73 minute read

REVIVAL

With contributions from The Innovation Group and the American Gaming Association, Tim Poole profiles the revitalization of New Jersey’s gaming industry – a recovery that was far from certain in the not-too-distant past.

As detailed in this issue’s From the Top column, New Jersey gaming is currently thriving. Online gambling and sports betting growth statewide is such that land-based casino revenue declines – unavoidable due to the COVID-19 pandemic – are being almost completely offset. Before coronavirus, New Jersey was on a sharp upward trajectory – and since, it has done as well as any other major gaming jurisdiction to stand tall during such an unprecedented era. Given the restrictions and limitations imposed by a global pandemic, the performance of Atlantic City casinos has been extremely strong on a relative scale.

But there was a time when such financial solidity was nowhere near guaranteed. While executives we have spoken to have pointed out “rags to riches” is perhaps an unfair reflection – Atlantic City has traditionally been the second-biggest US gaming hub after Las Vegas – it’s no secret the Garden State has undergone a complete revival over the last few years. If you think gaming percentage falls have been bad during COVID-19, just think how much higher they would have been had the pandemic hit a decade ago, when New Jersey gaming had a far bleaker outlook.

In many ways, a fairer comparison would look at New Jersey before coronavirus, when it was leading regulated gaming’s charge across the US. Even during the pandemic, though, records have tumbled for its digital casinos and sportsbooks; a feat it would have been difficult to foresee during a period when property closures were the biggest news items on Atlantic City’s agenda. So how did the jurisdiction turn things around and recover so well? And can the region offer a blueprint to other states looking to generate extra tax revenue to help recover from the devastation of COVID-19?

AN ALL-TIME LOW

In examining the New Jersey story, several key factors stand out, like the overturning of PASPA, the role of the regulator and the rise of online gaming. But to fully understand the state’s recent journey, we must first ascertain exactly where New Jersey gaming was historically. At The Innovation Group, Thomas Zitt, EVP and Brian Wyman, SVP, operations & data analytics, have collaborated with Gaming America to evaluate New Jersey’s modern history. Following positive projections in the 1990s, they conclude that by 2006, the market’s downward trend meant a confidence crash.

Initially, the outlook for New Jersey’s gaming hub was positive from the mid-1990s, when gaming revenue was in the $3.5bn range through the mid-2000s and a high water mark of $5.2bn was reached in 2006. According to The Innovation Group, much of the lift during this period resulted in substantial capital investment in the market, disproportionately stimulated by Borgata’s market entry in 2003 as the region’s first modern destination resort, whose president & COO, Melonie Johnson, features later in this issue. A 7.5% market lift that year can largely be attributed to the property.

But as Zitt and Wyman tell Gaming America, the reality of future regional competition subsequently set in: “Concerns about the market were most substantial as Pennsylvania began opening properties in 2006. This new competitive market next door resulted in a 4.6% decline that year and a 5% decline the following year. 2006 ultimately was followed by 10 consecutive years of decline exacerbated by the Great Recession beginning in 2009, and then Maryland and New York City opening their first casinos between 2010 and 2012.

“During these years of competitive expansion, The Innovation Group predicted the market would drop by nearly $1.5bn to $3.8bn as a result of initial competition from Pennsylvania, New York and Maryland. But then came the Great Recession, and by 2015 the full impact of regional competition and economic devastation was felt. 2014 brought the closures of the Atlantic Club, Showboat and Trump Plaza, and the proverbial nail in the coffin came in September 2014 when Revel, meant to be the new shiny object in Atlantic City, closed its doors. Declines of 14.7% in 2014 and 21.3% in 2015 left

Atlantic City gaming revenue at a mere $2.4bn, a more than 50% decline from its 2006 peak of $5.2bn. Confidence in the market was at an all-time low.”

It is perhaps poetic that Revel has since been reborn as the Ocean Casino Resort, now under the leadership of Terry Glebocki, who will also feature later in this edition. In our US CEO Special in the fall last year, Glebocki spoke of Ocean’s revival, something that has mirrored the wider New Jersey recovery. And yet, as The Innovation Group’s research shows, New Jersey’s odds of rising above its neighbors as a beacon for regulated gaming looked rather slim 15 years ago. Contrast that near-$3bn revenue drop to the state’s latest figures and you paint an entirely different picture.

PASPA: A BRIGHT SPOT FOR THE ENTIRE INDUSTRY

So where did the recovery begin? Was it when PASPA was overturned in May 2018, the most historic event in modern US gaming, which paved the way for the legalization of sports wagering? Thanks to the campaigning of then-New Jersey Governor Chris Christie, among others, it was not as though this landmark event happened overnight. Several executives have spoken to Gaming America about following this case throughout and judging the mood enough to expect a positive outcome, thereby being ready to launch as soon as possible. The success of sports betting markets across the US since has

THOMAS ZITT BRIAN WYMAN

demonstrated the ruling’s significance, despite the gavel only landing two and a half years ago.

“The overturning of PASPA has been a bright spot for the entire industry,” comment Zitt and Wyman. “We’ve gone from commentators subtly dancing around betting lines to a media frenzy around sports wagering. Ten years ago it was inconceivable there would be betting-oriented segments on SportsCenter or programming on The MSG Network focused on in-game wagering. New Jersey certainly benefitted from being one of the first states to market, particularly by bringing guests to Atlantic City from the greater Philadelphia market, where sports betting wasn’t yet legal. New York bettors also crossed the border to wager, but they had the Meadowlands as a closer option, so the benefit to Atlantic City was disproportionately from Pennsylvania.”

It’s worth noting that the openings of Ocean and Hard Rock (formerly the Taj Mahal) coincided with the introduction of legalized sports betting, providing a significant boost to Atlantic City visitation. The Innovation Group analysts note that even going into early 2020, year-on-year average growth was still in the high single digits. But that doesn’t detract from sports betting’s impact, they conclude: “We’d say Atlantic City has benefitted greatly from property openings, but the availability of sports betting made it a lot easier for people to decide to go ‘down the shore’ to check out the new properties. This has had a lasting impact and really launched a revitalization of the Atlantic City market.”

Revitalization certainly seems the key word here. And sports Commission and the Swedish Gambling Authority are seen wagering has played a massive role in that process, mirroring as some of the industry’s toughest, while the Malta Gaming its impact across the US as a whole. For land-based properties, Authority is viewed as more pro-industry. Across the US, the appeal is both obvious and wide-ranging. Televising major meanwhile, attitudes toward gaming can vary from full sports events and offering lines on them creates a whole new embrace to reluctant acceptance and even total opposition. audience for casinos. Rather than cannibalizing table game But there is a key distinction worth making: while several revenue, casinos have found this new audience not only states have legalized gaming under more stringent creates a segment in itself (sports betting) but adds revenue conditions, they may have lacked the foresight to across all other segments: table games (for those who actually help their market thrive. That’s not to say all can be cross-sold), food & beverage, entertainment and, gambling policy should be laissez-faire – far from it – fundamentally, hotel visitation. but there is a balance to be struck.

All in all, it’s difficult to downplay the role of sports betting Feil says: “I think what the DGE really does well is balance in the New Jersey revival. Jessica Feil, senior director, their regulation with being part of an industry that is an government relations at the American Gaming Association, economic driver, tax revenue generator and employer. They’ve feels this importance should be underlined. She tells Gaming balanced the need to ensure certain regulations are in place, America: “Not specific to Atlantic City but generally, what we see like diligent licensing, background checks, compliance in our research is sports betting recording, and those sorts of attracts a different and newer consumer to products. So there’s “DECLINES OF 14.7% regulatory standards that give the consumer and public confidence really an opportunity to grow IN 2014 AND 21.3% IN in our industry with the ability for that consumer into other areas of gaming and entertainment, 2015 LEFT ATLANTIC the industry to work with them directly. They learn from one eating out and other things like that at properties.” CITY GAMING REVENUE another about what the industry is looking to do, but also their AT A MERE $2.4BN, regulatory policies and objectives THE ROLE OF THE REGULATOR Yet without the state’s regulator A MORE THAN 50% as well. They are always so receptive to the industry in terms and lawmakers, there can be no sports betting, no gambling of any kind and even no Atlantic DECLINE FROM ITS 2006 PEAK OF $5.2BN. of us educating them on priorities and new initiatives.” The key characteristics of City. While this is true of any gaming jurisdiction, New CONFIDENCE IN THE the framework are notable, with credit due to New Jersey’s Jersey’s regulator specifically, MARKET WAS AT AN lawmakers and not just its the New Jersey Division of Gaming Enforcement (DGE), ALL-TIME LOW.” regulator here. Companies that operate online must be aligned has aided market growth as much as possible, arguably the – ZITT AND WYMAN with a land-based casino (a simple policy that has had very purpose of a regulator. tremendous benefits for casinos), As Feil explains, this brings us to while sports betting licences another crucial factor in the region’s recovery. are priced at $100,000. By comparison, Illinois offers some of

“The one thing I have to say about New Jersey overall the most expensive licence fees in the country, with online-only is that the regulator’s focused on being leaders in the licences costing operators $20m. Retail sports betting revenue industry and partners with the industry overall,” Feil says. is taxed at 9.75%, with mobile revenue taxed at 14.25%. Again, it’s “They understand how the gaming industry supports worth comparing this to neighboring Pennsylvania, where communities, local economies and the economic force we gross sports gaming revenue tax adds up to 36%. Outside are. They also understand the need to balance regulation of sports wagering, New Jersey casino gross revenue of the industry with the regulatory flexibility to innovate, is taxed at 8%. create new product and be first in class in what we do. Their “The tax rate is absolutely key,” Feil observes. “That’s a efforts to make the state a leader have put them to the front testament to the legislator’s understanding of the gaming of the pack in so many ways.” industry and sports betting on a deeper level, putting a tax rate

Throughout the world, regulators have developed in place that drives tax revenue but leaves the industry space contrasting reputations. Great Britain’s Gambling to reinvest in and innovate sports betting. Both the legislators

and DGE are very thoughtful about ways to create a competitive marketplace and create opportunities for operators, land-based and online alike. More generally, on the regulatory side, DGE is very focused on an outcomesbased approach. They set forth regulations that outline the objectives and goals of the regulatory system, rather than dictating certain processes that should be in place; and then give operators and suppliers the ability to create the best way for them to meet those objectives.”

DIGITALIZATION: MOVING WITH THE TIMES

It’s not just sports betting that has surged in New Jersey, however, with online betting more specifically helping transform performance levels. In embracing mobile wagering, the state has shown a foresight others have fallen well short of. Throughout past issues of Gaming America, we have assessed American attitudes toward digitalization. It’s not the future – it’s the here and now. But the issue is accepting this reality. In New Jersey, that acceptance has been resolute, with online sports betting accounting for the vast majority of handle. Online casino win, meanwhile, has come as an absolute revelation to anyone doubting its worth. Two prime examples came in November: Borgata’s internet gaming win was $23.4m (a 185% year-on-year rise) while land-based win was $36.6m (down 38%). Golden Nugget’s online success was even more emphatic: internet gaming win grew 38% to $26m, while landbased casino win was $8.7m, down 49%. In both November 2019 and 2020, Golden Nugget’s internet gaming win exceeded its retail casino revenue.

Zitt and Wyman explain: “New Jersey has been a great success story for online gaming, particularly during the pandemic. Online gaming, including online sports betting, gave brands a way to connect with guests and generate revenue while physical casinos were shut down. In general, operators in New Jersey have indicated little to no cannibalization of brick-and-mortar guests, suggesting online gaming is viewed as an entirely different bucket of entertainment spend than physically visiting casinos. The online channel also allows operators to interact with those who don’t physically go to casinos and to bring their brick-and-mortar offerings to the top of guests’ minds through advertising. It’s a huge win for the industry and we expect the online channel to continue to grow both within New Jersey and into other gaming markets.”

The impact of mobile and online gaming, as such, cannot be underplayed. This is especially emphasized by New York’s lack of mobile betting, an increasing source of frustration for campaigners who feel they’re losing heavy revenue to the Garden State. As Feil remarks, the success of mobile gaming and New Jersey’s wider framework has absolutely persuaded other states to legalize sports betting already, and will continue to do so. She adds: “It’s impossible not to look at New Jersey and see the opportunity for other states. They’ve had a couple of really good months in terms of handle and revenue, despite restrictions on land-based openings and things like that. They’ve really shown how their online sports betting market – especially with the unusual professional sports schedule the last few months – has given a lot of opportunity and helped support the rest of the business.”

The end result of this blend? A thriving New Jersey sector that is almost unrecognizable from the dwindling marketplace that befell the Atlantic City Boardwalk and its surrounding areas only a few years back. Naturally, landbased success has been somewhat deemphasized due to the coronavirus pandemic, but The Innovation Group is now far more optimistic about New Jersey and Atlantic City than it was a decade ago. As Zitt and Wyman point out, challenges will remain for the region: additional competition from New York, the pandemic’s impact on destination properties and the overall national economic fallout to come. But the state is now fit to face those challenges head on. Whatever the future holds, it has been some revival for New Jersey gaming, giving it the tools to be competitive during one of the most difficult times in its history.

JESSICA FEIL

SETTING THE EXAMPLE

Tim Poole speaks with Borgata president & COO Melonie Johnson and Ocean Casino Resort CEO Terry Glebocki, two of Atlantic City’s leaders at the forefront of gaming’s resilient stand during the COVID-19 pandemic.

TERRY GLEBOCKI

When looking at the senior management teams of Atlantic City casinos, it’s impossible not to observe that of nine properties, three are now led by women. It was previously four, too, until Bally’s Atlantic City Hotel & Casino was sold to Bally’s Corporation, which meant the recent departure of Karie Hall. Still, it’s a significantly encouraging number when you consider gaming boardrooms have traditionally been dominated by men. As Ocean Casino Resort CEO Terry Glebocki told us as part of Gaming America’s US CEO Special in the fall, “things have changed a lot.”

So often in her career, she said, she had been the only woman at the table. And the important distinction she went on to make was that, now, female executives are not in positions just because they’re women – “they just happen to be women,” she says. That means talent is finding its way to the top on merit, pushing the gaming industry to become a fairer and more inclusive place to work at elite levels.

There is still a long way to go, of course, when it comes to diversity in the boardroom – and not just when it comes to gender. AGS CEO David Lopez was open and forthright in telling Gambling Insider there is still plenty of room for improvement in that same US CEO Special edition. But the senior positions of Jacqueline Grace, SVP and general manager for Tropicana Atlantic City, Glebocki and Melonie Johnson, president & COO at Borgata Hotel Casino & Spa, prove there is now room for the women of gaming to assume roles at the very peak of the sector.

As part of our Atlantic City focus, both Glebocki and Johnson spoke exclusively to Gaming America, and the former feels the business case for diversity is being illuminated by the success of women in modern boardrooms. “I think more and more boards, including gaming boards, are realizing the benefits of inclusion of females,” Glebocki says. “I think it’s unlikely you'll find many boards, in any industry, that are predominantly female, but given time I think you'll see more females being invited into the boardroom. There are some amazing female gaming professionals out there that would be very beneficial for boards to consider. Diversity around the table is always beneficial.”

Glebocki’s career path to becoming Ocean CEO is inspiring, and when advising young female executives who aspire to become an SVP or CEO, her mantra is “the numbers never lie.” She explains: “Treat the business as if it is your own and utilize your entrepreneurial skills. Learn as much of the business as you can and offer to work on special projects whenever possible. Also, learn from your successes and failures as there is a lesson in each one of them. Understand the numbers and use them as a tool to grow the business. Don’t be afraid of the numbers. In the end, the numbers never lie.”

For Atlantic City’s top brass, learning from both successes and failures is an important theme. Johnson, for instance, believes some of her best learnings have come from her biggest mistakes. Her journey has been a tough one, she reflects, but she has no regrets looking back on her ascension to the Borgata president’s seat. Her appointment materialized in August, when she became the first ever African American woman to lead an Atlantic City casino. "I graduated from college at 21 years old and grew up in a very small town, so I didn't have a lot of exposure,” she says. “The one thing that helped me in my career is relationships: establishing relationships in the work environment and outside of the work environment, and having that network of people to shore me up. So to be successful, and to achieve this level of success, you've got to have the correct foundation. That’s the educational background, it's the on-the-job experience and then having your support group that can help you. You can bounce things off of people.”

Again, Johnson emphasizes the message of reacting to setbacks. For the Borgata president, it’s about accepting negative news in a positive manner and learning how to deliver messages where the individual will not take everything personally. Taking feedback personally is something you really can’t do, she says, which is a lesson we can all learn – in any industry. To move forward, Johnson encourages processing a setback and not wallowing in it or allowing it to become all-consuming. Completing her recipe, she focuses on the way she delivers messages herself, because everyone’s perception is their own reality.

These are lessons any executive, male or female, could heed. They are also lessons that have helped Johnson navigate the opening months of her role at Borgata; and there are few challenges more daunting than taking over a land-based property during the COVID-19 pandemic, when sudden closure is always an imminent threat and restrictions mean you’re unable to operate at 100% even when safely open. “By far, the first three or four months has been the most challenging period in my career, I must say,” Johnson admits. “And it’s not necessarily because of the technical aspect of the work or transitioning from one property to another, because that’s been part of my career. I’ve worked in multiple gaming jurisdictions and moving is just part of my natural journey.

“But the challenge with this was leaving a property during COVID-19 when we had all of these restrictions, coming to a property that had been closed and the employees had been here 20 years. They are very seasoned staff but the property’s closed, with a very limited number of individuals working here, and then moving into a role where other senior leaders were no longer here. I'm unknown to the staff; the staff is unknown to me. We're worried about health, we're worried about safety and we’re trying to figure out how we will reopen this property.”

Despite the obstacles, earning respect was something Johnson focused on early. Having worked at MGM Resorts International, Gold Strike Casino Resort, Tunica Mississippi, MGM National Harbor and National Harbor, Maryland, Johnson needed to now prove herself at Borgata, a property she describes as the flagship of Atlantic City. There were big shoes to fill, in her eyes, and combined with managing health and safety protocols and uncertainty regarding jobs and employees, 2020 became a year “no one could have ever imagined in our lifetime,” she says.

Yet, as part one of our Atlantic City focus established, New Jersey’s revival in recent years left the Garden State’s casinos in the best place possible to deal with this pandemic. And with the help of Atlantic City’s leaders, the outlook remains optimistic in the long term – certainly far more

MELONIE JOHNSON

positive than just a few years ago, now that record online gaming and sportsbook numbers are offering a lifeline to land-based revenue decline during COVID-19. The overall picture leaves Glebocki, for one, confident about Ocean’s future.

“It’s difficult to speak for the other properties but we believe our future here at Ocean is bright,” she says. “I'm optimistic. We had tremendous momentum prior to this crisis, as a property and as a market. Businesses are dynamic by nature. They adapt to changing situations to survive. Atlantic City has seen challenging times before and we will continue to adapt to meet the challenges of tomorrow.”

For Johnson, adapting to these new, unprecedented obstacles has meant utilizing the personal touch. As a “people person,” she loves to talk, meet the staff and get to know everyone. It’s about far more than just the business level; she is a firm believer in building a family atmosphere to be effective and efficient (although here, ultimately the business level also benefits). Johnson spent as much time as she could walking across Borgata’s floors, being amazed by the scale of it, and we were lucky enough to speak with her on the GI Huddle live from the hotel casino, by far the best Skype background we have seen so far.

Learning the lay of the land, Johnson asserts that she still has a lot to take on. By no means is her job done, an attitude that perhaps embodies the Atlantic City leadership when the going gets tough. Overall, Johnson believes she has embraced her new challenges, falling in love with living in South Jersey. “Our customers and employees are so friendly and it feels like a natural fit right now,” she adds.

Resilience is certainly a word that comes to mind for New Jersey gaming in recent years – especially during the pandemic. The same can be said of the women of New Jersey gaming, who have shown their value to the industry through their determination and aptitude, helping the sector move on from a time when only male executives could run some of the best-known properties in the world. For Glebocki, resilience and the ability to change course quickly and adapt to the current business environment are two factors behind the success of New Jersey casinos.

“Whether going through a recession, decrease in market share, increased competition or a pandemic, the ability of Atlantic City casinos to adapt to change has allowed casinos to survive and then eventually thrive in the changed business environment,” she concludes. “By way of example, the importance of online gaming, and the revenue generated by online gaming, demonstrates the ability of the casinos to adapt to a changing business environment. This ability to adapt has never been more important to the casinos than during this current year with the closures of the bricks-and-mortar operations in Atlantic City due to the pandemic.”

While it is important to recognize the contribution of Glebocki, Johnson and company to gaming, and to strengthening the position of women in business, it’s equally important to note the merit in their achievements. As Glebocki says, this isn’t about being in their roles because they are female. They just happen to be women who are the best candidates for their jobs. Women in gaming shouldn’t be an on-trend topic trivialized to generate a few clicks or page views, and no woman should be featured to lead a publication just because she is a woman (the same applies for men, of course). Française des Jeux CEO Stéphane Pallez, for instance, features on the current cover of Gambling Insider completely on merit. Speaking with Glebocki and Johnson has been a privilege for Gaming America, with their wisdom and honesty a breath of fresh air, balanced with a sense of authority that makes you sit up and take notice.

For anyone looking to emulate the journeys of these Atlantic City leaders, Johnson urges the need for patience above all other qualities. “Right now I'm mentoring quite a few young people,” she says. “They graduate from college and they've got their degree and all the education, but there’s a rush to ‘I should be a property president or vice president in 12 months.’ It doesn't happen that way. You've got to stay the course. It’s not a sprint, it’s a marathon. And you’ve got to learn. Book knowledge is one type of knowledge, but on-the-job experience goes a long way. And the only way you can learn certain aspects of your job is to have hands-on experience. The book knowledge is definitely important, but you’ve got to have on-the-job experience; you've got to stay the course, establish those relationships and be patient. Patience truly is a virtue.”

WHERE THERE’S SMOKE

Ezra Amacher examines the ongoing debate of whether smoking in casinos has overstayed its welcome, or if it’s still a fix to help maintain a bottom line.

When Park MGM reopened last September as the first smoke-free casino on the Las Vegas Strip, speculation arose over whether COVID-19 could push out smoking at gaming properties for good. Earlier that month, New Jersey Governor Phil Murphy extended a smoking ban at Atlantic City casinos, deeming the activity too risky amid an airborne pandemic. New Jersey joined Pennsylvania and Michigan as the most prominent states to temporarily prohibit smoking at commercial casinos, while several tribal casinos implemented smoke-free policies upon reopening as well.

Yet it was MGM Resorts’ decision to go smoke-free at Park MGM that drew the most national attention. Even in the middle of the pandemic, for a major operator to ban smoking at a Strip casino seemed, to some, an infringement on what makes Las Vegas … Las Vegas. The city, after all, built its reputation on allowing people to do (nearly) whatever they want, whenever they want.

“There have been a couple of attempts at smoke-free casinos, but they failed,” says Michael Green, a historian at the University of Nevada Las Vegas. “Granting that more people are aware of the dangers of tobacco, smoking seemed for many to go with drinking and other ways we abuse ourselves for fun.”

Vices are subject to cost-benefit analysis like anything else, and for decades state gaming regulators and operators have studied whether indoor smoking brings in customers or sends them out the door. Only in the past year have decision makers also been forced to factor in where smoking fits into the COVID-19 pandemic, including what additional risks it brings to guests and casino employees.

Before the pandemic, 20 states had laws requiring casinos to operate smoke-free indoors. In response to COVID-19, New Jersey, Pennsylvania and Michigan enforced temporary smoke-free policies last year, while Indiana regulators declared that Hoosier State casinos must designate an area for socially distanced smoking, eating and drinking. Several dozen tribal casinos reopened under smoke-free conditions, as did a few commercial casinos like Bally’s Corp. properties Tiverton and Twin River in Rhode Island.

“I would say the pandemic has accelerated the smoke-free trend that was already well underway,” says Bronson Frick, director of advocacy for the California-based American Nonsmokers’ Rights Foundation. “Prior to 2020, there were already nearly 800 smoke-free casinos and other gambling venues in the United States. Major gaming companies had already invested many billions of dollars into smoke-free gaming markets and they wanted those investments to succeed, and they have.”

Still, hundreds more gaming properties reopened with smoking allowed. That includes nearly all of Nevada’s 440-plus establishments that offer gaming, a testament to smoking’s influence in the Silver State. Nevada is one of 19 states without regulated smoking laws, and most of those states are in culturally conservative areas of the country.

Though smoking is widely recognized as a hazardous activity that can cause cancer, heart and lung disease and other longterm health ailments, approximately 14% of US adults smoke, according to the Center for Disease Control (CDC). The CDC warns that being a tobacco smoker increases your risk of severe illness upon catching COVID-19, but researchers have found little evidence that smoking itself increases the spread of the disease. However, “Second-hand smoke can propel viruses into the air from the nose and throat,” writes Panagis Galiatsatos, director of the Tobacco Treatment Clinic at Johns Hopkins University. Also, people who smoke indoors or outdoors must remove their mask, which enhances the chances that they will breathe or

cough on another person. Casinos that permit smoking can fight the spread of second-hand smoke, however, through upgraded heating, ventilation, and air conditioning (HVAC) systems.

When Circa Resort & Casino opened last October, Derek Stevens touted his property’s clear air system as an attraction for guests who smoke or don’t mind the presence of it. “Circa features the first HVAC system in a Las Vegas casino that cools the property from the ground up,” a Circa spokesperson told Gaming America. “The floor was raised 18 inches to allow for this system and the technique reduces energy usage and permits the resort to have a natural flow of air. The system also brings in 100% fresh air from the outside at all times and rarely recirculates indoor air.”

Smoke-free advocates like Frick say an improved HVAC system simply isn’t enough. “Ventilation systems don’t address the hazards of second-hand smoke,” Frick states. “So reducing but not eliminating the smoke doesn’t necessarily make it safer, it just gives the appearance that something has been done, or it might reduce the odor, but not address the health hazards.”

For decades operators assumed that casino goers were willing to accept the risk of spending hours in an indoor environment where smoking was allowed, if it meant they could indulge in gaming. Big gamblers have often been portrayed in popular culture as smokers, and to this day there remains the public perception that smoking and gaming go hand in hand. Academic studies as well as public polls have put that perception under the microscope in recent years, with results that challenge the long-held assumption of smoking’s popularity among gamblers. In a landmark 2008 study, University of Nevada, Reno professor Chris Pritsos observed approximately 14,000 gamblers at three Nevada sites and found four out of five were non-smokers. More recently, the American Lung Association conducted a survey in Indiana last year that showed 70% of state voters approve of prohibiting smoking in public places including casinos.

But when it comes to lawmakers and voters deciding whether to ban smoking at casinos, smoke-free supporters still find the chips stacked against them. In 2006 Nevadans passed a Clean Indoor Air Act that included prohibiting smoking tobacco in most indoor places like schools, restaurants and movie theaters. The bill excluded casinos.

“There really has been no concerted effort to ban smoking in casinos,” Green, the UNLV historian, says. “The most we have done was a ballot question in 2006. That year, casino operators, worried about the implications, backed another initiative question that essentially contradicted that one. The voters turned it down.”

Operators in Nevada feared that by removing smoking from casinos, they would see a sharp drop in revenue. Four years earlier, Delaware implemented a smoke-free law at its gaming properties as part of a 2002 Clean Air Act. The Federal Reserve Bank of St. Louis reported that Delaware’s three gaming properties saw average monthly revenue fall 13% relative to the year preceding the ban. When Illinois implemented a smoke-free policy at commercial casinos in 2008, the same Federal Reserve Bank later filed a report that the state saw a 20% revenue drop following the ban.

For years operators and state regulators have weighed enforcing smoke-free policies that could diminish revenue, versus maintaining the status quo and exposing casino workers to second-hand smoke. These days, they must also take COVID-19 into account.

“The business model has traditionally built in worker exposure to second-hand smoke, worker sickness, disease, death, and it doesn’t have to be this way,” Frick says. “By moving smoking to outdoor areas, it’s good for health and also good for business.” When MGM Resorts decided to enforce such a philosophy at Park MGM last fall, the move generated mixed feelings in Las Vegas, even though the operator has already gone smoke-free at six other properties. The operator incorporated feedback from its guests when deciding to take smoke-free to one of its marquee Strip casinos, says Jenn Michaels, senior VP of public relations at the operator.

“The initial response from guests has been very positive as they enjoy having the option of a smoke-free casino-resort, which wasn’t previously available to them,” says Michaels. “Las Vegas has always been focused on offering a wide variety of options, which makes the destination so attractive to so many, and offering a smoke-free option creates yet another way for guests to experience the city in the ways they prefer.”

If Park MGM reports consistent or improved business as a smoke-free resort, it could encourage other operators to imitate MGM’s policies in Las Vegas, a city that up until a year ago never considered banning smoking at its casinos.

“The accelerated trend for smoke-free air has been one of the few silver linings during the pandemic,” Frick says. “It has reminded businesses of the importance of respiratory health.”

ROUNDTABLE: ON TAP

Industry experts from Global Payments Gaming Solutions, Crane Payment Innovations, Sightline Payments, SuzoHapp and IGT discuss the appetite for contactless payments at land-based venues, and if the pandemic has accelerated its importance.

CHRISTOPHER JUSTICE

Global Payments Gaming Solutions president

BRIAN WEDDERSPOON, DOUG HADDON

Crane Payment Innovations VP of gaming and VP of connectivity

JOE PAPPANO

Sightline Payments CEO

JAMES BRENDEL

SuzoHapp president and CEO

BRIAN WEDDERSPOON & DOUG HADDON:

Not only contactless payment, but the need for alternate payment forms in general has been accelerated by COVID-19 because of the perceptions of cash use. While there is no increased risk associated with cash and the transmission of COVID-19, the pandemic did highlight the need for alternate payment methods for multiple reasons, including the reduction of touchpoints, as well as accommodating for reductions in workforce.

By enabling alternate payment methods at slots and table games, like contactless card or mobile payment, you eliminate the need to travel to the cage, cash out and redeposit money to your bank account. Alleviating these processes means lessening human touchpoints and interactions, and it’s a huge boost to customer convenience. This in turn has pushed the gaming industry one step closer to modernization and in the direction of the payment options consumers experience in their daily lives.

CHRISTOPHER JUSTICE:

Yes. COVID-19 has created a public health mandate to touch as little as possible. Due to this, we are seeing roughly 60% of consumers shifting to self-service in order to social distance, and 30% leveraging contactless forms of payments. Patrons want to play in a safe environment, and we will see higher play and frequency directed to properties that do the best job to make the guest feel comfortable.

RYAN REDDY:

Both traditional cash and cashless will continue to have a place in the gaming industry, but we’re seeing an ongoing progression of digital formats like electronic wallets being used along with cash. COVID-19 has definitely created a disruption point for this technology in the gaming industry. Pre-pandemic, we saw progressive operators moving toward cashless gaming. Since COVID-19, however, we’ve experienced an increase in demand for our Resort Wallet cashless solution, because reduced contact, sanitation and social distancing have become casinos’ highest priorities, and are top-of-mind for consumers.

RYAN REDDY IGT VP of VLT systems and payments products

JAMES BRENDEL: If the pandemic has taught us anything, it’s that we can only succeed if we’re able to adapt and be flexible. In this case, that adaptability means providing more options for our customers. What customers want is the flexibility to take whatever level of safety precautions they feel most comfortable with and pay in whatever format they would like, making contactless payments just as important as cashless, ticketing, or cash payments. Players today come from all demographics and all walks of life. For many, cash is still king as it reignites that sense of nostalgia that they enjoy while playing and is perceived as more secure and private. On the other side of the spectrum, contactless holds a lot of appeal after digital gaming during the lockdowns made payments seem effortless. But what is important is the choices available onsite for everyone to be happy.

JOE PAPPANO:

While much of the business world shifts to a cashless and contactless society, the casino industry today is still heavily cash-based and substantially underpenetrated by digital payment systems. The pandemic has created an urgency for our industry to adapt to a cashless and contactless payments system.

During the pandemic of 2020, cashless and contactless payment solutions have gained a lot of momentum, and the demand for contactless increased significantly. We’ve seen interest in a cashless wallet for casinos and related gaming gain momentum with resort operators and patrons for its critical safety advantages.

Many industries, including gaming, sports betting and lottery are moving away from cash and evolving and adapting to new cashless payment technologies from a health perspective or to accommodate the next generation. The pandemic has only sped up and accelerated this process.

Even before the pandemic, the use of cash had been steadily declining. The new generation of gaming and sports betting patrons want a seamless, instant solution and payments have finally infiltrated into the casino and resort operators.

Our goal, along with others in the industry, is to create that framework that ultimately protects the integrity of the operators, the networks, key ancillary service providers and, most importantly, the patron.

HAS THE PANDEMIC ACCELERATED CUSTOMERS USING CONTACTLESS PAYMENTS ACROSS LAND-BASED CASINOS, QUICKER THAN EXPECTED?

CHRISTOPHER JUSTICE:

It has. Before the pandemic, patrons were adopting contactless payment options at a rapid pace beyond the gaming industry. Due to COVID-19, contactless payment adoption was fueled as patrons needed safer, mobiledriven options to meet their needs and expectations. Today, we expect these behaviors to remain. Patrons have grown accustomed to the cashless gaming experience. As such, land-based operators will need to continue to provide and enhance these contactless and cashless services after the pandemic and move into the future.

BRIAN WEDDERSPOON

& DOUG HADDON: Yes and no. For the time being, operators are still limited in their offering of alternate payment methods for customers, mostly due to regulatory constraints and infrastructure. However, following initial installations in casinos where Crane Payment Innovations (CPI) has worked with operators to implement contactless payment options – namely through our Bluetooth-enabled mobile payment solution driven via our bill acceptors – not only has patron adoption been positive, but it has exceeded expectations.

Repeat patron use, in addition to quick adoption, signals to us that the move toward cashless payment methods will not be a one-off trend, but will hold far beyond the timeline of the pandemic. We’re seeing quite clearly that casino patrons are ready to take advantage of the convenience of cashless payment they know elsewhere, in retail, for example, into their gaming experience.

JOE PAPPANO:The issues

with cash on the gaming floor has always been there I suppose, but 2020 certainly put a spotlight on the potential health concerns and everyone is more attuned to those concerns in today’s world. Wherever contactless payment options are available, we have definitely seen patrons increasingly choose that route, but I think more than anything we’re seeing them demand more capabilities from the operators, which in turn is accelerating demand for solutions like ours. RYAN REDDY: Yes, we’re seeing increasing momentum as a result of COVID-19. In the US alone, IGT has one casino cashless solution that is live, and another just approved in a Nevada field trial, with additional deployments in process. Our Resort Wallet cashless solution marked the debut of cashless gaming in the state of New York when it recently went live at Resorts World Catskills. We also recently deployed a custom cashless solution for Svenska Spel’s VLTs in Sweden, which has driven an increase in new player registrations, mostly among a younger demographic. Four months after launch, cashless activity had driven nearly 20% of Svenska Spel’s VLT revenue.

JAMES BRENDEL: COVID-19 has definitely initiated a more expedited shift toward contactless payments than we likely would have had the pandemic not occurred. By force of requirement, innovation had to occur to minimize interactions. One example was that we saw many restaurants switch to digital QR code menus and online payments that allowed for the transaction to occur completely without waitstaff. It was a natural progression then for availability of these payment methods to become an expectation of customers in the gaming industry as well. As experts in the cash handling arena, early on we looked at the science behind the safety of cash and spreading the virus. Although cash and paper tickets have been shown to have a lower likelihood of transmission than credit cards given their smooth plastic surface, the perception of cash, and really all payment interactions except contactless, took a nosedive in terms of viral safety regardless of the science. As many have stated, one of the most crucial requirements of rebuilding the economy is making customers feel safe in their day-to-day interactions, so perception holds a lot of power in this situation. Therefore, it makes sense that we’ve seen more contactless payment options emerge.

CHRISTOPHER JUSTICE: Cashless payments mitigate the need for cash. Think of payment cards, mobile wallets, in-app purchasing and other forms of payment channels that enable a patron, or any consumer, to exchange money for goods or services without cash. Contactless payments take cashless payments a step further and mitigate the need for the payment method to contact a physical point-of-sale (POS) device. Again, we can think of mobile wallets, in-app purchasing and some payment cards. As an example, let us look at payment cards in particular. Most payment cards are cashless, but not contactless, as they require consumers to insert the card’s chip into the POS device. However, some cards are contactless as well, as they only need to be held near the POS reader to transact instead of being inserted.

Another good example of a contactless and cashless payment channel is VIP Mobility. It enables a true cashless and contactless casino gaming and resort experience while providing an easier, more efficient way to fund play. VIP Mobility gives casino operators the flexibility and opportunity to reduce costs while facilitating a seamless player experience from funding through cash-out. It surpasses traditional forms of wagering and betting by enabling casinos to connect to existing responsible gaming systems while equipping patrons with the technology to better track, manage and control expenditures across both gaming and non-gaming outlets. JAMES BRENDEL: There’s a lot of grey area in defining cashless and contactless as there is significant overlap between the two. Contactless includes a physical card that uses near field communication technology to make a payment, meaning proximity is required. The pandemic brought to light how many touchpoints we have in a day and begs the question about whether or not that surface is sanitary and if there has been any transference from that surface to ourselves.

Cashless, though, includes not only credit cards (swiped or inserted), but also online banking payments via apps including custom solutions, depending on the need. A casino offering a cashless payment method via an app has the ability to host customer profiles, track customer spending behavior, give rewards and unify data points. This could also work, however, in a contactless form such as Apple Pay or Google Pay, which still require proximity for a payment to occur.

JOE PAPPANO: Any type of payment that is made without using cash is considered a cashless payment method. Examples are credit card payments, bank transfers, debit card payments, mobile payments and digital wallets. Contactless payments are payments done that do not require a PIN or signature to complete the purchase. You can simply tap and go.

BRIAN WEDDERSPOON & DOUG HADDON: A contactless payment is simply an enabler of cashless payment technology. Whereas some cashless payment is facilitated via magnetic swipe or chipand-PIN technology, contactless payment is any cashless payment enabled by technologies like Bluetooth Low Energy (BLE), NFC, RFID and mobile payment.

RYAN REDDY: The TITO (Ticket-in, Ticket-Out) solution was an early version of cashless gaming, but it’s not contactless because it still requires the handling of physical vouchers. While it’s cleaner than cash, it’s still a less sanitary option than contactless. TITO also requires line-ups at the cashier or kiosk for ticket redemption, whereas IGT’s Resort Wallet eliminates contact with vouchers or cash and promotes social distancing by eliminating those line-ups.

For the player, the TITO solution also involves the risks of a printer malfunction, or loss or damage to the voucher. For the operator, TITO requires machine maintenance that contactless payments don’t. A truly contactless cashless experience, where currency is transferred digitally using our Resort Wallet solution, carries the greatest player convenience and operational efficiencies with the least risk.

HOW WOULD YOU DESCRIBE THE DIFFERENCE BETWEEN CASHLESS AND CONTACTLESS PAYMENTS?

RYAN REDDY: External funds payment, or digitally drawing funds from a bank account, debit and credit card accounts or eWallets, and loading them into a cashless wagering account, is the newest frontier for cashless wagering; and we’ve been leading the charge in payments gateway technology with our proven IGTPay funding solution. IGTPay is fully integrated into the IGT Advantage system for a truly turnkey, end-to-end solution, which is unique to the industry. Other gaming suppliers need to connect players’ cashless wagering accounts to a third-party gateway technology to access external funds. However, because our secure IGTPay funding gateway is fully integrated into IGT Advantage, day-to day operations are significantly streamlined, which greatly enhances cashless implementation and adoption. Another unique benefit is the full-service aspect of our cashless solution. Our experienced payments team supports operators in all aspects of paymentrelated services, including acting as the Merchant of Record, which means IGT manages the relationship with payment service providers. Without that level of day-to-day support, operators take on the risk, red tape and intensive work hours needed to manage the set-up and administration of foundational external payment services, such as vendor and funds management; as well as essential ongoing requirements for fraud and security, player identification and player support. JAMES BRENDEL: The biggest obstacles that face contactless payments are connectivity and security. A contactless transaction absolutely cannot take more time to process than a swipe or a cash intake otherwise it’ll create customer frustration, and currently it often does. If an ApplePay customer has to tap multiple times, it not only frustrates and embarrasses them, it also frustrates the people behind them in line, encouraging all to then resort to “tried and true” methods. With varying levels of connectivity and interference in many casinos, this will pose a problem. It must work without frustration for it to continue its growth trajectory. More important is security. With machines having close proximities and in large crowds (postpandemic, of course), customers might not feel their data and money is secure. RFID security is a known, substantial threat and until customers know their money is safe, the growth of contactless payments is unknown.

CHRISTOPHER JUSTICE: Payment solutions must be system agnostic and able to be interoperable with the infrastructure that’s already in place on the casino floor, allowing current systems to operate as they do.

So our VIP Mobility utilizes this insight by creating seamless, digital experiences during every step in the funding process. It leverages existing casino systems and infrastructure to enable guests to easily fund casino play from their personal accounts, play slots and tables using digital vouchers, and cash out in several self-service ways to create a contactless commerce environment that supports proper social distancing. What’s more, as a guest moves from casino to casino, there’s no need for multiple sign-ups or enrollments with VIP Mobility. It’s one balance of funds that seamlessly follows the guest, even for online gaming.

Also, VIP Financial Center fosters a seamless experience as it’s the industry’s first true full-service solution that provides convenient self-service TITO, bill breaking, e-check, ATM and cash advance capabilities to casino guests. VIP Financial Center not only enhances the player experience, but it also helps casinos maximize spend across all physical and digital properties.

JOE PAPPANO: Sightline’s flagship solution, Play+, is the first fully integrated cashless payment technology platform in the US gaming industry, and is a responsible, fast, safe, and convenient alternative for patrons to transact using their mobile devices, both inside and outside of the gaming industry. Play+ is a seamless and secure pay-and-play mechanism to safely and easily store money and fund entertainment, and gaming apps, on the gaming floor and on sports platforms with instant access to their money from a smartphone.

In 2020, Sightline launched the ability for patrons to add their Play+ funds to the Apple Wallet, enabling Apple Pay transactions at retail stores. This benefit reinforces the credibility and value of the Play+ account to our B2B clients – the resort, online gaming and mobile sports operators – as well as the individual account holders (B2B2C). The Play+ and Apple Pay combination is the type of innovative thinking that will continue to drive digital transformation in the gaming and entertainment industry.

Play+ solves the issue of portability of funds and offers a truly cashless and contactless experience, which doesn’t require interaction with cash, personnel, ATMs, a kiosk device or a gaming device.

HOW CAN PAYMENT SOLUTIONS MAKE THE CONTACTLESS PAYMENTS PROCESS MORE SEAMLESS IN THE GAMING INDUSTRY?

BRIAN WEDDERSPOON

& DOUG HADDON: To get to a retail-like experience on the casino floor, the gaming industry will face the hurdles of regulatory compliance, as well as the challenge of updating proprietary systems and hardware. In other words, it’ll require serious time and investments to reach a sophisticated cashless experience across the casino floor.

While the Nevada Gaming Board has removed language that prohibits electronic transfer of funds, there’s still no defined solution of how that technology can be implemented. What this means is that, for the time being, until the industry has more guidance and regulations on how to implement standalone cashless solutions, operators need to focus on solutions that comply with known and widely adopted regulations; and ones that can be implemented with existing slot and system configurations, providing a seamless and intuitive solution for patrons.

The winner, in the short term, will be solutions that can be implemented quickly and economically using existing casino technology, versus solutions that would require major systemic upgrades. CPI has already developed and implemented such solutions, working with gaming and financial partners to meet criteria for success and long-term adoption and use.

As always, we encourage operators to think ahead in terms of technology when they’re planning to invest or upgrade their slot floors. This means asking your payment supplier what their technology roadmap looks like, how they plan to develop alternate payment solutions, and how the payment technology you’re investing in now can be updated or adapted down the line to accommodate alternate payment methods.

IN-PLAY MAKES STRIDES

Swedish start-up Triggy is expanding its personalized in-play sports wagering products to the US market, as the pandemic forces bettors to consider new ways to engage.

BJÖRN NILSSON

Among the many changes the COVID-19 pandemic brought to the gaming industry was an increased awareness for in-play sports betting in the United States. Before the pandemic, sports bettors often had dozens of games a day to wager on between professional and college leagues. Pre-game wagers and the occasional prop bet often sufficed for the casual bettor. Then came the sudden postponement of leagues in mid-March, leaving wagerers desperate to find any action at all.

Though popular sports like European soccer, NASCAR, the NBA and MLB incrementally returned during the summer months, the stark drop-off in offerings from last spring created an important shift in American sports betting behavior. A presentation from Kambi’s chief commercial officer Max Meltzer at the 2019 G2E reported in-play betting grew 38% during the lockdown period of mid-March to mid-July, up from 26% pre-lockdown, but dropped to 30% between mid-July and the end of September.

As American sports bettors slowly migrated to in-play wagering, Triggy, an information technology and services company based in Stockholm, Sweden, took note. Launched in 2017 by Swedish-start up Flax Innovations, Triggy is a B2B2C company that offers data-driven live-score products for the sports betting industry; it aims to let the sportsbook own the whole customer experience through unique features that give players a better and faster experience via relevant, personalized notifications, either by using its white label app or integrated solution.

In 2019, Malta-based venture capital fund Vereeni Investments acquired a reported six-figure stake in parent Flax Innovations. By then, Triggy’s customers included LeoVegas and Sportsbet. io. The company, which partners with Sportradar and Kambi, recently launched Pinnacle’s Live Soccer Scores app.

And this past October, Triggy made strides by hiring banking and finance veteran Martina Akerlund as its new CEO. She will oversee the company’s expansion into the US market with the support of Darran Miner, Triggy’s vice president, North America, and formerly senior marketing director at the New York Racing Association (NYRA). With the US blowing past $3bn in legal sports wagers per month, expanding across the Atlantic was too good an opportunity to pass up, says Triggy co-founder Björn Nilsson.

“There is so much I’m excited about and looking forward to in the US market,” Nilsson tells Gaming America. “I believe casual and experienced bettors want quality, user-friendly products that enable faster and enhanced betting options. I also believe operators are looking for similar assets to increase engagement and revenue pre-game and in the in-play market. Our Triggy suite of products and technology really solves a need within the industry while bringing the bettor and operator close together like never before.”

When Triggy was launched four years ago, Nilsson and Flax co-founders Stefan Thunberg and Daniel Svenson couldn’t have envisioned a day like last March when sports betting came to a screeching halt. Triggy used the downtime to hire more people, raise capital and expand its app’s coverage of American football. All the while, the pandemic left bettors with more incentive,

and time, to explore new wagering avenues. By the time sports picked up to its pre-pandemic speed, Triggy was better positioned to capitalize on the growth of in-play.

“That’s something I found really impressive when I joined Triggy because if you’re a company looking to thrive in the long run, you will have to adjust and be innovative in this ever changing business landscape, whether it be tougher periods, changing regulatory requirements or meeting new customer demands,” Akerlund says. “Triggy’s way of adjusting business operations in the pandemic is quite impressive. To invest in the future and choose to grow the company when revenues halt due to a total cancellation of sporting events takes great courage. We took that opportunity to expand, build and be ready to capitalize on the growing US market.”

Akerlund spent over two decades in banking and finance, industries she says love planning and structure; sometimes even too much, she admits. Akerlund credits Triggy’s entrepreneurial mindset for creating clear goals and fostering a strong environment. In her role with Triggy, she plans to improve efficiency along with developing partnerships with operators, media companies, affiliates and sports teams.

“Most businesses and companies are facing the same demands at the moment: automated processes, personalization, data usage, customer experience, innovation capacity, scalable processes and high delivering teams,” Akerlund says. “This is something I have worked with for a long time. The golden days of banking are over, though, and it's all about cost efficiency going forward while the gaming industry is just in the beginning of a new era, which is extremely interesting to be part of. There is a tremendous opportunity within areas such as customer experience, data and innovation where I really see the technology of Triggy can contribute.”

Triggy is confident the timing is right for US expansion as more Americans than ever are not only betting on sports legally but participating in in-play wagers. Triggy is currently demoing its US live sports products, which aims to separate itself from the competition by giving customers a specialized experience. The products allow players to subscribe to their favorite teams and receive push notifications and alerts on starting odds, lineups and in-play game events.

“When a customer follows a team, they will receive push notifications with game updates containing suggested bets [NextBets],” says Miner. “When they click on the suggested bet, they are brought right into a betting slip on the operator’s site. It makes the process streamlined and smooth for the customer and the operator. Also, bettors can set triggers for each game they are following. This allows them to set the odds they want to place a bet at. When the odds hit the sportsbook, the customer is notified and is offered up a NextBet.”

As Triggy’s top US-based employee, Miner is tasked with developing marketing strategies for in-play, which comes with some significant hurdles. In-play betting makes up 75% of bets in Europe and around the world, says Miner, but in the US it’s between 20 to 30%. Customers in newly legalized markets may be unfamiliar with in-play wagering or lack user-friendly products. Miner says it’s on operators to educate their players about pre-game and in-play betting opportunities.

“While US sports betting as a whole is in its infancy, the in-play market is really just beginning to emerge,” Miner says. “Sports betting operators see the value in getting their existing customers to bet more often and our products not only help them engage and retain players, we make it easy for the customers through our NextBet Technology.”

Miner relies on his five years of experience at NYRA, where he gained an understanding of what customers want. He was part of a team that launched NYRA Bets’ national online wagering platform. In that role he developed relationships with operators in recently legalized markets and worked to acquire market share. Triggy affords operators in emerging markets a similar opportunity, he says.

“For years, bettors, casual bettors in particular, only knew of pre-game bets and maybe some of the prop bets for big events like the Super Bowl,” he says. “Operators are educating customers within newly legalized states who have probably never placed a legal bet before let alone a bet while the game is going on.”

Once Triggy and its partners are able to raise awareness for in-play, the Triggy team is sure its products will increase consumer acquisition and generate revenue.

“Our products are engaging,” Nilsson says. “Our idea is to grow even further by adding all the US sports. We already have soccer and football and are looking to add basketball before March Madness, baseball in the spring and summer, and hockey in late summer of 2021. It is going to be a busy time.”

POWER OF THE PEOPLE

The truth is, if you take gambling out of Las Vegas, the city would probably survive. But if you took conventions away, the city would have a serious problem. Oliver Lovat of the Denstone Group consultancy, which has a focus on casino resorts, details the extent of the reality that post-pandemic numbers might not return.

The Las Vegas Visitors and Convention Authority was established in 1955 with the aim of operating the Las Vegas Convention Center, which opened in 1959. The mission of the LVCVA is to get “heads on beds,” that is to support the constituent owners, that is the local resorts and the Chamber of Commerce. The rationale of building a convention center was to meet the strategic problem facing the resorts at that time: how do we get people to come to Las Vegas midweek?

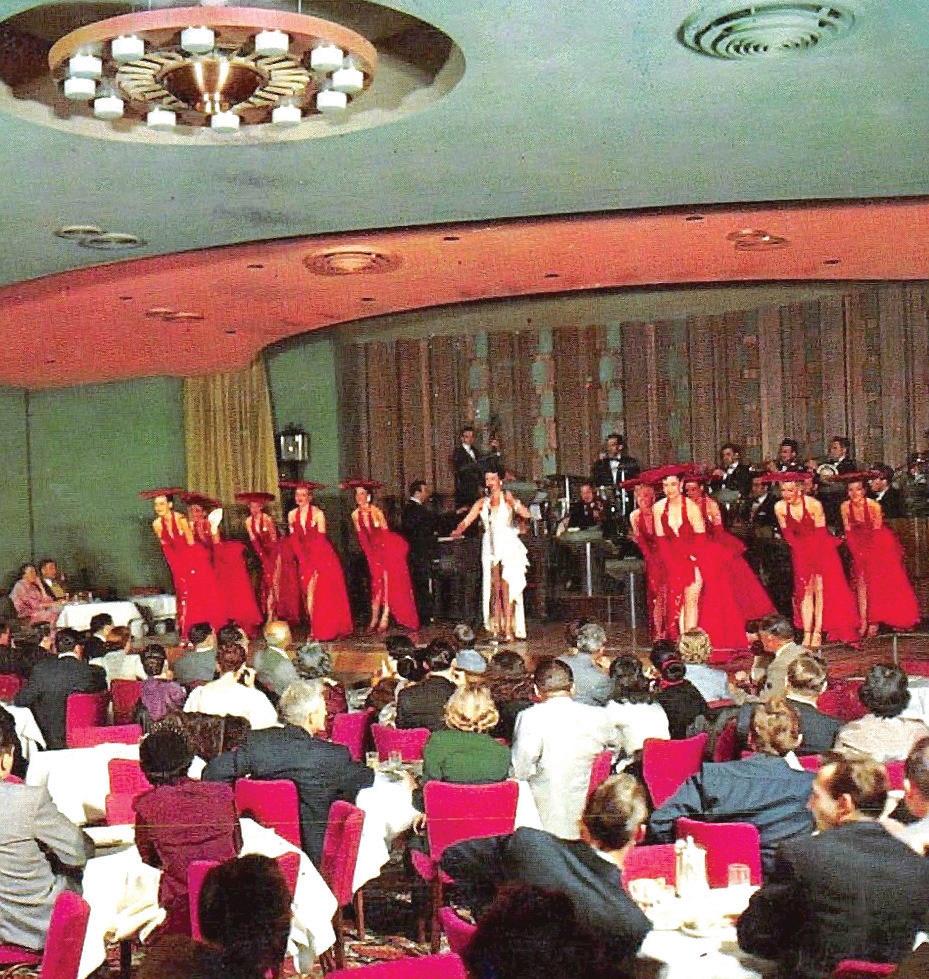

The Convention Center was a citywide, communal amenity, hosting events that the resorts could not host, not just meetings but sporting events and large concerts that could not fit in the showrooms, most notably hosting The Beatles in 1964. The Convention Center saw steady business, it slowly expanded over the next 20 years, but it was not until the 1980s when conventions really started to have an impact on the market.

As reported in my previous column, early ‘80s Las Vegas was hit by a triple crisis: economic recession, the proliferation of gaming in Atlantic City and The MGM and Hilton fires. Visitation, especially midweek, declined alarmingly. Turning to past solutions, the operators turned to encouraging the growing conventions business, marketing large-scale events midweek.

Throughout the decade, convention delegates grew by 130%. Without this midweek business, the viability of the city would have been in question as gamblers fled to Atlantic City.

In 1989, a consortium of convention organizers, including the late Sheldon Adelson, acquired the Sands Hotel and set about building The Sands Convention Center as a place to host their own events and leasing space to others.

Adelson’s investment in Las Vegas was to be a turning point in the city. As The Sands proved, the convention center was not an amenity but the primary driver of business. In the 1990s, the number of convention delegates was to grow by a further 117%.

The decade closed with the opening of Adelson’s Venetian resort, the business model of which was not predicated on casino revenues, but convention and hotel room sales, and was designed against much of the perceived wisdom that had evolved from the pit to the boardroom.

With the thesis firmly proved, Las Vegas expanded with the convention and meeting provision underpinning investment and growth forecasts, rather than traditional gaming revenues from high-end players.

As the next generation of resorts and expansion plans were developed after the turn of the millennium, the business strategy was not in growing gaming revenues, but how to grow average daily rates, occupancy and revenue per available room; noting that the average spend for the typical convention customer was about $200 greater for a convention guest than a leisure customer.

Between 2000 and 2019, room inventory and customer visitation grew on par, but there was a 73% increase in convention delegates. Alarmingly, there was a warning sign after The Great Recession of 2007.

When the US moved into recession, the number of convention delegates dropped from 6.3m in 2006 to 4.4m in 2010, only rising above 6.3m again in 2016. The recovery period for 2m lost guests was a decade.

Breakdown of Las Vegas visitation volumes from 2000 to 2019. Source: LVCVA

Year Visitation Room Inventory Occupancy Convention Delegates

2000 35,849,691 124,270 89.10% 3,853,363

2001 35,017,317 126,610 84.70%

2002 35,071,504 126,787 84.00%

2003 35,540,126 130,482 85.00%

2004 37,388,781 131,503 88.60%

2005 38,566,717 133,186 89.20%

2006 38,914,889 132,605 89.70%

2007 39,196,761 132,947 90.40%

2008 37,481,552 140,529 86.00%

2009 36,351,469 148,941 81.50%

2010 37,335,436 148,935 80.40%

2011 38,928,708 150,161 83.80%

2012 39,727,022 150,481 84.40%

2013 39,668,221 150,593 84.30%

2014 41,126,512 150,544 86.80%

2015 42,312,216 149,213 87.70%

2016 42,936,109 149,339 89.10%

2017 42,208,200 148,896 88.60%

2018 42,116,800 147,238 88.20% 5,014,240

5,105,450

5,657,796

5,724,864

6,166,194

6,307,961

6,209,253

5,899,725

4,492,275

4,473,134

4,865,272

4,944,014

5,107,416

5,169,054

5,891,151

6,310,616

6,646,200

6,501,800

HOW BIG IS THE PROBLEM?

Enhancements can be made to convention and meeting Las Vegas has bet big on business travel. LVCVA reported that space to meet changing customer needs, such as increased 6.6m conventioneers visited Las Vegas in 2019 and directly broadcast production facilities, but those resorts advocating supported approximately 45,000 jobs, $2bn in wages and this strategy are surely aware the market will return economic output of $6.6bn. Including indirect and induced incrementally over a long period. impacts, the totals increase to 70,700 jobs, $3bn in wages and The second is to close resorts midweek, with the aim $11.1bn of total economic output. of cutting operating costs until the return of systemic

There is currently over 3.2m square feet of pure convention midweek growth and diverting business to key properties. space in Las Vegas and 5.3m square feet of event space. The This is the fate of MGM Resorts' portfolio, especially older Venetian is enhancing its own 2m square feet of convention resorts, such as The Mirage and Mandalay Bay, which in and meeting space with the MSG Sphere, an 18,000 seated recent years have been repositioned away from leisure and arena. And the LVCVA to convention centric customers. Convention District with The third, and perhaps 1,000,000 square feet of new space will be “THE RETURN TO RECORD the most controversial, is to acknowledge that there’s an complete in 2021. LEVELS OF CONVENTION oversupply of convention and At press time, large gatherings are not VISITORS WILL HAVE meeting space. Legacy space has been supplemented by permitted in the State LITTLE TO DO WITH newer rooms and based on of Nevada despite the various steps taken by THE STEPS TAKEN BY past trends, 2019 levels will not return anytime soon. If this operators to reduce risks for those seeking OPERATORS. IT WOULD is the diagnosis, then there needs to be fresh thinking to meet at a resort; all RATHER BE DICTATED BY to redevelop these spaces the major convention operators have instituted A DUAL OUTCOME OF as revenue-producing areas. Executive efforts are currently measures to mitigate HOW COVID-19 EVOLVES still on managing phase 1 of potential risk and have elevated their AND MACROECONOMIC the pandemic crisis, which is keeping the doors open and safety procedures. However, the return to TRENDS, WHICH AFFECT managing expenses. However in mid-2021, the thought record levels of convention THE NEED OF BUSINESSES process into managing legacy visitors will have little to do with the steps taken TO HOLD MEETINGS AND conventions and meeting space will begin – and expect to see by operators. It would rather be dictated by a CONVENTIONS.” this as the beginning of the next cycle of innovation and dual outcome of how targeted attractions. COVID-19 evolves and Las Vegas has historically macroeconomic trends, which affect the need of businesses innovated to find unmet customer demand, so post-COVID, to hold meetings and conventions. who are the midweek customers if not conventioneers?

This leaves the current business model adopted by One hypothesis is that resorts should investigate active Las Vegas operators – midweek convention business, programing, as seen in other traditional vacation resorts and supplemented by weekend leisure customers – needing cruise ships. Program events for the morning, lectures, art urgent revision. galleries, focused midweek festivals and unique experiential

There are only three viable solutions to this problem. The retail for invited guests would hopefully drive occupancy, first is to try and actively stimulate meeting and convention rates, visitation and all revenues. It may even be that the business for when these events are viable; however, success responsibility for sourcing, attracting and coordinating this is not determined by individual efforts. This strategy involves next generation of attractions is led by LVCVA, which would carrying the burden for employees and ensuring facilities are seem an obvious choice to lead coordinated innovation. maintained, which may cause some of the larger operators But despite all the theorizing, one thing remains clear. with multiple venues to fill problems. But by shedding these Taking conventions away from Las Vegas is not an option. employees, it’s harder to ramp up as conditions change. It’s time to problem solve.

2021: THE SPORTS BETTING OUTLOOK

Brandon Walker, head of Amelco USA, gives Gaming America his sports betting industry predictions for 2021, focusing on how player habits will change in the US.

BRANDON WALKER

While US sports betting has been a hot topic ever since PASPA was overturned in May 2018, there is still much to ponder for suppliers and operators thanks to new challenges brought on by the coronavirus pandemic. Brandon Walker, head of Amelco USA, sees plenty of potential for change when it comes to player habits, especially prop bets. The gaming executive spoke exclusively to Gaming America to tell us more, discussing the major trends he expects in 2021, player behaviour and not being out of the woods just yet when it comes to COVID-19.

What major trends does Amelco foresee in 2021 for US sports bettors?

We’re in for another whirlwind year for the US sports betting scene, as more states look to regulate online and get in on the action. New Jersey alone continues to break its own records almost on a monthly basis, with some serious growth that is generating a hefty portion of tax revenue, which I’m sure plenty of other states are starting to notice.

I also believe there will be a more open attitude toward online casino, which has proven itself as a hugely reliable pandemic-proof alternative to sports betting. Up to this point, Pennsylvania and New Jersey were the only two states to really capitalize on offering an online casino experience.

The likes of Colorado, Tennessee and Indiana are set to be left out in the cold if we see another repeat of fixture cancellations in 2021, and they’d do well to speed up the process. Prop bets are also going to continue with the momentum they’ve already been building with US audiences. This is in effect inevitable, as the market was always set up to be stat-heavy for the big four sports, because it’s what we knew US sports fans would demand.

Last but not least, it’s been a very interesting few months in terms of commercial deals between big US operator groups and major sports teams, and 2021 will certainly be a time when these agreements begin to manifest themselves and show their effectiveness. Big-name involvement has the potential to really change the game and I look forward to seeing what other deals can be made, and how they’re activated to appeal to US audiences.

How will player betting habits change compared to previous years?

We’re on an exponential trajectory here and as more US audiences become engaged with the world of online and

discover what’s available, we’re going to continue seeing great change. As anyone who’s been to Las Vegas or Atlantic City will know, US sports betting is hugely geared toward stats. So much that punters arguably follow the player far more than the team. In baseball, for instance, we typically see more bets placed on a player’s average number of points, assists or RBIs than actual team results, which makes the US such a unique betting environment.

I also believe that as we see more spectrums of demographics getting familiar with online sportsbooks, we’ll see an even greater surge in stats-based prop betting. This is going to have a very broad customer base, from traditional daily fantasy sports players who want to transfer their knowledge to sportsbook, or even younger players who know their college football teams inside-out and want to test their skills in real money gaming.

When it comes to adoption and evolution of habits, a lot of this for me is based on educating the market on what’s out there. As legal sports betting continues to grow and the online experience will become more familiar, punters will be able to navigate through, find markets and better understand just how many options there are available. The knowledge is already there given the passion for sport, but they’ve only just begun to apply it to betting. In many ways we’re only just getting started, which again shows how much untapped potential the US really has.

How important do you think player props will be?

They’ll be a game changer. Take college football. In sheer numbers, it’s one of the biggest sports in the world, and in the majority of states, college teams are better supported and play in bigger stadiums than their professional counterparts. Students and fans know their teams very well and devote hours of their time to analysing the form, and they now have an opportunity to bet on that for the first time online. It’s a completely new world that we can’t compare to anywhere else. The potential in terms of customer base is huge.

We all know US fans may not care if the LA Lakers win or lose – it’s more about how well LeBron James plays and what he achieves. It’s the same with Patrick Mahomes and the Kansas City Chiefs. Superstar players transcend their teams, and punters will look to wager on their performance and numbers rather than the team as a whole. This is especially the case for basketball, where one player can be so instrumental. In a soccer match over in the UK, it’s completely different. If you lose a key player, that doesn’t mean the wheels come off. That’s not the same over here.

This opens the door to a whole catalogue of alternative betting markets and the entertainment potential for that. And the way it will resonate with US fans is going to be immense. A match result may be decided by the first half in some cases, but by betting on player props, even garbage time points or runs, the most uninspiring games can turn into a rollercoaster experience for punters.