The official magazine of Home Builders Association of Middle Tennessee President

Brandon Rickman

Vice President Jim Hysen

Secretary/Treasurer

Kelly Beasley

Executive Vice President John Sheley

Editor and Designer Jim Argo

Staff

Connie Nicley

Kim Grayson

THE NAIL is published monthly by the Home Builders Association of Middle Tennessee, a non-profit trade association dedicated to promoting the American dream of homeownership to all residents of Middle Tennessee.

SUBMISSIONS: THE NAIL welcomes manuscripts and photos related to the Middle Tennessee housing industry for publication. Editor reserves the right to edit due to content and space limitations.

POSTMASTER: Please send address changes to: HBAMT, 9007 Overlook Boulevard, Brentwood, TN 37027. Phone: (615) 377-1055.

For advertising rates and information, or to secure your ad, please email jargo@hbamt.org with your questions and requests.

The popular wine tasting event returned in March to Travellers Rest in Nashville.

Following two months of decline, consumer confidence rose last month thanks to short term optimism. 13

The HBAMT Spring Fling & Builders Show returns May 9th. Secure your booth or sponsorship to participate now.

Higher mortgage rates and home prices, as well as increased construction costs contributed to lackluster new home sales in February, but signs point to improvement later in the year.

Sales of newly built, single-family homes in February increased 1.1% to a 640,000 seasonally adjusted annual rate from a downwardly revised reading in January, according to newly released data by the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. However, new home sales are down 19% compared to a year ago.

“Builders continue to face challenges in terms of higher interest rates, elevated construction costs and access to critical materials like electrical transformers,” said Alicia Huey, chairman of the National Association of Home Builders (NAHB) and a custom home builder and developer from Birmingham, Ala. “Nonetheless, the lack of existing home inventory means demand for new homes will rise as interest rates decline over the coming quarters.”

“The February new home sales data points to an increase for the monthly pace of single-fam-

ily construction starts later in 2023 given a rise in builder sentiment and an increase for sales of homes not yet started construction,” said NAHB Chief Economist Robert Dietz. “However, concerns remain about the tightening of credit conditions for acquisition, development and construction loans for smaller builders due to recent stress for the banking system.”

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the February reading of 640,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory fell for the fifth straight month. The February reading indicated an 8.2 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. However, single-family resale home inventory stands at a reduced level of 2.5 months.

The median new home sale price rose in February to $438,200, up 2.5% compared to a year ago. Elevated costs of construction have contributed to a rise in home prices. A year ago, roughly 15% of new home sales were priced below $300,000, while that share is now just 10% of homes sold.

Regionally, on a year-to-date basis, new home sales fell in all regions, down 29.2% in the Northeast, 21.3% in the Midwest, 7.3% in the South and 40.6% in the West n

Concerns remain about the tightening of credit conditions for acquisition, development and construction loans for smaller builders.

Single-family production remained at an anemic pace in February as builders continue to wrestle with elevated mortgage rates, high construction costs and tightening credit conditions that threaten to be exacerbated by recent turmoil in the banking system.

Led by gains in apartment construction, overall housing starts in February increased 9.8% to a seasonally adjusted annual rate of 1.45 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

The February reading of 1.45 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 1.1% to an 830,000 seasonally adjusted annual rate. However, this remains 31.6% lower than a year ago. The multifamily sector, which includes apartment buildings and condos, increased 24% to an annualized 620,000 pace.

“Builders continue to grapple with increased market uncertainty due to ongoing building material supply bottlenecks, volatile mortgage rates and increased jitters in the banking sector,” said Alicia Huey, NAHB Chairman. “At the same time, builder sentiment has been edging higher in the early part of 2023 as a significant amount of housing demand exists on the sidelines and resale inventory is limited.”

“Despite persistent supply-side challenges, rising builder confidence is signaling a turning point for home building later in 2023,” said NAHB Chief Economist Robert Dietz. “Starts were up in February given a limited pullback for interest rates. We expect volatility in the months ahead as ongoing challenges related to construction material costs and

availability continue to act as headwinds on the housing sector. However, interest rates are expected to stabilize and move lower in the coming months, and this should lead to a sustained rebound for single-family starts in the latter part of 2023.”

On a regional basis compared to the previous month, combined single-family and multifamily starts were 16.5% lower in the Northeast, 70.3% higher in the Midwest, 2.2% higher in the South and 16.8% higher in the West.

Overall permits increased 13.8% to a 1.52 million unit annualized rate in February. Single-family permits increased 7.6% to a 777,000 unit rate. Multifamily permits increased 21.1% to an annualized 747,000 pace.

Looking at regional permit data compared to the previous month, permits were 2.8% lower in the Northeast, 9.6% higher in the Midwest, 10.9% higher in the South and 30.0% higher in the West.

Although high construction costs and elevated interest rates continue to hamper housing affordability, builders expressed cautious optimism in March as a lack of existing inventory is shifting demand to the new home market.

Builder confidence in the market for newly built single-family homes in March rose two points to 44, according to the NAHB/ Wells Fargo Housing Market Index (HMI) released today. This is the third straight monthly increase in builder sentiment levels.

“Even as builders continue to deal with stubbornly high construction costs and material supply chain disruptions, they continue to report strong pent-up demand as buyers are waiting for interest rates to drop and

turning more to the new home market due to a shortage of existing inventory,” said Huey. “But given recent instability concerns in the banking system and volatility in interest rates, builders are highly uncertain about the nearand medium-term outlook.”

“While financial system stress has recently reduced long-term interest rates, which will help housing demand in the coming weeks, the cost and availability of housing inventory remains a critical constraint for prospective home buyers,” said Dietz. “For example, 40% of builders in our March HMI survey currently cite lot availability as poor. And a follow-on effect of the pressure on regional banks, as well as continued Fed tightening, will be further constraints for acquisition, development and construction (AD&C) loans for builders across the nation. When AD&C loan conditions are tight, lot inventory constricts and adds an additional hurdle to housing affordability.”

Meanwhile, the HMI survey shows that builders had better than anticipated new home sales during the past two months because of continued use of incentives and price discounts. Thirty-one percent of builders said they reduced home prices in March, the same share as in February, but lower than the 36% that was reported last November. And 58% provided some type of incentive in March, about the same as the 57% who did in February, but lower than the 62% of builders who offered incentives in December.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

The HMI index gauging current sales conditions in March rose two points to 49 and the gauge measuring traffic of prospective buyers increased three points to 31. This marks the strongest traffic reading since September of last year. The component charting sales expectations in the next six months fell one point to 47.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose five points to 42, the Midwest edged onepoint higher to 34, the South increased five points to 45 and the West moved four points higher to 34. n

Housing starts remain down, builder confidence edges up

The popular “Taste of Torciano” returned to Travellers Rest in Nashville last month. The wine tasting event provides members a chance to taste some of Italy’s finest wines paired with palate-pleasing hors d’oeurvres and dinner selections. Proceeds from the evening benefit the Home Builders’ PAC.

A big thanks again to all our event sponsors: Builders Mutual, Dimplex, Ferguson, Metro Carpets, Ole South Properties, Tolbert Marketing & Events, and Tune, Entrekin & White. n

HBAMT members Ole South Properties and U.S. Bank have partnered with Freedom Alliance to honor one of our nation’s heroes with the gift of a mortgage-free home. U.S. Army Sergeant Xanthin Luptak and his family received the keys to their new home during a ceremony held last month at their new home.

The life-changing gift is made possible by a donation by U.S. Bank through its Housing Opportunities after Military Engagement (H.O.M.E.) program, in conjunction with Freedom Alliance’s Heroes to Homeowners program. Since 2013, U.S. Bank has donated 22 homes valued at $4.8 million to deserving military families in thriving communities across the country.

Sergeant Luptak’s service to our country began in 2004 when he secured his mother’s permission to enlist in the Indiana National Guard at age 17. The following year, he moved to active duty and was stationed at Hawaii’s Schofield Barracks where he used the island environment to train in jungle warfare. In 2007, at a pivotal time in the war, he served a 15-month deployment to Iraq. Using his skills as a combat engineer, he

performed dangerous route clearing missions in which he and his team removed hidden bombs in order to create safer passage for U.S. troops.

In 2010, while stationed at Fort Carson in Colorado, Xanthin met Jessica and they would later marry and start a family. During that time, Xanthin was proud to receive a temporary assignment at the U.S. Military Academy at West Point where he trained cadets on route clearance operations. Xanthin also trained Afghan police on these same procedures while in Afghanistan in 2011. During his deployments, he survived repeated engagement with enemy forces but was severely wounded. While overseas, Xanthin was exposed to dangerous toxins from burn pits and when he was examined prior to surgery for his combat injuries, he was diagnosed with non-Hodgkin’s lymphoma. He underwent chemotherapy and is in remission. He was medically discharged in 2017.

The new home was constructed by locally owned and operated builder, Ole South, which is consistently recognized by Builder Magazine as being one of the Top 100 Home Builders in the country. n

About U.S. Bank: U.S. Bancorp, with approximately 77,000 employees and $675 billion in assets as of December 31, 2022, is the parent company of U.S. Bank National Association. The Minneapolis-based company serves millions of customers locally, nationally and globally through a diversified mix of businesses: Consumer and Business Banking; Payment Services; Corporate & Commercial Banking; and Wealth Management and Investment Services. MUFG Union Bank, consisting primarily of retail banking branches on the West Coast, joined U.S. Bancorp in 2022. The company has been recognized for its approach to digital innovation, social responsibility, and customer service, including being named one of the 2022 World’s Most Ethical

Companies and Fortune’s most admired superregional bank. Learn more at usbank. com/about

About Ole South: Ole South Properties is Tennessee’s largest home builder.* Our Founder and Owner, John Floyd, started his career in Real Estate at the age of 23 and has experienced firsthand how providing a quality home is not just the right thing to do, but also a good business model to follow. Since inception in 1986, Ole South has been dedicated to providing the very best new home value to families in Middle Tennessee areas such as Nashville, Murfreesboro, Smyrna, Fairview, Pleasant View, Shelbyville, and Spring Hill. Ole South, headquartered in Murfreesboro, Tennessee and independently

owned, is proud to be recognized among the Top 100 Home Builders in the nation. Learn more at OleSouth.com

About Freedom Alliance: Freedom Alliance is a charitable organization providing help and support to wounded troops and military families. Freedom Alliance has awarded more than $20 million in college scholarships to children of heroes killed or disabled in military service and spent millions more helping injured veterans and their families with outdoor recreational therapy trips, Heroes Retreats, care packages for deployed troops, mortgage-free homes, all-terrain wheelchairs and much more. Learn more about Freedom Alliance at FreedomAlliance. org or facebook.com/FreedomAlliance n

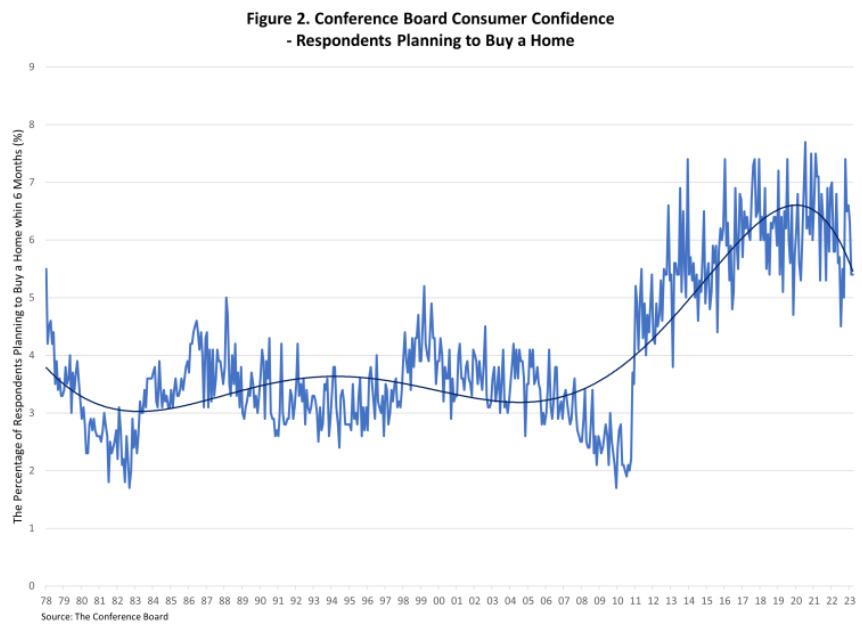

Consumer confidence rose slightly following two months of declines thanks to the optimism in the short-term outlook. Even though confidence rose in March, consumers are planning to spend less on highly discretionary categories such as concerts and dining. As a result, consumers are planning to spend more on less discretionary categories such as home maintenance and repair.

Consumers’ assessment of current business conditions declined in March. The share of respondents rating business conditions “good” rose by 0.4 percentage points to 18.4%. The share claiming business conditions “bad” rose by 1.9 percentage points to 19.3%. Meanwhile, consumers’ assessment of the labor market was also less favorable. The share of respondents reporting that jobs were “plentiful” fell by 2.1 percentage points to 49.1%, while those saw jobs as “hard to get” remained unchanged at 10.3%.

Consumers were slightly less pessimistic about the short-term outlook. The share of respondents expecting business conditions to improve rose from 14.6% to 15.5%, while those expecting business conditions to deteriorate fell from 21.6% to 18.5%. Similarly, expectations of employment over the next six months were more positive. The share of respondents expecting “more jobs” increased by 0.5 percentage points to 15.0%, and those anticipating “fewer jobs” decreased by 1.3 percentage points to 19.9%.

The Conference Board also reported the share of respondents planning to buy a home within six months. The share of respondents planning to buy a home remained at 5.4% in March. The share of respondents planning to buy a newly constructed home increased to 0.8%, while for those who planning to buy an existing home increased to 2.5%. n

The Builders Show exhibit tent will be located on the south side of the HBAMT building and measure 120 x 40 feet boasting space for forty-five (47) 10 x 5 feet exhibit spaces.

Return your registration form to the HBAMT today to reserve your space or sponsorship! Exhibit spaces are limited to two per company.

Return your registration form to the HBAMT today!

Secure your spot today by returning the registration form provided below to the HBAMT today!

I am registering as an: r EXHIBITOR - $595 per booth r SPONSOR - $550

EXHIBITORS are provided exhibit space inside the exhibit tent. SPONSORS enjoy all the benefits of an exhibitor, including access to the tent, without being provided exhibit space in the tent.

Your name: ______________________________________

Company: _______________________________________

Cell: __________________ Email: ____________________

EXHIBITORS: Top 3 booth location preferences (not guaranteed): ________ ________ ________

Number of booths you’re purchasing (no more than two): _______ x $595 = your total payment: $____________

SPONSORS: will be charged $550.

Credit Card ______________________________________

Credit Card # ______________________ Exp. __________

Credit Card V-Code _______________

The “v-code” is found on the back of the card, usually printed or embossed atop or near the signature strip. It is comprised of three digits found to the right of a longer number.

Signature ________________________________________

Twenty-seven SPIKES (in bold) increased their recruitment numbers last month. What is a SPIKE? SPIKES recruit new members and help the association retain members. Here is the latest SPIKE report as of February 28, 2023.

CHEATHAM COUNTY CHAPTER

Chapter President - Roy Miles

Cheatham County Chapter details are being planned. Next meeting: to be announced.

Chapter RSVP Line: 615/377-9651, ext. 310

DICKSON COUNTY CHAPTER

Chapter President - Mark Denney

The Dickson County Chapter meets on the third Monday of the month, 12:00 p.m. at Colton’s Steakhouse in Dickson. Next meeting: to be announced.

Price: FREE, lunch dutch treat.

Chapter RSVP Line: 615/377-9651, ext. 264

MAURY COUNTY CHAPTER

Chapter President - Lisa Underwood Maury County Chapter details are currently being planned. Next meeting: to be announced.

Chapter RSVP line: 615-377-9651, ext. 312; for callers outside the 615 area code, 1-800-571-9995, ext. 312

METRO/NASHVILLE CHAPTER

Chapter President - Tonya Esquibel

The Metro/Nashville Chapter meets on the third Tuesday of the month, 11:30 a.m. at the HBAMT offices.

Next meeting: to be announced.

Topic: to be announced.

Price: to be announced.

RSVP to: cnicley@hbamt.org

ROBERTSON COUNTY CHAPTER

Next meeting: to be announced. Robertson County RSVP line: 615-377-9651, ext. 313.

SUMNER COUNTY CHAPTER

Chapter President - Joe Dalton

The Sumner County Chapter meets on the fourth Tuesday of the month, 11:30 a.m. at the new Hendersonville Library. Next meeting: to be announced.

Chapter RSVP Line: 615/377-9651, ext. 262

WILLIAMSON COUNTY CHAPTER

Chapter President - Christina James

The Williamson County Chapter meets on the third Tuesday of the month, 11:30 a.m. at the HBAMT offices.

Next meeting: to be announced. Builders Free pending sponsorship.

Price: $10 per person with RSVP ($20 w/o RSVP).

Chapter RSVP Line: 615/377-9651, ext. 305

WILSON COUNTY CHAPTER

Chapter President - Margaret Tolbert

The Wilson County Chapter meets on the second Thursday of the month at varying locations in the Wilson County area.

Next meeting: Thursday, April 13th, 11:30 a.m. at the Lebanon Airport. 200 Aviation Way Suite 202 Lebanon, TN 37090

Topic: “Wilson County Growth and Community Update,” with guest speaker Corey Johns, Executive Director of the Joint Economic and Development Board

Join the Wilson County Chapter at the Lebanon Airport as Corey Johns shares what the future holds for Wilson County and responds to your questions & feedback.

HBAMT members free thanks to Lennar!

LIMITED TO THE FIRST 30 TO RSVP RSVP to: cnicley@hbamt.org

HBAMT REMODELERS COUNCIL

Council President - Eli Routh

The HBAMT Remodelers Council meets at varying locations throughout the year.

Next meeting: to be announced.

Topic: to be announced.

Council RSVP Line: 615/377-9651, ext. 263

RSVP to: cnicley@hbamt.org

INFILL BUILDERS COUNCIL

The Infill Builders Council typically meets on the third Thursday of the month, 11:30 a.m. at the HBAMT offices

Next meeting: to be announced.

Price: to be announced.

RSVP to: 615/377-9651, ext. 265.

MIDDLE TENN SALES & MARKETING COUNCIL

Council President - Kelvey Benward

The SMC typically meets on the first Thursday of the month, 9:00 a.m. at the HBAMT offices*.

Next meeting and topic: Thursday, April 6th at the HBAMT.

Topic: “How to Stand Out in Today’s Marketplace,” with Margaret Tolbert, Tolbert Marketing & Events.

Join the SMC in April to learn great ways to build relationships and stand out. Tips will include details on events, gifting, email marketing, social media, and more!

SMC members free thanks to Mortgage Mike and Movement Mortgage! Non-SMC members $15 w/RSVP, $20 w/o RSVP RSVP REQUIRED - LIMITED SEATING RSVP to: cnicley@hbamt.org