The past 18 months have seen a rise in M&A activity and the demise of some big-name companies as mounting pressures reshape the industry’s landscape

The past 18 months have seen a rise in M&A activity and the demise of some big-name companies as mounting pressures reshape the industry’s landscape

The guide before you is the 10th annual edition of the FPJ Big 50 Companies – a publication that has come to be regarded as something of an industry bible over the past decade.

Since our first FPJ Big 50, much has changed in the UK fruit and vegetable sector – cost pressures on supply chains have intensified, consumer behaviour has evolved, climate change has become a huge factor, and the cost and availability of labour has become a major headache for producers.

That said, it is interesting to note the similarities between then and now. Most strikingly, the analysis written 10 years ago by former FPJ journalist Martyn Fisher focused on the high level of M&A activity in the sector. Indeed, one industry expert interviewed by Fisher predicted this would become the norm for the following three to five years as the supermarket price war played out.

Fast-forward to 2023, and not much has changed in that respect. The major retailers are still locked in fierce price competition. And although the intensity and wider causes of industry cost pressures may have evolved, the trend for consolidation has only continued – both in fresh produce and across UK food and beverage (see analysis, p.6-7).

As retailers look to cut costs and keep down prices amid ongoing inflation, some of the UK’s larger fruit and veg companies have been mopping up business and winning new supply contracts. A good example is high-flying supplier DPS, which has grown turnover from £52.9m in 2014/15 to almost £430m in 2021/22.

Group chairman Paul Beaumont wrote in the company’s most recent accounts that the group had taken “increasing market share from its competition” thanks to its “transparent direct-to-grower model”, thus further accelerating consolidation in the sector.

Meanwhile, a number of big-name companies have entered administration amid the rising pressures on suppliers (see p.7).

In many cases, mergers and acquisitions are relied upon as a survival tactic when the going gets tough. And as political instability, climate change and cost inflation continue to shake up the fresh produce sector, it appears the trend for consolidation is here to stay. fpj

Fred Searle, Editor

Fred Searle, Editor

editor Fred Searle

+44 20 7501 0301 fred@fruitnet.com

contributing editor

Michael Barker michael@fpj.co.uk

senior reporter

Luisa Cheshire

+44 20 7501 3723 luisa@fruitnet.com

managing editor

Maura Maxwell

+44 20 7501 3706 maura@fruitnet.com

staff writer

Carl Collen

+44 20 7501 3703 carl@fruitnet.com

staff writer

Tom Joyce

+44 20 7501 3704 tom@fruitnet.com

design manager

Simon Spreckley

+44 20 7501 3713 simon@fruitnet.com

middleweight designer

Mai Luong

+44 20 7501 3713 mai@fruitnet.com

junior graphic designer

Asma Kapoor

+44 20 7501 3713 asma@fruitnet.com

ADMINISTRATION

finance director

Elvan Gul

+44 20 7501 3711 elvan@fruitnet.com

accounts receivable

Tracey Haines

+44 20 7501 3717 tracey@fruitnet.com

finance manager

Günal Yildiz

+44 20 7501 3714 gunal@fruitnet.com

subscriptions

+44 20 7501 0311 subscriptions@fruitnet.com

ADVERTISING

advertising manager

Gulay Cetin

+44 20 7501 0312 gulay@fpj.co.uk

account executive

Lucy Kyriacou

+44 20 7501 0308 lucy@fpj.co.uk

EVENTS & MARKETING

head of events and marketing

Laura Martín Nuñez

+44 20 7501 3720 laura@fruitnet.com

events executive

Poppy Bowe +44 20 7501 3719 poppy@fruitnet.com

MANAGEMENT

managing director, fruitnet europe

Mike Knowles

+44 20 7501 3702 michael@fruitnet.com

commercial director

Ulrike Niggemann

+49 211 99 10 425 ulrike@fruitnet.com

managing director, fruitnet media international

Chris White

+44 20 7501 3710 chris@fruitnet.com

The FPJ Big 50 Companies ranks the largest UK-based suppliers of fruit and vegetables. Companies may be growers, importers or traders, but must be suppliers of fresh produce rather than retailers, caterers or other businesses with broader remits than predominantly selling fruit and vegetables.

The only fair and comparative way to measure size is by turnover, and the figures used have come from filings to Companies House or directly from the businesses themselves. Where a company has offered FPJ a significantly different turnover than the one listed, or a consolidated turnover derived from multiple businesses, this has been explained in the commentary.

For the purposes of fair comparison, shares of joint ventures have been excluded where they are explicitly listed in accounts, as these figures are not readily available for all companies. Some significant fresh produce joint ventures have, however, been included where their turnover qualifies them in their own right.

Companies file results for different time periods, therefore the most recently filed accounts have been used. Companies that do not disclose turnover figures to Companies House could not be included. To be included, companies’ chief business must be the sale of fruit and vegetables, hence companies with wide portfolios across multiple other categories have not been included in the list, except where a UK fresh produce turnover figure is available or fresh produce represents the dominant part of the business.

At the back of the publication, there is a separate section on 'allrounders' – companies that supply multiple categories of food and drink, as well as lists of various other types of companies operating in the wider fruit and vegetable industry.

The FPJ Big 50 Companies has been compiled independently and in good faith by editors at the Fresh Produce Journal. All steps have been taken to ensure the accuracy of the list, and that no firms have been missed out, but it is an evolving document that will be updated annually. fpj

Extra copies of The FPJ Big 50 Companies – as well as The FPJ Big 50 Products – are available for £25 each. Contact us at subscriptions@fruitnet.com.

The top 10 companies account for £5.2bn, almost half the combined turnover of the entire FPJ Big 50, demonstrating the growing trend for consolidation in the sector.

The combined turnover of the FPJ Big 50 is just under £11bn, which is around £650m higher than last year’s total. The increase is roughly equivalent to Manchester United’s revenue for the year to 30 June 2023.

Foodservice suppliers enjoyed the strongest growth thanks to the recovery of the hospitality sector. Fresh Direct grew fastest at +124.2%, rising from 30th to 11th spot. Reynolds was the second-biggest riser, increasing turnover by 64.1% and climbing 16 places to 16th.

Wellocks, TH Clements and UK Salads have broken into the FPJ Big 50 for the first time since the publication’s inception. Meanwhile, Premier Foods Wholesale (formerly Premier Fruits) has re-entered.

AMFRESH once again recorded the biggest absolute rise in turnover, enjoying revenue growth of £90.1m. DPS also grew strongly, seeing sales increase by £74.4m.

The threshold for making it into the FPJ Big 50 has risen considerably since the publication was born. In the FPJ Big 50 Companies 2015, JO Sims squeezed into the list with sales of £43.6m. This year, UK Salads needed a turnover of £69.2m to secure 50th position. £650m

The industry has gone through a tumultuous 12 months as suppliers grapple with inflationary pressure, but that hasn’t stopped the best operators from growing their businesses. Michael Barker reports

Michael BarkerReading through the directors’ reports of the latest financial year, two words appear on repeat as symbols of the times – ‘challenging’ and ‘inflation’.

The two are, of course, deeply intertwined. The challenges are myriad and complex, stemming from the fallout of Russia’s invasion of Ukraine in February 2022 and the subsequent input cost pressure on suppliers and cost-of-living crisis hitting consumers. That has compounded problems around the cost and availability of labour, an increasingly unpredictable climate, and the painfully slow establishment of post-Brexit trading arrangements.

The biggest issue of the day, inflation, is slowing but has by no means gone away. The latest Office for National Statistics (ONS) data, published on 4 December, reveals that the average price of food and non-alcoholic drinks rose by 10.1 per cent in the year to October 2023, a figure that is down from 12.2 per cent in September and an eye-watering high of 19.2 per cent in March.

Whether the latest figures represent reason for cheer depends on your point of view. On the one hand, inflation has roughly halved over the course of the year; on the other, it’s still on a double-digit upward curve. As ONS notes, while food inflation is slowing, prices were still around 30 per cent higher in October 2023 than in October 2021. That is inevitably going to have a profound impact on balance sheets once again when accounts for this year are filed over the coming months.

We are told collaboration is the way through a crisis, but that has often been conspicuous by its absence in a year in which the camaraderie of the early Covid era seems to have evaporated. Suppliers would naturally never call out their customers

in writing, and directors’ reports speak of the strength of their relationships and the value of supply chain collaboration. But as the Groceries Code Adjudicator’s annual survey laid bare in September, there has been a notable rise in suppliers claiming to have experienced a code-related issue, up from 29 per cent in 2021 to 36 per cent in 2023.

The last two years represent a worrying reversal of a long, positive trend of reduced complaints dating back to the Adjudicator’s inception. While there have been some laudable moves by supermarkets to support suppliers – Morrisons’ trial to underwrite potato growers’ costs is one shining example – the tardiness of

cost price inflation being passed back to suppliers against the backdrop of the endless supermarket price war has put huge strain on relations. As former Asda senior buying manager Ged Futter bluntly puts it, “the retailers have disconnected food from anything other than price”.

In spite of all that, when it comes to the leading fresh produce suppliers, the big are getting bigger – much bigger. AMFRESH’s extraordinary emergence as the country’s leading supplier is putting it on course to be the UK’s first £1 billion fruit and vegetable company, catapulting it into the big leagues of fresh food supply alongside category giants like Arla (milk),

2 Sisters (chicken) and ABP (beef).

To put AMFRESH’s growth into context, in the FPJ Big 50 2020 its turnover was £567m, meaning it has grown sales by a stunning 66 per cent in no time at all.

Meanwhile, Total Produce might have lost its number one spot – a position it last held in the FPJ Big 50 2019 – but it can more than console itself with the fact that it is now part of the world’s largest fresh produce group, Dole, which posted global revenue of US$9.2 billion in 2022.

With a couple of exceptions, the top 10 businesses in the FPJ Big 50 all increased turnover in their most recent accounts, and while price inflation had a hand in that, it’s also a reflection of the growing strength of large, often multinational operators in today’s marketplace. Of the iconic, family-owned businesses that used to dominate UK supply, now you can only really point to G’s, BerryWorld and Fresca as having a seat at the top table.

Reflecting the end of the Covid era and the bounceback of the eating-out industry, foodservice suppliers Fresh Direct and Reynolds enjoyed huge surges in sales as they leapt back to the upper echelons of the FPJ Big 50.

tion. As a result, Gomez falls out of the FPJ Big 50, having finished 22nd last time around.

According to corporate finance house Oghma Partners, the volume of M&A activity in UK food and beverage rose 68 per cent in the middle four months of 2023, compared to the same period the year before, with deal value up 49 per cent. Tellingly, there has been a surge in distressed sales, with 27 per cent of deals being an acquisition out of administration, up from 15 per cent in the first third of the year.

It is a further reflection of the pressure on margins, and industry eyes are firmly fixed on Defra’s imminent horticulture supply chain review to see if government intervention is forthcoming.

All of this is not to say big is best, however. Smaller operators are finding success through innovation, specialisation, great customer service, and points of difference, such as B Corp status and imaginative marketing.

Source: ONS

TOP—Consumers are questioning if they can afford to buy fruit and vegetables as their budgets are squeezed

ABOVE—Food prices have soared over the past two years

This is unquestionably a time of winners and losers, as larger firms gobble up category share from often long-established rivals, in some cases sending them to the precipice as they do so. As margins tighten, in the past year and a half we’ve seen big names such as MyFresh, Wellpak (UK), Orchard House Foods, Jupiter Group, and, most recently, Gomez file for administra-

Finally, what of the consumer? A troubling report by the Peas Please campaign, published in December, paints a picture of shoppers struggling to make ends meet and cutting veg out of their discretionary spend. “Both sales data and citizen surveys point to a decline in the amount of veg being both bought and eaten, with the cost-of-living crisis continuing to impact on household budgets and incomes,” the report states.

There’s little doubt inflation cannot continue falling fast enough. The health of the nation, as well as fresh produce suppliers’ margins, depends upon it. fpj

Avocado specialist Greenpoint Trading is celebrating its fifth anniversary and setting its sights on global expansion

Over the past five years, Greenpoint Trading has become a wellestablished name in the Benelux. According to founder and managing director Carel van Krimpen, the success is down to a healthy dose of courage, a dedicated team, curious customers, and a persistent focus on quality.

“I am incredibly proud of our journey to success,” says Van Krimpen. “For me, it is essential to continue ensuring quality, especially in the midst of rapid growth. As quality relies on service, we always strive to fully support our customers. I am convinced that investing in each other is the key to sustainable success. The proof lies in our loyal customer base. We have also expanded our team because we prefer to remain personal but do not want to compromise speed and flexibility for our customers

and suppliers.”

One of Greenpoint Trading’s most notable successes was the launch of Avojoy in 2020, stemming from a collaboration with supplier partner Westfalia Fruit NL and packaging partner Eurowest. This partnership provided Greenpoint Trading access to unparalleled expertise and valuable industry knowledge.

Avojoy was positioned in the Benelux as a premium avocado brand for uncompromising quality. This strategic development resulted in exponential growth, even beyond the Benelux, opening doors to unique collaborations with leading partners such as Hello Fresh in the Benelux, Germany, and the Nordics.

During the challenging period of the Covid pandemic, Your Avojoy was launched – a consumer solution for avocados in various ripening stages, packaged in sustainable egg cartons. What started as a response to consumer needs, quickly evolved into an attractive option for business customers, leading to new partnerships, including a fruitful collaboration with the online supermarket Crisp.

With an eye on further expansion, Greenpoint Trading has worked hard over the past three years to establish its presence in Morocco. A key reason for this development is to ensure year-round supply

FAR LEFT—The senior team at Greenpoint Trading

LEFT—Avojoy is the company’s premium avocado brand

of the best avocados. Morocco has a favourable window for access to the European market, and there is a growing demand for avocados from the North African nation.

The short transit time from the country to the Netherlands is also advantageous for Greenpoint Trading’s customers. Additionally, it is Van Krimpen’s desire to build something meaningful in Morocco for his children, given their Moroccan heritage.

A noteworthy milestone is the participation in a fully certified 40-hectare avocado farm, providing the opportunity for collaborations with multiple growers. Thanks to this development, Greenpoint Trading can also deliver highquality avocados in the winter season. fpj

For more information, please contact:

Baris Saraç (Operations & Sales) baris@greenpoint-trading.com

+316 81429162

Victor Smit (Marketing & Sales) marketing@greenpoint-trading. com

+316 23064517

greenpoint-trading.com avojoy.nl

t’s been another year of bumper growth for Britain’s largest fresh produce supplier, which cemented its position at the top with a 10.6% uplift in revenue in 2021/22.

The biggest driver for the sales hike was the company’s expansion into topfruit and tropical fruit, as well as organic growth in its core categories of citrus and table grapes, and a rise in flower gifting.

The standout moment for the company in 2023 was the opening of its state-of-the-art ‘Fusion’ depot in Alconbury, Cambridgeshire. The new site, which hosted Festival of Fresh 2023, boasts next-gen automation, strong sustainability credentials, and a cutting-edge ERP system to ensure datarich decision-making and security from

Turnover: £942.6m

cyber attack.

The new base, which spans 300,000 sq ft, also includes a groundbreaking Innovation Centre, featuring laboratories and tasting facilities designed to boost product quality, particularly when it comes to flavour and storage life.

Away from wholehead produce, the business has also invested in its freshly squeezed juicing plant in Skelmersdale, West Lancashire, which now features a new bottling facility.

The supplier’s consolidated turnover of £942.6m was calculated by combining the revenues of its various British businesses: AMT FRESH, AMFRESH UK, MM FLOWERS, AMC Farming, Avalon FRESH, AMFRESH Group UK, and Tropical FRESH.

Mark Player, managing director of AMFRESH UK, spoke about the company’s investments in innovation at Festival of Fresh 2023

Turnover: £681.9m

Asda and IPL launched the Just Essentials range in May 2022 to help shoppers through the cost--of-living crisis

IPL might be a long way off the turnover of fruit behemoth AMFRESH, but it was a strong year for Asda’s dedicated fresh produce supplier, which saw revenue grow by a whopping £72.3m in 2022.

The business stated in its financial report that it continued to provide Asda with the “lowest-cost, best-quality sustainable sourcing and supply chain solution… to ensure prices in key product lines were competitive and to invest in supply chain and sustainability initiatives – in particular to improve production efficiency and reduce waste”.

Looking to help shoppers manage the cost-of-living crisis, in May 2022 IPL supported Asda with the launch of the budget-friendly Just Essentials brand, replacing its Smart Price range.

The new offering includes various fruits and veg, as well as fresh meat, fish, poultry, bakery, frozen and cupboard staples.

In 2023, IPL also partnered with Hark, a Leeds-based energy management and industrial IoT firm, to improve efficiency at its facilities. The two areas of focus for the project were energy monitoring and asset performance, with IPL looking to gain visibility of the industrial assets in its UK packing sites.

The initial goal was to retrieve energy and asset performance data to feed into IPL’s OEE (overall equipment effectiveness) metrics. Using Hark’s IoT software, IPL has established a central location to visualise and analyse its energy and process data.

Turnover: £663m

MFRESH might be the biggest supplier in the UK, but the biggest in the world is US business Dole, following its highprofile merger with Irish fresh produce giant Total Produce.

Dole UK is the British arm of the world-leading firm – and it is still a new name, only coming into being in November 2022 when Total Produce rebranded its UK operations to reflect the wider group’s new identity.

The company recorded a huge 24.6% rise in turnover in 2022, driven by inflation, the full post-Covid recovery of its hospitality-facing businesses, and growth in its retail sales.

“While the macro environment remains complex and impacts from weather events remain unpredictable,

we remain confident in the strength of our diversified supply base and the experience and quality of our operating teams,” says MD Mark Owen.

He adds Dole UK is pleased with its progress in employee engagement and sustainability, pointing to several award wins in 2023. At the FPC Fresh Awards Dole UK won Foodservice Supplier of the Year (for its Mark Murphy business) and HR Initiative of the Year (for its diversity and inclusion plan). This was preceded by a Pioneer in Wholesale gong at the Co-op Pioneer Awards, for its Better Berry concept.

In addition, the company has installed solar panels at its sites to cut emissions and reduce costs, as well as upgrading its delivery fleet and adding in electric vehicles.

nder the circumstances, the year to May 2023 was a strong one for salad veg giant G’s and its Spanish subsidiary G’s España. Between the two of them, the firms racked up a turnover of £544m, a 2.3% increase on the year before.

This was against the backdrop of the war in Ukraine and the cost-ofliving crisis, as well as labour pressures on factories and growers. Pushing for better government support in 2023, G’s chairman John Shropshire chaired an independent review calling for more continuity in the seasonal worker scheme to give fresh produce businesses the confidence to invest.

Underlying profitability at G’s Group suffered in 2022/23 due to inflationary cost increases and lower

demand across its higher-value product lines. However, CFO Francis Laud wrote in the UK company’s annual report that it continued to invest in its operations – “to improve efficiency and minimise the impact of inflationary pressures on customers”.

The rise in revenue was mainly due to inflationary price rises, he specified, but praised the business for continuing to source and deliver sufficient volume.

Over at G’s España, the big achievement was an impressive reversal in profitability, which swung from a €30.5m pre-tax loss in 2021/22 to an €8.9m pre-tax profit the year after. This was largely thanks to a “strategic focus on the profit improvement of business units which have not been positively contributing,” he explained.

Turnover: £509m

or major international softfruit supplier BerryWorld, 2022 wasn’t without its challenges but there were also a number of growth drivers, contributing to a 4.4% revenue rise.

CEO Adam Olins says a variety of economic, climatic and political issues affected business in 2022. South African port strikes had a significant impact on the southern hemisphere blueberry season, resulting in lost volume and quality issues on arrival. Across Europe, the unseasonably warm weather in July had an adverse impact on autumn strawberry supply. And the cost-of-living crisis affected Q4 sales at PrepWorld.

Nevertheless, Olins says

2022 was “a year of two halves” and also featured a number of “growth drivers”. The completion of a new prepared fruit facility in Kent allowed PrepWorld to supply a wider range and retailer base. And on the varietal front, award-winning genetics allowed BerryWorld to significantly boost sales of top-tier soft fruit and gain new retail listings across Europe. Agroberries buying minority shares in the BerryWorld Group was also a standout moment. The global producer-marketer has operations in Chile, Mexico, Peru, Argentina, the US and Europe –and Olins says the move will open up new possibilities for BerryWorld’s growers and customers.

Turnover: £490.7m

They might bring joy to shoppers, but flowers are ultimately a discretionary product – and a cost-of-living crisis is bad news for a business like Flamingo, whose turnover fell by £50.5m in 2022.

If you include revenue in Europe, Asia and the Middle East, the group’s total international turnover is still an eye-watering £658.5m. But the group made a pre-tax loss of £18.5m in 2022.

Like other fresh produce companies, the flower, vegetable and herb supplier was hit hard by inflation, which pushed up the cost of all farm inputs and caused business losses in UK flowers and plants – following a slight boost in

2021 sales due to the pandemic.

Nevertheless, Flamingo’s Ian Michell remains upbeat: “We have managed to consolidate and mitigate our position to be stronger in 2024. Strategically our customer alignment is now stronger, and our farm-direct pipeline is the fastestgrowing sector of our flowers and produce businesses.”

Flamingo completed the purchase of Kenyan rose producer Bigot Flowers in 2023, thereby boosting its rose-growing capacity in the country by 30%. And Michell reveals Flamingo is planning to expand flower and vegetable production further in 2024, both at its own farms and by partnering with “key strategic growers”.

Get the fresh produce content you love onto one easy-to-use platform. The Fresh Produce Journal app features the latest news, Fruitbox podcasts, videos and analysis, alongside our magazine editions. All on your smartphone, tablet or desktop.

DOWNLOAD THE FREE APP NOW

Fresca appears in this list with its £341.4m revenue excluding joint ventures, with the company posting sales of £459.4m once its share of JVs is factored in.

Group communications manager Nikki Churchill says the performance of three of Fresca’s businesses exceeded expectations in 2023. Firstly, the Ship Stores part of Mack Wholesale fared “extremely well”, having pivoted its activities to manage the resurgence of the cruise line industry. Secondly, Cartama Europe, Fresca’s Colombian avocado JV, enjoyed “significant” new business wins as

Turnover: £341.4m

the popularity of avocados continues to grow across the continent. And thirdly, Fresca’s largest JV, Thanet Earth, “reacted admirably” to salad vegetable shortages in February and March, which put pressure on UK growers to deliver extra volume. Fresca increased its ownership stake in the business in 2023.

Further investments are being made in a new Avocado Centre of Excellence at The Avocado Company, costing around £3.5m. Meanwhile, speciality veg business DGM Growers recently opened a new vertical ‘smart farm’, allowing it to grow its own pak choi rather than buying it in from abroad.

DGM Growers has opened a vertical ‘smart farm’ allowing it to grow its own pak choi in the UK

Fresca Group

Fresca Group

This is the first FPJ Big 50 not to list Berry Gardens, but the only reason is that in November 2022 the business was acquired by US giant Driscoll’s, prompting a name change.

In May, Berry Gardens filed 10-month accounts to 31 October 2022, posting turnover of £284.4m, but as Driscoll’s has yet to file in the UK and due to a change in the accounting period, the business appears in this list with the same turnover figure as last year.

“The acquisition was and is a huge opportunity for the category, UK consumers, and, of course, our business,” says UK general manager Nick Allen, adding that the market will benefit from Driscoll’s global

Turnover: £318.3m

network, swifter supply chain, award-winning varieties, and other innovations.

Allen describes 2021 as “a challenging year” due to global instability, inflation, climate events, and the impact of Covid on demand.

Aside from the acquisition, there were a number of other standout moments for Driscoll’s in 2023. For example, five of its berry varieties won Superior Taste Awards from the International Taste Institute, and Driscoll’s launched its brand and paper packs in Britain.

“We have lots to look forward to, particularly with the introduction of new Driscoll’s varieties, and the development and growth of our brand in the UK,” Allen says.

Turnover: £296.5m

Like all fresh produce companies, Fyffes had a challenging year in 2022 – but this did not stop the leading banana and pineapple supplier from boosting its turnover by £29m to £296.5m.

MD of Fyffes UK, John Hopkins, says the foremost challenge in 2022 was navigating inflation. He adds that securing enough skilled labour “emerged as a pressing concern”, for example when Britain faced a shortage of delivery drivers.

Hopkins says the standout moment for the business in 2023 was its investments in a sustainable end-to-end supply chain, both from an environmental and a social perspective. He adds that Fyffes

“made strides” towards achieving its climate targets.

Fruitnet reported that in 2023 Fyffes concluded its third year of human rights due diligence. The year before, the company conducted a Climate Change Risk Assessment, saying it would identify the more localised impacts of climate change at individual operations going forward.

Hopkins reports the installation of solar panels at one of the company’s sites, as well as the modernisation of facilities. This included the construction of a new banana packhouse in Costa Rica designed to be environmentally sustainable and to promote employee wellbeing and safety.

resh Direct has shot up this year’s rankings, rising 19 places. Its meteoric rise is thanks to a 124.2% leap in turnover to £282.7m for the year to 3 July 2022, up from £126.1m in 2020/21.

MD Andy Pembroke credits the company’s performance to the commitment, resilience and versatility of his “wonderful team” – in what was a very challenging period for the fresh sector, with Covid lockdowns and reopenings, staff shortages, delivery issues, and availability and inflationary pressures. Among other examples, he cites the procurement department’s resourcefulness in securing supplies at times of shortage, and Fresh Kitchen’s

Turnover: £282.7m

creativity in developing an awardwinning range of dishes and ingredients to meet the diverse and fluctuating needs of chefs.

Over the course of 2023, Pembroke says Fresh Direct has focused on reducing packaging, decarbonising its fleet and shortening its supply chain by focusing on British provenance. At the same time, it has continued to invest heavily in infrastructure, transport and logistics, as well as its systems and processes, and staff quality, training and recruitment.

A trial with vertical farming partner Fischer Farms to launch a range of British-grown herbs and leafy greens is also proving successful, Pembroke reveals.

Turnover: £261.1m

Banana supplier, ripening and distribution specialist SH Pratt is a non-mover in this year’s FPJ Big 50 rankings despite an almost £40m increase in annual turnover to £261.1m in the 12 months to 31 March 2023.

Business unit director João Barata says the reporting period was a tough one for the group. “Extremely challenging” conditions in source countries caused by the El Niño phenomenon affected production and the quality of bananas. Meanwhile, the business was also impacted significantly by huge increases in energy pricing. And at the same time, the surge in diesel costs hit SH Pratt’s transport fleet where it hurt.

Nonetheless, the business performed robustly, says Barata. And, although SH Pratt is braced for further headwinds in 2024, he says the group is well placed to manage them. “There are still labour challenges in the UK, but it’s positive to see some costs going down –including shipping,” Barata tells FPJ. “We keep investing in systems and procedures to make us more efficient. Our industry is super competitive, and we need to keep the operation as lean as possible.”

The biggest challenge facing the banana industry is the mounting climate pressure on growers, he adds. “They are facing increasing climate instability, impacting growing quality and quantities.”

The UK’s leading mushroom producer, Monaghan Mushrooms, has slipped three places, falling out of the top 10 after just one year at those heady heights.

The supplier saw turnover fall from £276.5m to £256.4m in the year to 30 June 2022. There was also a marked decline in profitability –from a pre-tax profit of £3.3m in 2020/21 to a pre-tax loss of £9.7m the following year.

In Monaghan’s financial report, the Wilson family, who own the business, noted that the supplier’s UK division continues to benefit from its relationship with sister company Monaghan Mushrooms Ireland. The link facilitates “an

Turnover: £256.4m

improved customer service as a result of a deep and geographically diverse supply base”.

Across the two businesses, the supplier has farms in Ireland, Northern Ireland, England and Scotland. Indeed, it is one of the largest mushroom producers in the world. However, in the spring of 2022 the business decided to discontinue its operations in the Monchamp mushroom business in Germany and Belgium.

In the past couple of years, mushroom sales have benefitted from the marketing activities of UK & Ireland Mushroom Producers, which won the Marketing Magic Award at the inaugural Festival of Fresh Awards in 2023.

Turnover: £236.1m

Sussex-based bagged salad supplier Natures Way Foods saw revenue jump to £236.1m in the 53 weeks to 31 March 2023, up 10.6% on its previous set of accounts.

This strong sales growth was thanks to the business securing “significant” retail contracts and reporting on a 53-week spell, as well as price inflation.

Product director Caryn Gillan says weather variability during the period created challenges in sourcing raw materials, which drove up costs. But the company was able to meet customer needs thanks to the resilience of its supply chain.

In terms of consumer demand,

Gillan notes that consumers reduced shopping frequency and cut back on the quantity of items purchased to manage the rising cost of living

“Consumers are both downtrading to value tiers to manage household budgets and trading up to premium tiers as spending habits shift from out-of-home to in-home,” she says.

“Last year we invested in research to enhance the category for an easier, more engaging shopping experience.

“Our focus for the year ahead revolves around driving bigger baskets and innovating products to encourage increased consumption,” Gillan concludes.

Turnover: £205.3m Keelings

R

ising six places in the rankings, global produce supplier Keelings International reported another stellar performance in the year to 26 November 2022. The familyowned firm saw its turnover rise by a further £35.1m over the prior reporting period to £205.3m.

The total figure, which combines Keelings’ UK sales, international operations and overseas farms, primarily reflects growth from new acquisitions, says CEO Steven Fagg. Like-for-like volumes actually dropped, he reveals, as shoppers bought less fresh produce due to inflation and smaller household budgets.

These challenges continued into

2023, and combined with reduced produce availability and a shifting retail proposition, put further pressure on the supply chain. Nevertheless, Fagg expects Keelings to continue to grow in 2024 – largely through increased market penetration and further acquisitions.

“We are really looking forward to some of our investments in 2023 being a flywheel in existing and new markets,” he says. “We are very proud of what we have achieved in diversifying our product range, brand and geographical scope on an efficient platform.

“I am glad be surrounded by a team that have used these numerous challenges as fuel to be better equipped for 2024 and beyond.”

Turnover: £200.9m

Shooting up from 32nd to 16th place in this year’s rankings, Reynolds has bounced back strongly from the ravaging effects of Covid, reporting an annual turnover of £200.9m for 2022 – up from a restated £116.4m the year before.

In spite of soaring energy costs and labour shortages in 2022, the Waltham Cross-based company experienced growth across all areas of its business: fruit and veg; prepared produce (Davin Foods and Solstice divisions); and meat and fish (Carnivore and Shoal), according to finance director Andy Austin.

He reveals that 2023 has been a challenging year, with inflationary

and energy costs continuing to put significant pressure on the firm.

“With an ever-increasing number of challenges seemingly facing the food industry, a robust sourcing model is ever more important, and at every level of the supply chain,” Austin says.

To that end, Reynolds has continued to work on several key strategic projects, including acquisitions and technology development. In 2022, it bought a stake in meat and poultry supplier Select Butchery as part of its plan to expand its meat business.

And in 2023, the firm invested in chef-to-chef supplier Braehead Foods, a producer of meat dishes and ingredients.

cottish potato giant Albert Bartlett had a solid year from a turnover perspective, increasing sales by £3.1m to £196.8m, but tough market conditions saw pre-tax profits take a sizeable hit, falling from £12.1m in 2020/21 to £2.3m a year later.

Director Ronnie Bartlett said the profit reduction came as a result of the overall impact of “limited revenue growth against a backdrop of relentless cost increases”.

Bartlett stressed, however, that despite the challenging market, the company continued to invest, adding both production capacity and new capability within its frozen division. This enabled it to meet growing sales volumes.

Turnover: £196.8m

The company also made investments in automation and process improvements to drive efficiency across the business. And it supported staff by increasing wages to alleviate the challenges of the cost-of-living crisis, Bartlett noted.

In terms of brand activity in 2023, Albert Bartlett said it continued to drive strong performance in fresh, while significant investment in its added-value operations brought continued growth in chilled and frozen.

The company has been on TV this winter, with the second outing of its ‘Extraordinary’ campaign, supported by digital and outdoor activity throughout December.

Turnover: £188.4m

Improved avocado availability, combined with retail support in store, helped maintain category growth and aided a slight rise in 2022 turnover for avocado specialist Westfalia Fruit UK.

Graham Young, group chief operating officer, adds that the cost-of-living crisis may have created more occasions to eat at home, further boosting sales. And he cites data that points to growing consumer demand, in spite of higher comparative cost, due to avocados’ flavour and health benefits.

Young warns, however, that unpredictable and extreme weather patterns, as well as geopolitical instability, are creating

challenges for the global sector. In 2023, Westfalia navigated multiple supply hurdles, such as floods in Chile, political instability in Guatemala and Israel, hurricanes in Mexico, and El Niño, to name a few.

Nonetheless, the group continued to widen its product portfolio. In 2023, it secured increased listings for its UK-made guacamole and smashed avocado range, Young reveals, and extended the availability of its premium Gem avocados in the UK and Europe.

Looking ahead, he says Westfalia’s avocado orchard in a northern Portuguese conservation area, established in 2016, is maturing well.

ranston felt the severity and speed of inflation following Russia’s invasion of Ukraine in February 2022 was so strong that it called for a long-term view to balance out the pressure between the business, its supply base, and its customers.

Close collaboration was the key to navigating those pressures, says Jim Windle, who stepped up from financial director to managing director in November 2022.

Inflation has continued to be the main theme in the 2023 financial year, Windle adds, with the first half seeing further high inflation and increased supply chain lead times.

“In addition, the UK potato crop

Turnover: £187.3m

harvested in Q3 2022 was impacted by the growing conditions endured through the extreme heat of June and July 2022,” he says. “That said, H2 saw the beginning of cost stabilisation, providing a more robust platform for all businesses in our sector to plan and invest with greater certainty.”

Branston continues to invest despite the margin pressure. Indeed, the company is currently building two new factories at its Lincoln site – a state-of-the-art mash facility and a potato protein extraction facility described as the first of its kind in the UK. “These investments will enhance our ability to derive value from all aspects of the crop,” Windle says.

Turnover: £183.8m

Turnover and profitability at major veg supplier

Barfoots largely held up in 2022, but it was a tough year.

The Sussex-based sweetcorn specialist cited a long list of industry headwinds, from the changes of government to the loss of subsidies, labour shortages, inflation and retail competition. Poor weather and a drought in the UK last year only compounded the stress.

The directors’ report observes a “falling market place in terms of consumer demand due to the cost-of-living crisis”, with vegetable consumption in general under pressure as shoppers tighten the purse strings.

For 2023, group chief executive

Julian Marks notes that inflation, again, has been top of the list of factors affecting business.

“Government-driven inflation in labour costs has been especially acute,” he says, pointing out that National Living Wage increases, combined with restrictions in labour supply, are putting pressure on producers. “There’s been better weather in the UK, but El Niño has affected other areas considerably.”

Barfoots has never been a business to stand still, however, and Marks notes that the company is continuing to invest in renewables and packhouse automation. Barfoots also recently began removing kernels from English sweetcorn for the frozen trade.

irmingham-based fresh produce supplier Minor, Weir and Willis might not seek out the glare of publicity’s spotlight, but the business continues to perform, with sales holding up well against the backdrop of industry challenges.

MWW has been putting the focus on its social and sustainability commitments in recent times, stating it can have a positive influence on 14 of the 17 UN Sustainable Development Goals.

In October the company reported having completed a transition towards a more responsible approach to waste management, a strand of which involved the repurposing of cardboard corners,

Turnover: £177.7m

while plastic corners are now sent to Oxford Fruit to create pallets for Lidl. Those two moves alone reduced the company’s waste disposal bill by £40,000.

Trading in 2022 was all about recovering from Covid and dealing with the increased cost of living and raw material inflation, director Parveen Mehta wrote in the company’s latest report.

“Overall, the group has navigated these challenges well, but for financial period 2023 and beyond, margins will be tighter as a result of the increased supply and operational costs that we and our supply chains throughout the world will continue to experience,” he explained.

Turnover: £176.7m

Nationwide Produce has been on an upward trajectory for a number of years, and again rises up the rankings following a £33m jump in turnover in the year to 2 June 2023.

Group managing director Tim O’Malley notes that in his 40 years in the trade he has never seen such high spot prices across as broad a range of products for so long as was seen in 2022/23. He summed up the year as one of “exceptional weather, exceptionally short supply and exceptionally high prices.”

Despite that, sales volumes increased as the business took on more traders and grew its customer base, with high prices also helping inflate the turnover to a

company record £176.7m. Importantly, pre-tax profits also jumped from £1.7m to £2.1m.

Investments continue at Nationwide’s Evesham depot and its AGP onion-packing site in Lincolnshire. In Evesham a £3.5m depot extension is now up and running; there is a new transport fleet; and a doubling of office space is next on the agenda. Meanwhile, at AGP the company is investing in a packhouse extension, a new fleet of vehicles, and new machinery and robotics.

On the product side, Nationwide has launched a new chefs’ range of premium frozen potato products in partnership with Albert Bartlett and TV chef James Martin.

Like other businesses in berry supply, Angus Soft Fruits found the going tough in its most recent financial year, with turnover dropping from £193.4m in 2020/21 to £173.1m in 2021/22.

Managing director John Gray notes that the past couple of years have been a challenge across the sector, with soaring production costs and increasingly volatile weather hampering supply.

Things have at least taken a turn for the better in recent months.

“Summer 2023 was a significant improvement on 2022, when a significant proportion of the UK berry crop went unsold,” Gray explains. “Indeed, for many weeks

Turnover: £173.1m

this summer demand exceeded supply. This was partly due to a later season, but also to a reduction in planted area in the UK due to pressures on grower margins.”

The challenges are never far away, with Gray noting that the start of the import season has seen volatile weather in regions such as Spain and Morocco, while South America has yielded fewer berries.

At the consumer end, Angus Soft Fruits continues to be a torchbearer for the category. Its trial work will soon see the first deliveries of new strawberry variety AVA Alicia, while two other new premium raspberries – AVA Monet and AVA Dali – are set for launch next summer.

Turnover: £166.4m

Topfruit and avocado specialist Worldwide Fruit slides 11 places down the FPJ Big 50 rankings after its turnover fell from £219.9m in 2021 to £166.4m a year later.

“The prime mover behind the drop in turnover is that an area of business that we had been facilitating for a customer changed to a different model,” explains CEO Steve Maxwell. “Overall, as for many produce businesses, 2022 onwards has been a challenging time where we’ve faced cost increases across the board while we try to limit the impact on consumers.”

Those challenges have continued into 2023, with Maxwell noting that costs are up across all

areas of the business. Meanwhile, many of the company’s supply partners have suffered major weather impacts, leading to structural availability issues.

“How growers have reacted to these challenges deserves huge appreciation,” Maxwell says, adding that Worldwide Fruit has “robust and resilient” relationships with both its customers and suppliers.

A difficult year hasn’t held the company back from spending, and Worldwide Fruit says it continues to invest in its site, people and partnerships. There has been a special focus on packhouse automation, Enterprise Excellence training, varietal development, and driving forward sustainability.

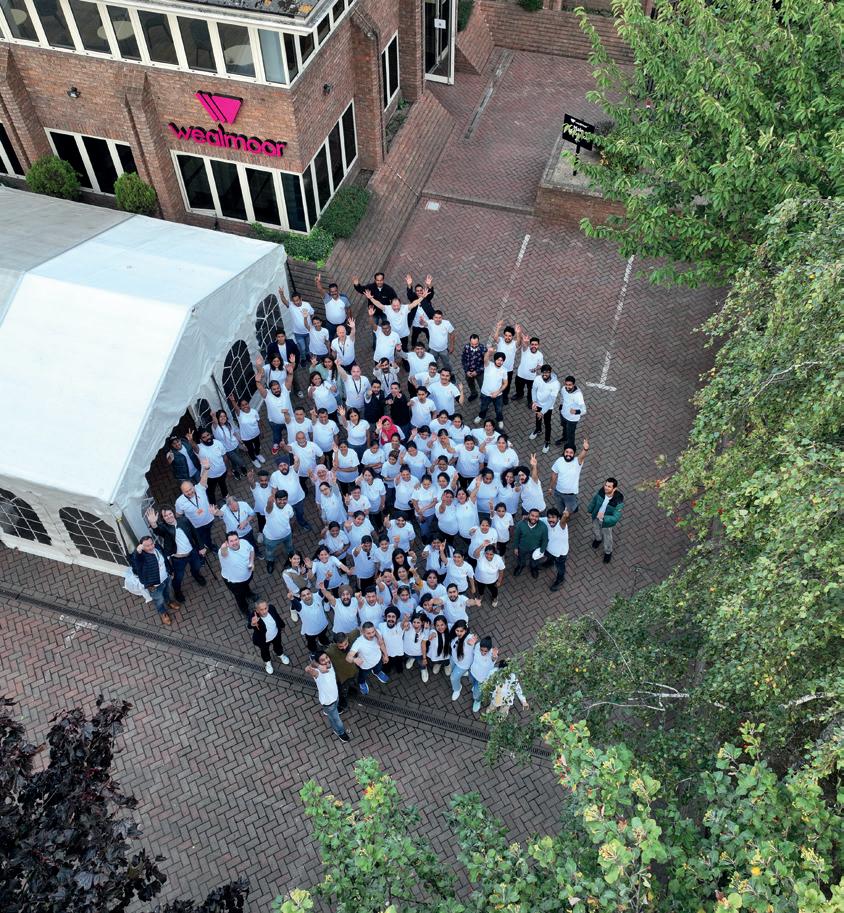

ealmoor celebrated its golden anniversary this year with events at each of its sites, and despite a difficult trading environment the company believes it is well placed for many more years of success.

The business hadn’t yet finalised its 2022/23 accounts by the time the FPJ Big 50 went to press, meaning the company appears in the rankings with the same £162m turnover as last time – for the year to 2 April 2022.

Nevertheless CEO Avnish Malde gave FPJ an update on the latest year’s performance, describing the period as “hugely challenging, with the spiralling effects of inflation, rising energy

Turnover: £162m

and labour costs, adverse currency movements due to UK political activity, and an overall downturn in volume impacting growth.”

Malde says that while some volume has returned to the market recently as consumers change their habits, there remains an issue around pressure on costs despite freight rates starting to normalise.

“Supply disruption through climate events has led to significant challenges and affected key crops, such as asparagus and peas, and El Niño threatens to cause havoc with supplies out of Peru,” he adds.

Wealmoor is working with customers to develop its broader end-to-end integration, with investments in Kenya, Peru and the UK.

Turnover: £154.8m

Despite recording a small rise in turnover, fresh herb and salad supplier Vitacress described 2022 as a “volatile year in all our markets”, pointing to rampant inflation. This inevitably impacted the company’s manufacturing and growing operations, group finance director Ashley Cooper wrote in the latest accounts. And pre-tax profitability fell significantly.

CEO Chris Jinks explains that inflation had a “significant impact” due to the increased cost of energy and its effect on purchase prices and supply chain availability. However, he says the business was able to mitigate supply concerns thanks to its “diversified portfolio of sup-

pliers” and “ability to benchmark suppliers to drive competitive sourcing”.

The supplier completed a major refurbishment of part of its UK salads factory at the start of 2023. And as the year progressed, Vitacress continued to install new machinery and further improved its operational processes, with plans to invest further in all its sites going forward.

Cooper reported that after a Covid sales boost, demand for fresh herbs “stabilised at levels closer to pre-pandemic” as customers returned to previous buying habits. However, new product launches and winning new customers helped Vitacress maintain revenues.

There’s no shying away from the fact that it was a challenging year for Fifebased fresh and prepared vegetable supplier Kettle Produce.

Turnover in the year to 28 May 2022 fell by £3m to £147m, and the business also suffered a £2.1m pre-tax loss. The ongoing impact of the Covid pandemic during the accounting period was cited as a principal reason for the outcome, together with inflation and costof-living challenges.

“The measures taken over the last two years to mitigate the risk of Covid have now been substantially removed and most operational activities have returned to a more normal basis,” director

Turnover: £147m

Liz Waugh wrote in the annual report. “The directors anticipate that the next year will be challenging, with significant cost pressures and competitive conditions in the fresh produce retail market.”

Kettle observed that the financial year was, at least, blessed with good product availability and quality of raw material, which eased operating pressure, improved efficiency and reduced costs.

In an unwelcome development at Orkie Farm in Fife, the firm was fined £360,000 by the Health & Safety Executive after a worker was dragged into a carrot machine and lost consciousness.

Turnover: £142.2m

Produce Investments – a leading player in potatoes, daffodils, crop storage and agri-tech – posted revenue of £142.2m in the year to 27 August 2022, 5.8% less than the year before.

The group’s subsidiaries include potato producers Greenvale and The Jersey Royal Company, potato storage system Restrain, Seed potato firm Greenvale Seed, Cornish daffodil grower Rowe Farming, and technical support consultancy Produce Solutions.

Business performance for the period was hit by inflation across the supply chain, which affected the group’s post-Covid recovery, says managing director David Rankin.

In potatoes, the business also faced major production challenges. “In the case of potato growers, 2023 presented a very difficult harvest – leading some to leave crops in the ground,” Rankin reports. “The national crop is potentially at its lowest volume ever.”

Despite these difficulties, sales volumes have remained robust, offering growers a degree of stability. “Potatoes, known for their versatility and affordability, tend to perform well notwithstanding the economic downturn,” Rankin explains. “We have been focusing on the growth of our Golden Kings brand, which is currently performing exceptionally well in various retail outlets.”

n 2023, prepared fruit specialist Blue Skies celebrated 25 years since the socially minded company sent its first consignment to Sainsbury’s.

Speaking to FPJ at the time, company chairman and founder Anthony Pile vowed to preserve the supplier’s culture of “people, profit and quality”. And the business certainly lived up to its profitability ethos in 2022, with both revenue and profits rising significantly.

Like all fresh produce businesses, Blue Skies felt the combined impact of the war in Ukraine and the post-Covid period, which resulted in major inflation in almost all the company’s direct

Turnover: £136.8m

and indirect costs. Nevertheless, CEO Hugh Pile said colleagues, suppliers and customers have worked hard to give shoppers the best value possible during difficult times.

Growing conditions have also been a challenge, and the 2023 Spanish melon crop was “especially poor”, Pile says, with “very limited volumes and extremely high prices” during the period of peak demand.

Fortunately, Blue Skies was able to source high-quality melons from its Egyptian business and worked with long-term suppliers to secure additional volume from a number of countries, including via its pomegranate farmers.

February 1998

Turnover: £128.8m

APS Produce hadn’t published its 2022 accounts and was unavailable for comment as the FPJ Big 50 Companies went to press, so it features with its Covid-hit 2021 revenue instead.

In the financial report, directors said the negative impact of the pandemic on trading performance reduced as the year came to an end, leading them to anticipate a more “normalised” year in 2022.

In reality, however, recent times have been anything but quiet for the Cheshire-based greenhouse grower of tomatoes, peppers, cucumbers and aubergine. Indeed, in March 2023 the firm was acquired by P3P Partners, a

sustainable energy and agri-tech specialist that had provided heat, power, light and CO2 to all the APS growing sites for over 10 years.

Former owners, the Pearson family – along with other shareholders – sold 80% of the business to P3P for an undisclosed sum, giving the business access to additional funding to develop into other fresh produce areas, Fruitnet reported at the time.

CEO Mark Pearson said the acquisition would “strengthen the excellent services and produce” that APS provides its customers.

APS is the UK’s leading supplier of British tomatoes to the high street and the largest organic producer of tomatoes in the UK.

Fresh food supply is about more than just fruit and veg. There are also other categories like meat, fish, dairy and desserts to consider. FPJ profiles five of the top companies offering the total package

Brakes is the UK’s leading wholesale food supplier, distributing what it claims is the most extensive range of own-brand products in UK foodservice, and employing more than 6,500 people. In 2016, the company became part of Sysco, the largest foodservice company in the world.

The foodservice giant enjoyed a strong sales recovery in the year to 3 July 2022, with turnover rising from £2.6bn to £3.9bn. Meanwhile, pre-tax losses were reduced from £217.8m to £57.2m. However, revenue remained 9.3 per cent below pre-pandemic levels.

In a bid to minimise the impact of food inflation on its customers, Brakes announced in April 2023 that it would freeze the price of 1,850 own-brand frozen and ambient products until October. And in March the wholesaler announced a new programme of activity to support British growers and promote seasonal British food.

The business also recently confirmed a £15m investment in its Brakes Scotland depot in Newhouse, expanding the site by more than 25 per cent and creating around 100 new jobs. Brakes Scotland already supplies more than 500 Scottish product lines, but once expanded, the site will allow Brakes to grow its Scottish range further.

BELOW—Brakes enjoyed a strong postCovid sales recovery

BOTTOM—Premier Foods Wholesale is The Menu Partners’ fresh produce arm

Mirroring a wider trend across foodservice suppliers, The Menu Partners achieved huge turnover growth in the year to 31 March 2023. Revenue shot up from £162.5m to £237.2m year on year, and pre-tax profits also rose sharply – from £1.2m to £5.5m.

As a multi-category supplier, the company is still in its infancy – it was formed in September 2020 when Premier Group (now Premier Foods Wholesale) signed a 50-50 merger with the Bicesterbased catering business Absolute Taste. Premier has been supplying fresh fruit and vegetables to the wholesale and catering sector for over 20 years. Meanwhile, Absolute Taste caters for a host of British

Imagine having everything you need to create your menu, delivered in one delivery.

The Menu Partners is designed to be the new leading food sourcing, procurement and distribution partner to hotels, pubs and restaurants.

One order, one delivery and one invoice. Find

and international sporting events, as well as a number of major hospitality chains.

In the year to spring 2023, cofounder Jason Tanner says procurement skills proved vital to circumvent customers’ inflation concerns. The Menu Partners strengthened pre-existing relationships with suppliers, as well as forging new ones. And it helped its customers develop their menus and remove product that was either out of season or desperately hard to source in order to keep down costs.

The business recently moved into state-of-the-art new facilities in both its London and Bicester locations, with a view to further expansion in both the immediate and long-term future. A culinary school was added to the London site and the freezer was expanded to hold more than 800 pallets. The company’s wholesale division will move into new facilities in February 2024, joining the prepared department which moved in mid2023.

Wide-ranging food and drink supplier AF Blakemore is one of the largest family-owned businesses in the UK, supplying retail, wholesale and foodservice. The business owns 263 Spar stores across England and Wales and is Britain’s largest Spar wholesaler.

The company’s portfolio of

brands also includes prepared food chain Philpotts and Vegan Store, a specialist online wholesaler and retailer. In addition, AF Blakemore is a member of the Unitas Wholesale and Country Range groups and is a significant supplier to the independent grocery sector, as well as pubs, restaurants and caterers across the UK.

In a recent restructuring of the business, the company combined its foodservice, fresh meat and wholesale divisions to create a Foodservice Business Unit, with former Aramark UK boss Lawrence Shirazian appointed managing director.

In AF Blakemore’s most recent accounts, for the year to 30 April 2023, the business saw sales rise by four per cent to £1.2bn, shifting from a pre-tax loss of £3.3m in 2021/22 to a pre-tax profit of £5.3m.

Chairman Peter Blakemore said the group “demonstrated fantastic resilience” and highlighted strong performances across the company’s Spar retail estate, together with improved stock availability and productivity gains across the supply chain, as the key growth drivers.

When it comes to fresh prepared food, Bakkavor is something of a behemoth. Its wide-ranging product portfolio includes ready meals, soups, dips, salads, desserts, pizzas and breads. And its customer base spans the UK, the US and China.

In 2022, a 14.3 per cent rise in revenue to £2.1bn was driven primarily by price in the UK, along with strong volume growth in the US, however Covid inevitably impacted volumes in China. While the company said it was largely successful in mitigating inflation through pricing and internal levers, there was some impact on profits, which fell year-on-year.

Looking ahead, Bakkavor CEO Mike Edwards said: “Whilst market challenges will persist in 2023, the actions we are taking to protect profits, our clear strategy, and our balance sheet strength, allow us to move forward with purpose and confidence, enabling us to deliver on our medium- to long-term ambitions.”

In September, when Bakkavor posted results for H1 2023, group revenue was up 7.9 per cent year on year and the company said it expected full-year adjusted operating profit to at least be in line with the year

before (£89.4m). The revised outlook was underpinned by a restructuring of operations (including an estimated £25m in annualised savings), a “strong pipeline to support UK share gains”, and post-pandemic volume recovery in China.

After an extremely tough period for restaurants and catering during Covid, heavyweight catering supplier Bidfresh rebounded in the year to 30 June 2022, boosting turnover from £144.6m to £269.2m. Meanwhile, profitability recovered from a £13.9m pre-tax loss to a £3.9m pre-tax profit.

The business supplies chefs from a wide range of establishments with fruit and vegetables, fish, meat and dairy products from its specialist businesses around the UK and Ireland. The umbrella company comprises several distinct supply businesses, including Oliver Kay (for fruit, veg and dairy), 11 specialist fish businesses and a national brand called Direct Seafoods, and Campbell Brothers (for meat).

According to Bidfresh, its decentralised management model encourages the entrepreneurial spirit of each of these businesses, which is directly responsible for its product range, buying, and sales approach. fpj

BOTTOM

Subscribers access the app’s content from the App Store/Google Play and desktop version. If you want to become a subscriber, get in touch with us: subscriptions@fruitnet.com

The UK continues to be an important export market for the world’s top fruit and veg producers. FPJ talks to five key suppliers about British trade in 2023

TOP—Delassus built 35 houses for families displaced by the September earthquake

MIDDLE—Indian

pomegranates are increasingly sought by UK retailers

BOTTOM—North Carolina sweet potatoes are popular in the UK

Peruvian citrus, grape, mango, avocado, pomegranate, sweet potato and blueberry grower-exporter La Calera says rising costs at source and in the UK influenced trade with Britain throughout 2023.

Increases in fuel, freight and energy prices inflated every aspect of the supply chain, the company said, in a year when Peruvian growers wrestled with El Niño. Nevertheless, La Calera said it fared better than

some Peruvian producers thanks to the geographical spread of its growing regions. Meanwhile, its biodigestors, solar farms, access to water, fruit canning factory, and IQF facility helped the firm mitigate the effects of the global inflationary environment.

Already shipping 42 per cent of its snacking tomatoes, 35 per cent of its citrus and grapes, and 90 per cent of its flower volumes to the UK, Moroccan grower-exporter Delassus has ambitions to supply more. As well as planning to grow its grape exports to Britain over the coming years, Delassus intends to add more tomato varieties to its offer with a view to becoming the UK’s go-to tomato specialist.

Meanwhile, its social and environmental projects continue apace. In September, the group launched a Moroccan earthquake appeal, and within two months had raised enough money to build 35 houses for displaced families.

France’s grower cooperative and exporter Blue Whale says it has never been so English. The French apple supplier, which opened a UK office in Spalding in 2021 to better serve the market, believes its UK investment has led to much closer alignment with British consumer needs. As a result, Blue Whale’s early Gala, Pink Lady, Jazz and Granny Smith apples have enjoyed growing UK sales – despite clashing with domestic crop.

Such is Blue Whale’s confidence in Britain, that it plans to launch its pears on the market within the next two years, once its new French orchard yields enough fruit.

While baby corn remains Kay Bee’s top export to the UK, the Indian fresh produce grower-shipper says its sales to Britain are expanding in new areas.

Erratic coconut supplies from traditional sources have led UK importers and retailers to increasingly look to India – the world’s largest coconut producer – as an alternative provider. India’s plentiful volumes, consistent quality and value for money has now established it as a reliable coconut hub, says Kay Bee.

At the same time, India’s affordable manpower, combined with year-round pomegranates, makes its hand-extracted arils a preferred option for UK retailers.

The UK was one of North Carolina’s sweet potato growers’ first export markets and continues to be a key destination for the state’s sweet spuds, which it supplies year-round.

To encourage Brits to add the product to their weekly food shop, the North Carolina Sweetpotato Commission launched a variety of marketing activities in 2023, including budget-friendly, healthy and easy-to-recreate air fryer recipes.

The commission’s primary aim going forward is to re-establish North Carolina as the UK’s sweet potato category leader. To that end, it has conducted indepth research into UK consumer habits with a view to informing UK retailer buying practices and finding new opportunities to boost consumption. fpj

Be part of the leading trade show for the global fresh produce business.

FPJ picks out three UK ag-tech start-ups that have attracted global and industry attention over the last year

Back in October 2023, US finance and media company Bloomberg named British ag-tech start-up BigSis as one of its 25 ‘Startups to Watch’. The Reading-based business offers chemical-free insect control solutions to farmers, and was selected by Bloomberg from more than 1,500 applications for its unique and innovative approach to cutting insecticide use and its commitment to diversity.

Founded in 2017, BigSis harnesses AI and robotics to automate the rearing of millions of sterile male insects that are released into a crop where they mate with wild females which then produce no offspring. Farmers subscribe to a seasonlong service, with BigSis taking care of insect releases and crop monitoring.

“The beauty of our system is that it’s species-specific, non-toxic, non-GMO, and demands minimal regulation,” says BigSis founder and CEO Glen Slade, who has a computer science degree from

Cambridge and 25 years’ experience in agribusiness. “Despite its minimal impact on the environment, BigSis solutions are capable of outperforming chemical insecticides in many agricultural and horticultural crops, with further opportunities in pest control for public health.”

In 2022, BigSis partnered with Berry Gardens (as it was known before rebranding as Driscoll’s) and NIAB in early field trials to prove the technology worked against Spotted Wing Drosophila (SWD), an invasive fruit fly. Introducing the sterile male insects reduced SWD populations in strawberries by as much as 91 per cent compared to untreated plots. In 2023, trials in raspberries showed up to 88 per cent reduction in SWD populations compared to plots treated with one spray of a chemical insecticide. The success of the company’s projects has caught investors’ attention. Led by specialist agricultural innovation fund Regenerate Ventures, the BigSis Series A funding round closed over-subscribed in November 2022 at £4.5m. BigSis is currently raising £3m to replicate its production system to treat up to nine times more hectares in 2024 compared to 2023. Most of this is pre-ordered.

UK start-up NatureMetrics won the 2023 Tesco Agri T-Jam Competition, securing fast-track introductions to the Tesco supplier network and a trial with one of the retailer’s supply-chain partners. NatureMetrics measures biodiversity using eDNA analysis of soil, water and insects. The firm then converts this complex data into simple metrics which can be viewed through its Nature Intelligence Platform, allowing users to comprehensively report on biodiversity improvement in their supply chain.

Tesco and WWF (World Wide Fund for Nature) teamed up with start-up tech innovator AgriSound

LEFT—BigSis partnered with Berry Gardens in 2022 in early field trials

BELOW— NatureMetrics won the 2023 Tesco Agri T-Jam Competition BOTTOM—AgriSound’s Polly device was rolled out in English apple orchards

in 2023 to roll out its AI insectmonitoring device Polly across several English apple orchards. Fifty of the AI listening devices, designed to capture and analyse the sound of a range of common pollinating insects, were deployed across three different sites in Kent.

The aim is to measure the biodiversity benefits of wildflower margins, and their impact on pollination, across three large commercial apple orchards.

AgriSound anticipates that by identifying areas of low pollinator activity in real time, the devices will support growers to boost biodiversity at key sites on their farms – and ultimately drive up crop yields. fpj

As the global population continues to grow, fruit and vegetable production is increasingly catching the eye of private equity investors

A UK-based “global family of companies focused on agriculture”, Camellia hit the headlines in the fresh produce industry in August 2021 when it bought an 80 per cent stake in innovative Kent topfruit grower Bardsley England. In addition, Camellia’s portfolio includes Kakuzi, the largest producer of Hass avocados in Kenya, and Maclands, the world’s secondlargest producer of macadamia kernels. Alongside fruit and nuts, Camellia claims to be the world’s largest private grower of tea, and has interests in the arable, livestock, forestry and rubber sectors.

Leamington Spa-headquartered Elaghmore describes itself as “a firm of industrialists, business advisers and investors who buy businesses in the UK that show real promise” from its £90m fund. Its track record includes buying and selling produce ingredients businesses Chaucer Foods and Phoenix Foods for good returns, however it had less luck with its 2021 acquisition of prepared fruit firm Orchard House Foods, which collapsed into administration in January 2023.

Mercia, through its Northern Venture Capital Trust funds, has been taking an increasing interest in the food sector in recent years.

The company says its funds provide an investment opportunity with an exposure to innovative businesses. To that end, Northern VCT invested £3m in wonky fruit and veg supplier Oddbox in 2020. The spend already appears to be paying off, with Oddbox posting revenue of £32.2m in 2021/22, from a standing start less than a decade ago.

London-based Sun European Partners is a heavyweight of the private equity scene, having amassed

Zintinus’s strapline is “your partner for growth capital in food tech”, and the venture capital fund focuses on projects that accelerate the food system towards greater sustainability. In April this year, Zintinus joined another equity investor, BGF, in leading a £6.7m Series B investment round for ItsFresh!,

an eye-watering $14 billion of cumulative capital commitments in current and previous funds. On the lookout for “defensible businesses in growing markets with tangible performance improvement opportunities”, the firm is the European adviser to US-based Sun Capital Partners. In fresh produce, its flagship investment is Flamingo Horticulture, the powerhouse veg and cut flower business that ranks among the top 10 suppliers in the FPJ Big 50. Also in the food and beverage space, Sun European’s portfolio includes Freshpak Chilled Foods, a UK manufacturer of sandwich fillings, dips, vegetable and fish pastes, mayonnaise and egg products.

the fresh fruit and veg shelf-life extending technology. Zintinus has also been putting a particular focus on investing in the growing plant-based market, with interests in alternative milk brands Blue Farm and Mighty. fpj

ABOVE—Private equity interest in healthy food companies is increasing

There have been a number of breakthrough packaging launches in the fresh produce aisle in the past 12 months. FPJ rounds up five of the best from some of Britain’s leading manufacturers

In the summer of 2023, Coveris opened a pioneering new recycling facility at its factory in Louth, Lincolnshire. It uses groundbreaking de-inking technology to help produce new printed films from recycled waste packaging. The new ReCover facility is the second in the Coveris portfolio and is dedicated to closing the loop and keeping plastic circular. It cleans and recycles printed polyethylene (PE) films and uses the waste packaging to manufacture new PE products. This has the benefits of reducing reliance on virgin raw material, eliminating waste, and recycling plastic.

At the start of the year, fibre-based consumer packaging firm Graphic Packaging International partnered with exotic mushroom grower Smithy Mushrooms to supply its premium mushrooms to UK supermarkets in recyclable cartonboard punnets. The fibrebased tray is coated with a water-based moisture and grease-resistant barrier, and the top film, supplied by D&M Flexibles, contains 30 per cent post-consumer recycled material. John Dorrian, managing director of Smithy Mushrooms, says the packaging solution offers a number of benefits in terms of recyclability, plastic reduction, packing speed, and branding potential.

In October 2023, paper-based packaging giant Smurfit Kappa proudly proclaimed it had solved a poorly fitting punnet problem for producer Isle of Wight

Tomatoes. The company’s new paper-based lattice box features diamond-shaped holes to prevent fungal growth. This not only ensures produce reaches customers in good condition, but also differentiates the tomato brand from its competitors, Smurfit Kappa said. Isle of Wight Tomatoes general manager Rob Waterhouse added that the vibrant yellow box is sleek, meticulously designed, and stands out on the shelf.

Thermoforming packaging specialist Waddington Europe has claimed a first by supplying a full range of soft-fruit punnets to the UK market that are easier to recycle and use less plastic than conventional punnets. Made with Waddington’s Monoair cushion technology, the new 100 per cent mono-material punnets are now available in large rectangular (WE80), square (WE62) and standard rectangular (WE37) versions. Standard soft-fruit punnet bases have traditionally been

inside. These conventional bases require an additional layer of bubble padding attached with a glue adhesive to protect soft fruit from bruising and spoiling in transit. If consumers do not remove the bubble padding and adhesive, the punnet cannot be recycled.

In October 2023, ProPrint Group launched an updated version of its Pro-Produce Pack for Taste the Difference Golden Kiwis at Sainsbury’s. The plastic-free linerless pack concept has been well received by consumers since its initial launch in 2020, according to ProPrint and kiwi supplier Chingford Fruit. They said customers welcomed the opportunity to recycle the pack at kerbside, as well as appreciating the protection offered to fruit during transit. The newest version incorporates a die-cut lid, supplied in the same easily stored reel format, that offers increased product showthrough and ventilation. fpj

Away from the fresh produce market, major frozen and processing brands are supporting British growers with their popular products

Britain’s frozen food giant Birds Eye is a major purchaser of vegetables from both the home market and abroad, from peas and carrots to broccoli and sweetcorn. A supporter of Veg Power’s Peas Please initiative, the brand has declared a target of sourcing 100 per cent of its vegetables from sustainable farming practices by the end of 2025 – a move it said would focus on maximising yield and nutritional quality while keeping resource inputs as low as possible. It also has key strands around responsibly managing soil fertility, water and biodiversity, and enabling local communities to maintain or improve their wellbeing and the environment they operate in.

Owned by Coca-Cola but run independently, Innocent is another major customer of the

global fresh produce industry, buying a wide range of fruit and vegetables from around the world for its range of juices and smoothies. Innocent puts sustainability high on the agenda, and as a B Corp, highlights the fact that its produce is sourced with both the environment and local communities in mind. Its recent work in that area has included Spanish strawberry production that uses less water and the use of bee hotels to help with the pollination process for apples.

Leading chip brand McCain purchases British potatoes in huge volumes, and plays an active role in industry affairs. It has a marketing budget that is the envy of fresh produce suppliers. Indeed, its latest campaign, Let’s All Chip In, featured Love Island commentator Iain Stirling, highlighting the positive impact regenerative farming can have on the planet. The brand also regularly innovates its lineup, its most recent product launch being Baby Hasselbacks in November 2023.

Ultimately under Japanese ownership, Ribena nevertheless remains one of the iconic British drink brands, loved by children across the country. The

ABOVE—UK cider producers buy huge volumes of domestic apples

brand essentially holds up the domestic blackcurrant industry, buying 90 per cent of all its fruit, with 11 different varieties used for production of the juice. Working with the James Hutton Institute to develop berries best suited to the British climate, Ribena has launched a sixpoint sustainability plan that includes measures around the conservation of hedgerows and the use of wild flowers and bird boxes to ensure it is farming with nature front of mind.