I PROPERTY HIGHTLIGHTS

• Location

• Features

• Amenities

• Other details

• Amenities

• Pictures

II SOUTH TAMPA SUBMARKET

• Sales Volume and Prices

• Occupancy

• Cap Rate

• Developments

III PROPERTY FINANCIALS

• Rent Roll and T12

• Variability

• P & L

IV 5-YEAR FORCAST

• Property Assumptions

• Acquisition and Exit Assumptions

• Source and use of funds

• Operating Assumptions.

• 5-year Proforma

• Internal rate of return.

Community laundry room

Community laundry room

In-unit washer and Dryer.

In-unit washer and Dryer.

• South Tampa is a liquid submarket, with about 74 trades over the past three years. The market price per unit , increased drastically over the pandemic period, and currently stands at $274,611.

• The submarket is largely residential with excellent walkability and proximity to downtown Tampa, popular beaches, and a variety of entertainment and dining options.

• South Tampa traditionally has low vacancy rates, steady upward moving property prices, and is a desirable location for renters and investors.

The South Tampa Submarket is a regular target among multifamily investors in Tampa. Annual sales volume has averaged $274 million over the past five years, and the 12 month high in investment volume hit $858 million over the same period. During the last 12 months specifically, $273 million worth of assets sold. Average apartment properties reached $274,611/ unit, during the second quarter of 2023 .

South Tampa has consistently been a highly liquid submarket with strong demand for multifamily real estate properties. Annual sales volume has averaged $274 million over the past five years, and the 12-month high in investment volume hit $858 million over the same period, and $273 million worth of assets sold during the last 12 months. Average apartment properties reached $274,611/ unit, during the second quarter of 2023 .

Occupancy Rate within South Tampa submarket has been traditionally high, reaching a healthy 96% at the height of the Coronavirus Pandemic.

Stabilized occupancy is expected to remain below 95% during the next 5 years

The market CAP rate has kept its historical downward trend for the last 10 years been one of the lowest in the market and expected to remain under 5% a clear indication of strong demand for multifamily properties,, rising property values and increasing rents.

South Tampa Submarket has seen more new development than the market overall during the past decade.

Development is set to continue, and roughly 630 units are currently on the way, which will substantially expand the existing inventory.* *Costar.com

The property exhibits low variability in its gross income and expenses, as well as a predictable net operating income, which a clear sign of effective management and a stable and secure environment for tenants while ensuring a healthy return on investment for owners

P & L Statement is based on Trail-12 2023 provided by the client. Gross income Rent is net after 9% vacancy, which is consistent with submarket current vacancy rate.

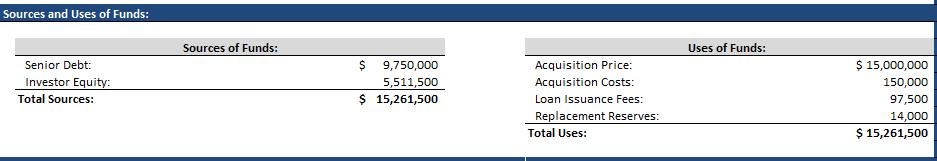

The acquisition target is a 56-unit multifamily located at 115 Lois Ave in Tampa, Florida. The average rentable square feet per unit is estimated to be 829 sqf/unit. Property Taxes are 1.18 % of the acquisition price. Management fee is assumed at 6% of effective gross income.

Asking Price is estimated in $15,000,000 ($267,857/unit). South Tampa Submarket registers $273,183/unit during the second quarter of 2023), for A Going-in capitalization rate 5.79% (current submarket cap rate is 4.5%). The Acquisition loan-to-value is assumed at 85%. 30years senior financing at 7% annual interest rate, with maturity of 5 years. Exit Capitalization rate is kept relatively univariable.

The following 5-year forecast is a projection of the property's future income, expenses, and cash flows, are based on less favorable assumptions about market conditions, tenant behavior, occupancy and other factors that may impact the property's financial performance in order to assess the financial viability of the property as a business.

It's important to keep in mind that the forecast is not a guarantee of future performance, and that actual results may differ from what was projected. Therefore, investors should use the forecast as a tool for decision-making and not rely solely on it.

In order to prove the acquisition viability which in turn helps to determine the potential return on investment the following operating assumptions have been made. on market conditions and other factors.

• In-place discount historically has been estimated to be 9% through the five-year outlook historically has been 25%

• General vacancy is estimated at 7%. Historically 5%.

• Utility reimbursement estimated at 7%. Historically 100%.

• Capital expenditure has been estimated in $700 per unit for the 5-year projection, keeping Replacement reserve at $250 per unit.

It's important to notice that these assumptions are just estimates and may be subject to change based on market conditions and other factors.

CENTURY21BegginsEnterprises

14995DGulfBlvd,MadeiraBeach,FL33708

mannyherrera@c21be.com Mobile: +1 (813) 951 5880

• My purpose is to create a platform where investors and property owners meet to acquire and sell multifamily real estate properties, in an organized, efficient and secure manner. We want to build the most reputable and secure source for multifamily transactions.

• I develop effective collaborations with: Real Estate Brokers, Mortgage Bankers, Title Companies, Syndication Law Firms, and other key players to provide comprehensive support in the acquisition, sale, financing and management of multifamily real estate properties in the USA.

I believe “ multifamily housing is critical to our society. It is the most efficient way to increase the supply of housing necessary to accommodate employment, promote community stability , and enhance quality of life.

Manny J Herrera

Manny J Herrera