Welcome to a health plan made with you in mind – access to doctors you trust, perks you deserve and customer service reps always ready to help. We’re happy you’re here and are excited to help you use your plan and all its perks made to fit your needs. Thanks for being a member.

it comes to coverage, it’s all about you.

Your plan is made to give you access to the care you need from a large network of providers you trust.

Our statewide network of doctors, hospitals and clinics connects you to world-class care with names you already know and trust. Wherever you’re at in Illinois, we connect you with the care you deserve.

You have access to a group of doctors, hospitals, pharmacies and other providers who agree to give you care at a discounted rate. Log in at hally.com or call Customer Service to find in-network doctors, hospitals and pharmacies.

For a full list, visit: HealthAlliance.org/StateofIllinois

With your health maintenance organization (HMO) plan, you can go out of network for emergency situations. If you have an urgent or emergency situation, we’ll still cover your claims at the in-network level anywhere you go.

Your doctor might require you to get a referral to see a specialist. Check with your doctor before you see a specialist or other provider to make sure you’ve taken the proper steps. If there’s no in-network specialist to treat your specific condition, we’ll help you find one. And you’ll still pay the in-network cost if you get prior authorization from us.

For specific drugs or services, your doctor must request prior authorization to make sure you meet certain requirements before we’ll cover them. To find out if a drug or service requires prior authorization, please refer to your policy document.

Providers can submit a prior authorization one of the following two ways:

• Submit a prior authorization request through our provider website.

• Fax a prior authorization form to (217) 902-9798.

Decisions are made within 24 to 72 hours of your provider’s request.

Get 24/7 answers to your health questions, like whether you need to set up an appointment or see a doctor right away.

Try setting up an appointment with your PCP if your injury or illness isn’t an emergency. Your PCP knows your health history and helps oversee your care.

(Convenient

If you can’t get an appointment with your PCP or you’re traveling, go to urgent care if your injury or illness isn’t an emergency. This can help you save time and money compared to the emergency department. You may need to pay upfront at some urgent care facilities but will be reimbursed. Pay attention to your bills to make sure you’re billed for urgent care. If your service is billed as a traditional office visit and is out of network, coverage may be denied on HMO plans.

Some injuries or illnesses require emergency care, but if your injury or illness doesn’t require immediate medical attention, calling your doctor or going to an urgent care clinic (sometimes called convenient care or a walk-in clinic) can save you time and money. Going to the emergency department for non-emergencies can increase costs for you and healthcare overall, and the emergency department doesn’t know your full medical history like your doctor does. Plus, it usually has long wait times.

Always go to the emergency department or call 911 if you experience:

• Stroke symptoms.

• Chest pains.

• Head or spinal injuries.

• Severely broken bones.

These are examples, not a complete list. If you think your condition is a life-threatening emergency, call 911 or go to the nearest emergency department. Then, after you’ve received treatment, contact your PCP and us. This will help us coordinate your care after your visit. Your plan covers emergency and urgent care out of network, so even if you’re traveling, you can still get the care you need without having to worry about finding an in-network facility.

When you get sick or injured, it’s sometimes hard to know where to go for care. Your plan is made with plenty of options for different situations based on how severe your condition is, where you are and other factors.

Where you get your drugs filled matters. Log in at hally.com or call Customer Service to find an in-network pharmacy near you.

Before you go, check the drug formulary for your drug’s tier at hally.com. Every drug listed in our formularies is put into a cost group, or tier. You typically pay the lowest price for a Tier 1 drug. As you step up to the next tier, the amount you pay increases.

Your provider can call our Pharmacy department at (800) 851-3379 (option 4) to ask about lower-cost options for your drugs.

See the list of drugs we cover in our formulary at HealthAlliance.org/Pharmacy.

You can find a list of drugs covered by your plan, including the payment tier for each drug, using the formulary. Drug coverage is voted on by the P&T (Pharmacy and Therapeutics) committee. It consists of a group of clinical pharmacists, medical directors and doctors in various specialties.

You can order a 90-day supply of certain prescription drugs through the mail for a discounted rate. Learn more about the program by calling Optum Rx ®, your pharmacy benefits manager, at (800) 763-0044.

Your plan is made for more than when you’re sick. It’s made to help you stay healthy in the first place, so you have a team of health coaches, care coordinators and more to help you with both.

Whether you’d like to speak to a dietitian, want to quit smoking or need help understanding a recent diagnosis, we have teams to help you achieve your goals or get you back on track.

Connect to a team of providers, like nurse practitioners, social workers, health coaches, dietitians, pharmacists and more, who work with your doctor to make sure you have the resources you need to stay healthy or work through your medical issues.

The care coordination team reaches out to offer these free services, but you can also request them if you’d like this personalized help.

Find helpful resources.

Care for yourself to help prevent illness and hospital stays.

Set and reach health and wellness goals.

Understand and manage health issues, like diabetes and asthma.

Coordinate your care when you have complicated health conditions.

Use your health benefits to save money.

We value giving you the member experience you deserve with a variety of options to fit your busy lifestyle –and as a member of our health plan, you get access to our comprehensive suite of health and wellness resources, programs, perks and offerings. We call this Hally health. Hally health is your ally in your wellness journey. Whenever you see the word “Hally,” it’s us at your health plan connecting you with a resource or support that’ll help you live your healthiest life.

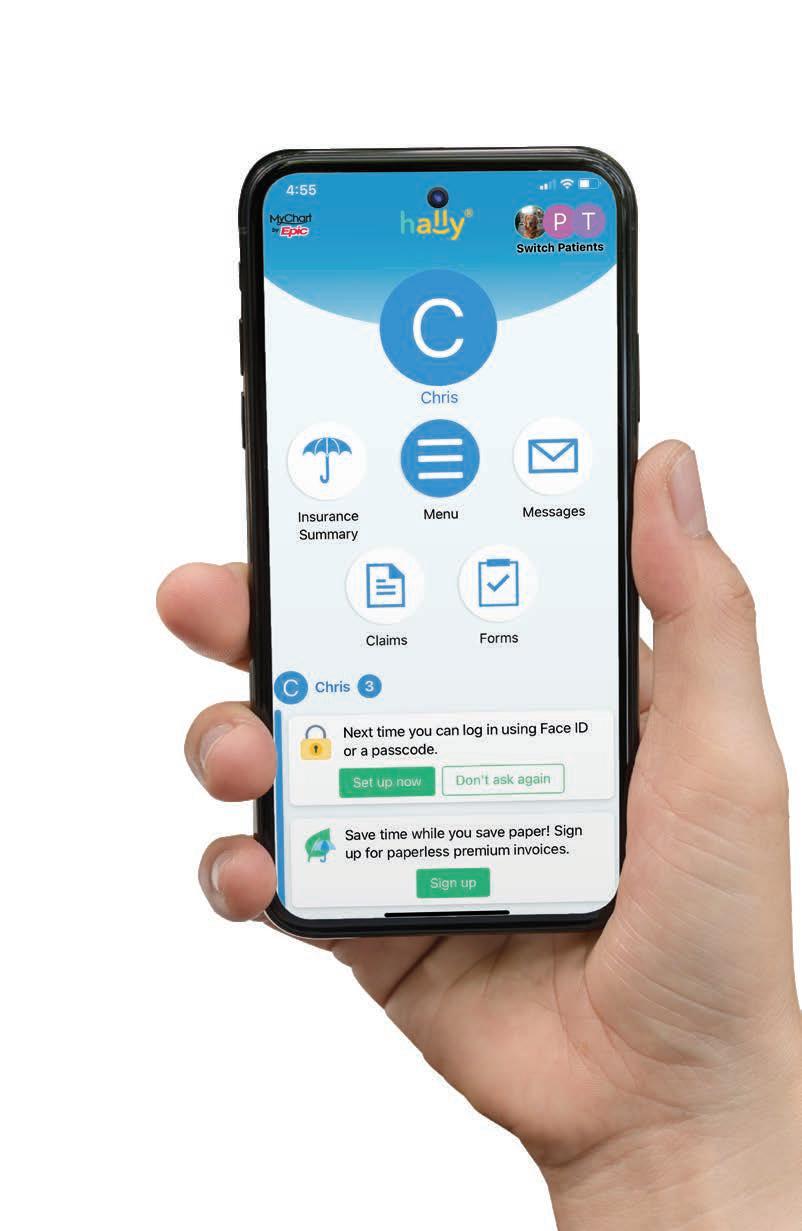

As a member, you also get secure, instant access to your health insurance coverage by logging in to your Hally account through the MyChart app or on hally.com. Review your plan coverage, discover resources and support for your health conditions, and find the care you need anytime, anywhere.

Exclusive perks for health plan members

– when you sign in to your member portal through hally.com, you can:

• Go paperless by opting in for secure e-Delivery of your plan materials.

• View past and current claims, authorizations and Explanations of Benefits (EOBs).

• Pay your monthly premium using Premium Bill Pay and set up recurring payments.

• Find doctors, facilities and pharmacies covered by your plan.

• Track spending on healthcare expenses.

• Know where to go for care depending on your symptoms.

• Ask a customer service or care coordination question.

• Sign up for text alerts.

• Compare costs with our Treatment Cost Calculator.**

**Not available for our Medicare members.

With your Hally account on the MyChart app, you’re able to:

• Go paperless by opting in for secure e-Delivery of your plan materials.

• View past and current claims, authorizations and Explanations of Benefits (EOBs).

• Pay your monthly premium using Premium Bill Pay and set up recurring payments.

• Find doctors, facilities and pharmacies covered by your plan.

• Track spending on healthcare expenses.

• Know where to go for care depending on your symptoms.

• Sign up for text alerts.

• You also stay seamlessly connected to all the Hally health resources, programs, perks and offerings from your health plan. You get the tools, tips and resources you need to help you live your healthiest life.

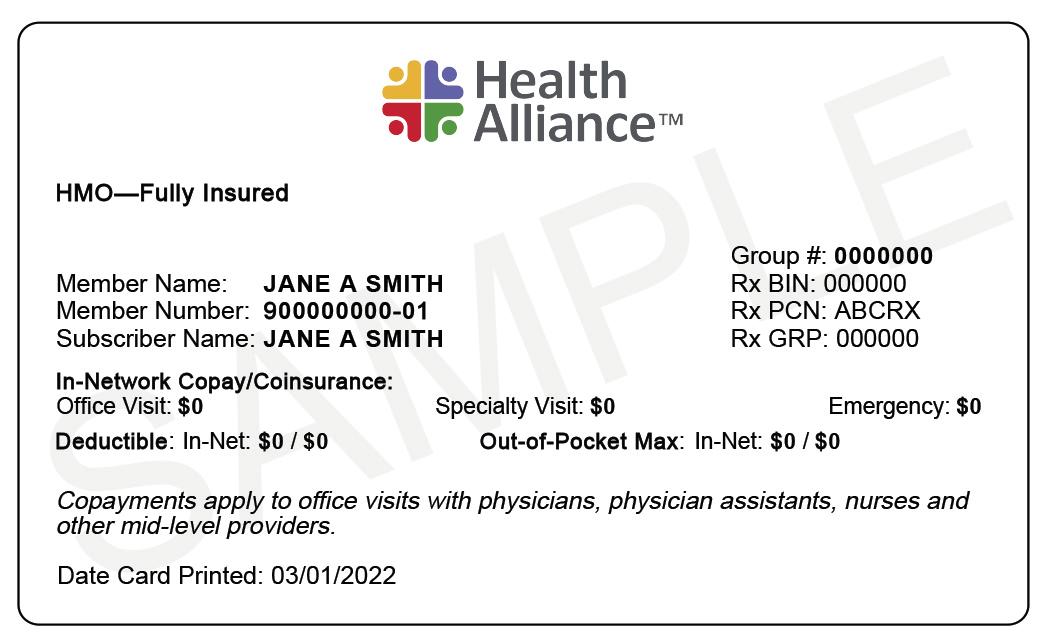

*Benefits and coverage may vary from plan to plan. Please review your plan documents or call the number on the back of your member ID card for specifics.

We know with everything going on in life, staying healthy is easier said than done.Download the MyChart mobile app to access your Hally account information on the go. Visit the App Store ® or Google Play ®, or simply scan one of these QR codes.

Health coaches are your health partners. They’ll help you reach your health goals in the following areas and more:

• Nutrition.

• Weight loss.

• Staying active.

Call the number on the back of your ID card to speak with a health coach.

Get care when and where you need it through virtual health coverage. With the telehealth benefit, you can connect with your primary care provider or specialist over the phone or online without the inconvenience of going to the doctor’s office or sitting in a waiting room. And with the virtual visit benefit, you can connect 24/7 with a board certified doctor or counselor by phone, secure video or our member app.

Get care when and where you need it with virtual health coverage. If you need to interact with your primary care provider (PCP) or specialist over the phone or online, you’re covered through the telehealth benefit. You don’t even need to leave the comfort of your home.

Get care for common conditions like allergies, cold, flu and pink eye from anywhere you have phone or internet connection in the U.S.

Whether at home or traveling, you can talk to a board certified doctor or counselor by phone or secure video through hally.com at any time of the day, any day of the year.

Get seen for 50+ conditions – physical and behavioral:

• Addictions.

• Allergies.

• Cold/flu.

• Depression.

• Ear problems.

• Fever.

• Grief and loss.

• Panic disorders.

• Skin conditions.

• Trauma.

Talk with a primary care provider virtually for routine wellness visits, preventive care and chronic care. There is no cost to members for up to six visits per year; visits 7+ follow the primary care copayment. For questions and enrollment, call (800) 400-6354.

Go to hally.com to log in and get started, or call Member Services at the number on the back of your member ID card for more information.

When you’re ready to quit tobacco, this program offers:

• One-on-one coaching.

• A quit plan made just for you.

• An online learning and support community.

Go to HealthAlliance.org/Quit-For-Life for more information.

Your plan is made with plenty of perks and programs to help you with your health goals.

Find a fitness center or stay active at home!

With the Active&Fit Direct program, you’ll have access to:

• 1,500+ digital workout videos so you can work out at home or on-the-go.

• 11,000+ fitness centers, with the ability to change anytime.

• Unlimited lifestyle coaching in areas such as fitness, nutrition, stress and sleep.

• Activity tracking with 250+ wearable trackers and apps.

• No long-term contract.

All for just $28 a month.

NEW! Two ways to try fitness for free.

• Join us for a variety of workout classes available anytime on YouTube and Facebook, designed for all levels!

• 200 free digital workout videos available to all eligible members, even before you enroll.

Disclaimer: The Active&Fit Direct program is provided by American Specialty Health Fitness, Inc., a subsidiary of American Specialty Health Incorporated (ASH). Active&Fit Direct and the Active&Fit Direct logos are trademarks of ASH and used with permission herein.

Get expert medical help when you’re 100 miles or more from home. Go to HealthAlliance.org/ Assist-America to learn more.

Other conditions and exclusions may apply.

If you have an HMO plan, all Assist America benefits apply. Don’t forget, Health Alliance™ only covers your emergency care while traveling. Assist America will not pay you back for

ambulance or other services you arrange on your own. In a life-threatening emergency, always call the ambulance right away.

You and your family get access to top-notch doctors and hospitals. That doesn’t have to change when your student seeks education outside our service area.

Through our Student Extended Network, dependent children on your plan who leave our service area to attend an academic institution, including (but not limited to) a college/university, technical school or vocational school, can get access to the national PHCS and MultiPlan networks while in school.

Your dependent student will receive a special ID card and can search the PHCS and MultiPlan networks by logging in to your Hally account.

All other family members on the plan will keep their current ID cards and use the standard provider network.

When your child gets care in the extended network, it’s their responsibility to make sure prior authorization is received when necessary. They can call Customer Service to check whether prior authorization is needed, and if so, should ask their doctor to request it. Scan the QR code below for more information.

Get one routine hearing exam for a $75 copay when you see a TruHearing® provider and lowered rates on up to two TruHearing hearing aids per year. Learn more at TruHearing.com. Or you can get access to comprehensive hearing services at any in-network hearing provider (when medically necessary) up to a certain cost. See the Your Comprehensive Hearing Benefits flier for details or call Customer Service.

We cover preventive services and tests to keep you healthy. Here is a partial list of the services included in your comprehensive preventive service bene fi t.*

• One preventive service exam per member (no age limitations) per plan year.

• One preventive service visit to a Women’s Principal Health Care Provider per plan year.

• Well-child care.

• The screenings, procedures and immunizations listed below, within the applicable preventive service bene fi t:

Blood sugar screening.

Cervical cancer screening (Pap smear).

Cervical cancer vaccine.

Childhood immunizations.

Chlamydia screening.

Cholesterol screening.

Colorectal cancer screening (flexible sigmoidoscopy, screening colonoscopy, fecal occult blood test, including FIT).

*Of fice visit copayment and/or coinsurance may apply.

Get a 10% discount code for a wide variety of competitively priced over-the-counter (OTC) products with OTC4Me. You can order online or by phone, and all orders are shipped directly to you. Shipping is free on orders over $25.

This tool lets you explore a wide range of healthcare treatment options, helping you potentially save money by seeing different costs.

You can:

• Compare costs on procedures, facilities and doctors.

• See in- and out-of-network cost estimates.

• Find doctors, hospitals and clinics in your area that offer the service you need.

After you visit your doctor or receive medical services, you’ll get an Explanation of Benefits (EOB) showing the cost of the service, how much we paid on your behalf and the amount you may still owe.

Always call us first (at the number on the back of your ID card) for claims questions. We can check if the claim was properly submitted to us and whether it has been paid. We also can help you with next steps.

Go green with paperless member materials and simplify your life.

• Always available.

• Get access to your plan materials and important information about your account anytime, anywhere.

• Less clutter and waste.

• Avoid mountains of mail, storing paperwork and wasted paper with online access to your plan.

• Secure access.

• Know your personal health information is safe from being intercepted or stolen in the mail.

For more information, visit HealthAlliance.org/Go-Paperless .

The healthcare services your health plan covers: doctor visits, routine physicals, diagnostic tests, etc.

The stretch of time your plan covers you (for example, July 1 to June 30). See your plan materials for your benefits’ start and end dates.

The monthly premium you pay for coverage.

The percentage you pay for services at a doctor’s office, pharmacy or hospital.

The set fee you pay each time you use a medical service covered by your plan.

The amount you pay before your benefits kick in. Some plans have separate medical and pharmacy deductibles.

Children or a spouse covered on your plan.

A list of drugs covered by your plan, including generic and brand-name drugs. Log in at hally.com to find your plan’s list of drugs.

Drugs with the same active ingredients as the brand-name versions reviewed and approved by the Food and Drug Administration (FDA). They cost less because their makers don’t have to spend money on research, development and marketing.

A person covered under a health plan, either the enrollee or eligible dependent.

Once you’ve paid this amount, we pay 100% of covered expenses for the rest of the benefit period. You’ll no longer pay copayments or coinsurance, just your monthly premium, as long as your copayment or coinsurance applies to the OOPM. In-network services (also referred to as Tier 1 and Tier 2) both apply to the in-network OOPM. Note that if you receive services that are not covered or use out-of-network providers (referred to as Tier 3), you may be required to cover costs above the OOPM. For some plans, there is no cap on the amount that you may have to pay for noncovered services or using out-of-network providers.

A review process your doctor must request for a specific drug or service to make sure you meet certain requirements before the health plan agrees to cover it. See Page 4 for more information.

A personal doctor (or advanced practice provider) you choose to oversee your care.

Remote healthcare you get from a primary care provider or specialist over the phone or online.

3310 Fields South Dr. Champaign, IL 61822 HealthAlliance.org

GPMBHA23-SOImbrhandbk-0923