TRAVEL AND EXPENSE CARD MANUAL

509-313-6370

zagstravelandexpense@gonzaga.edu

509-313-6807

gonzagaap@gonzaga.edu

509-313-5671

purchasing@gonzaga.edu

Purchasing

509-313-5629

gonzaga@anthonytravel com

509-313-6370

zagstravelandexpense@gonzaga.edu

509-313-6807

gonzagaap@gonzaga.edu

509-313-5671

purchasing@gonzaga.edu

Purchasing

509-313-5629

gonzaga@anthonytravel com

The Gonzaga University Zags Travel & Expense Card is a Visa credit card issued by U S Bank for eligible University employees Its intended purpose is to facilitate purchases associated with official University business for Ordinary, Reasonable, and Necessary Expenses. The card is strictly prohibited for personal use, unauthorized transactions, or sharing with other individuals. It is imperative to uphold proper internal control measures concerning the application process, adherence to acceptable usage, and meticulous and timely accounting for transactions.

The Gonzaga University Zags Travel & Expense (ZTE) Card Program is designed with a singular purpose - to empower employees with a streamlined and efficient means of acquiring lowdollar goods and services.

This program aims to improve overall efficiency, flexibility, and convenience in purchasing, leading to reduced transaction processing costs The ZTE Card serves as a valuable tool, enabling employees to enhance job performance and contribute to Gonzaga University's mission We are committed to offering our employees a reliable, cost-effective, and user-friendly solution for their everyday departmental needs

The ZTE Card, a VISA credit card, is widely accepted wherever VISA is honored Although these cards are issued by U S Bank in the names of individual employees, it is crucial to recognize that the cards, along with their associated transaction and audit data, are considered the property of Gonzaga University Cardholders are obligated to ensure that all transactions conducted using their ZTE Card comply with Gonzaga University's policies and procedures, and any guidelines provided in this manual.

Eliminates out-ofpocket expenses

Widely accepted Visa payment method

Enhances security & convenience for travelers

Quick turnaround time

Increased visibility into card transactions

Reduced paperwork

24/7 Visa customer service

Standardized cardholder training

Rebates for the University

1

2

Once your application is submitted and approved, your card will be delivered to the AD box or address listed in your application within 7-10 business days. SUBMIT A ZAGS TRAVEL & EXPENSE CARD APPLICATION

3

REVIEW & UNDERSTAND POLICIES & GUIDELINES

Faculty and staff must know and adhere to policies for ZTE Card use, ensuring compliance and responsible financial management.

ACTIVATE YOUR CARD

Upon receiving your new card, enclosed activation instructions will guide you for quick and seamless card activation.

Upload receipts, submit expense reports, manage travel, and approve invoices easily and on-the-go

Faculty and staff are required to reconcile expenses in Concur promptly after card use. Keep itemized receipts and attendee lists for accurate financial reporting.

Prior to activating your ZTE Card, ensure you have read and understand the following policies related to your card:

Zags Travel & Expense Card Policy

Booking Airfare Policy

Receipt Requirements Policy

Travel Meals & Incidentals Policy

Air travel must be initiated and approved in Concur Request, unless explicit approval is given by the CFO and AVP/Controller

All airfare bookings must be made using either the Concur online booking tool or the University's approved travel management company

Airfare expenses must be paid for using a Zags Travel & Expense Card or the University’s ghost card

Itemized Receipts are encouraged for all transactions, but are required for transactions over $50 For reimbursement claims, provide Itemized Receipts for transactions over $10

All efforts should be made to obtain an Itemized Receipt when required

If unable to obtain an Itemized Receipt, complete a Missing Receipt Declaration Missing Receipt Declarations are not accepted for airfare, hotel, and rental car expenses

Delegates cannot complete a Missing Receipt Declaration

Prioritize ZTE Card usage during travel to uphold a streamlined workflow Exceptions may be considered for unique circumstances, but proactive use of ZTE Card is encouraged

Review the University's Purchasing & Expense Resource Guide to identify preferred vendors, payment requirements, and special considerations, such as sustainability guidelines for appliances. Utilizing these resources will ensure alignment with the University’s mission and operational requirements.

Before making any purchases, consult with the Purchasing Department to determine if the University has a business account with preferred vendors Utilizing these accounts and adhering to specific guidelines can offer more cost-effective options for goods and services

At the time of application, the cardholder selects whether they are a staff/faculty or a student

If needed, you can request a limit increase via the Zags Travel and Expense Card Change Request after your card application is approved.

Cardholders can request changes through a Zags Travel & Expense Card Change Request. Please note that all change requests are subject to review from the Controller’s Office, as well as your area’s Budget Officer and VP Level Approvers.

Your ZTE Card is valid through the last day of the month in which it is due to expire. U.S. Bank will automatically issue a new card with the same card number.

If you will be traveling outside our region, please submit your travel dates so we can notify U.S. Bank in an attempt to avoid any fraud referrals on your account.

Contact the ZTE Card Administrator if you no longer wish to use your card or are going on leave

You are responsible for all transactions charged to your card If a transaction does not correlate with purchases that you have made, first contact the vendor involved to try to resolve the error If you are unable to resolve the issue with the vendor, contact U S Bank Customer Service within 60 days of the date of the purchase at 800.344.5696 and dispute the transaction. You may only dispute a transaction within 60 days of the transaction date. Be sure to review your transactions on a monthly basis for any unfamiliar charges. Delinquent reporting of fraudulent charges will be the responsibility of the department.

In case of a lost, stolen, or damaged card, promptly contact U S Bank Customer Service at 800 344 5696, available 24/7, and inform the ZTE Card Administrator

Merchant Category Codes (MCCs) consist of four-digit codes assigned by a merchant bank to suppliers, delineating the nature of the supplier's business. Each card profile is associated with specific MCCs, aligning with the permissible types of transactions these cards may facilitate. Any vendors with MCCs not authorized for approval on your card profile will result in transactions being blocked at the point of sale.

There are four common reasons why a transaction will decline:

1. Exceeding the single transaction limit.

Exceeding the monthly cycle limit - monthly cycle limits reset the 21st of each month.

2. Merchant category code restriction - highrisk categories are blocked by default.

4.

3. Purchase flagged by U.S. Bank as possible fraud - some transactions, such as transactions made online or made overseas, may be flagged as fraudulent by U.S. Bank’s system. To remove this flag, you will need to call U S Bank to confirm the transaction is legitimate

If you are still unclear as to why your card is declining, please contact the ZTE Card Administrator

Cardholders are accountable for all charges made on their respective cards To enhance the security of each card, please adhere to the following rules:

Do not share your card with others

Never write down or email the full 16-digit card account number

Make online purchases through “https” websites only.

Keep the card in your possession.

Never share sensitive information, such as card details. U.S. Bank may ask for the full 16-digit card number, but only if the call is initiated by the cardholder.

The Controller’s Office is responsible for the maintenance, controls and compliance regarding ZTE Card use and policies. The Associate VP and Controller, in consultation with the CFO, may suspend a cardholder’s ZTE Card without notice for card misuse, negligence or overt disregard to Gonzaga travel and expense related policies.

The intentional division of a transaction into multiple payments or on multiple ZTE Cards to evade spending limits, are strictly prohibited.

To purchase goods or services exceeding standard limits, cardholders may submit a Zags Travel & Expense Card Change Request. This ensures compliance with the policy and avoids penalties for non-compliance.

The following items are prohibited from being purchased on a ZTE Card:

Cash cards, stored value cards, pre-paid cards, travelers checks or similar products

Parking tickets and fines

Political contributions

Any ZTE Card transaction not used for business purposes requires timely repayment to the University by the cardholder, including inadvertent personal expenses charged to the card, which must be claimed as such and repaid

Any purchase deemed nonessential to the University or its Mission is considered to be card misuse Any purchase that is considered restricted should be purchased through the Purchasing Department using the purchase requisition process

Effective: April 28, 2015

Last Updated: April 28, 2015

Responsible University Office: Controller’s Office

Policy Contact: Zags Travel & Expense Credit Card Administrator

The Gonzaga University Zags Travel & Expense Card (Card) is a Visa-brand credit card issued by US Bank to eligible University employees and may be used solely for purchases related to official University business for Ordinary, Reasonable and Necessary Expenses. The Card may not be used for personal purchases, unauthorized transactions, or shared with any other individual Proper internal control should be maintained over the application process, acceptable usage, and accounting for transactions

Gonzaga University established the Card program to improve the efficiency, flexibility, and convenience related to purchasing goods, services, and travel while reducing transaction processing costs

Advantages to the Cardholder:

Added convenience to employees during business travel and while conducting University business by reducing the need for reimbursement

Faster order placement and receipt of goods

Travel insurance and assistance

No need to advance money for out of pocket purchases

Purchases can be made quickly, even outside of normal business hours

Expensing of charges is completed after the purchase and does not hold up the order process

Verification and reconciliation of transactions are done within Zags Travel and Expense online, on or off-campus

Purchase requisitions and purchase orders are not needed for transactions purchased with the Card

Advantages to the Department:

Reduces need for check and purchase requisitions

More flexibility in managing budgets

Less paperwork at the start of the purchasing process

Electronic approval and oversight

Transactions usually post to Zags Travel and Expense 3-5 business days from date of transaction, depending on the vendor

Posting to Banner, which allows for budget to actual comparisons, is automatic after submission of approved expense report

Advantages to the University:

Expedites and streamlines purchasing process

Vendors receive payment quicker

Uniform training for all Cardholders

Electronic system from start to finish

Cardholders are empowered to make purchases while controls ensure compliance with University guidelines

University funds spent through the Card program allows the University to earn a Rebate, helping to offset central administrative costs

Enhanced record keeping and tax compliance

All Cardholders and personnel who approve applications for new cards and process and approve Card transactions

Cardholders are responsible for the proper use of the Card in compliance with this policy as well as other University policies and must process the charges in a timely manner using Zags Travel and Expense. Prior to receiving a Card, the Cardholder must read and sign the Zags Travel & Expense Card Application & Acknowledgement Form. The Cardholder is responsible for all purchases made with their assigned card The Cardholder is responsible for obtaining necessary approvals before using the Card to purchase goods or services and for following the guidelines for purchasing set forth below Once a purchase is made, the Cardholder is responsible for confirming goods are received. Cardholders are responsible for safeguarding the Card as if it were cash and must notify the bank immediately if the Card is lost or stolen. Any Personal Expenses inadvertently charged to their Card and any charges considered Card Misuse will be claimed as Personal Expenses and repaid to the University by making a deposit to the Controller’s Office. Cardholders are responsible for notifying and turning their Card in to the Credit Card Administrator upon separating from the University

Expense Approvers are responsible for reviewing and approving Card transactions and receipts using Zags Travel and Expense in a timely manner, ensuring compliance with this and other University policies, and monitoring their Cardholder’s use to ensure Spending Limits are appropriate. The Expense Approver is the critical role in the Card process to identify potential or actual Card Misuse. Expense Approvers are also responsible to notify the Credit Card Administrator when a Cardholder has any change in employment status Expense Approvers are responsible for notifying the Credit Card Administrator and ensuring Cardholders separating from the University turn their Card in to the Credit Card Administrator.

Vice Presidents or assigned delegates are responsible for approving all Zags Travel & Expense Card Application & Acknowledgement Form and Zags Travel & Expense Card Change Request Form.

Credit Card Administrator is responsible for day-to-day Card program administration and maintenance including responsibilities to: provide training to Cardholders and Expense Approvers distribute Cards interact with the bank to add, change, and delete Cardholders issue and update Cardholder policy & procedures monitor purchases for compliance & propriety analyze purchase trends facilitate resolution of disputed charges manage Cardholder limits and activation levels

Billing Cycle The Card has a 30 or 31 day Billing Cycle ending on the 20th or next business day of every month. The next business day after the statement ending date is when the monthly card limit renews

Business Entertainment Any activity generally considered to provide entertainment, amusement, or recreation and may include meals The expense must be ordinary and reasonable All attendees must be accounted for per IRS Publication 463.

Business Expense Ordinary, Reasonable and Necessary charges for goods or services that support the ongoing work of the University.

Business Meals A meal attended by staff, faculty or students, which may or may not include other individuals not employed by the University and where there is a bona fide Business Purpose. All attendees must be accounted for per IRS Publication 463

Business Purpose Statement of justification that expense is directly connected with the performance of Cardholder duties (e g Finalize FYxx budget with Chair or 20xx AJCU Finance Officers Conference in Detroit).

Card The Zags Travel & Expense Card (Card) is a Visa-brand credit card issued by US Bank to eligible University employees and may be used solely for purchases related to official University business for Ordinary, Reasonable and Necessary Expenses.

Cardholder A person to whom a University Card has been issued. The Cardholder is accountable for all charges made with the Card.

Card Misuse Any charge that is determined to be a misappropriation of University funds or that is out of compliance with this and other University policies These charges will require repayment by Cardholder

Credit Card Administrator Controller’s Office staff member responsible for administering the Card program for the University and acting as the main contact between the University and the Bank.

Declined Charge Authorization for the charge has been refused

Expense Approver The person that is responsible for reviewing and approving charges.

Ordinary, Reasonable and Necessary Expense An expense is ordinary if it is normal and customary. An expense is reasonable if a prudent person would incur the expense in a similar situation. An expense is necessary if it is essential to University business

Personal Expense Any Card transaction not used for business purposes that requires repayment to the University by the Cardholder

Rebate The return of all or part of an amount paid for goods or services to the University’s general budget.

Spending Limit A dollar limitation of purchasing authority assigned to the Cardholder for each transaction as well as the total of all transactions during each Billing Cycle.

Split Transaction When the total transaction amount exceeds the Cardholder’s single transaction limit and the vendor splits the total charge into two or more transactions so that they will clear the Cardholder’s single transaction limit. This is not allowed.

Unacceptable Purchases Any purchase deemed nonessential to the University or its Mission, or is considered to be Card Misuse Any purchase that is considered restricted and should be purchased through the Purchasing Department using the purchase requisition process (Please refer to Purchasing of Goods and Services and Special Considerations.)

Zags Travel and Expense The University’s online expense management system. https://zagstravelandexpense.gonzaga.edu/

1.0 Applying for a Card 1.1 Who is eligible for a Card? 1 2 Who is not eligible for a Card?

Any authorized faculty or staff member who: travels on business, or is involved with business entertaining, recruitment, and/or student or employee development, or frequently has the need to purchase low dollar items including supplies, subscriptions, dues/memberships, and conference registrations

The Card is issued to an individual staff or faculty member, not a department.

Any individual not employed by the University

Purchaser Profile

For Cardholders to transact non-recurring low dollar value purchases that are not available through a University contract, not on the Purchasing of Goods and Services and Special Considerations list, and with a value less than the single transaction limit. Examples include membership dues, subscriptions and miscellaneous supplies.

Traveler Profile

For Cardholders to transact individual business travel and Business Entertainment purchases Examples include airfare, business meals, conference registration and travel meals

Combined Profile

For Cardholders requiring elements of both the Purchaser and Traveler Profiles above.

* Tier III is available for certain employees requiring limits in excess of Tier II. Cardholder must submit justification for the higher limit and additional approval from the Purchasing Director and Controller's Office is required To request a higher limit, submit a completed Zags Travel & Expense Card Change Request Form

The Card program is a company billed, company paid program Even though the Card will be issued in the Cardholder’s name and the Cardholder will receive a monthly informational statement by mail or online, the bank will not perform a personal credit check on the Cardholder. All transactions on the Card are the University’s liability. The Controller’s Office is responsible for paying Card statements.

1.6 The Card will not be ordered until all the following requirements have been met:

Complete the Zags Travel & Expense Card Application & Acknowledgement Form including obtaining the proper approval signatures.

Submit all completed required documentation to the Credit Card Administrator. Processing time to receive a Card is 2-3 weeks. The Card will be mailed to the Controller’s Office. The Controller’s Office will notify the Cardholder when your Card is ready for pick up

2.1 Each Cardholder is responsible for charges incurred on their Card. The following are some rules to abide by to help keep each Card as secure as possible. Not adhering to these rules will be considered a violation of this policy.

Under no circumstances should the Cardholder ever allow anyone else to use their Card. If another employee needs to make business-related purchases using a Card he or she should apply for a Card

Because email lines are not secure, Cardholders should never email their full 16-digit Card account number to anyone (including both external merchants and internal University employees). When completing online ordering at merchant websites, Cardholders must always verify that the website address begins with “https”. The “s” indicates that the website is secured and encrypted. If the website address begins with only “http”, it is not secured and encrypted and using it can compromise your Card account number.

Keep the Card in your possession unless other arrangements have been made to secure the Card within the department until needed

Do not write any portion of the Card number down or share the number with others. Never provide sensitive information, including your Card information unless you initiated the call. Neither the Credit Card Administrator nor US Bank will ask you for this information as they already have access to the records.

2 2 If your Card is lost, stolen or damaged, immediately notify US Bank Customer Service at 1-800344-5696 Representatives are available 24/7 Next, notify the Credit Card Administrator

3 1 The Card may be used for purchases in the normal course of business within departmental budget guidelines See Purchasing of Goods and Services and Special Considerations Misuse of the Card may result in revocation of Card privileges, disciplinary action, termination, and/or criminal prosecution

3.2 Purchases made with federally sponsored funds must be made in accordance with A-21 guidelines Please contact the Grant Accountant for more information

3.3 Cash advances are not allowed.

4 1 Any charge on the Card not considered to be an acceptable Business Expense or falling under Unacceptable Purchases will be categorized as Card Misuse and a violation of this policy. Every violation discovered will be monitored by the Credit Card Administrator and will result in a notification to the Cardholder and Expense Approver of the infraction Card Misuse is subject to corrective action which may include notification of Card Misuse, additional training, the suspension or loss of card privileges, disciplinary action, or termination of employment depending on the severity of misuse

4.2 Intentional and repeated Card Misuse shall result in immediate revocation of Card privileges, and may further result in restitution and/or criminal charges. The University reserves the right to pursue all legal remedies available to it with respect to inappropriate Card usage.

4 3 Any charges considered Card Misuse are required to be settled by either repayment to the Controller’s Office by the Cardholder or reduction of subsequent expense reimbursements As a Cardholder, you agree to settle the amount due in a timely manner Any amounts outstanding beyond a reasonable period of time will be reported to the cardholder’s area Vice President and Human Resources and may be repaid by way of immediate payroll deduction which you authorized by signing the Zags Travel & Expense Application (see Applicant Acknowledgement section).

4 4 Cardholders shall not Split Transactions in order to circumvent the per-transaction dollar limits. If the Cardholder has a business reason for making purchases that exceed the spending limit, refer to section 10 0

4.5 Your Card remains the property of the University You are required to surrender the Card upon request from the Credit Card Administrator. If the Card is not surrendered upon request, it will be considered stolen and appropriate action will be initiated by the University.

5 1 It is the responsibility of the Cardholder to review Card charges frequently using Zags Travel and Expense or monthly statements to ensure there are no fraudulent purchases being charged to the account. If unauthorized charges appear, contact US Bank Customer Service at 1-800-5239078 immediately US Bank will close your current account and send a replacement card to the Controller’s Office Contact the Credit Card Administrator to advise them as well The Credit Card Administrator may request a replacement card to be rushed should your travel plans require it

5.2 US Bank deploys a fraud monitoring service that monitors your usual purchasing habits and seeks to identify potentially fraudulent transactions before they can be approved. Should an attempted transaction be stopped, please call US Bank at 1-800-523-9078 to verify the transaction. Please also see section 6.0 Declined Charges.

5 3 By using a Card, the University is offered the consumer protection of having the ability to file a dispute for a suspected or identified errant transaction Common causes of disputes are goods lost in transit, incorrect charges or correct charges posted to the wrong statement, and receipt of an incorrect item or quantity.

5 4 Below is a flowchart of the dispute resolution process

6.1 If the Card is ever declined for a bona fide Business Expense, please consider the following Are you exceeding your monthly or single transaction limit with this purchase? Are you attempting to procure an item at a merchant that would not be considered a normal business vendor? (e g , jewelry stores, casinos) Are you attempting to procure an item that is not allowed within your Cardholder Profile? (e.g., purchasing airfare with a Purchaser profile) See section 1.4 If you feel the decline should not have occurred, you may contact the Credit Card Administrator or US Bank at 1-800-344-5696 for further information regarding the decline and/or assistance to resolve the problem.

7 1 It is the responsibility of the Cardholder to contact the merchant when merchandise purchased with the Card is received that is defective or incorrect. The Cardholder must arrange for a return for credit or an exchange. If a return for credit is made, it is the Cardholder’s responsibility to obtain a receipt from the merchant. The refund must be credited to the same Card on which the original purchase was made. It is strictly prohibited for a Cardholder to accept a refund in the form of cash or check If you have questions, contact the Credit Card Administrator

8.1 Your Card is valid through the last day of the month in which it is due to expire. Your renewal card will be mailed to the Controller’s Office The Controller’s Office will notify the Cardholder when your Card is ready for pick up If you do not receive your renewal card or have concerns, contact the Credit Card Administrator

9.0

9 1

The Zags Travel & Expense Card is property of Gonzaga University and must be surrendered when requested or upon separation from the University. Prior to separation from the University, Cardholders must surrender their Card to the Credit Card Administrator (or their VP who will forward the Card and notify the Credit Card Administrator of termination to update Card records). Do not send Cards via USPS or campus mail. To release the Cardholder from responsibility for the Card, the Credit Card Administrator will document when the Card is received on the Zags Travel & Expense Card Application & Acknowledgement Form. This action should also be taken if the Card is closed for any other reason

9.2 It is recommended that if a Cardholder goes on leave, the Credit Card Administrator be notified so that the Card can be temporarily suspended, then reactivated upon notification of their return.

10.1 Use the Zags Travel & Expense Card Change Request Form to request changes to your account profile (e.g., Card Profile and Tier or name changes).

10 2 Use the Zags Travel & Expense Card Change Request Form to request temporary or permanent changes to the Spending Limit of your Tier 3 cards A clear justification for an increase must be provided Processing time for limit changes is 3 business days following receipt of a completed Zags Travel & Expense Card Change Request Form

11.0

Your Card Transactions

11 1 Gonzaga University utilizes Zags Travel and Expense (http://zagstravelandexpense gonzaga edu) to expense all Card charges Contact the Credit Card Administrator for training and support. A library of training videos is accessible within Zags Travel and Expense under Help, Training.

11.2 Processing Card transactions should be done in a timely manner (within 15 days of the transaction). Any outstanding charges as of May 20th need to be processed and approved by May 25th. This will help with fiscal year end cutoff by ensuring transactions are booked into the proper period. Contact your Expense Approver or the Zags Travel and Expense Program Administrator with any questions regarding this expense program.

11 3

11 4

Any transaction, or portion of transaction that is a Personal Expense must be marked as Personal Expense (do not reimburse) and is required to be settled by either repayment to the Controller’s Office by the Cardholder or reduction of subsequent expense reimbursements. As a Cardholder, you agree to settle the amount due in a timely manner. Any amounts outstanding beyond a reasonable period of time will be reported to the cardholder’s area Vice President and Human Resources and may be repaid by way of immediate payroll deduction which you authorized by signing the Zags Travel & Expense Application (see Applicant Acknowledgement section).

Original itemized receipts are required to be uploaded and attached to the corresponding charge in Zags Travel and Expense E-receipts may take the place of an itemized receipt if the merchant provides one If an itemized receipt is lost, every effort should be made to obtain a duplicate receipt from the vendor. As a last resort, you can use the Missing Receipt Affidavit, available in the Receipts drop down menu on an Expense Report missing receipts, as support of your transaction. This should only be used on rare occasions and will not be acceptable as a normal practice.

11 5 Business Meals or Business Entertainment require attendee’s names to be entered into Zags Travel and Expense

11.6 All expenses require a documented Business Purpose. This explains the business reason money was spent. Please be as detailed as possible to explain your expense.

11.7 Although the University is tax exempt on its income, all purchases made by the University are subject to sales or use tax. Taxes should be included in the cost of all purchases; if erroneously not included in the purchase total, the tax liability will be calculated, accrued and charged to the Cardholder’s general leger account Items subject to use tax must be identified in Zags Travel and Expense by the Cardholder These types of items are generally tangible items purchased online that are shipped to and used in Washington If sales tax for these items is not charged, please use the check box labeled “Tax Not Paid” in Zags Travel and Expense so the proper tax can be assessed.

Reason for Policy

Scope

Policy Statement

Definitions

Exceptions

Sanctions

Related Policies, Documents & Forms

Archival

•

•

•

Effective: February 15, 2018

Last Updated: October 12, 2021

Responsible University Office: Controller’s Office

Policy Contact: Director of Financial Systems and Services

Capture all University travel spend data centrally, creating the ability to negotiate discounts with travel vendors, resulting in departmental budget savings

Increase the University’s credit card rebate, deposited to the general budget.

• Ensure all travelers have a clear and consistent understanding of how to book and pay for airfare

Maximize the University’s ability to proactively manage travel risk, and optimally protect and support travelers (duty of care).

This policy is relevant to anyone who travels on behalf of the University, spending University or grant funds, and anyone responsible for processing or approving travel arrangements and business expenses. Department approvers/managers are responsible for ensuring employee compliance to this policy.

Air travel must be pre-approved prior to airfare booking All air travel, unless specifically exempt from this policy via consultation with the Controller’s Office and approved by the Chief Financial Officer will be initiated and approved in Concur Request.

Airfare bookings must be made through the Concur online booking tool, or by directly contacting the University's approved travel management company as authorized by the Zags Travel & Expense Office

• All travel associated or charged to a grant should be approved prior to purchase by the Grant Accountant in the Controller's Office

Airfare expenses must be paid for using a Zags Travel & Expense card or the University’s ghost card (default in Concur and with the approved travel management company).

Group travel consisting of seven or more passengers, should be arranged with the assistance of the Travel & Expense Office.

Travel planning should be completed as far in advance as possible, ideally 14 days or more. Advance travel planning is key to obtaining the lowest airfares and securing first choice flight times

Non-refundable fares should be booked in the majority of cases.

Class of service: Travelers must purchase the lowest available economy class airfare that meets the needs of the business trip

• Business class may be used for travel if your Budget Officer confirms before purchase that appropriate funds are available, and if any of the following conditions are met:

o Any flight segment has a scheduled in-air flying time in excess of five hours, o The total scheduled in-air flight time, including connecting legs, is in excess of seven hours,

o A medical justification has been documented by a primary care provider.

Changes and Cancelations: Changes to an airline ticket for business reasons or circumstances beyond the traveler’s control are allowable expenses. When travel plans must be changed due to unforeseen circumstances, the traveler is responsible for notifying the approved travel management company responsible for the booking, as soon as possible

For tickets purchased using grant funds, contact the Grant Accountant in the Controller’s Office to determine if the penalty may be charged to the grant.

Frequent Flyer Miles/Reward Points: Travelers may keep all rewards related to travel (e.g., Delta Sky Miles, Starwood Rewards, etc.). Travelers will not be reimbursed for the value of any personal points used for travel

n/a

International Faculty Led Study Abroad Programs

n/a

Receipt Requirements Policy, Controller’s Office

Travel Meals & Incidentals Policy, Controller’s Office

n/a

Reason for Policy

Scope

Policy Statement

Definitions

Exceptions

Sanctions

Related Policies, Documents & Forms

Archival

Effective: February 15, 2018

Last Updated: February 15, 2018

Responsible University Office: Controller’s Office

Policy Contact: Director of Financial Systems and Services

To clearly define the University’s requirements for receipt documentation when spending University funds.

This policy is relevant to anyone incurring expenses on behalf of Gonzaga University, spending University or grant funds, with a bona fide University business purpose, and anyone responsible for processing or approving business expenses.

Department approvers/managers are responsible for ensuring employee compliance to this policy

Receipt Requirements

When using a Zags Travel & Expense card - itemized receipts are required for each individual transaction greater than $50. When claiming reimbursement - itemized receipts and credit card slip (when applicable) are required for each individual transaction greater than $10 In no instance is a credit card statement and/or credit card slip an acceptable form of Itemized Receipt documentation.

All efforts should be made to obtain an Itemized Receipt when required. When an Itemized Receipt is not obtainable, a Missing Receipt Affidavit must be completed by the person who incurred the transaction Missing Receipt Affidavits are not accepted for airfare, hotel and rental car expenses

Definitions-Unlessotherwiseindicated,thefollowingdefinitionsapplyonly withinthecontextofthispolicy.

Itemized Receipt - receipt copy that shows the details of the expenditure, including: business name, date, item(s) purchased, price of each item and total transaction amount, see example:

Acceptable form of documentation

Credit Card Slip - receipt copy that shows only the credit card authorization, see example:

Unacceptable form of documentation

Missing Receipt Affidavit - an attestation by the authorizing party that the expense is for goods or services with a legitimate business purpose

If a Vice President requires more rigorous receipt requirements, department approvers are responsible for auditing compliance.

Accounts Payable and the Controller’s Office will audit expense reports according to this University policy

Multiple and/or habitual Missing Receipt Affidavits will be considered as misuse and may result in the expense being classified as taxable income because justifiable evidence of the business purpose is not provided and may result in closure of the cardholder’s Zags Travel & Expense Card, if applicable.

Quarterly reports will be provided to Vice Presidents by the Travel & Expense Office to monitor policy compliance

TravelMeals&IncidentalsPolicy, Controller’sOffice

n/a

Reason for Policy Scope

Policy Statement

Definitions (Defined terms are capitalized ) Exceptions Sanctions Related Policies, Documents & Forms Archival

Effective: February 15, 2018

Last Updated: February 15, 2018

Responsible University Office: Controller’s Office

Policy Contact: Director of Financial Systems and Services

To establish an allowance for Meals and Incidental Expenses related to travel on behalf of Gonzaga University.

This policy is relevant to anyone who travels on behalf of the University, spending University or grant funds, and anyone responsible for processing or approving business expenses.

Department approvers/managers are responsible for ensuring employee compliance to this policy

There are two acceptable methods for expensing Meal and Incidental Expenses. Travelers need to consult their budget officer as to which method should be used: method selected must be consistent for the duration of the trip.

Actual Expense (preferred method): 1.

Report actual expenses for Meals and Incidental Expenses.

Meals should be charged to a Zags Travel & Expense card (when applicable).

Expenses should approximate the applicable General Services Administration (GSA) rate found at www.gsa.gov/perdiem or in Concur.

Per Diem: 2

Upon completion of a trip, travelers can request reimbursement of Per Diem based on the following:

Foreign/international travelers may claim 75% of the most current Per Diem rates available on the U.S. Department of State website, https://aoprals state gov/web920/per diem asp Rates are also preloaded in Concur

For international trips longer than 14 days, contact your department’s budget officer for Per Diem rates

Domestic Per Diem rates, for the lower 48 states, are reimbursable at 100% of the most current GSA rates, available at: www.gsa.gov/perdiem, and are preloaded in Concur.

Per Diem rates for Alaska, Hawaii and U.S. Territories, are reimbursable at 100% of the current rate set by the Department of Defense website, http://www defensetravel dod mil/site/perdiemCalc cfm, and are preloaded in Concur.

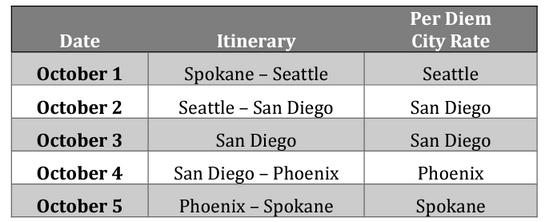

Per Diem rate is determined by the destination city (where the traveler spends the night), see example below:

Meals and Incidental Expenses (M&IE) Breakdown: Meals had at home prior to travel departure or after travel return and Meals provided through a conference or by another organization are not reimbursable and need to be deducted from the daily Per Diem rate. Separate amounts for breakfast, lunch and dinner can be found here on the GSA website: http://www.gsa.gov/portal/content/101518 and are also available in Concur

Definitions-Unlessotherwiseindicated,thefollowingdefinitionsapplyonly withinthecontextofthispolicy.

General Services Administration – (GSA) independent agency of the United States government, established in 1949 to help manage and support the basic functioning of federal agencies

Incidental Expenses – tips for porters, baggage handlers and hotel staff. Amounts should be reasonable, typically between 15-20%

Meals – Breakfast, lunch and/or dinner, including tax and tip, consumed while traveling on behalf of Gonzaga University.

Per Diem – allowance for Meals and Incidental Expenses incurred when traveling.

U.S. Department of State – the lead U S foreign affairs agency that represents the United States at more than 270 diplomatic locations around the world, including embassies, consulates, and missions to international organizations, in addition to providing information and services for U S citizens traveling abroad

Exceptions

n/a

Sanctions

n/a

Receipt Requirements Policy, Controller’s Office

Archival

n/a