Empowering Women: Bridging the Digital Finance Gap

Fostering Inclusion in Finance: Insights from Leading Female Finance Executives

International Women’s Day 2024: Four fintech leaders reflect on progress in the industry

Empowering Women: Bridging the Digital Finance Gap

Fostering Inclusion in Finance: Insights from Leading Female Finance Executives

International Women’s Day 2024: Four fintech leaders reflect on progress in the industry

Chairman and CEO

Varun Sash

Editor

Wanda Rich

email: wrich@gbafmag.com

Head of Distribution & Production

Robert Mathew

Project Managers

Megan Sash, Amanda Walker

Video Production and Journalist

Phil Fothergill

Graphic Designer

Jessica Weisman-Pitts

Client & Accounts Manager

Chanel Roberts

Business Consultants

Rick Saikia, Monika Umakanth, Stefy Abraham,

Business Analysts

Samuel Joseph, Dave D’Costa

Advertising

Phone: +44 (0) 208 144 3511 marketing@gbafmag.com

GBAF Publications, LTD

Alpha House

100 Borough High Street London, SE1 1LB United Kingdom

Global Banking & Finance Review is the trading name of GBAF Publications LTD

Company Registration Number: 7403411

VAT Number: GB 112 5966 21 ISSN 2396-717X.

The information contained in this publication has been obtained from sources the publishers believe to be correct. The publisher wishes to stress that the information contained herein may be subject to varying international, federal, state and/or local laws or regulations.

The purchaser or reader of this publication assumes all responsibility for the use of these materials and information. However, the publisher assumes no responsibility for errors, omissions, or contrary interpretations of the subject matter contained herein no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the publisher

Welcome to the 60th edition of Global Banking & Finance Review. Whether you are a long-standing reader or joining us for the first time, it's our pleasure to bring you the latest insights and developments from the forefront of the financial industry.

This issue is particularly close to our hearts as we celebrate the achievements and address the challenges facing women in finance, aligning with the spirit of International Women’s Day observed last month.

On page 26, delve into the reflections of four pioneering women in fintech as they share their insights on the progress and ongoing challenges of achieving gender equality in the industry. Their perspectives offer a compelling look at the future steps needed to advance equity and inclusivity.

Turn to page 36 to understand the digital finance gap's impact on women's empowerment. Through Howard Davidson’s insights, we examine the barriers and opportunities digital finance presents for women's financial independence, advocating for greater access and inclusivity.

Dive deep into the journey toward inclusivity in the fintech sector on page 16, where we spotlight the stories and strategies of leading female finance executives. Discover how they're forging paths for a more inclusive industry, breaking barriers and setting new standards for diversity and empowerment.

Rethink the essence of customer experience in the era of digital banking on page 30, with Elizabeth Tobey’s exploration of the often-overlooked aspects crucial for revolutionizing financial institutions' engagement with their customers. Discover strategies for enhancing connectivity and satisfaction in a rapidly evolving digital landscape.

At Global Banking & Finance Review, our commitment remains steadfast in providing you with comprehensive coverage and expert perspectives. Whether you're a seasoned professional or new to the world of finance, our magazine is your guide through the ever-evolving financial landscape

Send me your thoughts on how I can continue to improve and what you’d like to see in the future.

Enjoy!

®

Stay caught up on the latest news and trends taking place by signing up for our free email newsletter, reading us online at http://www.globalbankingandfinance.com/ and download our App for the latest digital magazine for free on Google Play and the Apple App Store

Venkataraman Balasubramanian, Chief Evangelist, Zafin 12 22

Revolutionizing Banking: Fintech’s Impact and the Compelling Need for LoyaltyDriven Rewards Programs

Mark Jackson, Managing Director, Valuedynamx

Progressive Core Modernization: The Key to Competing in Today’s Banking Landscape

How to make money in a recession

Mindy Paul, High-performance coach, and Founder of Mind, Money and Business

Benjamin Kluwgant, State and local tax expert and Director, Source Advisors 06

Ensuring Tax Efficiency in Global Payroll: Insights from Paul Miller, CPA Paul Miller, Managing Partner & CPA, Miller & Company, LLP

The telling signs of Imposter Syndrome and how to overcome them

Jeannette Linfoot, CEO, Jeannettelinfootassociates

Expert strategies for e-commerce businesses to stay tax compliant across their multi-state operations

From

Fang

Here’s

Elizabeth

How

Greg

PSD2:

Andy

Decoding

Oliver

Sumit Harriet Christie, Chief Operating Officer, MirrorWeb FINANCE

Ronald S. Niemaszyk, Principal – Wealth and Asset Management Industry Practice, Wipfli.

Bridging the SME trade finance gap

Eyal Moldovan, Co-founder, CEO, 40Seas

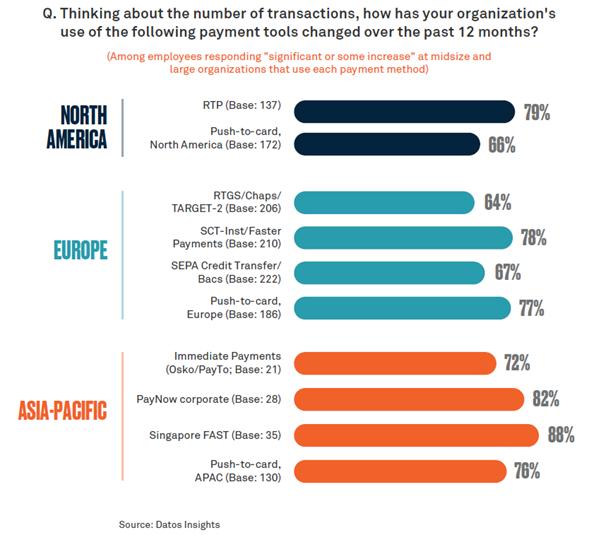

Financial institutions and businesses risk losing their competitive edge if they

real-time payments

Carl Slabicki, Co-Head of Global Payments, Treasury Services, BNY Mellon’s Erika Baumann, (Not pictured) Director, Commercial Banking and Practice Payments, Datos Insights

FINRA Report 2024: Recordkeeping Takeaways

International Women’s Day 2024: Four fintech leaders reflect on progress in the industry

Anna

Fostering

Some of the world’s biggest economies have recently fallen into recession. It was officially confirmed last month that the UK economy entered recession at the end of 2023. Japan’s economy shrank during the same period. When these turbulent times hit, the media dictates our thinking and how we act. 24-hour news cycles bombard us with bleak predictions. Panic sets in. We become fearful, doubtful, and start to retreat. Many business owners go into survival mode and take less risk. But times of recession can offer a huge opportunity to rethink the way we do things, to come up with a plan to push things forward. In fact, many millionaires are made during times of recession and adversity.

A huge part of this is about mindset. Thinking for ourselves. Thinking outside the box. Success is an inside job, so we can’t allow outside circumstances to do the thinking for us. After Covid hit in 2020, my company could have been crippled because our model had been based on live events. But instead of panicking, we used our imagination and got creative, and were able to pivot to an online model. We reacted quickly while similar companies were still reeling and worrying about how to respond. This not only saved the company but, in the long term, helped us reduce costs and massively expand the number of clients we were working with. Rather than being our downfall, it triggered our success.

Because in every adverse situation, there’s an opportunity. Why, for example, do you see successful business people purchase businesses that are losing money? To the average person, this may seem like a bad idea. But it was Richard Branson who said the best time to buy a new business is when it’s being run badly by others. People like this think differently. They see an opportunity. Why is this business failing and what can I do to capitalise?

For a lot of people, if they have a problem, that’s often all they see: the problem. But a problem and a solution exist side by side. And to find that solution, the first step is changing the way we think. Our conditioning and how we are subconsciously programmed.

Our subconscious operates without conscious awareness, influencing our decisions, actions, and habits. Just like an aeroplane has an autopilot system that keeps it on course, we all have a mental autopilot system. And many of us are ‘programmed’ to focus on the problem. We have naturally trained our brains to be this way over many years, and when we do this, rather than solving anything, the problem just tends to get bigger and bigger. But we can equally train ourselves to focus on solutions.

And where can we find the solutions we need to take advantage in times of recession? We can find them by learning about how our industry is changing. By learning from our own mistakes and the experiences of others who work in the same or similar industries. We can find them by listening to our customers and what they expect as circumstances change. By looking at what we offer our customers and examining what exactly it is that they need. In the answers to these questions lie not only how to stay in demand during troubled times, but become even more in demand.

The more we shift our mindset – and start thinking along these lines – the more our subconscious mind is going to work towards overcoming the problem. This takes time and repetition, commitment and determination, because our subconscious minds weren’t built overnight. Subconscious programming has to be done correctly, in a certain way, with certain steps and over a certain period of time. But ultimately, the key to finding solutions is within us.

Once a solution has been found, it’s important to be flexible and act quickly. A key part of this is surrounding ourselves with the right people. As a CEO or founder, you want to work with people who share your mindset because they will be an important part of creating the right culture for success. People who are open-minded and proactive, who are able to nimbly adapt when there is a need for it, are key.

By tapping into your imagination and focusing on solutions rather than problems, we can override the negativity and panic, and take advantage of gaps in the market. Because ultimately for every economic downturn, there will eventually be an upswing. And if you’re able to do this – and act quickly – you will put yourself in a position where you can reap the benefits.

Whereas once, the accounting and finance functions were siloed, now they are called on to leverage their expertise across every area of business, from identifying operational inefficiencies, to developing accurate business forecasting models, collecting valuable financial insights, and tracking employee progress.

The dynamic accounting evolution using robotic process automation (RPA) and IA to meet growing regulatory, audit, practice, corporate governance requirements, and transform core operational work is great, but where do you start?

Finance and accounting operations are wellsuited to intelligent automation. If you think about the many tasks undertaken in these departments, they often follow a clear set of rules, such as extracting data from invoices and entering it into the financial software.

The first place to go to are places with defined workflows to speed up your throughput. If you have a process spanning multiple applications or interacting with other departments, this is a good candidate for intelligent automation. Also focus on the use of structured data so your team can target processes using well-defined data formats such as invoice form fields so as your automation advances, RPA can work with more unstructured data formats.

When determining which automation to launch first, single-out a high volume and low complexity process that will deliver compelling ROI and quickly prove the value of IA. Some cyclical business operations only happen occasionally such as an unexpected audit. Processes and tasks like this can often be assisted — if not replaced — by intelligent automation.

Typically, ideal automation candidates include:

• Invoice processing

• Accounts payable and receivable

• Financial reporting

• Payroll administration

• Purchasing orders

As your intelligent automation practice advances, the scope of automations expands considerably, including processes involving decision-making, utilizing unstructured or semi-structured data, those poorly defined with multiple variations and much more.

However, it’s not all about reducing time on processes, or even improving the bottom line. As your intelligent automation matures, finance professionals can utilize their valuable strategic skills once relieved of their rules-based, procedural tasks. The core functions of the business continue, allowing the company to maintain its trajectory. And still, people are free to help the company make investment decisions, setting the business on a greater path to growth.

While “Big Four” firms* are leading this trend, many small independent chartered accountants, mid-size accounting firms, and in-house finance teams are still using traditional software packages to manage contract and payment analysis, payroll, or tax record retention, and to oversee employee tax IDs.

While most average main street accounting firms still manage annual tax assessments for self-employed workers and book-keeping services, today, they’re also multi-faceted business champions in all areas, from delivering essential accounting and compliance issues to offering tax planning advice and long-term strategic consultancy.

Equinix, for example, which provides interconnected digital infrastructure for its customers, including 248 data centers located on six continents, used intelligent automation as part of its end-to-end automated sourceto-pay (S2P) process. Each year, $3 billion flows through purchase orders handled by this process. Digital workers pass work to one another as purchase requests, from first request and purchase order creation to validation.

Digital workers also close aged orders and help resolve emailed invoice disputes from over 6,000 global requestors. Executing 98% of vendor, employee, and intercompany payments, digital workers have enabled the finance payables team to focus on issue resolution and strategic initiatives instead of manual work.

These changes have improved data accuracy, reduced errors, and help Equinix pay vendors faster. Equinix’s intelligent automation program has reduced operational costs (currently estimated at $7 million) and improved customer satisfaction.

The savings have been invested into strategic initiatives to enhance the business and employee experience, giving around 175,000 hours back to employees so they can focus on improving their skillsets and contributing to the business in new ways.

By adopting IA, it means finance teams are also able to shift focus from chasing paper to providing advisory – and more profitable services – such as financial planning, tax planning, or business strategy. Firms can offer better value or are more cost-effective when it comes to the business planning advice, finance raising, forecasting and management strategies.

Another largely untapped area for intelligent automation is fraud detection. While detecting fraud often sits within special financial crime or operation controls units, particularly within the FSI industry, there is still opportunity for accounting firms, in-house teams, or operations-led functions to consider how they can benefit from using IA in this space.

Every year financial fraud costs are impacting the reputation of affected institutions, with costs ultimately passed onto customers. The latest PwC Global Economic Crime and Fraud Survey reveals that – in 2022 – 51% of respondents experienced fraud in the previous two years, the highest level in 20 years of research. Globally, financial fraud is a $42 billion issue for large financial organizations, corporations, and enterprises alike.

With identity theft, employment, and insurance fraud on the rise, forensic accountants use their finance with legal investigative techniques to look within organizations for fraud, or financial irregularities, trace funds and identify assets, or validate losses.

lA is also an additional weapon in the accounting armory following the financial crash of 2008. Sometimes involved in valuing a business, forensic analytical skills are increasingly used in commercial negotiations. With greater demand for accountability and regulatory reform, forensic accounting has become more prevalent as the business environment has become more complex.

An example of this is Prudential plc, headquartered in London and Hong Kong, providing life and health insurance, and asset management to around 19 million customers in Asia and Africa.

The company uses bespoke fraud detection bots created by SS&C Blue Prism to analyze transaction data and detect fraudulent activity, across its 34 life businesses in 23 markets, served by more than 530,000 agents, 170 bank partners and 27,000 bank branches.

The automation can perform the same number of 100% approval check authorizations it would take 40 people to do in a year. Improving security for customers and ensuring Prudential’s 1,000 daily claims – worth around $100,000 – are 100% audit compliant, it has also drastically reduced losses due to fraud.

By using a mix of RPA and IA to automate mundane highly repeatable tasks, Prudential’s finance and customer teams can spend more of their time focused on higher-impact high-value business activities.

By making data instantly accessible and flexible in real-time for business owners and accountants, cloudbased automations are also impacting hybrid or remote accounting teams.

With secure user authentication and an internet connection, cloud-based accounting teams can better access and view financial data, and monitor transactions, making accounting possible and profitable from anywhere.

With IA performing automations or generating reports for teams, clients, and contractors alike, timely financial analysis and strategic planning is error-free and more focused, leaving financial experts to make greater – and more profitable – use of their expertise across every area of any business.

While accounting principles and processes have changed little in the last 200 years, automation and cloud has transformed it from siloed function to strategic driving force.

Assisted by intelligent automation, artificial intelligence, and real-time data-driven technologies, finance teams who are able to benefit from more efficient workflows will reap greater benefits from streamlined accounting processes and play a role in their organizations.

Companies that adopt these technologies –whether their teams are office based or digital nomads – will be more resilient, agile, productive and enhance their competitive advantage in the market.

*The four largest global accounting firms measured by revenue are Deloitte, Ernst & Young, PricewaterhouseCoopers, and Klynveld Peat Marwick Goerdeler (KPMG).

Paul Miller, Managing Partner & CPA is a driven individual and a tireless businessman with over 30 years in the accounting industry. Paul grew up in Queens and started working at age 12. In 1987, he graduated with a Bachelor’s degree in science from St. John’s University. In 1992, Paul earned his CPA and resumed working for Mahoney Cohen (now CBIZ, Inc.), a public accounting firm on the New York Stock Exchange. Five years later, he opened his own accounting office in Little Neck, NY. Miller & Company LLP officially formed in 2002 as a continuation of Paul Miller, CPA. Now a respected CPA firm throughout New York City and nationwide, the company has grown to a staff of more than 25 employees and services approximately 3,000 clients.

With tax day coming up, now is the best time to discuss tax efficiency within global payrolls, to make sure that those who need help have time to receive it. Navigating the complexities of taxes within payrolls across the world is a challenge, from compliance requirements to tax rates and regulations for each location. Employers must consider various factors such as tax deductions, credits, and employee benefits to minimize tax liabilities. Tax efficiency in payroll management is a critical aspect of financial supervision for businesses, requiring careful consideration and strategic planning. In this article, we will explore key considerations and strategies that businesses can use to achieve tax efficiency in their payroll operations.

At the core of tax efficiency lies a deep comprehension and understanding of the diverse tax layouts across multiple countries. Each area has its own specific tax laws, rates, and compliance requirements that must be followed. From income taxes and social security contributions to local taxes and statutory deductions, payroll professionals must grasp the specifics of each country’s tax system to accurately process payroll and remain compliant.

Before an employee is sent out or temporarily relocated to the planned area, make sure both the employee and management have looked into tax regulations and policies for said area. As well, if the employee is going to be working under a different form of management or a different company, make sure they are aware of not only their tax laws but of yours, to confirm accuracy when filing.

Successful tax efficiency in global payroll begins with strategic workforce planning. By strategically deploying talent across different areas, organizations can optimize tax structures and minimize tax liabilities. This involves assessing the tax implications of employee placements, considering factors such as tax treaties, permanent establishment rules, and residency requirements. By matching workforce deployment with tax optimization strategies, organizations can achieve significant savings while ensuring compliance with local tax laws.

Before employees travel to other locations for work, make sure they understand that there will be differences when needing to file taxes. Even if it is just different locations within the same country, but especially if it is another country, make sure they are aware and knowledgeable that there will be differences when filing. Even if it is temporary work under a different supervisor or stepping in for another company, make sure the leaders and representatives with the employee are aware of what they have to do, not only for the employee filing but in case they as the employers need to file for them or claim them.

Paul Miller Managing Partner & CPA, Miller & Company, LLP

Paul Miller Managing Partner & CPA, Miller & Company, LLP

Productive communication and education processes are essential parts of tax efficiency within global payroll. Providing employees with clear guidance and instruction on tax implications, compliance requirements, and available benefits shows transparency and increases tax literacy. Regular training sessions, having informational resources, and personalized support empower employees to make informed decisions regarding their taxes and benefits. By fostering a culture of tax compliance and awareness, organizations can help employees minimize errors and inaccuracies in payrolls, ensuring both tax efficiency and employee satisfaction.

Making sure there is an accurate calculation of financial withholdings is essential for tax-efficient payroll management. This means precise calculations for federal and state income tax withholdings, as well as deductions for Social Security and Medicare contributions. Staying informed about changes in tax rates and regulations as well as reviewing and regularly adjusting everything is necessary for appropriately adjusting your withholdings, preventing underpayment or overpayment of taxes.

Keeping detailed records of calculations will help you or your business by having consistent information not only for the present but also to look back on when reviewing previous years’ records for reports. If needing previous years’ records for proof during tax filing, keeping them in a safe and labeled spot will prove useful. Keeping tabs on all withholdings, deductions, and contributions will provide a more accurate amount of taxes filed and returned.

Leveraging pre-tax benefits can significantly improve tax efficiency for both employers and employees. Businesses must navigate the complexities of fringe benefits and employee reimbursement programs to truly optimize tax efficiency. Providing fringe benefits such as company cars, meals, and entertainment can have tax implications for both employers and employees. Understanding the tax treatment of these benefits and implementing appropriate reporting processes is crucial to avoid unexpected tax liabilities. Similarly, managing employee reimbursement programs for business-related expenses requires meticulous documentation and adherence to IRS guidelines to ensure that reimbursements are not treated as taxable income. For employees, keeping notes of your benefits will prove useful not only for your tax filing but for your employer’s tax filing.

Compliance with tax reporting requirements is essential for maintaining tax efficiency in payroll operations. Timely and accurate filing of payroll tax returns, such as Form 941 for federal income tax withholding and Form W-2 for employee wage reporting, is essential to avoid penalties and interest charges. Keeping detailed records and implementing strong internal controls keep watch over accurate tax reporting processes. Moreover, staying informed about changes in tax laws and regulations enables businesses to adapt their payroll practices proactively, thereby optimizing tax efficiency and minimizing compliance risks.

Not only should just the employee keep records, but the home employer and abroad employer (if applicable) as well if needed. If necessary to claim expenses through the company for travel, housing, etc. for taxes, having proof and records is always highly recommended. Making sure that everyone involved has accurate records of the expenses will provide clarity for when claiming them may become needed.

In conclusion, tax efficiency in payroll management is a multifaceted endeavor that demands meticulous attention to detail and proactive planning. By accurately calculating withholdings, leveraging pre-tax benefits, managing fringe benefits and reimbursement programs, and ensuring compliance with tax reporting requirements, businesses can optimize their payroll operations to minimize tax liabilities while maximizing benefits for both employers and employees. CPAs play a crucial role in guiding businesses through these complexities, developing tailored strategies to enhance tax efficiency and promote long-term financial sustainability.

Fintechs are setting a whole new standard in banking. As a result, many customers seeking the utmost value are migrating away from traditional banking institutions in favor of the customercentric approach and new products and services offered by these disruptors. As consumers increasingly demand personalized and relevant experiences, there is a growing expectation for additional benefits in exchange for their loyalty. The message is clear: FIs must quickly adapt to growing consumer needs or risk being left behind.

Maintaining customer loyalty is more challenging than ever, given the ease and speed with which technology allows customers to switch accounts. In the UK alone, more than 113,000 customers switched their current bank account in the first half of 2023. This upward trend in customer turnover shows the importance of financial institutions exploring innovative approaches to increase customer engagement and retain their business. As a result, many FIs are investing in loyalty programs to enhance customer retention, foster engagement, build brand loyalty, and ultimately drive revenue growth across their organizations.

When executed well, a loyalty program can be a game-changing element for FIs looking to innovate. There are the four biggest benefits an FI can expect from their customer loyalty program:

While it’s a common understanding among most marketers that acquiring new customers is more expensive than retaining existing ones, it’s essential to remember that attracting and securing new customers often comes at a cost 5-7 times higher than keeping current customers.

Loyalty programs excel in keeping established customers engaged and less prone to switching to competitors. This success is attributed to the additional benefits, including rewards, discounts, and exclusive offers, which contribute to customers feeling valued and appreciated. Moreover, many programs enable customers to use their earned rewards as credits, enhancing their existing accounts through increased savings or reduced mortgage payments.

The sense of relevance and authenticity is further heightened when FIs incorporate personalization into their loyalty programs. This may include bonus perks tailored to birthdays or regular discounts and offers based on a customer’s most frequented store or frequently purchased products.

Loyalty programs play a pivotal role in establishing a profound emotional bond with clients, nurturing a heightened sense of engagement and connection between customers and their bank. This, in turn, significantly enhances the likelihood of customers maintaining long-term loyalty.

While enhanced personalization stands out as a straightforward method to appeal to a customer’s emotions, additional techniques such as gamification and storytelling contribute to customers feeling not just valued but genuinely appreciated and recognized.

Taking it a step further, many banks and FIs leverage their loyalty programs to make impactful investments in local communities, charities, and other meaningful causes. Some innovative start-ups center their entire proposition around addressing social and environmental issues, like climate change and driving positive change.

In a world where customers prioritize positive social impact and environmental sustainability when selecting the brands they support, the knowledge that their bank actively contributes to such causes becomes a vital way to cultivate longterm trust and loyalty.

Effective loyalty programs rely on data as their essential foundation, providing a wealth of insights for deeper understanding and personalized engagement. This data-driven approach empowers banks to offer tailored rewards and additional benefits, reinforcing and enhancing customer relationships.

Mark Jackson Managing Director, Valuedynamx

Mark Jackson Managing Director, Valuedynamx

The insights derived from loyalty programs extend beyond the program itself, playing a crucial role in various business areas. From shaping future targeted marketing campaigns to informing product development strategies, the data collected proves invaluable in steering overall business initiatives.

Loyalty programs, by capturing behavioral and transactional data, enable FIs to categorize customers based on their preferences rather than mere demographic details. In a landscape where customer behaviors, preferences, and expectations are in constant flux, loyalty programs act as a dynamic tool, allowing brands to adapt by tracking everyday spend and activities. This flexibility enables brands to move customers seamlessly into new segments as their needs evolve over time.

Integrating these loyalty program insights with an open banking approach, where additional services from diverse brands are seamlessly incorporated into a bank’s offerings, equips FIs to personalize and market to customers based on a comprehensive understanding of their transaction profile. This holistic strategy ensures that customer engagement remains finely tuned to their evolving needs and preferences.

Certainly, loyalty programs extend their advantages beyond the end customer, proving highly lucrative for the overall business. With each purchase, FIs gain a percentage return, contributing to expanded revenue streams.

Loyalty programs foster repeat purchases and create opportunities for cross-selling, amplifying revenue and profitability over time. The most effective loyalty programs grant customers access to a vast network of vendors and merchants across numerous industries, simplifying the application of loyalty rewards to everyday spending. This not only boosts customer engagement but also strategically places FIs at the forefront of the ongoing competition in the race for account or card preference.

As consumers continue to be selective with where they spend their money and bank, there is a pressing need for FIs to set themselves apart. Now, more than ever, is the opportune moment for these institutions to integrate a loyalty program into their marketing strategy, establishing a powerful tool to enhance customer engagement and loyalty.

Today’s fraudsters are sophisticated and determined. Their sole job is to relentlessly look for opportunities to exploit vulnerabilities in the fraud defenses of financial institutions (FIs). When FI fraud strategies fail to effectively leverage customer lifecycle data, they are doomed to be reactionary at best – only catching fraud after it takes place. To fight financial crime, FIs can and must work smarter, not harder. There’s a wealth of data at their fingertips, from customer IP addresses, to digital footprints, and customer behaviors across the various products within their offerings. If you’re not squeezing all of the “juice,” a.k.a intelligence, from your existing data, you are missing out on the low-hanging fruit that could be saving you valuable time, money, and resources on your fraud strategy in the long run.

It’s not uncommon for FIs to organize their customer data in silos – not by choice, but out of circumstance. As an institution broadens its services and adopts digital banking solutions, it may need to implement various fraud prevention solutions to tackle different types of fraudulent activities. For example, a bank that adopts real-time payments (RTP) may at the same time adopt a fraud solution that is specifically designed to detect RTP fraud. That FI is also still working with another fraud solution, or even multiple solutions, to address fraud concerns across other offerings – from everyday banking to loans and investments. Without centralized intelligence across solutions, FIs leave themselves wide open to bad actors who can slip through the cracks.

While analyzing data in silos leads to fragmentation, so do linear approaches to data, or analyzing data in a sequential, one-dimensional manner. This approach prevents FIs from observing interactions between data points at different stages of the customer journey across various products, making it nearly impossible to detect sophisticated fraud schemes. As an example, envision a situation where an individual contacts the service desk to request a change in their phone number. Following this change, there’s a large money transfer to a new receiver. Viewed in isolation, each event in this customer journey might not trigger suspicions. However, when these actions are considered together, a red flag is raised.

When data is analyzed separately, anomalies or suspicious patterns may not be immediately apparent. In fact, fraudsters’ malicious behaviors can often go unnoticed when examined in isolation because many traditional fraud solutions lack the ability to correlate events across different channels.

Modern-day fraudsters have access to the most up-to-date technology that makes it easier than ever to exploit the gaps in today’s FI fraud strategies. This is why creating a centralized intelligence hub is key to any modern-day fraud strategy. By integrating various data sources and efficiently managing the analysis and processing of this information throughout the account lifecycle, business units and channels, it’s possible to achieve a comprehensive understanding of customer behavior. This holistic approach significantly enhances the ability to detect and prevent fraudulent activities.

Consider a sophisticated fraud ring conducting large-scale coordinated attacks, involving account takeover (ATO) and mass registration. The patterns of such a ring could include the use of different IPs and device IDs, IP addresses traced back to VPNs or data centers, the consistent employment of certain payment instruments, and the recurrence of specific payee account numbers, among other signs.

Viewed individually, these subtle signals might not immediately raise concerns. However, the true strength of data orchestration lies in its capacity to weave these scattered indicators of different accounts together, constructing a detailed picture of the fraud operation. The more data at hand, the clearer the patterns become, facilitating the detection and linkage of multiple accounts involved in the ring. Data orchestration is pivotal in aggregating this vast array of information, enabling organizations to harness it in real time to uncover and dismantle the sophisticated networks of fraud.

Effective data orchestration transcends the mere consolidation of internal data, extending its reach to integrate thirdparty signals directly into the centralized intelligence hub. This integration is pivotal for FIs looking to enhance their fraud detection capabilities without multiplying their operational complexities or costs. By streamlining integrations and consolidating vendors, organizations effectively reduce the total cost of ownership, offering a more economical approach to fraud prevention.

Crucially, it gives organizations more control and the ability to discern when and which third-party signals are necessary, avoiding superfluous data calls that can inflate costs and complicate analyses. This use of third-party data ensures that FIs are not just collecting data for the sake of it. Strategically employing these external signals not only bolsters fraud defenses where and when it matters most but also minimizes unnecessary interventions, thereby preserving a seamless and positive experience for legitimate users.

To meet the relentless demand for immediacy in today’s digitalized world, FIs are required to analyze vast volumes of data quickly and make precise decisions within milliseconds. The stakes are high, as errors in real-time transactions can incur substantial and irreversible costs. Real-time data transformation is a key advantage of a powerful data orchestration layer – giving FIs the ability to set their fraud strategy apart. It empowers institutions to respond immediately to emerging threats, offering a proactive defense that isn’t achievable with traditional batch processing.

A compelling case for data orchestration in modern-day fraud strategies is underscored by its ability to seamlessly ingest data from any source – whether internal or external, effectively integrating internal and third-party data, and providing real-time data transformation. As FIs leverage data orchestration to build a centralized intelligence hub, they not only strengthen their defenses against fraud but also pave the way for enduring customer trust, loyalty, and adaptability in an ever-evolving digital landscape.

Fang Yu CPO and Co-Founder, DataVisor

Fang Yu CPO and Co-Founder, DataVisor

As the finance sector evolves, so too does the conversation surrounding diversity, inclusivity, and gender equality. In honor of International Women’s Day 2024, we spoke with prominent female finance executives to gain their perspectives on inspiring inclusion within the industry.

Aja Heise, Senior Compliance Officer at XBTO “While we still have a long way to go, more organisations are actively working to create inclusive workplaces and increase the representation of women in fintech, and there are certainly more women pursuing a career in fintech than when I started out. However, this year’s International Women’s Day theme of ‘Inspire Inclusion’ draws attention to the fact there are still challenges when it comes to achieving full inclusivity, especially at higher levels of leadership and in larger organisations. For example, just 6% of leading crypto and blockchain companies have a female chief executive. While gender diversity is crucial, it’s just one aspect of building a truly inclusive workplace. It’s essential to consider diversity in terms of race, ethnicity, sexual orientation, disability, age as well as other factors to ensure women from all backgrounds are represented. To ensure women feel equipped and empowered to pursue their goals, the industry must continue to champion and prioritise programs, such as WMNfintech and Techstars, that provide women with the funding and resources to launch and grow their own startups. Professional organisations like the National Women in Banking Association and Financial Alliance for Women that offer networking opportunities and support for women navigating such a male-dominated and fastpaced industry are also crucial to create more inclusivity.”

Meri Williams CTO, Pleo , “Inclusivity has a lot to do with visibility. As the saying goes, “if you can’t see it, you can’t be it”. I used to think role-modelling wasn’t that important, but then I led university recruitment for a while at P&G, and saw that we got double the applications from women whenever a woman presented on campus. That changed my opinion rapidly! I was lucky in my formative years to have a number of great role models who were inclusive, from multiple genders, who I grew to want to emulate. I fear this is becoming rare, but is an area that businesses can focus on to improve inclusivity now and well into the future.

The best bit is, if business leaders can successfully create a framework for more diversity, inclusion and equality, everyone will reap the benefits. Inclusivity can bring greater creative thinking to solving any problem – as the more diverse teams are, the more varied the members’ ways of thinking and the broader the range of solutions they develop. By implementing the correct policies and practices – from fair hiring to offering mentorship and support –businesses can create a culture of respect and inclusion to actively support the career development of women and non-binary folks in the fintech space.”

Pratima Arora, Chief Product and Technology Officer, Chainalysis “This year’s International Women’s Day theme of ‘Inspire Inclusion’ highlights that much more needs to be done to make careers in technology more inclusive. The landscape is not changing fast enough, especially in male-dominated industries like crypto where female representation in senior positions stands at 22.39% across the board, compared to 77.61% for men. Women often feel as though they don’t belong and opt out of STEM-related professions early in life due to a lack of awareness of the opportunities available to them. This starts at an education level – when I was at university studying computer science, there were only three girls in my entire class of 50. To build diversity in the industry, we must focus on creating an inclusive culture that nurtures female talent. Many of the barriers women face when it comes to pursuing a career in technology are due to lack of engagement, the confidence gap, outdated societal stereotypes, an intimidating maledominated culture, and a lack of role models. We need to be role models and mentors for the next generation to inspire them and demonstrate what they can achieve. Industry events and recruiting conferences are a great opportunity to champion underrepresented talent to break these norms and highlight the various career paths for them within the industry. We also need more advocates, and it doesn’t just have to be women advocating for women.”

It may seem counterintuitive, yet economic uncertainty and market volatility set the stage for critical opportunities for asset management firms to shine in 2024. The stakes are higher now that the last bull market appears solidly in the rearview mirror. So, to stay in the game (and ahead of the competition), firms need to be extra careful and strategic with their prime resource allocations — for people and technology.

By the same token, investors benefit through extra assurances that their asset managers have the tools and the acumen to navigate effectively through this dodgy trading environment.

Improving efficiencies and mitigating risk in the asset management industry, whether it’s people management, data and analytics or regulatory compliance, will be core objectives for a strong and successful year ahead.

New digital technologies are shaping how asset management is done, which ties directly into the industry’s critical staffing challenges. The high-performance computing needed to analyze vast amounts of trading data means that firms have no choice but to bring on and retain computer science talent at the highest level. Even with the growing role of AI and automation, the role of human talent to drive decision-making remains paramount. People can focus on using their highest-level skills and let the machines do some of the tasks that used to eat up their time. AI actually helps your people become more valuable than ever.

Teams need to be able to support trading decisions with highly sophisticated data and should expect to compete with tech companies to recruit the top candidates for data analysis roles. You may need to look differently at how you source and compensate your talent to remain competitive. Your search for candidates likely needs to go beyond new finance grads (though you need them, too) as you scour for people on the technology side with advanced skills who will help make the right decisions for you as quickly as possible.

While the wealth management side of the business and other financial sectors have responded to employee expectations for hybrid or even fully remote work, the inoffice culture in asset management seems firmly here to stay. Real-time knowledge-sharing and collaboration are highly valued and so the broad consensus is that with all the rapid transformation and need for immediate feedback, employees should be working together in the same physical space. An in-office workforce may help foster a culture of trust and confidence in each other’s capabilities.

Most firms may be struggling with the best way to allocate resources to identify the tech products they need. They are significant investments, and the choices can be overwhelming. Many benefit from third-party assistance in technology planning. A road map that helps them define their current and future needs, determining the proper budget for those needs and a plan for expenditures can set firms up for a strong course for stability and growth, especially through periods of economic uncertainty. In fact, experimenting with various options with support from experienced advisors may be the only way to confirm your choices and keep from falling behind in this highly competitive sector.

Outsourcing some roles that are not integral to your technology core may make sense in your resource reassessment. An outsourced CFO or cybersecurity team may be a wise move so you can concentrate your in-house talent expenditures on your technology infrastructure and the people in the office who can help improve your trading acumen.

Similarly, supplementing your hiring with offshore hires in India or the Philippines, for example, may also be a smart move for firms struggling with budgeting and limited availability of local talent. Firms may need to exercise some flexibility in their in-house hiring priorities, as they can find excellent workers for certain support roles, particularly for data analysis, outside the U.S.

Ronald S. Niemaszyk Principal - Wealth & Asset Management Industry Practice at Wipfli.

Ronald S. Niemaszyk Principal - Wealth & Asset Management Industry Practice at Wipfli.

When considering the M&A landscape, the impact of increased valuations and interest rates is clearly a roadblock to large, transformational deals. However, firms are still eager to expand their offerings and knowledge with strategic acquisitions and partnerships. One of the factors driving more targeted M&A activity is the evolution of investment vehicles. While open-ended funds remain the dominant product in professionally managed assets, other options still attract attention and spur investments.

The products gaining popularity in the marketplace focus on serving the explicit needs of clients. Actively managed ETFs and direct indexing allow for greater tax efficiency and transparency. And theme-driven funds and portfolio construction allow for clients to focus on individual sectors, ideas or preferences, such as ESG, energy, infrastructure or other areas that align with their priorities.

Whether expanding offerings by acquisition or launching products in-house, each comes with its own series of challenges. Whether it’s integrating people and technology through an acquisition or developing the technology systems to support new product offerings, the path to success largely depends on asset management firms having a clearly defined road map and the resources to support their efforts.

For SMEs (Small and Medium-sized Enterprises) operating in today’s fairly unstable and fragmented supply chain landscape, having rapid, reliable access to financing is a prerequisite for survival and longevity. However, old-school, antiquated payment technology and legacy trade financing offerings are making life unnecessarily difficult for SME importers and exporters, exacerbating global supply chain fragmentation.

Despite accounting for 43% of global cross-border trade volume, SMEs are 7 times more likely to be denied trade financing than multinational companies, according to the WTO. For a key business segment which already faces a steep uphill battle to make it to the two year mark, this imbalance can’t persist.

The limited access to financing for SMEs has contributed to the growing trade finance deficit – which now stands at $2.5 trillion – having risen substantially from $1.7 trillion in 2020. The widening trade finance deficit is particularly concerning for smaller businesses in emerging economies who require sufficient levels of trade financing to establish a foothold in highly competitive markets. SMEs typically struggle to secure funding from traditional financial institutions due to their size, lack of collateral, and perceived higher risk. Additionally, rising interest rates, inflation, negative economic forecasts, and sustained geopolitical uncertainty are hampering banks’ ability and willingness to provide essential trade financing. Market volatility and ongoing uncertainty is also suppressing banks’ appetite for issuing credit, as evidenced by a report from the CEPR which examined levels of banks’ credit issuance in the context of trade fragmentation and increased uncertainty. The report noted how for large US banks, those exposed to trade uncertainty reduce credit originations by 0.5 percentage points.

Right now there’s a perfect storm of challenges for SMEs to contend with. They already have to grapple with a minefield of fluctuating demand patterns, evolving consumer preferences, rising shipping costs and nuanced regulatory frameworks, making it increasingly difficult for them to maintain competitiveness in the current market.

Moreover, by their very nature, SMEs often lack the established credit histories, making them ‘riskier’ propositions in the eyes of traditional banks and financial institutions – whose stringent criteria generally require reams of documentation, demonstrable collateral, and a bonafide track record before extending credit to new clients. As a result, SMEs are often denied access to essential financing, or face long delays that undercut their ability to compete on the global stage. The financing constraints are even more severe for SMEs who rely on Letters of Credit (L/Cs) to address cash flow issues. As I’m sure many SMEs can attest to, legacy trade financing processes can be slow and bureaucratic, and SMEs often find themselves navigating endless red tape, leading to delays in securing funds and getting their goods to market.

As a snapshot example of this financing glass ceiling, a recent report examined the high rejection rates for Bangladesh SMEs when seeking finance for foreign trade. The research found that 36% of applications were rejected due to a lack of collateral, 18% were rejected due to high interest rates, 17% for lack of previous transaction information, 11% due to their ‘high risk’ and 10% due to a lack of sufficient documents to support the application. For SMEs starting out, many of these factors are outside of their control – giving expression to the list of issues stacking the odds against SMEs.

Against a backdrop of macroeconomic uncertainties and the rising cost of capital, data-driven innovations can provide a timely lifeline for SMEs who are often unfairly overlooked by traditional financial institutions for the reasons listed above. Unlike conventional banks, fintech platforms can operate with a high degree of agility, employing innovative risk assessment methods and utilizing big data analytics to accurately evaluate SMEs’ creditworthiness – increasing SMEs’ chances of obtaining financing to fuel their international trade pursuits. By swiftly analyzing various data points like transaction history, AI-powered data analytics can be harnessed to plug the shortcomings of large institutions, offering tailored financing solutions, even to newer and smaller SMEs without the extensive credit histories that institutions get hung up on.

Fintech-led automated underwriting can deliver financing within hours, empowering SMEs to seize time-sensitive opportunities in the global market – a stark contrast to the slow and cumbersome processes of traditional trade financing, which forces SMEs endure lengthy delays for application reviews and approvals, and miss out on revenue generating opportunities. This new era of trade financing can help provide much needed clarity regarding capital availability for SMEs operating in today’s highly unpredictable supply chain landscape, enabling them to make informed decisions around inventory management and plan for the future with a real sense of confidence.

Since the 1980s and 1990s, legacy back-end core tech systems have served as the backbone of the banking industry, offering reliability and effectiveness. However, with the banking landscape swiftly embracing digitalization, the limitations of these legacy systems have become increasingly evident. The emergence of neobanks and digital banking platforms underscores the pressing need for traditional banks to modernize their core systems. Unlike some traditional banks, these newcomers boast the agility to swiftly introduce innovative products and pricing capabilities to the market, attracting a substantial customer base seeking a seamless digital banking experience and product and pricing propositions that are personalized and align with their life stage.

Furthermore, the monolithic nature of legacy systems leads to slower time-to-market and escalating costs. Even minor changes necessitate extensive testing and coding, further impeding agility. Moreover, the working knowledge required to navigate these legacy systems is typically concentrated among long-tenured individuals, fostering a reliance on specialized knowledge. Consequently, when these individuals depart, it creates a void in system management and maintenance.

There is an urgent need for modernization, yet the expense and time required for core system overhauls often deter many executives from embracing newer technologies.

In the past, banks seeking to modernize core infrastructure embarked on multiyear replacements with support from leading core banking providers. None of these replacement efforts achieved success and, in many instances, resulted in public and costly failures.

Recently, some banks began experimenting with light-weight neo-cores to modernize product- by-product while leveraging new stateof-the-art capabilities. Unfortunately, many neo-cores require significant effort to make them viable to operate within their complex banking ecosystem. This is largely because of the need to ensure that product and pricing are synchronized across all cores as well as the complex integration that is required to ensure a one-bank feel for its customers.

Research from McKinsey indicates that 70% of digital banking transformations surpass their initial budgets, with 7% ultimately costing more than twice the initial estimates. Furthermore, challenges such as time-to-market constraints, insufficient employee bandwidth to support, security vulnerabilities, restricted data integration and reporting, limited flexibility and coordinating the multi-core ecosystem, pose significant obstacles.

While replacing legacy cores and implementing neo-cores have not yielded the desired results in the required timeframe, a new path has emerged – one that embraces the demands of delivering near-term paybacks in terms of business agility and functionality while also satisfying the need to modernize the infrastructure and establishing a foundation for the future.

Venkataraman

Balasubramanian

Chief Evangelist at Zafin

Bank vendors with significant experience suggest an incremental approach to core modernization, eliminating the need for wholesale replacement. Instead, organizations can streamline their core systems by externalizing certain components and integrating them into a modern architecture, while maintaining connectivity with existing systems. Progressive core modernization is underpinned by abstracting three legacy core components: product management and pricing, customer arrangement master and customer information master from their core system reducing the core systems to operate as a thin ledger, which can continue to operate with low operational risks or be replaced/ augmented with new thin ledgers built on modern capabilities.

This approach enables faster delivery of new products and services without incurring the full expense of replacing the entire core infrastructure.

Additionally, banks can extract product and pricing platforms that centralize product data from disparate core systems into a single master platform. By leveraging these capabilities banks can drive product innovation through unlocking new product architectures that bring together different bank products to serve new, personalized propositions to bank customers while concurrently undergoing the complex process of core system modernization.

Why should banks consider partnering with a vendor specializing in core modernization?

Maintaining banking core technology systems demands significant resources, with none more valuable than employee time. Depending on scale of operations and product offerings, banks may require a comprising of software engineers, architects, developers, security analysts and product managers. Each bank must adequately staff these roles to consistently deliver current services while also innovating to meet evolving consumer demands.

While there is no one-size-fits-all approach to core modernization, banks can look to banking technology vendors as true partners to help internal teams and departments working to optimize business operations and develop products that meet and exceed banking customer expectations.

More importantly, core modernization and business transformation are no longer competing objectives. Working with banking technology vendors can increasingly allow banks to secure quick wins by leveraging banking technology capabilities to implement solutions that reframe business processes, create new enterprise capabilities and create initiatives that can uplift business metrics in the short term while simplifying the existing core infrastructure and increasing operational efficiency. The resulting savings, not only build internal confidence across business, technology and compliance stakeholders but can also serve as first steps towards funding the modernization of their core banking systems.

Core modernization isn’t a luxury for banks but rather a necessity. As market dynamics continue to change, business leaders must reimagine business models and modernize core technology to deliver sustainable revenue growth, reduce risk, and deliver an enhanced customer experience.

The telling signs of Imposter Syndrome and how to overcome them

Feeling like a fraud in your professional life is something that many highly successful people battle with. Thoughts of not being good enough, lacking necessary experience, or simply not deserving your success are known popularly as imposter syndrome.

The phenomenon is not as uncommon as you might think, with one recent study estimating that up to 82% of people experience it at some point in their professional lives. It’s particularly widespread in highachieving individuals, and if not identified early on, can create feelings of self-doubt that can hold you back from your true potential.

So, what are the common signs of imposter syndrome, and what can you do to banish it?

Have you ever brushed off an achievement with phrases like “anyone could have done this” or “it was down to luck”? A consistent pattern of dismissing your successes and downplaying otherwise impressive achievements is a widespread symptom of imposter syndrome, indicative of an inability to look at your own competence and skills in a positive light.

While a certain amount of humility in one’s achievements is admirable, a long-term pattern of minimising your achievements can be very damaging. It feeds into a negative self-view, bolstering those feelings of doubt that can make you reluctant to really showcase your skills and expertise.

A tendency towards perfectionism may seem like a rather positive trait. While this can certainly be true, more often, perfectionism involves holding oneself to an unattainably high standard. Far from pushing you to be better, failure to live up to unrealistic expectations can be incredibly harmful, resulting in feelings of unworthiness, or in this case, feeling like an imposter.

This behaviour goes hand in hand with low confidence in one’s own abilities, and the need to prove oneself by striving for perfection. At the root of this is the fear that you may be regarded as incompetent or found out as a fraud if you don’t produce what you consider perfect results.

Far from being a motivator, the need to perfect everything you do can hold you back considerably. Not only can it lead to feelings of inadequacy and failure, but can result in getting lost in a maze or details, micromanaging work and projects, and generally expending energy in unnecessary areas.

No-one enjoys their work being criticised, and though it can be a struggle for many people to accept even constructive criticism, for those suffering with imposter syndrome, it can hit much harder. Every piece of feedback, no matter how well-intentioned, can feel like you are on the verge of being exposed as a fraud, bringing those feelings of inadequacy to the forefront.

Rather than viewing constructive feedback and criticism as an opportunity to learn and improve, imposter syndrome can make it feel like it’s only a matter of time before you are “found out”.

The deep-seated feelings of inadequacy in those struggling with imposter syndrome can give rise to an unconscious effort to selfsabotage one’s chances of being recognised or praised for one’s work and efforts.

This can quickly become a self-fulfilling prophecy, where your belief that you don’t deserve your success, or are simply not good enough, can cause so much anxiety that it can make it harder to function.

If not kept in check, these feelings of self-doubt and unconscious attempts to self-sabotage can make you your own worst enemy, making you reticent to lead projects, go for promotions or embrace opportunities.

Perhaps the hardest part of overcoming imposter syndrome is addressing your underlying feelings. It may be tempting to simply push these thoughts down, but recognising your own negative self-talk will help you begin putting these feelings into context, and is the first step to forming more positive habits around acknowledging your success and accomplishments.

Likewise, it’s important to seek support and speak out. Low confidence in your abilities can seriously hold you back from your full potential, particularly if you’re in a vicious cycle of selfcriticism. Confide in those you trust about how you are feeling. Not only will this help you to gain some outside perspective and escape the cycle, but you may be pleasantly surprised by what others see in you.

Jeannette Linfoot CEO at Jeannettelinfootassociates

Jeannette Linfoot CEO at Jeannettelinfootassociates

Perfectionism can be a particularly difficult habit to break, but start by setting small, realistic goals. Change your focus from aiming for perfection to instead making continual positive progress, and begin reframing setbacks not as bitter disappointments, but rather chances to improve and learn.

Overcoming imposter syndrome requires a commitment to practising self-compassion. This can be difficult when you’ve convinced yourself of your feelings of inadequacy, but treating yourself with kindness will help you to break the habit of beating yourself up for minor perceived failures.

For those highly motivated to achieve in life, imposter syndrome can be especially common. Though difficult, it is not impossible to overcome, and begin to change the narrative you use about yourself. You have worth outside of any one specific goal or achievement, and understanding this is key to overcoming the feelings of inadequacy holding you back and stopping you from reaching your full potential.

In 2024, it’s concerning to see that, in the financial services industry as a whole, only 39% of board directors are women. While progress has been made towards gender equality in this sector, International Women’s Day serves as a reminder that more still needs to be done. Proactively working towards a more equitable industry is key to creating an open workplace culture, attracting diverse talent and nurturing future leaders. Additionally, diversity fosters innovation and drives positive disruption within the sector.

To mark the day, four female leaders from across the fintech industry have shared their insights and biggest learnings from their careers in the sector.

Better female representation attracts more diverse talent, boosts innovation and drives growth

Leaders within the financial services sector must keep in mind that diversity ultimately benefits the end-user – the most diverse group of all. In fact, with diversity comes a wide range of perspectives, which is key to keeping up with the latest trends and increasing competitiveness. For Anna Porra, Head of Market Development and Planning at Soldo , “Inclusivity fosters innovation and creativity which has been at the centre of the positive disruption we’ve seen in financial services over the past decade. Prioritising diversity not only advances individual careers but also bolsters overall economic growth by tapping into the full spectrum of talent. With the economic landscape looking gloomy, fintechs are doing all they can to stand out from the crowd. The ones that will, are investing both time and money in women – creating diverse workplaces that truly meet customer needs.”

She recalls that, “Research has continually proven that diversity benefits businesses, and in the competitive landscape of fintech, capturing talent and embracing a wide set of skills is not just a matter of social justice but a strategy for sustained success.”

Sarah Spoja, CFO at Tipalti , echoed this sentiment and believes that creating a diverse workplace is also vital to attract and retain young talent, saying that “Women made up just 16% of CFOs last year. While this figure has almost doubled over the past ten years, the percentages of women at the top remain too low. To combat the death of opportunities for female finance talent and inspire the next generation of leaders, we must create a more dynamic environment that embraces modernisation through technology to make the career more attractive to young talent, and continue to mentor our emerging talent through programs that showcase opportunities for their careers to grow across finance and accounting.”

She expresses that, “The finance office itself has evolved significantly in recent years. Traditionally, more junior roles were focused on compliance and control – in which graduates were led by a conventional ‘numbers CFO’. However, with the ongoing digital transformation of businesses and their increasing dependence on technology to shape strategic decisions, the dynamics of finance roles are shifting. Automation has played a pivotal role in this transformation by streamlining manual and mundane tasks, thereby freeing up time for young talent to engage in more strategic and value-added activities.”

We have come a long way with gender equality in the financial services sector. Emma Steeley, CEO at Aro , recalls that “If we go back to the 1980s, it was commonplace for lenders to demand the signature or consent of a husband or male relative when a woman, married or unmarried, applied for credit. This practice was rooted in historical gender biases and societal norms that considered women as financially irresponsible and dependent on men.”

However, while a lot has been achieved in the credit industry, Emma Steeley highlights the importance of data to in making credit more accessible for females. She adds, “In the world of credit, data reigns supreme. But many credit scoring systems continue to rely heavily on traditional bureau data, which may disadvantage individuals, especially women. This discrepancy may stem from the persisting gender pay gap meaning women have less financial stability and consequently, fewer opportunities to secure the credit they need.”

She believes that there is an urgent need for a renewed focus on open banking and a phasing out of standardised bureau data to foster a more inclusive and fair credit system, that doesn’t disadvantage women who lack extensive credit histories. She says: “Addressing these issues requires a concerted effort by governments, financial institutions, and a revamp of how we assess affordability with a system that promotes inclusive lending practices, eliminates gender bias, and considers open banking for assessing creditworthiness and affordability. Outdated models, which have hindered countless creditworthy individuals, must give way to a more comprehensive, data-driven approach.”

Too many women still believe they don’t deserve their place in the financial services industry and are less likely to succeed than men. Women need to break away from societal pressures and stereotypes regarding ambition and success. Nicole Olbe, Managing Director UK&I at Adyen society’s expectations of ambition. While I have been lucky enough to work alongside some fantastic allies, reflecting on my earlier career there were some difficult days in the office. A case of a ‘fake it until you make it’ mentality, turning up to meetings in a power suit and bringing more of what I felt was a ‘male energy’. It took time to embrace what I truly believe is ambition and therefore success.”

Fortunately, data demonstrates that women are starting to shake-off stereotypes and be proudly ambitious – according to Adyen research, 37% of respondents said they felt happiness when proclaiming personal ambition.

Nicole adds that we should consider more than workplace obligations when we think of ambition; “Becoming a mother was an impactful moment in my career and was when I reevaluated what ambition means to me. I’m a mother first and while I’m also driven by a mission to deliver on innovative payment solutions, I’m acutely aware of my role in the future and being part of a world that serves a diverse population for the better. We’re in a period of redefining work and how it fits into all our other identifiers. You can still be ambitious while having other priorities. Look for allies in your business, and consider networking in groups such as Women in Payments who provide opportunities to share their experiences and hear from others.”

Empowering women in the fintech industry to build a more inclusive future

As we celebrate International Women’s Day, it is evident that the progress made in advancing gender equality in the fintech sector must continue to be championed. By dismantling barriers, challenging stereotypes, and embracing diverse perspectives, the industry can unlock its full potential for growth and contribute to the transformative evolution of the financial services landscape.

As consumers demand more digital banking options and financial services, organizations grapple with uncertain global financial markets; it often feels like the banks have their hands tied. When you throw in the explosion of new startup financial institutions gaining popularity, the traditional banks that have commanded the market for years cannot rely solely on their trusted brand names to succeed. The banking landscape is entirely different than it was ten or even five years ago, and it keeps changing just as we think we have it figured out.

To stay ahead, FIs must embrace a digital-first strategy at the core of their business. This means something other than starting a new digital initiative or pulling together a task force. It requires something much bigger: an organizational shift. FIs need to take a holistic, strategic approach that considers digital’s impact on all aspects of the business, leading to a complete change in how things are done. It is no small feat.

As FIs scramble to figure out their digital strategy, it is easy to gloss over things when pursuing change at breakneck speed. The first thought when thinking about digital transformation is providing digital banking, usually a smartphone app. However, that is just one step to transforming operations.

Most financial institutions have dealt with the public for decades and have a reasonably predictable way of doing business. Here are five market issues that FIs could be underestimating in their pursuit of a smooth and customercentric digital transformation.

Delivering an omnichannel approach:

As banks work to become more digitalfirst, it is essential to remember that many customers still prefer face-to-face banking. Whether it is a newly married couple getting a loan for their home or new parents opening their baby’s first savings account, people sometimes prefer the in-person experience. However, banks still need to meet their customers on their preferred channels, and occasionally, those preferred channels may need to be digital. Banks must offer exceptional service on both in-person and digital channels through agent-assisted and unassisted interactions.

Educating your customers: As banks invest more in digital banking apps, a new world has opened up for banks to disseminate information to their customers. With these new banking methods, there are new systems for customers to adopt and learn when managing their finances. Banks can assist their customers by providing all the information they need at their fingertips. For example, FIs can offer an effective AI-powered “FAQ bot” that can answer customers’ questions instantly and accurately. This can significantly reduce call volumes as customers do not need to call in to have a question answered, they can get it answered in minutes while they are still online.

Operating in siloes: A report from WBR Insights found that one of the three most significant barriers to innovation in banking is data siloes. Furthermore, the study found that 85% of IT staff in FIs spend 25% to 50% of their time helping other staff access the required data and insights. True digital innovation cannot happen if data is siloed. This is especially true because artificial intelligence (AI) requires easy access to data to generate valuable insights. Data management should be on the shortlist of operational reviews.

Focusing on brand names: Traditional, well-known banks dominated the industry for decades, but that is not necessarily the case anymore. The rise of digital has ushered in new names in financial services competing directly with traditionally known banks. According to the digital finance platform Plaid, the popularity of neobanks is on the rise. Plaid estimates that global users of neobanks could reach 350 million by 2026, up from 146.2 million users in 2021. Another report from BAI found that two-thirds of FIs are seeing an increase in consumer deposit competition. The competitive landscape in banking has forever changed and requires innovative marketing strategies to stay ahead and retain customers.

Ensuring compliance: A report from Deloitte found that since 2021, outstanding supervisory findings have been on the rise in the US. Banks are facing more pressure than ever to meet regulatory and supervisory expectations. This is nearly impossible to do with legacy solutions and manual monitoring. AI can transform risk management, real-time monitoring issues, reporting on findings, and offering tangible solutions to fix the problems. It also provides a robust paper trail to outline to regulators what an FI is doing to mitigate risk. Examining one’s approach to compliance and the potential power of AI should also be on the shortlist for review this year.

As AI is democratized across organizations and industries, 2024 will become a turning point for Fis, and it may become more difficult for legacy banks to stand out. This is undoubtedly the year the next era of leading FIs will be defined. Banking leaders need to map out their digital strategy now. But where should Fis begin their process?

Here is a short checklist to get things started to begin to build a powerful strategy for success:

Number one—Purpose-built AI: FIs cannot use just any AI. AI trained on the open internet will not give FIs what they want. Banks need purpose-built AI trained on industry-specific data and built with the proper guardrails for brand language. This ensures that the insights generated by AI are accurate, appropriate, and relevant. It also drives intelligent bots. Purpose-built AI helps create bots that respond to customers’ needs and precisely what they seek. This equates to premier digital banking.

CX is the perfect example of a function that needs purpose-built AI, particularly with respect to a financial institution’s specialized concerns. Supporting customers and employees requires a unique approach to be baked into any solution, differentiating it from garden variety or generic AI applications.