Tampa's multifamily market has shown remarkable resilience and outperforms many national markets, receiving help from a remarkable employment growth rate of 4.7%, surpassing the national average and rivaling cities like Orlando and Miami

The Tampa Bay multifamily real estate market is divided into thirteen submarkets, each with its own unique characteristics and investment potential. Seven of those submarkets are a part of Hillsborough County, the fourthmost populous county in Florida Orlando and Miami

Due to economic challenges and rising interest rates, investment activity in recent quarters has significantly declined. The decrease in sales activity has persisted for three consecutive quarters, with the first quarter of 2023 experiencing the lowest transaction volume in the past ten years, totaling around $160 million.

JUNE 2023

The Tampa multifamily real estate market is undergoing a transformative phase, characterized by sustainable and enduring economic changes. This significant shift has been brought about by the impact of rising interest rates, leading to decreased investment activity throughout the overall market. Specifically, the first quarter of 2023 saw the lowest transaction volume in the past decade, totaling around $160 million.

Furthermore, property prices in Tampa are still on the rise, driven by increasing Net Operating Incomes (NOI) and declining capitalization rates across the board. This trend shows that property owners are asking for a higher price per dollar of property income compared to the previous year.

Thesedevelopmentshighlightamaturingmarketthatprioritizesstability, presentinginvestorswiththeopportunitytomakeinformedandprudentlong-term investmentdecisions.

Keydriversofasoundmultifamilyrealestatemarketinclude:astrongjob market,athrivingeconomy,abusiness-friendlyenvironment,andabalanced supplyofaffordablehousing

The Greater Tampa area enjoys a business-friendly environment with low taxes and incentives, attracting many corporations and fueling job growth Tampa Bay has a diverse economy with a strong base in healthcare, finance, and tourism.

Tampa is home to 20 corporate headquarters, including five Fortune 500 companies, and hosts over 500 foreign-owned companies from 40 nations This diversity supplies stability and resilience to the local economy, which can be a significant advantage for real estate investors.

Tampa's multifamily market has shown remarkable resilience and outperforms many national markets, receiving help from a outstanding employment growth rate of 4.7%, surpassing the national average and rivaling cities like Orlando and Miami. This robust job growth has led to a significant population increase of over 412,000 residents in the past decade, driving the demand for multifamily housing.

Additionally, Tampa's multifamily market leads the nation in permits and property prices. With an annual growth rate of 160% in multifamily permits, the market has a robust pipeline of new construction projects, while property prices continue to show steady annual growth at 4.4%,

Overall, the Tampa Bay multifamily market presents exceptional potential and stands strong among national real estate markets.

Our Mission is to become the platform where investors and owners meet to buy and sell multifamily real estate properties, in an organized, efficient, and secure fashion.

As a result of the earlier factors Tampa Bay 's rental market has traditionally experienced steady growth, with strong demand for multifamily properties. This trend has resulted in continuous increases in rental rates, high occupancy levels, and higher property values.

SUMMARY

Finally, due to its ever-changing demographic, Tampa Bay has traditionally experienced a shortage of affordable housing, a common issue in many big cities in Florida. This has been recognized as an opportunity for real estate investors to address the demand by developing multifamily properties that offer affordable rental, while attracting current population migration from more expensive areas such as Miami and Orlando.

Real estate markets are primarily local due to the unique nature of the real estate assets. This holds true with The Tampa Bay Multifamily market. Therefore, in measuring the potential of a multifamily real estate business, it's important to analyze various indicators for the specific submarket. Those Indicators include asset value, inventory units, under construction units, absorption units, vacancy rate, market rent, rent growth, sale price per unit, sale volume, and cap rate. By evaluating each indicator individually

and considering their interrelationships, investors can gain insights into the potential of the submarket.

The Tampa Bay multifamily real estate market is divided into thirteen submarkets, each with its own unique characteristics and investment potential. Seven of those submarkets are a part of Hillsborough County, the fourth-most populous county in Florida, three submarkets are in Pinellas County, which is considered one of the wealthiest counties in Centra Florida, and lastly, two submarkets are in Pasco and Hernando counties

Asset Value.

Overall,measuringassetvalueinthemultifamilymarketiscrucialforinvestors,lenders, andstakeholdersasitsuppliesaquantitativeandqualitativeassessmentofaproperty's worth.Ithelpsdecision-making,riskmanagement,andportfoliooptimizationinthe dynamicrealestateindustry.

In terms of Asset Value, five of those submarkets account for close to 60% of the total Tampa Bay Submarket asset value. Higher asset values write down a robust and potentially lucrative market for multifamily real estate investment.

We approach every transaction as a collaborative process. We focus on three core dimensions: market knowledge, transparency, Integration, and collaboration as showed by the many roles involved in every transaction.

MEASURING INVENTORY UNITS IN A MULTIFAMILY MARKET IS CRUCIAL FOR INVESTORS AS IT PROVIDES VALUABLE INSIGHTS INTO SUPPLY AND DEMAND DYNAMICS, MARKET TRENDS, RENTAL MARKET DYNAMICS, RISK ASSESSMENT, COMPETITIVE ANALYSIS, AND PORTFOLIO MANAGEMENT.

As of June 2023, the Tampa Bay Market features a total inventory of 215,720 existing rental units. Notably, a sizable part of this inventory is CONSISTENT WITH ASSET VALUE DISTRIBUTION Approximately 60% is concentrated within five prominent submarkets: Central Pinellas, Southeast Tampa, North Tampa, Downtown Tampa, and Pasco County

A high concentration of rental units in a multifamily real estate market suggests strong demand, a desirable location, as well as an established rental market. However, investors should be prepared for increased competition and evaluate the potential for future growth and portfolio diversification within the submarket.

If new construction leads to an over-supply of units, it can result in low asking rates due to competition and potential challenges for investors. Conversely, if new construction aligns with or slightly lags demand, it will support a healthy balance and potential for growth. Assessing this balance is crucial in understanding the impact on the multifamily market.

As reported by Costar Group inc. The Tampa Multifamily market has experienced a significant influx of new supplies, with 6,700 units completed in the past year and an added 19,000 units currently under construction. The ongoing construction is a 9.0% increase in existing inventory, well above the national average of 5.6%. As a result, the market vacancy rate is expected to further increase to around 9% in the next two years, according to CoStar's forecast.

While it's true that the supply of new units in the Tampa multifamily market has outpaced demand in the second quarter of 2023, it's reassuring to know that new construction capital is wisely being distributed to submarkets with the highest potential. Specifically, Pasco County, Southeast Tampa, South Pinellas, and North Tampa are receiving significant attention, which is clear sign of the direction of Tampa's multifamily market expansion.

The 12 Month Absorption Units metric calculates the net change in occupied units during a 12month period, considering both new leases and units becoming vacant. A positive absorption writes down that more units were leased than vacated, showing a healthy demand and a potentially strong market. Conversely, a negative absorption suggests that more units became vacant than were leased, saying weaker demand or potential oversupply.

As shown on graph above, while some submarkets such as Southeast Tampa and Pasco County show strong positive absorption rates showing healthy demand and leasing activity, other rates such as North Tampa and Northwest Tampa show negative absorption, suggesting higher vacancies or a slower leasing pace. It's important to analyze these absorption rates alongside other factors such as inventory units, under construction units, and asset values to gain a comprehensive understanding of each submarket's multifamily market dynamics

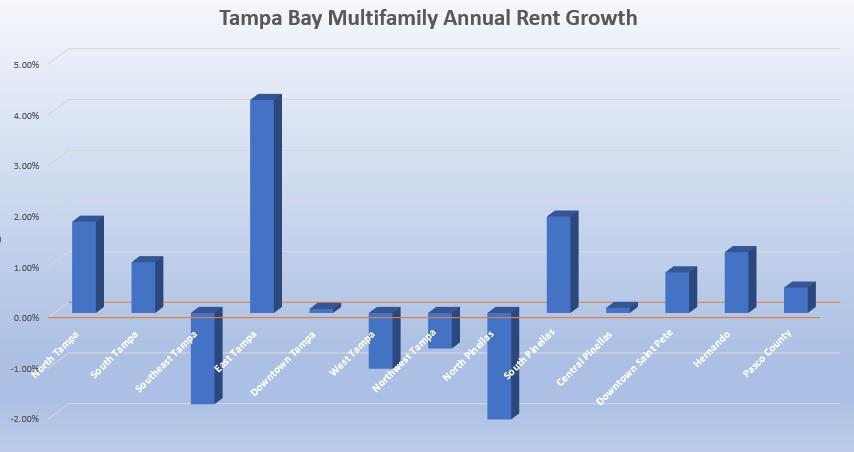

Overall, rent growth is an essential metric in the multifamily real estate market as it reflects the interplay between supply, demand, and market dynamics. It influences investment decisions, property performance, and market competitiveness, supplying valuable insights for stakeholders in the multifamily industry.

Rent growth in Tampa's submarkets varies, with 70% of the submarkets experiencing exceptionally positive rent growth, this is the case of East Tampa, North Tampa, and South Pinellas, while others have seen modest declines such is the case of Southeast Tampa, and North Pinellas the rest of the r submarkets had minimal changes in rental prices. It's important to consider factors such as vacancy rates, asset value, and overall market conditions to get a comprehensive understanding of the rental market in each submarket.

Due to economic challenges and rising interest rates, and declining capitalization rates, investment activity in recent quarters has significantly declined across the Tampa Bay Multifamily Real Estate submarkets. The decrease in sales activity has persisted for three consecutive quarters, with the first quarter of 2023 experiencing the lowest transaction volume in the past ten years, totaling around $160 million. The second

quarter of 2023 is on track to surpass this record, with only approximately $130 million traded so far.

Over the past 12 months, the total sales volume amounted to $1.1 billion. The largest transaction of the year occurred in August 2022 when Oaktree Capital Management bought 3939 Ehrlich Rd - Arbors at Carrollwood, a 780 -unit property in Northwest Tampa, for $99.8 million.

Multifamily sale prices in Tampa Bay have steadily risen over the past decade, reaching a peak in early 2022. By June 2023, the average sale price per unit has declined to $236,000, coinciding with an increase in the Capitalization rate. This rise in the Capitalization rate suggests a potential market correction and the start of a seller's market, although it's still too early to tell whether this trend will continue

The most active markets have been Southeast Tampa, Central Pinellas, North Tampa, and Northeast Tampa.

For years, financial and real estate experts have touted multifamily real estate as one of the most stable and efficient ways to grow wealth. However, mismanagement of such properties can lead to major financial disasters for owners. In Tampa, over 50% of multifamily real estate properties can be classified as asset type D and below due to various signs of financial stress such as rent below market, low occupancy, low rent collection performance, bad tenant management relations, high turnover expenses, bad reputation and online reviews, and lack of capital improvements.

While some multifamily property owners may choose to be hands-on and manage their properties themselves, many others are passive investors who rely on property management companies to handle the day-to-day operations of their properties. This can be a smart choice, as property management companies have the ability and resources to handle tasks such as rent collection, maintenance, and marketing, which can be timeconsuming and challenging for individual property owners to handle on their own. However, it is still up to the owner to make important financial decisions that will affect the overall success and profitability of the property.

As a passive multifamily property owner, you need to have access to key financial information to make sound financial decisions. This information includes:

• Rent Roll: A document that shows the total rent charged for each unit and the total rent collected, as well as any delinquencies or vacancies.

• Profit and Loss Statement: A statement that shows the revenue, expenses, and net income or loss for a given period.

• Bank Reconciliation: A process that ensures that the balance on the bank statement matches the balance in the accounting records.

• Key Performance Indicators (KPIs): such as occupancy rate, rent growth, revenue per unit, and operating expenses.

• Market Analysis: An analysis of the Market and Submarket multifamily real estate market, including market rental rates, vacancy rates, and market trends, to help inform decisions on pricing and marketing.

• Capital Expenditure Plan: A plan that outlines the expected costs of major repairs or upgrades to the property, such as roof replacement or HVAC upgrades, turnover costs.

• Budget: A detailed plan that outlines expected revenues and expenses for a given period.

Having access to this financial information will help you make informed decisions about your multifamily property and ensure that it is running efficiently and profitably.

Thank you for taking the time to read our monthly Market Report. I am Manny J Herrera, a licensed real estate agent in Florida, proudly affiliated with Century 21 Begins Enterprises and the Founder of the Multifamily Real Estate Exchange Group.

At the Multifamily Real Estate Exchange Group, we serve as the vital connection between property owners/investors and multifamily real estate as a valuable commodity. Our goal is to establish a convenient one-stop-shop for multifamily property owners and investors, offering a wide range of services that streamline the acquisition, sale, and management of these properties.

Our dedicated team consists of highly skilled professionals, including state licensed real estate agents, mortgage bankers, title insurance companies, real estate syndication attorneys, and property management companies. Together, we provide a comprehensive suite of services designed to assist property owners in buying, selling, financing, and effectively managing their multifamily properties.

To learn more about our services and explore potential collaboration opportunities, don’t hesitate to reach out to me directly at the following contact information: