3 minute read

BMBI

Q3 2022 GROWS YEAR-ON-YEAR, BUT INFLATION DRIVES INCREASE AMID FALLING VOLUMES

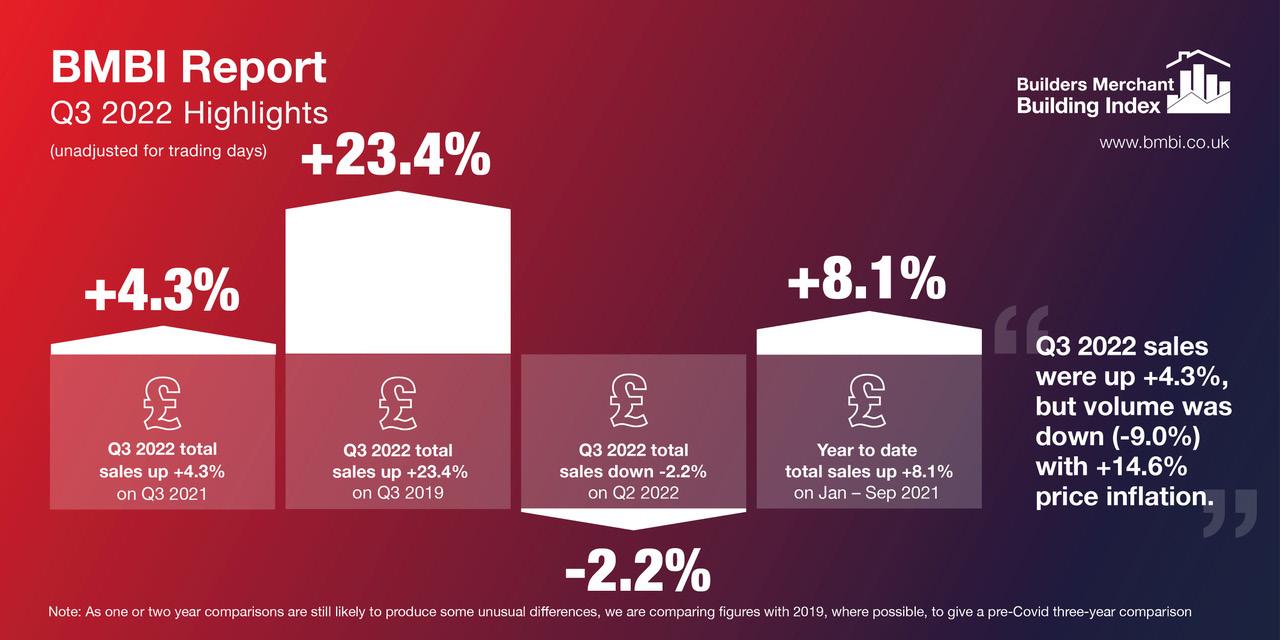

The latest total value sales data from Britain’s Builders’ Merchants shows Q3 2022 recorded +4.3% year-on-year growth. However, price inflation (+14.6%) continues to drive the increase in sales as volumes fall -9.0%.

QUARTERLY SALES, YEAR-ON-YEAR

Ten of the 12 categories sold more in Q3 2022 compared to the previous year with Renewables & Water Saving growing the most (+38.4%). Workwear & Safetywear (+23.6%), Kitchens & Bathrooms (+17.2%), and Plumbing, Heating & Electrical (+14.2%) all grew more than Merchants overall. Heavy Building Materials also increased (+11.9%) while Landscaping (-1.3%) and Timber & Joinery Products (-11.1%) were the only categories to sell less. With one less trading day this year, like-forlike sales were +5.9% up. Comparing Q3 2022 with Q3 2019, a more normal pre-Covid trading year, total value sales were +23.4% higher this year, but volume sales were -6.8% down while prices were up +32.4%. Despite one less trading day in the most recent period, like-forlike sales were +25.3% higher. All categories sold more.

QUARTER-ON-QUARTER

Quarter-on-quarter, sales were down -2.2% in Q3 2022 compared to Q2 2022. Volume sales were down -5.5% and prices were up +3.5%. Despite four additional trading days in Q3, like-for-like sales were -8.3% lower. Renewables & Water Saving (+14.5%) was again the standout category, followed by Workwear & Safetywear (+8.1%) and Kitchens & Bathrooms (+6.2%).

SEPTEMBER SALES, YEAR-ON-YEAR

September 2022 sales were +3.0% up year-on-year. Volume sales were down -9.6% and prices were up +13.9%. Like-for-like sales were +7.9% higher for September 2022, which benefited from an extra day compared to September 2021. Nine of the twelve categories sold more including Renewables & Water Saving (+62.6%) and Workwear & Safetywear (+32.5%). Total value sales in September 2022 were +28.3% higher than the same month three years ago, with no difference in trading days. Eleven of the twelve categories sold more than September 2019.

SEPTEMBER SALES, MONTH-ON-MONTH

Compared to the previous month, September 2022 total merchant sales were marginally down (-0.5%) compared to August. Volume sales were flat (+0.1%) and prices fell -0.6%. Half of the 12 categories sold more, again led by Renewables & Water Saving (+28.2%).

LAST 12 MONTHS

Sales in the 12 months from October 2021 to September 2022 were +9.5% higher than in the same 12 months a year earlier. Volume sales were -5.6% lower and price +16.0% higher. All categories sold more. Renewables & Water Saving (+23.1%) was higher than other categories while Kitchens & Bathrooms (+17.9%) also grew strongly. Landscaping (+2.9%) was weakest.

GfK’s Builders Merchant Panel

GfK’s Merchant Panel includes national, multi-regional and regional merchants such as Buildbase, Jewson, Travis Perkins, EH Smith, Gibbs & Dandy, MKM and Bradfords. GfK’s Builders’ Merchant Point of Sale Tracking Data represents more than 80% of the value of the builders’ merchant market. GfK insights can trace product group performance and track relevant features. GfK can also produce robust like-for-like market comparability, tailored to the requirements of an individual business.

The Builders Merchant Building Index

The BMBI is published every month, in print and online. A full quarterly report is available every three months. The BMBI is a brand of the Builders Merchants Federation. Launched and produced by MRA Research, it uses sales-out data from GfK’s Builders Merchant Panel. BMBI includes a panel of leading industry Experts, who speak exclusively for their markets.

Window Systems LTD