www.globalbankingandfinance.com Issue 61

Actimize Advanced risk analytics, Generative AI boost smaller FIs as they fight financial criminals FRAML –How Financial Institutions Are Streamlining Financial Crime

Exclusive interview with Eric Tran-Le, VP, Premier, NICE

Chairman and CEO

Varun Sash

Editor

Wanda Rich email: wrich@gbafmag.com

Head of Distribution & Production

Robert Mathew

Project Managers

Megan Sash, Amanda Walker

Video Production and Journalist

Phil Fothergill

Graphic Designer

Jessica Weisman-Pitts

Client & Accounts Manager

Chanel Roberts

Business Consultants

Rick Saikia, Monika Umakanth, Stefy Abraham,

Business Analysts

Samuel Joseph, Dave D’Costa

Advertising

Phone: +44 (0) 208 144 3511 marketing@gbafmag.com

GBAF Publications, LTD

Alpha House 100 Borough High Street London, SE1 1LB United Kingdom

Global Banking & Finance Review is the trading name of GBAF Publications LTD Company Registration Number: 7403411

VAT Number: GB 112 5966 21 ISSN 2396-717X.

The information contained in this publication has been obtained from sources the publishers believe to be correct. The publisher wishes to stress that the information contained herein may be subject to varying international, federal, state and/or local laws or regulations.

The purchaser or reader of this publication assumes all responsibility for the use of these materials and information. However, the publisher assumes no responsibility for errors, omissions, or contrary interpretations of the subject matter contained herein no legal liability can be accepted for any errors. No part of this publication may be reproduced without the prior consent of the publisher

editor

Dear Readers’

Welcome to the 61st edition of Global Banking & Finance Review. Whether you are a long-standing reader or are joining us for the first time, it's our pleasure to share insights and developments from the forefront of the financial industry.

In our cover story on page 24, dive deep into the innovative world of FRAML as we explore how generative AI is revolutionizing the approach smaller financial institutions take to combat financial crime. Eric Tran-Le, Vice President, Premier, at NICE Actimize, shares his expert insights on leveraging these technologies to enhance efficiency and safeguard operations against an ever-increasing risk of financial crimes.

Turn to page 22 to examine the vulnerabilities within sensitive content communications in financial services with Tim Freestone, Chief Strategy and Marketing Officer at Kiteworks. With cyber threats looming larger than ever, discover the emerging strategies that are paramount in protecting highly confidential data and ensuring compliance across digital platforms.

Page 28 features a compelling narrative by Kevin Cohee, CEO of OneUnited Bank, on the importance of financial literacy for enhancing business productivity. Discover strategic initiatives aimed at bridging financial education gaps and fostering greater inclusivity across diverse communities.

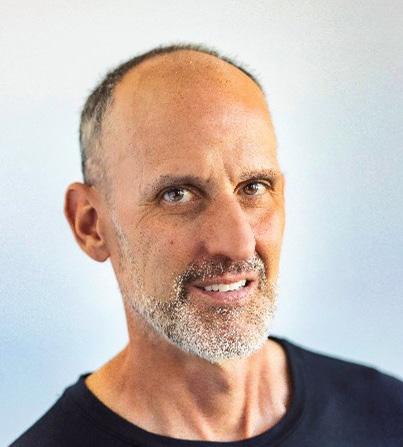

On page 34, join JB Orecchia, President and CEO of SavvyMoney, as he outlines a five-step strategy to foster deposit growth amidst economic uncertainties. This insightful piece offers practical advice for financial institutions striving to enhance customer relations and operational efficiencies without overextending their resources.

At Global Banking & Finance Review, our mission extends beyond reporting—we aim to be a beacon of knowledge, enriching your understanding with diverse perspectives and cutting-edge information. Our content is crafted for everyone with an interest in finance, from industry insiders to newcomers eager to learn.

We appreciate your continued readership and invite you to share your thoughts on how we can better serve your needs in future editions. What topics would you like us to cover next? Let us know!

Enjoy!

Wanda Rich Editor

Stay caught up on the latest news and trends taking place by signing up for our free email newsletter, reading us online at http://www.globalbankingandfinance.com/ and download our App for the latest digital magazine for free on Google Play and the Apple App Store

02 | Issue 61

CONTENTS

®

Hyper-personalisation and data-driven decision-making can boost the global banking sector

Frode Berg Managing Director – EMEA Provenir

Traditional banks that don’t prioritise digital inclusion face being left behind

Laura Rae Co-Founder Openbox

3 Ways Banks Can Better Meet the Needs of Today’s CFO

Brandon Spear CEO, TreviPay

How to prevent subscription revenue loss through automated payment recovery

Ash Lomberg, Vice President GTM, EMEA, Chargebee

Improving the Customer Experience but Stuck in Quicksand? Pay the Technology Debt First

Scott Simari, Principal, Sendero Consulting

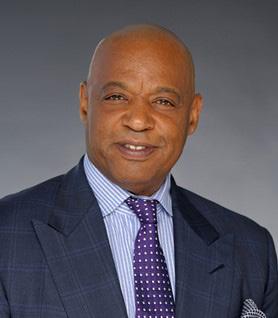

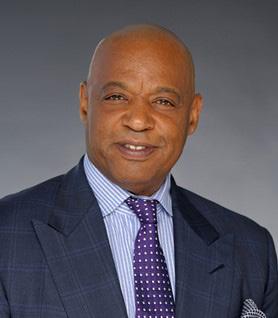

Strengthening Financial Literacy for Enhanced Business Productivity –Strategies for 2024

Kevin Cohee, CEO of OneUnited Bank

How to prepare your business for sale

Jeannette Linfoot, CEO of Jeannette Linfoot Associates

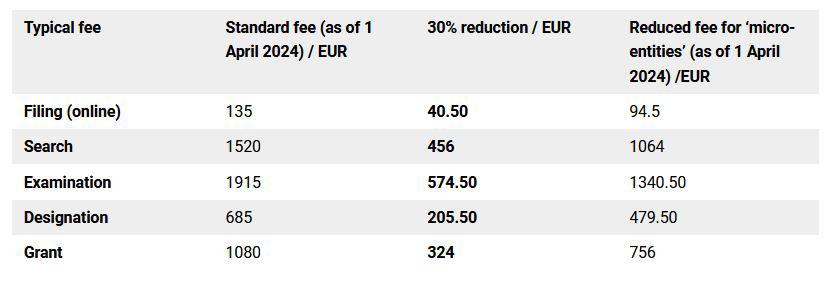

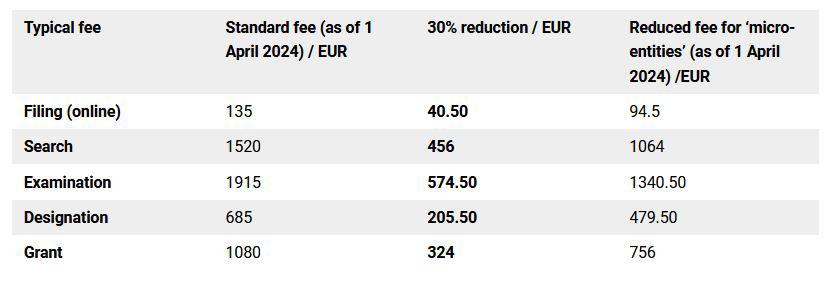

A boost for ‘micro-entities’ as the EPO lowers barriers

Annabel Williams, Senior Associate Marks & Clerk

Inside... CONTENTS Issue 61 | 03 BUSINESS

10 12 28 38 48 BANKING

08 20 44 08

financial services through Open Finance

Mark Horwood-James Managing Director of Personal Finance Technology Moneyhub

ESG data keeps on evolving, but are financial institutions keeping pace?

Yann Bloch

Head of Product and Pre-sales Americas NeoXam

The Need for Sensitive Content Communications Privacy and Compliance in Financial Services

Tim Freestone Chief Strategy and Marketing Officer Kiteworks

5 steps for FIs to stimulate deposit growth

JB Orecchia President and CEO SavvyMoney

Beyond chatbots: Elevating financial services with conversational utility

By Richard Winston

Industry

of Financial Services

Five ways AI is transforming data centres

Mark Grindey CEO, Zeus Cloud

Why regulators need to adopt AI now

Daoud Abdel Hadi Lead Data Scientist, Eastnets and Seun Sotuminu, Data Scientist, PDM, Eastnets

Re-architecting your platform for a competitive edge: A strategic approach

Michael Babushkin Founder and CEO Devexperts

How to close the gender pay gap in the technology sector

Sheila Flavell CBE Chief Operating Officer FDM Group

Big data, big risk?

By Ian McLean CTO, Pollinate

04 | Issue 61 CONTENTS Inside... 14 16 22 34 46 Redefining

Global

Lead

Slalom FINANCE 06 18 30 40 42

TECHNOLOGY

FRAML

How Financial Institutions Are Streamlining Financial Crime COVER STORY

Interview with Eric Tran-Le, VP, Premier, NICE Actimize

INTERVIEW Issue 61 | 05

–

24

06 | Issue 61 TECHNOLOGY

Mark Grindey CEO, Zeus Cloud

Mark Grindey CEO, Zeus Cloud

Five ways AI is transforming data centres

The tech landscape is undergoing a remarkable transformation. This is currently driven predominantly by advancements in Artificial Intelligence (AI), Machine Learning (ML), the Internet of Things (IoT), quantum computing, automation, virtual reality (VR), augmented reality (AR), and cybersecurity. These advancements are bringing unprecedented opportunities for business growth and improved quality of life. However, they also pose wider operational challenges that must be addressed. This includes concerns over job displacement for many people, privacy concerns, and cybersecurity risks. Within this wider landscape, AI, in particular, is playing a significant role in transforming and improving how data centres operate.

With that in mind, Mark Grindey, CEO, Zeus Cloud shares five ways that data centres can use developments in AI to their advantage to optimise efficiency, enhance performance, and streamline operations.

Optimising Efficiency and Performance

1. Predictive Maintenance: Data centres consist of numerous interconnected systems and equipment. AI algorithms can analyse real-time data from sensors and usage patterns to predict when equipment may fail or require maintenance. By identifying potential issues in advance, data centres can schedule maintenance tasks, minimise downtime, and reduce costs associated with unplanned outages.

2. Energy Efficiency: AI algorithms can monitor energy consumption patterns and optimise energy usage in data centres. By analysing data on workload demands, temperature, and power usage effectiveness (PUE), AI can identify areas where energy can be saved and provide insights for improving energy efficiency. This not only reduces operational costs but also contributes to environmental sustainability.

3. Intelligent Resource Allocation: Data centre resources, such as servers, storage, and networking equipment, need to be allocated efficiently to handle varying workload demands. AI can analyse historical data, usage patterns, and performance metrics to optimise resource allocation in real-time. This ensures that resources are allocated dynamically, matching workload requirements, and reducing inefficiencies or over-provisioning.

4. Enhanced Security: Data centres store large volumes of sensitive and valuable data. AI-powered security systems can analyse network traffic, identify anomalies, and detect potential security threats or attacks. By continuously monitoring data traffic and patterns, AI can provide real-time threat detection, prevention, and response, enhancing the overall security posture of the data centre.

5. Intelligent Data Management: With the exponential growth of data, data centres face the challenge of efficiently managing and processing large volumes of information. AI can help automate data management tasks such as data categorisation, classification, and retrieval. AI-powered data analytics can extract valuable insights from massive datasets, facilitating informed decision-making and improving operational efficiency.

Conclusion

By harnessing the power of AI, data centres can optimise their operations, improve efficiency, and provide better services to their customers. However, it is important to ensure that AI systems are implemented ethically, with appropriate oversight and safeguards in place. As AI technologies continue to evolve, the potential for innovation in data centres will continue to grow, enabling them to stay at the forefront of the everevolving tech landscape – all of which raises questions to end users around whether their data centre provider is making use of AI to not only improve the service they receive, but also to keep data secure.

TECHNOLOGY Issue 61 | 07

Hyper-personalisation and data-driven decision-making can boost the global banking sector

With the likes of Just Eat, Netflix, Amazon and Spotify shifting the dial, personalisation is no longer enough for consumers – they expect hyper-personalisation from their banking providers.

Hyper-personalisation sounds complex but simply refers to a detailed and nuanced understanding of each individual consumer’s needs, preferences, and behaviour – which are now changing more frequently as people battle volatile economic conditions and a fierce cost of living crisis.

Thanks to the evolving Open Banking environment, financial institutions have access to a plethora of customer data – and thanks to fintech advancements, they can also access the tools required to accurately analyse and categorise that data in real-time using machine learning and artificial intelligence (AI).

Challenges to overcome

However, there are major challenges when it comes to the implementation and use of this data and technology. A recent industry report highlighted that whilst 71% of banks are running personalised campaigns and targeted communications, less than half are leveraging customer data management, providing proactive

advice and recommendations, and incorporating AI and machine learning recommendations. In fact, according to McKinsey: “The cumulative benefits are so great that the annual potential value of AI and analytics for global banking might be as high as $1 trillion.”

Provenir’s 2024 Global Risk Decisioning Survey, meanwhile, revealed 38% of respondents point to data quality and integration issues when it comes to delivering personalised offers to customers, while 19% struggle with real-time decisioning.

Such challenges hinder an organisation’s ability to offer customised products and services, resulting in reduced customer engagement and missed revenue opportunities – as well as increased churn and ultimately higher acquisition costs.

As consumer behaviour changes and customers demand greater personalisation and real-time offers, banks and other financial service providers must embrace digital thinking and advanced technologies, such as AI and data analytics, to successfully pivot towards hyperpersonalisation, delivering tailor-made services in real-time.

This shift in mindset not only increases customer engagement – it also serves as a key differentiator in a crowded market. With the rapid adoption of customer analytics by fintechs and neo-banks, traditional incumbents must develop smarter data-driven strategies to remain competitive and retain customers.

The path to success

To achieve hyper-personalisation, banks will need to push past tired legacy infrastructure and deploy an agile tech stack with seamless integrations so they can monitor every aspect of their business in real-time.

Secondly, they need to offer innovative products that have a broader reach. For example, Buy Now Pay Later (BNPL) is popular because it effectively reaches an underserved population. With BNPL, hyper-personalisation is about financial services aligning themselves with the best merchants to drive up their customer base and reach.

Modern tech stacks should include access to lifestyle and contextual data, such as social media, to provide banks with a more complete picture of prospects so that offers can be better tailored to their specific needs.

08 | Issue 61 BANKING

Drawing on such data enables banks to use newer marketing models driven by AI. For example, Amazon doesn’t know a customer personally, but it does know what that person bought – and so suggests complementary products.

This translates to the financial services sphere where a consumer may get a mortgage online. At some point in the future, the provider could offer a loan for home improvements.

In order to achieve hyper-personalisation the use of data both internal and external is critical. This could be through use of open banking to understand how a customer likes to spend their money or via internal data where you can decipher a pattern on how the consumer spends e.g. they always pay for their holiday in January on their credit card so banks could be proactive in offering limit increases or promotional purchase offers in December to match the consumers spending habits. Either way, data is imperative in ensure hyper-personalisation is effective and tailored to each individual customer.

And when it comes to communication, customers now expect to be able to use whatever channel they want to interact with their bank, and whenever they want. Phone, AI-powered chatbots, websites, and mobile apps – customers in today’s digital ‘on-demand’ world will look to communicate with their bank as needed, and in multiple ways.

This is where banks can really start to differentiate themselves – by ensuring they can be reached 24/7 regarding any product, and for any reason.

This ubiquity of communication channels, combined with predictive and pre-emptive problem-solving, helps banks stand out from the crowd and show they are taking hyperpersonalisation seriously.

Banks may choose to partner with fintechs to achieve hyperpersonalisation – or they may decide to compete against them instead. Whatever approach they take, there isn’t any time to waste if they want to remain relevant and ensure that the industry thrives in the digital age.

BANKING Issue 61 | 09

Frode Berg Managing Director – EMEA, Provenir

Ash Lomberg Vice President GTM, EMEA, Chargebee

Ash Lomberg Vice President GTM, EMEA, Chargebee

How to prevent subscription revenue loss through automated payment recovery

Many organisations today take advantage of the subscription-based business model to steady their cashflows, lower the barrier to entry for their products and services, and attract new customers. With 80 percent of consumers in the UK signed up to at least one service – from TV and music to education and self-care essentials – the subscription model continues to be a popular choice for businesses and consumers alike.

Getting started with subscriptions can be easy – the challenge for most organisations comes from keeping customers interested over the long haul. In today’s macroeconomic climate, how well organisations can add value to their customer relationships is a key indicator of their long-term success.

Customer retention a top business priority

A definitive 87 percent of subscription leaders view retaining customers as important or more important than acquiring them. Yet, a whopping 96 percent acknowledge that cancellations occur for reasons that can be managed or resolved, highlighting the urgent need to proactively address and prevent customer churn.

Churn, or customer attrition, is on the rise across all major market sectors and 64 percent of respondents in Chargebee’s latest State of Subscription Industry Report expect the trend to continue in the future, too. With churn expectations increasing, businesses are increasingly becoming aware of the value of retention.

Involuntary churn – the silent killer

Losing a customer is never a great outcome, but in many cases, businesses will be surprised to know it’s not even the customer’s intention to end their relationship with the brand.

‘Involuntary churn’ occurs without action from the customer; it is the cancellation of a subscription due to a customer’s payment method, rather than active choice. This can happen when a payment fails due to issues such as an expired or maxed-out credit card, forcing the customer to churn. It could be a brand’s most loyal customer who has regularly used its products or services, but if the brand doesn’t live up to its responsibility to safeguard the relationship, a small payment issue can turn a once-happy customer into a detractor.

Left unchecked, failed payments can directly lead to a loss of revenue, customer loyalty, and customer lifetime value, all of which impact the long-term financial success of the business.

The role of automation in reducing churn

Bringing the customer relationship back from the brink is a difficult task. Businesses can either retry the failed payment later or proactively remind the customer to update their card information. However, manually identifying payment failures and initiating retries and reminders for each transaction can be a time-consuming and error-prone process.

10 | Issue 61 BUSINESS

Here, an effective dunning strategy can help subscription businesses cut through the complexities. ‘Dunning’ refers to the processes and communication practices that businesses employ to manage failed payments. Modern technology helps subscription businesses recover lost revenue from involuntary churn in four key ways.

1. Implement automated payment collection retries

Using smart retry logic, businesses can automatically retry failed transactions at dynamic intervals based on the reason for the payment failure. Additionally, businesses can customise rules for the time delay between payment failure and retry, the number of retries, and how customers are notified to update their card information. For restaurant management SaaS Zenchef , implementing automated payment collection retries meant the business was able to recover 60 percent of unpaid accounts.

2. Automate the customer retention workflow

Communication is key in the payment failure management process. Businesses must keep customers apprised that a payment date is approaching; that a payment card is about to expire or has expired; or that a payment attempt has failed. Rather than relying on employees to manage this process, businesses can set up automated reminder emails and SMS messages to customers that require no manual intervention.

An auto-engagement workflow capability enables businesses to send personalised messages to specific customer cohorts. It allows for the customisation of email frequency, escalation of pending invoices, and follow-up sequences based on customer interactions. Automating customer communication processes this way can save time and reduce the risk of human error.

3. Simplify the card update process

Savvy businesses know that the payment failure management process starts even before a transaction fails. To prevent involuntary churn, businesses must facilitate a smooth and frictionless card update process for customers. To achieve this, dunning emails should be designed to create a positive customer experience with minimal hassle. A direct and concise message, accompanied by a clear call-to-action (CTA) button linked to a dedicated page for updating card details, can help streamline the process.

In addition, businesses can leverage self-service portals that allow customers to easily manage their payment and subscription information. These portals enable customers to update their payment card details and ensure that businesses have accurate and up-to-date information for future billing cycles. Simplifying the card update process can enhance the customer experience and reduce the risk of involuntary churn for subscription-based businesses.

4. Personalise communication

Customers are more likely to engage with dunning messages when they are personalised. This requires businesses to develop a deep understanding of their customers and their behaviour. Modern subscription management tools can help businesses automatically segment customers into cohorts based on factors – such as their payment history, number of invoices, and the value of those invoices – to help them create contextually-aware engagement strategies.

Conclusion: Unlock growth by automating subscription revenue management

With subscriptions gaining traction as a powerful business model for ensuring growth and a predictable revenue stream, organisations must focus on customer retention as a top business priority. What better place to start than those customers who never intended to leave in the first place?

By reducing involuntary churn, subscription businesses can create a more loyal customer base, increased customer lifetime value, and more word-of-mouth referrals. As they set out on this continual optimisation journey, they must keep in mind that while some symptoms of attrition may look the same, every customer is unique – and as a result, the approach to engage them must also be unique. A successful strategy will leverage automation and personalisation to make each customer feel valued. This way, subscription businesses can turn their customercentricity into a competitive advantage and drive consistent revenue growth.

BUSINESS Issue 61 | 11

Improving the Customer Experience but Stuck in Quicksand?

Pay the Technology Debt First

In the ever-evolving landscape of banking, the drive toward digital transformation is not just a desire but a necessity. With extreme competition and rising customer expectations, banks must continuously innovate to stay ahead. According to Digital Banking Report, the number one goal for financial institutions is improving the customer experience. While this is a major priority, institutions often find themselves “stuck in quicksand” when trying to implement new digital tools and modernize call centers to improve the customer experience because they have technical debt that they failed to address first. Just like trying to move forward while trapped in quicksand, banks will find their efforts to implement new technologies come to a halt due to the underlying problems that arise from not addressing technical debt. This can lead to increased system complexity and operational disruptions, undermining the outcomes the new technology was designed to achieve.

What exactly is technical debt? It’s the compromises made across an organization’s technology strategy to meet immediate needs, often at the expense of long-term sustainability. Think of it like financial debt in corporate finance. Just as different financial debts come with varying levels of urgency, not all technical debts are created equal. So, the first step for financial institutions is identifying and prioritizing their technical debt.

Picture technical debt as a spectrum. At one end there’s first lien debts requiring immediate attention. First lien technology debts encompass critical areas like cybersecurity, disaster recovery and data integrity issues that impact customers or revenue. Neglecting this first lien technical dept poses severe risks. Without robust cybersecurity measures and reliable disaster recovery protocols, banks are vulnerable to cyber threats and operational disruptions, jeopardizing customer trust, the bank’s reputation and negative financial outcomes. Similarly, ensuring data quality and integrity is essential for informed decision-making and long-term sustainability.

Next on the spectrum is mezzanine technical debts, which includes issues like aging infrastructure and inadequate data management. While these may not need immediate attention like first lien debts, they cannot be completely disregarded. Neglecting infrastructure modernization and data optimization will stunt the institution’s growth and agility, making it almost impossible for banks to implement new innovative technologies without encountering “quicksand.”

12 | Issue 61 BUSINESS

However, just like in corporate finance, not all technical debts necessarily warrant action. You can think of this type of technical debt as common equity debt similar to public shares in corporate finance. Technical debt that falls under this category can be managed through strategic planning and resource allocation. Once it’s addressed, an institution might experience more efficient processes, but this type of technical debt does not critically impact an organization’s operational effectiveness.

Before deploying a new tool, it’s imperative to understand an organization’s technical debt landscape and develop a debt management strategy ahead of implementing an innovation. Without this evaluation, institutions risk that “quicksand” feeling because of unforeseen challenges and resource limitations.

Consider the analogy of constructing a house. Before you do anything, it’s important to ensure the ground you’re building upon is solid. Similarly, before implementing modern customer experience tools, banks must ensure their foundation is solid through operational efficiency and customer experience technologies. The “house’s foundation” is made up of the operational technologies that address cybersecurity, data management and API management. When there are flaws in the technology, it’s akin to trying to remodel a house on

Scott Simari Principal, Sendero Consulting

Scott Simari Principal, Sendero Consulting

cracked foundation – there’s inevitably going to be a problem maintaining the property over a long period of time. Likewise, core customer experience technologies must be in place before involving the latest and greatest customer experience tools. When core customer experience technologies such as CRM systems, customer support tools, payment platforms, and mobile applications fail to generate value on their own and do not contribute to an omni-channel customer experience, it will be increasingly difficult for financial institutions to implement new technologies like Large Action Models (LAMs), Generative AI, and predictive analytics tools. When institutions then take the step to identify and address these technical debts, the new technologies are not only implemented more efficiently, but the returns on investments are much more significant.

By adopting an understanding of technical debt and its importance, banks can develop a pragmatic approach, prioritizing critical areas while strategically addressing long-term challenges. Although opting for the flashy new customer experience tool might appear to be the best course of action, it is too often a short-term benefit that can’t be sustained until the “foundation” of underlying technology and processes are brought “up to code.”

BUSINESS Issue 61 | 13

Redefining financial services through Open Finance

Financial ecosystems are evolving rapidly, moving away from the once standard isolated and slow-paced models towards a new era characterised by fintech innovation and, more recently, Open Finance. This transformative movement is shifting the banking sector towards a paradigm that values connectivity, transparency, and collaboration, marking a significant break from past practices. Open Finance is revolutionising how financial services are conceptualised and delivered by facilitating secure and interoperable data exchanges. This shift is not just about integrating new technologies; it’s about fundamentally rethinking the provision of financial services to foster innovation, efficiency, and a commitment to meeting consumer needs.

Strategic approaches to embracing Open Finance

As businesses navigate Open Finance, they are often distracted by the tactical question of “build vs. buy” in technology adoption. This debate has become more complex and nuanced in the context of Open Finance, consumer expectations and the strategic agenda, so aligning technology investments with key objectives such as regulatory compliance, secure data management, and enhancing customer interactions takes precedence. In an increasingly interconnected environment, the importance of robust security and compliance frameworks cannot be understated, as these are crucial for manoeuvring through the maze of new regulatory challenges while maintaining trust and integrity within the financial landscape.

The “build vs. buy” debate is no longer a simple binary choice, and while focused on the how, not the what, it is a decision that impacts every aspect of an organisation’s operation in the Open Finance ecosystem. Organisations must evaluate whether their in-house capabilities can truly match the pace of change and innovation that Open Finance demands. For many, partnering with fintech innovators offers a fast track to delivering advanced features and functionalities that meet evolving consumer expectations without the heavy lifting of development and compliance adherence from scratch. The right choice varies by company, depending on their specific capabilities, resources, and strategic goals.

Additionally, the decision to build or buy should also consider the potential for scalability and future-proofing. Open Finance is not a static field; it continuously evolves, with new standards, regulations, and consumer demands emerging regularly. Adaptable solutions that can evolve with the landscape will provide organisations with a competitive edge, ensuring they remain relevant and compliant over time.

Beyond binary choices: Strategic alignment and customer centricity

The journey toward Open Finance extends beyond the traditional “build vs buy” decision, encouraging firms to align technology investments with their overarching goals, which demands evaluating how these investments bolster regulatory compliance and data security and encourage innovation through collaboration. Open Finance

fosters a more customer-centric approach to financial services, pushing for personalised, efficient solutions that meet distinct consumer needs. Viewing customers as central to the financial ecosystem and delivering tailored solutions becomes a critical competitive advantage in this new era.

The emphasis on a customer-first mindset is pivotal for cultivating trust and loyalty. It highlights the need for stringent data protection, privacy, and transparency, all key elements for building enduring customer relationships and achieving a competitive edge. Additionally, Open Finance encourages cross-sector collaboration, inviting partnerships that draw on collective strengths to create more innovative and inclusive solutions.

The role of data and analytics in Open Finance

An essential aspect of Open Finance is the emphasis on data and analytics. The ability to securely share and analyse financial data opens up new avenues for personalised services, risk assessment, and customer engagement.

Companies that can effectively leverage data analytics will gain insights into customer behaviour, preferences, and needs, enabling them to offer more targeted and valuable services. This capability underscores the importance of technological investments that can harness the power of data, further influencing the “build vs. buy” decision towards solutions that offer robust analytics and data management capabilities.

14 | Issue 61 FINANCE

The future landscape of Open Finance

Companies must stay agile and forward-thinking as Open Finance redefines the financial services landscape. Today’s decisions around technology investment and strategic direction will lay the foundation for future success. Embracing Open Finance principles means committing to an ecosystem that is more inclusive, transparent, and customer-focused. It requires a shift in mindset from competition to collaboration, where success is measured not just by individual achievements but by collective progress.

By embracing the opportunities and challenges presented by Open Finance, financial services organisations can enhance their offerings and contribute to a more inclusive and innovative financial ecosystem. The promise of Open Finance lies in its potential to transform not just how financial services are delivered but also how they are perceived and valued by consumers worldwide, paving the way for a future where financial empowerment is accessible to all.

FINANCE Issue 61 | 15

Mark Horwood-James Managing Director of Personal Finance Technology, Moneyhub

ESG data keeps on evolving, but are financial institutions keeping pace?

Earlier this month, Bloomberg published their muchanticipated annual European ESG Data Trends Survey report, carrying with it some fascinating findings on the current state of the market. The survey, taken by respondents from London, Stockholm, Geneva, Amsterdam, Frankfurt, Paris, and Milan throughout 2023, posed questions about ESG data prioritization, challenges, and data management practices.

According to the survey, the leading ESG data management challenge being felt by market participants right now is handling constantly evolving and new data content within the realm of sustainable investing. This chimes with what we are constantly hearing from current and prospective clients – that the kind of information on offer to support sustainable investment strategies is constantly evolving and changing, considering the different categories and developing understanding of this as an investment principle by the masses. This is partly on account of the demand for data, which has exploded over the last half-decade, and not just from funds marketing themselves as sustainable investing or ESG funds. The demand is coming from all funds in the same way that they demand information on financial performance –it is seen as essential to give more context to the assets that they invest in.

16 | Issue 61 FINANCE

Yann Bloch head of product and presales Americas at NeoXam

The fact is, it is now seen as a fundamentally important information category, which can also be relevant to the broader mission statements of both asset managers and their clients. All asset managers now must be able to show accurate ESG scores, and service providers need to be able to aid asset managers/clients to legitimise the actual scoring. However, a key issue that faces firms in dealing with this deluge of data that they now drown in, is managing it all.

This data is very different in many cases from the more traditional types of market data that they are used to having attached to the more vanilla asset types such as listed equities or fixed income. It can come in vastly different forms, and from a plethora of different suppliers who specialise in very particular types of sustainable investing information. This creates a major risk within the business that the information will not be utilised to its maximum potential, and that it may not even be easily accessible to all relevant teams within the institution.

Given the fact that to large parts of the market, this remains a nascent space that is developing extremely rapidly, this makes sense – many firms will be finding themselves in a position where they are relying on systems that are simply not fit for modern purpose. Many institutions are finding themselves facing a real disparity between the capabilities of their legacy data management systems, which sometimes may be little more than a scattering of excel spreadsheets across the business, and the requirements that they face when it comes to managing and utilising the ESG information that they consume at an increasing rate. This is why investment in modern technology, capable of processing these rafts of new data in an efficient manner, has been pushed up the agendas of many financial institutions. This was reflected in the results of the Bloomberg study, with 20% of firms currently considering their data management strategy.

It therefore is not surprising to me that so many European institutions have reported that they struggle to manage the evolving data content involved when integrating sustainable investing principles into their strategies. To address this issue head-on and make certain that the statistics are more favourable in the 2025 edition of this report, firms must find a way to ensure that this new, incredibly useful information that they are consuming is being normalised and centralised so that it can be productive and useful for the entire business.

FINANCE Issue 61 | 17

Why regulators need to adopt AI now

It’s a new world – defined by rapid technological advancements, and witnessing more organisations embracing AI. To navigate this ever changing landscape, it is essential that regulators recognise traditional governance principles no longer suffice.

In fact, relying on these outdated principles could result in more harm than good. Regulators must begin to use the power of AI to modernise their approach and promote responsible innovation. As the world turns, it’s essential for regulators to foster an ecosystem that integrates AI effectively and protects individuals at the same time.

The impact of AI on regulatory affairs

We are already seeing regulatory bodies beginning to embrace AI in its functions. The FCA, for instance, provides a digital sandbox where AI propositions and proof of concepts can be tested.

However, the topic of AI regulation remains its primary focus. FCA Chief Data, Information and Intelligence Officer, Jessica Rusu, stated at an event that innovation will lead to better AI regulation. She also added, “One of the most significant questions in financial services is whether AI in UK financial markets can be managed through clarifications of the existing regulatory framework, or whether a new approach is needed”.

The benefits of AI for regulators

Without a doubt, AI offers financial regulators powerful tools to improve how they work and what they can achieve. It promises many benefits, from predicting market changes to enhancing oversight processes. With its potential for digital transformation, there’s little reason for regulators to overlook AI in modernising their operations.

Providing regulatory foresight in addition to oversight

With AI, regulators can proactively assess market conditions and anticipate major market events such as the collapse of Lehman Brothers, Silicon Bank, FTX, Evergrande etc. They also have the authority to request relevant data from companies and use AI models to evaluate their financial health in comparison to their peers.

As an example, an AI model can be used for stress testing, simulating several stress scenarios such as an economic downturn to gauge the resilience of financial institutions. This proactive approach enables regulatory agencies to provide advanced warnings to the markets regarding the likelihood of such events.

Delivering holistic intelligence

Regulators can access a wealth of data from numerous businesses and their customers, enhanced by public sources and potentially shared by other regulatory partners. Though individual business may not have access to all this data, regulators can use it to create a comprehensive oversight. By employing technologies such graph models and link analysis, they can combine data from different financial and security agencies to gain a well-rounded understanding of nefarious activities, such as terrorist financing.

Improving regulatory operating processes

AI can enhance the efficiency of regulatory processes, leading to better outcomes. Using natural language processing (NLP) models, regulators and any regulated businesses can quickly get clear summaries and concise answers to specific inquiries, without the need to painstakingly sift through large volumes of documents. Financial institutions can also use generative AI to understand the applicability of regulation to their specific circumstances.

In essence, AI can handle complex, error-prone and costly tasks, making processes smoother for both regulators and the businesses they oversee.

18 | Issue 61 TECHOLOGY

Daoud Abdel Hadi Lead Data Scientist, Eastnets and Seun Sotuminu, Data Scientist, PDM, Eastnets

Emerging threats

Financial crime regulators are facing new and unfamiliar threats as cryptocurrencies, NFTs and digital wallets gain popularity. Criminals are using the anonymity, pseudonymity, and global reach of these assets to their advantage.

With new forms of payments like cryptocurrencies, assessing risk is more challenging because traditional attributes such as geographical location, currency, sender and beneficiary information are no longer relevant. However, AI can effectively analyse blockchain transactions to identify suspicious fund flows, adapting to these evolving risks. Similarly, Natural Language Processing (NLP) can be used to analyse cryptocurrency social media, websites, and forums to determine bad actors.

The implementation of AI

Integrating AI in regulatory operations is not going to be a straightforward task. Regulators must carefully consider numerous factors to avoid costly mistakes and manage risks effectively.

Divide between regulation and investigation

In many cases, the entities responsible for making the laws operate independently from the agencies tasked with investigating the resulting cases. When insights from investigations don’t directly inform the legislative process, it can leave financial institutions without clear guidance on case reporting. This gap can constrain how financial institutions use AI.

For example, incorporating insights and feedback from investigations, financial institutions can apply supervised learning to develop prescriptive models for detecting money laundering and child trafficking models. Without such feedback, they are limited to the use of unsupervised learning, which might not be as effective in complex scenarios where nuanced understanding and context are important. AI models benefit greatly from this feedback loop as it strengthens or challenges its recommendations.

Understanding this interplay informs regulators on how they might set rules, share information, and create frameworks that ensure financial institutions are equipped with the right data and guidance to use AI effectively. Regulators need to remember that their approach to legislation and coordination with investigative agencies can directly influence the effectiveness of AI in financial compliance and crime prevention.

Black box models

Many financial institutions are using black box models, predominately neural networks, for their ability to learn from complex data which makes them useful for financial crime analysis. However, the lack of clarity around how these models make decisions presents challenges in financial crime investigations, where transparency, fairness and the absence of bias are essential.

This creates a paradoxical situation where regulators discourage the adoption of this type of models, pushing financial institutions to opt for less effective ones. As a result, more low-quality cases arise and in a worst-case scenario, real criminal activities may go undetected.

Complexity of data from multiple sources

To be able to fully benefit from the use of AI, data sharing is often necessary. This may include obtaining publicly available data and information specific to the institutions they oversee. Addressing complexities such as data quality and establishing a common data dictionary is crucial for regulators to unlock the promises of AI.

As the world transitions to accommodate the continual technological evolutions, regulators must integrate AI into their systems. There has been progress made in adopting AI, but there still remain substantial gaps that need addressing.

Regulatory bodies cannot afford to lag behind the industries they oversee. It is necessary that they are not lax in their innovation and remain ahead of the criminals whose methods evolve and adapt day-by-day.

TECHNOLOGY Issue 61 | 19

Traditional banks that don’t prioritise digital inclusion face being left behind

It’s not so long ago that every financial transaction we wanted to make involved leaving the house and physically handing over notes and coins.

In the past people often made the weekly walk to the local branch of their building society to pay their mortgage in cash. Paying gas and electricity bills meant going to the Post Office. Even transferring money to a friend or family member involved writing a cheque, putting it in an envelope and walking to the post-box.

Today all of these functions can be performed in a matter of seconds on a smartphone, anywhere in the world. It’s easy to be seduced by the idea that, as technology advances, everyone benefits to the same extent, no matter who they are, where they come from or who they bank with.

The Accessibility Dilemma

However, despite much of the technology still being in its infancy, divisions are already evident in the quality of provision offered by banks that take issues like accessibility and inclusiveness seriously, creating user-friendly interfaces and intuitive customer experiences, and those that don’t.

While there’s always a danger with crude generalisations, there’s a perceived divide in the quality of digital banking products and services offered by traditional, high street banks and their online-only, fintech counterparts.

In the fast-evolving landscape of modern finance the winds of change are blowing, and legacy institutions are at risk of being left behind in the storm of innovation.

The core issue plaguing traditional banks is their reluctance or inability to pivot swiftly in the face of digital disruption. These banks are burdened by established management and reporting systems, and an organisational structure that separates digital teams from financial experts. This compartmentalisation has led to a disconnect, hindering the seamless integration of digital innovation into the financial experience.

20 | Issue 61 BANKING

Laura Rae co-founder of Openbox, a premium digital experience partner to the financial services industry

One of the critical pitfalls appears to be a sluggishness in catering to diverse user needs, for example for customers who have vision impairments, learning difficulties, or limited digital literacy.

Falling Behind Fintech Innovations

Traditional banks generally take longer to introduce innovations, hampered by long-winded, siloed decision-making, red-tape and a cultural resistance to change.

In contrast, nimble and innovative fintechs are more likely to have prioritised a streamlined, digital-first approach, that seamlessly blends technology and finance expertise, fostering an environment where customer needs are central to the design and execution of financial services.

They are more likely to make inclusivity an essential part of design, democratising banking by removing barriers to entry, making financial services accessible to a broader range of individuals.

This inclusivity is not merely lip service – the most successful fintech banks are those that have designed their digital interfaces with careful consideration for users with various needs, prioritising plain language, simple navigation, and an overall frictionless experience.

The Empathy Deficit

The challenge for traditional banks, if they are not to be left behind in this digital revolution, is to reconfigure those internal structures that stifle creativity and delay innovation, and to address an ‘empathy deficit’ that prioritises their own organisational structures over customer experience.

To bridge the gap, such institutions must align their technology and customer design teams, fostering collaboration and understanding. The ultimate goal should be the seamless integration of digital innovation, ensuring that customer experience is not only efficient, but also empathetic to diverse needs.

The Road to Redemption

Traditional banks can revamp their digital offerings by making the following three fundamental changes:

• Ensuring internal collaboration across teams.

• Prioritising user experience by aligning customer and tech perspectives.

• Advocating for a digital-first mindset to adapt to the evolving financial landscape.

These changes will help to facilitate changes that ensure the creation of a continuous digital banking interface that follows seven key principles – the need for personalisation, customisation, transparency, a mobile-first approach, simplicity, modern aesthetic design, intuitive design, and adaptable design.

Better internal collaboration between teams will mean those responsible for implementing inclusion policies across the organisation can better communicate their thoughts and ideas with technical staff.

Personalisation involves tailoring the user experience based on customer data, offering targeted services, and enhancing engagement. Customisation allows users to adjust the digital banking app’s UI and UX according to their preferences, fostering convenience.

Transparency is crucial in building trust, requiring clear communication about the consequences of user actions, and utilising various channels for notifications. A mobile-first approach recognises the dominance of mobile devices in users’ lives, advocating for a design strategy that prioritises mobile interfaces and ensures swift load times.

Simplicity is emphasised to prevent user frustration, encouraging a minimalist design that prioritises essential functions and respects accessibility requirements. Modern, aesthetic design is highlighted as crucial for positive first impressions,

advocating for a balanced and clutter-free interface. Intuitive design promotes ease of use, drawing from widely recognised elements in other applications to facilitate user navigation without the need for extensive instructions.

Lastly, adaptable design stresses the importance of creating consistent experiences across various devices, acknowledging the different contexts and screen sizes associated with smartphones, tablets, and smartwatches.

The Call for Change

As the financial sector moves towards digital currencies and innovative fintech solutions, banks must become more agile in anticipating and meeting evolving customer needs.

The future requires a commitment to continuous improvement, staying ahead of technological trends, and remaining attuned to the ever-changing expectations of customers.

As financial institutions do more to leverage artificial intelligence (AI), there is a responsibility to ensure that these technologies do not inadvertently perpetuate existing social inequalities. Traditional high street banks should not only embrace digital innovation but also to do so responsibly, with a keen awareness of the potential societal impacts.

To survive and thrive, banks must shed their legacy shackles, prioritise customer experience, and embrace digital innovation.

The rise of fintech banks demonstrates the rewards awaiting those who adapt swiftly to the changing winds of the financial landscape. The future belongs to the agile, inclusive, and customerfocused institutions ready to navigate the digital frontier.

BANKING Issue 61 | 21

The Need for Sensitive Content Communications Privacy and Compliance in Financial Services

Tim Freestone Chief Strategy and Marketing Officer, Kiteworks

Tim Freestone Chief Strategy and Marketing Officer, Kiteworks

For some time, the financial services industry has been at the forefront of a sophisticated and evolving digital landscape. It has witnessed rapid and transformative technological advancements that have delivered new services to customers and driven a myriad of operational efficiencies. However, the movement of more and more confidential data into the digital space and it being regularly exchanged with first and third parties has not gone unnoticed by those with unscrupulous intent. This had made the financial industry to continue to be a top target for cybercriminals. In fact, according to CrowdStrike’s 2023 Global Threat Report, the financial sector is now the second most frequently targeted vertical after the technology vertical. Among the data that is being targeted, Verizon’s 2023 Data Breach Investigations Report (DBIR) found that personally identifiable information (PII) is the top target of bad actors – making up almost three quarters (74%) of attacks. It has got so bad that 96% of financial services organisations tell us that they have experienced four or more exploits of sensitive content communications in the past year alone.

Too many disaggregated tools for sensitive content communications

Our Sensitive Content Communications Privacy and Compliance Report last year revealed that financial services firms today struggle to manage file and email data communication risks. Both within their organisations and with third parties. One of the reasons is the large number of systems that financial organisations use to send and share private data today. So much so that nearly seven in ten financial institutions have six or more sensitive content communication systems in place. No wonder they are struggling to secure them.

Ranking third-party content communications risk

Those systems are not just being used to send data internally either. In fact, financial organisations rank among the highest of any industry when it comes to the sheer number of different systems used to send and share content communications outside of the organisation with third parties. Six in ten (60%) use six systems or more. Surprisingly, in terms of ranking, web forms are at the top of the list, with a quarter (25%) of respondents giving them a number one ranking. When ranks one and two are factored together, email caught up with web forms, with 41% giving each a number one and two ranking. One of the ways email poses such a risk relates to challenges with its encryption. Specifically, when recipients cannot decrypt an email due to it being encrypted in a format not supported by their organisation. Out of the other applications thought to present the biggest risk, application programming interfaces (APIs) came in second, with 30% of respondents ranking them at number one and two.

22 | Issue 61 FINANCE

Somewhat surprisingly, governance plays an important causation role here. Less than a third (31%) only track and control access to sensitive content folders for certain content types. While only another 37% only do so for certain departments.

Whilst it is true that risk management of third-party content communications is seen as a problem across industry sectors, financial services is one at the top of the list. Because of this, a new approach is required or at the very least the current approach requires significant improvement.

Better digital risk management is required

The current lack of robust digital rights management (DRM) is undoubtably a big part of the problem. Having said that, weaknesses across different financial service organisations are not the same. Whilst two in five (43%) of respondents said they have administrative policies in place for tracking and controlling content collaboration and sharing on-premises but not in the cloud. At the same time, one in five (21%) said the opposite. Namely, that they have tracking and controls in place for the cloud but not on-premises. Worryingly, only slightly more than a third indicate they have digital risk management capabilities in place for both the cloud and on-premises.

A potential game changer

A change is needed. A Private Content Network could be the answer. A Private Content Network employs a content-defined zero-trust approach that would enable financial services organisations to unify, track, control, and secure all their sensitive content communications into one single platform. This would allow financial services organisations to track and control access to files and folders, who can edit and share them, and to whom and where they can be shared. This could be a game changer as doing so would enable financial firms to ensure private personally identifiable information, intellectual property, client financial records, insurance claims, and more would remain private and in compliance with increasingly stringent global regulations.

FINANCE Issue 61 | 23

FRAML – How Financial Institutions Are Streamlining Financial Crime

Global Banking & Finance Review recently interviewed NICE Actimize VP, Premier, Eric Tran-Le about everything from FRAML to Generative AI and its impact on lower tier banks and credit unions. Here is what TranLe forecasts for these financial institutions as they aim to benefit from today’s burst of innovation in financial crime technology.

Q: In today’s environment, FRAML is a term often used in conversations about financial crime technology. What does FRAML mean to NICE Actimize and its Premier team, and why has the concept become so important?

A: During our annual regional roundtables, many small and mid-sized financial institutions voiced their struggle to cope with Fraud and AML - FRAML. Most have limited analyst staff often switching between Fraud and AML alert review and disposition. These multitasking analysts are relatively rare at larger banks but are very much present in SMB financial institutions.

FRAML matters because, against the backdrop of a shifting regulatory landscape, the unification of fraud and anti-money laundering has been elevated.” - Eric Tran-Le

The dilemma they are facing is simple. Fraudulent transactions must be stopped in real time, whereas in AML, detected suspicious activities have 30-60 days to clear and stay compliant with regulations. A small team of FRAML analysts may need to work both Fraud and AML alerts. With these factors in mind, a FRAML solution provides unified alert and case management for Fraud and AML, so analysts can more easily collaborate on both.

FRAML matters because, against the backdrop of a shifting regulatory landscape, the unification of fraud and anti-money laundering has been elevated, and community banks and credit unions may be even more scrutinized. We have seen a rise in fines and lawsuits against financial institutions because of a lack of sufficient risk controls on both Fraud and AML processes.

Q: Smaller institutions face vastly different challenges than larger top-tier FIs. What do you think are the primary pain points, and how do they differ from the biggest FIs?

A: Scale matters when managing Fraud and AML compliance costs, particularly concerning headcount. The best way to comprehend this challenge is to understand the issues that small financial institutions face with their relatively limited number of Fraud and AML analysts.

24 | Issue 61 COVER STORY

Monitored in silos, certain behaviors can appear benign and may not be spotted by the respective Fraud and AML teams. These blind spots are even more significant, with smaller analyst teams faced with limited staffing.

Compounding this issue, creative fraudsters are increasing the volume of sophisticated AI attacks. They spread their criminal activities across transaction types and channels, with each activity appearing innocuous. These activities may be part of a fincrime bust-out chain representing severe losses or exposing the financial institution to regulatory penalties.

When fraud and AML departments work separately with their own point solutions to manage and report on cases, little communication happens across teams and there may be a reluctance to share information. This makes detection and investigation even more challenging. For example, a cross-channel fraud and money laundering scheme may combine digital fraud with structuring money laundering behaviors.

We have seen the transformative impact on banks leveraging solutions with AI. The benefits of aI include significant efficiency gains which enable smaller analyst teams to perform more efficiently.

Q: NICE Actimize has two well-known platforms that financial institutions use to lay the foundation for their financial crime technology strategy—X-Sight, for large FIs, and Xceed, which provides economies of scale for SMBs and credit unions. Describe what Xceed does and what the Xceed difference means to the industry.

A: NICE Actimize's Xceed AI FRAML is designed for small teams performing Fraud prevention and AML compliance activities. It is purpose-built for these smaller teams with AI-first technologies and a copilot fincrime assistant. FIs also have the option to leverage the Xceed FraudDESK service to alleviate the burden of a larger volume of investigations.

Xceed AI FRAML is unique in its design. It is reimagining Fraud and AML compliance with a blend of automated copilot capabilities for lowerpriority alerts and tasks and advanced investigation tools for high-priority alerts that are routed to an analyst for investigation.

Issue 61 | 25

COVER STORY

Eric Tran-Le, VP, Premier, NICE Actimize

Q: The wave of Generative AI offerings has started to deliver various benefits to financial institutions. How is Xceed using Generative AI to provide value to the industry?

A: NICE Actimize foresees many benefits, but the main one is to leverage AI and Generative AI to eliminate false positives and repeatable work, enabling analysts to work on what matters most, which in turn increases their work value. With legacy FRAML, 80% of the analyst's time is spent on manually triaging false positives, manually reviewing alerts to deprioritize what should be low-level alerts, manually analyzing alerts to detect fraud patterns, and manually deciding on opening a case and narrating it. Only 20% of analyst time is spent on high-risk alerts and case investigations. This is certainly not a successful approach—the focus is not where it should be.

With Xceed AI FRAML and its Gen AI CoPilot, this focus is reversed to where it should be and where it offers the most impact. With this advancement, teams realize an 80% efficiency gain. They can spend their time on highrisk alerts and high-value case investigations, while AI and Copilot automate alert triage and false positives.

When it comes to financial crime, specifically fraud and money laundering, many of the smaller financial institutions shared that they are experiencing a surge in scams, elder abuse, and the explosion of check fraud. Many are now experiencing a do more with less environment and are looking to generative AI to lift some of those burdens.

Q: What is the most exciting transformation you have seen advanced AI bringing to addressing financial crime?

A: A fincrime Gen AI CoPilot assistant is a game changer in the fight against financial crime. It helps when you fight fire with fire. In other words, you can respond to an attack by being “smarter, faster, and better” than the criminals who leverage the same technologies. With Xceed CoPilot continually tested internally by our own FraudDESK analyst queue, we are experiencing an average of 80 percent time savings in the alert-to-case process, an order of magnitude of efficiency unseen before.

"With Xceed AI FRAML and its Gen AI CoPilot, this focus is reversed to where it should be and where it offers the most impact." - Eric Tran-Le

Some vital, innovative features of Xceed AI FRAML are auto-filtering of false positives, auto-triage and deprioritization of low-level alerts, auto-fraud pattern and money laundering pattern detection, and optimized investigation with auto case creation and SAR narration.

Q: NICE Actimize has been conducting a city-bycity tour to meet banking leaders and discuss new technology and applications for AI. What similarities are you seeing from region to region? What are banks telling you at these roundtables?

A: The U.S. has a vibrant network of regional, community banks and credit unions representing over 8,000 financial institutions. To date, we have hosted networking events in 12 cities. At these events, industry experts in fraud or AML discussed changes in regulations and recent court decisions that could impact smaller financial institutions.

Q: Talk about a success story you recently experienced with a bank. How did you help the bank fight fraud, streamline operations, and protect its customers?

A: The best way to describe how a customer streamlines its fraud operations and protects its customers with Xceed AI FRAML and its CoPilot is to talk about the total cost of ownership of an alert-to-case.

For example, we have seen that at many firms analysts can clear 15-20 alerts per day on average. If that number of alerts rises to 6000 fraud alerts, it would require 18 fraud analysts to clear such a volume per month.

Xceed AI FRAML and its FraudDESK CoPilot can perform the same volume of alert review in 30 seconds and clear 80% of the false positives while prioritizing only 20% of high-risk enriched AI alerts to a high-priority analyst queue. This is a substantial cost savings and efficiency gain for any financial institution, especially for smaller ones.

The time savings allow banks to focus their high-value analyst resources on actions that better protect customers.

26 | Issue 61 COVER STORY

Q. What is on the horizon for NICE Actimize’s Xceed Premier team? What do you envision three years from now? Where will the AI revolution bring SMB and smaller tiered financial institutions in the future?

A: NICE Actimize’s Xceed Premier team is focused on providing solutions that continue to support SMB financial institutions in combatting financial crimes, using the transformative power of Gen AI. Assisting Fraud and AML Analysts in performing their jobs, “Smarter, Faster, Better” remains the core of that mission.

Among our next generation advancements, Xceed Premier is working to build a Fincrime Threat Intelligence capability to inform analysts of potential threats before an illicit threat strikes. This unique design leverages AI and GenAI, making the analyst team more efficient while saving 80% of time a transaction is performed.

For further information on NICE Actimize Xceed FRAML, please go to the web site here:

https://www.niceactimize.com/xceed/.

COVER STORY Issue 61 | 27

Strengthening Financial Literacy for Enhanced Business Productivity –Strategies for 2024

In conversations with human resource professionals, the impact of financial stress on employee absenteeism and productivity becomes evident. HR experts often highlight instances where employees resort to borrowing from their 401K to prevent eviction or address challenges such as unexpected expenses. Recognizing the direct link between financial wellness and productivity underscores the importance of addressing financial literacy as a pivotal factor.

For decades, the neglect of financial literacy education in schools has allowed families to navigate financial challenges through trial and error. This issue is acute throughout our society, particularly in Black and Latino communities, where lower family incomes and limited financial resources intensify the challenges. To bridge the racial wealth gap and enhance employee productivity, tackling this challenge becomes both a necessity and an opportunity.

Outlined below are strategic solutions:

28 | Issue 61 BUSINESS

1. Advocate for Financial Literacy Education in Schools

Businesses can advocate for a nationwide requirement to incorporate financial literacy education in schools. Proposing basic financial lessons, ideally starting in elementary school, will contribute to expanding financial literacy and empowering families to make informed decisions. Despite some progress, as highlighted by the Chaplain College’s Center for Financial Literacy, there is still a significant gap among states, with only a few earning high grades for their financial education requirements. Engaging in advocacy efforts to implement financial literacy across all fifty states is crucial.

2. Utilize AI-Driven Tools for Informed Financial Decision-Making

It’s important to recognize the limitations of traditional comprehensive finance courses, especially for working adults with time constraints. Businesses can integrate artificial intelligence (AI) tools to assist families in making better financial decisions. AI-driven solutions can analyze spending patterns, identify areas for improvement, and provide real-time prompts akin to technologically driven navigation guidance systems. This practical approach ensures that families receive timely support to safeguard and optimize their financial resources.

3. Collaborate with Arts and Entertainment for Engaging Financial Literacy

Financial institutions can partner with the arts and entertainment industry to create engaging content focused on financial literacy. Drawing inspiration from successful collaborations like OneUnited Bank’s venture with Marvel Comics and Visa , leverage popular culture to make financial education more rewarding and entertaining. By integrating basic financial concepts with entertainment, banking can shed its conventional image and become an exciting and rewarding endeavor for students and families alike.

Business professionals can explore the importance of financial literacy by participating in a short sevenquestion quiz offered by FINRA, the governmentauthorized non-profit organization which oversees U.S. broker-dealers and provides valuable insights into financial literacy levels.

To be clear, financial literacy alone cannot eradicate the racial wealth gap. While advocating for changes in public policy to address housing and transportation affordability, investing in financial literacy remains a cornerstone for wealth building and an impactful business investment. Together, the business community can play a powerful role in dramatically expanding financial literacy in 2024.

Kevin Cohee is the Chairman & CEO of OneUnited Bank, the nation’s largest Blackowned bank. OneUnited Bank introduces WiseOne Insights, the first AI-driven financial wellness companion offered by a Black owned bank to support low-to-moderate income families in making sound financial decisions.

BUSINESS Issue 61 | 29

Kevin Cohee CEO of OneUnited Bank

Re-architecting your platform for a competitive edge: A strategic approach

A new era of trading platforms is emerging

In recent years, end users’ behavior towards electronic trading platforms has drastically changed due to the overall developments in our everyday life. The 100% adoption of smartphones, companies embracing remote working during and after the pandemic, the disruptive changes in the retail brokerage landscape with zero-commission online brokers gaining popularity, and finally, the newly available technologies knocking on our doors at any given moment (blockchain, AI, AR/VR, and metaverses) have all impacted clients’ perceptions of online trading platforms.

Therefore, typical users no longer expect legacy desktop-based feature-rich trading platforms, but instead, an ecosystem of services and data summaries available at their fingertips. Still, the newest version of trading platforms requires market analysis tools to develop their trading strategies, as to not leverage the advice of a third party.

Knowing when to revamp

These new technologies such as cloud-based computing, data lakes and data oceans, modern powerful mobile devices, and AI, improve or completely change how firms can optimize market analysis.

AI itself can be the next technological revolution, and ignoring its potential would be a mistake for the electronic trading industry. Having said that, Devexperts encourages brokers to adapt their current solutions to the evolving technologies and to the changing end-user behavior. Can it be done gradually? We believe yes, and this is what we call re-architecting.

Although there have been no obvious breakthroughs in IT over the past few years, there are major trends in AI and cloud computing that have been observed that can give trading software systems a competitive edge.

Although there may not be a ‘specific’ moment in time where a platform’s revamp is encouraged, there are clear signs that a system is due for a redesign, re-architecture, or refactoring (even if the system fulfils its business requirements). Below are some examples of circumstances that signify a change is needed:

• Significant performance issues during operation.

• Implementing new requirements takes too much effort.

• Maintenance and support do not work smoothly.

30 | Issue 61 TECHNOLOGY

Developing the optimal technology stack

If we were to create the ultimate technology stack, with no limitations to budget or skill, we would certainly recommend using Java. With our expertise in the Java ecosystem, it is safe to say that Java is great for developing business applications due to its stability, huge variety of frameworks and libraries, and integrations with third-party systems.

However, Kotlin by JetBrains may be an even greater alternative to Java, as it is 100% interoperable with Java (and therefore it inherits the entire Java ecosystem). Kotlin promises to become more than an alternative, but something bigger.

Its multiplatform capabilities, compiler and interoperability layers already allow the creation of web and mobile applications using Kotlin programming language only.

Finally, Kotlin simply performs better than Java – it is modern, concise, and functional as well as object-oriented. The more homogeneous and standardized the technology stack is, the easier to recruit an engineering team and build the development processes. Also, the better it is for the interchangeability of team members.

A more realistic approach

Now that we had a look at the most optimal technology stack, let’s get back to reality and focus on a more realistic and manageable trading platform re-architecting method. Below are some best practices firms can implement for a successful revamp of their platform.

1. Reusing existing code: To save costs, it is important to reuse as much of the already existing business code as possible. Instead of copying/pasting, the code should be optimized in terms of efficiency for using algorithms and data structures, as well as resource consumption. It is important to note that your code must be well covered with tests for the refactoring process for it to smoothly be implemented into the re-architecting. Additionally, developers should avoid re-inventing the wheel, instead, use industry-standard protocols, best practices, and approaches for typical tasks to save time and resources.

2. Embracing microservices: Split the monolithic system into smaller components for better microservices. The microservice approach allows developers to scale individual components, achieving better performance while saving computing resources.

3. Utilizing cloud technologies: Take advantage of cloud technologies, containerize your applications, and equip them with distributed configuration, standardized logging and performance metrics to allow deployment and hassle-free operation on cloud platforms. Wellestablished CI/CD infrastructure (Continuous Integration/Deployment) is time-saving and it is overall much easier to maintain development, test, and QA environments in a private cloud.

4. Recognizing fully extensible architecture, as an ideal: A best practice would be to only have one core of the system, which defines the standard. All other components (e.g., customer-specific functionality, paid add-ons) are developed as extensions of that standard. Although extensible architectures may take more time to develop, the approach is very beneficial since product knowledge is better structured, and customerspecific development teams do not have to understand all the system code, they only need to know how to use it through extension points.

To build or buy?… or both!

Although there may be some benefits to building a technology stack from scratch, due to the lifetime of modern IT solutions getting shorter and shorter, it is important to consider that by the time the stack is built from scratch, it may very well already be outdated once completed. Therefore, buy or hybrid methods are recommended.

TECHNOLOGY Issue 61 | 31

Now that isn’t to say that building is a bad thing, however, it is simply not worthwhile for a broker to build themself, especially if developing a large upgrade that may require years and substantial monetary investment. Buying or going hybrid often leads to a quicker go-tomarket implementation.