GreenStone FCS

Fall 2016

Promoting the business success of our customers and the rural community

2016 Fall Market Outlook

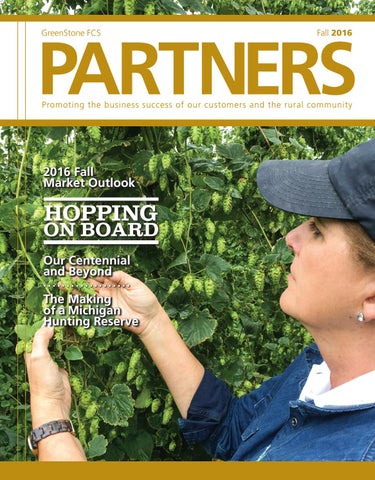

HOPPING

ON BOARD Our Centennial and Beyond The Making of a Michigan Hunting Reserve

FALL 16 5 YBSF Feature. Pam Bouma Miller has had her hands in the soil for many years. Now she finds herself farming in a unique and exciting way. It’s not a vegetable… it’s hops.

19

5

25

33

39

19 GreenStone Story. In late September, GreenStone hosted approximately 300 legislators, customers and agricultural leaders at a centennial celebration on the Michigan State Capitol lawn.

33 C rop Insurance Feature. Pasture, Rangeland and Forage (PRF) insurance is a risk management tool developed by USDA’s Risk Management Agency. Learn more about this coverage option. 39 Tax Feature. Low commodity prices

25 Country Living Feature. Ed Goings and his family have dreamed of owning a deer ranch. The Goings started the process about four years ago with the purchase of 120 acres.

may cause some farm operations to incur net operating losses in 2016. If it happens to you, be sure to take appropriate action when preparing your taxes.

3 CEO Comments. President and CEO, Dave Armstrong, discusses commodity conditions, credit and what may lie ahead for producers.

30 Health and Wellness. The holidays are a great opportunity to connect with family and friends, be sure to also pay attention to your health and safety! 31 Guest Column.

9 Market Outlook. Bob Utterback considers current market prices and what might spur higher prices in the future.

Jimmy Gretzinger of Michigan Out of Doors TV, tells us about a deer season he will never forget.

11 Guest Column. Is the world on the edge of a food and energy cliff? Maybe not.

37 Guest Column. Learn how a strong U.S.

13 Urban Agricultural Act of 2016. The most comprehensive urban agriculture bill to be introduced in Congress will create new economic opportunities, and increase access to healthy foods.

41 Careers.

21 Legislative Matters. There are very few things people agree on 100 percent of the time, but that has never dissuaded leaders to make the effort to move issues forward for the good of common interests. 22 PAC Progress. Strong foundations continue to be built, keeping the voice of agriculture ringing in the halls of the Federal and State legislatures. 23 Directors’ Perspective. As part of GreenStone’s 100th anniversary, we have asked each of your board directors to share a bit of their personal history with Farm Credit.

dollar can affect domestic agriculture. New overtime pay regulation rules begin Dec. 1, 2016. Here is what you need to know.

13 Open Fields Blog Brief

14 Member News 15 Candid Comments 16 Pause for Applause 17 Trends in Farm Credit 18 Behind the Scenes

Editor’s Note: And just like that, the year of our centennial—Farm Credit’s 100th anniversary—is nearly over. After decades of growth, transition, inspiration and relationships, we commemorated this milestone together with each of you throughout 2016. But just like the 50th anniversary of my parents’ marriage that I admirably celebrate with them this month, the relationship—GreenStone’s mission and commitment —keeps flourishing. And with another century to look forward to, we can’t help but be excited about the future. You inspire each day with your own ideas, aspirations, and attention to what’s next in your life, your family, your career, and your business. GreenStone, and the many business partners and friends we have made over the century, is no different. In this issue of Partners, hear from a new farmer finding success in a unique and growing industry, meet an outdoors enthusiast fulfilling his family’s dream, explore new risk management tools through crop insurance, learn about opportunities for veterans in agriculture and construction seminars for future homeowners, and discover a new source for food and farming connections. The CEO Comments offer a perspective on today’s economic challenges, and Dave also explains many of the ways GreenStone has been preparing with the future in mind, and is working one-on-one with customers to help them thrive far into the future. 100 years of Farm Credit service, 50 years of committed marriage, and 40 pages of learning...each growing, transitioning, and building on relationships for the future— what more inspiration could we need?

20 Calendar of Events This newsletter is published quarterly for the customers of GreenStone Farm Credit Services. 28 Michigan GROWN Michigan GREAT 29 Halloween Safety 29 Commodity Cuisine... Senate Bean Soup 32 Open Fields Blog Brief

Partners 3515 West Rd. East Lansing, MI 48823 517-318-2290 marketing@greenstonefcs.com Let’s Be Social

Connect with us online for news and updates. 34 Crop Insurance Calendar 35 Crop Insurance News 40 Tax Calendar 42 Tech Tip

CEO Comments:

Fall Has Arrived! IT SEEMS LIKE ONLY YESTERDAY THAT I COMPLETED MY COLUMN FOR THE SUMMER EDITION OF THIS PARTNERS PUBLICATION, AND NOW HARVEST SEASON IS ALREADY UPON US! IS THE OLD ADAGE TRUE THAT TIME REALLY DOES GO FASTER THE OLDER YOU GET? IF IT IS, I BETTER TIGHTEN MY SEATBELT! This summer and now early fall have been very busy here at GreenStone. All areas of the organization have been working hard to provide superior service for the increased demand for credit this year. At the same time, we’ve been working closely with members whose farm operations are experiencing financial stress due to below breakeven commodity prices, such as those producing corn, soybeans and wheat, as well as the protein (including dairy) segments. While much of the new loan growth is for capital purchases of land, machinery, and equipment, a significant portion is the result of revolving lines of credit increasing nearly $200 million over the same time as last year. From GreenStone’s perspective, “good” new loan growth is something we strive to achieve each year. However, the increased need for operating funds is concerning. If commodity prices were better and the overall profitability of the industry more positive, most farm operations would not need these additional funds to augment their working capital needs. Commodity Conditions To add “insult to injury,” many areas of Michigan were adversely impacted by extremely dry conditions through most of June and much of July, resulting in reduced yields for corn and likely soybeans as well. The 2016 sugar beet crop will likely be an exception with very good projected yields (tonnage wise) and sugar content at or a little below average. As many of you will recall, Michigan enjoyed record yields across almost all commodities last year which helped to minimize the impact of lower prices, but that certainly won’t be the case this year for many of these same farm operations. Fortunately, diverse geographies provide diverse results. Our northeast Wisconsin customers experienced just the opposite growing conditions than those I shared for Michigan, which will likely result in record yields for corn, beans, and forage. Plus, Wisconsin

3

Fall 2016 — Partners

dairy farmers have not been subject to the same negative price differential for their milk, as they have adequate capacity to process their current level of production.

proactive actions that has provided a little more risk bearing capacity to help those financially stressed operations remain viable until better profit margins return.

Credit Perspective

Speaking of those additional proactive steps, back in the fall of 2014 we started a comprehensive initiative to further train GreenStone’s newer financial services officers and credit analysts on how to work with businesses that encounter

It is still too early to tell exactly what the effects of back-to-back years of negative breakeven prices for nearly all major commodities will be on GreenStone’s portfolio. However, yearto-date statistics indicate the level of risk remains very manageable. As of the end of August, loan volume exhibiting significant credit weaknesses was at 2 percent of total volume. GreenStone’s 2016 business plan had projected 4 percent by year-end. Based on our current outlook, reaching this higher level is unlikely this year. However, once the 2016 crop is in the bin and members start reporting 2016 financial results in early to mid-2017, we may very likely reach or exceed the 4 percent mark.

“

While this, in fact, would be a doubling of the present credit risk, we must keep those numbers in perspective. GreenStone’s long term goal for adversely classified volume is 5 percent, which we’ve been able to operate well below for the last 5 years. In 2009 and 2010, as a result of the ‘great recession,’ the association approached 8 percent. Go back to 1987, and the ratio for all existing Farm Credit associations in Michigan was nearly 39 percent! Certainly we do not expect to reach anywhere near those numbers, but having a frame of reference to compare current conditions certainly helps to give appropriate perspective. Yet, it also doesn’t mean things couldn’t get worse as the worldwide surplus of commodities continues and the costs of production remain sticky. With all that said, we know for our members who are experiencing some financial stress, the fact that GreenStone’s overall risk bearing capacity remains strong is of little comfort. Preparation and Practicality As I have mentioned in previous articles, GreenStone has been proactive in preparing for the inevitable downturn the industry finds itself in today, by setting lending limits on farm land based on long term commodity prices in response to escalating land prices over the last decade. While this will certainly help GreenStone manage its exposure to falling real estate prices, it was also intended to help borrowers from becoming further extended on any land they might have otherwise financed with us since that time. Hopefully, this was one small step in our

s the current A economic conditions persist, it will continue to be increasingly important for producers to clearly understand not only their current financial condition, but the impact various scenarios could have on the viability of their business.

clear, consistent, and mutually understood communications about what we could do to assist AND what they need to do to help themselves. While we have all hoped for a quick economic recovery, the present forecast is discouraging with no significant change expected over the next two to possibly even three years. As the current economic conditions persist, it will continue to be increasingly important for producers to clearly understand not only their current financial condition, but the impact various scenarios could have on the viability of their business. Each must be prepared to make crucial decisions at the right times in order to prevail. While I am not a pessimist, my 35 years of experience does tell me that producers who thoroughly understand the financial condition of their operations, objectively evaluate their management capability, have several alternative plans documented to use in response to changing economic conditions, and have the ability and discipline to execute those plans in a timely manner have a high probability of long term success. Those that don’t, often end up seeking another career. While the struggles are real in the agricultural industry, I do hope you find a moment to find value in this issue of Partners. Our team continues to bring you interesting and relevant content that I believe will be of benefit to you. Best wishes for a safe and productive harvest season. Remember, if I can ever be of service, please feel free to contact me.

”

difficult financial times. As a result of this and other actions, GreenStone began working more closely with customers, focusing on those identified as being most “at risk” early in this current economic down cycle to help them understand their financial situation and to develop a plan for “weathering the storm” as well as establishing a benchmark to know when it is time to “return to shore” (exit the business).

Dave Armstrong

517-318-4105 dave.armstrong@greenstonefcs.com

Our staff have continued to closely monitor these and all operations as more start experiencing adverse financial trends to ensure

Partners — Fall 2016

4

GROW

PAM BOUMA MILLER HAS HAD HER HANDS IN THE SOIL FOR MANY YEARS. SHE HAS THE DISTINCTION OF BEING A MICHIGAN STATE UNIVERSITY (MSU) ADVANCED GARDENER AND HAS GROWN ROSES FOR MORE THAN 30 YEARS—HAVING ONE OF THE LARGEST ROSE GARDENERS IN THE GRAND RAPIDS REGION.

5

Fall 2016 — Partners

Hopping on board

By Jennifer Vincent Kiel

She’s now expanded that title from gardener to commercial farmer. She’s still growing flowers, but a much different variety that serves a totally different market. More than 25,000 vines hang on the small farm just west of Greenville that she owns with her husband, John. It’s not fruit and it’s not vegetables… it’s flowers. It’s hops. “Yes, hops are flowers,” explains Pam, who severs as head agronomist and business manager, while John takes care of logistics and the mechanical side of the operation. Being a hops farmer was not exactly the plan when they acquired a 150acre parcel in 2011. Pam and John were both widowed at relatively young ages. Being they shared a love of the ➡ Above: A cross section of a hop outdoors, both hunting and fishing, it cone. This is where the lupulin was not surprising that it was a Trout Unlimited gathering oils are found within the flower that initially brought them together. They married in and what adds the aroma and 2010 and bought the property a year later, somewhat as bittering flavors to the beer. a retirement investment. It is located just north of the largest lake in Kent County—Wabasis Lake, and has 125 Just a year after returning from out West, the Millers acres of woodlands for hunting. Almost as a bonus, it put their first acre of hops in the ground. But first there came with 20 acres of cultivated ground that was planted was a tremendous amount of planning and obstacles to in corn at the time of purchase. “We began to explore ideas of what we might do with that overcome. An investment of hops

ground,” Pam says. It was over Sunday dinner one night, she says, when discussion centered on an acquaintance who had put in a small hop yard. “I thought it was interesting. My son-in-law, Ian Mortensen, quickly said, ‘we could grow that. I had hops grown all around me.’”

One of the biggest barriers to entering hops farming, Pam says, is the up-front financial cost of infrastructure. From plant stock and irrigation equipment to the massive 22-foot wooden trellises and the special string that’s used to support vine growth in between, the costs can mount to as much as $17,000 an acre. That’s just to get started. There’s also annual input costs and labor.

Mortensen was referring to the state of Washington and Yakima Valley where about a third of all the hops grown in the U.S. are sourced. It sparked an interest, and it wasn’t long after, John, Pam and Ian were on a plane westbound. Mortensen’s old stomping grounds are lined with thousands of acres of hops. These neighboring farmers share a tight-knit community. “They were very gracious and welcoming and taught us what it takes to build a successful hop yard,” Pam says. “We gained enough knowledge to make ourselves dangerous,” she says with a snicker.

Figuring out the cost per acre was a challenge at that time, Pam says. “Michigan State University now has a really nice six-page guide, but we didn’t have it then.” The Millers planned to start with 10 aces and went to the township for approval, which came back with a plan to install an acre “to prove we were serious,” Pam recounts. “An acre of hops is considered, by state definition, to be agriculture.”

One thing was clear, it takes a labor of love, she adds. “You have to enjoy the great outdoors and be scouting for pests and disease – being within the hops themselves.”

With snow still on the ground in 2012, the trellises were lifted upright and then work started on the harvest barn, where the hops would be dried and baled before going into cold storage. “It took a lot of sweat equity,” Pam says. “We drilled every hole and hired high school kids and a local team of laborers to help us. It was a wonderful experience.”

Hops grow 120 days, which begins in May and typically ends in mid-September. The delicate flowers must be harvested and processed within eight hours. “Once they are cut down, it’s only a few hours before they turn to mush,” Pam adds.

Partners — Fall 2016

6

Growers of Michigan Association. As part of MSU’s 2015 Hop and Barley Conference in Grand Rapids, the farm hosted a tour and luncheon for 110 attendees. She’s also been asked to speak at MSU’s 2017 Hop and Barley Conference.

“

his is a teaching and sharing farm. T We’ve had almost 40 potential growers visit our farm. We invite all to come for week, day or a whole season and learn the entire process. In the beginning, John and Pam were meeting with GreenStone’s regional vice president of sales and customer relations, Ian McGonigal. “Hops were new to GreenStone at the time and not many financial institutions understood what hops was about and the potential,” Pam says. “It was very new to Michigan. We were very blessed to able to get started financially with private investments.” After up and growing, Pam says McGonigal took a tour. “That’s really when it set in, and he looked at me, and said, ‘what can we do for you?’ As we grew ourselves, GreenStone has been there for us.” GreenStone’s financial services officer for the Grand Rapids area, Mitch Schafer, has been intricately involved now for more than 18 months. “Now, my favorite saying when discussing business strategy with Mitch is to ask, ‘would you do that?’” Pam says. “Financially, we have that kind of relationship and total respect. He gets it and has even been out to help harvest for a day.”

7

Fall 2016 — Partners

”

The new business start-up, which may have been viewed as a hobby early-on, is now a full-fledged farm. “We have an open dialog about everything that is going on at the farm and changes in the industry,” Schafer says. “It’s a growing industry. We are walking with them, side by side, and her focus on being totally educated and teaching others really makes her unique. It’s a beginning business and growing operation. There are always challenges, but I strive to be a sounding board, to be involved with those decisions and helping them—to make GreenStone a trusted partner, not just a banker.” More than a private farm

After learning what they could in Washington, Pam says they came back with the mindset, “with this education we are going to pay it forward and teach others how to grow hops for themselves,” she says. “This is a teaching and sharing farm. We’ve had almost 40 potential growers visit our farm. We invite all to come for a week, a day or a whole season and learn the entire process.” Pam is a board member on the Hop

As a member of the Hop Growers of America, she was one of eight delegates representing the U.S. at the international show in Germany last November. “It was one of the greatest experiences,” she says. “International brewers are looking to purchase our varieties and are excited to try and sample beers made with Americangrown hops. We gave over 10,000 samples of hops for them to take home and brew.” Pam’s research and experiences are helping other growers build successful hop yards. “I’m shortening their research time, so they can get started sooner—I’m happy to do that,” she says. The craft brewing industry is exploding in Michigan and across the country and not enough hops is being grown to meet the need. “The market is not going away,” she says. Some might ask, why is she giving everyone her knowledge and expanding competition. She says, “It’s not a secret. It is a science, and I am willing to share what it takes to grow quality hops.” Quality rises

Hops grow best along the 45th parallel, offering the four-season climate the perennial crop needs to grow and thrive. That’s closer to the Traverse City region, but they also can do well as low as the 35th parallel and as high as the 50th. The Hopyards of Kent is close to the 43rd parallel. Pam wants the region to be known for producing top quality hops in Michigan. After submerging herself in research, Hopyards of Kent purchased a 30-some-year-old harvesting machine from Germany and developed a plan to give other producers easy access to processing. Because it takes a good three to four years to create a strong crown for the plant—producing the 1,500-pound,

pre-acre desired dry weight—the availability of nearby processing enticed the planting of hops without the financial burden of duplicating that investment. As is in Germany, a similar business model was adopted where people of small towns grow hops and bring their commodity to town to have it processed. Hopyards of Kent has a network of growers it contracts with to produce hops, but also processes and returns hops to growers that desire it. “I teach and train everything they need to know,” she says. “I have no fear of someone being bigger than me. I’ll be the first to congratulate anyone who has 2 acres to 200 acres because I know it’s a lot of hard work.” This year, Hopyards of Kent is establishing a new centrally located harvest center in Greenville with a network of 47 farms. In total, there are about 80 acres under production producing 120,000 pounds annually. The product is dried and baled and coldstored until it can be pelleted for brewer use. Properly handed, it can store up to three years. United Hops Brockerage, owned by Jim Parks, handles pelletizing cold storage and sales. He sells the product worldwide. For Hopyards of Kent, it has expanded

to include 14 acres and five varieties of hops. One variety is exclusive to Michigan, called Michigan Heritage. It was gifted to Hopyards of Kent by a Michigan centennial farm that has records of the family growing it since 1894. It has no relationship to any current bred variety in the U.S., making it what Pam likes to call a “Pure Michigan” choice. Its citrus and lemon aromas are unique, and is already contracted by multiple brewers five years out. Hopyards of Kent has an acre under production and has contracted other yards to grow it, as well. A royalty goes back to the family, but the hops are drawing a premium and establishing a “Taste of Michigan.” Schafer says, “Pam’s passionate, and she runs a very clean, tight ship. Just the knowledge she has about the industry is impressive. She wants to be successful, and wants others to be too. She loves farming and shares that passion.”

Did you know? • Michigan ranks fourth in the United States for hop production. • Commercial production of hops in Wisconsin dates back to 1837. • Hops are the flowers, usually called cones, of female hop plants, which have the Latin name Humulus lupulus. • Hop cones grow on bines, which are long stems that grow up from the plant’s crown. • Hop plants grow incredibly fast. Given the right conditions, bines can grow 4 to 10 inches a day. Source: Michigan State University Extension; Wisconsin Historical Society

Sitting in the rocking chair is not what Pam wants from her retirement. “Both John and I have gone through great losses,” she says. “But, we’re both young enough to do something purposeful in our lives—that includes helping others,” she says. “As my dear Uncle Richard, who passed away at 90 would say, ‘I would rather wear out than rust out.’” Pam affirms, “I’m not rusting.” ■

Straight Talk With Pam Bouma Miller When you were eight, what did you want to be when you grew up? “Veterinarian.” When did you first realize that you wanted to be a farmer for a living? “ Once we got the 20 acres, I knew I could grow flowers as an economic business.”

Who do you look up to; who is your mentor? “ In life – I have very strong and personal relationship with the God in my life and the faith to match. And, my parents, who taught me well about people, unconditional love and to have compassion for others who have less.”

What is the biggest challenge for young, beginning or small farmers today? “Financing.” What advice do you have for young, beginning or small farmers starting out? “ Research, research, research. Also, learn from others successes and failures.”

Partners — Fall 2016

8

Fall

MARKET OUTLOOK By Bob Utterback

Harvest is quickly ending, bin doors are shutting, and as we near the end of the year, many are starting to think about next year’s market plan. Livestock producers continue to react to the sharp slide in prices and profitability. It reminds me of the old saying, “the best cure for high prices is high prices, and the best cure for low prices is low prices.” Unfortunately, I believe it takes more time for the market to bounce off the lows prices and move higher than for the market to top and then go lower. Are we beginning or ending the bear phase of this market correction?

9

Fall 2016 — Partners

Many producers are wondering if we will ever see high grain prices like those seen in 2012 and later for hogs and cattle. The bull says yes, because we are going to have to feed more people in the world. We hear about how much world population will grow between now and 2030. Granted, world population will rise, but the opposite side of the argument is there is only demand if buyers can afford to pay for it and supply stays reasonably tight. There are rumors about increasing future yield potential. Would producers be any better off? Who will make money off feeding the world’s population—the producer or agribusiness? With the domestic and global debt continuing to rise to maintain worldwide standards of living, I am quite concerned about what happens to economic growth when monetary policy can no longer keep interest rates low. How can fiscal policy stimulate economic growth when our currency relationships are already strained? Unfortunately, this has been discussed for some time and many have become insensitive to imbalance between global debt and economic growth. Has “wolf” been cried too many times? To answer the question about when we can see higher prices again, I have outlined my response below. You tell me how fast it can happen! 1. W e have to see domestic and international acres taken out of production for all the primary grains and oilseeds. This is not done with the prospect of higher prices and increased demand. Instead, acres are taken out of production when economic stress exists. So the prospect for significant acreage reduction in 2017 in primary grain production areas is very limited, in my opinion. 2. D emand must continue to expand. I believe the possibility exists for all grains and livestock demand to improve on a gradual basis. The problem is I see no program of demand growth like ethanol has given corn and soybeans from early 2000 to present. Simply put, human demand growth programs cannot replace in the future what we have seen in the past from the energy growth program for corn and soybeans. We need continued support for ethanol and we really need a brand new demand initiative with MONEY behind it.

3. We need a period where the currency relationship of the U.S. Dollar falls in regard to that of our competitors, thereby improving exports. Note: The reason for the U.S. Dollar’s drop has to be that the global economy is growing faster than the U.S. economy, not a loss in confidence in domestic and U.S. economic conditions.

year, then I believe real financial pressure will develop the fall of 2017 and the winter of 2018.

bull has set the stage for the final act--the market’s response to a summer weather event like that of 2012. Yes, higher prices are possible; but I believe financial conditions have to get a lot worse than they are now. To my way of thinking, the earliest the bullish conditions for a price breakout are set up will be the spring of 2018, which implies 2017 prices will be range bound. If we experience another trend line year next

In summary, it’s going to take time to stimulate demand and reduce supply to levels where good profit margins come back into line. Weather, currency relationships and government policy will be the unknown events that will lengthen or shorten price cycles. I believe it is now time to be the last to sell and be right, rather than be the first to sell and be wrong! ■

My suggestions are simple: a. D ump soybeans at harvest and reown cautiously. b. Store corn, but sell the carry.

c. R eown 2016 corn below $3.20 but be 4. Producers inventory holding strategy: As realistic about expected gains. prices move up, producers must be eager d. B uy deep-out-of-the-money corn and to dump the inventory in their bins to soybean [courage] calls in September pay off debts. And most important, they 2017 or December 2017 contracts to be must be willing to sell aggressively into an orderly seller of cash inventory from spring price strength. Bottom Line: When May to July next summer. producers do not own the inventory, prices can move higher if an event e. B e prepared to aggressively reown occurs. expected 2017 corn on extreme fall lows from next September to October. When these four conditions are met, the

ABOUT THE AUTHOR

Bob Utterback is the Farm Journal Economist and President of Utterback Marketing in New Richmond, IN. Call Bob for strategy updates at 877-898-4324. Email comments on Outlook to utterback@utterbackmarketing.com.

The opinions stated herein are not necessarily those of GreenStone Farm Credit Services. This material has been prepared by a sales or trading employee or agent of Utterback Marketing Services, Inc. and is, or is in the nature of a solicitation. This material is not a research report prepared by Utterback Marketing Services, Inc. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Distribution in some jurisdictions may be prohibited or restricted by law. Persons in possession of this communication indirectly should inform themselves about and observe any such prohibition or restrictions. To the extent that you have received this communication indirectly and solicitations are prohibited in your jurisdiction without registration, the market commentary in this communication should not be considered a solicitation. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that Utterback Marketing Services, Inc. believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades

Partners — Fall 2016

10

Energy and Human Capital By Alan Hahn YOU MAY HAVE READ THE STORY EARLIER THIS YEAR WHEN ENVIRONMENTALIST, BILL MCKIBBEN, SAID IN AN INTERVIEW IN YES! MAGAZINE, “WE HAVE TO KEEP 80 PERCENT OF THE FOSSIL-FUEL RESERVES THAT WE KNOW ABOUT UNDERGROUND… (OR WE WILL) OVERWHELM THE PLANET’S PHYSICAL SYSTEMS HEATING THE EARTH FAR PAST THE RED LINES DRAWN BY SCIENTISTS AND GOVERNMENTS.”

While I appreciate Mr. McKibben’s passion for protection of the environment and preserving our planet so that future generations will have a better life, there are many reasons to believe his recommendation would actually result in the exact opposite outcome. Predictions of man’s impending demise are not new. According to past predictions, by now we should be in a global famine, out of energy, and living in an apocalyptic world…several times over. These predictions, many by well-intentioned and intelligent individuals, included a widespread famine beginning in 1975, with 35 million Americans dead of starvation by 1989, and all of the fossil fuels being consumed by the year 2000. Obviously, they were very wrong. As it relates to the recommendation to implement what is essentially a rather draconian banning of fossil fuels, we have a fairly good

11

Fall 2016 — Partners

idea of what would result just by looking into the not-so-distant past. Prior to our ability to release the energy in fossil fuels, life was very short, very dirty, and quite miserable. The Remarkable Positive Impact of Energy

The catalyst for the explosion in human life, plentiful food, and incredible advancements has been affordable, abundant energy. Not only have humans flourished, but seemingly contradictory statistics have emerged. For example, a recent report by the Food and Agricultural Organization on the State of Food Insecurity in the World documents that, despite adding nearly a couple billion people to the planet from the early 1990s to the mid-2000s, there were 216 million fewer people who were malnourished. Max Rosner (Our World in Data) shares similarly-remarkable data. In 1991, 19 percent of the world’s population was undernourished, yet in 20 years we have brought that number down to 11 percent. Equally contradictory is how much of our population is devoted to providing for this incredible growing need for nourishment. Logic might suggest we are devoting a majority of our population to feed people. But again, it’s the opposite. As countries develop using accessible, inexpensive energy, the share of their population devoted to agriculture drops. In poor countries, nearly 70 percent of the population works in agriculture; however, in developed nations, it’s closer to 5 percent of the population. In 1900, 41 percent of the U.S. workforce was devoted to farming. However, by the mid-2000s, it was down to 2 percent, while producing much more. We are feeding significantly more people, using significantly less human capital, with greater attention on environmental protection, and we are doing it far less expensively than in any other time in human history. In 1900, more than 40 percent of an American’s household budget was devoted to food. By 1950, it had dropped to 30 percent, and today it’s around 13 percent (“How America Spends Money: 100 Years in the Life of the Family Budget,” The Atlantic).

“

e are feeding significantly more W people, using significantly less human capital, with enhanced focus on retaining natural resources and improved quality, and we are doing it far less expensively than in any other time in human history.

”

Energy Abundance = Freedom + Food + Advancement2

How we have achieved such remarkable progress is a complex story of human history. The story also includes the advancements in agriculture, including Dr. Norman Borlaug’s “Green Revolution,” and advancements in seed technology. These previous pursuits into advancements in technology were likely less progressive because we didn’t have time. However, as less human capital is needed for agriculture, we are able to pursue other technologies. It is advancement building on advancement. It was just a few years ago when many experts believed, based on available data, that we were running out of fossil fuels. However, as there has been more of this invaluable human capital freed, we have found, for example, that by using horizontal drilling with hydraulicfracturing technology (“fracking”), we are able to obtain more abundant, clean, and inexpensive natural gas that has reduced carbon dioxide emissions and reduced energy costs. According to Alex Epstein, author of The Moral Case for Fossil Fuels, “…the estimated 500 trillion cubic feet of gas at Marcellus (geologic formation) is the equivalent of 90 billion barrels of oil, or 3.75 trillion gallons of oil! That’s one-third of Saudi Arabia’s current oil reserves—just in one formation.”

The reduction in energy costs that has accompanied these abundant sources of energy certainly helps those who spend a larger percent of their income on energy. As we conduct more research and gather new information, it turns out we are not running out of energy, and are not headed for an ecological disaster as some have suggested. Let’s hope we continue to wisely and carefully consider the various human need and environmental challenges that we might face in the future. Let’s also hope that we remember real solutions have consistently been found when we have enjoyed the freedom to use our minds and talents to pursue answers. ■

ABOUT THE AUTHOR

Alan Hahn is an Environmental Professional and Business Development Manager at The Dragun Corporation in Farmington Hills, Michigan.

The opinions stated herein are not necessarily those of GreenStone Farm Credit Services.

Partners — Fall 2016

12

SENATOR STABENOW ANNOUNCES THE URBAN AGRICULTURE ACT OF 2016 “Urban agriculture is steadily growing in cities and towns across Michigan and across our country, creating new economic opportunities and safer, healthier THE MOST COMPREHENSIVE URBAN AGRICULTURE BILL TO BE environments,” said INTRODUCED IN CONGRESS WILL CREATE NEW ECONOMIC Senator Stabenow. OPPORTUNITIES AND INCREASE ACCESS TO HEALTHY FOODS. “The Urban Agriculture Act will U.S. Senator Debbie Stabenow, Ranking continue this momentum by helping urban Member of the Senate Committee on farmers get started or expand their business, Agriculture, Nutrition and Forestry, so they can sell more products and supply announced the most comprehensive urban more healthy food for their neighbors.” agriculture bill to be introduced in Congress.

Highlights of the Urban Agriculture Act of 2016:

The Urban Agriculture Act of 2016 will help create new economic opportunities, giving Michigan families greater access to healthy food and creating a healthier environment in cities and towns across our state. The legislation addresses the unique needs of urban farmers by investing new resources and increasing flexibility through existing programs administered by the U.S. Department of Agriculture (USDA).

Increasing Access to Foods

i

“This initiative is an important step in supporting the evolving agriculture industry,” said Dave Armstrong, President and CEO of GreenStone. “GreenStone recognizes the growth of urban agriculture in Michigan, and is pleased to see the risk management, education, and expanded loan guarantees included in this Act that will all help our association to best serve the unique financing needs of urban farmers and their businesses.”

Creating New Economic Opportunities • Agriculture Cooperatives • Rooftops, Vertical Farms & Indoor Production • Cutting-Edge Research Providing New Financial Tools & Support • Loans • Risk Management Tools • New Urban Agriculture Office • Mentorship and Education • Community Gardens • Healthy Food Creating a Healthier Environment • Soil Remediation • Urban Composting ■

AGRICULTURE – OPEN FIELDS BLOG BRIEF GreenStone publishes regular updates on our Open Fields blog. Check out some of the posts you may have missed at www.greenstonefcs.com! • Starting the Conversation: Tips for Beginning Producers Before Talking to a Lender In farming, new producers must figure out why they want to work long hours in fields, pastures or feedlots, how they can turn that effort into a steady income, and what type of farm operation they can successfully operate from one year to the next. While passion is clearly a major prerequisite for farm life, capital is also vital for young or beginning producers and this can be a huge challenge due to a variety of reasons: steep entry barriers, substantial input costs, or depressed returns on farm commodities. Learning how to develop a business plan and building relationships is vital to ensuring success with your operation. • New Program Offers Ag Education for Agribuisness Professionals Dave Ballman, regional vice president of sales and customer relations for GreenStone, recently collaborated with industry peers to create a new program through Michigan State University Extension called Bridging the Experience Gap. For this blog, he sat down with us for a question and answer session about the new program. ■

13

Fall 2016 — Partners

CONNECT

NEWS:

95%

FARMER VETERAN COALITION TO HOLD 2016 STAKEHOLDERS CONFERENCE AT MSU The Farmer Veteran Coalition will host its 2016 Stakeholders Conference, United We Farm, Nov. 30 – Dec. 2 on the campus of Michigan State University in East Lansing. GreenStone is pleased to be a part of this exciting opportunity for veterans. The conference will bring together farmer veterans from across the country with the government, agriculture, educational and nonprofit groups that support them. Education tracks include: Livestock, Cropping, Bees and Beneficials, Business and Finance, Marketing, Employment and Training, and Continuing Education—as well as farm visits, networking and exciting guest speakers. Scholarships to attend are available for Farmer Veteran Coalition members. Additional information and registration is available at www.farmvetco.org/fvsc. ■

Customers Give GreenStone High Marks for 15 Years Straight GreenStone once again received a 95 percent satisfaction score among customers on a recently completed annual survey conducted by Michigan-based Advantage Research and Analysis. For 15 consecutive years, our members have rated the cooperative above 90 percent satisfaction, with a rating above 94 percent since 2011. “It is evident by consistently strong satisfaction results that each and every team member is working hard to deliver quality to our members,” said President and CEO Dave Armstrong. “We have been invested in the rural communities we serve for 100 years, and that strong commitment is reflected in the customer satisfaction survey results. As we look to the future, we are continually focused on how we can be the best at providing reliable, consistent and responsible credit and financial services to our members.” ■

Summer 2016 Internships Come to a Close This past summer GreenStone hosted eight interns for 14 weeks in the credit, audit, information services and legal departments. The interns worked with their mentors on a variety of real-world projects, and also had opportunities to visit farms and sharpen their presentation skills. The interns also participated in a series of blog posts chronicling their journey with GreenStone. Visit GreenStone’s Open Fields Blog at www. greenstonefcs.com to read their stories. ■

Office/Facility Updates • Allegan, Michigan - A building addition and interior remodeling of the current branch location began in August, and is expected to conclude early 2017. • Clintonville, Wisconsin – New building construction began last month, with an anticipated completion of summer 2017. ■

➡ The Conference will feature a special track on beekeeping.

Partners — Fall 2016

14

BUILD YOUR KNOWLEDGE WITH GREENSTONE: HOME CONSTRUCTION SEMINARS

“

GreenStone FCS, Thank you for your sponsorship to the Michigan FFA Masters Golf Tournament! Your support of our FFA members and our programs is greatly appreciated. The day was a great success, in large part due to the support of sponsors and volunteers like you. Over $20,000 was raised at this year’s outing to benefit Michigan FFA chapters, students, and programs. This outing has historically generated significant funding for the FFA Foundation to put towards maintaining programs and supporting chapters’ needs. — Michigan FFA Foundation

“

NOV. 1-2

• Options for financing your project For more information and to find a seminar near you, visit www.greenstonefcs.com/seminar. ■

GreenStone Promotions

”

GreenStone FCS, Thank you for being a clover pin sponsor! We appreciate your assistance in providing this opportunity for our youth!

”

Mahlich - VP of Crop Insurance Ben Mahlich has been named vice president of crop insurance for GreenStone Farm Credit Services. In this role, Mahlich will maintain a thorough understanding of the crop insurance products available in the marketplace, lead and serve as a resource for GreenStone’s crop insurance team of specialists and technicians, and stay upto-date with various policy regulation changes to best assist customers.

...Candid Comments

Have a comment to include in the next issue of Partners? Share it with us on social media.

Mahlich began his career at GreenStone as a credit analyst in 2002, and has Fall 2016 — Partners

• How to make selections that add value to your home • Working with a contractor or being your own contractor

— Cass County 4-H Leaders’ Association

15

If you are looking for room to grow, a new home in the country might be right for you! But with so many construction and home site choices, how do you know which options offer the best value? Join GreenStone at one of our upcoming free educational seminars on new home construction. Industry experts will cover a range of subjects including:

held progressive credit, lending, and management roles with the association. Most recently, Mahlich served as regional vice president of sales and customer relations, where he was responsible for leading and developing the financial services officers, crop insurance agents and financial services staff at four branches in northern Michigan. Bakker - Regional VP of Sales and Customer Relations Luke Bakker has been promoted to regional vice president of sales and customer relations for GreenStone, and will oversee the four branch locations in northern Michigan. Luke assumed this position following the recent promotion of Ben Mahlich, GreenStone’s new vice president of crop insurance. In this position, Luke will serve as the leader of financial services officers, crop insurance specialists, and tax and accounting staff throughout their region. He will not only be

responsible for the customer service from this group, but also for the guidance and development of the sales teams. In 2009, Bakker joined GreenStone as a credit analyst, and soon after, transitioned to the position of financial services officer before being promoted to vice president with GreenStone’s commercial lending unit in 2015. In this role, Bakker specialized in assisting large fruit, vegetable, cash crop, and greenhouse and nursery producers with their lending and financial services needs. ■

GREENSTONE TEAMS UP WITH TIMBER RATTLERS TO GROW A ROW For the third year, GreenStone and the Wisconsin Timber Rattlers have partnered on a vegetable garden at Neuroscience Group Field at Fox Cities Stadium. The garden produces tomatoes, potatoes, carrots, cucumbers, cantaloupes and green peppers, among the fruits and vegetables. All produce is donated to the St. Joseph Food Program to help feed hungry families in Calumet, Outagamie and Winnebago Counties. This season the garden produced a record-setting 320 pounds of food for the program. Students from Freedom High School’s FFA Chapter volunteered again this year to maintain the garden and harvest produce. ■ ➡ Freedom High School FFA Students and Timber Rattlers, Lucas Erceg and Trent Clark, harvested produce from the GreenStone garden.

GreenStone Connect Reception Visit GreenStone at the 2016 Fruit & Vegetable Expo, Dec. 6–8, 2016, at the DeVos Place in Grand Rapids, Michigan. Stop by our booth during the show and join us for an evening reception where you will hear from GreenStone leadership about the year in review, have the opportunity to ask questions, and connect with your local GreenStone team. More details will be provided online as we move closer to the event! Also keep your eye out for additional opportunities to connect with GreenStone during customer receptions at other industry events in 2017. Like the one in December, these will be your unique opportunity to hear stockholder information and stay connected with GreenStone! ■

Pause for Applause... 1. GreenStone customer Shoreline Fruit, LLC is sharing their harvest with those in need. The cooperative recently provided

40,000 pounds of frozen cherries to the West Michigan branch of Feeding America, one of the nation’s largest domestic hunger-relief organizations. Their generous donation to the local food bank will help deliver fruit to those who are struggling with hunger in Michigan.

2. GreenStone customers, Darrin

and Barbara Siemen of Harbor Beach, Michigan were selected as the state winning 2016 Michigan Milk Producers Association (MMPA) Outstanding Young Dairy Cooperators (OYDC). They will represent MMPA at various industry and association activities throughout the year. All Top 10 MMPA OYDCs will be officially recognized at MMPA’s 101st Annual Meeting to be held in March 2017. Congratulations to all!

SERVICE ANNIVERSARIES Help GreenStone congratulate and thank these staff who are celebrating an employment milestone. From five to 40, the years represent the dedication and service all employees provide our members. October: Dennis Nykamp (40) Keri Sheldon (20) Earl Zelmer (5) Emilie Reyome (5) Fran Knot (5) Julie Adams (5) Christopher Vargas (1)

November Tom Frisk (30) Phil White (30) Pam Jacobson (30) Kay Logan (20) Danielle Annala (5) Kristen Nienhuis (5)

December: Lee Rodgers (35) Yvette Hukill (15) Greg Cook (5) Michael Niesyto (5) Eric Smith (1)

Partners — Fall 2016

16

MONITORING TRENDS, PREPARING FOR THE FUTURE By Farm Credit Council THROUGHOUT 2016, GREENSTONE HAS JOINED THE NEARLY 75 OTHER FARM CREDIT ORGANIZATIONS ACROSS THE COUNTRY AND IN PUERTO RICO IN CELEBRATING 100 YEARS OF SUPPORTING RURAL COMMUNITIES AND AGRICULTURE. AT THE SAME TIME, WE’VE ALSO BEEN CONSIDERING INDUSTRY TRENDS AND ANTICIPATING THE CHANGING NEEDS OF OUR CUSTOMER-OWNERS. One significant development is the degree of land transfer expected to occur over the next few years. The USDA reports that 10 percent of all agricultural land in the U.S. will change hands before 2019. This transfer is driven in part by the aging of principal operators—according to the USDA, about a third of principal farm operators in 2014 were at least age 65. While this presents opportunities for those taking over management of the land, the current owners may be facing the challenge of finding the right people to take over the operations they’ve worked so hard to build. Many of these land transfers will be generational transitions to younger family members; in others, the new operators will also be new entries to the ag sector. The most recent Ag Census showed that nearly a quarter of all farmers and ranchers in the U.S. were beginning farmers. Beginning farmers face unique challenges as they strive to learn how to operate their farm, manage the business aspects of the operation, and obtain and manage the financing they need to succeed. At the same time, average farm size is increasing while the overall number of acres dedicated to farming is dropping, from more than 922 million acres nationally in 2007 to less than 915 million acres in 2012. Feeding a growing population using less land and managing larger farms is being made possible by improved techniques and inputs, as well as an increasing reliance on technology. GPS-guided auto steer, precision planting and soil sampling machinery are becoming 17

Fall 2016 — Partners

more and more common as technology takes to the air, with increasing use of drones to survey crops and livestock, enabling farmers and ranchers to monitor health, identifying problems and predict yields.

Farm Credit continues to follow industry trends, and we’re prepared to meet the financing needs these trends represent. As young and beginning farmers enter the industry, we’re here with not only specialized financing options for this unique group of members, but also

with education and advice built on our deep understanding of the challenges they face. As customers grow, we have the necessary capital reserves to support their more significant capital needs. As technology expands, we recognize both the need for and the benefits of these important tools. The agriculture sector continues to evolve. These changes may present some nearterm challenges, but these challenges will undoubtedly be overcome by resilience of our nation’s farmers, supported by the financial strength and industry expertise of Farm Credit. ■

Steven Eshelman, Senior Tax Accountant Adrian, Michigan What is your favorite thing about working for GreenStone? I have two favorite things. First, the people I work with. We have a great team in Adrian that works well together. We help each other out when needed and back each other up when someone is away. The second is working with the customers to develop a plan to pay the least amount of tax and keep more money for the family. It gives me great satisfaction to see these plans work. How did you first learn about Farm Credit as a potential place to work? The Career Placement Department at Adrian College received an inquiry from the Production Credit Association (PCA) of Southeastern Michigan in May of 1982 that they were looking for a tax and accounting person. Career Placement contacted me because they knew I had a farm background and just graduated with an accounting degree. I got the job and started June 1, 1982 and have been with GreenStone/Farm Credit ever since.

BEHIND THE SCENES– With the end of the year in sight, it is time to think about tax preparation. GreenStone’s tax accountants know the agriculture industry inside and out— whether they have been in the field for 30-plus years or only recently began their careers—our team knows your farm business. Before tax seasons gets into full swing, take a moment to meet two great examples of the expertise you get when working with GreenStone. Scott Martin, Tax Accountant St. Johns, Michigan What do you like best about working for GreenStone? I enjoy working with the people, both internal and external. My customers and co-workers are down to earth and are easy to work with. How did you first learn about Farm Credit as a potential place to work? When I was in college I came across an intern position with GreenStone and it sounded like a good place to work. I also knew of a couple people from my hometown who worked for GreenStone and really enjoyed it.

What changes have you seen in the tax and accounting world in your time working for GreenStone?

What changes have you seen in the tax and accounting world in your time working for GreenStone?

I have seen a lot more IRS impersonation scams even since I started almost three years ago. Each year, I take more and more calls from customers regarding fake phone calls from people pretending to be the IRS.

The biggest changes are with technology. When I started in 1982, we filled out input sheets by hand and mailed them to a tax processing center in Illinois. The finished returns were delivered to us 7 to 10 days later. Now we can input, print and e-file a return all in the same day from our office. The improvements in technology have enabled tax preparers to be much more efficient.

The tax rules and regulations are also constantly changing and make preparing the returns more and more complex. What advice do you have for someone thinking about a career in tax and accounting? I would tell them to stick with it. The accounting major and becoming certified is a lot of work and the classes can be tough, but once you get through everything and begin to practice it, it becomes a lot easier. What do you like to do outside of work? I enjoy spending time with family and friends, and watching and playing sports.

What advice do you have for someone thinking about a career in tax and accounting? Study. Gain as much knowledge as you can about the tax laws and how they can be used to your future clients’ advantage. This will help you serve your clients’ needs and make your work very satisfying. What do you like to do outside of work? I like to be outside. Whether it is home improvement projects, running, biking or just walking the dog, I enjoy the outdoors; spending time with family while doing these outdoor activities is the most fun. ■

Partners — Fall 2016

18

GreenStone Story:

Our Centennial and Beyond

19

Fall 2016 — Partners

IT HAS BEEN QUITE A YEAR FOR US AT GREENSTONE. WE MARKED 100 YEARS OF SERVICE TO RURAL COMMUNITIES AND AGRICULTURE; LAUNCHED OUR FARM FORWARD MENTORSHIP PROGRAM; HONORED FOUR MICHIGAN LEADERS IN AGRICULTURE THROUGH THE FRESH PERSPECTIVES SEARCH; RETURNED $35 MILLION IN PATRONAGE; SUPPORTED RURAL COMMUNITIES AT LOCAL FAIRS AND EVENTS; WORKED WITH THOUSANDS OF NEW AND LONGSTANDING CUSTOMERS; PROVIDED EDUCATIONAL OPPORTUNITIES ALL ACROSS MICHIGAN AND NORTHEAST WISCONSIN… AND THE YEAR ISN’T EVEN OVER!

In late September, GreenStone hosted approximately 300 legislators, customers and agricultural leaders at a centennial celebration on the Michigan State Capitol lawn. Michigan Senator Darwin Booher and State Representative Dan Lauwers each sponsored resolutions to officially recognize GreenStone for 100 years of service to rural communities and agriculture. Several GreenStone staff members were on hand for the event, networking on behalf of our members and promoting the great contributions our farmers make on the Great Lakes region. During his remarks, GreenStone President and CEO Dave Armstrong presented plaques to the Michigan Fresh Perspectives honorees, Addy Battel (Cass City), Alex Bryan (Lansing), Adam Montri (Bath) and Amanda Zaluckyj (Coloma). The four were recognized as part of a national search to identity 100 leaders who are creating the future of agriculture and rural America through their dedication and innovation. In addition to the House and Senate resolutions, several legislators also offered tributes to our local branches in recognition of 100 years of service. GreenStone would like to express our sincerest thanks to all of the legislators who attended the event, and especially to those who signed the resolutions and tributes. As an association, we are committed to being a champion for agriculture, and to educating our

decision makers on the importance of farming and rural communities so they may work in the best interest of the industry and those who make it their livelihood. The centennial celebration at the Capitol was a fantastic afternoon of networking, and we are certain our legislators walked away with a better understanding of Farm Credit and the importance of protecting the support we provide you, our members. As your trusted financial partner, we also thank you today and always, for your business and loyalty. While you are hard at work in the fields or office, we are here working alongside you to help keep your operation successful. None of the work we have done this year to support our industry would have been possible without the loyalty and dedication of our members like you. This past June, U.S. Secretary of Agriculture Tom Vilsack spoke at a Farm Credit centennial anniversary event in Washington, D.C. He said, “The rural communities and the farm community trust Farm Credit to be there in good times, but more importantly, in the tough times. Over the course of the last 100 years, that trust has been cemented.” We believe, and we hope you do too, that Secretary Vilsack’s words ring true. As a customer, we value your trust; it is what drives our mission to be the best at providing credit

and financial services to rural communities and agriculture. It is what pushes us to continue evolving, to meet your changing needs in both the good years and in the challenging years. It is also what drives our Customer Bill of Rights, which ensures that all customers receive personalized service; immediate responses to all requests; honest, fair and impartial treatment; confidential treatment of all information; and accurate information and advice. This is our promise to you. As we start our 101st year, we will continue to support you and strive to deliver the high quality financial products and services you expect. We continue to adapt, providing you with the best solutions for your unique operation. We want to ensure that everyone, lender and borrower alike, are able to make decisions together in the best interest of you, our member. We are your partner, as the name of this publication implies, and we are here to support you as a steady source of funding— today and for the next 100 years. ■

Visit our Facebook page to see photos from the Centennial Celebration held in Lansing, Michigan on Sept. 21. www.facebook.com/GreenStoneFCS

Mark Your Calendar... OCTOBER

13

Michigan Great Lakes International Draft Horse Show (13 - 16) Michigan State University Pavilion, East Lansing, MI

NOVEMBER

1 2

GreenStone Construction Seminar Builders and Remodelers Association of Greater Ann Arbor, Ann Arbor, MI GreenStone Construction Seminar VFW post 8303, Lowell, MI hite Horse Inn, W Metamora, MI

DECEMBER

12 24 29

Michigan State University AutumnFest Michigan State University Pavilion, East Lansing, MI GreenStone Offices Closed (24 - 25) In honor of Thanksgiving Michigan Farm Bureau Annual Meeting (29 - Dec.1) Amway Grand Plaza Hotel & DeVos Place, Grand Rapids, MI

Wisconsin Farm Bureau Annual Meeting and Young Farmer and Agriculturist Conference (2 - 5) Kalahari Resorts and Conference Center, Wisconsin Dells, WI

2

Great Lakes Fruit, Vegetable and Farm Market Expo/Michigan Greenhouse Growers Expo (6 - 8) DeVos Place Conference Center, Grand Rapids, MI

6

GreenStone Offices

23 Closed (23 - 26)

In honor of the Holiday

JANUARY

2

GreenStone Offices Closed In Honor of the New Year

6

Michigan Sheep Breeders Association Shepherd’s Weekend (6 - 8) Lansing, MI Dairy Strong

18 Conference (18 - 19) Monona Terrace, Madison, WI Great Lakes Crop

25 Summit (25 - 26)

Soaring Eagle Resort, Mt. Pleasant, MI

Partners — Fall 2016

20

Legislative Matters:

ELECTION IMPACT AND A TIME TO REMAIN ENGAGED THERE ARE VERY FEW THINGS PEOPLE AGREE ON 100 PERCENT OF THE TIME, BUT THAT HAS NEVER DISSUADED LEADERS TO MAKE THE EFFORT TO MOVE ISSUES FORWARD FOR THE GOOD OF COMMON INTERESTS. Sometimes, courage is the necessary tool to take action and bring people together. Agricultural leaders and Farm Credit members have demonstrated that leadership with much of their activity and engagement over the decades. Action has always

21

Fall 2016 — Partners

been the agriculture way, and acting together has kept agriculture strong. As we move forward, we know we need to stay together for the good of common interests. This may also actually serve as an example for others. Identifying common interests is itself a huge challenge during difficult economic times. Acting in a manner that engages others in those identifiable interests will advance the good for all. It starts with elections. Electing trustworthy public servants is a civic task we all share. Voting is our first action for moving issues forward. Keeping that momentum is always more fruitful with the best leadership from within each level of government. As election results occur, staying engaged and working together on identified common interests with legislative leaders, regardless of the election outcomes, will remain critical. What are those issues of common interest for the next term of Congress and State Government? Water, immigration, infrastructure, crop

insurance, and food production remain on the top of the pile. With those, there continue to be new issues arising. For example, GreenStone recognizes the growth of urban agriculture in Michigan as a business, and the opportunity to connect and educate consumers on the innovative and diverse practices of agriculture. How we respond together and demonstrate leadership and engagement on this issue will be essential. Having recently commemorated the Farm Credit centennial, GreenStone’s mission remains focused on being a leader in supporting the success of our customers and rural communities. Working with all aspects of agriculture and the leaders that are elected to serve, remains an important part of our mission fulfillment. Supporting all of agriculture in its many forms will be a measure of success to advance our common interests. Stay tuned, and stay engaged. ■

“

“

PAC PROGRESS

Strong foundations continue to be built, keeping the voice of agriculture ringing in the halls of the Federal and State legislatures.

GreenStone continues to reach out to legislators to build a positive conversation surrounding rural communities and agriculture. The focus is on the importance of ensuring that the future of agriculture and the Farm Credit System is bright. Without these opportunities, the economic engine of agriculture slows and has rippling effects beyond rural communities. This significant impact is recognized beyond GreenStone, resulting in both urban and rural legislators engaging to understand the issues of agriculture. In Michigan, 20 meetings have taken place with state Senators and Representatives in Lansing and out in their districts. The majority of the meetings have focused on connecting GreenStone members and employees to the elected officials, allowing for the organic demonstration of the depth of expertise by both the Farm Credit members and our staff. In addition, time continues to be spent discussing the risk mitigation factors used by agriculturalists during these challenging weather years.

The Farm Credit PAC continues to support federal elected legislators both in Michigan and Wisconsin. Forty meetings have been held this year with Senators and Representatives, both in our states and in Washington, D.C. These discussions continue to center around rural broadband and its impact on the success of rural communities. Other on-going issues discussed included: DoddFrank consumer compliance, crop insurance, immigration, and the Farm Bill. Elected officials in Michigan and Wisconsin continue to express deep appreciation for the relationships

built to provide trusted resources in the constantly evolving political landscape, and for the financial support. None of this can successfully be done without active engagement; thank you for helping build the voice of rural communities and agriculture. Other Highlights: On Sept. 21, 2016 a centennial celebration was held at Michigan’s capitol, where MI GreenStone PAC contributors were invited to meet legislators and commemorate 100 years of Farm Credit’s service to rural communities and agriculture. ■

“

lected officials in Michigan E and Wisconsin continue to express deep appreciation for the relationships built to provide trusted resources in the constantly evolving political landscape, and for the financial support.

”

Partners — Fall 2016

22

Directors’ Perspective:

Terri Hawbaker

GETTING STARTED AS PART OF GREENSTONE’S 100TH ANNIVERSARY, WE HAVE ASKED EACH OF YOUR BOARD DIRECTORS TO SHARE A BIT OF THEIR PERSONAL HISTORY WITH FARM CREDIT.

This issue, we hear from the final five directors as they share how they started with Farm Credit, why they continue to choose GreenStone as their financial partner, and even some of their favorite memories working with the association.

Tom Durand

I started working with the folks at GreenStone nearly 30 years ago, and have been fortunate to have had the same loan officer the entire time. During this time, I have found that my business relationship at GreenStone has been a big part of my success in growing my farm business. The advice I have received, along with the financial products they offer have proven to be very valuable over the years. On top of all of that, the support staff in our local office have also always been very friendly, professional and helpful. I would recommend to anyone to check out the farm and country living services and loan products GreenStone has to offer. It has been a very rewarding experience for me!

23

Fall 2016 — Partners

My husband and I first became members of GreenStone in 2002. As a young couple in our early twenties, we utilized a Farm Cash Management account to help start our seasonal grass-based dairy in Clinton County. My parents were members for 43 years. Farm Credit has played an integral part in the development and growth of our operations. Watching GreenStone grow, develop, and evolve over the past 14 years has been intriguing. What once was an organization supporting basic and standard farming enterprises, is now one of great diversification, with customers ranging from large single species farms to smaller operations who have tapped into the niche market with specialized crops and products sold locally. In my opinion, GreenStone has successfully recognized the shift with the agricultural industry and has embraced the change, finding a way to support and serve all types of farms and farmers. I have had the tremendous opportunity to serve on the board since June of 2015. Just this past fall, I had the opportunity to meet the Secretary of Agriculture of Uganda. As a female in a leadership role within the dairy industry, I was particularly impressed with her accomplishments and encouraged about my own opportunity to make a difference and serve. I also attended the director leadership conference, which offered valuable information on the history and making of the Farm Credit System, as well as up to date ideas for how to better serve our current membership. As GreenStone continues to enhance their young, beginning, and small farm sector, I would encourage entrepreneurs to start with GreenStone, where you will not only find a source of lending, but also a support system for your business. I look forward to being a member of GreenStone for many years to come.

Andy Snider

Ron Lucas

Farm Credit helped my dad 45 years ago to purchase the first cab tractor for our farm. I recall him being just as pleased with the services then as we are now! Years later, in 1998, it became evident that we had another generation interested in the dairy farm. In order for our sons to join the farm, we needed to expand. We were milking just 35 cows in a tie stall barn. GreenStone was our answer—offering stable, efficient, competitive loan opportunities. In 2001, we moved 100 cows into the completely new milking facility and free stall barn. Two expansions later, our now 270 cows are milked in a double 10 parallel parlor, and are housed in a barn three times as big. At the same time, farm land grew from 129 to 850 acres. This all is the result of the assistance from GreenStone. I strongly recommend GreenStone for anyone’s lending needs. Their knowledgeable staff work with each customer to develop your plans for today and the future. Today’s lending practices have changed, and GreenStone knows how to provide avenues for success. 100 years of Farm Credit is spectacular! Peter Maxwell

The 100 year milestone of the Farm Credit System is an important and distinguished honor. What a landmark year, a true testament to the fortitude of the American farmer and rancher. If it weren’t for access to financing, my family’s operation wouldn’t be where it is today: Farm Credit made my grandfather’s dream to become a farmer from a pipefitter a reality. He and his three sons were able to grow the operation by taking calculated measures with the help of the Farm Credit System by their side. While I wasn’t able to meet my grandfather, his passion for agriculture carries on with me, and my family today. GreenStone is a key player in operations like mine, as we strive to carry our legacies into the future. It is a unique organization and a strong partner because, as a farmer, I know they understand what we do and why we do it. They also understand the markets and the financial systems, standing by the agriculture industry’s side through both challenging and prosperous times. I hope to inspire the same passion in my children that my family has instilled in me. Whether it is my son’s first autonomous tractor or a young family trying to start a small farm (like Grandpa), GreenStone will carry us through the next 100 years.

I secured my first Farm Credit loan when I was 18 years old, as a senior in high school. Of course, my father had to co-sign, but I was buying my own two registered Holsteins to add to the family’s dairy herd. My father also did some loan business at Farm Credit, and being this was a farm purchase, Farm Credit (Production Credit Association (PCA) at that time) seemed like the logical choice. So I actually became a GreenStone member 35 years ago already! Similarly, my son took out a GreenStone loan to buy his first farm and house when he was in college a few years ago. Like it worked for me, I also co-signed and it went very smooth. As a family, we now have three generations of GreenStone customers. One of the main reasons I chose to do business with GreenStone, and it is still the same reason I appreciate this relationship yet today, is that they understand farming - the ups and downs, and the issues that come along over the course of time. We have had good and bad years, times of plenty and times of lean, and they have always been willing to work through these things. Up until a year and a half ago, I had the same loan officer for most of my entire career. It was a great relationship and I considered him a financial mentor. He was very conservative in the early years, which looking back, probably didn’t hurt me any (it actually probably kept me out of trouble), but one of my favorite memories was the day he confessed that he may have been a little too conservative over the years... I wonder if that was around the same time as they started paying incentives for new business. We were considered traditional farm customers for my entire career, until this year when we were transitioned to the commercial lending unit at GreenStone. My wife and I also just received our first country living loan for our new home, so we have experienced a broad spectrum of the association as a customer. Based on my perspective from each experience, I would highly recommend GreenStone to anyone wishing to work with a lender who has good balance between the needs of the association and the customer. ■

Partners — Fall 2016

24

LIVE

Game On! For more than 15 years, Ed Goings and his family have dreamed of owning a deer ranch. The Goings, who live near Chicago, actually started the process of making their dream a reality about four years ago with the purchase of 120 wooded acres with a cabin. The property is situated between Newaygo and White Cloud, and borders a national forest. After the first purchase, Ed scooped up the opportunity to purchase two adjacent lots of 160 acres and 40 acres, respectively.

25

Fall 2016 — Partners

family have made since buying the first 120 acres,” he said. “Ed continues to make improvements, and it is exciting to see his dream come to life.”

A Louisiana native, Ed went into the Air Force and fell in love with a girl from Ohio, Carla, who would later become his wife. His job in the Air Force covered territory throughout Illinois, Ohio and Michigan, and after he left the Air Force, Chicago became their home. Carla’s father lived in Midland, Michigan, and he and Ed often went on hunting trips together. “I’m a big deer hunter,” said Ed. “I grew up hunting down in Louisiana, and I’ve hunted all over the United States. Around 1992, I went hunting on some state land near Midland with my father-in-law, and I just fell in love with Michigan.” Ed started working with a wildlife realtor in Michigan to find the perfect parcel of hunting land. He recalls looking at nearly 12 different properties, and the moment he saw the 120 acres, he knew that it was the perfect place for his deer farm. “I was drawn to how natural it was. Several other lots I looked at had been cleared in spots, but this land had probably not been touched since at least the 1940s,” he said. “There are pine trees that have to be at least 150 years old. It’s just a gorgeous piece of land. When I saw it, I thought, ‘this is where I want my grandkids to remember visiting when they grow up.’ I want them to have memories of visiting their grandpa here.” Once he found this perfect plot of land, Ed worked with a bank to obtain

financing. He was disappointed to learn the bank did not want to factor in the value of the vacant land itself, they only considered the structure on the property. Ed didn’t concur with this assessment, which took him back to his wildlife realtor for a recommendation on an agricultural lender. “He gave me a business card for Mark Oberlin, a financial services officer with GreenStone,” said Ed. “I reached out to Mark and when we talked, I could tell that he understood the true value of the land, he saw what we could produce on it.” Ed put together a business plan for the land and shared it with Mark, who read through it and offered some advice. “That’s more than what a regular mortgage guy would do for you,” said Ed. “Mark has been out to my property, he knows what I have. I just like that when working with GreenStone, there is none of the big banking hoopla. I was able to sit down with Mark and get to know him.”

GreenStone also helped Ed with a loan for a tractor to make work on the property go a little easier. “It has been nothing but a pleasant experience working with Mark,” said Ed. “He has been there for every closing, and when we needed the tractor, he sent over the paperwork, and we had it within a week.” Ed grew up on a farm in Louisiana where his family grew soybeans, cotton and milo. “I was on a tractor from the time I was seven years old until I left for college,” he said. On the farm, he learned a lot about managing soil nutrients, a skill that has come in handy

“

I just like that when working with GreenStone, there is none of the big banking hoopla. I was able to sit down with Mark and get to know him.

Mark has enjoyed working with the Goings over the years. “It has been great to see the progress Ed and his

”

Partners — Fall 2016

26