Demand has returned to pre-covid sales levels and remained relatively stable since Q2 2022 Pended and closed sales are within 2% and 5% of ?normal? pre-covid levels respectively. Albeit, our market is not as impacted by interest rates as the national market, yet rates do have an influence on our market With rates declining and new inventory arriving this year, the outlook for demand is positive.

Inventory,whilealsoremainingrelativelystablesinceearly2022,hasnot returned to ?normal? and supply continues to struggle to be around 80% of pre-covid levels New construction may improve inventory levels, yet this impact may be muted due to pre- sales Overall, with demand returning to normal levels while inventory lags, and with absorption rates still below ?normal? levels, one may assumewewillremaininaseller?smarkets,at least inthenear term

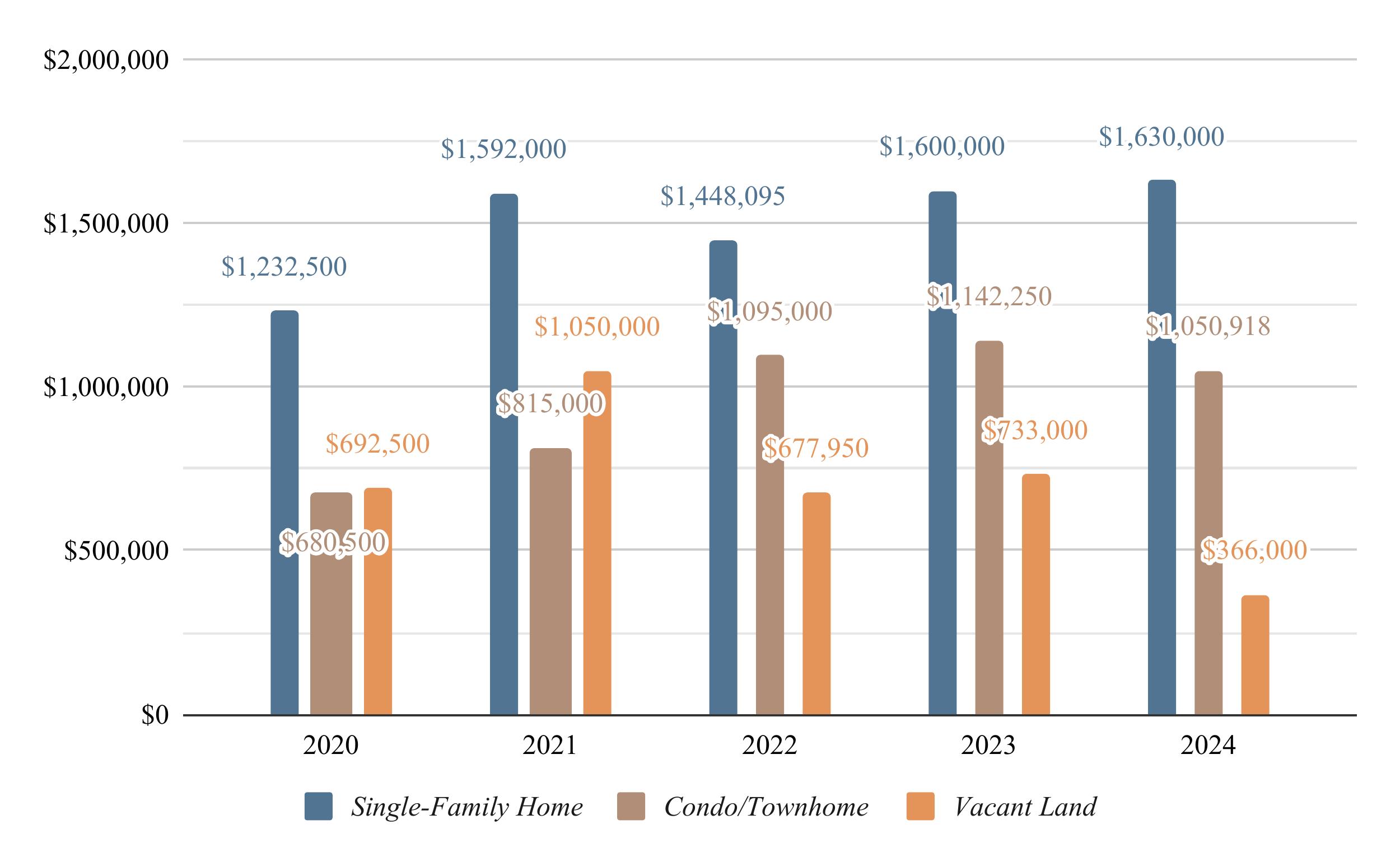

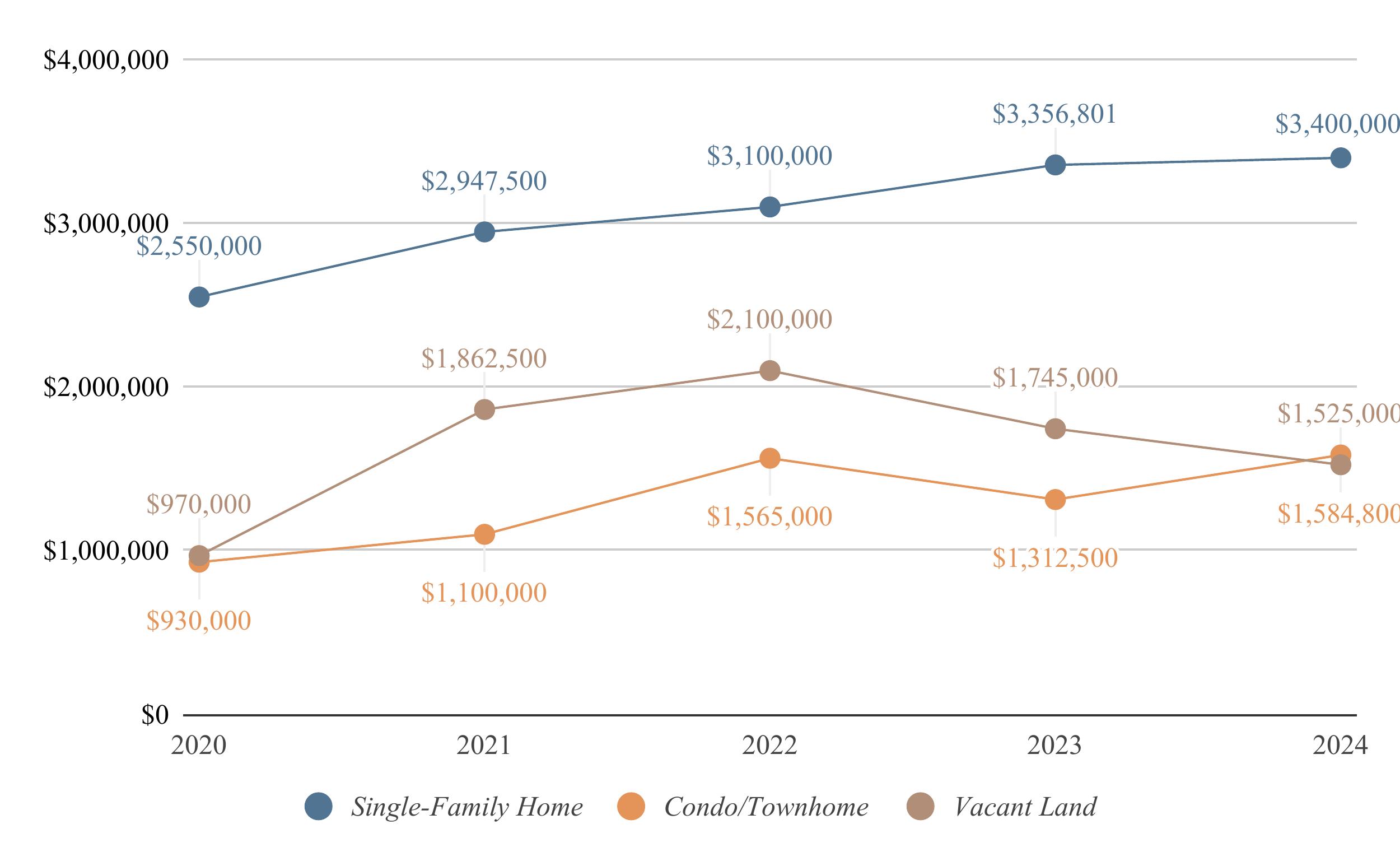

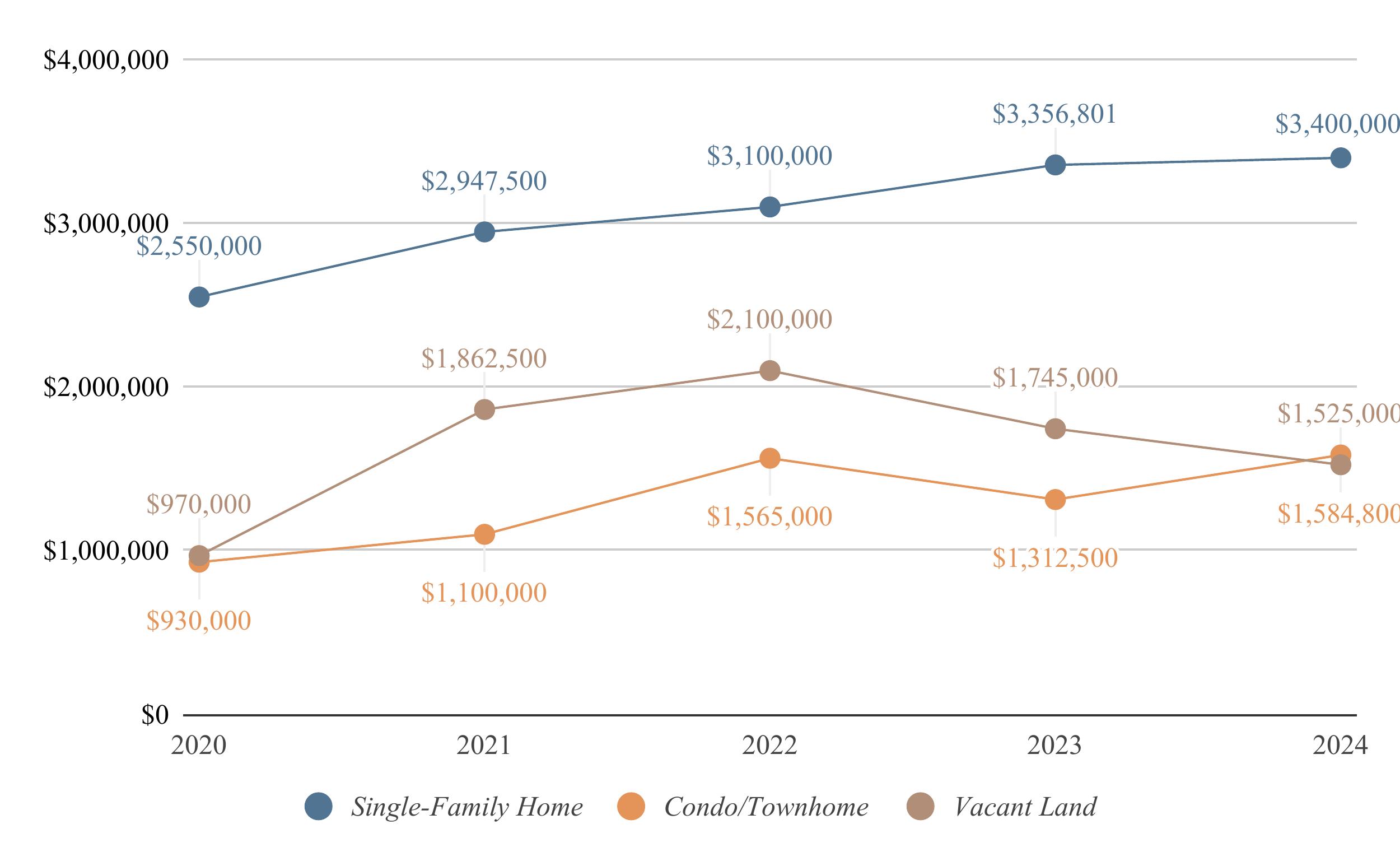

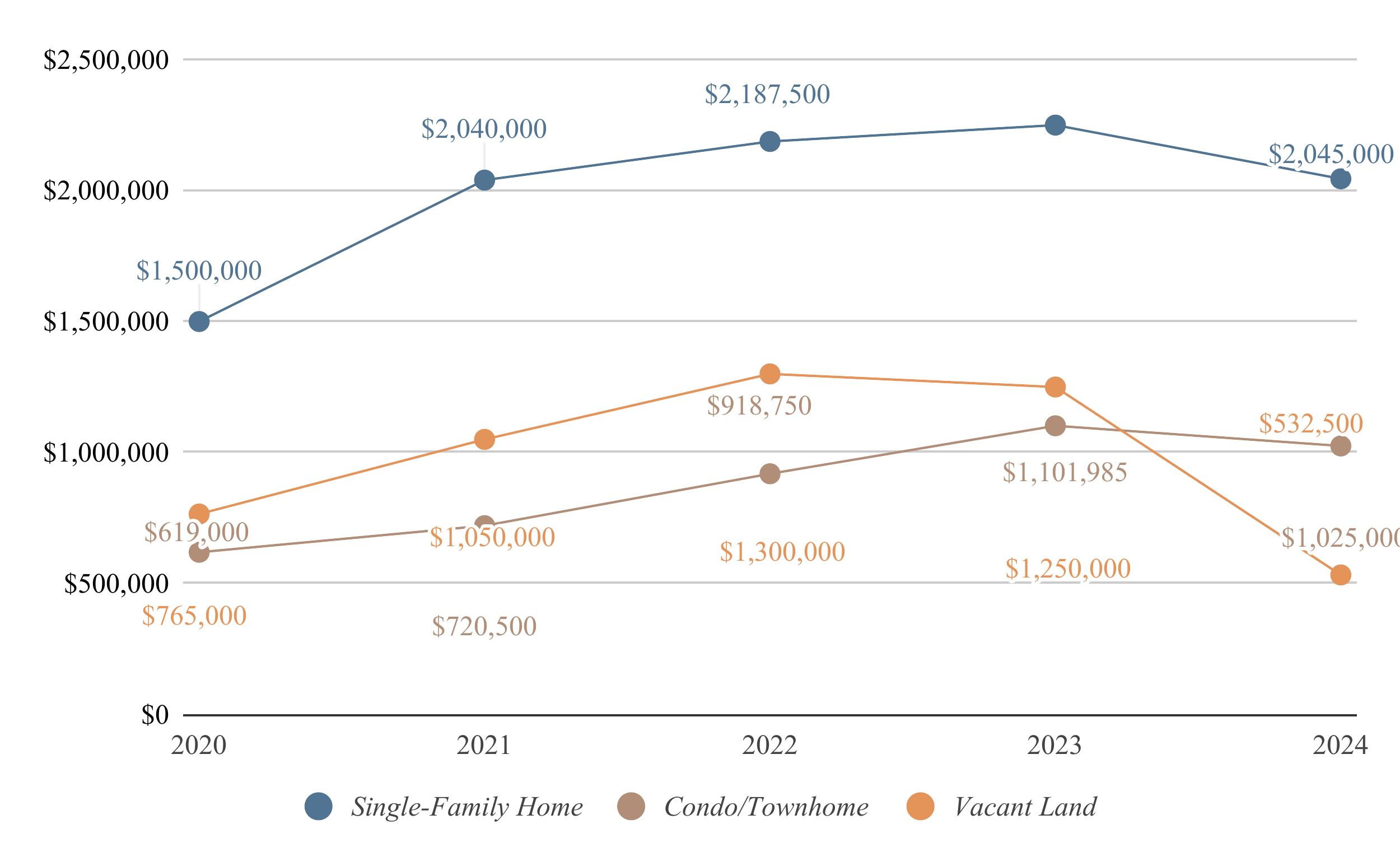

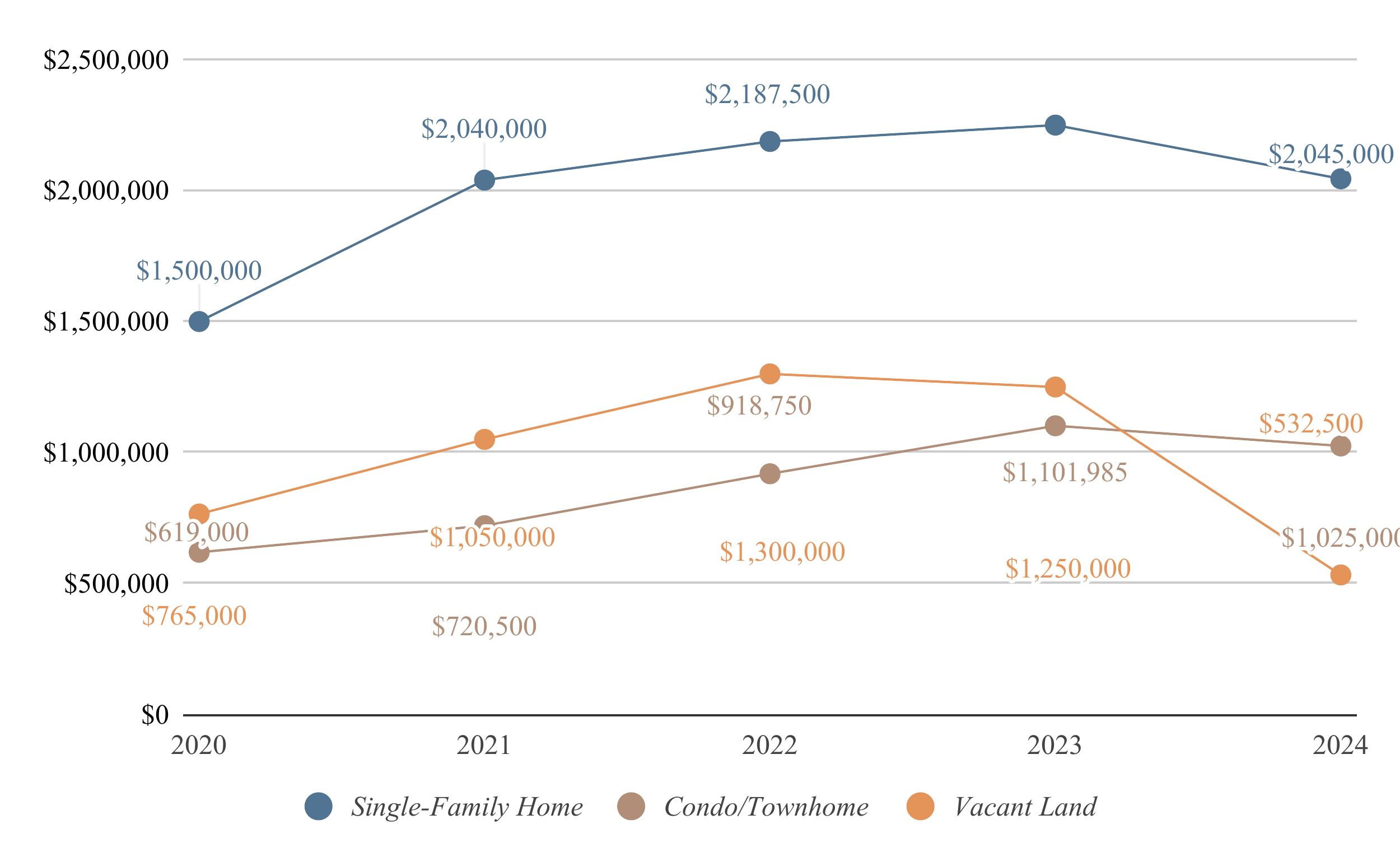

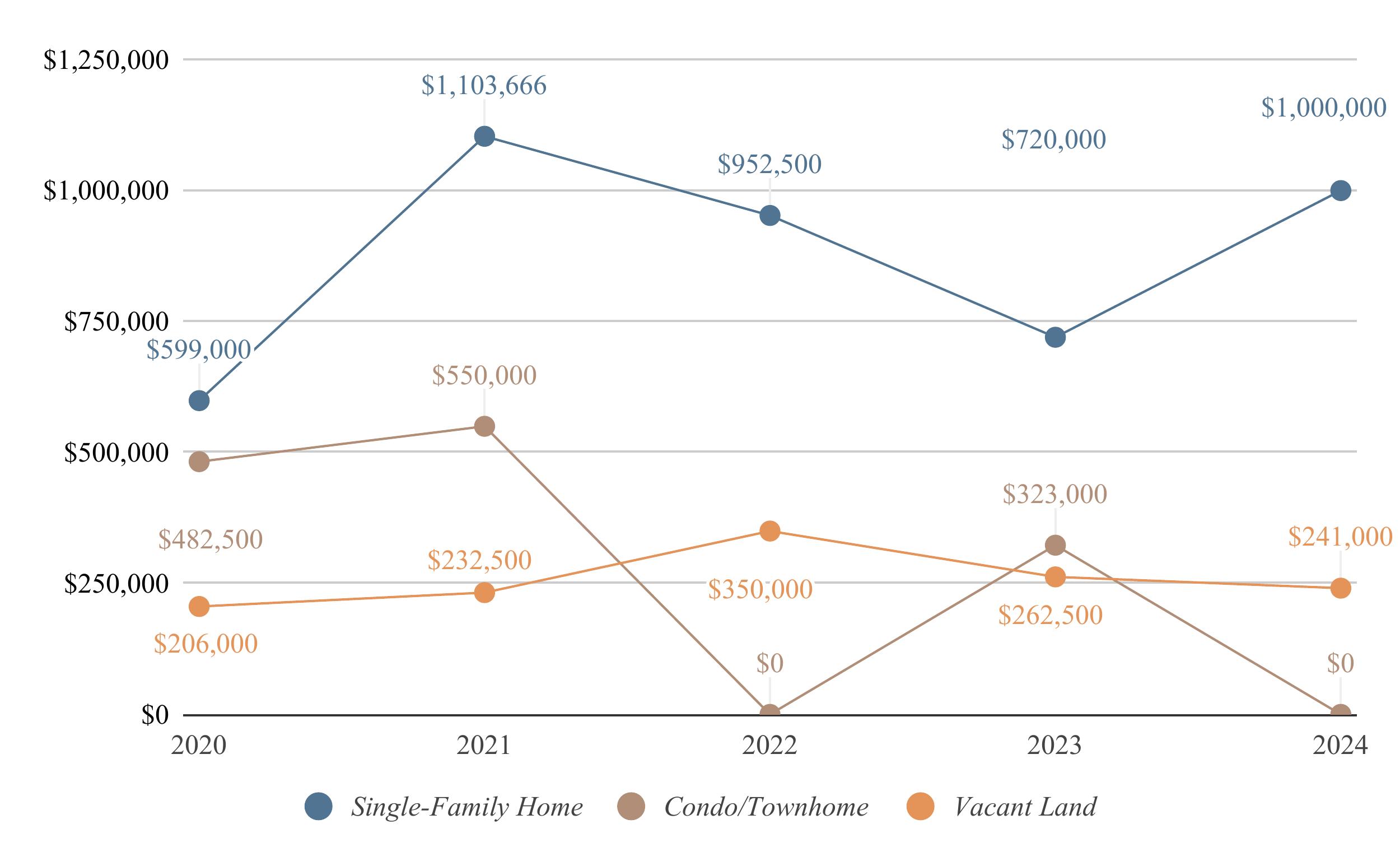

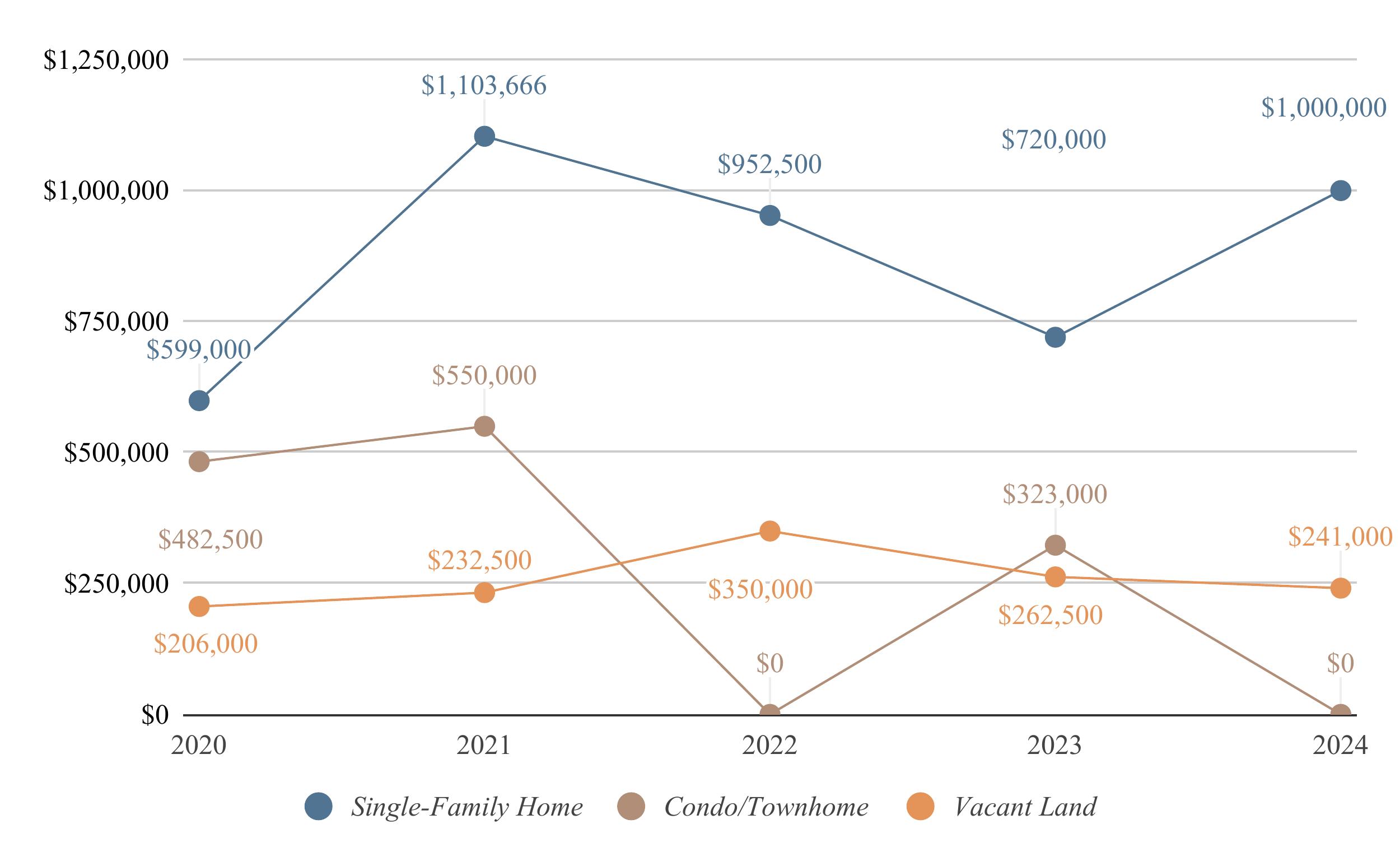

Pricing continues to increase with median prices for SFR and Condos for GPC increasing 5% However, considering any ?one? appreciation figure masks the considerable differences due to area, product mix and new construction For example,theMLSshowsSFRfor Jordanelleincreased 23%(and yes,samplesize is an issue) Yet, with 60% of the sales being new construction this has a considerable impact If we only consider existing homes in the Jordanelle, home valuesdeclined3%

?Attainability?remains elusive but has improved over prior quarters with more homes listed < $1M in Silver Creek Village with 12 overall listings under $1M For the 12 monthsending 2023 there were 23 salesof homes< $1M Yet, the median list price for a home In Town is $5.5M; in the Basin - $3M; and for Jordanelle$4 5M

Our market is nuanced, complicated and changing. More than ever, buyers and sellersneedhighlyeducatedagentstonavigateour realestatemarket

Data sourced from Park City MLS for the period of 07/01/2024 to 09/30/2024 All information provided is deemed reliable but is not guaranteed and should be independently verified

MedianDaysonMarket

38

MedianSoldPrice

$1,630,000

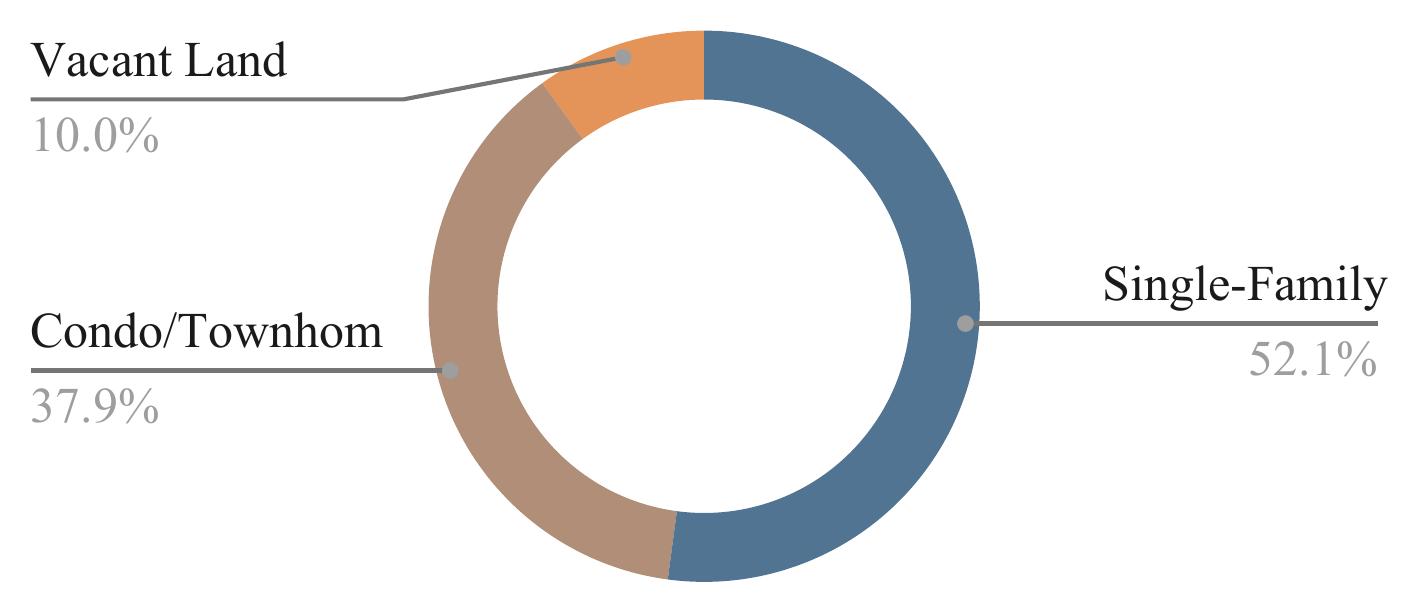

281 Number of SoldProperties

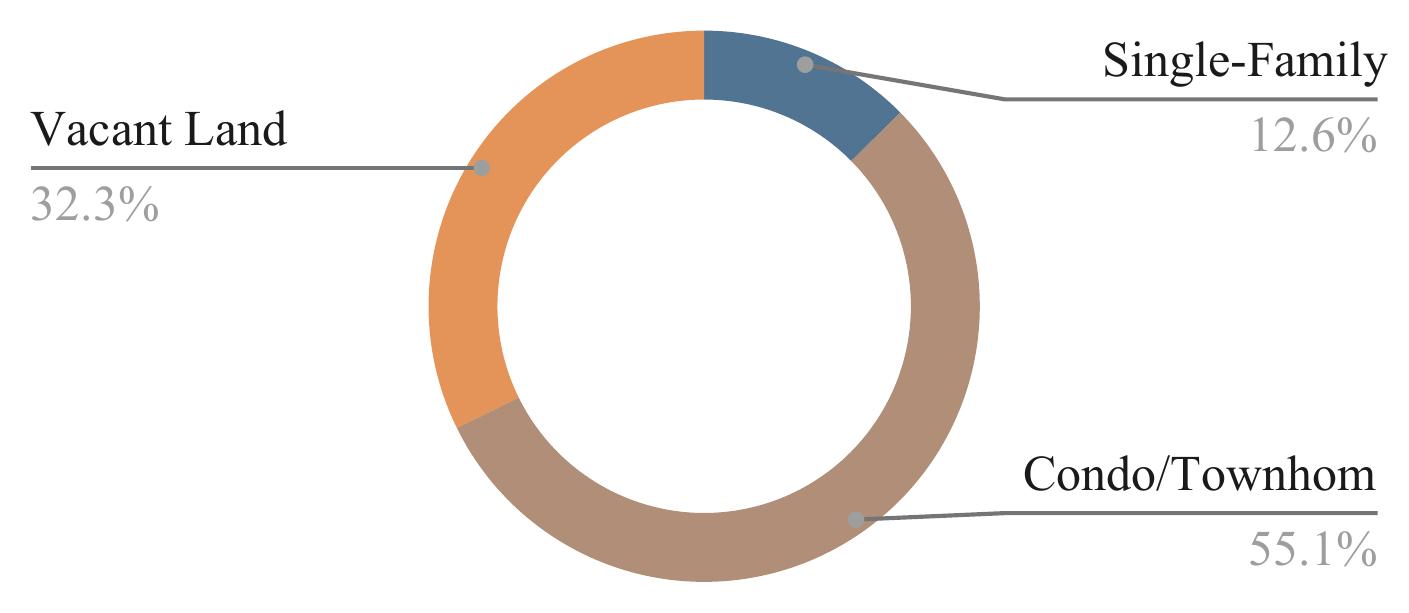

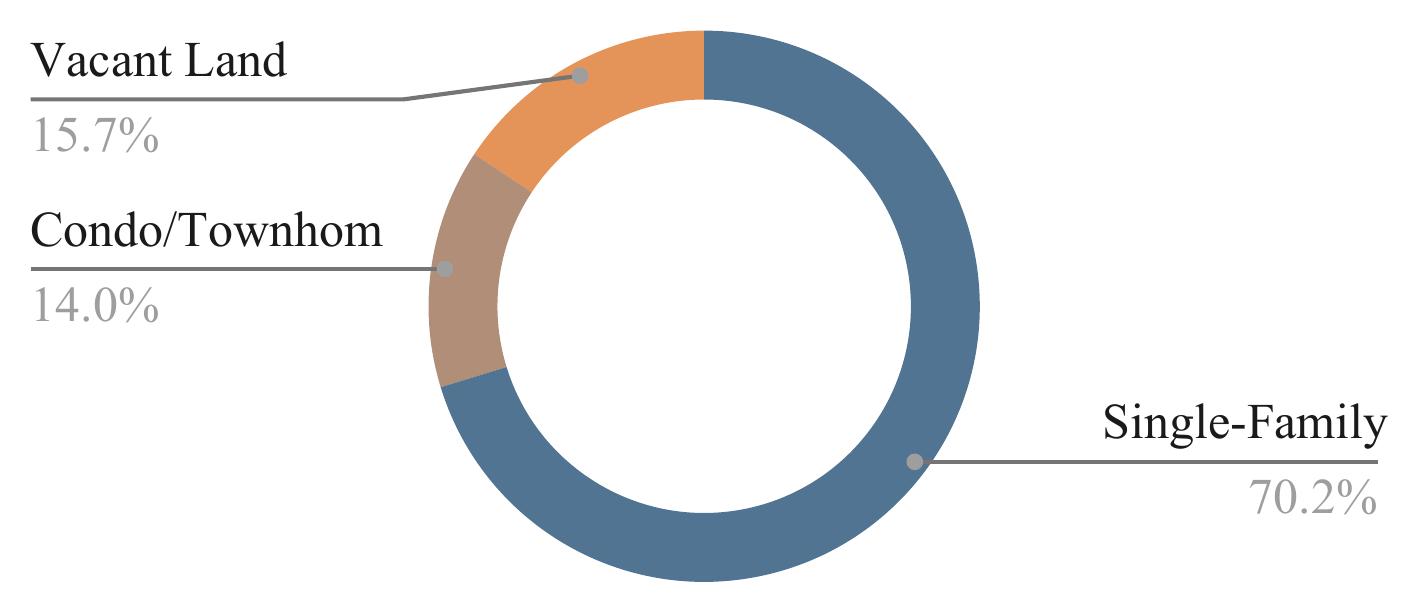

MedianSoldPrice | 2020 -2024 Q3 | AllMajor Areas

MedianDaysonMarket

48.5

MedianSoldPrice

Condo/ Townhome

TotalProperties Sold 99

Q3 2024

Condo/ Townhome

TotalProperties Sold 93

Q3 2023

MedianDaysonMarket

$2,045,000 MedianSoldPrice

Condo/ Townhome

TotalProperties Sold 172

Q3 2024

Condo/ Townhome

Q3 2023

TotalProperties Sold 190

MedianDaysonMarket

$3,850,000

Q3 2024

TotalProperties Sold

Q3 2023

TotalProperties Sold 127

Condo/ Townhome

Condo/ Townhome

MedianDaysonMarket

Condo/ Townhome

Q3 2024

TotalProperties Sold

Condo/ Townhome

Q3 2023

TotalProperties Sold

MedianDaysonMarket

Q3 2024

TotalProperties

Condo/ Townhome

Q3 2023

TotalProperties