Payday Loans Articles Rss Feed My writing with regard to each person wanting sound money and business finance help. You can find many qualified qualified finance advisors. Get In Touch With Us Soon... Matt White Lyles Financial Group 1430 Broadway, Suite 1105 New York, NY 10018 (212) 237-6647 ============================================================ Payday Loans Articles Rss Feedhttp://loans.org/mortgage/articles/feed enBattlelines: The Politicians Who Are With the Payday Loan Industryhttp://loans.org/payday/articles/battlelines-politicians-with-industry

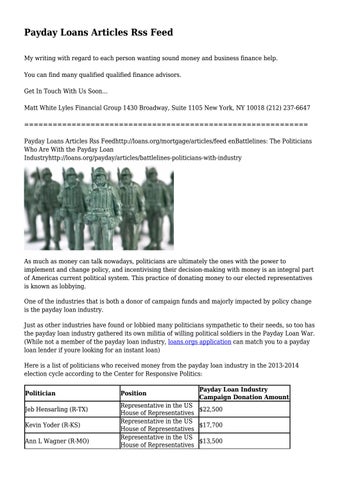

As much as money can talk nowadays, politicians are ultimately the ones with the power to implement and change policy, and incentivising their decision-making with money is an integral part of Americas current political system. This practice of donating money to our elected representatives is known as lobbying. One of the industries that is both a donor of campaign funds and majorly impacted by policy change is the payday loan industry. Just as other industries have found or lobbied many politicians sympathetic to their needs, so too has the payday loan industry gathered its own militia of willing political soldiers in the Payday Loan War. (While not a member of the payday loan industry, loans.orgs application can match you to a payday loan lender if youre looking for an instant loan) Here is a list of politicians who received money from the payday loan industry in the 2013-2014 election cycle according to the Center for Responsive Politics: Politician Jeb Hensarling (R-TX) Kevin Yoder (R-KS) Ann L Wagner (R-MO)

Position

Payday Loan Industry Campaign Donation Amount

Representative in the US $22,500 House of Representatives Representative in the US $17,700 House of Representatives Representative in the US $13,500 House of Representatives