Today is a day to remember for the course of Indonesian history, because for the first time, Indonesia, a developing country, is trusted to assume the G20 Presidency. This is also an opportunity for Indonesia to show the world that Indonesia can give a greater contribution to the world economic recovery and healthier and equitable governance development founded upon freedom, eternal peace, and social justice.

Under the theme ‘Recover Together, Recover Stronger’, Indonesia raised three priority issues, namely inclusive healthcare, digital transformation, and sustainable energy transition.”

President Joko Widodo launched the New Era Bali Kerthi Economic Roadmap in the kick off of the G20 Preparations. Bali invites the world in transitioning to a green and blue economy, health and wellness, sustainable and blended finance, and digital inclusion. Indonesia is

committed that the Presidency will produce a series of real actions along with the other member states, not just a ceremonial event.

“Through concrete initiatives, the world will soon recover and rise stronger. Recover Together, Recover Stronger.” Indonesia’s G20 Presidency will be used to promote the aspirations and interests of developing countries. Indonesia will seek to build a healthier and equitable world governance and ensure the impact can be felt by the entire community.

Inclusiveness and togetherness are the key words of Indonesia’s G20 Presidency. By raising the commitment of developed countries to assist developing countries, Indonesia seeks to strengthen solidarity in the effort to address climate change to realize sustainable development.

“President Joko Widodo launched the New Era Bali Kerthi Economic Roadmap in the kick off of the G20 Preparations. Bali invites the world in transitioning to a green and blue economy, health and wellness, sustainable and blended finance, and digital inclusion.”

Minister for Foreign Affairs of the Republic of Indonesia

G20 Foreign Affairs Ministers Meetings Nusa Dua Bali, 6 July 2022

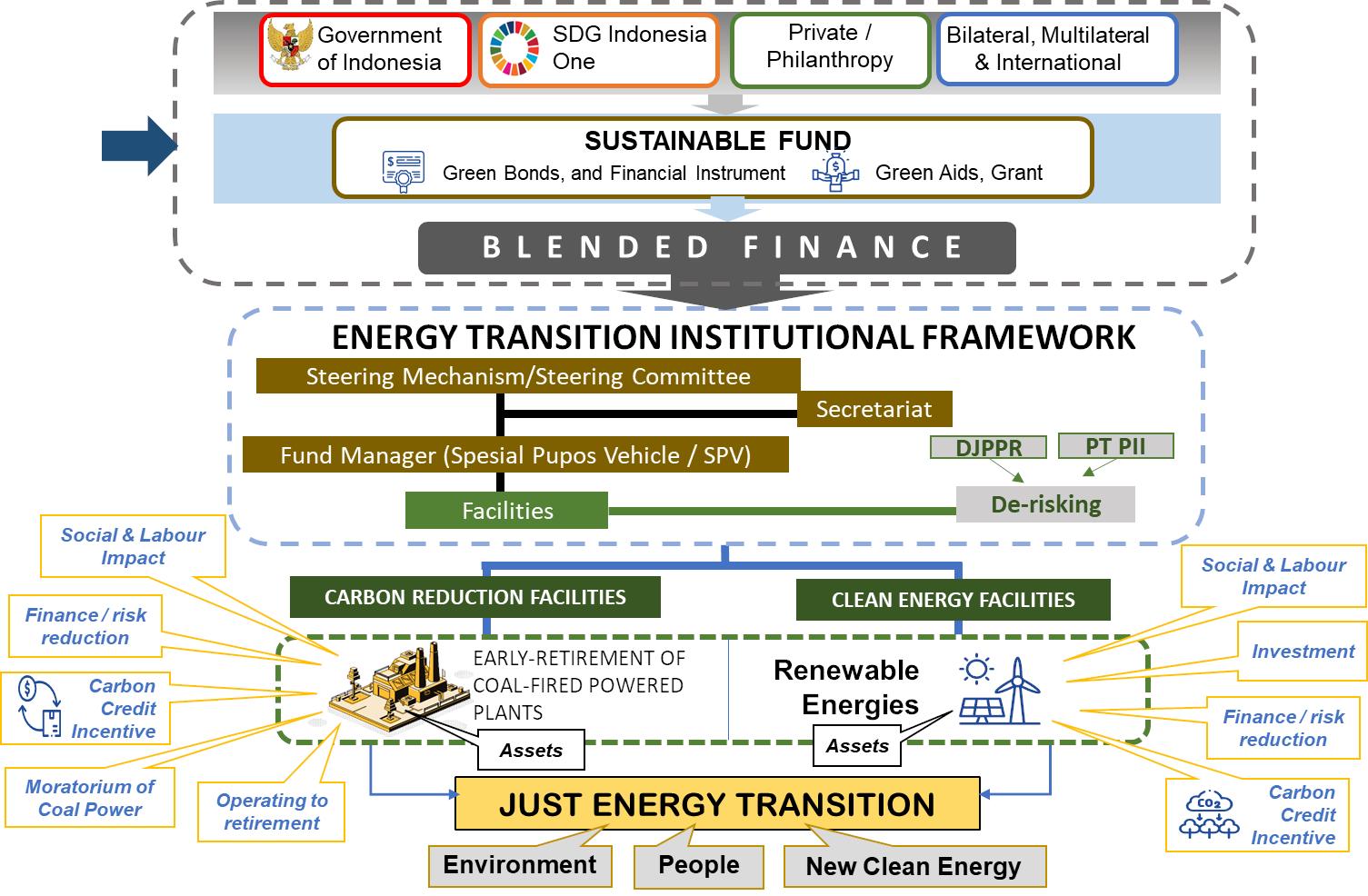

As for the energy…we need to accelerate progress in energy transitions. Our collaboration must focus on affordable transfer of technology and investments in particular for developing countries. Government funding alone is not sufficient for energy transitions… We need to look into blended finance as an innovative solution. We invite G20 countries and beyond to support the Global Blended Finance Alliance to be launched at the G20 Leaders’ Summit in November.

Minister of National Development Planning, Republic of Indonesia at Launch of New Era Bali Kerthi Economic Roadmap, 3 December 2021

Through Bali’s economic transformation, the Kerthi Bali economic roadmap towards New Era Bali, work force productivity is expected to increase 4 fold and local economy grows at 7.4% on average. Gross Regional Domestic Products per capita increases 8 fold. Poverty level shall be reduced to 0.18%. And unemployment drops to 0.5%.

The plan ushers in an era of sustainability, through the increase of green products and green jobs.It is our greatest hope that this roadmap prototype success can be replicated

in other provinces to redesign long-term post-pandemic development plans as we collectively work towards Golden Indonesia 2045 vision.

We thank all who have shown real support in the preparation of this Kerthi Bali economic roadmap towards the New Era Bali and Master Plan 8.

I wish also to acknowledge Kura Kura Bali is committed to support the Government in the effort to revive this Paradise Island from its pandemic situation and enter the New Era Bali.

I earnestly hope that all stakeholders align with the Government’s plan to serve as areas of development, innovation of the green sector, health, sports, creative, and digital technology. Kura Kura Bali, particularly, has the potential for technological transformation and sustainable development in line with the Kerthi Bali economic roadmap towards New Era Bali — Bali that’s green, resilient, and prosperous. Peace. May God bless us all.

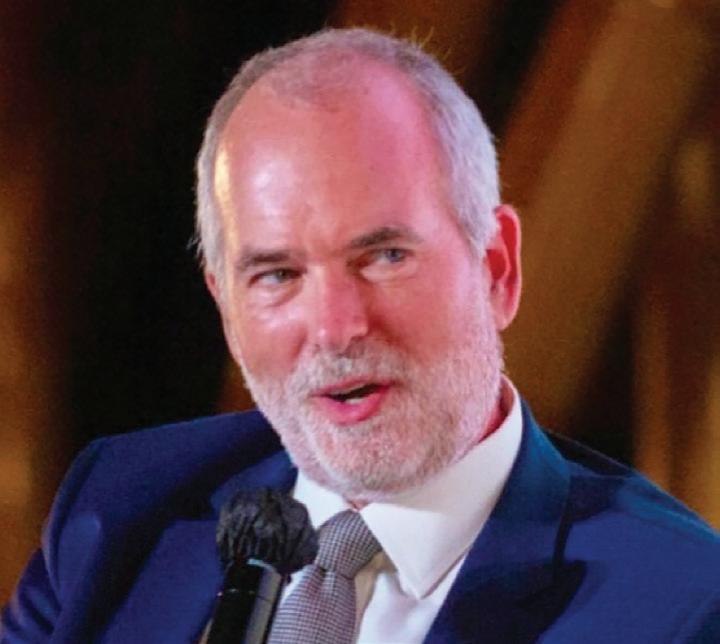

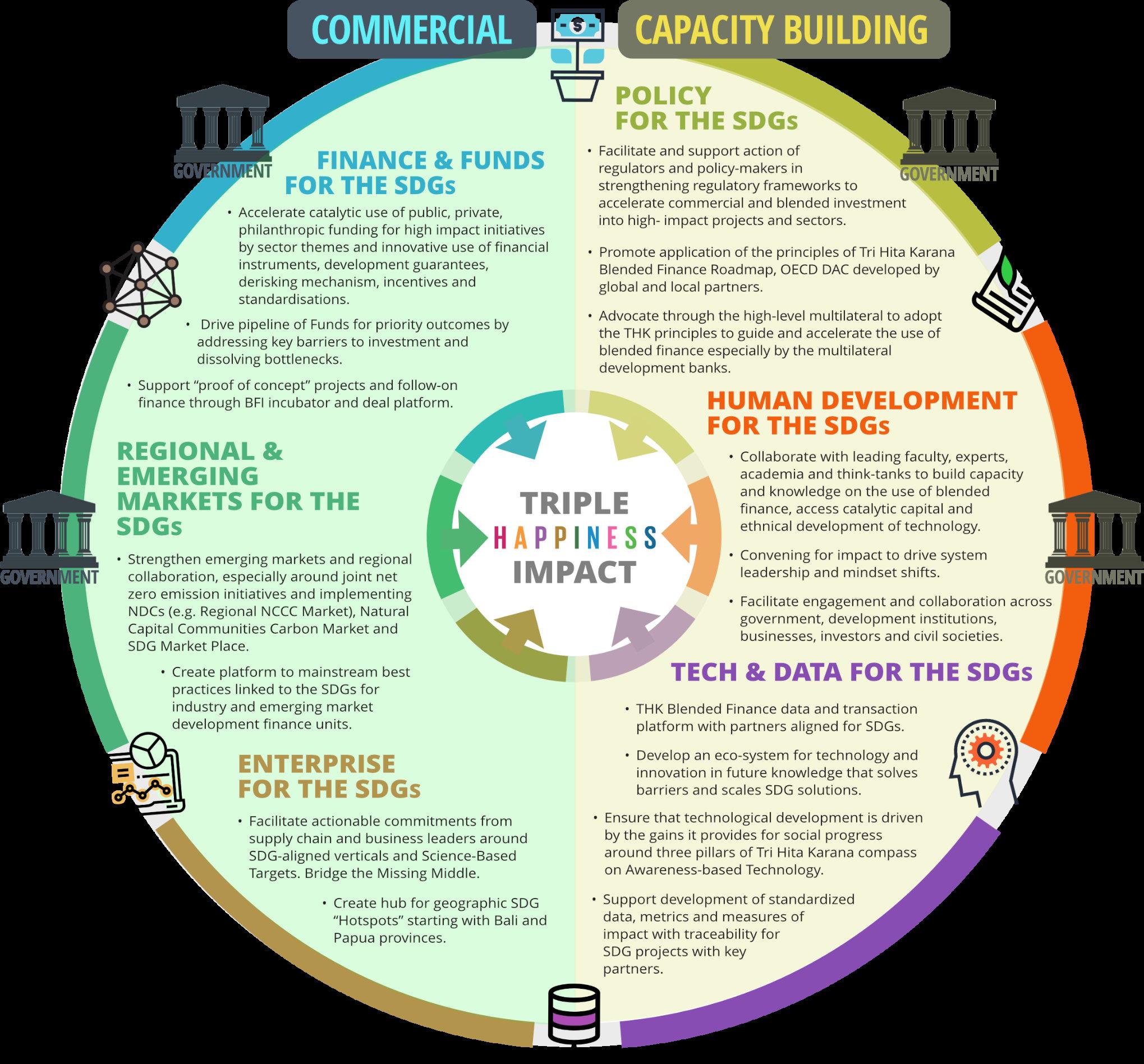

In launching the New Era Bali Kerthi Roadmap, President Joko Widodo said the pandemic has opened the door to a new development path. The New Era Bali Kerthi Economic Roadmap reflects the Balinese Tri Hita Karana philosophy of balance between people, nature and spiritual peace. The Tri Hita Karana Forum Road to the G20 captures this spirit and spells out critical next steps. It declared that now is the time for action; an opportunity offering a massive payoff to communities and business. Blended finance is one of the pathways to generate the needed investment. Indonesia will do its part including through the launch of the Global Blended Finance Alliance. These messages were delivered during the THK Dialogue Climate Road to G20, held at the Three Mountains Kura Kura Bali.

Minister

July 2022

I truly commend Indonesia for its leadership on the G20 agenda, especially putting sustainable finance at the heart of recovery,

security and sustainable growth. The G20 priorities go to the heart of people and planet. And this is an agenda that requires bold and transparent leadership, and most importantly, fit for purpose capital. These are also priorities for cop 27, as we will be hosting it in Sharm El-Sheikh next November. And we are committed to working together to accelerate climate action, especially the delivering just energy transition, as well as unlocking adaptation finance. This cop is truly about adaptation and resilience and trying to move from pledges to implementation. Indonesia has an example of both you’ve launched the world’s first sustainable land use bond to tackle deforestation. You’ve also prioritized the restoration of carbon-rich, Petland, mangroves and coral reefs. And you have deployed nearly a billion dollars to the

SDG one platform for sustainable infrastructure, including clean energy and circular waste management projects. We know that these initiatives in addition to trying to address the climate challenge also create jobs, strengthen GDP, reduce energy bills, and build physical and financial resilience for communities and companies. These experiences need to be built on in different forums and platforms. And this also encourages South-South cooperation. These is simply no time to reinvent wheels, but nonetheless, scale projects that have worked. And this is why launching the blended finance alliance is extremely important at this moment. And it will help accelerate knowledge sharing, prove new sustainable business models and unlock investments and reduce transaction costs to access catalytic capital for similar projects.

Coordinating Minister of Economic Affairs, Republic of Indonesia, THK Forum Co-host, at THK Forum Climate Road to G20 Dialogue

We plan to launch centres of excellence in technology and finance during our 2022 G20 tenure.

• We are looking to the private sector for tech innovation because, through private sector entrepreneurship, we can secure the massive change needed to meet the global goals. A Tri Hita Karana Centre for Future Knowledge is a platform for technological innovation and transfer with global collaboration.

• The Centre of Future Knowledge’s green and clean renewable energy hub will support value creation for better business better world. The Centre will focus on the role of technology transfer, R&D by private investment with leading global academia and research in realizing a sustainable future in Indonesia. We have launched the THK Roadmap on Blended Finance that has been developed by the global community with the guidance from the OECD DAC and we will initiate a Global Blended Finance Alliance in Bali to align Blended Finance principles with the acknowledgement of G20 countries in the Development Working Group.

Coordinating Minister of Maritime Affairs and Investment, Republic of Indonesia, THK Forum Co-host, at THK Forum Climate Road to G20

In launching the New Era Bali Kerthi Roadmap, President Joko Widodo said the pandemic has opened the door to a new development path. The New Era Bali Kerthi Economic Roadmap reflects the Balinese philosophy of balance between people, nature and spiritual harmony. The Tri Hita Karana Forum Road to the G20 captures this spirit and spells out critical next steps. It declared that now is the time for action; an opportunity offering a massive payoff to communities and business. Blended finance is one of the pathways to generate the needed investment. Indonesia will do its part including through the launch of the Global Blended Finance Alliance.

The Honorable John Kerry U.S. Special Presidential Envoy for Climate, Co-Host THK Forum Climate Road to G20

50% of the species on this planet are gone ... lost, record sea levels and instances of catastrophe on a monthly basis that put life at risk in every nation on the planet. It doesn’t have to stay that way. Doesn’t have to be that way. So we have a task which is to mobilize our communities, our business, our civil society, our government, and

bring people together to address this challenge. And my message to you is this. This is not something to fear. It’s something to be concerned about but also motivated by.

… it is an extraordinary moment of economic opportunity for everybody in the world. Why? Because we’re going to do what we fundamentally did in the Industrial Revolution. This is the largest market opportunity, bigger than the Industrial Revolution.

The Global Blended Finance Alliance is to be a platform to motivate the use of official finance to incentive private investment and to serve as a clearinghouse for sustainable investment project.

This is the decade for action, I hope that our leadership of the G20 can help make this a reality for both Indonesia and the world.

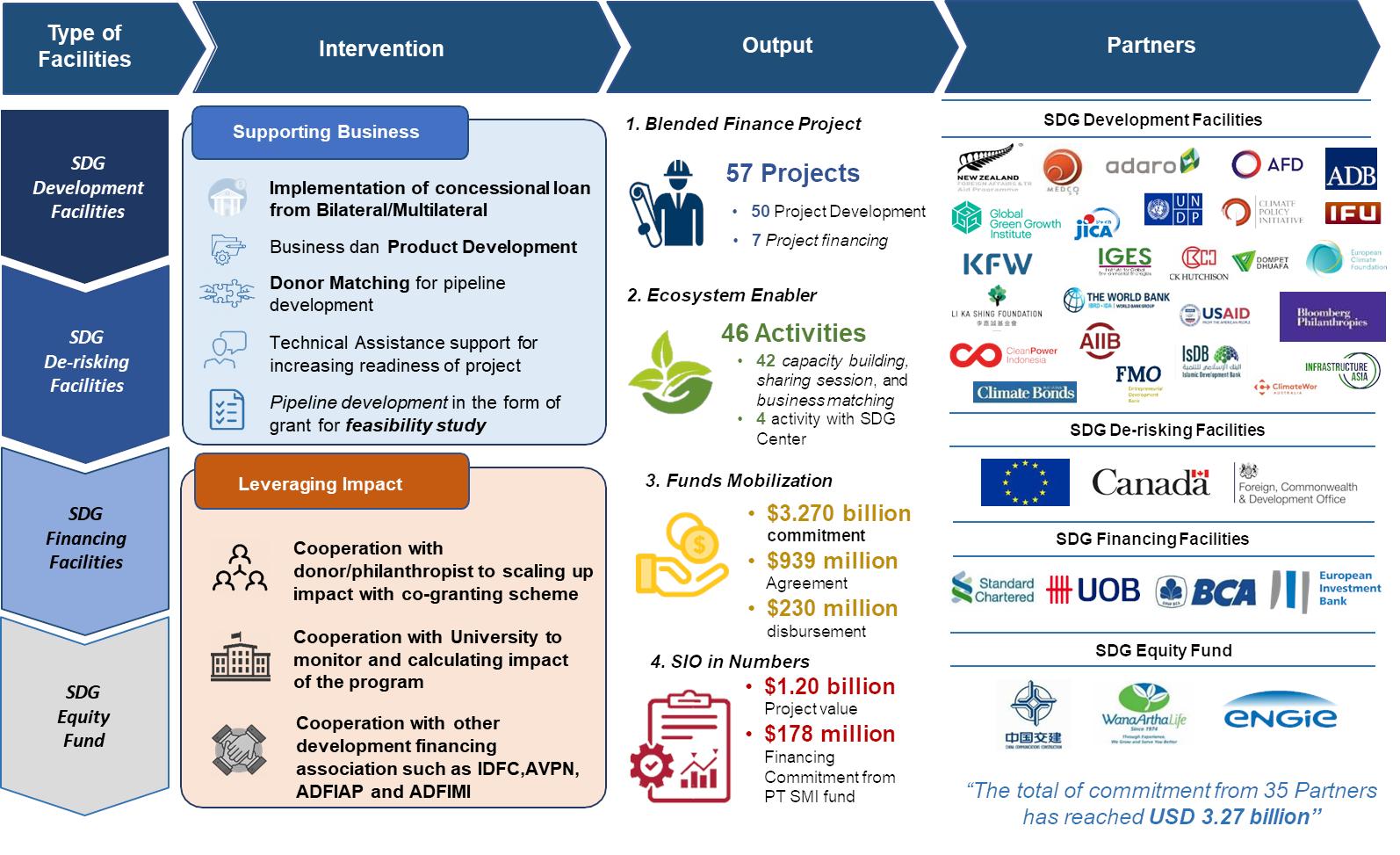

In addressing this climate change, that we all understand that it might be costly. So here, we need to be creative, we need to be innovative, how to find this key element, which is financing. Government cannot →

→ bear all the costs for sure. We have good experience when we started our blended finance journey with the establishment of SDG Indonesia One back in 2018. So it’s a breakthrough and we thank also the THK

that is very instrumental in helping us in promoting, in selling, in convincing investors for SDG Indonesia One. So for this energy transition mechanism, we come up with an initiative called country platform.. With global

Minister of Environment and Forestry, Republic of Indonesia at THK Forum Climate Road to G20 Dialogue Presidency 2022 has conducted and produced result. Environment and Climate Working Group President G20 has discussed, prioritize issues of first, supporting more sustainable recovery. Secondly, enhancing land and seabased action to support environmental protection and climate objectives. And thirdly, enhancing resource mobilization to support Environment Protection and

Director General of Budget Financing and Risk Management, Ministry of Finance, Republic of Indonesia, Co Chair THK Forum at Climate Road to G20 Dialogue

In addressing this climate change, that we all understand that it might be costly. So here, we need to be creative, we need to be innovative, how to find this key element, which is financing. Government cannot bear all the costs for sure. We have good experience when we started our blended finance journey

blended finance alliance, I think we can collaborate. This is what investors, what Philanthropies and Green Funds are waiting for, Ministers Pak Luhut and Sri Mulyani share similarly they look for something concrete.

climate objectives. Some of the grid issues are firstly reduced land degradation, impact and drought. Secondly, enhance the protection, conservation and restoration of the forest and ecosystem sustainably to control the climate change and biodiversity loss.

Thirdly, improved partnerships among deepen the members and stakeholders capacity building and nature-based solutions policies and enforce enhance the control of pollution and environment damage, waste management, water resource management, marine debris biodiversity loss and ocean conservation.

with the establishment of SDG Indonesia One back in 2018. So it’s a breakthrough and we thank also the THK that is very instrumental in helping us in promoting, in selling, in convincing investors for SDG Indonesia One. So for this energy transition mechanism, we come up with an initiative called country platform. With global blended finance alliance, I think we can collaborate. This is what investors, what Philanthropies and Green Funds are waiting for, Ministers Pak Luhut and Sri Mulyani share similarly they look for something concrete.

World Bank Managing Director of Development Policy and Partnerships, Co-founder THK Forum at THK Road to G20 Dialogue

What Indonesia with THK partners do is you come up with a portfolio of transformative projects on blended finance. How to plan diverse sources of finance to come in, government budget, multilateral development banks like the World Bank and the ADB with concessional or semi concessional funding, and then the grants that could come in, such as energy transition. It could come from donors, it could come from philanthropies, and so on. So how you come up with a

portfolio of transformative projects and then bring in the blended finance from all sources of funding is really what the Global Blended Finance Alliance is attempting to do as well as bringing together all the stakeholders. A lot of them are here. So I hope that we can continue to work on these.

As the chair of the B20 Indonesia, the business engagement group of the G20. I’m honored to continue our effort to advocate our business voices highlight the impending need to close the climate financing gap. Together with THK, this forum is the perfect place to discuss how we can better finance the global shift towards sustainable practices and reen energy.

Lord Nicholas Stern Chair of the Grantham Research Institute on Climate Change and Environment, London School of Economics, NCCC International Advisory Council, THK Forum Climate Road to G20 Dialogue

If you look at climate related investments in emerging markets and developing economies, excluding China, on energy, adaptation, resilience, and food and land use the central climate issues, you see that by 2030, that flow of investment in these emerging markets or economies outside China will have to be around $2 trillion dollars extra per year, that’s perfectly feasible.

President Director, PT. Perusahaan Listrik Negara (PLN) at THK Forum Road to G20 Dialogue

This climate crisis is global. The emission of CO2 in Bali here is the same effect as amount of CO2 emission in European countries or in Japan, in United States exactly the same. So it has to be a global effort. So this early retirement of coal fired power plants is using Blended Finance through the energy transition mechanisms. What do we need? super lowcost Finance, green finance. What else do we need ? Policy Framework? What more?

Our willingness to collaborate. We have all of those ingredients. We’ve been working with the Asian Development Bank, we’ve been working with the US and world. And we’ve been working hard with so many foundations.

Tomas Anker Christensen Climate Ambassador, Ministry of Foreign Affairs of Denmark at THK Forum Climate Road to G20 Dialogue

What is the single most thing we can do to save our oceans? They all said, with one voice, stop coal fired power plants. Because the acid coming from the coal going into the ocean warming that is the single most damaging feature for the ocean. And therefore, I just want to salute the Indonesian government, which is also thinking about how to bring down the coal generated power in Indonesia. Denmark has been very proud about the partnership we have with Indonesia, and in

assisting in the long term planning of energy transition. And that we think that actually within the current setup of the coal power system, it is possible to make it bankable and to find ways to finance within the current system, at least a reduction of the coal under the current circumstances.

I also wanted to say that the contribution that Denmark is doing to the ocean economy has a few levels and just let me speed you through them. Ocean based oil and gas exploration. We decided two years ago to end the exploration we have in the North Sea. When we took the decision, we were the largest producer of oil and gas in the European Union.. And the decision is also to use the underground crevices where we explored oil and gas to fill in to use them for carbon capture and storage from our cement factories. So under the ocean bed, and then on top, we build offshore wind farms. So ending oil and gas whilst adding ocean based economic activities. We are going to quintuple that is five time at the capacity by 2030 that we currently have about three gigawatts. We also invited our partners in

Northern Europe to join us in a joint project where we will build up to 65 gigawatts of offshore wind capacity. And the next step is to take this to the global level and build a global offshore wind Alliance were working with Irene and the Global Wind Energy Council, we will set a joint target of driving wind to 380 gigawatt by 2030 and 2000 Gigawatt by 2050. That’s a project that will be launched at COP 27. That energy that we will create on the ocean. In Denmark, we will use it to create also green hydrogen. Based on the ocean we will produce it on the ocean using the energy from the windmills and some of the carbon coming from the carbon capture and storage that we will put under the sea. That green hydrogen we will then use to fuel our ships. Because the Danish shipping industry is moving fast into decarbonisation. They’ve set a target for decarbonizing up to 2040. Asia can be part of that transformation of shipping, where the shipping industry will go green, the first green ships are being built in Korea, they will start sailing also through Indonesian waters within the next year.

This is an extraordinary and important initiative bringing together many threads of people who’ve been working in this area, all over the world. And that makes it tremendously exciting. As for me, I’m Senior climate advisor of a group called the

institutional investor roundtable that represents 45 of the 60 largest sovereign wealth funds on the planet, who have come together in something called the long term investment coalition on climate change, bringing together sovereign wealth funds, governments and industry to see what we can do to put real money on the table in a defined time frame.

The case study that we brought out in a Munich summit at the end of the G7, week and a half ago was focused on sustainable

transportation, the model of trilateral cooperation between long term institutional investors, governments, and industry working together can unlock opportunities in every sector, on a very large scale.. We need to reduce greenhouse gas emissions as we know, by 47% by the end of the decade. This is no mean feat. As an organization, we stand absolutely ready to cooperate with you in the blended finance alliance and look forward very much to participating and contributing.

Vice President for East Asia, Asian Development Bank (ADB), at THK Forum Road to G20 Dialogue

It’s lovely to be in this beautiful venue, talking about such important things… When we talk about blending public and private capital. When we talk about mixing these things, we have to make sure we’re not mixing oil and water. And so we need to blend other things. For example. The private sector is nimble and fast and has a culture of risks. We will not succeed in blended finance if the public organisations don’t also learn that, not just the money. The private sector also is trying to solve all problems simultaneously. It’s solving problems as they arise. And then ultimately, those drives changes to solve those problems. There are lessons for us in the public sector from the private sector. There are lessons for the private sector in what we do. We need to blend a lot more than our money to be successful.

CEO, Temasek Foundation, THK Forum Partner

Temasek Foundation Singapore crowdsources ideas for disruptive technologies in the area of sustainability and livability solutions. The Foundation grants 1 million SGD to researchers, innovators, and investors. This year’s winner will operate in Jambi, where they will work in social forestry by aggregating smallholders together so that they could sell high-quality timber. A few years ago, the Foundation started the piloting of impact investing, setting aside about 300 million SGD index funds to deliver both impact and market returns. To further impact investing, Temasek Foundation launched the center of impact investing and practices that could be a good complement to the Global Blended Finance Alliance.

Simon Hartford

CEO, Global Energy Alliance People Planet (GEAPP), at THK Forum Road to G20 Dialogue

We’re backed initially by Rockefeller and Bezos, but we work with all philanthropies to make the biggest difference we possibly can as philanthropy to a successful energy transition. We have also worked very closely in advance with all others with the same agenda, our friends at the ADB, the

Founder, BenihBaik, at THK Forum Road to G20 Dialogue

BenihBaik has three main pillars (empowerment of education, environment, MSMEs) that lead to the achievement of 17 SDGs through the funds raised from private companies and the community. BenihBaik accelerates the digitalization of MSMEs to ensure that they can roll in this era of the digital economy by facilitating the meeting between technology-based startups with conventional MSMEs. BenihBaik facilitates access to capital, such as community and corporate funds, and grants from global donors.

Head of Division Sustainable Economic Development, East and South East Asia, KfW Development Bank

KfW with its partner countries is actively setting up structured funds that promote MSMEs through individual legal entities that can also directly invite private investment. We also provide credit enhancement where private investors can invest in secure funds. KfW also has SME credit lines to provide specific credit lines which are tailored to the needs of SMEs. It’s also the aspect of policy-based ethics, which are not really directly investing in individual projects but entering policy dialogue of countries to transform their policies to be more investment friendly. Two ideas: 1) Deepening the capital market with the development of a green capital market (green bond, sustainable finance bonds, GSSP bonds) that can be new opportunities if the structure and viability provide the right incentives. It can also invite new investors looking for ESG investments; 2) Sustainable finances and funds.

World Bank, and so many others in this conversation today. What do we stand for? We stand for action. We stand for experimentation. We stand for innovation, flexibility, and a relentless focus on outcomes, but also the just on this, which is what we’ve been talking about, has got to say front and center for young people, for the environment for all aspects. number one is that cooperation is going to also require coordination.

B20 Chair/Coordinating Vice-Chairwoman III, Indonesian Chamber of Commerce and Industry (KADIN), THK Steering Commitee at THK Forum Climate Road to G20 Dialogue

As the chair of the B20 Indonesia, the business engagement group of the G20. I’m honored to continue our effort to advocate our business voices highlight the impending need to close the climate financing gap. Together with THK, this forum is the perfect place to discuss how we can better finance the global shift towards sustainable practices and green energy.

Kadin as the Indonesian Chamber of Commerce and Industry has kicked off our own framework of inclusive collaboration by launching the Kadin Net Zero hub is to serve as a networking facilitator, mapping and connecting companies in Indonesia to write the potential ecosystem partner including financiers and investors to enable the net zero transformation On a larger scale of the G20 Economy. Kadin, the organizer of the B20 2022 has also launched the B 20 legacy programs or we call the Global Blended Finance Alliance in cooperation with the Tri Hita Karana Forum and B20 Energy sustainable and climate Task Force.

The Bali G20 Leaders’ meeting comes at a pivotal point in time for the future direction of the world. The sequence of covid, conflict and climate are reverberating throughout raising challenges for global stability and prosperity. Analogous to the post World War II Bretton Woods discussions, G20 Leaders recognize the gravity of the present juncture and are coming together in Bali to map the way forward and discuss the institutions needed to navigate that path forward.

The world needs $2.4 trillion per year to achieve the SDGs according to the UN Sustainable Development Solutions Network. Despite its gigantic scale, this amount is eminently achievable. This is because total financial assets stand at more than US$290 trillion and are growing by five percent a year. But, redirecting even less than the one percent of these global financial savings needed for tackling climate change and sustainable development will not happen automatically. The holders of these financial savings need to be incentivized to focus their investment on sustainable development.

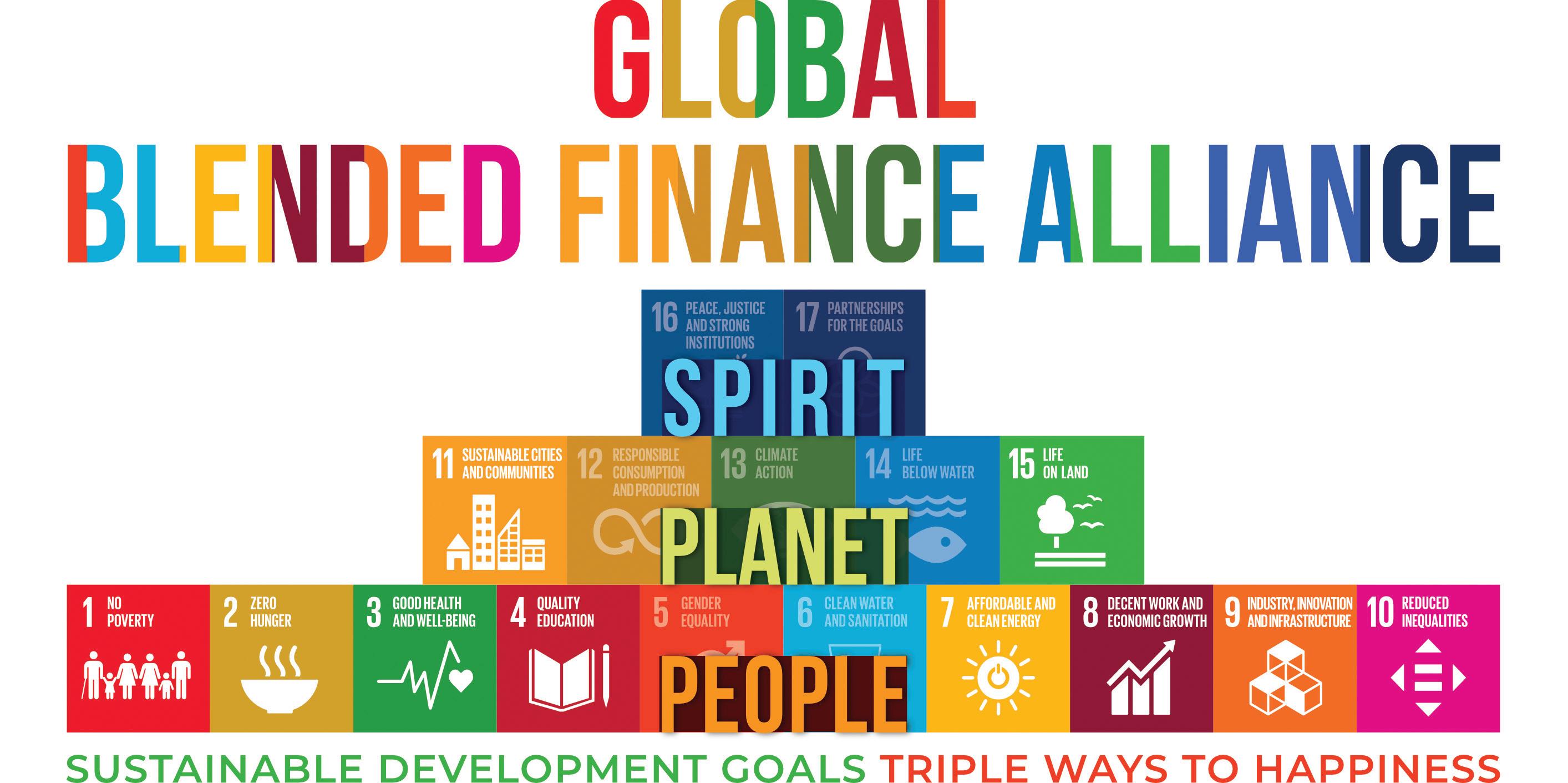

This is where blended finance comes in. Blended finance is a financial tool to mobilize, crowd-in and de-risk private financing to achieve the sustainable development goals and Paris-aligned nature-positive solutions. Blended finance is the strategic use of development finance for the mobilization of additional finance towards sustainable development. Blended finance is needed especially in developing countries including the small island developing states.

2022 is a pivotal year for Indonesia and the world. Faced with the triple crises of Conflict, Covid and Climate change, Indonesia’s leadership of the G20 comes at a moment where we need to come together in solidarity and with unwavering commitment to unlock the right finance, technologies and capacity for a more sustainable world.

President Joko Widodo has endorsed the founding of the Global Blended Finance

The Global Blended Finance Alliance is an international organization designed to mobilize, scale-up, replicate and accelerate financial and technological innovation, products, best practices and solutions to unlock investment capital for the sustainable development goals.

products, best practices and solutions to unlock investment capital for the sustainable development goals.

The Global Blended Finance Alliance is not a development bank nor will it provide financing, but rather will serve as a platform that interested parties – governmental, philanthropic, and private investors – can approach with interests to finance high impact projects. Through this matchmaking approach, parties can work with the Global Blended Finance Alliance to draw on the investment structures and blended finance models that are proven solutions.

The Global Blended Finance Alliance will be a multi-stakeholder entity. The Alliance will partner with international organizations, multilateral development banks, development finance institutions as well as the philanthropic community to promote structures to incentivize private finance and investment. The Alliance will support, in particular, the needs of countries that lack funds and know-how to design and implement requisite policies, as well as to establish key partnerships, institutional structures and financing solutions for the transition to a sustainable future.

Alliance and Tri Hita Karana Center of Future Knowledge to invite the world to bridge climate and sustainable development goal challenges together in Bali. The Indonesian government wants to use the opportunity of its G20 presidency to launch the multilateral Global Blended Finance Alliance to support efforts to realize the needed finance for the sustainable development goals and climate.

The Global Blended Finance Alliance will be the premier global institute delivering cutting edge technological and financial innovations toward meeting the sustainable development goals. Provide the supporting infrastructure that is needed to guide the international community along the path to sustainability.

The Global Blended Finance Alliance is an international organization designed to mobilize, scale-up, replicate and accelerate financial and technological innovation,

The G20 Leaders recognized in their Osaka Communique that blended finance can play a pivotal role in reaching the financing needs of the sustainable development and climate goals. The Global Blended Finance Alliance was presented to the G20 Development Sherpa Work group with endorsement from the OECD.

Now is the time for action, for global leadership and effective cooperation between developed and developing countries for technology innovators and technology transfer, transformative capital (including blended and just transition finance) and targeted funding to support the scale of investment needed to deliver the sustainable development goals.

It is to meet this aspiration for action on climate change and the global goals that Indonesia is establishing the Global Blended Finance Alliance and inviting G20 countries and beyond to join this global effort.

Minister Budi G. Sadikin H.E. Budi Sadikin, Minister of Health, Republic of Indonesia at THK Forum Road to G20 Dialogue “Global Health Architecture: Bali for the World on Health, Resilience, and Happiness” on 27 August, 2022

As global health leaders, today we are the determining actors in the course of human history. We can either let fate lead us through time, or we can shape the destiny of our future global health architecture.

The COVID-19 pandemic has shown the tremendous power of unity in facing all kinds of challenges. We have strived in bending iron rules of geography to reach people across the globe. We are finding

ways over, under, and through barriers to leave no one behind. And I believe that with such energy, we will survive any future health crisis.

Now more than ever, we need to recover; not individually, but together. Recover together, for a stronger & healthier global community.

Minister Budi Sadikin and the Government of Indonesia together with other countries, multilateral and foundations have set up the Pandemic Prevention, Preparedness and Response Fund of the G20, strongly endorsed the Global Fund to Fight AIDS, Tuberculosis and Malaria, and is Honorary Patron of the Health of Nations Fund representing tens of billions investment to promote global health. These will include the development of new diagnostics, vaccines, biological and pharmaceutical medicines for the prevention and treatment of infectious and non-infectious diseases. The programs will contribute to individual and public health gains, and will also stimulate the bioeconomy by creating many new jobs across the healthcare, pharmaceutical and biotechnology sectors. Under the New Era Bali Kerthi Roadmap launched in Kura Kura Bali, Indonesia will prepare Bali as a special hub inviting the world in health and wellness, research and technology, blue and green economy, sustainable and blended financing and medical tourism.

In December 2021, President Joko Widodo graced the Three Mountains in Kura Kura Bali to kick off preparations for Indonesia’s G20 presidency and the official launch of the New Era Bali Kerthi Economic Roadmap. This was done together with Indonesia’s Ministry of National Development Planning and the Bali Government.

Bali will no longer be known as just a tourist destination. This “New Era Bali” concept is based on a green low carbon economy. The focus will be on increasing human welfare and social equality while reducing environmental risks significantly. Among the low-carbon economic programs are clean energy solutions, development of low-carbon transportation, bio-agriculture, sustainable management of water resources, zero waste. Also in the pipeline is the development of a Low-carbon Asian Business Centre as well as a Vocational Low-Carbon Training Centre.

Bali will pivot from tourism to attracting and nurturing global and local enterprises in Health and Knowledge, Digital, Green and Blue sectors, Sustainable and Blended Finance, Integrative Infrastructure and Quality Tourism Sectors.

to deliver Bali Kerti Industries and business associations have a chance to come together and offer their support to build a better future, establishing the right priorities and helping the communities by providing jobs and economic opportunities while respecting rights and responsibilities. This business engagement is seen as critical to help achieve the Bali transformation.

Kura Kura Bali, an island project development, aims to be the prototype for this “New Era Bali for Better Indonesia and the World” on the road to the G20 Bali Leaders Summit 2022. We aim to partner with others, including competitors, critics, civil society and governments, to tackle big systemic problems which we cannot solve alone.

A 500-hectare canvas nurtured and developed to boldly paint the future island for happiness and welcome collaboration in leveraging Bali’s global branding in the New Era Roadmap.

Our world is at a turning point. Knowledge, learning and education need to be reimagined in a world of growing complexity, uncertainty, and deterioration.

At Kura Kura Bali, we know that learning and knowledge are the basis for renewal and transformation. This is why we have built a Campus before any other developments take place because we are convinced that education promotes social progress and transforms the world. Laying the foundation with creativity and care, we have built a Creative Campus that looks beyond the traditional purpose of education, a Campus that demonstrates how education relates to citizenship, providing growing opportunities for social mobility, economic development and equity. This is our vision of a campus that sparks solutions to global challenges and addresses the United Nations Sustainable Development Goals.

A forward-looking vision of what learning and education might yet become, the UID Creative Campus will host events and use

the convening power of Bali to attract talents as we co-create programs with talented people from all over the world. In addition, a TechPark will surround the Campus with an entire ecosystem of entrepreneurship and industry. It will also build on the culture of Bali, including its artistic and spiritual traditions.

Connecting young people with mentorship, meaningful work experiences, and training benefits our communities and the world. That is why this work is so important.

This November, we will be joining entrepreneurs, experts and leaders from around the world to explore various issues ranging from digital transformation to promoting inclusive social, environmental and economic justice that will shape future generations. We will showcase the innovation needed to shape sustainable futures in action, and we will honour the many contributions of the Balinese.

At some level, we are all connected. We share a common humanity. We are driven by the core idea that we can improve this generation’s and future generations’ lives together. The capacity to learn about each other and engage with different views doesn’t just open our minds and broaden our perspectives. We are proud to join leading innovation companies in announcing exciting partnerships which support technology innovation and Green Economy during these G20 side events at Kura Kura Bali.

Along with all our partners, we all believe in a fairer and more inclusive world and are ready to work together to help address critical challenges. We hope that we every step we take, we will gather other like-minded people to journey with us toward a sustainable future.

at

Blended capital provides an alternative solution to the mismatch between scientific and commercial time horizons. Here the initial providers of risk capital have a portion of the risk underwritten by noncommercial entities by providing either a loss-guarantee, an ironclad anchor-buyer commitment contingent of progress, or, as in the case of so-called impact investors, simply accepting less precise measures of social progress in lieu of more precise commercially ‘bankable’ measures.

A year ago, when THK initiated the first contemporary art exhibition for G20 visitors to experience, no one could imagine neither the amazing outcome of “Constellations: Global Reflections” nor its transformative impact. In a time that is rife with global tension, art can open constructive discourse and shed some toxicity. The artists in this exhibition never see differences; rather, they seek commonality. The straightforward curatorial process invited the leading artist from each G20 country to participate. We want to illustrate to the world how artists are empathetic and prophetic. They react to the world and strive to improve it for future generations through visionary and thoughtprovoking pursuits. Nationality and intersectionality do not constrain them.

Kura Kura Bali, THK, and UID inspired the curatorial theme of climate, equity, and global collaboration. The artists embraced these themes and brought their own culturally diverse experiences and unique artistic philosophy to the forefront. Each artist, a master in their own right, contributed to Constellations: Global Reflections. Like an individual star, but connected through community, a stronger and more relevant statement embraced the Tri Hita Karana philosophy of harmonies of people, place and spirit.

Balinese textiles, lanterns, and Wayang, a traditional form of puppet theater, became the aesthetic inspirations for the exhibition. Visible during the day and at night, these sculptures emit a quiet, reverent quality and act as beacons calling people from around the world to come together to experience art and discuss ways of creating a better and stronger future. The artworks, digitally printed on an eco-textile made primarily from recycled plastic, elevate the curatorial narrative to a monumental scale. Solar energy powers the rotation of the 20 huge, cylindrical lantern artworks and lights them after dark.

Artists Tony Albert (Australia), Dana Awartani, (Saudi Arabia),Xu Bing (China), Berkay Bugdan (Turkey), Genevieve Cadieux (Canada), Minerva Cuevas (Mexico), Arahmaiani Feisal (Indonesia), N. S. Harsha (India), Kota Hirakawa (Japan), Ilya and Emilia Kabakov (Russia/Ukraine), Kimsooja (South Korea), Naledi Tshegofatso Modupi (South Africa), A.D Pirous (Indonesia), Paola Pivi (Italy), Liliana Porter (Argentina), Caio Reisewitz (Brazil), Thomas Ruff (Germany), Yinka Shonibare CBE (United Kingdom), Kiki Smith (United States), and Ben Vautier (France) transformed this collaborative process into a passion project while fully devoting all their conceptual approaches and time.

One of many goals for Constellations: Global Reflections is to celebrate the people and rich culture of Bali while uniting them with guests from the visiting G20 nations. All of the art in this exhibition, curated and project managed remotely, was fabricated within Bali. This ecologically sound and deliberate approach infused the Balinese with a sense of ownership, pride, and employment. Art does not dictate, nor does it govern.

Constellations: Global Reflections aligns with these values.

Please visit constellationsbali.org for a virtual viewing of this ambitious initiative.

Space is ubiquitous. In the digital world and thanks to IoT, sensors, AI, robotics, etc. our world and our planet have become connected via space and in space. It is not an overstatement to say that today our world and our universe are dependent on space, whether it be for connectivity, observation, analysis of all things, people, weather, mobility, infrastructure, environment, climate change, etc.

It is also not an overstatement to say that “Space” is the perfect realisation of Global Blended Finance, having from the very beginning inspired innovation in a spirit of international cooperation that has benefitted governments, citizens, and our earth. One need only look at such examples as the International Space Station, public-private launch and satellite consortia, publicly funded research giving way to space exploration and exploitation as examples of “Blended Finance” in a sector which by its very nature is global. We are at a critical point in our utilisation of Space and just as we sounded the alarm bells for our planet, we must now all come together to make certain that Space remains the valuable resource it is for life on earth.

Space fulfils all of the SDG’s on earth and more in the universe. Were you only to think of the GPS satellites which are essential to our mobility today, not even mentioning autonomous driving; when you think of the weather satellites; when you think of the “traditional” satellites such as SES, Intelsat, Inmarsat, together with the new satellite constellations such as Kacific or Starlink providing the Internet either directly or via trunking to billions around the world; when you think of the advent of 5 G, many times enabled by satellite frequencies or in the case of new constellations such as AST Mobile, actually bringing 5G directly from satellites to the phone, space is green, clean, democratic, universal, connected and more. Space helps alleviate poverty, bring education and communication to all, monitor our oceans, our planet, our air, our climate.

One need only look at such examples as the International Space Station, public-private launch and satellite consortia, publicly funded research giving way to space exploration and exploitation as examples of “Blended Finance” in a sector which by its very nature is global.

In April of this year, 2022, the United Nations charted a new path for “Meaningful Universal Connectivity”. “Meaningful Universal Connectivity” means that anyone, anywhere, regardless of geographic location, socio-economic status, race, gender, or any other differentiating demographic, has access to affordable services and devices to connect to reliable and safe internet.

Whereas certainly space tourism captures the imagination of many, the role of space in our digital world and economy is crucial, critical, and enabling.

But just as we are recognising that the earth’s resources are not limitless, and that we must limit and if possible eliminate pollution and degradation of our earthly environment, we are now understanding that space is also a limited resource which must be shared equally amongst all of the world’s population, so that some countries, in particular the emerging “Space Faring “ ones are not excluded from reaping Space’s benefits. Just as we strive to overcome “Digital Divides”, we must make certain to not have a “Space Divide” with those countries who are only now asking for access to space orbital positions and frequencies.

This is why I recently helped pen the European Business Angels Manifesto for a Clean, Safe, Equitable and Peaceful Space for All, https://www.eban.org/manifestofor-a-clean-safe-equitable-and-peaceful-spacefor-all-by-eban-space/ and why I am urging all nations, citizens, and stakeholders to pursue the following 5-Point action plan to ensure that Space will continue to be the great resource for all life on our planet and in the universe:

• International co-operation through peaceful participation in international organisations, such as the UN and the ITU to devise new rules for space exploration and commercialisation.

• Transparency of space activities, so that everyone on earth can see and understand what companies and governments are doing in space, and what the implications for life on earth and their future will be.

• Co-ordination of our efforts through working together in diverse and open space communities on a national, regional and global scale.

• Use of good design principles, coupled with social awareness, to drive innovation and investment in new space technologies and services

• Entrepreneurs, governments and academia being involved on an equal basis in creating the peaceful use of space for the future.

Blended Finance is a revolutionary bridge that enables the philanthropy and financial markets realms to connect and collaborate, enhancing the best of each one.

The instrument allows the executives to think full heartedly about the socio and environmental impacts of their actions and in the meanwhile it generates more businesses opportunities, return and, above all, becomes a great innovation front for the institutions.

And that is precisely why, we, DFIs, have the key role in promoting this tool globally by putting governments, philanthropists, third sector, academia, companies and funds in the same direction in favor of fundamental issues in order to achieve our climate commitments, to foster social inclusion, bioeconomy, circular economy, urban development, education, microcredit, and health, among others.

Blended Finance is at the core of BNDES’s strategy, which begins to apply the concept of “Impact Factory”. We are tearing down walls that separate people,

institutions and, mainly, the walls that set values and prejudices apart.

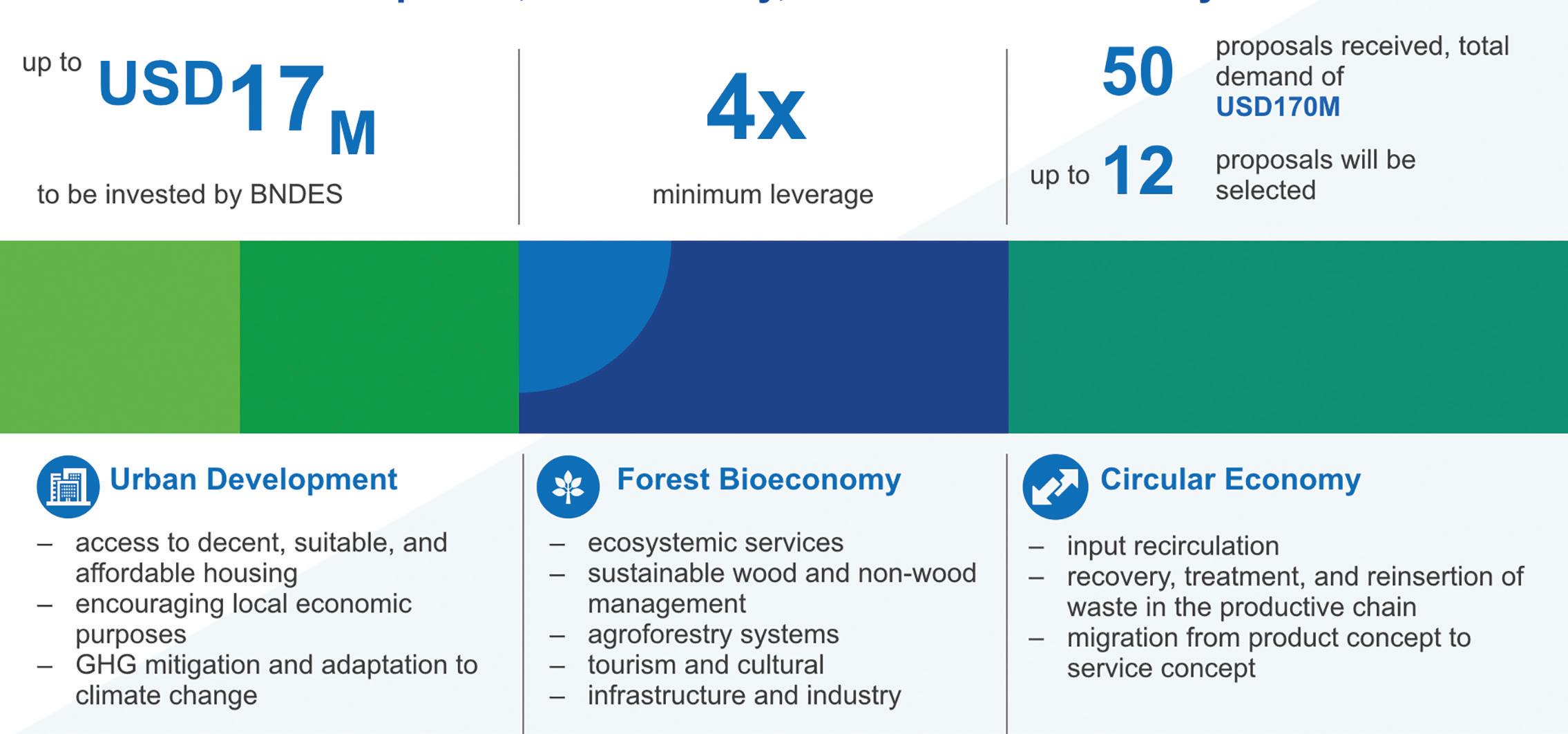

We have launched a first public call to select different blended structures to support projects in bio economy, circular economy, and urban development. We have offered US$ 17 million in grants, mobilizing the whole of the Brazilian ecosystem through an open innovation system. And we

succeeded: we received 50 proposals with an aggregate demand of over 10x our offer (approx. US$170 million in grants), in a varied array of structures. We expect to lever these grants 4x with commercial capital to deploy approx. US$70 million.

We intend to combine our expertise in E&S activities with the experience of private partners, optimizing and leveraging the use of BNDES’ non-reimbursable resources. We see this as a form of public banks to fulfill their mandates, underlining coordination and articulation capabilities, leaving a legacy for our countries.

Finally, the instrument can be a very important channel to attract international resources to Brazil, whether from philanthropy or from large investors. BNDES can be a partner in this journey. We have the instruments, mobilization of the financial ecosystem and the projects.

Gustavo Montezano CEO, BNDES

Connecting the dots: how Blended Finance can be a bridge to foster social and environmental positive im pact

BNDES Blended Finance will support the creation of financial structures to foster urban development, bioeconomy and circular economy

The next 5 years need to see a dramatic acceleration in the flow of capital to developing countries to invest in building socially just, net zero and nature positive economies. Some estimates suggest annual investment requirements of well over $2.5 trillion per year in developing countries (and over $3 trillion including China), much of which will need to be provided by the private sector. The most critical sectors in which this capital needs to be invested include power, transportation, housing, industry, health, education, agriculture and nature.

The challenge of mobilising and deploying this capital well is not new. But the magnitude of the investment requirements and the speed with which capital needs to be deployed is a step-change from previous periods. This is where blended finance can make a huge difference. At its core, blended finance has two over-arching principles. The first is that it targets a combination of public and private returns – what is also called a combination of impact and value creation. The second is that blended finance investment models aim to share risks and returns across public and private sectors in a way that play to the respective strengths of government and commercial actors. This makes blended finance a brilliant way of opening up new innovative areas of investment – from clean energy to regenerative agriculture to primary healthcare systems to sustainable tourism projects to better waste management systems – where public capital is scarce and private capital is still learning how to evaluate the opportunities and risks.

The last few years have laid the foundations of the blended finance revolution, with an acceleration of learning, standards and deal pipelines across the world. Top private financial institutions are all setting up their blended finance and impact investing teams. Governments are building their specialised vehicles to develop critical projects around environmental and social goals which can attract both public and private capital. Multilateral development banks, together with bilateral development finance institutions, are scaling up their efforts in a space where they have long had a

presence. And philanthropic capital is looking for the opportunity to shift resources from purely grant-making activities to much more creative, highly leveraged investment models that have impact at their heart.

Indonesia has been one of the pioneer countries in unlocking this revolution with creative, ambitious vehicles such as PTSMI’s SDG One, which has deployed almost $1 billion in key projects across the economy. More than that, Indonesia has been providing the intellectual capital for

this new investment era through the work of the THK Forum and the resulting multi-stakeholder commitment to a Global Blended Finance Alliance. This new Alliance has the potential to scale and transform the flows of capital needed for better growth in the Global South. On the one hand, it will accelerate the learning needed to put the right financial structures and risk-sharing systems in place, helping with the scale-up. On the other, it will build and share the practical experience needed to analyse and monitor the impact of the capital flows, helping to improve the quality of its deployment. The Alliance is the right coalition at the right time.

On behalf of the Blended Finance Taskforce and Systemiq, it has been an enormous privilege to work with the THK Forum and the Government of Indonesia to bring the Alliance to life. We look forward to partnering closely with the Alliance going forward and helping it to become a flywheel for net positive growth in developing economies across the world.

Jeremy Oppenheim Founder and Senior Partner, Systemiq THK STEERING COMMITEE, acting president, Global Blended FINANCE ALLIANCE

Jeremy Oppenheim Founder and Senior Partner, Systemiq THK STEERING COMMITEE, acting president, Global Blended FINANCE ALLIANCE

to the climate crisis, organisations around the world are making ambitious pledges to reduce carbon emissions in the coming decades. But, for a climate catastrophe to be averted, organisations must also actually deliver on their pledges. This requires rigorous, auditable, and dynamic corporate carbon accounting. The current global protocol for carbon measurement is no longer fit for purpose. The E-liability Institute has been created to advance easier, real-time carbon accounting and auditing. We will work with governments to urgently upgrade the global standards for carbon reporting, to drive decarbonisation innovation and to prevent us from falling behind on our collective NetZero responsibilities.

The current global carbon standard, the GHG Protocol, was designed in the early 2000s to inspire organisations to action, but not to hold them to account. For instance, the standard allows companies to use industry-average metrics in reporting on their own climate performance, obviating any incentive to compete and deliver on climate excellence. The standard also permits multiple-counting of emissions

and offsets, potentially misleading users and misallocating green capital to underproductive investments.

To address these shortcomings, we, two professors from Harvard and Oxford, developed a rigorous approach to corporate climate reporting that integrates wellestablished best practices from financial and cost accounting with recent advances in climate science and blockchain technology. The approach, called the E-liability method, won the 2022 Harvard Business ReviewMcKinsey Prize for “groundbreaking management thinking.”

The E-liability approach produces, for every product and service in the economy, an accurate and auditable measure of its total “cradle-to-gate” carbon footprint. This allows every purchaser – whether a company acquiring a batch of cement, a consumer buying a movie on their tablet, or a green investor looking for their next project – to see the total carbon emitted into the atmosphere in creating that specific product. For a product, that would include the emissions from mining all its raw materials, plus all further processing and transportation emissions, down to

emissions from last-mile delivery.

An Indonesia-based company, Giti Tires, was among the first to pilot the E-liability approach. It calculated the total emissions to produce a standard passenger-car tire, a product that is both crucial to the global economy and, given its high carbonfootprint, one where emissions-reduction excellence will be essential to fighting climate change.

Unlike a standard and static product life-cycle emissions report, which some companies currently produce about every three years, the E-liability approach produces dynamic, real-time reports on all of a company’s products, based on its current processes, sourcing, and designs. The E-liability approach provides strong incentives for innovations in real-time carbon reduction. For instance, as part of its pilot, Giti Tires will now collaborate with its steel suppliers to learn how to source low-emission, high-durability steel cord that reduces fossil-fuel usage over a car’s lifetime operations.

Beyond Giti, other leading organisations in cement, energy, healthcare, and steel are also piloting the E-liability approach. We have created, and a prominent group of climate philanthropists have begun to fund,

The urgent upgrade needed in carbon accounting to drive the green-finance revolution: The E-liability approach

the E-liability Institute, a global notfor-profit with a mission to rapidly ramp up adoption of this method and to communicate learnings with corporations, universities, and the public sector. This institute will create an ecosystem for rigorous carbon accounting worldwide, enabling well-functioning green-finance and carbonsequestration markets. The institute will work with organisations that voluntarily embrace the method and with rulemakers, such as the GHG Protocol, the International Sustainability Standard Board, and the US Securities and Exchange Commission.

The E-liability approach is the only nown method that can encourage bold innovation in climate-friendly processes whilst also producing fully auditable carbon accounting reports, a necessary condition for holding organisations responsible for their NetZero pledges. Accurate and timely carbon accounting will motivate commercial companies, not-for-profits such as educational and healthcare systems, and government agencies to decarbonise their own operations and those of all their suppliers.

OPENING E-LIABILITIES 3,600 Add E-Liabilities aquired from suppliers 39,800

Electricity 5,600

Sheetsteel 10,600

Glass

Monitoring and reporting on ESG KPIs catch a lot of attention. Misleading reports can become a serious problem – greenwashing accusations or public investigations of ESG reporting have recently generated a lot of scrutiny.

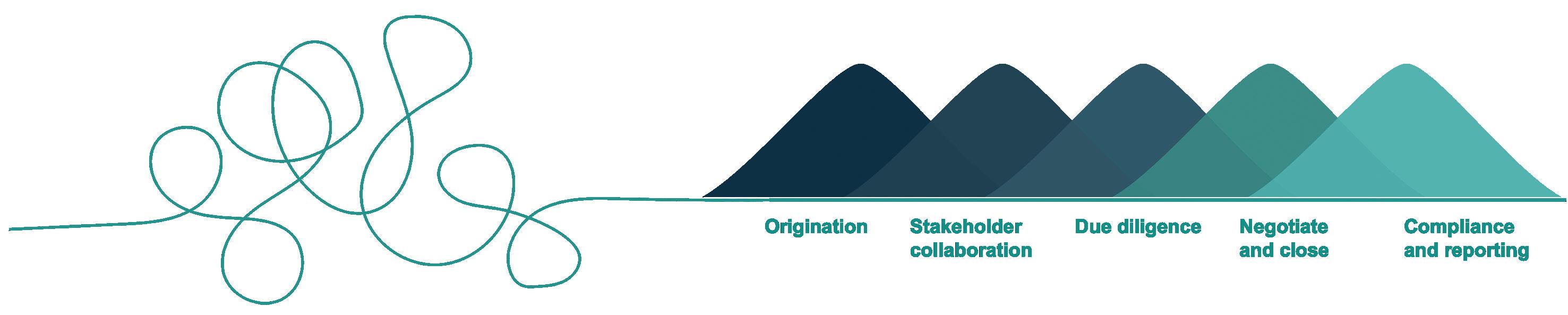

• Gather interest from counterparties

• Share information, communicate, and collaborate on documents – manage project tasks based on dedicated permissions

• Negotiate and agree T&C’s –keeping track of changes

Structuring transactions based on Environmental, Social and Governance (“ESG”) principles often means aligning commercial and non-commercial interests among heterogenous groups of sponsors, investors, and lenders.

Blended Finance can be helpful in this respect as it compounds private sector funding with development funding. Development funding is based on concessional terms provided by multilateral development banks (such as the World Bank, the Asian Development Bank, etc.), public entities or philanthropic sources. As concessional financing offers de-risking and credit enhancement, these structures are potentially attractive to private sector investors.

Data provider Morningstar reports a 53% increase for assets in ESG funds in 20211. ESG frameworks range from positive/negative screening (e.g., sectors) to strategies bringing about social or environmental changes.

A comprehensive description of the transaction, its background, objectives, benefits, and risks will benefit parties to be involved and create trust and goodwill. When all parties develop a common understanding of a project´s merits, even heterogeneous groups will come to a similar conclusion of risks and rewards, hence to credit approvals or positive investment decisions.

Intensive communication and wellprepared and structured meetings help parties to compromise. Transparent roadmaps to closing inspire parties to work together. Real-time information and easy access of documentation help alleviate arduous negotiations and generate trust in complex situations.

A digital workflow can make the difference

Capcade provides digital infrastructure for managing the above-described process end-to-end. The platform provides for secure, reliable, seamless communication and collaboration between transaction parties. On Capcade, a user can:

• Showcase and distribute aproject or transaction

• Develop comprehensive offering documents – link it to background data

• Integrate analytics and reporting functions, ensure post-closing administration.

Access to new sources of capital

Attract funding for invest ment projects by showcasing opportunities to a global network of investors using connected marketplaces.

Easily orchestrate internal and external stakeholders in a single place with advanced permission rights.

Unlock valuable man-hours with simple and intuitive data rooms and project management tools.

For further information, visit: www.capcade.com Source:

The SDG financing gap has widened in light of crises such as the COVID-19 pandemic and the Ukraine crisis, particularly with public resources being diverted towards crisis relief and addressing the crises’ immediate impacts. However, attaining the SDGs requires the effective and strategic mobilisation of resources towards the development of the necessary infrastructure and implementation of systems that ensure sustainable change. Now estimated to stand at 4.2 trillion USD, addressing the SDG financing gap requires the mobilisation of more resources in targeted, strategic, and therefore more effective ways.

As Asia’s largest network of social investors, we believe that blended finance is a unique and timely tool, as it effectively mobilises capital from both the philanthropic and private sectors, towards a common goal of sustainable development. In our capacity as the official Impact Partner of the G20 Indonesian Presidency this year, we engaged our platform of over 600 social investors working across Asia to bring to the fore the voice of the social investment community in the G20 and further our efforts to strengthen the blended finance ecosystem in Asia.

AVPN conducted a series of consultation sessions with our members, to gather their insights on challenges and areas of need and opportunity in the blended finance ecosystem. We are pleased to have taken these insights forward through our submission of input papers to key working groups under G20 Indonesia, such as to the Development Working Group and the OECD, who have been leading efforts on the ‘G20 Principles for Scaling-Up Private and Blended Finance in Developing Countries, Least Developed Countries and Small Island Developing States’.

We are glad that the pivotal voices of the social investment community in Asia have been incorporated into the G20 Principles to Scale Up Blended Finance, which will now be taken forward by the Global Blended Finance Alliance, a B20 legacy programme,

as a basis for knowledge sharing and building of best practices amongst various development actors.

Looking ahead, AVPN remains committed to strengthening the blended finance ecosystem in Asia, and will be taking this commitment forward through a formal partnership with Tri Hita Kirana. In this vein, we will continue to work closely with the Global Blended Finance Alliance, build on the momentum and progress gained thus far, and take this work forward to the G20 Indian Presidency in 2023. Leveraging on our strength as a community and other platforms such as the THK Center of Future Knowledge, we aim to enable greater knowledge sharing amongst capital providers around the blended finance instruments available, the opportunities these present, and potential case studies and best practices.

ABOUT AVPN

Asian Venture Philanthropy Network (AVPN) is a unique funders’ network based in Singapore committed to building a vibrant and high impact social investment community across Asia. As an advocate, capacity builder, and platform that cuts across private, public and social sectors, AVPN embraces all types of engagement to improve the effectiveness of members across the Asia-Pacific region. The core mission of AVPN is to increase the flow of financial, human and intellectual capital to the social sector by connecting and empowering key stakeholders from funders to the social purpose organisations they support. With over 600 members across 32 countries, AVPN is catalysing the movement towards a more strategic, collaborative and outcome-focused approach to social investing, ensuring that resources are deployed as effectively as possible to address key social challenges facing Asia today and in the future.

I applaud the Government of Indonesia and the Tri Hita Karana Forum for their visionary leadership in launching the Global Blended Finance Alliance here in Bali on the occasion of the G20. It comes not a moment too soon.

Governments today are besieged with multiple crises – conflict, inequality, climate change, health, rising energy and food costs, unsustainable debt levels and more. We know that to address these challenges, we must invest in real solutions, not just treat symptoms. The roadmap for this investment is the UN Sustainable Development Goals.

But to realise the promise of the SDGs will require an unprecedented investment of an additional $4 trillion per year, according to some estimates. An investment programme of this magnitude will not only tackle climate change. It can create jobs, build resilience to physical and economic shocks and drive sustainable growth.

To capture these benefits, we will need to crowd in trillions of private capital alongside the billions of official development assistance provided by donor governments. This is exactly what the Global Blended Finance Alliance intends to do by creating new private-public mechanisms to deploy capital at scale and by replicating solutions that already work. This is key if we want to move fast and mobilise the investment needed to

With a funding gap of over US$1.5 trillion for the Asia-Pacific region to achieve the United Nations Sustainable Development Goals by 2030, there is a clear imperative to further leverage and mainstream blended finance in the region. Bringing together business leaders, multilateral institutions, and philanthropic players the Global Blended Finance Alliance provides an important platform to help accelerate blended finance in the region and beyond.

meet global climate targets, protect nature and tackle inequality. The Alliance will play a crucial role in reducing the time and transaction costs of launching and implementing blended finance solutions.

It will help pilot, standardise, streamline and scale successful structures, so that Alliance members don’t have to reinvent the wheel every time. This will create a set of practices to ensure blended finance mechanisms are fit-for-purpose for the countries and communities where they are used.

Building on Indonesia’s demonstrated track record in launching blended finance models like the $3bn “SDG Indonesia One” platform for sustainable infrastructure, the Alliance will work with public and policy partners like the OECD, the ADB and the World Bank as well as institutional investors, developers and thought leaders to unlock capital for people, planet and prosperity. There is enormous potential to tap into private finance to help build the world we want, and the Global Blended Finance Alliance can lead the way.

Ruth A. Shapiro CEO Center for Asian Philanthropy and Society (CAPS)

In 2018 President Joko Widodo shared that the “… Indonesian government and Tri Hita Karana Forum envisage a *Global Blended Finance and Innovation Institute for Better Business Better World in Bali to scale up capacity building, policy research, and action labs for real solutions.”

Blended finance provides the ability for the realization of transformative climate results through a combination of public, philanthropic and private actors, the available capital makes impact investment opportunities promising financially for investors and addresses real local and regional challenges at a level of meaningful scale.

Tri Hita Karana Center of Future Knowledge offers the technology collaboration platform to attract local and global talents, corporates and innovators to solve climate and sustainable development challenges under the New Era Bali Kerthi Economic Roadmap.

The process of standardization is contingent on and promotes collaboration. It lowers barriers and costs to innovation, allows for greater market penetration and better returns on investment. In particular, the IEEE Standards Association enables technical and socio-technical consensus outcomes through its well governed, market-driven, globally open process. These outcomes result in local, regional, and global economic benefits through adoption and implementation of the standards, while offering scalability opportunities across geographies and markets.

Building on OECD DAC Tri Hita Karana Roadmap on Blended Finance, G20 countries can strengthen these principles through data traceability standards and –more generally - through an open and inclusive approach to data governance. This would support the Tri Hita Karana humancentric principles, which could be applied more generally to address the situation of developing, least developed countries and archipelagic island states. In particular, standardization of data and associated technology platforms will increase the probability of helping advance critical infrastructure projects with the help of Blended Finance in a scalable and

sustainable manner. Moreover, this approach, when coupled with access to neutral technical expertise and appropriate technical roadmaps, blueprints, architecture diagrams, bills of materials, would create a kind of Climatech Knowledge Commons. This specific blend of innovation and proper financing would eventually make reality the vision to “unite in diversity for our better world”. These necessary capacity building initiatives will be enabled through investments in systems and processes

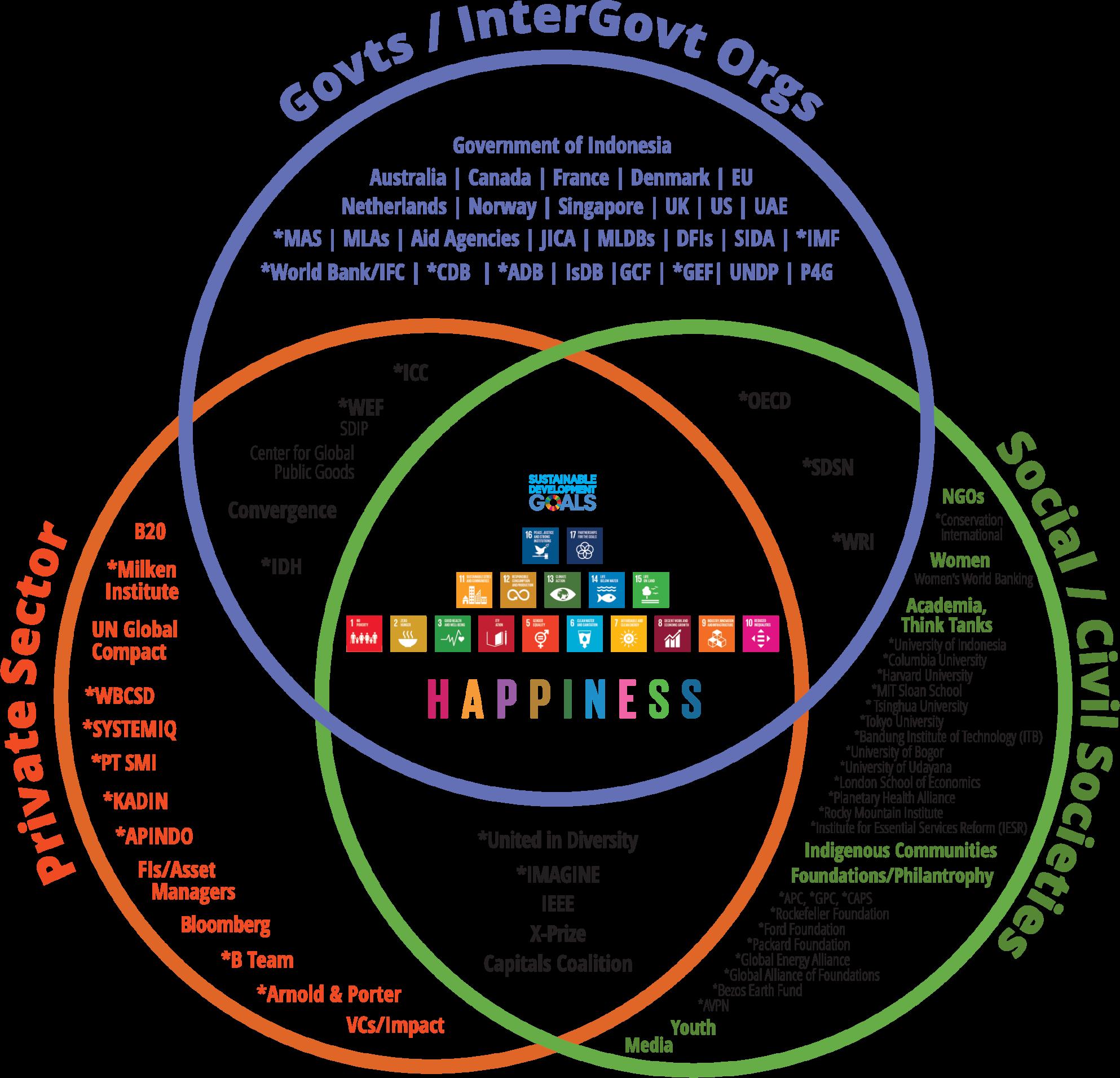

Note: (*) now referred to as the Global Blended Finance Alliance

facilitating access to knowledge. The Future Knowledge framework identifies the interoperable gaps that could create a dynamic shift toward an “ecosystem mode”. For example, a climatech or public health knowledge commons would create strategic ecosystem options, capable of scaling both knowledge and its proper application in order to meet SDG goals. There is evidently an urgent need for a science of governance approach, including the opportunity for standardized and interoperable implementations and sharing of practices. This would also enable the development of policies that support and incentivize private sector and markets toward a better business, better world behavior.

The combination of all these tools creates an environment that can truly move the needle towards a Tri Hita Karana world, inspired by the Bali Kerthi philosophy and practice.

Seven years ago in 2015, Heads of State and Government gathered at Addis Ababa and endorsed the ambitious Sustainable Development Goals, a shared blueprint for peace and prosperity for people and the planet, now and into the future. It was estimated that the investment needed to achieve the goals by the target 2030, was an additional $2.5 trillion in financing per year1.

In response, the World Economic Forum, in collaboration with its partners in the financial sector, defined an innovative new public-private financing model involving the strategic use of development finance and philanthropic funds to mobilize private capital flows to close the funding gap, a model that has become commonly known as “blended finance”2

Today, blended finance is a proven concept, with $60.2 billion4 in assets invested3. However, the annual run rate of $9 billion is still falling well short of the need. How do we move from billions to trillions? It is estimated that the climate change commitments made by 21 emerging market countries will already require as much as $23 trillion in investment by 20305

The magnitude of investment requires a massive activation of all sources of capital, from philanthropy and impact investing to early-stage venture capital for innovative

technologies and through to long term infrastructure development.

Our underinvestment in sustainable development and nature has the world facing escalating environmental and social risks. We cannot afford to wait. The costs of inaction on risks will be much higher than the costs of early action. For example, the CDP (Carbon Disclosure Report) Global Water report in 2020 noted that for businesses, the costs of inaction on water risks are up to five times the costs of action. Protecting coral reefs and mangroves is 50 times more cost effective over 15 years than building a concrete sea wall.

The launch of the Global Blended Finance Alliance by the Tri Hita Karana forum at the G20, and on the occasion of the Ocean 20 (O20) launch, in Bali, Indonesia is a welcome development. Recognizing the importance of multiple pathways to address the diverse needs and challenges faced by countries, the Alliance aims to support the strengthening of public policy as well as regulatory frameworks and standards, grow awareness of innovative blended financing solutions and expand the opportunities for cooperation from public, private and philanthropic players. This should hopefully, enable larger scale and a more rapid deployment of capital to build a more sustainable and resilient future for ourselves and our future generations.

Neo Gim Huay Managing Director, Head, Centre for Nature and Climate, World Economic Forum

In times of mounting global challenges, the SDG financing gap in developing countries has widened further to USD 3.9 trillion (forthcoming Global Outlook on Financing for Sustainable Development 2022). To bridge this gap, more policy action is needed to mobilize resources. However, private finance mobilization remains modest and behind expectations. The latest OECD data shows that private finance mobilized by official development finance interventions reached USD 51.3 billion in 2020, mainly for projects strengthening economic infrastructure and services (e.g. banking, business services and energy) in middleincome countries. In 2018-20, only 18% and 1% of total mobilized private finance targeted LDCs and SIDS respectively.

There is hence a need to devise policies that lead to systemic and transformational approaches and to more mobilization and alignment of resources, that reach those most in need. This means targeting blended finance to local contexts and harnessing blended finance to catalyze finance in the last mile. It means supporting domestic financial systems and market development and for developing countries to ensure that a pipeline of projects stands ready to attract blended finance.

The G20 Principles to Scale up Blended Finance in Developing Countries, including in Least Developed Countries and Small Island Developing States (‘G20 Principles’) are therefore very timely. They reflect a common strategic direction and aspiration for scaling up blended finance implementation in developing countries. The principles are embedded in and complementary to existing policy frameworks – such as the Tri Hita Karana Roadmap for Blended Finance, the OECD DAC Blended Finance Principles, and evidence, including the OECD stocktake report on ‘Scaling up Blended Finance in Developing Countries, Least Developed Countries and Small Island Developing States. Additionally, to make the G20 Principles more actionable for developing countries, the OECD has started to prepare, at the request of Indonesia, a Blended Finance Guidance for developing countries.

We need to move from innovative but piecemeal transactions to true scale. As the OECD stock take report highlights, a three-fold approach is needed: (i) developing stable pipelines of bankable projects, (ii) increasing the use of so-called “portfolio approaches and (iii) ensuring efficient and continuous coordination across different blending partners to match demand and supply. Similarly, a lot of work remains ahead in terms of ensuring rigorous and transparent account of the impact of blended finance transactions, through strengthened impact measurement and management, as laid out by the OECD -UNDP Impact Standards for Financing Sustainable Development. Building up knowledge through targeted capacity building and technical assistance will be crucial.

Indonesia has also shown leadership in developing The Global Blended Finance Alliance (GBF), which will support the implementation of the G20 Blended Finance Principles. The GBF promises to advance policies on blended finance, could offer to be a marketplace for innovative projects, and can help to advance knowledge sharing, capacity building and training for developing countries. The alliance could ensure that recommendations developed by G20 policy-makers are put into practice by governments, municipalities and the private sector across developing countries. The OECD stands ready to support the implementation of the G20 Principles, to continue to enable an exchange among policy makers, practitioners and partner countries, as well to support the Global Blended Finance Alliance.

1. See more at https://www.tossd.org/docs/Infographic_ Mobilised_Private_Finance_TOSSD.pdf and in a forthcoming report to be posted at https://www.oecd.org/development/ financing-sustainable-development/development-financestandards/mobilisation.htm

We commend the Indonesian G20 Presidency for its leadership in Blended Finance, and as the OECD were glad to support the development of the G20 Blended Finance principles. Indonesia played a critical role in establishing a common understanding of the ambition needed to deliver blended finance as well as the challenges faced.

By Haje Schütte and Ibu Raden Siliwanti

By Haje Schütte and Ibu Raden Siliwanti

Even before the arrival of COVID-19, the SDG financing gap was significant. The private sector is an important contributor to SDG delivery and has increasingly been mobilised with the support of blended finance approaches. Blended finance has been defined as the strategic use of development finance for the mobilisation of additional finance towards sustainable development in developing countries. In 2018-19, official development finance mobilised nearly $50bn of private sector finance for development. However, this amount is not enough. In particular, in countries where development finance flows, especially ODA, become a critical source to finance social services, the current share falls short from commitments. The impacts of the COVID-19 pandemic on developing countries are increasing financing needs while reducing available resources.

Without swift global action, years of progress made towards SDG targets could be undone. Blended finance has an important role in unlocking and channelling commercial finance towards sustainable development. Commercial capital is key as there is a lot available and channelling just one percent of total global financial assets (estimated at $382tn), could bridge the existing SDG financing gap, at $2.5tn annually. Essentially, blended finance allows for financial returns to investors while addressing investment barriers by improving the risk-return profile of investments. Blended finance operates as a market-building instrument that provides a bridge from reliance on development financing towards commercial finance, critical to ensuring SDG compliant sectors and markets get adequate financing for them to develop.

Despite the volumes mobilised the direction of the financing has been skewed towards middle-income countries and commercial sectors (like banking, finance, and energy). While Less Developed Countries (LDCs) are disproportionately affected by the COVID-19 crisis, they continue to receive the lowest share (despite a modest increase in overall volume) of private finance mobilised by official development finance interventions.

From a very low base, the mobilisation trends are positive with private finance mobilised for LDCs and other LICs increasing from $3.8bn in 2018 to $4.6bn in 2019. The share of LDCs and other LICs private finance mobilised increased from 7.5 percent to 12 percent as shown in Figure 1. However, the financing remains far below what is needed, as the SDGs are often the widest in the LDCs. This is despite the fact that the LDCs are home to over one billion people, about 14% of the world population across

46 countries. Furthermore, the vast majority of financial resources mobilised, $16.3bn, targeted the banking and business services with only $1.5bn mobilised in the water and sanitation sector.

Building back better from the pandemic requires a multilateral and multifaceted response that advances a transformational and systemic approach. It needs to include innovative financial

Figure 2: