4 minute read

Oil, gas and petrochemicals

South African ports are gearing up to service the oil and gas industry.

Natural gas lies offshore to the west of South Africa in the Atlantic Ocean (Ibhubesi) and off the southern coast in the Indian Ocean (Bredasdorp Basin). Both fields have great potential: Block 2A of the Ibhubesi gas field north-west of Saldanha is estimated to have reserves of 850-billion cubic feet of gas and the Bredasdorp Basin one-trillion cubic feet but getting to the gas has been difficult. In addition, massive new fields are being exploited off the coast of Mozambique, opening up opportunities in the region that never existed before.

Advertisement

Anadarko Petroleum, a US company, decided in 2019 to go ahead with a $20-billion project to build a liquid natural gas (LNG) plant in Mozambique. The projected spinoffs for the South African economy are estimated to top R7-billion. Part of the projected benefit for South Africa will be through the access to the project that will come with the expected involvement of the Export Credit Insurance Corporation of SA (ECIC). ECIC intends underwriting Standard Bank’s financing of this and other projects and part of the conditions of such financing deals is market access for South African firms.

A new addition to South Africa’s pipeline network is a pipe to get natural gas from Mozambique to Gauteng. SacOil’s R90-billion project aims to deliver gas to Johannesburg and the nearby towns in 2020.

Large quantities of oil are transported around Cape Point every year: 32.2% of West Africa’s oil and 23.7% of oil emanating from the

SECTOR INSIGHT

Coastal Special Economic Zones are investing in gas plants.

Middle East. Irrespective of market volatility, the long-term prospects for shipping and oil and gas are strong enough for national government to pursue Operation Phakisa (which includes a strong maritime economy element) and for Transnet National Ports Authority to spend heavily on upgrading the nation’s ports.

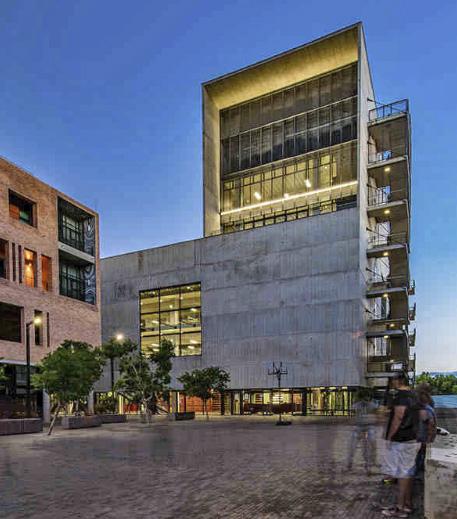

In the Western Cape thousands of direct jobs have been created in the ship and rig repair sector of the oil and gas business and the Saldanha Bay Industrial Development Zone is being

expanded with the oil and gas sectors as priorities. The same is true of Richards Bay in KwaZuluNatal and the Coega Industrial Development Zone.

The Port of Saldanha has a new open-access liquefied petroleum gas (LPG) plant run by Sunrise Energy.

In 2016, the Department of Trade, Industry and Competition (dtic) established a Gas Industrialisation Unit (GIU). The first two sites identified by the DoE for liquefied natural gas (LNG) plants are Richards Bay (2 000MW) and the Coega Industrial Development Zone (1 000MW) in the Eastern Cape. This has the potential to turn the Richards Bay Industrial Development Zone (RBIDZ) and its Eastern Cape counterpart into energy hubs. The fact that Mozambique has significant offshore deposits is a factor in this ambition.

The Coega IDZ is also home to the country first gas-fired plant to be run by a private consortium, the Dedisa power plant. A new gas turbine open-cycle power plant near Durban has been commissioned by Avon Peaking Power.

Supply news

A number of South African facilities are being expanded and new ones are being built to accommodate more fuel and gas storage. National usage of LPG currently amounts to 400 000 tons per year, but this is set to increase dramatically, partly as a result of this increased storage capacity. Some examples are: • Bidvest Tank Terminals is building a mounded LPG storage facility that will have the biggest tanks in the world. Each of the four 60m long tanks weighs 5 650 tons and they have a combined capacity of 22 600 tons. The expected supply from the new facility will be 200 000 tons per annum. The LPG will be supplied by Petredec. • Novo Energy have built a R130-million natural gas compression plant in the Highveld Industrial Park in Mpumalanga. The park is well connected by rail and road to all the major industrial nodes.

The facility will operate around the clock and has access to Sasol’s natural gas pipeline. • Sasol and BP have increased the storage capacity of the Alrode fuel depot south-east of Johannesburg seven-fold, from 9-million litres to 64-million litres. • Air Products recently invested R100-million in its existing carbon dioxide plants in Newcastle (KwaZulu-Natal) and at the Natref refinery at Sasolburg.

Assets

The South African oil industry generates annual sales of about R365billion and includes global giants such as Engen, BP, Shell, Total and Caltex. Sasol is a major player in the oil sector and the only company in the petrochemicals sector.

Most of the oil that feeds the country’s four crude-oil refineries is imported. The refineries are in Cape Town, Sasolburg and Durban (two). In addition to South Africa’s crude-oil refineries, natural-gas conversion plant, coal-to-fuel and gas-to-liquid crude-oil refineries, Sasol produces fuel from coal at its Secunda facility and PetroSA has the country’s only gas-to-liquid (GTL) facility at Mossel Bay.

Getting fuel to Gauteng is the key mission of the new multi-purpose pipeline (NMPP) which started delivering fluids in 2012. The NMPP terminals allow for greater flexibility in supply. Refined products such as jet fuel, sulphur diesel and both kinds of octane petrol are carried.

ONLINE RESOURCES

National Energy Regulator of South Africa: www.nersa.org.za Petroleum Agency SA: www.petroleumagencysa.com South African National Energy Association: www.sanea.org.za South African Petroleum Industry Association: www.sapia.co.za