INSIDE

Hot topics: Florida, fantasy and Fanatics

Features and interviews: Esports, integrity & data Company profi les: A who’s who of sports betting

Hot topics: Florida, fantasy and Fanatics

Features and interviews: Esports, integrity & data Company profi les: A who’s who of sports betting

COO, EDITOR IN CHIEF

Julian Perry

EDITOR

Tim Poole

Tim.Poole@gamblinginsider.com

STAFF WRITERS

Matthew Nicholson

Matthew.Nicholson@gamblinginsider.com

Lucy Wynne

Lucy.Wynne@gamblinginsider.com

LEAD DESIGNER

Olesya Adamska

DESIGNER

Christian Quiling

DESIGN ASSISTANTS

Svetlana Stoyanova, Gabriela Baleva

MARKETING & EVENTS MANAGER

Mariya Savova

PRODUCTION CONTROLLER

Oleksandra Myronova

IT MANAGER

LiveScore Group CEO Sam Sadi told the GI Huddle a few months ago that convergence was a great way for two struggling business models to reignite. The two models in question, of course, are sports betting and sports media. And it seems Sadi (who spoke to us again as part of the lead theme in this magazine) is not alone in holding this opinion.

Indeed, since our last Sports Betting Focus , Penn Entertainment and ESPN have joined forces to create ESPN Bet: the ultimate example of sports betting and media convergence. ESPN’s concrete entrance into the sports wagering sphere was long anticipated – even if the manner in which it arrived was, shall we say, unexpected (talks with Penn were a well-kept secret before it sold its full share in Barstool Sports back to owner Dave Portnoy for just one dollar).

For ESPN Bet, putting ‘Penn’ to paper is an expensive deal. The partnership bears heavy up-front costs for Penn for what is, effectively, just a rebrand, a fantasy database and a TV audience. But that is where a lot of the industry, and wider society, is now headed. After all, gaming is a form of entertainment and, as such, competes with any other form of entertainment: movies, music, streaming, leisure activities and the like. So why not combine the consumption of sports betting and sports media into one?

It’s a thought many operators have previously had. And it’s a plan that has already seen numerous operators fail. Can ESPN Bet, or anyone else for that matter, make it work? With insight from Sadi’s LiveScore Group, FanDuel, Sportradar and Scott Butera – who led the Fubo Sports brand that learned its convergence lessons the hard way – we explore this phenomenon in-depth in this issue’s cover feature.

Alongside convergence, we’ve also got a series of sports betting company profiles, ahead of a busy G2E and NFL season, as well as editorial on fantasy, esports, integrity and much more. So we hope you enjoy the issue in its entirety – whether you think convergence is the next big trend to take the industry by storm, or an expensive risk that history will judge years down the line.

TP, Editor

TP, Editor

Tom Powling

COMMERCIAL DIRECTOR

Deepak Malkani

Deepak.Malkani@gamblinginsider.com

Tel: +44 (0)20 7729 6279

SENIOR ACCOUNT MANAGER

Michael Juqula

Michael.Juqula@gamblinginsider.com

Tel: +44 (0)20 3487 0498

SENIOR BUSINESS

DEVELOPMENT MANAGER - U.S.

Aaron Harvey

Aaron.Harvey@playerspublishing.com

Tel: +1 702 425 7818

ADVERTISING SALES EXECUTIVES - U.S.

Ariel Greenberg

Ariel.Greenberg@playerspublishing.com

Tel: +1.702 833 9581

Tracy Robbison

Tracy.Robbison@playerspublishing.com

Tel: +1 702 485 3377

ACCOUNT MANAGERS

William Aderele

William.Aderele@gamblinginsider.com

Tel: +44 (0)20 7739 2062

Irina Litvinova

Irina.Litvinova@gamblinginsider.com

Tel: +44 207 613 5863

Serena Kwong

Serena.kwong@gamblinginsider.com

Tel: +44 (0)20 3435 5628

ACCOUNT EXECUTIVE

Samuel Sud

Samuel.Sud@gamblingInsider.com

Tel: +44 (0)207 729 0643

CREDIT MANAGER

Rachel Voit

WITH THANKS TO:

Tommy Molloy, Dotan Lazar, Sascha Paruk, Dima Reiderman,

Gambling Insider magazine ISSN 2043-9466

Produced and

Scott Leopold, James A. Lewis, Niklas Weber, Kevin Grigsby, Sam Sadi, Patrick Mostboeck, Scott Butera, Matt Heiman, Pat Pickens, Araksi Sargsyan, Rourke Struthers, Antonino Barra, Corey Plummer, Niki Beier, Geo Zochodne and Ronny Breivik, BetConstruct, IGT PlaySports, DataBet, Codium and EasyPay.46

20

6 KINDRED’S US TIMELINE Gambling Insider looks at the last five years within Kindred’s US operations

12 MASTERS OF THEIR DRAFT Sascha Paruk speaks to the GI Huddle about sports betting objectivity

18 ESPORTS: PAST, PRESENT AND FUTURE Bayes Esports’ Niklas Weber speaks to the GamblingInsider team

20 SPORTS BETTING MEDIA GamblingInsider speaks to industry experts about the convergence of sports betting and sports media

24 IN NUMBERS: NEW YORK FOCUS GamblingInsider looks at the state’s sports betting figures for August

26 FANATICS & POINTSBET: IGAMING DISRUPTION The Game Day’s Matt Heiman presents his thoughts on Fanatics’ deal to buy PointsBet’s US sportsbook operations

28 A SLICE OF THE FANTASY PIE Gambling Insider assesses the current state of the fantasy sports market. Is there room for new entrants?

32 OLYBET AND THE IBIA Corey Plummer speaks about Olybet’s recent partnership with the International Betting Integrity Association

38

24

34 PERSONALISING SPORTS BETTING

Niki Beier, SVP of ad:s at Sportradar, talks about how sportsbooks plan to make the 2023/24 season their most efficient yet

38 SHOULD PROFESSIONAL ATHLETES BE ALLOWED TO WAGER ON SPORTS?

Geoff Zochodne discusses whether or not professional athletes should be allowed to bet on sports

44 GETTING THE BAND BACK TOGETHER

GamblingInsider caught up with B90 CEO Ronny Breivik, where he discussed getting his old team back together

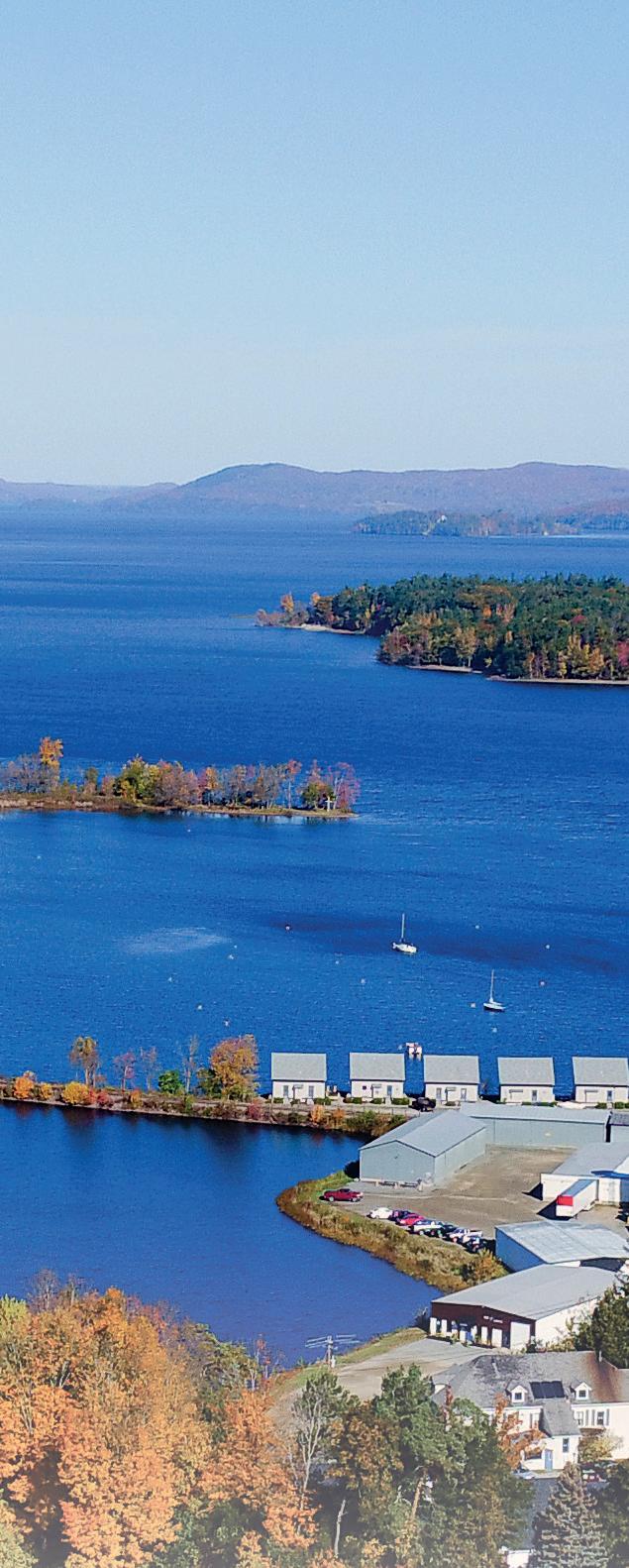

46 KEY US STATE DEVELOPMENTS

Scott Leopold and James A. Lewis of Duane Morris focus on Vermont, Florida and New Jersey as new legislation and opportunities abound in the US

8 SPORTINGTECH

10 LSPORTS

14 BETCONSTRUCT

16 IGT PLAYDIGITAL

29 DS VIRTUAL GAMING

30 ALTENAR

36 DATA.BET

40 CODIUM

42 EASYPAY

50 BTOBET

Ki ndred part ners wi th Hard Rock Hotel & Casi no in At lant ic Ci ty, NJ

Unibet launches in Pennsyl vani a

Ki nd red part ners wi th th e Qu echan Tr ib e of th e Fort Yu ma In di an Reserv at ion

Ki ndred en ters ag r eem en t wi th Kamb i and announces long-t erm sp or tsb ook pl an s

Ki nd red ex tend s it s part nershi p wi th th e Ph il ad el ph ia Eagl es

Un ib et ceases op er at ions in Iowa

Kindred receives approval for its proprietary gaming platform in New Jersey, The Unibet Arena launches in the Metaverse, Kindred launches in Washington State

Kindred platform live in New Jersey

10 MAY

Kindred partners with the Swinomish Tribe at Swinomish Casino & Lodge in Washington

13 JAN

Kindred posts 25% year-on-year increase in number of active customers in Q4

26 APR

Kindred confirms the resignations of: CEO Henrik Tjärnstrom, CFO Johan W ilsby, CMO Elen Barber and CCO Anne-Jaap Snijders. Nils Andén becomes Interim CEO

25 JULY

Kindred reports 29% Q2 revenue rise, to £307.3m ($394.6m)

The sports betting scene has never been as vibrant as it is currently. Operators are clamouring for the most engaging products and solutions, this is where Sportingtech comes into its own.

There has never been a greater emphasis from operators to have bespoke offerings that appeal to their users. Sportingtech has had to maintain its standards to keep up with the heightened demands. We understand the increased appetite for innovative products that helps operators stand out and it is a challenge we have welcomed.

Our conveyor belt of new solutions and integrations have been stand-out, maximising the breadth of opportunities. Rolling out game-changing products that give bettors an edge has certainly improved engagement and turnover for our operator partners. Our Bet Assist feature attracts and retains bettors by generating automated betting tips analysis, historical data, live-score and AI analysis. FastBet is the only feature of its kind on the market, enabling users to wager multiple single bets across all sports at the touch of a button without creating a bet slip.

Our Share-a-Bet feature is one for bettors who are active on social media platforms. This product allows them to share their bets to their social media followings via a few simple taps and for their followers to then place the same bet easily, should they wish to do so. Integrating such functionality showcases our ability to tap into current trends in bettor habits and enhance the bespoke offerings we provide.

But it isn’t ‘job done’ once a product is live. We continue to tweak and tailor our products and ensure it continues to perform to the highest level. Take the World Cup as an example, this was an opportunity that we grabbed with both hands as we delivered fantastic engagement for our partners.

Our World Cup Widgets solution was tailored to the tournament, offering outrights, stats, specials, group betting and more, fully highlighting how a standalone integration can be enhanced solely for one event.

Sportingtech doesn’t just cover global events; we also thrive in supplying regional content. Unsurprisingly, this resonates with audiences greatly and we can fully provide an array of markets and events that appeal to any audience, no matter the region.

This is down to our expert teams around the world tapping into the psyche of users, as well as understanding their likes and dislikes, arming our product

teams to provide an offering to operators so they can hit the ground running.

A sportsbook focusing on what locals engage in clearly provides a more bespoke experience. Although content can be further tailored, catering to users within certain territories can significantly increase retention rates. It is imperative we tap into the current trends, as well as examine the preferences of a diverse demographic to ensure our offering is as strong as possible across all sports and markets.

And what about AI? It is certainly a hot topic throughout many industries and it is starting to have an influence on sports betting. At Sportingtech, we are happy to utilise new tools and see how they impact our products and using AI has been a positive experience so far. Our Bet Assist uses AI analysis as well as other features to generate automated betting tips across more than 100 popular betting markets, both pre-match and live. With seamless bet slip integration, we are tapping into AI to boost turnover.

Sportingtech can cater for any bettor needs. Also boasting an outstanding content offering within the casino vertical which complements the sports betting product, our variety of content is easily accessible and provides bettors around the globe the best iGaming experiences. With leading brands entrusting us to supply this to their customers, we take pride in maintaining the highest standard known throughout the industry.

coverage and margins, LSports’ long-term product vision includes a set of innovative betting stimulation products aimed at providing users with modern, interactive experiences while addressing bookmakers’ challenges of differentiation and bettor engagement.

At the forefront of this line of products is LSports’ revolutionary Sports Expert Chat (SEC), a large language model utilising similar technology to ChatGPT, which acts as a sports advisor for bettors. SEC analyses bookmakers’ odds, offering data-driven tips while providing additional information about the event, such as news, weather and statistics.

Another exciting tool is “Points inplay,” an interactive social betting feature offering users contests and activations during real-time sporting events, elevating the excitement of the betting process.

These products will undoubtedly assist bookmakers in their efforts to retain customers in an era where users seek more than just raw betting odds and lines.

LSports is a leading sports data provider, offering cutting-edge solutions that give sportsbooks a competitive edge. Through advanced technology, LSports produces the fastest and most reliable database in the market, delivered with the lowest latency to its customers.

A decade after its foundation, LSports has fulfilled its vision of becoming “The Google of sports betting data.” It generates information from over 140,000 live events by combining methods like web scouting, TV/sports venue scouting, and advanced computer vision techniques extracting data from live streams of sporting events. The recent acquisition of STATSCORE has further boosted LSports’ data precision, approaching exceptional accuracy levels of nearly 100%.

What sets LSports apart is the unparalleled coverage it offers, making it the most comprehensive in the industry. Encompassing over 175,000 pre-match and 140,000 in-play fixtures across more than 100 sports, LSports supports a vast array of over 2,500 betting markets, including common markets, player props, outrights and more. This extensive scope positions

the company as a valuable ally for sportsbooks in various development stages, catering to well-established brands and those in their early growth phases. ***

In the face of skyrocketing customer acquisition costs and a consolidated market, LSports understands the urgent need for unique and differentiated solutions. Having operated in the sports betting industry since 2012, the company has gained an in-depth understanding of these challenges and reacts accordingly.

Alongside TRADE360, its stateof-the-art sports trading system, and BPS (Bookie Performance System), which monitors the market and offers operators real-time recommendations to adjust their

Recognising the unique challenges faced by sportsbooks in different regions of the world, LSports customises all its products to cater to local audiences, overcoming language and terminology barriers. With a strong client base in Europe and an official presence in key markets such as North America, Latin America, China, South Korea and South Africa, the company ensures culturally sensitive 24/7 support in sales, customer service, and customer success.

***

In this pivotal technological era, LSports believes sports data providers must be proactive to stay ahead of the pack. Identifying market trends, leveraging the most advanced technologies, and rapidly developing stone of LSports’ success over the past decade, making it the ideal partner for bookmakers worldwide, both now and in the future.

Transcribed by Hannah Ward

Our first question is about the journey Sports Betting Dime has been on since the website started in 2012 – despite PASPA not being overturned until 2018?

I joined in 2014 and it’s safe to say things were very different back then. There were about six people working out of a two-bedroom apartment. We catered largely to an audience that was not based in the US, so we’ve always been a sports betting information and analytics site, detailing existing sports betting odds.

We also wanted to ask how the legalisation of sports betting has changed? How do not only the fans interact with league drafts, but also athletes, journalists and analysts?

The site itself has mostly maintained that framework the whole time, but the audience that we have been targeting has obviously changed and so we were not always part of XLMedia. As the legalisation trends started to sweep across the US, I believe the powers at XL recognised Sports Betting Dime as the authority in the space and saw a good opportunity to bring us into their portfolio. At that point in time, they aimed to alter the focus of Sports Betting Dime to be further aimed at the US.

to alter the focus of Sports

like DraftKings and options

for the NFL

those offerings

From an SBD standpoint, legalisation has created a lot more content for us, especially concerning the NFL, NBA and NHL Drafts. To some extent, we do have a Canadian presence, as I live in Canada. The MLB Draft, however, is less of an event compared to the other three. Over the years, our coverage of the NFL Draft has grown, commensurate with the betting market type props offered by sportsbooks like DraftKings and FanDuel. The more betting options they provide for the NFL Draft, the more we will report on and analyse those offerings to determine where we think the value lies.

So, from a journalistic standpoint, legalisation has

So, from a

“THE BETTER YOU CAN EDUCATE PEOPLE ON THE RISKS FROM AN EARLY AGE, THE BETTER EQUIPPED THEY WILL BE AS THEY GO FORWARD AND BECOME ADULTS”

created a massive raft of content for us to cover, especially concerning the drafts. For fans, the obvious benefit is that you can have a much larger stake in the draft than you could previously before legalisation. When you’re watching the draft, you’re paying attention to who your team drafts and not much else. At this point in time, given the number of things that you can wager on at the NFL Draft, especially the NBA as well, you can have a stake in every pick out there.

Now, it is worth mentioning that sportsbooks are very good at mitigating their own risk, so the limits on the draft props will always be lower than the limits they offer for a standard NFL Sunday.

Do you think they are checking your sites, or maybe the informational and analytical sites, more than their sportsbook to find out how to bet? Do you see an increase in your website traffic from this?

Yes, we do. Over the years, we have developed something that we call an NFL Draft Tracker. Essentially, it aggregates the odds for the main betting market, specifically, who will be the number one pick. This betting market is offered

at FanDuel, DraftKings, Caesars and numerous other legal North American sportsbooks.

What our trackers do is average out all the odds being offered and display them in a graph, showing the average odds on different days. As you follow it, you can see that the amount of traffic a page like that received in 2016 pales in comparison to the traffic it got in 2023. It’s pretty clear that the reason people are visiting it now is because it’s something they actually want to wager on.

As far as providing graphs and odds to bettors, how does Sports Betting Dime make sure you remain neutral in this process?

We’ve noticed instances where certain markets were not actually being offered by sportsbooks for betting, so we took the initiative to provide odds ourselves. We did this quite often with the Super Bowl in previous years because the Super Bowl is known for being fun. There were times in the past when we came up with our own odds and put them out into the world, but we were very clear that these were our estimations of what the odds would be if this market were available for betting. We are not a sportsbook and we cannot take your money.

When it comes to presenting the existing odds, the dynamic with our odds tracker is that we collect as much information as possible and display it to you. It is an entirely neutral researchbased process; we don’t have any stake in the matter. Our goal is to provide you with the information available and aggregate it from as many sources as possible to give bettors the most accurate depiction of the odds.

However, they must be aware that those entities will do what they can to make money within the confines of the regulations and the law. It’s really important for the regulators in each state to implement very strong controls to protect every stakeholder involved.

I know we had the MLB Draft recently. Do you think that was possibly a bit less unscrupulous? Do you think there was some neutrality there that the NBA could have looked towards for guidance?

I think the MLB has a significant advantage when it comes to their draft in that – I’m not going to say that nobody cares – but far fewer people do. Victor Wembanyama, Brandon Millers, Scoot Henderson – these guys are celebrities before they even set foot on an NBA court. Paul Skenes, Dylan Cruise, I think if you go to Louisiana, they’re minor celebrities, but there’s not the same sort of rush from a national standpoint to predict what is going to happen with them. Yes, I do think the MLB did a better job of remaining neutral and ensuring that available information wasn’t disseminated to certain parties. Though, I do think they had a massive advantage of there being far fewer eyes on them.

What do you think the education for athletes and fans in each sport has been like? Do you think there has been some gaps; do you think they have been handling things well in sports?

There was a complicated situation

it could have been, can you give us some

There was a complicated situation possibly with the NBA Draft recently where a sportsbook may have gotten information and it was not as neutral as it could have been, can you give us some background about that?

I do not have any more information than you would. It’s a very delicate situation and I agree with you on that. When sports betting started to be legalised across the United States, it was always very clear that this was going to be a highly regulated activity. When you have an imbalance in power and knowledge that could potentially exist between the sportsbook and the bettors, I do think it’s incumbent on the regulators to put very strict controls in place, similar to how insider trading is protected against, and considered illegal and penalised.

to be legalised across the United States, it was put ensure that the industry we have legalised and interest is making money and need to do so to

I do think that type of framework needs to exist, but it’s going to be on the regulators to ensure that the industry we have legalised and created for the people of their constituency is not drastically unfair to them. They have allowed these corporate entities, whose number one interest is making money and need to do so to survive, to operate in this space and industry.

No, but I also think it was almost impossible for them to do so. Gambling is an inherently risky activity and when you look at our society and the way we deal with any risky activities like drug and alcohol consumption, we address these things from an early age and try to educate people when they’re young. The better you can educate people on the risks from an early age, the better equipped they will be as they go forward and become adults, so they don’t fall into the traps that risky activities present. When you legalise something such as sports betting, you are then presenting a brand-new risky activity to an uneducated population. It was a very difficult undertaking to ensure things were done perfectly safely. You are creating an idealistic society in which sports betting is a part of it and the way you approach education is different than the way you approach it when you are introducing it into an existing society. From the sounds of it, the NFL made concerted efforts to tell its players, “Here are the rules: you cannot bet on NFL games and you cannot place a bet inside a facility.” They presented that information to everybody in the league. However, at the same point in time, people either didn’t hear it, didn’t understand or ignored it. The lattermost, most people ignoring it, is a risk that you’re going to run.

One of the most remarkable aspects of the BetConstruct Sportsbook is its dedication to providing players with the ultimate betting experience; regardless of their preferences. Multi-currency and single wallet functionality empower players with the freedom to choose their preferred currency, while the seamless omnichannel capabilities ensure that bets can be placed on desktop, mobile, or in-store using a single account.

betting tools. Features like SuperBet and Counter Offer empower players to take their bets to new heights, while edit bet lets them make changes to active bets; enhancing engagement and interaction. The cash out option provides players with ultimate control over their bets, allowing full or partial cash-outs for added convenience.

Renowned for its comprehensive suite of over 50 tailored products and services, BetConstruct has emerged as an iGaming provider, dedicated to empowering its partners with cuttingedge solutions that drive success in the fiercely competitive market.

At the heart of BetConstruct’s offerings lies the crown jewel – the BetConstruct Sportsbook. A complete sports betting platform meticulously designed to enable operators to not only compete but thrive. Whether you’re a single betting shop, manage a chain of retail premises, or run an online operation, BetConstruct Sportsbook provides the arsenal of tools necessary to captivate new players.

The hallmark of the BetConstruct Sportsbook is its unparalleled array of offerings. It opens the gateway to a staggering 140,000 pre-match events and 70,000 live events every month. This diverse and engaging selection ensures that players are immersed in a world of endless possibilities, where both conventional and groundbreaking markets are at their fingertips. What’s more, the comprehensive coverage of over 6,000 pre-match and 12,000 live events from 20+ esports competitions caters to the rapidly growing esports community, underscoring BetConstruct’s commitment to staying ahead of the curve.

But the true genius of BetConstruct Sportsbook lies in its risk management prowess. Customisable margins, bet limits and cashout settings put operators in the driver’s seat, enabling effective risk management that aligns with its business strategies. This level of control is further extended through the comprehensive back office – a real-time hub offering insights, player data and robust reporting tools for streamlined operations.

Mobile betting has become an integral part of the iGaming experience and BetConstruct understands this well. The platform boasts an array of mobile solutions that cater to players on the move. From traditional mobile web interfaces to native iOS and Android applications, BetConstruct ensures that the transition from desktop to mobile is seamless and intuitive. The SpringBuilderX mobile web platform takes this a step further by offering SEO functionality and a comprehensive user interface, creating an optimal mobile betting experience.

The BetConstruct Sportsbook is a canvas awaiting customisation. Operators can tailor the Sportsbook to align with their brand’s identity and their players’ preferences. A variety of Sportsbook views – Classic, Modern, Combo, Asian, and European – offer familiarity and engagement. Tools like CMS Pro and SpringBuilderX grant effortless configuration, customisation and management of the interface, granting operators the power to create a unique and compelling platform.

BetConstruct Sportsbook comes loaded with a range of advanced

Promotions and bonuses are integral to player engagement and BetConstruct Sportsbook offers a variety of options – free bets, accumulator bonus, bad beat bonus, wagering bonus and profit boost. The in-house CRM solution adds a strategic edge, enabling operators to manage and execute successful promotional campaigns with ease.

BetConstruct thrives in the realm of exclusivity with an access to exclusive betting events, live betting and streaming on unconventional sports like table tennis, snooker, basketball shots, archery and pistol shooting keeps players engaged and excited.

Venturing beyond the virtual arena, BetConstruct offers an array of landbased solutions for retail businesses. From cashier and reporting systems, to odds display and self-service touch screen terminals, BetConstruct ensures that retail operations are equipped with the tools needed to thrive in the competitive market.

Diving into the future, BetConstruct’s in-house esports product offers a powerful betting platform for the rapidly growing esports industry. Covering 22+ competitive video games and providing over 12,000 monthly live matches, this offering speaks volumes about BetConstruct’s forward-looking approach.

BetConstruct Sportsbook is not just a solution; it’s a symphony of innovation, tailored experiences and endless possibilities. It empowers operators to elevate their offerings, engaging players on their terms and leading the industry with its cutting-edge features. With BetConstruct Sportsbook, the journey to betting excellence is more than a promise – it’s a reality.

Get in the game with the winning combination of B2B sports betting technology and comprehensive marketready solutions. IGT PlaySports offers everything sportsbook operators need to drive growth and build all-star success. Sports operators seeking faster revenue and market share growth know their winning play is to partner with IGT PlaySports. With a large presence in North America, IGT PlaySports offers a complete, omnichannel sports portfolio that includes top-tier sports betting hardware and solutions. From fully integrated gaming bar top and hardware products, to trading services and 24/7 customer support, IGT offers high-quality products and proven experience that operators trust.

The IGT PlaySports platform is one of the most powerful technology stacks in the rapidly expanding North American sports betting market. In the last year, IGT PlaySports expanded its presence in five key jurisdictions across 96 new retail locations, making it one of the largest and most influential suppliers in North America.

Backed by the versatility and market readiness of the PlaySports solution, IGT has helped commercial and tribal casinos, racetracks and lotteries establish and grow their sports betting enterprises and is poised to continue this positive momentum moving forward.

IGT PlaySports maintains a strong partnership with major commercial sports betting providers, such as FanDuel Group, Boyd Gaming and Delaware North, as well as partnerships in Ohio’s unique market with UBetOhio, SkyBox and SuperBook. In 2023, Ohio proved to be a major success for IGT with over 100 new kiosk deployments in Ohio alone, making it the most widely used self-service sports betting technology in the US. With the addition of Ohio, IGT’s PlaySports technology is currently available at more than 170 retail locations, including the FanDuel Sportsbook at The Meadowlands Racing and Entertainment – a historically highvolume US sportsbook.

Customers tell us they choose IGT for three key reasons:

• Our B2B sports betting solutions are built and certified for the North American market, including our aroundthe-clock, US-based trading advisory services tailored specifically for North America.

• A highly scalable platform allows operators to differentiate with retail and mobile capabilities, expanding their ability to reach players in multiple ways.

• A proven partner in profitability provides full organisational support in compliance, product development, operations, and training, backed by our extensive industry experience.

Personalisation of the user interface remains a continued focus. The deep integration between our player account management (PAM) platform and special offers allows for highly tailored sports promotions, which

ultimately helps drive the best ROI for our customers and maintain customer satisfaction. We were the first sports betting supplier to enable operators to pioneer unique marketing and retail promotions with our customers.

IGT’s in-house trading team provides PlaySports customers around-the-clock expert odds making with localised pricing for pre-game and in-play bets, continual offer monitoring and optimisation and on-call expertise in every aspect of day-to-day sportsbook operations. To address the growing demand for our trading advisory services, in 2022 we introduced a new trading application that uses multi-layered technology to make it simpler for our trading team to manage multiple sportsbooks at the same time. IGT’s PlaySports customers also benefit from compelling and original promotional bets, exclusive parlay, and combination wagering and player retention and acquisition strategies designed by the trading team’s content managers.

A TRUSTED ADVISOR, FULLY DEDICATED TO OUR PARTNERS IGT PlaySports goes beyond the transactional relationship with its customers and serves as a trusted advisor and partner in the sports betting business. The most common feedback we receive from our partners is in praise of our high-quality customer service. Our dedicated team of Relationship Managers focuses solely on interaction with the customers and ensures they provide assistance across every phase of sportsbook launch and management.

No other supplier takes the individual and relationship-first approach we do. Backed by decades of experience, operators have confidence they are receiving top-quality solutions from IGT PlaySports to support their business goals and move the player experience forward.

We speak to Niklas Weber, PR and Content Creator at Bayes Esports, about the company’s attendance of IEM Cologne, and the past, present and future of esports

at any time and that changed the way he looked at gaming in general and he felt a real passion for watching, playing and training together with other people in these virtual worlds. So he decided that he was going to try to essentially create the ‘NFL of esports,’ as he called it, and create a league or a stage where people can play competitively; and can spend time with each other in these virtual worlds on the biggest stages so everybody can enjoy it worldwide.

Bayes Esports held a roundtable at the IEM Cologne in August. Those speaking at the roundtable were Ulrich Schulze, SVP Gaming Ecosystem at ESL FACEIT Group, Alban Dechelotte, CEO at G2 Esports, Jens Hilgers, Founding General Partner at BITKRAFT, Christoph Thann, EMEA Director Esports at Ubisoft and Martin Dachselt, CEO of Bayes Esports.

What sort of topics were covered at IEM Cologne?

The roundtable was mainly going through the past, the present and the future of esports. We had some questions about the present of esports, what current issues are, what possible areas for development are; and then the future.

What potential is there? What markets the panelists would want to explore etc. The first question we had was directed at Hilgers and what led him to found the ESL in the late ‘90s and early 2000s; what made him get involved in esports. What was interesting was that in the late ‘90s, there was a shift in gaming, where before that, if you wanted to play with other people, you had to do it locally and you had to be at an arcade or in front of the TV; and you had to splitscreen essentially to play multiplayer games.

And in the late ‘90s, that changed because games started to move online, which meant that from then, at that point forward, you could play online competitively against other people

He also said that, since then, not a whole lot has changed. Back then, for him, it was the likes of Quake and those kinds of games where you spend a lot of time playing and, in today’s world, it’s the same with Fortnite. The youth are playing games like Fortnite, not just to compete against each other, but to also spend time with each other in those virtual worlds. So that’s why there has been this linear growth, and that’s something that he came back to later, where in esports it just keeps on growing with each generation that joins esports; that knows gaming; that grows up with esports and gaming; because the basic idea of it and the basic premise is that passion of wanting to be competitive, and playing games with the other, is basically the same from 1997 all the all the way up to today.

Esports itself has been growing, but what about the betting market? Esports has a large under-18 audience, so obviously, that will form a large portion of the market?

I think the issue with esports betting in that kind of sense is that, as you said, there is this need to do it right, because the more it’s allowed to just run freely, the more there is the risk of esports betting becoming a trap for younger audiences, for match-fixing and for integrity issues. That’s something that was also discussed during the

panel where there were questions of, “What do you do in terms of integrity? How can we ensure these games are not susceptible to match-fixing and the like?” To which Dachselt said that the entire field of integrity and doing esports betting right is very wide. There are a lot of fields that need to be worked on, to which there is not a singular solution because there’s matchfixing, there is insider trading, there is data scraping and that kind of stuff.

The way they want to move forward, they saw progress by getting official data and having partnerships with tournament organisers to gain access to their official data sources; and then working closely together with them to monitor player behaviour, to monitor the data that we get from them, to see abnormal behaviour of players. But also then having official data partnerships with betting partners to then run through the market and see ‘okay, where’s abnormal betting behavior? Or, where’s abnormal market behavior?’ Beyond that, esports betting is obviously still growing and there’s a lot to do. But as you mentioned, there is this caution of doing it right and seeing how we can bring esports betting into its audience, without it taking advantage of its younger audience.

What do people bet on most in esports and what are the common factors involved?

Have the biggest esports markets changed?

There are three big titles in esports. There’s counter strike global offensive (CS:GO), soon to be counter strike two – once that’s released – and there’s Dota 2 and League of Legends. There are also a multitude of other games like FIFA and Rocket League, that don’t have a similar level of audience. The majority of esports betting is on these three titles and the biggest one out of those three in terms of esports betting is CS:GO. That has a couple of reasons why; the first one is that it’s the most mature game; whereas League of Legends and Dota 2 are more catered towards a younger audience and teens. CS:GO is supposed to be for adults and it has a more mature audience; that then also attracts more betting.

The second one is that the gameplay itself lends itself to betting. The benefit for esports betting is that if given the right tools, esports betting companies can offer markets for individual round winners, such as who’s winning the next round? And that way you can encourage bettors

to bet over and over again during the match. In other games, for example, if you’re also looking towards football, as another market in sports betting, you might have a market for who’s winning the overall match but that takes 90 minutes and then you have side markets that are a lot less interesting, like who’s winning the next corner? Who scores the next goal? But even then, there is not a guarantee that these markets actually happen. It could just be that no team scores another goal, which for a bettor is not attractive.

By comparison, esports betting in CS:GO, there’s always going to be a next round winner and it happens so frequently. The benefit of CS:GO is that essentially every month there can be a big tournament in which the big teams will play and in which they will compete on the highest level; so it keeps people coming back to it because there are higher-stakes games as well.

How has the popularity of certain games changed over the last 10 years, considering you mentioned the top three at the moment? Strangely enough, over the last 10 years, they haven’t. Which is also something that Hilgers discussed during the roundtable. That is incredibly strange for esports. Usually, if we’re looking at the history of esports, there have been new titles coming up and conquering the scene on a more frequent basis. Before the 2010s, it was the likes of Starcraft, Starcraft Two, there was Quake, there were previous editions of those games; but also games that since then have fallen out of favour, like Warcraft 3 or StarCraft, World of Warcraft even had a thriving esport scene.

In the 2010s, when streaming services started to emerge, it became easier for game developers and tournament organisers to stream their tournaments to a broader audience. That’s when we saw the emergence of CS:GO, we also saw Dota 2 and we also saw League of Legends, all in the span of two to three years from 2011 to 2013. If I remember my timeline correctly, they all emerged at basically the same time and have been at the top now for over 10 years.

I think a part of it is, because of the developments that happened in gaming and streaming, these games managed to stay relevant through live action services. They are constantly updated and there’s always new content. They stay relevant over longer periods of time.

Before, you bought the disc, you played the games and then that’s what you got. Updates to games were a lot less frequent, as opposed to now. So these games managed to build an audience over 10, 11, 12 years and remained relevant during that time.

Therefore, they could stay at the top rather than eventually falling behind due to graphical deficits that you would expect after 10 years, but if you can update the game regularly, then these games will stay at the top over a longer period of time.

Something that Alban Dechelotte from G2E mentioned during the roundtable was that he’s interested in the possibilities of VR and creating a virtual world for the fans of G2E, so that they can log on into this virtual world and basically have their own home field where they are; where it’s just them enjoying the games together in this kind of virtual arena.

Because otherwise you don’t have this home stadium or a home field in esports, because the venues are always neutral. But through VR and those kinds of technologies, there is the possibility of creating this home-stadium feel. Maybe that’s also a way for teams to market their own games, their own tournament runs and for this kind of premium event experience to manifest itself in esports as well.

“There is this need to do it right, because the more it’s allowed to just run freely, the more there is the risk of esports betting becoming a trap for younger audiences, for match-fixing and for integrity issues”

Gambling Insider spoke to Kevin Grigsby of FanDuel, Sam Sadi of LiveScore, Patrick Mostboeck of Sportradar and Scott Butera of Sports Information Group, about the convergence of sports betting and sports media

When it comes to the media, they say ‘everybody’s a critic,’ but when it comes to media outlets lately, it seems everybody actually wants to be a sportsbook. Sports betting is now live and legal in over two thirds of the 50 states, and the companies who televise, stream and distribute those sports want to be part of the conversation. Though financial reports throughout 2023 have shown that FanDuel and DraftKings hold most of the market share when it comes to sports wagering in the US, this has not stopped many other tenacious operators, including media companies, from throwing their own baseball caps into the ring.

Betting and media have created global partnerships and acquisitions over the last few years, and now the trend could be at the top of its game. Virgin Bet launched in 2019, and now operates as part of the LiveScore Group. DraftKings acquired broadcast company Vegas Sports Information Network (VSiN) in 2021. TalkSport Bet launched in 2022, as the popular UK and Ireland radio station moved into betting. Entain acquired online sports media platform 365Scores in April this year. In August, Football.com announced a new purposeful combination of betting and media surrounding its namesake sport. But the biggest news this autumn was that sports media giant, ESPN, branched out to offering bets by teaming up with Penn Entertainment (after a few years of anticipation).

But for every new entry into the market, there are also cautionary tales. Flutter Entertainment announced the close of Fox Bet just a month earlier in July 2023; Fanatics Betting & Gaming purchased PointsBet’s US Operations in June after it announced a struggle to gain market share in April; and Fubo Sportsbook ceased operations in October 2022, with MaximBet following suit one month later. Meanwhile, 888’s Sports Illustrated venture also struggles to gain traction. With sports and media growing ever closer to each other, Gambling Insider spoke to four industry executives to see where the competition truly lies. How have the games we love, the ways we watch them, and the ways we bet on the action converged over time to make sports media and sports betting so intertwined?

Kevin Grigsby, Executive Producer and SVP of TV for FanDuel TV, is all-toofamiliar with the way in which sports media and sports betting have merged

to create a lucrative fusion. All the convincing anyone needs is to hear or see the words ‘FanDuel’ and ‘TV’ next to each other, and it’s immediately obvious that sports fans are now in the midst of a new era, based on betting-driven content. Grigsby told Gambling Insider: “FanDuel TV is a perfect example of that convergence. The sports media content we produce allows us to grab the attention of betting customers that paid marketing makes it difficult to replicate, and in a hyper-competitive industry, that is a massive advantage.”

Patrick Mostboeck, SVP Audiovisual for Sportradar noted, both FanDuel and DraftKings had expanded their AV offerings, as well as mentioned DAZN launching its own sportsbook, not just ESPN. He said this convergence between betting and media over the years has been natural: “In the fight for fan engagement, providing platforms where fans can both watch and bet has become the next logical step.” Sportradar, which uses technology and data for both engagement and integrity, also provided some research confirming the natural shift toward betting from today’s sports fan. “According to Global Web Index’s 2019 Sports Around the World report, 97% of legal sports bettors watch more live sporting events than those who do not bet; and according to American Gaming Association (AGA) research, nine out of 10 viewers are more likely to watch a sporting even if they placed a bet on it.”

The potential efficiency of acquiring customers based on their viewing habits was also mentioned by Scott Butera, the current CEO of Sports Information Group, Daily Racing Form and previous President of Fubo Gaming. He said: “Understanding how much an individual is watching sports is a pretty good indicator of their likelihood to be betting.” To Butera, three or four hours of daily sports viewership shows a possibility that a fan is watching multiple teams play multiple games,

and makes that fan 30% more likely to bet, while five hours increases that chance to 50%. Though studying fan patterns seems to be both possible and encouraged, reaching the ‘right’ fans still proves difficult within the States. Butera continued: “The cost of running a sports betting operation in the US is significant. In terms of being a media company wanting to take that on, it might be a bit daunting; but in terms of the actual relationship between viewing sports and betting on sports, that’s very strong.” The competition and saturation within the market, as well as the individual state licensing and regulation required, can put a heavy burden on media companies simply looking to drive their engagement and get in the game – but more on that later.

While convergence seems to be undeniable between sports media and sports betting, with more content, channels, campaigns, partnerships and sportsbooks saturating the US market everywhere we look, some feel as if initial opportunities have been missed. Sam Sadi, CEO of LiveScore, said this evident convergence has been “in general, very poorly executed despite all the efforts and a strong conviction around its potential.” The reasoning behind why the executive believes this convergence isn’t serving the industry is twofold. According to Sadi, the imperfect union of betting and media has been “pursued by separate companies with misaligned or conflicting goals,” and suffered from a “lack of understanding of the fans’ expectations of value.”

This time of discovery within the expanding US sports betting market has the opportunity to make or break a sportsbook if the secrets behind understanding and catering to fans’ desires can be unlocked. But how big do operators need to think to capitalise on the fans they already have and ultimately grow their fanbase with competitive new offerings?

Fan value and fan experience both come in many forms. For the sports fan watching hours of programming and several games a day, that experience might take place on multiple devices at once. It’s not hard to envision a group of fans cheering during a game at their favourite local sports bar while simultaneously checking the scores of other games on their phones. A fan watching a game on their laptop may have several tabs open, including their sportsbook of choice, as well as any

social media accounts held by the team, the players or the sportsbook itself.

Butera said it’s important to have “a really strong product that allows you to synchronise the streaming and betting experience in a way that is very attentive to individual customer desires and wants.” Mostboeck calls a platform able to integrate with multiple devices “essential.” Apart from following a bettor’s individual watching habits and trends, betting is a time-sensitive activity where latency and lag are an important part of the conversation surrounding mobile sportsbooks. Mostboeck adds: “Any delay or failure to deliver updates can massively impact the customer experience. Bettors expect the same features and functionality across devices and channels. In the competitiveness of our industry, any flaw in an operator’s platform provides an opportunity for rivals to gain the upper hand and sway customers.”

That competition must be noted, again, as something that applies to both sports betting and sports media. Streaming content must also be optimised for the perfect omnichannel experience for delivering content no matter where the viewer wants to access it. FanDuel TV has also already launched its own OTT platform, FanDuel TV+, in addition to hosting live web streaming and integrating its stream into the FanDuel sportsbook app. The company also plans to introduce a FAST channel. Grigsby said: “We want our viewers to be able to easily watch the bet they placed with us from wherever they are.” A new streaming service, just as much as a new sportsbook, would have to offer something truly unique to stand out and draw new customers to make the switch away from names with as much market recognition as ESPN or FanDuel.

One of those underrated selling points seems to be offering live and in-play betting options. Grigsby, Sadi

and Mostboeck all referred to these markets as either important or in demand. Sadi commented that the trend toward offering live and in-play bets is responsive, saying: “Those outside of our industry often underestimate how much consumer research goes behind product development. The clear reason why so much investment is being directed towards improving in-play and live products is that we see strong demand from our users.” Grigsby says live bets allow viewers to stay engaged with FanDuel’s product “throughout its entirety.” He said, “FanDuel TV is heavily investing in watch-and-wager content with live betting data and data visualisation.” Grigsby added that it’s not only valuable to the fans looking for this content, but from an operator’s perspective as well, saying live markets are “proving to be a valuable business model that generate more revenue per viewer.”

Mostboeck, acutely aware of how much both bettors and operators love sports data, said: “Sportradar offers more than 200 in-play markets on a single soccer match and provides the marketplace with more than 25,000 betting opportunities in soccer each month, which gives you an idea of the size of the opportunity.” Noting that the technology behind in-play betting is everadvancing, Mostboeck is counting on both enhanced fan engagement and experience in future, due to the use of AI and the accessibility of real-time information. The greater availability of mobile phones will also influence operators and their platforms greatly. Mostboeck added: “Prioritising mobile readiness is vital for business growth, as mobile betting drives the highest growth and expansion across key markets.”

Wherever a media focus lies, a swift

desire for varied and frequent content follows, often with a celebrity host. FanDuel, DraftKings, BetMGM, Caesars Sportsbook and many other US sports betting platforms offer livestreaming of sporting events alongside their own original content via either a collaboration with broadcast television, a proprietary OTT platform, online streaming, in-house podcasts, a company YouTube channel or even TikTok and Instagram videos. Both current and former athletes appear in the promotional images and on the mics for various shows, such as DraftKings Network’s “Gojo and Golic” with Mike Golic Sr and Mike Golic Jr; FanDuel TV’s “Run it Back” with Chandler Parsons; and BetMGM’s World Cup 2022 series of YouTube videos featuring Tim Howard. The entire existence of Jake Paul as a concurrent YouTuber, boxer and cofounder of sports wagering platform, Betr, also ties a neat bow around the theory of convergence in these areas.

For Grigsby, FanDuel TV aims to “purposely interweave betting narratives into all programming.” He added that FanDuel TV’s “gambling-centric lower screen ticker, displaying FanDuel odds, is a constant mainstay which has led to distribution in restaurants and bars.” The company has also thought about the social media applications of the FanDuel TV experience, stating that shortform “Action Updates” are “purposely produced and index very well on social media and digital platforms, such as the FanDuel Sportsbook Explore tab.” Butera, meanwhile, thinks betting content within media is “pretty prolific” now, but that we should still expect more to come. “In broadcasts, they’re talking about it a lot and it’s really kind of exploded – both visually and through radio, podcasts, all kinds of media: people are using betting lines as analytics to understand games.”

The trend toward multi-platform and omnichannel experiences has also

“For fans, the ability to watch and bet on a single platform can make the betting experience far more engaging and convenient, as it means they do not have to go elsewhere for live action or to place a bet”

created more types of data and more ways to integrate this data with both the sporting events and the media content that covers them. Mostboeck commented: “By providing fans with greater portfolios of live-streamed content, more ways to access live sports, and more compelling sports insights and data, betting companies are transforming their businesses into ‘one-stop-shops’ for live sports entertainment.” Sportradar offers a tool called EmBet, which provides live odds and statistical overlays, aiming to create more “holistic” fan involvement as well as customer loyalty.

Though some sports fanatics are after more data to help them make their wagering decisions, rather than the opinion or commentary from a celebrity host, in the end it all serves the same purpose: helping a fan become loyal to a particular betting operator, based on media preferences and needs. Mostboeck added, “For fans, the ability to watch and bet on a single platform can make the betting experience far more engaging and convenient, as it means they do not have to go elsewhere for live action or to place a bet. This is massively beneficial as studies have shown that 90% of viewers currently use a second screen when watching live sport.”

But how can sports fans who began their watching journey with ESPN, and their betting journey with an unrelated sportsbook app, either choose between the two, or make sure their games and bets exist in perfect harmony? Are customers swayed by the call of convenience that a ‘one app to rule them all’ situation could potentially offer? Butera said it could “certainly happen.” He continued, speaking first from an operator’s point of view and then from a fan’s: “If you can create a competitive enough product, or if you have a competitive enough partner, you should be able to overcome that. If you thought the company was very adept at both, you would just stay on one platform for the offers you could have.”

So far, the US has seen not only a rise in the convergence of sports media and sports betting, but also a few high-profile exits from this new double-industry. As mentioned earlier, PointsBet sold its US operations to competitor, Fanatics Betting and Gaming for $225m, after a brief bidding war with DraftKings, which also offered $195m before Fanatics’ winning counter offer. Fox Bet announced that it would stop taking bets in July this year, and was offline by the end of August.

Butera’s own previous experience at Fubo Gaming and Fubo Sportsbook also came to an end in 2022, after Fubo TV announced that the betting divisions would close following a strategic review.

When asked whether there is a drawback to the aforementioned conundrum of watching sports on one platform and betting on another, Butera said: “But that’s just competition, right?” Butera spoke of his previous ideas, as well as what sports streaming companies could do now to build on the possibilities for betting integration in the future. “When we were at Fubo, our TV broadcast was actually synced to our sportsbook, so I could be watching a game and be getting offers on my sports betting app as I’m watching it. If I were to change the channel, the app would go to that new game. There are a lot of things you can do, that are very fast. If it’s a streaming company, you could offer, free streaming for certain-level players. If you have a quality product through synchronisation, you can be very effective more broadly.”

This competitive US market, which has caused a few sportsbooks to ‘bet’ off more than they can chew, likely comes down to how much it takes to both fund and regulate a sports betting operation in such a large market with different needs, policies and demographics. Sadi said of what could have happened at Fox Bet, Fubo Gaming and PointsBet: “It’s hard to provide a single answer for three entities, except that all three, together with many analysts covering the opening of the US sports betting industry, underestimated how challenging the unit economics of growth would be and the amount of capital it would take them to reach long-term profitability.”

But how did the US sports betting market, which only began offering wagers after the overturning of PASPA in 2018, become so oversaturated so quickly? Sadi agrees: “The US market has already become the world’s largest regulated online market so you could certainly argue the growth has been spectacular.” Mostboeck, however, maintains that at its core, the US is “still a young and less mature betting territory.” He commented that both new and current US sportsbook operators must pay attention to the variance within: state regulation, individual state markets and individual player preferences. He said operators should “understand the local betting laws across the country and adjust their offerings accordingly to ensure they meet the licensing and compliance requirements of each jurisdiction.” He added that acquiring

customers has also “posed a significant challenge, with operators fiercely competing to entice sign ups, which can prove costly and unsustainable, with an overreliance on first-time deposit bonuses and free bets resulting in less customer loyalty in the longer term.”

While the convergence of sports betting and sports media may be obvious, what the future holds for the nature of the two seems less so. As more states legalise and launch sports betting, more operators may want a piece of the action. But at what cost? It’s been proven that the US certainly has the demand for sports betting, but how many sportsbooks are necessary to supply it? Will every active sportsbook have the capital, the content and the customers to keep going? As tough as the challenge may be, all of the executives Gambling Insider spoke to have some hope for the future of sports, media and their natural intersection. Sadi said, though initially there wasn’t “sufficient effort made in the early days to understand the market, which resulted in unrealistic and severely flawed strategies,” this era of sportsbook fumbles may be behind us. “Such periods are usually followed by correction, and then stability – a phase I believe we are now entering.”

New York’s August figures show an overall annual fall of 1% for its sports betting market, with FanDuel still ahead of the competition. However, DraftKings, as has been seen in recent trends, is closing the gap. DraftKings has seen a 37% increase in revenue year-on-year, while FanDuel has fallen by 10%. Furthermore, DraftKings market share has risen by 10% since this time last year and FanDuel’s has fallen by circa 4%.

In terms of handle, what can be seen is DraftKings overtaking FanDuel to become number one in New York. Again, this correlates with the swing in annual market share between the pair, as DraftKings has actually taken the lead from FanDuel when it comes to handle.

effectively such a highly established brand can sidestep traditional scaling inefficiencies, but also the means by which a disrupter brand with no historic iGaming credentials can continue to build meaningful traction among an informed audience.”

Fanatics CEO Michael Rubin’s endeavour remains one of the most recognisable company names among sports fans. Fanatics produces offi cially licensed team apparel and has partnerships with more than 900 athletic properties, per their website, and manages the team stores for the NFL, MLB, NBA, NHL, MLS and many others.

The June finalisation of Fanatics’ $475m acquisition of PointsBet’s sportsbook represented both a new beginning and the end of a tough fight for the online sports retail titan. (More on the exact valuation later). Fanatics had long sought to expand into the iGaming world, having performed market research and applied for a New York sports betting licence after the Empire State legalised online sports betting in the spring of 2021.

But when rebuffed by regulators in New York for one of the highly coveted initial sports betting licences, Fanatics pivoted and flexed its financial muscle. Fanatics has long been determined to enter the competitive – and still

blossoming – US iGaming landscape as an operator. Landing PointsBet’s assets – $225m for the company, plus $250m to buy out its existing NBC Sports marketing deal – cost a mere drop in the bucket of Fanatics’ circa $31bn market capitalisation.

This coup may also have provided a blueprint – not an easy plan, but a plausible path – for disrupting a market of well-established brick-and-mortar gaming houses, and new-wave online gaming leaders to capture a sizable share of the legal betting market.

“Fanatics’ entry into the iGaming space will offer a compelling case study,” said Steve Carey, the COO and Co-Founder of The Game Day. “Both of how

It felt a rare test, though, when DraftKings – a powerhouse in its own right – submitted a $195m bid for PointsBet at the reported ‘11th hour’ of the process. That late-stage move nearly shut Fanatics out of its quest to find its foundational product and built-in user base. DraftKings could’ve operated PointsBet, and its signature style of high-stakes ‘PointsBetting’ wagering, as a unique brand and alternative to the fixed-odds wagering and daily fantasy sports.

But instead of waiting even longer for licences to open, and for the bureaucratic process of assessing its application, Fanatics skipped the line. It went above and beyond to absorb the Australia-based sportsbook and its valuable licences in more than a dozen states. Plus, by acquiring PointsBet USA, Fanatics also squashed competition. PointsBet carries a modest 3.7% control of the US market share, according to the Australian Financial Review.

But that share is large enough to siphon some profits away from the generally accepted ‘big four’: FanDuel, DraftKings, BetMGM and Caesars.

Some sportsbooks and online media companies have built brand awareness with unlicensed merchandise. Barstool Sportsbook, an online media brand who also dove into the gambling space with a fervent fan base and plenty of attitude, was perhaps the most prominent in the media, gambling and clothing space (before becoming ESPN Bet).

But Fanatics could easily start producing licensed versions of kitschy sports wears or even produce bettingrelated swag to sell online. Or it could offer FanCash or league-store credit to lure new subscribers, like how Caesars offered a free NBA Store or NFL Shop credit for new signups in 2021, to further differentiate itself.

With Fanatics in the game, don’t be surprised if an arms race ensues and creates further consolidation in the sports betting space. Caesars actually skipped the line as well with its purchase of William Hill US, which closed in August 2021. DraftKings and FanDuel likely will seek further properties to bring aboard; FanDuel already has with its rebrand of horseracing simulcast TVG in 2022.

Despite the fact online sports betting is a fledgling industry, and dozens of new states still have to either legalise or roll out the practice, there have already been signs of fall-off in sportsbook competition. Flutter Entertainment and Fox announced the shuttering of their sportsbook, Fox Bet, on July 30 and that followed the 2022 closing of TwinSpires, a sportsbook founded by Churchill Downs which chose to focus on horse racing instead.

Objectively, few companies can take such a grandiose path at the moment, but the nearly 20-year-old Fanatics has built up long-term credibility and profi tability through partnerships. Sports betting and affiliate companies of any size should recognise the need to differentiate themselves from the competition to thrive or survive in a rapidly expanding universe that may often seem redundant.

Some entities have tried to build their product around high-priced

influencers and notable media members who can attract sports fans and bettors to their sites and/or TV products. However, those moves often tend to enrich the individuals but don’t necessarily positively affect the payer’s bottom line. Bettors want to wager on a site they enjoy rather than Drew Brees’ “favourite.”

This need for pivoting also applies to product: Introducing new promotions and wager types like micro and live betting have been some of the most notable changes to the landscape of ways for customers to wager. It’s how FanDuel became the No. 1 sportsbook in America, in part through its creation of same-game parlays in 2018, which have since become the industry standard.

PointsBet was onto something with its PointsBetting system. Since the landscape is full of fixed-odds betting, empowering players to potentially earn more – with the caution of higher risk – when their preferred wager hits big adds a unique wrinkle to the sportsbetting experience.

Yet, PointsBetting raises the concern of problem gambling since users may be required to lay out more than their initial stake if their wager is drastically wrong. The experience, which has been referred by experienced sports bettors as a “wild ride,” may be too much for novices who may want to add some juice to an individual game without putting up their whole paycheck.

PointsBet does also offer fixedodds betting, but it did not break out enough against competition. Thus, PointsBet’s decision-makers ultimately did not feel it could survive in the budding landscape, especially since its marketing efforts, which included former pro athletes like Shaquille O’Neal and Allen Iverson, proved too costly to sustain.

Another facet of the betting world that must rely on zagging when others zig is using unique voices or talents to connect with potential wagerers. Many sports fans have set their media-consumption habits, but those who soon will become legal bettors nationwide will reshape how sports information is consumed.

At The Game Day, we have found success in promoting young, upand-coming, in-house voices who know what modern sports fans and prospective bettors need. By having that talent produce podcasts and shortform video posted on socialmedia platforms fans are engaged with, we can grow a brand and have sustainable success even in the broad sphere of sports-betting affiliate sites and online sports media.

Similarly, Fanatics has a seamless way to fold under-21 audiences into its betting property. There should be a natural funnel from teenagers who previously purchased a hat or jersey from Fanatics to sign up for a sportsbetting account on or around their 21st birthday.

It’s a unique time to be affiliated with sports. We’re watching leagues transition further away from ticket sales and from linear TV to online media. Sports gambling has been standing at the forefront of this revolution – and it’s only a matter of time until online sports betting is legal in all 50 states.

Fanatics couldn’t wait any longer to get into the online betting game. The enormous merch operation is making its own wager that its partnerships with sports leagues, retail reach and household name recognition are enough to drive new signups and loyal, devoted players to a sportsbook that may or may not have its name on it.

It’s also why the future of sports media, and sports writ large, is so hard to predict. But Fanatics boasts the economic foundation, industry cache and potential for consumer domination that will keep them in the discussion for the long haul. Beyond the monetary advantage that cannot be built instantly, entrepreneurs and companies of any size and experience should note Fanatics’ forward-thinking plans. Indeed, it serves as inspiration to position one’s self more strongly for success in the surging and ever-changing iGaming universe.

Fantasy sports have always been popular on a casual level. Sports fans around the world will create drafts, or play various free-to-play leagues with their friends or colleagues. But playing fantasy sports for money separates those who are only in it for, perhaps, pride, and those who genuinely consider it a true hobby. We caught up with GameBlazers CEO Rourke Struthers to find out more about the current state of the fantasy sports market. Speaking of the growing interest in fantasy sports betting, Struthers told Gambling Insider: “I think ultimately, sports betting, sports gambling, DFS (daily fantasy sports), fantasy-style competitions and things like that aren’t going to go away. I think they’re only going to become more prolific as more and more states continue to write regulations in.”

He continued: “I think that as we continue to grow, as those regulations continue to pick up across different states, I think you’ll see a big change of consumer behaviour from – maybe not necessarily from a betting side to a playing side – but I think maybe from a playing side to a betting side.”

With most fantasy sports being a free-to-play game that can be aimed at teenagers and most operators’ aims being to convert free players into paid players, there have to be precautions in place to ensure those players don’t enter the realms of betting until it’s legal for them to do so.

To help with this, geofencing can be a good method to keep track of players and regulations as, if you’re not in that particular location, you can’t utilise the site. Different verification methods can also be used to regulate the paid side of fantasy sports, such as verifying your identity. Linking geofencing and KYC together, if you’re in an unregulated state, the geofence won’t allow you to participate, let alone get to the verification stage.

Verifying customer accounts also helps create data to see what age range fantasy sports is appealing to prevent players from trying to circumvent

the system in any way. Speaking about GameBlazers’ integrity systems, Struthers stated: “We have constant monitoring that’s going on on the site. So if you’re doing something you probably shouldn’t, we’ll pick up on it.”

As for market share, FanDuel and DraftKings dominate, holding around 90% of the fantasy sports market, as they currently provide DFS in 45 states. States in which they don’t provide their services (due to state-specific regulations against cash prize awards) include Arizona, Iowa, Louisiana, Montana and Washington.

However, new operators are coming to market. ESPN Bet recently signed a 10-year agreement with Penn Entertainment to launch a multiplatform online sportsbook in 16 states, with ESPN being famous for its existing fantasy database. Betr has launched Betr Picks, where you can pick more or less for your favourite fantasy players’ stats to win up to 100x your entry.

Struthers comments: “I can only hope that over time ESPN Bet and those users come to play GameBlazers. I’m hoping that we can all set this fantasy sports gaming industry on fire.”

DraftKings CEO Jason Robins said during the company’s Q2 earnings call: “DFS has had a great year. We’ve made improvements to the products – a really exciting year for DFS and we are continually adding more customers. We’ve seen really strong crossover for DFS in new

states and it continues to be a source of new engagement.”

Clearly, the competition is stepping up to reach demand. The Fantasy Sports and Gaming Association states that as of June 2023, over 81 million adults across the US and Canada now participate in legal sports wagering and fantasy sports. In the US this represents a 7% increase in total bettors/players since 2022 and 26% growth compared to 2021.

Upping the competition are the likes of StatHero, PrizePicks, Underdog Fantasy, Betr and more. Recently, FanDuel’s Senior Director of State Government Relations, Cesar Fernandez, made certain accusations: “There are companies today posing as fantasy sports operators, and they are running illegal sportsbooks” during a panel at the National Council of Legislators from Gaming States (NCLGS) summer meeting.

Underdog Fantasy CEO Jeremy Levine clapped back at the FanDuel Senior Director with an open letter to its customers, suggesting that FanDuel just wants to keep its position in the market and rid of any potential competition:

“When the Supreme Court later permitted states to legalise sports betting, DraftKings, FanDuel and their lobbyists went to work. But this time they wrote laws designed to make it hard for innovators to break into the brand new sports betting industry. The strategy worked and they had a near instant monopoly, capturing nearly 80% of the US sports betting market,” Levine wrote.

“But Underdog and other companies innovating in fantasy sports and sports betting threaten their monopoly. They’ve seen our company, and others, produce superior products, more exciting user experiences, and begin to challenge them for sports fans’ attention – and they’re scared that we will challenge their market positions. We’re already bigger than they are in fantasy. Frankly, they should be scared.”

So the big question is: is there enough of the fantasy pie for everyone to take a slice?

DS Virtual Gaming (DSVG) is a comprehensive service provider in the field of virtual sports betting and online games. Our victory run started with DS Software GmbH’s launch in Austria in 2003, which instantly started making waves with its strong dedication and fresh ideas. Today, it is a household name with strong recognition amongst countless betting shops and online gaming software developers.

A couple of years ago, the company underwent complete restructuring and realignment measures. Now DSVG proudly presents itself with a new identity and a recognisable character. Our iconic games are unparalleled and they clearly stand out from the competition. We exclusively use real-life pre-recorded videos of races, fights or draws, which is a sure-fire way to spark thrills in front of the screens. We use our tried and tested odds generator to keep all outcomes fair, and the same draw, fight or race is displayed in all locations simultaneously. This foolproof technology is meant to protect both the customer and operator from any hitches or fraudulent activity. Our compact product portfolio includes charismatic and traditional titles. Greyhound and horseracing with multiple variations are our unwavering classics that are extremely successful in Latin America.

We are also very proud of our userfriendly innovation, the “Online Retail Solution,” which will revolutionise the way we perceive retail. We were able to reduce the gaming system with all titles, odds and transmissions to a single link or QR code that can be inserted into the betting firm’s computers. The new element is that now punters can scan QR codes from their own smart devices to take part in the betting process. The clients have full control over their wagers and only need to pay for the betting slips at the cash desk. As a consequence, the bookmakers need less cashiers in the crowded betting shops. Also, less mistakes are made, since the customers are responsible for the whole procedure, except for the payment. Additionally, given the fact that available hardware can be used, no investments need to be made in terms of new equipment. We seamlessly merge online and offline by using the same layout as the

web offering. At DSVG, all processes are automated, so we can instantly connect all our titles to multiple bet shops.

Kickbox Mania is yet another game that we would like to shed light on. Three rounds of complete excitement with footage of real kickboxing competitions give punters the genuine fighting atmosphere. The images of the fights stemmed from WGP Kickboxing, which was founded by the legendary Brazilian kickboxing pioneer Paulo Zorello. What originally started in 2011 as a Pan-American Kickboxing event is increasingly gaining in international significance with athletes participating from all over the world, especially from Ibero-America.