17 minute read

Transport and logistics

A private-public partnership is upgrading facilities at ports.

Africa’s first plastic road is under construction near Humansdorp in the Eastern Cape. Finding ways of creating roads that can last longer is an important priority for South Africa which has yet to find a way to direct significant amounts of goods traffic back to the rail system and away from trucks. Scottish company MacRebur will partner with local firms Scribante Construction and SP Excel Holdings in building 1km of road to test the technology which adds waste plastics to asphalt for road construction to strengthen the bitumen binder. It is estimated that 1.8-million plastic bags could go into the building of just 1km of road.

Advertisement

With the completion the Gauteng Freeway Project, the South African National Roads Agency (SANRAL) has been tackling big projects in every province: • the R573 east of Johannesburg, traverses three provinces and is used by 50 000 commuters daily, is to be upgraded • the R1.14-billion Mount Edgecombe interchange has been opened in KwaZulu-Natal • the R71 road out of Polokwane towards Moria in Limpopo carries more than 17 000 vehicles per day at Easter time. A new intersection and double carriageways have been constructed • the N2 between Mtunzini toll plaza and Empangeni has been made safer by the creation of a dual carriageway • the Wild Coast toll road project – the bridge over the Mtentu River will be the highest bridge in the country at 217m and will cost R1.6-billion

South Africa has 21 000km of railway lines and 747 000km of roads, 325 019 heavy-load vehicles and the road freight industry employs 65 000 drivers. The logistics and courier market is worth R10-billion. There are 135 licensed airports in the country, 10 of which have international status.

SECTOR INSIGHT

Plastic bags are being used in road construction.

Air

Airports Company South Africa (ACSA) owns and operates the country’s 10 biggest airports. The company also manages airports in India and Brazil.

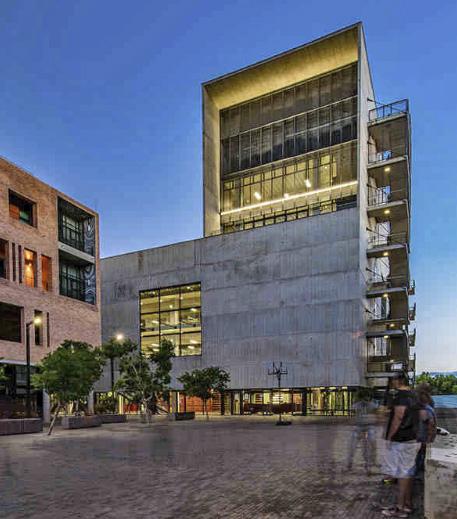

Ekurhuleni wants to leverage the location of South Africa’s biggest airport, OR Tambo International, into a major economic asset. OR Tambo International Airport in Gauteng (pictured) caters for more than 21-million passengers annually. The Cape Town International Airport recorded 10-million passengers in 2016. King Shaka International Airport (KSIA) is north of Durban.

Several airports are possible future regional freight nodes: Wonderboom Airport in Pretoria, Polokwane Airport in Limpopo and Mahikeng Airport in North West Province.

The South African Department of Transport has several agencies and businesses reporting to it: Air Traffic and Navigation Services Company, Airports Company South Africa (ACSA), National Transport Information System, Road Accident Fund, South African Civil Aviation Authority, South African Maritime Safety Authority (SAMSA), the South African National Roads Agency Limited (Sanral) and the Passenger Rail Agency of SA (PRASA).

Rail

Transnet is the state-owned enterprise focussed on transport and logistics. It comprises Transnet Freight Rail, Transnet Engineering, Transnet National Ports Authority, Transnet Port Terminals and Transnet Pipelines. Transnet Freight Rail’s operations represent about 80% of Africa’s rail infrastructure. With 25 000 employees TFR has specialist divisions for hauling coal and iron ore together with a general freight division which transports everything from grain to chemicals.

The major rail haulage lines are the manganese line from the Northern Cape to Port Elizabeth; iron ore from Sishen in the Northern Cape to the Port of Saldanha; and from the coal fields of Mpumalanga to Richards Bay. More than 55-million tons is regularly transported along the former and upwards of 70-million tons can travel annually along the latter.

A total of 600 new passenger trains will be added to Metrorail’s fleet at a cost of R51-billion. Transnet Freight Rail has ordered 1 064 diesel and electric locomotives from four suppliers.

Sheltam Group is expanding its services beyond rail services. A new lease company (for rolling stock) and an investment company (focussed on rail infrastructure) underpin the group’s African ambitions.

Logistics

South Africa’s largest agricultural company has signed an agreement with Transnet to partner in upgrading grain facilities at two ports. East London and Durban will receive R100-million revamps as part of a 15year tender won by Afgri.

The East London Grain Elevator is operating well below capacity, processing about 90 000 tons a year. At full capacity, the elevator could handle as much as 720 000 tons. Durban’s other two agricultural terminals are currently run by Bidvest and SA Bulk Terminals. Transnet is hoping that the partnership will help it towards reaching its goals in its road-to-rail strategy.

The building of the Musina-Makhado Special Economic Zone (SEZ) will boost Limpopo’s role as a transport and logistics hub. The Musina Intermodal Terminal is 15km from the busy Beit Bridge border crossing. It will boost efforts to move cargo from road to rail.

The Nkomazi SEZ near the border with Mozambique in Mpumalanga has similar advantages as it forms part of the Maputo Development Corridor.

Investment in improved infrastructure is being made at all of South Africa’s ports and Special Economic Zones are in place at four of them. The Maputo Development Corridor is Africa’s most advanced spatial development initiative. Run by the Maputo Development Corridor Logistics Initiative (MCLI), the corridor runs from near Pretoria in Gauteng, to Maputo in Mozambique.

The Harrismith Logistics Hub at the Maluti-A-Phofung SEZ on the N3 is an inland port that can handle cargo containers and shift cargo from road to rail, reducing congestion and costs.

ONLINE RESOURCES

Airports Company South Africa: www.acsa.co.za National Department of Transport: www.transport.gov.za Road Freight Association of South Africa: www.rfa.co.za South African Association of Freight Forwarders: saaff.org.za South African Heavy Haul Association: www.saheavyhaul.co.za

ICT

Cloud services have come to South Africa.

Cape Town and Johannesburg recently became the first South African cities to host Microsoft Azure data centres. Microsoft will make available cloud services for Office 365 and Dynamics 365.

Amazon Web Services (AWS) will set up a data centre in Cape Town in 2020 to serve Sub-Saharan Africa. The French government has officially designated the city as one of six global French Tech Hubs.

The Industrial Development Corporation (IDC) estimates that spending on cloud services in South Africa will reach R11.5-billion by 2022, nearly three times its level in 2017 (Tech Central). This trend could generate more than 100 000 new jobs. Acuity Consultants was quoted in 2019 as saying that software developers’ salaries had risen by 30% in a year (Business Times).

The Council for Scientific and Industrial Research (CSIR) in Pretoria will host a new body aimed at preparing South Africa for the Fourth Industrial Revolution (4IR), the South African Affiliate Centre of the World Economic Forum.

Among the biggest investors in new technology are banks and other players in the financial sector, where technology is rapidly lowering the barriers to entry for new businesses.

The Small Enterprise Development Agency (Seda) runs the SoftstartBTI ICT incubator in Midrand and Tuksnovation, a high-tech incubator, at Pretoria University. Several incentives relevant to companies and educational bodies in the ICT sector are available from the Department of Trade, Industry and Competition (dtic).

The Information Technology Association (ITA) is the trade and employer body of the Information Technology industry in South Africa. The ITA represents more than 200 companies which supply information technology equipment, systems, software and services. Members include IBM, Microsoft SA, Siemens, SAP and Axiz.

South Africa’s appetite for fast Internet connectivity is growing. The state-owned company Telkom controls most of the country’s fibre cable

ONLINE RESOURCES

Independent Communications Authority: www.icasa.org.za Information Technology Association of South Africa: www.ita.org.za State Information Technology Agency: www.sita.co.za Technology Innovation Agency: www.tia.org.za

SECTOR INSIGHT

IT skills are at a premium.

but several smaller private companies are winning contracts to lay fibre-optic cables around the country.

Allowing access to the Internet to rural people and poorer people in urban areas is a policy priority. As part of its mandate, the Independent Communications Authority of South Africa (ICASA) has organised that private operators have connected more than 623 schools.

Dark Fibre Africa, a Remgro subsidiary, has established a Digital Villages unit to roll out fibre in low-income areas. Another company in which Remgro has a stake, Vumatel, plans to offer uncapped broadband services in Alexandra (Johannesburg) for less than R100 per month.

Private mobile communications company Vodacom has pledged to spend R50-billion on network infrastructure in rural areas. Vodacom is also developing an affordable sheep-tracking collar with farmers in the Eastern Cape. There are 2 000 ICT firms in the Western Cape, with 17 000 employees. The Cape Innovation and Technology Initiative (CiTi) supports startups and entrepreneurs.

Banking and financial services

New stock exchanges are attracting investors.

SECTOR INSIGHT

Africa’s financial services sector has also been enlarged with the opening of several new stock exchanges. The decision by pharmaceutical giant Aspen Pharmacare to conduct a second listing on one of them, A2X, suggests good timing by the people behind the latest trend.

A2X has attracted nearly 20 companies in a wide range of sectors in less than two years, with a primary focus on secondary listings. Patrice Motsepe’s African Rainbow Capital is an investor in A2X.

Of the four new exchanges, Equity Express Securities Exchange (EESE) trades in Black Economic Empowerment (BEE) while ZARX and 4AX are targeting companies that are not listed elsewhere. ZARX has agricultural holding companies like TWK and Senwes among its first clients.

The JSE is the world’s 19th-biggest exchange and nearly 400 companies are listed on the JSE or AltX, the JSE-owned exchange for smaller companies.

The green bond issued by the City of Cape Town is a sign of the “climate change” times. South Africa’s third-ever green bond attracted bids over R4-billion on an initial offering on projects worth R1-billion. The JSE intends opening a green section to deal with the expected growth of such instruments. The lead arranger for the bond was Rand Merchant Bank.

In 2017 Tyme Digital received a licence to run a bank. By early 2019, TymeBank was available in 500 Pick n Pay and Boxer stores and more Discovery Bank has

On top of the recent issuing of new banking licences, South

been launched.

ONLINE RESOURCES

Financial Sector Conduct Authority: www.fsca.co.za Insurance Institute of South Africa: www.iisa.co.za South African Institute for Chartered Accountants: www.saica.co.za South African Reserve Bank: www.resbank.co.za than 50 000 customers had an account. Tyme stands for Take Your Money Everywhere and refers to the fact that the bank does not have a branch network. The bank is targeting the lowerincome segment and promises speedy transaction and approval times. African Rainbow Capital began as the venture’s BEE partner but in 2018 bought out the Commonwealth Bank of Australia.

Second to market among the country’s new banks was Discovery Bank, which officially launched in March 2019. Discovery Bank will apply the behavioural model it uses in its health business to reward good financial behaviour. The Discovery group is already a giant on the JSE (market value of R83-billion) with access to millions of customers.

The insurance market now offers a greater variety of products to more market segments, including middleincome earners. An example of a specific product responding to new realities is Old Mutual’s iWYZE medical gap cover, designed to pay the difference between what a medical aid scheme is willing to pay and what the hospital or doctor is charging.

Developing excellence in the auditing industry

Natalie Khambi, Business Development Manager of Audit and Risk Management Solutions (ARMS), gives an overview of the company history.

Natalie Khambi, Business Development Manager

BIOGRAPHY

Natalie Khambi is the Business Development Manager at ARMS where her responsibilities include managing a team of business development consultants, stakeholder relations, marketing and communications. Natalie joined the company in February 2018.

How do you differentiate yourself as a company?

Audit and Risk Management Solutions (ARMS) is a 100% black-owned and black-staffed company. We develop black entrants to the auditing industry and are committed to prove that black excellence does exist. Our client list built over 13 years of existence is testament to this.

What are your main services?

Our services include internal auditing, risk management, assurance and advisory, forensic investigations as well as training.

Do you focus on particular sectors?

Currently our client base is predominantly the public sector; however, we have made noticeable inroads into the private sector in the last year.

How was the company formed?

The founders met while working together at a university where one of them was the Chief Financial Officer. They decided to start a company and couldn’t get funding from the banks. They then set out to self-fund and gradually grew the business to where it is now.

How important is the training component of the business?

Training is a very important part of our business. We grow our own talent internally through training and mentoring new entrants. We also offer training as a service to our clients to capacitate their organisations. Further to this, we ensure that skills transfer is prioritised with each project that we undertake.

Please list some clients you are working with/have worked with.

Some of our clients include National Treasury, City of Ekurhuleni, City of Mbombela, Polokwane Municipality, the Department of Social Development, just to mention a few.

Audit and Risk Management Solutions (ARMS)

ARMS is a dynamic South African auditing firm founded by black professionals with a passion for transformation, professionalism and upliftment of previously disadvantaged persons. The firm focuses on servicing all spheres of government and SMMEs in South Africa. ARMS has established its base of operations in Gauteng with headquarters in Johannesburg. ARMS assists clients with all matters relating to assurance, enterprise- wide risk management and governance. The founders and partners of this firm bring decades of accounting and auditing experience to the business. This group of professionals are leading the company as it establishes a reputation of providing high quality professional services.

The value drivers that ensure that we provide consistent high- quality service to our clients are: • Client focus • Utilising appropriately skilled staff for each assignment • Rigorous staff selection and development • Innovation • Developing in-depth specialised knowledge in each service area • Competitive pricing Our services

We provide the following services:

• Advisory & Assurance • Internal Auditing • Governance & Compliance • Risk Management • Specialised Training • Special Investigations • Performance Auditing • Performance Management Systems and Support • IT Auditing • SCOA implementation, support & training

Clients include

• City of Johannesburg • Johannesburg City Parks • Greater Tzaneen Municipality • Randfontein Local Municipality • City of Tshwane • City of Ekurhuleni • City of Polokwane • Eastern Cape Liquor Board • Joe Gqabi District Municipality • Mkhondo Municipality • Department of Home Affairs • National Heritage Council South Africa

CONTACT INFO

Address: 1st Floor, Block 9, St David’s Place PI, Parktown 2019 Tel: 011 484 1235 • Fax: 086 619 9887 Nkululeko Swana: 083 462 5606 Adv Boreka Motlanthe: 084 588 3820 Namhla Gogo: 078 213 0746 Email: info@armsaudit.co.za • Web: www.armsaudit.co.za

Development finance and SMME support

Supply chains can create and support small businesses.

Funding for more than 2 300 small, medium and microenterprises (SMMEs) and support for 50 000 jobs – that’s what Anglo American’s Zimele programme has achieved in 30 years of supporting small businesses.

Most of the support came through the purchase of goods from small businesses in the supply chain of Anglo mines or from companies supplying services to the relevant mine. Zimele (which means “stand on one’s own two feet”) changed focus somewhat in 2017, with more emphasis being placed on building up skills and on improving the sustainability of SMMEs.

Most big companies in South Africa have two main programmes to support SMMES: enterprise development (ED) and local supplier development (or procurement). Venetia Mine in northern Limpopo is a De Beers Group mine. Anglo American is a majority shareholder in De Beers. As of 2019, more than 50 SMMEs had enrolled in incubation programmes, 27 businesses were supported by the mine’s ED programme and 34 locally owned companies were doing business with the mine.

For Patience Nqaba of Ikefree Projects (pictured), the chance to offer maintenance services to the Venetia Mine was an opportunity to take her business to a new level. With 29 employees, Ikefree has subsequently signed up with Nando’s (to deliver food) and with Tiger Brands, to main-

SECTOR INSIGHT

tain the food company’s property.

One of biggest problems faced by SMMEs is cash flow. Most government departments have rules about procurement which are biased in favour of purchasing from SMMEs or co-operatives. However, for many South African entrepreneurs, the inability or unwillingness of government to pay within 30 days presents a major risk to sustainability.

Public procurement from township enterprises from provincial and municipal governments

in Gauteng, the province where more than half of the country’s SMMEs are located, increased in 2017 to R17-billion, up from just R600-million in 2014. This expenditure has allowed many township businesses to enter the formal economy and for them to become more sustainable. The City of Johannesburg runs seven SMME hubs where office space, Wifi and advice and training are available for small business operators.

South African Breweries, a subsidiary of AB InBev, wants to use its four entrepreneurship programmes to create 10 000 jobs by 2022. In 2018, Coca-Cola Beverages South Africa launched the Mintirho Foundation, a R400-million fund to pay for training of farmers and support business in the agricultural value chain.

Toyota South Africa Motors is funding the newly created Toyota Empowerment Trust (TET) to the tune of R42-million. The trust will at first train specialised automation technicians with the long-term intention of helping qualified technicians to start their own maintenance firms.

An Incubation Centre has been launched at Nissan’s assembly plant in Rosslyn, north of Pretoria. The facility supports small enterprises through subsidised rental and mentorship and training. Management of the centre is done by the Automotive Industry Development Centre (AIDC), a subsidiary of the Gauteng Growth and Development Agency (GGDA). The Jobs Fund contributes to financing the project.

A small business can become a substantial business quite quickly with the right support. Programmes such as the Black Umbrellas offer different levels of support, from early advice about business plans through office support to mentoring. Civtech Engineers, a Richards Bay consultancy, has grown its revenue and staffing levels as a result of being on the full incubation programme.

The National Department of Small Business Development (DSBD) has several programmes to assist SMMEs and co-operatives. These include: • The Black Business Supplier Development Programme, a cost-sharing grant to promote competitiveness • The Co-operative Incentive Scheme, a 100% grant.

The Small Enterprise Development Agency (Seda) is a subsidiary of the DSDB. Seda has 42 incubation centres in South Africa under its Seda Technology Programme (STP).

In a recent publication, Seda reported that the number of SMMEs in South Africa increased by only 3%, from 2.18-million to 2.25-million between 2008 and 2015.

The National Department of Trade and Industry and Competition (the dtic) is trying to stimulate township and rural economies. Various programmes within the dtic and its agencies contribute to the creation of SMMEs or to the rescue of ailing SMMEs in tough times.

The Enterprise Investment Programme (EIP) has achieved considerable success. Having received a grant in 2014, Thorax LP Equipment, a 100% black-women-owned company based in Gauteng, has subsequently turned over more than R8-million and employed many young people. A grant to Kalagadi Manganese in the Northern Cape helped to create 8 857 jobs.

The National Gazelles is a national SMME accelerator jointly funded by Seda and the DSBD. The aim is to identify and support businesses with growth potential across priority sectors. Businesses can receive up to R1-million for training, productivity advice, business skills development and the purchase of equipment.

The Industrial Development Corporation (IDC) supports SMMEs either by disbursing loans or by taking minority shares in enterprises and giving advice. An agricultural project in the Northern Cape is an example of the kind of work it does. Through the IDC’s Transformation and Entrepreneurial Scheme, a black economic empowerment project is underway at Kakamas. The emerging farmers of Vaal Community Citrus are planting citrus.

ONLINE RESOURCES

Industrial Development Corporation: www.idc.coz.a National Department of Small Business Development: www.dsbd.gov.za National Small Business Chamber: www.nsbc.org.za Small Enterprise Development Agency: www.seda.co.za