2022

for the Top 50 Fuel Brands in the Convenience Retail Industry SPECIAL ISSUE 2023

FUEL LEADERS Rankings

WARREN I � ����t.. ROGERS� II' PRECISION FUEL SYSTEM DIAGNOSTICS Fueling your profitability. ������� ����� �

� �

��������� PRECISION F EL SYSTEM DIAGNOSTICS 76 Hammar und Way, Ste. 200 · Middletown, RI 02842 · 800-972-7472 · 401-846- 4747 · Fax: 40 1-847-8170 · info@warrenrogers com · warrenrogers.com

EDITORIAL

Keith Reid Editor-in-Chief (847) 630-4760; kreid@fmnweb.com

Ben Nussbaum Editorial Director (703) 518-4248; bnussbaum@convenience.org

Lisa King Managing Editor (703) 518-4281; lking@convenience.orgt

DESIGN Imagination, part of The Mx Group www.imaginepub.com

Cover image by Doug Armand/Getty Images

ADVERTISING

Ted Asprooth (847) 222-3006; tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski Publisher (703) 518-4231; ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290; npappas@convenience.org

Logan Dion Digital Ad and Media Trafficker (703) 864-3600; production@convenience.org

EDITORIAL COUNCIL

RETAILER/MARKETER MEMBERS

Mark Fitz, president, Star Oilco; Derek Gaskins, chief marketing officer, Yesway; Jeff Reichling, general manager of fuel, Kwik Trip Inc.; Jim Weber, executive vice president of merchandise and marketing, The Spinx Company

VENDOR/SUPPLIER MEMBERS

Regina Balistreri, director of marketing, ADD Systems; Joe O’Brien, vice president of marketing, Source North America Corporation; Kaylie Scoles, marketing director, RDM Industrial Electronics Inc.; Jen Threlkeld, product marketing manager, Dover Fueling Solutions

Fuels Market News Magazine is published quarterly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscription Requests: circulation@fmnweb.com

POSTMASTER: Send address changes to Fuels Market News Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria, VA, and additional mailing offices.

1600 Duke Street, Alexandria, VA, 22314-2792

PUBLISHED BY

SPECIAL ISSUE 2023 16 04 02 Methodology Behind the 2022 fuel leaders rankings. 2022 Into 2023—Inside the Store and on the Forecourt Lori Buss Stillman and Denton Cinquegrana discuss convenience retailing and fueling. The Top 50 Fuel Brands We look at who excelled last year in five key areas of success. Finding The Right Brand Partner Choose what fuel to carry wisely because it’s an ongoing partnership. The Top 5—and the New 6 Wawa comes out on top in the rankings for the third year, and six newcomers join the ranks. 2022 Fuel Leaders 06

14 FuelsMarketNews.com 2022 Fuel Leaders | 1

Behind the 2022 Fuel Leaders Rankings

The 2022 Fuel Leaders supplement published by Fuels Market News and NACS is based on data collected by the Oil Price Information Service (OPIS) and drawn from hundreds of retail operations of all sizes throughout the fuel retailing industry. OPIS, a Dow Jones Company, tracks the performance of over 250 fuel retailers and ranks them in an annual report. Through a special partnership with OPIS, NACS is presenting a targeted subset of this data in the third-annual Fuel Leaders supplement to Fuels Market News Magazine.

Analysts use the OPIS rack-to-retail margin methodology to estimate the

gross profit on a gallon of gasoline. While some chains may pay more or less than the posted rack, the OPIS methodology provides a reasonable metric for each chain.

OPIS also tracks the market share based on volumes sold on the WEX Universal fleet card. While fleet purchases may vary slightly from how the everyday consumer buys fuel, the analysis shows that they trend closely, and the relative consistency makes it a valid datapoint.

As a further enhancement, OPIS partners with Orbital Insight, a company that tracks location information on more than 116 million

SUPACHAI PANYAVIWATGETTY IMAGES

FuelsMarketNews.com 2 | 2022 Fuel Leaders

cellphones in the U.S. through various mobile apps. OPIS geo-fenced all 130,000 stations (by hand) in the country to track the number of times a device visits a convenience store to provide insight into which sites are seeing the most potential customers. While there may be regional disparities in smartphone usage, the relativity of visits between a site and its direct competitors is unprecedented. These cellphone ping data are used to calculate an alternative market share for each brand.

Getting the best estimate on each chain’s volumes starts with the monthly taxable gallon information reported on a state level by government entities. Analysts then apply two market share methodologies to estimate total gallons by calculating each chain’s market share in the state against the total taxable gallons reported each month, and then dividing that number by the count of stations to offer an approximate monthly volume per site. Matching the estimated volumes to the margins shows total profit on gasoline sales and estimated profit per site. Both methodologies are separate but also averaged together to try to flatten any biases in either technique.

Taking it all a step further, analysts study the data on a localized level, comparing a chain’s sites to the other sites in the communities in which they operate within a one-mile radius. This information makes it possible to determine each brand’s market share against direct competitors. Researchers also calculate a head-to-head “winning percentage” by examining chain performance against competitors in the same community

to identify which brand was more efficient. As an example, if “chain A” and “chain B” compete in the same 10 communities, and “chain A” was more efficient (market share divided by outlet share) in eight of those communities, that would indicate that “chain A” had an 80% winning percentage against “chain B.”

OPIS ranks each chain in a variety of categories but weights them differently based on conversations with industry insiders on what they felt were the most important metrics. Estimated monthly profit per site is rated the most important category, followed by total overall estimated profits. Other categories ranked include price differential, overall market share, local market share, margins, property values and more. The final overall ranking takes weighted ranking by category into consideration to determine the chains with the best performance.

Some chains in the report had thousands of sites with a huge multistate footprint, while others were small single-state operators with just a handful of locations.

As OPIS notes, “In summary, this report is our best answer to the question we are so often asked. While we may not be able to tell you with 100% certainty who the most-profitable fuel retailer is, or which convenience store chain or major brand is the strongest, this data-rich report is an excellent relative approximation from which many critical insights can be gleaned.”

The full OPIS report containing highly granular information on each chain is available for purchase from OPIS at www.opisnet.com.

Getting the best estimate on each chain’s volumes starts with the monthly taxable gallon information reported on a state level by government entities.”

FuelsMarketNews.com 2022 Fuel Leaders | 3

2022 Into 2023— Inside the Store and on the Forecourt

Lori Buss Stillman and Denton Cinquegrana discuss convenience retailing and fueling.

BY KEITH REID

Lori Buss Stillman and Denton Cinquegrana discuss convenience retailing and fueling.

BY KEITH REID

When will we see a return to normal? The lockdowns have passed and demand is returning, nearing pre-pandemic levels. Supply chain issues triggered by the lockdowns are easing but remain. But now we have the supply disruptions linked to the sanctions against Russia over its aggression in Ukraine.

Fuel prices skyrocketed once the conflict began, though there has been some moderation. Inflation is also working its way into the picture, adding to operator costs and impacting customer behaviors.

The opening general session of the Midwest regional M-PACT show, held April 4-6 in Indianapolis, featured Lori Buss Stillman, NACS vice president of research and education, and Denton Cinquegrana, chief oil analyst of OPIS. They provided a perspective on business both inside the store and on the forecourt in 2022 and some possibilities for 2023.

Last year was solid for convenience retailers. “Through the end of Q3, all sales were up nationally in 2022 by about 30%, driven largely by fuel sales growth,” Stillman said. “The average national selling price jumped

from $2.98 in 2021 to $4.18 in 2022.” Average fuel margins approached $0.35 per gallon.

High fuel prices tended to make “filling the tank” less common for some consumers, as they might just purchase $20 worth of fuel per visit. However, that change in behavior helped boost store sales to near pre-pandemic levels. “We saw an increase in transactions, because people were coming more often even though they weren’t putting as many gallons in the tank,” Stillman said. “We certainly see that they were spending significantly more inside. And whether it was driven by increased consumption or price inflation, inside sales benefitted from the increased frequency.”

Foodservice was a bright spot in 2022. “Foodservice sales were up 16.2%,” Stillman said. “Some of that is food inflation, some of that’s people getting back into morning dayparts and other routines that had diminished over the course of the pandemic. But then, as expected, we see cigarettes continue to decline. However,

WENDELLANDCAROLYN/GETTY IMAGES

FuelsMarketNews.com 4 | 2022 Fuel Leaders

overall total transactions grew 4.2%— that’s encouraging.”

There were some strong headwinds as well, specifically cost increases with direct store operating expenses. Stillman noted this was the third year of double-digit increases. “If you look at wages and benefits, they are up another 14%, credit card fees are up almost 30%, utilities up 14%, repairs and maintenance up 16%—so total direct store operating expenses nationally are up about 16.2% total when you roll in facility expense.”

Despite gross profit growth in the top 10 convenience categories, the expense line is growing faster.

A particular concern that NACS continues to address is credit card fees. Stillman noted that they are up almost 80% percent since 2019. “It’s our top issue. We had our recent Day on the Hill event where we called on as many members of Congress as we could to talk about what this means to consumers. This was the single topic we addressed. It’s not sustainable,” she said.

Cinquegrana’s presentation on fuels in 2022 and going into 2023 noted that production has rebounded to 2020 levels, though it still trails 2019 by about 20% on a same-store basis. However, refiners are disciplined against overproduction and OPEC+ just announced a significant production cut of 1.6 million barrels per day. What will that mean for prices in 2023?

“Well, $100 per barrel is still possible, but so are prices under $70,” he said. China’s economic activity and the health of the world economy in general can influence demand in either direction, as well as further production disruptions. As far as street prices for gasoline are concerned, he doesn’t see a scenario for $5 gasoline this summer.

“Something can happen that you can’t predict, but all things being equal and even with this recent OPEC+ production cut of 1.6 million barrels I think we’re going to be pretty close to the current national average—a $3.60 or $3.30 type of number.”

Where distillates are concerned, Cinquegrana noted that EIA’s calculations seem to be recessionary indicators. A recession would impact demand for fuel in general, and most certainly diesel, which powers construction and logistics. “It’s been said you know you are in [a recession]

maintained a strong foothold in the workplace. Census data from 2021 indicated 27.5 million people worked from home. A back-of-the-envelope calculation he provided on typical miles driven and various two-day or three-day schedules indicates potential demand destruction of up to 170,000 barrels per day.

What explains those unusually high retail gasoline margins in 2022 and going into 2023? While the previously noted increase in costs certainly provides an incentive to keep margins high, Cinquegrana cited recent, extreme volatility in the spot markets as a primary factor.

“After the invasion of Ukraine things got really volatile,” he said. “So big days up put downward pressure on margins and big days down upward pressure on margins. The average difference between the high and low RBOB futures contract price is typically about $0.04 and maybe $0.05. Last year it was $0.12. So, you have a lot of price movements.”

six months after you’re already in a recession,” he said. “Those distillate numbers may be telling us that either we’re on our way to a recession or we might already be in one. So just keep an eye on that EIA data that’s coming out for distillate demand.”

With gasoline demand, despite a considerable recovery Cinquegrana doesn’t see it reaching 2019 levels. He cited vehicle efficiency as the primary driver, with some other factors. “I know everyone likes to think about electric cars, but it’s more than just that,” he said. “They’re coming, but it’s not now and it’s not tomorrow. It’s not even next year. It’s a couple of decades away. Yet we are looking at [CAFE standards of] 49 mpg by 2026.”

He further noted that the pandemic-driven telecommuting trend has

The industry is highly competitive with a product, gasoline, that the consumer typically has a strong emotional attachment to and will go out of their way to save even a few pennies per gallon on—especially with the price transparency provided by the large price signs at each outlet. Without the volatility, margins are traded for potential volume after the wholesale price swings downward (though typically somewhat more gradually than margin drops as prices go up). The volatility disrupted those more extended natural cycles.

Are these margins here to stay? “This may be the new normal,” Cinquegrana later clarified, especially if the volatility remains unchecked.

Keith Reid is editor-in-chief of Fuels Market News. He can be reached at kreid@fmnweb.com

“We saw an increase in transactions because people were coming more often even though they weren’t putting as many gallons in the tank.”

—Lori Buss Stillman, NACS

FuelsMarketNews.com 2021 Fuel Leaders | 5

The Top 50 Fuel Brands

By Keith Reid

We look at who excelled last year in five key areas of success.

The Top 50 fuel brands tend to be a fairly consistent group year to year. That does not mean they fall into a specific profile, as they range from operators with 31 sites to nearly 6,000, are regionally diverse and go to market with a variety of formats, ancillary profit centers and key offers. What makes them consistent is that they have figured out how to operate their fueling programs in a highly efficient manner that is integrated with their full business models. They also, undoubtedly, have a deep insight into

the competitive markets in which they operate and know how to effectively execute on this knowledge.

FMN covers five critical performance factors for the Top 50 brands in partnership with the Oil Price Information Service (OPIS) with data from its OPIS Top 250 Retail Power Brand Report. The full report provides more granular and typically localized detail in a number of additional categories and is available for purchase.

Our 2023 report (based on 2022 data) sees six new companies entering the Top 50, with some

FuelsMarketNews.com 6 | 2022 Fuel Leaders

FuelsMarketNews.com 2022 Fuel Leaders | 7

making significant jumps from their positions outside the Top 50 in 2021. They are Ohio-based Truenorth (82 to 49); California-based Fastrip Food Stores (81 to 41); Ohiobased United Dairy Farmers (78 to 46); California-based Rotten Robbie (66 to 35); California-based We Got It (65 to 25); and Georgia-based Parker’s (53 to 42).

There were some similarly significant movements within the Top 50. However, the top five were highly consistent:

1. Pennsylvania-based Wawa (ranked 1 last year)

2. Pennsylvania-based Sheetz (ranked 3 last year)

3. Oklahoma-based QuikTrip (Ranked 2 last year)

4. Utah-based Maverik (ranked 5 last year)

5. Georgia-based RaceTrac (ranked 6 last year)

ECONOMY OF SCALE VS. SPEED AND FLEXIBILITY

Economies of scale give the larger players in the industry a range of advantages, such as favorable purchasing power, broader brand recognition and often greater cashflow/credit and human resources to apply to initiatives. Countering the economies of scale, smaller operations tend to have more flexibility to pursue opportunities, can be better focused on their markets compared to broader operations and can increasingly take advantage of powerful but affordable technologies that help level the playing field where efficiency is concerned.

The top five tend to be midsize chains (relatively speaking).

Size, Top 5 Brands

Four companies on the full list operated over 1,000 stations (with an additional one a handful short), yet generally ranked toward the middle of the pack. On the larger side, 56% of the brands ranged in size from nearly 6,000 sites to slightly over 100 sites and included the top five performers. The remaining 44% ranged in size from nearly 100 sites to 31 sites.

The ability to operate efficiently regardless of size is illustrated by comparing the 10 largest brands to the 10 smallest. A perfect example is found at the extremes with Arizona-based Circle K (nearly 6,000 sites) and New Yorkbased Delta Sonic (31 sites). The companies are ranked similarly, with Circle K coming in at 28 and Delta Sonic trailing by a few positions at 32.

10 Largest Chains

10 Smallest Chains

PRICING STRATEGIES

The industry draws customers to its sites through a variety of offers. Operators look to differentiate themselves and win the market through foodservice, car wash offerings, beverage programs and packaged goods—to name a few. However, the traditional traffic driver (though not necessarily a top profit generator except for unusual years) is motor fuels. NACS research has shown that consumers have a strong emotional attachment to the price of fuel and will often endure inconveniences such as driving extended distances to save a few cents. In a string of unusual years, 2022 was no exception. Gas prices have been high (though now receding) due to the impact of the Russia-Ukraine war on crude oil and refined product. Margins at all levels have been high, and they stayed high longer than is typically the case. How have the Top 50 responded in their markets?

All the top five brands price lower than their market averages.

Rank Brand Stations 1 Wawa 790 2 Sheetz 677 3 QuikTrip 976 4 Maverik 400 5 RaceTrac 583

Rank Brand Stations 28 Circle K 5,968 39 7-Eleven 4,989 11 Speedway 3,378 24 Casey’s 2,460 3 QuikTrip 976 1 Wawa 790 10 Kwik Trip 688 2 Sheetz 677 5 RaceTrac 583 44 Cumberland Farms 569

Rank Brand Stations 32 Delta Sonic 31 35 Rotten Robbie 36 26 Buc-ee’s 46 50 On the Run 51 47 Wesco 55 43 Fastrac 57 30 Dash In Food Stores 59 31 Johnny’s Markets 64 37 Byrne Dairy 66 16 OnCue Express 67

FuelsMarketNews.com 8 | 2022 Fuel Leaders

Price Differential, Top 5 Brands

Higher Price Leaders

Some 62% of the Top 50 brands price below the average for their competitors in their market, compared to a near even split in last year’s report. The impact of the RussiaUkraine war has led to significant increases in fuel prices, which is likely having an impact on competitive pricing decisions.

Topping the list for a lower-than-market-average price were Fastrip Food Stores and Rotten Robbie, at 30.3 cents and 19.4 cents respectively. It should be noted that these two companies, along with We Got It at 11.1 cents below market, made dramatic jumps into the Top 50 this year.

Lower Price Leaders

ATTRACTING CUSTOMERS

A look at the OPIS Consumer Market Share data (an overall national gasoline market share based on visits to a chain’s properties measured through cellphone location tracking), reveals once again that while the report is focused on many efficiency factors, scale can come into play in this category. As was the case with the previous two Top 50 brand reports, the top rated companies were a mix of some of the largest operators in the industry and dynamic midsized operators.

Consumer Market Share, Top 5 Brands

*Overall national gasoline market share based on visits to the chains’ properties through cellphone location tracking.

Note: Figures in red are below market averages.

Among those in the Top 50 that priced above their markets, California-based ExtraMile topped the list at 18.2 cents.

Rank Brand 1 Wawa ($0.018) 2 Sheetz ($0.010) 3 QuikTrip ($0.032) 4 Maverik ($0.047) 5 RaceTrac ($0.026)

Figures in red are

market averages.

Note:

below

Rank Brand 41 Fastrip Food Store ($0.303) 35 Rotten Robbie ($0.194) 26 Buc-ee’s ($0.117) 32 Delta Sonic ($0.115) 25 We Got It ($0.111) 45 Murphy Express ($0.107) 42 Parker’s ($0.057) 4 Maverik ($0.047) 33 RaceWay ($0.046) 6 QuickChek ($0.045)

Rank Brand 13 ExtraMile $0.182 38 Terrible Herbst $0.150 20 Jacksons Food Stores $0.078 23 G&M Food Mart $0.057 27 Spinx $0.049 22 Twice Daily Convenience $0.036 49 Truenorth $0.020 31 Johnny’s Markets $0.018 40 Family Express $0.016 43 Fastrac $0.014 18 Kum & Go $0.009

Rank Brand *U.S. Market Share (Traffic) 1 Wawa 1.711% 2 Sheetz 1.428% 3 QuikTrip 3.078% 4 Maverik 0.487% 5 RaceTrac 1.552%

FuelsMarketNews.com 2022 Fuel Leaders | 9

Consumer Market Share Leaders

*Overall national gasoline market share based on visits to the chains’ properties through cellphone location tracking.

ATTRACTING FLEET CUSTOMERS

OPIS tracks an overall national gasoline market share based on WEX fleet card gallons sold. The scale of an operation can be a significant factor favoring midsize and larger companies. Fleets (in many cases) appreciate a widespread availability of sites in their business area for drivers to access.

Fleet Card Market Share, Top 5 Brands

*Overall national gasoline market share based on just WEX fleet card gallons sold.

Fleet Card Market Share Leaders

*Overall national gasoline market share based on just WEX fleet card gallons sold.

Rank Brand *U.S. Market Share (Traffic) 28 Circle K 6.971% 11 Speedway 3.674% 39 7-Eleven 3.445% 3 QuikTrip 3.078% 24 Casey’s 2.537% 1 Wawa 1.711% 5 RaceTrac 1.552% 2 Sheetz 1.428% 10 Kwik Trip 0.953% 45 Murphy Express 0.799%

Rank Brand *U.S. Market Share 1 Wawa 3.402% 2 Sheetz 2.518% 3 QuikTrip 3.222% 4 Maverik 1.085% 5 RaceTrac 1.667%

Rank Brand *U.S. Market Share 28 Circle K 7.235% 11 Speedway 4.797% 39 7-Eleven 4.057% 1 Wawa 3.402% 3 QuikTrip 3.222% 2 Sheetz 2.518% 24 Casey’s 2.062% 5 RaceTrac 1.667% 4 Maverik 1.085% 9 Holiday 0.946%

FuelsMarketNews.com 10 | 2022 Fuel Leaders

The impact of the Russia-Ukraine war has led to significant increases in fuel prices, which is likely having an impact on competitive pricing decisions.

TOP 50 FUEL LEADERS

2021 Rank 2022 Rank Brand Stations # Communities # States 1 1 Wawa 790 507 6 3 2 Sheetz 677 464 6 2 3 QuikTrip 976 568 16 5 4 Maverik 400 248 12 6 5 RaceTrac 583 370 9 4 6 QuickChek 96 75 2 7 7 GetGo 268 208 5 12 8 Thorntons 214 149 6 14 9 Holiday 538 272 11 9 10 Kwik Trip 688 333 5 13 11 Speedway 3,378 2,102 37 16 12 Bolla Market 210 112 2 15 13 ExtraMile 503 336 4 8 14 Royal Farms 238 141 6 18 15 Alltown Markets 73 63 6 23 16 OnCue Express 67 39 2 17 17 Rutter’s 82 46 3 10 18 Kum & Go 421 223 12 19 19 Weigel’s 74 37 1 30 20 Jacksons Food Stores 284 187 7 34 21 My Goods Market 227 190 5 20 22 Twice Daily Convenience 95 47 4 43 23 G&M Food Mart 111 77 1 25 24 Casey’s 2,460 1,592 16 65 25 We Got It 94 78 1 11 26 Buc-ee’s 46 39 7 22 27 Spinx 86 42 2 32 28 Circle K 5,968 2,816 41 24 29 Kwik Star 115 78 3 27 30 Dash In Food Stores 59 48 3 38 31 Johnny’s Markets 64 47 2 37 32 Delta Sonic 31 27 3 42 33 RaceWay 220 195 12 44 34 Bell Stores 79 56 1 66 35 Rotten Robbie 36 33 1 40 36 Stewarts 327 174 2 29 37 Byrne Dairy 66 50 1 28 38 Terrible Herbst 113 46 4 41 39 7-Eleven 4,989 2,355 39 33 40 Family Express 82 44 2 81 41 Fastrip Food Store 73 59 3 53 42 Parker’s 73 32 2 31 43 Fastrac 57 43 2 21 44 Cumberland Farms 569 397 9 36 45 Murphy Express 365 343 23 78 46 United Dairy Farmers 167 97 3 45 47 Wesco 55 41 1 26 48 Gate 76 41 4 82 49 Truenorth 103 82 2 39 50 On the Run 51 40 3 FuelsMarketNews.com 2022 Fuel Leaders | 11

HEAD-TO-HEAD COMPETITION

An operator knows the competition and knows, generally, how well it stacks up against direct competitors. But what is the true metric for that success? OPIS provides this metric in a specific, detailed format for companies that purchase the full report. Here, we share the general head-to-head performance of the Top 50 operators. This represents the percentage of times a specific brand was more efficient in gaining its head-to-head market share compared to individual competitors in its markets. This is a combination of both fleet and consumer business.

This is an area where the top five brands truly show their competitive market leadership with efficiencies above 90% and solid representation at the top tier of the category.

Head-to-Head Efficiency, Top 5 Brands

WHOLESALE FUEL & LUBRICANTS

Fuel Software

Business Software for Fuel Marketers of All Sizes

“Trinium

Call (310) 214-3118 to schedule your one-on-one demo today or email sales@triniumtech.com www.TriniumTech.com/Fuel

has enabled us to upgrade our technology to a more modern and functional system, while providing us the necessary flexibility to customize the system to fit our specific needs." Dave Olson,

Ernie’s Fueling Network www.erniesfuelingnetwork.com

Partner

CARDLOCK

INTEGRATED ACCOUNTING

MANAGEMENT

Rank Brand 1 Wawa 98% 2 Sheetz 99% 3 QuikTrip 96% 4 Maverik 98% 5 RaceTrac 91%

Leaders Rank Brand Efficiency 26 Buc-ee’s 100% 35 Rotten Robbie 100% 2 Sheetz 99% 1 Wawa 98% 4 Maverik 98% 10 Kwik Trip 96% 3 QuikTrip 96% 27 Spinx 95% 29 Kwik Star 94% 6 QuickChek 93%

Head-to-Head Efficiency

FuelsMarketNews.com 12 | 2022 Fuel Leaders

Keith Reid is editor-in-chief of Fuels Market News. He can be reached at

kreid@fmnweb.com

IS E15 A

THE TEARS OF YOUR COMPETITION? Make a clean break with Flex Fuels — and give yourself a financial advantage the majors don’t want you have. It’s more affordable for customers and more profitable for you. Add E15 & E85 today. We can help. flexfuelforward.com SCAN ME

CLEAN FUEL OR

FINDING THE RIGHT BRAND PARTNER

Choose what fuel to carry wisely because it’s an ongoing partnership.

14 | 2022 Fuel Leaders FuelsMarketNews.com

IF AN OPERATOR IS LOOKING TO SWITCH FUEL PARTNERS OR IS CONSIDERING GOING FROM UNBRANDED FUELS TO BRANDED FUELS, WHAT ARE SOME OF THE MOST IMPORTANT THINGS TO CONSIDER?

The power of a brand plays a large role in your consumer’s willingness to consider you. Trust, perceived higher-quality fuel and the drive for higher-margin premium fuel sales are all key considerations for operators. Brands can bring with them established programs such as loyalty, private-label credit cards and other gallon-driving partnerships, such as grocery loyalty or other exclusive relationships. Marketing support from the brand, inclusive of national partnerships and sponsorships, is also a differentiator for a station owner’s customers. Value-added programs such as Sunoco’s industry-leading dispenser equipment discount program provide significant savings to station owners and imaging programs also offer business benefits: Sunoco’s centennial program drives more than 10% gallon growth when a site rebrands.

FLEXIBILITY IS A KEY PART OF THE VALUE PROPOSITION ANY PARTNER PROVIDES, BUT WHAT DOES THAT MEAN IN PRACTICE?

Flexibility means finding ways to meet your customers where they’re at today and to give them what they need to continue to be successful in the future. Sunoco recognizes every business is unique and has its own criteria for success. Our flexible financing options are unique in our industry: We’re able to provide capital up front if that is what a customer needs and update term options and pricing when those situations arise. Having a flexible approach means more than offering a range of financing options; it speaks to a brand’s commitment to its partners in communication and customer support, too. One of Sunoco’s biggest differentiators is accessibility. Sunoco’s customers can pick up the phone and call anyone within their account team organization, including our leadership. Flexibility isn’t just about the deal, but about how you manage the relationship moving forward and meeting station owners where their needs are.

AFTER A PARTNERSHIP AGREEMENT IS SIGNED, WHAT ARE SOME ONGOING WAYS A PARTNER CAN HELP AN OPERATOR?

One of the first things our new station customers read in their onboarding kits is: “Your success drives ours,” because Sunoco is successful when our stations are successful. This involves supporting operators with programs and partnerships driving business to their station(s), including generating demand through digital avenues (e.g.: location-based Google ads), regional/national advertising and more. Our

Sunoco Go Rewards app helps station owners generate demand by offering discounts on fuel. As a company, we invest in consumer research to fuel innovative solutions and programs. The Sunoco mystery shop program helps operators gauge how their stations appeal to consumers and details what can be done to create the safest, most approachable station possible. And the brand provides ongoing quarterly point-of-purchase (POP) promotions to continue to promote the brand and a station owner’s business.

WHAT IS SUNOCO’S VALUE PROPOSITION WITHIN THE REALM OF FUELS?

Sunoco’s value proposition is first and foremost about the fuel quality itself. High-quality fuel is a top consideration driver for consumers—behind only price and convenience. Sunoco Ultratech is a top-tier certified fuel proven to make your engine run cleaner and last longer. This is evidenced by Sunoco’s 20 years as the exclusive fuel provider of NASCAR, where we’ve done 20 million miles across three different fuel blends, and we’ve never had a defect. It’s a testament to the quality of our fuel and the excellence of our operations team. We fuel every race, every driver, flawlessly every time. Sunoco puts the same focus and care into the fuel at its stations as it does for the fuel that powers the fastest racing machines around the world. And as the largest fuel distributor in the country, Sunoco’s reliability as a fuel supplier is something our operators appreciate.

SUNOCO REVAMPED ITS FUEL BRAND IMAGE. WHAT WAS THE MOTIVATION FOR THAT, AND WHAT ARE THE RESULTS?

In our consumer research, consumers’ perception of station safety showed to be a significant determining factor when they selected where to refuel. When updating our fuel brand image, we focused on making safety a priority by adding additional lighting, as well as making LED mandatory at every station. The result is a modern, clean and simpler design for the next generation of Sunoco consumers. We leveraged our heritage to bring back the iconic Sunoco diamond to the canopy and our dispenser valences. We place an emphasis on our product quality with Sunoco Ultratech as well as being the official fuel of NASCAR. We introduced a new POP element dedicated to communicating the benefits and quality of Sunoco Ultratech fuel. These culminate in a big impact for our operators: We see more than 10% gallon growth at the stations that receive the new image.

2022 Fuel Leaders | 15 FuelsMarketNews.com

This article is brought to you by Sunoco LP, a NACS member.

Fred McConnell, Director of Brand and Fuels Marketing at Sunoco LP www.sunocolp.com

By Keith Reid

5 THE TOP

16 | 2022 Fuel Leaders

1 2

Wawa began in 1803 as an iron foundry in New Jersey. Toward the end of the nineteenth century, owner George Wood took an interest in dairy farming, and the family began a small processing plant in Wawa, Pennsylvania, in 1902.

As home delivery of milk declined in the early 1960s, Grahame Wood, George’s grandson, opened the first Wawa Food Market in 1964 as an outlet for dairy products. Today, Wawa is an all-day, everyday stop for freshly prepared foods, beverages, coffee, fuel and surcharge-free ATMs.

Wawa stores are located in Pennsylvania, New Jersey, Delaware, Maryland, Virginia, Florida and Washington, D.C. The stores offer a large fresh foodservice selection, including custom-prepared hoagies, freshly brewed coffee, hot breakfast sandwiches, specialty beverages and an assortment of soups, sides and snacks.

Established in 1952 in Altoona, Pennsylvania, Sheetz Inc. is one of America’s fastest-growing family-owned and operated convenience store chains, with more than 23,500 employees. The company operates more than 670 store locations throughout Pennsylvania, West Virginia, Virginia, Maryland, Ohio and North Carolina.

Sheetz provides an award-winning menu of sandwiches and salads that are ordered through unique touchscreen order-point terminals.

The brands that made it into the top five this year (and tend to find themselves in or close to the top five most years) are familiar to most readers. They tend to have reputations for “doing things right” throughout their operations. Here is a quick overview of each brand.

All Sheetz convenience stores are open 24 hours a day, 365 days a year. Recognized by Fortune as one of the 100 Best Companies to Work For, Sheetz is committed to community engagement and offering employees sustainable careers built on an inspiring culture. 2022 Fuel Leaders | 17

QuikTrip Corporation is a privately held company headquartered in Tulsa, Oklahoma. Founded in 1958 by Burt Holmes and Chester Cadieux, QuikTrip has grown to a more than $11 billion company with 900+ stores.

QuikTrip began to sell gasoline in 1971 as states legalized self-service stations. In the early 1970s, co-founder Cadieux eliminated slow-moving merchandise from the stores’ inventory, such as canned vegetables, and stocked a larger quantity of items priced low for high-volume sales, such as beer, soda, coffee, cigarettes and candy.

Made-fresh-to-order food, premium specialty drinks and tasty frozen treat selections are available at QuikTrip’s QT Kitchens counters each day.

QuikTrip gives back to the communities it serves, donating five percent of net profits to charitable organizations in those communities. With more than 24,000 employees, QuikTrip has consistently been ranked as one of the top convenience store marketers in product quality and friendly service.

After saving up money from renting roller skates throughout Idaho and Utah, Reuel Call opened his first gas station in 1928 in Afton, Wyoming. In 1964 the company expanded to Moab, Utah, and has kept growing to hundreds of stores and millions of gallons of gasoline sold. Maverik has helped millions of people gear up for adventure. The company is committed to building the coolest convenience experience on the planet, and that adventurous spirit fuels every operational decision.

Maverik operates more than 380 locations across 12 Western states, making it the largest independent fuel marketer in the Intermountain West. It’s known for its premium BonFire foodservice offering—made fresh in every Maverik, every day—and values on fuel, drinks and snacks. Maverik sells exclusive products such as burritos, sandwiches, pizzas, toasted subs, cookies and coffee blends from around the world.

Headquartered in Atlanta, Georgia, family-owned RaceTrac has been serving guests since 1934 and now operates over 550 convenience store locations in the Southern United States.

Operating under the mission of making people’s lives simpler and more enjoyable, RaceTrac stores offer guests an affordable one-stop shop featuring a wide selection of food and beverage favorites, as well as Swirl World frozen desserts, freshly ground, freshly brewed coffee and competitively priced fuel.

The company has been named a top workplace across four of the states in which it operates and has been recognized on Forbes’ list of largest private companies every year since 1998.

3 4 5 FuelsMarketNews.com 18 | 2022 Fuel Leaders

...And the New 6

Six companies made it into the top 50 this year that were not in last year’s ranking.

We Got It (25)

We Got It is a brand of United Pacific, which has established itself as one of the largest independent owners, suppliers and operators of gas stations and convenience stores in the Western United States. United Pacific offers motor fuels products under the 76, Conoco, Shell and United Oil flags and convenience items through We Got It Food Mart, My Goods Market and Circle K brands. United Pacific operates its retail and wholesale businesses in California, Nevada, Oregon, Washington and Colorado.

Rotten Robbie (35)

Rotten Robbie gas stations are a fourth-generation family business with a 75-year history, owned and operated by Robinson Oil Corporation. Rotten Robbie has 36 locations in the greater Bay Area, with its headquarters in Santa Clara. It offers high-quality gas at a low price at the pumps and quality snacks and drinks. Rotten Robbie is an active member of the community, supporting local charities and school drives.

Fastrip Food Stores (41)

Fastrip started in 1968 as a small dairy store in Bakersfield, California. Following the success of its first location, Fastrip started expanding and taking its concept of great selection, great value and great customer service throughout the Bakersfield area. Today, the company has locations in California and Arizona, with all the stores offering a complete selection of grocery items, quality gasoline, all the snacks and drinks you want, and 24-hour convenience.

Parker’s (42)

Headquartered in Savannah, Georgia, Parker’s has a commitment to exceeding customer expectations and has repeatedly been recognized as one of the nation’s leading convenience store and foodservice companies. Parker’s Kitchen,

the popular food-centric brand under the Parker’s umbrella, serves world-famous hand-breaded southern fried chicken tenders as well as made-from-scratch mac and cheese, a breakfast bar and daily specials. The company’s popular Parker’s Rewards loyalty program, which includes more than 300,000 members, has saved Parker’s customers more than $15 million to date.

United Dairy Farmers (46)

UDF has nearly 200 dairy stores across Ohio, Kentucky and Indiana and is committed to quality, customer experience and being a trusted neighbor in the communities that it serves. UDF aspires to be the best convenience retailer in the region. UDF stores sell high-quality proprietary products that include hand-dipped ice cream, signature malts and shakes, fresh baked goods from the family bakery, premium coffee and other fresh foods and dairy products. After over 80 years, United Dairy Farmers continues to be family owned and headquartered in Norwood, Ohio.

Truenorth (49)

True North Energy was founded in 1999 through a 50/50 partnership between the Lyden family and Shell Oil U.S. The Lyden family has been in business since 1919, with the third and fourth generations presently at the helm. Truenorth stores have an ever-growing footprint with stores primarily located in Ohio, Michigan, Illinois, Wisconsin and Michigan. Truenorth prides itself on being a premier Shell distributor through fast, friendly, clean convenience stores and dealer network.

Keith Reid is editor-in-chief of Fuels Market News. He can be reached at kreid@fmnweb.com.

FuelsMarketNews.com 2022 Fuel Leaders | 19

Florida Man Accused of Tampering with Gas Pumps and Stealing Fuel! Tampa, FL Thieves Steal $8,000 of Diesel Fuel! Spring, TX It’s Dangerous Out There! Secure Your Tanks & Pumps with Lock America High Security Lock Kits! • Replace your “universal” shipper locks with Lock America’s easy-to install kits. • Unique registered key code for each customer, with master key option. • Weather-resistant brass and stainless steel. Locks That Secure YourUndergroundTanksandPumps! www.laigroup.com sales@laigroup.com 800-422-2866 ADD SYSTEMS Back Cover addsys.com AMERICAN COALITION FOR ETHANOL 13 www.flexfuelforward.com LOCK AMERICA INC. 20 www.laigroup.com OPW RETAIL FUELING Inside Back Cover www.opwglobal.com/opw-retail-fueling TRINIUM TECHNOLOGIES 12 www.triniumtech.com/fuel WARREN ROGERS PRECISION FUEL Inside Front Cover www.warrenrogers.com OUR ADVERTISERS Thank you to these advertisers who have demonstrated their support of the fuels industry by investing in Fuels Market News. FuelsMarketNews.com 20 | 2022 Fuel Leaders

WITH YOUR DIESEL FUELING STATION

Keep your diesel forecourt clean with OPW’s 14 Series Diesel Nozzles. Together, the highly-acclaimed 14C Nozzle and the all-new 14HC High-Flow Diesel-Capture Nozzle won’t leave you searching for a rag to wipe your hands.

Patented diesel-capture technology drains any residual fuel in the nozzle into a special chamber where it rests before being reintroduced into the fuel stream during the next fueling event, resulting in a cleaner, greener fueling experience.

STAY CLEAN

High-Flow Nozzle

Learn More At opwclean14.com

High-Flow Nozzle

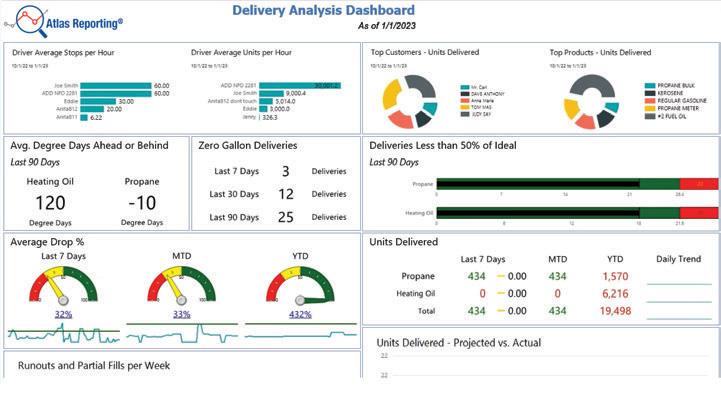

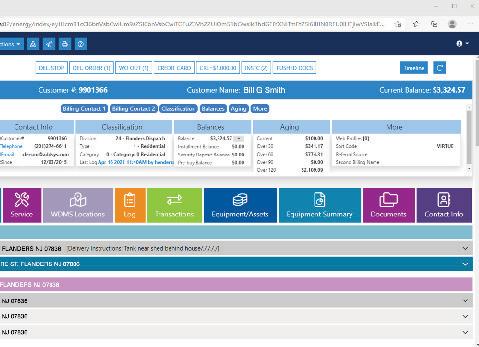

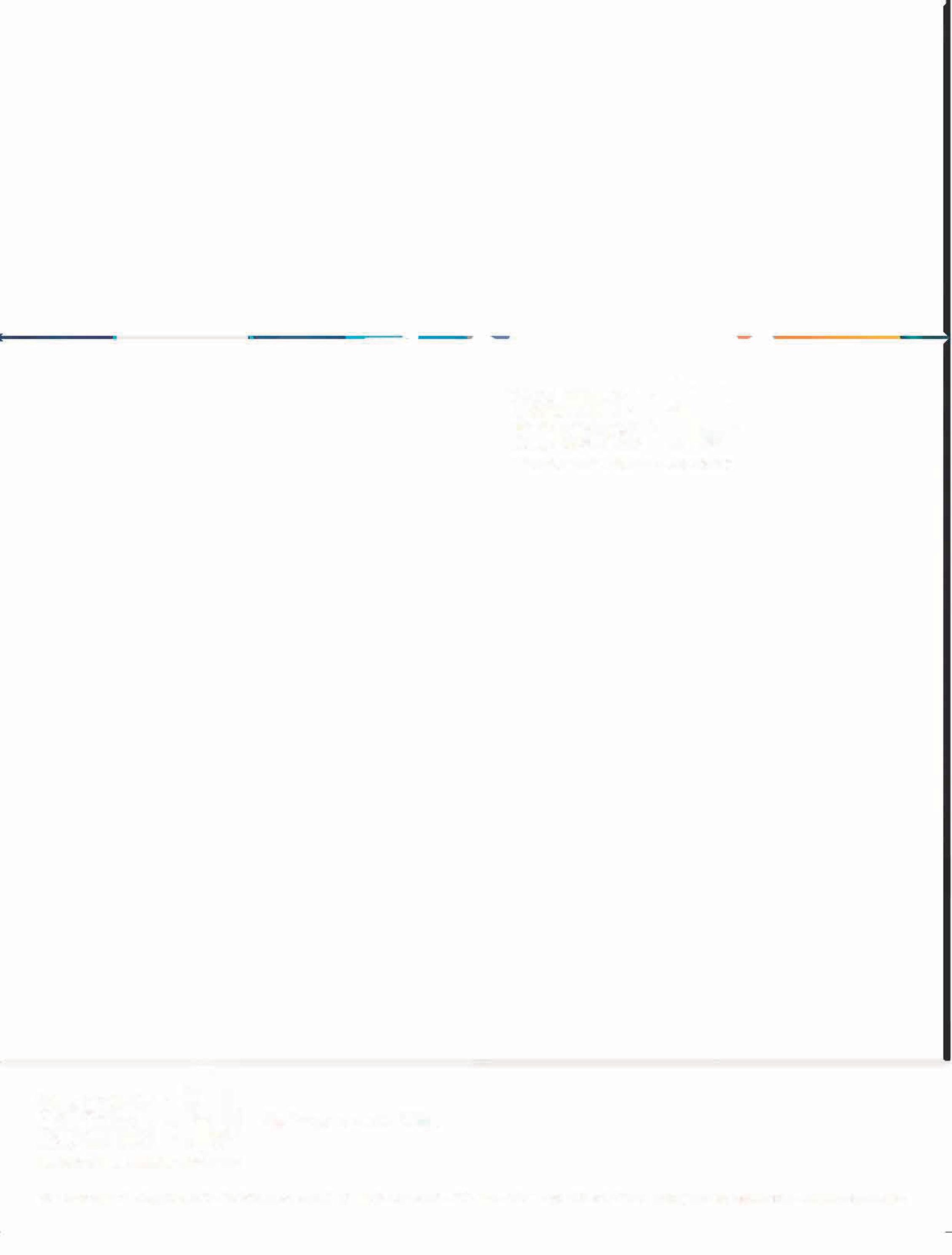

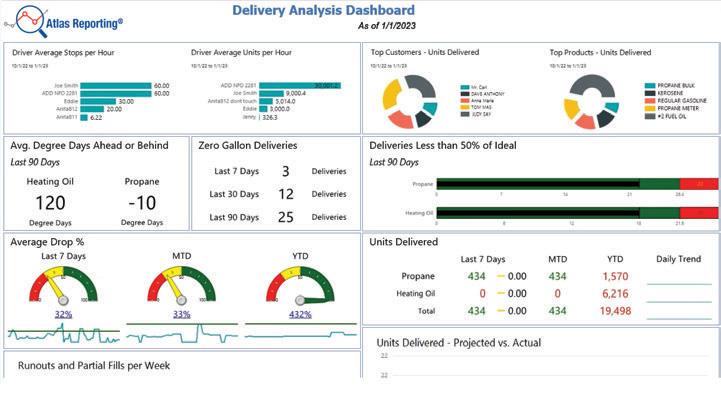

SOFTWARE FOR THE PETROLEUM & CONVENIENCE STORE INDUSTRIES Learn more at addsys.com 800-922-0972 SYSTEMS ALWAYS MOVING FORWARD Thank you to our clients for consistently collaborating with us to bring innovative software solutions to the industry. Experience that fuels the Future Your driver Jim B will be delivering fuel today to 400 East 2nd St. Ocean Isle Beach, NC ADD ENERGY Co.

Lori Buss Stillman and Denton Cinquegrana discuss convenience retailing and fueling.

BY KEITH REID

Lori Buss Stillman and Denton Cinquegrana discuss convenience retailing and fueling.

BY KEITH REID