MTN is evolving into a technology company with a broad range of services across many platforms, as CEO Charles Molapisi outlines.

MTN has, over the years, been connecting millions of South Africans. Currently, MTN shares the benefits of a modern connected life with 33-million customers across South Africa.

Our Ambition 2025: “Digital solutions for Africa’s progress” is driving accelerated growth and faster deleveraging, positioning MTN for greater relevance to 2025.

Our brand refresh is inspired by our new strategy, Ambition 2025. MTN is ushering in a new look that is aligned to our evolution from a telecommunications company to a technology company underpinned by one simple, consistent, yet striking brand.

As a platform business we build digital platforms that enable Africa’s progress across the telecom, fintech, fibre-data, API and content and messaging ecosystem.

The new brand identity is modern, simple, bold and digitally dynamic. It kicks off with a provocative and simple question, “What are we doing today?”

With a clear and concise brand strategy that Opportunity + Energy = Progress, MTN understands that to truly unlock the full benefits and potential of the digital world, people require a combination of drive, progressive thinking and the right tools. ■

Mercia Grimbeek, ENERTRAG South Africa’s Development Director, believes that a collaborative approach is needed to achieve a Just Energy Transition.

Is the Renewable Energy Independent Power Producer Procurement Programme (REI4P) proceeding satisfactorily?

The REI4P has gained momentum after a significant hiatus. Industry has seen the commitment from government to significantly deploy renewables through the execution of Bid Rounds six and beyond.

What are the biggest challenges in the sector in South Africa?

The most significant challenges relate to grid infrastructure. The country has a supply of well-developed projects that can be executed but a lack of transmission grid to evacuate power in certain geographical areas is a major constraint. A second challenge is the regulatory environment. Once again, as evidenced by the recent presidential announcements, there has been positive movement to expedite certain processes. As industry we now look forward to placing electrons on the grid with more streamlined regulatory processes in place.

Does ENERTRAG believe a “Just Energy Transition” is possible?

ENERTRAG is fully supportive of a Just Energy Transition but we are mindful that this can only be achieved through a collaborative process that includes consultation with a multitude of stakeholders. We view the Just Transition as the journey to low emissions and a climate-resilient economy, while engaging to ensure that the transition is equitable. ENERTRAG acknowledges that the transition is not only climate related but it addresses social and economic issues that impact the competitiveness and livelihoods of South Africans.

Mercia Grimbeek is a seasoned development professional in the energy and environment industry. She has extensive local and international experience in the development of renewable projects. She currently holds the position of Development Director at ENERTRAG South Africa. Mercia continues to contribute to the development and growth of the renewable industry and serves as Director and Chairperson of the South African Wind Energy Association (SAWEA). She is an avid champion for the development of women and youth in the industry.

Where are the company’s operations in Mpumalanga?

ENERTRAG has invested substantially in the development of projects across the Mpumalanga province. Areas that have sufficient wind and solar resource were identified and are being permitted for execution.

What is the point of difference that ENERTRAG offers?

ENERTRAG’s point of difference is its holistic-energy system approach. We differentiate ourselves through the optimisation of technologies to support the transition to a carbon-neutral economy. To this end we have been operating a green-hydrogen production facility since 2010 and provide fuels for heating and transportation that are completely green.

Are there new technologies that lie ahead which could help the world move away from fossil fuels?

The advancements in electrolyser technology will shift the way the world produces and consumes fuels such as hydrogen and ammonia. This will support the acceleration away from fossil fuels and aid the production of sustainable fuels. ■

A new agency has been created to smooth the way to a greener economy while Eskom makes land available for renewable projects.

ABOUT THE COVER: Top left, then clockwise: Sasol’s octene plant at Secunda, Sasol; Textile techniques, Standerton Mills; More than 500 bird species have been spotted in the Kruger National Park, Mpumalanga Tourism and Parks Agency; Some of the country’s best architectural firms competed to design buildings for the University of Mpumalanga; University of Mpumalanga; Macadamias, Freepik.com; Precision is vital in mining, SASOL; Centre; Hot-air ballooning, MTPA.

Publishing director:

Chris Whales

Editor: John Young

Managing director: Clive During

Online editor: Christoff Scholtz

Designer: Tyra Martin

Production: Yonella Ngaba

Ad sales:

Gavin van der Merwe

Sam Oliver

Gabriel Venter

Vanessa Wallace

Shiko Diala

Administration & accounts:

Charlene Steynberg

Kathy Wootton

Distribution and circulation

manager: Edward MacDonald

Printing: FA Print

The 2022/23 edition of Mpumalanga Business is the 13th issue of this successful publication that since its launch in 2008 has established itself as the premier business and investment guide for the province.

With messages of welcome to potential investors from both the provincial premier and the MEC responsible for Economic Development and Tourism, this edition of the journal also contains the official Mpumalanga Investment Prospectus, a comprehensive survey of the province’s assets and the potential of the region. Major catalytic projects such as the Nkomazi Special Economic Zone (NSEZ) and the Mpumalanga International Fresh Produce Market (MIFPM) are examined in detail, outlining how producers, processors and logistics firms stand to benefit and where there is potential for investment. In addition to the Prospectus, the journal contains a special feature on education and a series of brief news briefs about some of the most important sectors in the provincial economy.

To complement the extensive local, national and international distribution of the print edition, the full content can also be viewed online at www.globalafricanetwork.com. Updated information on Mpumalanga is also available through our monthly e-newsletter, which you can subscribe to online at www.gan.co.za, in addition to our complementary business-to-business titles that cover all nine provinces, our flagship South African Business title and the new addition our list of publications, African Business, which was launched in 2020. ■

Chris Whales

Publisher, Global Africa Network Media | Email: chris@gan.co.za

PUBLISHED BY

Mpumalanga Business is distributed internationally on outgoing and incoming trade missions, through trade and investment agencies; to foreign offices in South Africa’s main trading partners around the world; at top national and international events; through the offices of foreign representatives in South Africa; as well as nationally and regionally via chambers of commerce, tourism offices, airport lounges, provincial government departments, municipalities and companies.

Member of the Audit Bureau of Circulations

COPYRIGHT | Mpumalanga Business is an independent publication published by Global Africa Network Media (Pty) Ltd. Full copyright to the publication vests with Global Africa Network Media (Pty) Ltd. No part of the publication may be reproduced in any form without the written permission of Global Africa Network Media (Pty) Ltd.

PHOTO CREDITS | Anglo American, Air Liquide, Enaex, Eskom, Eurowings Discover, Gert Sibande TVET College, MEGA, Middelburginfo, Motheo Group, PG Bison, Southern African Wildlife College, Ubank, University of Mpumalanga.

Global Africa Network Media (Pty) Ltd

Company Registration No: 2004/004982/07

Directors: Clive During, Chris Whales

Physical address: 28 Main Road, Rondebosch 7700

Tel: +27 21 657 6200 | Fax: +27 21 674 6943

Email: info@gan.co.za | Website: www.gan.co.za

ISSN 2222-3274

DISCLAIMER | While the publisher, Global Africa Network Media (Pty) Ltd, has used all reasonable efforts to ensure that the information contained in Mpumalanga Business is accurate and up-to-date, the publishers make no representations as to the accuracy, quality, timeliness, or completeness of the information. Global Africa Network will not accept responsibility for any loss or damage suffered as a result of the use of or any reliance placed on such information.

Companies in a wide range of sectors are already invested in Mpumalanga – and are ramping up the commitments with new investments

Mpumalanga’s diverse and resource-rich economy makes it one of the most attractive trade and investment destinations in South East Africa. A large, growing domestic market and excellent access, supported by world-class infrastructure, to the East African and Indian Ocean markets through Maputo Port makes Mpumalanga an ideal investment location for export-driven manufacturing and production.

Mpumalanga is one of South Africa’s most productive and important agricultural regions and through strategic investments in the Mpumalanga International Fresh Produce Market (MIFPM) and the Nkomazi Special Economic Zone (NSEZ) the province is set to become a major force in food production and distribution.

Mpumalanga’s sophisticated and well-segmented tourism and hospitality sector in a post-Covid world is ripe for investment and expansion.

68% of land area in the province is used by agriculture

Mpumalanga’s three biggest sectors are manufacturing, mining & agriculture.

• Abundant resources: minerals and agricultural produce

• Established manufacturing infrastructure: smelters, petrochemicals, food processing, paper, sugar

• Strategic location and access to regional and global markets

• Tourism hotspots: the iconic Kruger National Park, worldclass reserves, adventure tourism and new UNESCO World Heritage Site

• Mpumalanga International Fresh Produce Market (MIFPM)

• Nkomazi Special Economic Zone (NSEZ)

• Newly established University of Mpumalanga

• Support for Green Economy research and investment

MpumalangaMpumalanga’s STRATEGIC LOCATION makes it a valuable transport and logistics hub

Capital City

province in eastern South Africa, bordering the nations of Swaziland and Mozambique

• Maputo Development Corridor enhances logistics

• Preferential access to lucrative EU market

• Proximity to South Africa’s economic heartland

• Access to regional SADC market: 360-million population

• Access to deepwater

Port of Maputo

Mbombela (Nelspruit)

Main major towns

Ermelo

eMalahleni

Middelburg

Secunda

Airport

Kruger Mpumalanga

International Airport

Population

4.5-million people

The Maputo Development Corridor is South Africa’s leading Spatial Development Initiative (SDI), linking Mpumalanga Province, Gauteng Province and the Nkomazi Special Economic Zone with the deepwater Port of Maputo in Mozambique. This efficient corridor provides investors and exporters with good access to the export markets of South East Africa, the Indian Ocean Rim and Far East Asia. The Maputo Development Corridor comprises

road, rail, Special Economic Zone, border posts, port and terminal facilities. The corridor runs through the most highly industrialised and productive regions of Southern Africa. The Corridor has been extensively upgraded to international standards and links the industrial heartland of South Africa to its nearest port in Maputo, Mozambique, which is one of the fastest-growing countries in South East Africa.

On behalf of the Provincial Government and the people of Mpumalanga I wish to welcome this opportunity for our province to present its policies and programmes, business opportunities, and private sector success stories.

Despite what many consider an uncertain global economic outlook, our province has embraced a post-Covid ascendance with bountiful opportunities that can be tapped into through entrepreneurship and collaboration.

Mpumalanga is the home of more than 4.68-million residents (7.8% of the national population), and is the fifth-biggest regional economy in South Africa. It has a diverse and resource-rich economy that makes it one of the most attractive trade and investment destinations in South-East Africa.

This publication is intended to expose potential investors and business communities to market opportunities in Mpumalanga relating to identified sectors such as agriculture, manufacturing, mining, tourism and renewable energy.

We wish to welcome all interested parties to join us in an inclusive growth and sustainable development journey through innovative flagship projects such as the Mpumalanga Economic Reconstruction and Recovery Plan

(MERRP), the Nkomazi Special Economic Zone (SEZ), the Mpumalanga International Fresh Produce Market (MIFPM) and many more outlined in the following pages. Private-public partnerships are bearing fruit in the tourism sector, as illustrated by the exciting Skywalk Project at God’s Window an d a hotel and conference centre under construction in Middelburg. We are delighted to welcome direct flights to our province from Eurowings Discover, a division of Lufthansa. A Just Energy Transition and Climate Change Working Group has been established to guide policy on these vital issues. Our province is aggressively pursuing the implementation of strategies for economic recovery from Covid-19 that will also foster diversification of its mineral-rich economy and increase labour absorption in its key sectors. The provincial government, together with districts, local municipalities and state-owned enterprises, has identified interventions that are aligned with the national Economic Reconstruction and Recovery Plan (ERRP). Mpumalanga has adapted elements of the plan to ensure relevance and effective implementation. This will help our economy to grow as we actively build back in a more efficient manner. We invite investors to join us on this journey to a more prosperous and inclusive future.

investors to share in the growth of Mpumalanga, together with the residents of a province rich in resources and talent.Premier Refilwe Mtshweni-Tsipane

There are many varied and exciting opportunities for investment in Mpumalanga. Department of Economic

Mpumalanga Province is increasingly being seen as an investment destination of choice and we are working hard to market it as such.

Quarterly investment roundtable discussions in each of the province’s three districts have been held and international visits are promoting the province’s qualities. The Investment Summit is a culmination of this process, but it will also continue beyond the Summit.

The private sector has announced huge investments in the province, targeting projects in solar energy, wind energy, biomass, battery storage, gas, wood-bonding material, hybrid fuel rods, waste gas from ferrochrome, land rehabilitation, reclamation of mine water and sustainable agriculture.

We are proud to announce that the Mpumalanga Green Cluster has been granted membership of the ICN (International Cleantech Network). This gives the province access to over 15 000 tech companies, providing opportunities for information, knowledge, technology and business exchange, further boosting Mpumalanga’s prospects for job creation and investment attraction.

These sorts of structures and partnerships are relatively new and are a way to ensure that the best aspects of government, business and academia

can be applied towards development that unlocks jobs and investment.

We see the Green Cluster as a key mechanism for the implementation of enabling investment in the Green Economy. Several energy projects have been launched. For example, investment commitments to the value of R75-billion in wind energy have been secured, which have the potential to create over 13 000 jobs. Municipalities are aware of the work that must be done to grow the Green Economy. In support of potential new investments and working with the Office of the Premier, our department has successfully hosted an Energy Summit at eMalahleni, with the objective to create pathways for a “Just Transition”. Rebooting the economy to accommodate the Green Economy in a just way will create tremendous opportunities for creative investors in Mpumalanga.

As an indication that we are on the right track, the Nkomazi Special Economic Zone already has an investment pipeline worth over R10-billion in the agroprocessing, green energy and logistics sectors.

We invite other investors to join the new wave of investing in Mpumalanga!

MEC Vusi MkhatshwaThe Mpumalanga Economic Growth Agency (MEGA) is the official Economic Development Agency for the Mpumalanga Provincial Government.

MEGA’s primary mandate is to foster the sustainable growth and development of Mpumalanga’s economy through its operational activities of Trade and Investment Promotion, Development Funding, Equity Investments, and Property and Infrastructure Development. The Agency remains accountable to the Mpumalanga Department of Economic Development and Tourism (DEDT).

MEGA is the foreign investor’s or trader’s first point of contact for doing successful business in Mpumalanga Province. Through the Trade and Investment Promotion Division, the Agency provides a variety of services to potential investors and trading partners.

MEGA staff will go out of their way to make the process of investing in Mpumalanga or starting a business in the province easy. MEGA is focussed on customer needs and provides innovative solutions with a high level of service. Services include:

• Foreign Trade Promotion

• Investment Promotion

• Funding

• Property Management and Infrastructure Development

National government has articulated a Nine-Point Plan which seeks to prioritise projects that will tackle key economic issues. MEGA is aligned with the plan, which include issues relevant to growing the provincial economy:

• revitalise agriculture and the agro-processing chain

• advancing mineral beneficiation

• implementing the Industrial Policy Action Plan (IPAP) effectively

• unlocking the potential of SMMEs, cooperatives and township and rural enterprises

• resolving the energy challenge

• stabilising the labour market

• upscaling private investment

• investment in science and technology, water and sanitation, transport and broadband connectivity

Africa’s exports could increase by $560-billion and some experts predict that continental business and consumer spending could reach $6.7-trillion by 2030.

$450 BILLION

AfCFTA could boost regional income by 7% or $450-billion

(Source: the World Bank)

AfCFTA could lift -million people

30

out of poverty, according to the World Bank

10% AfCFTA could boost wages by up to

* World Bank estimate

South Africa is a member of one of Africa’s oldest regional organisations, the 16-member Southern African Development Community, (SADC). This enables duty-free trade within a growing market of more than 360-million people. All goods shipped under SADC Certificate of Origin receive duty-free status.

within a GROWING MARKET of more than360 million people

The provincial economy of Mpumalanga is exceptionally diverse. Established industries in the province include Mining, Stainless Steel, Petrochemicals, Pulp and Paper, FerroAlloys, Energy Generation, Tourism, Agriculture and Agro-Processing, among others.

Companies in these sectors include global giants in their industries such as Sasol (energy and chemicals), Sappi (paper, packaging, pulp and forests), Samancor Chrome (ferrochrome), Sibanye-Stillwater and Glencore (mining). The province’s commercial farmers are among the most efficient in the world, exporting huge quantities of everything from citrus to macadamia nuts. Columbus Stainless is the only stainless-steel manufacturer on the continent.

28% 38% 34% Nkangala

Transport

The province has three district municipalities and 17 local municipalities. Several agencies which promote the regional economy report to the Mpumalanga Provincial Government. Large parts of the province comprises extensive rural villages that form part of areas run by traditional authorities.

Two airports at Hoedspruit (Eastgate Airport) and Mbombela (Kruger Mpumalanga International Airport, KMIA) plus many airfields. Extensive freight rail network, busiest in South Africa. N4 highway (Maputo Corridor) is an east-west spine of highly-developed road system.

The Mpumalanga Economic Growth Agency (MEGA) is the official Economic Development Agency for the Mpumalanga Provincial Government.

MEGA’s primary mandate is to foster the sustainable growth and development of Mpumalanga’s economy through its operational activities of Trade and Investment Promotion, Development Funding, Equity Investments, and Property and Infrastructure Development. The Agency remains accountable to the Mpumalanga Department of Economic Development and Tourism (DEDT).

MEGA is the foreign investor’s or trader’s first point of contact for doing successful business in Mpumalanga Province. Through the Trade and Investment Promotion Division, the Agency provides a variety of services to potential investors and trading partners.

MEGA staff will go out of their way to make the process of investing in Mpumalanga or starting a business in the province easy. MEGA is focussed on customer needs and provides innovative solutions with a high level of service. Services include:

• Foreign Trade Promotion

• Investment Promotion

• Funding

• Property Management and Infrastructure Development

National government has articulated a Nine-Point Plan which seeks to prioritise projects that will tackle key economic issues. MEGA is aligned with the plan, which include issues relevant to growing the provincial economy:

• revitalise agriculture and the agro-processing chain

• advancing mineral beneficiation

• implementing the Industrial Policy Action Plan (IPAP) effectively

• unlocking the potential of SMMEs, cooperatives and township and rural enterprises

• resolving the energy challenge

• stabilising the labour market

• upscaling private investment

• investment in science and technology, water and sanitation, transport and broadband connectivity

Agriculture in Mpumalanga is responsible for 3% of the province’s gross value added by region (GVA-R) and can be divided into the following categories (see map, right).

Mpumalanga Province is one of South Africa’s most productive and important agricultural regions and plays a key role in the export profile of South Africa, primarily in fruit and nuts. The province’s economic diversity extends into the agriculture sector where the natural topography of the province divides this sector between the Highveld and Lowveld Regions.

AGRICULTURE

SUMMER CEREALS & LEGUMES

MAIZE Maize meal

SOYA Meal, Edible oil

CANOLA Edible oil

SUNFLOWER Edible oil

TROPICAL & SUBTROPICAL FRUIT

CANE SUGAR Sugar / confectionery

CITRUS Juice & concentrate

MANGOES Dried, frozen, juice & concentrates

LITCHIS Dried, frozen, juice & concentrates

AVOCADOES Avocado oil

GUAVA Dried, frozen, juice & concentrates

MACADAMIA NUTS

Processed & confectionery

$94.9-million

91 000 tons

Highveld Region: Summer cereals and legumes: maize, soya, canola, sunflower. Animal products: bovine meat, swine, sheep and poultry. Lowveld Region: Subtropical and citrus fruits, nuts and cane sugar.

The Highveld Region in the west of the province is at an elevation of between 4 000 and 6 000 feet above sea level. This allows for the large-scale and commercial production of cereals and legumes like maize, soya, canola and sunflower. The subtropical region of the Mpumalanga Lowveld plays a key role in the agricultural export profile of the province, primarily in fruit and nuts.

Mpumalanga Province is one of the world largest producers and exporters of citrus fruit. Duty-free exports of South African citrus to the USA under the African Growth and Opportunity Act (AGOA) reached a peak of 91 000 tons in 2020 ($94.9-million) and are expected to continue their strong annual growth as the USA is still considered a premium market. Mpumalanga Province is the world’s largest producer and exporter of macadamia nuts. The province earned $207-million in exports in 2019, $76-million of this to the US. There have been major new investments in processing facilities in Mpumalanga.

Mpumalanga’s rich agricultural produce is utilised

4 000ha

Forestry is a key driver for the development of Mpumalanga’s rural economy and a major provider of job opportunities. About 40% of SA’s sustainable forests are located in Mpumalanga Province. The industry comprises logging, saw-milling, wood products, wood board, pulp and paper as well as specialised cellulose.

Specialised cellulose is a sought-after natural, renewable fibre with a wide range of uses in the textile, consumer goods, foodstuff and pharmaceutical industries and is produced in large quantities at Sappi Ngodwana.

PG Bison has recently invested R560-million in a new front-end dryer for its particleboard plant in Mkhondo (Piet Retief). The company is also building a new medium-density fibreboard (MDF) plant at its Mpumalanga plant.

SAFCOL/Komatiland is the state forestry company with commercial and non-commercial operations covering a land area of 187 320ha.

R9.5 billion Amount invested in the foresty industry

40%

Of South Africa’s sustainable forests are located in Mpumalanga and it leads the nation in hectares planted and export earnings

R560-million

Sonae Arauco is a Portuguese investment. A new entrant, local BEE company the FX Group, is commissioning a greenfield particle board plant in Lothair in the Gert Sibande District.

PG Bison’s recent investment in a new front-end dryer for its particleboard plant in Mkhondo (Piet Retief)Mining is the province’s largest single sector providing employment to 5.2% of the province’s workforce and making up 20% of gross value added by region (GVA-R).

Coal: 83% of South Africa’s coal production, 50% of national coal reserves, third-largest coal-exporting region in the world. Coal is the lifeblood of provincial economy, fuelling 11 Eskom power plants, which produce 80% of South Africa’s electricity. Coal is Mpumalanga’s single largest export product, shipping mainly to India and Pakistan.

50% of South Africa’s national coal reserves

Other minerals: Gold mining takes place in Evander, Pilgrim’s Rest and Barberton. Gold is the second-largest export from the province.Platinum and chrome ore mining is located in the Steelpoort and Burgersfort areas in the north of the province and make up part of the Bushveld Igneous Complex. The mining services and technology industry is an important subsector in Mpumalanga. With over a century of commercial mining operations in the province, homegrown technologies are now exported globally. National utility Eskom will spend R3.3-billion on the revival of the Matla coal mine. Exxaro Resources will manage the project and do the mining while major companies such as DRA, Worley, Sandvik and WBHO will also be involved. Other companies engaged in expansion of life-of-mine projects are Pan African Resources and Evander (Elikhulu tailings), Exxaro Resources (Leeuwpan) and South32, which is spending about R4.3-billion at Klipspruit. Platinum is an important mineral for the modern economy. Two Rivers is a joint venture between Implats (46%) and African Rainbow Minerals which is located on the southern part of the eastern limb of the Bushveld Igneous Complex, 35km south-west of Burgersfort in Mpumalanga.

Lydenburg is home to the Lion ferrochrome smelter that is a joint venture between Glencore and Merafe Resources.

R3.8-billion

69 000

Platinum group metals (PGMs) projects are underway in the province, home to part of the eastern limb of the Bushveld Igneous Complex

Mpumalanga has historically been at the heart of the South African energy and industrial complex and is still heavily reliant on the mining and burning of fossil fuels. The Mpumalanga Provincial Government has been proactive in exploring opportunities in the Green Economy and pursuing a just transition to a low-carbon economy which secures the future and livelihoods of workers and their communities. Achieving such a just transition would require an integration of economic opportunities in sectors outside of energy and mining.

A Just Energy Transition (JET) to a Green Economy presents the following opportunities:

• Renewable energy: solar, biomass, natural products

• Gas and associated industries

• Sustainable smart agriculture: environmentally-friendly agriculture and agricultural processing

• Circular Green Economy: waste recycling, water reclamation, land rehabilitation

• Soft infrastructure: reskilling and institutional capacity-building for a carbon-neutral future

• Hard infrastructure: investment and expertise are needed in urban planning, water and waste management

• Building technologies: greener and more energy-efficient

The biomass

• Transport and logistics: greener and more energy-efficient

Specific opportunities include:

•There are plans for the decommissioning of 11 000MW of Eskom’s coal-fired capacity by 2030. Opportunities are presented by repurposing land.

• The vast new fields of natural gas found off the coast of Mozambique could have a big impact on the Mpumalanga economy.

• A Renewable Energy Development Zone (REDZ) is planned for eMalahleni / Witbank where coal jobs are at risk.

Mill

in March 2022 and can get through 35 tons per hour of biomass

Three primary pillars of the manufacturing sector in Mpumalanga account for more than 60% of the output of the manufacturing sector, which overall makes up 15% of gross value added, regional (GVA-R).

Fuel, petroleum and chemical products are manufactured at the Sasol Secunda plant in Secunda, Gert Sibande District. It is one of the world’s largest synthetic fuels facilities, producing 60-million litres of liquid fuel a day. Products produced include petroleum, paraffin, jet fuel, creosote, bitumen and waxes.

The ferro-alloy and stainless-steel industries are based in the Nkangala District. Columbus Stainless in Middelburg is Africa’s only producer of stainless-steel flat products. Samancor Chrome (Ferrometals), the world’s second-largest ferrochrome producer, has two plants in Mpumalanga.

MAIN EXPORTS

STAINLESS STEEL

Cutlery

Catering equipment

Surgical instruments

Automotive components

STEEL White & grey goods

Pipes & tubes

Wire

PETROCHEMICALS

Plastic products

Recycling plastics

Artificial rubber products

Paint & vanish

Inks & dyes

FOOD PROCESSING

Maize meal

Machinery

Frozen & dehydrated

VEGETABLES Preserves, pickles & condiments

Nuts

PAPER Recycling

SUGAR Confectionery

MINING Machinery and services

RENEWABLE ENERGY

Solar and biofuel

Biomass

Agro-processing is mainly based in the Lowveld Region and consists of manufacturing forestry products (pulp, paper and cellulose), sugar at the Selati RCL Foods plants in Nkomazi and processing subtropical fruit and nuts. The province’s flourishing macadamia nut industry has a number of large processing facilities based around the provincial capital Mbombela. Subtropical fruits like mango, banana, papaya and citrus are processed into juice concentrate or dried for export.

There is a geographical divide in the manufacturing sector. Fuel, petroleum and chemical production occurs in the southern Highveld Region clustered around Sasol’s plants.

The northern Highveld area, including Middelburg and eMalahleni (Witbank), is home to ferro-alloy, steel and stainless-steel concerns. Creative thinking kicked in when Highveld Steel’s troubles reached a tipping point. The 1 000ha property in Emalahleni has been re-purposed as a multi-purpose site for industry and commerce. Called the Highveld Industrial Park, the project promotes a wide range of manufacturing enterprises.

In the Lowveld, agricultural and forestry products are processed while Sappi’s giant mill is close to the company’s forests south-west of the provincial capital, Mbombela.

The importance of tourism to the economy of Mpumalanga cannot be overstated. The effect of the Covid-19 pandemic has been strongly felt. Mpumalanga received only 340 000 international visitors in 2020, down from 1.6-million international visitors in 2019. The key source countries were Mozambique, eSwatini, the USA, Germany, France and the UK.

Domestic tourism has steadily increased. The total tourist foreign direct spend (TTFDS) in Mpumalanga for 2020 was R7.5-billion, down from over R21-billion in 2019. The sector accounts for 6% of gross value added, by region (GVA-R). The announcement in 2022 by Eurowings Discover, a new division of Lufthansa, that it would start flying three times a week to Mbombela from Frankfurt, via Windhoek, will give a certain boost to tourist numbers visiting Mpumalanga. The Kruger National Park is Mpumalanga’s most famous tourist asset and safaris and hunting are major tourist attractions. The Manyeleti Reserve, a 23 750-hectare game reserve sharing a fenceless border with the Kruger National Park, is operated and managed by the Mpumalanga Tourism and Parks Agency (MTPA). God’s Window and the Blyde River Canyon Reserve are other provincial treasures attracting investment.

1.6 MILLION

Number of visitors

Business travel, including conferencing, adventure, heritage and cultural tourism, all hold huge growth potential in Mpumalanga, but require investment in infrastructure and product development.

ANNUALLY pre-COVID-19

3.7km

A hotel and conference centre project in Middelburg is making progress and should be completed in 2023.

Selected Strategic High Impact Projects:

This natural water wonder is a major tourism attraction in the Mpumalanga Lowveld. This project presents an investment opportunity for a five-star hotel and a top-quality restaurant.

Feasibility study: completed

Environmental Impact Assessment (EIA): commenced

Model: Joint Venture (JV), Build-Operate-Transfer (BOT)

Value: R100-million

The Blyde River Canyon is the largest and deepest green canyon in the world and offers a spectacular opportunity to build a cable car transporting tourists from the top of the canyon to the peninsula below.

Feasibility study: completed

EIA: commenced

Model: JV, BOT

Value: R500-million

The project to build a “Sky Walk”, an incomegenerating tourism attraction off the edge of the 700m

God’s Window cliffs, giving 360-degree panoramic views out and down through a glass floor.

Feasibility study: completed

EIA: commenced

Investors secured

Model: JV, BOT

Value: R100-million

MEGA is establishing a R1.2-billion fresh produce market facility located in Mbombela, the Mpumalanga International Fresh Produce Market (MIFPM). To date the province has invested an estimated R540-million in the project.

Mpumalanga is one of South Africa’s most productive and important agriculture regions. It is home to predominantly tropical and subtropical crops and vegetables owing to its conducive climate. The tropical and subtropical crops consist of avocado, banana, citrus, ginger, granadilla, guava, litchi, macadamia nut, mango, papaya and pineapple.

The vegetables produced include potatoes, tomatoes, pumpkins, sweet corn, onions, sweet potatoes, beetroot, carrots, green peas, cauliflower, cabbages and green beans.

Site: The site is in Mbombela on a 248ha plot less than 10km from the Central Business District. It is situated within the Maputo Development Corridor (MDC), linking Mpumalanga, Gauteng Province and the Nkomazi Special Economic Zone with the deepwater Port of Maputo in Mozambique.

The market: The market will give local farmers access to local, regional and international fresh produce markets and will aid in ensuring food security for the region.

The infrastructure of the MIFPM will attract international as well as the large domestic food retailers as a key processing and distribution point. It will also secure Mpumalanga’s position in the regional export market in fresh produce.

The market will offer:

• Open trading halls for fruit and vegetables

• A meat, fish and flower market

• Complementary cold storage, ripening facilities and pallet handling

• Processing facilities

• An export hall

• Bulk-breaking facilities for retail outlets

• Links with statutory organisations such as customs, PPEBC and EuroGap

• Transport and logistics enterprises

• Shared collation and pack house facilities for SMMEs

• Commercial services including banks and restaurants

• A food bank for NGOs

Feasibility study: completed

EIA: completed

Bulk infrastructure: completed

Top structures: underway

Model: JV, BOT

Value: R1-billion

Selected Strategic High Impact Projects:

The Nkomazi Special Economic Zone has been officially designated and MEGA has been appointed to establish the entity.

Manufacturing

SEZs are geographically designated areas set aside for specifically targeted economic activities that are supported through special tax incentives. An SEZ aims to be an economic development tool to promote rapid economic growth by using various support measures to attract targeted foreign and domestic investments and technology. The main goal is to support the implementation of South Africa’s industrial development programme.

2022/03/23

Strategically positioned in the border town of Komatipoort, the SEZ offers a multi-sector base of operations along the Maputo Development Corridor which provides exporters with good access through Maputo Port to the export markets of South East Africa, the Indian Ocean Rim and Far East Asia.

Distance to:

► Johannesburg –449km

► Mbombela –103km

► Maputo –99km

The Nkomazi SEZ will target investment from the agriculture, agro-processing, nutraceuticals and fertiliser production sectors, as having a strong focus on logistics and trade services.

The NSEZ offers the investor a unique and incentivised base of operations on the Maputo Development Corridor running through the most highly industrialised and productive regions of Southern Africa.

The Maputo Corridor is bound to develop even more as the Maputo harbour improves its handling and scheduling capacity. In the event that a second rail line to Maputo to complement the current rail link is developed, the shipment of mining products and agricultural produce to and from the Limpopo and Mpumalanga provinces will increase.

The NSEZ is set to provide One-Stop-Shop services, incentives, innovation platform, a competitive and transparent market environment, and timeous and efficient responses to investors’ market requirements.

Mpumalanga is proving to be a key player in the local economy as well as internationally.

Ferroy-alloys R33-billion ($2.2-billion)

Stainless steel R8.9-billion ($593.3-million)

Platinum R8.7-billion ($580-million)

Gold R7.3-billion ($486.7-million)

Macadamia nuts R4.2-billion ($280-million)

Coal R3.7-billion ($246.7-million)

Chrome ore R2.2-billion ($146.7-million)

Manganese R1.2-billion ($80-million)

Fuel wood R1-billion ($66.7-million)

Citrus fruit R604-million ($40.3-million)

UAE R9.9-billion ($664-million)

People’s Republic of China R9.8-billion ($663.3-million)

USA R8-billion ($533.3-million)

Mozambique R7.4-billion ($493.3-million)

Japan R5.5-billion ($366.6-million)

Korea R3.8-billion ($253.3-million)

Netherlands R3.3-billion ($220-million)

eSwatini R3-billion ($200-million)

Indonesia R2.9-billion ($193.3-million)

United Kingdom R2.7-billion ($180-million)

South Africa has eased the barriers to doing business for locals as well as international companies and individuals.

new legislation, no new Close Corporations can be created but CCs can convert to companies.

Registration of company

The company must be registered with the Companies and Intellectual P roper ties Commission (CPIC) in Pretoria within 21 days of the company being started There are a range of administrative procedures that need to be fulfilled.

A business bank account must be opened in the company’s name with a bank in South Africa.

Registration with the receiver of revenue

• As a Provisional Taxpayer

South Africa has a sophisticated legal, regulatory and banking system. Setting up a business in South Africa is a relatively straightforward process with assistance b eing offered by organisations such as the Department of Trade, Industry and Competition and provincial investment agencies like the Mpumalanga Economic Growth Agency (MEGA).

South African law regulates the establishment and conduct of businesses throughout the country. Tax, investment incentives, regulations governing imports, exports and visas are uniform throughout the country.

The particular environment varies from province to province with regard to the availability of human and natural resources, the infrastructure and support services, business opportunities and the quality of life. In this respect, MEGA can offer specific advice about the business environment in the province.

Business is regulated by the Companies Act and the Close Corporation Act, which cover accounting and reporting requirements. Under

• As a VAT vendor

• For Pay As You Earn (PAYE) income tax payable on money earned by employees

• For Standard Income Tax on Employees

Registration with the Department of Labour Businesses employing staff will have to contact the Department of Labour regarding mandatory contributions to the Unemployment Insurance Fund (UIF). Register with Compensation Commissioner for Compensation Fund: Files with the Compensation Fund (in the Department of Labour) for accident insurance (Workmen’s Compensation).

Registration with the local authority

Relevant only to businesses dealing in fresh foodstuffs or health matters.

• Checking exchange control procedures (note that non-residents are generally not subject to exchange controls except for certain categories of investment).

• Obtaining approval for building plans

• Applying for industry and export incentives

• Applying for import permits and verifying import duties payable

• Registering as an exporter if relevant and applying for an export permit.

or she has tried to find a suitably qualified local employee prior to hiring a foreigner?

INDUSTRIALPROPERTYTORENTINHARRISMITH FDCisrentingout18850sqmstandalonefactoryincludingFurniture ManufacturingMachinery,Equipment,andFurnitureforBusiness Operation..

INDUSTRIALPROPERTYTORENTINHARRISMITH FDCisrentingout18850sqmstandalonefactoryincludingFurniture ManufacturingMachinery,Equipment,andFurnitureforBusiness Operation..

ThefactoryisSituatedatSite2277inHarrismithandcloseproximitytoallamenities,on mainarterialroutesandQuickaccessontoN3Freeway.

• Is the prospective employee appropriately qualified and do they have the relevant experience?

ThefactoryisSituatedatSite2277inHarrismithandcloseproximitytoallamenities,on mainarterialroutesandQuickaccessontoN3Freeway.

Thisfactoryoffersthefollowing: SprinklerSystem.

4RollerDoors

Thisfactoryoffersthefollowing:

SprinklerSystem.

4RollerDoors

There are a variety of forms which businesses can take, including private and public companies, personal liability companies, non-profit companies, state-owned companies and even branches of foreign companies (or external companies).

Security uardHouse Wellfencedandsecured

Security uardHouse Wellfencedandsecured Ampleparking 3phasepowerwith100amps 8toilets,6officesandboardroom,reception,kitchenandseparatewarehouseablutionswith shower

Ampleparking

3phasepowerwith100amps

Occupationavailableimmediately.PleasecontactMrTefoMatlaformore informationortoview:

8toilets,6officesandboardroom,reception,kitchenandseparatewarehouseablutionswith shower

Tel 0514000800Email tefo fdc.co. awww.fdc.co. a

Foreign nationals who wish to establish their own business or a partnership in South Africa must, apart from having sufficient funds to support themselves and their family, be able to invest at least R2.5-million in the business.

Occupationavailableimmediately.PleasecontactMrTefoMatlaformore informationortoview:

Branches of foreign companies fall under Section 23 of the Companies Act of 2008 and are required to register as “external companies” with the CIPC. An external company is not required to appoint a local board of directors but must appoint a person resident in South Africa who is authorised to accept services of process and any notices served on the company. It must also appoint a registered local auditor and establish a registered office in South Africa.

Trademarks (including service marks) are valid for an initial period of 10 years and are renewable indefinitely for further 10-year periods. Patents are granted for 20 years, normally without an option to renew. The holder of a patent or trademark must pay an annual fee in order to preserve its validity. Patents and trademarks may be licensed but where this involves the payment of royalties to non-resident licensors, prior approval of the licensing agreement must be obtained from the dtic. South Africa is a signatory to the Berne Copyright Convention.

In considering whether or not to grant a work permit, the Department of Home Affairs will first evaluate the validity of the offer of employment by conducting a number of checks to confirm the following:

• Has the Department of Labour been contacted?

• Has the position been widely advertised?

• Is the prospective employer able to prove that he

FDCISZEROTOLERANCETOFRAUDANDCORRUPTION.PLEASEREPORTFRAUDAND CORRUPTIONINCIDENTSTOTHEFRAUDHOTLINE0800212154

Tel 0514000800Email tefo fdc.co. awww.fdc.co. a

CORRUPTIONINCIDENTSTOTHEFRAUDHOTLINE0800212154

The funds must originate overseas, be transferable to South Africa and belong to the applicant (ie emanate from the applicant’s own b ank account). The business must also create jobs for South African citizens. After six months to a year, proof will have to be submitted that the business is employing South African citizens or permanent residents, excluding family members of the employer.

Appl ications for work permits for selfemployment can only be lodged at the South African Consulate or Embassy in the applicant’s country of origin. The processing fee is US$186. The applicant would also have to lodge a repatriation guarantee with the consulate/embassy equivalent to the price of a one-way flight from South Africa back to his or her country of origin.

This guarantee is refundable once the applicant has either left South Africa permanently or obtained permanent residence. Any application for an extension of a business permit may be lodged locally. The processing fee per passport holder is R425. Some countries also need to pay R108 per return visa.

A list of countries to which this applies is available from the Department of Home Affairs. MEGA assists investors in applying for the relevant work permits to conduct their business.

MEGA will help new businesses by assisting in project appraisal and packaging, putting investors in touch with relevant agencies and government departments, a lerting i nvestors t o i nvestment incentives and setting up joint ventures where required. ■

A list of countries to which this applies is available from the Department of Home Affairs. MEGA assists investors in applying for the relevant work permits to conduct their business.

The South African government, particularly the Department of Trade, Industry and Competition, has a range of incentives available to investors, existing companies, entrepreneurs and co-operatives across many sectors.

South Africa wishes to diversify its economy a nd incentives are an important part of t he strategy to attract investors to the country.

The Department of Trade, Industry and Competition (the dtic) is the lead agency in the incentives programme, which aims to encourage lo cal and foreign investment into targeted economic sectors, but the Industrial Development Corporation (IDC) is the most influential funder of projects across South Africa.

Th e re are a variety of incentives available and these incentives can broadly be categorised according to the stage of project development:

• C onceptualisation of the project – including feasibility studies and research and develop-

ment (grants for R&D and feasibility studies, THRIP, Stp, etc)

• C apital expenditure – involving the creation or expansion of the productive capacity of businesses (MCEP, EIP, CIP, FIG, etc)

• Competitiveness enhancement – involving the introduction of efficiencies and whetting the competitive edge of established companies and commercial or industrial sectors (BBSDP, EMIA, CTCIP, etc)

• S ome of the incentives are sector-specific, for example the Aquaculture Development and Enhancement Programme (ADEP), Clothing and Textile Competitiveness Improvement Programme (CTCIP)

Key components of the incentive programme are the Manufacturing Incentive Programme (MIP) and the Manufacturing Competitiveness Enhancement Programme (MCEP). The initial MCEP, launched in 2012, was so successful that it was oversubscribed with almost 890 businesses receiving fundin g. A second phase of the programme was launched in 2016. The gran ts are not handouts as th e funding covers a maximum of 50% of the cost of the investment, with the remaind er to be sourced elsewhere.

The Enterprise Investment Programme (EIP) makes targeted grants to stimulate and promote investment, BEE and employment creation in the manufacturing an d tourism sectors. Aimed at smaller companies, the maximum grant is R30million. Specific tax deductions are permissible for larger companies investing in the manufacturing sector under Section 12i of the Income Tax Act.

Other incentives available to investors and existing businesses in more than one sector include the:

• Technology and Human Resources for Industry Programme (THRIP)

• Support Programme for Industrial Innovation (SPII)

• Black Business Supplier Development Programme (BBSDP), which is a cost-sharing grant offered to black-owned small enterprises

• Critical Infrastructure Programme (CIP) that covers between 10% and 30% of the total development costs of qualifying infrastructure

• C o-operative Incentive Scheme, which is a 90:10 matching cash grant for registered primary co-operatives

• S ector Specific Assistance Scheme, which is a reimbursable 80:20 cost-sharing grant that can be applied for by export councils, joint action groups and industry associations.

A lot of emphasis is placed on the potential role of small, medium and micro enterprises in job creation and a number of incentives are design-

Investments in infrastructure can attract rebates. The Highveld Industrial Park hosts factories in different sectors.

PG Bison are investing heavily in expanding manufacturing capacity. Credit: PG Bison

ed to promote the growth of these businesses. These include:

• Small Medium Enterprise Development Programme (SMEDP)

• Isivande Women’s Fund

• Seda Technology Programme (Stp).

• Seda is the Small Enterprise Development Agency, an agency of the Department of Small Business Development that exists to promote SMMEs.

The Export Marketing and Investment Assistance (EMIA) Scheme includes support for local businesses that wish to market their businesses internationally to potential importers and investors. The scheme offers financial assistance to South Africans travelling or exhibiting abroad as well as for inbound potential buyers of South African goods. ■

Department of Trade, Industry and Competition: www.thedtic.gov.za

Industrial Development Corporation: www.idc.co.za

Mpumalanga Economic Growth Agency: www.mega.gov.za

Official South African government incentive schemes: www.investmentincentives.co.za

The University of Mpumalanga is growing fast and has the potential to help the regional economy grow by developing the skills base of the province and through targeted research. More than 40% of the academic staff complement of the university have doctoral degrees and research is encouraged with various internal awards.

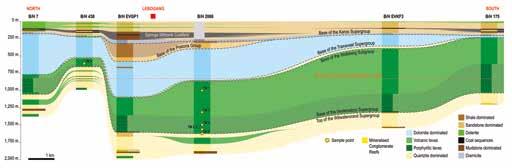

Dr Taufeeq Dhansay, Manager of the Minerals and Energy Geoscience Mapping Programme, explains how important geoscientific mapping can be for every aspect of society and gives a progress report on the Council for Geoscience’s carbon capture research.

In recent mapping, what have you found in Mpumalanga?

Mpumalanga is very rich is terms of its geological variety. You find some of the earth’s oldest rocks that tell you about how the earth evolved and formed. Many international scientists visit the province to investigate these rocks, some that are more than four-billion years old. You also find some of the youngest rocks, so that variety from the oldest to youngest means that you have the entire history of the earth’s processes within the province. Some of these processes include how various minerals systems formed and evolved.

This implies that it is a very rich province in terms of its natural resources. This includes, coal, gold, platinum and other types of critical minerals that are needed to sustain future energy like renewable resources and batteries.

Now we are looking at integrated research. What happens as we shift away from coal in the province? Does it mean that the coal was the only drawcard of the province in terms of its economy? We are finding that the answer is no.

Is coal the province’s only resource?

After earning a bachelor’s degree in Geosciences from the University of Cape Town, Taufeeq spent time at the International Institute for Applied Systems Analysis in Austria on his way to a Master’s, where his focus was geothermal energy. Another overseas experience was at the Structural Geology and Tectonics Research Group at Jena University in Germany. Nelson Mandela University awarded Taufeeq a PhD in Geosciences in 2017.

There are other mineral resources that can also be looked at. That is a primary focus at the moment. More than two thirds of the province’s economy is now reliant on coal so this brings into context the idea of the just transition.

We are asking what geoscience can tell us about a transition in terms of sustainability.

Coexistence between mining and agriculture only happens if you understand the geology. We have to maintain the integrity of the groundwater in such a way that you can have mining and agriculture existing perfectly in harmony. We are finding that this is possible. Secondly, if you can identify an area where you might find a fossil fuel on the surface like coal, then you can dig a bit deeper and find gas. Deeper still and you might find gold. That means that in terms of the valuation and the investment potential, the land is looked at differently, both for the GDP and for the sustainability of life in the province.

If you draw a cross-section through Mpumalanga, within the top four kilometres we have found a number of mineral resources and natural resources such as groundwater. Secondly, this is a good natural laboratory where you can study and look into the issue of sustainability.

Mpumalanga is also the site of your Carbon Capture Utilisation Storage (CCUS) project. How is that progressing?

Mpumalanga has the highest CO2 emissions in the country, which is no surprise because this is where we have the bulk of the coal-fired energy plants.

We were challenged as scientists to look at the issue. We have to transition towards a low-carbon economy. This is known. If tomorrow you had to turn off coal what would happen to the 150 000 people directly employed by the coal industry? The challenge is how to manage this transition in a way that actually enables sustainability. This is where the just transition comes in.

The problem is CO2, carbon dioxide. Technologies exist where you can capture the carbon dioxide. You do not release the carbon dioxide into the atmosphere. Carbon dioxide has many uses. There are a number of things that you can do with the carbon dioxide. Many industrial processes require carbon dioxide: we drink sparkling water, we drink fizzy cooldrinks. Those products use carbon dioxide, for example.

We had assumed that South Africa’s larger storage potential for carbon dioxide was generally near-shore, so we were looking at coastal provinces and offshore. That’s because the relevant rocks are very spongy, or absorbent of CO2. Now we have gone back to Mpumalanga and we have looked underground to find if there are additional geological areas where you can viably and safely store the CO2. This is what we have found. We have recently published a paper that shows these rocks could very likely support the injection and sequestration of CO2.

The idea would be that we take the gas and convert it into a solid. When CO2 reacts with certain metals, it forms a new mineral that just has the carbon incorporated. By the way, this actually happens in nature. We stop the gas from going into the atmosphere, and put it in the ground. It reacts naturally with other types of minerals which are very reactive and then it forms a new mineral and it stays in the ground forever. That is the principle.

The first step is that we have identified the potential reservoirs. Everything comes down to

making this financially viable so it is important to mention that these areas are below the current coal fields. You would not need to transport the CO2 very far to be stored.

The type of storage is quite critical. At a depth of about 1km you find saline aquifers. That holds the type of water that you can’t necessarily use for anything. If you pump the CO2 into that salty water, the CO2 slowly reacts with the salt in the water but it can take up to thousands of years before the CO2 becomes immobile. However, if you store the CO2 in the type of rocks that we are looking at, that reaction can theoretically happen much quicker. The sooner you convert the gaseous CO2 into a solid CO2, the sooner it is rendered immobile. Then it cannot move around and get back into the atmosphere.

What effect would these processes have on the environment?

A lot of our work so far has been specifically on environmental monitoring. This is a critical point. Before we actually develop this technology, we are doing a significant amount of environmental research to make sure that we can understand the baseline environmental conditions on the ground.

We want to get a footprint of the area – the flora, the fauna, the chemistry of the groundwater, the amount of groundwater there is – all of that information.

Are CGS staff excited about the CCUS project?

Yes. It is a very big project. The principle is that it’s a challenge. There are a lot of different opinions around the transition. Some say we are not moving fast enough. Others say we are moving too fast. This is the nice thing about being pragmatic – a fundamental scientist if you like – being practical and finding solutions that will be sustainable.

Our technology for renewables is still developing; we are not there entirely yet. It’s a big challenge and we need to buy ourselves some time. For the first time in a long time, the issue is being looked at directly by scientists, not necessarily only by policymakers. We have to guide them, we need to show what is possible, scientifically and empirically. How do you present empirical data that has passed peer review? That is the principle that we are focusing on.

The carbon capture project is a large, integrated project. The project is funded both by the South African Government and the World Bank and the entire project budget is about $23-million.

We have to be very unbiased in terms of the type of research we do. We will be doing full Environmental and Social Impact Assessments (ESIAs) before we do any type of sub-surface investigation. Our data portal is available to the public online.

At the CGS you will find somebody who is working on hydrogeology, while another person is an environmental geologist, who might be interested in what this is going to do for the environment.

What is the nature of new mapping CGS is doing?

The first thing to touch on is that what we are doing is very much geoscientific mapping, not just geological. The second thing is that the scale is very important. We have generally mapped to a scale of 1:250 000, so that means if a hill is less than 250 metres, it will not appear on the geological map. We have shifted to the 1:50 000 scale. South Africa was only covered to 4% in terms of 1:50 000-scale maps. After about five years, we are now moving up to a figure of 12%.

People often think that mapping is for minerals only. What other functions does it have?

We have not exclusively focused on minerals. We’ve been able to identify certain zones and certain geological features where specific types of geohazards are concentrated. We are researching that further to mitigate possible natural disasters or loss of human life.

The recent landslides in KwaZulu-Natal are an example. Many of the landslides are due to specific geomorphology and geological controls. If we don’t have the map resolution required, we can’t necessarily create the necessary mitigation scenarios. The same is true in Gauteng. A large portion of Gauteng is built on dolomite, the type of rock that forms sinkholes. The state spends a lot of money on infrastructural development and the risks can be mitigated if we understand the geology.

There are many areas in the country where the dams are not efficient in supporting farming, so we look at groundwater resources. To understand those resources, you need to understand the geology of very specific structures, essentially pathways that allow the water to flow. The other aspect that is not necessarily being considered is the surface of the earth. This is where all of our food comes from. In areas where we want agricultural sustainability,

you need to understand the geology of those areas. Similarly, you cannot build a large solar plant on soil that might sustain agriculture. We want to avoid sterilising the ground and ruling out the possibilities of groundwater or minerals.

Tell us more about groundwater.

We have been very successful in identifying significant groundwater resources, especially in the Karoo. We have been able to find, test and research many groundwater aquifers that can sustain groundwater resources in those areas.

And what are the new maps showing in terms of mineral resources?

We have focused on specific areas where we anticipate there to be some investment in exploration. Some of the mineral resources we are also looking at in terms of our developmental needs. We have to look for the type of minerals needed to sustain renewable energy, including batteries.

A number of mineral resources can support battery development. Specifically, mobile devices have lithium ion batteries and some of our mapping has discovered that South Africa has quite a significant quantity of lithium that can possibly be extracted and researched.

Where is lithium found?

It is mostly in the Northern Cape and it is also found in KwaZulu-Natal. We also found lots of vanadium, which is a critical metal needed for larger-format batteries. So mapping goes far beyond mining, it’s vital to every aspect of the economy.

Development hinges on earth science. We need to understand the earth. When we map, we try as hard as possible to look as deep as possible. Humans generally interact with the top five kilometres of the earth. We have gold mines that touch four kilometres. If you go to any province the geology you see just below your feet is not necessarily the geology that you will see at a kilometre below your feet. The Karoo might be dry but if you had to go down several hundred meters you would find significant natural resources to sustain socioeconomic development, such as water and minerals. ■

A new agency has been created to smooth the way to a greener economy while Eskom has made land available for renewable projects.

By John YoungOpinion in government and civil society has been turning sharply against fossil fuels for several years. Successive international conferences have been setting global targets for weaning economies off coal and oil but Russia’s invasion of Ukraine has changed that. Rich countries are bringing coal plants back on stream and nuclear plans have been reactivated.

With Mpumalanga’s economy being so strongly geared towards coal (in mining and for energy generation) this trend has significant implications for regional planning in the short term. More than 80% of South Africa’s coal is currently sourced in Mpumalanga and it is the third-largest coalproducing region in the world.

However, the province is not sitting on its laurels. Nor is it imagining that it can stop the world. Rather, the Provincial Government of Mpumalanga has established the Mpumalanga Green Cluster Agency to bring together government, academia and industry to create the environment for businesses to develop in a green economy.

The agency has already published a series of market intelligence opportunity briefs to highlight current opportunities for investors such as carbon capture, cleaner aviation fuel, energy storage and green hydrogen. The key working groups show the agency’s focus: sustainable agriculture, circular economy, energy and water. One of the tasks is to transition to a new economy in a way which creates jobs.

The Cluster, an initiative of the Mpumalanga Department of Economic Development and Tourism with the support of GreenCape and the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), has joined the International Cleantech Network, a group that has 15 000 businesses affiliated to it across the globe.

National utility Eskom is also moving into the new era, partly through a process whereby the entity will be broken into three more competitive units, but more immediately through the announcement in July 2022 of 18 winnings bids from independent power producers (IPPs) for renewable projects on Eskom land, 4 000ha of which the utility has made available for this first phase. Eskom owns 36 000ha in the province. A total of 1 800MW will become available to the grid and it will be cheaper to transmit because the solar or wind plants will be right next to the existing Eskom transmission lines.

Ten coal plants are due to be closed by 2040, with four Mpumalanga plants (Hendrina, Grootvlei, Camden and Komati) first in line. Eskom is undertaking studies to assess the potential impact on local communities of these closures. Options to get these plants producing energy again include gas, biomass and hydrogen but it is possible they might be used for something quite different. Eskom wants to be a net-zero company by 2050.

Another major player in the energy market in Mpumalanga (and the world), Sasol, has announced plans to start producing 1 200MW of renewable energy by 2030. An integrated oil, gas and chemicals company with more than 30 000 employees and operations in 31 countries, Sasol runs several plants at Secunda. Products manufactured at the complex include synthetic fuel, petroleum, paraffin, jet fuel, creosote, bitumen, diesel and lubricants. The primary feedstock for synthetic-fuel production is coal, and the plant is in the heart of Mpumalanga’s coalfields.

Sasol regularly spends tens of millions on upgrades and improvements at the complex. The Sasol Synfuels refinery is the only commercial coalto-liquid fuel plant in the world and constitutes a key component in South Africa’s oil and gas sector.

National government’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) has seen the investment into this totally new sector of more than R200-billion since 2012 and South Africa is now home to 112 IPPs, whereas just 12 years ago there were fewer than 40 in Sub-Saharan Africa.

The relaxation by national government of the rules regarding setting up a power plant of 100MW or less is well suited to the requirements of big timber-processing companies such as Sappi and PG Bison and all the large mining concerns that are active in Mpumalanga.

Several infrastructure investment projects in the tourism sector have been put forward by the Mpumalanga Economic Growth Agency (MEGA). There is a special focus on BRICS countries and the province was glad to welcome the announcement of a new flight into Kruger

Mpumalanga International Airport in 2022 by the tourist division of Lufthansa, Eurowings Discover. The TRILAND partnership with Eswatini and Mozambique is another avenue, as is the collaboration with KwaZulu-Natal, Eswatini, Mozambique and the Seychelles. The latter project is called east3ROUTE Tourism Initiative and proclaims “Experience, Adventure, Scenery and Trade” between the participating provinces and countries.

MEGA is an equity investor in a number of Mpumalanga concerns, including Afrimat, Highveld Fruit Packers, Kangwane Anthracite, Loopspruit Winery and Tekwane Lemon Farm.

In the Nkangala District Municipality, a publicprivate partnership is due to deliver a hotel and conference centre in the town of Middelburg in the Steve Tshwete Local Municipality.

It may seem ironic that R350-million is to be spent on a Radisson-branded hotel in the aftermath of Covid-19 but conferences and tourism will return. Elsewhere, mining and timber companies are making large investments in increased production or in extending the life of mines.

A major concern for provincial planners is to diversify the economy and to grow the manufacturing sector. The Mpumalanga Economic Growth and Development Path (MEGDP) identifies beneficiation, agro-processing and the development of value chains as priorities. Various industrial parks are planned which will focus on agriculture and forestry, mining and metals and petrochemicals. An International Fresh Produce Market in Nelspruit and the planned Nkomazi SEZ (Special Economic Zone) are other priorities.

Steel and associated manufacturing remains one of the province’s strong suits and Mpumalanga has rich and varied mineral resources and fertile soil that support diverse farming operations, agroprocessing and forestry. The province also hosts large companies in the manufacturing sector such as Middelburg Ferrochrome and the Manganese Metal Company.

The province’s rich agricultural produce is used by companies such as McCain, Nestlé and PepsiCo and there are also pulp and paper plants (Sappi

and Mondi), with PG Bison set to start producing more than 1000m³/d per annum at its Mkhondo particleboard plant after two investment injections of R600-million (on a press and forming line) and R560-million (on a front-end dryer).

York Timbers is another forestry company and the sugar mills and refinery of RCL Foods (formerly TSB Sugar) along with fertiliser facilities and textile manufacturing concerns are all contributors to the provincial economy.

The southern half of the eastern limb of the platinum-rich Bushveld Igneous Complex runs south towards the towns of Lydenburg and Machadodorp. Deposits of chromite, magnetite and vanadium in this area are the basis of the ferro-alloy complex in Witbank-Middelburg and Lydenburg.

The town of eMalahleni is the centre of the coal industry. Other minerals found in the province include gold, platinum-group minerals, chromite, zinc, cobalt, copper, iron and manganese.

Middelburg is home to Columbus Stainless, South Africa’s only producer of stainless steel, and several big engineering works. It is about 130km from Pretoria and less than three hours’ drive from the Malelane Gate of the Kruger National Park.

Visits to game reserves and nature reserves have shown signs of recovery from the lockdowns associated with Covid-19 but for a province where 7% of GDP is derived from tourism, the recovery can’t come soon enough.

The Kruger National Park remains the province’s most visited asset but the decision by UNESCO to afford World Heritage Site status to the Makhonjwa Mountains near Barberton will boost geological tourism to the province and supports the efforts of the province to diversify its offerings. Major projects to improve tourist experiences are underway at the Graskop Gorge (where a transparent lift takes tourists into the depths of the gorge), a Skywalk is to be built at God’s Window and a cable car is planned for Three Rondavels.

The international body’s decision has also had the effect of expanding the curriculum at the relatively new University of Mpumalanga. On the basis of the UNESCO ruling, UMP has a new offering in geology as part of a BSc degree. ■

General Manager Kagiso Moncho shares good news for the region as MTN SA invests R820-million into network modernisation and infrastructure.

Another major highlight will be rural connectivity to help close the digital access gaps in South Africa. More than 700-million people in Sub-Saharan Africa remain offline and at risk of exclusion from the emerging digital economy.

“We have extensive plans to drive growth and connectivity solutions into under-serviced areas. With unemployment in South Africa reaching new peaks, it is critical to focus on harnessing digital solutions to drive the recovery, especially in those areas that were hardest hit,” Moncho adds.

“An important point is that the pandemic, loadshedding and the prevailing economic environment have underscored the value of mobile networks, which remain the only form of Internet access for many. MTN’s investments are directly targeted at accelerating recovery and significantly enhancing growth and job opportunities,” says Moncho.

MTN SA is ramping up investment to modernise existing and deploy new network infrastructure across Limpopo and Mpumalanga. The R820-million investment will go toward MTN’s “Modernisation of Network South Africa project” (MONZA) as well as expanded rural reach, 5G expansion and restoration of vandalised network infrastructure.

“Our aim is to significantly enhance access and open the door to new digital opportunities for many more people across the province. Our investment is specifically targeted at increasing network coverage, improving throughputs, and connecting the previously unconnected,” says Kagiso Moncho, General Manager: Northern Region from MTN South Africa.

The MONZA rollout in the two provinces will include modernisation and new sites. The extension of MTN’s 5G connectivity includes rolling out new sites in 2022.

One stumbling block to growth remains the activity of criminals and syndicates. Due to high incidences of vandalism and battery theft, MTN has partnered with Bidvest Security and set aside an additional R101-million in 2022 to combat this criminality.

“Ensuring users receive quality and network stability is our number-one aim, but the fight against battery theft and vandalism remains a major hindrance. I am pleased that our ongoing efforts to make a dent in these criminal acts are seeing change, but all South Africans are requested to remain vigilant and report any suspicious activity,” says Moncho.

“We have big targets this year in Limpopo and Mpumalanga. Every completed project, or success achieved against battery theft, ensures our clients can take that one step forward and benefit from the magic of the modern, connected world,” concludes Moncho. ■

A new university and active technical and vocational colleges offer a wide range of qualifications.

The northern edge of the city of Mbombela has a striking new architectural addition – the University of Mpumalanga. On a hill north of the Crocodile River a complex of department headquarters and residence buildings is taking shape as home to the province’s first university.

By building on existing institutions such as teacher training colleges, the university has progressively offered more courses and taken on more students over the last few years. The official launch was in October 2013 with the first cohort of 169 students registered in just three programmes in 2014. By 2020, the university was offering 26 qualifications to 4 200 students.

The university currently offers 48 programmes in three faculties: Education; Agriculture and Natural Sciences; and Economics and Business Sciences. There are plans to add new programmes at both undergraduate and postgraduate levels and to establish the faculty of Humanities and Social Sciences and the School of Law. By 2024, the plan is to offer approximately 70 qualifications to over 8 000 students. That is the year in which the university’s first doctoral graduates will be capped. Research relevant to the needs of the province can now be done at local level. Issues such as acid mine water leaking from abandoned mining sites and new applications for products in the timber industry are among the kinds of

research that will boost economic productivity in Mpumalanga, and lead to better socio-economic conditions for citizens.