Asia Food Journal

Television Asia Plus

For advertising opportunities, please contact:

Simon Lee

Sales Director, HK & International (+852) 9437 2779

sales@harvest-info com

Chua Chew Huat

Sales Director, Asia Pacific (+65) 9863 7382 sales-sg@harvest-info com The publisher of Payload Asia

Harvest Information Pte Ltd 531 Upper Cross Street, #04-16 Singapore 050531

Office Address:

From the Editor

Innovation in Every Bite: Exploring the New Era of Healthy and Indulgent Snacks

Snacking is a daily ritual for many, serving as a way to satiate hunger between meals and as a source of pleasure. Yet, the choices we make at these times can have a significant impact on our overall health. Opting for a handful of almonds instead of reaching for a bag of chips can boost energy levels without the guilt that often accompanies less healthy choices.

Conversely, a piece of fine chocolate can lift spirits and satisfy cravings without derailing a healthy diet.

Balancing health and indulgence in our snacking habits is not just about maintaining weight or preventing chronic diseases but about enhancing overall well-being and ensuring our dietary habits contribute to a happier, more satisfying life. This balance helps manage cravings wisely, supports an active lifestyle, and keeps us connected in social settings, all while boosting mood and mental health.

We kick off with our cover story on Mondelēz, a trailblazer in the snack food industry, and its strategic pivots towards healthier options that do not compromise on taste. It offers an exclusive look at how this global giant is reshaping its portfolio to meet the evolving consumer demands.

Chocolate remains a perennial favorite in the realm of snacks, and no one knows this better than Cargill. Our feature explores how traditional chocolate-making is being transformed by innovative approaches that cater to health-conscious consumers without skimping on the sensory experience.

We also examine the dynamic changes in the European snack market as the European Snacks Association uncovered the strategic decisions driving the sector forward amid fluctuating market trends and consumer preferences.

Turning our attention to the international stage, we highlight the rising popularity of American cheeses. This piece from the U.S. Dairy Export Council highlights the craftsmanship and quality that have enabled these cheeses to captivate food enthusiasts worldwide.

Asia’s own food and beverage sector is not left behind, with burgeoning trends shaping its future. Kerry’s report identifies and analyzes the movements set to influence market dynamics in the coming year.

Lastly, our exploration into the burgeoning field of plant-based beverages offers a glimpse into how BENEO’s novel ingredients are setting new standards for nutritional value and taste in the industry.

Join us in savoring the flavors of innovation and strategy that are currently defining the global snack sector.

Snacking without the guilt,

Cath Isabedra Editor

Cath Isabedra Editor

EDITORIAL/PUBLISHER

Keen Whye Lee Publisher

Cath Isabedra Editor editor-afj@harvest-info.com

Danico Acosta Layout and Design

OPERATIONS

Mari Vergara Head of Operations mari@asiantvawards.com

SALES

Simon Lee Hong Kong, U.S.A. sales@harvest-info.com

Chua Chew Huat Asia Pacific sales-sg@harvest-info.com

Erhardt Eisenacher Europe info@eisanacher-medien.de

MARKETING

Lali Singson mktg@harvest-info.com

TECHNICAL SUPPORT

Michael Magsalin tech@harvest-info.com

Harvest Information Pte. Ltd. 531 Upper Cross Street,#04-16, Singapore 050531

AsiaFoodJournal

AsiaFoodJourna1

asia-food-journal-magazine

May-June 2024 3 AsiaFoodJournal www.asiafoodjournal.com

May-June 2024 4 www.asiafoodjournal.com AsiaFoodJournal CONTENTS INGREDIENTS NEWS SPOTLIGHT COVER STORY FEATURE STORY PACKAGING NEWS PROCESSING NEWS 07 28 22 32 Beyond Borders: The Flourishing Journey of USA Cheeses Conquering Global Palates Mondelēz Unwraps the Future: A Bold Leap Towards Revolutionizing Global Healthy Snacking Cargill’s Strategic Innovations in Indulgence and Health 10 11

May-June 2024 5 AsiaFoodJournal www.asiafoodjournal.com INDUSTRY NEWS FEATURE STORY FEATURE STORY SPECIAL FEATURE EVENT CALENDAR AUTOMATION NEWS 14 44 38 35 48 3 Key F&B Trends Driving Asia’s Food & Beverage Industry in 2024 Levelling Up Your Plant-Based Drinks with Faba Bean and Barley Beta-Glucans Crunch Time: How Europe’s Snack Sector Is Navigating Change and Seizing Strategic Opportunities 16

Ingredients |NEWS

Water-soluble Zynamite® S creates fresh innovation opportunities for functional beverages

Nektium has developed a new watersoluble formulation of its award-winning nootropic Zynamite® for cognitive and sports nutrition drinks.

Used to support mental and physical energy, Zynamite® is a Mangifera indica extract created from sustainably harvested mango leaves. The natural caffeine alternative has been the subject of 10 clinical studies and multiple industry awards since its launch in 2018, earning global recognition for its fast-acting, experiential benefits.

Nektium’s scientists have now created Zynamite® S to meet the growing demand for innovative energy, sports, and hydration drinks. It is designed for use in applications such as RTDs and shots where solubility, heat stability, and transparency in solution are key.

Zynamite® S also has a neutral taste and is formulated to enable improved absorption of its bioactive component, mangiferin, which allows for reduced dosages.

Nektium Commercial & Partnership Director Bruno Berheide said: “Excessive caffeine intake is becoming a hot topic, and there is high demand for alternatives that deliver instant power and energy that consumers can really feel. Zynamite® stands out as a nonstim energy alternative, naturally enhancing mental and physical energy in a smarter way – and without the side effects of caffeine. Our new Zynamite® S allows manufacturers the opportunity to formulate innovative beverages that can help consumers ‘get in the zone’ and perform at their best without suffering jitters and anxiety.”

March-April 2024 7 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Ingredients

Hybrid drinks

Zynamite® S can be used alone or in combination with caffeine to provide mental energy and focus, as well as support physical energy, improved performance, and recovery.

It is, therefore, ideally positioned to tap into the trend for hybrid beverages that blur the lines between energy and sports drinks. Innova Market Insights research shows that of the 56% of consumers worldwide who regularly use hydration products in conjunction with their exercise routines, more than a third use energy drinks.

Bruno Berheide added: “In today’s dynamic functional beverage market, many brands are innovating with hybrid products that offer both mental and physical energy. Zynamite® S is the perfect option for these products as it delivers clinically backed benefits for mental energy and sports performance within just one hour.”

Clinical benefits

Zynamite® is supported by a portfolio of safety data, and its efficacy has been demonstrated in clinical studies in recognized journals.

Research has shown that, within one

hour, a single dose of Zynamite® enhances mental energy and improves performance under fatigued conditions. In addition, it does not increase heart rate or blood pressure, avoiding the side effects associated with caffeine.

In 2020, Nutrients published a clinical study examining its impact on cognitive performance in adults. It provided evidence that a single dose of Zynamite® significantly improved cognitive function and performance across a battery of cognitive tasks, including improved focus, improved memory, and reduced mental fatigue.

An independent study in Nutrients in 2024, meanwhile, examined the effects of a single dose of Zynamite® combined with quercetin on top basketball players in Greece during a basketball exercise stimulation test. Participants in the supplement group were faster, showing a statistically significant improvement in mean circuit lap time compared to those in the placebo group.

March-April 2024 8 www.asiafoodjournal.com AsiaFoodJournal

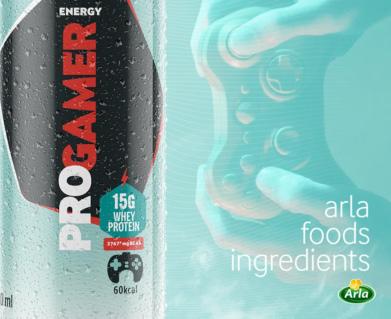

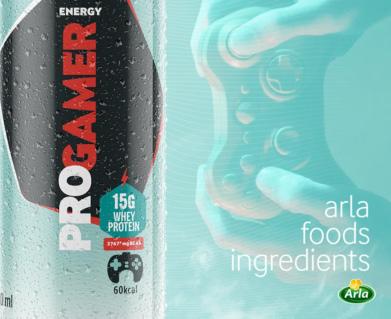

Arla Foods Ingredients targets nutrition-conscious gamers with new beverage concept

Arla Foods Ingredients has launched a high-protein concept for gamers wanting to level their nutrition. Titled ‘PROGAMER,’ the ready-to-drink solution is designed to meet the needs of e-sports enthusiasts seeking benefits for their health and gaming performance.

The concept features energyboosting ingredients alongside the game-changing whey protein isolate Lacprodan® SP-9213, which is clear, provides a refreshing taste, and is high in essential and branched-chain amino acids.

Cido Silveira, Arla

Foods Ingredients Marketing & Business Development Manager – South America,

said: “There’s a stereotype of gamers bingeing on unhealthy snacks and guzzling down energy drinks, but a new, nutritionfocused generation is emerging. They want to maintain their energy and concentration levels over marathon sessions, but they also want the many benefits that high-protein products offer.

PROGAMER allows manufacturers to formulate unique, refreshing, clear, highprotein solutions for gamers who want more from their energy drinks.”

Protein is crucial in general health, supporting muscle growth, repair, and overall body function. Research has also found that consuming essential amino acids improves attention and cognitive flexibility.

Meanwhile, a study on esports athletes showed that sufficient protein intake is associated with improved cognitive performance in gaming.

A 310ml can of the ‘PROGAMER’ beverage concept features 15g of protein, including 3767mg of branched-chain amino acids. It also contains taurine, magnesium, zinc, caffeine, and vitamins A, B3, B6, and B12 to support essential gamer needs such as concentration and vision. In addition, the concept is free from sugar, fat, and lactose and contains only 60 kilocalories per can.

March-April 2024 9 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Packaging

Research shows food and beverage companies committed to plastic reduction, prompted by consumer demand

• Three of the top five sustainability commitments by businesses involve plastic reduction.

• Satisfying consumers’ demand for sustainability is a primary driving force for tackling environmental issues.

• 77% of businesses are willing to accept the cost of implementing sustainable business practices.

Singapore (16 April 2024): Today’s food and beverage (F&B) companies are poised to minimise plastic as a favoured packaging material, as recent research has unveiled that three out of the top five commitments made by business leaders to address sustainability challenges include the reduction of plastic usage. Tetra Pak’s research examined F&B manufacturers’ attitudes to sustainability, now and in five years’ time.

Half of the surveyed businesses pinpointed consumer demand as the main catalyst behind implementing new sustainable solutions within the manufacturing and processing arena. This echoes the sentiment found in a separate Tetra

Pak consumer study on packaging. It found the intention to buy among almost three out of four respondents (74%) would increase if a brand talked about environmental topics, while 42 percent believe that an “environmentally sound package” justifies a higher price, providing the industry with a reassuring case for adopting a business model that reduces environmental impact.

Seventy-seven percent of businesses expressed a willingness to accept costrelated trade-offs associated with the implementation of sustainable manufacturing and processing solutions, despite the industry facing ongoing macro-economic challenges. This insight follows COP28, which saw many private sector stakeholders committing to sustainability targets and initiatives, including Tetra Pak’s action-oriented approach towards food systems transformation.

Business’ focus on environmental impact is seemingly at a tipping point, with the urgency to adopt practices that decarbonise the world’s food systems

March-April 2024 10 www.asiafoodjournal.com AsiaFoodJournal

predicted to surge by 10 percent in the next five years, from 49 percent to 59 percent. When asked how packaging and processing suppliers can contribute, 65 percent of companies identified the importance of new product developments, confirming the critical role played by innovation in our global fight against climate change.

Terrynz Tan, Sustainability Director for ASEAN, Tetra Pak, notes: “The result from this study confirms the consumer shift we are witnessing when it comes to the environment. They want F&B brands to be transparent, credible, and make a positive impact. Sustainable packaging isn’t just about being eco-friendly — it’s a chance for beverage makers to connect with customers in meaningful ways. By choosing renewable materials, brands can stand out in a crowded market and appeal to those who care about the planet. At Tetra Pak, we’re passionate about creating the most sustainable food package possible. It’s not just about business; it’s about our commitment to responsibly sourced, recyclable, and carbon-neutral packaging.”

Gilles Tisserand, Vice President of Climate & Biodiversity, Tetra Pak, comments:

“The food and beverage industry is at a critical moment, rethinking its way of doing business to help address the climate emergency and dealing with the inevitable impact this has on their operations and solutions. They are looking to suppliers to help them thrive in an increasingly competitive market, and we remain committed to playing our part, keeping the innovation engine running to develop new research, collaborative ecosystems, and product offerings.”

He continues: “Our innovation pathway is driven by renewability and recyclability, ensuring the decarbonisation and circularity of materials and addressing the need for sustainable food packaging. Findings such as the fact that cartons are considered by consumers to be the most ‘environmentally sound’ beverage package, while plastic is considered the least, are a testament that we are on the right path. You only need to look at the fact that we sold 46 percent more packages made with plant-based polymers in 2023 compared to 2021 to see that the industry is committed to change.”

May-June 2024 11 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Industry

IFF Trends Report: Added value key to success in inflation-hit dairy space

New research into dairy and alternative dairy trends highlights the advantages of offering functional health benefits and connecting with consumers’ values

Amidst a challenging economic climate, IFF (NYSE: IFF), a global leader in food and beverage, home and personal care, and health, unveils a report that uncovers the evolving consumer trends in the dairy and alternative dairy categories.

The report, derived from a comprehensive quarterly global survey of 21,000 consumers and monthly market data*, highlights how brands can win over budget-conscious consumers by offering health benefits and resonating with consumer values.

“In the face of a global cost-of-living crisis, dairy and alternative dairy brands have found a silver lining by focusing on quality and value,” said Richard Neish, Head of Global Futures, Consumer Intelligence at IFF. “It is not about competitive pricing; it’s about delivering products that enhance wellness and align with consumer values ─ a strategy that is proving to be a gamechanger.”

The report identifies five key trends that

will drive market changes and product innovation, with ‘Better-Being’ as a leading trend, reflecting a significant shift in consumers’ health preferences. Six in ten (60 percent) respondents said they were always or often influenced by health labelling in their product choices.

Dairy has been one of the categories worst hit by inflation, with value compound annual growth rate (CAGR) outstripping volume CAGR. Despite inflation’s impact on the dairy industry, the report highlights that since 2022, consumers have prioritized quality over cost, with many opting for premium brands that promise uncompromised quality.

Private-label dairy products have emerged as a popular choice during

May-June 2024 12 www.asiafoodjournal.com AsiaFoodJournal

the economic downturn, with 35 percent of consumers gravitating towards budget-friendly options without sacrificing quality. 63 percent of respondents said they started, or continued, to buy more expensive dairy brands in Q4 of 2023, and 52 percent said they preferred to pay more to ensure that quality is not compromised. The report emphasizes the strategic importance of integrating functional wellness ingredients, such as probiotics, to add value beyond pricing.

The IFF insights also reveal a compelling narrative of brands “driving value with values,” resonating with consumers who seek to express their personal beliefs, like sustainability and authenticity, through their food choices. This is reflected in 61 percent of respondents and particularly true for Gen Z, with 67 percent emphasizing the importance of aligning purchases with values. Additionally, the report highlights a shift towards indulgence and convenience, highlighting consumer desire for pleasurable experiences and consuming on-the-go products like ice cream.

*Quarterly consumer surveys are conducted by leading research company, GlobalData, with 21,000 consumers across 42 countries. The latest data used here was collected in Q4 2023. GlobalData also tracks market trends with their data updated monthly. The results were combined with insights from the IFF Panoptic Framework, the company’s in-house trend intelligence tools, to identify the key trends shaping dairy and alternative dairy in 2024 and beyond.

Industry |NEWS AsiaFoodJournal www.asiafoodjournal.com

NEWS | Industry

Axelum seals multi-year deal with Vita Coco

Axelum Resources Corp. (PSE: AXLM), the country’s leading fully-integrated manufacturer and exporter of premium coconut products, signed today a multiyear deal with The Vita Coco Company, Inc. (“Vita Coco”), one of the world’s largest coconut water brands. This renewal contract marks the continuing strategic alliance between two industry leaders, who are strongly positioned to capitalize on the robust trajectory of the global coconut water segment in the coming years.

Based on the latest SkyQuest Technology report, the global coconut water market size was valued at US$ 6.57 billion in 2022, and is poised to grow from US$ 7.63 billion in 2023 to US$ 25.18 billion by 2031, at a compounded annual growth rate of 16.1 percent during the forecast period. Rising market demand is primarily driven by a rapidly growing health-conscious population with an increasing preference for non-conventional beverages and expanding awareness of the nutritional benefits of coconut water.

In 2009, Axelum became the first supplier to Vita Coco outside Brazil. Axelum operates a state-of-the-art ultra-high temperature processing facility, skillfully manned by dedicated personnel, to

produce some of Vita Coco’s best-selling products – Original Coconut Water, Farmers Organic and Pressed Coconut Water. Recently, Axelum commissioned a new filling machine to augment its existing production output to meet the increasing volume requirements of Vita Coco in the long-term.

“We are proud to be associated with an iconic better-for-you beverage brand, who shares our passion for delivering

May-June 2024 14 www.asiafoodjournal.com AsiaFoodJournal

high-quality and better-tasting coconut water products to the international mainstream market. Our longstanding partnership is the epitome of technology and innovation, transforming a tropical fruit derivative into a high-demand global consumer product. For Axelum, this will only further strengthen one of our fastestgrowing segments,” stated Mr. Romeo I. Chan, Chairman and Chief Executive Officer of Axelum Resources Corp.

“Axelum has been an integral part of our growth story. Throughout the years, they have proven to be a reliable partner that has consistently ranked amongst our top suppliers in terms of quality and service. With this new deal, we are excited to continue our relationship and look forward to driving exponential growth for many years to come,” said Mr. Michael Kirban, CoFounder and Executive Chairman of The Vita Coco Company, Inc.

May-June 2024 15 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Automation

Mettler-Toledo presents cutting-edge product inspection solutions at SnackEx

Mettler-Toledo Product Inspection, a global leader in food product safety technologies, is proud to announce its participation in SnackEx, hosted by the European Snack Association. The event will take place at Mässvägen 1, 125 30 Älvsjö, Stockholm, Sweden, on 19-20 June 2024, where MettlerToledo will be both exhibiting and speaking.

Among the featured product inspection solutions will be:

Metal Detection:

A unique cut-away throat metal detector will give visitors an immersive experience, allowing them to witness firsthand the inner mechanisms of the Automatic Test System (ATS). By simply pressing a button, visitors can observe ATS in action as it cycles through test samples, demonstrating its robust metal detection capabilities and reliability. To demonstrate the dramatic difference in detection capability with other real-world metallic contaminants will be the

latest Mettler-Toledo throat detector with eDriveTM and ATS. These metal detectors not only showcase the innovative solutions from Mettler-Toledo but also serve as educational tools, enlightening attendees about the importance of metal detection in product safety and integrity.

X-ray Inspection System:

The X12 X-ray inspection system showcases cutting-edge technology in product safety and quality assurance. Engineered to deliver exceptional contaminant detection capabilities, the X12 provides unparalleled sensitivity to detect a wide range of foreign materials, including metal, glass, mineral stone, and dense plastics. With its high-resolution imaging and advanced algorithms, the X12 offers superior inspection performance, enabling snack manufacturers to safeguard their products against contaminants and uphold the highest quality standards. Designed as an entrylevel solution, the X12 combines affordability with state-of-the-art functionality, making X-ray inspection accessible to all budgets without compromising on performance or reliability.

May-June 2024 16 www.asiafoodjournal.com AsiaFoodJournal

Checkweigher and Vision Inspection

Combi-Solution:

Representing a groundbreaking advancement in product inspection technology, checkweighing and vision capabilities are combined within a single system, offering enhanced accuracy and efficiency. The Combination Solution provides precise weight measurement and comprehensive label inspection, thereby optimising packaging integrity and compliance with regulatory standards. With its innovative design and advanced features, the Combination Solution is positioned to set a new standard for product inspection solutions in the snack industry.

Data Management Solution:

In addition to showcasing cutting-edge inspection technologies, Mettler-Toledo will also feature its innovative ProdXTM data management software at the event. ProdXTM offers snack manufacturers a comprehensive solution for data collection, providing real-time insights into production performance, facilitating proactive decision-making and optimising operational efficiency. The information provided by ProdXTM helps manufacturers comply with regulatory standards and enhance quality control measures throughout the production process. Visitors to the stand can discover firsthand how ProdXTM empowers snack manufacturers to achieve greater transparency, productivity, and compliance in their operations.

During the event, Rob Stevens, Market Manager for Metal Detection at MettlerToledo, will deliver a compelling presentation

Automation

titled “Metal Detection, X-ray Inspection or Both?” scheduled for 19th June at 4.20 pm. He will explore the critical importance of foreign body detection in snack manufacturing processes and will also look at how both metal detection and x-ray inspection technologies play complementary roles in achieving product safety and quality.

Visitors will be able to see firsthand how Mettler-Toledo solutions work in real-life examples. A success story of MettlerToledo products in action is PATA S.p.A., one of Italy’s leading producers of savory snacks. Through a longstanding partnership with Mettler-Toledo, PATA has achieved compliance with industry standards while optimising productivity and reducing costs. PATA’s adoption of the Mettler-Toledo product inspection solutions, including dynamic checkweighers and advanced metal detection systems, exemplifies the transformative impact of innovative inspection technologies on snack manufacturing operations.

“We are excited to engage with industry professionals at SnackEx and demonstrate how the Mettler-Toledo cutting-edge product inspection solutions can empower snack manufacturers to enhance product safety, compliance and efficiency,” said Stevens.

Attendees are encouraged to visit MettlerToledo at booth 244 to explore the latest advancements in product inspection technology and learn more about the benefits of integrating metal detection and x-ray inspection in their manufacturing processes.

|NEWS May-June 2024 17 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Processing

MycoTechnology’s honey truffle sweetener achieves new technical and safety milestones on accelerated path to market

Following the ground-breaking discovery of a new sweet protein from honey truffles last year, MycoTechnology, Inc. has made significant strides toward commercialization, demonstrating the product’s potential as a valuable alternative to sugar and existing sweeteners.

As a leader in food technology and innovation, MycoTechnology is leveraging its biotechnology, manufacturing, and regulatory expertise to meet a series of technical and safety objectives, surpassing initial timeline expectations on its path to market. In less than a year since the announcement of its discovery, the company has scaled production from the lab bench to 3000-liter tanks, improving production process efficiency, optimizing costs, and validating safety and digestibility.

Sweet proteins represent an exciting category in the sweetener market, offering appealing, non-nutritive alternatives to sugar and artificial sweeteners. As the first new naturally derived sweetener discovered in decades, honey truffle sweetener is emerging as a unique, cleanlabel addition to this category. With a long history of consumption, honey truffles have been referenced in historical texts as part of the human diet as early as 2000 BCE, recognized for their intensely sweet taste.

After isolating the protein responsible for this sweet taste, MycoTechnology used precision fermentation technology to produce the first ever honey truffle sweetener, with a uniquely clean taste profile and potency ranging from 1000-2500 times sweeter than sucrose.

Recent safety evaluations have shown exceptional results, including genetic testing for toxicity, allergenicity, and digestibility. The protein is not considered allergenic or toxic and is fully digestible by the human GI tract. Rather than being absorbed in its intact form, it breaks down completely into amino acids routinely found in other dietary protein sources such as meat, fish, or eggs. In silico analysis also suggests that the molecule has no similarity to any other known protein structures and, therefore, has minimal potential for other secondary effects beyond sweetness.

March-April 2024 18 www.asiafoodjournal.com AsiaFoodJournal

“Following global best practices in partnership with world-class industry experts, our findings suggest that honey truffle sweetener is likely to be an ideal general-purpose sweetener for foods and beverages,” said Sue Potter, Ph.D., Sr. Director, Global Regulatory Affairs. “We’re confident in the results we’ve received so far, and we’re on track for regulatory submissions in key global jurisdictions.”

As MycoTechnology continues to scale production in its facility, it is also making steady improvements in strain development, process yield, and quality. Simplified downstream processing will allow for flexible and less capital-intensive manufacturing, positioning honey truffle sweeteners economically competitive with sugar and other high-intensity sweeteners.

MycoTechnology’s Chief Technology Officer, Ranjan Patnaik, Ph.D., added: “Our team has achieved remarkable results, exceeding initial expectations for speed of scale-up, mechanistic understanding of the protein, sensory characterization, and applications development with industry partners. This progress is a reflection of Myco’s unique ability to integrate discovery with commercial development to quickly create innovative, impactful solutions from nature.”

With its global patent portfolio and growing interest from major industry partners, MycoTechnology continues expediting the market path. It looks forward to a lasting impact on the future of sweeteners and sugar reduction.

March-April 2024 19 AsiaFoodJournal www.asiafoodjournal.com

NEWS | Processing

Nurasa unveils Asia’s premier Food Tech Innovation Centre to enable sustainable nutrition solutions

• Nurasa’s Food Tech Innovation Centre is a strategic hub for product innovation and commercialisation for sustainable foods

• The company is committed to being an integrated solutions provider of R&D and capabilities for food sustainability in Asia through open innovation and strategic partnerships

Nurasa, a wholly owned company of Temasek and a leading organisation in sustainable nutrition development in Asia,

proudly announced the inauguration of its cutting-edge Food Tech Innovation Centre (FTIC) in Singapore. Deputy Prime Minister and Coordinating Minister for Economic Policies Mr. Heng Swee Keat was the Guest-of-Honour at the ceremony, which marked a significant milestone in Nurasa’s commitment to advancing sustainable food solutions.

Located strategically within Biopolis, a key part of Singapore’s innovation community, Nurasa’s FTIC is a 3,840 sqm food-grade facility that features high-tech laboratories with advanced capabilities in precision

March-April 2024 20 www.asiafoodjournal.com AsiaFoodJournal

fermentation (PF) and food processing. The PF lab includes bioreactors that have production capacities of up to 100 litres, allowing companies to produce at a greater scale beyond developmental capacities. These labs tap on ecosystem capabilities at the Agency for Science, Technology and Research (A*STAR), ScaleUpBio and others.

The Centre serves as a pivotal hub for Nurasa’s NuFood Concept Studio – an open innovation platform that pioneers the product development and commercialisation of sustainable foods.

The NuFood Concept Studio fosters culinary creativity and encourages consumer-centric food innovation and sustainable practices. It addresses emerging food industry innovations like low-sugar, cholesterol-free, and gut-friendly foods with exceptional flavour profiles. Corporations and startups will have access to scout out the latest ingredients, co-create recipes based on the latest technologies and market insights, and ideate on the delivery of accessible, adaptable, and affordable sustainable food solutions that will feed more people in the future.

Designed to accelerate and scale product commercialisation, the FTIC is designed to sustain and amplify the impact of innovation and new breakthroughs to strengthen food security. The robust ecosystem comprises industry partners, portfolio companies and joint ventures like ScaleUp Bio and Cremer, who collectively contribute to a sustainable food future through innovation. The Centre features meticulously designed shared laboratories and collaborative workspaces alongside private suites adaptable for small offices or laboratories where partners can co-create and enable innovation across the value chain.

With the support of Nurasa and the FTIC, Cremer Sustainable Foods now produces plant-based alternative proteins at one of Singapore’s largest HME manufacturing facilities. The 1,000 sqm facility has a production capacity of 1,300 tonnes per annum, scaling the production of plantbased products that closely resemble meat, enhancing their appeal to consumers.

As part of the official opening, DPM Heng toured the NuFood Concept Studio and engaged in discussions with Nurasa’s partners, a testament to innovation in culinary design with food tech joint labs to facilitate research and development. Every aspect, from ingredient storage to preparation areas, adheres to Good Manufacturing Practices (GMP), guaranteeing quality and safety.

Guo Xiuling, Chief Executive Officer at Nurasa, said, “Nurasa is poised to lead insightdriven product innovation and accelerate commercialisation to meet the increasing demands for wellness and sustainability. At the Food Tech Innovation Centre, cuttingedge technology is at the heart of everything we do. Our facility enables us to challenge the status quo of the existing food system and develop solutions alongside our startup and corporate partners. Our mission is simple yet profound: to enable accessible, appealing, affordable sustainable nutrition solutions for the everyday person.”

The launch of the FTIC reaffirms Nurasa’s steadfast dedication to building a sustainable food future for people across Asia. Looking ahead, Nurasa continues to work with upand-coming food tech companies and partners to collectively cultivate an extensive food tech ecosystem full of fresh solutions and nourishing ingredients.

May-June 2024 21 AsiaFoodJournal www.asiafoodjournal.com

MONDELĒZ

Mondelēz Unwraps the Future: A Bold Leap Towards Revolutionizing Global Healthy Snacking

By Cath Isabedra

The tide of consumer preferences has shifted distinctly towards healthier living, with an increasing number of people prioritizing well-being in their dietary choices. This transformation is reshaping industries, none more so than the global snack sector, which is now navigating the complex demands for products that are not only tasty but also nutritious and guilt-free.

The rising interest in health-conscious snacking springs from a broader awareness of how diet impacts overall health and wellbeing, compounded by an escalating global health crisis linked to obesity and noncommunicable diseases. Consumers are increasingly seeking snacks that contribute positively to their health, driven by desires for better nutritional content, reduced caloric intake, and more natural ingredients.

However, the industry faces significant challenges in meeting these demands, including maintaining taste and texture with reduced sugars and fats, ensuring the affordability of healthier options, and overcoming logistical hurdles in sourcing and producing these innovative products.

In response to these challenges, Mondelēz leads the charge, crafting strategies that effectively address consumer needs while setting new standards for the snack industry. Through a combination of rigorous product innovation, strategic market adaptations, and a deep commitment to sustainability, Mondelēz is not just adapting to trends but actively shaping the future of snacking.

Tomás Centeno, Vice President of Strategy & Commercial Excellence for Asia Pacific, Middle East, and Africa (AMEA) at Mondelēz, offers an insider’s view into the company’s proactive strategies that are not just responding to but driving the revolution in healthy snacking.

What recent innovations has Mondelēz introduced to cater to the growing demand for healthier snacking options?

Recent data from our State of Snacking report revealed that 82% of Asia, Middle East and Africa (AMEA) consumers prioritize healthconscious decisions choosing snacks, which serve as vital health boosters, meeting needs like energy (82%), mood improvement (82%), and fitness goals (78%). We aim to empower consumers with contemporary well-being options and choices, Mindful Snacking habits and portion balance.

Through product renovations across the

world, we work to reduce levels of ingredients like sugar and sodium. In Australia, we launched a new delicious 50% Less Sugar lollies range, under The Natural Confectionery Co. brand, which contains 50% less sugar compared to the average amount of sugar present in leading candy jelly products.

Additionally, below are some of examples of our efforts to enhance the nutrient profile of products across our portfolio in 2023:

• In India, we reduced sugar content by approximately 15% in our Bournvita biscuits and by about 5% in Oreo Chocolate.

• In the Middle East and Africa, we reduced sodium content in Oreo by around 5% in Morocco, and by approximately 30% in Saudi Arabia and United Arab Emirates.

We also enhanced the nutrient profile of certain brands through fortification. They include:

• Kinh Do mini savory cakes are now enriched with Vitamin A and Zinc.

• Tang now delivers approximately 100% of the recommended daily allowance of Vitamin C in India and the Philippines.

How is Mondelēz integrating technology to enhance the mindful snacking experience for its consumers? What strategies has Mondelēz employed to stay relevant and competitive in the rapidly evolving snack food industry?

We are at the forefront of leveraging cuttingedge technology to enhance the mindful

May-June 2024 23 AsiaFoodJournal www.asiafoodjournal.com

snacking experience for our consumers. Through the integration of Artificial Intelligence (AI), data analytics and robotics, we are evolving our operations to meet changing consumer preferences and needs.

In India, Cadbury Celebrations introduced an AI-led initiative that lets users create customized birthday songs for their loved ones. The concept of personalized #MyBirthdaySong leveraged four types of Generative AI tools – namely AI generated lyrics, AI composed music, AI generates vocals and real-time generation of personalized songs to allow users to personalize ‘b’day songs’.

During the height of Covid lockdowns, we launched an innovative digital campaign during the Mooncake festival in Vietnam. The theme of the campaign was “Kinh Do Mooncakes, finely crafted to keep stories alive” and through AI technology, consumers were able to pass on their stories and traditions to the next generation by animating the faces in their family photos and recreating precious memories.

Another example would be the development of our AI-powered sales automation platform. This platform equips our sales teams with invaluable data-driven insights by analyzing historical sales data and understanding consumer preferences and purchasing habits - as a result, we can offer product recommendations tailored to each store.

Our recent State of Snacking report indicates that three-quarters of AMEA consumers are also interested in snacks tailored to their individual health and nutrition needs, while more than seven in 10 are keen on snacks allowing for personal customization, such as

preferred flavors or ingredients.

By aligning our technological advancements with consumers’ desires for personalized snacking experiences, we are committed to meeting the diverse needs of our customers while driving innovation in the snacking industry.

Can you detail Mondelēz’s approach to nutritional transparency and how it impacts consumer trust?

We have been committed to providing clear and comprehensive nutrition labeling on all products globally, aligning with international standards. Portion size is a key ingredient for mindful snacking as consumers look to meet a variety of snacking needs.

Over seven in 10 AMEA consumers say they look for snacks that are portion controlled (74%). Our back-of-pack information includes essential nutrients per serving or per 100 grams, while front-of-pack labeling, such as calorie counts, provides quick headline information.

Additionally, we ensure that any nutritional claims are based on appropriate serving amounts and undergo rigorous regulatory review for accuracy and transparency.

As part of our Mindful Snacking strategy, we are also providing information about our products’ portion size as an addition to our labeling. This helps consumers to feel in control of their snacking choices without a sense of sacrifice.

To help consumers savor our snacks while they manage their calorie intake, we are

May-June 2024 24 www.asiafoodjournal.com AsiaFoodJournal

expanding our range of individually wrapped Mindful Portion packs of 200 calories or fewer. For products that are not pre-portioned, our aim is to provide Mindful Portion information on the pack.

More than eight in 10 of those surveyed in our recent State of Snack report said they feel in control when moderating their snack portions (81%), while 75% percent stated that they would rather have a smaller portion of an indulgent snack than a bigger portion of a low fat/sugar alternative version, to help balance their diet and align with their healthy lifestyle.

Our goal by 2025 is to aim for up to 100% of net revenue through Mindful Portion Snacks –those in either individually wrapped mindful portion serving sizes or with mindful portion labeling.

In what ways is Mondelēz contributing to the global conversation on obesity and non-communicable diseases through its product portfolio?

People need simple and straightforward information to help them make dietary decisions that they believe are best for them and their families. So, we:

• Provide nutrition labeling on our products across global markets, according to applicable local laws and regulations.

• Where space permits and when permitted by law, include information on eight key nutrients: calories (energy), protein, carbohydrates, sugars, fat, saturated fat, fiber, and sodium.

• Deliver meaningful information at a glance through front-of-pack (FoP) and calorie labeling on relevant products.

• Call for a harmonized approach to food labeling and collaborate with industry peers, consumers, and health authorities.

What

are the key challenges and achievements in Mondelēz’s journey towards sourcing ingredients sustainably? How does Mondelēz’s commitment to sustainability influence its product innovation and packaging strategies?

Consumers are thinking more critically about how and where their snacks are made. Many are making an effort to bring snacking closer to home by shopping locally to support small businesses (59%) and trying to buy snacks / brands that are made locally (49%). Organic snack seekers are motivated by the fact that those ingredients are better for the planet. The majority will also pay a premium for sustainably sourced snacks, especially those in Asia Pacific.

To make snacking more sustainable, we strive to understand risks and their potential impact, focus on opportunities to lead where we matter most, and drive change where the world needs it most. We set goals in these areas – and add new ones over time – to enhance our ambition, impact, and delivery at scale.

We have set clear 2025 goals that put us on the path to pursue bold long-term ambitions. Our ambition is to source our key ingredients – including cocoa and wheat – more sustainably and support more economically

May-June 2024 25 AsiaFoodJournal www.asiafoodjournal.com

and socially resilient communities. These two ambitions mutually support and reinforce each other and are at the heart of our aim to create a future where together people and the planet thrive.

With this aim in mind, we’ve established the following goals: achieving a 100% cocoa volume for chocolate brands sourced through Cocoa Life by 2025 and attaining a 100% wheat volume required for Europe business biscuit production cultivated under the enhanced Harmony Regenerative charter by 2030.

Our strategic focus areas, goals, and ambitions map to the areas of our business best positioned to drive progress and are aligned to what we believe is significant to our long-term business success. They also support our vision to lead the future of snacking and our aim to reduce our environmental footprint and have a positive lasting impact on people and communities as we continue to grow.

Can

you share insights into how Mondelēz measures the impact of its health and sustainability initiatives on brand loyalty and market share?

Mondelēz empowers healthy snacking with delicious, nutritious options. We offer portion control and prioritize responsible ingredients to promote mindful eating and informed choices.

To help consumers savor our snacks while they manage their calorie intake, we are expanding our range of individually wrapped Mindful Portion packs of 200 calories or fewer. For products that are not pre-portioned, our aim is to provide Mindful Portion information

on the pack. We strive to guide mindful choices through partnerships with health experts in the ecosystem.

We continually strive to enhance the nutrient and ingredient profile of our snacks portfolio through efforts to reduce sugar, sodium and saturated fat content and use more whole grains, increasing fiber and micronutrients as appropriate. We do this while continuing to deliver delightful brand experiences, and partner with experts to advance technologies that support nutrient and ingredient enhancements.

Our public Responsible Marketing Position also reinforces that our marketing and labeling not only complies with all regulations and standards, but helps our consumers snack right.

We do not advertise our products in any media where 30% or more of the total viewing audience is under the age of 13.

As a founding member of the IFBA, we work with others across the industry to support responsible marketing, including underrepresented communities, and have made a global pledge to the World Health Organization (WHO) in the areas of nutrition and responsible food marketing In addition, we have external and internal food marketing standards in place that provide additional guidance and are in line with the International Chamber of Commerce (ICC) Code of Advertising and Marketing Communication Practice and the ICC Framework for Responsible Food and Beverage Communications.

May-June 2024 26 www.asiafoodjournal.com AsiaFoodJournal

As one of the world’s largest snack companies, we live and breathe snacks – and we want to make them right for people and the planet.

We are guided by our values, and we follow through on our commitments of doing what is right for our consumers, right for our partners, right for our brands and right for the environment.

Looking forward, what are Mondelēz’s priorities in aligning its brand story with future trends in health, wellness, and environmental stewardship?

We’re strategically aligning our brand narrative with upcoming trends in health, wellness and environmental responsibility, including our commitment to exploring reusable, recyclable or compostable options, such as eco-friendly packaging. As the demand escalates for plant-based and alternative ingredients, exacerbated by climate change awareness and health consciousness, we’re investing accordingly.

Embracing nutrition literacy advancements, we’re also foreseeing a shift towards personalized, healthier diets.

As such, we’re also prioritizing clean labeling and ethical sourcing, meeting consumer expectations for transparency. Through these strategies, we hope to lead the conversation in promoting health, wellness, and environmental sustainability in the food industry

Tomás Centeno is the Vice President of Strategy and Commercial Excellence, Asia Pacific, Middle East & Africa (AMEA) for Mondelēz International and a member of the AMEA Leadership Team.

Tomás brings almost two decades of consumer business experience and most recently served as President for APAC Region at Dyson. In this role, he delivered exceptional business results and led the growth cycle for Dyson’s Asia business. He was also instrumental in leading the turnaround for Dyson’s Korea Business. Tomás also held the role of Managing Director for the Benelux region driving expansion and business model transformation.

Prior to Dyson, Tomás spent over six years at Philips, where he demonstrated deep commercial acumen, drove pricing levers, led customer P&L, and developed a strong leadership bench. He started his career at P&G and was primarily responsible for building deep foundations within the customer function through sales and account leadership roles in Europe.

Tomás is an Advisory Board Member for Enabling Leadership, a global non-profit fostering leadership skill in children.

Tomás is originally for Portugal and is married with two children. He holds a Master of Science in Civil Engineering from Instituto Superior Técnico. Outside of work, Tomás is active in sports, literature, and social activities.

May-June 2024 27 AsiaFoodJournal www.asiafoodjournal.com

CARGILL

Striking the Perfect Balance: Cargill’s Strategic Innovations in Indulgence and Health

Words by Xiaoling Liu, Indulgence Leader, Food Solutions Asia Pacific, Cargill

In the modern culinary landscape, the delicate dance between indulgence and wellness is more pronounced than ever. Consumers are increasingly seeking experiences that cater not just to their cravings but to their health, demanding a fusion of flavor and function that challenges industry norms.

The art of snacking is more than just a way to stave off hunger—it’s an opportunity to nourish the body and delight the senses. While it’s easy to grab a quick, indulgent treat that promises immediate gratification, thoughtful choices about what we eat between meals can profoundly impact our health and well-being.

Striking a balance between nutritious snacks and those occasional indulgences is crucial. It allows us to enjoy life’s culinary pleasures without compromising our health.

Xiaoling Liu, Indulgence Leader, Food Solutions Asia Pacific, Cargill shares insights about how they’re working to respond to consumer trends while shaping the future of food by crafting innovative solutions that delight and deliver wellness.

Why is the indulgence space important for Cargill?

As our customers look to us for innovative solutions to the fast-evolving consumer trends and taste preferences, Cargill aspires to be our customers’ go-to partner for innovation and growth. To this end, we aim to co-create with them to deliver innovative food solutions that are driven by our deep market insights and research into global and regional consumer trends, e.g., with the annual Cargill TrendTrackerTM, our proprietary perspective on global food and beverage trends.

With our expertise and capability to support our customers end-to-end, from research and development to production and commercialization, we provide a full suite of comprehensive solutions, of which indulgence is one of key growth segments in Asia.

The need to be agile and nimble is more pronounced in Asia Pacific, where there is a diverse group of consumers, and we see APAC as a dynamic playing field for indulgence. With all the buzz around healthfulness, there still is a growing appetite for flavorful and indulgent treats. These are largely driven by a large youth population and rising incomes, coupled with how new and enjoyable experiences around food and beverages are important for consumers.

Delving deeper into indulgence, 33 percent of APAC consumers associate and peg rich flavors and taste as the primary factor of an indulgent food and beverage experience, and the top three ranking texture claims in the region would be creamy, crispy and crunchy. When asked the motivations behind ‘treating’ themselves with food and beverage, 42 percent of consumers cite the fact that it boosts their mood, while 34 percent believes that it provides them comfort. To that extent, we have also seen brands responding with an increased 12 percent in product launches with a mood-related claim.

The indulgence space proves itself to be a growth area and holds much opportunity for innovation and co-creation with our customers.

With our over 40 years of global experience in cocoa and chocolate, having one of the most comprehensive food solutions portfolios in the industry, and expanding sourcing, manufacturing and innovation capabilities in APAC, we believe we are well-positioned to support our customers on their growth ambitions and continue to lead in the indulgence space.

May-June 2024 29 AsiaFoodJournal www.asiafoodjournal.com

How do we balance indulgence and healthfulness?

The trend of healthy eating is something that we’ve been seeing for a few years now. Consumers today are proactively adopting a holistic approach to health, being more thoughtful and deliberate regarding their food and beverage choices, as well as more discerning about ingredients that go into their foods.

In fact, with ingredient consciousness, we see that most consumers are either trying to limit certain ingredients, or actively seeking certain food, beverages, and ingredients with health benefit in their diet.

Based on findings reflected in our TrendTrackerTM report, sugar is the top ingredient that APAC consumers are actively trying to limit in their diet.

This also rings true in the indulgence space and when it comes to chocolate, 50 percent of APAC consumers prefer dark chocolate for its less sweet taste profile and hold the perception that the darker the chocolate, the healthier and more premium it is.

In response, Cargill has developed a range of product with high cocoa content – Pâtissier by Aalst ChocolateTM chocolate artisan dark 85 percent chocolatier and Pâtissier by Aalst ChocolateTM chocolate artisan dark single origin Ghana 75 percent coverture.

This range allows chefs and food professionals to reimagine creations that are health-conscious, while still maintaining the richness and intensity of flavor. Additionally, our customers can also tap on our extensive food solutions portfolio for sugar replacement solutions, from low-to zero-calorie solutions to specialty sweeteners which utilise stevia.

Cargill’s chocolate portfolio also includes products such as Pâtissier by Aalst ChocolateTM chocolate dark couverture 55 percent with no added sugar and Aalst mellow sweet white chocolate 34 percent, to respond to the growing consumer demand in Asia for healthy and mindful consumption.

May-June 2024 30 www.asiafoodjournal.com AsiaFoodJournal

Our avenue for innovation does allow us to meet the strong demand that Asian consumers have tasty, flavourful chocolate treats while also being more mindful of the quality, nutritional value and source of the foods they are enjoying.

Now, consumers want indulgent and healthy products, and both factors are important to them – more are looking for a tasty treat while maintaining nutritional balance. Studies show that within the indulgence space, there has been a six percent CAGR growth for products that have an active health claim, further emphasizing the growth potential of healthy indulgence.

As a response to this need, some of our key customers have also approached us to collaborate on the inclusion of higher protein content into chocolate coffee-based beverages.

Asia for Asia, Bean to bar

Just as there is growing awareness of what is going into their bodies, consumers in APAC are also seeking transparency in terms of sourcing. Sixty-seven percent of APAC consumers actively look out for claims about local sourcing, and 1 in 3 are interested in understanding the product’s “source to shelf” journey.

Cargill has continuously invested in the region and is able to support our customers to meet this trend, with our extensive cocoa sourcing networks, state-of-the art production capabilities, and its deep R&D and innovation expertise. Within Asia, Cargill

has been accelerating sustainable cocoa sourcing practices in Indonesia for more than 10 years, complemented by a world-class cocoa processing plant in the country that also houses Asia’s most advanced cocoa development center.

Later this year, the plant in Gresik is set to complete enhancements to its production lines that will support the development of premium cocoa solutions through flavor and color customization.

Further supported by food innovation centers across Asia, Cargill is a food solutions provider with one of the most comprehensive portfolios in the industry and is able to offer its cocoa & chocolate customers access to a wide array of ingredients and solutions, such as specialty fats from edible oils – all of which well positions the company to deliver value, innovation and growth for customers across the region.

Through it all, Cargill is at the forefront of a more sustainable food system and is committed to doing what’s right at every step of the value chain, from sourcing to product. With regards to the cocoa sector, through the Cargill Cocoa Promise, a program to enable farmers and their communities to achieve better incomes and living standards while growing cocoa sustainably, we ensure that our sourcing network is sound and ensures a thriving cocoa sector for generations to come.

Under the Cargill Cocoa Promise program, farmers receive training and 1-on-1 coaching programs in good agricultural and environmental practices, get support in running sustainable cocoa farming and cocoa nurseries, and getting access to agricultural inputs and sustainable market.

May-June 2024 31 AsiaFoodJournal www.asiafoodjournal.com

Beyond Borders: The Flourishing Journey of USA Cheeses Conquering Global Palates

Words By Dali Ghazalay, Regional Director – Southeast Asia, U.S. Dairy Export Council

As the world’s largest cheese producer, the U.S. not only leads in quantity but also quality, with American cheeses winning numerous international awards. Join us as we explore how these cheeses have captured the hearts and taste buds of cheese lovers worldwide, making a mark far beyond American borders.

Discover how centuries-old cheese-making traditions brought to the U.S. by European settlers have transformed into a booming industry, producing over 1,000 cheese varieties.

U.S. DAIRY EXPORT COUNCIL

The Evolution of CheeseMaking in the USA

The United States, known as a melting pot of diverse cultures, boasts a rich culinary heritage shaped by centuries of immigration. Cheese-making in the U.S. traces back to the 1600s when European settlers introduced dairy farming traditions along with cheese production. As settlers moved westward, fertile lands enabled the cultivation of grains, sustaining dairy cattle year-round and yielding surplus milk for cheese making. Originally a home-based practice, cheese production expanded, leading to local trade and international exports.

Cheese is a nutrient-rich food with numerous health benefits. It’s a concentrated source of essential nutrients like protein, vitamins, and minerals, making it an ideal snack or addition to vegetarian diets. High-quality protein in cheese supports various bodily functions, while its retention of fat-soluble vitamins, such as vitamin A, enhances its nutritional value. Additionally, cheese, particularly aged varieties like cheddar, contains little to no lactose, making it suitable for those with lactose intolerance.

Leading The World in Cheese Production and Export

The story of incredible, award-winning cheese begins with a focus on the 9+ million cows found in all 50 states. Across the rolling hills of New England and the green pastures of Wisconsin to the canyons of Utah and the dramatic landscapes of California, farms, both big and small, participate in the first livestock animal care program in the world to be recognised by the International Organisation for Standardisation (ISO). U.S. milk production oversight and regulations have resulted in a reputation for products that are safe, nutritious, and delicious. American farmers work closely with animal nutritionists and veterinarians to ensure a steady year-round supply of sustainably produced milk that is then transformed into a wide variety of high-quality cheeses.

Today, the U.S. stands as a global cheese powerhouse, producing over 1,000 varieties inspired by global cultures and fuelled by American innovation and entrepreneurial spirit. Using state-of-the-art facilities, the U.S. contributes more than a quarter of the world’s cheese output, showcasing its evolution from humble farm beginnings to an industry of scale and innovation.

With a rising milk production capacity and competitive product portfolio, U.S. dairy farmers are well positioned and eager to fulfil the world’s expanding appetite for nutritious and delicious cheese – making the U.S. the world’s largest cheese producer. In 2023, the United States produced 6.3 million metric tons of cheese, which is 19 per cent more than the top three European Union producers (Germany, France, and Italy) combined. The number one U.S.-produced cheese was mozzarella, representing 34 per cent of total U.S. cheese production, with cheddar a close second, representing 29 per cent of total U.S. production.

Of the cheeses produced in the United States, 435,568 metric tons were exported in 2023, representing 6.8 per cent of total U.S. cheese production. This is an 845 per cent increase over 2000 export levels. Mexico and North Asia represent the top two regions for cheese exports, comprising 54 per cent or 235,145 metric tons.

May-June 2024 33 AsiaFoodJournal www.asiafoodjournal.com

USA Cheeses: A Global Champion in Quality and Craftmanship

The U.S. cheese community has gained recognition and praise on the international stage for many years, winning numerous awards and competitions. These accolades from cheese experts are a clear testament to the fantastic quality and craftsmanship of USA Cheeses.

The long-standing heritage of Cheese from the USA was at the forefront of the industry’s biggest competitions in 2023, receiving a combined total of 235 accolades and medals – 88 medals at the 2023-2024 International Cheese and Dairy Awards (including 34 Gold, 29 Silver, and 25 Bronze) and 147 at the 20232024 World Cheese Awards (including 7 Super Gold, 22 Gold, 41 Silver, and 77 Bronze).

The U.S. cheese industry continues to gain recognition against its international counterparts in recent years, having earned

134 medals at the 2022-2023 World Cheese Awards and 131 medals at the 2019-2020 World Cheese Awards, including the firstever American recipient crowned the “World Champion Cheese”: Rogue River Blue by Rogue Creamery in Oregon; an aged blue cheese wrapped in organic, hand-picked Syrah grape leaves that have been soaked in pear spirits. At the 2020 World Championship Cheese Contest, the U.S. brought home 265 medals, including 89 Best of Class.

Elevating Culinary Experiences in Singapore

The introduction of award-winning USA Cheeses to Singapore stems from the commitment of the USA Cheese Guild (managed by the U.S. Dairy Export Council) to sharing craftsmanship, quality, and innovation.

While USA Cheeses may not have the same historical fame as those from traditional cheese-producing countries, their numerous international awards underscore their ability to compete on the world stage.

Recognising the unique opportunity in the Southeast Asian market, the Guild aims to cater to discerning consumers seeking innovative, value-added cheeses that offer a distinct and elevated culinary experience. Through immersive cheese experiences, educational initiatives, and strategic partnerships with local distributors and culinary influencers, the Guild endeavours to deepen appreciation for USA Cheese while fostering brand loyalty and contributing to the dynamic growth of the cheese market in Singapore and the broader Asia-Pacific region.

May-June 2024 34 www.asiafoodjournal.com AsiaFoodJournal

Crunch Time: How

Europe’s Snack Sector Is Navigating Change and Seizing Strategic Opportunities

By Sebastian Emig, Director General, European Snacks Association (ESA)

In a landscape where tastes and trends evolve with the speed of a scrolling feed, the European snack sector emerges as a paragon of adaptability and forward-thinking. Amid challenges of rising production costs and environmental scrutiny, this vibrant industry is more than just surviving—it’s setting the pace.

Uncover the strategic endeavors and innovative breakthroughs steering the European snack market towards a future where every nibble tells a story of resilience, taste, and sustainability. Get ready to taste the future of snacking in Europe, where each bite is a step forward in a delicious revolution.

SPECIAL FEATURE

Salty Snacks Sector: Resilient

and Evolving

The European snacks market stands out in this changing landscape for its resilience. Despite soaring production costs and logistical challenges, the sector has remarkably adapted and thrived. The rise of “snackification” is a testament to this adaptability, highlighting a shift towards convenient, nutritious, and sustainable snacking options.

This evolution is particularly evident in how snacks are integrated into regular meal routines.

Driven by time constraints and a desire for culinary creativity, consumers increasingly turn to snacks as between-meal fillers and as components of their diets.

The future of the snack market is bright, with significant growth anticipated, especially in healthier and more sustainable options. Consumers are increasingly aware of the impact of their food choices on their health and the environment, and this awareness is driving innovation in the snack sector.

Manufacturers are responding with snacks that are not only tasty but also nutritionally enriched, meeting the demands of a discerning consumer base.

Strategic Opportunities in the Snacking Sector

As we look towards the upcoming political cycle in Europe, ESA is strategically positioned to influence and shape industry strategies.

Our commitment to sustainability, health, and nutrition has never been stronger.

Through initiatives such as the EU Code of Conduct for Responsible Food Business and Marketing Practice, we aim to guide the industry towards responsible practices that align with consumer expectations and regulatory frameworks.

The upcoming EU Parliament and Commission elections present a unique opportunity for the ESA to advocate for policies and regulations that benefit the snack industry. Projections suggest that nearly 60 percent of the members of the European Parliament will be replaced, and the next European Commission will have to tackle fundamental drivers of food systems like declining food security amidst environmental degradation, resource depletion, and climate change.

A further fragmentation and rise of the extremes in the European Parliament is expected and several national elections will change the political landscape in the Council. Migration and economic security will gain further importance on the EU agenda. With all this in mind, the EU may probably give up on some of the Farm to Fork ambitions, notably nutrient profiling and front-of-pack nutrition labelling. Your team in Brussels is dedicated to being a reliable partner for policymakers, striving to balance industry needs with consumer demands and environmental stewardship.

Navigating Inflationary Pressures and Consumer Priorities

May-June 2024 36 www.asiafoodjournal.com AsiaFoodJournal

Inflationary pressures are a significant concern in today’s market, impacting production costs and consumer spending power. The snack industry is not immune to these challenges. However, it is encouraging to see manufacturers innovate to maintain affordability while ensuring quality. This balance is crucial in retaining consumer trust and loyalty in a competitive market.

Another critical aspect is the increasing consumer focus on sustainability and environmental impact. The snack industry is responding with initiatives that promote sustainable sourcing, reduce waste, and embrace eco-friendly packaging solutions. These efforts resonate with environmentally conscious consumers and contribute to the broader goal of a sustainable food system.

Health, Nutrition, and Flavour Trends

Health and nutrition continue to be at the forefront of consumer priorities. Growing demand for snacks offering health benefits, such as those rich in protein, fibre, and essential nutrients. This trend is complemented by a rising interest in global flavours and culinary diversity as consumers seek snacks that offer nutritional value and exciting taste experiences.

The concept of ‘healthy indulgence’ is still gaining traction, where consumers look for snacks that satisfy their cravings without compromising health.

This trend reflects a more holistic approach to snacking, where enjoyment and wellbeing go hand in hand.

The Role of Technology and Innovation

Technology plays a pivotal role in shaping the future of the snack industry. From advanced manufacturing processes to innovative packaging solutions, technological advancements enable manufacturers to meet consumers’ evolving needs more efficiently and sustainably.

Innovation is not limited to product development but extends to how brands engage with consumers. Digital platforms, social media, and data analytics are transforming marketing strategies, allowing for more personalized and interactive consumer experiences.

With AI’s rapidly expanding possibilities, our industry faces a crucial revolution that will touch all aspects: raw material sourcing and quality control, transport considerations, and more adapted and refined manufacturing processes for smarter and more agile marketing of our wonderful products.

Since 2012, Sebastian has been the Director General of the European Snacks Association asbl (ESA), a diverse membership base of over 170 companies encompassing snack manufacturers, their suppliers, and national trade associations.

For several years now, Sebastian has been chairing the FoodDrinkEurope Diet and Health Working Group that looks after the health and nutrition debate on the EU level and the FoodDrinkEurope Food Taxation Task Force.

He is a member of various European industry platforms and stakeholder gatherings.

May-June 2024 37 AsiaFoodJournal www.asiafoodjournal.com

About the Author Sebastian Emig Director General, European Snacks Association (ESA)

Sebastian has nearly 20 years of experience in advocacy and public affairs in and around Brussels.

FEATURE STORY

3 Key F&B Trends Driving Asia’s Food & Beverage Industry in 2024

By Jie Ying Lee, Senior Strategy Manager for Taste, Kerry APME

With snacking and healthy indulgence shaping the food and beverage industry, Kerry’s findings will help manufacturers direct the trajectory of their business for the remaining quarters of 2024.

Personal health, sustainability, and enhanced sensorial experiences are the biggest consumer themes that will shape the sector across the Asia Pacific, the Middle East, and Africa (APMEA).

Consumer behaviour has changed significantly in recent years and continues to evolve rapidly, influencing food and beverage trends.

Recent Kerry proprietary insights on the future of food and beverages, show that consumers in APMEA continue to prioritise their personal health by placing more importance on self-care. They are also adapting to a more sustainable lifestyle that focuses on conscious consumption and knowing where their food comes from. At the same time, new sensorial experiences, particularly around traditional flavours and modern twists, are in demand. But how can product and menu developers tap into these trends to develop food and beverages people want?

Tools that provide an in-depth analysis of the flavours, ingredients, and trends that will shape what we consume, are essential in guiding successful food innovation.

Consumers love fresh interpretations of traditional flavours

The APMEA consumer is heavily influenced by the region’s diverse cultural traditions. According to Kerry research, Asia Pacific consumers are rediscovering the magic of their own culinary heritage while looking for unique regional ingredients and flavour profiles.

Findings from FMCG Gurus on innovative flavours mirror this, with 55 percent of consumers worldwide rating traditional flavours as a key influence on their food and drink choices.

According to proprietary insights from Kerry’s 2024 Taste Charts, trending savoury flavours in Thailand, such as Japanese teriyaki, Japanese sukiyaki, Japanese curry, Japanese miso, Korean gochujang, Indian tikka, and Mediterranean, indicate that Thai consumers are looking for global fusion flavours.

As a result, cross-cultural flavour combinations with an unexpected twist and modern takes are getting big. You’ll see this in unlikely pairings like Thai curry with miso and rendang with gochujang, and elsewhere in the region, Sichuan peppercorn ice cream in China, calamansi-infused yogurt in the Philippines, or black sesame latte in Japan.

Other savoury flavours like soy sauce, fish sauce, and fermented fish are also tickling the tastebuds in Thailand. Growing consumer interest in fermented foods and the health benefits they offer—which include antioxidant and anti-inflammatory properties—is leading to innovative dishes like charcoal-grilled skewers with fermented chilli paste.

By harnessing the depth and complexity that fermented flavours bring, industry players can create products that satisfy the consumer craving for modern updates of their favourite traditional food.

May-June 2024 39 AsiaFoodJournal www.asiafoodjournal.com

Hot and spicy flavours are on fire

Kerry insights show that consumers are developing sophisticated taste preferences, and bold flavours like hot and spicy appeal to many. People are always up for a challenge and enjoy pushing their boundaries when it comes to hot and spicy foods. Millennials and Gen Z even regard the ability to eat hot and spicy food as a life skill.

While the demand is widespread across the globe, hot and spicy is part of the Southeast Asian DNA with almost every cuisine claiming a variation of a chilli condiment. People want familiar spices but are also open to new types, further fanning the trend.

In Japan, where hot and spicy foods are traditionally not widely enjoyed, consumers are now riding the “gekikara” (extremely spicy) craze.

A study showed that 32 percent of Japanese consumers who originally did not like spicy food now relish them, prompting brands to launch more hot and spicy options across different channels.

Within APMEA, people are replicating ethnic dishes they sampled during their travels — many of which are hot and spicy — resulting in diversity across markets. In Indonesia, crispy prawn chilli, ghost pepper, Korean buldak sauce, jalapeno chilli, and habanero chilli are trending. This reinforces the desire for complex and nuanced heat experiences that offer authentic and exotic flavours, particularly region-specific spices, chillies, and hyperlocal flavours.

In South Africa, authentic local flavours such as Chicken Dust, a popular South African street food of seasoned chicken pieces chargrilled over open flames, creative combinations of chilli lemon and chilli lime, and universally appealing flavours such as jalapeno atchar, are enjoying great popularity.

Wellness and sustainability influence dietary habits

The emphasis on self-care has evolved from mere health-consciousness to prioritising health in food choices. A FMCG Gurus report on consumer perceptions of health and wellness shows that 68 percent of global consumers have actively sought to improve their diet in the last two years.

The APMEA region is unique in that consumers view sustainability and transparency as inherent to their wellbeing — the source of their food directly influences the quality of their health.

May-June 2024 40 www.asiafoodjournal.com AsiaFoodJournal

The preference for local ingredients is strong; in Vietnam, beverage flavours such as mango, pink guava, honeydew, custard apple, dragon fruit, and longan are trending, indicating a resurgence of pride in local ingredients and time-honoured cooking methods. This holds potential for innovation in sustainable flavours and solutions –people want food that supports their health and that they feel good eating.

Elsewhere in Kerry Taste Charts, data from the Philippines reveals a rise in functional flavours in beverages. Honey, calamansi, almond, matcha, turmeric, and elderberry are piquing interest for their perceived health benefits, and this is evident in drinks such as lemongrass tea and turmeric latte; similar preference goes for beverages that boost mental alertness and physical performance.

Fruits such as yuzu and passionfruit are also coming to the fore. Yuzu can be seen in recent launches like Yuzu Gose beers in South Africa, yuzu and pepper mayonnaise in China, and Yuzu low ABV wines and alcoholic beverages in Australia. Cold beverage passionfruit flavour appeared in 13 different global regions in Kerry’s Taste Charts, with passionfruit already a mainstream ingredient in New Zealand, and an emerging flavour in the Middle East.

When it comes to plantbased products, health, and sustainability concerns continue to be driving factors, but now novel flavours in meat and dairy alternatives are capturing consumer tastes.

This has led to the launch of foods like jackfruit rendang in Indonesia, mushroom jerky in Australia, and chickpea falafel with a Middle Eastern twist.

Understanding and delivering on market preferences