3 minute read

Real Estate

FIXED RATE MORTGAGE CLIFF IS IMMINENT AND WILL IMPACT HOUSEHOLD CONSUMPTION

Australia’s fxed rate mortgage reset is imminent and potentially about to get messy, according to Pete Wargent, co-founder of Australia’s frst national marketplace for buyer’s agents, BuyersBuyers.

Mr Wargent said, “the fxed rate mortgage cliff has been talked about as a potential issue for some time, but only now is it about to become a signifcant problem for the Australian economy.”

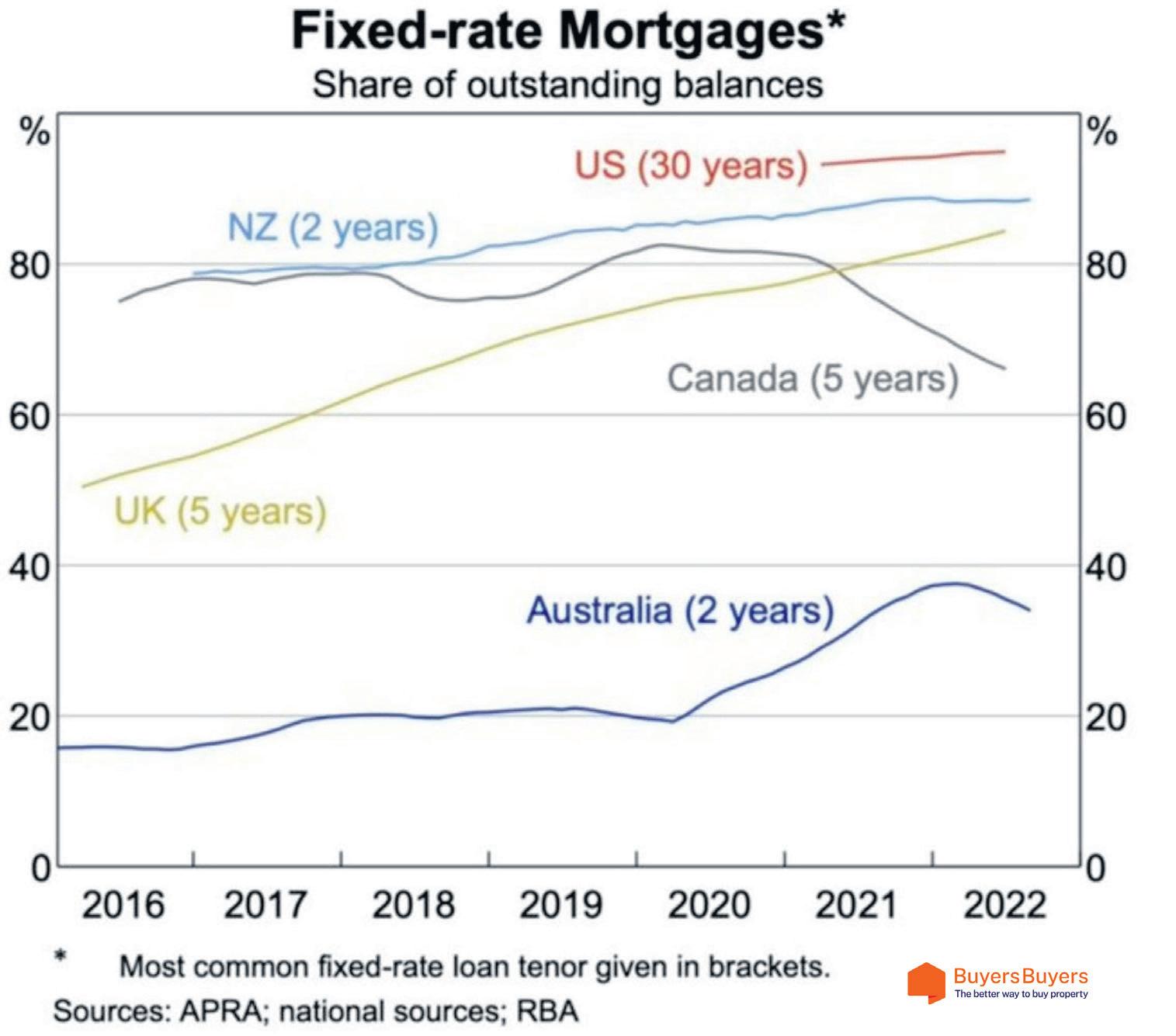

“Historically only a relatively small share of mortgages written in Australia have been accounted for by fxedrate mortgages.”

“But as interest rates were dropped to a record low through the pandemic, fxed-rate mortgage volumes were extraordinarily high for six consecutive quarters from the September 2020 quarter through to the quarter ended December 2021.”

BuyersBuyers CEO Doron Peleg said that while borrowers understood that recordlow mortgage rates would not be sustained, the lending rules now in place leave many with few attractive options.

Mr Peleg said, “many existing borrowers are going to be trapped in a mortgage prison being unable to refnance due to the increased lending assessment buffers in place since October 2021.”

“If a mortgage rate resets from 2 per cent to a rate or around 6 per cent, for example, borrowers will naturally be minded to shop around for the best possible mortgage rate or product to cushion the blow”.

“Unfortunately, under the present lending conditions, many do not have the choice of refnancing due to tighter lending rules.”

“While loan serviceability expectations including a lending assessment buffer of 3 percentage points made sense when the cash rate target was reduced to the zero lower bound, from this month forth we’ve now experienced close to 300 basis points of monetary tightening, so the same buffer should no longer be required.”

“The irony is that rules introduced to bolster fnancial stability could end up being a major source of fnancial instability if they aren’t taken back to the prepandemic settings,” Mr Peleg said.

Household consumption to be impacted

BuyersBuyers cofounder Pete Wargent says that the increase in mortgage rates delivered to date will negatively impact household consumption over the next 18 months.

“There are plenty of moving parts, but it’s not hard to see that such a huge switch is going to create some major tremors for existing borrowers, which will in turn have signifcant implications for household consumption going forward,” Mr Wargent said.

Mr Wargent said, “the good news is that with full employment there’s currently a job for effectively everyone who wants one, and even the option to work additional hours in many cases.”

“We also know that most Aussies will do whatever it takes to continue making mortgage repayments, in the absence of a very deep housing market downturn or recession.”

Policy settings are key

Household consumption has a major impact on Australia’s economic growth, and policy settings will be a key determinant of outcomes from here.

Mr Wargent of BuyersBuyers said, “household consumption is a key factor for the Australian economic outlook. It’s not yet clear how much further the Reserve Bank plans to take interest rates.

Mr Wargent of BuyersBuyers said, “household consumption is a key factor for the Australian economic outlook. It’s not yet clear how much further the Reserve Bank plans to take interest rates higher before pausing to take into account the lagging effects of monetary tightening. And obviously, the trajectory of mortgage rates will be the single biggest driver of mortgage stress.”

“There is some headroom for some of the worst hit borrowers to be cushioned by lenders offering interestonly loan terms, or even mortgage holidays in more extreme cases.”

“A far better outcome, however, would be to allow the mortgage market to function more freely by restoring the lending conditions in place prior to October 2021, so that stressed borrowers can shop around for more attractive mortgage rates and terms,” Mr Wargent said.

“The alternative path looks decidedly messy,” Mr Wargent said.

Figure 1 - Share of fxed rate mortgage lodgement volumes by quarter

Figure 2 – Fixed rate mortgages - share ad tenor of outstanding loan balances

AUCTIONEERS I REAL ESTATE LIVESTOCK I PROPERTY MANAGEMENT TENTERFIELD...purchase the lifestyle! History I National Parks I Cool Climate Country Living 277 Rouse Street, Tenterfi eld P: 02 6736 3377 • STEVE 0428 100 328 E: general@alfordduff.com.au W: alfordduff.com.au