1 minute read

Potential $1 Trillion Cost to Taxpayers from Superannuation Withdrawal for Home Deposits

Newly released modelling commissioned by the Super Members Council reveals significant long-term fiscal implications for Australian taxpayers stemming from proposals allowing young Australians to utilize their superannuation to fund house deposits. According to the analysis, unrestricted access to superannuation funds for this purpose could saddle taxpayers with costs amounting to a staggering $1 trillion over time.

Key Findings of the Report

• Financial Impact:

The proposal to allow a capped withdrawal of $50,000 from superannuation accounts for home deposits could result in a $300 billion drain on federal resources across future decades. In contrast, an uncapped withdrawal policy could inflate this cost to approximately $1 trillion by century’s end.

• Increased Pension Dependency: The report underscores a critical concern that enabling first-time homebuyers to dip into their superannuation will lead to significantly reduced balances upon retirement. This reduction is expected to increase reliance on taxpayer-funded age pensions, thereby escalating government expenditures considerably.

• Economic Consequences: At its peak, the capped withdrawal policy could impose an additional annual cost of $8 billion on taxpayers, with the uncapped option potentially reaching an annual cost of $25 billion.

Impact on Housing Market and Home Ownership

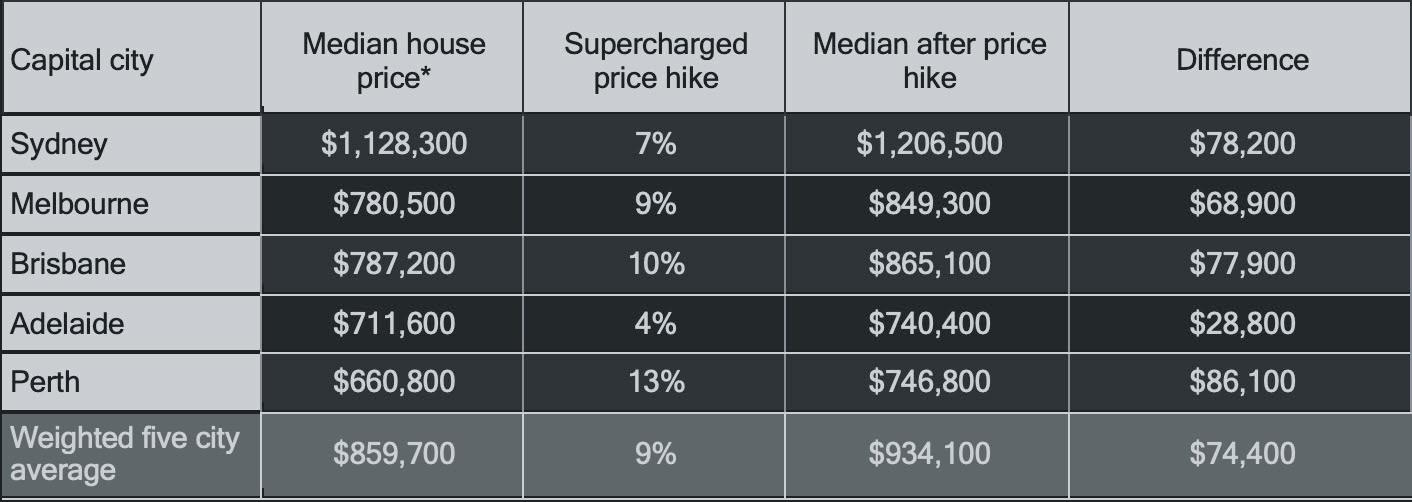

The modelling also highlights adverse effects on the housing market, predicting an increase in capital city house prices by an average of $75,000, which could further exacerbate the housing affordability crisis. This inflationary effect contradicts the policy’s intention to enhance home ownership rates, instead potentially delaying entry into the housing market for future generations.

Expert Opinions and Recommendations

Misha Schubert, CEO of the Super Members Council, criticized the policy proposals as economically imprudent.

Schubert emphasized that such policies not only fail to address home ownership rates but also worsen housing affordability and erode retirement savings, leaving a hefty tax burden for all Australians.

“Economic evidence consistently shows that breaking open super for house deposits will not resolve the housing crisis but will rather inflate property prices and amplify pension costs,” said Schubert.

Call for Policy Rethink

The Super Members Council is advocating for a reconsideration of any policy that might weaken the integrity and success of the superannuation system, which has been pivotal in ensuring a secure retirement for millions of Australians. The Council warns against the long-term economic pitfalls of such policies, suggesting they would undermine the foundational goals of the superannuation system.

Analytical Backdrop

The findings are based on comprehensive microsimulation models developed by Deloitte, accounting for demographic shifts, superannuation contributions and balances, and projected tax and pension expenditures. This robust analytical approach reinforces the credibility of the projected fiscal and market impacts.

Conclusion

The Super Members Council urges policymakers to preserve the superannuation system’s strength, cautioning against decisions that could compromise both individual financial security and broader economic stability.