IN ONE PL AC ACE E

But with good reason. US sports betting is growing fast, generating excitement and gross gaming revenue aplenty. When all is said and done, though, only a handful of operators are benefiting from that growth – and most are still yet to approach anything near turning a profit.In Europe, core markets are just as competitive, requiring the resources to either advertise en masse or overhaul compliance procedures in the face of changing regulation.

So, in terms of pure growth prospects, that leaves us with Latin America, the sports capital of which is… Brazil. And industry anticipation is reaching ‘Carnaval’ levels after a regulated sports betting market was finally written into Brazilian law at the turn of the year – with a launch to follow later in 2024.

Understandably, then, it is a busy time for Brazilian sportsbooks priming to capitalise on this newly legalised source of revenue, while it is equally busy for international brands looking to earn their slice of the pie. Our cover feature duly explores the potential of Brazil’s legal sports betting market, during a year that not only sees the Euros in the summer but (more importantly for Brazilians) the Copa America. Indeed, we hear from EveryMatrix, WA.Technology, OpenBet and SCCG Management about what’s on the horizon.

Elsewhere, we have an exclusive, in-depth interview with Stéphane Pallez, the Chairwoman and CEO of La Française des Jeux (FDJ) – French gambling behemoth and potential buyer of Kindred Group (in what is the biggest industry merger of the year so far).

We dedicate four full pages to the FDJ CEO. Beyond that, however, we look as far afield as VR in gaming, global compliance, Paddy Power’s UK innovations and the Canadian market.

Particularly interesting, in my opinion, are insights from iGaming expert Itsik Akiva, who tells us all about how sweepstakes now form a multi-billion-dollar industry. Beware, though, sweepstakes may be a perfect companion for casino companies in the US – but Akiva explains exactly why US sports betting is not yet a natural cross-sell. Coming full circle, alongside our regular company profiles, all that’s left for me to do is bring our conversation back to Brazil and say: Bem vindos à festa! TP,

6 SPORTS BETTING CALENDAR

We look at some of the key dates in the sporting calendar for the remainder of 2024, giving our thoughts on what the betting activity may look like

8 DATA: AFRICAN CUP OF NATIONS

Sports betting supplier Betby provides Gambling Insider with exclusive data on its African Cup of Nations trading, after home country Ivory Coast defeated Nigeria 2-1 in the final

14 FOOTBALL’S CHANGING RELATIONSHIP WITH FANS Gambling Insider delves deeper into LiveScore’s Evolution of Fan Report

20 CASINOS WITHOUT THE GAMBLING

Gambling Insider speaks with Itsik Akiva about the rise of sweepstakes in the US, and what this could mean for the wider industry

26 BEM VINDOS AO CARNAVAL

With the help of industry experts, Gambling Insider attempts to measure the potential of Brazil’s regulated sports betting market

32 “AN ALIGNMENT OF THE PLANETS”

FDJ CEO Stéphane Pallez speaks to GamblingInsider Editor Tim Poole

40 WHAT DOES VR LOOK LIKE IN 2024?

SB22 CTO Marko Savkovic investigates the current state of VR in and outside of gaming. Can it truly enhance the player experience?

42 GLOBAL REGULATION FOR ONLINE SPORTS BETTING Ievgeniia Derbal, Chief Legal, Tax & Regulatory Officer at Energame, champions installing global regulation for the online sports betting market. It’s an interesting take...

44 SPORTS BETTING, CANUCKS STYLE

Larry Fisher and Robert Davies speak about the Canadian market and Canadians’ sports betting preferences

48 CHANGING THE GAME

Paddy Power has debuted its Super Sub feature. Similar to Sky Bet’s AccaFreeze, bettors are being afforded a greater level of control as the competitive UK market heats up

10

12

16

18

22

24

36

38

50

Gambling Insider has looked at some key dates in the sporting calendar for the remainder of 2024, giving our thoughts on what the betting activity may look like

Sports betting supplier Betby provides Gambling Insider with exclusive data on its African Cup of Nations (AFCON) trading, after home country

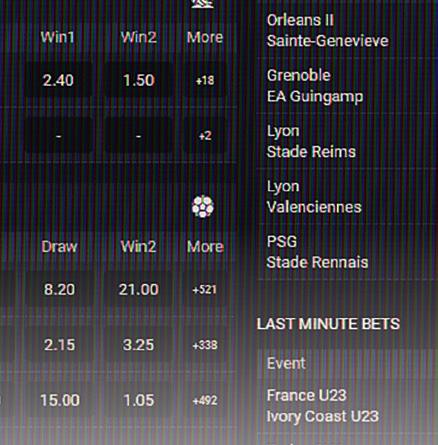

As we can see in our rst graph, Betby’s data (from the tournament as a whole) shows two interesting trends when it comes to the total amount of bets placed before the match versus in-play (or live). Firstly, we can see that 61% of all bets – the vast majority – were placed before kick-o . However, when it comes to the percentage of turnover, 67% came from in-play betting. That means that, while less bets were placed during the game, these bets were bigger and – overall – represented a far higher number. Factors at play here could be an increased level of confidence given fans saw how the game was unfolding, or perhaps a different profile of player preferring to bet in-play.

As the chart shows us, a staggering 77.1% of bets were actually placed on the losing team, Nigeria. However, Nigeria was in fact the pre-match favourite, despite Ivory Coast being the home side. The game ended up pro table for operators on Betby’s platform, too, because Nigeria also accounted for 51.3% of total turnover.

Interestingly, 71.3% of bets for the final were placed pre-match, and 53.9% of turnover. That bucks the trend of the overall tournament, slightly, perhaps as fans (and those supporting the nations involved) wanted to focus more on the game itself without wagering – and may have also been betting with their heart before the game.

Bet builders only represented 1% of total bets, suggesting they are yet to gain popularity in African markets

- This graph shows us the vast popularity of the match result market – i.e players betting on who will win, lose or draw. This market may suit the more casual players, as the % of bets is much higher than the % of turnover, suggesting lower stakes

- The ‘To Qualify’ market is not as popular as betting on results within 90 minutes

- The ‘1st Half – Total Bookings’ and ‘Sending O ’ markets may have attracted more serious bettors; both represented less than 1% of total bets, yet combined they represented 6% of turnover

Betby data shows us the journey of Ivory Coast’s odds throughout the African Cup of Nations nal. Starting as second-favourite, Ivory Coast’s odds jumped from 2.90 to 6.63 when Nigeria took the lead in the 38th minute.

The odds slightly drifted until Franck Kessié’s 62nd-minute equaliser. But Ivory Coast was never odds on to win until Sébastian Haller’s late winner, truly defying the scales of probability.

When measured head to head, AFCON accounted for 58.2% of wagers on Betby’s platform while the Asian Cup represented 41.8%

The sports betting a liate landscape is fastpaced and demands constant adaptation to stay ahead. Growe Partners isn’t just another a liate program; it’s your weapon of choice for maximising pro ts in this exciting niche.

Growe Partners draws on over 10 years of iGaming experience to equip you with the tools and resources needed to win. Here’s what sets us apart:

- Unparalleled Sportsbook Selection:

Promote the biggest names in sports betting, like Parimatch and JugaBet, attracting a massive audience of passionate sports fans.

- Expertise Meets Earnings:

Growe Partners isn’t just about earning; it’s about empowering you to earn big. Our competitive commission plans, including CPA (up to $100) and RevShare (up to 45%), ensure you get rewarded for your success.

- Your Dedicated Partner:

Growe Partners doesn’t leave you on your own. Our team of affiliate marketing specialists provides ongoing support and guidance, ensuring you have the knowledge to thrive.

- Performance Tracking and Growth:

Gain valuable insights with Growe Partners’ advanced tracking and reporting tools. Optimise your strategies for maximum impact and continuously improve your affiliate marketing efforts.

Growe Partners is more than just an a liate program; it’s your trusted partner in the dynamic world of sports betting affiliate marketing. It empowers you to leverage your sports knowledge, target the right audience and maximise your earnings.

Join Growe Partners today and become a dominant force in sports betting affiliate marketing!

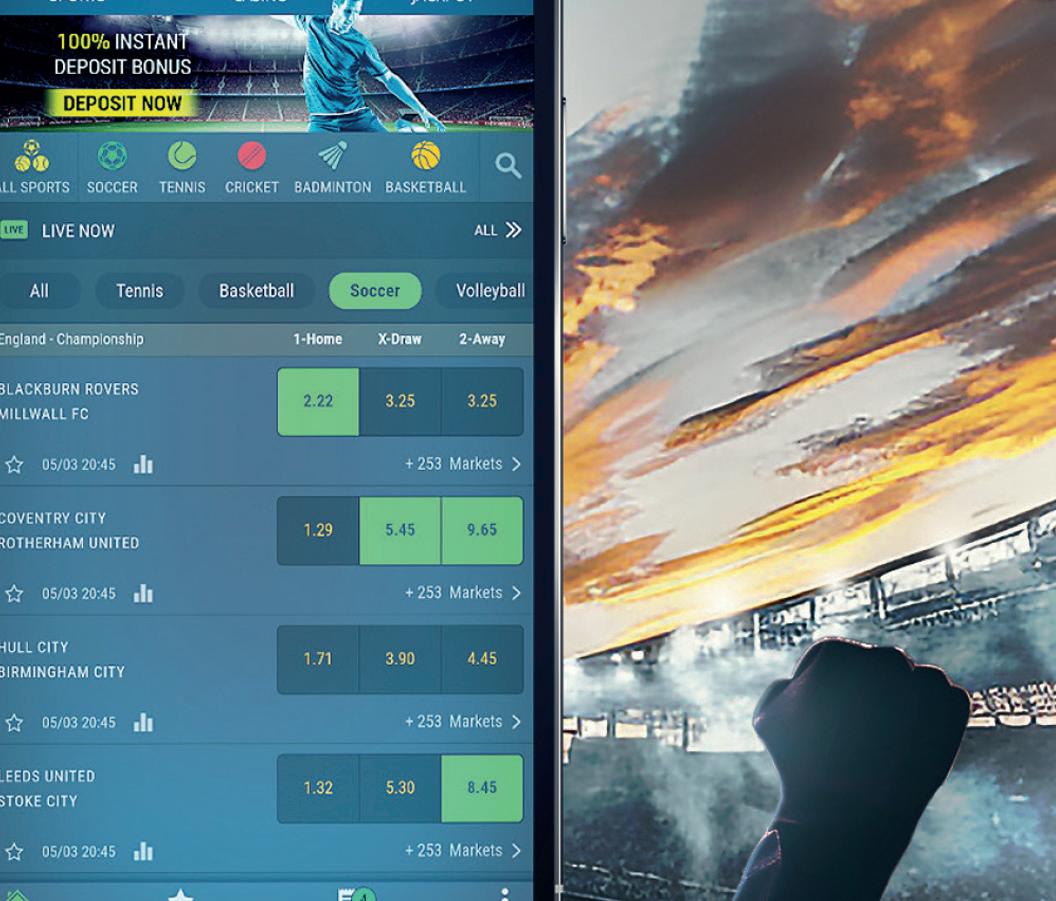

The sportsbook provider discusses turning sportsbooks into a profitable business instead of just an acquisition tool

In the modern iGaming ecosystem, sportsbooks are often viewed more as an acquisition tool than a signi cant revenue generator – a role traditionally reserved for casinos. However, this stereotype can be challenged and that’s exactly what we do at GR8 Tech, leveraging our deep practical insights and technological prowess to transform sportsbooks into signi cant revenue generators. Our vision is to rede ne the role of sportsbooks in the iGaming ecosystem. With GR8 Tech, sportsbooks are no longer just a game; they’re a winning strategy.

GR8 Tech’s high-performance Sportsbook platform stands out from the competition with its unique margin management capabilities, which enable operators to dynamically adjust odds and margins in real time, catering to both the competitive landscape and player preferences. The result is a nely tuned balance between o ering attractive betting options and maintaining pro table operations. Our partners report an average pro t increase of 15% – a testament to the platform’s effectiveness in turning every bet into a potential win for both the player and the operator. In certain cases, the pro tability can grow to over 30% without any additional investments.

The profitability of the GR8 Sportsbook is coupled with exemplary tech performance.

Engineered for resilience, it easily maintains a stable 99.96% uptime. With the capability to process up to 30,000 bets per second and settle millions of bets per minute, our platform ensures high-volume events go off without a hitch. This level of reliability means that during the world’s most watched sporting events, when the action is fast and furious, GR8 Tech stands strong, keeping operators and their customers in the game. Notably, even if something happens, GR8 Tech’s proactive approach to problemsolving guarantees that the majority of the incidents – over 82.5% – will be detected and addressed before impacting operators. Most often, the issue gets fixed before the operator’s teams even notice its existence.

Diversity and depth of content are crucial in capturing and maintaining player interest. GR8 Sportsbook offers a rich selection of nearly 100,000 monthly events, spanning a wide array of sports, esports and 24/7 fantasy sports. Our proprietary Sports Feed empowers operators to go beyond the conventional, enabling the creation of unique betting opportunities tailored to their market’s speci c tastes and preferences. Whether it’s underground sports, rare tournaments or innovative non-sporting events, GR8 Tech brings operators’ visions to life, ensuring their o erings stand out in a crowded marketplace.

GR8 Sportsbook utilizes a wide range of bonus types and mechanics, as well as gamification elements like stickers, achievements, quests, loot boxes and tournaments. These tools allow operators to create a vibrant betting ecosystem with active engagement and an average player retention of 80%.

GR8 Tech made the GR8 Sportsbook its flagship product for a reason – its long-standing market presence, stellar reputation, robust functionality, and unique earning capabilities that guarantee operators to achieve a profitable margin within 12 months, make it a go-to choice for iGaming industry players who want to take leadership positions in the eld. GR8 Sportsbook played a key role in major deals, helping us to sign four new clients by the end of last year and close three more contracts in the rst months of 2024.

As GR8 Tech continues to evolve, we focus on building and sustaining lifetime partnerships with operators. By aligning the GR8 Sportsbook platform and our suite of services with the unique needs and aspirations of our clients, we aim to be at the forefront of the iGaming industry’s next wave of growth. We aim to establish GR8 Tech as a provider of choice, offering solutions that are not just reliable and predictable but are also finely tuned to the nuances of local markets.

Gambling Insider delves deeper into LiveScore’s Evolution of Fan Report to

see how football

fandom

has developed and what might

be to come over the next quarter of a century

Football’s impact on society is undeniable. Culturally, it is important to many people around the globe in many ways, and the way it is consumed has changed greatly.

To that end, as part of its 25th anniversary celebrations, LiveScore released a report called ‘Evolution of Fan’ looking at “changes in the way football is experienced, consumed and loved,” as it looks at its own ongoing role to contributing to the future of football fandom.

Gambling Insider was present at a live event, held at LiveScore Group’s London office, involving Sport Business podcast Unofficial Partner, with Richard Gillis conducting a Q&A session with LiveScore CEO Sam Sadi as part of the report’s launch.

The report features a timeline throughout of significant events in football

and wider society, including LiveScore’s own journey, with data from nearly 25,000 surveyed football fans and LiveScore users. The key stats scattered throughout the report highlight fan attitudes towards football viewership and how they have shifted and the differing attitudes between ages.

Overall, the report underlines how fans have become more connected to the teams and players they care for most, driven by a greater variety of methods to consume content, including through social media, and increased broadcasters and streaming providers. The origins of LiveScore go some way to explaining how noteworthy the group has been in creating the next wave in football fandom.

Founder of the company, Peter Jerie,

was on a trek in South Africa, but wanted to keep up with his (and many people’s) team, Manchester United...

As someone who was a programmer, Jerie had the skills to create a code which would send Teletext score updates to his mobile phone via SMS, so he wouldn’t miss what was going on in the match. This proved popular with Jerie’s friends and eventually led to LiveScore’s website being launched later that year, in 1998. Since then, as the report conveys in great detail, technology’s advancements through the years has shifted the way in which fans consume football content. From the gradual decline of Teletext to smartphones’ widespread usage, social media’s influence and the changing face of broadcasting rights, this report really does call attention to how much change has taken place in such a short space of time.

Football fans today are almost completely different to what they were 25 years ago and much of this has come from the opportunity’s technology has provided. What the report shows most of all is that not being present at a game doesn’t mean fans can’t feel attached to it, with more chances to interact and be involved with football fandom.

Within the data from LiveScore, it highlights that 81% of people agree that technology has improved the sense of community among football fans, while 84% of fans feel more connected to their favourite teams since the emergence of instant score updates. This is further emphasised with 93% of fans claiming that social media has enhanced their match experience.

Overall, the report points to technology being a positive driving force for football fandom, with 93% of those surveyed believing technology, and the ability to

keep up to date with football news and results in a real-time sense, has positively impacted the game of football off the pitch.

Betting is, of course, included within theLiveScore experience, something it integrated into its app for users of 18 years or above in the UK back in December 2020. Sports betting has continued to grow in that time, with more US states going live and other regions including LatAm seeing more countries gradually introduce legislation surrounding it. Mobile sports betting may have become more popular in recent years with smartphone development, but its relationship with fan viewership has clearly grown incredibly in that time.

In total, 56% of fans said the integration of betting features within football related apps has improved their fan experience. With sports betting operators bringing more features to the table that go beyond a simple match result bet placed before a match, such as bet365 becoming one of the first major operators to offer inplay betting or Sky Bet’s newest feature ‘AccaFreeze’, the involvement of betting within the fan experience of watching football will no doubt continue to grow.

This subject was touched upon briefly during the podcast event, with Sadi explaining how the betting industry gives another layer of excitement to sport itself. During the Q&A event, LiveScore’s CEO was asked what the future may hold within the sporting industry. The idea of ultra personalisation within the LiveScore

app was something that could become reality seen sooner rather than later, whereby content is filtered in such a way that each person using the app will have their ‘own’ LiveScore in some way. The technology for this would recognise what each person wants from their app by way of content such as news, highlights, etc. to tailor it accordingly.

In some ways, Sadi suggested that the plan for LiveScore in the coming years was to become the main source of information in the world of football. A tough ask, though... Nowadays, most football fans have multiple apps for different angles of content. The aim for LiveScore, it was suggested, is a future where all the content fans currently consume surrounding football would be accessed through LiveScore and that there would be no need for any other apps. But, again, that is an ambitious goal.

An interesting point made during the podcast session was surrounding young fans and how they consume content. Sadi noted that many of the younger generation generally rely on short clips from social media to consume football content. In some cases, they don’t even watch full matches... citing an example of a young basketball fan not understanding that players actually missed shots during matches – until they watched a full game.

Sadi also left some closing remarks in the report itself, looking ahead to what the next 25 years may hold for football fandom. “The landscape of football broadcasting has undergone signi cant changes over

the past quarter-century, from exclusive rights holders Sky delivering Premier League games, to the complete fragmentation of subscription-based services, with multiple streaming services all vying for subscriptions. Looking ahead, we anticipate a rebundling of these rights, with a renewed focus on delivering a streamlined, user-centric experience through direct-toconsumer platforms.

“These platforms will prioritise fan experience, offering flexible subscription models tailored to individual preferences,with fans having the flexibility to choose subscription levels, unlocking various features and content, and offering a seamless and consolidated viewing experience. Additionally, the emergence of the Metaverse offers the potential to connect fans globally in virtual stadiums, creating a shared sense of community across countries and continents.

“As we harness the power of AI to capture the individual essence of each fan, we can then anticipate the emergence of new sub-communities centred around niche interests and preferences, who will then be able to connect and celebrate their individual nuanced love of the game.”

Football fandom’s development in such a short time span has been remarkable, and technology’s advancement has played a key part in this. With the methods of football consumption changing all the time, it makes for interesting viewing on what technology will bring next. How will fans continue to engage with the beautiful game – and how may this even change the game of football itself?

In recent years, esports betting has emerged as a transformative force within the sports betting landscape, reshaping strategies for both operators and players alike. The growth trajectory of the industry has been remarkable, with statistics projecting signi cant expansion. In 2022, esports witnessed exponential growth with a $9.9bn market size value, which will continue in the foreseeable future.

Here, Alex Kozachenko, Chief Product Officer at Data.Bet, delves into the motivations behind betting operators to include esports in their portfolio offerings, their challenges and the keys to maximising return on investment.

The allure of esports lies in its potential to unlock new market segments for operators,

thereby expanding their market share. With a rapidly growing audience fueled by the popularity of competitive gaming, operators are motivated to include esports in their portfolio. Various forecasts indicate substantial growth of up to $33bn by 2032 in the esports industry, incentivising operators to invest in this burgeoning market.

Despite the promising prospects, operators encounter several challenges when integrating esports into their betting lines. One signi cant hurdle is aligning esports with the operator’s brand identity as a product. The decision to introduce a new product feature must resonate with the existing customer base to avoid resistance and low adoption rates.

Additionally, the cost of acquiring or developing esports products, including trading and risk management, presents a considerable investment for operators. To navigate these challenges effectively, operators often choose to obtain data from trusted partners, reducing costs and ensuring a high-quality product.

The timeline for recouping expenses and achieving profitability hinges on various factors. Considerations include the type of esports product acquired from providers, with higher quality typically correlating with more extended payback periods. Marketing expenditure further complicates the equation, as the e ectiveness of campaigns directly impacts customer engagement and uptake of esports betting options.

By investing in targeted marketing campaigns and fostering constant communication with users, operators can

accelerate the recoupment of expenses and drive profits. Strategic alignment of esports within the overall product portfolio is paramount. Opting for specialised providers, robust marketing strategies and consistent customer engagement constitute a winning formula for business success in the competitive esports betting landscape.

Esports offer unparalleled flexibility, with matches conducted online and accessible remotely. Unlike traditional sports, esports are not bound by physical locations, driving substantial growth within the industry. Data providers continually innovate engagement tools tailored to enhance player interaction and increase engagement, propelling industry growth.

Furthermore, its appeal to a young, educated audience expands bookmakers’ reach, while its strategic depth attracts highly engaged bettors, influencing betting trends. Collaborating with influencers, famous sports players and league ambassadors further solidifies brand loyalty and strengthens connections with the audience.

The future of betting lies in esports and operators should embrace this transformative shift to remain competitive and position themselves for success in this rapidly growing market. With strategic partnerships, targeted marketing and a commitment to quality, they can easily unlock the full potential of esports integration and chart a course toward sustained growth and pro tability. Now is the time for the industry to seize the opportunities presented by esports and pave the way for a new betting era.

DS Virtual Gaming has been expanding its presence in different markets since its launch in Austria in 2005, with Latin America as its most recent prospect. Our team’s constant efforts towards developing and improving products & services have made us a top provider in the field of virtual sports betting and online games. Our charismatic and traditional titles such as RacingDogs, RacingHorse, RacingKarts and Kickboxing, along with multiple betting options, are some of the highlights of our product portfolio. To ensure the best experience for our players, we have a localised teams that provide fast and customised solutions to suit their needs. We understand the challenges of each market, and are pleased to see the enthusiastic and successful acceptance of our Greyhound and Horse Racing product in the Latin American market.

As a company, DS Virtual Gaming is committed to providing the best experience for our players. Our pre-recorded videos are of the highest quality to give a sense of reality during their betting time. We also offer attractive odds and enhancement tools to bring greater excitement to bets. DSVG games are designed to give players the best bang for their buck through a friendly RTP that helps achieve long-term success.

We understand the importance of speed and simplicity in the betting process, which is why we’ve developed a user-friendly system that allows players to set their bets through their mobile devices in

just three simple steps for a seamless and enjoyable betting experience. We are also very proud to bring our latest technology that simplifies management systems for operators and administrative teams. Our devices can display pre-recorded videos 24/7 requesting only 1-2 mbps, guaranteeing a seamless transmission of events in betting shops. Our “Online Retail Solution” reduces the acceptance betting system by using a QR code, allowing players to scan and participate in the betting process, ultimately solving the problem of queue times and increasing the number of bets placed. Our localised technical team in Latin America is also available to provide support/assistance to operators and cashiers.

As part of our expansion strategy in LatAm, we licensed our games in the Colombian and Panamanian markets. Recently, we have received our certification for the Peruvian market, becoming the first virtual gaming provider to be certified. Our engagement with the expansion in this market involves hard work to understand the need of operators and players to apply our knowledge of the product. LatAm is a promising market for the betting industry, with a population of around 650 million inhabitants, 70% of whom have access to mobile devices, and 50% are part of the working sector. This has led to significant growth in betting activity in countries like Brazil, Mexico, Colombia, Peru, Chile, Ecuador and more. We recognise that

there are two segments of players in the market: conservative players who are used to traditional games like racing, bingo and lotteries, and young players seeking more attractive gaming options with state-of-theart graphics and devices that allow them to play from anywhere. We believe these two segments complement each other and will continue to drive market growth in LatAm.

Finding the right balance between innovation and a conservative approach is key to success in any industry. At DS Virtual Gaming, our mission is to do just that. We bring the logic of the segment as it was planned 20 years ago, while staying one step ahead technologically. This helps us to not only maintain the acceptance of our games but also to make them more accessible to the younger generation.

Our upcoming exhibitions this year in Latin America will be GAT Cartagena, SIGMA Sao Paulo and PGS Peru, and we have our own individual approach to each market. We think our games will start their winning march in the north of Colombia thanks to the close proximity to the Dominican Republic, where we have become a must-have at every box office. We are bringing back to Brazil WGP, on the basis of which our Kickboxing game is developed. The best sellers in Peru should be Racing Dogs 8 and Racing Horses 7 due to particularly high odds and incredible speed. We fully understand what we have to do to entertain players and we come to you to share our vision.

Meet us at Stand M120 23-25 April, São Paulo

We are bringing back home

Gambling Insider speaks with Itsik Akiva, an iGaming expert & consultant, about the rise of the “multi-billion-dollar” sweepstakes casino sector in the US, and what this could mean for the wider industry

When you say sweepstakes, in the UK we might think of sports like football or horseracing. Can you explain just what you mean by sweepstakes in the casino context?

In the US, for something to be considered gambling, it needs to meet three requirements –prize, chance and consideration. Prize means winning something of value, consideration means payingto participate and chance meaning that chance determines the outcome and not skill, or other factors.

Normally, free-to-play social casinos don’t deliver any prizes and therefore they’re not considered gambling. However, sweepstakes casinos operate a little differently. As a way of promoting

the sale of virtual coins, a sweepstakes casino will award purchasers with free sweepstakes entries which are offered in the form of sweepstakes coins. These coins can be played on casino-style games which act as the sweepstakes and any winning may be redeemed as cash prizes

So if you’re a sports betting operator in Europe targeting the US, and you’re thinking ‘this could be a good addition for us,’ how would you go about attaining a licence for a sweepstakes casino?

This model is not required to be licensed, which is part of the appeal, because like I said it’s not defined as gambling. As such, it doesn’t fall under the jurisdiction of the different regulators in different states. When

we do that, we obviously need to obtain a legal opinion, and the legal opinion will analyse the legality of this.

So the legal opinion works as a statement from one of the company’s officers. We’ll present the model to the lawyers, and they’ll respond that, based on their analysis, this does not conflict with any of the gambling or other laws in different states. So you go to a stateby-state analysis with all of the different aspects of the business model. When it comes to casinos the legal analysis is fairly straightforward. For the different peer-to-peer games. There’s a bit more of a conversation that needs to be had, but we’ve seen it happen with both bingo and poker.

As for sports betting…here I believe

in taking a more conservative approach in order not to conflict with the Wire Act and other federal and state laws, specially with sports betting being regulated in the majority of US states. These laws talk specifically about sporting events and, therefore, if you offer anything that has to do with sporting events, you may be associated with that category and may be in conflict with some of these laws. And this is an area that you need to be more cautious about, because there we are not only getting into legal exposure on a state level but possibly also on a federal level. So sweepstakes are ideal for casino sites in the US – but not for sports.

What’s the best advice you can give for somebody looking to get into the sweepstake casino model?

I’ll paraphrase advice that a lawyer gave me a while back: You need to make sure this is legally defensible. Understand what are the legal boundaries of the sweepstakes model and ensure not to cross into the definition of gambling. Secondly, if you are a company that may be in a position of acquiring licences in the US, you may face a regulator that will say, “What is this sweepstakes thing? I don’t understand it. We’re not gonna give you a licence because of that.” So this is where it may become a little more risky.

However, many content providers that hold licences in US states did their ownanalysis and realised that they are not exposed. They can do both. They can provide the content, both sweeps and casinos, while still maintaining their licence activities.

In the US, we even have this one major studio called High 5 Games. They’ve really converted their free-to-play social casino into a sweepstake model and they’re running with it quite aggressively. So it just tells you that there are major tier-one licensed providers that capitalise on this model. We may not see licensed brick-and-mortar operators entering the space, but we can certainly see online organisations that make it a part of their strategy.

You mentioned that you don’t need a licence for a sweepstake, and that that’s part of the appeal. But could it get to a stage where in two-three years, if the industry booms, a regulator says ‘hey, these guys are making a lot of money off sweepstakes. We need to start licencing this.’ What happens then? Definitely, yeah. In my opinion, this is probably an inevitable outcome, and we’ve seen it before with daily fantasy sports. Although, it’s slightly legally

different because the argument was that fantasy leagues were carved out of theUIGEA and that they exploited that to turn it into a model that is very close to gambling.

But that legal argument didn’t really hold up once it became big, and once they pushed the envelope a little bit, all of a sudden the lawmakers started to look into it. That can certainly happen here, too, and this has to do with the maturity of sweepstakes operators and how they conduct themselves.

How fast is the sweepstakes industry growing?

Sweepstake casinos have been steadily growing over the past decade, but they were kept under the radar to the point that most people in the gambling industry weren’t even aware of them. And then it changed around the Covid-19 pandemic, when there was a huge explosion of interaction. At that time, the marketplace had maybe 50 operators. Since then, we’ve seen an influx of around 50 new operators now, and they keep growing. So that will definitely bring attention and discussion of responsible gaming issues to the forefront.

So, if there were going to be any issues with sweepstakes casinos, would this be enforced by state governments? I will say that, in my opinion, and this is what I’ve been hearing, it is less likely to be addressed on a federal level. I don’t expect something like that to happen. If anything, it’s going to come on a state-by-state basis. And that’s a process that takes time. It can also be challenged through payment providers and the credit card companies. They are usually on board as long as you come with a proper legal opinion and you meet their requirements when it comes to adequate responsible gaming policies and tools, complying with AML laws, and ensuring that your KYC procedures are effective in detecting and limiting underage

and other ineligible players. So if you go with all of these best practices and you pretty much self-regulate, they’re fine, and they’re happy to take part in this growth.

But if we see that more rogue actors are getting into this and the industry becomes more of a Wild West, then that can turn things. So this is where this industry needs to self-regulate and be responsible as much as possible. And I understand, like anything else, there’s quite a lot of money to be made but it has to be done responsibly. I think it will, which would prolong that window of opportunity. Will it be five years or 10 years? That’s a bit hard to say.

I don’t know if numbers might be difficult to project, because you’re talking about the whole industry. But how big are we talking here?

So we have to keep in mind that this industry, as opposed to the gambling industry where we may be looking at turnover or gross gaming revenue, here it’s a bit different because we’re talking about overall purchases. That’s gross revenue: essentially the coin packages sold to players.. And then let’s say the net revenue will be the purchases minus the player’s prize redemption. This is going to be your net. And from there, you start deducting the rest.

Let’s look at Chumba Casino, they also operate other sites, both for poker and casino. I believe the projections show they are going to be exceeding $4bn in annual sales. Sure, that’s not pure profit, but that shows you tremendous volume and growth. So this is definitely a multi-billion dollar industry now, and the expectation is that it’s going continue to grow.

What we’re seeing, and I cannot disclose exact numbers, but I’m seeing new entrants to this market that are definitely growing fast, even doubling on a monthly basis, and reaching profitability quite fast.

“Sweepstake casinos have been steadily growing, but they were kept under the radar to the point that most people in the gambling industry weren’t even aware of them. And then it changed around the Covid-19 pandemic, when there was a huge explosion of interaction”

Brazil’s recent approval of regulated sports betting and iGaming marks a transformative moment for the country’s entertainment sector. With its vast population and fervent sports culture, Brazil presents a potentially lucrative opportunity for both operators and suppliers. Dima Reiderman, Managing Director at BtoBet, shares insights into the company’s strategic approach towards navigating Brazil’s emerging sports betting landscape.

The nal approval from the Brazil’s chamber of deputies for regulated sports betting and iGaming in Brazil signals a signi cant shift in the country’s approach to gambling. For us, Brazil represents more than just a market; it’s a strategic focal point for our expansion efforts. Understanding the potential we believe Brazil presents, we have been proactive in establishing a robust local infrastructure, and we have recognized the need to invest in payment systems, content localisation and ensuring comprehensive coverage of local sporting events and leagues.

By laying this groundwork, we aim to seamlessly integrate into the Brazilian market and position ourselves as a leading provider in the region. Presently, we are in an accelerated negotiation phase with several significant deals and we’re making

ongoing efforts to bolster our team through strategic recruitment initiatives.

One size does not t all when it comes to the Brazilian market. With its diverse population and unique cultural preferences, we understand the importance of tailoring solutions to resonate deeply with local dynamics. This involves more than just language translation; it requires a deep understanding of Brazilian consumer behaviour and regulatory requirements.

With a population exceeding 215 million, Brazil boasts immense potential. By offering fully customisable solutions that align with local preferences and regulations, we’re aiming to enhance user experience and foster deeper engagement with our platform. Recognising the need to be compliant, we strive for our solution to adhere to regulatory standards providing peace of mind to both operators and players alike.

However, success in Brazil requires more than just a strong product; it also relies on strategic partnerships and alliances. We recognise the value of collaboration and have been proactive in forging partnerships with local stakeholders, which we’re looking forward to announcing in the coming months.

While football undoubtedly holds a special place in the hearts of Brazilians, with the Campeonato Brasileiro Série A and a large majority of their biggest stars playing in the major European leagues, Brazilians boast a rich sports heritage, with national pride extending beyond football to encompass MMA, volleyball, basketball and countless other sporting achievements. Our observations, however, extend beyond the realm of sports. We recognise Brazil as a dynamic and diverse market, characterised by evolving consumer preferences and emerging trends. Through continuous market research and analysis, it’s an ongoing e ort to identify patterns and behaviours among players.

This research enables us to adapt our offering accordingly, ensuring what we present our partners in the market remains relevant and appealing to the ever-changing

Brazilian audience. By embracing innovation and responsiveness, we can stay ahead of the curve and enable our partners to have a competitive edge.

As the regulation of sports betting and casino gaming looms, it heralds a transformative moment for the industry. I envision a future where these two verticals leverage each other’s strengths to offer a comprehensive experience. This has been observed in other markets, where the integration of sports betting and iGaming has proven mutually beneficial.

Brazil’s regulatory landscape is evolving, presenting both opportunities and challenges for industry players. While the recent approval of regulated sports betting is a positive development, navigating the regulatory framework will require careful consideration. It’s vital to acknowledge the importance of compliance and work closely with regulatory authorities to ensure every facet meets all legal requirements. It is our intention to collaborate with a wider network of sports integrity groups to ensure consistent monitoring and sharing of information, which helps us in the process of being fully prepared for a newly regulated environment. By closely monitoring regulatory changes and proactively addressing compliance issues, we are dedicated to mitigating the risk and maintaining our reputation as a trusted partner.

No doubt challenges lie ahead, particularly in navigating regulatory complexities and competition within the market. As the regulatory framework emerges, we anticipate significant milestones, such as the finalisation of online gambling regulations and the official launch of the market being the next major steps. These developments are likely to shape the industry landscape in the forthcoming years, presenting both opportunities and challenges for operators. Nevertheless, we remain steadfast in our commitment to the Brazilian market, confident in its long-term growth trajectory, and our ability to innovate and adapt to meet the evolving needs of local players.

How the sports technology company is leveraging its partnership with TDI to provide the industry with more tennis betting content.

By Sophie Thomas, VP, Group Product Operations at SportradarTennis betting is huge. It ranks as one of Sportradar’s top ve betting sports by turnover globally and last year we o ered clients coverage of more than 90,000 matches. From a customer perspective, it’s a simple sport to bet on; there are only two players who can in uence the outcome and the scoring format is easy to follow.

Given its established position among operators and bettors alike, the big question is how to develop and grow the product offering, while elevating the customer experience. That’s the core focus of our multi-year agreement with Tennis Data Innovations (TDI), a joint venture vehicle of ATP and ATP Media.

We’re working together to develop new betting and media products for the market. Our approach combines previously unavailable deep data from the ATP with Sportradar’s proprietary arti cial intelligence technologies to engineer the next generation of valueadd betting products and services.

The first aspects of ATP Service+, the name of Sportradar’s purpose-built suite of tennis betting solutions, went live at the end of December. For the initial launch, our focus was on having the core offering of live data, odds, trading and streaming products available for clients to use.

combined with an operator’s real-time and predicted liquidity, via Alpha Odds, we’re able to provide the best possible way for them to maximise trading e ciency.

use.

In addition to increasing the volume of tennis betting content available on the market, we’ve strengthened the connection between our data and live odds offering, and the streaming world. We know streaming has a positive impact on fan engagement, with live sport increasing customer dwell time on betting platforms. What’s more, studies suggest that sports fans and bettors want data incorporated within streams to enhance their viewing experience, and are more likely to watch if real-time statistics are displayed within a live match.

pure betting perspective, we’ve introduced a raft of

We’ve been mindful of these insights with the introduction of Sportradar 4Sight, our AI-driven streaming technology which transforms the viewing experience for fans by incorporating real-time match data into a live stream and visualising the data as dynamic digital overlays.

Since launch, the team has released several new elements of ATP Service+ to the market. From a pure betting perspective, we’ve introduced a raft of new odds products for operator clients, increasing the number of betting markets they can offer their customers.

the match; for example, ‘points score.’

Our markets are designed to engage bettors throughout the match; for example, ‘points scored after a specific number of games,’ ‘both competitors to win a set,’ and ‘tie break correct score.’

With Sportradar 4Sight we want to create new markets and push the boundaries away from typical in-play betting categories. Historically, 80–90% of tennis bets have been placed on three markets – game, set and match. Fundamentally, the contextually relevant insights displayed within the stream will enrich the sports betting experience, providing bettors with a deeper understanding of what’s going on on the court and help to shape their betting decisions.

We’re also integrating ATP are uniquely tailored to each individual sportsbook and by further

We’re also integrating ATP data into our Alpha Odds solution, which recently expanded into tennis. Alpha Odds provides operators with liability-driven markets that are uniquely tailored to each individual sportsbook and by further enhancing our models with deep data we can engineer sharper prices.

Our partnership with TDI/ATP has gotten off to a strong start, but there’s so much more to come throughout 2024 and beyond. This is a long-term, strategic partnership that will continue to innovate and evolve. Within the next 12 months, the market can expect further new pre-match and in-play markets, including Player and Micros, as well as combining di erent betting selections with Custom Bet.

ATP deep data, which is available for the first time, allows us to predict the probability of an event taking place more accurately. When this is

ATP deep data, which is available for the an

With a global tennis audience of 1.6 billion, Sportradar’s ATP Service+ suite of products provides operators with the tools they need to realise the full potential of tennis betting.

ATP Service+ leverages deep data to provide a next-level tennis betting experience. Captivate your customers with augmented streams, micro markets, short-form video highlights, and engagement tools for 17,000 matches per year.

Visit us at sportradar.com to find out more

With the help of industry experts, Gambling Insider assesses the potential of Brazil’s regulated sports betting market amid a frenzy of excitement and activity in the Latin American nation

It took ve years, but Brazil nally enacted a law to regulate sports betting in late 2023. Sports betting actually has been legal in country since late 2018, but former President Jair Bolsonaro spent his entire four-year term without taking any action to regulate it. It wasn’t until current President Luiz Inácio Lula da Silva signed into law regulations on December 30 2023 that sports betting was finally made above board, opening the floodgates to what will undoubtedly be a lucrative new market.

As Tor Skeie, CEO of OddsMatrix, tells Gambling Insider: “We’re very bullish about it and see huge opportunities across all our product areas, including large sportsbook and casino turnkey deals, that involve multiple products and services coming together to launch or relaunch operator offerings. This includes online casino and sportsbook platform; sports data feeds; esports data and odds; a liate management, and a liate optimisation software and services; gamification; bonus and loyalty features and functionality; localised content and aggregation; as well as bespoke safer gambling tools and services that we have created for tier one customers and that have seen a spike in demand newly regulating and regulated markets.”

Indeed, the Brazilian sports betting market is expected to generate billions in annual revenue. And that is no surprise, given Brazil’s cultural ties to sports (and particularly football). Stephen Crystal, Founder of SCCG Management, tells Gambling Insider: “Sport is big in Brazil. No other country in the world has had the availability of sports on free-to-air broadcasts or digital platforms. Free-toplay games such as Cartola, or informal prediction games between friends (called ‘bolões,’ especially during the World Cup), were part of the sports fan journey for years, paving the way to the enormous amount of players that engaged with sports betting even before regulation. With regulation, sports betting will become even more a part of Brazilian sports culture, so I believe

it can become the number one country in terms of the number of players.”

Marc Crean, OpenBet’s VP LatAm cannot necessarily remember a sports betting regulation that was bigger. He points out that comparisons have been made to the US, but the “key di erence” is that Brazil is being regulated at a federal level and the size of the single market is vast. Indeed, that’s a key di erentiation. As Crean comments, it’s safe to say Brazil is set to become one of the most important territories for key stakeholders within the industry, such is the sheer scale of the user base.

He adds: “Ultimately, regulatory and operating costs will have an impact on the market’s potential size, and it’s likely to result in fewer operators being active. However, we believe it will eventually rank within the top four markets in terms of size. Proposed costs of licences are in line with UK and US costs, and given the 12% GGR tax on operators, as well as 5% tax on bettors’ net gains, the market is likely to generate around R$3bn (US$160m) in revenue for the Brazilian Government each year.”

Skeie, meanwhile, is most excited about potential for growth in the Brazilian market. According to the CEO, Brazil ranks in the top three global sports betting markets alongside the UK and the US with an estimated 42.5 million unique users, while predicted market revenue growth is 20%+ year-on-year. “So to say the opportunity is vast is an understatement.”

Like any market, however, Skeie warns that there will be downsides. For example, the current proposed regulatory structure is likely to be prohibitive for many, according to Skeie, with multi-million dollar licence fees and GGR tax estimated to be 18%, plus other local taxes pushing the total tax burden to above 30%. “It won’t be for the faint hearted at least in the early stages.”

Everyone Gambling Insider spoke to for this story said regulation would be a game-changer for the Brazilian market. Naturally, we are unsurprised! “I believe regulation will provide safety

for big players to invest even more in the Brazilian market,” explains Crystal. “We have seen tremendous growth over the last few years, but it still has a lot of room to develop. Regulation will attract big domestic companies that were afraid of putting existing businesses at risk, as well as foreign companies that need a clear legal framework to commit to long-term investments.”

For Waldir Marques, WA.Technology’s Director of Regulatory Affairs, there has never been a better time to enter iGaming in Brazil. The future of the national gaming market is “very promising,” he says, with the eyes of the world attentive to continuous updates. Brazil’s legislative process towards regulation is a journey that encompasses and establishes the ability to guarantee a “transparent, safe

Tor Skeie, CEO, OddsMatrix

Tor Skeie, CEO, OddsMatrix

and prosperous environment” for the industry with increased tax revenue for the Government, and generations of jobs and income for society.

Understandably, Marque points out that regulation is crucial to combating illegal gambling. He believes the improvement of standards and the implementation of regulations signify the good intentions of the Brazilian Government to develop a regulated and safe iGaming ecosystem, focusing on the integrity of sports, corporate social responsibility, and the prevention of money laundering. The optimism surrounding the regulation of sports betting in Brazil is not unfounded; Brazil’s deeply rooted sports culture and its young, tech-savvy population are the “ideal setting” for a thriving sports betting sector.

He continues: “As main benefits, we can highlight the application of the best international practices in the distribution of revenue from sports betting, significant attractiveness to potential operators, and improved potential for increasing revenue from this modality for the Government, resulting from the increase in transfers via social beneficiaries, such as social security and personal income tax, in the case of awards. For new companies entering sports betting in Brazil, the role of partnerships for operators and providers goes beyond regulatory bodies. Partnerships with local experts are essential. WA.Technology, for example, collaborates with teams of local experts who understand the importance of

differentiated markets. Along with external associates, teams should hire experts within their own organisations who have a grounded understanding of the finer details, underlying needs, and strategies to meet those needs. These alliances optimise player engagement and retention potential This collaborative approach has helped many of Brazil’s most prominent names succeed and strengthen Brazil’s attractiveness as a premier destination for sports betting operations.”

Naturally, the journey towards regulation will have its challenges. Transitioning to a regulated market requires extensive management to ensure companies align with legal standards. Brazil can achieve this success by establishing a comprehensive regulatory framework and a respected, knowledgeable and experienced regulatory body to oversee its implementation. Marques adds: “If iGaming companies follow regulations and brands choose their partners wisely, Brazil’s sports betting market will offer abundant opportunities for expanded success. Regulation attracts investors, companies and actors. Brazil’s regulatory progress is just the beginning of its success in the sector; The power of sports betting is now a driving force in the heart of Latin America.”

presence in Brazil through our agreement with Play7.Bet to power their new offering, we’re excited to see how the market develops. We continue to hold positive and advanced discussions with other operators looking to launch within the country’s new regulated framework.”

Brazil and its people have a long relationship with gambling. In the 1940s, reportedly 70 casinos operated in Brazil, employing more than 60,000 people. But in October 1941, then-president Getúlio Vargas enacted Decree Law 3,688, which declared all games of chance, except federal lotteries and horseracing, misdemeanors. Licensed casinos later got reprieves from their death sentence due to another law enacted the following year. But a few years later, Vargas’ successor, Eurico Gaspar Dutra, took casinos out entirely banning gambling (and the Communist Party) in 1946. In the ensuing decades, gambling faced social stigma in Brazil, but apparently remained popular, at least informally.

“The Brazilian betting market was shaped over informal games between friends for many years,” reflects Crystal. “The penetration of social platforms and communicators in Brazil is bigger than anywhere else on the planet, so I expect that Brazilian players will demand more social features than what is available on the market right now.”

Operators are “hungry to launch” in Brazil, according to Crean of OpenBet. He believes the proposition is an exciting one and a market that is definitely a potential growth area for OpenBet. “Given this diverse country’s renowned enthusiasm for sports, and football in particular, and considering our existing

in particular, and considering our existing

Stephen Crystal, CEO, SCCG Managment

Stephen Crystal, CEO, SCCG Managment

Crean, meanwhile, believes Brazilians’ love of sports should propel interest in sports betting. He says: “The country’s obsession with football will inevitably see the sport rank as the biggest betting opportunity. Naturally, it means popular products like BetBuilder will resonate with a wide audience and become an imperative component of the sportsbook offering. Elsewhere, mixed martial arts are extremely popular in Brazil. We are in a unique position to offer the industry’s first UFC BetBuilder product, demonstrating the power of the Endeavor network. Engagement levels with LatAmfacing operators for the product have been very impressive and we expect this to grow as we roll the concept out in Brazil’s regulated market.”

Still, there’s much to be learned about the Brazilian player. Skeie tells Gambling Insider that the market is still gaining insights into customers, but what has so far been discovered is that a significant portion of sports bettors see themselves as experts and bet to make a living. For those who were active in the UK market 12-15 years ago, this will ring a bell.

“Given this, pushing a one-size-fits-no-one product onto these bettors will not drive up retention rates,” says Skeie. ”At EveryMatrix (OddsMatrix’s parent company), we’re concentrating on developing automated

solutions that enable operators to treat their customers as individuals. For instance, our AI recommendation banners ensure that when customers visit the sportsbook, they immediately see recommendations based on their past betting activity, ensuring a fast and seamless experience. We’ve also observed that, besides football, basketball and volleyball are popular sports for betting.”

Already, operators are studying the Brazilian market, trying to determine how its will di er from other sports betting markets across the globe. Indeed, according to Crean, understanding that Brazil is a unique territory is very important. He believes the country’s cultural, social and economic dynamics will have a significant influence on the types of products, operations and marketing activities the industry develops. Key trends such as the unprecedented consumption of social media and capillarity of Brazilian industry will drive innovation forward.

He explains: “The need for a local product is important, but it also needs to be underpinned by regional marketing and operation initiatives, which are often overlooked by companies when entering a newly regulated market. With a proud heritage of entering new sport betting markets for over 25 years, OpenBet is well

positioned to have a strong presence in Brazil.”

Crystal, for his part, sees the market as not all that different from others worldwide, although he acknowledged that marketing to Brazilian players will have to be different. He sees a “very commoditised” product o ering between platforms currently available in Brazil. According to Crystal, di erentiation comes only in terms of marketing and bonus o erings. That is another principle that will ring a bell with those familiar with the UK market... As Brazilian sports betting evolves, consumers will demand more di erentiation in terms of product o erings, and Crystal believes that those who understand the “extremely social” nature of the Brazilian audience and its need for social entertainment will capture more value, both in terms of market share

and loyalty.

Skeie expects the Brazilian market to develop much like other markets have – in its own way. Like bonzai trees,

admittedly a lesson told in the Karate Kid movies... “It’s a similar story to many other emerging markets; localisation and understanding the culture and players is key; being 110% ready for compliance and adaptable to regulatory changes is vital; and having experienced ‘boots on the ground’ experts who speak the language, who can operate in the same time zone and who are connected to the right people is essential. This is further heightened in Brazil as many either simply don’t understand LatAm as much as they think they do, are not prepared for compliance or the costs involved, or they don’t have the expertise in place to manage operations locally.”

However, Skeie warns that, while many providers talk about their excitement for Brazil and Latin America, the majority “are simply not ready.” The key with any rapidly regulating market is simply to be fully ready, the CEO remarks. And, indeed, there is plenty to be ready for, as all of our contributors have noted. Bem vindos ao carnaval.

“Sport is big in Brazil. No other country in the world has had the availability of sports on free-to-air broadcasts or digital platforms. Freeto-play games were part of the sports fan journey for years, paving the way to the enormous amount of players that engaged with sports betting even before regulation”

Freeof sports way of

Waldir Marques, Director of Regulatory Affairs, WA.Technology Marc Crean, VP, OpenBet

Waldir Marques, Director of Regulatory Affairs, WA.Technology Marc Crean, VP, OpenBet

Stéphane Pallez, Chairwoman and CEO of La Française des Jeux, speaks to Gambling Insider Editor Tim Poole about the French operator’s sports betting performance, a “big sporting year,” working with the ANJ and, of course, this year’s big-ticket merger: FDJ’s offer to buy Kindred Group

In 2021, you featured in Gambling Insider’s CEO Special. How do you re ect on life at FDJ since then? Well, it’s been a very exciting period. I think it was in 2021, so we were just coming out of the Covid-19 crisis. I think we were very much in the transition to a normal period. And I think the first element of satisfaction after this, or even during this period, is that we were able to come through this period with strength in terms of digital penetration, increasing growth and performance.

So I think the first thing I could say

about those years, based on this, is the solid performance that we’re able to draw from our current activities. We have engaged a new phase of the development company because, of course, we’re going to talk about Kindred further on.

But before Kindred, let’s talk about how we diversified and developed the company. First of all, we bought the Irish National Lottery operator, and we also bought some assets to develop our payment and service activities. So we’ve been developing the company with new assets in new businesses. It has been an exciting journey.

And, of course, Kindred is a continuation of this journey, but at another scale.

Kindred is the big story and I would be remiss if I didn’t ask you about it. But before we move on to that question it’s probably worth pointing out that you’ve been CEO for several years now. That is quite an achievement given the average lifespan of a CEO can greatly vary. It’s a testament to the consistency of the company. But it also means my

Board and shareholders are happy with performance. As a matter of fact, I was appointed first as the CEO in 2014, to prepare for the privatisation and IPO of the company. By November 2019, the IPO of the company and privatisation was a big success.

Now, on the basis of what we’ve been building, my continuation will be proposed during the next General Assembly of FDJ on April 25. Part of this will be the proposal to renew my mandate for four more years, and I, of course, hope this will be accepted. So it’s a part of the success of the company to have gone through this strategy with the continued team. Not only with me, of course, but with the whole team.

You’ve already mentioned your acquisitions of Premier Lotteries Ireland, while FDJ has also bought horseracing operator ZEturf. With Kindred, there are obviously plenty of questions I can ask! To start o with, what were the opportunities you identi ed that assured you this was the right choice?

I think it was based on the strategy that we explained to our capital market in November 2022. We have been very clear about our willingness to look for international assets to diversify the company further. So we have been looking at different assets and opportunities. Kindred is, of course, a

company we have known for quite a while. Not only were they already present in the French market, there then came the opportunity with the fact that the Board of Kindred launched a strategic review in April 2023. So it gave us the opportunity to have a deeper dive at the company, at its business and at its technology. Of course, we had an intense conversation with the management and the Board of the company, too.

We took our time to make our judgement. This asset has a strong character that we are looking for in terms of international presence. It also has some key markets in terms of brands, in terms of technology, and, again, in terms of its teams; because this is all really part of what we buy. Of course, we were also able to form a price about the value of the company that was compatible. The Board was willing to accept the fact that we were able to make an offer that was recommended by them, with commitments from five of the main shareholders also making this deal possible. So it’s an alignment of the planets. Now we are entering the offer period. So we are not the owner of the company at this point. In fact, right now, we are even competitors in some markets, including the French market, so we have to abide by competitive rules to proceed. But we are very confident in our capacity to complete this deal.

How will the merged organisations operate? It’s obviously at an early stage, but will Kindred have autonomy or are there plans to change things up? You’re a little bit ahead, there! (Laughs). But I strongly believe that if we do this deal, we will create a new group, a very di erent group with which we have around 20% of activity outside France and around 20% of its activity will be in the online gaming business (based on current gures), so it’s a very different group. We intend to use Kindred as a strong asset that will become the core of our activities in online gaming both in France and outside of France. So I think the question is not whether it will stay independent or not, the question is what kind of new group will we form together?

A couple of follow-up questions on that. Obviously, there are other things than Kindred we will discuss later... But you talked about planets aligning. Was it very bene cial that Kindred had already decided to leave the US market?

In regards to your point about the US market, yes, it’s true it was among the elements that made the planets align. I think the fact that Kindred announced its withdrawal from the US market did contribute to the alignment and to our capacity to make the deal. I think it was quite a rational conclusion. At this point, there was no real visible perspective

of the benefits of their investment in the US. If we were to buy Kindred without the decision, we would have closed the US business ourselves probably. So the fact they announced it and are in the process of implementing this decision is a positive element into the picture.

Where do you think the new group can rank? Obviously, I understand you can’t be too speculative, but looking at massive groups like Entain and Flutter, these are some of the biggest in the industry. What are you looking to produce on a global basis?

We want to address the European

market because this is at least, first, where we believe we have a natural positioning, natural complementarity, better knowledge and capacity to build a very strong European leader. So in that sense, it’s not obvious to compare us to a group that has a strong US position as some of the ones you mentioned. We want to be among the leading groups in Europe.

I recently spoke with Isabelle Falque-Pierrotin, the Chairwoman of the Autorité Nationale des Jeux (ANJ), and I find how operators work with the French regulator fascinating. I explained to her

that, from a UK perspective, the fact that operators have to submit an advertising strategy to the regulator in advance is a completely alien concept. From your side, what’s it like working with the ANJ from the operator side?

Well, you know that FDJ is the biggest company in the French market. In addition to that, of course, we are the company that has exclusive rights to the lottery and also the point of sale sports betting. So, by definition, we have a strong interaction with the regulator. This is part of our job, and this is part of our business. We have a strong interaction with this regulator that has been created in the context of our privatisation.

So it’s something that FDJ has seen as it’s evolved as a listed company. We are definitely the company that I think has the most numerous authorisations to get from the regulator. I’m not going to tell you I like it, but I’m going to tell you that it’s a mirror of the fact of our position in the market, which is a strong position.

I believe that if you want to be successful in this activity, you have to be able to manage the relationship and use the regulation as something positive for your business. When you talk about responsible gaming, we believe hugely in responsibility in our business, because if you’re not able to manage this with the vision within your business, you’re not going to be successful in the long term. So, yes, there’s a lot of tight regulation, and again, as any operator, we submit our ad campaign to the ANJ. I’m not going to tell you whether it’s good or bad, it’s just a fact. When you look at our results, you’ll see that we’re able to manage this and be a very successful operator. So that’s part of our business.

That is certainly a respectable position. Over the next few questions, I wanted to focus on sports betting in particular. If you take the potential synergies with Kindred aside, do you feel FDJ performs well in sports betting, and where could you improve? Firstly, we’ve had very good results in our sports activity this year. And I think it shows in our results. We were able to strike a very goo d level of growth, in fact, over 10% growth in GGR. But also, we are very proud of the fact that, as of today, in the online sports and gaming French market, we are actually able to increase our market share. We believe it’s linked

to the fact that over the last few years, we’ve definitely invested in this activity. We invested with the vision that, to have competitive sports betting activity, we had to become a global online operator in the French market. This is what we are aiming to do, not only by creating a popular offering, but by being open to competition for the online market in France. So we invested in the quality of our customer service, the quality of the app, the quality of our offers.

However, we are the number four in the French market today. So with all of this effort and performance, I think that there comes a question of what Kindred is bringing to us. If you look only at the French market, definitely Kindred is an opportunity to grow our market share. It’s also an opportunity to improve our brand, our customer relationships and to improve our technology. So, I think this alone isn’t a sufficient reason for buying Kindred, but it’s part of the positive impact we expect. I think more generally speaking, we believe that to be a competitive operator in the online market today does require sufficient scale to invest in the long term, to invest in brand and technology and in consumer relations. When you look at how the market has been structured in recent years, you can see the emergence of big players that have invested in proprietary platforms and technology.

At FDJ, we have invested in strong brands, and we believe that if we want to sustain this activity, on a profitable and sustainable basis, we need to be at a higher level. So I think Kindred is really the conclusion of this vision. We believe in the vision we see from the current market today and we hope to be able to implement it with this acquisition. But it will be in 2025, because we’re going to need most of the year to complete the acquisition.

Sure. I wanted to ask you about FDJ’s share price. It peaked in 2021 and has fallen since. But this year you’ve seen a healthy increase. As the CEO of the company, how do you reflect on that? Obviously, it’s not the only metric to judge your business by, but it’s an important one. Well, I think you described it very well. The evolution of the share price in 2021 – clearly, we benefited from the fact we were able to manage the Covid-19 crisis and come out stronger. So I think the share price did reflect that there was clearly a change of vision in terms of risk, with the announcement of the inquiry of the European Commission on potential state aid. That

was in July 2021. This is clearly where things change.

After that, our shareholders have definitely been quite happy with the devolution and the business performance of the company. But I have been waiting for a conclusion of this inquiry, because they don’t know how to price the risk, which is absolutely fair – even though we are very confident about the fact that this should not be a big risk for the company. But that’s what has been happening since. Now I think what is very interesting, and it’s not always the case when you announce a big deal: when we announced the Kindred offer at the end of January 2024, there was a positive reaction from the shareholders. So they were interested.

And I am convinced by the fact that, if this deal goes ahead and is executed well, in terms of using it to develop our strategy and synergies, it is a very attractive deal for our shareholders, which has the potential for more value creation. This is what we explained during the announcement in terms of the potential increase in our revenue per share for the shareholder. And, again, I think the reaction showed they were convinced by this potential. So we now hope to be able to realise this potential and to gain more value from it in the meantime, for our shareholders and for us.

Brilliant. A final question from me – you already mentioned a big job for this year will be the offer for Kindred. But in terms of the rest of 2024, what kind of goals remain for FDJ? What are you aiming for for the rest of the year?

Firstly, we want to continue to meet the commitments we have taken in terms of financial guidance within our current plan. So we aim to show that, during

the offer period, we can continue to manage the company, and gain growth and increased profitability to reach our target for 2025. And, of course, with Kindred, we will be in a position to set a new perspective for the medium term. So one is to fulfil our guidance for 2024. Second, in the meantime, is to complete the Kindred transaction – which means to convince Kindred shareholders our offer is a good offer. It seems that the indications are going very well in this direction, so we’re quite confident. But of course, we need to complete this.

We also need to get agreement from the anti-trust authority in France, as it’s an important topic. As we mentioned, the Kindred deal will also give us more opportunities to grow our business in France. So it’s important to fulfil this goal too; we are preparing the rules we have to abide. But we are preparing for this new group that we want to create with Kindred and the objective we will set ourselves for the year to come. So it’s going to be a busy year. And on top of this, of course, we have the Olympics and Paralympics in Paris. Of course, London, is the major benchmark we want to beat. You always want to beat your competitors. So, we hope to succeed in the Olympics and FDJ has always been very active in sports. It’s very kind of you to compliment London.

It’s always nice for an Englishman to hear that we serve as inspiration for France...

I only talked about the Olympics! (Laughs)

Yeah, I mean, given what happened at the World Cup… Just down the road in Germany, we’ve got the Euros coming up this summer as well.

Absolutely. It’s a big sporting year.

“It’s an alignment of the planets. Now we are entering the offer period. So we are not the owner of the company at this point. In fact, right now, we are even competitors in some markets, including the French market, so we have to abide by competitive rules to proceed”

In this Sports Betting Focus issue, Betby provides Gambling Insider with an in-depth analysis of sportsbook statistics within the dynamic and rapidly evolving landscape of the Latin American region. Through an exploration of data trends and forecasts, we gain valuable insights into the transformative journey of the Latin American sports betting market, its current state and its promising future.

Amid this broader market expansion, sports betting has emerged as a signi cant growth driver within the Latin American gambling landscape. The data reveals a substantial increase in sportsbook GGR, rising from €0.7bn in 2016 to €2.1bn in 2022. Projections indicate that this growth trajectory is set to continue, with GGR expected to reach €6.9bn by 2028. Such exponential growth underscores the strong demand for sportsbook offerings in the region, positioning it as a highly pro table segment for companies operating within this space.

The Latin American market for sports betting has witnessed a remarkable surge in recent years, underscoring its growing prominence within the global gambling industry. From €7.7bn ($8.35bn) in total gross gaming revenue (GGR) in 2016, the market has expanded significantly, reaching €12.4bn by 2022. This represents a substantial €4.7bn increase over the span of just six years. However, perhaps more compelling are the forecasts for the market’s trajectory up to 2028, which suggest even more remarkable growth. With the regulated Brazilian scenario as a key driver, projections indicate that the market could nearly double from its 2022 total GGR. Such forecasts highlight not only the market’s expansion in terms of size and geographical reach but also its increasing monetary value, driven in part by ongoing regulatory reforms across various countries in the region.