INSIDE

Football & soccer: New hopes for the new season

Data review: Euro 2024 & Copa America tournaments

US sportsbooks: In defence of revenue over profi t?

Football & soccer: New hopes for the new season

Data review: Euro 2024 & Copa America tournaments

US sportsbooks: In defence of revenue over profi t?

Same game. New ways of playing. Are same-game parlays and bet builders changing the industry?

It is a basic economic principle that choice leads to greater market efficiency. If a customer has greater choice, they can shop for the best product, forcing businesses to operate at their very optimum – or risk losing that customer.

In sports betting, same-game parlays and bet builders embody this whole principle. Not only will brands that offer bet builders attract more customers than those that don’t, the brands with the best bet builders will offer the most possible choice within the very sports betting experience.

Of late, the ability for a sports bettor to construct their own wager while watching a football, basketball or soccer game is probably the most innovative development since the ‘cash out’ concept was invented. Both cash outs and bet builders offer a kind of win-win scenario.

Indeed, with both, the bettor has more options to choose from and, to a degree, more control over their own destiny. Yet with more options comes a larger probability of outcomes that can go wrong. Therefore, while the bettor in theory has more ‘control,’ they can now cash out early on a potentially winning bet – creating stronger margins for sportsbooks – and, while they can create their own bets, (wagering on tip-offs, touchdowns, fouls, three-pointers, tackles etc all in one) there is more freedom to choose but less chance of actually winning.

In essence, bet builders and same-game parlays ultimately earn more for the sportsbook, but still create unparalleled entertainment for the player. Sounds pretty good, doesn’t it?

The key question – and one we look to explore in the cover feature of this Sports Betting Focus magazine – is how popular have bet builders become? Have they transformed the industry, or will they find their place as somewhat of a side offering?

We still need more data to truly answer that question, especially over a longer period of time. For instance, if a sports bettor keeps playing same-game parlays and keeps losing, they may over time revert to traditional money line or spread bets. They may argue there is more reward for less research and calculation.

But a crucial fact – and advantage – remains, which makes bet builders and same-game parlays well worth pushing for sportsbook brands. As our magazine title suggests, they can keep players in-play i.e engaged and entertained until the very last second. With so many distractions for a sports fan’s attention in today’s environment, this has the potential to become a major strength for sports betting companies.

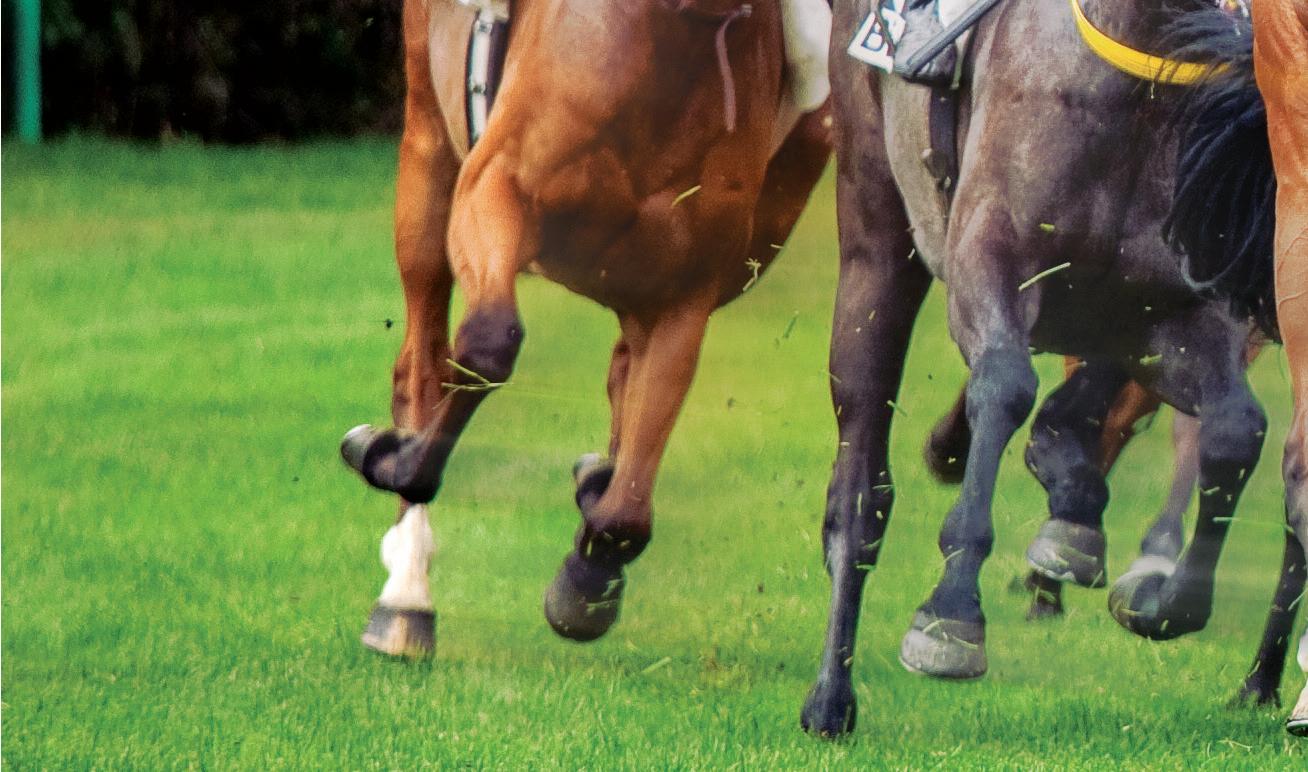

Elsewhere in this issue, not only do we present our regular company profiles for key players within the sector, we also analyse tournament data, sponsorship trends, historical horseracing and more. Indeed, Betby provides a breadth of statistical insights into its operator network during Euro 2024 and Copa America, while Exacta Solutions talks all things horseracing and we speak with BetMGM and LiveScore Group about sponsorships in the UK vs US.

We don’t just stop there, as we attempt to defend the revenue vs profit model in US sports betting – just for objectivity’s sake – and we look ahead to new sporting seasons with Covers.com, DraftKings, ESPN Bet and Sportradar. Let the games begin!

TP, Editor

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

STAFF WRITERS

Beth Turner, Will Underwood, Ciaran McLoughlin, Kirk Geller

CONTENT WRITER

Megan Elswyth

LEAD DESIGNER

Olesya Adamska

DESIGNERS

Claudia Astorino, Callum Flett, Gabriela Baleva

JUNIOR DESIGNER

Medina Mammadkhanova

ILLUSTRATORS

Maria Yanchovichina, Judith Chan

MARKETING & EVENTS MANAGER

Mariya Savova

FINANCE AND ADMINISTRATION ASSISTANT

Dhruvika Patel

IT MANAGER Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR BUSINESS DEVELOPMENT MANAGER

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062 Irina Litvinova

Irina.Litvinova@gamblinginsider.com Tel: +44 (0)207 613 5863

Serena Kwong

Serena.Kwong@gamblinginsider.com

Tel: +44 (0)203 435 5628 Max NGarry Max.Ngarry@gamblinginsider.com Tel: +44 (0)207 729 0643

AWARDS SPONSORSHIP MANAGER Michelle Pugh Michelle.Pugh@globalgamingawards.com

Tel: +44 (0)207 360 7590

CREDIT MANAGER Rachel Voit

WITH THANKS TO:

Betby, Data.Bet, DS Virtual Gaming, Andrew Garven, Mike Morrison, Greg Karamitis, Sportradar, Sam Behar, Sam Sadi, LSports, Aristocrat Interactive, Wise Gaming, Jonathon Hurst, Andrew Bramley, ZohrabKarapetyan, AnnabelleLee,NikiBeierandWA.Technology.

6 NEW US PROPERTIES

Gambling Insider looks at the new casinos and betting venues developing around the US

8 SOCCER DATA

Gambling Insider breaks down the latest Euro and Copa America data provided by Betby, to see how and what players are betting on

16 COVERS.COM Q&A

The affiliate speaks to Gambling Insider about the summer months and the upcoming NFLseason

18 NEW HORIZONS

With insight from DraftKings and ESPN Bet, we preview what lies ahead for sportsbook operators

22 SPONSORSHIPS

Gambling Insider compares sports sponsorships from across the Atlantic, looking into key US and UK differences

30 COVER FEATURE

Gambling Insider assesses the rising popularity of bet builders and what they mean for players and operators

38 REVENUE VS PROFIT

Just how much revenue does a sportsbook need before it makes a profit? Gambling Insider crunches the numbers

42 TO THE RACES

What is historical horseracing and eHorseracing, and how do they impact the traditional horseracing market? Gambling Insider investigates

48 PERSONAL MARKETING Sportradar answers our burning questions on the new soccer season, how to conduct successful marketing and more

Gambling Insider looks at the new casinos and betting venues developing around the US

Operators of the new Chicken Ranch Casino Resort held a soft opening on July 15 in preparation for the property’s full opening this Fall. Chicken Ranch Casino Resort is owned and operated by the Chicken Ranch Rancheria Me-Wuk Indians of California.

The $200m WarHorse Casino Lincoln is under construction at the Lincoln Racecourse. Construction has been completed in phases following breaking ground on 12 July 2022. The first phase opened a temporary casino on 24 September 2022 while the second phase will fully expand the property this Fall.

Red Rock Resorts, owner of Station Casinos, held a private ceremony to break ground on the $780m resort in March of 2022. On 6 December 2023, Station Casinos opened the Durango Casino and Resort in Summerlin, Las Vegas, Nevada.

The Mirage Hotel and Casino held a closing ceremony on 17 July to commemorate a 34-year run. Hard Rock International acquired the Mirage from MGM Resorts for $1.08bn in 2022. The rebranded property has an early estimated opening set for 2027.

Caesars Entertainment announced in July of 2021 that the Columbus Exposition and Racing selected Caesars to build and operate a Harrah’s casino and racetrack in Columbus, Nebraska. The $75m Harrah’s Columbus, NE Racing and Casino property opened on 17 May 2024 with a ribbon-cutting ceremony.

Bally’s won a competition in 2022 to build a $1.74bn casino at the site of the Chicago Tribune printing plant in River West. Bally’s bought the site for $200m and plans to open a permanent casino in late 2026. There is currently a temporary casino operating inside the Medinah Temple in Chicago as well.

In 2022, The Cordish Companies announced its intentions to build a major facility at Pointe Orlando, set to open this Fall. The project is a joint development between Pointe Orlando owners, the Brixmor Property Group, and Live! Hospitality & Entertainment, a division of the Cordish Companies.

The Catawba Indian Tribe announced on 31 May that it would begin construction on a $700m casino property in North Carolina, with a ground-breaking ceremony having taken place on 7 June. The Kings Mountain Casino in Catawba is estimated to open in early 2026. However, due to construction delays, it could face delays until 2027.

The Cordish Companies unveiled its plans to the Louisiana Gaming Control Board in April 2023 to redevelop the Diamond Jacks Casino & Hotel in Bossier City. Live! Casino and Hotel Louisiana is a $250m project and will open its doors to the public in 2025.

The Seminole Tribe of Florida and Seminole Gaming broke ground on the Seminole Casino Hotel Brighton in January of 2023. The reservation is projected to open in late 2024 and will replace the existing Seminole Brighton Casino which opened in 1980. It will be the first hotel to be built on the Brighton Seminole Reservation.

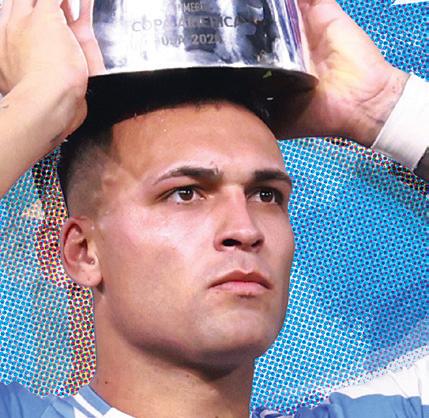

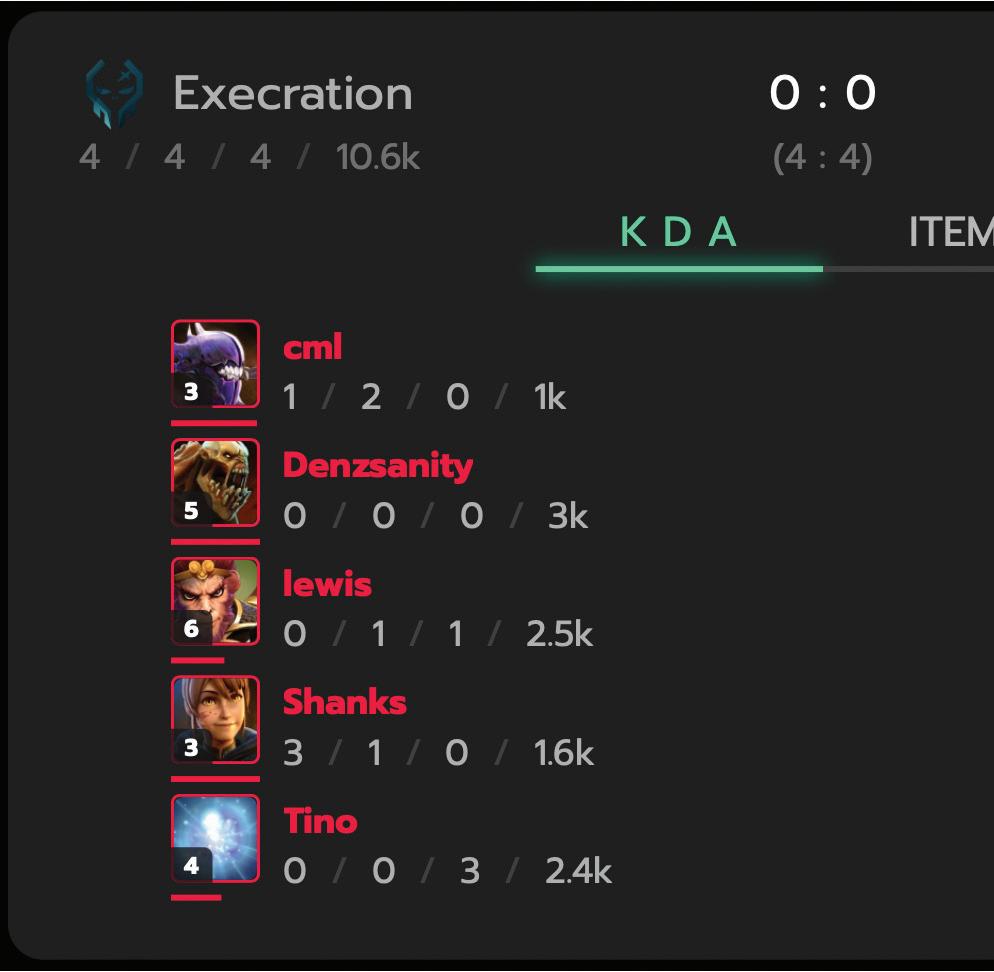

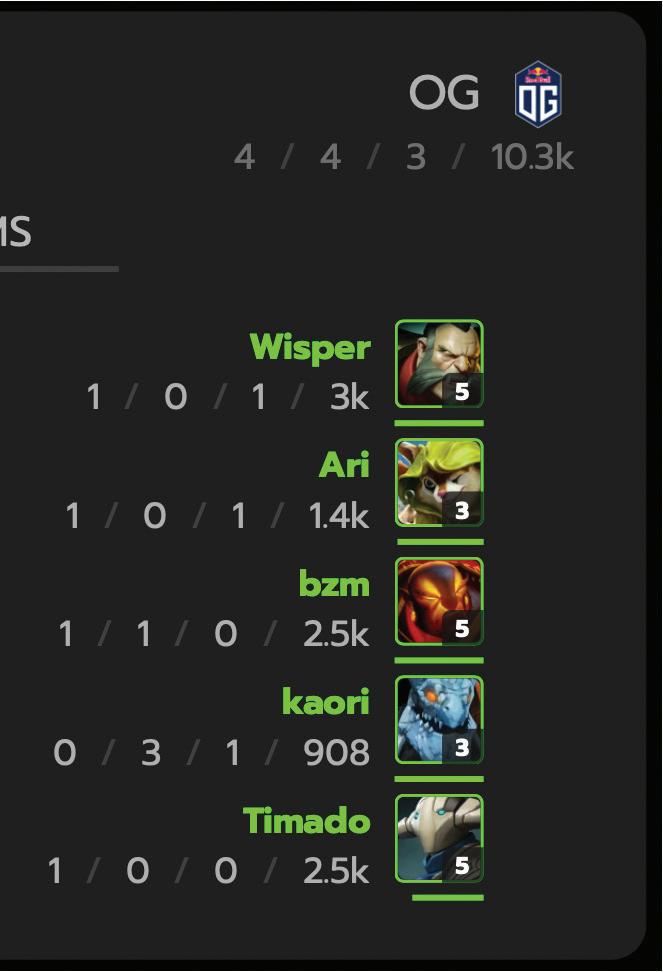

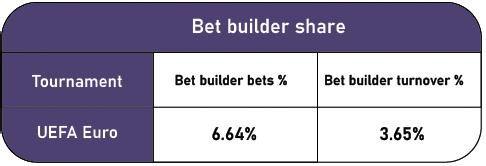

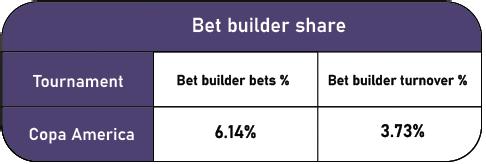

Sports betting supplier Betby provides Gambling Insider with exclusive data from its operator network at both tournaments

78% of bets on the final were pre-match

71% of bets on the tournament were pre-match VS

- According to data from Betby’s partner network, pre-match betting was king for Euro 2024. Only 33% of total bets were placed in-play – and 22% during the nal.

- In terms of turnover, this was more even across the tournament, with 48% of the money being wagered live. But, during the final, 79% of turnover was also pre-match.

75% of turnover went on Spain in the final

- Unsurprisingly, the Euro 2024 final between Spain and England topped the billing for bettors in terms of both turnover and betting popularity.

- Other notable inclusions were Germany vs Hungary – which would have attracted betting interested based on Germany being such a heavy favourite, and Portugal Slovenia, which went to penalties despite Portugal’s overwhelming odds.

- When it came to team betting, most bettors were on the right lines – with both nalists, Spain and England, heavily backed. In player markets, operators had a far better time of things.

- Indeed, all three of Kylian Mbappé, Cristiano Ronaldo and Harry Kane underwhelmed during the tournament, despite being the most heavily backed players.

- Bettors had better luck with the Netherlands’ Cody Gakpo and Spain sensation Lamine Yamal, who only turned 17 a day before the nal.

70% of bettors backed Spain in the final

- Heartbreakingly for England fans, the market saw Spain’s 2-1 nal victory coming, as the vast majority of both bets and turnover on the Betby network backed Spain over England.

81% of bets on the Copa America final were pre-match

78% of bets on the Copa America were pre-match VS

- According to data from Betby’s partner network, pre-match betting was even more emphatic during the Copa America than in Euro 2024.

- In terms of turnover, far less of the money was bet in-play during the Copa America, totalling 32% - with just 23% of turnover coming live in the nal.

- Across the tournament, eventual champion Argentina was well backed across a number of different markets, attracting almost 30% of turnover and 20% of bets.

- An ageing Lionel Messi continued to attract turnover despite exerting less influence over this Argentina side, while the mercurial Darwin Núñez was also a popular choice as one of Uruguay’s leading men.

- In terms of total bets, Colombia’s Luis Díaz was actually the tournament’s most popular player –followed closely by teammate and renaissance man James Rodríguez.

- Any bets on a mis ring Vinícius Júnior would have likely been pro table for operators.

- Compared to the Euros, the difference in interest between the Copa America nal and the rest of the tournament was far more signi cant. Argentina vs Colombia attracted 3% more bets than any other match during the tournament, almost generating 15% of the turnover of the whole event.

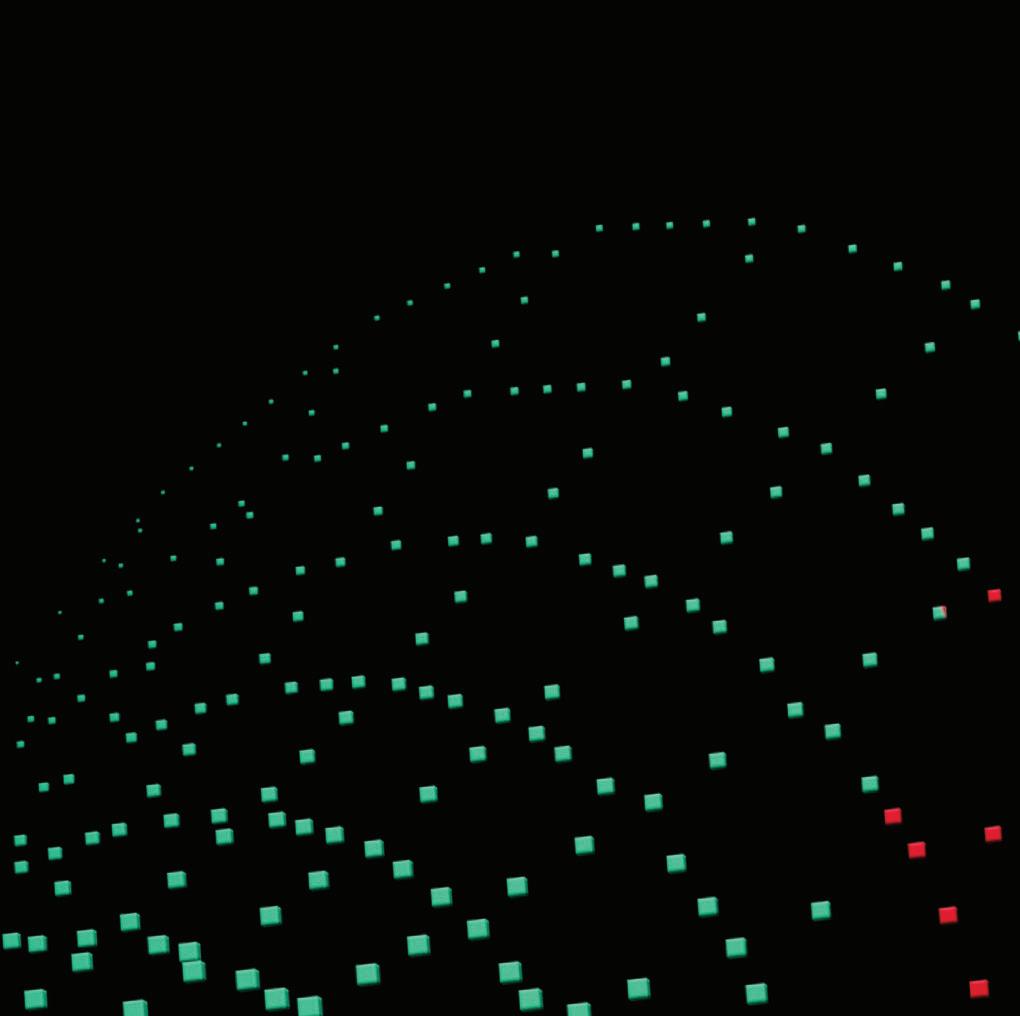

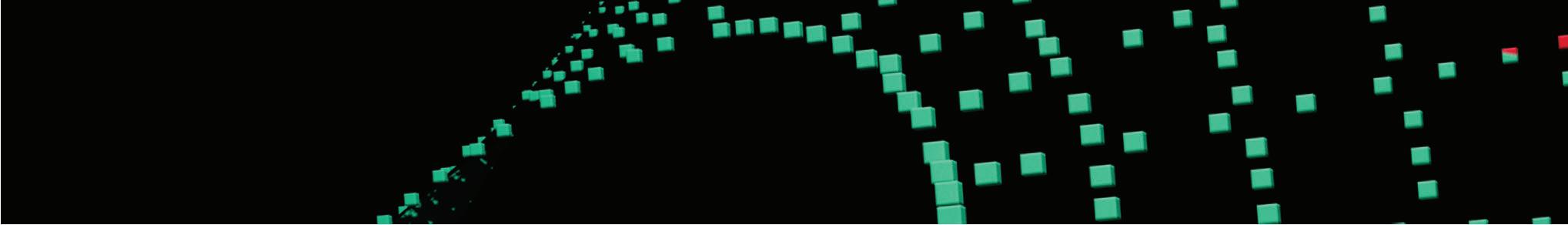

Esports data provider Data.Bet discusses developing the master key for user retention

Engagement and retention are paramount in the esports betting industry. Today’s users expect more than just basic functionalities; they seek an interactive experience that captivates their attention and encourages loyalty. The advanced tools Data.Bet uses fulfil this demand by offering real-time data, in-depth analysis and personalised options. They enhance the betting process as well as create a deeper connection between users and the platform.

Staying updated with statistics is very important in the bettor’s decision-making process. Modern Scoreboards offer detailed insights into various aspects of the game, including player statistics and team performance. With time, Data.Bet transformed these widgets from simple displays of scores to dynamic, interactive ones that provide comprehensive real-time updates. This level of detail not only keeps users informed but also increases their interest by providing a deeper understanding of the game.

Esports is characterised by its rapid pace and constant action. Unlike traditional sports, esports can involve multiple complex strategies and rapid shifts in momentum, making it both exciting and challenging to follow. This dynamic nature requires tools that can keep up with the intensity and provide users with a comprehensive view of the action. Data.Bet’s Pitch Tracker is a perfect example of such a tool, offering a visual representation of the game with real-time tracking of player movements, strategies and in-game events. This allows bettors to follow the action closely and make more informed betting decisions, being always in sync with the game.

Bet Builder has emerged as a revolutionary tool that empowers users by offering the flexibility to create bets tailored to their preferences. Skilled bettors seek an interactive and personalised experience that allows them to leverage their knowledge and insights to develop unique betting opportunities. This

feature caters to this demand by enabling users to combine di erent betting options into a single, comprehensive bet. This level of customisation is particularly appealing to experienced bettors, offering a range of possibilities that standard markets cannot match.

As the esports industry continues to grow and evolve, the integration of advanced tools, such as Scoreboard and Pitch Tracker widgets or Bet Builder, will be crucial for staying competitive. These Data.Bet’s features, supported by o cial data sources and rapid data delivery, provide bettors with a rich, immersive, and personalised betting experience, providing a more strategic, engaging and customised approach to betting. These tools are not just enhancements; they are essential components of a successful platform because they meet the ever-changing demands of the audience and help operators stay ahead of the market.

DS Virtual Gaming stands at the forefront of the gaming industry, leveraging advanced technologies to redefine the landscape of virtual gaming experiences. Founded on the principle of innovation and customer-centricity in 2005, DS Virtual Gaming has successfully integrated traditional land-based operations with cutting-edge online platforms, catering to a diverse global audience.

The Austrian company is committed to achieving a harmonious balance between land-based and online gaming experiences, acknowledging the inherent strengths and unique appeals of each segment. Our vision is to empower players with seamless access to our portfolio of games, whether they prefer the convenience of online platforms or the immersive environment of physical betting shops. By embracing technological advancements and market insights, we continuously enhance our offerings to meet the evolving demands of the gaming community worldwide.

Central to DS Virtual Gaming’s success is our robust portfolio of virtual games, meticulously crafted to ensure both entertainment value and fairness. Each game is underpinned by rigorous statistical analysis and incorporates random number generators, akin to any real sports, to maintain integrity and excitement. Our dedication to technological prowess ensures that players experience exclusive HD-quality transmissions and uninterrupted gameplay, whether on desktop computers, POS terminals, single-player terminals or mobile devices.

While acknowledging regional variations, DS Virtual Gaming has strategically expanded its footprint across diverse markets, including Europe, Africa and Latin America. Our tailored approach recognises the unique dynamics of each market, allowing us to forge strategic partnerships and adapt our services accordingly. Recent initiatives include establishing a presence in Lima to strengthen our foothold in the Latin American market, highlighting our commitment to localised operations and customer service excellence.

At DS Virtual Gaming, innovation is ingrained in our DNA. We pride ourselves on being at the forefront of technological innovation within the gaming industry. Our agility in developing bespoke solutions, with a turnaround time of up to three weeks, sets us apart from competitors. Moreover, our exclusive video content offerings further enhance player engagement and satisfaction, solidifying our position as a leader in the virtual gaming sector.

The dynamics of the gaming industry are multifaceted, in uenced by the ability of providers to develop the solution which matches the expectations of the operators and players all over the world. This exibility not only drives increased sales but also highlights the distinct preferences of our diverse customer base. While some players gravitate towards qualitative service

o ered by cashiers, others remain loyal to their independence, underscoring the complementary nature of our offerings. Our data-driven approach ensures that we anticipate market trends and align our strategies accordingly to maximise growth opportunities.

DS Virtual Gaming is dedicated to upholding the highest standards of integrity, transparency and responsible gaming practices. Our commitment to fairness is reflected in our statistically based odds and the stringent measures we implement to safeguard player interests. We prioritise customer satisfaction by delivering seamless integration across all platforms, fostering long-term partnerships based on trust and mutual success.

Looking forward, DS Virtual Gaming is positioned for sustained growth and advancement. Our strategy includes expanding our global footprint, strengthening technological capabilities and diversifying our product lineup to meet evolving market needs. Emphasising seamless integration of land-based and online services underscores our dedication to delivering exceptional gaming experiences worldwide.

In summary, DS Virtual Gaming embodies integrity and customer-centricity in the virtual gaming sector. Through advanced technologies and deep market understanding, we aim to reshape gaming experiences globally, establishing new standards for excellence and progression in the future.

Andrew Garven, Head of Marketing at Covers, tells Gambling Insider how the sports betting affiliate handled the summer months, as well as its preparation for the upcoming NFL season

How does Covers notice activity change from what could be seen as down summer months sports-wise, compared to when the NFL season is approaching?

It’s night and day; the NFL trumps everything at Covers. We take our Before You Bet show, which is typically three times a week, and ramp that up to ve days a week – as well as bolster our ambassador team. I think we have one of the largest internal teams in the industry, but we supplement those with ambassadors that are speaking speci cally to di erent areas of football betting.

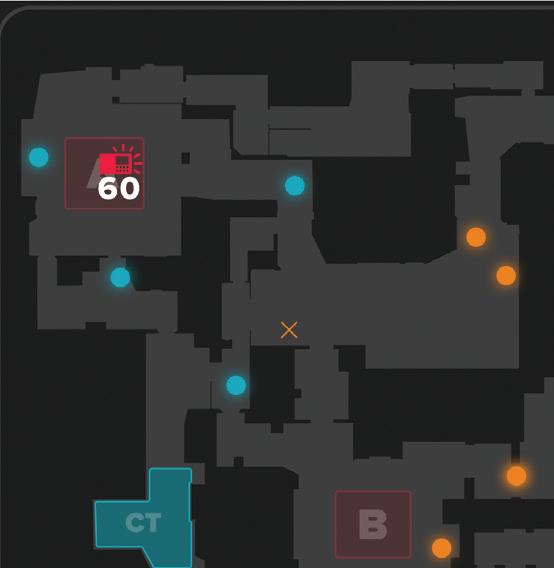

Operators definitely pull back spending over the summer, and then they ramp it up at this time of year so it goes from zero to 60 really,

really quickly. There’s so much information out there, it can be pretty overwhelming for new bettors. We try to simplify that process for them as much as possible and at the same time work closely with our partners to make sure we can present the best offers to our users.

Consumers still look at sportsbooks as being biased in their content and nobody will ever believe they want bettors to win. Being a neutral, third-party site, we really push the fact that we’re trying to win as well. We’re trying to beat the book too. Yes, they’re our partner, but we’re giving out our best bets and boosted SGPs (same-game parlays –see our cover feature!). While we do partner with sportsbooks on content, our editorial team has complete right of refusal. Being neutral, covering every single game, making the volume of picks that we do is what differentiates us.

Do you Covers’ marketing strategies differ from how operators will market when the NFL season approaches? We work together with our sports partners knowing

there’s going to be this influx of new bettors that want to wager on the NFL and everyone’s trying to stand out. There are some unique promotions, whether it be FanDuel or DraftKings who partner with the NFL to include a free month of NFL RedZone and things such as that. At the same time, it makes things interesting for us because we have to break all of that down and show sports bettors where the best opportunities are for them when evaluating sportsbooks. There’s just so much activity this time of year that it makes for a really fascinating time.

Regarding FanDuel, could one of the strategies you spoke of be the operator’s new partnership with YouTube?

Absolutely. Fanatics changed the game with its model. They have that access to their licensing arm of merchandise and other sectors. I think it’s a great way for sportsbooks to di erentiate themselves. They have to do more than just the standard bonus because everyone can do that and it’s been exhausted at this point.

They want to bring down player acquisition costs as well, so it could be a lot cheaper and smarter over the long run to include something other than a bonus. These books, DraftKings and FanDuel, are spending a fortune to partner with the leagues, but anytime you’re running that type of partnership and can take advantage of different league assets, you need to do it.

This summer in particular featured the Olympics, Euros and Copa America; did Covers take advantage of those events or notice any operators using them to bridge the gap to the NFL season?

It was a really nice surprise. At first, there were a couple of us internally who wanted

to cover every game of the Euros and Copa America. There was a little bit of resistance internally just because soccer has never been the strongest sport for us; but we went ahead and did it with great results.

I would say our soccer coverage was on par with our NBA playoff coverage in terms of visitors, which was a really welcome surprise. Over the summer months, we brought in a new audience because soccer betting is still new in North America. It was a great opportunity for mature soccer bettors,

“Being a neutral, third-party site, we really push the fact that we’re trying to win as well. We’re trying to beat the book too”

but also for first-time soccer bettors to gain experience with major tournaments and get familiar with the players as well. We also worked with Betano in Canada, which was the official sportsbook partner of the Euros and Copa America, and created an operator integration there. We covered the player props throughout both tournaments, too.

A lot of this was testing to see if we can level it up even more come the World Cup in 2026, knowing that it’s going to be in North America. Like I said, it was almost like an extended NBA playoffs, so it was very welcome along with the new audience. Some of the operators such as bet365 did a really great job with boosts. You could tell their traders really understood the game. The response I’ve heard from operators is that they weren’t sure what to expect, but in terms of overall handle it was a really nice surprise for the summer.

Do you feel added responsibility when something like the NFL season comes around?

Yes, we have to cover every single game and we know we have to continue to enhance our internal programming. We have a new betslip tool that’s dropping now, where players can build their parlays as they’re doing their research and click out once

they see which operator offers the best price. Presenting that information to help sports bettors make informed choices and constantly updating our content to reflect the changing markets.

I’ve heard it out of the NFL’s mouth that their goal is to turn fantasy players into sports bettors. How’s that going to happen? It’s not going to be by betting the second half under in the Bills-Chiefs game, it’s going to be introducing player props for guys like [Patrick] Mahomes and [Travis] Kelce. Those stars will be the ones that pull those fantasy players so they can bet alongside their favourite athletes, while also participating in fantasy leagues at the same time.

Do you see a way in which player props can be combined with a lineups feature? Such as a soccer formation or baseball lineup. You’re starting to see more of it. The integration is only getting better and better. DraftKings has a really strong player prop integration, FanDuel also. Those operators that have the licensing deals with the NFL, I believe that’s the future of this space.

Old-school sports bettors might shake their heads but people want to bet on props, they want to bet on SGPs. They’re not necessarily as price sensitive as sports bettors in the past, so it definitely seems as if that is where things are going. It’s not even where it’s going, it’s already there and there’ll be more of that going forward. The products being offered just have to catch up a little bit; some sportsbooks are there while others are still trying to make up ground.

How does Covers market to people who stick to retail sports betting? Is there a way for you guys to reach that audience?

In the past, we did a lot of ground activation in Las Vegas, Atlantic City and other markets that have changed in the space. It used to be that the sportsbook was in the corner of the hotel and if you had a third-party partner that wanted to bring more attention to your sportsbook, you welcomed it.

I would say over the last few years sports betting has become more popular in terms

“I would say our soccer coverage was on par with our NBA playoff coverage in terms of visitors, which was a really welcome surprise”

of the marketing departments of casinos to the point where they run their own events. I think Circa in Las Vegas is probably the best at it. They’re constantly running events, integrating that with Stadium Swim, doing different things.

For us, it’s something we definitely want to do more of. We’ve started to do some partnerships with operators in Canada, which is our home market. Those types of events have been primarily online over the past three years or so, but we recognise that in an ever-changing market, we need to get more boots on the ground. So it’s definitely part of our marketing strategy going forward.

Are there any contests or promotions Covers will be offering for the NFL season or possibly NBA and NHL coming up in the fall?

Absolutely, we’re going to have a $10,000 survivor NFL contest. We have a Beat the Experts weekly contest where our personalities go up against our users. We’ll definitely run unique programmes for the NBA and the NHL, as well as free-to-play daily contests. We also have a great partner in Chalkline that we work with. Overall, that means a wide variety of offerings that can be used by either a more seasoned Covers user, or someone who is new to our site as well.

“I think Circa in Las Vegas is probably the best at it (retail marketing). They’re constantly running events, integrating that with Stadium Swim, doing different things”

Gambling Insider explores how the top sportsbooks are gearing up for the NFL season after an eventful summer that included the Euros, Olympics and Copa America, with insight from DraftKings and ESPN Bet

Operators around the US are preparing for the in ux of activity that comes with the arrival of the new NFL season each year. Futures bets, player props and money lines all take centre stage as customers return from what is typically a slow period for most operators during the summer months. With the NBA and NHL Finals concluding in June, sportsbooks are forced to nd alternatives to continue driving audience retention and revenue. Luckily, in 2024, sporting events such as the Euros, Copa America and Paris Olympic Games all took place and provided a bridge between popular US sports coming to the end of its seasons and the beginning of the NFL season on 5 September.

“While the NBA Finals and Stanley Cup Finals were certainly busy, it has been an exciting summer for DraftKings with plenty of key moments on the sports calendar that

grabbed the attention of new and existing customers. The Euros and Copa America both brought in a strong amount of betting activity on soccer, which was great to see as we get ready for the highly anticipated 2026 World Cup [hosted in North America],” DraftKings CRO Greg Karamitis told Gambling Insider

“Of course, this year’s Olympic Games created another big moment during the summer as well, generating plenty of interest among our customers. As we turn our attention to the return of football, we were very pleased with the results we were able to achieve and look forward to continuing to provide our customers with year-round offerings.”

Now with the NFL season returning, companies can turn attention back towards the sport

that generates the most activity across the US. Some operators have chosen to strike partnerships with the NFL as well as companies that offer features such as NFL Sunday Ticket and NFL RedZone ahead of the 2024-2025 season.

For example, FanDuel recently announced a renewal of its partnership with YouTube to offer its customers the chance at a free trial of NFL Sunday Ticket. Customers who bet $5 will have received a three-week free trial for NFL Sunday Ticket from YouTube and YouTube TV, also making FanDuel the only US sportsbook to partner with the streaming service.

“Football season is an exhilarating time for fans, and we are committed to delivering an unparalleled sports betting experience all season long,” FanDuel President of Sports Mike Raffensperger said at the time of announcement. “As we continue to raise the

bar with new product features that allow fans to engage with the NFL in new ways, we’re also thrilled to again partner with YouTube to offer a NFL Sunday Ticket free trial to our customers, providing an NFL betting experience only available with FanDuel.”

FanDuel also increased its offering for Same Game Parlays (SGP), a feature that continues to draw interest from users of any sportsbook. SGPs offer bettors the chance to combine player props and money lines to create parlays that build increased odds for a specific game’s results. FanDuel’s additions give its customers the chance to include player quarter props, defensive props, players to catch a pass and more.

New products prior to the start of the NFL season are all made in an effort to take advantage of a returning consumer base that departed once the Kansas City Chiefs defeated the San Francisco 49ers to win the Super Bowl in February. Player props and SGPs are quickly becoming perhaps the most popular feature for bettors to use once they sign up with a respective sportsbook. Fans want to get the most out of their viewing experience, and finding ways to incorporate sports betting into that experience seems to be the common goal for operators whose markets are in the US.

“We have seen player props grow in popularity and as we continue to drive innovation forward, we will certainly be focusing on expanding these markets across several major sports. It’s important that we are delivering our customers with the content they want and enjoy, while also nding new ways for customers to engage with our products,” DraftKings’ Karamitis said.

“Throughout the offseason, we made a series of enhancements to our online sportsbook in an effort to further amplify DraftKings’ offerings. Some key initiatives our team worked on included bringing player props in-house, differentiating our live betting experience and optimising trading capabilities. This fall, customers will see these enhancements reflected across fan-favorite features such as in-game betting, same-game parlays, player prop markets and more.”

Karamitis also spoke on how DraftKings is looking to market its product to football fans this season, “While our campaigns will air nationwide, we know football fans are very passionate about their favorite teams and players, so we also create localized content within the DraftKings sportsbook app customized to their betting experiences. DraftKings customers will be able to access our extensive menu of betting markets and see select offerings on the individual state level that tap into the interest of fans who may root for the local team. This allows us to engage with our customers throughout the season both on the national and local level, no matter how big or small their market is.”

The new strategies created by FanDuel and DraftKings highlight a growing awareness towards what is to come once the NFL season begins in September. The sports betting industry is constantly evolving to bring in younger and more expectant consumers that are very technology-savvy, but still desire a simple process to place wagers. While these additions will assist operators in marketing to the returning client base, actually executing these features and providing an improved experience will be tested from now until the season concludes next February. With the NBA and NHL returning early in the fall, perfecting these strategies could lead to further increased activity for both DraftKings and FanDuel prior to those respective seasons starting.

Sportsbooks such as Fanatics and ESPN Bet have the advantage of marketing to an already existing consumer base due to the popularity of their respective brands in other sectors. Fanatics built its network of customers through clothing and apparel, now connecting that portion of the brand into its sportsbook o ering through FanCash. With the ability to earn rewards based on wagers made, users of

Fanatics Sportsbook are more inclined to take advantage of the possible promotions or deals the operator may offer before the NFL season begins.

ESPN Bet obviously has a pre-established built-in media network it can attach to its sports betting offering at any time, including promoting its money lines or spreads across different ESPN television programs. While the access ESPN Bet has at its discretion will always be an advantage for the operator, it is also responsible for marketing to its consumer base in a responsible manner. Attempting to highlight the odds of a certain bet or influence viewers to place wagers could present challenges especially as the NFL season approaches and betting activity begins to rise.

“A way for us to drive audience growth is to integrate across our platforms. ESPN Bet is the sponsor of various ESPN programming, and it keeps ESPN Bet top-of-mind with our leading database of sports fans,” ESPN Bet and Fantasy VP Mike Morrison told Gambling Insider

An avenue operators could choose to follow in due time is tying in its player prop offerings with a line-ups feature for each game. Take a soccer formation or baseball line-up, for example, the ability for users to simply select any player in the line-up and instantly have the option of wagering on one of their respective player props could be an advancement many operators execute in the near future. The delicate balance of finding ways to constantly enhance one’s product while also keeping the wagering process simple and effective will always be a proponent of the industry that sportsbooks are forced to maintain.

“There are always ongoing updates to the user experience and Penn continues to work to innovate the product. We are working toward new integrations within the ESPN and ESPN Fantasy apps, which will include deep-linked markets and personalised in-app betting offers,” Morrison said.

The sports betting industry is constantly changing, forcing operators to evolve and enhance its product offerings to satisfy a consumer base that will only continue to demand more improvement. Ahead of events such as the NFL’s return to play and the reappearance of the NBA and NHL in the Fall, activity across all sportsbooks spike as wagers for the country’s most popular sports are made available once again.

How US operators choose to prepare for these events helps distinguish which generate the most business throughout the fall and winter months while these sports are occurring. Through a number of new promotions, enhancements and even partnerships in some cases, the sports betting industry is gearing up for the gridiron as fantasy and sportsbook consumers alike look towards a new season –and new horizon.

Brian Josephs

, VP Account Management, North America, walks us through Sportradar’s Managed Trading Services for the US marketplace

As sports betting continues to reach new heights in the US, with expanding regulation and legalisation, the marketplace becomes increasingly competitive. More than six years after the United States Supreme Court overturned PASPA, 12 states, including the major markets of California and Texas, are yet to legalise and regulate sports betting, leaving great opportunities for new players to enter the game and claim a significant share of the market.

For Sportradar and the larger betting industry, the US continues to be a priority. Online sports betting revenue was predicted to reach $14.3bn in 2024, with an annual growth rate of 10.7%, resulting in a projected market volume of $23.8bn by 2029, which would represent approximately 37% of the global sports betting market.

In other hyper-competitive, high-growth markets such as Europe, LATAM and Africa, we have seen new operators struggle to establish a foothold and obtain significant market share, while simultaneously developing the necessary proprietary backend technology to compete.

What we’ve seen recently, as operators navigate these challenges, is a significant uptake of our MTS solution with 44 operators signing on for the solution in the first half of 2024. In its simplest form, MTS is a bet

validation tool whereby our team of traders review an operator’s betting tickets to assess the risk associated with each bet and determine which ones should be accepted or rejected. In a marketplace that requires a rapid go-to-market strategy, MTS allows operators who lack the proper infrastructure to almost instantaneously utilise Sportradar’s team of experts and stack of leading sports betting technology to begin accepting bets.

Furthermore, our MTS is completely customisable, allowing operators to choose which services they want from us based on the needs of the business. For example, if an operator already trades NBA and NHL matches in-house but wants to quickly add MLB to their offering for the upcoming MLB postseason, they can utilise MTS to do so in-line with their existing trading strategy.

The US is a uniquely challenging market for operators. Along with the additional intricacies that come along with state-bystate regulation, bettor behavior in the US differs from those around the globe. Due to the country’s history in fantasy sports, US sports fans tend to focus on individual player performances rather than team outcomes. ‘Prop bets’ and ‘parlays’, a bet where the bettor ties multiple bet types together to combine odds, have become especially

popular. MTS performed exceptionally well throughout the 2023-24 NBA and NHL seasons, providing clients with margins of 10.3% and 11.5% respectively.

For operators looking to further enhance their risk management strategy, the MTS integration provide operators with access to Alpha Odds, Sportradar’s AI-driven personalised odds technology, which recalculates a sportsbook operator’s financial exposure after each bet is placed using advanced AI models, allowing operators to manage their liability in real time to reduce the associated risk. Alpha Odds is proving to be a game changer for our clients. Over the course of UEFA European Championship qualifying matches, clients with Alpha Odds increased their profit margins by 15%, helping those operators boost their trading performance. As we approach key moments in tennis, soccer and basketball, operators in the US can win with MTS and Alpha Odds, increasing profitability and minimising risk.

The US sports betting industry is remarkably competitive and new market entrants need a partner they can rely on to hit the ground running. Sportradar and our Managed Trading Services provide the unique ability to take on the US market with confidence and efficiency.

Gambling Insider looks at the shift between gambling sponsorships within sport, with insights from BetMGM UK and LiveScore Group

Gambling has been prevalent in sports for years and its presence has continued to grow, especially given the expansion of online betting. In the UK, high-street bookies have been accepting online sports wagers since the 2000s. In the US, legal online sports betting is a lot more recent. It was born in 2018 to be precise, after the overturning of the Professional and Amateur Sports Protection Act (PASPA), which allowed states to start legalising online sports betting. Growth has been rapid in both regions.

Alongside this, the exposure of gambling advertising, promotion and sponsorship has also seen significant growth within sports, including teams, tournaments, leagues and even stadiums.

While gambling sponsorship is seen in many sports in the UK, such as darts, rugby league, horseracing etc., one of the main examples in the UK, naturally, is football, something

that comes as no surprise given the size in popularity of the sport within the region. From Stoke City’s home ground being named the bet365 Stadium to Betway being present on the front of West Ham United’s matchday shirts, and even William Hill’s title sponsorship of the Scottish Professional Football League (SPFL), there are a variety of clubs who are in some way, shape or form connected with a gambling company.

The Premier League is by far the largest football league in the UK, if not the world, so the global appeal of gambling companies being involved with clubs in the league is clear to see; especially when it comes to branding and promotion. It has become almost common to associate gambling with football when so many companies in the industry have naming rights, such as Sky Bet’s sponsorship of the English Football League, covering the Championship, League One and League Two, and general involvement surrounding the sport. However, in recent times there have

been concerns raised by some stakeholders regarding gambling’s widespread presence in the sport, highlighted by a recent survey conducted by the Football Supporters’ Association. It showed that three quarters of football fans are concerned about the prevalence of gambling advertising and sponsorship around football. The data also showed that gambling advertising was significantly more likely to influence those who are already experiencing gambling harm to spend additional money and time on gambling.

Not only has concern been raised in recent times but, prior to this survey, action had already been taken related to the Premier League. In April 2023, clubs in England’s top tier voted to outlaw front-of-shirt gambling sponsors from the league by the end of the 2025/26 season, becoming the first sports league in the UK to take such action voluntarily to reduce gambling advertising. This decision came ahead of the UK Government’s review

of gambling legislation, with the policy proposal described in the UK White Paper as a voluntary commitment by the Premier League. While this has in no way slowed down the plethora of deals still occurring both in the Premier League (more than half of teams in the league have a gambling front-of-shirt sponsor in the 2024/25 season as they cash in before the ban comes into effect) and wider afield in UK sports in general, it does suggest there may be a shift in gambling advertising and sponsorship’s relationship with sports.

Further to this, towards the end of July this year, the EFL, Premier League, The FA and Women’s Super League agreed on a new Code of Conduct for Gambling Related Agreements in Football. This code covered areas such as the protection of children and other vulnerable persons, social responsibility with regards to how gambling sponsorship is promoted and delivered, reinvestment of income for the benefit of football fans and communities, and ensuring integrity is maintained in football competition.

On the other hand, in the US, given the overturning of PASPA only took place in 2018, there hasn’t yet been as much scrutiny of gambling sponsorship in the same sense. So, while the US sports betting market continues to expand, reaching more states, teams and leagues, sponsorship by gambling companies within the sporting realm has likewise continued to new heights.

The likes of FanDuel, Caesars Entertainment, BetMGM and DraftKings have secured partnerships throughout the US surrounding the sporting industry; with teams across a number of verticals, including in the MLS, NBA, NFL, NHL, NASCAR, among others, as well as the related associations for the sports. This branding has also stretched out to companies having brand ambassadors, including sporting stars, such as former NHL player Wayne Gretzky for BetMGM and many, many more.

Sports betting operators not only hold a presence with their corresponding sports team partners in the form of branding and advertising, but on top of this feature in stadiums through sportsbooks. Some examples of this include at the Allegiant Stadium in Las Vegas, an obvious choice, where fans can use the BetMGM app to place wagers through MGM Club; then at the Rocket Mortgage Fieldhouse in Ohio where Caesars partnered with the Cleveland Cavaliers to open a sportsbook in the arena; and at the Capital One Arena in Washington DC where William Hill opened a sportsbook. These sportsbooks will of course vary in size, but generally will be larger than any betting booths/kiosks that might be seen in a football stadium in the UK. Often in the US they will almost look more like bar lounge areas than actual sportsbooks, where people can place bets on their phones, and will feature the branding of the sports betting operator.

This example alone highlights the

potential shift between the UK and the US when it comes to sports betting advertising within sports and the potential perceptions surrounding it. While little has been made of the influx of gambling advertising and sponsorship within the US sports market to date, there is the potential that allowing it to get too out of hand may lead to the US following the same path as the UK. Here, we are talking about potential backlash and scrutiny, with sports betting itself already facing criticism in some parts of the US.

To analyse this trend, we spoke with BetMGM UK Director Sam Behar and LiveScore Group CEO Sam Sadi about the differences in gambling sponsorship within sports and what could change.

Though BetMGM UK doesn’t have any frontof-shirt partnerships in the Premier League, it does currently have deals with clubs in the division, such as Wolverhampton Wanderers as its official European betting partner, Newcastle United, and Tottenham Hotspur as its o cial betting and front-of training wear partner. Given this, Behar believes the ban in the Premier League won’t a ect business for the operator too much.

“I think the impending self-imposed ban on front-of-shirt partnerships is something we support. Our position in the market is bigger, better and more responsible and so we support this because we don’t have any front-of-shirt partnerships; we aren’t planning to have any. We are focusing

our efforts on reach in sponsorship in a different way and using our partnerships in a different way in football. And we believe the best route for us to do that, as we’ve displayed this year, is utilising training kit assets and betting partnerships.”

Behar explains that no matter what type of partnership a company may have with a football team, for example in the UK, the rules themselves will still be the same and ultimately “the only benefit you are getting from a front-of-shirt match day partnership is retail,” with BetMGM UK’s Spurs deal meaning fans don’t actually have the sponsor included on the shirts they buy, but rather have a blank non-sponsored shirt.

Looking wider afield, BetMGM UK’s Director highlights that this sort of regulation regarding gambling sponsorship is already seen in other sports both in the UK and in Europe, with there being “self-imposed regulatory requirements on brands appearing on match kit.” Behar believes further rules and regulations in the UK regarding gambling sponsorship may be seen, similar to what we have already in the Premier League and other areas.

“I think that, in general, the UK will continue to strengthen the regulatory position it has on ensuring the protection of minors and those at risk; and if that translates to sports that get broader appeal and broader reach for those people who are at risk or under 18, I’m sure there will be more restrictions in place.”

While BetMGM UK has a number of sponsorships in the world of sport, Behar says the operator does the utmost to ensure what is being promoted is not being advertised to those who are underage or at-risk customers.

“If you look at some of the partnerships we’ve done outside of football, for instance,

notably, TalkSport, an adult audience, darts, an adult audience, horseracing, an adult audience, we have focused our primary objectives on ensuring we deliver advertising to customers who are not at risk and who are not underage.”

this trend has already materialised in many countries.

“Collaboration is essential,” was the main point made by Sadi when talking about how gambling companies can work with their partners. Especially when it comes to avoiding issues such as advertising to underage fans, pointing out that “both parties must recognise the mutual benefit of protecting underage fans from excessive gambling exposure. They need to agree on this principle and actively seek ways to minimise such exposure.”

As a final point, Sadi delved into the reasons behind the differences between gambling sponsorship in the UK and the US. “The key difference lies in market maturity. In the newly regulated markets such as the US, building brand awareness is crucial due to the lack of established brands. By contrast, the UK market, being more mature, places greater emphasis on performance-led marketing channels. Additionally, in new markets like the US, sponsorships and abovethe-line marketing are vital for successful channelisation during the early regulation years; unlike in the UK, where these methods are already well-established but currently facing challenges due to regulation.”

For LiveScore Group, the majority of its sponsorship deals, especially in recent times, have come about through its Virgin Bet brand in the world of horseracing, such as the sponsorship of Cheltenham’s December Gold Cup. However, with its focus being on the convergence of sports media and sports betting, Sadi can o er detailed knowledge surrounding sports’ relationship with the gambling industry.

Reflecting on the impending ban on front-of-shirt sponsors in the Premier League, the LiveScore Group CEO underlined the potential consequences this could have in a wider sense and the possible change of strategy from companies as a result.

“The impact varies depending on the type of gambling company. For Gambling Commission-regulated companies, the effect will be minimal since few rely heavily on this marketing method. However, offshore operators targeting unregulated territories will lose a key tool for mass brand awareness. Consequently, we may see an increase in regional partnerships as these companies adapt their strategies.”

On whether regulation may lead to fewer gambling partnerships in sport in general, Sadi commented: “That’s a reasonable expectation. In fact, if we exclude newly regulated markets, we exclude newly regulated markets,

EDUCATION OCTOBER 7–10, 2024

EXPO HALL OCTOBER 8–10, 2024

THE VENETIAN EXPO, LAS VEGAS

G2E is the catalyst for gaming - fostering innovation and driving growth by convening the global industry to define tomorrow. CONVENING GAMING

REGISTER TODAY AT G2E2024.COM/GAMBLINGINSIDER

CRO Yoav Ziv discusses how advanced computer vision and a combination of official and independent data feeds helped create LSports Tennis Premium - its recently introduced tennis product

With a global audience of over a billion fans growing year by year, tennis continues to captivate huge crowds worldwide, well into the post-Roger Federer era. The same can be said for tennis betting. As a dynamic sport offering thousands of fixtures and countless in-play betting opportunities annually, its popularity among sports bettors is immense. Sportsbooks naturally benefit, as tennis consistently ranks among the highest-turnover sports for bookmakers and is ranked as the fourth most ordered sport by LSports’ clients.

This tremendous traction and potential customer base have driven many industry players to leverage advanced technology to develop superior tennis products, providing users with an exciting, unique, and allencompassing experience. This is precisely what we’ve been doing at LSports in recent years, to the point where I feel confident saying we have the best and surely most costeffective tennis product on the market.

LSports Tennis Premium, our recently introduced tennis product’s strength and uniqueness, come from several factors. First, it’s the technology. We combine various data collection methods; web scouting, TV/In-venue scouts and advanced, fully operational computer vision techniques allow us to deliver super-accurate data to our partners in real time.

Our tennis data feeds are the most extensive bookmakers will find. When we say we cover everything, we mean it literally. Wherever

there’s a tennis ball, two players with racquets, and a chair umpire, our partners will have the match’s data. This results in coverage of over 130,000 fixtures, 2,000 tournaments and more than 150 unique markets, including ITF and ATP & WTA premium packages, with continuous improvements in coverage, provider choice, and uptime guarantee.

Our tennis feeds are backed by a brand-new LSI (Live Score Intelligence) model powered by the wisdom of crowd-based algorithms. This enables us to make smart decisions when choosing between sources, and ensures our partners receive maximum precision and speed of delivery.

The latest development is the enhancement of our offering with real-time official data from more than 50,000 tennis matches yearly. Combined with LSports’ independent feed, this official data further boosts LSports Tennis Premium’s accuracy and speed, making it as bulletproof as possible.

To make our partners’ lives easier, we offer a seamless, one-time integration of both independent and official feeds, providing a 360-degree tennis data solution. This approach keeps them unaffected by the frequent rights-holder changes the industry has recently experienced. On the business level, it’s no secret there’s a lot of buzz in the industry around tennis these days, mainly due to rising data costs and uncertainty about rights holders. Consequently, we have seen significant movement lately from tier 1 and tier 2 bookmakers looking for alternative providers for tennis data.

As the market’s attention increases, this presents us with an opportunity to step up our marketing efforts so that more sportsbooks learn about the advantages our tennis product has over the offerings of other big players. Over 220 of our partners already use LSports Tennis Premium, enjoying the ability to fully customise their packages to meet their specific needs. With ongoing enhancements to our capabilities and the launch of our limited time joining offer, I am confident that this number will soon increase.

Could you give a brief summary of your product offering?

Wise Gaming is a fast-growing complete platform, o ering both White-Label & Turnkey Solutions. Our robust solution is built from our team’s extensive experience: 15 years B2C and 10 years B2B. We understand the importance of a truly modular approach, allowing our partner the ability to obtain either our entire solution or individual components that enhance what they currently have.

Your product is regulated in territories around the world. Where would you want to go next and why?

Extensive experiences have given us a solid foothold in the European & LatAm continents. Incredible successes with our current operations as well as the successful growth of our partners, our focus is not only on established markets but exploring unique and emerging markets also. This approach allows us to increase our market and industry knowledge as well as the ability to learn and adapt, truly focusing on our partners needs without limitations.

2025 will be Wise Gaming’s year of expansion! 2024 is our stepping stone, by continuing to build on our successes in EU & LatAm whilst planning next years’ growth in both Africa & Asia.

Beyond football, what are the most popular sports to bet on?

Does that change in different parts of the world?

Football is a very important sport across the industry, with an estimated four billion fans globally. However, other sports must be acknowledged and catered for depending on the regions you are operating in.

A few examples after football you must consider:

1. ASIA

a. Basketball

b. Table Tennis

c. Cricket (Indian Subcontinent)

2. OCEANIA

a. Rugby

b. Cricket

c. Field Hockey

d. Horseracing

e. Aussie Rules Football

3. LATAM

a. Baseball

b. Basketball

c. “Bloodsports” MMA, Cockfighting (probably not on many sportsbooks) etc

4. AFRICA (USUALLY DOMINATED BY SOUTH AFRICAN TREND):

a. Rugby

b. Horseracing

5. EUROPE

a. Basketball

b. Tennis

c. Horseracing

d. MMA

This is why knowing the markets is extremely important for our partners’ success. How important is it to offer esports betting, especially to Gen Z players?

This topic can start some controversial conversations; I think esports is playing a part in the future of the iGaming industry. Back in my youth (I’ll be showing my age now) it was all about going to the betting shops with my father/grandfather to place a physical bet. It wasn’t just about the gambling but the social interaction with peers.

Now, that social interaction has been replaced by digital technology. Gen Z interactions are mainly through social media channels creating this “digital world” where all interactions take place. Esports, as both a product for gambling entertainment and social interaction, will be a core product as it allows “non-sports” individuals to still be included.

It is EXTREMELY important, as well as our responsibility, to make sure such product a is implemented properly with the necessary safeguards in place that it protects the young and vulnerable who may be misled to thinking its simply “gaming.”

What are Wise Gaming’s goals for the next year?

As mentioned above, throughout 2024 Wise Gaming has been growing from strength to strength. Our focus has been two-fold, building new strategic partnerships as well as enhancing our current one. These partnerships are setting us up for our most successful year EVER! Our vision for 2025 is clear, disrupt the current statue quo by becoming a leading White-Label & Turnkey provider, that truly offer our partners the best opportunity at success!

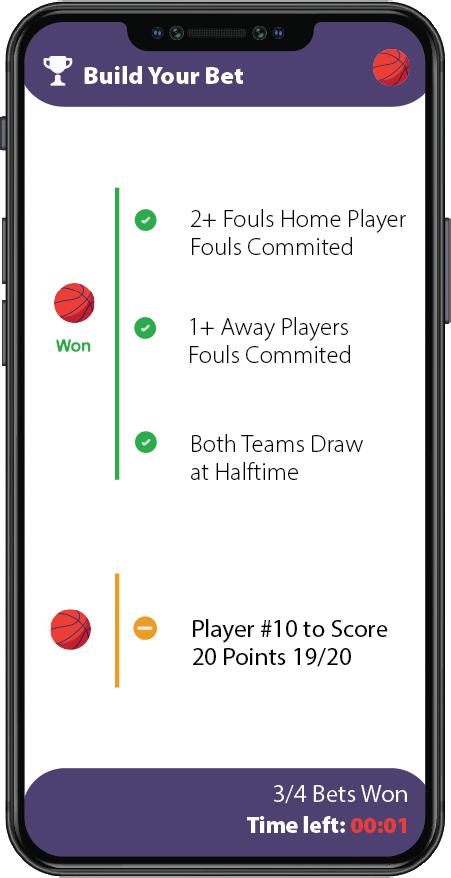

Same game. New ways of playing. Are same-game parlays and bet builders changing the industry? With contributions from Fair Play Sports Media, Digitain and Kambi, Gambling Insider digs deeper

Bet builders, better known as same-game parlays (SGPs) in the US, have come to redefine how players place sports bets in the mobile betting era. Improved access to real-time data has allowed odds to become more accurate and more specific, creating opportunities for more specific bets, especially for in-play bets when the odds are forever changing. Combined with the interface of sports betting apps, crafting a multi-part bet for a football team to win a game, with a specific player taking the win and another getting a yellow card with odds of +1300 is as simple as personalising a takeout order on a delivery app.

Personalisation is a crucial factor in bringing players to (and back to) a platform (something we delved into in our July/August issue of Gambling Insider magazine) and with bet builders, a wager can be wholly customised. If players are bored of just betting on which team will win or which player will rake in the most points, now they can combine these bets, with the chance of even higher returns than placing those two separately (and many more).

“We’ve seen a meteoric rise in popularity for bet builders in recent years,” Kambi Head

of Soccer Jonathon Hurst tells Gambling Insider. “Bet builder now accounts for a significant proportion of pre-game bets and handle, which obviously differs greatly depending on the sport. For example, most recently during the Copa America and Euros soccer tournaments, we saw bet builders account for 24% and 18% of bets on each tournament, respectively.”

“As a general trend, we are seeing bet builder growth across the board, with some operators now reporting a contribution of over 30% of all football bets,” added Andrew Bramley, Commercial Director, Sports for Fair Play Sports Media. “I’d expect this coming season to be the watershed for bet builder comparison as a normalised part of the customer journey, as the bet builder offering in general cements itself even further in both digital and retail settings as the go-to bet type for a significant audience.”

But where exactly did the idea of bet builders come from and how have they gone on to make up such a big portion of today’s sports bets?

While it was FanDuel that brought the same-game parlay to the US in 2019, it was not FanDuel that came up with the concept. Industry reports tell you that honour would go to Sky Bet, which had begun its work on bet builders almost a decade prior. Notably, FanDuel and Sky Bet both operate under the same parent group, industry giant Flutter Entertainment.

for that specific bet. Of course, as is always the case with social media, not every bet was what was expected; however, one bet type that continuously appeared on #RequestABet was that of multi-part bets.

requested bet is added to the platform, mind – ‘Sorry, this is not something we are looking

The account is active to this day and is still adding requested bets to the Sky Bet platform. On 2 August 2024, one user requested ‘Over 0.5 goals in each Leicester, Southampton and Ipswich premier league games,’ to which RequestABet replied four days later ‘Added at 60/1 in the Over 0.5 Goals in Each Game market.’ Not every requested bet is added to the platform, mind – ‘Sorry, this is not something we are looking to offer’ is a reply seen fairly frequently in RequestABet’s tweets. Sometimes, the Sky Bet team is simply too busy (or chooses not to) reply.

not to) reply.

From here, multi-part bets (accumulators/parlays) began to become more and more commonplace, with other operators both experiencing similar calls for multi-bet options (see Sportsbet in Australia) or using a similar framework set out by Sky Bet (William Hill’s #YourOdds is just one example of this). Their popularity in Europe began to

According to various sources, around 2012 Sky Bet noticed its X (then Twitter) account was filled with player requests for specific bets – ones that, at the time, Sky Bet did not offer. Soon, Sky Bet decided to give its players what they wanted and, with this, RequestABet was born.

RequestABet went live on X in January 2015. As the name suggests, RequestABet was a Sky Bet-ran account through which SkyBet customers could request specific bets and traders could return with odds

develop alongside the popularity of #RequestABet and not long after PASPA was overturned in the US in 2018, same-game parlays arrived on US soil.

As previously mentioned, the customisability of SGPs provides them with diversity and, crucially, choice. An operator offering SGPs a player is interested in will provide more value than one that doesn’t, and even more value than a sportsbook only offering just standard, singular bets.

When asked if bet builders are keeping bettors engaged and online longer, Zohrab Karapetyan, Chief of Sportsbook Product at Digitain, tells Gambling Insider : “Based on our research findings, yes. One reason for this is the desire of bettors to have more control over their betting activity rather than having to choose from pre-existing bet types offered by the operator. Instead of being restricted by the bet options that are set, the bet builder feature allows bettors to combine different selections into a single bet. For example, 49% of bet builders include cards and corners as the most popular statistics markets, again showing that players prefer to combine statistics in choosing their bet builder selections. This helps open up unique betting possibilities that go beyond traditional markets. By being able to create personalised bets, players can discover new sources of excitement and maximise their potential winnings.”

a player’s potential winnings, as Karapetyan and Hurst mentioned. If a player bets $10 on a –108 bet, their returns are $19.25 on the DraftKings app. Add another –108 bet and that figure jumps to $36.40, with odds

Moreover, specificity in bets allows players to show off their support and belief in certain players and teams. Pointing them out specifically is proof of their belief, and if that 1300+ bet goes through, that belief will only increase tenfold. Plus, with the ability to share bets among friends and on social media platforms, a high-stake bet can become proof of a fan’s genuine belief in an outcome.

Or, as Karapetyan put it: “Bet builders offer value when the 1X2 odds are not attractive or one-sided. So value is a driver of adoption for bet builders. Similarly, players are interested in their favourite team; thus, bet builders allow the bettor to look at stats and offer more choices throughout the game instead of just the 1X2 90-minute result for the team that they favour.

Hurst responded similarly, stating: “Sports bettors now have the ability to craft and bet on their own storyline within a game – one that allows them to include more outcomes – adding to the entertainment that comes from engaging with the sportsbook and keeping players engaged. With an almost limitless number of combinable markets, bettors are able to navigate the sportsbook and build a bet that suits their interests; whether that be their favourite teams, players or sports. Complementing this popularity is the potential for a big win coming from a small stake.”

Beyond just the ability to create unique, custom bets, SGPs also drastically increase

Add something with low odds, like a +125 odds bet, and

suddenly your payout is $140, with odds of +1300. Same-game parlays are riskier, given the number of parts involved, but when it’s possible to turn a $10 bet into $140, is it surprising that players are interested?

“Builders are gaining traction among regular or casual bettors who have previously engaged in multi-bets on multi-leg events. Our data shows that 65% of bet builder bets are combo bets, meaning players combine multiple bet builder selections or mix them with standard bets. The increased adoption is due to the expanded choice that bet builders offer within a single football match, providing a deeper and more engaging betting experience.”

For operators, this is also a bonus. While payouts may potentially be bigger, the specificity of the bets makes them far less likely to be successful, resulting in better returns for sportsbooks. Sharp bettors may prove something of a spanner in this plan, but given that the majority of players do not fall into this category, sportsbooks can utilise SGPs to make a little more from casual bettors. Sharp bettors may also prefer to stay away from SGPs or bet builders as they offer less expected value plus.

As Hurst puts it: “Bet builders have become a crucial product for any ambitious sportsbook. Sports bettors increasingly want to be able to drive their own experiences and catering to the growing desire to create bets ‘off-menu.’” Bet builders have become vital, says Hurst, both for the personalisation they offer players and the margins they generate for operators. “Bet builder does

typically generate higher margins than single selections on fixed-odds markets, although it is important that the right balance is struck here, as generating too high a margin from a particular part of the betting product is unlikely to see customers return to it consistently.”

Karapetyan echoed a similar sentiment, saying: “Our bet builder... enables users to customise their betting experience, enhancing engagement and satisfaction for pre-match and live game betting.” He went on to explain the demand for more markets among users, and Digitain’s delivery on these demands, explaining that the operator has “increased the maximum selections from 10 to 16, as 3.7% of users prefer more customisation in their bet builder experience,” concluding that, “As players require more market choices within their respective bet builders, the sportsbook’s margins within that bet type will be higher.”

Bramley of Fair Play Sports Media also tells Gambling Insider: “There’s no doubt that bet builders are a win-win. Customers now have the ability to make their own betting storylines with more customised odds, while operators are now seeing the high margin traffic that justified the heavy investment in these products. Those sportsbooks willing to offer market-leading prices will inevitably realise the loyalty benefits when presented alongside competitors. After all, we’re talking price differences of 200/1 against 50/1, rather than 6/5 and evens, with the former far more appealing to the more recreational bettor that Bet Builders generally appeal to.”

Neither DraftKings nor FanDuel provided details or analysis for this feature, however by looking at recent quarterly results from the operators, the impact of SGPs becomes undeniable. Said DraftKings CEO Jason Robins in its Q2 2023 earnings call, samegame parlays had been “a huge part of the story” in terms of the sportsbook $874.9m in quarterly revenue and loss decrease from $308.9m to $69m (amounts which have since risen to $1.1bn and reduced loss of $32.4m respectively).

With SGPs offering small, more specific circumstances to bet on, like players receiving penalties or kicks from certain positions, the question becomes, are more people betting live? After all, if you have a bet on a game and see that two players already have yellow cards, why not bet on one of them getting a red and signi cantly increase your win potential?

On the topic, Karapetyan tells us: “Live betting is becoming

increasingly popular due to the fact that bettors are busy and have limited time to place bets. They also prefer the flexibility of being able to place bets throughout the game rather than right before it starts. We are indeed seeing growth in both pre-match and live bet builders. As far as trends are concerned, bettors react to the events on the eld and closely analyse statistics.

“Our bet builders are designed to support a wide range of bet types, including playerto-score markets and statistics markets such as corners, yellow cards, o sides and fouls. We’ve also made it easy to incorporate other popular types of sportsbook bets within our builder, such as Acca Bonus, Cash Back Bonus, Bad Beat Bonus, Double Dooble, Sports Jackpot and 2 Goals Ahead.” Hurst added: “We have seen rapid growth when it comes to live bet builders including cashout, which is the next natural step in the evolution of the product and will be a new battleground for the industry.”

if it seems their full parlay bet will not be fruitful. Bet on X team to win, Y player to score twice and Z to get a red card, but it’s reached half time and Y still hasn’t scored at all?

Cash out options have been available to players for longer than SGPs have, initially coming onto the market some years ago. It is widely acknowledged that Colossus Bets Founder Bernard Marantelli was heavily involved in the creation of the cashout concept, although bet365 is also recognised as the rst major operator to introduce the concept. Gambling Insider won’t take sides but will acknowledge that both had a part to play in the history of the feature.

As Hibai Lopez-Gonzalez and Mark D Griffiths summarise in their Gaming Law Review 21 contribution, ‘“Cashing Out” In Sports Betting: Implications For Problem Gambling And Regulation,’ cash out options are “a feature o ered on single and multiple bets on various sports... CashOut gives you the opportunity to settle your bet early at the value displayed, without having to wait for the event to nish. The amount you are o ered to CashOut is based on your original bet, the status of any selections which have already completed and the current market price(s) of your unsettled selection(s). The CashOut amount may be more than or less than your original stake.”

Cash-out, as Hurst mentioned, has become particularly popular among SGP bettors. These systems allow bettors to tap out, if you will, during a parlay bet, leaving with a percentage of their winnings

Cashouts o er a few incentives to players – namely, that there is a safety net available to them when placing a risky bet, which may encourage bigger spends as, if things go poorly, tapping out early will mean a bet isn’t a complete loss. Of course, this can lead to some less than ideal situations (survey based studies, including those by Hing et al., 2016 and LaPlante et al., suggested that in-play

sports betting was more pervasive among problem gamblers), cash out also provides players with an invaluable tool: a sense of control.

Being in control of your betting experience is something also seen with SGPs; it is no longer the bookies in control of their bets and their outcomes, but the players. Diversifying the way bets are made and played has made them a must-have for sportsbooks – but what else is there too them that may have some see them as the bigger innovator compared to cash outs? And moreover, could the bet builder ever come to replace the single bet?

SGPs are popular, sure, but will they ever displace conventional, single bets as players’ go-to?

First of all, it must be acknowledged that, while bet builders have been particularly popular among some operators, for others, it has not yet become so widespread. As seen by data provided by Betby (see Figure 1), only 6.6% of Euro 2024 bets and 6.1% of Copa America bets on its operator network were bet builders, both representing 3.7% of each event’s turnover. All that is to say, while users are utilising bet builder options, they have not made traditional bets obsolete just yet.

Bramley responded with a similarly balanced reply. He explained: “More committed bettors will always stick to core markets and single bets at higher stakes, while casual bettors love the thrill of bigger wins for a more recreational stake, which also add a deeper engagement layer when watching live sport. In that sense,

“Players are interested in their favourite team; thus, bet builders allow the bettor to look at stats and offer more choices throughout the game instead of just the 1X2 90-minute result for the team they favour“Zohrab Karapetyan

recreational customers are bene tting the most from this growth, but we haven’t seen notable signs of cannibalism of traditional markets and I would argue there’ll always be a place for them both.”

Bramley’s statement is backed by what we have seen so far – that casual bettors and big sports fans are placing big bets for fun, with less riding on the necessity of the win (but obviously winning is still an aim) and more on adding thrill to the experience. If they make a big return from a hyperspeci c bet? Well, to them that is just the cherry on top of an already good game.

Karapetyan highlighted the particular appeal bet builders have to the new generation of bettors, stating: “Bet builders o er a variety of features for today’s digitally savvy individuals who want to feel unique and independent and choose how they interact with brands. This trend is apparent in social media and in consumers’ interactions with other digital products and services that are not related to betting.

“It’s not just about change, it’s about empowerment. Bet builders do not just serve as a transformation of traditional markets; they serve as a tool that empowers players to engage, bet, and feel in control on their own terms. This inclusive CRX experience is precisely what today’s players are seeking.”