Gambling Insider assesses the state of US online gaming. As some decide to leave the space, others are in pole position to capitalise

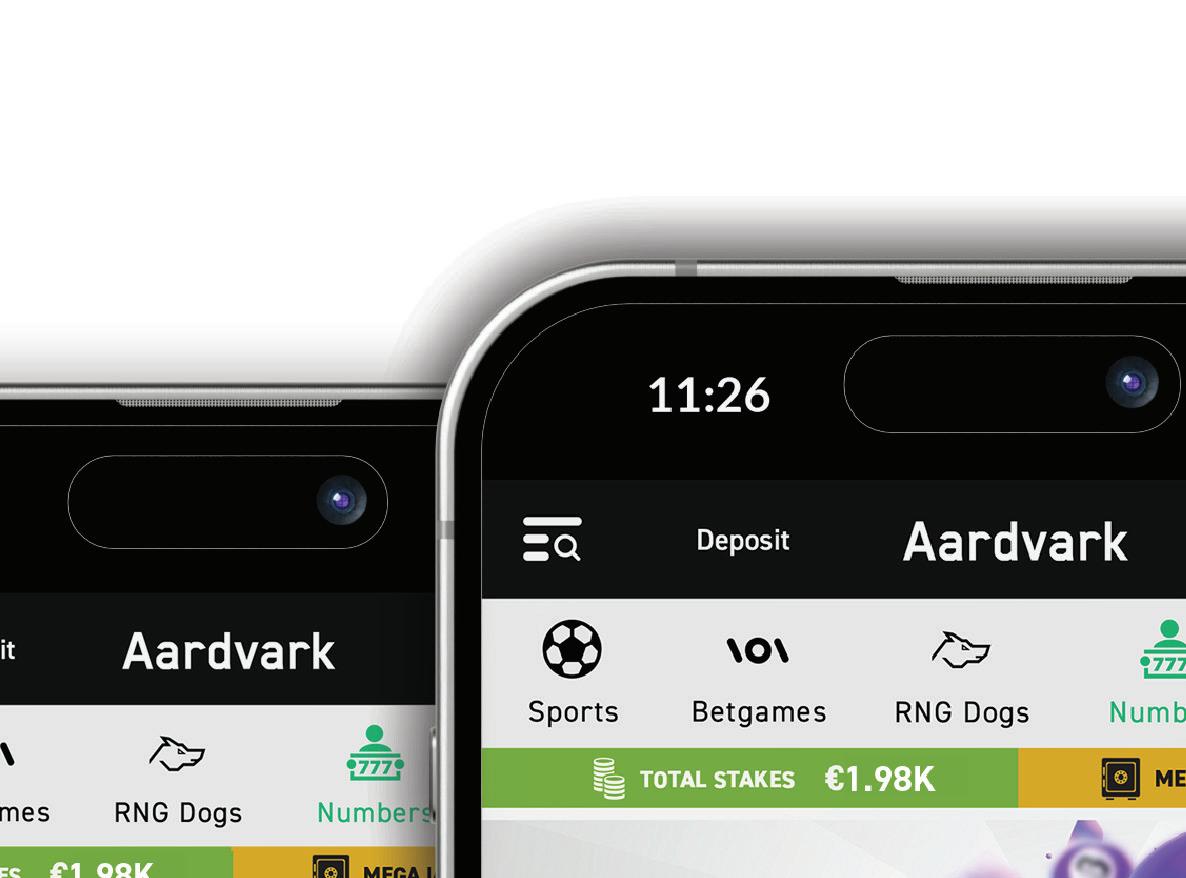

LEADERSHIP Q&A s : The CEOs of BoyleSports & Svenska Spel join us

MARKET FOCUSES: ROUNDTABLE:

What goes into a winning slot theme – and its design?

Latin America, Alberta, Australia & South Africa

MJulian Perry,COO, Editor-in-Chief

ore than six years after the overturning of PASPA, it remains fascinating to reflect on legal sports betting’s progress within the US.

While online casino is only regulated in seven states (when this changes, we could see a real surge of new players) sports betting has 38+ legal markets in some shape or form in the US – and is seeing multiple states thrive on the mobile side.

Now, as we explore in this issue’s cover feature, FanDuel and DraftKings rule the roost. And, objectively speaking, if just two companies hold c. 67% market share, anyone will tell you that is not the healthiest set of circumstances. There is, of course, a list of challengers: MGM and Caesars; bet365 is always in the running; Fanatics and ESPN Bet follow, while the likes of Betfred USA and Rush Street Interactive are currently fighting for a smaller piece of the pie.

But a running theme, of late, has been the departure of high-profile operators: Evoke (formerly 888), Kindred Group, Super Group (from sports betting; it is remaining in a couple of iGaming markets), Fox Bet, MaximBet, Fubo and more. Even WynnBet, considering Wynn Resorts’ prowess and prestige in land-based, is scaling back its mobile sports betting operations.

That just leaves more of the market for FanDuel and DraftKings to eat up… Is there any hope for the rest of the pack?

Of course there is! In recent conversations I’ve had with a number of industry CEOs, they’ve emphasised a simple message: you can succeed in the US if you do things right. It’s unfortunate to say but several of the operators in the list above simply did not enter the US with the right strategy. It’s something Betfred USA CEO Kresimir Spajic, consultant Stephen Crystal, lawyers Jeff Ifrah and Marc Balestra emphasise in our cover feature: that big companies with massive resources entered a hypothetical singular ‘US market’ with expectations of X investment returning Y profit.

With high acquisition costs and a different set of consumer preferences to Europe, we are seeing a very different reality. But there is a market there waiting to be attacked with the correct strategy. In New Jersey and Pennsylvania, recent revenue figures have shown a small decline in land-based gaming but huge yearly growth in iGaming and online sports betting.

These states are two of the most mature in the US in terms of mobile gaming and show that there is a growing sea of players looking to wager online. Do we really believe these customers would say no to a wider choice of operators to bet with?

Yes, the US is an expensive region. But is it an impossible one…?

Before PASPA, it was indeed a legal impossibility. Now, however, the first wave of failed imports to online US sports betting can only serve as a lesson. Don’t just recruit based on reputation, don’t be wasteful with your advertising, listen to your customer and, overall, bet smart. Several brands are still standing strong; there is no reason they can’t have company.

Elsewhere this issue, we speak with high-profile operator CEOs – Vlad Kaltenieks at BoyleSports and Anna Johnson at Svenska Spel. We also have a host of high-calibre contributions, ranging from a legal update on deposit limits in Germany from Dr Joerg Hofmann, to an interview on free-play research with Dr Anthony Lucas from the University of Nevada, Las Vegas.

Our coverage in this issue extends to gaming around the globe, with market focuses on Alberta, Australia and South Africa, while our roundtable talks all things slot themes – followed by one of our busiest Insiders sections ever. Happy reading!

TP, Editor

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

STAFF WRITERS

Beth Turner, Will Underwood, Ciaran McLoughlin, Kirk Geller

CONTENT WRITER Megan Elswyth

LEAD DESIGNER Olesya Adamska

DESIGNERS Claudia Astorino, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER

Medina Mammadkhanova

ILLUSTRATOR Maria Yanchovichina

MARKETING & EVENTS MANAGER Mariya Savova

FINANCE AND ADMINISTRATION ASSISTANT

Dhruvika Patel

IT MANAGER Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR BUSINESS DEVELOPMENT MANAGER - U.S. Aaron Harvey

Aaron.Harvey@playerspublishing.com

Tel: +1 702 425 7818

U.S. BUSINESS DEVELOPMENT MANAGER

Erica Clark

Erica Clark@playerspublishing.com

Tel: +1 702 355 0473

ACCOUNT MANAGERS

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0)203 435 5628

Max NGarry

Max.Ngarry@gamblinginsider.com

Tel: +44 (0)207 729 0643

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0)207 360 7590

CREDIT MANAGER Rachel Voit

WITH THANKS TO:

KresimirSpajic,Je Ifrah,StephenCrystal,MarkBalestra, VladKaltenieks,AnnaJohnson,DrJoergHo man,PaulSculpher, MalcolmWilkinson,DonBourgeois,JamieNettleton,SallyGainsbury, Garron Whitesman, Gil So er , Anthony Lucas,Chriso erMelldén, ThomasSchmalzer,DavidFall,ChristinaMuratkina,RenatoAlmeida, AraksiSargsyan,SimonWestbury,JohnConnelly,BrandonWalker, ArcangeloLonoce,Peter Korpusenko, Bogdan Holovnov, LT Game, Novomatic, Apex.

2043-9466

28 Standing strong

With insights from Kresimir Spajic, Stephen Crystal, Mark Balestra and Jeff Ifrah, Gambling Insider assesses the state of US online gaming

36 Healthy growth

BoyleSports CEO, Vlad Kaltenieks, speaks about his time in the role so far, global expansion, branding and more…

40 Leading with humility

Anna Johnson, Svenska Spel Group Chief Executive, speaks about succeeding Patrik Hofbauer, land-based casino challenges and reporting “healthy” gaming revenue in a new way

44 Push it to the limit

Dr Joerg Hofmann discusses gambling limits – be they stake, deposit or loss – and the balance that must be struck by regulators to ensure their effectiveness

46 A radical departure

Paul Sculpher catches up with We the Bookie Founder Malcolm Wilkinson, discussing the brand’s rebate system and bringing new ideas to the market

48 Down regulation road...

With Alberta set to follow in Ontario’s regulatory footsteps, Don Bourgeois explains exactly what goes into the process of provincial development

54 Cause & effect

Sally Gainsbury and Jamie Nettleton speak to Gambling Insider about the regulatory state of play Down Under

70

58 The best of both worlds

Garron Whitesman explains why the South African market falls in both the emerging & established categories – and what that means moving forward

62 Large-scale localisation

Gil Soffer unpicks the challenges, nuances and non-negotiables of successful entry into Latin America’s gaming markets

66 Is free play free falling?

Professor Anthony Lucas explains his latest research into the declining efficiency of free play, and how casinos can better spend their marketing bucks

70 Roundtable: Slots

Industry experts answer Gambling Insider’s burning questions on all things related to slot themes

81

78 Thomas Schmalzer Novomatic

79 Araksi Sargsyan DS Virtual Gaming

80 Simon Westbury SportGenerate

81 John Connelly Interblock

82 Brandon Walker Amelco

84 Arcangelo Lonoce Habanero

85 Peter Korpusenko Betcore

96

90 What's new?

Gambling Insider delves into the latest products on offer

96 Bogdan Holovnov Data.Bet

How have sports betting and iGaming in North America been developing and how successful have different operators been in different states so far this year? Gambling Insider investigates...

Source: American Gaming Association (AGA)

• Despite the growth of iGaming and sports betting since PASPA was overturned in 2018, land-based casino betting still makes up roughly three quarters of commercial gaming revenue quarter-on-quarter. However, this market has remained relatively stagnant, growing by 3.5% from Q4 2022 to Q1 2024 from $11.92bn to $12.34bn.

• Conversely, sports betting in the same period has grown in revenue by 31.1%, from $2.54bn to $3.33bn. Growth in iGaming has been even more significant, up 42.4% from $1.39bn to $1.98bn. While it is unlikely these markets will outperform casino gaming in revenue anytime soon, it is likely they will continue to account for a larger part of the commercial gaming revenue pie.

Source: iGaming Ontario

• Since the launch of iGaming in Ontario on 4 April, the market has grown rapidly, hosting 50 operators and 81 sites as of 11 July 2024. The data above covers the time period up to and including 31 March 2024.

• While the number of operators stabilised (and even decreased) during the 2023-24 period, revenue continued to grow, showing an increase in interest from players or improved marketing strategies from operators already providing iGaming options in Ontario.

fiscal year runs from 1April to 30 March

Massachusetts sports betting taxable revenue by licensee ($m)

Source: Massachusetts Gaming Commission

• Unlike the majority of states, and in direct contrast to the quarterly reports submitted by FanDuel, DraftKings has routinely generated a higher revenue than its primary competitor

in Massachusetts. Both operators outperform all other state sports betting operators by a significant margin.

• The gap between the operators was its largest in February, with DraftKings making $30.8m

to FanDuel’s $14m. However, FanDuel has begun to close the gap, with a difference of just $2.8m in taxable sports betting revenue reported in June 2024. Crucially, Massachusetts is DraftKings’ home state.

Michigan operator sports betting handle ($m)

Source: Michigan Gaming Control Board

• When looking at Michigan’s top gaming operators by monthly sports betting handle, MotorCity Casino consistently comes out on top. Operating a FanDuel Sportsbook on the property, MotorCity Casino saw high handle

at the start of the year that has declined as the year has gone on – a trend notable among sports betting operators in multiple states.

• Conversely, Bay Mills Resort and Casino, operated by the Bay Mills Indian Community, plays host to a DraftKings sportsbook on its property. As seen in Massachusetts, summertime seems to be the time when FanDuel and DraftKings share the most equal footing, compared to the start of the year when the dominant state operator becomes more visible.

Source: Commission websites

*Total gross sports betting receipts

**Net proceeds

***AGR

• Pennsylvania and Indiana show similar sports betting trends to Massachusetts and Michigan, in that they tend to reach highs early in the

year only to decline as they enter the summer. Louisiana bucks this trend, however, having its most lucrative sports betting month in the year so far in April.

• Massachusetts and Pennsylvania experienced the most significant drops in revenue from January to June, while Louisiana remained

relatively consistent across all six months.

• Indiana and Michigan are shown to routinely swap leads month-on-month, with Indiana outperforming Michigan in January and February and Michigan outperforming Indiana in the remaining months until June. Interestingly, in June Michigan outperformed Indiana by just $0.4m.

Iowa online sports net receipts by operator ($m)

Source: Iowa Racing & Gaming Commission

• Excluding Iowa’s two largest operators, Crown IA and Betfair, and focusing on the state’s mid-tosmall sized operators, BetMGM and American Wagering routinely perform better than their peers, outperforming operators including Penn Sports and RSI.

• Tipico saw its monthly revenue decline sizeably between March and June 2024, going from net receipts of $103,681 to $30,971, down 70.1%. In July, Tipico was acquired by BetMGM subsidiary LeoVegas, pulling the brand from the US market.

• Meanwhile, Betfred has kept its net receipts fairly

consistent month-on-month, declining by 8.1% between March and June. However, operators have generated net receipts nowhere close to those made by native operators, which may be indicative of why some non-US-owned brands are choosing to leave the US market (see our cover feature for more on this topic!).

Gambling Insider tracks land-based operator and supplier prices. Stock prices are taken across a six-month period (March 2024 to August 2024) – and from the close of the first available date of the month

MGM RESORTS INTERNATIONAL

• Six-month high - April (47.78 USD)

• Six-month low - August (37.29 USD)

• Market capitalisation - US$13.48bn (as of 1 August 2024)

CHURCHILL DOWNS INCORPORATED

TABCORP HOLDINGS

• Six-month high - August (139.96 USD)

• Six-month low - March (119.62 USD)

• Market capitalisation - US$10.54bn (as of 1 August 2024)

• Six-month high - April (0.75 AUD)

tabcorp

• Six-month low - June (0.62 AUD)

• Market capitalisation - US$0.96bn (as of 1 August 2024)

WYNN RESORTS LIMITED

• Six-month high - April (106.56 USD)

• Six-month low - August (78.71 USD)

• Market capitalisation - US$9.28bn (as of 1 August 2024)

• Six-month high - August (106.23 USD)

• Six-month low - May (90.00 USD)

• Market capitalisation - US$9.69bn (as of 1 August 2024)

• Six-month high - August (12.93 USD)

• Six-month low - June (7.37 USD)

• Market capitalisation - US$1.10bn (as of 1 August 2024)

• Six-month high - August (54.32 AUD)

• Six-month low - May (39.34 AUD)

• Market capitalisation - US$22.48bn (as of 1 August 2024)

Six-month high - April (1,960 JPY)

Six-month low - August (1,467 JPY)

Market capitalisation - US$0.76bn (as of 1 August 2024)

The Global Gaming Expo returns to the Venetian Las Vegas for its 24th year and Gambling Insider previews what to expect at the US’ biggest gaming trade show

It’s that time of year again. The gaming world is gearing up for its annual trip to Las Vegas for the 24th iteration of the esteemed Global Gaming Expo (G2E). The G2E Summit is a chance for organisations from across the industry to bring their best and brightest in products and people, to showcase all they have to offer.

Hosted by Reed Exhibitions (RX) and the American Gaming Association (AGA) at the Venetian in Las Vegas, the exhibition will take place in the Venetian Expo Hall. The event kicks off on Monday 7 October and will reach its conclusion on the afternoon of Thursday 10 October.

Last year, Las Vegas saw an influx of 25,000 gaming professionals and 268 exhibitors from 125 countries to the Venetian. This year’s G2E will, of course, aim to build on that, as

well as the years that came before. Therefore, guests and exhibitors alike, can expect bigger and better from G2E 2024.

With over 300 scheduled keynote speakers and 95+ sessions and presentations, G2E 2024 has partnered with the likes of the Indian Gaming Association, Global Gaming Women and the International Association of Gaming Advisors as part of the design process of this year’s programme.

The goal of G2E is to be a hub of gaming sessions, presentations and expositions. Focusing on the latter, the Exposition Hall will, this year, become the temporary home of over 350 exhibitors looking to showcase their latest gaming innovations. Further, there will be an iGaming Zone for online gaming suppliers and operators. This space is dedicated to exploring the latest in both

online casino and online sports betting across the Americas. Naturally, in recent years, G2E's focus on iGaming has become greater and greater.

Moreover, a recent addition to the G2E Summit has been ‘The Lab’. Formerly known as ‘The Innovation Lab,’ ‘The Lab’ acts as a centre for both networking and discussion around the topics of iGaming innovation and the future of the industry.

This year’s G2E features a New Exhibitor Zone for first and second-time G2E exhibitors, with a view to offering a dedicated space for visitors to explore exhibitions from companies they may not have seen in previous years.

The AGA initially hosted the first ever Global Gaming Expo in October 2001 at the Las Vegas Convention Center – which would remain the home of the exposition for 10 years

until the location was updated to the Venetian by the AGA in 2010. At the first meeting, keynote speakers including then Chairman and CEO of MGM Studios, Alex Yemenidjian and actress Whoopi Goldberg, who presented to the 10,000 attendees. Since then, G2E has grown to accommodate 25,000 attendees in 2023, making G2E one of the world’s fastestgrowing trade shows by attendance.

G2E 2023 signified the show’s full recovery from Covid-19 and was just 2,000 attendees shy of topping the summit’s record attendance figures of 27,000, recorded shortly before the pandemic at G2E 2019.

Looking ahead, G2E 2024 will aid the discussion of key industry topics via carefully selected panels and presentations constructed by the event’s organisers. Broader topics for G2E 2024 include conversations around advancements in crisis communications for gaming leaders, and the roadmap for online gaming and sports betting expansion. Further, customer journey mapping for casino marketing will also be on the agenda.

Taking a closer look at this year’s schedule, however, a range of events will take place

across seven different stages entitled Veronese 2401, Titan 2301, Titan 2303, Titan 2305, Titan 2205, Bellini 2101 and Bellini 2103. Kicking off on Monday at 9:00am on the Veronese 2401 stage is the ‘Casino Loyalty 2.0: Creating Lifelong Patrons’ talk. Other interesting early discussions include the ‘Lessons from a Year of Change’ discussion at 9:00am on Titan 2301, ‘Where Sports Betting Sits on the Regulatory Agenda’ at the same time on Bellini 2101 and ‘The Role of DEI in the Gaming Industry,’ also at 9:00am on Titan 2205.

‘Navigating Cyber Extortion’ will be explored at 10:10am on Titan 2301 – particularly interesting given the high-profile MGM cyber attack of last year – while ‘Opportunities in Tribal Gaming: Growth and Regulation’ will take place on the Titan 2303 stage at the same time. The afternoon also plays host to a number of interesting topics, such as ‘Women in AI: Pioneering the Next Generation of Casino Tech’ on Titan 2301 at 2:40pm and ‘Seizing Opportunities in Brazil’s Sports Betting Market’ on Bellini 2103 at the same time.

Tuesday begins with the ‘G2E Welcome and State of the Industry’ presentation on the main stage, followed by the Tuesday Keynote Speaker (TBC) from 8:30am – 10:00am. The

“ Whatever unfolds is no doubt sure to shape top-level strategy for the gaming industry heading into 2025. Whether it’s AI, M&A, tribal gaming or online casino, a transformative year most likely awaits. After all, in this dynamic industry, what year isn’t transformative? ”

Expo Hall will then be officially opened for exploration between 10:00am and 5:00pm.

Wednesday’s Keynote will appear from 9:00-10:00am, followed by a range of talks, including two both held at 11:40am on ‘Regulatory Modernisation in the UK and What the US Can Learn’ on Bellini 2103 and ‘Deep Dive: Online Gambling in Latin America’ on Veronese 2401. While, at the time of writing, G2E's keynotes are unconfirmed, they usually deliver with high-level conversations from the industry's big-named CEOs.

Finally, Thursday concludes the exposition with four separate workshops, held on Veronese 2401, Titan 2305, Titan 2205 and Bellini 2103, covering subjects including casino marketing, sports betting expansion, enhancing efficiency with Lean Six Sigma and crisis communications with gaming leaders. The Expo Hall will also be open from 10:00am – 3:00pm, before the summit reaches its conclusion.

One of the key motivations for many considering attending the G2E Summit is the opportunity to network with other industry participants. The event has, therefore, included a G2E Networking Lounge for this year’s exhibition, which will attempt to spark discourse through the arrangement of themed meetups and events. RX is certainly emphasising the benefits of networking at this year's event.

Overall, whether it's networking, attending conference panels or simply walking the show floor, there is an abundance of opportunities to look forward to at this year's G2E. Whatever unfolds is no doubt sure to shape top-level strategy for the gaming industry heading into 2025. Whether it's AI, M&A, tribal gaming or online casino, a transformative year most likely awaits. After all, in this dynamic industry, what year isn't transformative?

The gaming industry’s most prestigious Awards ceremony takes on a new form in Europe, making its debut in the Catalan capital of Barcelona

Anyone fortunate enough to attend multiple Global Gaming Awards will know that every ceremony is different. New nominees, new winners and new industry developments guarantee an air of renewed exuberance at every annual Awards ceremony. The Global Gaming Awards EMEA 2025, however, promises to be a unique experience for all in attendance. After seven years of memories at the Hippodrome Casino in London, the ceremony takes on a new form in the city of Barcelona.

The Global Gaming Awards took on its first form in Las Vegas 10 years ago in 2014. Four years later, the Awards expanded to London, finding their its home on this side of the pond at the Hippodrome Casino in London. Following the success of the awards across the Americas and Europe, the Global Gaming Awards expanded once again to the Asia-Pacific region in 2022, with the first in-person ceremony being held in Manila in conjunction with the SiGMA Asia Summit in June 2024.

Barcelona, of course, is a city adorned with both beauty and history – making it the perfect location for the gaming industry’s most coveted awards. For the first time, 2025’s iteration of the Global Gaming Awards EMEA will be held at the Fira Barcelona Gran Via. Designed by Pritzker Architecture Prize winner Toyo Ito, the venue is located close to the city’s airport and boasts an exhibition area of 240,000 square metres – making it one of the largest and most modern fair halls in Europe. Home to 3 million visitors and 270+ fairs, congresses, activities, seminars and other events each year, the Fira Barcelona

Gran Via is also set to play host to the gaming industry’s largest annual summit in SiGMA ICE Barcelona 2025.

World-class ceremonies require world-class settings, which is why the next Global Gaming Awards EMEA will be held at a prestigious Fira Barcelona Gran Via restaurants on the 20 January 2025, during ICE week. The location of the 2025 Global Gaming Awards EMEA has, indeed, been updated. However, the selection process remains as thorough as ever.

As always, the awards will be judged by a panel of over 50 industry leading executives and independently adjudicated by KPMG in the Crown Dependencies. Executives, of course, are unable to vote in any categories in which there may be a conflict of interest. Nominees and winners alike are determined through a meticulous selection process and broken down into 16 categories.

The Global Gaming Awards are designed to cover the length and breadth of the gaming industry, ensuring recognition for each corner of the business. Awards for sports betting operators, suppliers, retail operators, online & in-person casinos and affiliate programs are all up for grabs. Additionally, Awards for the year’s best social responsibility programs, platform providers, breakthrough companies and individual executives are also on the agenda.

Taking a look back at some of this year’s winners, bet365 were among the afternoon’s biggest beneficiaries and one of two organisations to go home with multiple Awards – winning awards for both Affiliate Program of the Year and Online Sports Betting Operator of the Year. Pragmatic Play also took home the Awards for Online Casino Supplier of the Year, as well as Product Launch of the Year for its live casino game, Treasure Island.

We would also be remiss if the Global Gaming Awards did not reflect on its seven-year tenure at designed in 1898, the Hippodrome Casino

We would also be remiss if the Global Gaming Awards did not reflect on its seven-year tenure at London’s iconic Hippodrome Casino. Originally designed in 1898, the Hippodrome Casino building has taken on a range of forms over its numerous lifetimes. Initially introduced as a circus hosted by Charlie Chaplin in the early 1900s, the Hippodrome’s theatrical introductory phase also saw a one-off performance from Harry Houdini in 1904.

The building later took on a more musical form, notably playing host to the UK’s first ever jazz concert by the Dixieland Jazz band in 1919 and, rather poetically, also hosting Prince’s last ever UK show nearly 100 years later.

Following the opening of The Hippodrome Casino in 2012, the venue saw seven Global

Empowering operators with cutting-edge technology and unparalleled flexibility, Kambi, along with Abios, Shape Games, and Tzeract, delivers unrivalled sports betting and entertainment experiences. As pioneers in the industry, we push the boundaries of innovation, providing best-in-class products that meet diverse strategic needs and set the standard for excellence. Together we are limitless.

Gaming Awards ceremonies come and go between the years of 2018 and 2024, playing an invaluable role in the Awards’ evolution.

Mariya Savova, Global Gaming Awards Event Manager, reflects on the Hippodrome’s contribution as long-term host: “The Hippodrome Casino is a true innovator and one of the driving forces of the UK gaming industry. We can’t thank Executive Chairman Simon Thomas enough for giving the Global Gaming Awards a home for seven years. Even in 2021, when we couldn’t host an in-person ceremony due to Covid-19 restrictions, we filmed the virtual presentation at The Hippodrome. It has been an honour and a pleasure to work with The Hippodrome Casino’s team, gathering the best of the best from the gambling industry in the UK’s most fabulous casino.

“Change is, of course, difficult – but it is also incredibly exciting! The Global Gaming Awards EMEA have always been held during ICE week and we would like to keep that tradition, which is why next January we will celebrate the best suppliers and operators from Europe, the Middle East and Africa in the beautiful city of Barcelona. I am pleased to share that the Global Gaming Awards will be held at the ICE 2025 venue, Fira Barcelona Gran Via, at the end of Day 1. I’d like to thank the Clarion Gaming team for welcoming our event to ICE week, which is certainly shaping up to be fantastic. ¡Hasta pronto, Barcelona!”

Barcelona’s Global Gaming Awards EMEA 2025 will see a few changes from its previous, Londonbased ceremonies. Hosted in tandem with ICE week in Barcelona, the event will be held at a slightly earlier date of the 20 January, meaning the self-nominations will be set to close at a slightly earlier date. Self-nominations are now open and are set to close at the end of October.

Afternoon tea will be swapped out for afternoon tapas – with the historical suave of the Hippodrome Casino making way for the sleek modernism of the Fira Barcelona Gran Via. However, in between now and the 2025 EMEA Global Gaming Awards stands the 11th Global Gaming Awards Americas ceremony. With the full Shortlist soon to be revealed, the voting for this year’s Global Gaming Awards Americas is set to commence on 9 September. The ceremony follows shortly after on the 7 October.

As always, the Global Gaming Awards Americas is bound for the legendary Venetian Resort Las Vegas for its eleventh outing. Doors will open at 11:45am, with the presentation ceremony officially commencing at 12:30pm.

With three annual Global Gaming Awards now being held around the world for the Americas, EMEA & Asia-Pacific regions, a ceremony is never far away – and while the Americas is around the corner, the

Asia-Pacific ceremony is still visible in the rear-view.

This year saw the Asia-Pacific Global Gaming Awards’ first-ever in person ceremony following the loosening of Covid restrictions in the region. Held in tandem with the SiGMA Asia summit at the Conrad Manila, the Awards celebrated the best and brightest the industry has to offer in the region – which is all but returning to full strength following the pandemic.

As always in gaming, there has been a lot to acknowledge in the industry so far this year. The continuous boom in technologies such as AI has generated countless examples of innovation and re-innovation across the global market. Personalisation technologies, responsible gambling, cryptocurrency integration and the continuous development of interactive VR online casino – to name but a few – have re-shaped the industry over the course of 2024.

These pioneering innovations are exactly what the Global Gaming Awards are put together for – recognition of the brilliant minds behind these new ideas. A new setting awaits this year’s attendees for the Global Gaming Awards EMEA. However, the ceremony itself promises to remain a celebration of another stellar year for gaming.

With insights from Kresimir Spajic , Stephen Crystal , Mark Balestra and Je Ifrah , Gambling Insider assesses the state of US online gaming. As some decide to leave the space, others are in pole position to capitalise…

If you’ve been keeping up with the headlines over the past six months, you will have noticed that a lot of operators have been leaving the US – a lot. At the same time, some operators have remained. Those such as FanDuel, DraftKings, BetMGM, Caesars and bet365 are – to varying degrees of success – standing strong.

Whether the brands who have exited the US were via acquisition, the sale of assets or a calculated step back, one thing has been made clear: Even for big-name brands, financial success in the US is no guarantee. From Tipico to Evoke to Kindred, operators exiting stage left have become increasingly noticeable, with many of the States’ largest operators still struggling to report quarterly profits. Even homegrown WynnBet and Superbook have scaled back their online operations. So, what is causing operators to leave the US, while those that remain solidify their market share?

Gambling Insider investigates...

Before looking into the organisations that have succeeded and those that have faltered in the US, it’s important to look at the region's turning point, or overturning point, if you will: the overturning of the Professional and Amateur Sports Protection Act of 1992 (PASPA). Occurring on 14 May 2018, those familiar will know this ruling changed everything for online sports betting in the US. The overturning of the law gave individual states the power to legalise the practice of sports wagering, with some offering online betting, some offering retail sports betting and others offering both.

For operators already working in the US, such as MGM and Caesars, as well as the fantasy sports apps operating at the time such as FanDuel and DraftKings, the overturning of PASPA meant the opportunity to take on a particularly lucrative new vertical. International operators, though, also had the same idea, resulting in a gold rush of operators arriving Stateside. It was at the time

of PASPA’s overturning that iGaming began to make its presence known in the legalised gaming market, too.

Online gambling was hit hard in the mid2000’s when the US Senate passed the Unlawful Internet Gambling Enforcement Act (UIGEA) in 2006, which prohibited “knowingly accepting payments in connection with the participation of another person in a bet or wager that involves the use of the internet and that is unlawful under any federal or state law.” However, states in the past decade have changed their tune and are now able to legalise iGaming, with iGaming now legalised in seven US states. The first of these was Delaware in 2013, with states including Michigan, Pennsylvania and Rhode Island following suit. Naturally, though, there is still some way to go here compared to the 35+ states with legal sports betting.

paying taxes – with rates as high as 51% (New York), even leading DraftKings to announce a Q2 surcharge for its customers (before shortly rescinding it) – operators must invest in technology, which can be over $2m per state, according to Spajic. Then operators must go through the licensing process, both for the product and the company owners; something Spajic describes as “very intruding for some individuals” and a “very lengthy process.”

present from 2013, but not much happened until the PASPA overturning,”

. “Then everybody rushed into the US because they knew this would be

in the culture. Although it wasn’t legal, many people were betting offshore between themselves. So even for they rushed because they would have been punished by the stock

“At first, digital gaming in the US was present from 2013, but not much happened until the PASPA overturning,” Kresimir Spajic, Betfred USA CEO, tells Gambling Insider everybody rushed into the US because they knew this would be a large market. In the US, sports and sports betting is so ingrained in the culture. Although it wasn’t legal, many people were betting with offshore books or just between themselves. So even for the people that didn’t want to go into the market or didn’t know exactly what to do in the market, they rushed because they would have been punished by the stock markets for not participating in such a great opportunity.”

Yet this is not just the case for operators. Suppliers must also go through this process –with costs higher than the rest of the world, from technology and licences to salaries and simply every-day costs for employees and executives. When operators dived into the market en masse, they were not “really thinking,” says Spajic, “because people were thinking ‘I’m going to have 3% of the market and 3% of $27bn sounds like a sizeable amount of money.’ But this is where

Six years on, Spajic now calls the market

taxation rates; all things operators are now feeling the brunt of following the market’s stabilisation. As well as money.’ But where

“ The US needs to be treated like each state is a separate country, as you have it with Europe ”

- Kresimir Spajic, Betfred USA CEO

Six years on, Spajic now calls the market one of “reflection” for those that rushed in. The cost of operating in the US, the taxation rates; all things operators are now feeling the brunt of following the market’s stabilisation. As well as

mistakes were made, because many models were built from the top town, instead of from the bottom up to understand the cost structure.

“Now, everybody is saying ‘Oh we lost several $100m or billions of dollars, and now we are getting penalised either by our core business, which is our brick-and-mortar business, or for hitting good results in the rest of the world by losing tens or hundreds of millions of the dollars in the US. So, now you see that mostly public companies are withdrawing.”

As a privately funded company, Betfred is able to take a “long-term approach,” with Spajic explaining that “I believe there is a market share at the bottom. You are not looking to be the market leaders. You’re going to be market participants with a sustainable business.” But what makes a market leader? And where does that leave the operators that cannot sustain operations at the bottom?

thinking of Googling for SEO or

their minds will go the company’s

can ensure huge success going forward. Not always, of course, but it creates the advantage of a customer associating the first product they used with that service (like thinking of Googling for SEO or Kleenex for tissue paper). When people think of major casinos in the US, their minds will likely go the properties located on the Strip; Caesars Palace, The Bellagio, Luxor and thus their operators, Caesars and MGM. Similarly, when they think of mobile sportsbooks, their minds will go the company’s that first popularised it first via fantasy sports – namely, DraftKings and FanDuel.

Secondly, wise M&A activity and in-

The US market is dominated by a handful of operators. FanDuel and DraftKings alone, according to various data and company earnings reports, hold 67% of US sportsbook market share by gross gaming revenue (GGR), with BetMGM and Caesars Sportsbook following behind with an 11% and 6% GGR market share, respectively. This means just 16% of the market is to play for for the rest. How did FanDuel and DraftKings manage to pull this off?

verticals than they could on their own. As SCCG Management Founder and CEO Gambling Insider :

US iGaming and sports betting market is driven by strategic acquisitions, partnerships

acquisition of SBTech enabled a proprietary

diversified its offerings, including racing and poker. BetMGM leveraged MGM Resorts’ brick-and-mortar presence

while Caesars expanded its digital footprint with the acquisition of

The first factor to consider is first.

being first.

Engaging in a market before anyone else, or being the first to gain public attention and recognition,

anyone else, or recognition,

media, big tech, teams, leagues and influencers. Only operators

like Prime Video, AppleTV, CBS, NBC and ESPN can leverage the

Secondly, wise M&A activity and inhouse tech has allowed operators like DraftKings and FanDuel to hold influence over a wider range of verticals than they could on their own. As SCCG Management Founder and CEO Stephen Crystal tells “The dominance of major operators in the US iGaming and sports betting market is driven by strategic acquisitions, partnerships and proprietary technology. DraftKings’ acquisition of SBTech enabled a proprietary platform and its recent purchase of Jackpocket targets the digital lottery market. FanDuel’s merger with Flutter Entertainment diversified its offerings, including racing and poker. BetMGM leveraged MGM Resorts’ brick-and-mortar presence for omnichannel experiences, while Caesars expanded its digital footprint with the acquisition of William Hill. Partnerships have also played a crucial role across media, big tech, teams, leagues and influencers. Only operators that can afford to pay a premium or partnerships with major platforms like Prime Video, AppleTV, CBS, NBC and ESPN can leverage the

“Additionally, paying premiums for business characterised by small margins makes it exceedingly difficult for smaller operators to and DraftKings this off?

extensive reach

dominance of these media brands to enhance their content offerings and co-branding opportunities.

extensive reach and market dominance of these media brands to enhance their content offerings and co-branding opportunities.

“Additionally, paying premiums for competitive marketing and league data in a business characterised by small margins makes it exceedingly difficult for smaller operators to operate efficiently. These extensive media deals set a high precedent for customer acquisition costs and market share expansion, driving smaller operators out of the market.”

Notice how many of the US’ biggest operators are US-based companies? This is another factor to consider. American born-and-bred operators have shown an ability to dominate the market, while European-based operators like Kindred and Evoke have had to return to their side of the pond. However, opinions on whether operators from the US have a market advantage over overseas operators are mixed. According to Crystal: “US-grown operators have an edge in the US market due to their familiarity with local regulations and consumer preferences, rapid adaptability

and strong brand recognition created by partnerships with major US media brands. However, international operators benefit from extensive experience in mature markets, advanced technology and global brand them to bring products and strategies to the US.”

recognition, enabling innovative operator a better chance

dominated their respective markets prior to legalisation in the United States.”

Thinking back to the overturning of PASPA, Ifrah Law Founder Jeff Ifrah recounts how, initially, it was assumed that “sports bettors want to bet with a brand they know,” pointing to brands like bet365 and Betfred as early candidates for US success. Of course, that was not the case, noting that for the brands that were successful, it was not the brand itself that drove their success.

Similarly, being in the market early gives an operator a better chance of securing the correct licences to operate in a new vertical, according to Segev LLP US Special Counsel Mark Balestra. Balestra made Gambling Insider that, while “US operators have the advantage of exclusive licensing rights,” international operators have “invaluable experience in the online space,” pointing to how many partnered with online providers from outside the US.

Mark a similar point, telling while “US operators have the advantage space,”

many

Another school of thought at the time was that it would be casino brands that would find success in the newly legalised sports betting market – MGM, Caesars and so on. It was “the initial concept that these casino operators would succeed because of their recognition in America, which was wrong. So what was right? It seems what was right was someone already in America. If you look at FanDuel and DraftKings, what was their recipe for success? They were already in America. They already had loyal fans on the fantasy side. And I think one of the things that doesn’t get spoken about a lot is that they had payment processing lined up.”

customer acquisition in the US – something European operators may have been unprepared for. “Six years [after PASPA], a new market opens up, and DraftKings and FanDuel on day one occupy over 80% of it,” says Ifrah. “They’ve got brand recognition. They have a product that seems to satisfy that market. Now they have volume throughout, which helps them succeed anywhere they go on day one. MGM, Caesars and Fanatics have done a good job of catching up. In Ontario, bet365 is doing very well, in Ohio they’re doing very well. So there still is room for someone below those top five. But it’s very difficult. It’s not going to be for everybody. And it’s not going to follow the mould that the European operators are used to.”

All this is to say, to some extent, and especially in the market's opening years, yes, homegrown talent did have something of an advantage, though it was far more than just being there first that sealed FanDuel and DraftKings’ success. Being on top of taking payments and the regulatory frameworks of different states is critical – especially considering the idea that, as Spajic puts it, each state is like its own country.

US operators have “In many cases, well-established existing opportunities for newcomers have course the operators who dominate the US market

“In many cases, well-established existing land-based operators were the only businesses eligible for licensure, so opportunities for newcomers have been limited,” he says. “When landbased licensees partner with online operators they are of course apt to work with providers with a track record for success.

Indeed, gaming has often faced challenges with online payment processors, with many opting to avoid the industry due to perceived risk, especailly when it comes to banking. According to Ifrah, “the statistic used to be that only 35% of customers are successful in onboarding from a payment perspective, on their journey on a given operator. When the numbers are that low, and on top of that you are having tension with your payment suppliers or with the card networks, it’s not a good recipe.”

risk, especailly when it comes to banking. According to Ifrah, “the statistic used to be customers successful their journey on a given operator. When the numbers are that low, and on top are tension card networks, it’s not a good recipe.” While DraftKings and FanDuel

“I come from Europe and I’ve lived in the US for over 10 years. Here in the US, people were just using what they knew,” Spajic recounts, thinking back to the overturning of PASPA. “It

thinking back to the overturning of PASPA. “It was a standard approach to think ‘we already have our technology, let’s bring it to

So for the most part, the handful of major operators who dominate the US market is the same handful of major operators who

While DraftKings and FanDuel may have had a headstart due to their card processing capabilities, Ifrah also pointed to the cost of

When smaller or international operators exit, the market becomes increasingly dominated by a few major players ”

- Stephen Crystal, SCCG Management CEO & Founder

the US. We have been doing this for so many years and so many countries, let’s do this again.’ But the US is very specific. The US needs to be treated like each state is a separate country, as you have it with Europe. You cannot also use the same approach in Wales, Ireland and England. It’s the same as how you treat Iowa, New York and Florida. It’s very different. There are some similarities and commonalities, of course, but legislation might be different. Bettor preferences might be different.”

Indeed, US and European markets are very different – the models used in Europe are not guaranteed to work in the US, and considering how different each state is, having just one game plan for the US as a whole is already playing the field with a disadvantage. When asked where he feels international operators are going wrong when entering the US, Crystal tells us: “One major issue is their difficulty in appealing to US consumers’ preferences and betting habits. International operators sometimes misjudge the popularity of certain sports and betting types in the US, failing to offer the right mix of options that resonate with American players. Their marketing strategies, which might be effective globally, often need significant adjustments to cater to the cultural nuances and media consumption habits of the US audience.”

But what do operators have to contend with when they make it to the top?

Operating in the US is expensive. Consider again the market’s largest operators; FanDuel, DraftKings, MGM. Despite bringing in billions in revenue annually – even quarterly - these operators struggle to report positive EBITDA or net incomes, with some yet to break this glass ceiling.

Looking at some recent Q2 results, the expenses of operating in the US become more apparent. In its Q2 report, DraftKings even went so far as to announce its plans to introduce a surcharge fee for large bets made by players in certain high-tax states at the start of the new year, supplementing the charges made to the operator. This, CEO and Co-Founder Jason Robins said, would hopefully allow it to “drive adjusted EBITDA upside on an annual basis.” DraftKings quickly reneged on this decision, but the fact it was even a consideration shows exactly the kind of cost level operators are dealing with.

implement a customer surcharge” according to CEO Richard Schwartz, stating that “as we put our customers first, it was an easy decision for us.” Ouch.

But beyond this, consider the price of customer acquisition in the US. Speaking on DraftKings and FanDuel, Ifrah says: “They were spending a lot of money on customer acquisition. They were operating in a way that European operators weren’t used to, in terms of the money spent to acquire customers.”

To assess the cost of a new customer and whether that expense can be turned into profit, operators will need to compare these versus the player's lifetime spend. For the most part, at least in the US, the cost of acquiring a customer can far outweigh the latter. As Ifrah puts it:

“Those metrics are always upside down. The lifetime customer spend has historically been less than the cost of acquiring a customer. We used to see figures of upwards of $1,000 for a new customer and under $1,000 lifetime spent by that customer. So it is not a good picture.”

This kind of spend is not one many European operators will be familiar with in their home territories. Instead, the US is a region centred on staying afloat despite the losses – those that succeed are those with a tolerance for staying “upside down,” Ifrah states.

Of course, being from the US brings an advantage here too – putting FanDuel and in a particularly favourable position.

Consider the mobile tax rate in New York. At 51%, it is the highest in the US. There is also the recently announced tax hike in Illinois, which will take rates from 15% to 40%. DraftKings pointed to Illinois, New York, Pennsylvania and Vermont as the only four states to initially face the surcharge... though if another state chose to follow in Illinois’ footsteps, who’s to say they may not have been impacted by a surcharge too?

Of course, not every operator expressed a desire to copy DraftKings in this decision – Rush Street (RSI), while doing so without naming names, said it “has no plans to

So, with all this to consider, where is the US market heading? With the dominance of the US’ major players showing little in the way of change, it will likely mean more small-scale operators pulling the plug, or finding new and creating ways to survive “upside down.”

Going niche in your product offering was the advise given by Crystal for small to

“ For the most part, the handful of major operators who dominate the US market is the same handful of major operators who dominated their respective markets prior to legalisation in the United States ”

- Mark Balestra, Segev LLP US Special Counsel

mid-size operators. “They can survive in the US by focusing on niche markets and innovative offerings that differentiate them from larger competitors. Effective bankroll management, strategic partnerships, targeted marketing and leveraging unique technologies or customer experiences are crucial for gaining and retaining market share. Developing exclusive content, forming partnerships with local influencers or sports teams and offering specialised products such as localised betting options or unique gaming experiences can attract a dedicated customer base and drive growth,” he explains.

Ifrah has a similar idea, pointing to the range of verticals that businesses could target to avoid competing in a pond with the likes of DraftKings and FanDuel. Using Super Group, another recent US sportsbook market exitee as an example, he says: “You can survive with online gaming. You can survive in live dealer. They may have databases they can monetize through affiliate arrangements. Also, if they have good content, they can enter into rev-share agreements with DraftKings, FanDuel etc to offer that content on those sites. The skill is maybe to not just be a B2C operator of sports betting.”

Moreover, Ifrah notes that, for the most part, it is the suppliers in the US market that

are making the money, not the operators. “Suppliers of tech; geolocation or identity verification of KYC, fraud detection tools,” as well as affiliates and odds makers, provide particular value to operators, making them potential verticals to explore.

For Ifrah, avoiding the sports betting market is also key because, to him, while the monopoly on sports betting is likely to remain, the iGaming market is still one to play for – and it is one operators should not overlook. “I don’t think we’ve seen what can happen there because that market is a lot more profitable. It’s funny. DraftKings reported their numbers and, in New Jersey, 55% of their revenue comes from online casino. I think that when it comes to online casino, you are going to see other brands be able to take market share. We’re not going to see DraftKings and FanDuel taking the market share they take in sports in casino.

While the iGaming market has potential to be profitable for alternative operators, for Balestra, it is important to note that this market is even newer than the sports betting market, with even less regulation in place. “Online casino gambling in the US may be approaching a crossroads,” he explains. “The sweepstakes casino model is thriving because companies have – at least up to this point – been able to offer casino entertainment without having to comply with government regulations. There’s a lot of legal uncertainty surrounding the model, however, and that leaves licensed casinos with a dilemma: either enter the space and put their licenses at risk or sit back and watch the sweepstakes casinos make hay.” The American Gaming Association's recent note to regulators on sweepstake casinos, advising them to clamp down on the practice, certainly adds to this dilemma.

“If you notice, Betway announced that they were leaving. But, then they announced they’re staying in Michigan and New Jersey on the online casino side. That’s because they recognise that’s a profitable market. Maybe sports aren’t. Maybe we don’t need omnichannel, maybe we don’t need to be able to sell our consumers everything.”

profitable market. Maybe sports aren’t. Maybe we of the market, it is likely we will see more exits, more buyouts and more specification

operators exit, the market becomes increasingly concentration can lead to reduced competition, consumers in terms of betting options and

drive new ideas and technologies to differentiate

seen professional sports leagues and sports media conglomerates begin to steer the market,

wanted nothing to do with betting, which was seen only as a threat to the integrity

With just a handful of operators occupying the majority of the market, while the rest of the US’ operators fight for their share of less than 20% of the market, it is likely we will see more exits, more buyouts and more specification in operator product offerings. Crystal comments: “When smaller or international operators exit, the market becomes increasingly dominated by a few major players. This concentration can lead to reduced competition, potentially resulting in fewer choices for consumers in terms of betting options and promotions. A less diverse market may also stifle innovation, as smaller operators often drive new ideas and technologies to differentiate themselves.” Current market trends, meanwhile, have led to a “snowballing” effect, according to Balestra. “In the last five years or so, we’ve seen professional sports leagues and sports media conglomerates begin to steer the market, and this will only continue… Not long ago the sports entertainment industry in the US wanted nothing to do with betting, which was seen only as a threat to the integrity of sports. That has changed drastically in recent years, and partnerships among the leagues, the sportsbooks and the media are flourishing,”

leagues, the sportsbooks and the media are flourishing,”

will get there first.

Indeed, and with it only being the largest operators that can afford to participate in these partnerships, the divide between top dog and small operator will likely continue to widen. But should we be concerned? We feel not. Innovation in the gaming industry is always just around the corner, and with that presents routine opportunities for operators to claw back a place at the table, or to turn themselves downside up. Where there's a will, there's a way. It’s just a case of who will get there first.

Gambling Insider Editor Tim Poole speaks with BoyleSports CEO Vlad Kaltenieks about his time in the role so far, global expansion, branding and more

BoyleSports is a sign of the international nature of world sports because it started out as a family-owned bookmaker, but it’s not just a handful of employees in Ireland anymore; it’s a big company. Talk me through your journey to how you got to where you are today. I began as an entrepreneur. I ran my own IT business and then fate took me to the UK where I got into the world of data. Data, at that time, wasn’t anything exciting or sexy to talk about. It’s not like these days where everything runs on data. But it was very interesting in terms of allowing me to understand the fundamentals of different businesses, and gain perspective on the fundamentals of KPIs and other metrics that allow you to judge the health [of an] organisation.

Because data tends to be found all across the business, there is always a need to bring it together and, as you’re bringing it together, you have an opportunity to understand how different parts of the business connect with one another. They contribute to the overall success of the organisation, whether that’s operationally or customer-facing, and I think that combination led me to have a mindset that allows for holistic thinking; and a bit of a landscape mapping where I can have a look at the organisation and how the different parts contribute to each other.

I’ve also been working on a number of transformation journeys and, after having spent a number of years at Betsson I can ask the question: what’s important for the customers and how does the business need to react to that? My journey later took me to William Hill, which was this very wellestablished heritage business. At the time, it was very strong in retail but falling behind in digital and that journey at William Hill was transformational in terms of rebuilding the capabilities; building towards a much stronger digital proposition and being able to succeed in a very, very competitive market. Many people, when they enter iGaming and gaming, never leave.

You joined BoyleSports a year or so ago. It’s not the longest amount of time to change every aspect of a business under your leadership, by any stretch, but what has changed and what are you looking to do long term?

My biggest focus is not to break things that work well and to create scalable capabilities that would allow us to grow in a meaningful way. That’s probably one of the biggest challenges out there. We’re not talking about massive investments where you see big players putting in enormous budgets to be able to win in just one market – and they are doing that across multiple markets. For us, it’s a journey that needs to be meaningful for the business we have and where we are in our own internal capability. There is much to be improved.

We’re working tirelessly on getting more brand and marketing alignments, and to preserve what is good and viable and strong about it, but also to reflect the 21st century. We’re still working on that. It’s a long-term project and one that requires care and attention. It’s not something you can do on a whim and be done with it. It requires testing and a deep understanding of who we are fundamentally, and who our customers are now and will be in the future so that we are relevant to them. We must also be true to ourselves, the products and technology in general.

This is such a fast-moving and changing environment but, at the same time, to be able to change the technology and to deliver something tangible is a long journey. I’ve seen that at William Hill. It takes many years; it’s not a six-month job. We’re probably talking two to three years where you need to be extremely focused and well articulated on what you want to do, what it looks like and what’s needed in order to achieve it. Then it’s about making sure we’re qualifying our opportunities and creating the structures and abilities to realise them, whether that’s our expansion in the UK, growth in South Africa or in Peru.

You mention South Africa and quite a few brands are looking at that market, including yourselves, MeridianBet and, of late, Betfred too. What is so appealing about it? And how much of it has to do with it being an English-speaking market? South Africa is a fascinating country; it’s not just the English-speaking aspect either, as English is one of the languages that you can use everywhere, it’s universal. There is a strong connection to the UK in terms of socio-economics, as well as sports affinity and, from the customer perspective, it’s a very interesting market.

I was reading research a few months ago,

it was done by a local South African business when they were looking at comparing South African gambling markets to the UK markets, especially the offers. They were saying there are a lot of similarities in terms of the South African customers enjoying an odd gamble. They enjoy the element of betting on sports, it’s probably part of their culture, and the size of the market is very similar, if not bigger than the UK – and we know the UK is one of the most developed and well-regulated markets in the world. So from that perspective, I think there is definitely big potential in that country.

Unlocking it, as with many things, is going to be the tricky part. Although, this is where the competition and changing economic and social conditions can also come into play. Whether one is successful or not in terms of that digital and retail split, I think many businesses found that digital is driving revenue generation, even before Covid. You have to consider customer engagement from that perspective and our business is no exception to saying that digital is really on a growth trajectory. I have a feeling and believe retail still has a lot of potential. Again, we are continuing

to invest in retail stores and this is probably the only gambling business that still is opening or acquiring retail stores, because we have to run retail well in Ireland. I think that’s one of the strengths sports has, in seeing what incredible value to the customer a good retail environment or digital experience can bring. We want to continue on that journey, as long as it makes sense for us. My sincere hope is that retail will still see a very long life ahead.

It’s a fair point, because the world is increasingly digitalised. Paddy Power said in its recent report that retail actually showed growth. At the SiGMA Asia Summit recently, there was also a lot of talk about player trust. If they’re playing a slot machine in a casino, they know what’s going on. They can trust the physical maths behind it, whereas an online slot doesn’t have the same feeling. Overall, retail might not be the biggest out there, but it certainly still has potential for growth...

It’s never going to go away. There’s a big social element, too. It doesn’t need to be about gambling or betting. Sometimes it’s great to

give people opportunities to come together, watch games and enjoy that, and with the services we provide and amenities we provide in our retail environments, we’re definitely enabling those opportunities.

You mentioned branding. I’d like to ask about your sponsorship and ambassador strategies. When there’s a new ambassador or sponsorship, what kind of planning and thought goes behind it? How do you resonate with the player?

It’s a million-dollar question. We have a methodology that we’re refining internally, there’s nothing revolutionary or groundbreaking about it. It’s very much common sense and it’s very much in the spirit of joining multiple channels together to maximise impact. If we’re talking and thinking about brand, the brand is probably the slowest-moving piece that you can’t necessarily measure immediately. So, it’s something you need to, as I said, spend time to get right, then take a leap of faith and believe

this is the right thing; and that it has time to come to fruition.

I think sponsorships need to reflect the brand. So while we’re looking at that, we’re also thinking in terms of, ‘Where is the right place for this?’ For us, to play horseracing is natural. We’re sponsoring a lot of different horse courses in Ireland and also greyhounds. But, for the other jurisdictions, it’s something we’re working behind the scenes on, to understand where the right place for us to advertise is. Not only that, but who are the right people we want to be working with?

I’m a big believer that the right combination of sponsorship, whether that’s football clubs or something else, combined with well-known names, can deliver a good outcome. But we also need to make sure we activate that so we take it to its full potential. It’s not just about getting a face and getting them to sport a polo shirt with both logos on. There’s a lot of work that needs to go into activation. My simple goal is to take these great ideas and figure out what we are going to be do with them over the next year and beyond, but also decide if we have everything we need in order to make the most out of it.

“ My biggest focus is not to break things that work well and to create scalable capabilities that would allow us to grow in a meaningful way ”

there, but the competition is rife in those and I’m not sure whether it’s going to be the best product, the biggest budget, or the strongest brand that is going to win there. We are not trying to compete with that. It’s not our path.

revolutionary. It’s refreshing to hear,

I like the candid nature of the first part of your answer, that it’s nothing revolutionary. It’s refreshing to hear, because as you say sometimes common sense is what’s most important. Sometimes you can have an algorithm, but when it comes to sponsorships and ambassadors to work with, that’s an area where there is less data. A lot of people talk about how the future is influencers and other bits and pieces. Sure, but if you look at our competitors in areas like Latin America particularly, they are all doing that.

We’re looking at the niche that we can comfortably occupy and use as a launch pad to build a bond. For us, it’s not about grabbing market share, then trying to make sense of it and rationalise it into some revenue; it’s about finding that niche and making sure we are geared and successful in realising the opportunity.

Sometimes you can have an algorithm, but

It sounds like US markets are perhaps something you’re not looking into? We had plans, or considerations to go into Canada, for example, but we decided against that.

In terms of the future for yourself and the company, do you have any personal goals that you’re aiming towards for the rest of this year and 2025? If, let’s say, in 20 years someone looks back and thinks about Vlad’s legacy at BoyleSports... What would you like that to be?

actually mean? That’s the big question.

So it’s an area you feel is over-saturated? Yes. I mean, maybe a few years ago it was the thing to do. Now, ito win in that space, you have to be a little bit creative. What does that actually mean? That’s the big question.

growth,

In terms of where you see the biggest growth, both industry-wide and for BoyleSports, is there a particular vertical or geographical area? Or is it simply, as you said earlier, about streamlining internal processes, the use of data, etc?

vertical can offer more growth for us and we have some plans in the

There are some very hot markets out

For us, it’s definitely getting that internal machinery sorted and, once that is in a better place, it can unlock external opportunities. Whether that’s any particular sports or casino, I still think our gaming vertical can offer more growth for us and we have some plans in the background that we’re working on. There are some very hot markets out

It’s a long way away, giving away our strategy there, Tim! But I will tell you I’d love for our product to be more intuitive, flexible and in tune with our customers. We are working to make it relevant and engaging for customers. I think we have great market coverage. We were first with some products or betbuilder offerings, and we want to continue building on that and deliver a great experience to our customers, so that’s in the works.

For me, a successful legacy would look like this… When the time is right and I leave the business, it’s in excellent shape and it continues to be very profitable. It has multiple engines that deliver value and a positive experience to customers across the globe and we have very happy, not just customers, but also employees working for us. I think that’s very important.

Anna Johnson, Svenska Spel’s new Group Chief Executive, speaks with Tim Poole about succeeding Patrik Hofbauer, land-based casino challenges and reporting “healthy” gaming revenue in a new way

Anna, congratulations on your new role and welcome to the gambling industry. What are your first impressions in the job?

Thank you! I started at Svenska Spel on 17 June and, since then, I have been immersing myself in the business and the industry. I have met my new colleagues and participated in Svenska Spel’s seminars at Almedalen – a yearly meeting place in Visby for dialogue and exchange. It was the perfect flying start where I got to engage with current topics in the sector, discuss and network.

It is exciting to join a new company and learn both about Svenska Spel and the gambling sector, which is new to me. In addition to Svenska Spel’s strong position in the Swedish gambling market with well-established product brands, it is particularly motivating that we are

the largest sponsor of Swedish sports, and our surplus benefits society as it goes back to our owner, the Swedish state. Running a company based on these principles is something I find incredibly inspiring.

We have four million customers and, every day, we offer them gambling experiences that bring joy, excitement and dreams. At the same time, being active in the gambling sector comes with significant responsibility – maintaining a balance between providing entertaining games and doing so in a responsible and sustainable manner. As a state-owned company, it is crucial to stay ahead, be proactive and simultaneously shoulder a substantial responsibility. These are driving forces that matter to me as a leader, and I feel like I’m in the right place.

What are your first impressions of the gambling sector?

Overall, the Swedish gambling market appears to be functioning well. However, there are challenges, such as unlicensed gambling –companies that operate without a licence in Sweden but still target Swedish consumers. This is an issue that politicians, authorities, and we as gambling companies need to continue working together to address and find solutions for. We also need to actively work on increasing trust in the gambling sector, both as individual gambling companies and collectively within the sector. At Svenska Spel, we emphasise creating sustainable gambling experiences that contribute to a better Sweden. This includes setting an example, and driving the entire sector toward greater responsible gambling practices and increased focus on sustainability.

One example of our efforts is that we have decided to start reporting healthy revenues – that is, the share of revenues coming from customers with a lower risk of gambling problems. We do this to highlight that it is possible to run a gambling company in a sustainable manner and to enhance transparency within the sector. The first report will be at the end of August and, thereafter, this key metric will be included in regular interim reports.

While a few other licensed gambling companies in Sweden currently report, in diverse ways, the share of healthy versus unhealthy revenues, we have worked for several years to establish a common measurement method and definition for what constitutes a healthy revenue. Unfortunately, the sector has not reached a consensus on this. Therefore, we now start reporting based on risk models in our analytical tools. It’s an important step in building trust in the gambling sector overall.

What are the main targets you’ve laid out, or perhaps been assigned by the Board?

Our main goal is to continue offering entertaining games in a responsible manner, which means creating growth in healthy revenues. We hold a position as Sweden’s leading gambling company, and we aim to strengthen that position through our unique games, providing the best customer experience and leading in responsible gambling. By leveraging technological development and increased use of AI, we can make datadriven decisions to offer our customers even more enjoyable, simpler and safer gambling experiences. We constantly challenge ourselves to be faster, more efficient and to provide the best employee experience. It is also essential for us to be an attractive employer so that we can attract the expertise needed for this transformation.

How do you reflect on Svenska Spel’s current performance?

We offer a wide range of games and assist our customers in playing safely. Additionally, we contribute long-term value as Sweden’s largest sports sponsor, support research on gambling problems and allocate our entire surplus to the national treasury. This is what makes us the gambling company for all of Sweden and enables us to create lasting value for our customers, owners and employees. Over the past year, the Swedish gambling market has experienced declining growth. It

“ I approach the task of taking over and continuing to lead Svenska Spel with humility ”

is a mature market with an increasing share of consolidation. Looking at Svenska Spel’s recent half-year performance, our business area for number games and lotteries has performed strongly, aligning with the Swedish gambling market where lotteries accounted for the most significant growth in the first quarter.

Our business area Sport & Casino has seen a slight decline during the first half of this year. However, it is essential to consider that we have simultaneously strengthened responsible gambling measures. This has negatively impacted revenues across all our business areas, particularly affecting sports and casino gambling. On the other hand, responsible gambling efforts positively influence the share of healthy revenues. This balance between growth and responsibility is crucial. We benefit from offering gambling responsibly, even if it affects revenues. We aim for more sustainable play among our customers and strive for healthy revenues. During the first half of this year, we have implemented several actions to transform the organisation for the future, address challenges and create space for new initiatives. This includes reorganisation and downsizing of personnel, with a new structure in place since 1 April. By doing so, we create room for essential investments, primarily focused on transformation and growth.

We have also closed our land-based casinos in Malmö and Göteborg, resulting in reduced losses within the Casino Cosmopol business area. Land-based casinos have faced challenges for many years – not only in Sweden but also in countries like Finland – due to declining visitor numbers caused by increased online casino gambling and Covid-19 pandemic-related closures. However, our casino in Stockholm remains open, offering the same services as before. The significant transformation through reorganisation and casino closures has already yielded positive results, evident in the second-quarter interim report – lower costs, improved results, and a strengthened

operating margin. This confirms that we’re on the right track with the changes we’ve implemented.

How do you reflect on Patrik Hofbauer’s legacy as your predecessor?

While I was at Grant Thornton during those years, I understand that Patrik made a significant contribution as CEO and Group Chief Executive during his five-year tenure. Notably, he navigated Svenska Spel into the new gambling market following the reregulation on 1 January 2019, which involved new gambling legislation, the division of the Svenska Spel Group, and all the substantial changes that ensued. His leadership played a crucial role in maintaining Svenska Spel’s strong position in the gambling market. I approach the task of taking over and continuing to lead Svenska Spel with humility, aiming for continued success.

What are the main lessons you’ve learned from your career that you intend to apply here?

Two key takeaways I carry with me are the importance of building an organisation that creates long-term value, and having a shared strategy and vision where everyone feels involved.

What benefits does a background in accounting/finance bring to the role?

My experience from the audit and consulting industry is valuable. Particularly, leading a company in a regulated market where compliance matters are central – adhering to the laws and regulations we must follow. In this context, I feel confident and experienced. Additionally, I can contribute my leadership experience, especially in defining a common vision and strategy, as well as emphasising customer focus and value.

Are you focused on addressing any specific challenges in your first few months?

My overarching challenge is to continue building value at Svenska Spel. We aim to remain competitive, offering gambling experiences that customers desire while ensuring they play safely and responsibly. Our priority is not solely growth – the balance between growth and sustainability is paramount.

Finally, what is your outlook for the next year – how quickly, or gradually, are you looking to implement change?

Given our recent major organisational transformation, our focus after the summer is to set a clear direction for the future. I will be happy to share more about our plans further on!

There is no question that limits are important and useful. They can protect players from placing stakes that exceed their economic capacity. This is why they can be found in most frameworks for gambling regulation. We are talking about stake limits, deposit limits and sometimes also loss limits in this context.