5 minute read

Mining

A public mining company is planned in the Northern Cape.

Photo: Anglo American

The Premier of the Northern Cape has announced that his administration wants to “vigorously pursue the possibilities of establishing a Northern Cape State Mining Company”.

This company will do prospecting, apply for licences and look for investments on behalf of the people of the Northern Cape. The Northern Cape Economic Development, Trade and Investment Promotion Agency (NCEDA), the province’s investment agency, is tasked with researching feasibility.

Base metals are showing great potential and it is in that sector that any public mining company would likely be active. The world market for base metals (which includes zinc and nickel) is in good shape because of trends in the energy and automotive markets and the fact that the global supply of copper is expected to decline.

One of those base metals, manganese, is finding its ways to ports much more rapidly and in greater bulk thanks to a concerted effort by Transnet Freight Rail (TFR). In 2019 TFR announced a ninth manganese mining freight contract. The decision to rail manganese to a variety of South African ports, rather than being limited to Port Elizabeth, led to 14.5-million tons of the metal being transported in 2018, a massive increase on the five-million tons achieved in 2012. The target is 16-million tons.

The other reason TFR is able to cope with such volumes is the incredible Sishen-Saldanha train, which continues to set world records in terms of length of train and volumes. The latest is 375 wagons carrying 63 tons each and seven of the 49 weekly trips on this line have been given over to manganese, the balance being devoted to iron ore.

The biggest new mine in the country is a zinc mine at Aggeneys, the Gamsberg project of Vedanta Zinc International, which will deliver 600 000 tons of zinc when phase three is complete. About $400-million has been invested since the project began and the company started trucking product to the Port of Saldanha in 2018.

The provincial government is using the mine’s location (and possible future smelter) as

Sector Insight Transnet Freight Rail is ramping up manganese volumes.

Our History

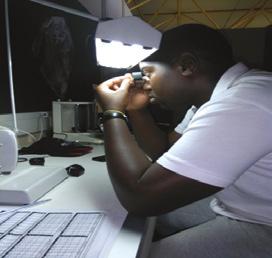

We are located at the Kimberley Diamond Jewellery Centre in the Northern Cape Province of South Africa. We have entrenched ourselves as the only incubator in the Precious Stones

exchange, shared infrastructure and technology support services to the unemployed,

Our Clients

have work experience or informal sector businesses.

Our Purpose

Our Vision

To be the premium incubator in the diamond and precious metal

Our Mission Our Values

• Provide an enabling environment that gives access to technology and business development; • Assist entrepreneurs • Integrity; • Innova • Transparency; • Reliability; • Customer centric.

and sustainable.

Our Partners

the basis for an application to create a new Namakwa Special Economic Zone.

An old zinc mine that produced a million tons of zinc and 430 000 tons of copper before it closed in 1991 is to be revived by Australian miner Orion Minerals. A bankable feasibility study was completed in June 2019 and it confirmed earlier positive findings.

Good earnings

Good prices for iron ore served Northern Cape mining companies well in 2019. Afrimat, a construction materials group which recently got into mining with the purchase of Demaneng mine, boosted overall earnings for FY 2018/19 on the back of this diversification strategy. Afrimat hit a record R3-billion in revenue. The company intends expanding into coal.

Assore was another company to set a record, with its R6.4-billion in headline earnings (12 months to June 2019) being 25% better than the year before. This was despite small decreases in production and sales. Major expenditure on Gloria, Nchwaning and Black Rock has been underway for some time, with 93% of the latter expansion project spent.

Kumba Iron Ore’s six-month earnings to June 2019 followed the same trajectory, with global prices and a weak rand mainly responsible. The company expected to produce between 42-million and 43-million tons but sell 44-million tons, drawing on reserves. The improved services of TFR, noted above, contributed to better sales.

The National Youth Development Agency (NYDA), the provincial government and Mintek is collaborating on the Prieska Loxion Hub (PLH), which beneficiates Tiger’s Eye for jewellery and stone- cutting products.

Mining assets

The Northern Cape Department of Economic Development and Tourism’s “Economic and Investment Profile” reports that the province is responsible for: • 95% of South Africa’s diamond output. • 97.6% of alluvial diamond mining. • 13.4% of world lead exports. Aggeneys, in the Namaqualand district produces approximately 93% of South Africa’s lead. • 80% of the world’s manganese resource. • 25% of the manganese used in the world. • 100% of South Africa’s Tiger’s Eyes. • Largest national production of sugilite (a semi-precious stone).

Super-conductors, X-ray machines, nuclear batteries and PETscan detectors are just some of the technologies that rely on rare earth elements (REEs) such as promethium, thulium and holmium. China controls 95% of the world’s supply of REEs and the search is on for alternative sources. Two sites have attracted investors’ attention: Zandkopsdrift (Northern Cape) and in the adjoining province of the Western Cape, Steenkampskraal.

Away from the underground kimberlite pipes and fissures, river and coastal deposits of diamonds are also present in the Northern Cape. Diamonds have been recovered along the Orange, Buffels, Spoeg, Horees, Groen, Doom and Swart rivers in the province, while coastal deposits have been found from the mouth of the Orange River to Lamberts Bay.

Diamond mining company West Coast Resources (WCR) has a production plant at Michells Bay. Trans Hex, with a 40% shareholding in WCR, manages the mine and market the diamonds produced from it. The National Department of Trade, Industry and Competition (dtic) owns 20% of WCR.

The Kimberley International Diamond and Jewellery Academy provides training with a total of 406 graduates having so far passed through the academy. In a recent development, De Beers Sightholder Sales South Africa awarded KIDJA an amount of R500 000 for bursaries. ■

Online Resources

Minerals Council of South Africa: www.mineralscouncil.org.za National Department of Mineral Resources: www.dmr.gov.za Northern Cape Department of Economic Development and Tourism: www.economic.ncape.gov.za South African Mining Development Association: www.samda.co.za

markets dependent on Small Medium Enterprise phase.

Phase Title Timeline

3. Graduates/Exits SME Support Services Contract (GSSSC) Ad-Hoc contract

CLIENT BUSINESS TECHNOLOGY INCUBATOR MODEL

GRADUATE/EXITS SME SUPPORT SERVICES CONTRACT (GSSSC) PHASE 3

INCUBATION PHASE 2 SME PERFORMANCE PROGRESSIVE PROGRAM (ISPPP) 24MONTH CONTRACT

PRE-INCUBATION PHASE 1 PROGRESSIVE DEVELOPMENT PLAN(PIPDP) 3-6MONTH CONTRACT

RECRUITMENT CYCLE

or volunteer services please email us on info@kdji.org