Above the clouds

As rising costs and lower demand cast a shadow over the market, Italy’s leading produce suppliers a empt to rise above the storm

THE ANNUAL PUBLICATION FROM FRUITNET MEDIA INTERNATIONAL NEWS INTERVIEWS ANALYSIS SUPPLIERS BUYERS INNOVATION

SUSTAINABILITY MARKETING

p.15 FF (Italy Cover).indd 1 13/04/2023 09:58

Home of apples

The Origin of our apples, Expertise that has ripened over years of working together, a focus on Sustainabilty: this is where our wide variety of Products and Brands comes from. These are the building blocks of our company, where the best apples can always be found.

VOG Eurofruit AZ EN 210x297+3.indd 1 09.02.23 09:41

Suppliers remain on a perilous path

Italy’s fresh produce business must hold its nerve as it heads towards 2024. On the surface, the country’s fruit and veg exports remained in good shape overall during 2022, and earned a little more than they did in 2021 from more or less the same volume. But that increase has been attributed, at least in part, to soaring inflation, some of which no doubt has been absorbed by suppliers and, to a lesser extent, their customers. In the 12 months ahead, it seems the issue of inflation could have a lasting impact: not necessarily on the supply side, where the white heat of those energy and transport costs has at last begun to cool, but potentially in the markets themselves, where geopolitical and economic shockwaves have continued to influence consumer behaviour for a more sustained period of time. The road to sustainability is suddenly not just one paved with greener environmental and ethical milestones, but with financial ones too. That’s because the seismic shifts caused by Russia’s invasion of Ukraine have left this path to profit perilously high above a chasm of economic ruin. As a result, Italy’s fruit and vegetable suppliers must work even harder to survive and compete at a time when the fresh produce business has never seemed more perishable

01 fresh focus italy

Contents Analysis: Exports, imports and demand 2-4 Interview: Luca Antonietti, Novafruit 6-7 Interview: Giancarlo Amitrano, Cedigros 8-10 Mazzoni extends kiwifruit supply base 12 Apofruit puts faith in premium berries 14 Innovation inspires apple trade 16-19 A bright future for two key pear brands 20-21 Tough times for grape export business 22-23 New impetus for citrus suppliers 24-25 Ondine flat peaches start to make waves 26 Pachino tomatoes on McDonald’s menu 28 Fennel specialist on fertile ground 30-31 Mike Knowles, Editor

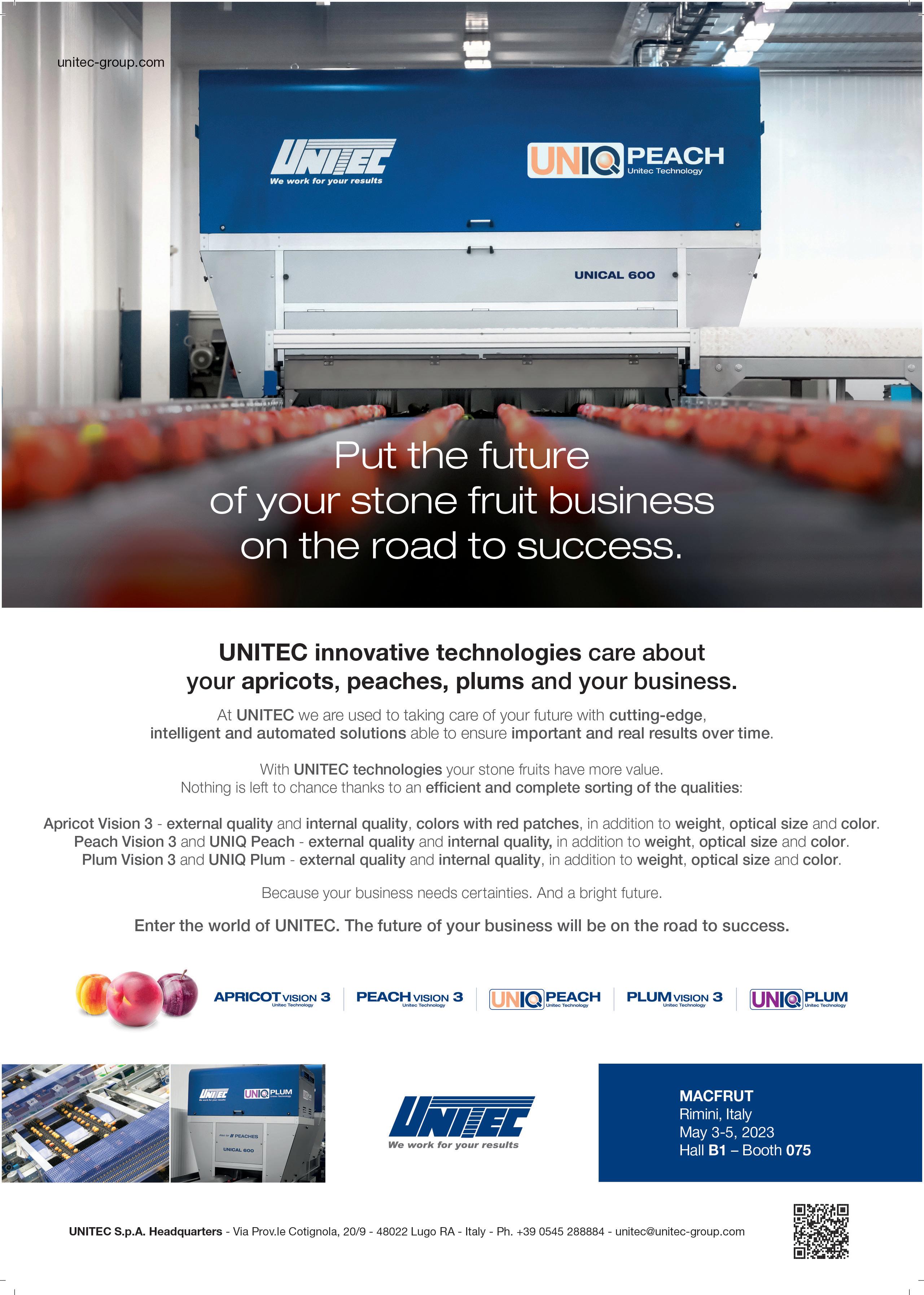

Asiafruit Congress 2023 17 Apo Conerpo 11 Apofruit Italia 15 Crimson Snow 19 Festival of Fresh 2023 13 Fruitbox IBC Frutmac 27 Global Tomato Congress 2023 29 Global Tropicals Congress 2023 9 Ilip 23 Macfrut 2023 31 Martignani 25 Melinda 18 Serroplast 5 Unitec BC Vip 3 Vog IFC © Fruitnet May 2023 · Full details at Fruitnet.com Follow me on LinkedIn @mikefruitnet Follow me on Twitter @mikefruitnet p.17 (1) Leader.indd 1 13/04/2023 10:08

While inflation has started to ease, the impact of recent economic and geopolitical pressure continues to make life difficult for Italy’s fresh fruit and vegetable exporters

Advertisers

Inflation weighs down Italy’s expansion

The country’s fruit and vegetable business faces an uphill struggle as exports come under intense pressure and consumer demand enters a worrying decline.

by Mike Knowles @mikefruitnet

Italy’s fresh produce trade continued to grow in 2022 and build on a recordbreaking result in 2021, but some big challenges remain for the country’s second highest-earning agrifood sector behind the wine trade. In particular, the recent rapid rise in inflation may have a lasting impact into 2023, as consumer demand comes under continued pressure.

According to Istat data analysed by trade association Fruitimprese, the value of the country’s fresh produce exports increased by 1.5 per cent to reach €5.3bn, while

volumes remained steady compared with the previous year, down by only 0.4 per cent.

However, a positive trade balance of around €666m was back down to 2020 levels, 38 per cent lower on the year. Meanwhile, the balance of volume traded decreased by 110,001 tonnes, with the 3.7m tonnes of produce imported notably a li le above that exported – approximately 3.6m tonnes.

Fruit continued to generate the bulk of the country’s fresh produce export revenue. That sales drive was led by apples (€863m), table grapes (€738m), and kiwifruit (€509m). Fruitimprese noted that fruit continued to perform well despite some serious challenges posed by rising production costs and geopolitical tensions. Fresh fruit sales were up 6.3 per cent to €2.8bn, but this was partly as a result of inflation.

For vegetables, meanwhile, there was also positive growth: total sales were €1.6bn, up 4.1 per cent. Exports of dried fruit struggled, down 25.8 per cent due to declining consumer demand. Exports of citrus increased 2.4 per cent in value terms, but the amount imported (403,000 tonnes) was almost 14 per cent higher yearon-year, and more than double the volume Italy exported (201,000 tonnes). Vegetable imports were also up significantly, by 34.1 per cent.

02 fresh focus italy ANALYSIS

p.18-20 (S2-4).indd 2 13/04/2023 10:10

ABOVE—Italy has plenty of fresh produce to offer consumers (Photo: Adobe Stock) »

Among Italy’s most exported products, peaches and nectarines also performed very well, with sales up 43.5 per cent due to a poor season in Spain. But there were production challenges for oranges and pears. Among the leading imported products, bananas and pineapples increased in value, by 12.6 per cent and 15.9 per cent respectively, in line with inflation.

Commenting on the results, Fruitimprese president Marco Salvi underlines the overall resilience of the sector despite some big economic challenges –not least the EU’s increasingly stringent rules on packaging, and a worrying decline in consumption.

“The competitiveness of fruit and vegetable companies has been severely tested in 2022 by increases in energy, transport, packaging, and fertiliser costs that are out of control,” he says, “and

we continue to demand a fair redistribution of costs and responsibilities along the entire production and distribution chain.”

DOMESTIC CONCERNS

One big problem for the majority of Italy’s fruit and vegetable companies is the downturn in consumer demand. With the exception of cabbage, the volume of all vegetables sold in 2022 was lower than in 2021, and by 20 per cent for some products including asparagus, radicchio, and fennel. The average decline in vegetables was 9.4 per cent, exceeding that of fruit (-7.8 per cent).

“This made 2022 unusual, because normally a decrease in fruit and vegetable consumption has always depended more on the fruit,” comments Elisa Macchi, director of CSO Italy. Average retail prices in the country rose by 13 per cent overall, and according to Macchi this was in part due to problems in production.

“Let’s not forget that vegetables are among the products most sensitive to climatic trends, and during 2022 we had several calamitous events,” she observes.

“The biggest drops in consumption have not always been recorded at the same time as the biggest price increases and vice versa.”

It’s important to note that sales of frozen vegetables in Italy were up on 2021, by around 9 per cent excluding potatoes. “Certainly, families find themselves in a very particular economic moment,” Macchi adds, “and to encourage the purchase of [fresh] fruit and vegetables there is an increasing need to produce well and communicate even better.”

ABOVE—’Freshness at prices never seen’ for shoppers in a branch of Conad

04 fresh focus italy ANALYSIS

“The competitiveness of fruit and vegetable companies has been severely tested by cost increases that are out of control”

p.18-20 (S2-4).indd 4 13/04/2023 10:10

At Serroplast, we develop 100% recyclable plastic films to be installed on customized structures, according to climatic and varietal conditions. This is to protect the farmer’s fruit and along with it, the surrounding environment.

DO YOU WANT TO KNOW MORE ABOUT US? VISIT > serroplast.it

We make plastic films for every farmer’s need, all with the same protagonist: Nature .

doc.indd 1 24/02/2023 15:18

Broad horizons bring brightest opportunities

One of Italy’s most international fresh produce traders, Luca Antonietti, talks exclusively to Fresh Focus Italy about the continued challenge of opening markets outside Europe, the importance of supply chain partnerships, and opportunities to invest in production closer to home.

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

Over more than two decades, Genoa-based company Novafruit has transformed itself from an exportfocused trading company into a strategic partner for suppliers and customers all across the globe. Today, the company operates in almost every region of the world, connecting fresh produce supply chains with market demand, wherever that may be. As a result, managing director Luca Antonietti is well placed to comment on recent market trends that have a direct impact on Italy’s own fruit and vegetable export trade.

Luca, when I first met you, you were based in Genoa, in northern Italy. Nowadays, you are more likely to be found outside Italy, at your office in Dubai for example, as you continue to maintain and develop commercial relationships with customers across the world. How important has that business outside Europe become?

Luca Antonietti: The Middle East market has become a bit more difficult but we do have an advantage there because we have a presence with our office in Dubai. We’re in direct contact with the supermarkets and we have direct commercial links with the most important importers and

INTERVIEWS 06 fresh focus italy

p.22-23 (s6-s7).indd 6 13/04/2023 10:14

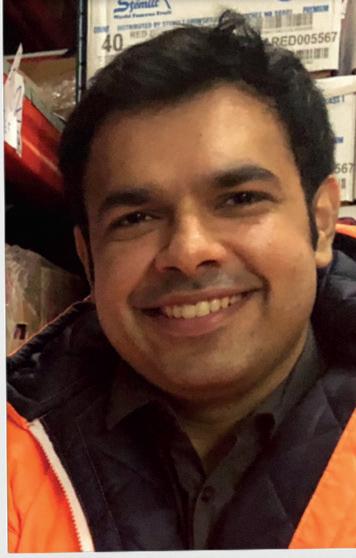

BELOW—Luca Antonietti is managing director of Novafruit

coldstorage operators. So we can more or less maintain the market share we have built up in the last 20 years.

Asia is another very important market for us. But in the last few years it has diminished slightly. Not by much, but some markets have become more difficult for Italian product in particular. For example Indonesia, as you will know with its phytosanitary measures has become much more closed and complicated. Also Taiwan, where we used to send around 120-150 containers during the kiwifruit season, now we only do around 50 because the market has become more complicated due to phytosanitary and import regulations, as well as temperature testing.

China, for Italian kiwifruit, is not easy at all. At the moment, the preparation required costs too much and the risk of running into problems is very high. China is a market with huge potential, but it’s too tricky at the moment. We have a presence there and send a few containers per year, but not much.

Which markets look good for Novafruit right now?

LA: The markets that have grown for us are North America, South

America and South Africa. That’s kiwifruit from Italy and Greece to North America; kiwifruit, apples and plums to South America; and we’re sending citrus from Spain, stonefruit, and Italian kiwifruit to South Africa. We’ve been doing Spanish citrus to South Africa for quite a few years now. The South African authorities can be fairly strict when it comes to allowing European product into their own country, but we have already managed this for 15 years.

What about on the procurement side, from which other parts of the world outside of Europe do you now source produce?

LA: In South America, we have our own company in Ecuador, which exports a lot of bananas. Then of course we source lots of other products like kiwifruit, apples, grapes, stonefruit and citrus from South America. In Peru and Chile we do this through partnerships. We do grapes and pomegranates from Peru, for example, as well as asparagus and blueberries. From Chile, we do kiwifruit, apples and grapes. We try to bring kiwifruit from the Southern Hemisphere to our clients in Middle East and Asia when Italy’s season is finished. Then from Argentina it’s mainly citrus.

In which other parts of the world are you trying to develop new business at the moment?

LA: Another place where we have been working is in Brazil, to procure apples for customers in India and the Middle East. But last season the demand was in the other direction and we did some good work taking Italian apples to Brazil.

In the past couple of decades, it seems like you have managed to create quite an extensive network of suppliers and customers around the globe, right?

LA: Exactly, that’s really positive because by diversifying a lot, we reduce the risk and we can always go somewhere. If one market goes bad and one goes well, it balances out. We change our programme constantly to react to the situation that exists at any time. We don’t depend exclusively on Italian kiwifruit, for example. And after 25 years or so, we have got used to it. What is important is to work with good business partners in production and logistics. Without them, customers will go elsewhere.

And despite the various challenges that you currently encounter in the international fresh produce business, what new opportunities do you expect to see in next few years for Novafruit?

LA: We are considering the possibility that we might invest in some production, although not in a major way. We have opportunities in various places, for example in the kiwifruit business in Italy itself or in Greece, but we need to evaluate them properly. There are other investment opportunities, in new varieties of grapes in Peru, for example, and in Ecuador for bananas.

INTERVIEWS 07 fresh focus italy

p.22-23 (s6-s7).indd 7 13/04/2023 10:14

By diversifying, we reduce the risk and can go somewhere… If one market goes bad and one goes well, it balances out

Prices put pressure on retail procurement plan

Fresh Focus Italy speaks to Giancarlo Amitrano, head of fresh produce buying at Rome-based retail group Cedigros, about the challenges associated with maintaining profitable retail supply lines.

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

Giancarlo, you recently wrote a comment piece about the challenge that retailers and suppliers face when it comes to matching availability to price promotions for fresh fruit and veg. Can you sum up that challenge for us?

Giancarlo Amitrano: Yes, the big challenge comes when you try to build promotional activities. First, you have to identify the product lines that can be included in the promo, then you have to match them up with suppliers who have enough availability and can cover the volumes required. So it’s not that the retailer presumes to just select a product and put it on promotion in an exorbitant manner. They have to deal with the whole production side of things and understand in that period of the year whether the

product is there in the field. Not just for generic volumes, but a large enough volume to have that promotional impact.

The schedule o en depends on when a promotional leaflet has to be printed. If the publication date is a week from now, then clearly all of the printed material has to be ready at least ten days before. That’s for all of those retail companies who still produce a paper leaflet. Perhaps for those who have already switched to a promotional flyer on the web, the timings can probably be shortened.

I don’t believe producers should leave it entirely to the buyers to decide what goes on promotion. They should suggest products according to what they have planted and the production cycle they see in the field. This could prepare the way for a good promotion which satisfies both parties.

This must be more difficult with the more perishable products that have a shorter shelf-life, for example tomatoes or berries. How can you overcome that challenge?

GA: Certainly for products which are harvested and delivered every day to retailers, pu ing them on a promotional leaflet is harder. But it’s inconceivable that, during the course of the year, there will not be a moment when you can promote tomatoes, strawberries, vegetables. It’s not true that you cannot forecast what might happen with those crops.

In the UK, supermarkets tend to fix longer-term contracts with fresh produce suppliers. And in early 2023 we saw big shortages of very perishable products like tomatoes, cucumbers, and peppers. Do you think the ‘mixed management’ model favoured in Italy could offer potential solutions or even be possible in the UK market?

GA: Countries like Italy and Spain have a strong domestic production footprint. For retailers who ply their trade in these countries, working at fixed prices over long periods would probably

08 fresh focus italy INTERVIEWS

» p.24-26 (s8-s10).indd 8 13/04/2023 10:17

BELOW LEFT & RIGHT—Promotions in store to boost sales of fruits and vegetables are a key part of the merchandising strategy for Roman supermarket group Cedigros

Organised by Supported by @tropicalscongress tropicalscongress.com Discover new business opportunities in tropical and exotic fresh produce SAVE THE DATE THE HAGUE 14 SEPTEMBER 2023 GTRC2023 Filler V2.indd 1 29/03/2023 15:54

be counterproductive from a commercial point of view, because market prices for fruit and vegetables vary almost every day. With a fixed price, at a moment when there is a shortage of product and prices are high, you will probably do well. But when there is excess supply, you run the risk of being completely out of the market, unlike the retailers with flexible prices.

By contrast, for countries with a strong focus on imports, because they have a small, or insufficient, production base – and I’m thinking of the UK in this case – they tend to fix annual contracts for predefined volumes at standardised prices. I think this is the right answer to avoid seeing the pictures that circulated in the last few days, of British supermarkets with shelves that are completely empty.

We did not seen the same shortages in Germany. Do you think they are they doing something different, or even better?

GA: I think we went through three weeks when more or less everyone suffered when it came to availability. If you look at the average list prices for late February, certain fresh produce prices –vegetables especially – reached peaks never seen before in recent years. I’m talking about tomatoes, peppers, iceberg lettuce, a major lack of fresh-cut produce across all of Italy, which supplies large part of Europe at this time of year.

So procurement was also a challenge in Italy during that period?

GA: Certainly it has been a difficult moment. Those countries that suffered less in terms of availability are probably those who knew to organise themselves in advance with suppliers who, despite it being difficult, respected the client.

Nowadays, I don’t believe anything can be improvised. If, during a shortage like the one that’s

just occurred, you approach new suppliers for product, it’s obvious that the response will be negative. That’s because they maintain a loyalty to their existing customers, who they will try to keep happy. Then in the future, when there is oversupply, they can counterbalance by withdrawing product.

I don’t want to suggest that in the UK they don’t have preventative measures in place in terms of their supplier base, but it makes me think that if it has suffered more than others, it was missing some link in the chain and something did not work correctly.

Did you have to pay more for these products, or take them from the spot market, in order to maintain supply?

GA: We certainly suffered in terms of price. We paid prices that, well, we haven’t seen such price anomalies for a long time. We tried to give suppliers a good return in terms of price and, as far as possible, to maintain the same sales price. Obviously, when you reach a certain price range, you cannot force through the same margins as are usually possible. We also had to reduce our average margin on certain lines to avoid setting unthinkable prices and therefore overheating our customers’ credit cards.

10 fresh focus italy INTERVIEWS

ABOVE LEFT—An in-store display to promote Dole bananas

p.24-26 (s8-s10).indd 10 13/04/2023 10:17

ABOVE RIGHT—Giancarlo Amitrano

In&Out on the front line in the fight to save water

THE RIGHT PATH

Results demonstrate the path taken is the right one, says Vernocchi. “For over a decade, Apo Conerpo has promoted the spread of increasingly precise and effective irrigation and fertigation systems on its member farms.”

Two crops, in the collective imagination, are perceived as particularly water-consuming: tomatoes and kiwifruit. “For the former, we have demonstrated how the transition away from irrigation with the classic ‘reel hoses’ allows us to reduce water use by up to a fifth in the production of industrial varieties. And the percentage rises to 30 per cent with other vegetables.”

Accelerate change to solve the water crisis.” This is the challenge launched by World Water Day 2023. A goal that comprises many others: reduce waste, protect the most precious resource on the planet, and do everything to help quench the earth’s ‘thirst’ and that of its inhabitants.

It’s a challenge that European fruit and vegetables, promoted by In&Out have met for some time, with important results.

Research shows that, thanks to innovative technologies and new agronomic techniques, more can be produced with less water: 30 per cent less in the case of kiwifruit; and up to 20 per cent less for tomatoes used in processing.

“Fruit and vegetables enhance water and do not waste it, as some narratives try to tell the consumer,” comments Davide Vernocchi, president of Apo Conerpo, the EU’s largest fruit and vegetable producer

organisation and promoter of the In&Out project.

“When we engage with the water cycle, from source to the sea, and we use it to irrigate fields and orchards, we are well aware of the responsibility we assume, especially at a moment when drought represents a threat to the entire planet,” he continues.

“We are convinced, however, that every drop of water that is transformed into good, healthy and wholesome fruit and vegetables is not wasted. On the contrary, it contributes to the well-being of the earth and its inhabitants. Hence our dual commitment: to make the best use of only the necessary water and to continue investing in research and technological development to provide farmers with solutions that allow them to produce in an increasingly sustainable way.”

But that’s not all. “By using the hoses for fertigation – the spreading of fertilisers with water – our producers have significantly increased yields per hectare by reducing CO2 emissions into the atmosphere,” Vernocchi observes. “A reduction of up to 50 per cent compared to the emissions produced by traditional irrigation and fertilisation techniques. In essence: less water and less carbon dioxide for an industrial tomato that is increasingly friendly to the planet.”

The use of sensors in the soil that calculate the exact degree of humidity required, and high-precision systems that deposit the exact number of drops needed at the precise point where they are needed, means today’s kiwifruit production uses 30 per cent less water than a few years ago, with a reduction of more than two-thirds of the energy needed to irrigate.

“Thanks to this innovation, over 1,500 cubic metres of water are saved for each hectare of kiwifruit per year, without affecting the quality, taste and wholesomeness of the fruit.”

To find out more about Apo Conerpo’s commitment to water conservation, visit the In&Out project website at www.ineout.eu

11 fresh focus italy

ADVERTORIAL

p.26-27 (10-11).indd 11 13/04/2023 10:19

ABOVE—Producers can now deliver nutrients and water to plants at the same time

Joint venture extends Mazzoni supply base

A newly established business in neighbouring Greece should enable the Ferrara-based supplier to sell more kiwifruit to customers across Europe and beyond.

by Mike Knowles @mikefruitnet

Mazzoni Group, one of Italy’s leading fresh produce companies, has established a majority-owned joint venture in north-east Greece to extend its kiwifruit supply base, as it looks to build sales outside of its home market.

The investment in MS Fruits includes the creation of a new packhouse 30km to the east of Kavala, in eastern Macedonia. The facility is apparently equipped with high-tech coldstores with controlled atmosphere, as well as the installation of sizing machine from Italy. Crucially, it means Mazzoni can now process the fruit locally and market it directly to customers from Greece itself.

“We have been processing and marketing Greek kiwifruit for over 15 years,” explains Ma eo Mazzoni, the group’s commercial manager. “Having such a close and long-lasting relationship with Greece has allowed us to start a business project on site. We have always believed a lot in the quality of this product and we wanted to strengthen our work with Greek kiwiruit to be able to serve Italian and European distribution partners directly from there.”

It is understood Mazzoni owns 76 per cent of the business, while local partner Schotman, a kiwifruit and asparagus specialist founded in 1998, has 24 per cent.

As international business manager of Mazzoni Group, Atilio Saldias is responsible for the exploration of new commercial avenues for the company’s kiwifruit – as well as other fruits – in markets further afield. This includes destinations beyond Europe, for example in Asia, where

new potential is certainly evident but by no means guaranteed.

“I would say that India is the most a ractive market in Asia right now,” Saldias comments. “There, we’re talking mainly about kiwifruit and apples. But with kiwifruit there is always competition from Iran. Theirs is definitely a product with different quality and at a price level at which we could never really compete. So the window for Italian kiwifruit in India depends a lot on the presence, or lack, of Iranian product. And Turkey is also making inroads in the Indian market for apples and kiwifruit.”

While he sees China as an important but “complicated” outlet for the group’s kiwifruit exports, Saldias believes there is definitely untapped potential in south-east Asian markets like Thailand, Malaysia, and Singapore. “They want Italian product and the demand is there,” he says. “But there too, you can run into technical problems. For example, they ask for large sizes in some of these markets, and this season the kiwifruit was particularly small. This means it’s hard to develop volume programmes. But other markets can sometimes take that product.”

12 fresh focus italy

KIWIFRUIT

RIGHT—Mazzoni Group’s international business manager, Atilio Saldias

p.28(s12).indd 12 13/04/2023 10:19

Join us to celebrate the best of fresh produce in Britain! FESTIVAL OF FRESH takes place on 21 June 2023 at the home of UK fresh produce innovator AMFRESH. We can’t wait to meet again at the company’s new, state-of-the-art facility in Alconbury Weald, Cambridgeshire. #festivalo resh Alconbury Weald, Cambridgeshire Contact our team at advertising@fpj.co.uk to sponsor the event, book a stand or secure a tasting station. For more information, visit fruitnet.com/festivalo resh Hosted by Organised by Sponsored by Platinum sponsors Sponsors Save with Early Bird FOF filler-2023-sponsors Reg now.pdf 1 12/04/2023 14:42

Apofruit puts faith in premium varieties

The company says its strategic focus on sourcing the best strawberries from southern Italy offers the best chance to grow the category.

by Mike Knowles @mikefruitnet

Italian marketer Apofruit Italia sees further strong potential for growth in its strawberry business as it focuses on sourcing premium-quality varieties from the southern Italian region of Basilicata for sale under its Solarelli and Piraccini brands.

The Cesena-based cooperative sources the fruit from a total of 38 different member producers in the region, which is famed throughout Italy for its strawberries. Their combined area adds up to more than 120ha, and in 2023 the expectation was for them to supply around 5,500 tonnes in total.

With the spring and Easter seen as an especially important time for strawberry sales, the company regards its commercial campaign as an “excellent prospect”. It is also confident that investment in the best varieties – Sabrosa-Candonga, Rosse a Gold, Marimbella, and Limvalnera – will mean that consumers, and therefore customers in retail and wholesale, purchase the fruit again and again.

marketing manager, says success in the berry category depends a lot on the ability and expertise of the growers. “The marketing campaign for our strawberries already starts in December with the introduction, last year, of cultivars with rooted tops,” he explains. “This allows us to offer continuity of supply and high quality standards thanks to the great professionalism that distinguishes our producers.”

At the time of writing, Casadio awaited the coming months’ strawberry campaign with eager anticipation. “We are satisfied with the commercial results achieved so far and we are preparing for the Easter boom, which traditionally drives consumption. Apart from this, for a few years, we have also added our other quality line under the Piraccini brand to the Solarelli line.”

According to Apofruit, recent research into consumer preferences shows that a shopper’s first thought when it comes to strawberries is always taste, followed by food safety and freshness. Furthermore, Italian

origin is always a plus.

The group faces plenty of competition when it comes to reaching those consumers. More than 4,600ha of strawberries are grown in Italy, which produces around 100,000 tonnes of marketable fruit. According to G data processed by CSO Italy, consumption per household was equal to 4.8kg per annum in 2022.

For Apofruit, the primary goal of its Solarelli and Piraccini brands is to increase that value. And to achieve that goal, the strategy is to offer constant and guaranteed quality.

ABOVE—Apofruit now uses two premium brands for its strawberries

14 fresh focus italy BERRIES

p.30 (S14).indd 14 13/04/2023 10:22

Fruit and Vegetables made in Italy

On the Italian and European scene for more than 60 years. 12 production plants and 12 reception and storage centres. Specialization in the top italian fruit and vegetable products. 143.000 tons production. Adoption of integrated production for over 70% of production. Leader in organic production APOFRUIT Italia • Viale della Cooperazione, 400 • 47522 Pievesestina di Cesena (FC) - Italy Tel. +39.0547.414111 • Fax +39.0547.414166 • www.apofruit.it • E-mail: info@apofruit.it

SOLARELLI TOP OF THE RANGE SOLEMIO TOP QUALITY

EAST INNOVATION AND STRATEGIC PRODUCE

BRAND FOR FAR

APOFRUIT_ann2_trade_210x297_ING_24_11_2022.indd 1 24/11/22 17:27

Apofruit Italia is a member of the Consorzio Patata Italiana di Qualità (Italian Quality Potato Consortium), owner of the Selenella® brand.

Innovation proves upli ing for Italy’s top fresh fruit export earner

Better varieties, engagement with consumers, and continued efforts to make the business more sustainable are all key ingredients in the Italian apple sector’s recent success.

by Mike Knowles @mikefruitnet

The new European marketing campaign for Cosmic Crisp apples got up, up and away at the end of March with the launch of the trademarked variety’s first ever national television campaign in Italy, as well as the planned appearance of a branded hot air balloon across the continent over the next few years.

Expectations are sky high for this latest chapter in the story of an apple that originated in the US state of Washington. The two South Tyrolean companies behind Cosmic Crisp, Vog and Vip Val Venosta, say they will have around 5,200 tonnes to sell in 2023, around four times what they had available in 2022.

Marketing promotions are planned for several European countries. The primary goal is to appeal to modern consumers and position the product as a “next-generation apple” thanks to its deepred, speckled appearance, crispness, juicy flesh, and balanced sweet-tart flavour. As the slogan has it, “an apple that promises a heavenly taste with every bite”.

As well as a two-week television debut in late March, a multi-platform digital campaign will strengthen awareness of Cosmic Crisp in Italy, Spain, and Germany from March to June. Point-of-sale initiatives and samplings to a ract new consumers and support sales are also set to continue.

“Cosmic Crisp is an apple that is eagerly awaited by our customers,” comments Vog sales manager Klaus Hölzl. “Last year, we received enthusiastic feedback from retailers and consumers, so we are expecting a very good season. Thanks to the significant increase in quantity, as planned, we are continuously present in points of sale until late June.”

Fabio Zanesco, head of protected varieties at Vip,

says quality is “very good” with ideal sizes to satisfy different markets. “In addition to the increase in quantity, we have planned innovative and distinctive marketing initiatives to grow the brand,” he confirms. “We expect an increasing number of people to experience the heavenly taste of Cosmic Crisp and to be won over by it.”

Organic production also plays a key part in the companies’ future development plans. Production in South Tyrol was around 250 tonnes in 2022, but this volume is also expected to increase.

16 fresh focus italy APPLES

p.32-35 (S16-19).indd 16 13/04/2023 10:23

ABOVE—The Cosmic Crisp balloon takes to the skies over Europe in 2023

»

AsiaWorld–Expo in

GET INVOLVED Contact our team: info@asiafruitcongress.com 6-8 SEPTEMBER 2023 HONG KONG

by Together with asiafruitcongress.com @asiafruitcongress FOR

INSIGHT, FRESH PERSPECTIVE

NETWORKING AFC 2023 Filler.indd 1 11/04/2023 16:54

Asiafruit Congress takes place alongside Asia Fruit Logistica on 6-8 September 2023 at

Hong Kong

Organised

STRATEGIC

AND QUALITY

MELINDA FOLLOWS THE SWEETNESS

Meanwhile, Trento-based consortium Melinda has launched a new sweet apple brand called Melinda Dolcevita, which is available in the early months of each year. The launch is part of an overall strategy to stand out in a crowded and complex market, by selecting distinctive varieties and dedicating targeted marketing activities to each one.

“In an increasingly complex market, it is necessary to simplify how consumers understand what’s on offer, through brands that are self-explaining and able to group together apples with similar characteristics,” explains Paolo Gerevini, the group’s general manager.

In 2023, its strategy for Dolcevita centres on a new TV commercial, which features haute couture in order to position the variety as a prestigious branded fruit with an

intensely sweet taste and floral notes.

Other activities will be rolled out across various digital channels and through wholesalers, vendors, and retail store chains. Prior to the TV campaign, Melinda organised an event in Milan where thousands of people were invited off the street to

taste Dolcevita and explain on camera what sweetness means to them.

SUSTAINABILITY IS IN THE BAG

Elsewhere, Vip has underlined its leadership in European organic apples with the launch of new packaging made entirely from paper. The new packs, which feature a linen net to keep the product visible, were released into the

CULTIVATED

Loved because it’s grown sustainably, in harmony with nature. Loved because it’s produced using only renewable energy. Loved because it’s the only one in the world stored in the heart of a mountain.

Loved because its flowers are naturally pollinated by bees, thanks to the partnership with beekeepers from the valley.

APPLES

P.D.O.

Mela Val di Non

Loved because it’s

IN the perfect apple-growing region.

FOLLOW US ON

p.32-35 (S16-19).indd 18 13/04/2023 10:23

From the Melinda valleys, an apple that’s just like you.

LOVED BY YOU

market at the beginning of March.

According to the consortium, the switch reflects a desire to achieve “the fullest environmental sustainability” in organic apples, which it can now supply for the entire year, thanks largely to the huge number of varieties it produces.

In addition to organic Golden Delicious, on the market from September for the next 12 months, and organic Gala, available from the end of August to April, Vip offers a range of organic club apples which have different tastes, ripening and marketing periods all the way through to late summer and the start of the next season. These include SweeTango, Ambrosia, Kissabel, Envy, Kanzi and Cosmic Crisp.

“This multiplicity of varieties provides advantages on several fronts,” says the group’s organics varieties product manager Gerhard Eberhöfer. ”Dividing the market risk, which is essential in such a

convulsive moment; satisfying tastes and preferences of a variety of consumers; and serving the distribution chains of many countries around the world.”

For Eberhöfer, a new processing and high-capacity packaging plant created in 2019, entirely dedicated to organic products, has allowed it to respond quickly to demand in its top target markets, Italy and Germany, followed by northern Europe, Spain and the Middle East. It also means the company can guarantee “100 per cent traceability of each apple”, he adds.

Also important is Vip’s geographic location, especially given recent heatwaves across Europe. “During the hot summer of 2022, our Alpine position and the ideal microclimate helped us a lot,” he notes. “Thanks to these conditions, which are peculiar of Venosta Valley, our apples maintain the right freshness and crunchiness and a long shelf-life.”

19 fresh focus italy APPLES SALES

SRL (BZ)

soc. agr. (BZ)

(CN)

(CN)

Novi SAD

ISEPPI Frutta SA

Mesfruits BIODYNAMIC BIO MERAN www.crimsonsnow-apple.com GREAT FEELING, GREAT SALES AVAILABLE N O W BALIAVAIEL IWON VA A I L ABLENOW I

KIKU Ltd info@crimsonsnow-apple.com FOLLOW OUR JOURNEY Crimson Snow is a registered trademark, not a variety name.

ITALY F.lli Clementi

VOG coop.

Rivoira Giovanni & Figli SPA

Sanifrutta Soc.Coop.R.I.

SERBIA Verda Vivo Doo

SWITZERLAND

FRANCE SARL

Licensor:

CULTIVATED p.32-35 (S16-19).indd 19 13/04/2023 10:23

OPPOSITE PAGE—Dolcevita is Melinda’s new, high-end brand ABOVE—Gerhard Eberhöfer shows off Vip’s new paper bag

A bright future in store for Fred and Emilia Romagna

As a new Swiss product offers the industry a potential shot in the arm, the country’s leading pear region has underlined its commitment to promoting the value of its own unique varieties.

by Mike Knowles @mikefruitnet

Fred, a new breed of pear developed in Switzerland over the past two decades by the research centre Agroscope, has a chance to become a leading product in the pear category for Italian producers and exporters.

That’s according to Alessandro Zampagna, general manager of Origine Group, a consortium of Italian and Chilean fruit companies which has the exclusive rights to grow the variety in Italy.

Since it began to trial Fred back in 2019, Origine has overseen the expansion of planted area in the country and the development of a commercial marketing plan. In the autumn of 2022, that plan took a major step forward.

“The quantities produced are still small,” Zampagna concedes, “but this year for the first time the pear was marketed on the Italian market with two major, large-scale distribution chains, with good commercial results. So the prospects are encouraging.”

Fred is a medium-sized, bicoloured pear that offers an aromatic, sweet taste with a slight acidity. Its flesh is described as “compact, but crunchy and juicy”

and its shelf-life is said to be excellent, an important advantage in a category known for the challenging perishability of its products. And for growers, high yields and a tolerance to fireblight and scab offer key advantages.

“It’s clear that Origine Group’s decision to focus on this pear was a suitable one,” Zampagna adds, “because of its organoleptic and aesthetic characteristics, but also because it has excellent shelf-life and high productivity. So it’s an interesting variety for the entire supply chain, and we think that our sector needs new varieties with these characteristics.”

Origine Group’s Italian members are Apofruit, Frutta C2, Gran Frutta Zani, Kiwi Uno, Minguzzi, Salvi-Unacoa, and Spreafico. Its members in Chile are David del Curto and Copefrut.

20 fresh focus italy PEARS

p.36-37 (S20-21) .indd 20 13/04/2023 10:24

“It’s an interesting variety for the entire supply chain, and our sector needs new varieties with these characteristics”

ABOVE—Volumes of Italian-grown red pears remain small, but two chains in the country now stock the variety RIGHT—New funding has been secured to promote PGI pears from Emilia Romagna

SPREAFICO SETS OUT SUSTAINABLE PLAN

Import-export firm Spreafico’s recent Sustainability Report highlights the company’s efforts to protect people and the planet, for example by conserving energy usage and introducing more environmentally friendly forms of packaging. The report also lays the groundwork for the development of a sustainability plan to be implemented during 2023. “As a company, we want to further increase the quality standards in all stages of the supply chain with the various players involved and in harmony with our growth objectives,” says CEO Raffaele Spreafico.

PROTECTED STATUS

Italy’s largest pear-producing region Emilia Romagna, meanwhile, relaunched its protected geographical indication (PGI) brand in November 2022. This means the quality mark, which distinguishes its unique Abate Fetel and Decana varieties from other types, will be promoted for a further two-year period.

In March, the region’s PGI pears featured at a special event in Brussels organised by the Association of European Regions for Products of Origin (Arepo), to promote Europe’s protected regional food products. A rare privilege, given that Emilia-Romagna has a total of 44 PDO and PGI products, including Romagna peaches and nectarines, Vignola cherries, Reggiana watermelons, Reggiano parmesan, and balsamic vinegar from Modena.

“Being selected as one of the reference products of regional agri-food production, among the richest in all of Europe in terms of PDO and PGI, is certainly a reason for great pride,” says Mauro Grossi, president of the Pera dell’Emilia Romagna IGP consortium, “and it rewards the intense work of recent months for the promotion and enhancement of this product appreciated throughout the world.

Alessio Mammi, regional councillor for agriculture and agri-Food, believes the creation of a dedicated association of pear producer organisations called UnaPera in 2021 has helped sustain the industry. More than half of Italian pears are grown in Emilia Romagna, and the number of companies with PGI pear production in the region apparently increased by 78 per cent in 2022.

“The relaunch of the PGI Emilia-Romagna Pear through the UnaPera AOP has a strategic value,” he comments. “In a complex situation like the one that fruit and vegetables are going through in our area, we intend to seize all the opportunities that allow us

to promote our good, quality and safe fruit and vegetables.”

For Mammi, it remains important for the region to defend the value of its PGI pears and other specialities that enjoy EU protection. “Fruit and vegetables represent an important economic asset in terms of production, skills and jobs that we will always continue to support.”

PEARS

p.36-37 (S20-21) .indd 21 13/04/2023 10:24

The wrath of grapes

Anger among Italy’s table grape growers at the rockbottom prices paid for their fruit last season now appears to have given way to constructive and concerted action, but is it enough to secure the sector’s future?

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

To the red, white and black grape country of southern Italy, the last rains came heavily… The country’s table grape industry faces a tough road ahead. This year and beyond, it must recover from an extremely difficult campaign in which the economy and the climate conspired against it and, with prices that plummeted to as low as €0.25/kg, left several producers to question the viability of their entire business model.

Growers in Puglia may find some relief soon, thanks to a reported €300m local government support package – announced in late 2022 by regional agriculture councillor Donato Pentassuglia –that has been earmarked to provide direct economic aid.

They also stand to receive help in the form of a television advertising campaign, while the planned opening of new coldstorage facilities at Taranto-

Grottaglie Airport may also help to ensure the wheels do not fall off Puglia’s vital table grape export business.

The story is a similar one in Sicily, where some of the region’s iconic Mazzarrone PGI grapes were pulped because the market wouldn’t pay enough for them to be picked, packed and sold fresh. Growers in Italy’s second-largest grape production region fear their entire business may wither on the vine. They say they want more help to facilitate trade, to convert their vineyards to more profitable varieties, and to convince retail customers of the need to pay more for the fruit they buy and pass on to consumers.

Fedagricoltura Sicilia, a new regional branch of the national grower federation, was established at the start of April and has already set its sights on addressing the crisis with the help of various governmental and financial institutions.

Its inauguration took place in Canicattì, in the province of Agrigento. “This town, together with its district straddling the provinces of Agrigento and Caltanissetta, has always been a very important agricultural district for the production of table grapes of about 22,000 hectares,” commented Massimo Fasciana, Fedagricoltura’s national president, during that first meeting.

Giancarlo Granata, who heads the new branch, underlined the scale of the challenge: “The economic

GRAPES 22 fresh focus italy

p.38-39(s22-23).indd 22 13/04/2023 10:25

crisis, also as a result of the international political situation, the very high production and transport costs, the long period of drought, the market problems due to a sharp drop in consumption, require the recognition of the state of crisis for the table grape sector.”

POSITIVE PROTOCOL

The sector took another step in the right direction in late February when a pan-industry group called the Italian Commission for Table Grapes oversaw the signing of what it calls the Protocol for Stability, Sustainability, and Enhancement of the Fruit and Vegetable Supply Chain in Puglia. This document,

it says, signals a “shared intent” among actors in the region’s fruit and vegetable supply chain and a recognition of the challenges faced in creating value, innovation, and competitiveness in prices and demand. Time will tell if that message carries through to the major retail chains that incurred the wrath of several growers last season.

BRAND NEW BRAND

In the meantime, a new brand for PGI-certified grapes from Puglia will be created in the near

future after the group responsible for marketing the protected geographical indication was granted official ministerial recognition in March.

That green light means the Uva di Puglia PGI Consortium is the only entity permitted to work with Italy’s Ministry of Agriculture and European authorities to manage the EU-certified PGI. It also has permission to develop a programme of marketing activities aimed at boosting the commercial potential of grapes from Puglia.

“The work of the consortium represents an important opportunity to relaunch the consumption and competitiveness of Puglia table grape varieties, at a time of great need for communication towards the consumer for the development of demand and the growth of quality in the offer,” said a spokesperson.

GRAPES 23 fresh focus italy

“The economic crisis, the high production costs, the drought, the drop in consumption, all require state recognition”

a

p.38-39(s22-23).indd 23 13/04/2023 10:25

OPPOSITE PAGE—Freshly harvested table grapes on display at a farmer’s market in Sicily, southern Italy

business of

Bitesize lemons create consumer buzz

Dutch importer Yex believes demand for the diminutive Italian limequat variety with an edible skin is likely to grow across northern Europe.

by Mike Knowles @mikefruitnet

Positive progress for citrus exports

Sicily’s blood orange campaign went well this year, with high quality and good sizes reported. Nello Alba, CEO of Unifruttiowned marketer Oranfrizer, reported that this season’s cold weather coloured the fruit well both inside and out, and demand was reportedly high for its unique Ippolito variety.

However, the campaign itself was not helped by the weather. A hurricane that hit Sicily in February resulted in a reduction in volumes of about 30-40 per cent, with the effect that prices were pushed higher. And although the UK market has proven a strong outlet for the company’s products over recent months, Oranfrizer says it has not been able to resume its exports to China, which began in 2019 but were halted by the global pandemic.

Elsewhere, examples of innovation in Italian citrus continue to emerge. Another Sicilian group, Barbera International, launched a new line of red-fleshed oranges called Extra Rosse at Fruit Logistica 2023 in Berlin. The company selectively chose specific clones of three varieties – Moro, Tarocco, and Sanguinello Moscato – which it says contain up to four times more anthocyanins than other types.

Tiny lemons with edible skins and a sweeter taste have created a buzz in parts of northern Europe over the past year, as demand for the relatively unknown fruit increases.

Marketed as Lemon Snack and grown in the southern Italian region of Basilicata by the producer organisation OP Ancona, the fruit recently made a notable splash on social media channel TikTok in Sweden.

One video posted by Swedish influencer Anna Antonje, which shows her as she samples the fruit enthusiastically, has attracted more than 2.1m views since it was posted in early November.

At present, Rotterdam-based importer Yex is the only importer in the Netherlands that sources the product – actually a variety of limequat – for sale to customers throughout Europe.

“We started with Lemon Snack in 2022,” says managing director Martijn de Graaf. “We stepped in halfway through the season, so we only did around two to three pallets per week. The rest was already pre-sold to other customers.”

But he says when last season ended in May 2022, the positive market response and strong demand from customers and consumers convinced the company to secure bigger volumes for this campaign.

Meanwhile, Taranto-based mandarin specialist Linbo says that recent investment in new facilities and improvements to existing ones have enabled it to launch a new line of zero-residue fruit. According to commercial manager Aldo Gallo, the consortium has also welcomed a number of new members. As a result, it has increased its combined planted area to 140ha.

24 FRESH FOCUS ITALY CITRUS

p.40-41 (S24-25).indd 24 13/04/2023 10:26

OPPPOSITE—Lemon Snack is a variety of limequat that can be eaten whole LEFT—Several people posted videos of themselves eating the fruit on TikTok

SURGE IN SALES

As a result, sales growth has been strong. The fruit is now sold in the Netherlands, Germany, Denmark, Norway, Finland, Sweden, France and Belgium.

“We sold them mainly to retail customers, but also our wholesale customers did really like the product,” De Graaf explains. “Requests for more volume came especially from Sweden, but in particular since 2022, demand has increased heavily in all the countries.”

According to Mario Ancona, who oversees the Lemon Snack project at OP Ancona, the citrus fruit is harvested between December and March. “For now, cultivation only comprises half a hectare,” he

told Italiafruit News. “But the idea is to expand the planted area in the coming years.”

Consumer tests organised by the supplier apparently suggest the limequats have good potential as a snack fruit, since their acidity is lower than a typical lemon. “The pleasant taste is the result of the particular flavour contrast between the peel and the pulp,” Ancona adds.

For Yex, the commercial opportunity is an intriguing one. “We already agreed on larger volumes for next year,” says De Graaf. “The product looks very nice, it tastes good, you could use it in different recipes, and you have no waste. And if we haven’t convinced you yet, it’s also packed in a really nice basket.”

CITRUS

p.40-41 (S24-25).indd 25 13/04/2023 10:26

Life’s a flat peach: Ondine starts to make waves

Growth in Europe’s peach category mght be pretty slow, but the success and expansion of so-called flat peaches suggests the arrival of branded, season-long supply out of Italy may be very well timed indeed.

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

Acollection of flat peach varieties known collectively as Ondine could hold the key that unlocks new value in the Italian stonefruit category, according to its Italian partners. Originally developed in Spain, the white-fleshed product gives producers in Italy, for the first time, the opportunity to offer season-long supply in a sub-category still seen as ripe for commercial expansion.

“In the summer of 2022, we carried our our first sales trials, and the outcome was very positive,” says Rita Biserni, international marketing manager at Alegra. “Ondine is a set of different

varieties. so for the whole season from June to September you can have the same quality.”

In the summer of 2023, the product will be launched officially on the Italian market. So far, three companies – Alegra-Agrintesa, Greenyard Fresh Italy, and Mazzoni – have been granted permission to market the fruit there under licence from French variety developer Agro Séléctions Fruits and renowned Spanish stonefruit breeder Frutaria.

And the product has already won crucial recognition as a premium-quality item. In France, it was recognised as a leading fresh produce item during the two most recent editions of annual consumer

taste awards Saveur de l’Année.

Ondine is good for growers too, says Biserni. “It also solves one of the problems they normally have with flat peaches, and that is cracking around the peduncle. This variety does not have that problem.” Production currently stands at around 140ha in Italy, split between Emilia-Romagna and Calabria, but is expected to reach 500ha within the next three years.

What’s more, it has already a racted the a ention of some big European retail customers. On its official website, it proudly displays a long list of names that include Aldi, Auchan, Edeka, Kaufland, Marks &

Spencer and Waitrose.

TOP LEFT—Ondine is a branded collection of similar varieties ABOVE—The fruit apparently has advantages for growers

26 fresh focus italy

STONEFRUIT

p.42 (S26).indd 26 13/04/2023 10:26

BLITZ SOLUTION

EFFICIENT CARTON PACKAGING

THE USE OF CARDBOARD LID ON TRAY BRINGS UP TO 15% COST SAVINGS .

PACKAGING OF ALL FRUIT SIZES AND SHAPES

COST SAVINGS THROUGH OPTIMAL PRODUCTION AND LOGISTICS

LINE INTEGRATION: FILL AND CLOSE

THE SOLUTION:

JOLLYPACK & BLITZMATIC+ EFFICIENT CARTON PACKAGING LINE

Via Vilpiano 46 | I -39010 Nalles (BZ) | Alto Adige | T

WRAP-TRAY Adaptable to sizes FLAT®-TRAY Free fillable 100% CUSTOMIZABLE DESIGN 15% COSTS OPTIMIZED TRAY + LID 100% PRODUCT FLEXIBILITY

PACKAGING

100% SUSTAINABLE

€ NEW

Pachino tomato group secures deal with McDonald’s

The US-owned chain has agreed to source tomatoes from the Sicilian region as part of a wider plan to develop closer ties with Italian supply chains.

by Mike Knowles @mikefruitnet

PGI-certified tomatoes from Pachino in Sicily are to feature on the menu of fast food giant McDonald’s in Italy from the second half of 2023, after the consortium responsible for the protected geographical indication signed a protocol agreement with the US-owned chain.

The deal sees McDonald’s commit to purchasing around 250 tonnes of Pachino PGI tomatoes each year for use in a number of its products. According to those involved, the move is part of the restaurant operator’s plan to boost the quality and local provenance of its ingredients.

For the tomato business in Pachino, it’s an achievement that could generate even more awareness among consumers, and a welcome step forward a er devastating floods and storms hit the region back in the autumn of 2022.

“It’s an important agreement, one which brings visibility to an Italian product, specifically the Pachino PGI tomato, through a large global chain,” says Sebastiano Fortunato, president of the consortium.

For McDonald’s, the addition of such an iconic product shows that it wants to support Italian supply chains. The group’s Italy chief executive Dario Baroni, is keen to underline that point. “By now, 85 per cent of our suppliers come from the Italian agri-food sector,” he points out. “The Pachino PGI tomato is an Italian excellence, and we have decided to introduce it in all our products and recipes. An important commitment to support an important Italian consortium.”

Mauro Rosati is director of the Qualivita Foundation, which works to promote PGI and PDO products. For him, the deal is an important breakthrough. “It will bring value to the Pachino supply chain, which is one of the most important we have in Italy, for a product that is distinctive for our nation,” he comments.

28 fresh focus italy TOMATOES

“It’s an important agreement, one which brings visibility to an Italian product through a large global chain”

p.44 (S28).indd 28 13/04/2023 10:38

LEFT—Pachino tomatoes are protected by an EU-certified PGI

16 MAY 2023 GET INVOLVED! Sponsorship opportunities are open Contact our team on info@tomatocongress.com The annual meeting point for leading players in the global tomato business globaltomatocongress.com Organised by Supported by @tomatocongress Sponsored by Platinum Sponsor REGISTER NOW Sponsors GTC 2023 yellow.indd 1 12/04/2023 15:38

Lago D’Oro remains on fertile ground

Abbruzzo-based company says it sees huge potential to grow its sales to countries outside of Italy, thanks to the completion of Europe’s largest fennel packhouse on the edge of the Fucino Plain.

by Mike Knowles @mikefruitnet

Lake Fucino, to the south of L’Aquila in the region of Abruzzo, was once Italy’s third-largest lake. But when two decades of work to drain it entirely came to an end in the late 1870s, what remained was a vast swathe of new and highly fertile agricultural land. The locals were so delighted, in fact, they even made the project’s lead architect Alessandro Torlonia a prince.

Today, the Fucino Plain’s countless delineated plots form a patchwork of fields that cover more than 100km2. Scan the area from above, and it resembles a kind of giant, green barcode. What is clear is that, for some of the region’s budding growers, Torlonia’s impressive feat of engineering really paid off.

As with many of Europe’s agricultural regions, water conservation is a major issue here. A new irrigation system across the entire plain has been proposed, to the tune of some €65m, by the regional authorities. In addition, the construction of reservoirs to avoid the withdrawal of water from local aquifers is also under consideration.

All the while, the value of that absent lake is certainly not lost on brothers Luigi e Nicola D’Apice, whose fennel brand Lago D’Oro literally means ‘lake of gold’. Their father Domenico loved the area so much, in fact, in 1988 he uprooted his family-run business in Naples and transplanted it here.

Since then, that company has evolved from a wholesaler of various vegetables into a specialised fennel supply business, a case study in successful diversification. Today, Lago D’Oro not only markets its locally grown produce from 13,000ha of its own land, but it also sells fennel on behalf of other growers in the regions of Molise, Puglia,

Campania, Basilicata and Calabria.

“Fennel was a chance discovery and it was love at first sight,” the D’Apice brothers recall. “In Fucino, it was not among the traditional crops, so much so that our father had to host teams of pickers who came from Capitanata (in Foggia) because the workers here were not specialised in this harvest.”

30 fresh focus italy FENNEL

TOP—A view of Abruzzo’s Fucino Plain, with Avezzano in the foreground

RIGHT—Field irrigation in progress

OPPOSITE PAGE—Lago D’Oro sells fresh fennel from across Italy

p.46-47 (30-31).indd 30 13/04/2023 10:41

(Photos: Halpand, Dreamstime; Adobe)

NEW FOUNDATIONS

In April, Lago D’Oro opened what is believed to be Europe’s largest fennel packing facility in San Benedetto dei Marsi, right on the Fucino Plain’s eastern edge. The 6,000m2 centre will run 365 days of the year and boasts a processing capacity of 150 tonnes per day. What’s more, it generates practically all of its own electricity from photovoltaic panels and apparently has enough to charge all of the machines, tractors and trucks that are used to grade and transport the vegetables.

The facility itself is equipped with plenty of innovative technology, including sorting machines on the processing lines, as well as a cold chain that is controlled by digital sensors to minimise energy consumption.

According to the brothers, everything at the new centre is interconnected and managed via one piece of software. This means the fennel is monitored from the moment it enters the packhouse from the fields, to the point where it is loaded as a finished product on to trucks.

Production data from the harvesting and processing phase right up to dispatch are downloaded and made available to an administrative department which controls, in real time, various aspects of the business – from sowing and harvesting calendars to warehouse stock levels, from orders to invoicing and payments.

Following the centre’s completion, the company is poised to expand its business significantly.

“With my brother Nicola we have

realised the dream of a lifetime.” says Luigi D’Apice. “But we do not stop here. The next goal is to take the company and our producer organisation international. As agricultural entrepreneurs we work to create jobs and to provide food at an affordable price for everyone.”

31 fresh focus italy FENNEL

p.46-47 (30-31).indd 31 13/04/2023 10:41

VIP & POLI VAL VENOSTA, ITALY

Val Venosta producers association Vip organised in-store tasting events at selected branches of the Poli supermarket chain in early spring 2023 to promote the region’s speciality apple variety Pinova. The producers themselves carried out the promotions, which aimed to increase sales of the recently introduced variety.

32 fresh focus italy

MARKETING p.48 (S32) Retail.indd 32 13/04/2023 10:42

Tune in every Thursday for new ideas and insights For better business in fresh fruits and vegetables Support the finest new digital content from Fruitnet Contact us for more information advertising@fruitnet.com | +44 20 7501 3709 Search for FRUITBOX at Fruitnet.com, Spotify, Soundcloud, Anchor or your favourite place for podcasts anchor.fm/fruitbox “EXCELLENT PODCAST...REALLY GOOD INITIATIVE” “GREAT LISTENING!“ “TIMELY AND INNOVATIVE” Chris White in conversation with the world’s fresh produce business leaders

Jose Antonio Gomez Camposol

Dan Mathieson Zespri

Stephan Weist Rewe

Fabio Zanesco VIP

Soren Bjorn Driscoll’s

Filip Fontaine VLAM

Monica Bratuti Turners International

Alk Brand Westfalia

Tarun Arora IG Group

fruitbox A4 Chris main.indd 1 21/01/2021 15:03

Shawn Harris Orange Wings

doc.indd 1 11/04/2023 14:52

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet

by Mike Knowles @mikefruitnet