THE FPJ in association with BIG 50 PRODUCTS 2023

Your favourite mono-material punnet just got bigger

Key

•

•

We wouldn’t trust our fruit in anything less.

In our trials this range of high-quality mono-material punnets offered excellent product protection. On top of that they’re easy for consumers to recycle

Radoslav Marinov, Angus Soft Fruits

Waddingtoneurope.com info@waddingtoneurope.com Producepackaging.co.uk info@producepackaging.co.uk

the MONOAIR® range The

MONOAIR

Waddington

Introducing

revolutionary

cushion technology from

Europe is now available in multiple sizes up to 1kg.

features and benefits:

• No bubble padding

• Lighter gauge technology requires less plastic

Fully recyclable back into food-grade rPET

• UK Plastic Packaging Tax compliant

Waddington Europe 2023. All rights reserved.

Available in up to 100% rPET Copyright

“

now available in a variety of sizes WE37 WE62

TO YOU BY WADDINGTON EUROPE & PRODUCE PACKAGING

MONOAIR

WE80 BROUGHT

Ads.indd 1 07/07/2023 15:20

“

Worst may be over after year to forget

The FPJ Big 50 Products is now in its ninth year and each time there are different overarching trends shaping the sector’s sales performance. In 2021, the Big 50 was all about Covid and an unprecedented sales rise across most (if not all) categories. Last year, a messier picture emerged as shopping behaviour started to return to pre-pandemic norms and inflation began to affect sales. In this year’s publication, the cost-of-living crisis is by far the dominant factor and has had a major impact on consumer habits.

We have seen significant changes in purchase frequency, volume per trip, and penetration across many categories. And shoppers have managed the squeeze in a number of ways: they have exited certain categories, switched to others, traded down to cheaper tiers, simplified their shopping lists, sought better value for money, started preparing meals differently, switched spend to other supermarkets, and focused a bit more on frozen and tinned produce.

The bottom line is that, overall, volume sales are down – a sad but unsurprising consequence of the current economic crisis. However, we should not forget the sector is arguably still annualising on aboveaverage sales during “the gradual Covid unwind” (see p.6-7).

At a time when the majority of shoppers are tightening the purse strings, it is no surprise that volumes of certain commodity products (such as apples, bananas and baking potatoes) have held up better than more discretionary items (like limes, melons and asparagus). Berry sales, too, have slipped, bucking a long-term trend of strong and steady growth in the sector.

It is interesting to note that premium lines have fared relatively well despite the economic headwinds. In fact, sales of premium and branded produce grew by 2.5 per cent year on year in the 12 weeks to May – evidence that shoppers are still treating themselves.

In and amongst all this, is it is important to remember that there are other important factors at play, notably climate shocks, logistical challenges, and the extent to which the UK market is prioritised when volumes are short. I refer, of course, to the intense retail shortages earlier this year.

It is certainly a complicated picture, but as D:Ream put it in their 1993 pop hit, “things can only get better”. As grocery price inflation starts to ease, I am confident they will. fpj

Fred Searle, Editor

01

The cost-of-living crisis has harmed volume sales and shaken up shopper behaviour in myriad ways, but suppliers can be hopeful that the worst effects are now over

Follow me on LinkedIn: Fred Searle ON THE COVER Getting

to drive sales

shoppers

to

pick up fruit and veg has been more challenging, and retailers and suppliers have had to redouble efforts

p.1 Leader.indd 1 21/07/2023 15:02

Flag

EDITORIAL

editor Fred Searle

+44 20 7501 0301 fred@fruitnet.com

contributing editor Michael Barker michael@fpj.co.uk

senior reporter

Luisa Cheshire

+44 20 7501 3723 luisa@fruitnet.com

managing editor

Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

staff writer Carl Collen

+44 20 7501 3703 carl@fruitnet.com

staff writer Tom Joyce +44 20 7501 3704 tom@fruitnet.com

DESIGN & PRODUCTION

design manager

Simon Spreckley +44 20 7501 3713 simon@fruitnet.com

middleweight designer

Magdalena Witecka

+44 20 7501 3721 magdalena@fruitnet.com

middleweight designer Mai Luong

+44 20 7501 3713 mai@fruitnet.com

ADMINISTRATION

finance director Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Thomas

+44 20 7501 3717 tracey@fruitnet.com

accounts assistant Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions +44 20 7501 0311 subscriptions@fruitnet.com

ADVERTISING

advertising manager

Gulay Cetin +44 20 7501 0312 gulay@fpj.co.uk

account executive

Lucy Kyriacou +44 20 7501 0308 lucy@fpj.co.uk

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez +44 20 7501 3720 laura@fruitnet.com

events executive Poppy Bowe +44 20 7501 3719 poppy@fruitnet.com

MANAGEMENT

managing director, fruitnet europe Mike Knowles +44 20 7501 3702 michael@fruitnet.com

commercial director

Ulrike Niggemann +49 211 99 10 425 ulrike@fruitnet.com

managing director, fruitnet media international

Chris White +44 20 7501 3710 chris@fruitnet.com

FPJ Big 50 methodology

The FPJ Big 50 Products ranks the 50 best-selling fresh fruit and vegetable products by sales value. This special edition of the magazine has been produced in conjunction with Kantar, which supplied FPJ with the value and volume figures from retail sales for the 52 weeks to 14 May 2023.

All of the headline figures in this issue originate from data provided to FPJ by Kantar, but some of the data on other retail metrics may come from alternative sources. All of the fruit and vegetable items featured in the FPJ Big 50 Products relate to wholehead or mono pack sales. Pre-packed, pre-cut and mixedproduct pack items do not count towards a product’s figures in this list.

While some products have been grouped together – such as red, white, black and mixed grapes – others, such as potatoes, have been broken down into old, new and baking. This is because these are products with a clear point of difference from one another.

Each entry includes the product’s ranking in the list; the amount in pounds sterling consumers spent on it in the year to 14 May 2023; the amount by which this has risen or fallen compared to the previous year; the volume of the product sold, measured in kilos; and the amount by which this has risen or fallen compared to the year before. An arrow indicates whether it has risen, fallen or stayed the same compared to the 2022 ranking.

The figures are accurate to the best of Kantar and FPJ’s knowledge. fpj

Extra copies of the FPJ Big 50 Products – as well as FPJ Big 50 Companies – are available for £25 each. Contact us at subscriptions@fruitnet.com.

©2023 Market Intelligence Limited, part of Fruitnet Media International. All rights reserved. Neither this publication nor any part of it may be reproduced, stored or transmitted in any form, including photocopies and information retrieval systems, without the prior permission of Market Intelligence Limited.

Printed by Bishops Printers, Portsmouth (UK)

Fruitnet Media International

The Food Exchange, New Covent Garden Market London SW8 5E, United Kingdom

tel +44 20 7501 3700 info@fruitnet.com fruitnet.com

02

p.2-3.indd 2 21/07/2023 15:01

Price pressure suppresses category growth

A confluence of factors has led to substantial volume decline in UK fresh produce sales. Michael Barker looks behind the numbers

Michael Barker

From a pandemic to a costof-living crisis, via the fallout from the Ukraine war and the ramifications of Brexit – to say this has been a heavy few years for fresh produce suppliers is the understatement of the century.

At a category level, Kantar figures show total fresh produce sales standing at £11.9 billion for the 52 w/e 14 May 2023, representing a 2.6 per cent increase on the year before. That figure is higher than every year except the £12.5bn seen in the first year of the pandemic, where locked-down consumers bought supermarket produce in record amounts.

The problem is that the raw numbers doesn’t tell the real tale of what appears on the face of it to be a sales success story; the reality is that volume sales are at their lowest point in the past four years, with a worrying 4.7 per cent decline in the past 12 months as soaring food prices and an inflationary crisis hits consumer spending power. Quite simply, people are buying less fruit and veg.

There are many reasons to be concerned about this. From a pure industry perspective, the extent of the volume sales decline is a disap-

pointment after years of positive growth. Indeed, only four products in the entire Big 50 (blueberries, carrots, plums and kiwis) managed any kind of volume uplift, and two of those were under one per cent. One in five lines, by contrast, suffered huge double-digit volume decreases, an outcome unheard of in recent years.

There are fears that an underlying health crisis is emerging as worse-off consumers struggle to afford healthy food. Child food charity Meals & More claimed in July that more than half of families are being compelled to seek cheaper food, with 28 per cent having to buy less healthy food. An alarming number of parents reported missing meals this summer just to be able to feed their children.

It had been hoped that the pandemic would spark both a lasting cooking and healthy eating revolution, but the worry is that the progress made has been stymied by price rises that are putting many people off the category. While the fall in disposable income should ostensibly boost home food preparation, there is plenty of evidence that cooking has focused around stripped-back meals, as well as

greater use of tinned and frozen produce.

Further making 2023 a year to forget, in winter salad vegetables had the unwanted attention of making the front pages of the national press after adverse weather decimated production. It’s one thing that consumers are buying less, but quite another when it’s not available to buy at all.

Suppliers, hit by soaring production costs, have in many cases reduced plantings, with some ceasing production altogether until growing becomes profitable again. At the other end of the chain, there has been much talk of supermarkets profiteering, but as retail expert Ged Futter observes, retailers are “powerless to prevent food price inflation” and the leading stores’ profits are all down in the past year. Nobody is having a good time of it.

Looking for crumbs of comfort, there are strong signs that inflation has peaked and is now falling, and that cost price increases are finally making their way through to suppliers. Several input costs have started to come down. A number of premium lines have also performed well, indicating that those consumers who have the cash are willing to spend on quality.

Not all bad news then, but there will be hopes for a much more positive overall picture in the 2024 Big 50 rankings. fpj

03 Analysis

p.2-3.indd 3 21/07/2023 15:01

ABOVE—Shoppers have bought less fresh produce this year

FPJ Big 50 Products 2023

Souce: Kantar, 52 w/e 14 May 2023

04

Rankings

Rank Product Value Position Page compared to 2022 1 Dessert apples £906.2m Non-mover 8 2 Grapes £884.5m Up 1 8 3 Tomatoes £881.1m Down 1 10 4 Strawberries £776.9m Non-mover 10 5 Bananas £601.3m Non-mover 12 6 Blueberries £503.2m Up 1 12 7 Easy peelers £491.3m Down 1 14 8 Mushrooms £464.9m Non-mover 14 9 Old potatoes £461.8m Non-mover 16 10 Peppers £435.7m Non-mover 16 11 Raspberries £353.6m Non-mover 18 12 Cucumbers £341.3m Up 1 18 13 Onions £289.4m Down 1 19 14 Broccoli £282.9m Up 1 19 15 New potatoes £257.9m Down 1 20 16 Lettuce £250.3m Non-mover 20 17 Pears £228.8m Non-mover 21 18 Carrots £200.2m Non-mover 21 19 Avocados £197.6m Non-mover 22 20 Baking potatoes £197.4m Up 1 22 21 Oranges £185.1m Down 1 24 22 Melons £164.1m Up 1 24 23 Beans £153.7m Down 1 25 24 Cauliflower £117.1m Up 1 25 25 Cherries £114.9m Down 1 26 26 Sweetcorn £106.4m Non-mover 26 27 Cabbage £101.1m Up 1 28 28 Nectarines £97.7m Down 1 28 29 Spring onions £97m Up 4 29 30 Courgettes £89.5m Non-mover 29 31 Lemons £87.8m Down 2 30 32 Leeks £84.3m Up 2 30 33 Plums £83.9m Down 1 32 34 Asparagus £75.4m Down 3 32 35 Kiwis £72.3m Up 1 34 36 Sweet potatoes £69.7m Down 1 34 37 Celery £64.8m Non-mover 36 38 Garlic £61m Non-mover 36 39 Mangoes £54.8m Up 1 37 40 Peas £54.2m Down 1 37 41 Blackberries £49.7m Up 1 38 42 Brussels sprouts £47.6m Down 1 38 43 Beetroot £45.9m Up 1 39 44 Peaches £45.3m Up 1 39 45 Parsnips £43.6m Up 1 40 46 Spinach £43.2m Down 3 40 47 Pineapples £36.8m Up 1 41 48 Aubergines £32.2m Up 1 41 49 Limes £31.5m Down 2 42 50 Coriander £29.6m Non-mover 42

Limes -9.9% Cherries -10% Cucumbers +31.9% Parsnips +20.5% Kiwis +16.6% £11.9bn The UK retail market for fresh

2.6% on a year

TOP THREE RISERS AND FALLERS BY VALUE WITHIN THE TOP 50

produce is worth £11.9bn, up

ago

Asparagus -12.3% p.4.indd 4 21/07/2023 12:52

Some 6.2bn kg of fruit and vegetables were sold in supermarkets over the past year. That’s almost 17 times the weight of the Empire State Building in New York

RZ_EPAL_AZ_Jubilaeum_210x297mm.indd 1 06.12.21 17:26

RETAIL rethink

to

Fred Searle

How has the cost-of-living crisis affected fruit and vegetable sales in the past 12 months?

I’d probably split it down into three main trends in consumer behaviour, all of which have affected sales. Firstly, food preparation has become simpler. We’re putting fewer items on our plates and simplifying the ingredients in our meals. Part of that is about getting rid of superfluous items due to the cost of living. And part of it is driven by retailer ranges and an absence of promotions. That has big implications for a number of sectors across fresh produce because shoppers don’t have the promotions screaming out at them.

up during the pandemic. There was an obvious slump after that, and in the past year it’s fallen further.

The second key trend, driven by the cost of living, is the de-prioritisation of health as a reason for consumption. Wholehead veg, in particular, did well off the back of years of prioritisation of health before the pandemic. Now people still want to get their fruit and veg in to a degree, but they are much more willing to switch to other sectors that deliver that.

We’ve seen a trade down from chilled prepared items into wholehead items, and from wholehead items into frozen and canned items. So, people are still looking to eat healthily, but they’re going right down the chain to get it.

Sales of frozen and tinned veg are a lot more resilient than the wholehead equivalents, and they’ve been much more able to pass on price rises. We’ve seen a big, big uptick in the value of frozen veg recently, whereas fresh has been much more held back by decreasing volume demand.

The third big trend is that our convenience needs have been on the up again in the latest two quar-

Side points within that theme are that ‘assembled meals’ are on the up, and scratch cooking is down, which is a headwind for a lot of produce sectors, particularly vegetables. Rather than cooking from scratch, increasingly we’re simply putting ingredients together, with less time and effort involved. This decision is also linked to people’s concerns about energy usage and the cost of turning on the gas or the oven.

The number of produce categories that people are buying is also down versus pre-pandemic. Before Covid hit, we were on an upward trajectory of buying more and more types of produce each year. And that continued to shoot

ters, but we’re limiting energy usage. Oven cooking is down, which affects roasting vegetables for example, and the use of microwaves and air fryers is on the up. This changes the way people perceive fresh produce and the types of meals they prepare. In spite of this trend, prepared produce continues to lose out to wholehead because it is more expensive.

How have retailers responded in this challenging economic climate?

There has been much more focus on customised loyalty schemes, rather than traditional promotions across the board. It’s born out of the fact that the Big Four, if you can call them that anymore, are so scared of losing volume to Aldi and Lidl. They’re in this loyalty battle, and the promotional landscape has changed massively.

The volume of grocery sold on promotion has continued to move down. There’s still a decent number

06

Interview

Fred Searle speaks

Kantar’s Joe Shaw Roberts about how the cost-of-living crisis has shaped shopping behaviour and supermarkets’ strategies over the past year

p.6-7.indd 6 21/07/2023 11:15

of promotions available, but because you now have to fulfil certain criteria to unlock many of the deals, such as having a Tesco Clubcard, many more people end up picking up the items at full price.

In addition, the market continues to move to more everyday low pricing, and the implications for produce seem quite negative if you consider that the fresh produce sector does well when people buy across a number of different categories. The absence of multibuy promotions and even price-cut deals on items that people may not otherwise have bought in the same basket, or at all, disincentivises shoppers’ buying repertoire.

There’s also been a big push for range simplicity at Tesco and across the retailers. The implications for manufacturers holding several different lines with retailers are pretty tough, but I imagine it is a big efficiency for retailers.

This range simplification is arguably evidence of the traditional Big Four trying to replicate Aldi and Lidl’s success through their low-cost model, which has fewer lines and is really efficient. The discounters are starting to influence how the bigger retailers are operating given the pressure on their bottom lines.

Which supermarkets have been the big winners and losers in fresh produce over the last year?

All the retailers have had high volumes to annualise on because we’re comparing to that rundown at the end of Covid. Aldi, Lidl and M&S are the only ones that have seen volume growth in total fresh produce over the last year.

With Aldi and Lidl, it’s pretty clear why that is, whereas with M&S it’s down to the fixture redesign and the massive emphasis they’ve placed on fresh produce. M&S understands its shopper base, and a third of the population is still financially comfortable, so there’s still a big enough chunk of people who will pay higher prices for fresh produce.

With the exception of Waitrose, who are doing very poorly, the bottom end and the top end of the market are seeing pretty good volumes. When we think about the middle of the market, Asda have rebounded strongly because of the revamp of their Just Essentials range and their highly effective focus on tiering.

This has meant their volume decline in fresh fruit and veg has been softer than that of their competitors. Sainsbury’s has also done pretty well, again through a strong focus on low pricing, tiering, and premium, which suits their customers. The rest of the pack has found it very difficult in volume terms.

What are your predictions for the year ahead?

The cost-of-living crisis isn’t going to go away. Inflation will still be uncomfortable, even if it’s trending downwards, and now we have the mortgage shock – similar to the energy shock last year – so shoppers are still going to have lower-than-normal spending power. There will be more focus on value, more focus on loyalty, and I think the retail landscape will continue to be really disrupted by that.

When you look at the rate that Aldi and Lidl are growing, and the extent to which they’re premiumising, there will be a huge amount of pressure on middle-of-

the-road retailers, as well as the premium end.

On the plus side, there’s still really strong demand for the sector.

I don’t expect the volume decline that we’ve seen to continue, especially because we will be annualising on more stable shopping behaviour and not that gradual Covid unwind. This should hopefully give fruit and vegetable suppliers encouragement that the toughest period is behind them, but lower consumer demand will continue to be an issue.

I think there needs to be a really clear focus on why consumers should buy each part of the range, so tiering is really important, especially during the current economic crisis.

More broadly, if the role of fresh produce in our lives isn’t communicated succinctly to consumers, the industry will face further headwinds and risk losing out to more heavily marketed processed foods. The industry needs both legislative support, to encourage healthy eating, as well as targeted retailer action, to encourage purchasing across a wider number of varieties. The societal benefits of these moves are undeniable. fpj

FAR OPPOSITE —Inflation has had a big impact on shopping habits

NEAR OPPOSITE—Supermarkets have focused on loyalty schemes

ABOVE—Aldi and Lidl have continued to perform well

07

p.6-7.indd 7 21/07/2023 11:15

Value: £906.2m (-2.5%)

Calls for ‘more theatre’ as apple sales slip

Apples hold onto the top spot once more, however it’s not been a stellar year for the category, which saw sales fall by over £23m, as grapes closed the gap at the Big 50 summit. That said, apple spend is now higher than pre-Covid, despite a reduction in volume.

The impact of inflation is clear from the figures, but James Simpson of Adrian Scripps says we also need to consider the longer-term trends in the category. In recent years, purchase frequency, volume and penetration have all slightly decreased.

“Competition from other categories remains strong,” he says, “both in terms of price/value offer and theatre around

Dessert apples / Grapes GRAPES

the category. Topfruit needs to see innovation and theatre on the retailer’s shelf, both in pack format and presentation, as well as in varietal development.”

Shoppers have traded down in the past couple of years, with value offers taking share from core lines, however premium lines continue to hold value and volume better than some core products, Simpson reports.

When it comes to UK production, Ali Capper of BAPL says strong availability of British apples has helped sales, with 2022 marking one of the best-ever UK crop volumes. The proportion of British apple sales has risen, however she stresses that for this trend to continue, growers must get a fairer return.

Value: £884.5m (+1.7%)

Inflation boosts sales in tricky year for grapes

Grapes move up to second spot, leapfrogging tomatoes, but this is more down to the difficult year endured by tomatoes than any shining success for grapes.

As in many other categories, purchase frequency in grapes fell, with the average consumer buying grapes every 20 days rather than every 18. This trend was offset by a rise in average price. Since November 2022 retail inflation in grapes has outstripped total fruit.

“Price-oriented consumers are more aware of their expenses, trading down to cheaper options, such as apples and pears,” says Silvia Segura of AMFRESH Group. She adds that basket size has shrunk, and retail pro-

Volume: 433.7m kg (-3.8%)

Volume: 256.9m kg (-5.9%)

motions have decreased.

To complicate matters, bad weather caused lower availability at certain points in the year. For example, the end of the South African season was badly affected by rain and the European harvest ended sooner than expected.

In terms of consumer trends, Segura says demand for seedless varieties continues to grow, and there is now a heavy focus on premium quality. Almost half of consumers surveyed by AMFRESH in May said they were willing to pay more if great quality was guaranteed. She stresses that improving shopper education – in variety, flavour profile, nutrition, and culinary use – is key to growing the category going forward.

08

DESSERT APPLES 02 01

p.8.indd 8 21/07/2023 11:54

Let’s go to market

Are you eager to tap into the thriving UK wholesale market and showcase top-quality fruit?

Discover the essence of freshness with Fruit Vision! We’re your go-to specialists for premium fresh produce in the UK wholesale market.

From crisp apples and juicy pears to delectable strawberries, cherries, melons, citrus, and salads, we’ve got it all. Producers looking to tap into the UK wholesale market, contact us today and unlock new opportunities!

The opportunity awaits.

For more information please contact Thomas at Fruit Vision on: Mobile 07712 119983 or Email sales@fruitvision.co.uk or Alex Mobile 07931 756586

Tomatoes / Strawberries

Value: £881.1m (-1.5%)

Volume: 270.9m kg (-5.9%)

Tomatoes slip a place in troublesome year to forget

Tomatoes have lost second place in the Big 50 rankings to grapes – a further blow in the product’s annus horribilis

Skyrocketing energy and input costs made production unviable for many glasshouse growers in both the UK and Europe last winter, leading to reduced plantings. Then extreme weather in Spain and North Africa decimated production. This led to the extraordinary and unwanted situation of tomatoes making front-page news as empty shelves in UK supermarkets were rife.

Supplies have returned now, but there’s no doubt the sector is feeling bruised and could do with some respite.

In the Lea Valley, growers have

planted later than usual and some have left sections of their glasshouses empty, according to Lee Stiles, secretary of the Lea Valley Growers Association.

“We have also seen a reduction in lines as specialist vine varieties require additional labour, which is becoming harder to recruit,” he adds.

Given all that, it is perhaps surprising that value and volume sales declines are relatively modest, and that is a reflection of the essential place tomatoes have in so many baskets.

While shoppers have been buying less and switching to value lines, sales will be expected to rebound as pressures ease on supply and consumers’ finances.

Value: £776.9m (+0.8%)

Volume: 132.8m kg (-8.9%)

Unsustainable economics challenge strawberry sector

The year to 14 May wasn’t an easy one for the strawberry category, with retail inflation resulting in a sharp downturn in volume as some shoppers switched to bananas and topfruit instead.

During the winter months, there was reduced availability, particularly from January to March, due to the unseasonably cold weather in Spain and Morocco. And this contributed to the decline in volume sales.

The main talking point in berries, according to John Gray of Angus Soft Fruits, continues to be that grower economics are “broadly unsustainable”. UK producers have faced a 25 per cent increase in the cost of production,

according to Nick Marston of British Berry Growers, and this hasn’t been reflected in returns from supermarkets.

Marston warns that this mismatch is “threatening the very existence of the UK berry industry”, pointing out that, especially in strawberries, there is no overseas source that could readily replace UK production.

On the plus side, Gray says berries are still a “fantastically healthy Britishgrown product that retailers want to sell, and consumers want to buy”, so he remains hopeful. “I would expect there to be a reduction in berry availability in the next couple of years, and then a recovery as cost-of-living pressures ease and market demand picks up.”

10

STRAWBERRIES 04

TOMATOES 03

p.10.indd 10 21/07/2023 11:54

Home of passionate growers of fruit and vegetables

Our top 3 products

Bananas / Blueberries

Value: £601.3m (+4%)

Steady year for bananas despite tough market

Given the current economic climate, it has been a solid year for bananas, which suffered a fairly modest volume decline of 2.9 per cent in the 52 weeks to 14 May.

Katie Smith of SH Pratt notes that, as in most other fruit categories, shoppers bought less banana volume per trip and less frequently due to the ongoing costof-living crisis.

Supply chain inflation has driven an increase in retail banana prices across all lines, with loose seeing the highest rise. Nevertheless, Simon Trewin of Compagnie Fruitière stresses that bananas remain one of the most popular grocery items, enjoying high consumer penetration. “It is therefore

difficult to see how more can be sold,” he says, but that hasn’t stopped the sector from innovating.

In store, most retailers are moving from pre-packs to banderoles to reduce single-use plastic packaging, and instead of using single-use cardboard boxes to transport and display bananas, supermarkets are switching to reusable crates.

From a production perspective, Compagnie Fruitière has invested heavily in precision farming to identify hot spots of disease and underperforming plants. These plants can then be treated on a localised basis using drones, helping to reduce inputs, cost and environmental impact.

Value: £503.2m (+4.5%)

Volume: 642.1m kg (-2.9%)

Volume: 52.5m kg (+0.5%)

Solid year for blues but inflation dampens demand

Although a far cry from the bumper sales growth that the blueberry category has enjoyed in recent years, a slim 0.5 per cent volume rise is not to be sniffed at in the current climate.

BerryWorld’s Kate Russell notes that shoppers have been purchasing slightly higher volumes of blueberries, driven by the wider availability of pricecompetitive larger packs in the year to 14 May. Russell also reports that toptier blueberries have enjoyed growth despite inflation-driven changes to shopper behaviour.

When it comes to retail spend, the chair of British Berry Growers, Nick Marston, highlights a rise in value sales

as supermarkets look to cover their increased costs. Retail inflation in blueberries has been modest compared to many grocery items, he says, but price rises have still dampened demand for the superfruit.

“The main talking point is the massive 25 per cent plus increase in the cost of production that British berry producers have suffered in the last two years and the complete lack of any increase in returns from supermarkets to growers in spite of some retail inflation,” Marston says. However, he remains optimistic for the future, thanks to the “ongoing interest in healthy eating, and the convenience, quality and enjoyment factor of fresh berries”.

12

06

BLUEBERRIES

BANANAS

05

GALKIA No with the YU&ME A sweet or SUNIONS A doesn’t SUNIONS outstanding and chain. is is BASF assurance p.12-13.indd 12 21/07/2023 11:55

GALKIA® MELON

No doubt, always delicious. GALKIA® Melons with ripeness indicator change skin color in the field when ripe.

YU&ME

A tiny snack tomato with a crispy bite and sweet taste. YU&ME is a real treat to yourself or to enjoy with friends.

SUNIONS ®

A real gamechanger as the first onion that doesn’t make you cry while cutting.

SUNIONS®, GALKIA® and YU&ME are consumer brands. These outstanding products come from the BASF innovation program and are launched in collaboration with partners in the value chain. The use of the brand names SUNIONS® and GALKIA® is part of the corporation agreement. The YU&ME brand name is owned by one of the chain partners. In the collaborations, BASF provides the seeds, growing recommendations, quality assurance and connects chain partners from ‘farm to fork’.

Vegetables People Love We make healthy eating enjoyable and sustainable

Whether you’re a grower, a processor or a retailer, there’s never been a better time to listen to and answer the demands of the end consumer who are asking for better quality, enhanced taste, increased convenience and availability of the vegetables they love. At BASF we specialize in breeding a diverse range of vegetable varieties and team up with other leading companies in the chain to develop vegetable solutions for a better, healthier tomorrow.

By truly answering the needs of the consumer everyone in the chain will benefit and together we will have a positive impact on people’s lives.

Join the movement today.

ANALYSIS LATEST NEWS INSIGHT TRENDS INNOVATIONS DEVELOPMENTS THE SINGLE, MOST RELIABLE SOURCE OF FRESH PRODUCE BUSINESS NEWS Get the latest information on the global fresh fruit and vegetable industry, direct to your inbox SIGN UP FREE www.fruitnet.com

Nasir Ahmed, Consumer & Customer Manager +44 7796473392 | nasir.ahmed@vegetableseeds.basf.com p.12-13.indd 13 21/07/2023 11:55

Easy peelers / Mushrooms

Value: £491.3m (-3.3%)

Volume: 231.1m kg (-5.9%)

Easy peeler sales su er from sharp fall in production

Asignificant decline in production volume dented sales of easy peelers, with extreme weather resulting in the lowest level of Northern Hemisphere production for 10 years.

Paul Chuter of Green Star Produce estimates that Mediterranean production of soft citrus fell by 30-40%, which drove up prices. However, inflation remained “moderate”, according to Carolina Palomo of AMFRESH Group. The average price of easy peelers rose 3.1%.

Chuter and Palomo agree that the category has suffered from a reduction in promotional activity in the past year. Sales struggled most at the start of the campaign in October and November

when retailers ran fewer promotions than the year before.

In a reversal of fortunes, orange sales ate into easy peeler purchases, increasing their share of wallet, and this was driven by a mix of factors, says Palomo, notably lower price, longer shelf life, and flavour consistency.

Chuter argues that since easy peelers is a wide-ranging category, there is work to be done to educate consumers in varietal differences and the superior flavour of premium cultivars such as Nadorcott, Tango and Orri. These are gradually becoming the dominant varieties at UK retailers, but there remains a lack of product consistency, and shelf life can be a barrier to consumption.

Value: £464.9m (0%) MUSHROOMS

Availability issues hit mushroom sales

Inflation and fewer price promotions are the main reasons why year-on-year value sales of mushrooms remained unchanged despite a fall in volume.

The average retail price of the vegetable was up 6.5% during the period, according to Paul Parmenter of Walsh Mushrooms, who noted that his firm’s sales dropped by 4.8%, mainly due to less frequent purchases.

“This is probably because shoppers are more aware of what they are spending on their total basket and are more conscious of not wasting product,” he says.

UK sales were also down in 2023 due to a shorter crop, Parmenter adds.

Volume: 131.9m kg (-6.1%)

“Last year’s poor wheat harvest in Europe, due to the drought and coupled with the Ukraine situation, led to a shortage of straw for compost, which meant production was down overall. Together with the inflation in the cost of production, producers’ margins are being squeezed, which meant there was less availability.”

Like most other produce categories, it will be a challenging few months ahead for mushrooms, says Parmenter. “Recovering inflation along with labour availability and skills puts enormous pressure on producers. However, mushrooms still represent a very healthy, sustainable, and relatively cheap food.”

14

EASY PEELERS

08 07

p.14.indd 14 21/07/2023 11:55

Experience the

Produce Journal app

Get the fresh produce content you love onto one easy-to-use platform. The Fresh Produce Journal app features the latest news, Fruitbox podcasts, videos and analysis, alongside our magazine editions. All on your smartphone, tablet or desktop.

DOWNLOAD THE FREE APP NOW

Or visit: desktop.fpj.co.uk

Fresh

FPJ app.indd 1 19/07/2023 15:44

Old potatoes / Peppers

OLD POTATOES

Value: £461.8m (+9.8%)

Penetration gains o er hope in di cult times

Potato suppliers haven’t had it easy, grappling with wet weather and price inflation in a tough year for the category.

Average price increases of 12% have been the key driver for the value sales increase, but despite overall volume declines there has been a slight rise in customer penetration and volume per trip, explains Lucia Washbrook, sales and marketing director at Branston.

White and red potatoes are in growth, but the decline in Maris Piper sales – driven by average price increases of 22% in the past year – has slowed overall category growth.

Tonnage volume is slightly behind pack volume, suggesting shoppers are

purchasing smaller packs to manage their overall basket spend.

“As prices go up, we see that customers are managing their spend in the current cost-of-living crisis by buying less per trip, such as by buying a smaller bag, and by buying potatoes less often,” adds Amy Stamp, senior customer insight manager at Greenvale.

Looking for positives, Washbrook says the fact that penetration in the fresh potato category is in year-on-year growth augurs well. “Consistent quality across supply is essential for returning purchases, however it is also important to continue informing and inspiring shoppers through recipe suggestions and meal ideas,” she concludes.

Value: £435.7m (+9.7%)

Choppy

waters

set to continue for peppers

Shoppers clamoured to get their hands on any peppers they could find earlier this year, as empty shelves in the winter and spring brought national discussion over the state of the nation’s food self-sufficiency and the increasing volatility of Mother Nature.

Both at home and abroad, growers have been asking themselves whether this is a product worth investing in right now. “Many pepper growers did not plant as usual, did not plant at all, or changed their crop this year due to the low prices and high energy costs,” explains Lee Stiles, secretary of the Lea Valley Growers’ Association.

Supply for the months ahead are

Volume: 828.9m kg (-3.2%)

Volume: 150.9m kg (-5%)

likely to be subdued as a result of the lower plantings, which have been replicated in other key glasshouse sources across Europe such as the Netherlands and Belgium.

At the peak of the supply crisis in the winter, when cold weather in Spain even harmed protected crops by reducing yields, size and quality, the price of all colours of sweet peppers at least doubled across UK wholesale markets.

Relative to cucumbers, retail prices did not soar as much as one might expect, and the category’s 9.7% value growth is not remarkable in this year’s Big 50. With supply problems set to continue, it won’t be plain sailing for peppers for a while yet.

16

PEPPERS

10 09

p.16.indd 16 21/07/2023 11:55

Vivaflor

• Activates plant hormones for improved reproductive health • Reduces issues with fruit set caused by environmental stress • Improves homogeneity of berries, evens cluster weight and increases overall yield • OF&G approved www.npp-ag.com UPL Europe Ltd, Engine Rooms, 1st Floor, Birchwood Park, Warrington, Cheshire WA3 6YN T: +44 (0) 1925 819999 E: info.uk@upl-ltd.com twitter: @upl_uk VIVAFLOR contains GA142 (seaweed filtrate), boron 26.8g/L, magnesium 68.8g/L and sulphur 136.6g/L. VIVAFLOR is a registered trademark of UPL. © UPL Europe Ltd 2023. Use plant protection products safely. Always read the label and product information before use. Pay attention to risk indications and follow the safety precautions on the label. 30606 UPL NPP VIVAFLOR Fresh Produce Journal (Aug 23).indd 1 18/07/2023 11:16

Biostimulant for use in Viticulture

Raspberries / Cucumbers

Value: £353.6m (-2.4%)

Inflation dampens sales but shoppers trade up

Inflation was central to raspberries’ sales performance over the past year. With prices increasing, some consumers switched to less expensive fruits to manage spend, and this decreased purchase volume, driving a 2.4% decline in raspberry value.

Kate Russell of BerryWorld adds that the British season was slower to start than in previous years, and total production was lower. However, there were more promotions on premium raspberries, which encouraged shoppers to trade up. “The top tier saw large growth despite the change in shopping behaviours,” she says.

From a varietal perspective there have been some standout varieties

coming into production. The Reyna raspberry variety from Discoll’s was given a three-star rating by the International Taste Institute at the Superior Taste Awards 2023, while BerryWorld Jewel landed two stars last year.

From a production perspective, Chambers has invested heavily in its Spanish raspberry crops, doubling plantings from 15ha to 32ha last season. The grower says the motivation for the investment was to mitigate supply difficulties from Mexico, which occupies a similar supply window, and to offer UK customers more fruit grown closer to Britain during the winter months. This is a benefit in terms of sustainability, transport costs, and freshness.

Value: £341.3m (+31.9%)

Volume: 31.2m kg (-5%)

Volume: 189.5m kg (-2.8%)

Huge price inflation doesn’t hold back cucumber sales

Soaring energy prices and some of the biggest production cost increases in the entire fresh produce aisle have had a profound effect on the cucumber category. Shelf prices are up substantially, leading to the largest value sales increase in the Big 50, of 31.9%.

The fact that volume sales only declined by 2.8%, despite huge retail price rises, is a reflection of the priceinelastic and essential nature of cucumbers in shoppers’ baskets,. Cucumbers undoubtedly belong alongside bananas as one of the products where shoppers would struggle to name the price.

At production level, while UK growers still see the value in cucumbers and

have favoured them over other salad veg in the past 12 months, matching supply with demand remains a real headache.

“We have seen a lot of crop changes this year,” explains Lee Stiles of the Lea Valley Growers Association. “Glasshouses where peppers and aubergines were grown changed to cucumbers on two crop cycles.

“Growers opted to plant later than usual, which resulted in empty shelves in February to May. However, produce was also dumped in June when Dutch produce entered the market in volume, combined with Spanish growers extending their season due to earlier weather events.”

18

RASPBERRIES

CUCUMBERS

12 11

p.18-19.indd 18 21/07/2023 11:55

Onions / Broccoli

ONIONS

Value: £289.4m (+7.2%)

Imports and inflation push up onion prices

Despite falling one place in the Big 50 rankings to number 13, the UK onion category nevertheless experienced a +7.2% surge in sales value in the 52 weeks to 14 May 2023, and only a -0.5% dip in sales volume.

The Kantar figures reflect the product’s resilience in the face of market inflation and cost-of-living pressures, illustrating its enduring popularity among Britain’s domestic chefs, believes Tim Elcombe, chairman of producer group British Onions.

“In spite of having to pass on inflationary costs to the consumer from the front half of this year, it’s good to see that sales volumes didn’t fall. It

shows that everyone still needs onions,” he says.

The data offers a ray of light after a gloomy 2022/23 British onion season, when unseasonably high summer temperatures cut August 2022 yields by 20%, and growers were hit by soaring energy costs (the crop is held in coldstores for months after harvest). Onion imports were up as a result, which may have further pushed up price inflation towards the end of the sales period, Elcombe says.

Nonetheless, onions still represent excellent value for money, he adds, and are comparatively cheap compared to other fresh produce categories, leaving optimism for a better year ahead.

BROCCOLI

Broccoli bucks brassica sales trend

Value: £282.9m (+13.2%)

Bucking a downward value trend in British brassicas, broccoli spend rose by 13.2% over the prior year.

Julian Marks of Barfoots says broccoli has benefitted from a shift in consumer purchasing habits, whereby shoppers are becoming more thrifty and choosing broccoli over premium green vegetables such as asparagus and fine beans. However, this did not prevent a 6.2% volume decline.

The growing popularity of Tenderstem, thanks to concerted marketing efforts, is also helping to drive category growth, according to master licensor Coregeo. The Tenderstem brand now accounts for 28% of UK broccoli

Volume: 260m kg (-0.5%)

Volume: 110.8m kg (-6.2%)

sales in value terms. “Tenderstem has enjoyed consistent growth of 14% yearon-year,” says Lorraine Fountain, Tenderstem’s senior commercial manager. “In-home dining during Covid boosted retail performance, and we have kept those consumers. It is also great to see foodservice sales now rebounding. Foodservice is an important category for Tenderstem growth, as it provides consumers with a different outlet to try new foods and convert them into athome consumers too.”

Nevertheless, the weather extremes experienced over the past 12 months have affected UK and European broccoli seasons, hitting overall category availability, says Julian Pitts of Veg UK.

19

14 13

p.18-19.indd 19 21/07/2023 11:55

Value: £257.9m (+0.7%)

Mixed picture for promotion-driven new potatoes

New potatoes are in their peak sales period right now, and with hopes for a long summer, the category will be looking for a boost following a tricky year.

Average prices of new potatoes have risen by 6.3% year on year, at a time when all other KPIs for the category have been in decline, according to Lucia Washbrook, sales and marketing director at Branston. That situation has been the key driver of the volume slump.

“Value sales growth across all potato subgroups is driven by retailer inflation,” adds Greenvale’s Amy Stamp. “This is mixed across retailers, but we have seen the largest £/kg increases in the discounters. Equally, retailers have

been competing on price within key products to try to drive footfall.”

The category has become increasingly promotion and price-driven, Stamp adds, with significant switching between promoted products and reduced consumer loyalty.

Arguably the best-known and most anticipated new potato is the Jersey Royal. After drought conditions affected crop development and harvesting in 2022, this year got off to a much better start with ideal planting conditions in January and February. The product also benefited from a collaboration with Jamie Oliver that saw recipe creation and tips for how to cook with the famous potatoes.

Value: £250.3m (+11.5%)

Volume: 208.4m kg (-6.4%)

Volume: 122.4m kg (-2.1%)

Weather puts a downer on lettuce’s year but sales hold up

Lettuce growers have had an ongoing tussle with Mother Nature over the past 18 months, which saw a wet April 2022 in Spain followed by unseasonable heat and then cold in spring of this year. That particularly impacted premium varieties.

Cold spring weather in the UK meant British crop was slow going initially too, but it has since caught up, according to Matt Godboldoffering of G’s, offering hopes of a more consistent summer performance.

Supply shortages and input cost rises have driven up prices in the category, but consumers still see lettuce as a versatile and cost-effective purchase,

leading to a comparatively small 2.1% drop in volume sales.

In prepared lettuce, marginal value growth of 0.7% has been counteracted by a hefty 11.5% drop in volume sales. Caryn Gillan, product director at Natures Way Foods, says this has also been driven by price inflation, combined with shoppers saving money by trading out of bagged lettuce into wholehead.

Gillan says the prepared salad category would benefit from more accessible pricing, so that it isn’t the first product to be crossed off shopping lists when budgets are tight. She would also like to see pack formats suitable for smaller and single households.

20

LETTUCE

16 15

New potatoes / Lettuce NEW POTATOES

p.20-21.indd 20 21/07/2023 11:56

Value: £228.8m (+2.5%)

Low production causes headaches in pears

From a supply perspective, it’s been a tricky year for the pear category, with 2022-23 delivering the third-lowest EU pear crop in the last 10 years.

To make matters worse, topfruit consumption has declined overall due to reductions in both penetration and volume per trip. However, retail inflation has helped to push up total spend.

“There has been an element of subtle retail inflation across the 52 weeks as prices have, at points, had to reflect the reduction in volume,” says Orchard World’s Sam Trebbick. “Many growers wanted to sell their fruit early in the season to avoid increased storage costs, and this in turn put pressure on

the later months of the season, both in terms of demand and pricing.”

The current outlook for 2023-24 is also cause for concern. Production in Italy and France is expected to be down, and the Netherlands predicts a similar harvest to last season. According to initial estimates by Interpera, the forthcoming European pear harvest will be one of the smallest in the last decade, with around 1.9m tonnes forecast.

In the UK, meanwhile, growers continue to invest despite challenging market conditions. Ali Capper of BAPL reports that in response to the energy crisis, there has been significant investment in renewable energy on farms and in packhouses.

Value: £200.2m (+4.6%)

Consumers overlook ‘cheap’ carrots

Persistently low carrot prices have not translated into greater sales over the last year. In fact, sales volumes for the 12 months to 14 May fell by 2.3% compared to the prior year – a further drop from the -7.7% decline in 2021-22.

Producer Martin Evans of FreshGro believes carrots are potentially overlooked by consumers because they are “too cheap”. He argues that the UK root veg sector, and retailers, are missing a marketing opportunity to promote these healthy, low-cost products to cash-strapped shoppers.

“Cost of production has been up by over 20%, and on the whole low carrot pricing should have meant more sales,

Volume: 113.7m kg (-2.7%)

Volume: 369m kg (-2.3%)

but this has not transpired at all,” says Evans. “Carrots at 50p per kg are too cheap and almost overlooked.”

General UK food consumption patterns are towards ready meals, snacking and convenience, he adds. Yet scratch cooking of wholehead produce is by far a cheaper option, but is still not a choice selected by most consumers.

“Our messaging is totally absent as an industry. We are not engaging with our consumers on cooking using carrots. We need consumer engagement more than ever to teach, create and encourage carrot consumption,” says Evans.

Meanwhile, weather issues have added to carrot growers’ difficulties, both at home and abroad.

21

PEARS

Pears / Carrots CARROTS 18 17

p.20-21.indd 21 21/07/2023 11:56

Avocados / Baking potatoes

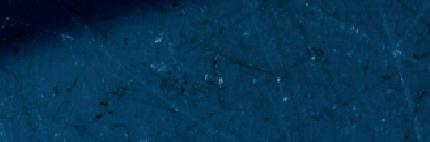

Value: £197.6m (+5.3%)

Volume: 60.3m kg (+2.2%)

Feelgood factor continues for mainstream avocados

There can be no bigger confirmation of avocados’ elevation from luxury item to the fresh produce mainstream than the fact they are one of just four products in the list to have increased volume sales in the past year.

Even at a time of intense financial strain, the thought of foregoing their avocado fix is too unpalatable for many consumers.

That’s not to say the category hasn’t had to cut its cloth in what is a challenging economic climate. In the latter part of 2022, there was a shift in sales away from twin packs towards loose product, as well as less price-driven marketing compared to

the previous year. This had an impact on value, according to Westfalia Fruit UK’s general manager Graham Isaac.

“Avocados are becoming a regular purchase for many shoppers as they combine them more into their daily diets other than just brunch,” Isaac explains.

“We anticipate continued growth, as UK consumers continue with their love of avocados and the health benefits they deliver.

“Supported by consistent supply throughout the year of good quality fruit, the future is positive. Since 2017, penetration of avocados has increased by 10% and does not show any signs of declining.”

BAKING POTATOES 20

Value: £197.4m (+8.4%)

Hero product is versatile cost-of-living champion

At a time when the potato category overall had been viewed as being in a gradual decline, baked potatoes have re-emerged, Lazarus-like, as a hero product for the age.

First during Covid lockdowns, when people needed easy and versatile food to cook at home, baked potatoes were the ideal option with their wide variety of toppings. Now, as a cost-of-living crisis engulfs the nation, they again serve as the ideal affordable product with universal appeal.

While bakers are as affected by input cost increases as every other product, volume sales have held up remarkably well as consumers con-

Volume: 269.3m kg (-0.7%)

tinue to recognise their benefits. “Performance is being driven by an increase in average price of 9.1% year on year,” says Branston’s sales and marketing director Lucia Washbrook. “However, the increase has not led to a decline in other KPIs as we see penetration and volume per trip driving the volume performance.”

Greenvale’s Amy Stamp believes the key to overall potato category growth is making them part of more meal occasions, and that’s an area where baked potatoes have particular strength. Suppliers will hope their versatility maintains them as a regular feature in shoppers’ baskets for the foreseeable future.

22

AVOCADOS 19

p.22.indd 22 21/07/2023 11:56

doc.indd 1 16/03/2023 14:59

Oranges / Melons

21

Value: £185.1m (-2.5%)

Volume: 95.8m kg (-2.1%)

Switch to lower-quality varieties ‘putting o shoppers’

As a less snackable or convenient fruit than many others, oranges have an “easy disappointment factor”, according to Paul Chuter of Green Star Produce. What he means is that since oranges are messy to eat on the go, they are more likely to be enjoyed at home, and in order to persuade consumers to take the time to sit down with a plate and eat one, the quality has to be just right.

Unfortunately, many supermarket buyers have switched from better-eating Navel oranges to lower-cost Valencia types in the past three years, to manage supply chain inflation and pay less for the product. This has damaged consumer perceptions of the fruit, caus-

ORANGES 22

MELONS

ing a downturn in sales, Chuter believes. Production challenges in recent months have not helped matters, with late-season South African supply running short and subsequent Moroccan volumes down 50% on last season. This affected availability and pushed up consumer prices.

The former commercial manager of IPL believes that going forward there is a need for more focused marketing to attract younger shoppers by touting the fruit’s eating quality and health benefits. Most importantly, he says the category must prioritise high-quality Navel oranges, with the right balance of acids and sugars, if it hopes to win back shoppers in future.

Value: £164.1m (+6.1%)

Melon volumes plummet amid high inflation

Aside from asparagus, melons suffered a bigger volume decline than any other product in this year’s Big 50, down a whopping 16.3%. This was set against a 6.1% rise in retail spend, evidencing a significant increase in retail prices.

This consumer price inflation resulted in a decrease in demand, says Sisco Tello of Melon&Co, although much of the impact was absorbed by the supermarkets in an attempt to protect shoppers. “We foresaw this trend at the early planning stages of the 2022/23 season and adjusted our volumes accordingly,” he says.

As the economic pressures on shoppers persist, Tello says there continues

Volume: 146.3m kg (-16.3%)

to be a need for “good value produce on our shelves, that offers consistent quality and good availability”. He believes the melon category is well positioned to deliver on all counts.

With freight rates expected to come down over the coming months, along with other supply chain costs, Melon&Co aims to incentivise consumption and recover volumes, while continuing to “operate sustainably”.

Tello is hopeful that improvements to growing and handling techniques, as well as the introduction of climateresistant varieties, will allow the sector to pass savings along the supply chain and deliver a better, more affordable product in future.

24

p.24-25.indd 24 21/07/2023 11:58

BEANS 23

Value: £153.7m (-2.7%)

Fine beans swapped for cheaper options

Volume: 30.3m kg (-8.5%)

I

nflation, on top of the alreadyelevated price of more premium vegetable categories, such as fine beans, is having a dramatic impact on sales, as customers switch to cheaper alternatives, according to Julian Marks of Barfoots.

“Customers are still buying green veg but they are being more savvy and choosing cheaper options for the side of their plate,” he says. “It is clear that inflation and the cost-of-living crisis are definitely taking their toll, and Kantar data supports this theory,” says Marks.

Indeed, overall sales figures for beans in the 52 weeks to 14 May 2023 reveal a 2.7% dip in spend and an 8.5% fall in volume compared to the prior

year, which also saw a near-10% drop in both value and volume sales. There is evidence of customers dropping down to entry-level tiers, according to Marks. For example, Sainsbury’s Stamford Street beans have seen significant growth, he says.

Flamingo’s Ian Michell warns that the UK green bean market could see periods of oversupply before global growing programmes adjust to the inflation piece and mounting competition for basket space. Going forward, innovation in higher-yielding and better eating-quality varieties to improve product tiering will be vital to compete for that shrinking basket space, he adds.

Value: £117.1m (-2.8%)

Cauliflower caught short amid weather woes

It has been a difficult year for brassica suppliers, with narrow margins combining with major weather disruption to make it a season to forget.

Cauliflowers got caught up in the well-documented vegetable shortages at UK retailers this winter as Spanish supply went short. Asda was among the supermarkets putting a limit of three items per person on a range of vegetables, including broccoli and cauliflower. UK growers later warned that freezing temperatures had cut a scythe through the British crop, with one Lincolnshire producer predicting there will be no local cauliflowers until February 2024.

Julian Pitts, managing director of

Julian Pitts, managing director of

Volume: 107.1m kg (-14.7%)

Veg UK, described 2023 as “a rollercoaster year” for product availability, with both flushes and extreme shortages. A large part of the problem is that the current supply chain is not working, he says, and this is making fresh produce a difficult business to invest in. Specifically, he says the system is too rigid to react to changes such as unexpected weather, with fixed seasonal pricing leading to empty shelves when supermarkets are unable to source product at times of shortage.

One south-west grower described 2023 as “a very tricky year for brassica growers”, with the weather, energy costs, inflation and cost of labour all contributing to a complicated picture.

p.24-25.indd 25 21/07/2023 11:58

25

Beans / Cauliflower CAULIFLOWER 24

CHERRIES 25

Value: £114.9m (-10%)

Economic uncertainty rocks cherry sales

In terms of both volume and price, cherries is a notoriously volatile category due to the fruit’s vulnerability to adverse weather and the supply gaps that persist in the spring and autumn.

There have been some big swings in value and volume over the past few years, and this again proved the case, with a number of factors conspiring against the sector in the year to 14 May.

Winter supply was challenging, and the overall volume imported from Chile fell by 27% as exporters instead decided to prioritise the Asian market, particularly China.

“There was a general nervousness around the European economy and the

war in Ukraine, so Chilean exporters decided to send less fruit to mainland Europe and Britain,” explains Norton Folgate’s Matt Hancock. “Meanwhile, UK importers took a fairly cautious view given all the inflationary pressures on consumers and brought in less fruit. This had a significant impact on sales.”

The current Northern Hemisphere season is proving even more difficult. Heavy rain hit production across Europe, just as peak production got underway, while cold weather in May affected the UK crop. Many retail promotions were cancelled as a result. In future, it will be interesting to see whether more European growers invest in rain covers to mitigate climate risks.

Value: £106.4m (+3.9%)

Sweetcorn sector adapts to climate challenges

According to Barfoots, changing weather patterns are creating big new challenges in the sweetcorn category, which saw a mismatch between value growth and volume decline due to inflation.

“Over the past decade or so, climate change, extreme weather events, and the scarcity of water have all been important considerations in our supply strategy,” says Kim Barfoot-Brace of Barfoots. “There are also the much talked about issues of labour availability and cost inflation. And this, combined with the low perceived value of vegetables, makes it a difficult industry to be part of.”

Barfoot-Brace says a “normal” UK

Volume: 20.4m kg (-10.5%)

Volume: 32.5m kg (-4.8%)

growing season “would be very welcome”, but stresses that a lot of work is going on to ensure the producer has effective varieties for the world’s changing climate over the next few years. She adds that ensuring whole crop utilisation is at the forefront of the industry’s mind as it deals with tight margins.

Sweetcorn is a vegetable that enjoys a sales boost when the sun comes out, but going forward, she sees an opportunity to expand the mealtime occasions at which people enjoy the vegetable.

Barfoots will also be hoping its recent FreshLock packaging innovation, to extend the life of sweetcorn, leads to a boost in sales, as well as a reduction in food waste (see p.46-47).

26

SWEETCORN 26

Cherries / Sweetcorn

p.26.indd 26 21/07/2023 11:59

doc.indd 1 17/01/2023 14:12

Cabbage / Nectarines

CABBAGE

Cabbage clings on to customer baskets

It has been a rollercoaster year for cabbage, as unseasonable weather patterns have disrupted production in the UK and abroad.

Availability issues have been exacerbated by fewer growers planting the commodity vegetable, as well as reduced plantings by those still in the game. This shortfall, combined with inflationary pressures, has pushed up retail prices and put off purchasers, says Julian Pitts of Veg UK.

“Prices generally have been expensive all winter,” he adds. “The reason is that UK producers can’t afford to grow more than programmed, so volumes are down. There are also fewer growers. And thirdly, we’ve had a winter and

summer that has cocked up the whole UK growing season, making yields onethird short. It’s the same in Europe. We had to bring cabbage in from Portugal because of the UK shortages.

“The weather is just not normal,” Pitts continues. “One week it’s warm, then cold, then wet, then dry. It’s like a rollercoaster. To grow crops and expect them to be available at normal times is just not going to happen anymore.”

Given the changing climate, Naylor Farms believes diversification is a route to better times. The Lincolnshire-based business is investing €38 million in a smart factory to extract brassica protein, fibre and umami syrup from cabbage.

Value: £101.1m (+8.2%)

Volume: 79.7m kg (-2%)

Value: £97.7m (+1.4%)

Supply headwinds drive down nectarine volumes

Stonefruit hasn’t had an easy ride in recent years, and several factors have contributed. Both nectarines and peaches are imported year-round, and a full range isn’t available at certain times due to seasonality. As such, the majority of sales are made during the summer, and over the past five to 10 years penetration has been driven by heavy promotional activity at this time of year.

An industry source reports that adverse weather, the weaking of the pound, increased freight costs and delays, and infrastructure challenges in South Africa have created supply chain challenges over the past 12-24 months. All these factors have driven cost infla-

Volume: 39.5m kg (-8.7%)

tion, which has had a negative impact on volume.

Several UK retailers have responded by investing in everyday low prices, however this strategy generally impacts volumes more in products, such as nectarines, that were previously more promotion-driven.

The anonymous source notes that fewer promotions on the bottom tier, along with varietal improvements, have made premium and ripe-and-ready products more attractive, prompting some shoppers to trade up. Royal’s Shazad Rehman sees opportunities for sales growth through early-season redflesh varieties, like the Spanish supplier’s recently launched Royal Sanguine.

28

28 27

NECTARINES

p.28-29.indd 28 21/07/2023 12:00

Value: £97m (+12.5%)

Hope springs eternal for upwardly mobile crop

Spring onions have jumped four places in this year’s Big 50, and the product is remarkable in having largely held up sales since the pandemic.

This year’s value and volume sales figures have both outperformed 2020, and while the second year of Covid saw an outlying high performance, the overall trend is a positive tale of consumer popularity. That success is even more notable considering the truncated Spanish supply in spring 2022 and lower UK production this spring due to cold weather.

In the past 12 months, the spring onion category has experienced the same trend as many other products in

Spring onions / Courgettes COURGETTES

the salad veg sector: higher prices leading to value sales increases, while shoppers cut back on ingredient spend and reduced volume sales.

As a less core ingredient in many meals, spring onions have inevitably been one of the lines that has suffered. “Spring onions rely on regular, off-shelf promotional activity to drive new shoppers into the category as it has lower penetration compared to the big salad categories,” notes Matt Godbold, category marketing director at G’s.

A summer favourite, spring onion suppliers will hope the coming months remain dry and warm, tempting consumers into more salads and Ploughman’s lunches.

Value: £89.5m (-4.1%)

Courgettes navigate cost-of-living crisis

Anon-mover at 30, courgettes hold firm in the Big 50 rankings despite a double-digit drop in volume and a smaller decline in value sales.

According to Julian Marks of Barfoots, the year-on-year figures do not tell the whole story. “Factors behind the annual decline in both volume and value are numerous but also changeable, with the annual year-on-year reductions generally being turned into growth over the past 12 and 24 weeks in some categories,” he says.

“Courgettes are now showing growth, while fine beans and asparagus are still in decline.”

It is clear that inflation and the

Volume: 24.3m kg (-6.3%)

Volume: 36.5m kg (-11.8%)

cost-of-living crisis are definitely taking their toll, Marks adds. Customers are still buying green vegetables, but they are choosing cheaper options and different-sized packs.

“In summary, there are four options of switching within customers’ behaviour,” Marks. says “Switching to lowertier versions of their favourite veg; switching to different sizes or formats; switching to cheaper, less premium vegetables; and switching to frozen.”

The outlook continues to be volatile, with unpredictable weather and growing patterns, as well as changes to shopper behaviour linked to the cost of living – all of which is conspiring to reduce sales volume.

29

30

SPRING ONIONS 29

p.28-29.indd 29 21/07/2023 12:00

31

Value: £87.8m (-6.2%)

Large-scale plantings deflate lemon prices

Most products in this year’s Big 50 saw retail price inflation, but lemons bucked that trend due to extensive plantings and excessive supply.

“The level of fruit planted is deflating the price year on year, certainly in the UK marketplace,” says Lee Parkinson of Pacific Produce. “We still need a change in the market to increase prices, but with more supply than demand, it could take a few years until prices can stabilise and hopefully increase.”

Parkinson adds that open-market lemon prices generally reduce to their lowest level in late July and August as South Africa ships high volumes to all open markets. If this season is similar to

32

Volume: 55.1m kg (-3.8%)

last, “we can expect some unsustainable prices for growers”, he says.

As in other fruit categories, high production costs have been a significant challenge in lemons, but a reduction in freight rates has eased the situation slightly.

On a more positive note, Carolina Palomo of AMFRESH Group says seedless lemons have been a good addition to the range, delivering an incremental sales boost to the category. A reduction in scratch cooking over the past year, and a simplification of shopping lists, has seen lemons drop out of some shoppers’ baskets. However, Palomo notes that consumption has recovered during the last quarter.

Value: £84.3m (+12.6%)

Volume: 32.6m kg (-12.8%)

Leeks could prove perfect fit for cash-strapped consumers

A30p rise in 500g leek retail packs appears to have contributed to a significant drop in volume and a large rise in value, but the British Leek Growers Association (LGA) believes this versatile vegetable has a lot to offer cash-strapped consumers.

“Consumers are facing tough decisions that can be seen in their shopping behaviour patterns, for example trading down and buying less,” says LGA spokesman Nasir Ahmed. “Leeks offer a great fresh produce alternative. They are relatively cheap to buy per gram and are also very versatile to cook from scratch. They also have good shelf life, which means less wastage in the home.”

Ahmed believes fewer Brits will travel abroad this summer as they opt to save money. “This means that as an industry we have an opportunity to increase sales,” he says. “As an association we try to inspire consumers. But there is a real need to differentiate on shelf so that products appeal to consumers and they are willing to pay a little more.”

Retailers, consumers and suppliers continue to look at packaging as the main area for innovation within the category, says LGA chairman Tim Casey. But he adds that the drive for change is stagnating slightly as the sector struggles with profitability and economic uncertainty.

30

Lemons / Leeks LEEKS

LEMONS

p.30.indd 30 21/07/2023 12:00

Plums / Asparagus

33 PLUMS

Value: £83.9m (+9.2%)

Premium plums bolster sales performance

Stonefruit has been on a steady downward trajectory in recent years, but plums were one of the few products in the Big 50 to register marginal volume growth in the year to 14 May. The category has benefitted from retailers’ shift to more premium and ready-to-eat lines, such as Metis pluots.

From a production perspective it has been tough, with both inflation and climate change challenging growers. Shazad Rehman of major Spanish producer Royal says the main countries and growing regions for stonefruit are all experiencing climate issues, be it with water supply, frost, or extreme heat. This is having a detrimental impact on

volume, fruit quality, and the length of season.

“More and more, retailers are looking to mitigate the risk by expanding their sourcing portfolio,” Rehman says. And Royal is looking to improve its endof-season varieties to ensure they have the same great flavour as those harvested in the main season.

Retail inflation has driven a strong 9.2% rise in spend, but when it comes to consumption, Oli Pascall of Clock House Farm believes future growth will be dependent on communicating the fruit’s health benefits, combined with consumer messaging on flavour and highlighting the wide choice of highquality British plum varieties.

34 ASPARAGUS

Spears sales slide as inflation bites

Value: £75.4m (-12.3%)

Inflation and the cost-of-living crisis are hitting UK asparagus sales hard, as consumers switch to cheaper, green vegetable options.

This trend was reflected in double-digit declines in both value and volume. In fact, asparagus suffered the biggest volume decline of any product in the Big 50 at -17.3%.

Availability issues, too, have contributed to the category’s lacklustre performance, say suppliers, as exemplified by the delayed start to the UK asparagus season in April. In addition, there is a current shortage of Peruvian spears due to hot weather and the widely recognised El Niño effect.

In total, Britain produces approxi-

Volume: 36.9m kg (+0.5%)

Volume: 8.2m kg (-17.3%)

mately 5,000 tonnes of (mainly green) asparagus between April and late June each year. It is a crop whose arrival is typically greeted with much fanfare by foodies and chefs alike, and it is regarded by many Brits as heralding the start of spring.

“I think the inflation piece is affecting everything, isn’t it?” says Chris Chinn, chairman of the British Asparagus Growers Association. “In terms of price point, we have got to keep demonstrating that asparagus is the jewel in the crown of the UK veg crop. And that it is worth every penny. British asparagus has always been a premium product and we have got to demonstrate that it is good value.”

32

p.32.indd 32 21/07/2023 12:01

Eurofruit app is available for download, try it for free now!

For information about how to subscribe, please contact: subscriptions@fruitnet.com | +44 20 7501 0311 All delivery costs included in your subscription. Digital Subscriptions includes access on 3 devices only. fruitnet.com/subscribe CHOOSE THE SUBSCRIPTION PACKAGE THAT’S RIGHT FOR YOU AND YOUR BUSINESS: SUBSCRIBE NOW! CORPORATE PRICES UPON REQUEST All the benefits of print & digital Bespoke packages available for your team or company Volume discounts for 3+ subscribers Personalised account management DIGITAL ONLY

200 PER YEAR

digital copies of Eurofruit

Fruitnet Specials Access to latest news and

to

offline Fruitnet Daily News: fresh news

sent to your inbox PRINT & DIGITAL

Digital

€

10

Magazine plus all

download content

read

updates

€250 PER YEAR 10 printed copies of Eurofruit Magazine plus Fruitnet Specials

edition: online access included Fruitnet Daily News: fresh news updates sent to your inbox

MAGAZINE

EF2023 Subcard.indd 1 17/07/2023 12:30

THE LEADING

FOR FRESH PRODUCE BUYERS AND SUPPLIERS IN EUROPE AND THE MIDDLE EAST

35

KIWIS

Value: £72.3m (+16.6%)

Strong year for kiwis as penetration picks up

Kiwis recorded higher volume growth than any other product in this year’s list, and suppliers of the furry fruit will be hoping this is the start of a UK sales rise. Kiwi consumption is considerably lower in Britain than in other key European markets, but in the year to 14 May there were signs of progress.

Zespri’s Susan Barrow-Dodd reports a penetration boost, as well as a rise in purchase frequency and volume per buyer. These are all “positive signs”, she says, but concedes that the large 16.1% rise in spend is skewed by inflation.

“We have seen a significant shift in retail prices that we hadn’t seen in previous years,” she says. “The entry-level

Kiwis / Sweet potatoes 36

pack in the category, offering six small fruits, has moved from 65p+ to closer to £1 in most retailers.” By contrast, more premium tiers have seen lower rises.

In terms of production, higher costs and lower supply have proved challenging, with both New Zealand and Chilean volumes down due to adverse weather in recent months.

On a more positive note, Barrow sees opportunities to boost sales through more health messaging. “Most shoppers know kiwis are rich in Vitamin C, but are not aware they are rich in fibre or great for gut health,” she says, adding that direct retailer investment in promotions and in-store activations is key to driving the category forward.

SWEET POTATOES

Value: £69.7m (+£4.7m)

Volume: 26m kg (+6.1%)

Volume: 61.5m kg (-0.1%)

Lack of promotions and plantings hamper sweet potatoes

Sweet potatoes haven’t had the best few years from a sales perspective, but their strong health credentials would seem to chime with current consumer trends and the latest figures are cautiously positive.

A flat volume sales performance is no failure in a year when virtually every product is in decline, and that comes despite a market where retailers are reducing the number and depth of promotions.

“Volume has started to see a little growth in the past 24 and 12 weeks’ data, but the only retailer who has seen any significant growth over the past months is Aldi, who have actively

added sweet potatoes into their Super Six mechanic, and yet again it has been a winner,” points out Julian Marks, group managing director at Barfoots.

At a category level, future growth could be affected by a lack of confidence from growers. “‘In recent years we have seen a global oversupply of this crop, which has led a number of big growers to scale back their production,” says Barfoots’ head of buying Ketan Dave.