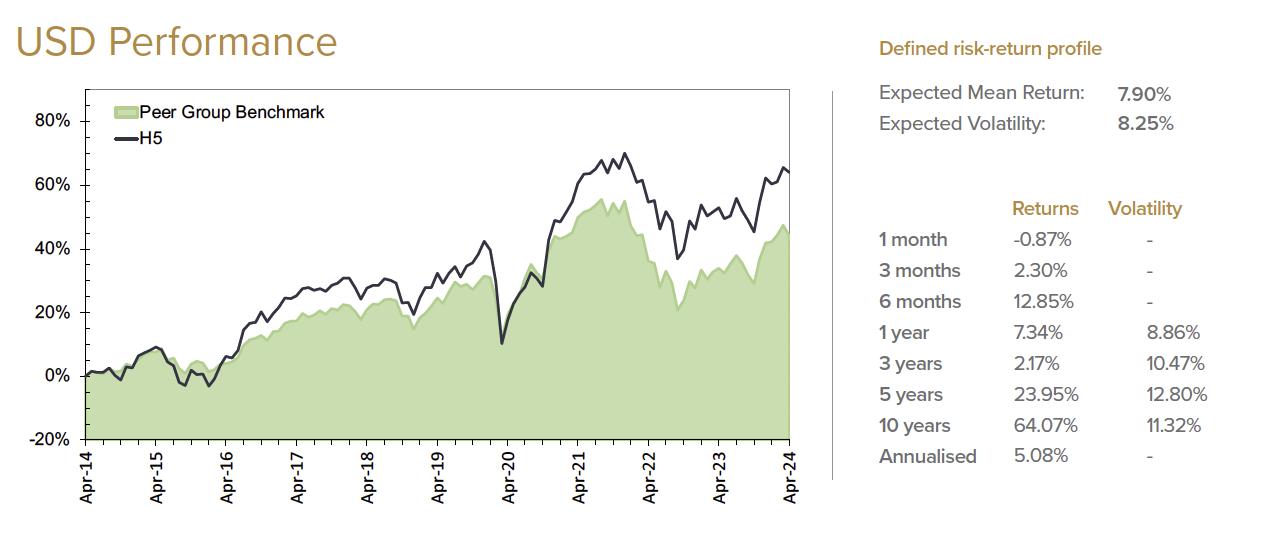

The overarching objective of the multi-asset team is to achieve real (i.e. inflationadjusted) returns of three to five percent over the medium term, while also limiting negative returns over a rolling thirty-six-month period.

A multi-asset approach to achieve this objective offers two potential avenues for generating returns. Firstly, it enables tactical allocation among asset classes (such as equities, fixed income, and cash) when disparities in relative valuations emerge. Secondly, it allows for the selection of the top-performing assets within each asset class. When constructing portfolios, the team is largely unconstrained by benchmarks. Each individual security included must significantly contribute to performance while also maximising the number of independent or non-correlated positions in the portfolio to mitigate concentration risk.

J oin the FPI at Africa ’ s largest gathering of busines s leaders, professionals and entrepreneurs on 10 September 2024 at Sandton Convention Centre .

Lelané Bezuidenhout, CFP®, CEO, Financial Planning Institute of Southern Africa

The CEO of the Financial Planning Institute of Southern Africa shares the FPI’s latest news.

elcome to this edition of Blue Chip magazine –the official FPI-supported industry publication.

This year marks the 35th annual FPI Professional’s Convention, and it’s always an exciting journey to devise the theme and plan each year’s event. We have planned this convention with an approach of “for-members-by-members”, and this year has been no exception. We have gathered to share great ideas and reflect on the potential vision for the convention, focusing on practice standards, management and thought leadership over technical content.

This year marks the 35th annual FPI Professional’s Convention.

For technical discussions, the FPI hosts other events throughout the year like the Annual Refresher, Retirement and Investment Masterclass as well as various other masterclasses focusing on estates and trusts, ethics and AI. If you missed any of these events, you can still register to access the recorded content via our website and the FPI portal.

Nevertheless, let me dive into providing all the details about this year’s convention in the breathtaking city of Cape Town, returning for the first time since 2016 at the Century City Conference Centre.

Our theme, Cultivate Growth to Harvest Excellence, perfectly captures our goals to foster professional advancement and exceptional capabilities within our profession.

We have convened respected local and international speakers to share insights on the latest trends and updates in financial planning, such as growth mindsets, great company cultures and striving for overall excellence. The convention offers a broad

spectrum of topics, including innovative strategies, technological advancements and ethical considerations.

Participants are able earn up to 12 verifiable Continuing Professional Development (CPD) hours across various educational sessions. These are critical for maintaining our professional standards and keeping up with industry developments. Networking and collaboration are, as always, a significant part of the convention, providing attendees a platform to build valuable professional connections. I am also particularly excited about the variety and effort our exhibitors have put into impressing and engaging with attendees this year.

As is tradition at the FPI, the first day of the convention transitions into the Gala Dinner where we present several awards to deserving professionals. This year’s finalists for the Financial Planner of the Year are Gareth Collier, CFP®, Rudolph Geldenhuys, CFP®, and René van de Spreng, CFP®.

Congratulations to all the finalists!

Another highlight to look forward to is the announcement of the winners of the Diversity & Inclusion Award, Harry Brews Award, It Starts with Me Award, the student competition and recognising the Top Profession Competency Examination (PCE) candidates of the year.

On a note of gratitude, I would like to thank Soré Cloete, CFP®, Jill Larkan, CFP®, and Luke Martins, CFP®, for their years of dedicated

service on the FPI Board. Their contributions have greatly enriched our profession. We are thrilled to welcome Dan Bergland, CFP®, and Thato Mahapa, CFP®, to the board, anticipating great strides in moving our profession forward.

Looking ahead, we are transitioning to the Next Generation Standards starting in 2025, changing the format of our exam component to include a financial plan. The final PCE sitting in the current format is in October 2024. Registrations are open.

The FPI will also feature at LeaderEx 2024, where our volunteers will provide consumer education. Members will offer pro-bono one-on-one sessions, so check out www.mymoney123.co.za or www.leaderex.com for more details.

Lastly, in our commitment to enhancing the experience for our CFP® professionals, we have partnered with the Financial Planning Standards Board (FPSB) to launch digital credentialing, offering a new way for our professionals to showcase their certifications.

This is just one of the many ways we are driving value-driven innovation in our profession. If you have not seen or activated your credential yet, please contact membership@fpi.co.za to assist you.

That’s all from me for now.

Until next time.

Lelané Bezuidenhout, CFP®, CEO, Financial Planning Institute of Southern Africa

This year’s finalists for the Financial Planner of the Year are Gareth Collier, CFP®, Rudolph Geldenhuys, CFP®, and René van de Spreng, CFP®.

The purpose of financial advice is to assist investors and guide them to make informed decisions to achieve their investment objectives, says Edward Semenya, Alexforbes. However, he concludes that the true value of financial advice lies in the tangible actions and unique perspectives that financial advisors offer clients (page 46).

Hannes van den Berg, Momentum Advice, says that only when you understand advice, do you understand its value. An advisor offers a holistic approach to financial planning by considering all aspects of a client’s life and financial circumstances before advising on a financial plan. He says that positioning the value of advice is critical to the growth of the industry (page 20).

Rob Macdonald, Fundhouse, says that acting in the client’s best interest takes courage despite the risk this may pose to the client, the relationship and potentially to the financial planner’s income (page 66).

And while on the topic of courage and financial advisors – it is time for the 35th FPI Professional’s Convention and the theme is Cultivate Growth to Harvest Excellence. We pay homage to this theme by announcing the three runners-up of the FPI Financial Planner of the Year Award 2024: Grant Collier, Rudolph Geldenhuys and René van de Spreng. Blue Chip congratulates all three of you and celebrates the growth that you cultivated and the excellence you are harvesting (page 26).

And so, too, we celebrate other financial planners who have shown courage and cultivated growth to harvest excellence: Lara Warburton, CFP®, winner of the 2023 Financial Planner of the Year Award, who encourages other financial planners to enter this competition and view it as a part of your personal growth as a professional. (Don’t miss her article on page 70.) Kim Potgieter, CFP®, won the FPI It Starts with Me Award 2023 for her unyielding dedication to promoting the CFP® certification (page 34). Olwethu Masanabo, winner of the FPI Diversity and Inclusion Award 2023, is celebrated for promoting the inclusiveness of diverse communities in the profession (page 33). Meet Stephan Lombaard, the 2023 Top Candidate Award winner on page 32.

While we celebrate those who cultivate growth to harvest excellence, we honour Lelané Bezuidenhout, FPI CEO, for growing the FPI to what it is today and making it an Institute of true excellence. Blue Chip speaks to her on page 28.

See you at the conference!

Alexis Knipe, Editor

Blue Chip Journal – The official publication of FPI

Blue Chip is a quarterly journal for the financial planning industry and is the official publication of the Financial Planning Institute of Southern Africa NPC (FPI), effective from the January 2020 edition. Blue Chip publishes contributions from FPI and other leading industry figures, covering all aspects of the financial planning industry. A total of 7 500 copies of the publication are distributed directly to every CERTIFIED FINANCIAL PLANNER® (CFP®) in the country, while the monthly Blue Chip Digital e-newsletter reaches the full FPI membership base. FPI members are able to earn three verifiable Continuous Professional Development (CPD) points per edition of the print journal (four per year) under the category of Professional Reading. Special advertising packages in Blue Chip are available to FPI Corporate Partners, FPI Recognised Education Providers and FPI Approved Professional Practices.

Publisher: Chris Whales

Editor: Alexis Knipe

Digital Manager: Kerenza Lunde

Designer: Monique Petersen

Production: Sharon Angus-Leppan

Ad sales:

Gavin van der Merwe

Sam Oliver Bayanda Sikiti

Venesia Fowler

Vanessa Wallace

Tahlia Wyngaard

Managing director: Clive During

Administration & accounts: Charlene Steynberg

Kathy Wootton

Distribution and circulation manager: Edward MacDonald

Printing: FA Print

PUBLISHED BY

Global Africa Network Media (Pty) Ltd

Company Registration No: 2004/004982/07

Directors: Clive During, Chris Whales

Physical address: 28 Main Road, Rondebosch 7700

Postal address: PO Box 292, Newlands 7701

Tel: +27 21 657 6200

Email: info@gan.co.za

Website: www.gan.co.za

Alexis Knipe

Column by Rob Macdonald, Head of Strategic Advisory Services, Fundhouse

(THREE-COMPONENT)

Column by Kobus Kleyn, Tax and Fiduciary Practitioner, Kainos Wealth

THE KEY TO

Momentum’s purpose is to build and protect its clients’ financial dreams

Meet the three 2024 FPI Financial Planner of the Year finalists

Blue Chip interviews Lélane Bezuidenhout, CEO of FPI

Meet Stephan Lombaard, the 2023 FPI Top Candidate Award winner

Blue Chip meets up with Olwethu Masanabo, winner of the FPI Diversity and Inclusion 2023 Award winner

Meet the 2023 FPI It Starts with Me Award winner, Kim Potgieter

What drives the shifts in global equity markets, asks Peter Foster, Chief Investment Officer, Fundhouse

ROUND TABLE SERIES

How and why a financial planner should use a DFM

COACHING SKILLS FOR PLANNERS

Introducing Old Mutual Wealth’s integrated financial coaching course

DO YOU HAVE A “TYPE”?

Finding the perfect investment partnership offshore, by Capital International Group 46 THE TRUE VALUE OF ADVICE

The notion of financial advice is an intriguing one says Alexforbes

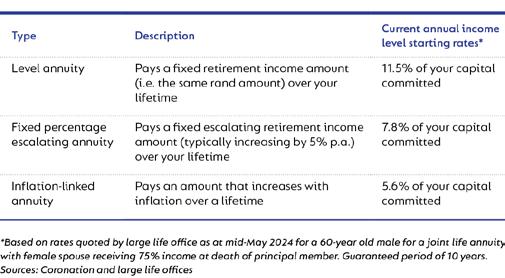

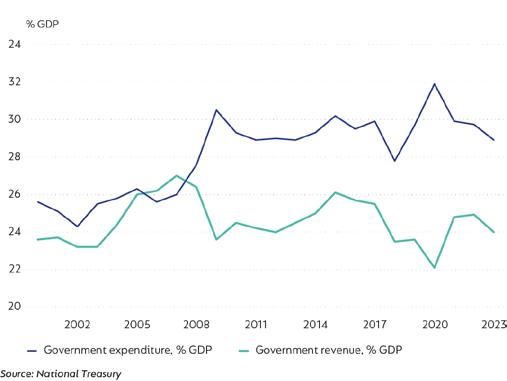

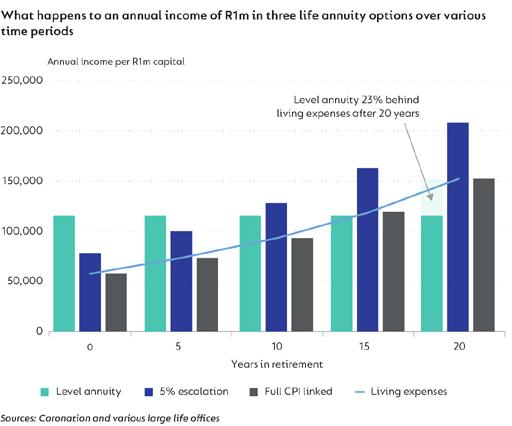

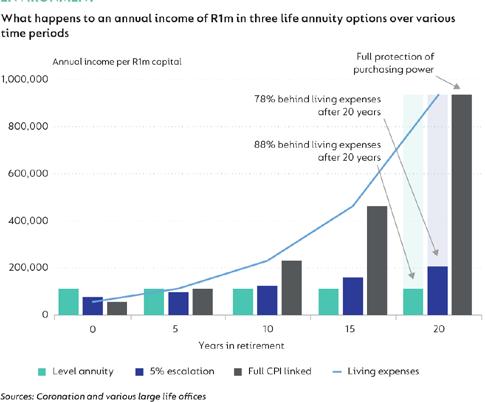

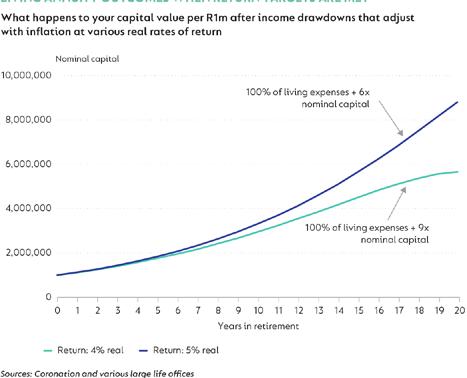

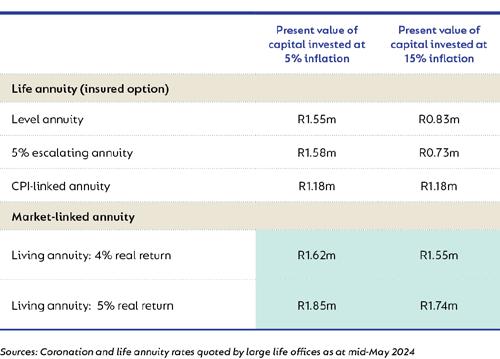

48 POST-RETIREMENT ANNUITY OPTIONS AMID POTENTIALLY HIGHER INFLATION

Coronation Fund Managers explains the importance of choosing the right retirement income option within the context of higher inflation 51 LEVERAGING GAMIFICATION FOR ENHANCED RETIREMENT PREPAREDNESS ALONG MILLENNIALS

Innovative approaches are imperative to engage and educate today’s workforce

52 CAPTURING VALUE FOR CLIENTS FROM SOUTH AFRICA’S ETF BOOM

Kingsley Williams, Chief Investment Officer, Satrix attests that ETFs are an attractive option for investors 54 GAMES OF LOANS: CHOOSING AN INCOME MANAGER How do you choose an income manager

best suited to your needs, asks André van der Merwe, Head of Retail, Matrix Fund Managers

56 CAPITALISING ON GLOBAL OPPORTUNITIES

The case for South Africans investing in global income assets, by Bastian Teichgreeber, Chief Investment Officer, Prescient Investment Management

58 HOW MAZI MULTI-ASSET DELIVERS LONG-TERM RETURNS

As professional fund managers, our job is to provide investors with solutions that meet their requirements

60 ADDRESSING KEY RISKS IN A RETIREMENT PORTFOLIO

By Marius van der Merwe, Chief Executive Officer, Amity Investment Solutions

62 SUPPORTING INDEPENDENT FINANCIAL ADVISORS WITH GROWTH AND SUCCESSION

Carmel Wealth has recently received strategic investments from two global investment companies

64

ROUND TABLE SERIES

Offshore investing: tax issues and jurisdictions

66

COURAGE: ESSENTIAL FOR AUTHENTIC FINANCIAL PLANNING

By Rob Macdonald, Head of Strategic Advisory Services, Fundhouse

70

INDEPENDENCE: IS IT IMPORTANT

Lara Warburton, CFP®, 2023 FPI Financial Planner of the Year, speaks about the importance of independence for financial planners

72 ARE INDEPENDENT FINANCIAL PLANNERS FACING EXTINCTION?

By Warren Ingram, CFP®, Executive Director and Co-Founder, Galileo Capital

74

THE GREATEST GIFT OF CONSOLIDATED INVESTMENTS IS PEACE OF MIND

Private Client Trust cautions against messy portfolios

76

TOUCHING THE HEARTS AND MINDS THROUGH DESIGNTHINKING COMMUNICATION

Medihelp speaks about the importance of having a strong communication strategy

78 ENHANCING CLIENT RELATIONSHIPS THROUGH STRATEGIC TOUCHPOINTS

By Francois du Toit, Founder, PROpulsion

80 ARTIFICIAL INTELLIGENCE: A VITAL FUTURE FOR FINANCIAL ADVISORS

Dr Roddy Carter, Physician, Performance Scientist, Master Coach, Corporate Leader and Author, takes us through this daunting path

82 HOW EMPLOYEE BENEFIT FIRMS USE AI TO BEAT COMPETITION

Zeldeen Müller, CEO of inSite Connect and Creator of AgendaWorx, shows us how employee benefit firms are leveraging AI

84 CLICKS, CONVERSATIONS, CLIENTS

Discerning the art of timely advice in modern (family) financial planning

86 THE FUTURE OF DIGITAL CURRENCY

The proportion of cash versus digital currency is shrinking – slowly but surely

88 CRYPTO ASSETS: AN EVOLVING LANDSCAPE. PART TWO

Second article in the series on cryptocurrency

91 MIRROR SUCCESS FOR ADVISORS

A review of the latest book written by Kobus Kleyn, CFP®, Tax and Fiduciary Practitioner, Kainos Wealth

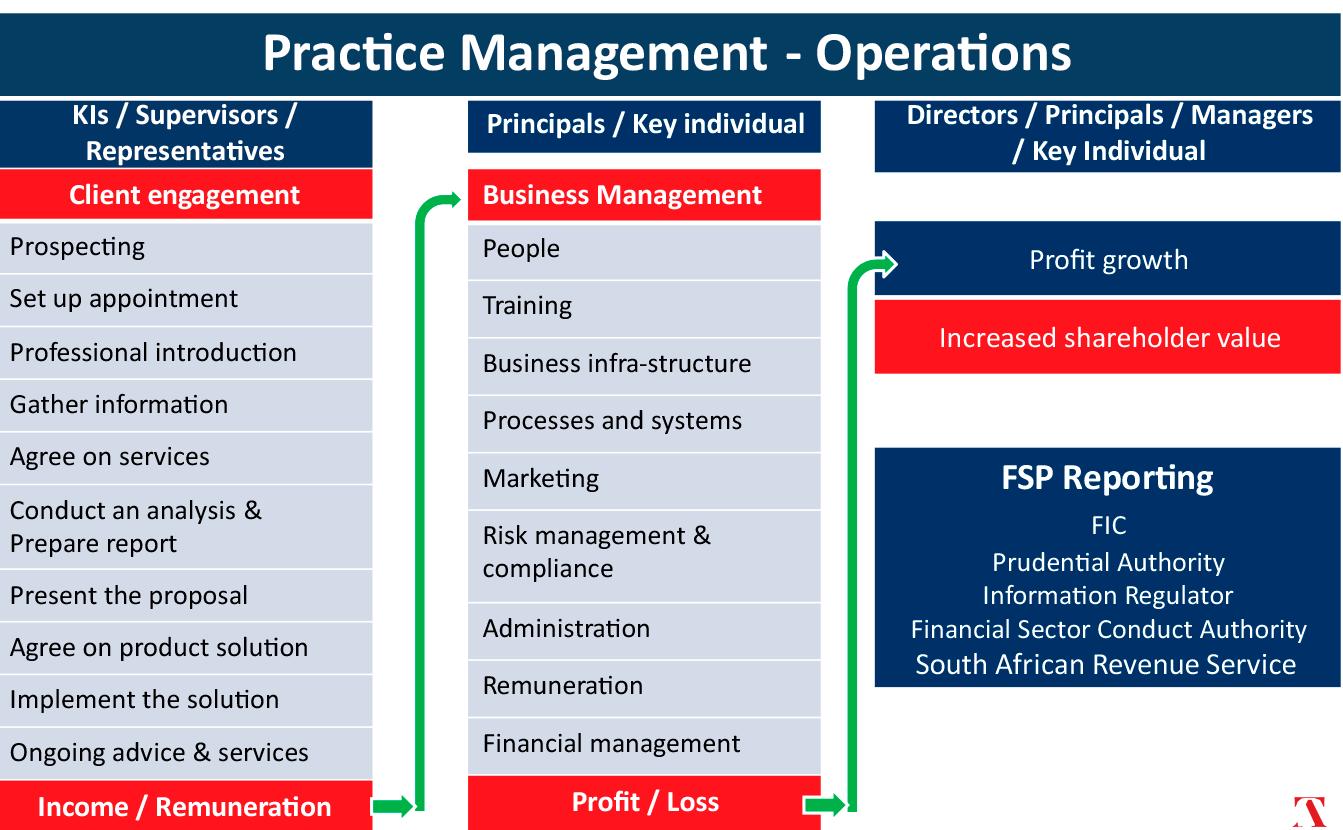

92 THE PRACTICE MANAGEMENT AND COFI PUZZLE

Building a successful practice under the much-anticipated COFI legislation and putting a jigsaw puzzle together are very similar, says Anton Swanepoel, Founder, Trusted Advisors

95 NAVIGATING SUCCESSION: FINANCIAL ADVISORS RETIRE MUCH LATER THAN THEY REALISE Succession planning for the independent financial advisor, by Jaco van Tonder, Advisor Services Director, Ninety One

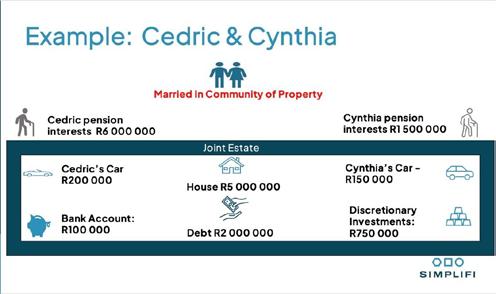

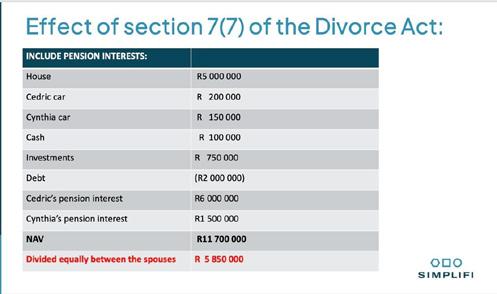

96 THE TREATMENT OF PENSION INTERESTS IN DIVORCE

By Hannah Wilson, Director, Simplifi Law

98 THE INVESTOR VALUE OF SMALLER FUND MANAGEMENT FIRMS VS THE BIG BEHEMOTHS

By Reza Khan, CEO, Lodestar Fund Managers

10 PROFILING FINANCIAL PLANNERS

Blue Chip asks the questions to the answers you always wanted to know

0 2

10 BIG DATA: THE DIGITAL DISRUPTOR RESHAPING THE SOUTH AFRICAN INSURANCE SECTOR

The application of big data has become a cornerstone for transformative strategies across various sectors

Available for purchase from Takealot at the following link: https://www.takealot.com/perspectives-in-financialtherapy/PLID93031126

As we deepen our understanding of the interplay between money and psychology, financial therapy has emerged as a popular field of study. This book offers a diverse range of perspectives on the practice of financial therapy, exploring its benefits, challenges, and potential critiques. The book also provides practical guidance for financial therapists as well as financial planning and mental health practitioners who incorporate financial therapy into their work.

The book covers a wide range of topics, including the neurobiology of financial decision-making, models in financial therapy, online financial therapy, generational differences in financial attitudes, incorporating financial therapy into divorce planning, and techniques for coping with the stresses associated with estate planning. The book addresses the need for culturally relevant assessments of financial therapy in African contexts and offers a critical appraisal of the field of financial therapy. By providing multiple perspectives and practical guidance, this book will be a valuable resource for students, scholars, and researchers in financial therapy, financial planning and related fields, as well as the broader field of psychology.

C o m p l e t e a n

a c c r e d i t e d q u a l i f i c a t i o n

from the UFS School of Financial Planning Law.

We offer the following programmes through distance learning:

Advanced Diploma in Estate and Trust Administration

Postgraduate Diploma in Financial Planning

Postgraduate Diploma in Investment Planning

Postgraduate Diploma in Estate Planning

Financial Coaching Short Learning Programme

Employee Benefits Short Learning Programme

Fundamentals of Short Term Insurance

Short Learning Programme

Advanced Financial Coaching Short Learning Programme

Benay Sager, Chairperson, National Debt Counsellors’ Association

There is enormous potential to release back into the economy more of the R2.5trillion in outstanding personal debt that South Africans owe. According to the National Debt Counsellors’ Association (NDCA), around R100-billion of this outstanding debt belongs to consumers who are in debt counselling, with an estimated R15-billion currently being paid back annually.

“South Africa has a world-class debt-counselling system, which has been proven to work. It’s conceivable that if more people sought help to

Private Client Holdings has been recognised in the 2024 Krutham (previously Intellidex) Top Private Banks & Wealth Managers Awards as the Top Wealth Manager: Boutiques.

These awards are based on a comprehensive survey of 170 wealth management firms and private banks and their clients to benchmark the top performers in South Africa. The Private Client Holdings team

manage their debt, the R15-billion being returned to the economy annually could be increased to R25-billion,” says NDCA chairperson, Benay Sager.

It is estimated that there are around 250 000 consumers who are in debt counselling and are actively paying back their creditors every month. Collectively, they are estimated to pay around R1.25-billion per month to creditors. Part of this includes regular repayments on 20 000 homes and 60 000 vehicles. While this debt remains with the original lenders, it is still an asset which they want to recover, even when restructured as part of the debt-counselling process. Sager says that because debt counsellors help manage the repayment of these assets, it is time to think about the sector as an arm of the asset management industry, albeit one that is managing some of the distressed assets.

spent considerable time and effort reviewing its client journey across all its Family Office service pillars to identify client pain points and then challenged its teams to resolve them.

“Our sincere thanks to all clients who participated in this year’s survey. Understanding what makes us good only drives us to be better,’’ Grant Alexander, founder of Private Client Holdings, said on winning the award.

Few aspects of life are as important as personal finance, as suffused with misinformation, noise and confusion. Dr Roger Silk and Katherine Silk cut through that confusion and share with you the fruits of their knowledge developed over the last 43 years in the new book, The Investor’s Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your Goals.

After completing a PhD at Stanford where he studied at the cutting-edge of finance theory, Dr Silk’s experience includes managing billions of dollars at the World Bank and running a Family Office for one of the nation’s wealthiest families. For the last 26 years as CEO of the nation’s leading firm, Sterling Foundation Management, which advises high-net-worth individuals on financial aspects, Dr Silk has worked with countless financial professionals. Katherine Silk, who holds a master's in history from Stanford, adds a valuable historical perspective.

The book gives you the tools that 99.9% of investors never master, allowing you to understand how to think about almost any category of investment. The Silks take a deep dive into topics including:

• What generates investment returns (it’s probably not what you think).

• Is owning a home an investment?

• Should you own gold?

• What is a hedge, and are commodity funds an inflation hedge?

• What risk is, and isn’t, and why the “safe” course might be the riskiest.

• How professional financial advisors can add huge value to their individual clients.

Building on the success of its Institutional Manager Watch™ series of surveys, Alexforbes is excited to announce its new Retail Manager Watch™ surveys. The new retail multi-asset class survey, published monthly, is segmented into three categories: low equity, medium equity and high equity. These categories, aligned with the Association for Savings and Investment South Africa (ASISA) guidelines, offer a granular view of performance and risk statistics, allowing IFAs and investors to make informed decisions.

Low equity. Designed for conservative investors seeking steady growth and lower risk, this category includes portfolios with lower exposure to equities, offering more stable returns with reduced volatility.

Medium equity. Balancing risk and reward, the medium-equity category includes portfolios that maintain a moderate level of equity exposure. These portfolios aim to provide reasonable returns while managing risk. High equity. For those with a higher risk tolerance, the high-equity category consists of portfolios with substantial equity exposure. These portfolios have the potential for higher returns but come with increased volatility, suitable for investors looking for significant growth over the long term.

The survey is linked to the QR Code.

The days of sticking to one profession or even with one employer for life have quickly been replaced by a new generation of professionals. This younger workforce engages in “slash professions” by pursuing multiple income streams or job roles simultaneously rather than committing to a single profession for their entire career. According to Aubrey Faba, channel director at Momentum Financial Planning (MFP), this is the perfect time for young professionals to consider pursuing a career as a professional financial advisor.

Faba says South Africa is facing significant economic challenges, with many grappling with financial insecurities and a lack of adequate financial literacy. He adds that the need for knowledgeable financial advisors has never been more pressing. Empowering a new generation of financial advisors is essential for true economic empowerment in South Africa.

However, to bridge the age gap and meet the evolving needs of clients, the financial planning industry requires a radical generational transformation.

“In today’s fast-paced world, South Africans are looking for advisors who not only understand their financial goals but also resonate with their life experiences and aspirations. This is where the power of youth comes into play.”

Faba says a younger population requires a youthful perspective and drive. By becoming a financial advisor, he says young professionals can leverage their unique insights and energy to connect with clients on a deeper level.

“Becoming a financial advisor offers substantial benefits, including high earning potential and a flexible schedule. Financial advisors can earn significantly.”

South Africa’s card payments market is forecast to grow by 11.4% in 2024 to reach R2.3-trillion ($125-billion), supported by a constant consumer shift towards non-cash payments, according to GlobalData, a leading data and analytics company. GlobalData’s Payment Cards Analytics reveals that card payment value in South Africa registered a growth of 13.4% in 2023, driven by a rise in consumer spending.

Siddharth Das, an analyst at GlobalData, says, “South Africa remains a cash-driven society, with consumers preferring to use cash

for day-to-day transactions. However, the country’s payments market is steadily shifting towards electronic payments, driven by the combined efforts of the government and financial institutions.”

The central bank’s “Vision 2025” strategy includes several initiatives promoting financial literacy, with expanding the country’s payment infrastructure to support low-cost digital payments as one of the key initiatives. Retailers’ growing acceptance of payment cards and a rise in contactless payments are steering the transition towards card payments.

South Africa is steadily transitioning towards becoming a less cashcentric economy, backed by government initiatives promoting electronic payment methods. The transition from cash to cards is evident in the number of POS terminals, which rose from 424 873 in 2020 to 531 387 in 2024.

Auckland, New Zealand, is set to become one of the major financial hubs of the Global South within the next five years, predicts the CEO and founder of deVere Group, Nigel Green.

He sees the city competing “more effectively and aggressively” with other international finance hubs in the Global South including São Paulo, Johannesburg, Mumbai, Shanghai and Singapore. He notes: “Auckland’s geographic position is a significant advantage, strategically

located at the crossroads of the Americas, Asia, and Oceania. This unique positioning facilitates international trade and finance, making Auckland a prime base for multinational corporations looking to expand in the Asia-Pacific region.

Auckland International Airport is one of the busiest in the region and is undergoing significant upgrades to accommodate future growth.”

The city’s port facilities are among the most advanced in the southern hemisphere. These robust infrastructural foundations enhance Auckland’s appeal as a global business hub, providing seamless connectivity for international trade and investment. “Compare this, for example, to São Paulo, which is more regionally focused compared to Auckland’s broader Asia-Pacific reach; and Johannesburg faces challenges with regional instability.” Government policies fostering a business-friendly environment are crucial. New Zealand has ranked first in the World Bank’s Ease of Doing Business Index, reflecting its efficient regulatory framework.

The city is a burgeoning fintech centre, with numerous startups and established companies innovating in areas such as digital payments, blockchain and cybersecurity. The New Zealand fintech sector has a 10-year compound annual growth of 32%, four times higher than the tech industry.

The Financial Sector Conduct Authority (FSCA) and the Prudential Authority (PA) published Joint Standard 2 of 2024 on Cybersecurity and Cyber-Resilience Requirements in May 2024. The Joint Standard applies to all financial institutions as defined in the Joint Standard. It sets out the requirements for sound practices and processes relating to cybersecurity and cyber resilience for financial institutions. The Joint Standard requires financial institutions to:

• Mitigate and cater for any risks relating to cybersecurity and cyber resilience from juristic persons structured under a bank, the insurer or the insurance group when applying the requirements of the Joint Standard.

• Notify the responsible authority of cyber incidents or information security comprises they classify as a material incident. The specific format and manner for reporting these incidents are yet to be determined.

• Establish and maintain a regularly reviewed cybersecurity strategy to manage cyber risks and address changes in the cyber-threat landscape.

• Identify business processes and information assets that support business and the delivery of services, conduct risk assessments on its

critical operations and information assets and maintain an inventory of all its information assets.

• Ensure that access to information is limited to authorised users and devices only. Develop data loss prevention policies and measures. Implement a cybersecurity awareness programme.

• Maintain effective cyber-resilience capabilities to monitor, detect, respond and recover from cyberattacks on IT systems.

• Regularly test all elements of its cyber-resilience capacity.

• Enforce strong password security controls for users to access IT systems and information assets.

• Implement multi-factor authentication for all users with access to critical system functions, including user accounts utilised to access applications containing sensitive information.

• Test and apply security patches to address vulnerabilities in IT assets.

The Joint Standard strengthens the financial sector’s cyber defences. Financial institutions have one year to comply, requiring proactive measures for a smooth transition and a more secure future.

South Africans are increasingly diversifying their wealth into developed markets, which introduces complexities such as evaluating offshore jurisdictions and navigating cross-border tax and estate duty planning. South African-based wealth managers often lack the resources to advise on these matters comprehensively, unlike private banks that have a diversified team of legal and tax advisors. The International Investing Symposium will convene subject matter experts to demystify the intricacies of international wealth management.

Iam always surprised when I ask a financial planner about their financial planning or investment philosophy and get a blank stare in response. When it comes to a financial planning philosophy the most common retort is that they follow the six-step financial planning process. But a process is not a philosophy. And regarding investing, I’m usually told that it is the investment managers who have the philosophies and that the job of a financial planner is to combine different philosophies when they choose investment managers.

What is a philosophy? In literal terms, it is a “love of wisdom” and is usually associated with the concept of “fundamental truth”. People who study philosophy are trying to understand the fundamental truths about the world we live in. When we think about it as a practical application, it can be defined as “a theory or attitude that acts as a guiding principle for behaviour”.

agree with your philosophy, then they will know immediately that you are not the right financial planner for them. Some financial planners have labels for their philosophy, like Lifestyle Financial Planning, Goal-based Planning or Financial Life Planning. The label is less important than having a philosophy, which will inform your financial planning approach.

Rob Macdonald has held several senior positions in the investment industry. At Fundhouse, he acts as a consultant and coach to financial advisors and develops and facilitates training programmes in behavioural coaching and practice management. Before joining the financial services industry, Macdonald was MBA director at the UCT Graduate School of Business. He has written the book The 7 Pillars of Financial Health and is co-author of Rethinking Leadership and has consulted, written and spoken widely on a range of topics. Macdonald has a Master’s degree in Management Studies from Oxford University and is a CFP® Professional.

Therefore, the concept of having a philosophy is so important for a financial planner, because without a philosophy around advice and investing, what is the guiding principle that you use to influence the behaviour of clients?

Financial planners often use terms such as educating, guiding, coaching, and even mentoring, when describing how they influence client behaviour. These are all great concepts, and each is effective in its own way. However, their impact is likely to be muted if not informed by a consistent and sound philosophy around advice and investing.

What constitutes a financial planning philosophy? I believe it’s articulating for your clients what you believe are fundamental truths about financial planning. At the core, you may wish to tell your clients that you are a partner in their decision-making, not an order taker.

You may want to share beliefs like, needs are more important than wants, or return on life is as important as return on money. If clients don’t

When it comes to investing, fundamental truths would include concepts such as: investing is a means to an end; risk and return are related; time in the market is more important than trying to time the market; and we can’t predict the future which is why diversifying investments is so important. If clients are clear on your investment philosophy and know the fundamental truths of investing, they are unlikely to come to you asking about your latest hot share or crypto pick. But if they do, you can remind them of your investment philosophy and encourage them to see another financial planner if they really want that hot pick.

The power of having a strong philosophy was demonstrated in a different context in the recent political negotiations to form a Government of National Unity. Fikile Mbalula, the Secretary General of the ANC, spoke about how it was much easier to deal with parties who had a clear ideology, or political philosophy, than with parties whose ideology “changed with the weather”. It’s much easier to deal with people if you know where they stand. As we have seen in the political negotiations, this doesn’t mean the conversations will be easy or quickly resolved. Having a clear financial planning and investment philosophy doesn’t make your conversations easier or quicker with clients, but it does mean that your clients will know what you stand for. This will help you attract like-minded clients and is a critical starting point for being able to influence their behaviour on an ongoing basis.

As the implementation date of South Africa’s two-pot (three-component) system approaches on 1 September 2024, financial advisors must brace for a significant shift in the retirement planning landscape. This new framework aims to enhance the sustainability of retirement funds.

Understanding the two-pot system

The two-pot system restructures the traditional retirement savings model into three components:

Savings pot. Designed to provide immediate access to a portion of retirement funds, this pot allows members to withdraw up to one-third of their contributions at any time. This component addresses short-term financial needs and provides a safety net for emergencies.

Retirement pot. Comprising two-thirds of the contributions, this pot is preserved until retirement, ensuring long-term financial security. Withdrawals from this component are only permissible upon retirement age.

Vested pot. This component includes funds accumulated before implementing the new system. These funds remain subject to the old rules and are only accessible upon retirement.

the changes and their potential impact. Personalising these communications will enhance client trust and engagement.

4. Educating clients on financial discipline. While the savings pot offers flexibility, it also introduces the risk of premature depletion of retirement funds. Advisors must emphasise the importance of financial discipline, guiding clients on prudent withdrawal practices and reinforcing the benefits of preserving funds for retirement. As the implementation date draws near, financial advisors should focus on several steps:

1. Continuous professional development. Staying updated with the latest legislative changes and best practices is essential. Collaborating with peers can also provide valuable insights and strategies.

2. Client education initiatives. Developing educational materials, such as guides, FAQs and infographics, can help clients grasp the new system’s fundamentals. Ensuring that all communication is clear and jargon-free will enhance client comprehension.

Kobus Kleyn, CFP®, is a leading financial planner and tax and fiduciary practitioner in South Africa. He has published over 200 articles and authored five books. He is a multiple awardwinning professional and holds memberships with eight local and international professional associations. His awards include four from the Financial Planning Institute, including a Lifetime Achievement Award, and two from the Million Dollar Round Table, including a Lifetime Award and the President’s Award. Kleyn also received the Liberty Group Lifetime and INN8 Diamond Award for Best Overall Impact and Contributions to the Advice Profession in South Africa.

Key implications for financial advisors

1. Increased demand for guidance. Introducing the two-pot system will likely result in a surge of clients seeking professional advice. Advisors must be prepared to explain the system’s nuances, helping clients understand how to optimise their contributions and withdrawals.

2. Reassessing client portfolios. Advisors must review existing retirement portfolios and assess the implications of transferring funds into the new pots. This includes evaluating the tax implications of withdrawals from the savings pot and ensuring clients maintain a balanced approach to their long-term savings goals. The transition period will be critical, and advisors must provide tailored strategies to ensure a smooth shift.

3. Enhanced communication. Effective communication will be paramount. Advisors should proactively contact clients to discuss

3. Strategic review of client portfolios. Advisors should conduct comprehensive reviews of client portfolios to identify opportunities for optimisation under the new system. Personalised action plans should be developed to align with each client’s unique circumstances.

4. Strengthening client relationships. Building trust-based relationships with clients will be critical. Advisors should proactively reach out to clients, demonstrating their commitment to guiding them through this transition.

The advent of the two-pot system represents a significant evolution in South Africa’s retirement savings landscape. Financial advisors are pivotal in ensuring clients navigate this transition smoothly and make informed decisions that secure their financial futures. By staying informed, enhancing communication and providing tailored advice, advisors can turn this challenge into an opportunity to strengthen client relationships and improve their advisory practices.

In our complex and fast-moving world, quality advice aligned to our clients’ specific needs is the most valuable key to building and protecting financial dreams. At Momentum, this is exactly what our purpose is.

Dreams, by their very definition, are not reality, but they have the potential to shape a person’s future reality.

Unlocking financial success is not only possible, but it also becomes probable when it starts with expert financial advice. This is why advisers have always been – and will always be – an integral part of Momentum’s business. It’s also why the best-of-the-best advisers work with us. And anyone who doesn’t, really should!

Only when you understand advice, do you understand its value

Hannes van den Berg says that only an adviser with the expertise to offer a truly personalised journey to success can provide great advice. No-one is the same, and no journey follows the same path to achieving one’s financial dreams.

We believe advice should be:

• Tailored to everyone to create healthy financial habits and a positive mindset towards money.

• Recommended by experienced, trained professionals, informed by the most up-to-date information and offering the best products, solutions and services for every need.

• Empowering and inspiring to meet each client’s long-term goals.

• Ethical, without an emotional bias and based on the best interests of every client.

• Results-oriented with meaningful outcomes and progress that can be measured.

• Continuous through long-term one-on-one relationships that evolve and grow.

An adviser offers a holistic approach to financial planning by considering all aspects of a client’s life and financial circumstances before advising on a financial plan. We offer the full spectrum of solutions and services for every stage of a client’s life, from cradle to grave, with the security of dealing with any unexpected challenges. We offer credibility, transparency and a clear fiduciary role in creating trust.

Design simplified and impactful client experiences

Jeanette Marais says, “We are committed to building long-lasting relationships based on trust, transparency and excellence. We believe that behind every event, every transaction and every decision, there is a human being with hopes, fears, dreams and aspirations, and a unique story that is unfolding.

“We understand that money is not just about numbers but about emotions. So, giving advice is more than just about, for example, providing people with medical cover. What we do, makes people feel healthy. It’s not about giving people comprehensive insurance either; it’s about making them feel safe. It’s not about offering investment options and products, but about making people feel prepared. And it’s not about selling life insurance; it’s about making people and their families feel secure.”

One of the ways in which Momentum strives to humanise what we offer clients is through simplicity. It is our strategic objective to design simplified and impactful client experiences.

In today’s complex financial landscape and in an era where consumers are inundated with options and information, simplicity stands out as a beacon of clarity. By simplifying our offerings, we reduce complexity for clients, making it easier for them to understand and engage with our solutions, services and advisers.

In an industry like ours, where trust is paramount, complex solutions and services can lead to confusion and distrust. By driving simplicity and embracing advice, we, as a business, are enabled to be more efficient and stay agile and responsive to changing market dynamics and our client needs.

She says, “We also aim to enable our advisers to understand and anticipate the evolving needs of our clients, leading to solutions, service and advice that drive real value. For this, we focus on using technology and data analytics to offer insights and recommendations tailored to our clients’ needs. At the same time, these solutions enhance the human touch and drive real value for our advisers – creating a strong, positive outcome for clients and advisers.”

Crucially, more than 90% of our payouts are made possible by financial advisers.

Positioning the value of advice is critical to the growth of our industry

Van den Berg says that advisers, as entrepreneurs, operate in the world of finance as the bridge between financial services institutions and ordinary households and businesses. To play this connecting role in an ever-evolving, complex environment, advisers are required to be equipped with a myriad of skills and a solid understanding of the law, economics, finance and human behaviour.

Advisers contribute to economic growth and employment, playing a vital role in household wealth accumulation, ensuring that more South Africans can afford to retire with dignity and live their financial dreams while protecting their most important assets and growing their wealth.

As our industry is still largely advised, this wealth accumulation would not have been possible without financial advisers.

In the 2023 calendar year, Momentum alone paid R210-billion to clients in the form of claims and annuities. To put this in context, the Reserve Bank statistics show that gross household income from all sources amounted to R6.2 trillion in 2023. Of this, R1.9 trillion is income received from business, dividends, interest, rent, insurance and annuity receipts. That means our pay-outs to clients generated an income equal to 11% of non-salary and grant income. Crucially, more than 90% of our payouts were made

Jeanette Marais, CEO: Momentum Group

possible by financial advisers. Put differently, advisers contribute massively to building and protecting our clients’ financial dreams – and helping us, as Momentum, to live our purpose.

At the same time, it is well known that most of the population can’t afford to save, invest or insure. This means they are largely excluded from accumulating wealth through insurance and investments. Statistics from SARS and Stats SA indicate that only 6.2 million people contributed to a pension or retirement product in 2023. This equates to only 25% of the labour force, or 27% of all households, providing for their retirement through pension funds and retirement annuities. And we know that only a small minority of those who are providing for retirement, provide enough.

Our estimates from the Momentum/Unisa Household Financial Wellness Index indicate that around 750 000 households earning more than R30 000 per month (gross household income) do not provide for retirement. Our estimates also show that about one million households with an income exceeding R30 000 per month do not have any life insurance.

As an industry, we need to work harder, for a start, to reduce these households’ financial vulnerability and include them in the wealth-building process. We recognise the gaps in financial inclusion, access to financial solutions and services, and use them effectively in South Africa. These underserved segments span various demographics, and our objective is to identify their unmet needs and address them effectively to create financial inclusion and empowerment.

To make this possible, we as insurance and investment companies must grow and support financial advisers so they can assist more households to share in this wealth accumulation.

Only an adviser with the expertise to offer a truly personalised journey to success can provide great advice.

Enabling financial advice for all South Africans

Van den Berg says, “To make South Africa a more inclusive country, we need to dramatically increase the number of qualified financial advisers. Our Momentum adviser value propositions are tailored to develop and grow experienced and new professional financial advisers.

“By becoming serious about supporting new and experienced financial adviser entrepreneurs, we can assist in propelling significant economic growth.”

Humanity and innovation to serve client needs to empower great financial advice

Danie van den Bergh adds that over a long time, the Momentum brand has established an incredible reputation for innovation.

The development of creative financial products and solutions has been a major focus of this innovation, so it should come as no surprise that Momentum product solutions have long been acknowledged as the most comprehensive, flexible and competitive in South Africa. At the same time, we were always very focused on developing solutions that would live up to our clients’ expectations.

One of the ways in which Momentum strives to humanise what we offer clients is through simplicity.

Because of its emphasis on the needs of the client, Momentum has consistently produced solutions with exceptional features and benefits that have exceeded clients’ and advisers’ expectations.

Van den Bergh says, “In a world where our innovation is product solutions with unique benefits and features built into systems and processes, we realised that the human element plays an important part in such an environment. We are very proud of the culture we created that is described as a brand with a heart. Our employees, partners, clients, advisers and the public experience this when they engage with us.”

This innovation and culture of caring naturally spilt over to the advice side, and we managed to attract many advisers in the industry to both our well-established and successful advice businesses in the group, one being a registered financial adviser (RFA) and the other a product supplier agent (PSA). Given that advisers have always been an integral part of Momentum’s business, our objective is to attract more best-of-breed advisers to work with us.

To attract advisers, we needed to acknowledge and understand the challenges and requirements of advisers and create specific adviser value propositions for different adviser profiles. The following is an abbreviated list of the challenges advisers are facing:

• Complex systems and processes

• Inadequate succession planning

• Limited or no ownership or equity in their practices

• Vested advisers with large client books battle to service all their clients

• New advisers in the industry struggle to find clients

• Lack of adequate technology to manage their practices

• Retention of clients

• Lack of a sense of belonging and recognition

• Growth in income

• Limitation to diversify income

o Limited product solutions on offer by FSP

o The adviser is licensed for limited product solutions

o Specialisation excludes other product solutions.

Advisers contribute massively to building and protecting our clients’ financial dreams – and helping us, as Momentum, to live our purpose.

A game-changing adviser value proposition from Momentum Van den Bergh says, “We are proud that the adviser value propositions we have created and further enhanced recently, solve the aforesaid challenges and even create new opportunities for growing practices.” Below is the positive impact it has:

Career and personal needs

• Our unique career contract enables advisers to build equity while earning an income with our compelling remuneration model. We encourage our advisers to be entrepreneurial, and therefore we provide advisers with capital assistance to grow their practices.

• Our unique succession planning solution facilitates a positive outcome for an adviser and his complete client book. This is achieved with the assistance of capital regarding events such as death, disability and retirement. We do this for both an existing adviser’s practice and a new adviser joining us as the successor of the existing adviser.

• Our compelling business model diversifies advisers’ income by partnering them with another specialist in a product category that is not their speciality. This enables advisers to ensure that all their clients’ needs are dealt with holistically and that they retain their clients within their practice.

• For us, it is of the utmost importance that the meaningful contributions advisers make to the business and their clients’ lives are celebrated. We formally acknowledge and reward advisers’ achievements.

Practice and office needs

• With the realisation that advisers need cutting-edge technology with increased complexity, we offer one digital workspace with

end-to-end processes, integrated advice tools and embedded compliance. The same workspace includes all data and functionality to manage your practice, including selected access for an adviser’s admin staff.

• Within our advice businesses, advisers can tap into a team of experts from different product solutions, legal advisers and practice development managers to offer professional advice to their clients.

• We have a trademarked business development programme and process that enables the adviser to grow a more sustainable advice practice and grow new business.

Client solutions

• We have developed a financial advice framework that follows a robust financial planning model across all major client needs. This advice process is on one platform with integrated tools and embedded compliance.

• Our product offerings and solutions are widely regarded as the most comprehensive, competitive and flexible in the South African market. The adviser can reassure their clients that the product solution is always the best of the breed and that the advice methodology used will always secure a perfect match between the client’s needs and the appropriate solution.

At Momentum, advisers are at the centre of building and protecting our clients’ financial dreams!

Advisers who find this proposition compelling can engage with us confidentially by emailing us at advice@momentum.co.za or they can SMS Advice and their name and email address to 3 11 44.

Wealth accumulation would not have been possible without financial advisers.

The FPI presents the three finalists for the illustrious 2024 FPI Financial Planner of the Year Award. Meet Gareth Collier CFP®, Rudolph Geldenhuys, CFP® and René van de Spreng, CFP®.

The FPI Financial Planner of the Year Award is a highly sought-after prize that recognises excellence in the profession and practice of financial planning. The Award was launched in 2000 for FPI members with the first winner being crowned at the annual convention gala dinner in 2001.

The competition to recognise the country’s top CFP® is stringent and challenging. It has developed over time to include the assessment of financial plans prepared by the financial planner and a site visit thereby examining the financial planner’s competency, practice management skills, knowledge of the wider financial planning industry and the ability to be the spokesperson for the financial planning profession.

All the nominees had to showcase their talents and abilities, exhibiting innovative ideas, excellent skills and impeccable ethics when dealing with clients.

The FPI Financial Planner of the Year competition is open to all CFP® Professionals who are practicing professional financial planners or those who provide specialist financial advice to clients as part of their full-time business. A practicing financial planner is defined as a person who engages in financial planning using the six-step financial planning process when working with clients.

THE SIX STEPS OF FINANCIAL PLANNING

1. Understanding the client’s financial circumstances.

2. Identifying goals.

3. Analysing the client’s current course of action.

4. Developing financial planning recommendations.

5. Implementing the financial plan.

6. Monitoring progress and updating.

GARETH

COLLIER,

CFP® Director, Crue Invest

Gareth Collier is deeply committed to financial planning, guiding clients towards lasting financial freedom through strategic investing and wealth creation. He was awarded a BCom degree from UNISA and achieved the CERTIFIED FINANCIAL PLANNING® professional designation. Collier serves as a director and shareholder at Crue Invest, which is recognised as one of South

Africa’s most distinguished FPI Approved Professional Practices. His expertise extends to employee benefits, where he excels in crafting personalised, cost-effective solutions for employees.

RUDOLPH GELDENHUYS, CFP®

Senior Financial Planner, WealthUp

Rudolph Geldenhuys graduated from the University of Stellenbosch with a BCom in 2012. He pursued further education at the University of Stellenbosch Business School, earning his postgraduate diploma in financial planning in 2014, followed by a specialised postgraduate diploma in financial planning (summa cum laude) from the University of the Free State in 2018, where he achieved top accolades in investment planning and financial planning law. Geldenhuys serves on the FPI’s Western Cape Regional Committee. He has a strong conviction about giving back to the community.

RENÉ VAN DE SPRENG, CFP®

Wealth Manager and Director, Apex Private Wealth

René van de Spreng has worked in the financial services industry for both large corporate and independent advisory firms for close to two decades. He has a deep passion for independent financial planning, investment management, retirement as well as estate and tax planning. He serves as his client’s trusted thinking partner while understanding and addressing their needs.

Blue Chip congratulates the three finalists. Keep cultivating growth and harvesting excellence.

Blue Chip speaks to Lelané Bezuidenhout, Chief Executive Officer of the Financial Planning Institute of Southern Africa.

Thank you for granting this interview and reflecting on another successful year for the FPI under your leadership. We have many milestones and achievements to celebrate, so let’s begin. Please provide an overview of the FPI since the 2023 convention.

The progress since the 2023 FPI convention has been substantial and multifaceted. From educational enhancements and professional achievements to digital innovations and community building, the FPI continues to lead the way in advancing the financial planning profession. Our continued focus on growth, coupled with a commitment to professionalism and excellence, ensures that the FPI remains a key force in shaping the future of financial planning in South Africa.

What are the areas of growth for the FPI over the past year?

The FPI is implementing its 2023-2025 Growth and Awareness Strategy, focusing primarily on increasing our pipeline of students and candidates. This year, under the leadership of Fatima Fakier, our education manager, we have successfully launched and initiated Student Professional Development (SPD) programmes. Our education providers and professional members have contributed significantly, delivering substantial content to students and candidates. We have introduced live student sessions nationwide, enhancing their preparatory journey in completing their studies. Additionally, more resources have been allocated to support our candidates, who transition from student status upon qualifying.

Our Young Financial Professional Organisation (YFPO) committee has been notably active this year. Under Gugu Sidaki’s leadership, we have facilitated several collaborative sessions

I advocate for an initiativetaking approach to learning and encourage those around me to embrace change, set clear goals and maintain a positive outlook, regardless of challenges.

between younger professionals and those under the age of 45. The increasing interest and participation in YFPO activities are evident in the positive feedback and engagement on our YFPO YouTube channel and social media platforms.

Professionally, the FPI has advanced to number six globally in the ranking of CFP® professionals. This ranking allows us to continue as a member of the Chief Executives Committee (CEC) of the Financial Planning Standards Board (FPSB), highlighting our sustained global participation in the CFP® certification programme.

From a corporate perspective, our FPI Approved Professional Practices are contributing significantly to the growth of the profession by serving as approved mentorship centres. These practices have demonstrated exceptional efforts through their mentorship programmes and initiatives. Moreover, our FPI Approved Professional Practice Forum meetings have been a resounding success. These sessions discuss critical topics such as succession planning, skills development, nurturing talent, fintech, AI, practice management and regulatory updates from FAIS to COFI, to mention a few of the subjects covered in the year-todate. In terms of raising awareness, the FPI has adopted a digital marketing strategy, enhancing our engagement across various

social media platforms. This shift to digital has allowed us to reach a broader audience.

Finally, consumer awareness has been strengthened by the relaunch of our websites, www.FPI.co.za and www.fpimymoney123.co.za, and the reintroduction of the Find a Financial Professional tool. This tool is crucial for consumers seeking professional members of the FPI, including Registered Financial Practitioner® (RFP®), Financial Services Advisor® (FSA®) and CFP® professionals. We have also revamped our consumer newsletter to provide relevant content from our members to their clients.

And milestones reached?

This year has seen significant milestones in both membership retention and growth. We have retained 97% of our CFP® professionals and about 90% of our RFP® and FSA® professionals, thanks to their continued trust and support. The number of CFP® professionals has grown from 4 748 in January 2023 to 4 804 in January 2024. We aim to reach 5 000 CFP® professionals this year, with the support of our education providers, corporate partners and professional practices.

The growth in the RFP® and FSA designations has been slow but steady. The FPI has reintroduced these advice designations after recognising the need for such roles in South Africa. Our efforts to update and enhance the curriculum and competency standards for these designations have been met with positive feedback.

Our events and conferences have marked significant milestones, with well-attended sessions like the Budget Breakfast and Annual Refresher events. We look forward to hosting more impactful events, such as the upcoming FPI Professional’s Convention in Cape Town and workshops on Estates and Trusts and Ethics and AI later in the year.

We have more than 600 candidates who have sat for the CFP® Professional Competency Exam (PCE) to date, for 2024. Additionally, we launched the CFP® digital credential, and we thank those members who have updated their social media platforms, business stationery and emails with their digital credentials.

What are the FPI’s near-term objectives?

As we progress through our current three-year strategy, our nearterm objectives are clear and focused. We aim to grow our CFP® professional members to approximately 5 000 by 2025 and increase our RFP® and FSA® professional members as well. The growth of our advice designations (RFP® and FSA®) is progressing more slowly than expected, partly because employers have not yet fully recognised the value of professional membership in contexts that primarily involve product advice. At the FPI, we are diligently working to help Financial Service Providers (FSPs) understand the benefits of professionalising product sales and encouraging their representatives to join a professional body’s peer community. This effort is aimed at enhancing the professionalism and quality of financial advice within the industry.

Being professional builds trust and credibility with clients, peers, employers and the public, which are crucial in the financial planning profession.

Ensuring that all the FPI corporate partners meet the 25% minimum professional membership target by the end of 2025 is also crucial. We furthermore plan to expand our FPI Professional Practices and enhance our digital marketing strategies to improve user experience. This includes incorporating AI into our CRM systems, launching a new online seminar system and increasing the relevance and frequency of our consumer and member newsletters.

Please tell us about your journey as the FPI CEO.

My tenure as CEO of the FPI since June 2019 has been challenging yet rewarding. We have navigated governance issues, lockdowns and even a flood in our office. Despite these hurdles, these years have been some of the most enriching of my career, offering opportunities for significant growth and improvement. We have transitioned to a more diverse and inclusive environment, both in terms of staff and board composition and have embraced technology to enhance our operational efficiency. We have also intensified our stakeholder engagement efforts to advocate for global financial planning standards and fair customer outcomes.

What is your philosophy of continuous growth?

My philosophy centres on the belief that continuous learning, resilience and adaptability are key to personal and professional success. I advocate for an initiative-taking approach to learning and encourage those around me to embrace change, set clear goals and maintain a positive outlook, regardless of challenges.

A focus area for the FPI has been professionalism. Please discuss. Professionalism is a fundamental principle of the FPI Code of Ethics. It requires professional members and staff of the FPI to uphold the highest standards of integrity, competence and ethical behaviour. Being professional builds trust and credibility with clients, peers, employers and the public, which are crucial in the financial planning profession. Additionally, professionalism fosters a culture of continuous professional development and accountability. This encourages all members and staff to remain up-to-date with industry developments and adhere to best practices. A steadfast commitment to professionalism not only enhances the reputation of our members and staff but also elevates the entire profession, ensuring that clients receive the highest quality of professional financial advice and financial planning.

What is the Financial Planning Standards Board (FPSB) and what is the relationship between the FPI and the FPSB?

The Financial Planning Standards Board (FPSB) is the standards board that establishes, promotes and enforces professional standards in financial planning. The FPSB owns the CFP® mark outside of the United States, while the CFP® Board owns it within the United States. Currently, the FPSB has affiliate and licensing agreements with 28 territories globally. The FPI was one of the founding members of the FPSB when it was established 20 years ago.

As mentioned, the FPI is an affiliate of the FPSB. As an affiliate, the FPI is the only licensed body in South Africa authorised to administer the CFP® certification programme. The FPI’s senior staff, including the CEO, the FPI board chairperson and education specialists, serve on various FPSB committees as volunteers. The FPI holds a position on the Chief Executive Committee as one of the top seven affiliates globally and is ranked sixth in terms of CFP® professional numbers worldwide.

The FPI is on a mission to localise the latest global financial planning standards. Please expand. All FPSB affiliates are required to integrate the updated curriculum into their financial planning standards. The FPI is updating its curriculum and certification standards to include the “Knowing, Being and Doing” concept from FPSB’s revised guidelines. We have also started incorporating these updated learning outcomes into our CPD content and are working with the FPI Approved Educational Providers to revise their educational programmes accordingly. Nici Macdonald, CFP®, our Head of Certification and Standards, is leading these updates in collaboration with other FPSB affiliates.

What are the latest trends, developments and innovations in the financial planning sector?

Globally, financial planners are recognising the benefits of incorporating more robust financial planning technology and AI into their practices. This integration allows planners to spend more time with their clients and ensures a more thorough focus

on the client’s financial well-being. Planners are also realising the importance of partnering with Discretionary Fund Managers (DFMs), fiduciary specialists and other allied professionals to provide a more comprehensive service to their clients.

There are three types of transformations taking place globally: Digital transformation. This involves integrating advanced technology and AI into financial planning, as mentioned above, which helps in optimising client interactions and backend processes. Regulatory transformation. There is a global shift in regulatory frameworks, focusing extensively on anti-money laundering (AML) and counter-financing of terrorism (CFT). This transformation aims to enhance client outcomes and bolster consumer protection. Diversity and inclusion transformation. It is crucial to include a broader group of diverse candidates within the financial sector. True diversity is ineffective without inclusion.

Additionally, more financial planning practices are adopting a client-centric approach, emphasising clients’ financial wellbeing. This approach includes setting clear financial goals and enhancing consumer education to help clients understand the broader financial landscape, with a particular focus on the client’s financial well-being.

What advice would you give financial planners on how to cultivate growth so that they can harvest excellence?

A growth mindset is key in the financial planning industry, where challenges teach resilience and determination. Continual learning, such as engaging in Continuing Professional Development (CPD), is crucial for meeting professional requirements and for personal and professional growth. Understanding the right technology and assembling a competent team is vital for business growth. Effective mentorship tailored to company culture further enhances staff development.

Maintaining high ethical standards and adhering to a professional code of ethics are essential for cultivating excellence. Regular feedback from clients and other stakeholders is crucial for identifying strengths and areas for improvement, ensuring that financial planners are responsive and initiative-taking in enhancing their services.

What do you deem to be the most critical component of success for financial planners?

Trust is the cornerstone of success in financial planning. Establishing and maintaining trust involves consistent ethical behaviour, transparency, competency and the ability to deliver tailored, effective financial advice. Building strong, trust-based relationships with clients ensures long-term engagement and success.

How does the two-pot system respond to the socio-economic challenges in South Africa?

We know that South Africa has a poor savings culture and that the average household carries more debt than they can afford to pay off. Access to the savings component, after taxation (at marginal tax rates)

and administrative fees, may leave fund members with an amount far less than they expected to receive. However, this access could provide some temporary relief for severely cash-strapped families.

From the perspective of the retirement pot, the compulsory preservation until retirement will significantly aid in bolstering retirement savings over the long term.

SARS collects taxes from members withdrawing at marginal tax rates which will provide additional revenue that could potentially support economic development and hopefully reduce public debt.

What advice do you have for financial planners concerning the two-pot system?

Provide your clients with sufficient information to make informed decisions. Only the relevant retirement and taxation laws were changed to accommodate the two-pot system; FAIS and its subordinate legislation remain. Financial planners need to ensure that they provide suitable advice and help clients understand the impact of withdrawing from their retirement savings before retirement.

It is also in the interest of financial planners to stay up-to-date on the latest developments in retirement reform. Unfortunately, ignorance is no excuse for non-compliance with legislation.

The bottom line is that financial planners must continue to do what they do best – always put the client’s interests first and act with due care, diligence and competence.

Please discuss the challenges of bringing more women, people of colour and young people into the industry. The biggest challenge is the availability of funds to assist diverse candidates in obtaining the qualifications they need to operate in the industry, as well as opportunities to gain the right type of experience to become a financial advisor or planner.

Focusing on product sales and meeting sales targets does not help diverse candidates reach their full potential, which could be achieved with more structured mentorship and guidance from experienced mentors. Additionally, I have observed that disparities in salary scales are unfortunately still a reality. Why is it acceptable to pay someone less just because they are female or young?

Please provide a message to the FPI members.

We extend our heartfelt thanks to our members for their unwavering support. During the Financial Planner of the Year final interviews, one entrant highlighted the importance of member involvement in the FPI. I wholeheartedly agree – a professional body is only as strong as the support it receives from its members. Reflecting on this, I am filled with gratitude for those members actively engaged in the workings of the FPI. We have over 300 members contributing to the FPI as an extension of our human capital arm, helping to advance our vision and mission. It would be impossible for FPI to achieve what we do with only our 40 staff members. We are who we are because of the support from our professional and corporate members. Thank you for your dedication and commitment.

Meet the Top Candidate Award Winner 2023, Stephan Lombaard. The Award recognises the top candidate who completed the CFP® Professional Competency Examinations for professional membership of the FPI.

Please supply a brief biography of yourself.

I grew up in a small town called Wellington in the heart of the Boland, Western Cape. I originally studied Human Resource Management in Stellenbosch, after which I completed my Postgraduate Diploma in Financial Planning at the Stellenbosch Business School. I have always been passionate about working with people and during my undergraduate studies, I developed a strong interest in finance. Financial planning therefore served as the perfect intersection between the two. I am currently working at Allan Gray where I enjoy the corporate side of investments and finance. In my spare time, I enjoy making music and exploring the Western Cape with good company.

I hope to see a future where our industry plays a larger role in advancing financial literacy.

What did you achieve by entering the competition?

I participated in the CFP® Professional Competency Exam (PCE) to earn the CFP® designation and equip myself with the essential knowledge to excel in my career. I knew that the standard of excellence that the mark provides would boost my career and provide me with the credibility and knowledge to navigate my future in the industry.

The winner is selected from the highest mark received for the CFP® Professional Competency Examination. What did the examination entail?

The PCE examination forms part of the requirements to gain the CFP® mark in South Africa. The exam is presented in a case study format and tests the application of the knowledge gained during the Postgraduate Diploma in Financial Planning. It covered all aspects of the financial planning process from the initial client meeting to preparing for retirement and managing a client ’ s estate. The exam requires individuals to go beyond memorisation of facts and instead tests their ability to apply knowledge

across various topics and think critically, ultimately better preparing them for the industry.

How did taking the examination equip you for the future?

Passing the PCE exam has provided me with thorough knowledge of the financial planning landscape with an in-depth understanding of the product rules, tax and legislation. I believe that the knowledge gained is invaluable to anyone likely to pursue a career in the investment and personal finance sectors.

Although I am not currently functioning as a financial planner, the knowledge gained is a massive value-add to my career as it gives me the confidence and ability to do my best in any direction I pursue.

What changes would you like to see in the profession?

A big challenge we face in South Africa is a lack of general financial literacy among most of the population. Many South Africans have little to no knowledge of investments, retirement planning or healthy financial habits. With savings rates being critically low and very few individuals being able to retire comfortably, education is imperative to lift our country out of poverty and inequality. I believe that the financial planning industry is uniquely positioned to address this gap through advocacy, training and education. I hope to see a future where our industry plays a larger role in advancing financial literacy and enhancing the accessibility of education through collaboration with government and local communities.

The FPI strives to increase professional opportunities for the widest spectrum of people so that all may thrive in the financial planning profession. The Institute established the FPI Diversity and Inclusion Award to promote the inclusiveness of diverse communities in the profession. Olwethu Masanabo was nominated as the winner of this Award in 2023.

Please supply a brief biography of yourself.

I am the director and founder of Pragmatic Academy which aims to be what I can only describe as a hub of excellence for financial planning with a particular focus on the black middleclass demographic. The services include training, coaching and mentoring of financial advisors to better service the black middleclass segment. We also have programmes for para-planners, managers of financial advisors and assistants to financial advisors. Our existence was sparked by a realisation that the world has ushered in remarkable diversity among financial professionals and the recipients of financial planning services. However, the methods employed for professional training have remained static and are suitable for serving a narrow demographic.

I am also a non-executive director and chairperson of the Human Capital Management Committee and Diversity and Inclusion subcommittee at the FPI, a non-executive director at BDO Wealth, an independent trustee at the Old Mutual Black Distributors Trust as well as a non-executive director of the BDT SPV (a company that is owned by the Trust).

Please talk to us about your background and experience of diversity and inclusion in the profession.

I started in the industry as a financial advisor many years ago and it was extremely challenging for me as a black person. All the things we were taught that were meant to make us successful financial advisors just did not seem to work with black clients (which is the demographic I was mainly working in) and there were no alternatives that were provided. So, I ended up moving to other roles which included training financial advisors. That is when I started bringing in aspects of how financial advisors could better service the black population and add value to them based on my experience. I also started bringing in other aspects that could help black financial advisors to increase their chances of being successful.

What did you learn through the process of applying for the award?