What are the most popular crypto coins in gaming? Check, check, check: Affordability and ID verification Retail, kiosks and land-based casino payments

It is that time of year again, as we welcome all our readers to the pages of our annual Payments Focus magazine. Across this issue, you will find topics ranging from retail, the US, affordability, ID checks, kiosks and, of course, digital payments. And that’s all without mentioning that this edition is a cryptocurrency special.

As the Editor putting this magazine together, however, I am actually a little taken aback by the above list. A couple of years ago, there seemed to be two distinct focuses across gaming payments: how to make withdrawals and deposits as streamlined and frictionless as possible on the digital side – and how to make the land-based side as cashless as possible.

As time has gone on, the industry has seen the need for variety – even if that means offering a greater amount of old-fashioned options. Yes, society is becoming increasingly cashless. But has cash gone away completely? Not at all.

Just look at the Philippines, where the recent SiGMA Asia Summit was held. The Philippines is one of the foremost online gaming regions in Asia – but, with a bustling land-based casino sector in Manila, too, cash is king. The same can be said of plenty of other regions across the world.

Retail payments strategies are therefore paramount to success: kiosks, terminals and figuring out how payments form part of a gaming company’s omnichannel strategy.

Yet, from traditional retail payments to a far more modern concept in crypto, we can see that the simple idea of making a payment can provide a broad spectrum of potential methods and offerings.

In our cover feature, Gambling Insider speaks to several industry experts and breaks down the history of crypto payments – from their origin after the financial crisis of 2007, deriving from a distrust of the big banks, to the most popular cryptocurrencies used today.

Gaming and crypto have definitely come together. But today’s challenge for gaming firms is how to bring together crypto payment options, fiat payment options, online, retail and any other way in which a customer would like to pay.

ACCOUNT MANAGERS

Because, in business, those who adapt to what their customers want will always succeed in the long run. Those who try to dictate to the market, carefully explaining why they can’t offer certain options, will fall by the wayside –no matter how prestigious or previously successful they may have been.

TP, Editor

William.Aderele@gamblinginsider.com Tel: +44 (0)20 7739 2062

Irina.Litvinova@gamblinginsider.com Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com Tel: +44 (0)203 435 5628

NGarry Max.Ngarry@gamblinginsider.com Tel: +44 (0)207 729 0643

AWARDS SPONSORSHIP MANAGER

Michelle Pugh

Michelle.Pugh@globalgamingawards.com

Tel: +44 (0)207 360 7590

CREDIT MANAGER

Rachel Voit

WITH THANKS TO: Paul Kavanagh, Mandi Hart, Tamsin Blow,

6 GIVING USERS MORE CONTROL

Gambling Insider sits down with Paul Kavanagh, MiFinity CEO, to discuss why iGaming operators are switching from traditional online payment solutions

12 INTEGRATING CASHLESS PAYMENTS INTO LANDBASED CASINOS

Sightline’s Head of Product, Mandi Hart, discusses how the cashless integration process is carried out and the attitude shift from land-based casinos

18 UK AFFORDABILITY CHECKS: WHAT’S NEXT?

Gambling Insider runs through the latest developments related to affordability checks in the UK, with some help from legal experts

24 COMING TOGETHER: A NEW ERA FOR ONLINE GAMING?

Gambling Insider investigates the history of crypto gambling, the pros and cons of its use and why so many operators are integrating it into their platforms

32 PAYING IT FORWARD

Gambling Insider looks at how operators can use payment methods to support CSR and omnichannel

36 CLOSING THE OPEN-DOOR POLICY

Gambling Insider investigates how different countries are approaching ID checks for gambling

40 MAXIMISING RETAIL PROFITABILITY

Fivos Polymniou, Director of Ask Global, explains how kiosks that accept both card and cash payments can empower retailers

42 HOW TO ACHIEVE THE ‘HOLY GRAIL’ OF ID SAFETY & CONVENIENCE

Aware Biometrics CRO, Craig Herman, discusses ID checks and the ‘achievable’ goal of balancing safety with convenience

44 & 46 THE HOUSE THAT BITCOIN BUILT

Gambling Insider investigates the most popular betting cryptos in today’s market

PRAXIS TECH

PAYSAFE

PAYHOUND

PAYNEARME

What are some common pain points people experience when paying online with traditional online banking accounts or payment solutions (e.g. PayPal or Apple Pay)?

Traditional online payment methods often present several challenges. One of the primary issues we hear from users is the cumbersome and lengthy process of signing up for new accounts or linking their bank details. This can be particularly frustrating for individuals looking for quick transactions. Security concerns also top the list. Users are rightly cautious about sharing their personal and nancial information online.

Additionally, transaction fees can accumulate, especially for smaller transactions, leading many to abandon their purchases upon seeing the added costs. Cross-border transactions present another hurdle. They

often take a long time to clear, which is far from ideal in the iGaming environment, where players want to fund their accounts and start playing immediately.

Gambling Insider sits down with Paul Kavanagh, MiFinity CEO, to discuss the supplier’s goals, and why iGaming operators are switching from traditional online payment solutions

is particularly appreciated by iGaming customers who prefer direct payouts to their bank accounts.

You offer over 75 payment methods to customers. Which of those are most popular and are there any that are more popular than you anticipated?

Our eVoucher has gained signi cant traction, exceeding our expectations. It is particularly popular in the iGaming sector due to its exibility, allowing users to utilise eVouchers for personal online transactions, and as gifts for friends and family. This method is especially favoured in regions where traditional online payments pose challenges.

Local direct bank transfer solutions are also well received. Our PayAnyBank service, which supports both B2C and B2B payments,

Could you tell me a bit more about your eVouchers? What was the thought process in creating them and why do customers use them?

The MiFinity eVoucher was developed to give users more control over their online spending, combining the ease of digital payments with the security and privacy of cash. It functions similarly to a gift card, usable for various online purchases, including iGaming. This secure eMoney product facilitates instant online deposits in multiple currencies and denominations worldwide. Users can top up their MiFinity accounts with the voucher and use those funds across hundreds of iGaming operators.

This flexibility makes it an excellent budgeting tool and, crucially, it allows users to maintain privacy by not sharing personal details online.

For players, this means easy account top-ups regardless of their location. For operators, it opens new markets and caters to a broader audience, making it a truly global payment solution. It also complements other payment methods, offering players more choices.

What are some unique needs for iGaming platforms and how does MiFinity look to cater to those?

Seamless, instant transactions and an excellent customer experience are critical in the iGaming industry, and MiFinity provides these. Players need to deposit and withdraw funds quickly without disruptions, so our eWallet transactions are instant, allowing uninterrupted gameplay. Security is also a top priority. We implement advanced security measures, including the latest encryption and secure authentication methods, to protect our customers and partners. Our platform also features robust fraud detection systems with advanced monitoring, and reporting tools to detect and respond to potential fraud in real-time. Moreover, the iGaming market’s global nature necessitates a wide range of payment methods and support for multiple currencies. MiFinity offers familiar payment options that users trust, no matter where they are located. Our cross-border solutions support our iGaming partners’ market expansion strategies. The needs of the iGaming industry are continually

evolving, and MiFinity is designed to adapt through the flexibility and scalability of our solutions. We continually innovate by adding new features, integrating fresh payment methods and complying with new regulations to stay ahead.

What are MiFinity’s biggest goals for this year and beyond?

MiFinity aims to become a global leader in seamless and secure payments, breaking down barriers and enabling transactions anywhere in the world. Our focus includes expanding into new markets globally, which will allow us to serve more people and merchants, solidifying our position in the fintech industry. We also plan to diversify our services beyond traditional payments, offering multi-eWallet currency exchange capabilities to simplify financial management for our customers.

Latin America represents a significant opportunity due to its booming digital economy. We plan to collaborate with local banks and businesses to establish a strong presence, and provide tailored payment solutions for the region. We will also invest in educational initiatives to promote the benefits of digital payments and encourage broader adoption. Our expansion strategy includes leveraging our MiFinity Affiliates and MiFinity Bonus channels to grow in these markets. Asia is another promising market, and we will develop products and services that cater to the unique preferences and regulations of each country.

As a tech-driven company, staying ahead technologically is crucial. We are committed to constant innovation and implementing

cutting-edge solutions. We aim to establish ourselves as an innovation hub in the fintech sector, setting new standards for secure and seamless financial transactions. Ultimately, MiFinity strives to create a world where payments are frictionless, secure and accessible to everyone, regardless of location. We also see ourselves as growth partners for our merchants, helping them overcome challenges related to market expansion, compliance and security. By providing tools to streamline processes and offering robust security solutions, we build trust and credibility within the iGaming space for both operators and players.

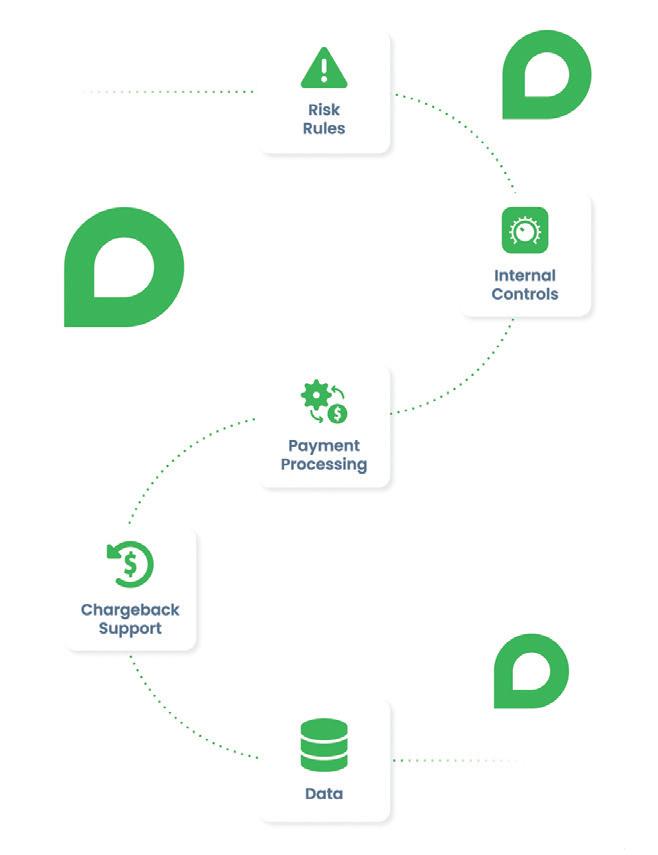

Praxis Tech’s CTO Guy Karsenti highlights how the company’s Payment Orchestration Platform liberates iGaming merchants from restrictive Gateway, PSP and Acquirer agreements. It also enables them to scale operations, diversify payment options, and leverage advanced features in conversion and transaction approval.

As an iGaming merchant, you’re constantly bombarded by various gateways, payment service providers (PSPs), and all-in-one solutions promising better, quicker, cheaper and safer payments. While these promises may be true some of the time, you often find yourself locked into your current payment systems due to the time, cost and technical challenges of integrating better solutions.

This lock-in can prevent merchants from utilising best-in-class payment solutions that streamline their payment operations, and from offering their players a more intuitive transaction experience with features like one-click payments in live games, multilingual checkouts, and automatic top-ups when balances fall below a certain threshold.

Perhaps most importantly, it limits them from offering their global customer base the local payment methods they all prefer, such as PIX in Brazil, UPI in India, or Apple Pay and PayPal in Europe.

“As a result, merchants miss out on opportunities to enhance their players’ experiences, which inevitably impacts their conversion rates, retention levels and even their transaction approval ratios.”

The solution to this problem lies in choosing a PSP-agnostic Payment Orchestration Platform like ours, which allows merchants to choose from over 600 pre-integrated PSPs and access 1000+ alternative payment methods (APMs).

“By connecting to our platform through a single API integration, merchants save costs, increase revenue and strengthen their ability to scale their operations, all while also bene ting from additional services not o ered by basic gateway solutions.”

Our Decline Recovery suite, for example, tackles common issues that lead to transaction declines in the iGaming industry, enabling merchants to recover up to 20% of payments that would otherwise have been lost last year.

We’ve recently expanded this suite with our 3DS Cascading feature, which intelligently re-routes payments encountering processing issues, sparing users the frustration of having to reattempt their transaction and undergo multiple identity checks, significantly reducing abandoned payment sessions.

This feature is part of our broader cascading functionality, which seamlessly redirects transactions across various payment methods and scenarios. For instance, if a payment is initially sent to a PSP experiencing downtime, our platform immediately redirects card payments to alternative PSPs and can also switch card payments to Open Banking routes, or even shift card payments to popular alternative payment methods (APMs) through our Retry with APM feature.

This, alongside our APM Cascading feature that similarly allows us to route the same

APM to substitute PSPs in case of technical issues, enables us to better support iGaming merchants’ payment needs as their players show an increasing preference for non-card payment methods.

We also prioritise offering our merchants’ customers quicker deposits by securely tokenising and storing their payment details using the latest PCI DSS standards.

Our Background Dynamic Currency Converter (BDCC) also enables businesses to accept multi-currency payments, even if their gateway doesn’t natively support this functionality. This enables them to effortlessly expand their reach and tap into new markets.

When dealing with multiple currencies, however, providers require certain safeguards to protect against FX market fluctuations that may occur while a withdrawal request is being processed.

To address this, our Lock FX Rate Management suite offers merchants added protections, showcasing how our Payment Orchestration Platform was designed with the industry’s specific needs in mind.

We’re not stopping there and continue to invest and innovate our solutions. This includes adding a Network Operations Center (NOC) in Dubai earlier this year to boost our resilience and continued investment in building our team across both our Limassol HQ in Cyprus and Dubai regional office in the UAE.

“Constantly aiming higher, in 2024 our target is to con dently surpass $5.5bn in approved transaction volume, having approved over $4.5bn last year.”

Merchants looking to break free from the limitations of their existing payment systems and embrace a more exible, e cient and pro table solution should visit our website and get in touch to learn more.

Cross-border payments are no longer optional – they’re a must-have for any merchant who wants to make a splash in the global iGaming scene

Jonathan

Vintner, Global Head of Sales, PayRetailers

At PayRetailers, we handle cross-border payments with ease, giving merchants the edge they need to stand out and o er their gamers an unparalleled experience.

PayRetailers is a payment processor operating in Latin America and Africa. We equip our merchants with the tools they need to embrace a borderless state of mind.

With our single, flexible API, we deliver a neatly wrapped, one-stop-shop solution that allows merchants to accept both traditional and local payments and process cross-border transactions.

What was once a bold ambition in 2017 has since transformed into an extraordinary reality – today we offer 300+ payment methods in over 20 countries.

Our ambitious vision is embodied by our recent acquisition of Transfeera, a payment institution that leads the payments scene in Brazil. With advanced technology that will grant PayRetailers access to PIX directly from BACEN, Transfeera is the ideal partner for our strategic growth in Brazil.

The transaction remains subject to approval

from the Administrative Council for Economic Defense (CADE) and the Central Bank of Brazil. Until then, we are thrilled about this acquisition and how it will strengthen our combined position in the Brazilian payments space.

When it comes to payments in iGaming, we tick all the boxes:

• Instant payments

• Fraud protection

• Tailored service

Today’s intrepid iGamers don’t want to idly wait around – they want to seize the opportunities that come their way immediately. Unlocking instant payments is easy for merchants who integrate PayRetailers into their infrastructure, as our technology empowers customers to pay and play when it suits them.

Protecting people from fraudulent activity is also top of mind – now more than ever. As a concerning rise in fraud schemes plagues today’s iGaming sector, we remain committed to offering our merchants robust fraud protection and KYC procedures that keep iGaming both fun and safe.

Our technology is complemented by a people-centric approach, as we also work tirelessly to put our customers first. Our scalable infrastructure powers long-term growth as businesses expand over time, and our support team is on-hand 24/7 to provide assistance.

In short, we go all in when it comes to our customers.

Seven licences speak for themselves.

At PayRetailers, we mitigate the risk for our clients and prioritise regulatory compliance. We do so by working tirelessly to obtain the licences we need to operate as a payment institution and electronic money issuer in the countries we serve.

The latest licences added to our portfolio were for Brazil and Argentina, cementing our status as the go-to global payments company for merchants who handle process cross-border transactions.

The work that goes into obtaining these licences brings us great pride, as it grants us the robust reputation and seal of professionalism that today’s go-getter merchants seek.

There’s no need to go in blind when you work with us – we’ve got you covered every step of the way.

As for our own bets, we go all in on the future.

Our most recent endeavour was our expansion into East Africa in May, which saw us elevate the service we provide cross-border merchants and strengthen our global presence.

With this launch, PayRetailers now offers coverage in Rwanda, Zambia, Uganda and Tanzania. We are delighted to do so by giving our merchants access to SPENN, Airtel and MTN, enabling them to facilitate the mobile payments that are so prevalent in Africa’s financial infrastructure.

This exciting development, which will empower our merchants to thrive in the African region, will be followed by future growth in Africa. Our eyes are set firmly on the horizon as we size up future operations in West, North and Southern Africa, and consider how we can boost business growth and financial inclusion in this dynamic region.

PayRetailers is here for the long haul. Our organisation strives to grant merchants the peace of mind they need to focus on their business goals and drive long-term success.

With PayRetailers, hitting the jackpot has never been easier.

All-in-one processing for seamless global transactions in LatAm & Africa.

+300 payment methods Single API integration

Gambling Insider speaks with Sightline’s Head of Product, Mandi Hart , to discuss how the cashless integration process is carried out, plus the attitude shift from land-based casinos to becoming cashless payment providers for guests

If you wouldn’t mind going into the development of Sightline’s cashless solutions and how they’re integrated within online and brickand-mortar casinos?

Ten years ago, we started building out our cashless solution. The heart and core of our cashless solution is our Sightline Payments Authorization Network (SPAN). It’s the way we tie together our transaction processing between operators, which would be casinos, online gaming, and digital sports betting to the backend payments infrastructure. So we’re really the gateway between casino operations and payment solutions.

That’s really where we started that hub. We based it on top of a financial payment vehicle. Initially, we were using what is called a stored value account, tied to a prepaid access account, which allowed for a customer to now tie their casino funds to a payment vehicle that was accessible outside of the gaming space in the open loop markets. Allowing the portability of the funds so that when they want to use them for their gaming purposes, that same account was available on-site at their casino; and when they want to leave and go back to their normal world and pay for their groceries or a pair of shoes, they also have that capability as well. That’s really the framework.

What kind of advantages do your solutions offer those companies or operators compared to typical payment solutions of the past?

First off, it’s acceptance. There’s the ability to tie the casino payment solution directly into an integration where we are processing on their behalf. So it simplifies and streamlines as we continually look to improve the consumer experience around payments. Historically, in the gaming space, payments have been a pain point. There is friction when trying to access cash while walking onto a casino floor and, in the early stages of online and digital sports, many payment methodologies were not available.

How much work with sportsbooks, or the sports betting market in general, do you do?

As of today, we do work with most of the major sportsbooks. Many of the relationships we had expanded into sports when PASPA was overturned (the verdict was reached in May 2018). We do business with a number of the sports providers, although every operator is unique and different, and every brand has its unique strategies. We find our solution fits well for the various brands, whether they’re small physical casinos, large

Mandi Hart, Head of Product, Sightline Payments

“The modernisation of the machines and the systems themselves have also made cashless more possible and relevant in the eyes of the operators. It’s really just a matter of how we want to connect”

brands, multiple casinos or sportsbooks. In the industry itself, sports betting started out as a kind of silo, as does most gaming. And now sports betting is becoming more of the mainstream and aligning so closely with legacy casino brands that really it’s becoming just another feature of the entertainment offered by these brands.

So out here in Las Vegas, we noticed that a lot of stadiums and arenas this year have begun to implement cashless payment solutions, as well. Do you think it’s just a matter of time before all casinos offer cashless

payments? Or is there a reason that some might stick to the old ways? That’s a great question. So this might be a lengthy answer...

An amazing paradigm shift has happened over the past several years. First and foremost, the introduction of iGaming, digital gaming and then sports betting has really propelled. It started getting us into a space where cashless payments were absolutely needed. And we were able to fill that need. Then, the next thing that happened was the Covid-19 pandemic. For the first time in the history of gaming and casino operations, casinos closed their doors and turned the lights

o . That had never happened before. Especially in a market like Las Vegas, that’s a 24/7, 365 operation. And so there was a need to reintroduce and drive customers back to gaming facilities. Suddenly, instead of me banging on doors trying to talk about cashless, I started receiving phone calls asking me to nd time to talk about cashless.

think it is just a matter of time.

That definitely paints a picture that quite the shift has taken place. Is the reason some casinos are slower to integrate this process a fear of consumer feedback, or possibly the lack of knowledge they may have when it comes to cashless payment solutions?

So your question was, do you think casinos are moving towards cashless? Yes, they will. They’re in the process of it now. They’re dabbling in it. Yes, you do still have some operators who are taking it piece by piece because they’re not quite ready for that full solution. But I think the industry is moving quickly in that direction now, and I

From the operator standpoint, it is shifting the mindset of how to run operations without cash and yet still feel they and their consumers are safe. So it’s really about education. It’s about educating their entire teams. When you think about the casino operations, it has been much of their operations process for years. Removing that is hard at first for an operator to envision. I like to guide the operator to remember that you could turn on a cashless solution, but cash is probably not going away. Even if you try to minimise it, it’s never going away completely, so you’re always going to have an element of it. But it should reduce over time and decrease some of that operational heaviness you deal with when handling so much cash.

On the ip side, there has also been quite an evolution in the past three to ve years in casino management systems. Ten years ago, when I walked into casinos, some of the oors did not have high-speed internet. Their machines were not connected. There is no way to actually connect to a machine through an integration or via a system.

That process has been evolving. A decade ago, an operator would tell me I can’t do this because my system doesn’t have the ability to accommodate it. But what we have seen is they are all moving towards modernising the games, the connectivity and the features that are available. The modernisation of the machines and the systems themselves have also made cashless more possible and relevant in the eyes of operators. It’s really a matter of how we want to connect.

What type of feedback have you received from your operators or consumers directly? Are there specific features Sightline offers that they enjoy most?

I’ll start with consumers. Consumers appreciate the access to their funds. If you say you enjoy sports or digital sports betting, one of the challenges that has occurred in that is getting your money out. It’s very easy to deposit money, it’s easy to put the $100 in. You place your bet, your team wins. Now you want to cash out –that has historically not been as easy. There are reasons why and they’re valid. It goes back to regulatory requirements around compliance that we all have to be part of. But one of the things customers really like about our program is that they have the ability to access their funds and still have the ability to use them the way they want. The feedback we get from our operators is always an appreciation for being on

the forefront of innovation – and not being afraid to get out there and do it. Once we have deployed a solution, we do not consider ourselves finished. We consider ourselves a partner, and we continue to work with our partners to improve the experience. Take any lessons learned that we have and apply them. We assist with marketing messaging, we assist with best practices and we also come to the table as payments experts. We tend to be the consultants on the payment side to make sure we’re doing everything to keep their customers safe. I think it gives them the con dence that, if they’re going to take the step, they’re not alone.

Are you able to list some of the operators you work with through Sightline, whether they be landbased casinos or digital sports betting apps?

Resorts World Las Vegas and Mohegan Sun, Connecticut are a few of our brick-and-mortar casinos. We also work essentially with all of the major sportsbooks including FanDuel, DraftKings, Caesars and MGM.

Resorts World is a great example of going out there with a new casino. Everything is cashless there. I would say we still have some work to do on the user experience, and we continue to work with them in the direction we want to head in for that customer base.

Did their personnel changes affect you guys at all?

It does. When the original group who spearheads cashless hands it off to folks that are coming in trying to understand it, this creates hesitancy and concerns with operators. If you bring in a new team who has not had the experience, now they’re looking around saying, ‘Well, what do we do with this?’ It’s a continued process and that’s part of what we do. We continue to evolve and we will continue to educate the team. But we needed to let them get their feet wet and gure out what they are doing, too. As far as the whole operation, that certainly has an impact for sure.

Finally, are there any goals for 2024 Sightline can tell us about?

Yes, I can’t share all of it, but here’s what I will share... Our goal is always to continue to find areas where we can solve issues; whether it is for the consumer or for the operator. With our background being payments and gaming, we have an advantage of saying, ‘okay, how do we look at both of these areas and look for opportunities?’ We’re continuing to look at areas where payments can be a driving factor and a bene t for both the operator and their patrons, continuing to provide opportunities where payments can tie into their loyalty in a more streamlined way. We anticipate launching new products late in 2024 and into 2025.

FinXP is a dynamic fintech company specialising in best-in-class payments and banking solutions, particularly focused on carefully serving regulated markets such as iGaming, Digital Assets and Fintech among others.

Founded in 2014, FinXP is licensed as an electronic money institution by the Malta Financial Services Authority, with its licence valid across the EU and EEA.

At the heart of FinXP’s offerings is IBAN4U, a dedicated Euro IBAN Account that empowers merchants to seamlessly make and receive SEPA payments including instant payments and direct debits. By supporting a variety of account-to-account payment types, the IBAN account solution caters to diverse needs such as recurring payments and mass payouts.

But that’s not all. IBAN4U extends its capabilities beyond SEPA, enabling B2B and B2C cross-border payouts to over 100 countries.

Furthermore, complementing these accounts are Mastercard debit cards issued by FinXP, providing users with easy access to their funds on the go. These cards are versatile, serving as employee expense cards or cards for VIP players, all manageable via a mobile app that offers features like transaction tracking, card freezing, setting transaction limits and more.

FinXP distinguishes itself by blending deep technological expertise with extensive nancial services experience.

This synergy allows us to offer not only ready-made services, but also bespoke solutions tailored to the unique needs of our enterprise clients. Oftentimes, for businesses with turnovers in the eight or nine- gure range, customisation is key –whether it involves integrations, portals, branded cards or new product features. Our skilled in-house development team is dedicated to crafting these custom solutions.

One standout example is our closed-loop payment solution. This system enables platform companies and their users to open IBAN accounts with FinXP, fostering a unified banking ecosystem. This setup ensures fast, cross-border transactions with high approval rates, benefiting operators, exchanges, and marketplaces where users frequently need to deposit and/or withdraw funds. To enhance the user experience, we can customise certain aspects, such as the onboarding process for end users.

At FinXP, we are committed to delivering innovative, flexible and reliable payments solutions, continually evolving to meet the demands of our clients and their markets.

FinXP recently announced the launch of a groundbreaking cross-border payments service designed to offer a faster, more transparent, and more a ordable alternative to traditional SWIFT transfers. Leveraging various payout channels – such as bank transfers, card payouts and digital wallets –this service is poised to revolutionise global transactions for many businesses.

In today’s increasingly borderless world, making payments to service providers,

employees, partners and customers worldwide has become a daily necessity. According to Mastercard’s Borderless Payments Report 2022, 47% of small businesses are conducting more international business than before the Covid-19 pandemic. However, the current process for international payments is often slow, costly, and unpredictable – challenges FinXP aims to eliminate.

The B2B cross-border payments market was worth $44trn in 2023, highlighting the immense scale and potential for improvement in this sector. Long and unpredictable processing times remain significant issues for businesses operating globally. FinXP’s new service strives to make international transfers as seamless as domestic ones.

Our innovative solution will enable iGaming operators, affiliates and service providers to execute secure payments to over 100 countries in more than 60 currencies. Notably, we can facilitate real-time, account-to-account transfers to more than 50 countries, ensuring that transactions are executed efficiently. Supported currencies include USD, GBP, NOK, TRY, BRL and many others, offering broad flexibility for global operations. This service will be available at a fraction of the cost of equivalent SWIFT transfers. This is set to be a game-changer for many operators, allowing them to offer superior payout terms to their affiliates and players abroad.

To connect with FinXP, the best method is through the contact form on our website at www. nxp.com. We look forward to helping you streamline your international payment processes.

Dedicated Euro IBAN Accounts

Pay-out to 100+ Countries Globally

Issue Debit & Prepaid Cards

Funds are 100% Protected Next-Level iGaming Payments

Established in 2014, FinXP is very experienced in serving the iGaming industry, with various Tier 1 operators using our payments and banking solutions.

Gambling Insider’s Ciarán McLoughlin runs through the latest developments with affordability checks in the UK, with help from some legal experts

The UK White Paper was released last April, with recommendations for the UK Government’s reform of gambling regulation set out. Since the publication of the White Paper, the Gambling Commission has consulted on a number of issues, such as gambling management tools, socially responsible incentives, direct marketing consents, online game design and financial risk checks.

During the consultation process, the Commission addressed some common misconceptions surrounding proposed financial risk checks, aiming to ensure that individuals are protected from gambling

harm, but at the same time respecting the freedom of adults to engage in gambling activities responsibly.

In February, the Commission outlined the next steps for financial risk checks and at the start of May it announced what this would entail. The new rules covered a variety of areas, such as reducing the intensity and increasing consumer understanding of online products, options for direct marketing, age verification and personal management licenses, as well as affordability checks.

Rules set out by the Commission are to be implemented in four stages until completion in February 2025, while Betting

and Gaming Council (BGC) rulings, which have been jointly written with the UK regulator, is a voluntary financial assessment scheme. These set of rules have been created ahead of the implementation of the UK Government’s White Paper.

The BGC’s new voluntary industry code on Customer Checks is aimed at reducing the need to request private financial documents and one of the guidelines includes conducting risk assessments on those wishing to make rolling net deposits of £5,000+ ($6,390) monthly (£2,500+for those aged 18-24), and those wishing to deposit £25,000+ annually.

In relation to the Commission’s rules surrounding affordability checks, these looked specifically at financial vulnerability checks and financial risk assessments. On top of the changes, a pilot of frictionless financial risk assessments was announced, which is set to last around six months, aiming to prevent cases where customers can spend large amounts in a short time period without any checks. Customers will not be affected during the pilot to ensure the Commission can refine the data-sharing processes before assessments are rolled out live, with data coming from gambling companies and credit reference agencies. The enhanced financial risk assessments will only be introduced if the pilot proves they can be conducted in a frictionless way. The light-touch financial vulnerability checks look at identifying financially vulnerable online customers and supporting those who are subject to bankruptcy orders, or those with a history of unpaid debts.

These checks will rely on publicly available data and apply to those customers with a net deposit of more than £150 a month on gambling. Checks will initially come in at £500 a month from 30 August 2024, before being reduced to £150 a month from 28 February 2025.

The checks must be a public record information check and no further check will be required if one has previously been completed within 12 months. In a media briefing after this announcement from the Commission, which included Executive Director Tim Miller and Chief Executive Andrew Rhodes, there was confidence that these checks will be relatively easy to implement for most operators and, for some, may only require a few small changes.

Richard Williams, Partner at Keystone Law and Tamsin Blow, a partner at CMS, have given their insights into these latest updates on the affordability checks, looking at the impact it may have on players, operators and the industry as a whole.

How will these new rules related to a ordability checks impact operators?

Of course, affordability checks will have some effect on the operators who will implement them and Williams has emphasised the di erence between the two: “So-called ‘light-touch’ nancial vulnerability checks will not impact operators a great deal, as many will already be undertaking these checks for risk ags.

“Those that are not will need to incur

“I expect that there will be some humps and that this will not be plain sailing, but that is the reason for it to be a pilot” - Richard Williams

extra expense and will need to modify their procedures so that they can take proportionate action where a risk is flagged – this does not mean closing accounts in all cases. Costings should not be significant for these checks and I expect them to be frictionless. Financial risk assessments with data sharing are a different matter, and it’s not known yetif these will work and will be frictionless.”

Blow offered her take on the checks: “The new financial vulnerability check provides some measure of clarity for operators as regards the appropriate financial threshold for vulnerability checks. However, the impact on operators is limited because the new Social Responsibility Code provision:

· Does not provide clarity as to the steps that need to be taken by an operator in response to the results of the vulnerability check.

· Does not replace any existing legal or regulatory duties. This means that operators also still have to comply with existing SRC 3.4.3 on customer interaction as well as licence conditions related to AML. The threshold for the financial vulnerability check is based on customer spend but under the existing

SRC 3.4.3 operators also have to consider other potential indicators of harm: patterns of spend, time spent, gambling behaviour, customer led contact, use of gambling management tools and account indicators.

· Limits the financial vulnerability check to publicly available information, but operators must consider this together with all the other information they know about the customer and are permitted to use.

Do you think the pilot will prove to be effective going forward?

On the topic of the nancial risk assessment pilot, Williams stated: “It will cover the largest gambling operators and volunteers who wish to participate. This will not be in a live environment. I expect that there will be some humps and that this will not be plain sailing, but that is the reason for it to be a pilot. Whether these checks can be frictionless remains to be seen.”

Blow added: “During the course of the pilot the Gambling Commission’s intention is that it will have no direct impact on customer journeys. The

thresholds at which the financial risk assessments are to be carried out are yet to be determined by the GC and may be refined during the course of the pilot, so it is difficult to say how effective the output will be.

“It is also not clear the extent to which financial risk assessments will replace existing obligations. A key challenge for the GC moving on from the pilot is that it has committed that mandated financial risk assessments will be entirely frictionless; and will only be introduced if the pilot proves they can be done in a frictionless manner, based on data-sharing.”

How important will these a ordability checks be in ensuring operators protect customers?

are set to bring in: “Financial vulnerability checks will ensure that even at a low level of losses (£150 per month from Feb 2025), customers will be flagged for issues such as bankruptcy, CCJs or other financial risk markers. These are only public records but are the sort of checks you’d expect somebody o ering you finance to undertake.

“They are obviously not conclusive, because a person without these risks can still lose a significant amount of money gambling. Financial risk assessments with data sharing, including items such as mortgage or loan arrears (prior to any formal action having been taken) will be much more thorough.”

A key part of these new rules from the Gambling Commission is related to increasing the safety of customers, and Williams has underlined what these checks

Blow highlighted the importance of the affordability checks for protecting customers: “Prior to the new vulnerability checks, operators were already subject to significant requirements to identify and take action to reduce the risk of harm to vulnerable customers. These new checks should help ensure greater consistency across the industry in respect of a key threshold for protecting customers.”

Do you think players being driven to the black market is a realistic threat as a result of these checks?

There have been some fears that introducing these measures will lead to players being driven to the black market, but this has been disputed by Williams: “There is a good argument that tightening of AML and social responsibility measures has already led to a lot of customers migrating to the black market. Many large spending gamblers (including those with a gambling problem) will already be gambling with black-market operators, many using crypto and connecting via a VPN. I therefore don’t think these measures will have much impact, as the migration has already taken place.”

Blow also doesn’t believe there will be too much of a threat: “The new financial vulnerability checks are an overlay to existing social responsibility requirements, and for the majority of operators we don’t expect it will result in a significant lowering of initial thresholds driving customers to the black market. It may impact small operators (and therefore customers) at the fringes – where they have a licence but

were still using high thresholds that the GC could have found to be uncompliant under the old rules.”

Can you see the UK payments industry in gambling changing dramatically as a result of the a ordability checks?

Looking ahead on if the industry may change much as a result, Williams said: “No not really, although there will obviously be more opportunity to ‘turn o ’ customer spending whenever nancial vulnerability is agged and the operator feels it is necessary to take the proportionate step of closing the customer’s account.”

Blow concluded: “Given the focused nature of the new condition on financial vulnerability checks, I would not expect it to have a dramatic impact on the payments industry. The outcome of the pilot may have a bigger impact, but that depends on its scope.”

Prior to print of this magazine, Gambling Insider was invited to attend the CMS Gambling Conference 2024 (as seen in the images below), led by CMS partner and Head of Gambling David Zeffman. The conference was attended by a variety of UK gambling executives, who heard from a panel featuring insight from Gambling Commission CEO Andrew Rhodes, Betfred CEO Joanne Whittaker,

“These new checks should help ensure greater consistency across the industry in respect of a key threshold for protecting customers”Tamsin Blow

Tamsin Blow, Partner, CMS

Evoke (formerly 888) CEO Per Widerström and ex-Sky Bet CEO Richard Flint.

Within the one hour and thirty-minute session, attendees heard from Rhodes in a one-on-one about his time in the Commission, as he reflected on the many changes within the industry in his short time at the regulator. Rhodes was then joined by Whittaker, Widerström and Flint on stage to answer questions on the big issues currently present in the UK sector.

Given the conference was right in the middle of a General Election campaign, the timing seemed almost perfect; but the main talking points surrounded the UK regulatory framework, affordability checks, growth opportunities within gambling and much more. Overall, the event underlined the growing positive relationship between the Commission and the industry, but emphasised that going forward collaboration and communication will be key.

Zak Cutler , President of Global Gaming at Paysafe, discusses connecting operators to all the ways players pay via the single-integration Paysafe Gateway

In 2024, online bettors’ payment preferences have never been more diverse – encompassing cards, alternative payment methods (APMs) and local payment methods (LPMs) available only in a particular market. With the strong correlation between payments and player acquisition and retention, bettors’ transactional experience at the cashier can make or break an operator – and the single-integration Paysafe Gateway was built to make iGaming brands last.

When choosing an online sportsbook, players prioritise streamlined payouts above all other factors, including brand trust, good odds, promotions, user experience, sports markets, team sponsorships and brand ambassadors, according to Paysafe’s 2024 global iGaming research. Other payment factors such as seamless deposits and the availability of preferred payment methods are almost as important in customer conversion, with players

prioritising these over everything else except whether they trust a brand and its odds.

If payments are crucial in acquiring new customers for iGaming brands, the relationship doesn’t end there. A strong and reliable payment experience will maximise customer lifetime values and reduce churn. Paysafe’s research indicates that 78% of global players consider the transactional experience an important factor in why they stay to play with a brand.

And when the payment experience goes wrong? A single bad payment experience will make 72% of global players consider leaving an iGaming brand for a competitor.

It’s essential for operators’ cashiers to feature payment methods supporting fast payouts and deposits, but the broader takeaway from our research is the need for operators to o er payment choice at their cashiers. With 26% of bettors choosing a brand based on whether they offer their go-to payment method, operators should ensure they’re satisfying customers preferences.

And their preferences are diverse. Cards remain very popular, with 38% of global players Paysafe surveyed saying debit cards are one of their top three payment preferences. Even with major markets like the UK and US states like Massachusetts restricting credit cards for online gambling, 25% of all global bettors still prefer wagering with one, trending as high as 30% in Canada’s Ontario and 47% in France.

But operators cannot rely solely on cards. APMs and especially digital and mobile wallets are increasingly popular, with 37% of global players listing a wallet like our Skrill and NETELLER solutions as a top payment preference and 28% favouring a mobile-focused wallet like Apple Pay.

Other APMs are also in demand. A quarter of players (25%) prefer funding wagers via direct bank transfer using open banking while, though niche, online cash products like our paysafecard and Paysafecash solutions are a preference of 13%, trending higher in the US and Germany (both 16%). And when discussing individual markets, payments localisation is a key part of the conversation. LPMs with high brand loyalty locally like Venmo in the US and Interac e-Transfer in Canada are essential options in both markets, where 17% of players consider these a preference.

The unprecedented diversity of how players like to fund wagers and their prioritisation of transactional speed plus security can leave operators feeling daunted when it comes to strengthening their cashiers. To save operators having to integrate an almost inexhaustible range of payment methods, we o er a simple solution in our Paysafe Gateway.

Through a single, streamlined integration, the Paysafe Gateway connects operators’ cashiers to all the payment options a player would ever need. This includes card payments, with all transactions processed in seconds, as well as our suite of APMs – from Skrill, which supports instant deposits and unprecedented payout speeds, NETELLER, paysafecard and Paysafecash to our Pay by Bank solution. This new product enables US bettors to fund real-time wagers by logging-in to their bank accounts right at the cashier.

The Paysafe Gateway complements our own solutions with connectivity to third-party products, including digital and mobile wallets, major LPMs, warrantied ACH solutions and other APMs.

Built on our 25+ years’ experience, the Paysafe Gateway enables iGaming operators to maximise their player acquisition and retention and therefore growth through payments. Through the simplicity of a single integration, operators can skilfully negotiate the complexity of today’s payment ecosystem while simultaneously evolving their cashiers for an even more diverse tomorrow.

With contributions from BitStarz, Gamblineers, Finix, Payhound and FinteqHub, Gambling Insider Staff Writer Beth Turner investigates the history of crypto gambling, the pros and cons of its use and why so many operators are integrating it into their platforms

Bitcoin was launched in 2009, in the wake of the 2008 financial crisis. Created by an entity known only as ‘Satoshi Nakamoto,’ Bitcoin’s whitepaper described the currency as a ‘peer-to-peer electronic cash system,’ removed from the big banks and corporations that had proven themselves to be unreliable in their handling of people’s finances.

As the first cryptocurrency, the concept of Bitcoin in its early days was somewhat novel. Bitcoin was bought and sold among small circles of investors and internet users, with the anonymity of wallet addresses and global capabilities of the blockchain making it an ideal alternative for those disenfranchised with big banks. It also made it ideal for the black market sale of drugs on the internet... but that’s another story.

Bitcoin is built on the Bitcoin blockchain. When buying or selling with Bitcoin, the transaction is listed on that blockchain, unable to be altered, deleted or changed. To verify these transactions, crypto miners will use computers to complete mathematical verification sums. These validate the transaction, with the machine to validate the transaction first and affix it to the blockchain, as part of a block of data, receiving a small amount of the currency, called a mining reward.

Around 2013, Bitcoin began picking up steam, with its value hitting triple digits. It hit quadruple digits in 2017 and from there grew rapidly, exploding in value in 2021, when Bitcoin rose to a peak worth of over $61,000 in March. This was outdone in November when prices reached over $64,000, with the Bitcoin all-time high (ATH) price as of writing sitting just shy of $71,500, as reported in March 2024. (At press time, its current value sits at around $52,000.)

It is generally understood in the crypto market that where Bitcoin goes, the market follows. Altcoins describe any cryptocurrency that is not Bitcoin and include stablecoins (coins whose value is based on a fiat currency, such as the US dollar), meme coins (see the Elon Musk favourite Dogecoin and Shiba Inu) and utility coins, which includes the market’s second-highest traded coin,

Ethereum. These coins are often built on their own blockchains, or may be designed on an existing blockchain, with examples including Shiba Inu being built on the Ethereum blockchain.

With Bitcoin’s explosion at the start of the decade, more and more businesses across sectors have begun to see the potential of crypto as an alternative payment method for their business. The gaming industry, specifically, has taken particular note, giving rise to the growing trend of crypto integration across the market.

One of the primary ways that crypto has been utilised in the gaming industry is through crypto casinos. Much like any other online casino, a crypto casino will offer a host of online games that may include slots or virtual table games, though, instead of betting with fiat currency, they are simply made through crypto.

The level of crypto functionality on each casino will differ. Some may only offer a wallet-linking system for bets to be deposited, while others may provide a more extensive crypto exchange, where currencies can be bought, sold and swapped on-site. Some crypto casinos may also offer an in-house currency for exclusive use on their platform, which may come with certain player benefits to encourage its use.

Crypto sportsbooks function similarly to crypto casinos, using cryptocurrency to make bets on sports. There are several notable sportsbooks that fit this definition, including Stake, which recently became the primary sponsor of the former Alfa Romeo F1 team, changing its name to Stake F1 Team Kick Sauber. However, to state that all crypto casinos and sportsbooks are a 1:1 reflection of traditional online gaming sites – and that they always have been – would be false...

Online gambling has existed since the early 1990s. As Finix CEO and Co-Founder Richie Serna tells Gambling Insider: “Back in the late

“It is fair to say that the early crypto gamblers in our casino were most likely into crypto as investors more than anything... But that has clearly changed as it has gained popularity in the mainstream”

BitStarz OG Olle Dickson

1990s and early 2000s, if you wanted to place a bet online, you were probably using wire transfers and e-wallet payments, not cards.” From the beginning, it seems, online betting operated differently to other industries –Serna points to the 2006 Unlawful Internet Gambling Enforcement Act (UIGEA) as a reason for this in the US; but across the globe, the 2000s existed as a time of routine change and adjustment, as regulation caught up with the new frontier of online gambling.

The earliest crypto casinos and sportsbooks came to being in the early 2010s, combining the still-niche crypto market that had bloomed in the last half-decade with the developing iGaming market. “I think crypto started appearing two or three years after Bitcoin’s conception in 2009,” Adam Gros, Head Affiliate of Gamblineers, tells us. Gros explains how, as seen with the trend in Bitcoin value, cryptocurrency was still relatively niche and confined to small groups until the mid 2010s, though “by 2014, Bitcoin definitely became a thing in online casinos and bookmakers. From that point on, its large adoption in the gaming market began.”

Crypto casinos are not necessarily just carbon copies of other iGaming platforms, accepting crypto payments to play on various digital slots. This was especially so among the earliest crypto casinos, which Gros describes as “one-game websites accepting Bitcoin.” “It all started with dice games developed by crypto and technology enthusiasts. These were one-man-band websites with no features as we know in casinos today (no support, no promotions, only one game). One such example is SatoshiDice, which still exists!”

Indeed, many will suggest that SatoshiDice, launched in 2012, was one of the first crypto ‘casinos,’ with other early entrants to the market including BitStarz. BitStarz OG Olle Dickson tells Gambling Insider : “You could put the early crypto casinos into two categories. You had the casinos that derived from traditional fiat casinos who looked and operated like your standard casino... Then, you had the casinos that started to focus more on very simple, scaled-down games, like plinko, crash etc, wanting to move away from the traditional casino label.”

In this early period, crypto was niche, but provided a workaround for placing online bets when laws and regulations may have made it challenging or impossible for traditional payments processors to operate. As was the case in the US, Serna explains: “When UIGEA was passed in 2006, it didn’t ban online gambling outright, it just made it illegal for financial institutions to knowingly process payments for illegal online gambling... It became harder for players to fund their accounts, expensive for gambling operators to process payments and many payment processors pulled out of

the US altogether. This pushed the remaining players to use alternative payment methods like prepaid cards, cryptocurrencies, bank transfers and more specialised payment processing solutions.”

have enhanced the ease of anonymous transactions, it is not a fundamentally new concept in the context of payment methods and anti-money laundering (AML) practices.

the right screening and transaction monitoring tools.

As crypto’s popularity began to skyrocket at the start of the latest decade, crypto has become more present and popular among players. Payhound Managing Director Elton Dimech points to crypto gaining popularity in iGaming for two primary reasons: “Firstly, operators can easily accept player deposits in crypto by integrating an API. Secondly, companies have been using crypto to pay B2B fees and commissions instantly around the globe. Given the iGaming industry’s strong connections to the crypto world, we can expect more expansion from here.”

“To ensure these systems operate within legal frameworks, several measures are

in place. First, crypto-processing systems like CoinsPaid conduct blockchain analysis to track the origins and sources of funds, categorising the associated risks. Second, AML teams request documents when they identify suspicious factors... Additionally, in crypto by integrating an API. Secondly,

New online casinos may launch offering fiat and crypto payments off the bat, while others may choose to integrate crypto payment methods onto a pre-existing platform. The days of single-game ‘casinos’ are, for the most part, behind us. But with this newfound popularity comes a wave of questions – questions that are key to understand, given cryptocurrencies’ general technicalities.

When writing this article, a major thought I had regarding crypto casinos and crypto sportsbooks was the legality of it all. Speci cally, how can these businesses assure bets are coming from legitimate sources, when crypto is global and anonymous?

“At the end of this year, we are expecting the enforcement of a new upcoming legislation that will help widespread adoption of crypto across EU member states. This new regulation called Markets in Crypto Assets (MiCA), together with the newly introduced Travel Rule, will allow companies to have better access to information for a better AML landscape. “

Many will describe crypto as being a faster and cheaper solution to transactions using traditional banks.

Blockchain wallet addresses are pseudoanonymous. The address can be used to prove activity from a wallet, but the individual’s name or details are not connected to it. The decentralised nature of the blockchain also makes the location of transactions challenging to ascertain, hence why it was so popular with illegal product vendors during its early years.

So, when each country around the world has different laws and regulations on gambling, with some countries having a complete blanket ban on gambling, how are platforms able to ensure they are accepting bets placed legally?

AML protocols for cryptocurrencies involve monitoring transactions from different sources. For example, a deposit from one address and a withdrawal to another.

Fast transactions are a crucial need for online gamblers, Serna explains, noting that “Instant withdrawals and payouts are something people have come to expect in online gambling. This sometimes means supporting alternative payment methods like e-wallets, prepaid cards or cryptocurrencies.” For crypto, Gros states, “faster transactions and very low fees are a consequence of no third-party intermediaries such as banks and credit card companies.” While this may be true for some currencies, depending on their usage and validation speed, for some cryptocurrencies like Bitcoin, this may not be the case.

others may choose to integrate crypto a need prepaid to concept gas blockchain must this Depending is, to to of like time,

Gambling Insider put this question to FinteqHub CEO Vadim Drozd. He explains: “Anonymity in payments is not exclusive to cryptocurrencies. Voucher payments and prepaid cards also offer users anonymity, which has long been a feature of the payment industry. While the advent of crypto may

This thorough scrutiny complicates fraudulent operations.”

This thorough scrutiny complicates

Payhound Managing Director Elton Dimech echoes similar ideas, stating: “In Malta there has been a solid regulatory framework in place for years. Crypto payments can be deemed to a certain extent anonymous; however, all crypto asset service providers that are subject to a regulatory regime similar to Malta must adhere to AML obligations which mitigate the anonymity aspect, by implementing

Now is a good time to bring up the concept of gas fees. When making a blockchain transaction, the user typically must pay a gas fee for this transaction. Depending on how busy the network is, these prices can go up, with those willing to pay a higher gas fee able to skip a portion of the wait time. This means for blockchains like Bitcoin, transactions can take a long time, or alternatively, be quite pricey.

important to note. When a transaction is validated, to There the is of-work. engage system, to the

How these transactions occur is also important to note. When a transaction is validated, the machine to add the transaction to the blockchain must do so with proof. There are many proofing methods; however, the one used by Bitcoin is known as proofof-work. With this system, any computer can engage with the proofing system, though to receive the mining reward, typically only the best machines win. This means a lot of wasted energy from other machines, alongside the high energy use needed to run a high-tech mining computer.

Naturally, this is not the most eco-friendly solution, with some estimating that Bitcoin mining uses more energy than some small countries annually. The wider altcoin market has been working to alleviate this issue as much as possible, it must be noted. In September 2022, Ethereum completed what was known as ‘The Merge,’ migrating

“The most popular cryptocurrencies used in casinos are the ones with the highest market cap simply due to the fact that a higher market cap usually correlates with the highest number of people owning that coin”

Gamblineers Head Affiliate Adam Gros

from the aforementioned proof-of-work validation system to a proof-of-stake system; a system that was quicker, more scalable and operating using over 99% less energy. Even so, each Ethereum transaction still uses as much energy as it takes to fully charge an iPhone 13... three times.

Other altcoins, such as Solana, operate on even less energy, with each Solana transaction using less kilojoules than a Google search. These solutions are better, undoubtedly, yet Bitcoin is still the cryptocurrency with the highest market capitalisation by far, with a market cap 2.8x larger than Ethereum and Solana’s combined. But, if people are gambling with crypto, there’s a good chance they’re gambling with Bitcoin.

“The most popular cryptocurrencies used in casinos are the ones with the highest market cap simply due to the fact that a higher market cap usually correlates with the highest number of people owning that coin,” says Gros, while Dimech adds: “It is estimated that 80% of crypto transactions are made using the 2-3 most popular coins, so it is understandable that operators interested in offering crypto as a payment option should offer these coins for ease of access for players.”

Navigating this energy use, the associated

similar sentiment, noting that FinteqHub crypto provider, Coinspaid, uses various mechanisms to aid in transaction cost and speed optimisation. He adds: “Operators often absorb the increased costs of crypto transfers, ensuring that players do not experience the higher fees typically associated with such transactions. Essentially, the operator pays extra to expedite payments.”

Finally, there is price volatility. As any crypto investor will tell you, the price of most non-stablecoins can fluctuate rapidly, with some coins such as meme coins being particularly volatile. Buying when prices are low (otherwise known as ‘buying the dip’) and selling when they are high again is a key to crypto trading; however, for those just wanting to use crypto to make bets, this volatility could result in a player paying more or earning less than expected due to the very quick price changes.

We ask Drozd how crypto payment solutions ensure the value of a $5 bet remains solid during volatile periods: “The value of a bet is secured through hedging mechanisms. When a player deposits any cryptocurrency, such as Bitcoin, and chooses to play with fiat money, crypto payment providers hedge this deposit based on the current exchange rate. This ensures that, at the time of withdrawal, we have the necessary liquidity to match the player’s fiat balance.... However, if the player opts to exchange between

cryptocurrencies, such as Bitcoin and USDT, we employ the same

hedging strategy as we do with fiat currencies to manage and secure the funds.”

Dickson adds: “There are a few things to bear in mind with cryptocurrencies and that is that volatility varies a lot between them. Some coins have extreme volatility and some rather mild (within the realm of crypto volatility of course). There are, however, stablecoins that eliminate the volatility problem altogether, such as USDT. At BitStarz, you also have the opportunity to instantly convert the crypto amount to a fiat currency upon deposit, in case you’re worried about the swings in price.”

Aside from using stablecoins and relying on fiat conversions to curve price volatility, one solution to the challenge of market volatility and transaction prices is the use of an in-house currency. Some crypto casinos and sportsbooks may offer a currency for use exclusively on the site, which can typically be purchased on the platform with both fiat and other cryptocurrencies.

As Gros outlines, “There are two challenges involved with cryptocurrency for operators: Crypto volatility and in the case of smaller crypto tokens, their support by game providers. While crypto players want to deposit and withdraw cryptocurrency, they mostly still want to play with the display currency of Dollars or Euros. Most bet limits and promotions are also carried out in fiat currencies, which means constant conversions and keeping track of the live crypto market prices. By converting all deposits to in-house currency, you do the conversion only once. After that, everything is simple because internal currencies can have a fixed value. This also means players can play all games with any cryptocurrency, even if that cryptocurrency otherwise isn’t supported by game providers.”

However, in-house currencies may not be the solution for every operator. As gas price and wait time for Bitcoin transactions is a challenging issue to navigate, Dickson admits. “One of the issues now and again are the fluctuations in price for sending BTC as an example. When that’s the case, we always encourage our players to use another cryptocurrency for the time being. As we accept many, they’re able to pick an alternative such as Litecoin (LTC) and avoid the potential BTC traffic jam.” Although he states that, with the right tools, “it shouldn’t take away from the overall gambling experience.” Drozd echoes a

Drozd notes: “Developing and maintaining

a proprietary token requires significant resources and attention, which can divert focus from the casino’s primary objective of providing entertainment and quality games. Additionally, there are extra costs associated with building player trust and convincing them to adopt and use the internal cryptocurrency, necessitating a substantial marketing budget.”

In the early days of crypto casinos, before Bitcoin hit the ve-digit or even four-digit pricetag, gambling was like any other reason to use Bitcoin. Dickson comments: “It is fair to say that the early crypto gamblers in our casino were most likely into crypto as investors more than anything. We also have to understand that back in the day many places didn’t accept crypto. But that has clearly changed as it has gained popularity in the mainstream now.

“I remember it being very stigmatised early on; people equated crypto to the dark web and Silk Road among other things. Now we see a lot more people realising the benefits of virtually instant peer-to-peer transactions, especially when banking regulation is getting stricter. To give you a concrete gambling-related example, I remember a friend having a hard time getting a mortgage simply because the bank saw gambling transactions on his statement. The benefits of utilising crypto are becoming more and more evident.”

Indeed, it was a rebellion against the big banks that kicked crypto off in the first place, and now it seems that cycle of using crypto as an alternative to typical bank oversight has continued as it has entered the gaming market. So crypto exists and is popular, especially among ever-elusive under 35s. That alone will be enough to convince some operators to integrate crypto payment solutions into their platforms, or

crypto-based services into their offering. But beyond that, as seen above, crypto is not perfect. So why are some people, especially those who are not typical crypto investors, turning to the alternative currency as a payment solution?

Serna tells us: “Gambling operators will often face higher processing fees, cash reserves and volume caps because the compliance and financial risks are higher for this industry than others. These higher fees and risk mitigation techniques can be passed along to consumers, but there’s a constant risk of upsetting customers and driving them to a competitor. Whatever the case may be, each business is unique and there is no one-size-fits-all approach to payments.”

As such, many operators may seek out alternative payment solutions, be it crypto or another payment processing solution. Sarna continues: “To thread the needle between compliance, risk, growth and customer delight, it’s important to find a payments solution that’s dynamic and customisable. Many traditional processors won’t work with gambling businesses and, even if they do, implementing their tools can be a nightmare for developers.”

He points to the fact that some traditional payment processors will “charge high fees for gambling transactions because they see it as a risky industry,” which may in turn force operators to seek out nontraditional options.

Apple Pay and PayPal, for example, are popular payment choices online among players. When we asked why these solutions may be sub-optimal for the gaming industry, Gros responded: “While services like PayPal and Apple Pay are convenient, they usually require you to add your credit card or bank account, which serves as a source for your payments. This means bank and credit card fees are still there (sometimes even additional

“Another factor is anonymity. Obviously, giving away your personal information is unavoidable when using a bank or a credit card, as well as when buying crypto in an exchange. However, after that, paying with crypto doesn’t require giving your personal information to anyone else, which isn’t the case with services like PayPal or Apple Pay.”

It seems, with crypto betting, both operators and players gain access to a freedom not afforded by fiat casinos. In using crypto, they are free of data brokers and others who may use their data when inputting into online casinos, and are also free of the limits imposed by banks. This is the longstanding mindset behind crypto, after all: your money is yours; banks should not be the ones dictating what is done with it.

But it would also be untruthful to say every crypto gambler out there is doing so purely to spite the banks. Bettors play with crypto for the simple reason that playing with crypto is fun.

Crypto is different, exciting and constantly changing. It is a market that has never sat still – something anyone who has spent any time in the online gaming market in the last 30 years can likely relate to. When new technology is accessible, those with an interest will follow. Crypto is just the latest in a line of new technologies and, considering its anonymity and innate rebellion, makes it particularly appealing to younger players seeking something new and exciting.

Yet, beyond the fun of it all, crypto has also come to serve as something of a lifeline for those in financially challenged nations. Bitcoin has become legal tender in El Salvador and the Central African Republic, while in Venezuela, gambling can only be conducted via cryptocurrency. As Dimech puts it: “Crypto transactions

some providers and suppliers to integrate

have no chargebacks and are settled almost instantly. This gives operators a better ability to accept deposits from players and execute payouts in their target markets, particularly in countries with inefficient banking infrastructure.”

fees by the gateways). You’re also limited to how much or how little you can pay and how fast the transactions are, most notably for withdrawals. If a casino implements crypto payments directly on the blockchain, the only fees that are left are the mining fees, which are negligible in most cases. There are also no payment limits except those set by the casino itself, and the transaction speed depends only on the average block time.

While it may serve as an alternative to some, for others it is crucial – putting at least a little more weight behind the argument for continued crypto integration. And, as far as gaming and crypto and concerned, we can definitely conclude the two are coming together.

With a mission to empower companies to deal with cryptocurrency as easily as they deal with at, Payhound is providing payments solutions tailored to the needs of the gambling industry. Originally established in Malta, Payhound has grown to cater to a wide array of clients within the gambling space and beyond, in industries such as Forex, Payment Services and Investment Services.

Payhound empowers gambling operators with the ability to accept player deposits in cryptocurrencies, by seamlessly integrating Payhound’s API into their platforms. This service enables gambling operators to accept deposits and process withdrawals in cryptocurrencies without needing to maintain any crypto balance themselves. Payhound handles all aspects of the conversion, providing a seamless experience for both operators and players. This solution not only simplifies the integration of crypto payments but also enhances the speed and efficiency of financial transactions within the gambling ecosystem.

Payhound’s second core service addresses the complexities of cross-border payments. The company facilitates global settlements, invoice

payments and other nancial transactions between B2B partners, a liates and service providers. This solution is particularly bene cial in the gambling industry, where international partnerships are common and timely payments are crucial for maintaining smooth operations.

For companies looking to manage substantial amounts of cryptocurrency, Payhound o ers large-volume trading services. This specialised o ering is designed for businesses seeking to convert signi cant crypto holdings into fiat or to build crypto exposures on their balance sheets. With the increasing popularity of cryptocurrencies among listed companies, this service is gaining traction as a strategic nancial tool.