With the virus at the forefront of the industry’s thoughts, we speak to those fighting back

With the virus at the forefront of the industry’s thoughts, we speak to those fighting back

The sweeping response to the threat of tomato brown rugose fruit virus from those responsible for developing new varieties is admirable and encouraging

ou will not be surprised to see that much of the focus of this year’s Fresh Focus Tomato special is fixed firmly on the battle against tomato brown rugose fruit virus, or ToBRFV. Since its emergence and spread in the past decade, the virus has been identified as the single biggest challenge that faces the category today. However, the reaction of the industry has been swift and determined – if evidence is needed, take a glance at the next few pages – with breeders working hard to develop varieties that offer resistance to the threat. Seed companies are featured heavily in this special, and with good reason. They are the ones on the front line, researching and ultimately introducing those characteristics that stand strong against ToBRFV. The range of resistant products that have already been launched is both admirable and encouraging. And let us not forget, this is in addition to the plethora of other traits that must be considered when producing a new cultivar, be it yield, climate resilience, shelf-life, colour, and of course flavour. There is much to be positive about when it comes to tomatoes, one of the healthiest, tastiest and most versatile fresh product segments out there. And with so many taking on ToBRFV head on, that positivity will hopefully remain for some time.

Carl Collen, EditorRuud Kaagman, Syngenta Vegetable Seeds global crop unit head tomato, tells Fresh Focus Tomato that the category continues to innovate, evolve and grow despite the challenges presented by ToBRFV.

by Carl Collen@carlfruitnet

Where is Syngenta’s current focus when it comes to developing the tomato category?

Ruud Kaagman: Syngenta has been actively breeding in all major tomato segments and growing

methods. From high-technology greenhouses to open field production, growers need solutions wherever they are and for any of the unique challenges and diseases they face. Some of this research includes future-ready production, ready for mechanical harvesting and AI. We’re continually sharing these insights with our growers

to help them prepare for future challenges and opportunities.

Obviously a lot of the talk right now is about ToBRFV resistance. What have you been doing in this area?

RK: Tomato Brown Rugose Fruit Virus (ToBRFV) represents the biggest threat to tomato

By the end of 2023

OPPOSITE LEFT— Ruud Kaagman

OPPOSITE RIGHT—

The company’s Maturbo variety

more modes of action to protect this important crop.

“We know ToBRFV is top-of-mind for growers, and we’ve been dedicated to finding solutions since its discovery”

productivity today: it diminishes yields up to 100 per cent, damages fruit quality, and is incredibly expensive to remove from greenhouses. We know this is topof-mind for growers around the world, and we’ve been dedicated to finding solutions since it was discovered in 2015.

We introduced our first resistant varieties in 2020, beefsteak tomatoes, but we haven’t slowed down since. By the end of 2023 we had 15 tomato varieties on the market with ToBRFV resistance, including beef, cluster, and baby plum/snacking tomatoes.

In 2024, we will launch many more resistant varieties. We’re actively trialling four new rootstock varieties for commercialisation this year, where growers will have access to ToBRFV-resistant rootstock and ToBRFV-resistant scion. In addition to resistance on the market today, we’ll continue to integrate ToBRFV resistance into all kinds of tomatoes and growing styles and continue researching

What are the other key traits when it comes to tomato development?

RK: When you look at the different segments, there are obvious trends in what growers need. In hightechnology greenhouse production, we’re expanding our portfolio by adding more cherry on-thevine and cocktail types. For these tomatoes, retailers need year-round supply, which is why we accelerate trait development for both heated and unheated greenhouses, to help enable supply stability for retailers and consumers.

In open field environments, we are supporting growers with varieties that can stand against the increasing pressure of stress and disease, especially our programmes for Asia and Africa/Middle East. At the same time, we’re creating the best shelf-life for our varieties as they need to survive long distance travelling from growers to consumers in these regions.

When it comes to agronomic concerns, ToBRFV resistance is often top-of-mind, but that’s not the only threat tomatoes face. We’re continually finding and combining resistances to diseases and threats that matter to growers. Additionally, taste is important to protect tomato space in the grocery store and appeal to consumers, so

we’re developing novel traits to improve taste.

Are there any new varieties that are exciting you?

RK: We’re thrilled with the planned 2024 launch of resistant rootstock to be paired with resistant scion, giving growers improved options in greenhouse grafting. We also introduced ToBRFV-resistant Climundo, an on-the-vine variety, in addition to several snacking and baby plum varieties with resistance to ToBRFV as well as with excellent taste and shelf-life. When it comes to taste and consumer preferences, we’re launching a new golden cherry tomato called SunFun. It was recently awarded by the International Taste institute in Belgium and it is launching this year in the US.

Is the tomato market still a strong one globally?

RK: The tomato still one of the most eaten vegetables around the world, and we do not see this changing. In fact, there is still a growing demand for small types as more countries adopt these types as a healthy snack. There is also an ongoing trend in increasing the acreage of greenhouse tomatoes, especially as it allows growers to produce closer to urban areas and significantly improve yield, consistency in quality, and strongly improve the ecological footprint due to less pesticide use and less water usage. We see these developments in Asian countries, Central Asia, Dubai, and Saudi Arabia. Across the globe, the demand for tomatoes will continue to grow due to new innovations for consumers.

Do you think enough is done to market the benefits of tomatoes to consumers?

RK: We’ve seen great strides in consumer marketing in recent years. For example, baby plum ‘snacking’ tomatoes. These small, bite-sized tomatoes

provide excellent health benefits, convenience, and ‘fun’ for consumers around the world. That market space is continuing to grow, and consumers are asking for more options, because it fills a need they have. This is a great example of how innovation, together with retailer support and marketing, has created new opportunities for growers and a great product for consumers.

As always, there are more opportunities to reach consumers. We’re seeing great innovations like the purple Yoom tomato with more anthocyanins for an overall greater health profile. As it and other innovations enter the market with features that clearly target consumers, we’ll want to make sure we’re working closely with retailers, restaurants, and consumers to explain the benefits of these new innovations, and how they can easily fit into lifestyles to provide healthy alternatives.

How else do you see the tomato industry evolving?

RK: At Syngenta, we’re passionate about innovation and continuous improvement, and one thing many people don’t realise about tomato production is that it’s incredibly high tech. It’s exciting

to think about the steps we’ve taken to improve our research and development to get new products to growers and consumers, faster. For example, we’re using a robotic tomato harvester in our greenhouses. This machine is capturing data as it harvests tomatoes, removing any potential human error and capturing incredible amounts of data in a short time. In addition, as robotic harvesting becomes more popular for growers around the world, it will be important for us to understand preferred plant structures that help support robotic harvesting. The trial we’re

completing with robotic harvesting is helping us learn how to breed and adjust plant structures, and ‘teaching’ the robot more about how to differentiate ripe tomatoes from the rest of the plant.

Robotics aren’t the only innovation we’re experimenting with. AI and many advancements in data analytics are helping us push breeding advancements to growers, faster, too. Altogether, technology is opening doors through faster data collection and organisation, and we’re able to take what we know inherently about genetics, combined with this data to discover next-generation tomatoes.

ABOVE —Syngenta’s ToBRFV-resistant range includes cluster, baby plum, beefsteak and many more tomato options BELOW—There is also an “ongoing trend” in increasing the acreage of greenhouse tomatoes, Kaagman says

The roadmap to ToBRFV-resistant tomatoes.

Tomato viruses are evolving, which means our research is ongoing. We will continue to expand our portfolio of resistant varieties, find new and better solutions to ToBRFV and whatever comes next...

We will not compromise on taste, shelf life and other important characteristics that growers need to harvest plentiful crops keeping grocery stores and plates full of healthy tomatoes – of every shape and size!

The greenhouse, located in Kwintsheu near The Hague, features over 150 ToBRFV-resistant varieties.

by Carl Collen @carlfruitnetBASF-Nunhems has officially opened its Tomato Experience Center in Kwintsheul, near The Hague in the Netherlands. According to the seed specialist, the greenhouse features over 150 ToBRFV-resistant varieties.

The greenhouse is complemented by meeting facilities to showcase these varieties and exchange with customers on their needs, BASF’s innovations and trends in tomato breeding, it said.

“Customers and growers from around the world can explore the greenhouse and displays filled with different tomato varieties, offering opportunities to taste, touch, smell and slice the diverse range first-

hand,” BASF-Nunhems stated.

A comprehensive data collection on cultivation facts, production statistics, shelf-life, weight and more are also on display at the centre to provide customers with valuable insights for informed decision making.

Silvia Cifre, vice-president marketing and sales at BASFNunhems, said that tomato breeding held an “immense” significance given the importance of the segment globally.

“From the moment ToBRFV erupted, BASF-Nunhems has been at the forefront in finding solutions to win the ba le against this virus,” Cifre commented. “Until now more than 25 ToBRFV-resistant varieties

ABOVE—Vitalion, one of BASFNunhems’ ToBRFV-resistant varieties

Hazera has announced the acquisition of a new high-tech greenhouse next to its headquarters in Made, the Netherlands. According to Yossi Shapiro, head of R&D, the acquisition marked a “significant step” in Hazera’s journey to establish a strong position in the high-tech greenhouse tomato industry.

“Our goal is to establish ourselves as one of the leaders in the high-tech tomato market with our mid- to long-term plan, as there is strong competition there,” he said. “This goal was the primary motivation to invest in a state-of-the-art active tomato greenhouse, as you need the best facilities to compete with the best.”

The group said that it was empowering its tomato portfolio worldwide through the new high-tech tomato project with the support of Limagrain’s vegetable seed division.

Shapiro noted that multiple options were considered, such as renovating existing facilities or building a greenhouse from scratch.

“But the answer was right in our own backyard: to buy an industrygrade, commercial greenhouse operation that we can readily transform into a research facility with the help of our experts,” he said.

are providing solutions to tomato growers worldwide.

“We are proud to open the doors today of our Tomato Experience Center,” she noted. “BASF has been in the tomato seed business for over 50 years and with this innovative facility we can show how much our portfolio and cultivation technology have evolved. In this inspiring environment, we will be able to take our collaborations with all players along the value chain to the next level.”

Win the battle against rugose, don’t compromise on quality

Sometimes you can have it all

BASF | Nunhems stands out with versatile solutions for all different segments and the multitude of challenges that growers face. The BASF | Nunhems portfolio is highly regarded when it comes to ToBRFV-resistant tomato varieties. They all meet the requirements of the different levels of the agri-food value chain. Despite their good marks in vitality, productivity, and plant health, Nunhems® Rugose resistant varieties do not compromise on crucial consumer aspects such as flavor, color or visual appearance.

All in all, we offer over 200 tomato varieties, including top sellers:

• Vitalion, Ronvine for High-tech production

• Azovian, Blindon, Freezon, Brovian in the saladette segment

• Cabosur for cluster

• Mohikan for single winter for Mid tech production

Discover our Tomato Experience Center in Kwintsheul, the Netherlands

The BASF | Nunhems Tomato Exerience Center offers a unique platform for customers to explore, test, and showcase these innovative varieties grown in high-tech conditions. Curious to see the impact of our solutions firsthand? Join us at the Tomato Experience Center and be inspired by our passion for innovation and top-notch quality in the tomato business.

Get in touch with us

Contact our experts if you are interested in learning more about our offerings.

Ester Serrano Banuls

Regional Crop Lead EMEA ester.serrano@basf.com

Harm Ammerlaan

Regional Crop Lead Hightech harm.ammerlaan@basf.com

Jose de Jesus Morales

Regional Crop Lead Americas jose.de-jesus.morales@basf.com

Or visit our global website www.winthebattleagainstrugose.com and select your country page.

Resistance is important as the fight against ToBRFV continues, but other traits such as taste, shelf-life, colour and yield are also crucial given retail and consumer preferences.

by Carl Collen @carlfruitnet

Two major themes stand out when it comes to the tomato category, according to seed specialist Enza Zaden. These are the emergence of Tomato Brown Rugose Fruit Virus (ToBRFV) and its impact on the sector, and the way retail trends are reshaping the category. The former has brought about significant challenges, testing the adaptability and resilience of the tomato industry worldwide.

Mari Carmen Manjon, sales manager Iberia at Enza Zaden, says that the virus represents a considerable threat to all agents in the chain, from production to postharvest quality. “At Enza Zaden, we’ve led the innovation charge with the development of High Resistance (HREZ) varieties and rootstock, providing an effective solution to combat this threat,” she explains.

Enza Zaden’s growers have been instrumental in the fight against ToBRFV, Manjon notes, implementing enhanced phytosanitary measures and adjusting cultivation practices, such as modifying planting dates and shortening harvest cycles, to safeguard their crops. Despite these concerted efforts, the ba le against widespread infections of ToBRFV remains “formidable”, which underscores the need for a united and robust response from the entire industry, with the group taking a collaborative approach.

“In parallel, our commitment extends beyond disease resistance to embracing sustainability,

including the development of varieties more resilient to abiotic stress and suitable for organic cultivation,” she tells Fresh Focus Tomato. “These innovations align with our mission to support the industry’s adaptation to environmental challenges and shi ing consumer preferences for sustainable products.”

Manjon explains that Enza Zaden was a pioneer in the field of ToBRFV, being the first to bring HREZ varieties to the market, addressing the virus with “a unique hypersensitivity reaction”. This mechanism prevents the virus from multiplying within the plant and blocks ToBRFV’s spread under normal virus conditions, taking a significant step towards long-term eradication.

“Our rapid development and offering of a comprehensive programme and an extensive assortment of varieties with High Resistance have addressed the sector’s urgent needs in record time,” she continues. “This approach not only mitigates the immediate threat posed by ToBRFV but also underscores our commitment to the tomato industry’s sustainability and the health of the food supply chain.

“It’s important to note that HREZ does not equate to immunity. We continue to encourage growers to implement robust phytosanitary measures alongside adopting HREZ varieties and rootstocks to limit the virus’s spread effectively. Our introduction of HREZ

»

rootstock represents the next level of innovation, adding a critical defence layer by blocking ToBRFV at the root level and contributing to the plant’s overall resistance.”

The HREZ collection includes varieties across all significant tomato types, from large roma, beef, grape, cherry and cocktail to on-the-vine tomatoes, demonstrating Enza Zaden’s ambition to bring the innovation to all tomato growers.

When it comes to those aforementioned retail trends, it is evident that supermarkets are increasingly organising shelves by function rather than product category, which means distinguishing snack tomatoes from those intended for cooking. Manjon points out that packaging now often includes clear information about the best use of each tomato variety – be it for cooking, grilling, snacking, or salads. This trend towards functionality over category helps guide consumer choices and highlights the diverse applications of tomatoes in daily diets.

Beyond resistance, critical traits

versatile breeding strategy that not only caters to the broad spectrum of consumer preferences but also ensures that traders and retailers can offer the best quality across their main tomato assortment.”

“Consumers’ desire for variety is strong. Preferences vary from higher-taste segments to more economical options”

in tomatoes include taste, shelflife, colour and yield. These meet the growers’ need for healthy, productive plants, and align with traders and retailers’ challenges of ensuring year-round availability and quality in their main assortment, such as salad, truss, and plum tomatoes. Indeed, the last two years have underscored the necessity of consistent supply, she notes, with the unprecedented sight of empty shelves highlighting the importance of resilience in production and distribution.

“Consumers’ desire for variety remains strong, with preferences varying from higher-taste segments for special occasions to more economical options that provide the foundation for a healthy meal,” Manjon comments. “This diversity in consumer choice highlights the necessity for a

Enza Zaden is adopting a proactive approach to customer management through the development of a new tomato programme, she confirms, which is focused on introducing new, tasty, and highquality varieties that cater to the evolving needs and preferences of customers.

“It’s this commitment to listening and responding with useful, quality products that truly sets us apart,” says Manjon. “By addressing the demands of the market with solutions that meet their expectations, we further solidify our position as leaders in the tomato industry, committed to innovation, quality, and customer satisfaction.”

The tomato business is seeing stable demand in key markets like the Benelux, with consistent consumer interest driven by the crop’s versatility and nutritional value. The industry’s ability to innovate and adapt, particularly through the introduction of HREZ varieties, supports this steady demand, she explains. However, there is room for growth in espousing the benefits of the product to shoppers.

“While the intrinsic health benefits of tomatoes are recognised, there could be room to enhance consumer engagement through branding tomato varieties,” Manjon adds. “Greater emphasis on marketing the unique qualities of different tomato varieties, including taste profiles and health benefits, could enhance consumer engagement and appreciation.”

TOP LEFT—Key traits include taste, shelf-life, colour and yield

TOP RIGHT—A range of HREZ varieties is available

The global solu�on to improve the performance of your tomato processing facili�es

· Versa�lity (sor�ng and grading a large variety of tomato types)

· Delicate fruit handling

· Easy maintenance (automa�c cleaning and lubrica�on)

rodasale@mafroda.es

Rijk Zwaan’s new congress Tomeet discusses the challenges and opportunities facing the sector.

by Maura Maxwell @Maura MaxwellLeading players in the Spanish tomato business met in Almería in April to discuss the current and future challenges facing the sector at Rijk Zwaan’s first-ever Tomeet Congress.

Once the dominant player in Europe’s winter tomato market, Spain has borne the brunt of an influx of cheaper Moroccan tomatoes in recent years that have gradually whittled away its market share. At the same time, the impact of climate change, rising production costs and an increasingly punitive European legislative environment have created a grim commercial landscape for tomato producers in the Iberian Peninsula.

Luis Fernández of Coexphal highlighted Spain’s loss of competitiveness against third country suppliers like Morocco where costs – particularly labour costs – are much lower. “This means that we have to work more efficiently, with the help of new technologies, and that we have to differentiate ourselves from our competitors,” he said.

David Uclés of Cajamar agreed that producers faced growing insecurity and uncertainty in the short-term, but painted a picture of a more positive future, in which lower interest rates will fuel more investments in technological improvements; the move to a plantbased diet will boost demand and imports from third countries

will be forced to comply with EU regulations.

The programme then moved on to the subject of sustainability.

Ana Hernández, director of R&D&i and Environment at Grupo Paloma, gave an overview of how the company is adapting its processes to become more sustainable and meet the challenges of climate change. These include opting for biological controls and hydroponic cultivation, optimising water usage and reducing CO2 emissions.

There then followed the first of two round table discussions featuring José María Naranjo, head of the Tomato Project at Carrefour Spain; Antonio Algarra Ibáñez of Grupo Agroponiente, and Pedro Ruiz García, president of Cooperativa La Palma. All

three producers agreed that adopting varieties with resistance to ToBRFV was a priority for the sector. The need for retailers and producers to work more closely together to address common challenges, such as educating consumers about the different strands of sustainability was also highlighted.

Maria José González of consumer research firm NiQ presented the results of a survey showing that German consumers prioritise appearance, taste and price when buying tomatoes, although they highly value proximity and local products.

Continuing with the opportunities and challenges of the future of tomato exports, Wouter de Ruiter of De Ruiter Interim & Consultancy, talked about the very different strategies of European retail chains and the need for suppliers to tailor their offer and service to each one.

The challenges that the sector must face to differentiate itself and lead winter supply were analysed in a second round table featuring Juan Jesús Lara of Casi; Mais Zakarne of SanLucar and Enrique de los Ríos of Unica Group. The relative merits of different marketing strategies were discussed – from SanLucar’s success in positioning its brand with European retailers to the creation of an Almerían of Spanish tomato brand.

All the speakers agreed that it was necessary to invest more in promotion and once again called for greater unity between the entire sector to be stronger in the market.

At the end of the congress, Rijk Zwaan presented some of the solutions it has developed to respond to the new challenges facing the sector, notably ToBRFV.

series

Bayer’s vegetable seed segment is launching its first wave of ToBRFV-resistant tomatoes this year, encompassing a range of types and varieties.

by Carl Collen@carlfruitnet

It has been a busy year at Bayer Crop Science’s vegetable seeds division. In the tomato segment it is running full steam ahead, launching ToBRFV-resistant tomato varieties, driving pipeline breeding processes, supporting growers and factoring in breeding and selection for sustainable production into its targets. This is all while responding to climate volatility and safeguarding scarce resources along the food value chain.

When it comes to ToBRFV, Bayer has taken the time to do things properly, according to Anne Williams, head of protected, vegetable seeds.

“Rather than rush in to bring low-grade single gene resistance or single gene high resistance with poor fruit quality, we’ve taken a little longer to build stronger and protect both growers’ livelihoods as well as consumer demand,” she outlines.

Bayer’s multi-gene resistance stacks are launching across a range of tomato types and varieties this year, bringing durable resistance to anticipate future adaptations by the ToBRFV virus. Tested across Bayer’s multi-environment, multiseason, multinational and multivirus inoculated and background infection long cycle crop trials series, Williams says growers can enjoy the confidence of producing these varieties.

At the same time, Bayer has been protecting fruit quality and taste to ensure that consumers continue to enjoy the taste they choose tomatoes for, with every ToBRFVresistant variety launched tastechecked through Bayer’s consumer R&D panels. And there are several exciting prospects on the horizon.

“This season sees the first wave of our ToBRFV-resistance variety launches, so we have a lot to choose from and we’ve many, many more to follow,” she reveals. “There is a very nice tasting cherry plum variety that looks good and tastes great, and the first large truss varieties are holding fruit size well –a characteristic that often suffered in some of the earlier competitor material. We also have some beautiful saladette varieties in the ground this year.”

Williams rightly points out that “growers don’t like surprises”, so breeding tomatoes with traits that make for consistent production is critical.

“Consistent performance in behaviour and output, adaptability to changes in management conditions and resilience to pest and disease attack across an increasing range of challenges –this is part of the reason we have a broad base trait stack included as standard across most of our breeding pipelines,” she explains.

“If we switch to our consumer

hat, we want attractive fruit with great taste, shelf-life to avoid food waste, and to know that every time we buy a tomato it tastes exactly as we expect it to taste,” Williams adds. “We buy with our eyes so it needs to look good, and whilst we’re prepared to pay more for premium products if we can afford them, everyone needs access to year-round, affordable good quality fresh produce.”

Group continues to showcase its commitment to leading in tomato breeding through innovation, offering a diverse range of products.

by Carl Collen@carlfruitnet

Sakata is ramping up its research and development efforts in the EMEA region, focusing on creating the best vegetable varieties. This is according to Stéphane Bucamp, senior product manager tomato at Sakata Vegetables EMEA.

The group is working across all key tomato segments, such as cherry, miniplum, salad, saladette and more, aiming to offer a diverse selection that meets a wide range of tastes and growing needs.

Bucamp says the work is driven by Sakata’s core philosophy, which is about understanding and addressing global challenges like environmental conservation and the need for healthy food.

“This philosophy pushes us to produce tomatoes that stand out for their taste, nutritional value, and how well they grow,” he tells Fresh Focus Tomato. “Our aim is to ensure that each variety of tomato we develop not only meets but exceeds the expectations of everyone involved, from growers to consumers. Sakata focuses on making sure tomatoes taste great, can grow in different environments, and are good for your health.”

This includes tackling ToBRFV, and Sakata is actively tackling this challenge by screening existing varieties for tolerance and developing new ones that can

yield, fruit quality, and disease resistance to other pathogens, with growers prioritising robustness and ease of cultivation while consumers demand taste, nutritional value, and appearance. “Our breeding programmes focus on meeting these diverse needs, ensuring our tomatoes satisfy all market segments effectively.”

On the consumer side, Bucamp feels that while efforts have been made to highlight the health benefits of tomatoes in recent years, there remains room for enhancing awareness about the nutritional

resist the virus.

“With the introduction of varieties like Chocostar F1, Luciestar F1 and Royalstar F1, which confirm consistent levels of tolerance to ToBRFV (intermediate resistance), we’ve made significant progress,” Bucamp continues.

“Moving forward, Sakata aims to enhance breeding programmes further, incorporating advanced research to bring varieties that not only resist ToBRFV but also meet the high standards for taste, yield, and environmental sustainability.”

The coming months will see Sakata announce new materials across different tomato segments that will have intermediate resistance to ToBRFV, marking a significant milestone, he confirms.

There are also many other traits that Sakata focuses on, including

advantages and the diverse range of tomato products available.

Educational campaigns and collaborative marketing initiatives could elevate the profile of tomatoes as a key component of a healthy diet, he says. One such initiative is Sakata’s La Pandi programme in Spain, a project designed to promote healthy eating among school children, which won Spain’s NAOS Award for its contributions to advancing public health. Such educational campaigns and collaborative marketing efforts play a crucial role in enhancing the perception of vegetables as essential to a nutritious diet.

“Our continuous investment in research and development, coupled with our proactive approach to addressing challenges like ToBRFV, underscores our commitment to excellence in the tomato category,” Bucamp concludes. “We aim to remain at the forefront of delivering innovative solutions that benefit the entire value chain, from growers to consumers.”

Fogliati believes its new Nama brand will drive sales of domestically grown beef tomatoes across Italy, and provide shoppers with a top-quality, local option.

by Mike Knowles@mikefruitnet

Turin-based company

Fogliati has supplied Italy’s supermarkets with local and imported tomatoes for many years, among a range of different products under its long-established Trifoglio brand.

But now it has unveiled a new brand, Nama, for what it describes as a highly promising cuore di bue variety grown exclusively in Italy.

And it says demand for this locally grown product, which it markets as ‘born mature, born Italian’, is only going to increase.

With an intense flavour and colour, as well as apparently excellent shelf-life, the product was initially grown in Sicily, Veneto and Piedmont. The production window is currently over nine months, but this is expected to extend to year-round supply shortly with the addition of new plantings in Calabria and Lazio.

Of course, to achieve commercial success with a new product in this category would be no small achievement in a country where tomatoes are already extremely popular and play such a central role in the national cuisine.

But Fogliati’s hope is that a highquality, Italian-grown beef tomato can a ract consumers who would otherwise purchase imported ones.

“The Nama project was created primarily on the back of our experience importing tomatoes,”

“The market for cuore di bue tomatoes in Italy is growing, and retailer interest in particular is strong”

explains company owner Eraldo Fogliati. “We understood the importance of developing an Italian supply chain that meets the needs of consumers and buyers in Italy. The market for cuore di bue is growing, and retailer interest in particular is strong.”

Stefano Landolfi, project manager at Fogliati, believes the skill and expertise shown by Nama’s growers gives the product a major commercial advantage.

“Nama’s product quality is guaranteed, not only by its specifications and technical data sheets, but also by the way the

product is managed in the field, which ensures compliance with the specifications,” he comments. “We are fortunate to have had a decades-long collaboration with a team of agronomists – led by Francesco Furnari –who take care of its production throughout Italy.”

Cost pressures, supply chain disruption, and the threat of ToBRV are taking their toll on the British tomato sector, but Alex Margerison-Smith of Keelings sees opportunities for innovative growers with a focus on premium varieties.

by Fred SearleWhat are the main trends in the UK tomato sector currently?

Alex Margerison-Smith: Extreme cost pressures. UK tomato growers are facing continued high input costs – primarily energy, but also labour, packaging and fertiliser, This is making it difficult to remain profitable.

Supply chain disruption, with the collapse of some growers, challenging weather conditions, the shortage of labour, Tomato Brown Rugose Virus (ToBRV), and increased border checks and costs all present challenges to the sector.

Alternative crops, with some growers diversifying into other greenhouse crops.

Innovation and sustainability. Growers and researchers are looking into ways to reduce energy reliance, optimise production techniques, and combat pests and diseases in a sustainable manner.

The UK greenhouse sector has had a number of casualties, the most recent being UK Salads. Can we expect further casualties?

AM-S: The collapse of UK Salads highlights the fragility of the UK tomato sector in the face of extreme

ABOVE—There are opportunities for tomato growers despite challenges including costs and supply chain disruption

cost pressures. Smaller growers or those without long-term contracts are especially vulnerable, and further casualties cannot be ruled out if costs don’t stabilise.

Despite the difficulties of the glasshouse sector, there has been some recent expansion in so fruit. Has there been any similar investment in tomatoes?

AM-S: Before the energy crisis, there was an increase in the area dedicated to growing tomatoes during the winter season. However, the high cost of energy made this practice economically unsustainable, leading to a significant reduction in the area under cultivation.

If energy prices continue to decline, this trend could reverse, with a return to increased winter tomato production.

How are tomato imports to the UK likely to be affected by the introduction of physical border checks on plants (in April) and fresh produce (in October)?

AM-S: The introduction of border checks on plants and fresh produce will add complexity and potential delays to imports. This could disrupt supply chains and lead

to increased costs for imported tomatoes, potentially affecting availability for shoppers.

How are UK growers protecting themselves against the threat of ToBRV?

AM-S: UK growers are implementing strict hygiene and biosecurity protocols to prevent ToBRFV introduction and spread. This includes measures like restricting access to greenhouses, sanitising equipment and people, and sourcing seeds and plants from reliable sources.

“Smaller growers or those without long-term contracts are vulnerable, and further casualties cannot be ruled out”

Ongoing research is focused on developing resistant varieties and be er detection methods.

What is the current state of play when it comes to the spread of the virus in Britain? And what is being done to mitigate the risk?

AM-S: While there have been some isolated ToBRFV outbreaks in the UK, vigilant biosecurity measures have largely contained widespread dissemination. The situation remains dynamic, and growers must remain a entive to the threat.

Growers are increasingly choosing varieties with ToBRFV resistance or tolerance to reduce the risk of crop losses. This is limiting the choice of varieties.

The high price point of Dutch producer Looye Kwekers’ premium tomatoes raises expectations, but the company’s commitment to delivering the best taste means consumers should never be disappointed.

by Tom Joyce@tomfruitnet

Ever since its inception in 1946, Dutch tomato grower and marketer Looye Kwekers has had the desire and the will to grow the tastiest tomatoes in the world, aiming always for the perfect balance between sweetness and acidity. The highest quality tomatoes in the company’s greenhouses are sold under the company’s premium brands, Honeytomatoes (Honingtomaten) and Looye Joyn tomatoes, with those that just miss out marketed under a separate label, including the Dulcita and Cortez brands.

“There are customers for all kinds of tomatoes,” says the company’s Jos Looije, son of founder Jacobus Looije. “If you’re a consumer on a budget and you don’t want to spend too much money, you will of course buy cheaper tomatoes. But we focus on taste. Looye is not huge in terms of volumes, but the value is high. We try to give our brands a unique identity, and we invest in marketing them.”

“Our job is to make sure the consumer is never disappointed, and expectations are understandably high”

Looye Kwekers produces two varieties, cherry tomato Piccolo and vine tomato Avelantino. The best of the former are sold under Honeytomatoes, the la er under Looye Joyn. “Besides a beautiful design and very good branding, we make sure our tomatoes packed under Honeytomatoes taste the best and look the best,” says Margriet Looije, commercial director and daughter of Jos.

The company’s fixed price strategy ensures consumers are not put off by frequently fluctuating prices, including in the winter months. “We want to be available in the winter because that’s important for our brand strategy,” she says. “We choose not always what’s best in the short term financially, but what’s best in the long term.”

According to Looye, many fruit and vegetables are currently sold too cheap in the market, especially compared with unhealthy foods. Although the price of Honeytomatoes may make them a li le too steep for many consumers to buy each week, that is not the company’s core strategy.

“We don’t expect consumers to always buy our tomatoes,” says Jos. “We actually don’t want everybody to buy our tomatoes all the time because then we wouldn’t have enough of them!

“When we started out, we considered what kinds of consumers would be our target, such as people living in cities who like to cook. But what we actually saw was a lot of grandparents buying them for their grandchildren. Grandparents like to give their grandchildren something tasty and healthy, and when they buy our tomatoes, the kids eat them and enjoy them because they are so delicious.

“Our job is to make sure that the consumer is never disappointed, and expectations are understandably high, as they pay a lot of money for our product. So they have to get the taste they expect, and we are able to deliver that.”

A lack of consumer knowledge about tomato varieties and their different uses, and an absence of in-store assistance, leave many shoppers overwhelmed and likely to reach for the cheapest option, warns RedStar’s Martijn van Keulen.

by Tom JoyceShoppers across Europe will have noticed the proliferation of tomato varieties over the last couple of decades, but a lack of guidance through such a varied category can leave many consumers feeling daunted, according to Martijn van Keulen, head of marketing at Dutch producer RedStar.

“I did some consumer research to see where the frictions are in the supermarket,” he tells Eurofruit “Many shoppers are following their partners’ shopping lists, and they come into the supermarket thinking they just need 500g of tomatoes. But when they look around, they see as many as 40 different varieties, so which ones do they choose? We try to help this kind of consumer make a better choice by adding guidance on the packaging about the flavour and the best occasions for consumption.”

Van Keulen estimates that around 75 per cent of shoppers will look at the price of tomatoes, and that will be the deciding factor.

“We are focused on the more premium, tastier tomatoes so we don’t necessarily compete on price,” he says. “For many consumers, the issue is not wanting to pay more for a tomato if they’re not sure it’s

the right one, if it’s worth the extra cost. So they buy a cheaper one and then at least it’s not the price that is the concern. Obviously if you buy on price, quality is less of an issue. So it’s a case of trying to break that routine. It’s about behavioural change, trying to get consumers into the mindset of making a better, more informed choice.

“There are so many tomato varieties, and there is likely to be a regular worker attending the grocery section, not a specific fruit and veg expert, so we need to help the supermarket more. Something I’m looking forward to is the switch in the coming years from barcodes to QR codes. As a producer, we can include all sorts of information for the consumer, telling the story of our tomato, where it comes from, add a video of the tomato’s journey, offer recipes, all of which help the consumer to make an educated decision.”

The main reason people visit an actual supermarket rather than buying online is the vegetable section, according to van Keulen, and in the vegetable section, tomatoes are the main target. “So, in fact, the main reason people visit the supermarket is tomatoes,” he says. “This is massive. So it’s important for supermarkets to have

“For many consumers, the issue is not wanting to pay more for a tomato if they’re not sure it’s the right one”

that section under control. If people skip the tomatoes in the supermarket, they might even skip the whole thing and go online.”

RedStar has also investigated the differences between offline and online purchases, especially when it comes to the specific packaging needs of tomatoes. “Online, shoppers basically buy a picture of a tomato, so the packaging doesn’t need to display the tomato like it does in the store,” van Keulen points out. “The packaging can also be much tougher to protect the tomatoes during transportation. These are some of the concepts we are sharing with our retail partners.”

At the moment, the main challenge in tomatoes is ToBRFV, with breeders focusing on developing tomatoes with resistance. According to van Keulen, the tomato category is currently going through a transition phase.

“If you look at the tomatoes we have right now, I’m betting that in five years the whole assortment will have changed,” he says. “It’s such an accomplishment by breeders to have developed so many resistant tomatoes. But they are not finished yet. I am convinced that the next-generation tomatoes will have an even better taste. A major shift is coming, with the voice of the consumer increasingly at the heart of new developments.”

TOP—Martijn van Keulen, head of marketing at Dutch producer RedStar

Monterosa is the is the perfect combination of taste, texture, shape and colour to enjoy a quality tomato all year round.

The Belgian cooperative has announced the sale of its first Coeur de Boeuf tomatoes of the season, with expectations high following annual growth in the production area of 28 per cent.

by Tom Joyce@tomfruitnet

In March, the first Belgian Coeur de Boeuf tomatoes of 2024 were sold at Belgian cooperative BelOrta, grown by producers Wim and Brecht Vertommen of Den Overkant in Sint-Katelijne-Waver.

“With its distinctive shape, mild taste and special colour, the Coeur de Boeuf tomato is the ideal choice to welcome spring and summer to our region,” stated the cooperative, the leading supplier of the variety in Benelux.

According to BelOrta, Den Overkant’s more than 20 years’ experience growing

the Mediterranean Coeur de Boeuf enables the producer to “accurately tailor the product to the desired specifications of the customers”.

“This special tomato has the property of colouring from the inside out, which means that a green Coeur de Boeuf can be perfectly ripe on the inside,” it revealed. “The combination of a red internal colour with a green exterior provides a visually attractive addition to various dishes, both hot and cold.”

In 2023, BelOrta growers supplied more than 2,000 tonnes

of Coeur de Boeuf tomatoes, and the production area has increased this year by 28 per cent to over 5ha. “As a result, a significant increase in the harvest of Coeur de Boeuf tomatoes is expected compared to last year,” BelOrta said. “BelOrta offers these tomatoes in various packages, ranging from 3-6kg, but smaller packages are also available. The Coeur de Boeuf tomatoes are at their best from March to November.”

The snack tomato season has also begun in Belgium. With 8ha of production and sales of nearly 2,000 tonnes in 2023, BelOrta said it was determined to supply delicious snack tomatoes. “The season runs from week 13 to week 46,” the cooperative said, “and BelOrta has chosen to use virus-resistant varieties, ensuring both growers and consumers a reliable and tasty experience.”

LEFT—Wim Vertommen shows off the first Coeur de Boeuf of the season in Belgium

The Andalusian cooperative has overcome some big challenges to sustain its supply of top-quality tomato varieties to customers across the continent.

by Chris McCullough

When a fruit and vegetable cooperative in the south of Spain exports 87 per cent of its total produce to countries around the world, high quality is of paramount importance to its continued commercial success.

In operation for the past 51 years, Andalusia-based Granada La Palma brings together around 750 farmer members that together produce 73,000 tonnes of crops per year from 850ha. With a number of produce handling and packing centres strewn across Spain’s south coast, the group focuses mainly on supplying cherry and speciality tomatoes, as well as other mini vegetables.

But as it becomes harder for Spanish companies to secure vital inputs like water and energy, efforts to improve the sustainability of those operations are key. And that’s certainly true for La Palma, for whom these areas have become essential priorities.

The Granada region, where the cooperative’s growers farm, benefits from a Mediterranean and subtropical climate that makes it possible to supply all year round.

Many of the growers already harvest the power of Andalusian sunshine to meet their energy needs. And although production of tomatoes requires a

lot of water, the region does have excellent natural water resources drawn from the mountains of the Sierra Nevada.

Using hydroponic systems and optimising traditional irrigation methods, La Palma’s crops receive just the right amount of water via drip irrigation, so none is wasted.

Growers have also introduced an integrated pest control programme, which means they don’t have to use chemical pesticides.

Juan Gallego, sales executive commercial at La Palma, says product taste and flavour remain hugely important. “Our growers and our systems strive to produce fruit with lots of taste. That is what our customers, which are

supermarkets and wholesalers, require. Everything we sell is produced by our growers in this region. We are not allowed to buy anything in, as that means we lose our traceability.”

The cooperative’s main market is Europe, where 98 per cent of its exports go. But it does export some to the US and Middle East.

It employs around 1,200 to 1,500 staff that work on shifts depending on peak production requirements. It runs five packhouses where growers deliver their produce.

“Staff work from 6am to 2pm, then 2pm to 10pm five days per week, and then one shift on a Saturday,” Gallego adds. “We have three peak production times per year – August, November and May.”

One of Scandinavia’s leading vegetable suppliers says the recent addition of a Newtec high-speed packing line has helped it to become more sustainable and more efficient.

by Mike Knowles@mikefruitnet

BELOW—The firm’s flowpacked San Marzano tomatoes

Nordic Greens, one of Scandinavia’s largest vegetable suppliers, says the recent delivery of a Newtec high-speed container filler has enabled it to reach new levels of speed and efficiency.

Danish technology firm Newtec has apparently helped to automate the supplier’s operations, minimise waste, and optimise overall performance.

“Production and the various packaging types are streamlined and fully automated compared to before, and the number of employees to handle this process is reduced,” explains Nordic Greens’ Rikke Dybkjær Pedersen.

Nordic Greens grows tomatoes, cucumbers, peppers and salad veg at state-of-the-art greenhouses in Funen, Denmark, and Trelleborg, Sweden.

The company was apparently the first producer in Europe to hand-pick its products and place them directly into trays. That approach, it says, was intended to minimise any damage to the products that might otherwise occur.

So perhaps unsurprisingly, it was concerned that automating the process could damage very sensitive items like tomatoes. That concern turned out to be unfounded.

“The quality of the product has also improved, as there is less handling compared to manual operations, and therefore the process is more gentle on the tomatoes,” Dybkjær Pedersen comments. “The solution is flexible, as we can run several types of packaging simply by changing the se ings.”

Newtec’s technology is apparently versatile enough to enable Nordic Greens to fill a range of different packaging containers, with everything managed via a touchscreen without too much human intervention. Apart from punnets, which can be open or foil wrapped, it also allows the supplier to run buckets and cups with lids through the line – all via flexible dispenser systems and adjustable punnet conveyors.

Dybkjær Pedersen says the machinery has helped the company boost its environmental sustainability too, by enabling it to reduce its use of plastic, cut waste, speed up operations, and consume less energy.

“Sustainability and climate considerations are always high on our agenda in all our phases of production,” he says. “This means that we use recycled cardboard and 100 per cent recycled and reusable plastic, although it is not always the cheapest solution.”

Nordic Greens is a co-founder of Denmark against Food Waste, whose objective is to cut food waste by half in the food sector by 2030. In fact, the company says it has achieved the UN’s Sustainable Development Goal on food waste reduction ahead of target.

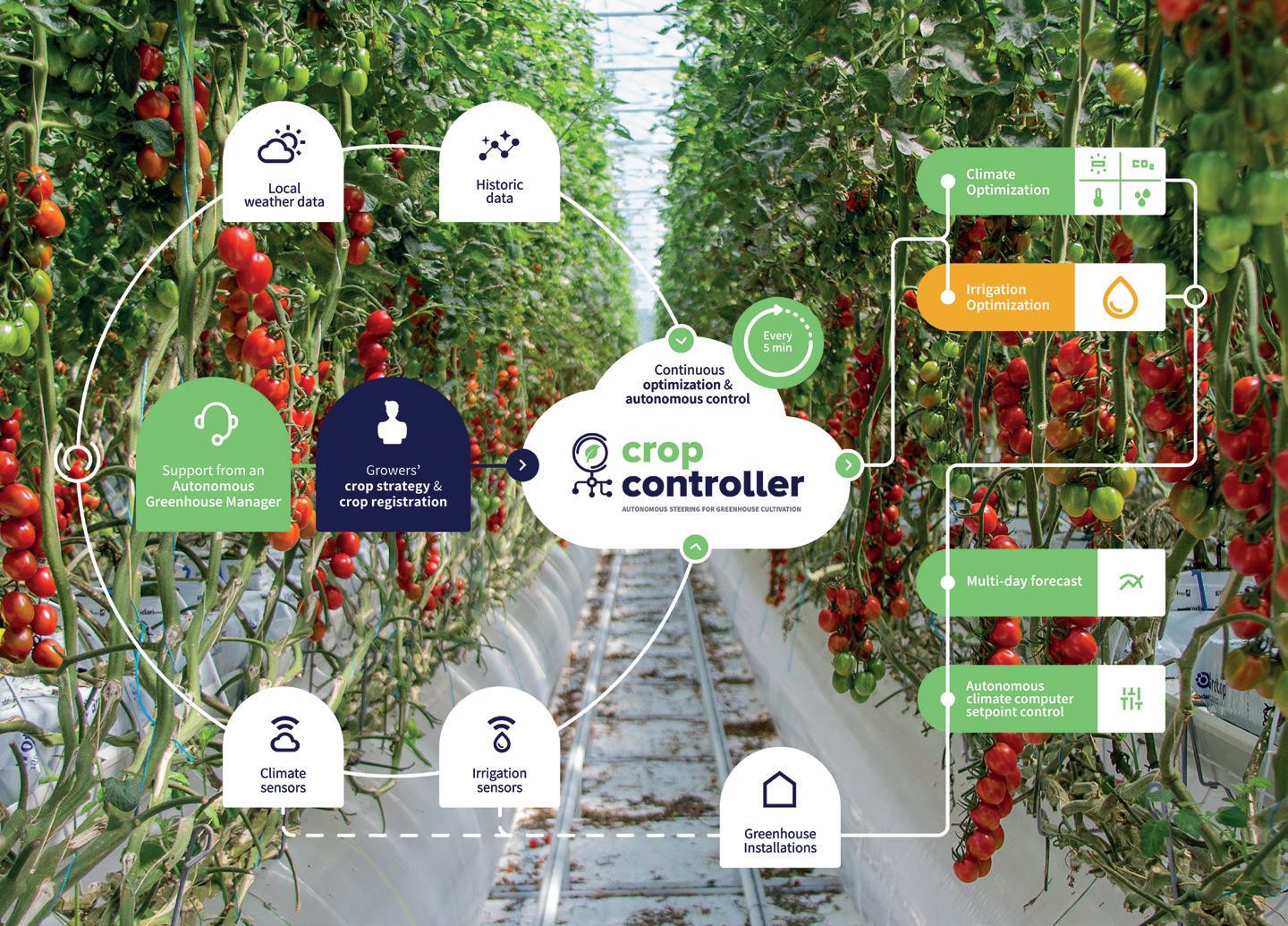

Autonomous climate and irrigation management can benefit growers and greenhouse companies in multiple ways, according to Ronald Hoek, chief executive officer of Blue Radix.

by Carl Collen

What role does Blue Radix play in the tomato sector?

Ronald Hoek: Blue Radix is a specialist and market leader in autonomous growing. We develop and implement algorithms for daily processes in greenhouses around the world. With AI we support growers to optimise their climate, irrigation and energy management.

Working with Crop Controller, growers can manage more hectares, while improving yield and significantly reduce the usage of resources like energy and fertiliser. We have 35 employees based in Ro erdam and have customers in 15 countries across four continents.

ABOVE—Crop Controller helps growers manage more hectares, while improving yields and using fewer resources

LEFT—Ronald Hoek, CEO of Blue Radix

offer an integrated solution for autonomous climate and irrigation management. This reduces the work for growers behind the climate computer by 80 per cent. This time and mental a ention can now be transferred to time in the greenhouse and to labour.

You operate in autonomous greenhouse management. What are your key products?

RH: Crop Controller is the system for autonomous climate and irrigation management. The grower defi nes the strategy and the goals for the season. The grower is in charge of what has to be realised. With Crop Controller we support the grower in a number of ways.

What developments have you seen across the category?

RH: The horticulture industry is growing year by year. At the same time skilled and experienced growers are becoming scarce due to ageing. The average age of growers in North America and Europe is 59. In Japan it’s 68. This is limiting the growth of the industry. Greenhouses are complex systems that demand professional high-end management. Working with AI can provide an answer to this challenge, while it also improves the accuracy, yield and predictability of produce.

As Blue Radix we are commi ed to contributing to the resilience, sustainability and growth of the industry. With Crop Controller we

It structures the crop strategy, so it’s a realistic calculation of yield expectations. Typically every week the grower checks if the strategy is OK, based on crop registration and observations. Crop Controller takes care of the execution, 24/7.

Growers benefit from Crop Controller on multiple levels. It’s a win-win for both the growing team and the greenhouse company. Growers have a be er work-life balance, because they don’t have to pay so much a ention to the climate computer se ings. These time-consuming tasks are done by AI/Crop Controller. They can manage four times more hectares, and/or spend more time in the greenhouse and work with the labour force.

The company benefits from higher yields (up to 10 per cent) and a reduction in resource usage (fertilisers by up to 10 per cent, energy by up to even 15 per cent), providing improved profit.

Finally, the company benefits from improved yield prediction and securing the valuable, unique crop knowledge of the company, with less dependency on individual growers.

Swedish retailer teams up with Swedish Growers Association to develop 10ha facility that will ultimately supply 8,000 tonnes of tomatoes per year.

by Mike KnowlesSwedish retailer ICA has revealed it plans to source more locally grown tomatoes later this year from a new greenhouse facility west of Stockholm.

The group said it was investing “heavily” in the 10ha production centre in in Frövi, near Lindesberg, in collaboration with Svenska Odlarlaget, the Swedish Growers Association. The facility will use waste energy from nearby industry for its heating and is expected to supply 8,000 tonnes of tomatoes per year. Its first harvest is scheduled for autumn 2024.

The investment should enable ICA to increase the proportion of Swedish-grown tomatoes in its central supply all year round, and therefore enhances Sweden’s selfsufficiency in fresh produce.

“We want to contribute to strengthen the Swedish food supply and our investment in Swedish tomatoes is an example of how @mikefruitnet

we can do that,” commented Eric Lundberg, CEO of ICA Sweden.

“The investment means that we undertake to increase responsibly the supply of Swedish tomatoes. It benefits both the environment and long-term sustainable Swedish agriculture, while at the same time meeting consumer demand.”

According to a Sifo survey conducted by ICA and LRF in May 2023, there is strong demand among Swedish consumers for food produced in the country.

The research suggests around half regard homegrown products as a way to reduce dependence on

imports, while one-third see it as a means to “strengthen Sweden’s preparedness”.

But a large proportion of Sweden’s tomato supply is imported each year. ICA said it wanted ultimately to offer consumers Swedish-grown product for twelve months of the year.

“Our goal is always to offer Swedish in season,” said Jonas Andersson, business area manager for fruit, vegetables and flowers. He revealed that ICA had increased the proportion of Swedish-grown vegetables in its range by 5 per cent over the past year.

“Today, around 60 percent of our vegetable assortment is from Sweden. Through the collaboration with the Swedish Growers’ Association, we are taking another big step forward in this work.”

ABOVE—The new facility near Stockholm is expected to produce around 8,000 tonnes of tomatoes every year

With

GOLD SPONSOR

Fokker Terminal Netherlands