6 minute read

CATTLEFAX TRENDS

LONG-TERM CALF OUTLOOK

The IBBA is proud to bring you the CattleFax Trends Publication that is sponsored by Ritchie Industries. Look for this article each month in the Brangus Journal and Frontline Beef Producer. If you would like to learn more about CattleFax, please go to www.cattlefax.com.

To say 2020 has been a disappointment for cow-calf producers is an understatement. While this year has been a challenge, there is light at the end of the tunnel. Because of the long life cycle for cattle, it is important for producers to always be forward looking and planning for the next few years down the road. A breeding decision that is made today or next spring likely will not generate revenue for at least another fifteen months or more. The following discussion will provide an outlook with emphasis on the calf market, so producers can start developing business plans for the next three to four years.

The two major variables that drive expansion and contraction in the cow-calf segment is profitability and precipitation or available grazing resources. In 2019, margins were thin, especially in the fall, which caused the beef cowherd to liquidate 374,000 head. Unfortunately, this year profitability has not improved much, or at all for some, and Mother Nature has dealt the western half of the country a bad hand with drought conditions. Consequently, further contraction is expected again this year. Unlike the past liquidation phases of the respective cattle cycles, this one should be shorter and shallower with the lowest beef cow numbers likely occurring in 2022 or 2023. Obviously, with a reduction in the cowherd, annual calf crops will decrease, which in turn will limit total beef production.

Economics suggest tighter supplies should push prices higher, given constant demand. Based on how resilient domestic beef demand has been the last several months, one must assume the demand side of the equation will not be a major issue. Also, any significant gains in global demand will be a positive to move more product out of the U.S. to support prices. In addition, the quality of beef being produced continues to improve, which should help in the market share battle versus competing proteins. Through September, 83% of fed cattle graded Choice or Prime. During the same period in 2019, 79.5% graded Choice or better and the five-year average is 77.2%. While the year-over-year change may not be as large, the trend should continue, especially if older and lower performing females are culled during the next couple years and younger, higher quality genetics make up a higher percentage of the U.S. cowherd.

The fundamentals have been laid out implying calf prices should be higher the next few years, but how much improvement can be expected is now the question on everyone’s mind. Measuring the amount of money coming into the beef industry at the consumer level will set the foundation for the price discussion. First off, USDA All-Fresh retail beef prices are on pace to average roughly $6.30/lb. in 2020 – a new annual record. While retail values will likely experience a pullback the next few years, they should still remain elevated from a historical standpoint. During the past six-plus months, the U.S. consumer has been conditioned to pay more for beef. (continued on page 42)

(continued from page 40) Adding in inflation and the long-term uptrend that has been in place for a couple decades, should keep beef prices near $6.00/lb. as a practical target. Current projections are for annual retail prices to average within a dime of $6.00/lb. from 2021 to 2024. This implies the amount of dollars entering the overall beef system will be plentiful.

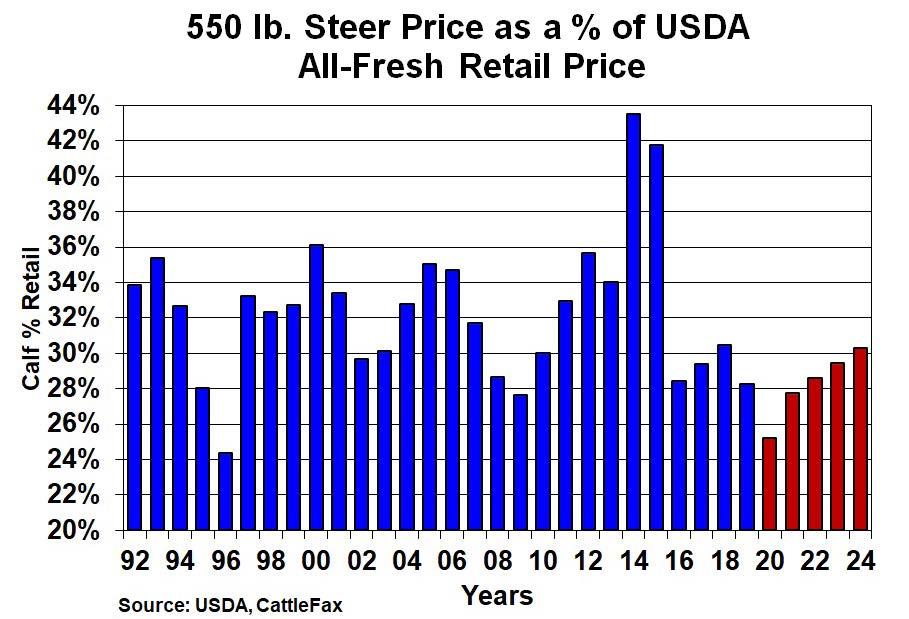

The next component of the price discussion is leverage, to determine how that money is allocated between segments. With the bottleneck at the processing level, it has been a challenge for cow-calf producers to capture a large percentage of retail prices. However, as cattle supplies tighten, the tide should turn and more money will flow back to the cow-calf segment. Year-to-date, the 550-lb. steer price as a percent of the retail price is 25%. By 2024, this leverage measurement is expected to reach 30%, with calf prices averaging $185/ cwt and retail values near $6.10/lb. for the year. In the accompanying chart it is easy to notice the leverage trends follow closely with the historical cattle cycles, and more importantly the prior peaks exceeded the long-term average of 32% by at least two percentage points. Based on this, either 30% by 2024 is too conservative, or leverage will continue to improve further into the decade before making another top. If this were to occur, the odds favor it would be a function of calf prices going higher than what is currently penciled in. The calf values used to calculate the 2021 to 2024 leverage increased about $5 to $7/cwt each year. For reference, the U.S. average 550-lb. steer price is on track to average about $160/cwt in 2020.

To capitalize on the future market trends, the obvious thing for an operation to do is grow the herd if it is viable. Because of the strong positive correlation between calf values and female prices, expansion should occur sooner rather than later if females are going to be purchased. History suggests the cost of adding females will increase as time goes on, assuming the outlook discussed comes to fruition. Also, once the drought breaks, producers in those regions will likely be looking to re-stock their herd – strengthening demand for females.

There’s no doubt expanding the cowherd is easier said than done, as there are many headwinds that producers are currently coping with or may deal with in the future. Probably the most important factor is the grazing resources that are provided by Mother Nature. The U.S. is currently in a La Niña weather pattern. As of early October, the models suggest the La Niña pattern will continue to intensify into the first of the year before changing the trend. The predictions show a switch from La Niña to El Niño occurring late in the second quarter or early third quarter 2021. There is still a lot of time between now and next spring/summer, so this will need to be monitored, but El Niño is typically favorable for most major grazing regions.

A few other variables that could adversely affect the longterm calf outlook would be a strong and sustained rally in corn prices and/or beef exports that significantly underperform leaving burdensome volumes of beef on the domestic market, and of course an unforeseen Black Swan type of event. Because these factors are not easy to predict, producers will still want to incorporate a sound risk management strategy. The plan should constantly be evaluated but it could be as simple as respecting the market seasonals, forward contracting, utilizing futures/options, or participating in value-added programs.

The odds favor 2019 and 2020 will be the lows in calf prices at least until the middle of the decade. While the absolute price levels may change, the trends that have been covered should be valid. All evidence is pointing to a slight reduction in the cowherd and a tighter calf supply over the next two or three years. A progressive cow-calf producer should take action as soon as possible to put the operation in the best position to maximize revenue.