The Path to HOME OWNERSHIP

How REALTORS® Champion the American Dream

Local REALTORS® explain why they think point-of-sale inspections are a barrier to homeownership.

By Jill Sell

Point-of-sale (POS) inspection. Depending upon someone’s perspective and experience, the term conjures up visions of just another routine step in the homebuying process to memories of a nightmarish experience — for possibly both the home seller and homebuyer.

A POS is a legally required visual inspection of a property that must be completed before it can be sold. There are no uniform laws or requirements in Ohio for the action. The inspection can include a home’s exterior, interior or a combination of both, as well as a requirement to create an escrow account to hold the funds necessary to make required repairs.

From Aberdeen to Zoar, some communities in Ohio have a wide variety of practices — from non-existent POS rules to what some consider to be rather questionable requirements. Northeast Ohio has its own hodgepodge of different POS

practices. Most have some sort of condition standards for roofs, windows, doors, plumbing, heating, chimneys, foundations and siding.

One related concern is about those who carry out POS inspections. Both city-appointed and private inspectors hired by the seller or buyer may see things differently even when examining the same property. Homeowners and real estate professionals perceive certain inspectors as being “tougher” than others. Some inspectors are said to have certain prejudices, such as a dislike for gravel driveways or types of porch railings.

At first glance, a POS may appear to be a policy put in place to protect buyers from purchasing a house that has known or unknown major building violations and/or that needs significant repairs. Also, having the inspection may also reduce the liability of a seller to fully disclose defects. A community’s incentive

for adopting a POS inspection also may be a desire to maintain safe and secure residences, as well as preserve a neighborhood’s value.

But not everyone agrees a POS is beneficial. Those opposed to what they consider unfair and unrealistic POS practices say the policy significantly cramps homeownership. Delve even deeper and some real estate professionals, community leaders and homeowners/buyers and sellers are exposing disturbing stories associated with POS inspections that have occurred historically and in the present.

“Akron Cleveland Association of REALTORS® (ACAR) is opposed to point of sale inspections. We believe they are a barrier to homeownership,” says Jamie McMillen, ACAR’s Vice President of Government Affairs. “Studies have shown they actually hurt a local real estate market. Instead of city-mandated inspections at the time of sale, ACAR’s position is to

support systematic, exterior inspections of all properties, not just the ones for sale or rent. That way the city is really helping to make sure our communities and neighborhoods are maintained while also preserving the property owners’ and residents’ privacy.”

Drew Gaebelein is a REALTOR® with eXp Realty and the 2024 ACAR President-Elect. Gaebelein uses an example of two houses, side by side. House A is up for sale every five years and so is subject to a POS at each transaction. House B’s title is still signed by the original owners, who haven’t moved in 50 years and who have not been subject to a POS inspection. Gaebelein points out House B might need more tender loving care, but House A is the one that attracts all the attention.

The additional cost of buying a house in a community that requires a POS, and especially one that requires an escrow account, can be daunting, according to McMillen. Homebuyers need money for a down payment, closing costs, a private inspection if desired, an appraisal and, if necessary, money for the POS escrow account.

“That escrow can be 100 to 150% of the estimated repairs that are listed by the city,” says McMillen. “In some cases, a city won’t release the money until all repairs

are done. Some cities will release in smaller amounts, but most won’t unless the house is re-inspected and passed.”

“I recently listed a property for a client in Maple Heights. The client said, ‘We know the city is going to come up with something on the POS inspection. So, let’s price the house a little higher so if they ask me to do some repairs, then it is built into the price of the house.’ POS inspections just drive up the process of selling,” says Gaebelein. “In some homes, a driveway may need to be replaced. That’s a huge expense. If the seller can’t afford to replace it, it’s really the buyer who is going to pay for it.”

POS arrangements are generally decided in three ways. The first is that the seller assumes all costs for repairs. Of course, some homeowners simply cannot afford that responsibility. For those sellers, it may mean they must remain in a home they really want or need to sell. Or it means a financial hit on their home’s equity and projected generational wealth

for their families, according to some real estate professionals.

A seller can also sell a house “as is” with the buyer footing all repair and violation costs. The third option involves the buyer and seller negotiating the cost for repairs. POS inspections are not widespread across the country. The practice is only found in “pockets in Ohio,” according to McMillen.

Gaebelein adds that they are mostly on Cleveland’s East Side. Many houses are inspected by the buyer/and seller in private agreements anyway, adds McMillen.

“The City of Bedford used to have point of sale until a property owner took them to court where the practice was ruled unconstitutional. If you look at property values in Bedford, compared to Maple Heights and Garfield Heights, which have similar housing stock, but also point of sales inspections, housing values are now higher in Bedford,” says Gaebelein.

The City of Shaker Heights has a POS that requires an interior, exterior and escrow account. The Building and Housing Development director, Kyle Krewson, says home sales there, however, “in the last three years have skyrocketed at a rate higher than many inner-ring communities.” Krewson credits POS inspections for “allowing property values to remain high.”

He points out that the older housing stock in Shaker Heights, with “its architecture and charm,” requires appropriate and regular maintenance. He says he believes POS will help make sure the houses “are here for another 100 years.”

“ I recently listed a property for a client in Maple Heights. The client said, ‘We know the city is going to come up with something on the POS inspection. So, let’s price the house a little higher so if they ask me to do some repairs, then it is built into the price of the house.’

— Drew Gaebelein

Nikki Raichart, a REALTOR® with HomeSmart Real Estate Momentum in Mentor, moved to Ohio from Oregon three years ago. Raichart was shocked at the limitations local POS inspections “unfairly impose on sellers and buyers.”

To her, POS inspections create not only financial burdens, but are discriminatory.

“Point of sale inspections are racist, illegal red-lining, dressed-up wolves in sheep’s clothing,” says Raichart. “I work with a lot of local investors, refugees and refugee organizations. The inspections and associated costs are barriers to them. I worked with a man from the Congo who got a job as a janitor with University Hospitals. He worked his way up to become a phlebotomist and was ready to purchase a home. With all his heart, he wanted to buy in Shaker Heights because he was bringing his daughter here from the Congo and wanted the best schools for her.” The client thought Shaker Heights had the best school for her.

Complications involving the city’s POS prohibited the individual from buying the Shaker Heights property that Raichart said would have been suitable for his needs.

“He had to purchase in an area that wasn’t even close to where he wanted to be,” says Raichart.

She says Shaker Heights wants to be a diverse city, but that most of that diversity “comes from renters in buildings owned by investors.” She says she believes if the city is hoping to attract young families with children to bolster shrinking school enrollment, more barriers to homeownership, including POS inspections, must be overcome.

Some housing experts and REALTORS® who have studied the history of Greater Cleveland’s housing scene are uneasy with the possible negative origins of POS.

“I’ve always heard that POS here originated when some communities were starting to become more diverse. It was a way to keep

people who couldn’t afford repairs out of their communities,” says Gaebelein.

Tiffany L. Hollinger, a REALTOR® with Berkshire Hathaway HomeServices Professional Realty in Shaker Heights, says she believes the most damaging part of a POS inspection is not the physical inspection itself as much as the required escrow.

“We live in an area today that is very much taboo against outside investors,” says Hollinger, whose background also includes being a financial counselor, personal real estate investor and agent to both local and out-of-town investors. “But who is going to have that money to put into escrow other than a person in California who thinks nothing of spending $500,000? Point-of-sale escrow is a roadblock for smaller, minority investors and minority buyers. It is a civil rights issue. It discriminates against the people who are least economically able.”

McMillen says she believes over the past several years there has been a “trend where cities are rolling back pieces of their POS inspections, but not the whole thing.

“One of the most recent examples is the City of Euclid, which had a POS that included mandatory exterior and interior inspections, as well as escrow requirements for repairs,” says McMillen. “But as different cases have gone through Ohio courts, Euclid and several other cities made the interior inspection optional.” The City of Euclid also later eliminated its escrow requirement.

Opponents of POS inspections (especially those that threaten criminal charges against who do not comply) look to Thompson V. City of Oakwood (a suburb of Dayton), a 2018 case that found a POS ordinance to be unconstitutional. That ruling was based on the Fourth Amendment’s purpose to safeguard the privacy and security of individuals against arbitrary inva-

sions by government officials, according to the court’s interpretation.

However, some cities in Ohio turn to their municipal courts to circumvent that ruling, according to real estate professionals who have studied the policies. If a homeowner checks off a box on an online application for a POS indicating they agree to a POS, it means, according to some cities, the seller is requesting the POS. If a seller does not want a POS, some communities say they “will be required to request a search warrant from the court to perform the inspection.”

“We need all these communities and their residents to really understand the effects of point of sale,” says Hollinger. “We need a massive number of voices in Northeast Ohio to alter the point of sale’s negative points or else the harm to Northeast Ohio’s economy and homebuyers and sellers will continue.”

NOTE: ACAR has commissioned an independent analysis of Point of Sale Inspections that will be released tentatively in November 2024.

HAVE YOU EXPERIENCED A TRANSACTION CHALLENGE DUE TO GOVERNMENT POLICY?

If you have experienced a delayed or failed transaction due to the point of sale inspection process or any other government policy, ACAR and its Legislative Committee want to know. The better we understand challenges from local, state, and/or federal government policy, the better we can serve you.

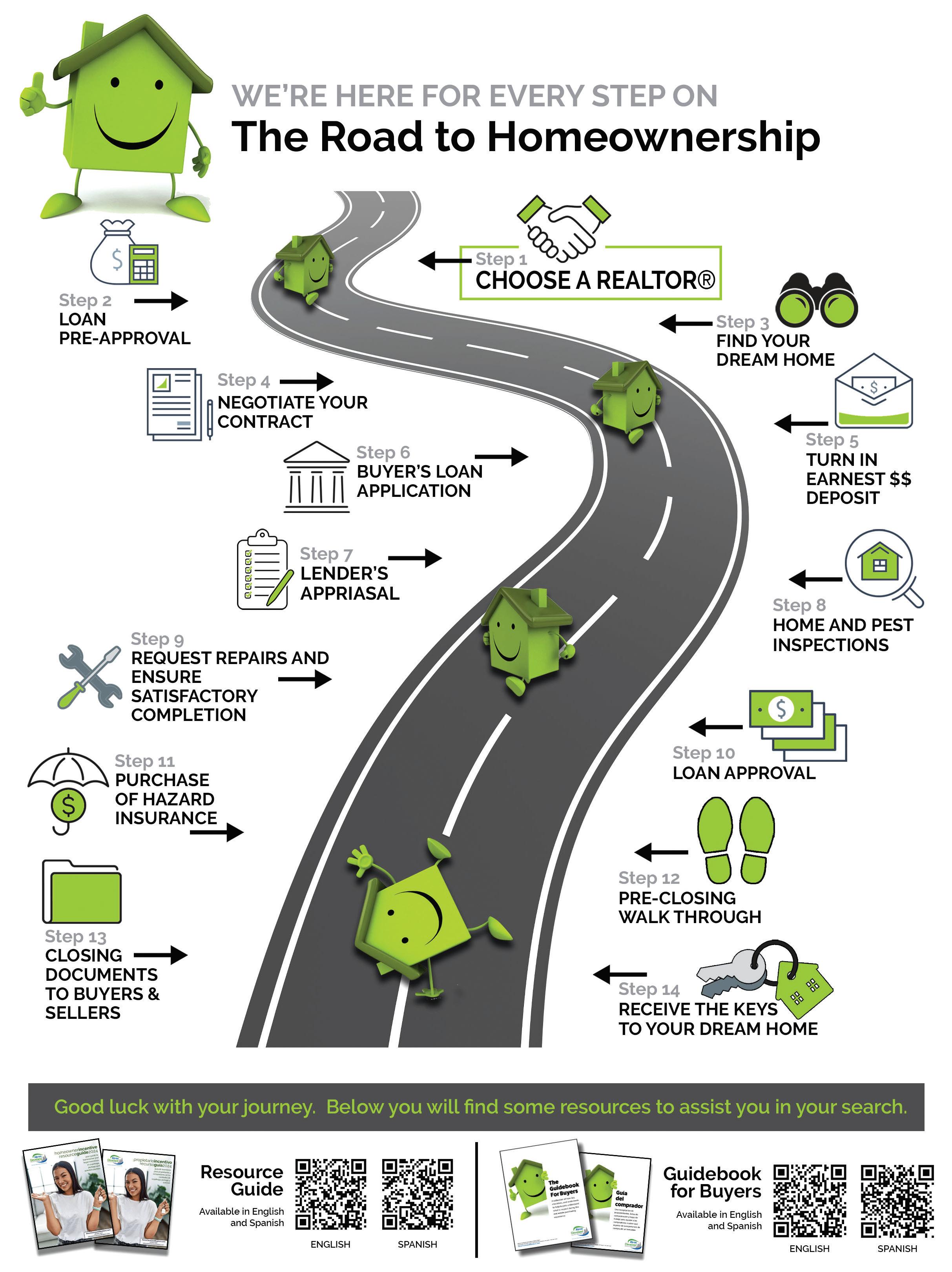

Learn about local programs that can assist potential homebuyers purchase a home.

By Jill Sell

This can certainly be a rewarding time to buy a house. No matter if that means first-time buyers proud of their starter home, move-up buyers or empty-nesters ready to embrace a more carefree homeowning option. But it’s no secret there are also challenges.

Housing experts say the country faces a shortage of 4 to 7 million homes — mostly affordable ones. The National Association of REALTORS® (NAR), of which ACAR is an affiliate, notes that the real estate market traditionally needs five to six months of housing supply to be balanced — not favoring either a buyer’s or seller’s market. Existing home sales stats say the Summit, Cuyahoga and Portgage counties was at a 1.9-month supply in July.

Cost is still a factor for many as well. In July, the median existing home price for the same region was $231,000, an increase of 6.5% from a year ago. That increase also boosts down payment requirements, which can be a significant obstacle to homebuyers.

Also consider that the historically low interest rates we were getting used to are now on the rise and that many credit scores are being adjusted. Add in the rising costs of appraisals, point-of-sale inspections and other factors, and it’s no wonder homebuyers are looking for help.

ACAR has compiled a list of many local programs available for homebuyers and/or

homeowners. This useful resource and other tools can be found at HomeForAllNEO.com. Resources are available to the public at no cost. Here is sampling of local programs:

The First Home First Loan Down Payment Assistance Program aims to increase the accessibility of homeownership for lowmoderate income households in Summit County, excluding Akron, Barberton and Cuyahoga Falls. Applicants must not have owned a home in the past three years and total gross household income is at or below 80% of the area median income.

The maximum purchase for a home is $163,000, with a maximum purchase price not to exceed 90% of the appraised value of the home. Single-family homes, condos and townhouses are eligible for the program. Mobile homes and duplexes are not. Before closing, the house must be free of defects that “pose an immediate danger to health and safety.”

Potential homebuyers must be able to obtain a commitment from a bank, savings and loan association, credit union or another private lender for a first mortgage. They also must agree to reside in the property as their primary residence.

Information: Department of Community and Economic Development, co.summitoh.net

The Portage Growlink Program makes low-cost loans to homeowners, small businesses and family farms within the county. Eligible homeowners are those seeking energy efficiency improvements (which can include solar panels, septic system upgrades/sewer), as well as home repairs, remodeling, property upgrades and other permanent projects.

This program, from the Portage County Treasurer’s Office, provides home equity loans at up 3% below the rate a bank would normally offer. Because the focus of Portage Growlink is to improve properties within the county, there is no limit on a borrower’s income.

“There is a huge demand for these kinds of loans,” says Portage County Treasurer John Kennedy, adding that the loans are an asset to homebuyers who may choose to buy in Portage County knowing money is available to make improvements.

Homeowner loans are available for up to $25,000 and the discounted interest rate applies only to the first five years of home loans. Applications can be made at any participating bank.

Information: Portage County, 330-297-3586, portagecounty-oh.gov

“It’s like a golden ticket.” That’s how Laura Boustani, vice president of external affairs for CHN Housing Partners, describes CHN Housing Capital’s Believe Mortgage products. The Believe Mortgage helps those who may not qualify for traditional mortgages and is available in Cuyahoga, Lorain, Lake, Medina and Summit counties.

A number of obstacles are swept away under this program. The entire borrower profile is considered, not just a credit score. The applicant is not required to be a first-time homebuyer; and no monthly private mortgage insurance is required. In addition, 100% financing may be available through Believe100 and there is no cost for required homeowner classes.

CHN Housing Capital, a nonprofit, affordable housing developer and lender, also offers a Down Payment Assistance program. Homes can be located in any of the 51 Cuyahoga County eligible communities, but must be single-family and owner-occupied. Homeowners must not have owned a home in the past three years, take homeownership classes, and be at or below 80% area median income.

Information: CHN Housing Capital, 855-764-5626, chnhousingcapital.org

Cuyahoga Falls uses funds provided by the federal Community Development Block Grant (CDGB) Program to help residents and the city fight blight and infrastructure problems. The city offers grants up to $30,000 to eligible residents.

Eligible properties must be single-family, one-unit dwellings inspected by Neighborhood Development Services and suitable for rehabilitation.

Applicants must have low-to-moderate income and be the property’s owners. Owners must also be up to date with property taxes and or on a tax payment plan, current with City of Cuyahoga Falls income tax and utility accounts and have property insurance.

Information: 330-971-8173, cityofcf.com

The Lakewood HOME Program offers first-time homebuyers interested in buying a home within the city a 0%, no monthly payment second mortgage (a lien) to assist with both down payment and closing costs. To qualify, participants must complete several steps. Those have been described in a variety of ways from “unnecessary hoops to jump through” to “important steps to assure the city (and the buyer themselves) that a potential homebuyer is well prepared to make a commitment to homeownership.”

Steps include taking HUD Lead Assessment training, Program Orientation and a Program Quiz after watching a video. The City of Lakewood will present Certificates of Completion, which can be taken to a participating lender, although that action does not guarantee funding or entry to the program.

Applicants may not have owned a property within the past three years, and the property must become a primary residence. Maximum property purchase price cannot exceed $129,000 for a single-family residence or $165,000 for a two-family residence.

Information: Housing and Building Department; 216-529-6270, lakewoodoh.gov

The City of Kent wants to assist its residents in needed rehabilitation to their homes. That can include providing new roofs, windows, doors and other energy saving elements, as well as replacing or updating heating and electrical systems. Accessory buildings and additions to the home on the property are not covered.

This Owner Occupied Housing

Rehabilitation loan/grant program can provide up to $85,000 of assistance.

“Twenty percent of the loan is forgiven every year over a five-year period, which means that 100% of the original loan will convert to a grant and will not have to be repaid by the homeowners, provided the homeowners maintain the home as their primary residence for five full years,” according to information supplied by Bridget Susel, community development director the City of Kent.

Information: City of Kent, 330-678-8108, kentohio.gov

Buyers typically searched for 10 weeks and looked at a median of 7 homes and viewed 4 homes only online. 10 Weeks

89% of buyers recently purchased their home through a real estate agent or broker, and 6% purchased directly through the previous owner. 89% • 6%

The typical downpayment for firsttime buyers was 8%, while the typical downpayment for repeat buyers was 19%. 8% • 19%

54% • 53% • 23%

For 54% of buyers, the source of the downpayment came from their savings. 53% of repeat buyers cited using the proceeds from the sale of a primary residence, while 23% of first-time buyers used a gift or loan from friends or family for the downpayment.

For first-time home buyers, 38% said saving for a downpayment was the most difficult step in the process. 38%

Buyers continue to see purchasing a home as a good financial investment. 82% reported they view a home purchase as a good investment. 82%

81% of buyers were White/Caucasian, 7% were Hispanic/Latino, 7% were Black/AfricanAmerican, 6% were Asian/Pacific Islander, and 6% identified as some other race. 81% • 7% • 6%

88% of recent home buyers identified as heterosexual, 3% as gay or lesbian, 2% as bisexual, 1% prefer to self-describe, and 6% preferred not to answer. 88%