, to which all kinds of flavourings, colourings, thickeners and preservatives have often been added.

“Our soups are made exclusively from fresh raw materials, to which we only add extra virgin olive oil, salt and pepper – the water content is only that of the vegetables themselves. That’s what gives them their incredible flavour and properties,” he says.

As freshness is such a priority

for

xExprimir, the company dispatches its finished product at the end of each day and doesn’t hold anything in stock to ensure that customers lose only one day of shelf-life by the time they receive the product.

xExprimir already supplies retail and foodservice customers throughout Spain and is in talks with several companies in Portugal and the south of France. It is also looking to expand further afield, albeit under a different business model.

“The nature of our product means that we need to be as close as possible to our customers, so our intention is to find fresh-cut partners in markets like the UK, Germany and the US who will allow us to use their manufacturing and distribution network in exchange for our technology and know-how,” Cuevas explains.

“The possibilities are endless –our technology allows us to adapt to the infinite recipes and options depending on the tastes of each

country, the seasonality of the ingredients or the season of the year itself. Take cold soups, which are consumed in many countries and cultures and form a regular part of the Mediterranean diet. We believe there is huge potential to grow the market.”

xExprimir is also exploring options in the B2C channel, possibly teaming up with a logistics operator to guarantee an efficient service and full control of the cold chain.

Cuevas says the Fruit Attraction and Alimentaria awards have helped raise the company’s visibility and sparked interest from potential partners. At this year’s Fruit Attraction it will present new flavours of soups and juices, as well as a range of formats developed specifically for the Horeca channel.

“We continue to work on innovation. Right now, we’re researching the world of infusions and other categories, which we understand can be a complement to our range, but we still have a lot of work ahead of us,” he admits. E

ABOVE & LEFT—The range can be adapted to suit the individual tastes of different market, Cuevas says

The company has been celebrated by the UN Global Compact for its strong commitment to sustainability.

by Maura Maxwell

Armando Álvarez Group may not be a household name, but the family-owned company is an integral part of Spain’s horticultural landscape. Founded in 1964, it is the country’s leading manufacturer of polyethylene plastic film. With a production capacity of 450,000 tonnes and an annual turnover in excess of €1bn, it currently operates in 115 countries worldwide.

The group’s 18 companies serve the needs of diverse sectors, including agriculture, forestry and renewable energy. It is best known in the horticultural sector for the manufacture of greenhouse covers, as well as a wide range of mulches.

“One of the pillars of the business is our commitment to the circular economy, promoting the optimisation of resources, reducing the consumption of raw materials and reusing waste products, recycling them and giving them a new life,” explains marketing director Carlos María Molina.

These efforts were most recently recognised by the UN Global Compact Spain, which praised the company for its contribution to Sustainable Development Goal 2, achieving zero hunger, in a report on how the 2030 Agenda is being implemented in Spain.

The company is showcasing two new products at this year’s Fruit Attraction. The first is its range of Oasis Iyris covers, specifically designed for hot climates and water-scarce regions. “With

advanced Second Sky technology, developed by Iyris, these covers allow us to save water and energy, exponentially improving crop profitability,” says Molina.

The second innovation is its next-generation Solar Shrink Mulch. Molina describes it as a more intelligent mulch that shrinks with the sunlight, thereby avoiding damage to the plants. “The film offers a better fit, as it tightens with sun exposure, ‘hugging’ the crop bed and avoiding heat loss,” he explains. “It is also lighter, stronger and more environmentally friendly.”

Armando Álvarez Group’s ongoing commitment to sustainable development and corporate responsibility is set out in its 2023 Corporate Sustainability Report.

“At Armando Alvarez Group, we are not only governed by economic criteria, but also by social, environmental and good governance criteria. These nonfinancial criteria, also known as ESG (environment, social and governance), have an impact on both our company and our environment, and it is essential to take them into account when making business decisions to achieve long-term sustainable development,” Molina says.

“We have developed an ESG Plan based on these three pillars which has nine levers on which lines of action are deployed with their corresponding objectives for 2030. This year, in addition, we have added new objectives in all areas.” E

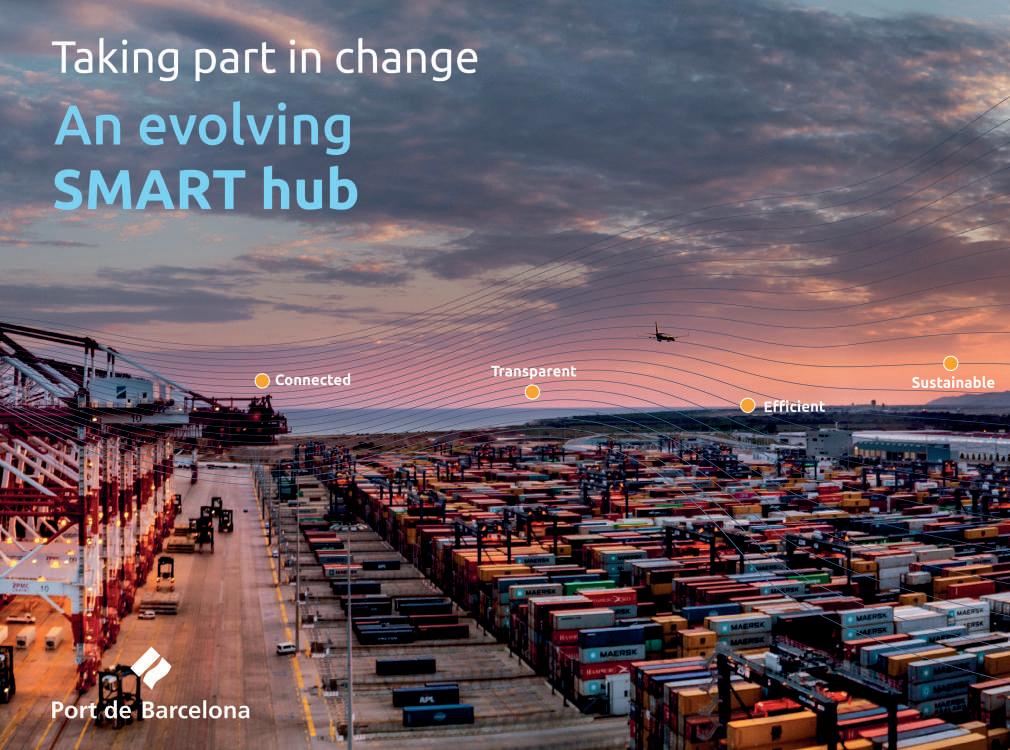

Throughput of refrigerated containers has risen fivefold over the last decade.

by Maura Maxwell

With its strategic location and direct connections with more than 200 key destinations, it’s easy to see why the Port of Barcelona has become a global logistics hub for agri-food products.

The port boasts direct connections to the main ports of the western Mediterranean and access to a wide hinterland. And in addition to regular land connections with the

main agricultural and livestock regions of Catalonia, Aragon and Navarre, it has access to wholesale markets such as Mercabarna, Mercazaragoza, Mercamadrid or Saint Charles.

At the end of 2023, the port launched the first direct container rail service between Spain and France, without transfers or changes of axles or locomotives at the border. The train, powered by APM Terminals Railways Spain,

Nuestras plantaciones, situadas en las fértiles llanuras de la provincia de Girona y rodeadas por los parques naturales del Alto y Bajo Ampurdán, nos proporcionan una fruta singular, mimada por nuestros agricultores bajo la tutela de nuestro personal especializado, y con la calidad que garantiza la IGP Poma de Girona.

OPPOSITE

PAGE—Continual investments in infrastructure ensure optimum service

Synergy and Naviland Cargo and based at the BEST terminal, connects three times a week with Toulouse and weekly with Lyon. It is also the first regular container service in Spain provided by a 750m-long convoy, with a capacity for 108 TEUs per journey. According to the port authority, this direct connection saves time and money and speeds up transport, improving transit time for imports and exports compared to ports in the north of the continent.

This combination of factors has made refrigerated containers one of the fastest-growing segments at the Port of Barcelona in recent years, multiplying traffic by five in the last decade.

Moreover, the Port of Barcelona continues to invest in new infrastructure and services for the agri-food sector. The terminals exceed 3,000 permanent reefer connections and there are projects underway to add new connections, providing coverage for the more than 100 regular lines that connect Barcelona with 200 ports around the world.

The BEST terminal, as part of its growth strategy in cold logistics, is set to increase its fixed connection points for refrigerated containers from 2,200 to 4,000 within the next 2-3 years, which will improve efficiency and reduce transit times for perishable products. These new connections will reinforce the terminal’s capacity to handle a greater volume of refrigerated cargo, supporting the growth of the fruit and vegetable trade, which

requires optimal temperature conditions.

These services are completed in the Mediterranean with daily short sea shipping links with North Africa and the rest of Europe, creating a complete intermodal offer and reliable and competitive logistics services.

Logistics operators are also increasing their services at the port. Following the success of the daily train for refrigerated cargo between Zaragoza and Barcelona, another was launched with the Monzón Intermodal Terminal in Huesca, with four weekly frequencies, and a third similar one with Noain in Pamplona.

“The combination of specific infrastructures and services for temperature-controlled containers and highly competitive regular lines, both in transit times and

costs, with the main issuing and receiving markets, make Barcelona the best logistics hub for the fruit and vegetable and refrigerated products sector,” the port authority says. E

Orus Logistics is the brainchild of exporter Juan José Barrionuevo.

by Maura Maxwell

Afruit and vegetable exporter from southern Spain has developed an innovative logistics app to take the strain out of ordering and tracking trucks used to transport perishable goods.

Orus Logistics provides realtime information on the status of shipments so that exporters and customers can track their whereabouts and get up-to-date information on their estimated time of arrival, or any incident which occurs between loading and unloading.

“Right now, keeping track of shipments involves countless phone calls between the supplier, transport company and final customer, which is inefficient and time-consuming, especially when you consider that groupage is the most commonly used method of sending produce to Europe,” says Juan José Barrionuevo.

“This easy-to-use tool simplifies and speeds up the process, leaving users free to focus on other areas of their

With Orus Logistics, exporters or customers send cargo orders to transport companies through the app, and traffic operators just have to click to update the arrival time of the order, which is then transmi ed to both the exporter and customer in real time.

Ultimately, Barrionuevo’s aim is to establish a global platform, so that transport companies can provide this service to both exporters and customers. For that reason the app will be available in English, Spanish, French and German. In September, it was launched to a select group of transport companies in Spain.

“Each company that wishes to offer and contract this service will pay a fixed fee per truck per month, so they will only pay for what they use, and it is completely free for exporters and clients,” says Barrionuevo.

right now. The beauty of Orus Logistics is that it provides full transparency and security “so you can completely forget about the multitude of calls, emails and Whatsapp messages required today”. E business.”

He says there is no other solution on the market serving the industry

www.oruslogistics.es orus@oruslogistics.es +34 629 819 035

50 years of experience, more than 450 professionals and a commitment to innovation and technology

The company has made ground-breaking improvements to its range of fruit and vegetable processors.

by Maura Maxwell

MAF Roda will present a full line-up of its latest technological innovations at this year’s Fruit Attraction, emphasising the company’s ongoing commitment to integrating artificial intelligence (AI) to enhance defect detection accuracy and improve efficiency in fruit and vegetable processing.

At the fair, the company will introduce several significant advancements in its quality systems. A key highlight will be the new generation of its Smart platform, designed specifically for citrus classification.

“This groundbreaking solution, launched earlier this year, is now integrated as standard in all our Globalscan 7-Viotec equipment,” the company says. “Smart technology

represents a substantial improvement over previous models, offering key benefits such as increased user autonomy and more intuitive operation.”

The new platform allows operators to independently customise results, tailoring the system to the specific needs of each batch. It features a simplified and user-friendly interface, streamlining handling and configuration and reducing the time required for staff training. And because the consolidated interface is on a single screen, operational efficiency is enhanced by minimising the need to navigate through multiple views.

The integration of AI not only improves defect detection but also enables constant updates to classification models for unmatched accuracy. The platform facilitates quick adaptation to new types of defects, ensuring consistently up-to-date classification.

MAF Roda will also unveil its new QS series in Madrid. This includes CherryQS and BerryQS models, software solutions designed for small fruit classification, again featuring notable improvements over previous versions.

“The QS series boasts a more intuitive and easier-to-configure

interface, optimising operational time and reducing errors, while users also benefit from greater autonomy in adjusting analyses to meet their specific needs,” the company says.

“Artificial intelligence is utilised for more precise classification and clear defect visualisation. And the system provides enhanced user security and superior operational potential.”

Another highlight of MAF Roda’s participation at Fruit Attraction 2024 will be the introduction of a new ozone treatment system developed by Arrowlake, a start-up in which MAF Roda is a shareholder. “This innovative system represents a paradigm shift in water treatment, offering a sustainable solution by eliminating harmful chemicals traditionally used in the process,” the company explains.

The technology enables water reuse without the need for fresh water addition, promoting more sustainable practices. The system also adjusts treatment based on water quality, regardless of raw material quality or operational hours.

The use of ozone removes the need for chemical products, reducing waste and enhancing food safety. And finally, the system provides effective treatment against biofilm, ensuring high levels of hygiene and quality. E

LEFT & ABOVE—The incorporation of smart technology into MAF Roda’s range represents a substantial improvement over previous models

The exporter’s new initiative, Un Sello Que Suma, is helping growers to improve their production.

by Maura Maxwell

The high costs and heavy administrative burden of certification has long been a bugbear of Latin American banana producers wishing to supply the European market. But one Ecuadorean exporter, Grupo Palmar, continues to believe in the value of such certifications – so much so that it has launched its own initiative to encourage further uptake amongst