Human Capital Management

Q3 2024 Report

Q3 2024 Report

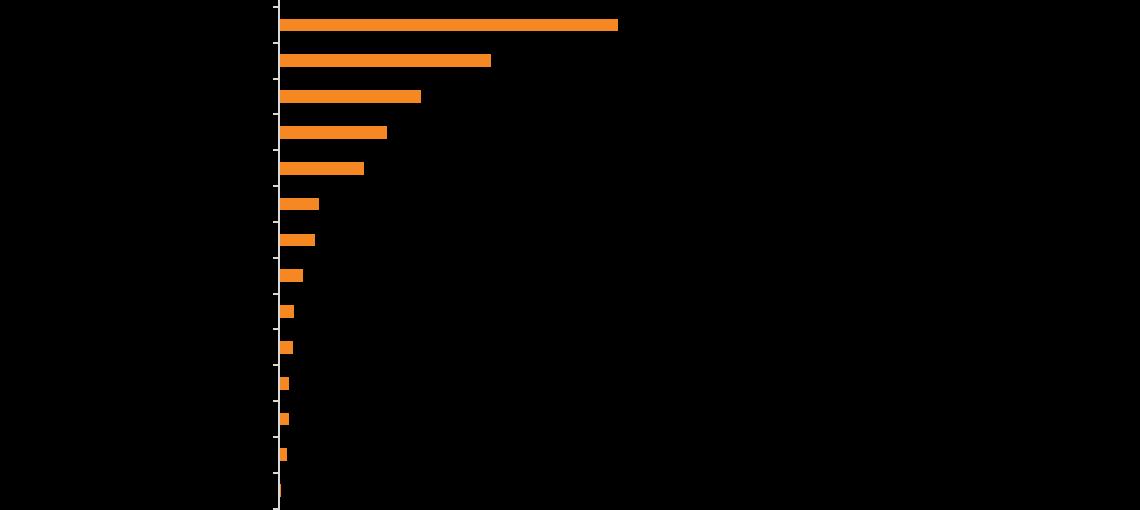

There were 106 HCM transactions in the third quarter of 2024, and although each sector slightly decreased its M&A activity from Q2 2024, acquisition activity increased by 14% from Q3 2023 and quarterly transaction counts are consistent with pre-2023 levels. The Staffing sector witnessed the highest levels of M&A activity of the sectors tracked as the market focused on fulfilling the demand for specialized IT and healthcare talent In September, the Federal Reserve reduced interest rates by 50 basis points We anticipate M&A activity to accelerate as acquirers seek to ramp up inorganic growth strategies amidst a more favorable interest rate environment

Although the total VC dollars raised increased 13% from Q2 2024, funding in the HCM space over the past six quarters has stabilized below 2021 levels (around $1B per quarter) and average deal sizes have decreased ( Page 11) There was increased investor caution surrounding early-stage technology companies as ongoing market uncertainty stifled funding round sizes However, established companies attracted large check sizes in Q3, as four VC rounds raised over $100M (Page 12), and four unicorns raised new rounds at increased pre-money valuations (Page 13). As inflationary concerns subside, investors are likely to fund companies with strong fundamentals and the potential for sustainable long-term growth

A still-improving macro environment, the upcoming election, and ongoing geopolitical tensions kept staffing demand cool. Larger firms continued to focus on internal initiatives (cost control, technology) – but did selectively pursue deals where there was a clear strategic advantage to be gained. There is optimism around increased transaction activity in 2025 given rate cuts and a growing backlog of expected private equity exits. Q3 2024 compared to Q3 2023 $1.2B

Staffing:

• Vistria, a middle market private equity firm, acquired Soliant, a staffing firm focused on the healthcare and education industries from Olympus Partners

Staffing Technology:

• Bullhorn, a staffing software platform for recruiting agencies, acquired KonaSearch, a Salesforce-based advanced search and match solution for staffing and executive search firms

Executive Search:

• ZRG, a portfolio company of RFE, acquired Bravanti, a leadership coaching firm, and Linked4HR Solutions’ Executive Interim & HR Advisory Services in the Middle East and Africa region

In the Talent Management sector, M&A activity decreased by 40% compared to Q2 2024. Transaction activity was concentrated in wellness and leadership development tools, driven by a demand to improve employee retention through focusing on well-being and enhancing the employee experience via effective leadership.

Wellness:

• Pinnacle Health Group, a provider of employee health checks and wellness workshops, was acquired by Medibank Private to broaden its service offerings and increase operational expertise

• Digital well-being platform Raiys acquired employee wellness training platform Ashia to grow the digital side of its proactive well-being services

Leadership Development:

• Operations consulting provider DSS Sustainable Solutions acquired leadership development and cultural transformation firm ETSCAF to deepen their expertise in operational risk management and strengthen their leadership development and cultural change capabilities

• Ask-Teach, an executive coaching and sales performance training solution, was acquired by HCG Capital to expand its international footprint

In Core HR, transaction activity was driven by acquisitions of compensation management, benefits administration, and payroll companies. Consolidation in this space reflects employee demand for readily accessible payroll, transparent pay equity, and competitive compensation packages.

Compensation & Benefits:

• Pluxee, a global employee benefits provider, acquired Cobee, which offers compensation and employee expense management via a mobile app, to enhance their technology capabilities

• Risk management consulting firm Arthur J. Gallagher acquired pay equity analysis firm Zayla Partners to enhance its compensation consulting solution

Payroll:

• PEO Vensure Employer Solutions made its 12th acquisition of the year through its payroll subsidiary Execupay acquiring Professional Payroll, Charleston Payroll, and Payrolls Unlimited to expand its HR software portfolio

• Fintech lending platform MoneyView attained unicorn status through acquiring payroll and earned wage access platform Jify

Talent acquisition had the highest public company performance of the HCM sectors tracked (Page 2). M&A activity was concentrated in recruiting and pre-employment screening platforms focused on the frontline workforce. Page 7 covers additional trends within the frontline workforce.

Sourcing:

• Online recruitment platform Monster Worldwide merged with job board CareerBuilder to consolidate market share and compete with Indeed

• HourWork, a recruiting platform for hourly frontline workers, was acquired by Sprockets to service the full employee journey and recruit past applicants and former employees.

• Breakroom, a UK-based frontline employment marketplace that aggregates pay and culture data, was acquired by ZipRecruiter (ZIP) to launch in the USA Pre-Employment Screening:

• Frasco Profiles, an employment verification and background checks platform, was acquired by AccuSourceHR to provide customizable screening programs

Source: PitchBook, Data as of October 1, 2024

Driven by modest revenue growth and 45%+ increases in EV from two >$160B companies: Oracle and SAP

Driven by >15% increases in EV from the two largest companies in the index: Recruit Holdings (+100% EV) and Seek (+18% EV)

The S&P 500 outperformed all four HCM indexes during this period. The Talent Acquisition index emerged as the topperforming HCM index, with the largest stock (Recruit Holdings, parent company of Indeed) increasing its EV by +100%. The Staffing index decreased by 2%, driven by AMN Healthcare (-35% EV) and Adecco Group (-12% EV).

$188M SEP 2024

$8.4B

• Cobee is a financial software that manages employee compensation plans and provides a digital interface that generates insights on employee expenses and savings

• This transaction is the first milestone in deployment of Pluxee’s international M&A strategy, broadening their existing benefits offering and enhancing its technology capabilities at global scale.

• Smartsheet is a collaborative work management software that supports workflow management across teams, provides real-time visibility into projects, and offers reporting and automation capabilities.

• The acquisition will drive long-term growth by leveraging Blackstone and Vista’s combined resources to accelerate investment in the next generation of work management solutions.

$2.5B AUG 2024

UNDISCLOSED JUL 2024

$1.2B

JUL 2024

UNDISCLOSED SEP 2024

UNDISCLOSED SEP 2024

UNDISCLOSED AUG 2024

UNDISCLOSED JUL 2024

• QGenda is a workforce management software for healthcare organizations that offers scheduling, clinical capacity management, and labor analytics.

• Hearst acquired QGenda from investment firms Francisco Partners and ICONIQ Growth and will improve the efficiency of QGenda’s clinical team solutions

• Octime is a time management software that provides absence management, badging, payroll metrics, and schedule management capabilities.

• The acquisition will support Octime in continuing to build its time management market position through acquiring new clients and expanding throughout Europe.

• Strada is the payroll and human capital services division of Alight (NYS: ALIT). Strada provides international global payroll and HR administration capabilities.

• Following the transaction, Alight and Strada will establish a commercial partnership to bolster their collective competitiveness, combining their service capabilities to offer a compelling value proposition.

• SGF Global, a provider of comprehensive staffing and human capital solutions across more than 35 countries acquired Adecco Uruguay, a provider of talent solutions and advisory services.

• This acquisition reinforces SGF Global’s commitment to serving and near-shoring the Latin American region

• LLR-backed True Search, the sixth-largest executive search firm in the US, acquired Paradigm Search, a San Francisco-based executive search firm specializing in placing engineering and product executives.

• This is the 5th acquisition in True’s roll-up strategy since December 2021 – Paradigm will help enhance True’s product, data, and technology practice.

• Avionte, a provider of a comprehensive end-to-end, cloud-based technology staffing solution designed for scalability and growth, acquired AkkenCloud, a staffing software company.

• This acquisition will enable Avionte to keep pace with the latest trends in AI, security, platform automation, and mobile capabilities – and underscores the consolidation among smaller staffing software providers who are finding it increasingly difficult to make the investments required to remain competitive.

• Alvarez & Marsal, a management consulting firm specializing in providing business performance improvement, turnaround management, and advisory services, acquired Wilkinson Partners, a Londonbased provider of executive search solutions.

• With this acquisition, Alvarez & Marsal launches its executive search practice, A&M STAR, which will deliver executive search services to professional services firms, private equity funds, their portfolio companies, financial institutions and corporates.

noun

A worker who deals directly with customers, clients, or other users of an organization’s services. They are often “deskless” and do not work in office settings. Frontline workers represent a critical and expansive population of the workforce and they are present across industries with shared characteristics that lead to challenges with retention and replacement. There is an increased need for HR Technology tools to address frontline workers’ productivity and turnover.

of companies rely on frontline workers to operate5

of the global workforce consists of frontline workers, receiving only 1% of software spend6

of frontline workers have no digital tools to assist them5

of frontline workers are ready to quit their jobs in search of a better experience5

Cost to Replace

Physically and Mentally Demanding

Dispersed and Remote Certification Requirements

Limited Access to a Computer

Career Instability and Lack of Advancement

• Beekeeper is a mobile communication platform for enterprises with non-desktop employees. They offer onboarding, training, shift management, surveys, and talent analytics for the frontline workforce.

• The company raised $140M to date and acquired Lua, a performance management and communications software that delivers workflow instructions to employees in their native language, for $21M (March 2021).

• Fountain enables companies to efficiently screen and hire frontline employees through hiring automation software that simplifies the recruiting and onboarding process.

• The company raised $217M to date and acquired Clevy, a worker chatbot tool that answers employee questions and provides access to internal company information (June 2023).

• Workstep is a hiring and retention software that provides analytics and transparency across the employee lifecycle to source, screen, onboard, train, and retain critical, non-exempt frontline talent.

• The company raised $53M to date to increase product functionality and combat the frontline workforce talent shortage through innovative hiring and retention tools. Adoption of Mobile-First Technology Flexible Scheduling Comprehensive Safety Protocols Focus on Wellness and Benefits Utilizing Workforce Analytics Surge in Upskilling and Training

Sep-24

$140M SEP

$120M AUG

$100M

Workforce Management

As interest rates have risen, the number of large VC funding rounds has fallen below 2021 and H1 2022 levels. Recent interest rate cuts are expected to enhance capital flows, support startup growth, and improve exit conditions.

There were no newly minted HR Tech unicorns this quarter

$140M SEP 2024

RECEIVED INVESTMENT FROM $100M JUL 2024 RECEIVED INVESTMENT FROM

$59M SEP 2024

RECEIVED INVESTMENT FROM UNDISCLOSED JUL 2024 RECEIVED CAPITAL FROM

Sep-24

Sep-24

Sep-24

Aug-24

Aug-24

Aug-24

Operating at the intersection of investment banking and management consulting, we partner with inspiring companies and private equity firms to help them design and execute their strategies for growth or exit. With decades of successful client outcomes, we help growing teams improve their opportunities for success. We provide Sell-side advisory, Buy-side advisory and Strategic Consulting to innovative companies and financial sponsors.

The material in this report is for information purposes only and is not intended to be relied upon as financial, accounting, tax, legal or other professional advice. This report does not constitute and should not be construed as soliciting or offering any investment or other transaction, identifying securities for you to purchase or offer to purchase, or recommending the acquisition or disposition of any investment. Harbor View Advisors does not guarantee the accuracy or reliability of any data provided from third party resources. Although we endeavor to provide accurate information from third party sources, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.