Time for a fresh look at citrus

With targeted messaging on health and nutrition, the cost-of-living crisis could be an opportunity for citrus to shine

With targeted messaging on health and nutrition, the cost-of-living crisis could be an opportunity for citrus to shine

Hgher production and logistics costs took a chunk out of the profitability of the citrus sector last year and as we ease into 2023 the outlook remains uncertain. However current headwinds notwithstanding, it is worth noting that citrus is better positioned to ride out the cost crisis than other parts of the fruit trade. Staples like citrus tend to be more recession-proof than higher-value fruit lines. But it is true that some parts of the trade are holding up better than others. We heard recently at the Global Citrus Congress, for example, how summer citrus continues to show healthy growth in key consumer markets like the US and Europe. And sales of lemons and limes are also buoyant. Even oranges have seen something of a revival over the past couple of years thanks to the Covid bounce. With the right focus and messaging, there is no reason why the sector cannot weather this storm and fulfil its long-term potential. The congress highlighted a range of strategies to future-proof the industry, from promoting fruit at the peak of its season to joining forces to create generic marketing campaigns showcasing the nutritional aspects of citrus. The right branding can also help to tell a story that resonates with consumers. Time to get creative!

Citrus suppliers are feeling the squeeze, but when it comes to the long-term outlook, the signs are more positive provided they get the basics right.GLOBAL CITRUS CONGRESS

The third edition of the Global Citrus Congress heard there is plenty of room for growth in the citrus category – with the right messaging on health and nutrition.

by Maura Maxwell @maurafruitnetInflationary pressure and logistical headaches are making life difficult for citrus suppliers. But the long-term outlook remains bright, with plenty of scope to grow the category through targeted promotions focusing on the health and nutritional benefits of regular citrus consumption.

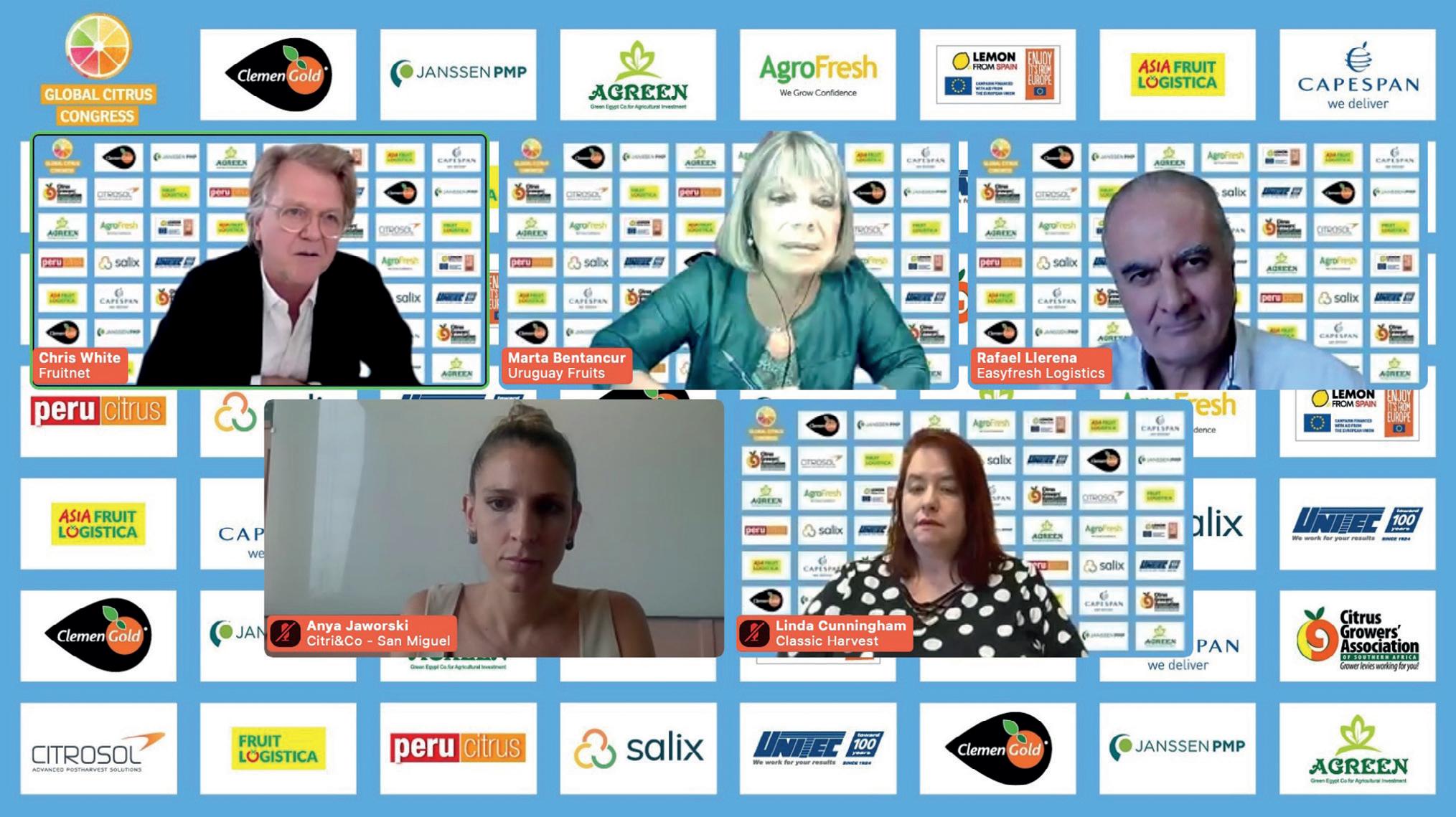

This was the message from the 2022 edition of Global Citrus Congress, which took place online on 30 November. More than 500 delegates from around the world registered for the annual online gathering of the international citrus trade organised by the World Citrus Organisation and Fruitnet Media International and moderated by Fruitnet’s managing director Chris White.

Under the theme ‘The outlook for citrus in unpredictable times’, the free-to-register event featured a top line-up of industry experts discussing ways of bolstering the global citrus business as it navigates through the current challenging landscape.

The three-hour programme covered a range of topics, including logistics, marketing and sustainability. Setting the scene, the WCO’s secretary general, Philippe Binard, and Eric Imbert of Cirad provided an overview of the Northern Hemisphere production forecasts for 2022/23 and current market trends. These show a 13 per cent contraction in volume to 25.96m tonnes due to high temperatures

and drought impacting crop development in several Mediterranean countries. Only two Mediterranean countries, Greece and Egypt, will see an increase in production this season, the former by 10 per cent and the latter by 8 per cent.

Approximately 15m tonnes of citrus were traded in 2021/22, accounting for around 21 per cent of the global fruit trade. Together, the European Union and UK account for 42 per cent of the global trade, making this the biggest market worldwide.

However, the rate of growth varies widely according to market and citrus category. Summer citrus – particularly soft citrus – has become a key driver of sales growth in the European and North American markets, while lemons and limes are also showing very healthy growth across the board. Imbert said Europe represents around 20 per cent of global trade in fresh limes, noting that with average per capita consumption of 300g, there is plenty of room for growth in this market.

In Asia, meanwhile, Chinese growth appears to

have stalled since the onset of Covid. However, other markets like the Philippines, Thailand and Indonesia have seen decent growth in the last year.

The focus then turned to logistics. According to Richard Bright of Reefer Trends, there has been a big increase in demand for specialised reefer capacity since the start of the pandemic due to container carriers being affected by a shortage of equipment and poor service reliability.

Although the container shortage has eased in recent weeks, Bright predicts that container carriers will try to protect high freight rates.

“As far as reefer vessels go, the fleet has benefited tremendously over past two years – they’ve shown they can offer a fast, dedicated and direct service, with good service reliability, whereas container carriers have really struggled,” he said.

“I would imagine that cargo that defected to reefers from carriers over last couple of years will stay there, provided service is more important than price and premium for specialised reefers isn’t too great.”

In the subsequent panel discussion on how to curtail crisis and ensure the survival of today’s citrus business, Rafael Llerena of EasyFresh Logistics echoed Bright’s view, noting that “the pain will remain” and the sector should not expect to see a huge drop in reefer rates.

Marta Bentancur explained how higher shipping costs, connectivity problems and slower transit times are causing big problems for Southern Hemisphere citrus suppliers.

In spite of the current challenges, there are plenty of opportunities to expand the citrus category.

Linda Cunninghamof Classic Harvest said the US summer citrus market has seen a lot of growth in easy peelers and oranges as retailers embrace different sourcing options and intensify their focus on engaging with and educating consumers.

“The flavour profile of the fruit is so important,” Cunningham said. “Promoting the fruit when it is at the peak of its season and communicating the different attributes of each variety to the consumer is really crucial.”

San Miguel’s Anya Jaworski pointed out that this is a great time for the trade to join forces and create generic marketing campaigns focusing on the nutritional aspects of citrus. Agreeing, Bentancur added that such promotions should be targeted at different segments of the population “to see how we can push consumption, particularly in countries where demand is lower”.

Claudie Dhuique-Mayer of Cirad in France and Rosa Walsh of the Florida Department of Citrus outlined some of the

studies being done into the health attributes of fresh citrus and 100 per cent citrus juice and their role in helping to reduce the risk of lifestyle-related diseases.

The research conducted by both is used to educate the general public, shape school meal programmes, inform health professionals including dieticians and physicians, and inform future research.

Helen Prosdocini of GlobalGAP introduced the organisation’s ‘Spring’ add-on, which identifies and mitigates water risks in agricultural supply chains, helping growers to improve water management and supporting communication on such issues.

“Consumers want to know where their products are produced and in what conditions,” said Prosdocini. “We originally developed Spring with Coop in 2018, but increasingly all European retailers are asking for water requirements for their producers. Since 2020, we have received big demand for Spring.”

OPPOSITE—

Panellists discuss strategies to strengthen the citrus sector at Global Citrus Congress BELOW—The congress heard how more can be done to promote the health benefits of citrus

LEFT—Northern Hemisphere production is down by around 13 per cent in 2022/23

Spain, Morocco, Italy, Turkey and Tunisia all set for shorter crops as hot, dry summer impacts production.

by Maura Maxwell @maurafruitnetNorthern Hemisphere citrus production is set to fall by 13 per cent to 25,958,275 tonnes in 2022/23 according to the World Citrus Organisation (WCO). The preliminary forecast, which was presented during the third edition of the Global Citrus Congress in November, is based on data from Egypt, Greece, Israel, Italy, Morocco, Spain, Tunisia, Turkey, and the US.

Philippe Binard, WCO secretary general, commented: “The market insights we received from the major citrus-producing countries in the Northern Hemisphere suggest that the 2022/23 citrus crop is projected to drop to 25,958,275 tonnes. This represents a marked 13 per cent decrease compared to the previous season.”

Eric Imbert of Cirad and WCO Technical Secretariat added, “This year’s crop is one of the smallest of the last seasons, mainly due to climatic issues in leading export countries.

“But despite the decrease in Northern Hemisphere production, the citrus market continues to remain buoyant. Citrus is still one of the leading fruits on the global market”.

Orange production is projected to decrease by 11.79 per cent to a total of 13,995,754 tonnes. A similar decrease is also expected for the other citrus categories, namely grapefruit (down 16.88 per cent to 769,043 tonnes), soft citrus (down 13.32 per cent to 7,176,116 tonnes), and lemons (down 15.70 per cent to 4,017,362 tonnes).

In the European Union, production is forecasted to be down 15.09 per cent and a 20.97 per cent respectively in Spain and Italy, while WCO estimates a 10.83 per cent increase for Greece.

In the Southern rim of the Mediterranean, production is also expected to decrease, by 33 per cent in Morocco, 27.24 per cent in Turkey and 17.12 per cent in Tunisia. Volumes are forecast to remain stable in Israel (+0.40 per cent) and increase in Egypt (+8.24 per cent). The citrus crop in the US, according to USDA estimates, is expected to decrease by 5.16 per cent compared to last season.

WCO’s citrus forecasting activities take place on a biannual basis ahead of the Northern and Southern Hemisphere seasons. All forecasting is undertaken on a pre-competitive basis, supported by proactive member engagement in citrus data collection.

Both forecasts are available to all WCO members as part of their WCO membership to facilitate global understanding of current citrus market developments. From this knowledge-sharing exercise, the sector is able to be er position the citrus category on domestic markets and further afield.

The experts behind a strategic plan to boost the competitiveness of Valencian citrus map the sector’s evolution and direction of travel.

by Paco Borras, Lorena Tudela andIn 2022, the regional government of Valencia launched a Comprehensive Citrus Plan to develop strategies to improve the competitiveness of the Valencian citrus sector. The team behind the plan are Lorena Tudela and Francesc Cervera of the Polytechnic University of Valencia and Paco Borras, consultant and former commercial director of Anecoop. Here they set out their analysis of how the industry has evolved in the past two decades and where it is heading in future.

Throughout the 20th century, great changes have taken place in Spanish citriculture. During the last two decades in particular, the citrus ecosystem has undergone a radical transformation, both in terms of production and marketing. Regarding the former, it is worth noting that planted area has remained broadly stable at around

275,000ha in the last two decades, although productivity has increased by about 20 per cent. This is mainly the result of the modernisation of farms and the move towards more productive varieties. The most significant change to Spain’s production base has been the number of citrus farms, which has fallen from 184,485 to 78,023. Of the 106,000+ farms that have disappeared, most of them were less than half a hectare.

We can therefore deduce that the average size of citrus farms has increased.

The geographical location of the farms has also changed, with less production in what was historically the most important area – the Valencian Community – and new acreage springing up mainly in Andalusia and Murcia. Generally, orange and mandarin production is more concentrated in the regions of Valencia, Castellón and Andalusia,

while lemons and grapefruits are grown in Murcia and the south of Alicante.

The marketing structure of the citrus sector has also changed. In 1994 there were 773 registered citrus exporters, of which 641 were private businesses – almost entirely familyrun – and 132 were cooperatives. Today there are roughly 220 private companies and 50 cooperatives.

Taking into account that during

this period the production of citrus has increased, we can conclude that there has been a process of consolidation and an increase in the size of citrus marketing companies.

It is worth noting that the top 100 companies (both private and cooperatives) between them handle 75 per cent of Spain’s citrus production volume, along with the bulk of the 280,000 tonnes of citrus that Spain imports each year, mainly from the Southern Hemisphere. This process of concentration has led to a rise in the number of companies supplying citrus through 12 months of the year, giving them more negotiating clout with the big supermarkets.

Another notable trend has been the growth in the value of lemon and grapefruit exports. As can be seen in the chart below, two decades ago, exports of oranges and mandarins represented 85 per cent of the value of total exports, with lemons and grapefruit accounting for the remaining 15 per cent. Today oranges and mandarins make up 75 per cent of Spain’s citrus export value, while lemons and grapefruit have reached 25 per cent.

Perhaps the biggest change has been the entry of the private investment funds and venture capitalists in Spanish citrus in recent years. They first appeared in 2016 and since then there has been a continuous stream of deals that has seen funds acquire majority shares in some of Spain’s biggest produce companies. At this moment there are at least eight funds with a stake in non-citrus fruit and vegetable companies in Murcia and Almería with a turnover of close to €500m. But it has been in the citrus sector where the operations carried out have been the greatest. Right now these funds are

active in around 15 citrus companies which together have a turnover of more than €1.3bn.

The latest deal, in December, saw Fremman Capital, owner of The Natural Fruit Company (TNFC), acquire Bollo International for €300m. Following Fremman Capital’s purchase of a majority stake in Murcia-based TNFC in 2021, it has embarked on an ambitious growth trajectory as it seeks to position itself as a worldleading supplier of conventional and organic citrus through 12 months of the year. In the past two years it has acquired SG Marzal, Hermanos Bruñó, Fruitxeresa, Frutas Naturales, Frugarva and NaturGreen.

With the incorporation of Frutas Bollo, TNFC becomes a major supplier of year-round citrus to rival Citri&Co, the group created by Barcelona-based private equity firm Miura Partners.

To date, these funds have kept the same managers in charge of the operations of the companies they have acquired. It will take time to see the impact of these new players on the evolution of Spanish citrus farming in the future.

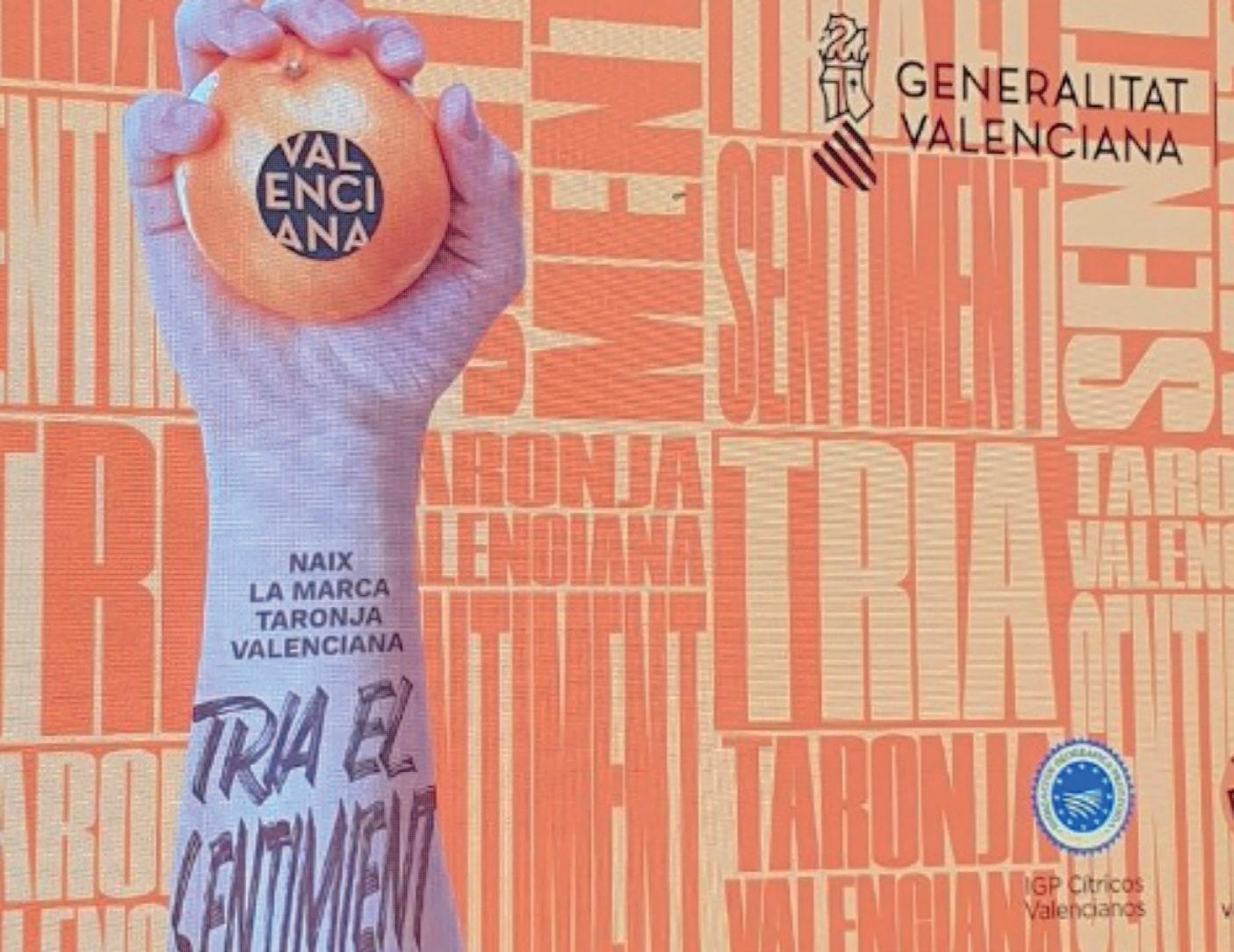

In a turbulent sector that suffers from chronic problems, I truly hope Naranja Valenciana will be much more than a fruit sticker and a nice design.

Fruit and vegetables have traditionally been considered commodities. This, along with other factors, is why fresh produce has been somewhat slower than other sectors in creating successful and differentiated marketing strategies. In a word: brands.

Luckily, and thanks to the efforts of smart marketing teams and dedicated agencies, that’s changing. Nevertheless, if you visit your local supermarket today you’ll probably find fewer brands on the fresh produce shelves than in any other store aisle.

Is it right then to consider fruit and vegetables as commodities? In my opinion – as you’ve probably guessed by now – the answer is a resounding “No”.

A product is a commodity when all units are identical, regardless of who produces them. But an orange is never the same as another orange. A tomato never equal to another one. Variety. Season. Origin. Maturity. Size. Colour. Weight. All these, plus a thousand other attributes could be applied to differentiate them.

And those are just the product-centric aspects. Start looking at the ethics involved on their production, the stories of the growers who cultivated them, the environmental impact of the whole process… and you’ll find a whole world that sets apart those two apparently identical fruits.

Think about it and you’ll realise that perhaps industrial food could be more a commodity than any fruit and vegetables. While recipes and machinery can be more or less replicated, no one can imitate nature, heritage and land. That’s what makes our industry so magical, so unique.

Then why are fruit and vegetables often treated as commodities? Why are they considered as serial products? The answer is a huge lack of information. Place two similar looking oranges in front of consumers without giving them any other information and all they’ll see will be how much they’ll have to pay

for each of them. Price will be the main differential and therefore price volatility and product commoditisation will follow suit. The whole wheel of problems will start rolling yet again.

That’s why new fresh produce brands should always be celebrated. And that’s why now I celebrate the creation of the Naranja Valenciana brand (see opposite page).

I hope it’ll truly tell a powerful story and build emotional ties with consumers from around the world. Above all, I hope it’ll receive the continued support it will need to succeed and survive during time in a very competitive environment.

Because let’s remember: it’s only our duty to tell our own story. If we don’t tell it, who else will? Just think about it.

Fresh produce brands should be celebrated

“No one can imitate nature, heritage and land. That’s what makes our industry so magical, so unique”

Brands can tell a powerful story and help companies build emotional ties with consumers from around the world.

RAQUEL HERCE Mint Managing Director

The launch of Naranja Valenciana will be backed by a national marketing campaign that will be extended to EU countries from 2023.

by Maura Maxwell @maurafruitnet

by Maura Maxwell @maurafruitnet

European fresh produce association FruitVegetablesEUROPE launched a new marketing initiative last autumn to encourage consumers to increase their intake of fresh citrus as the new European season got underway.

The campaign highlighted the specific nutritional benefits of oranges and mandarins, such as their high vitamin C and fibre content, as well as introducing a range of original recipes to make it easier to incorporate citrus into daily diets, be it through smoothies, salads or snacks.

The initiative is part of FruitVegetablesEUROPE’s #longlifechallenge encouraging consumers to eat five pieces of fruit and vegetables a day. “As the citrus season kicks off and the colder days arrive there is nothing better than preparing our body to resist winter with optimum health,” the association said at the start of the campaign.

“The nutritional properties of citrus fruits, with their high antioxidant capacity and their Vitamin C content, are perfect for keeping our defences high.

“Their characteristics are perfect to help you meet the #Longlifechallenge and consume five pieces of fruit and vegetables a day.”

FruitVegetablesEUROPE is made of the national and regional associations and companies from the main fruit and vegetable producing countries of the EU – France, Germany, Greece, Italy, Poland, Portugal and Spain.

The regional government of Valencia has launched a new brand to promote the community’s citrus in the national and European market.

‘Naranja Valenciana’ (Valencian Orange) was presented by the president of the Generalitat, Ximo Puig, at an event held at the Palau de les Comunicacions.

It will be used to promote a “new renaissance” of Valencian citrus, the “best in the world” according to Puig.

He said the Valenciana brand, registered by the regulatory council of the IGP Citrics Protegits, will be used as a quality seal for oranges and clementines grown in the Valencian Community, allowing it to be easily identified at points of sale in supermarket aisles.

The new brand will be accompanied by a marketing campaign, beginning this year. Under the slogan ‘Tria sentiment’, the campaign will initially cover the Valencian Community, before being rolled out to the rest of Spain and, from next year, to EU countries. The first two phases of the campaign each have a budget of €500,000.

The aim of the campaign is to increase the consumption of oranges and to reinforce the identification of the orange with the Valencian Community, which produces 2 per cent of the world’s citrus and accounts for 14 per cent of global exports.

Naranja Valenciana is the second geographical indicator for Valencian citrus. The first, IGP

The southern Italian region of Calabria continues to provide an important source of top-quality citrus for one of the country’s most experienced fresh produce suppliers.

by Mike Knowles @mikefruitnetItalian fresh produce company Mazzoni continues to develop its range of premium-quality citrus, with a range of eye-catching products reportedly set to make a good impact on customers and consumers this year.

According to the group’s commercial director Matteo Mazzoni, lemons, clementines and oranges produced by grower partners in Calabria are all very much in demand, especially at the premium end of the market.

For that reason, lemons are very much a flagship item as far as Mazzoni is concerned. Sold with their leaves intact and presented in brightly coloured packs under the Ioni brand, these fruits come from Rocca Imperiale in the province of Cosenza.

They also enjoy geographic protection under the EU’s PGI certification scheme, by virtue of their unique place of origin that overlooks the Ionian Sea. According to Mazzoni, they are very popular with buyers in Italy, Germany and France.

“The soil fertility and the typical sunshine and temperature conditions in Rocca Imperiale produce lemons with optimal organoleptic characteristics in terms of Brix levels, juiciness, flavour, aroma and colour”, he says.

“Ioni lemons are a true paean to Calabria and are sold in an original pack of four fruits with a bluegreen leaf. They are extremely recognisable on the shelf.”

Clementines are also a key part of the range. The group

sources them from Calabria’s Piana di Sibari, a major production area that begins to supply the fruit in the second half of October. Even though volumes declined this season, demand apparently remains strong.

“From the beginning of November, our premium line Emma La Tua Clementina returns, sold in 1.5kg punnets, and in past seasons this was much appreciated by consumers,” says Mazzoni.

Another key product is the navel orange, also sourced from the Piana di Sibari. Thanks to recent new plantings of late varieties, supply will soon be guaranteed until the first part of June.

“We have been working for decades with Italian and European retailers, subject to the most stringent certifications and specifications of our customers,” Mazzoni adds. “We are ready again this year to tackle an important citrus campaign, making available the agricultural and commercial knowhow we have acquired over more than 65 years in business.”

TOP—Mazzoni’s PGI-certified Ioni lemon packs

ABOVE—Premium product Emma La Tua Clementina is sold in cardboard punnets

Companies show that using Citrosol’s plant-based coating can save 4,000kg of waste per 100 containers of fruit.

by Maura Maxwell @maurafruitnetCitrosol and Jaguar The Fresh Company have announced that they have eliminated plastic packaging from Jaguar’s Chinese pomelo programme by replacing individual wrapping on fruit with Citrosol’s PlantSeal range of plant-based coatings. Traditionally, most Chinese pomelos are wrapped in plastic film, and with each container holding 17,000kg of fruit this equates to a saving of around 40kg of plastic film per container.

Raúl Perelló, Citrosol’s international operations director, said: “This collaboration has enabled Citrosol to undertake extensive scientific studies, the results of which were presented at the first Circul-A-Bility Conference. “Through the project ‘Advances to save the packaging plastic film in grapefruit’ we have demonstrated the advantages of PlantSeal as the best solution to replace the plastic film that is used to extend the commercial life of Chinese pomelos”.

Sven Thomas, technical manager of Jaguar The Fresh Company, commented: “Our Group has a firm commitment to all aspects of sustainability. For decades we have placed product quality at the heart of our strategy.

“With this development we are now able to combine environmental aspects of removing plastic from the supply chain for pomelo, whilst maintaining the quality of the product. Together with Citrosol

we have created a solid win-win situation. For every 100 containers of pomelos we are now able to remove 4,000kg of plastic waste from the supply chain”.

PlantSeal is suitable for vegan consumption and does not contain any plastic components. According to Citrosol, the product achieves a high degree of weight loss control, minimises rind disorders due to chilling injury, and delays the aging of fruit by reducing transpiration and respiration in a way that the

quality of the fruit remains intact.

“Furthermore, it addresses the need to employ new methods to tackle export challenges with guaranteed results,” the company said. “PlantSeal is currently in use at an industrial level, with the first containers arriving soon at different destinations. For growers, a main benefit of PlantSeal is that it creates access for fruit into markets that have limitations and requirements in the use of plastics.”

BELOW LEFT— PlantSeal does away with the need for individual plastic sleeves

Martignani’s electrostatic spraying system can help citrus growers make significant savings in time and chemical and water usage – meaning healthier fruit for the consumer.

Italy’s Martignani was founded by engineer Claudio Martignani in 1958. The company, currently managed by Stefano Martignani, has been a leader in the field of electrostatic spraying in agriculture for many years and has always been at the forefront in the development of innovative models and systems. For more than 60 years, it has manufactured low-volume pneumatic sprayers for all types of crops that enable the sustainable use of pesticides.

All Martignani sprayers adopt a pneumatic spraying system assisted by the Electrostatic Charging device, the first of its kind developed in 1981, which guarantees speed of execution, fine and constant mist, uniform distribution, exceptional penetration and effectiveness in fungicide or insecticide treatments.

Our experience of more than 60 years and the various testimonies of farmers and growers around the world show that with Martignani it’s possible to make significant savings on time (around 60 per cent), chemicals (40-50 per cent) and water (up to 90 per cent). All thanks to the low volume and electrostatic charge. In citrus, a comparative study between different field trials was carried out in Spain for the application of foliar nutrients (zinc and manganese) with both

a conventional sprayer and the Martignani electrostatic sprayer.

In particular, the study showed a 34 per cent higher absorption of zinc and 16 per cent higher absorption of manganese, thanks to the better coverage provided by Martignani’s uniform pneumatic spraying and the enveloping effect of the electrostatic charge.

These advantages, of course, also lead to better results in all other types of treatment required on citrus involving products such as acaricides-insecticides and fungicides. Martignani’s sprayers are a guarantee of sustainability and lightness for the environment, but also of considerable savings for producers. All while protecting the environment and the health of consumers.

Regarding treatment costs, in the same study it was shown that with the use of Martignani electrostatic sprayers, the mixture saving is 71 per cent due to the greater adhesion of product in all parts of the plant, thanks to the electrostatic charge, and the absence of drift and run-off.

Growers in Egypt anticipate a rewarding citrus season, with prices expected to remain good despite rising volumes and new markets opening up for exporters.

by Tom Joyce @tomfruitnetLast season, citrus exports from Egypt reached 1.8m tonnes, and with production continuing to increase, that figure is projected to keep on rising, according to Ahmed Ghazy, export director at Capital Agro Co. The country has been the top exporter for oranges for the last three years, and declines from rival producing countries, the result of extreme weather, could bode well for Egyptian growers.

Egyptian citrus production extends over nearly 200,000ha, not just oranges, but tangerines, lemons, grapefruit and other varieties. Oranges are number one, accounting for 85 per cent of total citrus exports, according to data from the Egyptian Ministry of Agriculture.

Although Egyptian growers have also been affected by the weather, the impact has varied greatly depending on the production area, according to Ghazy. “Some citrus growers are reporting an increase in volume of 15-25 per cent,” he says, “while others have seen a reduction of up to 40 per cent.”

Ghazy anticipates a good orange season in terms of demand this year due to a lack of oranges in storage. “The Egyptian season is arriving at a time when the remaining stock from competing countries is quickly running out,” he says. “With the decline in production of oranges in Spain and Turkey this year, prices of Egyptian oranges have been reinforced, while the markets are hungry for the new crop from Egypt.”

Ghazy described the past season as “near perfect”. “Optimal weather conditions during the flowering of the orange trees increased fruit se ing and production,” he says. “On the other hand, heat prior to the harvest affected the size of the fruits, leading to a majority of small and medium-sized fruit.”

Even with the heat waves during the blooming period, which affected flower set in some areas, Ghazy expects a good-sized crop and for Egypt to remain the top orange exporter to the EU. Egyptian exporters have also managed to open up new markets, including New Zealand, Brazil and Japan in order to help shi the continuously growing volume.

As production grows, says

Ghazy, so will exports. Production is estimated to increase by 20 per cent to 3.6m tonnes and exports by 30.77 per cent to 1.7m tonnes, according to the Ministry of Agriculture. Top export markets remain Russia, the EU and the Middle East, as well as East Asia, where the increased supply of Egyptian oranges caused a drop in prices at the end of 2022.

Besides the favourable weather, Ghazy puts Egypt’s recent success down to a host of reasons, including the implementation of integrated pest managements approaches by growers and commercial farms, using biological controls and closely monitoring crops for pests and diseases.

“The idea of coding farms has also been applied, giving each shipment and farm a verification number, the aim being to achieve full control of the product from farm until export overseas,” he says. “Here at Capital Agro, we export our products to more than 52 countries around the world, and we work to implement all procedures and requirements for each customer, guaranteeing the export of a high-quality product that conforms to the specifications of each market.”

Capital Agro intends to more than double its usual export volume of 11,000 tonnes this season, as the company targets new markets such as Brazil, Japan, the Philippines and New Zealand.

LEFT—Soaring production and transport costs eroded profitability in 2022

The South African Citrus Growers’ Association (CGA) has announced the results of the 2022 export season, stating that growers packed 164.8m 15kg cartons for shipment to global markets.

The CGA said the results highlighted an extremely tough season for growers that negatively impacted returns and the volumes they were able to export.

“It threatens the future sustainability of the industry, which sustains over 140,000 jobs and brings in R30bn in revenue to South Africa every year,” the association noted.

CGA chief executive Justin Chadwick said that the last statement of 2022 painted a picture of challenges and events that turned the season into a nightmare for growers.

“The challenges faced by the industry this season include a surge

in farming input and transport costs as well as astronomical shipping price hikes,” he said. “This made the cost of getting fruit to market commercially unviable for many growers.”

At the same time, the ”unjustified and discriminatory” new False Coddling Moth (FCM) regulations passed by the European Union in mid-season placed further financial strain and risk on growers.

“These challenges were coupled with ongoing decay of public infrastructure such as roads, rail and ports, erratic electricity supply and a decline in real export prices,” Chadwick continued. ”This means that already tight margins for citrus producers were squeezed to the point where only one in five farms are likely to make a positive return this season.”

While there was modest growth in fruit packed and exported across

some citrus categories compared to 2021, the final figures were far lower than what was predicted when the season started in March this year.

In the end 31.8m cartons of Mandarins were packed, an increase of 900,000 cartons from 2021, but 2.7m fewer than the seasonal forecast.

Chadwick said that volume growth in lemons continued unabated, with 34.7m cartons packed for export in 2022, an increase of 3.6m cartons compared with the previous year, and 2.4m cartons more than the pre-season estimate.

The perfect storm of challenges also resulted in a drop in export volumes of some varietals.

“For example, 16.7m grapefruit cartons were packed for export this year, which is 800,000 less than the 17.5m cartons the previous year,” Chadwick explained. ”There was also a decrease in the number of cartons of Valencias packed for export, with 53.8m cartons exported compared to 55m in 2021.

“The only other category that saw growth was Navels, with 27.8m cartons packed for export in 2022, which was an increase of 600,000 cartons when compared to last year,” he added. ”However, it was 900,000 cartons less than the 28.7m carton forecast at the start of the season.”

A challenging 2022 saw the country’s citrus growers export less fruit than originally predicted, although volumes were still up on the previous campaign.

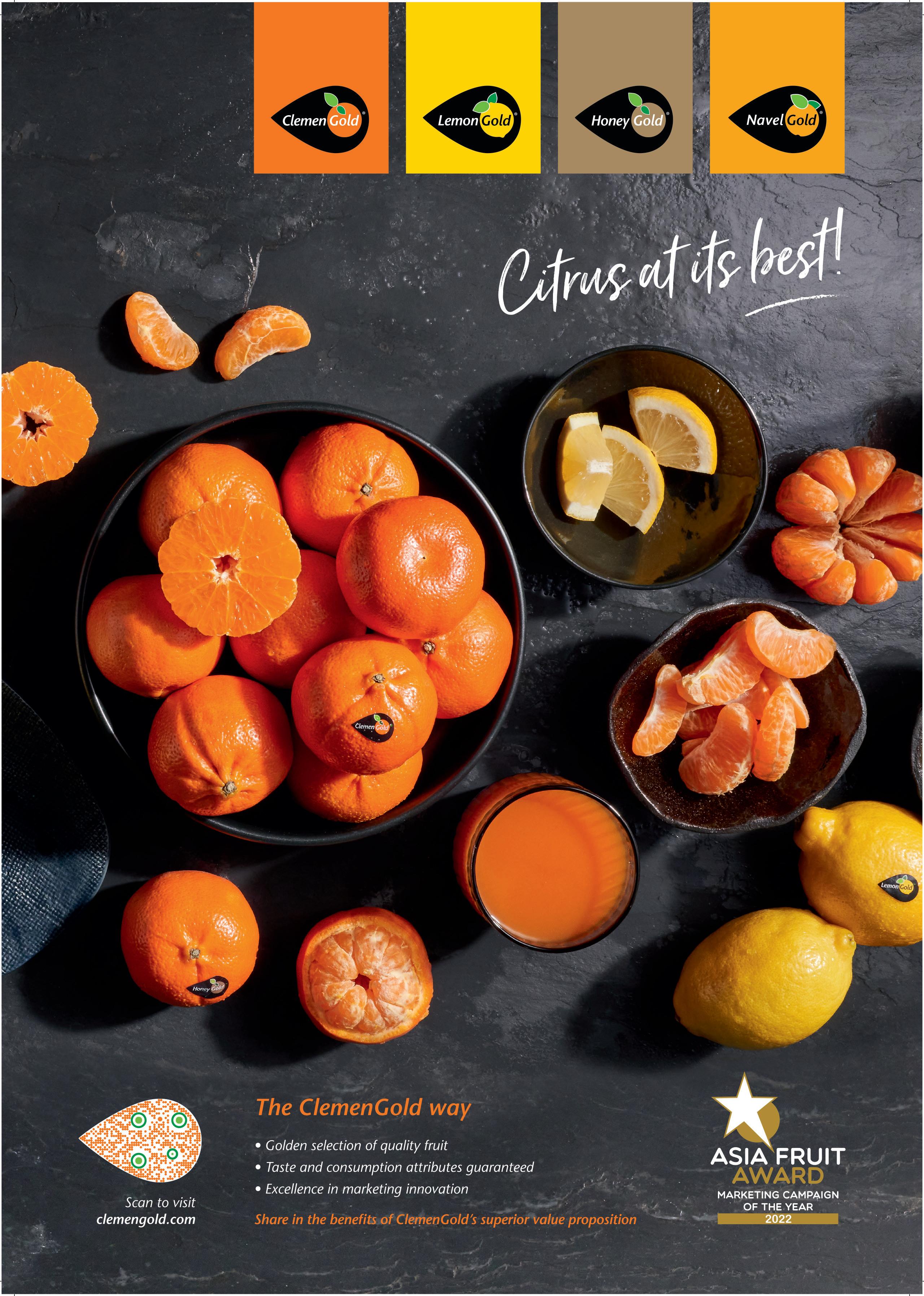

Fresh produce brand ClemenGold has been recognised at the Asia Fruit Awards in the tough Asian market.

by Fred Meintjes

by Fred Meintjes

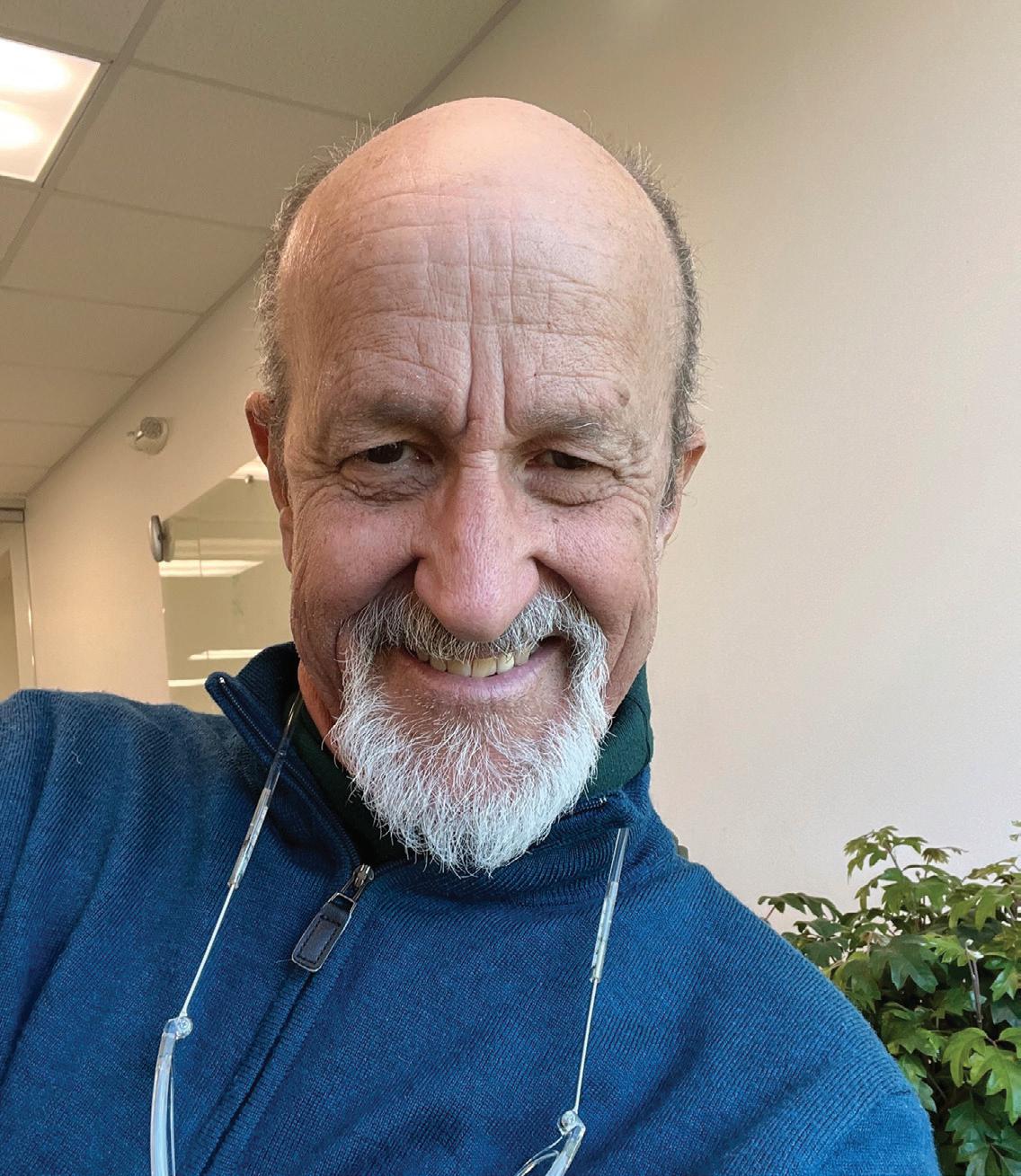

Fast-growing South African citrus brand ClemenGold is celebrating the success of winning the Marketing Campaign of the Year award at the 2022 Asia Fruit Awards for its mandarin marketing in China. It’s not an award to be taken lightly: China is the world’s biggest mandarin producer, accounting for 68 per cent of global output, or 27m tonnes a year according to the World Citrus Organisation. This makes South African marketing success with ClemenGold mandarins in China even more impressive.

Southeast Asia and the Far East are vitally important for the success of the South African citrus export industry. Although Europe is still its largest marketing region, around 21 per cent of the country’s total export volume is shipped eastwards, with an estimated sales value in excess of R5bn out of a total R25bn.

Adéle Ackermann, marketing manager at Fruitalyst, which manages the ClemenGold brand, says its long-term success relies on quality fruit and smooth logistics. “It has more to do with strong branding, backed by marketing excellence and the strength of the complete value chain supporting the process,” she says.

Just as vital as delivering consistent quality to retailers and consumers, is having a visible brand, Ackermann claims. “This was especially important in a challenging citrus year like 2022, where supply campaigns, backed by branding and marketing

investment, had a significant impact,” she notes.

Abs van Rooyen, founder of the ANB Group, the holding company for Fruitalyst, highlights the innovation and “cutting-edge technology” that underpins the brand’s success in Asia. Being growers themselves, he says the group understands the challenges involved in supplying a consistently good product. As well as running companies that develop citrus varieties and nurseries, ANB has one of the biggest fruit-packing operations in the country.

Most of the group’s activities centre on equipping growers to compete in a globalised, competitive industry.

“This extends from spearheading the introduction of leading global varieties into the industry, to creating a reliable and scaled source of quality plant material, pioneering new ways of growing, establishing a consolidated marketing platform that affords partner growers with secure shelf-space and market positioning,” says Van Rooyen.

Van Rooyen has confidently expanded ClemenGold production in recent years, converting whole citrus farms to Nadorcott mandarins, from which ClemenGold is packed, and even turning one of South Africa’s iconic wine farms into a citrus producer specialising in what he refers to as the Gold range of products. He has big plans to further develop the brand concept. It has already been extended to LemonGold for seedless lemons, and Sweet C

and ClemenOrange.

According to Ackermann, the company’s approach is based on focusing on “pockets of opportunity” to persuade customers in Asia to deliberately choose South African brands. “Our brands and their marketing messages are tailormade to speak to different cultures globally,” she says.

Fruitalyst CEO Lianne Jones points out that being able to supply as close to 12 months of the year as possible is vital in positioning a brand globally. “Making sure that there is consistency in quality elevates the brand and keeps consumers coming back for it,” she explains.

TOP & LEFT—The success of the ClemenGold campaign lies in its strong consumer branding, underpinned by consistency in quality and supply ABOVE RIGHT—Abs van Rooyen, founder of the ANB Group

by Maura Maxwell @maurafruitnet

by Maura Maxwell @maurafruitnet

How would you sum up the 2022 season for Peruvian citrus? Was it a profitable campaign overall?

Sergio del Castillo: I would summarise the 2022 campaign as the worst in the last 13 years. Only in 2008, due to a severe climatic problem, did we see a similar drop in volume, however, at that time we were experiencing strong growth in the planting of new varieties and were therefore able to recover quickly.

On this occasion, the national and global situation is different: the profitability of the citrus business has decreased significantly in the last two years. It has been seriously affected by the increases in production, postharvest and export costs, mainly due to the increase in freight rates that makes the export of certain varieties unfeasible.

The exchange rate has also affected us and led to a reprioritisation of markets, with the US receiving a much bigger proportion of overall shipments than usual to the detriment of other markets. With the euro and US dollar almost at parity, 56 per

cent of Peru’s volume ended up going to the US last year, with only 13 per cent going to Europe, 10 per cent to the UK, 5 per cent to Asia, 5 per cent to South America, 4 per cent to Canada, 3 per cent to Central America, 2 per cent to Russia and 2 per cent to Mexico.

To what extent were shipments affected by logistics problems? And was the impact felt equally across all markets?

SdC: Logistics were the biggest problem we faced last season. Such was the hike in seafreight rates that for a few weeks it simply didn’t make sense to ship anything at all, which meant that a large amount of fruit ended up not being exported. Overall, exports contracted by 2.5 per cent last season.

What new developments can you share regarding Peru’s efforts to diversify its citrus exports? Are there any new markets openings

SdC: While we continue in our efforts to diversify our exports, the current trading situation is hindering our progress, especially in the most distant markets. These take a considerable logistical effort to reach and we simply don’t have the conditions to develop them right now.

Having said that, SenasaPeru continues with official negotiations to open new markets such as Vietnam, the Philippines, Korea and other countries in Asia. But for now, efforts are more focused on improving access to

ABOVE & RIGHT— Newer varieties, like W Murcott, are still profitable but older varieties generate negative returns

existing markets like the US, China, Japan and others.

So how would you sum up the current state of the citrus sector in Peru? Would you say we’re seeing the development of a twotier market – one for profitable new mandarin varieties and one for old varieties and secondrate fruit that are no longer profitable?

SdC: The Southern Hemisphere citrus sector is in crisis. This is not only due to rising production and post-harvest costs, which could not be passed on through

the FOB export price, but principally because of the significant increase in the cost of exporting and distributing the product. This has increased so much that it makes the business unfeasible. Citrus is like a commodity, it constitutes a basic fruit within the food basket, that is very affordable for the consumer. The profitability of the business depends on handling a large volume at a very constrained production cost. Today, with the global crisis we are going through, we have a market for varieties that still offer a positive return to the producer and another, mostly made up of old varieties, that generate negative returns.

Going forward, what would you say is the outlook for Peruvian citrus in the coming years? What are the most important challenges that you’ll have to overcome as a sector?

SdC: The situation at this moment is very uncertain, the only certainty is that since 2021 all expansion of citrus planting in general in Peru has stopped. Newer varieties that would show a positive return are not even being planted, it’s just not attractive enough to risk investing in them right now.

The biggest challenge that we have as a sector

Chilean citrus production is set to rebound this year after frosts in the Valaparaíso, Metropolitana and O’Higgins regions reduced volumes in 2022, according to a new USDA report.

Mandarins, the main citrus crop, are projected to see an increase of 39.4 per cent this year to 237,000 tonnes, with acreage expanding to around 33,400 acres compared to 27,600 acres in 2022.

“Due to the high profits, the area planted with mandarins increased significantly in the last ten years of commercialisation,” the report states. “Specifically, the variety W. Murcott became a viable alternative to replace other crops such as oranges or table grapes, which are less profitable than tangerines, or avocados, which are very sensitive to frost.”

Orange production is forecast to increase to 200,000 tonnes, 22 per cent higher than the 164,000 tonnes produced in 2022. The report estimates the planted area for oranges at 15,814 acres, 0.5 per cent more than in 2022.

Finally, lemon exports are expected to reach 100,000 tonnes this year, up from 60,000 tonnes in 2022. The lemon marketing year begins in April, with the bulk of exports taking place between June and September. The US is the main market for Chilean lemons, taking some 65,682 tonnes in 2021, or about 65 per cent of total Chilean lemon exports.

and as a union is to maintain the competitiveness of Peruvian citrus. For the trees that are already planted we must have the technological tools that allow us to reduce production costs, especially when it comes to labour and phytosanitary inputs. At the same time, we need to see an increase in the productivity and quality of our fruit, in order to survive this new reality and make the business viable for the long term.

The trend toward globalisation over the last several decades has been a windfall for exporters of counterseasonal fruits to the Northern Hemisphere. Beginning in the 1970s, Chile was the first country to prove that it could successfully deliver top-quality table grapes despite the time and distance involved.

Since then, implementation of free trade agreements combined

with science-based phytosanitary requirements have served to open the flood gates for Southern Hemisphere-grown produce.

American consumers have come to take for granted the yearround presence of formerly “offseason” fruits – such as avocados, blueberries and stonefruit – on their supermarket shelves. For sheer volume, citrus leads all other categories sourced from the

Southern Hemisphere. Marketed as “summer citrus,” fruit continues to arrive in increasing quantities on both US coasts from April through the end of the calendar year, usually to the annoyance of domestic producers.

Additional product availability can result in greater per capita consumption in a particular market; depending on the variety, that has been the case for the citrus category in the US. For instance, USDA data shows that as mandarin imports surged by 291 per cent between 2000 and 2020, US consumption grew commensurately by 133 per cent; for lemons over the same period, a 314 per cent increase of imports saw a 104 per cent consumption upturn.

On the other hand, a 335 per cent surge in fresh orange shipments from the Southern Hemisphere did little to enhance US demand as consumption fell by 19 per cent from 11.3 lbs per capita in 2000 to 9.1 lbs; grapefruit consumption dropped even more steeply (-71 per cent), although the devastation of the Florida citrus industry from disease has had a lot to do with this.

With the onset of the Covid-19 pandemic, however, fresh orange consumption has seen a rebound in popularity lately among US consumers, according to Peter

BELOW—Easy peelers are becoming more and more popular with US consumers, says Seald Sweet

Anderson, commodity manager for Seald Sweet International.

“Although mandarins have held their own, due to the impact of the Covid phenomena on citrus demand, starting in mid-2020 the orange category has seen an upturn in demand, especially for bagged product,” says Anderson.

“We feel this is in part due to consumer sentiment that bagged product is ‘safer’ on store shelves as well as the consumer gaining a renewed perception of the ‘value’ in the orange category that had been cannibalised by the mandarin category. In addition, and to a lesser extent, the Cara Cara (orange) variety has been given more retail space over the last four years by American retailers, thus creating an increased demand for that variety within the orange category.”

Easy-to-peel mandarins are expected to continue to increase in popularity among US consumers, likely at the expense of other citrus categories, due to convenience as well as their outstanding taste.

Over the last few years, Peru has emerged as a major source for the American market, particularly for the later season W. Murcott and Tango varieties. According to industry sources, Peru’s share of market for mandarins in the US rose from 25 per cent in 2019 to 39 per cent in 2022.

“We expect that there will be more Peruvian percentage increases over the next several years,” notes Anderson. “Although the percentage in any given year can vary due to weather and orchard seasonality, the overall trend is for Peru to be about one-

“Although mandarins have held their own, the orange category has seen an upturn in demand due to Covid”

third of the overall volume that the US receives from the end of April through November.”

At one point, Chile was the dominant counter-seasonal source for easy-peelers. But this is no longer the case. “Five years ago, Chile was 70 per cent or more of the total volume,” says Anderson. “But although that percentage has certainly changed with the onset of Peru, do not forget that Uruguay and South Africa have increased production and exports to the US as well.”

The US, of course, is a major producer of fresh citrus with California the leading source, especially as Florida’s production continues to decline. There were reports of a significant overlap of Southern Hemisphere citrus with the beginning of the California Navel and clementine seasons this year and this is likely to be recurring depending on seasonal circumstances.

“Every year is different, since

the weather plays a role – as does the crop size and timing,” says Anderson. “This is not an exact science even after harvest, packing and shipping; ships can get delayed; growers pack and send what is left on the tree which may or not be what this market wants but they send it anyway.

“Importers ultimately plan in conjunction with retailers according to what the industry has been told about when California will end or start. Retailers want to be sure to have their orders covered, early or late.”

Anderson goes on to point out that “if the Southern Hemisphere Tango mandarins and Midknight Valencias are a better quality and tasting commodity than early California mandarins or Navels, then the demand for those commodities will, in the end, will be determined by the consumer.”

The Citrus Breeding Program of Uruguay has released a new set of mandarins and oranges through the National Citrus Consortium. The varieties are the result of 30 years of research and development involving the National Agricultural Research Institute of Uruguay (INIA) and the University of the Republic of Uruguay (Udelar). According to INIA, they have been ”thoroughly selected, covering a wide market window, and tested by growers and consumers, coping the new trend in citrus consumption”.

The varieties will be available to producers in the Southern Hemisphere and North America following their successful release last year when the consortium signed an agreement with Genesis Innovation Group (GIG) signed an agreement for the evaluation, development and commercial management of the new varieties in the Mediterranean Basin. GIG is an international group of companies specialised in the development and comprehensive management of new protected varieties worldwide.

The National Citrus Consortium is made up of Ministry of Agriculture, INIA and the Uruguayan Union of Fruit and Vegetable Producers and Exporters (Upefruy) with the aim of improving the international competitiveness of the sector. table of authorities

“This is an example of the useful and necessary publicprivate union in pursuit of a key objective for citriculture. Uruguayan research is generating materials that are relevant for world citriculture,” said the Minister of Livestock, Agriculture and Fisheries, Fernando Mattos when the agreement was signed in August.

INIA’s president José Bonica commented: “The agreement makes us proud for the innovative development work behind it in coordination with the productive sector and the government, and that managed to attract key foreign partners. This confirms the place of the Uruguayan citrus industry today and that it is a sector that seduces, with foreign investment”.

Dr Fernando Rivas, a leading citriculture researcher at INIA, added: “The consortium work model in the form of an alliance between companies, the government and research and development institutions once again shows its power to generate innovative products that improve the competitiveness of production chains, in this case, the citrus fruit production chain. our country”.

A new call for candidates to manage the license for evaluation, development, production and commercialisation of the new varieties has been opened. “This is an excellent opportunity to boost market strengths and build up longterm R&D alliances for developing new citrus varieties,” said Dr Rivas.