echnological advances are revolutionising the cultivation of Hass avocados worldwide. From the breeding process right through to ripening and delivery, these innovations are enhancing the quality, yield, and sustainability of avocado production, ensuring that consumers receive the best possible fruit. New rootstocks and varieties are being developed with specific attributes to combat pest and disease and produce healthy trees in a range of local environmental conditions. Precision agriculture involving the use of sensors, drones, and satellite imagery allow growers to monitor and manage crops more efficiently. In the post-harvest arena, technology is also playing a crucial role in maintaining the quality of Hass avocados. Innovations in ripening, packaging and transportation are helping to extend the shelf-life of avocados, ensuring they remain fresh from farm to table. These developments are not only helping consumers to enjoy the best possible avocados but also promoting more sustainable and efficient farming practices. Over the course of these pages, we report on some of the advances that are delivering better avocados and therefore driving repeat purchases. And as global supply continues to climb, that’s needed more than ever.

Maura Maxwell Editor

CEO Bertrand Guely explains how the company’s two-pronged strategy is boosting its bottom line and helping local producers.

by Maura Maxwell

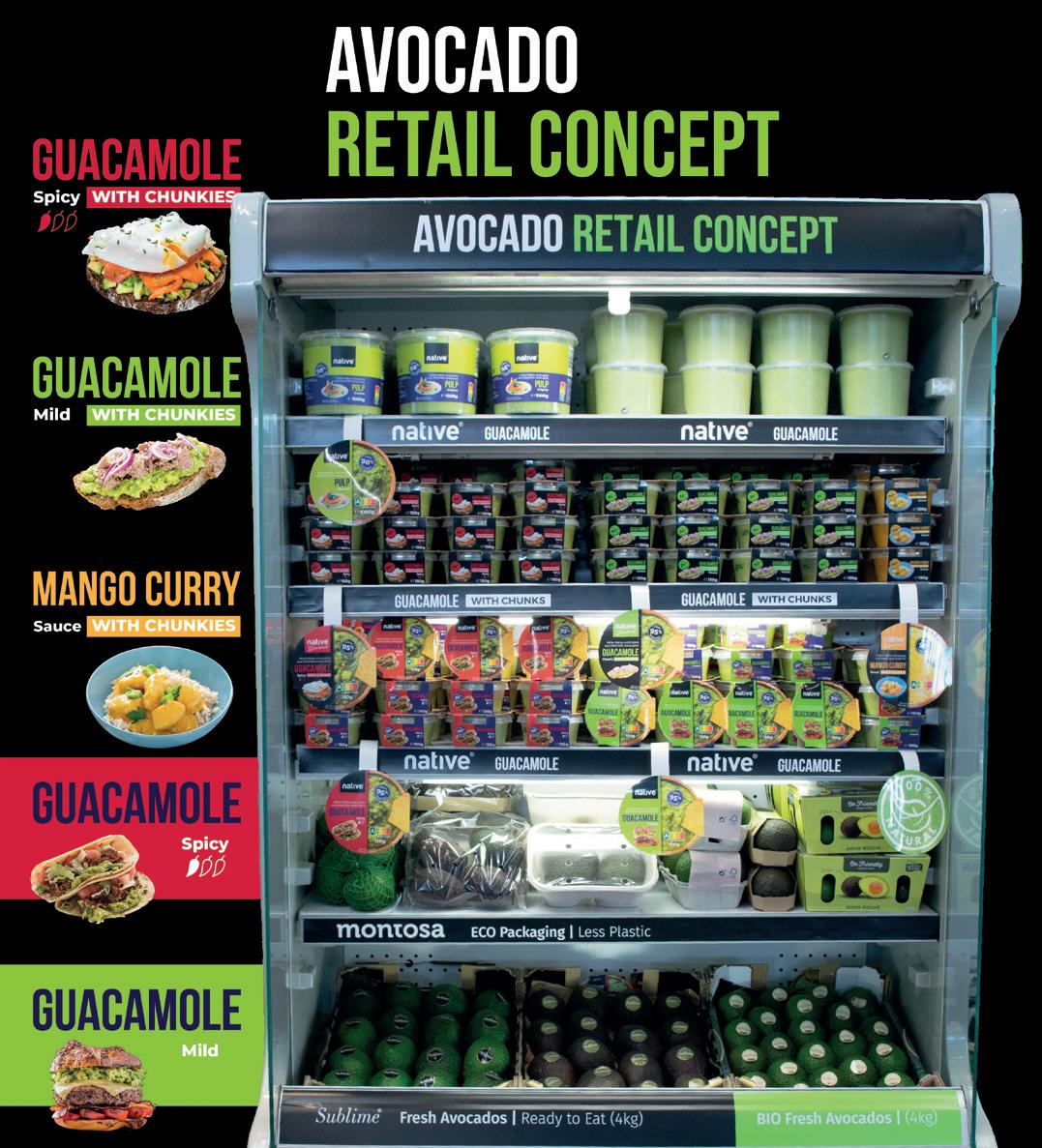

Frutas Montosa has seized on Europe’s growing appetite for guacamole to add value to an increasingly commoditised sector and offer a lifeline to farmers in southern Spain. For more than 40 years, Montosa has been a leading supplier of avocados to European retailers. In 2007 the company pioneered the production of fresh guacamole using high pressure

processing (HPP) technology, and it has never looked back.

“Today, Montosa has its feet in two camps,” says CEO Bertrand Guely. “The business is split 50:50 between whole fruit and guacamole – but it’s the latter that is growing fastest.”

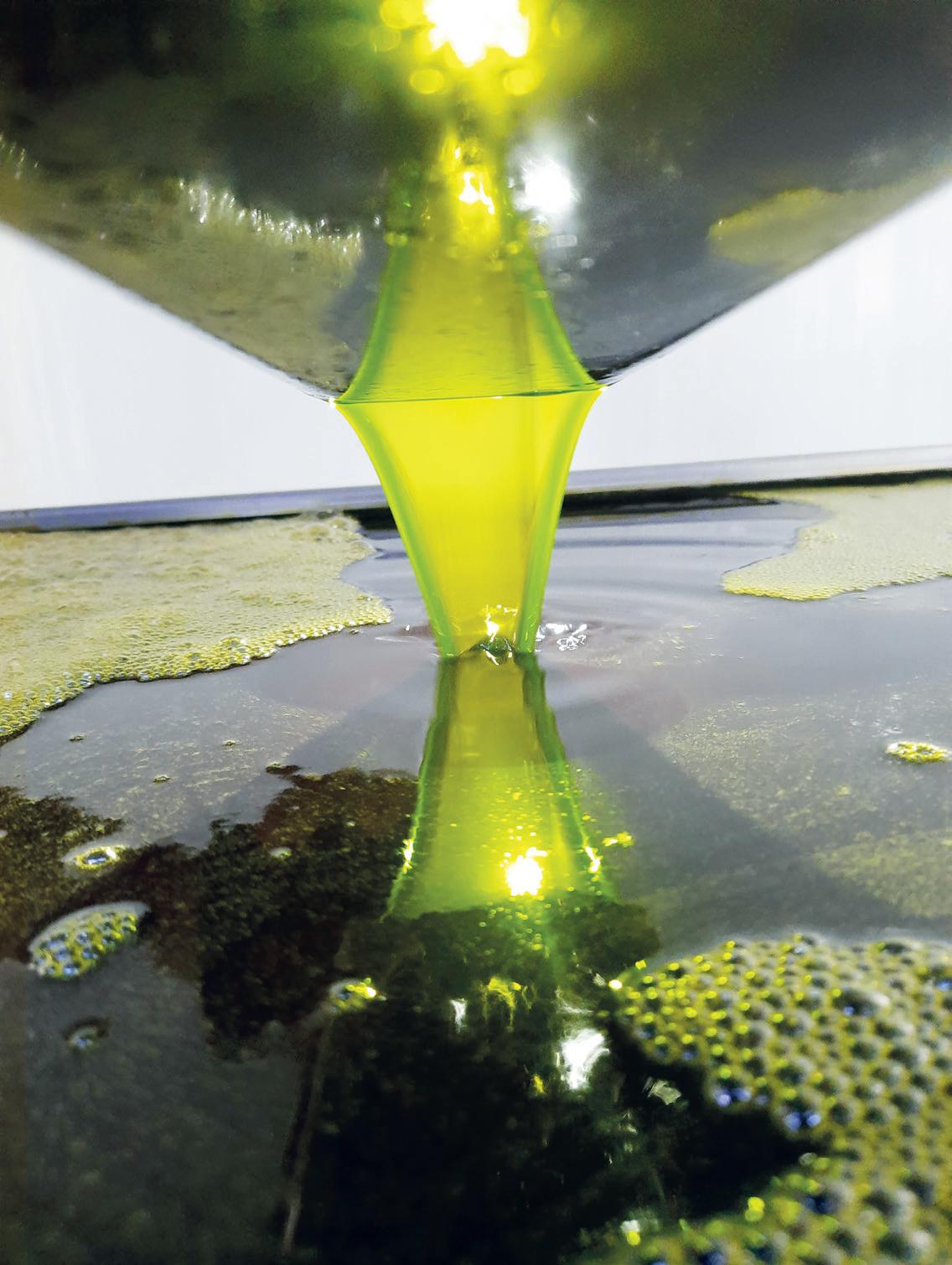

HPP, a non-thermal preservation method, gives the guacamole a shelf-life of almost 40 days without compromising on flavour, texture or quality. As Guely explains: “Compared to other preservation methods, it’s like the difference between Tropicana and Sunny Delight.”

As well as being the exclusive supplier to Spain’s biggest retailer Mercadona, the company sells its guacamole to leading UK chains like Marks & Spencer and across virtually every market in Europe. It produces

ABOVE—Montosa takes all of its growers’ fruit which it sells either as fresh, or through its processed lines

LEFT—Bertrand Guely

OPPOSITE—The company’s guacamole is sold in virtually every European market

around 15 different recipes, tailored to the tastes of each market, with varying degrees of spiciness, lemon juice content or avocado pieces.

Montosa’s decision to expand its guacamole business is not just down to the product’s growing popularity, but also the need to find a solution for farmers struggling to deal with the impact of rising temperatures and drought.

“It’s very important to us to cultivate long-term partnerships with our growers. Take last season when there wasn’t much fruit and we had an abundance of smaller sizes. You can’t just rock up to a producer and say, ‘we’ll take a few counts 14s and 16s’. The grower will quite rightly ask, ‘well what do I do with the rest of my crop?’,” Guely says. “We go from our ultrapremium brand, Sublime Gold, right down to lower categories. Together with our processed line this means we can take all their fruit, all sizes and all categories. It’s about adding value.”

Guely’s career in produce spans three decades – two-thirds of which have been working as a retail buyer. More recently he had stints at Compagnie Fruitière and Fall Creek before arriving at Montosa in October 2022.

Being able to look at the industry from both sides of the fence has played a key part in shaping his vision for the company. “We know what our retail customers are looking for and how to provide it,” he says.

In the fresh market, for example, Guely sees plenty of potential to grow demand provided the quality and consistency are there. If you put a properly ripened avocado with no internal bruising on the supermarket shelf, the consumer will always come back for more.

“You have to get the ripening right – this is the very heart of what we do,” he says. “That means knowing how to ripen an avocado that has been shipped from Olmos in Peru, one that has been airflown

from Mexico, or the last fruit of the Spanish season, all of which will have a different dry matter and oil content. At Frutas Montosa we have more than 20 ripening chambers and employ state-of-the-art sorting technology to guarantee optimum ripeness and no internal bruising. Our philosophy is ‘We don’t do everything, but what we do, we do best’.”

Guely acknowledges that retailers in some markets opt for green fruit because it is less complicated to handle and has lower shrinkage than ripened avocados, but he insists this needs to change.

At the same time, the industry needs to mount an effective counteroffensive against what he calls the “BS” spouted in the press about the environmental impact of avocados, while reinforcing health messaging and finding new consumption opportunities. “Guacamole, for example, can be used as a healthy fat to replace butter in a Mexican-style breakfast,” he says.

Another way to grow demand is to offer more segmentation. “Some 15 years ago avocados were just one more tropical fruit, sold alongside papayas and mangoes. Today it is a category in its own right, just like citrus or apples, and you need to market it accordingly. At Montosa we supply year-round fresh premium avocados in all formats –conventional, organic, Zero Residue, eco, loose, packaged, Fairtrade – you name it we do it.”

When it comes to guacamole, Guely says sales are doing “really well”. Again, retail strategy is key – and coming from a supermarket background he has a lot to say on the matter. In the UK and France, for example, guacamole is typically positioned in the dip section between the salsa and the hummus, which he believes limits its appeal. By contrast, Mercadona stocks it in the fresh produce section.

“They do a fantastic job

positioning our products. You can find the 200g and 500g guacamole tubs alongside fresh avocados sold in packs and loose. This generates much more traffic,” he says.

Part of the challenge when it comes to convincing other retailers to adopt this approach is that the avocado buyer and the guacamole buyer are typically two different people. Guely believes retailers should take a more global view. To help them, Frutas Montosa has manufactured a branded chill cabinet stocking its entire range that it displays at trade fairs.

Asked about the long-term future of Spain’s avocado industry, Guely is sanguine. “Here in Málaga we produce fantastic Hass avocados. We can reach the market in one day by truck, so we can’t be beaten on freshness or sustainability,” he says. “But water is a real issue. The consequence is that volumes are falling and sizes are smaller. It doesn’t impact us too much as we can source from other areas, but it’s terrible for local producers. And we owe them. When they have a bad year they need to know that we are still here for them.”

With expanded capacity out of Chile and South Africa, and regional hubs in six countries, the multinational has invested heavily in its European ready-to-eat avocado business.

by Maura Maxwell

Since the creation of Dole plc in 2021, the global giant has made no secret of its ambition to lead the avocado category in Europe. We caught up with category director Oscar Dominguez Donaire and marketing and sustainability vice-president Vincent Dolan to find out what progress they have made.

How has your avocado business evolved since Dole Exotics was launched 18 months ago?

Oscar Dominguez Donaire: It has been an extraordinarily exciting time. We promised to raise the bar in exotics, with the emphasis on avocados and mangoes. So we have spent much of our time putting in place the foundations to deliver on that promise – concentrating on both production and marketplace operations.

We have invested at source, most noticeably at farm level in Chile and expanding our packing capacity in South Africa.

Across Europe, investment in ‘the last mile’ is ongoing. By the end of this year, we will have six fully operational regional hubs for the marketing of avocados, in the UK, Denmark, Netherlands, Poland, France and Spain. Each will deliver ripened product that meets local customer demand, and ensure consistently ripened product for pan-European customers,

irrespective of where the avocados are sold.

What does Dole Exotics bring to the avocado market that other suppliers don’t?

ODD: The collective strengths, reach, and experience of our global business are critical. Dole Exotics offers customers the reassurance of our vertically integrated supply chain, our streamlined route to market, and, in the marketplace, infrastructure and expertise to meet the most exacting, bespoke specifications consistently. The reliability of our sourcing, the harmonisation across our supply chain, and the care we take from farm to fork, allows us to bring to market ready-to-eat avocados grown to the very best agronomic and sustainable standards. For customers and consumers alike, it’s a compelling proposition.

How is the roll-out of your Dole BE Exotic! brand going?

Vincent Dolan: We’re very pleased with the progress our Dole BE Exotic! Avocado and Mango brand has made. We expect it will continue to grow as our new hubs open. Its message ‘Embrace your inner adventurer’ resonates with consumers, and our sustainable packaging options are popular with retailers. In 2024, we added a

third line, Dole BE Exotic! Papaya, to our range.

What future developments do you see in the avocado category?

VD: Consumption of avocados in Europe lags behind the Americas and beyond, which suggests there is dormant, untapped potential. But it’s important complacency does not undermine that potential. As a sector, we need to earn those extra sales: bringing greater consistency of quality to the retail shelf; investing in an exceptional ready-to-eat experience; assuring sustainable practices; and bringing innovation to category promotions. At Dole we are committed to all those things. We are confident we will drive the category forward, in 2025 and beyond.

Citrosol has developed two outstanding technologies: PlantSeal® Tropicals and CITROCIDE® AVO SYSTEM, both certified for organic agriculture.

PlantSeal® Tropicals is an organic vegetal coating that controls avocado weight loss, allowing additional weight savings in shipments and improving the firmness and appearance of the fruit and extending its shelf-life. In addition, it significantly reduces cold damage during transport and storage, with an effectiveness of up to 84 per cent in reducing internal damage. PlantSeal® Tropicals, which is already used to protect avocados shipped to Asia and Europe, maintains the quality of the fruit without affecting

its ripening process. It also has the vegan V-Label seal, making it attractive to the most demanding consumers and markets.

CITROCIDE® AVO SYSTEM guarantees the hygienic washing of avocados, ensuring food safety and minimising losses caused by stem-end mould, a problem that often develops during fruit shipping and storage. This system effectively controls the appearance of stem-end mould without leaving residues on the fruit, offering an organic and efficient solution comparable to traditional fungicides. More and more customers are adopting CITROCIDE® AVO SYSTEM to ensure effective postharvest washing that meets

the requirements of importing countries.

The combination of PlantSeal® Tropicals and CITROCIDE® AVO SYSTEM extends the shelf-life of avocados, reduces losses in the supply chain and maximises the quality of the fruit that reaches the consumer, all through organic and sustainable solutions.

ABOVE—On the right, avocados treated with PlantSeal after 46 days in coldstorage and six days in ambient storage, compared with untreated avocados on the left

A well-timed investment in technology and a carefully planned procurement programme have combined to give UK importer Worldwide Fruit a considerable advantage.

by Mike Knowles

The UK is ripe and ready for growth. Despite the pressures of high inflation and reduced consumer spending power, there remains a defiant and remarkable appetite in the market for top-quality, perfectly ripe avocados. And it’s a market that only a handful of companies appear properly equipped to supply.

One such company is leading UK importer Worldwide Fruit. Fifty per cent owned by Fruition, a group of around 40 British growers, it has managed to develop an impressive business in avocados, to complement those producers’ apple, pear, and stonefruit supply.

“In the last five years, we’ve seen significant growth in the market, particularly in ripe and ready to eat,” explains Mark Everett, director of the company’s

avocado business unit. The UK market is still growing, he says. In the 12 weeks to mid-May, the group noted a 12.5 per cent increase in sales. “Some of that was inflation, but underlying it is still volume growth which has come in and maintained itself in ready-to-eat. That segment was 16 per cent up in value and the same in volume.”

“In the last five years, we have seen significant growth in the market, particularly in ripe and ready-to-eat”

The group’s own numbers back up this impressive expansion story. It currently imports, ripens and packs about a million avocados

PICTURED—

Worldwide Fruit’s new brand is built on the promise of premium-quality, ripe-and-ready avocados

each week – mainly from Peru, Chile, and South Africa. In 2023, it sourced almost 60m individual pieces of fruit from ten different countries – equal to around 3m cartons – for a turnover just shy of the £30m mark.

In some ways, for a business that had a much larger focus on topfruit just a couple of decades ago, that success has appeared more or less out of nowhere. But this would be an unfair assessment of a well-run commercial operation which already had an active role in the avocado import market, and took some very good decisions at the right moments. One such decision was a strategic procurement focus on building supply with larger-scale suppliers in existing countries of origin, rather than trying to source more from lots of different parts of the world. »

It’s also fair to say, however, that the company enjoyed its fair share of luck. When its packhouse in Spalding was ready for a refit around five years ago, it was already clear the avocado market was preparing for lift-off. And so, presented with an opportunity to meet rapidly growing, market-wide demand for consistentquality avocados, it decided to invest in ripening technology called Softripe. Inspired by a visit to a banana ripening centre in Switzerland, it was the first such installation for avocados anywhere in Europe.

“Softripe has been a game-changer for us,” Everett insists. “It’s allowed us to ripen fruit without going into the rooms, with a far more controlled process where you micromanage the gas mix, you measure the fruit’s respiration, and then it tells you when the pallet of fruit is going to be ready.”

In the past, Worldwide Fruit’s ripening staff would put newly arrived pallets into a warm room, check them every day, and estimate the time they might be ready – usually after five or six days. As Everett points out, those days are over. “With Softripe, after 24 hours of the fruit being in the room, the system will tell you when the fruit is going to be ready.”

The technology, which was supplied by Frigotec and installed in collaboration with JD Cooling, means taking samples and cutting them open is no longer required. Over the course of the year, that equates to several hundred thousand avocados saved.

“Softripe was a game-changer for us. It’s allowed us to ripen fruit without going into the rooms with far more control”

There is a significant cost saving too in terms of the energy used. Softripe is reckoned to use about 30 per cent less electricity per kilo to ripen the fruit. Ultimately, that means better returns to the grower and better product for the customer.

“With Softripe, we found a system where we can get the fruit from an individual producer or even pallet to ripen far more consistently from fruit to fruit within that arrival batch,” Everett adds. “And because of that, our output now is more consistent in terms of fruit firmness and being in the ready-to-eat spectrum than ever before. We want to give our end consumers a great piece of fruit, a great experience. And where

we sell product and class it as ripe and ready to eat, we want it to be just that.”

With more predictable quality at its fingertips, Worldwide Fruit recently started marketing yearround, fully ripe and ready-toeat avocados to the wholesale and foodservice trade under its own brand.

As the company’s senior technical manager Alison Tagg points out, that new label is already winning over customers. “Because we’ve achieved complete consistency with Softripe and the procurement,” she says, “it’s a brand that is really driving itself.”

BELOW—Worldwide Fruit’s new

avocado facility was the first of its kind in Europe

Shelly Vorster explains how retail collaborations underpin the World Avocado Organisation’s efforts to promote category growth.

by Maura Maxwell

Shelly, tell us about how the World Avocado Organisation came about, and who its grower members are?

Shelly Vorster: The WAO was founded in 2016 as a non-profit organisation. The aim was for growers from Latin America, Africa and Spain to join forces to promote avocados in European consumer markets. As well as representing the top five avocado exporters in Europe, we have grower members from all over the globe, including from Peru, South Africa, Chile, Tanzania, Colombia, Spain, Zimbabwe and more. WAO now supports over 12 different EU and UK countries with retail marketing that spans more than 30 retailers in the last year. We’re also in our second year of supporting the Indian market. We invest in marketing activity at the point of purchase, as opposed to other methods like price and promotional activities.

How are your activities funded?

SV: Our model is voluntary, with funding coming from member contributions based on the volumes supplied across the UK and Europe each year. Member growers pay a levy per kg and they receive a continuous stream of updates on our activities so they can see how their contribution helps boost the category’s success. Through the data we have collected, we have a comprehensive understanding of consumer behaviour, including their purchasing habits, frequency, and price sensitivity across various retailers and countries. We support marketing activities that look to household penetration, thereby educating and inspiring both current and new consumers about avocados.

Health and nutrition appear to be key drivers in sales. Does WAO fund its own nutritional studies or do you rely on work done by other organisations?

SV: Health is the number one decision driver for avocado consumption in Europe, so it is fundamental for us to educate consumers on their health benefits and the latest scientific studies carried out. WAO does not fund its own research for health studies, instead, we actively and continuously gather third-

RIGHT—Shelly Vorster of the WAO BELOW—WAO provides point-of-sale marketing materials

party, independent research from reliable scientific sources on all health topics concerning avocados to ensure that we can supply a complete, credible picture for our audience.

Recently, WAO has been much more proactive in responding to negative press stories about avocados. Why do you think they get such a bad press compared to other fruits and vegetables?

SV: The avocado is a unique superfruit that found fame online in recent years, and because of this, we receive our share of the limelight, including both positive and negative headlines that attract the public’s attention. WAO is devoted to stepping in when these negative stories include sensationalist, unfounded claims based on little or no evidence

or incorrect information. WAO, together with our international media partner, Marco agency, tackles negative press head-on with hard facts and research to give the industry and consumers the real truth about a fruit that is sometimes misunderstood or under-represented.

Finally, how do you plan to support the further development of the avocado market worldwide?

SV: With more members signing on and switching from a cost to investment model, WAO is bringing value through sharing insights, data and research. We aim to further improve our membership stewardship programme so that paying members are given a voice and receive relevant information to then make more informed trade decisions.

The country continues to offer avocado suppliers plenty of potential for expansion, as two of its leading importer-marketers confirm.

by Mike Knowles

Italy grows hungrier for avocados with every passing year. And with growth in consumer demand for the fruit set to continue, a number of importers have opted to focus more attention and investment on the category as they look to repeat the product’s success in other major European markets.

Gruppo Orsero, one of the market’s leading players in tropical fruit imports, is one of a small number of companies that have moved to source greater volumes of the fruit and even invest in domestic production.

As the group’s chief commercial officer Alessandro Canalella explains, recent impressive sales growth might have slowed this year as a result of lower availability in Italy’s biggest supply country Peru, but overall the prospects for further increased demand remain positive.

“In terms of volumes, avocados are growing in double figures year on year,” he confirms. “In Italy in 2023, we recorded an increase in volume of more than 30 per cent compared to the previous year.”

Although consumption in Italy is still low compared with the European average, there are signs that this will change. In terms of usage, consumption in salads is the main sales driver of sales, and a lot of consumers favour the product for its healthy properties. Many agree this could propel the category forward in the country.

BELOW—Demand has grown but more must be done to educate consumers

Luca Battaglio, president of Turinbased importer Battaglio, is one of those who believes the market potential is great. This year, his company will source around 8,000 tonnes of avocados, mainly for retail customers. “We started from very low levels compared to other European countries, but we are recovering with significant progress in terms of consumption,” he notes.

A lot of progress has been made already. “If we consider that we have gone from 250g per capita a few years ago to consuming about one kilo per person today, with this constant increase it is reasonable to imagine that we can soon align ourselves with the current European average of 2kg.”

Battaglio feels that more can be done to encourage more enjoyment and experience when it comes to avocado usage and consumption, however. “It would be helpful to create a kind of culture by talking about avocados in a proper and reasoned way,” he suggests, “and by teaching people how to consume it in the most appropriate and appetising way possible.”

He thinks television programmes have an especially important role to play here. “These can inform users about avocados’ excellent nutritional and beneficial properties. It must become an accessible product, especially for that part of the population that does not yet know or consume it.”

Conscious of this emerging potential, Orsero recently went into partnership with a Sicilian company called Faro to produce and market Italian avocados. For more than two decades, the importer has produced avocados in Mexico with two local companies, Productores de Aguacate de Jalisco and Comercializadora de Fruta Acapulco. »

In eastern Sicily, it has already established a 50ha production area on the slopes of Mount Etna, between the towns of Giarre, Riposto and Fiumefreddo. This will soon be expanded to 100ha, says Canalella.

“The main variety grown is the dark-skinned Hass,” he adds, “which is much appreciated by consumers and increasingly widespread in the world for its organoleptic characteristics. The fruits are harvested between November and March, and are distributed both in the large-scale retail trade and in the traditional channel.”

There are variations across the Italian market in terms of demand for different varieties. By some distance, Hass is the market leader and that trend is expected to remain as the overall market grows. But suppliers also see room for the sale of green-skinned products, especially in parts of southern Italy.

As far as overseas procurement is concerned, Peru’s dominant market window in Italy runs from spring to early autumn. After that, Mediterranean sources, such as

Israel, Spain, and Italy itself, are in play. Beyond those origins, South Africa, Mexico, and Chile meet the remaining market demand.

A number of African countries including Morocco, Kenya, and Tanzania have shown potential for growth in the market, as has Colombia, which should see a large volume spike in the next few years.

Battaglio sources mainly from Peru, Chile and Colombia. “These countries are well prepared and consistent in terms of production, as well as very efficient from a logistical point of view,” Battaglio comments.

In 2018, the group set up a project in Colombia called Agricola Persea with a local family called Restrepo, with the aim to develop its own dedicated supply. Soon it will have around 1,000ha of in-house production in total.

“Having started from scratch, in the first few years we had to face the typical start-up problems,” Battaglio admits, “but fortunately we have now overcome them and we are confident that we can count on significant production in the coming years, both in terms of quantity and quality.”

ABOVE—Alessandro Canalella (left) and Luca Battaglio (right) both see strong growth potential in Italy’s avocado market BELOW—Orsero Group’s partnership with Faro is expected to create 100ha of production in eastern Sicily

Tesco and Westfalia Fruit are swapping barcode stickers for laser etching on extra-large avocados in latest trial to limit plastic waste.

by Kristian Bayford

Tesco and Westfalia Fruit are cutting down on plastic waste by introducing laser etchings and scrapping plastic stickers on extra-large avocados. The UK’s largest grocer said highpowered lasers remove a small section of the top layer of avocado skin, where it etches information on the size and variety of the fruit in a third of a second.

The laser etching trial is a joint initiative with the UK’s biggest avocado supplier, Westfalia Fruit, and could remove the need for nearly a million plastic stickers. Westfalia is behind the etching technology and says it has conducted extensive trials to ensure the quality, shelf-life and taste of the fruit are not affected.

At the same time, Tesco is also

launching a trial to replace the plastic tray packaging for two of its most popular avocado lines. Instead, the retailer is switching to a cardboard container that is easier to recycle.

If rolled out across all Tesco stores, the moves could save more than 20m pieces of plastic tray packaging from twin-pack avocados alone, and up to 25m pieces across the whole pre-packed range.

The trials will take place in around 270 Tesco stores in southeast England. If feedback from customers is positive, they will be rolled out across the Tesco estate. At present, the retailer sells nearly 70m avocados a year and has seen demand for the fruit grow by 15 per cent in the last year.

Tesco avocado buyer Lisa Gilbey said: “We’re always looking for innovative ways to reduce the environmental impact of our products and cut down on plastic waste in the home through changes to our packaging.

“We’re really excited to hear customer feedback on our new laser-etched avocados, avoiding the need for a barcode sticker that can easily be forgotten and left on when recycling through household food waste.”

Westfalia Fruit general manager Graham Isaac added: “We are confident that, with a clear focus and united effort as an industry, we will be able to significantly reduce our waste, use natural resources responsibly, and protect the environment and biodiversity for all our futures.

TOP—The project is a joint initiaive with Westfalia Fruit, the UK’s leading avocado supplier

Uptake of Frigotec’s innovative ripening technology is growing, says managing director Roland Wirth.

by Maura Maxwell

Frigotec’s patented Softripe fruit ripening system is being adopted by an increasing number of ripeners in Europe and beyond. The German company has just completed major avocado projects in the Netherlands and Belgium, while in Sweden, Helsingborg-based packaging company Swedlog recently extended its capacity to supply Softripe-ripened avocados to the Ica supermarket group.

“We are constantly developing and optimising our unique Softripe AI maturing algorithm so that current projects are delivered in version 3.0,” managing director Roland Wirth tells Fresh Focus Avocado. “We now offer customers over 200 special recipes to ripen avocados of different varieties, countries, regions and to different ripeness levels.”

In addition to bananas, avocados and mangoes, the technology has been shown to ripen non-climacteric fruits such as pineapples – something that up to now has not been possible with conventional ripening systems.

Another benefit of Softripe, says Wirth, is that it can significantly reduce the time it takes to ripen avocados. “On average we guarantee a ripening time of 3-3.5 days, even with difficult overseas fruit – and in emergencies, the ripening time can be further accelerated by using the turbo function without compromising on

quality,” he explains.

Turbo ripening allows customers to react to fluctuating supply, market and sales situations such as delivery delays or orders received at short notice. And Softripe can even be used on avocados that have been treated with edible coatings to extend their shelf-life as it is able to completely control the ripeness of the fruit and its state of development.

In addition to expanding its presence in European countries, Frigotec is now turning its attention towards the US and Asian markets. Wirth notes that countries like China, South Korea and Japan, where consumers value exceptional fruit quality, are an ideal target for the company’s Softripe ripening technology.

“Softripe is the only ripening system that can communicate with the fruit and has its condition completely under control. This enables the fruit to be guided through the ideal biological ripening process without any stress using a complex AI algorithm,” he explains.

“The fruit ripens from the inside out, so fruits with varying dry matter content are homogenised in their speed of development during the ripening process. The stress-free and biologically ideal ripening process preserves the health and vitality of the fruit and significantly extends its shelf-life.”

The result, says Wirth, is fruit

ABOVE

& RIGHT— Frigotec recently completed major avocado projects in the Netherlands and Belgium

“On average we guarantee a ripening time of 3-3.5 days, and this can be further accelerated with the turbo function”

with a firm and stable skin, soft, ready-to-eat pulp and maximum aroma development. And this is borne out in consumer surveys, with one survey for Special Fruit showing that 25 per cent of respondents rated Softripe-ripened avocados as better tasting than avocados that had been ripened using conventional ripening technology.

Such is his faith in the system that Wirth believes it could generate more avocado sales if it were also marketed to consumers. “Softripe improves fruit quality and extends its shelf-life, making it more sustainable, so we see great potential to promote this innovation, through branding and product information,” he says.

Uncertainty in the fresh avocado market and the growing popularity of avocado oil is fuelling demand for the company’s avocado oil extraction machines.

by Maura Maxwell

Demand for avocado oil has risen steadily during the past year. A series of events – led by last season’s olive oil shortage – has caused prices of crude avocado oil to increase globally. For Bari-based Amenduni, a leading manufacturer of avocado oil solutions, this had prompted a surge in demand for its avocado oil processing machines.

It says sales of its larger machines, with a high hourly capacity, are booming. “A growing number of customers are opting for bigger machines to reduce their operational costs, so that they can achieve the maximum efficiency and competitiveness in a market where competitors are becoming more and more aggressive,” says Aldo Pesce, Amenduni’s export manager for Africa and Asia.

Founded in 1905, Amenduni supplies avocado oil extraction machines to more than 15 countries worldwide. In recent years, countries like Mexico, Colombia and Peru have drastically increased their production of avocado oil. In Central America, there are already several large operators who have made sizeable investments to meet growing demand in the US. This is the world’s biggest market for avocado oil, where sale are forecast to reach US$715m by 2018.

Kenya has also become an important producer of avocado oil. According to Pesce, most of the oil

there is extracted with Amenduni machines. “In 2021 we had just two machines installed in the country, but today we are working on a number of projects in Ethiopia, Rwanda, Uganda, Tanzania and Zimbabwe as well as Kenya, and for the past three years the Kenyan Avocado Society has awarded us with the prize for best avocado processing machines,” he says.

Transporting Kenyan avocados to Europe has become increasingly risky since last October due to the Red Sea crisis, which has seen a number of containerships attacked by Houthi rebels. Many players have been forced to divert shipments round the Cape of Good Hope, causing long delays and pushing up costs.

This uncertainty in the fresh market is pushing more companies towards the avocado oil industry. Avocado oil is already a staple of many US shopping baskets and demand is taking off in other regions, such as Northern Europe, while other markets like Asia remain largely unexplored.

“Our machines are made in Italy to the highest standards, and we provide an excellent service through our global network of technicians,” says Riccardo Stillavati, export manager for the Americas and Oceania. “We also offer a complete consultancy service at no extra cost, guiding customers through the entire avocado oil project.”

Experience Fruit Quality and De Laat have teamed up to create innovative bespoke ripening solutions for avocados and other fruit.

by Maura Maxwell

Two Dutch companies, QC software specialist Experience Fruit Quality (EFQ) and ripening room builder

De Laat, have teamed up to create RipeWise, a groundbreaking solution suite designed to revolutionise fruit ripening.

RipeWise captures extensive data on fruit development and ripening room conditions and uses it to form the foundation for tailored ripening recipes based on the origin of the fruit, its size, the grower, the time of year, and other contextual parameters. It uses artificial intelligence to identify patterns in this data, translating them into actionable alerts for ripeners to support recipe creation, monitoring, and intervention.

De Laat’s bespoke ripening cells allow for precise measurement and control of sensors, enhancing ripening outcomes. Tappers are used to monitor fruit development over time, while AI models track colouration changes, ensuring consistent and predictable ripening results, saving time, fruit and energy.

“Combining state-of-the-art hardware and software, RipeWise equips ripeners with the tools to achieve optimal ripening results in any situation,” says EFQ’s CEO Marco de Jong. “By capturing and leveraging their own ripening experience, ripeners can improve daily processes, enhancing efficiency in terms of time and energy.”

Ripening has traditionally relied heavily on the expertise of the ripening team using the hardware available to them. But both EFQ and de Laat saw the potential to make the ripening cycle more predictable and the fruit more homogeneous. By merging EFQ’s data and AI capabilities with De Laat’s extensive knowledge of ripening hardware, they created what Adriaan van Beek, CEO De Laat describes as “an ideal blend of human expertise and technological innovation for ripeners”.

“RipeWise monitors every step of the ripening process in detail, providing ripeners with all relevant information to make informed decisions and evaluate outcomes,” he says. “It captures a wealth of contextual data, including harvest dates, transit conditions, and quality checks, to predict the optimal ripening recipe for the desired result. During ripening, we collect data on fruit development and ripening conditions, using historical data to create and refine recipes and monitoring protocols.”

By capturing and connecting data from pre-ripening to postripening, ripeners can refine their techniques for each batch of fruit.”

De Laat’s hardware features bespoke temperature control using patented airflow technology, which saves time and energy, enhances flavour, and reduces quality issues. Additionally, stateof-the-art sensors measure and control respiration and ripening

ABOVE—RipeWise combines state-of-the-art hardware and software, equipping ripeners with the tools to achieve better ripening results

conditions, seamlessly integrating with EFQ’s software to provide comprehensive ripening management.

Currently, RipeWise is optimised for bananas, avocados, and mangoes, but it can also be adapted for kiwifruit and stonefruit in the future.

The first version of RipeWise will be available this fall, enabling ripeners to start capturing their experiences and creating tailored recipes.

As more data is gathered, the AI component of RipeWise will grow increasingly powerful, optimising current practices and paving the way for more autonomous ripening strategies. “This will allow ripeners to concentrate their expertise on handling the most challenging batches of fruit,” De Jong says. “The software simplifies data capture and insight generation, allowing ripeners to focus on optimising processes rather than time-consuming inspections and communications.”

Following a disappointing campaign in 2023, Israeli avocado producers have welcomed a big rise in production this year, with efforts ongoing to develop new export markets.

by Gerry Kelman

Many new avocado orchards have been planted in Israel in recent years, and even near Gedera, south of Tel Aviv, avocado orchards have been appearing among the plantations of pomegranate and citrus.

Official figures show that there were 4,000ha of avocados planted in Israel in 2004, 7,000ha in 2014, rising to 9,600ha by the end of 2018. Planting has slowed down to 500600ha a year in recent years, with

There are two major producing cooperatives, Galilee Exports and Granot Fresh. Three packing houses exclusively supply Galilee Exports, growing on a total of 6,500ha. They are Milopri, situated on the coast, north of Haifa, and covering production from Western Galilee; Zemach, which is located at the southern end of the Sea of Galilee, covering production areas around the sea and southwards into the Jordan Valley; and Avocado-Gal, situated in the Upper Galilee.

Granot Fresh, based on the coastal plain in the centre of the country, is part of Granot, Israel’s largest cooperative belonging to 43 kibbutzim, and grows about 3,200ha of avocados. In addition, there are a

current cultivation at 14,300ha.

After an all-time record yield of 210,000 tonnes in 2022, the disappointing 2023 harvest totalled about 150,000 tonnes, mainly due to adverse weather conditions.

However, this year’s yield is expected to be close to 250,000 tonnes, an annual increase of 60 per cent.

number of smaller packing houses affiliated to other exporters.

Around half of Israel’s avocado production is exported, with a similar quantity sold locally. In recent years, per capita consumption in Israel has increased from 8kg per year to 12kg.

The two major exporters – Galilee Exports and Granot Fresh (established only four years ago) – cover about 70 per cent of total exports. Mehadrin exports a further 14 per cent.

The most popular variety, Haas, represents about 60 per cent of exports, with Galilee Exports one of the largest exporters of the variety in the world.

The green-skin varieties – led by Ettinger and Pinkerton – make up about 40 per cent of exports.

Galilee Exports sends green-skin varieties mainly to Poland and Russia. Mehadrin exports to a wide range of markets, while other green-skinned varieties exported are Fuerte, Arad, Galil and Reed.

Although most of the exported crop from Israel (80 per cent) is bound for Europe, this represents only about 25 per cent of total European avocado imports, with big competition from Morocco, Spain and Chile. Efforts are ongoing to develop new markets worldwide, including the Far East.

Galilee Exports has recently invested in Peru, controlling about 100ha of avocados, with 1,200 tonnes produced. This quantity is to be delivered to Galilee customers at a time when avocado exports from Israel are winding down.

There is a slow but steady increase in the concept of readyto-eat avocados on the shelves. The fruit is treated in a highly controlled atmosphere – in special ripening rooms – with various combinations of warm air and natural gases (such as ethylene) to ripen the fruit immediately prior to retail display.

The introduction of precision irrigation in plantations has succeeded in optimising yields. On the one hand, avocados have a wide and shallow root zone with very low drought tolerance while, on the other hand, the tree shows a high sensitivity to flooding or overirrigation.

ABOVE—As well as Hass, Galilee exports the green-skin Ettinger and Pinkerton

Unitec, an international group with 100 years of knowhow in the field of fruit and vegetable sorting and quality selection technologies, continues to stand out for its ability to innovate and provide advanced technological solutions to its customers worldwide.

Innovation has always been in the DNA at Unitec, which designs and implements solutions in over 65 countries across five continents, covering all stages of the sorting of more than 50 types of fruit and vegetables, including avocados.

Indeed, in recent years consumption of this fruit has significantly increased in Europe and around the world. This has stimulated local production of the Hass variety in particular, for example in Italy, Spain and Portugal, where favourable climatic conditions are an important aid in obtaining high-quality fruit.

In order to meet the increasing demands of avocado producers to offer consumers fruit of consistent quality over time, the Unitec group, through its Unisorting brand, has developed cutting-edge technologies such as Avocados Sort, dedicated to the external quality selection and UNIQ Avocados, dedicated to the internal quality selection of these fruits.

Specifically, Avocados Sort is able to scan 100 per cent of the surface of each fruit, detecting any external defects, as well as weight, optical size and colour.

This innovative system, entirely developed within Unitec’s

R&D department, thus permits suppliers to offer the market fruit of consistent quality over time, enhancing the value of the product and fostering customers’ loyalty.

UNIQ Avocados is Unitec’s innovative solution for internal quality selection of avocados. It allows companies to determine their dry matter, a crucial indicator for assessing the ripeness of the fruit.

Traditionally, without the aid of UNIQ Avocados, this process was long and arduous. But thanks to the innovative Unitec system it can be carried out on the line, combining high productivity, high precision and reliability in the fruit

sorting with extreme delicacy.

Unitec demonstrates its proximity to customers with a team of specialised technicians, a wide availability of spare parts on site, and the ability to anticipate and foresee possible difficulties with professional maintenance plans, organised in collaboration between the Unitec team and the customers’ technical team.

Therefore, Unitec innovation never stops. The company, thanks also to its new research and development centre at its headquarters in Italy, continues to work closely with its customers all over the world to develop new and innovative solutions for them and to constantly improve existing technologies. In this way, it positions itself as a technology partner that can be counted on, today and in the future.

ABOVE—UNIQ Avocados uses advanced technology to determine the fruit’s internal quality and assess its ripeness

The South African avocado industry is celebrating gaining better access to Asian markets, but it is not going to be plain sailing yet.

by Fred Meintjes

South African avocado growers are celebrating new gains made in markets of the east. Following years of complex negotiations, China, India and Japan have recently opened and all eyes are now on 2025 when the first full export season gets underway.

However, things are unlikely to change dramatically in the foreseeable future. “South Africa

will continue to service its traditional markets of the EU and UK,” says Clive Garrett, responsible for Marketing at Exporter ZZ2 and previous chairperson of the South African Avocado Growers’ Association (Saaga). “There will not be a dramatic swing away from these markets as both China and India have very high tariffs, some as high as 30 per cent, so South African producers will probably

BELOW LEFT—

China and India impose high tariffs on South African avocados, so returns will have to be high to tempt shippers

only export to these new markets when the returns are higher than in the EU and UK.”

Nevertheless, the breakthrough in Asia is sure to bring new impetus to South African growers, who have ramped up investments in new orchards in recent years. Increases in early-season and lateseason production in southern and western regions have dramatically extended South Africa’s marketing windows, with the country also becoming selfsufficient as far as the local market is concerned.

“The opening of these markets provides South Africa with many more marketing opportunities,” says Garrett. “Firstly, as everyone is aware, South Africa has enormous challenges in its ports. By opening markets in the East, avocado producers will now not have to send all their fruit through Cape Town but will be able to use Durban and even Maputo in Mozambique as well.”

The South African avocado industry is also hoping that the authorities will soon negotiate access to the US market. “This has been a 17-year-long struggle and should this market open then there will be many opportunities open to our growers,” says Garrett.

He points out that South Africa’s traditional markets of the EU and UK have come under tremendous pressure in the last few years because of increased Peruvian shipments to these markets.

“This is one of the reasons South Africa is a founding member of the World Avocado Organisation which has as its aim to promote avocados in these markets. We have seen a steady increase in per capita consumption in these markets but nothing like what has happened in the US.”

He says the European economy has also been struggling ever since Covid and the spending power of consumers in Europe has been under pressure.

For South African avocados, 2024 has been a momentous year. Apart from opening new markets in the East, South Africa is blessed with a big crop and a strong market in its traditional marketing regions. “We are still expected to ship around 20m cartons and due to lower competitive shipments from Peru our growers are having an excellent season,” says Derek Donkin, CEO of Subtrop.

With a production footprint spanning four continents and presence in all the major consumer markets, the company is well positioned to take advantage of growing global demand, says business development executive Zac Bard.

by Maura Maxwell

This is a big year for Westfalia. What milestones has the company reached in its 75th anniversary year?

Zac Bard: Celebrating Westfalia’s 75th anniversary gives us the opportunity to reflect on our achievements since 1949. From the original orchard in Tzaneen, South Africa, Westfalia now has the most diverse production footprint, with orchards throughout South America, Africa, Asia and Europe.

Our research and development division team is the largest privately funded sub-tropical research unit with colleagues across the globe working in partnership with local growers. The Dusa rootstock developed by

the Westfalia team remains the market’s rootstock of choice.

Our founder, Dr Merensky, had the generosity and foresight to establish the Hans Merensky Foundation, which continues to provide education, local resources and opportunities to many in our local communities. Libraries, IT access, scholarships, bursaries, targeted education programmes for literacy, numeracy and languages as well as charitable donations are just some of the activities the foundation continues to support.

With continued, sustainable development we look forward to celebrating our 100th year and achieving lifetime carbon neutral status.

LEFT—Westfalia has orchards in Africa, South America, Europe and Asia

BELOW—Zac Bard, Westfalia’s business development executive

OPPOSITE—One of Westfalia’s farms in Colombia

Last year saw a notable increase in avocado consumption across Europe, despite the cost-of-living crisis. What do you put this down to? What does your consumer research tell you about which markets and consumer segments are driving the growth in avocado sales in Europe?

ZB: Research tells us that the number one driver for eating avocados is health, followed by taste. Although other fruits or salads may be more cost effective in Europe, the flavour and health credentials of avocados are unique and cannot be easily substituted.

How and when avocados are eaten does vary across the markets, for example in Germany almost half the avocado consumption is at breakfast, whereas in the UK consumption is spread across breakfast, lunch and dinner.

The demographic profile of who is consuming also varies across the countries, in the UK, Germany and Italy demand is driven by younger consumers, whereas in Spain the older generation are the heavier consumers. It is clear to see that in terms of marketing, supply and retail channels one size does not fit all!

Asia is one of the growth hotspots for avocado consumption. Given that per capita consumption of avocados across the region is less than 0.05kg per person (versus 1.6kg in Europe and 3.5kg in the US), this suggests that there is huge potential for growth in the Asian market doesn’t it?

ZB: Asia is an exciting market. Looking at the current consumption and population mass, the potential for the Asian market is significant. However, avocados are not naturally part of the local diet. For example, contrary to popular belief, sushi with avocado is a relatively new addition introduced by Western cuisine.

Education around handling, storing and establishing a secure supply chain will be key to unlocking the potential in Asia, together with effective advertising and media campaigns to drive demand and ignite local interest. We welcome the recent market access given to South Africa and anticipate the first shipments later this year following agreement of all protocols.

Westfalia has established itself as the market leader in India, one of the most exciting markets in the region. How do you plan to develop this in the coming years?

ZB: Avocados are a relatively new fruit to the Indian market and education is key in developing interest and demand. The World Avocado Organisation has been working with several key chefs and influencers sharing dishes and ideas of how avocados can be added to daily dishes.

The recent access granted to Australian and South African suppliers over the last year is very welcome. With our supply network it enables us to maintain consistent supply over 12 months. Maintaining availability of good quality avocados is particularly important to develop regular buying patterns.

Westfalia will also continue investing in the domestic infrastructure, including the maturing of our avocado orchards, nursery and using our extensive experience in ripening.

Developing such a huge market with such a highly fragmented retail sector presents very unique challenges doesn’t it?

ZB: It does indeed – combined with the sheer size of India and the local climate, an integrated, robust supply chain is key. For example, we are currently establishing regional distribution centres to service smaller cities and tier 2 towns. Providing key retailers with knowledge of how they can best store, merchandise and promote avocados is an important

element of encouraging and supporting the development of the market. We recently hosted several retailers at local workshops in key areas to share our experience and continue to work on instore activations and promotions.

How are sales of your proprietary Gem avocado evolving? Do you have more new varieties in the pipeline? And do you think there is room for more segmentation in the avocado market generally?

ZB: Gem continues to establish itself as the premium avocado product and we work with selected retailers across Europe and Africa to provide consumers choice and that extra special avocado experience. Our world-renowned research and development team continues to trial and develop new varieties that are suitable for planting in a diverse range of natural environments.

Development of new varieties is a significant investment, taking up to 25 years to successfully commercialise. In the last few years we have commercialised Zerala and Leola rootstocks, both developed with specific attributes to combat pest and disease and produce healthy trees in a range of local

environmental conditions. We believe there is room for segmentation within the category, particularly with the wider introduction of avocadobased products, such as frozen avocado chunks, smashed avocado, guacamole and other dips and condiments that can fit into today’s lifestyle choices while also providing exceptional flavour and health benefits.

Finally, what are the big changes happening in the global avocado supply base? Where are the emerging regions and countries that are set to make the biggest difference to the international trade in the coming years?

ZB: Just 20 years ago, around seven countries supplied the European market – that has now more than tripled, with suppliers from across the world supporting the market through 52 weeks of the year. As demand continues to grow, we anticipate that emerging sources such as Guatemala, Lebanon and Morocco will support the established regions, particularly on the shoulders of seasons. Sources such as Turkey, Crete, Egypt also show potential with the right resources and infrastructure.

Investments in growing and packing bring new dimensions to the produce sector in the Western and Southern Cape.

by Fred Meintjes

The expansion of fruit growing and packing in the Southern Cape region of South Africa is providing a major boost to the region’s exports. In recent times these regions have also become significant producers of blueberries and cherries, while the avocado industry is also now making major strides in the Cape.

Spearheading the change are new investment partnerships in these regions. Two leading South African companies, ANB Investments – which runs Indigo Fruit Farming, the Du Roi group of nurseries, and several packhouses in South Africa – and Smuts Brothers, which operates under Lucerne Agri Investments, have formed a joint venture which

manages the Arisa Packhouse in Swellendam and Lucerne Pack near Robertson. The advantages include more produce being packed at both packhouses, which are situated in close proximity of each other.

Arisa was previously known as the only sharon fruit packhouse in South Africa but has now undergone a transformation to becoming fully focused on citrus and avocados, plus stonefruit at certain times of the year.

Underlying this is the expansion of Indigo Fruit Farming over the past decade or so. The company’s citrus farms now stretch from near Ashton to Heidelberg on the Duivenhoks River, with huge investments being made in new acreage and varieties.

ABOVE—Major investments in new acreage and varieties will boost export volumes

“Arisa has become a highly competitive packer of citrus and avocados, while also packing stonefruit in between,” says Etienne Brewis, general manager for Arisa and Lucerne Pack. “It is the growth in avocado and citrus production in the Cape which are major drivers in increased exports.

“Arisa has significantly increased its job opportunities because it offers employment right through the year,” Brewis continues. “Volumes are set to grow substantially over the next 5-8 years so the opportunity to employ local people will continue to grow. Arisa is, and has been for some years, involved in community projects mainly at the local schools.”

One of Arisa’s production partners, sister company Indigo Fruit Farming, is still developing a new citrus production unit at Ashton called Sarah’s Valley, where significant plantings under net are already underway. “Plans are in place to continue to plant more citrus, at least the same number of hectares have already been planted, but likely more,” says Brewis. “This will increase volumes for both packhouses.”

Excessive rain and the ongoing Red Sea crisis have created headaches for Kenyan avocados this season, delaying ripening and increasing the transit time to their main market in Europe.

by Tom Joyce

Despite the devastating floods in Kenya this year, the avocado season at grower-exporter Karakuta has been relatively unaffected, according to CEO Grace Ngungi.

“The rainy season brought more rain than usual,” she said, “but this typically reduces irrigation needs, increases yields and enables us to attain a bigger fruit size throughout the season.”

Karakuta’s farm, located in Juja, stands 1,600m above sea level, she says. The area receives around 130mm of precipitation annually, and the tropical climate gives the fruit a creamy rich taste, according to Ngungi.

However, the longer than usual rainy season delayed the ripening of the fruit, she said. “Usually we

reach a dry matter of 22-23 per cent by March, but this year it was around 19-20 per cent, so we only entered the market in April, which is slightly late,” explained Ngungi.

“This had a negative impact on our sales, especially with the arrival of Peruvian fruit in June and July.”

Late ripening meant missing out on the high prices usually received for early avocados in March. “We continued to export the large size fruits in May and into June,” said Ngungi, “but these volumes failed to cover the lost sales expected in March. Competition from Peru also resulted in lower market prices for Kenyan avocados.

“Additionally, the ongoing Red Sea crisis increased our transit time to Europe and the UK, hence reducing our trading month

LEFT—A longer than usual rainy season delayed ripening of avocados in Kenya

even further, as well as increasing our freight costs significantly. This impacted the dynamism of the supply chain.”

According to Ngungi, when the European window reopened after Peru’s supply period in mid-June, the dry matter of Karakuta’s avocados was too high to withstand the long voyage of 40 days to Europe. To mitigate such risks, Karakuta is striving to penetrate markets like China and India.

“Our current relationships with suppliers in these Asian markets are still developing and immature,” she said. “We hope to establish more reliable connections soon to enhance our market presence in these regions, while positive lobbying from the government can boost Kenya’s competitiveness in these two markets.”

Kenya’s Keitt Exporters is looking to continue its growth in East Asia, according to the company’s Anne Kavai. “Among the new lines we have launched this season is the ready to eat avocado (RTE),” she says. “We are also excited about our ongoing value-added avocado oil project.”

Despite a tough season, Keitt has continued to invest, even if logistics and rising competition remain a challenge. “We continue to push for growth on the Chinese market and also hope to see the South Korean market open up,” says Kavai. “We had good volumes of avocados in Kenya this year, and the rains will help boost production and improve quality and sizes for the coming season.”

One of the main issues this season has been transit times due to the Red Sea crisis. “We need more options with shorter transit times,” says Kavai, “Australian fruit has also flooded the market in Asia and Peruvian fruit is earlier, so we have to brace ourselves to remain competitive in this region.”

Burundi avocados have a mission to reach international markets, with Tanzania and Kenya between the landlocked country and the Indian Ocean, but Jenika is looking for direct partners to ensure better returns for its growers.

by Tom Joyce

BELOW—Jenika founder Jessy Katia Niyonkuru

Burundi producer-exporter Jenika produces its green beans almost exclusively for the local market, but its Hass avocados are nearly entirely for export, reaching shelves in Europe and the Middle East.

“We have our own avocado farm with 500 trees,” says Jenika founder and CEO Jessy Katia Niyonkuru. “When the demand for avocados is especially high, we also work with other growers.”

Since the demand for avocados is there, the company does have plans to plant more trees, but there are other priorities in the shorter term, according to Niyonkuru. “We are looking for better contracts with better prices for the growers,” she says. “Most of our

produce ends up in Europe and the UAE, but it travels through Tanzania and Kenya, so I’m looking for direct partners.”

The cheap cost of labour may be an advantage in Burundi, but it is also the company’s ambition to ensure fair wages for all workers. “This should be part of a company’s mission,” says Niyonkuru. “I want to do something that benefits people for generations and helps to develop our communities, not just deliver short-term profit.”

At the moment, of course, there are challenges in the Red Sea. “This is a problem for shipments from East Africa, increasing the journey time,” she says. “For frozen vegetables, the extra shipping time can be an issue.”

There is also the issue of climate change. A report by Christian Aid revealed that avocado production was under threat from climate change, with avocado regions expected to decline by 14-41 per cent by 2050.

Jolis Bigirimana, an avocado farmer and president of Farmer’s Pride Burundi, told Sky News that climate change was a “huge problem, especially for avocado growers” in the country.

“We are experiencing hot temperatures, heavy rain and erosion,” he said, “which is having a terrible impact on farmers’ productivity and their income. It now costs us a lot of money to water our crops.”

Arecent Rabobank report studying the global avocado business has predicted a shift in the market, anticipating an increase in both production and trade. The RaboResearch Food & Agribusiness report shows that the industry is gearing up for further growth, with Latin America holding its position as the top exporter and the US continuing to be the primary importer.

“Despite a fragmented industry landscape in some regions, the market is moving toward consolidation, especially in South America, where competition and margin pressures are intensifying,” Rabobank says.

According to the report, global avocado exports are expected to surpass the 3m-tonne milestone by 2025. While Latin America will remain at the forefront of production, the export scene is diversifying. Mexico, Peru, and Colombia will lead the field as the largest avocado exporters according to the projections, while Brazil, Ecuador, and other countries are also emerging as exporters.

Meanwhile, the rapid growth of the European avocado market has spurred increased production in the EU, mainly in Spain. However, water

availability remains a “significant factor” limiting large-scale expansion of avocado production, and further area expansion is not expected for European production.

Africa, too, is witnessing steady growth, with Kenya maintaining its upward trajectory and Morocco’s exports “burgeoning” as its trees mature. To stay ahead, Rabobank urges industry players to innovate amid a “competitive and challenging supply environment”.

The US’ appetite for avocados keeps on growing, setting import records at 1.26m tonnes in 2023, an 11 per cent increase year-on-year. Mexico remains the country’s primary supplier, with a “staggering” 90 per cent share of imports.

Europe’s consumption patterns have evolved, meanwhile, with a projected increase in avocado purchases for 2024/25 – assuming stable supply conditions – while its reliance on imports is set to grow given its “low self-sufficiency rate”. “Opportunities abound in Asia and Latin America, with untapped markets poised for growth,” explains David Magaña, senior analyst – fresh produce at Rabobank.

“South American countries, in particular, are ripe for increased consumption, pending promotional

New report by Rabobank highlights growing consolidation in the region.

by Carl Collen

and marketing initiatives,” he outlines. “Asia’s imports have surged by 29 per cent year-on-year in 2023, with China leading the way.

“While Hass avocados will continue to dominate, Hasslike varieties will gradually gain ground, particularly those with higher yield potential,” Magaña adds. “The industry faces price pressures as global production volumes rise, with quality and size being pivotal in the American and European markets.”

South America’s industry is consolidating, the report says, with large-scale companies increasingly dominating the landscape.

This trend is expected to continue as the market responded to competition, margin pressures, and demand for year-round supply.

ABOVE LEFT—The global appetite for avocados keeps on growing BELOW—David Magaña, senior analyst – fresh produce at Rabobank and one of the report’s authors

As the Chilean Avocado Committee prepares to hold its 2024 Global Avocado Summit, Fresh Focus Avocado talks to its executive director Francisco Contardo about the state of the Chilean industry in 2024.

by Maura Maxwell

Can you give me an overview of the Chilean avocado industry today?

Francisco Contardo: Over the past four years, the core focus of our work at the Chilean Avocado Committee has been on sustainability. Since 2021 we have been working with the consulting firm Sustenta+ on a roadmap setting out the social, economic and environmental production standards aligned with United Nations’ 2030 Agenda for Sustainable Development. At the same time, we have

sought the advice and opinion of different technical organisations to monitor the effect avocado trees have on the environment. Our findings confirm the results of the 2019 Cazalac study, which shows the positive long-term effects of avocado plantations in preventing desertification and soil erosion, given that once planted, avocado trees have a minimum lifespan of 40 years.

During the 2023/24 season that recently ended, Chile produced around 150,000 tonnes of avocados. According to Odepa (Office of Agrarian Studies and

Policies, Ministry of Agriculture), Chile has 33,000ha of production, mainly located between the regions of Coquimbo and O’Higgins. We’re not seeing any expansion in acreage, but in some areas orchards are being uprooted due to various issues related to climate change, while production is moving into other areas where these conditions do not exist.

When it comes to exports, Chile has fairly well diversified markets. What markets would you say offer the best growth potential for Chile in the coming years?

FC: Thanks to our high quality and production standards, Chilean avocados are very well positioned in several markets. Europe continues to be our biggest export market, but we also see opportunities to

expand in Asia. China is a market that we consider has great growth potential. The Indian market is new and transportation times are long, but it is definitely a market of interest in which we are gaining more knowledge.

Per capita avocado consumption has skyrocketed in Chile, hitting a massive 8.2kg in 2023. What do you put this increase down to? Does the Chilean industry carry out extensive marketing campaigns to encourage local consumption?

FC: Chileans are among the biggest consumers of Hass avocados in the world, surpassed only by Mexico. In just over 20 years we have gone from consuming 2kg per inhabitant to 8.2kg in 2023. This growth is principally due to the promotions carried out by the Chilean Avocado Committee from 2000 onwards. By 2019, per capita consumption had reached just over 4kg, and since Covid consumption has skyrocketed thanks to the fruit’s immune-boosting properties. At the same time, supply has increased significantly. Many Chilean producers now supply the domestic market, some even exclusively, while imports of Peruvian avocados now satisfy demand when no national fruit is available.

Drought and climate change are changing the face of avocado production in Latin America. How is it affecting Chile and what steps are producers taking to mitigate its impact?

FC: Avocados have always proven to be a resilient

crop in the face of adverse climatic factors. In fact, one farm, located in Chile’s Quillota province, is believed to be 75 years old. But there’s no doubt that climate change has impacted avocado production, and many growers have had to relocate to areas where this fruit is not traditionally produced.

Today, around 80 per cent of Chile’s avocado farms are found on hillsides, as this provides some protection against adverse weather conditions. Investments in modern irrigation systems have also helped mitigate the impact of drought.

Despite the best efforts of the industry, avocados get unfairly maligned in the media for their environmental footprint compared with other fruits and vegetables, especially their water footprint. Is this criticism justified? What can be done to counter the bad press?

FC: Unfortunately, a number of myths have sprung up around avocado production. For example, many poorly informed people believe that they are a crop that requires a lot of water, which is totally false. Avocados are not particularly high consumers of water – according to a 2013 study by the Institute of Agricultural Research (Inia), producing 1kg of avocados requires an average of 410 litres of water, well below other crops and foods that we eat on a daily basis, such as meat, dairy products and many processed foods.

What’s more, practically 100 per cent of production uses highly efficient irrigation technology to keep water usage to a minimum. As an organisation, we are constantly promoting new technologies to make avocado production even more sustainable so that we can continue to be a world leader in this respect.

OPPOSITE—Chile has around 33,000ha of avocado production

LEFT—Francisco Contardo of the Chilean Avocado Committee

The avocado industry has changed dramatically worldwide, particularly in Chile, Peru, and the South American region. Today there are new supplier countries, growing markets, an increase in local consumption, and great challenges such as enhancing the competitiveness of the avocado and promoting progress in sustainability.

With that intersecting and current view, the former “Avocado Day” returns this year as the Global Avocado Summit. Organised by the Chilean Avocado Committee and Yentzen Group, the event will take place in Santiago, Chile on 21 November, 2024 at the Casino Monticello Events Centre.

The Global Avocado Summit is aimed at farmers, marketers, and exporters who want to analyse the current status of the sector, address potential destination markets, and delve into the commercial, marketing and communications strategies of the avocado supplier countries, with sustainability as a central theme.

Date: 21 November, 20024

Place: Santiago, Chile

Web: www.globalavocadosummit.com

The country is set to become the world’s third-biggest supplier as acreage continues to grow.

by Maura Maxwell

Colombia’s avocado boom continues. According to a recent Rabobank report, the country is on course to overtake Spain and Kenya to become the third-largest avocado exporter in the world behind Mexico and Peru.

However, there are signs that the rapid increase in planted area is slowing down. According to Ricardo Uribe, CEO of Colombia’s biggest avocado grower-exporter Cartama, acreage had been growing at around 30 per cent a year over the past decade but this has decelerated somewhat recently. Nevertheless, he points out that with several large-scale projects underway, Colombia is set to consolidate its position as a global supplier in the coming years.

At the same time, as growers gain more experience of how to grow and ripen the fruit in different parts of the country, the quality and consistency of Colombia’s offer is improving all the time.

Cartama exported 27,500 tonnes of avocados worth US$54m in 2023 and this year it expects to see a 24 per cent increase in shipments. “Europe continues to be our main market but we’re also seeing a rise in shipments to the US. Each year we register more acreage to enable us to increase exports to this market,” Uribe tells Fresh Focus Avocado.

He sees the creation of the new Avocados From Colombia label as a key strategic moment for the

industry. “We hope it becomes a seal that endorses the quality and sustainability of our product and helps us promote it in the markets we serve,” he says.

Uribe has high expectations for the future of the global avocado market. “If you look at the latest reports, imports and per capita consumption continues to grow across all markets. And when you consider that 50 per cent of US households don’t purchase any avocados, this leaves us plenty of room to continue growing,” he says.

“And there are many other markets to develop. Colombia has barely touched the Asian market and we believe that as our output grows, we can be a supplier to this region, especially in the summer season.”

BELOW—The new Avocados From Colombia label highlights the quality and sustainability of the countrys’ avocado offer

Colombian Hass avocado exports to the US are projected to hit 50m lbs this year, an increase of 50 per cent on the 32m lbs shipped during 2023, according to the Colombian Avocado Board.

The growth of the Colombia avocado market comes on the back of the continued expansion of avocado acreage in Colombia’s main growing regions and ongoing infrastructure investments. Today, more than a dozen state-of-the-art packing sheds and more than 400 growers are certified to ship Hass avocados to the US market.

Due to its tropical climate, Colombian avocados are available year-round. The country has two distinct harvest seasons – the main season, which runs from September to January, and the current Traviesa season.

Manuel Michel, executive director of the CAB, commented: “Colombia is at a crossroads of opportunity that is generating economic development and the Hass avocado sector is spearheading efforts in sustainability thanks to their rich agricultural heritage and commitment to maintaining biodiversity through environmental stewardship.

“CAB is excited to be part of the ongoing development and to support the avocado growers, exporters and importers as they invest in Colombia and leverage their logistical advantage to the East Coast”.

The Californian avocado specialist marks a significant milestone as it continues to strengthen its position at home and overseas.

by Carl Collen

Calavo is celebrating its 100-year anniversary in 2024, and the company is reflecting on the past while also looking ahead to the future of the avocado business.

As a Californian business, it takes pride in its history of grower relations in the US and Mexico as well as new emerging sources, according to senior director of international sales Tommy Padilla, and continues to strengthen its position in key markets.

“This season we have controlled a very strong market share from the state of Jalisco, which is a key source for the US and International markets,” he tells Fresh Focus Avocado. “Calavo is the only US company to own and operate a packing facility in this region.”

Not only does Calavo enjoy strong market share in the US, but it has also become one of the foremost suppliers of avocados to Japan and Canada over the

Granot Fresh, the largest avocado grower cooperative in Israel, has invested in Neolithics’ high-performance AI-based optical automated, non-destructive produce inspection solution. The technology analyses fresh produce inside and out, picking out everything from internal defects and acidity to scarring and anomalies.

Granot is using the technology to measure dry matter and pressure in avocados and analyse a “significant volume” of the fruit, allowing it to offer its clients valuable data that will help them improve the product for the end customer, reducing food waste and losses. It is also replacing other destructive tests for its growers and distributors.