2 minute read

Right Revenue Mix

Land-based gaming revenue remains strong but sports betting and iGaming continue to rise

The commercial gaming industry entered 2023 on the heels of back-toback record revenue years, generating more than $60 billion in 2022. With continued macroeconomic uncertainty likely this year, all eyes in the industry are focused on whether consumers will be able to propel the continued expansion of the commercial gaming market.

Advertisement

January revenue numbers are now in across the country, and it’s clear gaming is off to a quick start in 2023: commercial operators brought in $5.4 billion in gaming revenue in the month, an all-time monthly high.

Here are three key takeaways on the industry’s promising beginning to the year and its outlook for the future.

Brick-and-Mortar Gaming Remains Strong

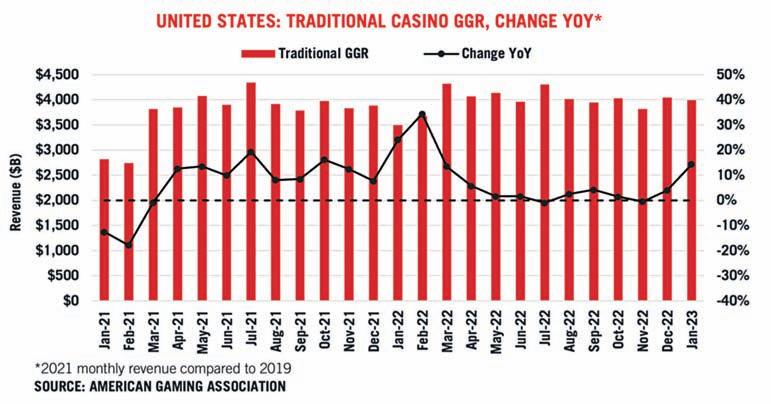

Combined revenue from land-based casino slot machines and table games across the country reached $3.99 billion in January, marking a 14.3 percent increase from January 2022. Slots generated $2.86 billion in revenue, a 15.5 percent year-over-year increase, while revenue from table games gained 14.7 percent year-over-year, reaching $838 million.

This rise is partially due to the impact the Covid-19 omicron variant had on consumer behavior last January—as well as the launch of two additional commercial casino markets since last January in Virginia and Nebraska. Last year’s favorable comparison aside, this was the highest grossing January in history for the brick-andmortar segment.

Demand for Gaming is High Across the Country

While gaming’s expansion to new markets is contributing to growth, so is rising revenue in existing markets. At the state level, 31 of 33 commercial gaming jurisdictions that were operational in January 2022 (and have reported Jan- uary 2023 revenue figures) posted year-over-year revenue growth.

The only two markets that did not report growth are Washington, D.C. and West Virginia. The sports betting market in Washington, D.C. experienced a decline of 23.8 percent compared to January 2023, likely due to increased competition from Maryland launching online sports betting. Meanwhile, West Virginia revenue declined by 6.3 percent, largely due to one less week of reported operations in January 2023 compared to January 2022.

Sports Betting and iGaming Making up Bigger Piece of the Pie

While in-person gaming remains the bedrock of the gaming industry, the expansion and maturation of complementary verticals is also an important driver of gaming’s momentum.

Fueled by a busy sports calendar and the launch of mobile sports betting in Kansas, Louisiana, Maryland and Ohio (retail and mobile) since January 2022, nationwide sports betting activity—both online and in-person—saw a significant boost, with January wagering handle expected to reach an all-time high of more than

BY DAVE FORMAN

$10 billion once all states report their data.

This surge in betting activity resulted in revenue of $922.7 million, a year-over-year increase of 43.3 percent. The Ohio market alone generated gross revenue of $208.9 million in its first month of operation, setting a single-month sports betting record for any state, albeit helped by promotional spending.

Combined January revenue generated by continuing iGaming operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia increased by 20.6 percent yearover-year to $482 million, tying the single-month record from December 2022. All six markets reported annual growth for the vertical, with Connecticut, Michigan and New Jersey setting single-month state records for iGaming revenue.

Taken together, the online sports betting and casino gaming segments captured a quarter (24.8 percent) of monthly industry revenue—their largest share since the peak of the Covid-19 pandemic when brick-and-mortar casinos across the country were shuttered.

Ultimately, January’s revenue figures show that gaming is appealing to consumers in new markets but is also still growing its share of con- sumer entertainment spending across existing verticals and markets. While we can’t predict how shifting macroeconomic conditions will affect the industry throughout the year, it’s evident gaming’s fundamentals remain solid and the industry’s future remains bright.

The American Gaming Association will continue to track and analyze the commercial gaming sector’s performance throughout the year via our Commercial Gaming Revenue Tracker.

This column was written prior to the release of January 2023 Arizona and Illinois commercial sports betting revenue figures.

Dave Forman is vice president, research for the American Gaming Association.