Pick of the crop

Which of the new licensed table grape varieties will be tomorrow’s export winners?

Which of the new licensed table grape varieties will be tomorrow’s export winners?

As grape growers grapple with climate change and cost inflation and marketers muse over how to sell ever-increasing volumes at profitable prices, breeders are delivering a new generation of innovative varieties that promise higher yields, better resistance, longer shelf-life and that all-important wow factor to tempt jaded consumer palates. They are much needed. According to Rabobank, per capita consumption in the EU has been trending downwards in the past ten years, while in the US, consumption has remained broadly flat over the last two decades (USDA). Delivering increased growth and profitability for growers and retailers in such a mature category is not easy. Surveys like the one conducted by Nielsen on behalf of Hort Innovation in Australia (p26) are providing crucial insight into what shoppers want. The answer seems to be a combination of freshness, price and taste. The research also shows that knowledge of individual varieties is limited, with many consumers not looking beyond red, green or black. Crucially, the same study reveals that consumers will happily substitute grapes for other fruits if the availability, display or price are not right, so where and how they are displayed in the store is also critical. Of course, there will always be room in the market for niche specialty varieties. But when it comes to boosting grape consumption, it seems quality and consistency really are king. _

Company says enhanced system will help it make better decisions and foster success of licensees.

by Maura Maxwell @maurafruitnetBrazil’s Kuara Comercial e Exportadora de Frutas has been named by IFG as the winner of its second annual DW Cain Award. Named after founder Dr David Cain, the award recognises grape licensees that support and promote IFG’s vision through the best adoption and promotion of its varietal logos and trademarks.

The IFG team says it selected Kuara for its work in the American and Brazilian markets, which has included marketing, events and consumer tastings. “Their unique programmes for the development, appreciation, recognition and promotion of IFG fruit has never been done before by another Brazilian marketer,” IFG said.

Arnoldo Eijsink (left) and his daughter Ilonka are pictured below accepting the second annual DW Cain Award from IFG’s CEO Andy Higgins.

International Fruit Genetics

(IFG) says it will be able to support its licensees in making better planning and planting decisions thanks to the recent completion of its digital transformation process.

As a by-product of its licensing, IFG collects vast amounts of data that it says can now be summarised and consolidated to aid decisionmaking for itself and its licensees. In 2019 the company launched a project to consolidate this data into a more integrated system boosted by artificial intelligence.

Thanks to this newly enhanced system, the company says it can provide be er recommendations, make more informed decisions for both existing fruit varieties and licensees and be led by consumer experiences.

“Like many companies today, IFG is transforming and improving its data processes. We are taking

advantage of newer digital tools that allow both old and new data to be analysed and utilised for greater insights and predictive analytics,” says solutions architect/manager IT Carol Higgins, adding that this can then be shared throughout the supply chain, ranging from the field to harvest, packaging and sales.

According to Higgins, a big part of the success of the system relies on providing globally standardised tools to collect and take notes in the field, which is critical to providing the right advice for growers in vastly different regions.

She notes that prior efforts to collect data ranged from using spreadsheets to the paper and pencil method. “With all IFG personnel using the same tools, information is being collected in a more consistent manner which can now be fed into the AI algorithms fostering insights and leading indicators in easily digestible

formats,” she explains.

One of the company’s main goals was to streamline its massive quantity of data, allowing historical and recent data to be used for research and reporting to provide licensees with a snapshot of their performance in the marketplace.

Additionally, the new data strategy has helped the IFG research and development team engage in the natural breeding processes to develop new varieties of table grapes and sweet cherries.

“We have tens of thousands of new seedlings every year. The ability to sequence the genome of virtually all individuals of our breeding populations has helped create amazing new opportunities in breeding,” says Dr Chris Owens, lead plant breeder at IFG.

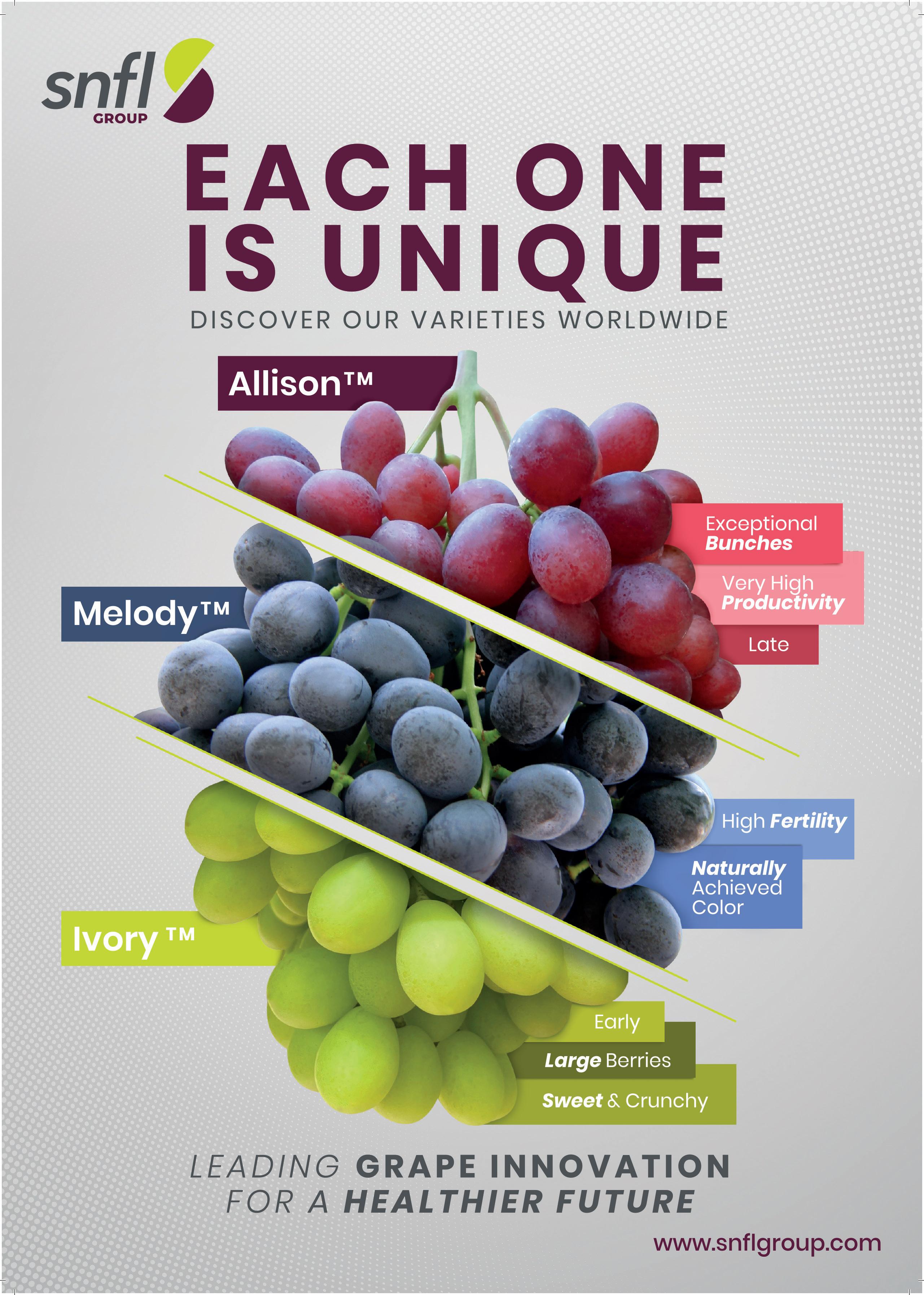

SNFL managers around the world share their insights on the rapidly evolving global table grape industry.

by Maura Maxwell @maurafruitnetNew licensed varieties are driving global demand for table grapes and accelerating the sophistication of the industry according to leading breeder SNFL.

Marcos Felici, SNFL’s general manager for Mediterranean countries, says the replacement of seeded grapes with seedless varieties has been very dynamic across the region over the past decade. “It has transformed a good fresh product into an exceptional product aligned with consumers expectations and demand for novelty,” he tells Fresh Focus Grape. “Grapes are a great option for snacking: you can eat them anywhere, they are easy to consume, clean and leave li le residue.”

Both growers and consumers are benefiting from the move towards growing new licensed varieties offering technical and organoleptic characteristics that improve levels of production and consumption.

Juan Guillermo Nuñez, SNFL’s commercial manager in Peru, comments: “In Peru, we have seen a 360-degree pivot from past seasons,

with traditional varieties such as Flame, Crimson, Superior, among others, being replaced by new licensed varieties which deliver exceptional characteristics on texture, flavour and sweetness.”

By 2022, around 70 per cent of Peru’s 21,099ha of table grape production had undergone a process of varietal replacement – although Nuñez notes that the country still produces a significant volume of Red Globe.

One of the big advantages of these new varieties is their high fertility, guaranteeing an increasing and sustainable production of bunches and berries per hectare year a er year, as well as general cost reductions.

“Also, the size of the grapes has increased and it is easier to obtain colour naturally. This means berries can reach the calibre that the market requires today, (2024mm), without the need for major agronomic interventions, and

without compromising the quality standards demanded by consumers,” Felici explains.

In South Africa, the challenges of rising costs, changing weather pa erns and logistical disruption means the focus remains on improvements to the shelflife of the fruit, and how to grow these varieties with reduced inputs. “We need to be able to manipulate the bunches manually and only use hand labour for the finishing touches, before we pack the fruit into the carton,” says Hein Koch, SNFL’s general manager for South Africa.

Felici believes the high expectations imposed on new varieties has accelerated the professionalisation of the industry. “Due to good management of the varieties, profits are much higher and thus it is possible to continue reinvesting in new technologies that allow be er cultivation and with consistent and good quality,” he notes.

In Peru, for example, companies have started employing trained agronomists to technically assess crop production in each main area of the country to optimise their productive objectives.

Ignacio Letamendi, SNFL’s general manager for Chile, says a key part of the company’s role is to provide strong technical support to growers and exporters. “We share periodic newsle ers on specific technical tasks and assess growers in the field to prioritise actions and make the process easier, more productive and more profitable,” he says.

This support extends right through to harvesting and packing. In Chile, SNFL has a quality control team during the harvest to supervise the quality of grapes packed and ensure the correct labelling of boxes and use of trademarks. This season specifically, the company has strengthened its presence in Peru by incorporating a quality control manager at source to guarantee the positioning of SNFL varieties.

Both growers and consumers are benefiting from the move towards growing new licensed varieties

Cost inflation and stagnant demand are leading to greater industry consolidation in the Golden State.

by Jeff LongCalifornia is home to 99 per cent of US table grape production. What started as a fledgling industry in the early 1800s has morphed into a US$2.1bn success story with some 81 varieties in production and new, high-yielding cultivars coming into bearing every year.

Today, however, the industry finds itself dealing with a plethora of challenges threatening its long-term health, chief among them the rising cost of production driven in part by federal food safety regulations, labour shortages, restrictions on water availability, as well as energy. According to a study by California Polytechnic State University-San Luis Obispo, grower costs in the San Joaquin Valley rose 265 per cent between 2012 and 2018.

With inflation fuelled by the ongoing pandemic and the Ukraine invasion, production costs have only risen further in the years since. Unfortunately, pricing for table grapes has not risen commensurately, leading to industry consolidation in the hope that scale can provide greater efficiencies and improve bottom lines.

Since the 117m carton (8.6kg) season of 2018, California’s table grape production has been in steady decline. According to California Table Grape Commission projections, just 92.3m cartons were packed and shipped last year. However, the state’s acreage has not contracted with tougher times but actually increased in recent years.

“There is the potential for 105-110m carton crops every season,” notes John Pandol of Pandol Bros. “There has been a lot of pricing below the cost of production in recent years and in some cases, growers are concluding that their best economic outcome may simply be to not harvest.

According to the USDA’s Economic Research Service (ERS), per capita consumption for table grapes has essentially remained flat over the last two decades, ranging between 3.0 kg to around 3.6kg.

California’s market “window” for table grapes is also getting compressed on both ends of its season. Mexico’s volume now dwarfs the high-cost Coachella Valley’s during the spring and early summer months while Peru continues to make inroads on established export markets late in the California season.

And with the ocean shipping scenario still in disarray,

Also, many of these new varieties do not ‘pan out’ and end up not being picked or shipped.”

And Pandol notes that rising costs and a general shortage of fruit may also be impacting consumer purchases as California becomes less cost competitive vis-à-vis other products from either other states or countries. He says he can name three firms that have exited the California table grape deal altogether in recent years. “All three were heavily into proprietary varieties. If we look at the influence of the new varieties over the last decade, they have not increased consumption.”

California is increasingly reliant on the North American market to absorb the bulk of its production, with Mexico and Canada the primary export destinations. USDA/ Foreign Agriculture Service statistics show that a decade ago, the two countries received 39 per cent of California’s annual export volume; by 2022, that share had climbed to 62 per cent.

In comparison, China-Hong Kong imported more than 41,400 tonnes of US table grapes in 2012; last year, that figure had fallen to just 5,270 tonnes. Price-sensitive markets such as the Philippines are increasingly supplied by Chinese fruit.

Peru’s certified table grape acreage reached a record 20,799ha in 2022, representing an increase of 2.5 per cent on the previous year, according to plant health authority Senasa.

Peru has enjoyed a meteoric rise up the table grape export rankings over the past decade. Thanks to a ready availability of land, favourable climatic conditions, extended supply window and the speed and agility with which growers have embraced newer, higher-yielding varieties, the country has established itself as a leading supplier to almost 60 markets worldwide.

For the 2022/23 season, shipments were on course to reach 73m (8.2kg) cartons or 598,000 tonnes, representing an increase of 13 per cent on the previous season and putting the country on track to become the world’s biggest exporter of table grapes.

However, the campaign was almost derailed by the widespread protests which followed the

ousting of former president Pedro Castillo at the end of 2022. As running battles between police and protesters left 50 people dead and hundreds injured, blocked roads prevented workers from reaching farms and packhouses and severely disrupted trucks bound for the country’s ports. It remains to be seen how bad the fallout from the demonstrations will be but Provid has warned that it is unlikely that shipments will reach the pre-season forecast of 73m cartons.

What’s more, at the time of going to press, a number of exporters were being forced to review their export programmes in light of the deteriorating condition of grapes left on the vine or in storage for longer than usual. Some shipments were reportedly being diverted from Asia to closer markets in an effort to reduce transport times and preserve fruit quality.

Gabriel Noboa, a member of the commercial board of Peruvian grape association Provid and commercial manager of agricultural Don Ricardo, says exporters were making the “responsible decision” of switching destinations.

“It’s true that some fruit may have changed colour as is not going to reach Asia and will instead

Ica led the way with 9,157ha, followed by Piura with 8,262ha. Between them they accounted for 84 per cent of the country’s plantings. In third place was Lambayeque with 1,656ha.

In terms of varieties, Sweet Globe accounted for the biggest acreage with 4,551ha, up from 3,423ha in 2021. By contrast, Red Globe, the second most planted variety, saw acreage contract from 4,493ha in 2021 to 3,622ha last year.

The other main varieties were Autumn Crisp (1,875ha), Allison (1,477ha), Crimson Seedless (1,179ha), Sweet Celebration (926ha), Timpson (861ha), Superior Seedless (809ha) and Ivory (800ha).

be destined for the US, EU and Latin American markets,” he explains. “It’s difficult to estimate how much as it depends on the reality of each exporter.”

Noboa says the delays are also likely to lead to greater congestion in the markets as February and March are typically peak supply months due to the presence of other origins.

“At this stage it’s difficult to put a figure on the financial losses resulting from the protests, but companies will be impacted by fewer deliveries, the loss of fruit that will not be exported but left on the national market, and the fall in market prices due to the concentration of supply,” he says.

LEFT—Peru’s speed in adopting new varieties has boosted its export success

Chile’s table grape industry has reached a tipping point as new varieties replace old.

by Liam O’Callaghan @liamfruitnet

by Liam O’Callaghan @liamfruitnet

The Chilean table grape industry sits at an important moment, according to Ignacio Caballero, coordinator of the Chilean Table Grape Committee and marketing director of Asoex.

A er a decade of investment, production has finally passed 50 per cent of new varieties and three of the most prominent challenges of the past few years – Covid19, logistics disruption and poor weather – seem to be easing.

To effectively harness this opportunity, Asoex has reinstated its Table Grape Commi ee with three main goals: to coordinate and unite the sector; to improve quality; and to improve competitiveness.

Caballero says the commi ee has brought together 53 companies representing more than 75 per cent of export volume. It has also started publishing export forecasts and addressing logistics issues.

“We have many things planned to positively impact the industry this season, including international promotional campaigns to increase consumption of our grapes in the US, China and Korea,” he says.

“We are also working with the USDA to get a systems approach approved for the US market, which would be an important step for our industry.”

Caballero says switching to new varieties is essential to achieving growth in the current global grape

market, a process that has been elongated by Chile’s unique climate. Now the industry has a handle on these varieties it can meet demand with confidence.

“The biggest new reds are Timco and Allison, but they are already decreasing to give more space to even newer varieties like Sweet Celebration, Jack’s Salute, Candy Hearts, Scarlo a and Arra 29, among many others. Buyers can expect to have much more volume in the next couple of years and more than 17m cases this season,” explains Caballero.

“Production of new white varieties grew 267 per cent last season, this season we expect to have more than 14m cases to offer. The trendy new white varieties we can offer big volumes of include Arra 15, Sweet Globe, Timpson, over 1m cases of AutumnCrisp, and more.

“New black varieties were a focus last season, now we expect to stabilise their growth while still providing new offers to the markets. We expect to have 4.5m cases of new black varieties this season, with significant volumes of Sweet Favors, Sable and Sweet Sapphire. Volumes of Maylen and Midnight Beauty are also growing.”

Producing new varieties is only the first step, if Chile is to make its transition a success. Caballero says the industry must educate buyers so when they seek new varieties with high quality and consistency they will think of Chile first.

“We have to deliver consistent, high quality products and that’s what we are working towards. Chile can offer the trade decades of experience as one of the world’s top grape growers. We have had some recent challenges, but we understand the business and the needs of the buyers,” says Caballero.

“With the new commi ee we expect to have a more coordinated sector and will offer markets new solutions to work side-by-side as partners, remembering that the biggest challenge for grapes – that we all need to work towards – is increasing consumption.”

by Maura Maxwell @maurafruitnet

by Maura Maxwell @maurafruitnet

Christian, you’ve been in the grape business for many years. You must have seen some difficult seasons. How would you qualify the situation facing Chile today?

Christian Corssen: I believe after 33 years in the business the most important thing is that you never stop learning. In this industry, every season presents new challenges and as a company we must always be prepared to constantly analyse what is happening in order to make timely decisions that allow us to react in a timely manner.

We thought nothing could be worse than the heavy rains at the end of January 2021. But then came

Covid and the logistical chaos that resulted from the pandemic, showing us that new problems can always appear. Thankfully, this has allowed us to sharpen our focus and improve the way we work as a team. It has also taught us that the best producers growing the best fruit are the least affected by these crises. So even if a season is bad overall, we are one of the companies that manages to better weather the storm.

How is the 2022/23 campaign going? Will it be an improvement on last season?

CC: I believe that this season has started very well for Chilean grapes despite the fact that to date [early February] we’ve only exported around 13 per cent of the estimated shipment total, which has allowed us to reach a fairly undersupplied North American market with good prices. And we’re also seeing strong demand in Asian markets.

Unfortunately, the volume exported in this first stage has been very low (to date we are 12 per cent down

on the previous campaign). This was due to the later harvest in northern Chile and delays in shipping services to the US resulting from rough seas which prevented loading.

From now on I think we’re going to see a situation of greater supply as production in northern Chile overlaps with the south-central zone, where the harvest has come on time and is very concentrated. At the same time, Peru is resuming shipments [after the social unrest disrupted exports in January] so by the beginning of March we’ll see a lot of fruit on the market.

In order to avoid a repeat of last year, when the US market became heavily oversupplied in the second part of the season, we need to diversify our markets as much as possible, as well as collaborate with receivers to schedule promotions in a timely manner.

It’s also important to enhance the value of our grapes by only shipping high quality fruit in good condition. Our producers need a good season, so as exporters we have to do things right to help them achieve this goal.

Cost inflation and challenging logistics make for a complicated

scenario for grape exporters. To what extent do you think it will affect the profitability of the campaign?

CC: It is difficult to quantify the effect of these issues. In the end, good results are all down to good yields, good quality, good prices and low costs. Obviously, any increase in costs works against the results. On the logistics side, things have so far been much better than last season both in price and in terms of operation and we hope it will continue like this.

As exporters we have to be very careful to keep costs low and be as efficient as possible. As I

mentioned previously, I believe that the key is to diversify the markets as much as possible and ship good quality fruit. The challenge is in achieving the balance between volume, quality and condition. Another important factor is the evolution of our exchange rate, which today is close to CLP800 per US$, since any significant drop directly affects the results of the season.

What about the market situation? What are the key consumer trends we’re seeing right now and how do you think rising prices will influence consumer demand?

CC: Clearly there is a consumer preference for new varieties, and this is forcing us to improve the quality of traditional varieties like Red Globe which still account for 46 per cent of Chile’s offer. In terms of prices, we want to try and avoid oversupply from March onwards as this leads to significant price drops. The best way of achieving this is through market diversification –something that proved difficult last season due to the effects of Covid and the logistical fallout of the pandemic.

AMERICAS

OPPOSITE PAGE—

The company is increasing its offer of licensed varieties

LEFT—Christian Corssen, CEO of Compañía Frutera

Santa María

LEFT & BELOW

LEFT—Corssen says adversity of recent seasons has forced the company to sharpen its focus and improve the way it works as a team

It’s important that we work very closely with our customers to plan for the peak supply period and programme good promotions with smooth logistics that allow us to move big volumes but at prices that are profitable for the grower.

Finally, with consumers taking care of their finances, it is key to arrive with a very good product for which they are willing to pay a little bit more.

What big projects do you have lined up for 2023?

CC: We continue to expand our offering of licensed varieties, while at the same time improving the quality standards for traditional varieties. We’re also rolling out new software that will help us improve our quality control systems at origin.

But the most important thing is that we have reorganised our team so that is motivated to face the challenges ahead and provide the service that our producers and customers require. Everything we do is focused on being able to place the right fruit in the right place at the right time in order to achieve the best possible results for our producers.

After joining the AM Fresh group last year, the Alicante-based company is ready to fast-track its production of speciality seedless grapes.

by Maura Maxwell @maurafruitnetSpain’s Uvasdoce is set to significantly increase in its production of speciality table grape varieties after acquiring a new farm and investing in the modernisation and expansion of its packhouse in Alicante.

Last year the company became part of the AM Fresh group following its acquisition by Bluestone Food and Tech Investments, the Murcian investment firm owned by AM Fresh co-owner Alvaro Muñoz.

The deal gives Uvasdoce Fresh, as it is now known, access to the new cultivars develop by AM Fresh’s varietal innovation firm, Special New Fruit Licencing (SNFL Group), allowing it to fasttrack their testing and delivery to market.

“We’re testing a number of new and novel seedless grape varieties

with special flavours and properties at our new farm that we believe will be a big hit with consumers,” says marketing manager Maria Jose Gallego Cutillas.

At the same time, the company is ramping up production of its flavoured line, which features varieties such as Candy Snaps, Candy Dreams, Candy Drops, Candy Crunch and Candy Hearts, along with the increasingly popular Co on Candy, all the product of IFG’s breeding programme, acquired by AM Fresh in 2022.

These are marketed under the company’s Las Chuches de Uvasdoce’ brand, reserved for its sweetest seedless varieties and launched two years ago to encourage healthy eating habits by appealing to families and children.

Gallego says the company will continue to develop the brand,

along with its popular Uvasdoce Nochevieja line, which responds to the Spanish New year’s Eve tradition of eating 12 grapes, one of each month of the year, on the stroke of midnight, which went viral on Tiktok at the end of last year.

With production costs skyhigh and consumers feeling the squeeze economically, Gallego acknowledges that 2023 is likely to be another challenging year for the company.

“It is likely that some people leave out certain products in their weekly shop, in addition to which they will be very aware of prices. We’ll have to work hard to offer them the best product with the best quality, at the best price, so that they feel satisfied with their purchase and come back for more,” she says.

ABOVE—Uvasdoce says it puts quality front and centre for guaranteed consumer satisfaction

Greece’s Zeus Kiwi says the past grape season would have been a great one in any average year, as its growers seek to adapt to a future of higher costs.

by Tom Joyce @tomfruitnet

by Tom Joyce @tomfruitnet

In a “normal” year, the past grape season in Greece would have been a great success, according to Zeus Kiwi, but normal years are starting to appear a thing of the past, and most agree that higher costs look set to stay.

“The market in Europe was quite good,” says managing director Zisis Manossis. “We had a good grape season commercially and the selling price was not bad, but not enough to cover all the extra costs of the last 18 months. We are seeing higher costs for fertiliser and labour, and there is also a shortage of workers. On the packing side, costs have increased by around 20 per cent overall.”

“Growers’ returns have been lower than previous years,” adds sales manager Antonis Ioannidis, “so the growers are suffering and exporters are also facing difficulties. It’s a tough situation, that’s for sure. A couple of years ago, when Covid hit, the impact on logistics was a big concern. Nowadays there is availability of containers and the situation is more stable. But the cost of transport has risen significantly, and that is affecting the overall profitability of growers and exporters.”

According to Manossis, switching to nearby markets in order to cut down on transportation costs is not really

a short-term option. “Some overseas destinations are a possibility,” he says. “But when your market is 100 per cent in Europe, it is not easy to switch to alternative markets quickly. It takes years to build relationships with customers outside Europe. That’s what we’ve been trying to do in recent years.”

“Our growers are also conscious of the need to adapt,” says Ioannidis, “looking at new varieties, fruit that is more productive. I don’t see the cost situation improving in the short term. I think the higher costs will stick with us. Any increase at retail level will not be enough to cover additional costs, and the average consumer has lost a lot of buying power.”

“It is not an easy situation, but what can you do?” asks Manossis. “It is not easy to persuade the retailers to increase their prices. If they can avoid it, they will. And there is a lot pressure from the media to keep prices at the same level.”

“Our growers are conscious of the need to adapt, looking at new varieties, fruit that is more productive”

The risks posed by climate change are becoming an ever-more present threat in table grape production. Growers ignore extreme climatic events, such as rapid and violent rains, hailstorms or excessive solar radiation at their peril.

Mitigating these risks is second nature to Pugliabased Serroplast. The company has been providing a suite of technical solutions for grape growers around the world, including protective nets and canopies, packaging films and a range of vineyard accessories for almost four decades.

“After almost 40 years of experience in the world of table grapes, we are convinced that managing production in the field in a controlled and organised manner guarantees better efficiency in terms of quality and costs,” says new market developer Giuseppe Borracci.

“Knowing how to intervene and react to the consequences of an increasingly evident climate change means creating solid foundations for the entire production and commercial chain. That’s why Serroplast’s strategy has always been focused on offering a direct and tailored service to the farmer, listening to their individual needs.”

He says the know-how the company has today is the result of years of field visits, during which a team of technicians analyse individual customers’ needs, design and install the necessary materials and structures and – crucially – are on hand to provide all the necessary after-sales service.

“Together with the fact that we ourselves have been growing table grapes for more than 25 years allows us to offer our customers the entire package to help them achieve their desired results,” Borracci continues.

Installing covers for large-scale production is a significant financial undertaking and in these straitened times, convincing growers of the need for such an investment is not easy. While Borracci acknowledges the challenge, he insists that highlighting the value of the investment can help to win customers round.

“We are continually improving the competitiveness of our technical solutions so that the agronomic benefits offset the financial commitment and guarantee a reduced time to the break-even point,” he says.

As a result, demand is growing worldwide, particularly in areas where double annual harvesting is possible. Borracci says Serroplast’s technology can guarantee that the quality and quantity of the second harvest is comparable to the first, generating big export gains for the grower that justify the expense of installing the equipment.

At Serroplast, we develop 100% recyclable plastic films to be installed on customized structures, according to climatic and varietal conditions. This is to protect the farmer’s fruit and along with it, the surrounding environment.

DO YOU WANT TO KNOW MORE ABOUT US? VISIT > serroplast.it

We make plastic films for every farmer’s need, all with the same protagonist: Nature .

Leading Portuguese growerexporter Vale da Rosa knows all too well the importance of sustainable growth. Located in the region of Ferreira do Alentejo, one of the country’s poorest and least populated areas, the company says one of its biggest challenges is to find and retain good employees to accompany its ongoing international expansion.

To solve the dilemma, the familyowned company set up the Vale da Rosa Foundation in 2019 to support the growth of the company and region by hiring and training staff from all over the country.

“The main goal of the foundation is to bring families to our region to guarantee a stable workforce for the company and contribute to the local

development of the area,” explains marketing director Susana Ferreira. “As a company we are commi ed to expanding our production footprint and improving the economic situation of Ferreira do Alentejo.”

Today, Vale da Rosa employs around 300, rising to 500 during the peak harvesting season between June and November.

Respect for its surroundings is one of the company’s founding principles. Set up by the Silvestre Ferreira family more than 40 years ago and today run by António Silvestre Ferreira, it prides itself on its approach to sustainability, which is based on six pillars: soil conservation, water management, production factors, pest management, vermicomposting (the use of worms to convert organic waste into fertiliser) and packaging.

Ferreira describes last year as one full of challenges. “The sudden rise in all the costs involved in grape production ate into our margins,” she explains.

“Nevertheless, as always, our focus remained on quality. We have had to learn to be more efficient with what we have and fortunately we were able to achieve our goals

and can consider 2022 a positive year.”

She is similarly sanguine about the prospects for 2023, noting: “As in any crisis, it seems to me that we have to reinvent ourselves. We must not be frightened by the difficulties but seek out the opportunities that always arise in these moments. At Vale da Rosa we try to differentiate ourselves through quality. We work with the best and newest varieties and are in constant search of novelties that justify a fair price.”

And she is confident that this dual focus on quality and sustainability will see the company in good stead for the future. As Vale da Rosa continues to plant new varieties, renovate its farms and expand its acreage, it will forge ahead into new export markets as its production volume grows.

The company is also working on new and more environmentally friendly packaging options. All of its plastic packaging is 100 per cent recyclable and incorporates recycled material in its manufacture, allowing the company to reduce the use of virgin raw materials. And soon, it will introduce a new packaging format that eliminates the use of plastic altogether.

ABOVE—Quality and sustainability are at the core of the company’s ethos

OPPOSITE

Can you tell us a bit about the Namibian table grape business, and the benefits of production in the country?

Andrew Vermaak: It's a very remote area. In 1988, the first 20ha of Thompson Seedless were planted through a very well-known South African grower partnership, and it stayed like that for many years. And then in 2000, the advantages of supply in NovemberDecember became really important as production in the Upington area (of South Africa), the Orange River area, started to increase dramatically. So in Namibia, people said “this could be similar for us”.

The advantage of production in Namibia is that it is two to three weeks before the Orange River. It has clear virgin soils with very good water supply. The annual rainfall is 1-3mm and it's usually in May in June, before pruning. And then, obviously, there is the demand and supply before the Christmas period in Europe and the UK, that was important. As we started implementing professional farming procedures and protocols, it's grown from, let's say, 100,000 cartons up to 9.6m cartons in 2023.

You mentioned a couple of export markets there. Where are the key export markets for Namibia?

AV: Europe is key and the UK is key. The Far East obviously is a market that needs to be developed, and some of the new varieties are giving Namibia opportunities to go to the Far East. But at the moment, you're talking 95 per cent to Europe and the UK.

In terms of new varieties – an area that you are very heavily involved in with Grapa Varieties – which are the most exciting?

OPPOSITE

AV: The demand from the client has changed a bit and everyone's talking about taste. Flavour is the key word for the new varieties, like Honey Pop for instance. Due to the dramatic increase in costs, more labour-friendly varieties and those with higher yields are also the preferred choice for growers. So a variety like Honey Pop will replace, in my view, the likes of Prime and Early Sweet. Then we have the Arra 15 and we have Sweet Globe. Sun World has just entered Namibia after 20 years of not being involved in the country, so there's also AutumnCrisp.

Due to the low rainfall and climatic conditions, basically all the varieties can now go into Namibia. The industry is more than 20 years old, knowledge is much more available and there are fewer mistakes. We are talking about 28-40 days of shelf-life that you need, so the new varieties replacing Flames, Thompson Seedless and Red Globes have given us the opportunity for high yields, better shelf-life and flavour.

How is the Namibian table grape industry facing up to the really big challenges that we're seeing across the industry?

AV: It's extremely sensitive at the moment. I think most people don't understand the problems with fuel, electricity, labour costs, shipping costs – after Covid it was unreal, costs were three times more than before the pandemic – and it all comes back to the growers

as expense. The sad thing in my mind is that the price per kilo or for 500g of grapes is the same as what I received in 1984, and it's now 2023, I do understand that the entire world is also in a tight spot – salaries after Covid and so on –and that consumers will prioritise potatoes and bread. This is where the new varieties come in because of the lower labour costs and high yields. You need to maximise your profits, but it's very sensitive. It's a difficult, tough time, a really tough time.

What about the well-documented logistical problems in the region?

What is the latest with that?

AV: I must say that the South African table grape industry (SATI) has had an amazing few months of communication with Transnet, and things are running much smoother than 12 months ago, when it was absolute chaos. From

the port side, we’ve seen a 50-60 per cent improvement. We've just heard that the government will now allow private shareholders to come into Transnet so it will be run as a business. I think I am always optimist, and I'm sure that things will improve.

Where do you see the Namibian table grape business heading?

AV: We always talk about volumes, that is the nature of our industry, and we said in 2005 “If we reach 4m cartons, we are happy”. Now it's 9.6m cartons. As long as there are opportunities if you can invest and get a return on that investment then I'm sure it will grow, maybe not at the pace we would like, but I'm optimistic and there is never a ceiling.

There are regions where grapes were planted in summer rainfall areas. We've seen now that because of climatic changes, it's getting really difficult to grow grapes in these areas. So that could be an area of decline, and that this could be an opportunity for Namibia to increase its volumes. I could be wrong but I think this will be an opportunity for the country.

“Demand from the client has changed a bit and everyone is talking about taste. Flavour is the key word for new varieties”

With less than three months of the country’s grape season left, the focus is now firmly on the mid- and late-season regions of the Western Cape.

by Fred Meintjes

by Fred Meintjes

After a difficult start South Africa’s table grape season is in full swing, with growers in the mid- and late-season areas expected to meet or exceed targets. This marks a recovery after disappointing volumes in three early regions during the first months of the season.

While South Africa’s Table Grape industry body, SATI, said that table grape growers were expected to deliver peak volumes as various cultivars ripen, it is also clear that the trend towards a lower crop is continuing.

Two early regions have

completed their packing and in the northern regions things went slightly better than predicted, with 5.5m cartons delivered for export. In the Orange River, South Africa’s biggest early table grape region, 16.3m cartons were delivered for inspection, 2 per cent higher than the original estimate. Significantly, though, export volumes have dropped by 27 per cent in this region compared with last year.

The harvesting season is now focused on the midseason Berg River Valley and the late season Hex River in the Western Cape. SATI said that good weather had been experienced in both regions. The Berg River is expected to pack just short of 20m cartons, while the Hex River now forecasts a 24m carton crop. The South African season will conclude in April.

SATI noted that the current electricity supply problems in South Africa and the use of load shedding

to manage supply remain a challenge for the industry and country. A ministerial task team has been appointed to investigate potential solutions, while the association said that two surveys had been circulated amongst growers to try and better understand the situation.

In February load shedding reached level six, meaning that supply is disrupted for more than ten hours a day. SATI said it was partaking in weekly industry forums discussing various factors including load shedding and would continue to inform growers accordingly.

“Liaisons with the network supplier, Eskom, to explore load curtailment efforts are ongoing,” SATI stated. ”Progress has been made in two table grape growing regions, with Hexkoel, the central cold storage complex in the Hex River Valley granted the opportunity to introduce load curtailment during certain time frames and a one-month curtailment pilot project approved in the Berg River Region.”

TOP—There is a trend towards a lower table grape crop LEFT—Grape volumes in mid- and lateproduction areas are on track

It marks a recovery after disappointing volumes in three early regions during the first months of the season

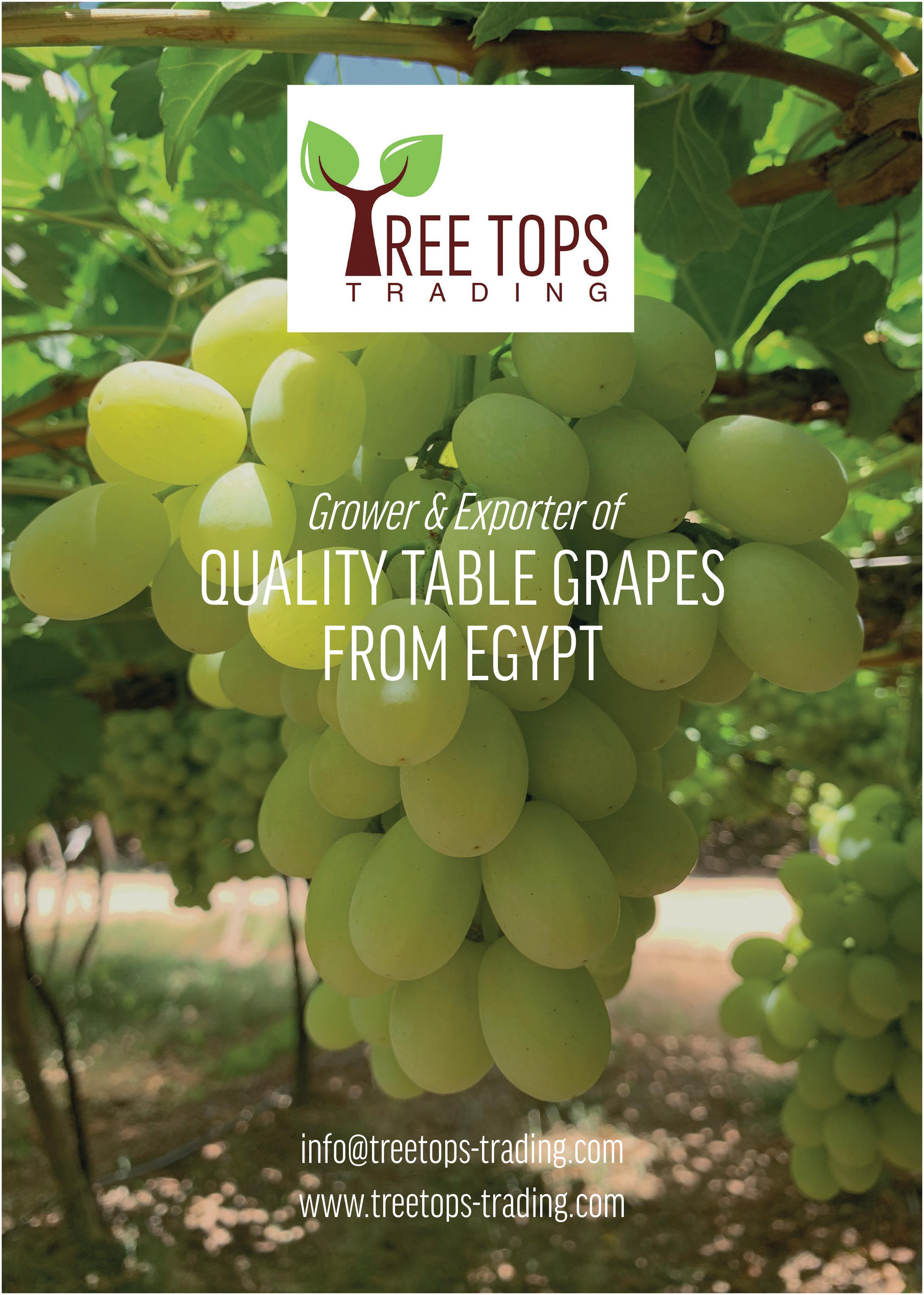

The depreciation of the Egyptian pound is exacerbating rising costs for Egyptian firms, but progress on new varieties is good news for the country, says Karim Fayed, operations manager at Fata Farms.

by Tom Joyce @tomfruitnetWhat advantages does Egypt enjoy over some of its competitors in the European grape market?

Karim Fayed: Two of our main competitors in the grape season are India, which comes right before us in the EU market, and Spain which comes right after us. One advantage we have is a shorter transit time than India and we offer a quality that our customers really

appreciate. Regarding Spain, we are lucky to have great late varieties that keep EU customers buying from us even when Spain arrives on the market, since they only have the Ralli during that time.

How have weather conditions affected production? Are climatic conditions becoming more of an issue?

KF: Weather conditions have been a challenge for us growers in recent years as we find it difficult to use our extensive data from previous years to predict important stages of our season today, as well as issues like pests and diseases.

How are rising costs affecting you?

KF: This is arguably the most challenging year we have faced in terms of costs and reductions to our margins. The cost of the plastic needed to cover our grapes has risen by 200 per cent this year, not to mention the imported fertilisers and packing materials that keep rising by the day as the Egyptian pound depreciates against the dollar. Maintaining the best quality while reducing costs has become a key challenge we have in our daily operations.

Have you made any new investments aimed at improving quality and maximising output?

KF: We are looking to invest in a new fogging system at the packhouse to chill the produce as soon as it enters the packhouse before it gets to the appropriate temperature to be sent to the

sorting lines. Moreover, we are aiming to have semi-automated grading lines in the packhouse to reduce our dependency on seasonal workers, as well as reducing our wastage and human error.

We are very happy to announce that we just signed with IFG this year after signing with SNFL and Sun World in the last two years. We are working on improving our grape variety portfolio amidst the very difficult investing environment in Egypt to match our clients’ ambitions.

What are you looking for in a new variety?

KF: We are looking at new varieties in our trial plot such as ARD 42 from the new Grapa varieties and Sugra53 from Sun World. We also just planted Sweet Globe and Sweet Celebration from IFG for our late season market.

Regarding new varieties, we are looking at the potential of some varieties to substitute Flame in the early red seedless market. It’s also important for new varieties to be cost-efficient and not require a lot of manpower during the year.

Do you think the efforts of Egyptian authorities to enforce IP rules is good for the country’s producers?

KF: Very good. It is very important to note that Egypt is a big player

all year round in exporting fresh fruits and vegetables to European markets, and with that rule it shows that the government is working alongside its growers to help provide the best varieties and quality that can compete with all other markets. This has allowed some of the biggest breeders to come into the Egyptian market with more varieties and trust that the Egyptian authorities will take the required action in case of any breach.

Which other markets are looking promising at the moment?

KF: Asia looks promising, especially for very late varieties when Spain takes over the EU market. We currently export to East Asia, including Hong Kong, and will be looking to start working with other countries such as Singapore and Malaysia this year.

Is sustainability becoming increasingly important at Fata Farms? What sort of initiatives are you involved in?

KF: Sustainability is becoming very important both from an economic and an environmental standpoint. As previously mentioned we are currently looking for ways to reduce costs and we are taking the first steps toward having our farm completely running on solar energy in the short to medium term.

Regarding water consumption, we are applying for Spring certification this year as well as currently having a semi-automated fertigation machine running on our blueberry project that allows us to minimise our water usage and save water. Should it be successful we can look to have that working on all our grapes and stonefruit fields as well.

Wages at Fata have had to be increased twice since last summer as a result of the strong depreciation of the Egyptian pound against foreign currencies, as well as increasing living costs due to the ever-rising prices of imported goods.

PICTURED—Fata Farms says the best breeders are coming to Egypt, offering the highest quality varieties

“It’s important for new varieties to be cost-efficient and not require a lot of manpower during the year”

While China is the world’s largest table grape consumer, representing more than 46 per cent of global consumption, grapes are underrepresented in the fruit basket, with only 26 per cent of Chinese consumers purchasing them.

This fact was pointed out by Josep Estiarte, CEO of SNFL, at a tasting day for Peruvian table grapes held at the Jiangnan wholesale market in Guangzhou recently. Following the launch event for the trade, a series of consumer-facing promotional events also took place in City’super store in Shanghai, at which SNFL said it received positive feedback from the shoppers.

Headquartered in Hong Kong, City Super Group is a retail chain selling premium products. Among its fresh produce offering, table grapes are on the shelf all year round. Momo Huang, fresh produce

procurement manager of City’super Shanghai, says the retailer is working closely with Chinese importers such as Riverking and Frutacloud for imported grapes. Australia and Peru are their two favourite off-season suppliers from the Southern Hemisphere.

“City’super is not sensitive about price, but pays more attention to quality and unique features of products. Australian table grapes with high quality match our customers’ demand,” she explains.

“As for Peru, they have been very active in bringing in new varieties in recent years, in line with our customers’ curiosity about new products.”

New varieties are a main focus for City’super. Last year, the retailer, together with Korea Agro-Fisheries & Food Trade Corporation (aTcenter) live streamed a launch event for the new variety Sunny Dolce.

“Korean fruit is also considered very high quality. As a result, we always make sure to highlight this point. During the live stream, we invited a dessert

chef to create recipes featuring Korean-grown Shine Muscat grapes, bringing an immersive live broadcast experience to the audience,” Huang says. “The live stream was quite a success and we saw a wave of sales afterwards. “

According to Huang, varieties such as Shine Muscat and Autumn Crisp have brought green grapes to the fore in recent years. “Green varieties, such as Candy Heart, normally have bigger berries as well as a crisp and sweet taste that help them stand out,” she says.

“Our customers are getting more and more ‘picky’ now. Seedless, crisp, sweet and unique aroma are some of the factors that they consider when purchasing. There is news that grape varieties with floral or mint scent have been developed and I believe that will excite the consumers.”

Another trend in the Chinese market is the wide variety of packaging on offer. Thanks to China’s well-developed online retail and home delivery channels, there are different types of packaging to suit different ways of purchase.

“Boxes are good for home delivery,” Huang explains. “When shopping in person, bags or trays are accepted. As I can see, small plates of ready-to-eat packages will be a trend for Gen Z consumers.”

“Our customers are getting more picky. Seedless, crisp, sweet and unique aroma are some of the factors they now consider”At City’super, China’s premium supermarket chain, shoppers are seeking products to brighten their day.

Consumer research is helping the Australian table grape industry deliver on quality.

by Liam O’Callaghan @liamfruitnet

by Liam O’Callaghan @liamfruitnet

In 2019 the Australian Table Grape Association (ATGA) introduced national minimum maturity standards for domestic and export markets to ensure growers harvest their fruit at the optimum maturity.

It was felt that improved eating quality and consistency throughout the season would be er meet the needs of both domestic and export customers; resulting in increased purchasing, increased average weight of purchasing, be er returns/ profitability and a reduction in waste.

To help further understand how this standard delivers be er quality grapes for domestic consumers the ATGA has been working with grower-owned, not-for-profit

research and development corporation Hort Innovation, Kitchener Partners (retailer engagement), QAPartners (fruit monitoring), NielsenIQ (consumer monitoring) and Australian retailers to measure consumer sentiment towards Australian table grapes across the last three seasons.

As part of the multi-year project, consumer insight specialist NielsenIQ has been surveying shoppers who purchase Australian table grapes across the season to help demonstrate consumer acceptance across locations and retail channels.

The project – funded by Hort Innovation, using the table grape research and development levy and contributions from the Australian government –provides the industry with hard data about the link between optimum maturity, a quality grape and a positive consumer experience.

It is also providing insight into consumer behaviour such as key purchase drivers, eating occasions and

knowledge of table grape varieties.

Collating this data gives all stakeholders along the supply chain, including growers, packers, market agents and retailers, evidence of how a grape’s journey to the point of purchase can affect consumer decisions.

Equipped with this information, industry is able to further improve its practices and retailers are able to more effectively present their product to give consumers an even be er experience when they purchase Australian table grapes.

The improvements made by the Australian industry from these domestic learnings are also set to help its export offering as it works to deliver the best possible eating quality.

The project has provided a window into what Australian consumers are thinking when they purchase table grapes. The most popular colour is green with around three quarters of consumers opting for the lightest colour, this is followed by red which is closer to a third and black which is around 10-20 per cent. However, there remains limited knowledge of table grape varieties with most consumers unaware of specific varieties beyond green, red and black.

According to the data a combination of quality and price are the top drivers of purchase. Quality, stock levels and ease of finding all help drive consumers to choose table grapes when they are in-store.

Snacking remains the main reason consumers purchase table grapes but there are other occasions such as lunch and morning/ a ernoon tea that consumers turn to table grapes.

Table grape growers and retailers can harness this information to help drive quality and make grapes the first choice when consumers decide between the plethora of options in the competitive Australian fruit and vegetable market.

ABOVE—Freshness, price and taste are the top three drivers of purchase for Australian consumers

Indian plastic punnet manufacturer is helping the table grape industry comply with an increasing number of requirements.

by Liam O’Callaghan @liamfruitnetAvi Global Plast is leveraging its decade-long experience and technical expertise in manufacturing punnets with recycled content certified by InterTek to help table grape growers, exporters and retailers meet the latest packaging demands.

Stringent plastic packaging laws are being introduced across

the globe and Avi has updated its rPET punnet offerings to meet these new benchmarks. Director Sukhdeep Sethi says Avi takes a holistic approach to meeting its customers’ sustainability needs.

The company’s rPET punnets are not just designed with PET waste but can also incorporate ocean-bound plastic certified by Control Union and Zero

Plastic Oceans, to ensure the highest standards in environmental protection.

Meanwhile, downgauging has helped Avi reduce the amount of plastic used while preserving the integrity of the packaging and the grapes inside, reducing food waste and its associated environmental impact. The punnets can be deposited by end-consumers for further recycling resulting in be er end-of-life outcomes.

Meeting new sustainability requirements can o en come at a cost, an equation that Avi believes makes off shore sourcing from India a viable option. Sethi notes India recycles approximately 90 per cent of its PET waste. This abundance of material reduces variability in price and supply, thus reducing the cost of using recycled content in packaging.

Sethi says this cost advantage, combined with Avi’s extensive market knowledge, machine automation, and in-house capabilities – such as tool-making with testing and custom thermoforming – position the company perfectly to meet any international interest.

Australian table grape brand a hit with consumers.

by Ma hew Jones“The leading cultivar licensed varietals offered through the IFG breeding programme have been the key to the success of the Hellooo programme, due to their distinctive and innovative characteristics.”

Caia says the Hellooo range has been well received by Grape Co Australia’s customers and endconsumers, both domestically and in export markets. The company works with its sales partners to grow brand recognition and awareness of the various varieties.

“Collaborative and continued promotion with our valued customers has significantly contributed to the success of our Hellooo range,” says Caia.

“We are continually working on innovative and unique promotional activities to deliver across our customer base.”

Leading fruit breeder Sun World International appointed Grape Co Australia as one of its licensed growermarketers for Australia in July last year (2022).

Although previously licensed to grow Sun World varietals, Grape Co Australia can now market and distribute Sun World varieties internationally.

“The collaboration with Sun World provides access to a portfolio of leading and advanced cultivars, which complement our current varietal offering,” says Caia. “It provides a further opportunity to extend our window of supply with early and late season varieties.”

LEFT—Co on Candy is one of the trademarked varieties in the Hellooo range

An innovative brand concept from Grape Co Australia is introducing consumers to a unique range of table grape varieties.

The leading grower-packer-marketer has developed the Hellooo brand, brought to retail shelves via various pack-types, including pre-packed punnets.

The brand is used to promote Candy Hearts and Candy Snaps, exclusive varieties to Grape Co Australia in the Sunraysia region, Victoria, Australia. The Hellooo range also includes the trademarked Co on Candy, Sweet Sapphire and Sweet Nectar.

Each variety’s packaging displays a distinct artwork design, reflecting the unique characteristics of the proprietary offerings in the range.

“The range offers consumers a wide selection of unique, flavoursome tastes and desirable textures,” explains Adrian Caia, managing director of Grape Co Australia.

Discussing the production outlook for the current 2022/23 season, Caia says a late start to harvest shouldn’t derail the campaign.

“Although the harvest period here in the Sunraysia region is running slightly later than usual, we are very excited about the upcoming season,” Caia explains.

“Despite a challenging growing season, which included above average rainfall, overall fruit quality is looking very promising across all varietals. Projections on yields are also up across plantings, compared to volumes produced last season.

“Favourable weather conditions permi ing, we are well positioned to deliver our customers a successful export programme over the coming months.”

Grape Co Australia began exporting in the first week of January, with sales set to extend through to late June or July.

Result Group has been recognised with a global award for its work on the Australian Table Grapes Traceability Pilot. The Melbournebased company won the fresh fruits and vegetables category at the 2023 WorldStar Awards, presented by the World Packaging Organisation (WPO).

The awards registered 488 entries from 41 countries, growing from 440 entries and 37 countries in 2022. “These numbers confirm that WorldStar is the most prestigious and important packaging award in the globe,” says Soha Atallah, WorldStar coordinator and WPO vice-president of events.

The Australian Table Grapes Traceability Pilot was one of the largest traceability and authentication projects deployed in Australia.

To help grape growers connect with consumers and supply chains,

as well as improve consumer safety and quality standards, Result Group developed an industrycustomised traceability platform.

This was supported by a label printing and management programme, NiceLabel, as well as process automation and scanning technologies, designed to collect end-to-end shipping data.

More than 840,000 units of table grapes – including bunch bags, clamshells, and cartons – were labelled with a unique serialised QR code, further enhanced by the use of GS1 Digital Link standards. The grapes were exported to over 15 markets in the Asia-Pacific region. The aim was to sell more Australia table grapes by proving authenticity and provenance.

Michael Dossor, Result Group general manager, says collaboration was key to the pilot’s success. “Winning the award is very humbling and a great recognition

for our hard-working and dedicated team,” Dossor explains.

“Collaboration with current system vendors and developing interoperable protocols is always a challenge and requires trust and respect. The upside, it opens up new opportunities in the traceability sector, as we continue to strive to further innovative solutions in the Australian market.

“We couldn’t have done it without our partners, the Australian Table Grape Association, Agriculture Victoria, Perfection Fresh Australia, and GS1 Australia, so this is a joint triumph.”

The WorldStar Awards are open to packaging solutions that already received a national or regional packaging award in a competition recognised by WPO during the last 24 months.

Result Group was awarded Silver in the ‘Outside of the Box Design’ category at the 2022 (AIP) Australasian Packaging Innovation & Design (PIDA) Awards, thereby qualifying for the WorldStar Awards

New US study shows taste, appearance and pesticide levels are more important considerations than whether grapes were bred using gene editing.

by Maura Maxwell @maurafruitnetNew research led by Washington State University shows US consumers care more about taste than gene editing when it comes to selecting table grapes. The study, published in the journal PLOS One, surveyed more than 2,800 people across the US to see how accepting they might be of gene-edited table grapes, even though none are yet available on the market.

Most respondents cared more about the grapes’ taste, followed by their appearance, than how they were bred. Participants also ranked a preference for fewer pesticides, third, and only fourth, did they express a slight preference for traditionally bred grapes over geneedited ones.

“In general, the biggest thing they cared about is taste, the flavour-related a ributes,” said Karina Gallardo, a WSU economics professor and corresponding author on the study. “They did state wanting a price reduction for gene editing, but the difference was not statistically significant, which means they were basically indifferent.”

More than half of the survey participants said they knew the difference between the geneediting technology CRISPR, and genetic modification, which involves combining genes from different species, although they couldn’t state what exactly that difference was.

To better understand the survey responses, the researchers segmented the participants into

four groups depending on their level of acceptance of geneediting.

They found that one group, representing 22 per cent of the participants, who were the most accepting of gene editing were also the most informed and trusted many sources of information, ranking scientific sources the most highly.

The group that most strongly rejected gene-editing, accounting for about 16 per cent of respondents, knew the least about the technology and had li le trust in any sources of information including scientists, government and the media.

The other two groups were seen as slightly or moderately rejecting gene editing.

Very few gene-edited foods, and currently no gene-edited table grapes, are sold in the US. But applications to market gene-edited food products are expected to increase.

According to Gallardo, the technology will become an increasingly important tool for producers to meet demand for food especially in the face of climate change and its associated increase in pests and plant diseases.

“We cannot rely on the plant breeding technologies of 30 to 40 years ago to make improvements we badly need now,” Gallardo said. “People should know that this technology is safe. Gene editing has been developed in academia, so everything is transparent. We publish everything we do. Nothing is hidden.”

In addition to Gallardo, co-authors include first author Azhar Uddin of WSU’s Institute for Research and Education to Advance Community Health (IREACH) and Bradley Rickard of Cornell University as well as Julian Alston and Olena Sambucci of University of California, Davis.

Arecent human study published in the scientific journal Antioxidants has found that consuming grapes protects against ultraviolet (UV) damage to the skin. Subjects showed increased resistance to sunburn after consuming 2 1⁄4 cups of grapes every day for two weeks.

Additionally, subjects displaying UV resistance demonstrated unique microbiomic and metabolomic profiles suggesting a correlation between the gut and skin. Natural components known as polyphenols found in grapes are thought to be responsible for these beneficial effects.

The new study reinforces previous research in this area. In this investigation with 29 human volunteers, researchers examined the impact of consuming whole grape powder – equivalent to 2 1⁄4 cups of grapes per day – for 14 days against photodamage from UV light.

Subjects’ skin response to UV light was measured before and a er consuming grapes for two weeks by determining the threshold dose of UV radiation that induced visible reddening a er 24 hours – the Minimal Erythema Dose (MED). Additionally, metabolomic analysis of the gut microbiome, blood, and urinary samples was undertaken.

Ultimately, one-third of the subjects demonstrated UV resistance following grape consumption, and these same subjects displayed significant differences in the microbiome and metabolome compared with the non-responders.

Notably, the same three urinary metabolites were depressed in the UV-resistant group. One metabolite in particular (2’-deoxyribose) is a strong indicator of reduced photodamage and suggests unique genetic profiles of relevance for personalised medicine.

Furthermore, three of the UV resistant subjects showed a

New study reinforces promising role of grapes in photoprotection.

by Maura Maxwell @maurafruitnetdurable response where UV protection remained a er reverting to no grape consumption for four more weeks. This work suggests that a segment of the population is capable of resisting sunburn following grape consumption, and that there is a correlation between the gut-skin axis and UV resistance.

Millions of people are affected by skin cancer each year, largely as a result of exposure to sunlight. It is estimated that one in five Americans will develop skin cancer by the age of 70. Most skin cancer cases are associated with exposure to UV radiation from the sun: about 90 per cent of nonmelanoma skin cancers and 86 per cent of melanomas, respectively. Additionally, an estimated 90 per cent of skin ageing is caused by the sun.

John Pezzuto, lead author of the paper and professor and dean at Western New England University in Springfield, MA, said: “‘Let thy food be thy

medicine and medicine be thy food’ dates back to the time of Hippocrates. Now, a er 2,500 years, as exemplified by this human study conducted with dietary grapes, we are still learning the reality of this statement.”

This work suggests that a segment of the population is capable of resisting sunburn following grape consumption

Together we can do something meaningful for the good of Planet Earth. But also you can do something meaningful for you and your harvest: by choosing our Serroplast 100% recyclable plastic films you save up to 30% of water, protect the soil fertility and reduce pesticides.

DON’T WASTE YOUR FUTURE, DON’T WASTE YOUR TIME, VISIT > serroplast.it