HEATHER SACRE and JAMES CARONA FOUNDERS

Heather James Fine Art has been in business for more than 25 years with galleries located in Palm Desert and Jackson Hole, as well as consultancies in Los Angeles, New York, San Francisco, Newport Beach, Palm Beach, Lake Como, and Basel. As we have dealt with important artworks spanning a wide cross-section of genres and time periods, we have been fortunate to place works with some of the world’s top collectors. Always aiming to be a resource in art decisions for our clients, we have created this guide to the investment potential of art as an asset.

Some of our clients have asked why they should consider buying art in an uncertain economy. We do understand the instinct to wait for markets to stabilize before making any large purchases; however, many seasoned collectors are actively looking for opportunities now more than ever. In fact, it is precisely during times of financial uncertainty when many choose to invest in tangible assets such as art. Investors are seeing that art is one of the few assets where they can currently get yield, as other assets like commercial and residential real estate are less reliable. Our experience has been that during financial crises, such as in 2001 and in 2008, there is a flight to blue-chip tangible assets. Historically, blue-chip artwork has performed at a commensurate rate versus the S&P 500, as the graphs in the following pages demonstrate.

Warren Buffet has famously said to “be greedy when others are fearful,” suggesting that times of turmoil can present great opportunities to buy. With this catalog, we hope to demystify the art market a bit and to offer some examples and data on art as an investment.

It would be our pleasure to assist you in your personal art endeavors by connecting you with one of our Fine Art Consultants. Please do not hesitate to reach out.

Heather James has received many questions regarding the art market’s performance during volatile economic cycles. To respond, we are happy to share this video of gallery co-founder Jim Carona offering his in-depth analysis on the topic. Looking at the art market’s resilience during the 2008-2009 recession, we present our key observations as to why the art market has proven to be more resilient than other assets.

ART MARKET OUTLOOK

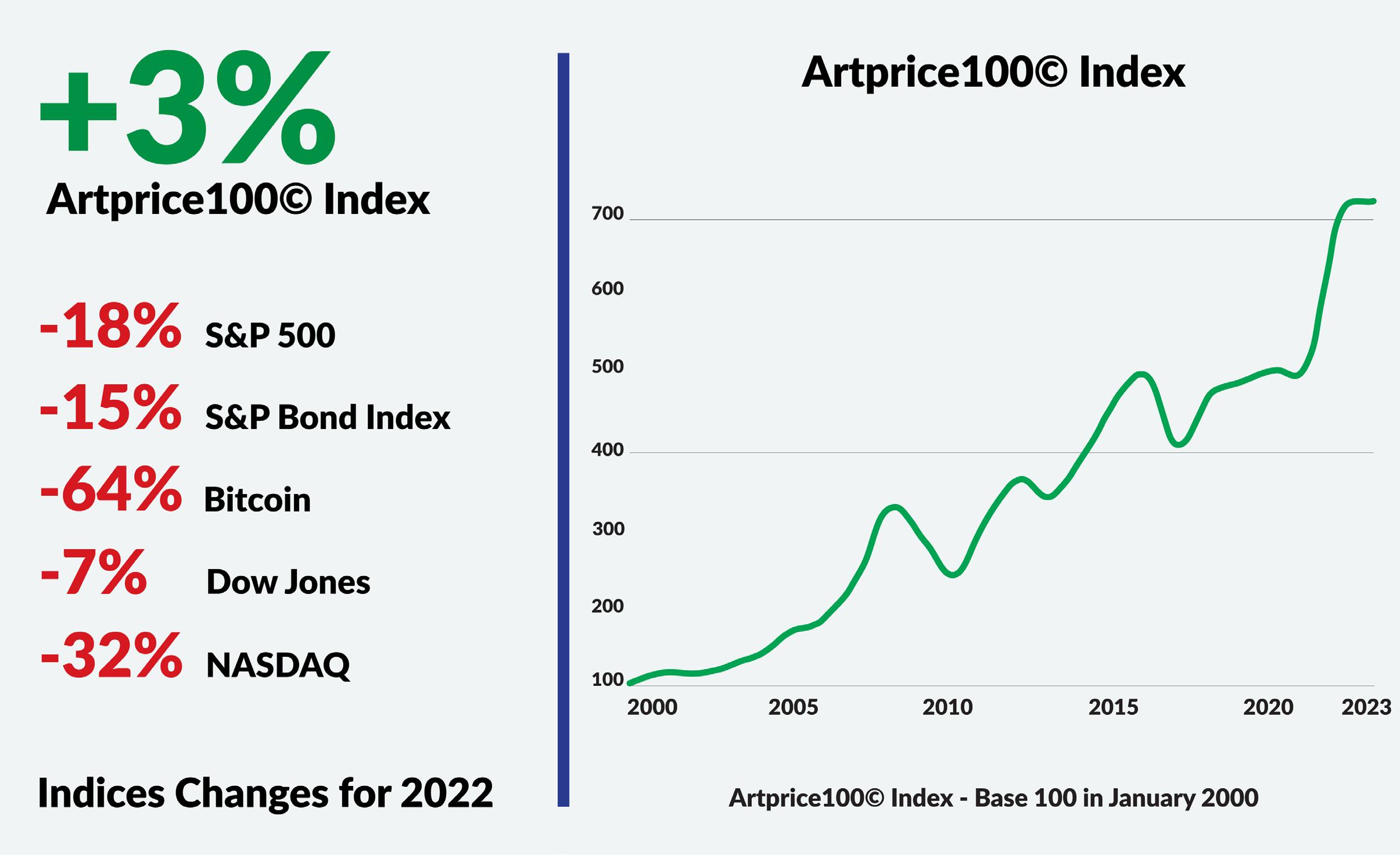

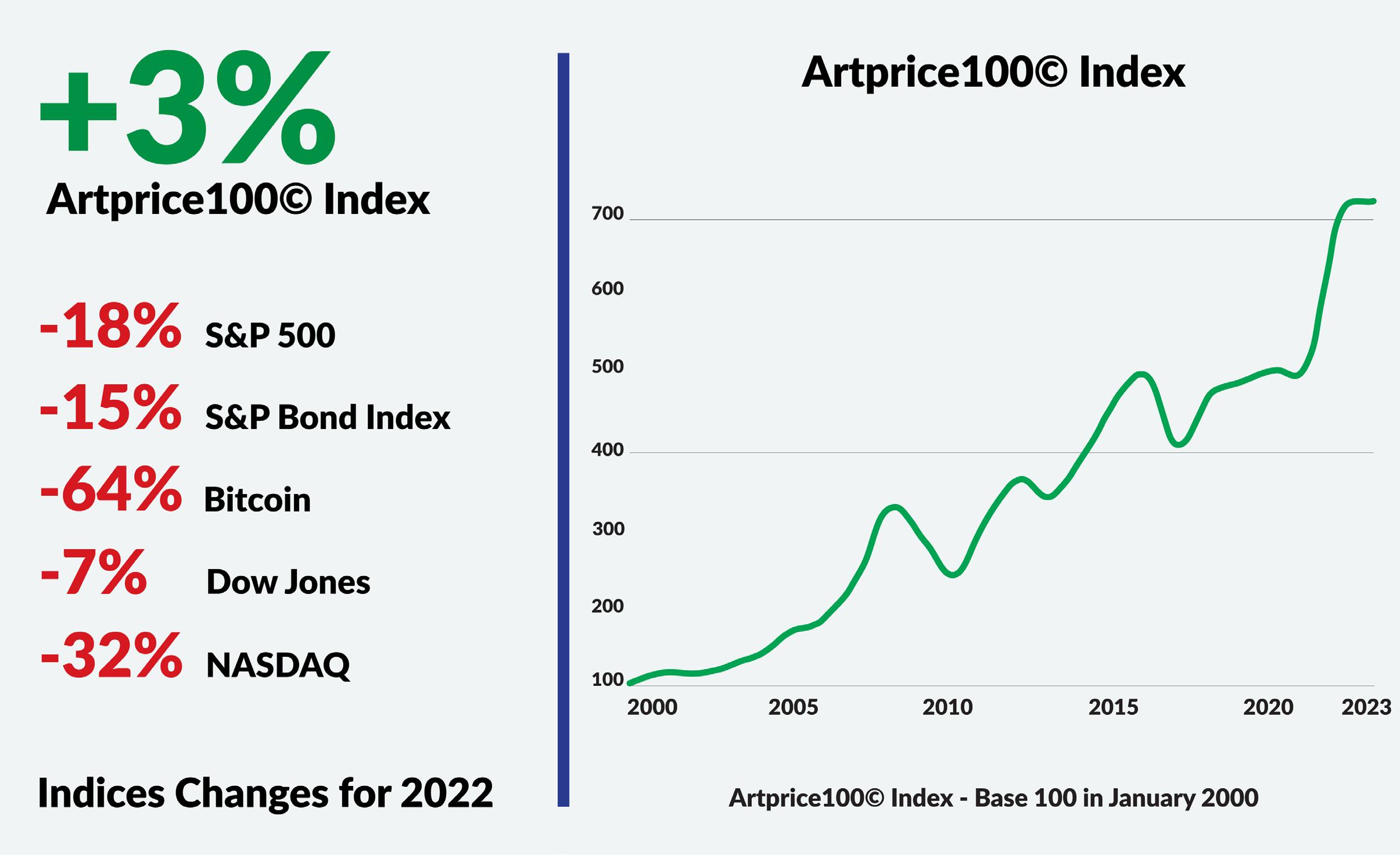

The last year has seen volatility across financial markets. At every turn, markets have been pummeled and it seems there are few safe places for your cash. Concerningly, the S&P 500 and bonds have been positively correlated this year, falling in lockstep. All the while, the art market has grown, as indicated by this graph of the Artprice 100 Index. As an asset class, fine art boasts a low correlation of only 0.12 to developed equities and acts as an inflation hedge, making it all the more favorable in this highly correlated and inflationary environment. The strength of the art market this year echoes what we have seen in the past. Historically, the art market is relatively insulated from economic turmoil and tends to be last to decline and first to recover in recessionary periods, as seen in the 2008-2009 global financial crisis.

HISTORIC RECESSIONARY TRENDS

In recessionary periods, the art market has been the last to decline and first to recover. We saw this during the global financial crisis of 2008-09.

While the S&P began declining in mid-2007, the all-art index did not trend down until late 2008.

At its lowest point, the art market saw a 19.3% decrease from pre-recession highs, while the S&P saw a 47.7% decrease. The S&P 500 took four years to return to its pre-recession high from the low point, and this bounce-back occurred in under a year for the art market.

Measured from the pre-recession highs, the art market took just 20 months to regain, while the S&P 500 took 5.5 years. In the early 2000s, the art market experienced a much milder recession than the financial markets. The peak to trough decline of the S&P 500 was 49.1%, whereas the all-art index only declined 18.82%

Fine art has a low correlation of 0.12 to the stock market, partially accounting for the strength of the art market during economic turmoil.

In February 2009, while traditional financial markets remained down, the hugely successful Yves Saint Laurent sale at Christie’s totaled nearly $484 million, setting the record as the most expensive private collection at auction. 95.5% of all lots sold

Business Insider, 2015

BlackRock CEO Larry Fink:

BlackRock CEO Larry Fink:

“The two greatest stores of wealth internationally today include Contemporary Art…and I don’t mean that as a joke, I mean that as a serious asset class, and the other store of wealth today is apartments in Manhattan, Vancouver and London.”

Heather James Fine Art - Palm Desert gallery installation Winter 2022-2023

Heather James Fine Art - Palm Desert gallery installation Winter 2022-2023

2022 ART BASEL & UBS REPORT

The global value of art is expected to grow by 53% by 2026.

Art market growth: According to UBS, the art market saw $50.1 billion global sales in 2020. 86% of wealth managers recommend offering art services to clients according to Masterworks.

Rise in worldwide wealth: Based on a 2020 report from Credit Suisse, more than 1% of all global adults are millionaires (USD) for the first time in history, with their combined wealth up nearly fourfold in a 20-year period.

2022 ART BASEL & UBS REPORT

30% of millennial collectors have over 30% of their wealth held in art – UBS/Art Basel Report

Museum growth: By the end of 2020, China was home to 5,788 museums, all seeking top-tier artworks for their collections. According to the Economist and ChinaDaily, an average of 1 new museum opened every 2 days across China between 2016 and 2020, and this trend is continuing globally.

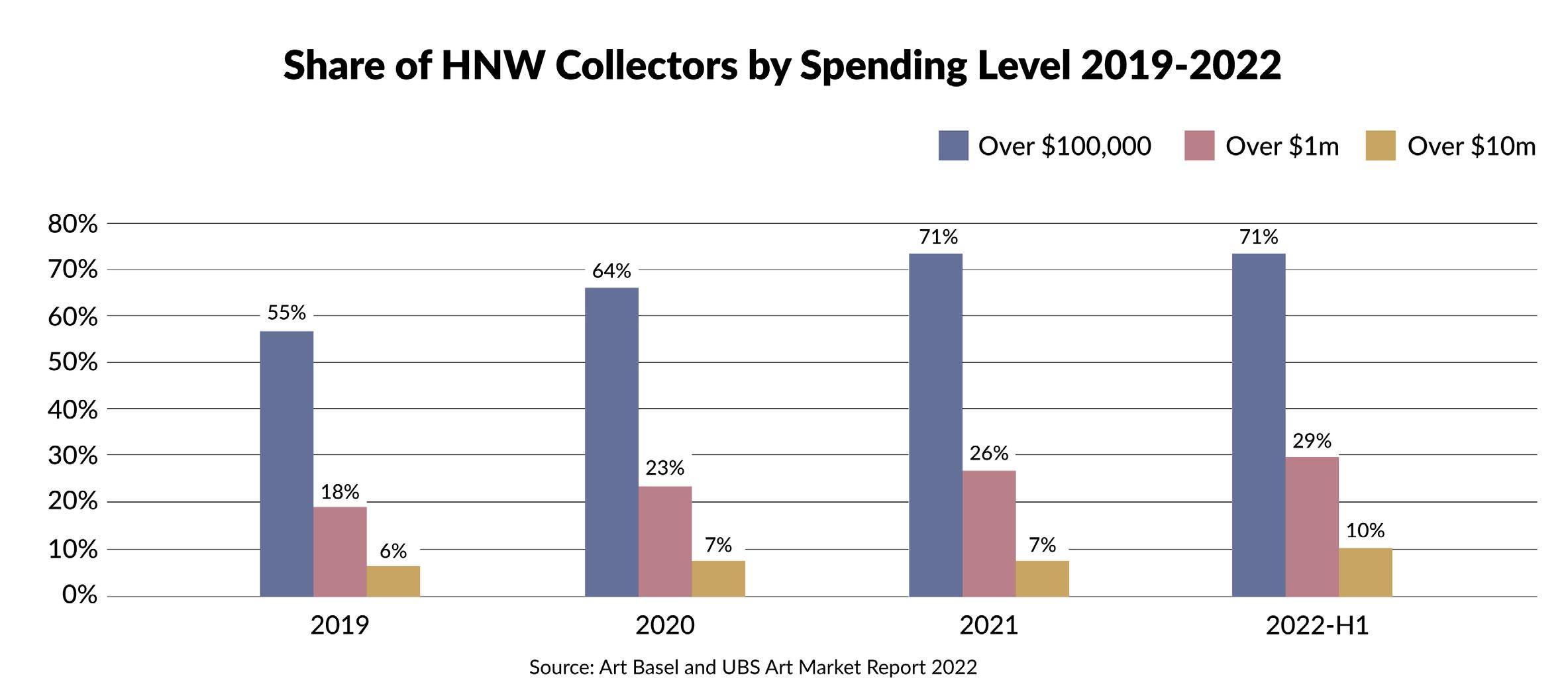

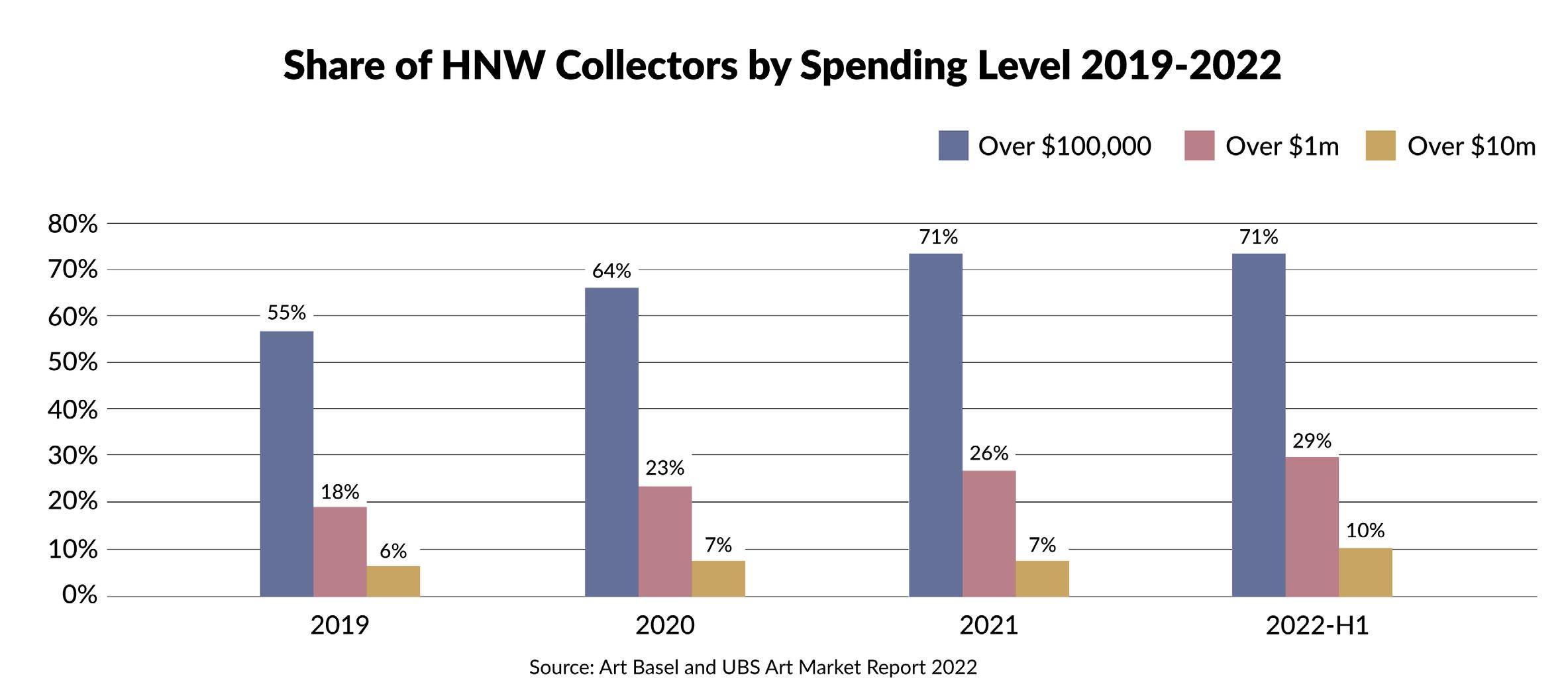

More investors collecting: The latest UBS/Art Basel Report indicates that more collectors are using art as an alternative asset: 61% of the HNW collectors surveyed had over 10% of their portfolio invested in art.

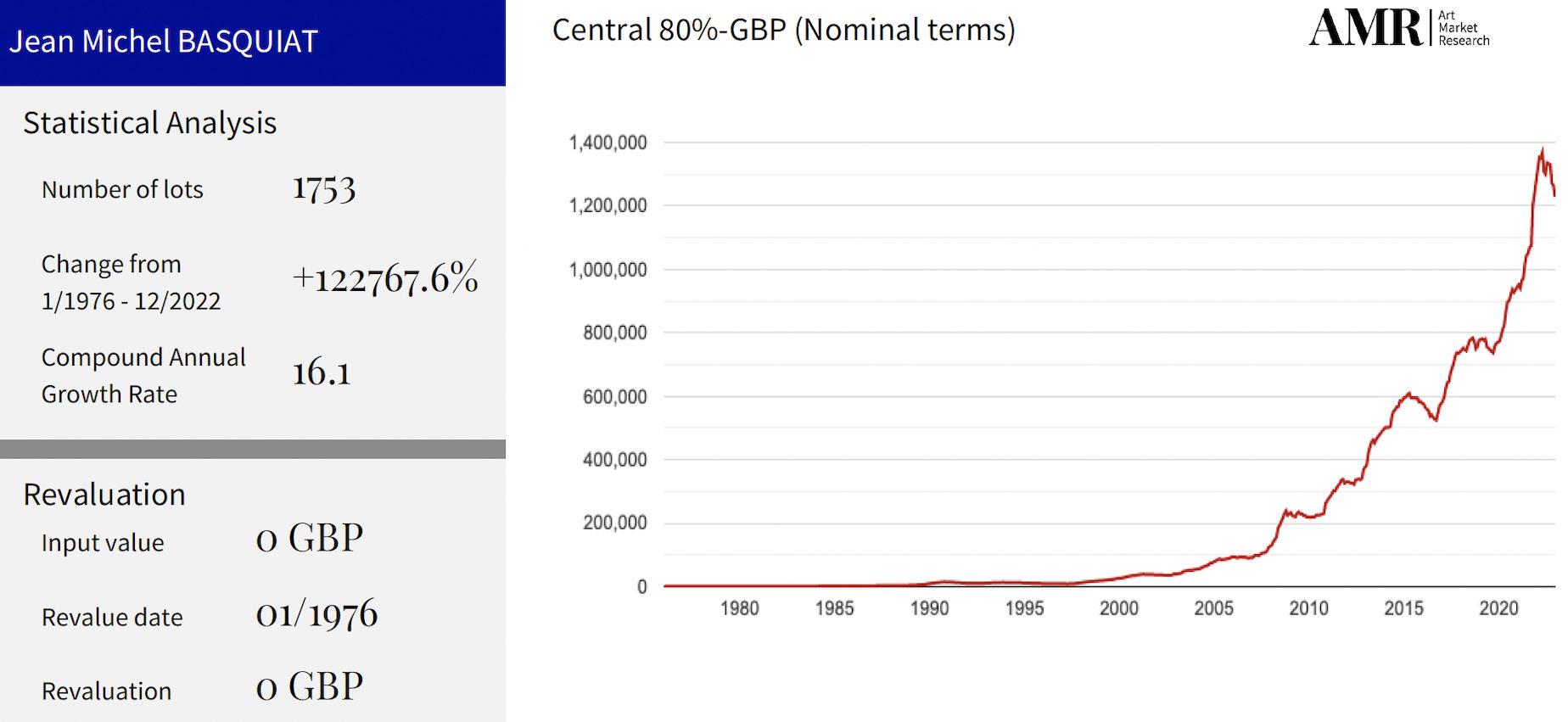

SAMPLING OF ARTIST’S MARKETS SINCE 1976

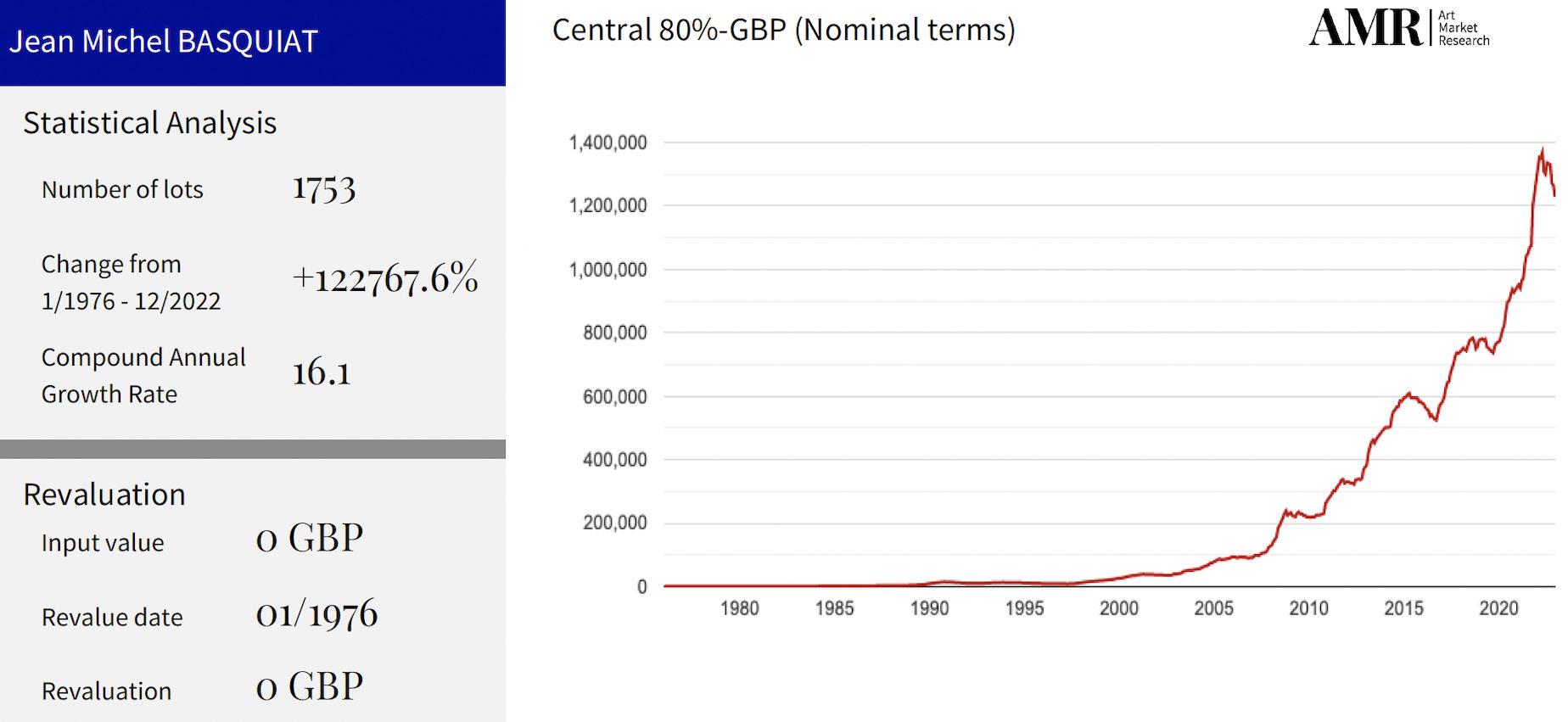

The graphs prepared by Art Market Research show the annual rates of return for a selection of artists: Claude Monet, Jean-Michel Basquiat, and Willem de Kooning.

For each of these artists, look at what the trend appears to be over a long period of time.

SAMPLING OF ARTIST’S MARKETS SINCE 1976

JEAN-MICHEL BASQUIAT

CLAUDE MONET WILLEM DE KOONING

Charles Stewart, CEO of Sotheby’s:

“When our market slows down, fewer things become available to sell, but anyone waiting around to get a 30% discount on a masterpiece may be disappointed and frustrated. We’re kind of like the oceanfront property that everyone’s waiting for the right moment to buy, but there’s a lot of money waiting for that moment. As soon as the price for anything goes down even a little bit, people start to jump in.”

Heather James Fine Art - Jackson Hole gallery installation Summer 2022

Heather James Fine Art - Jackson Hole gallery installation Summer 2022

CASE STUDY:

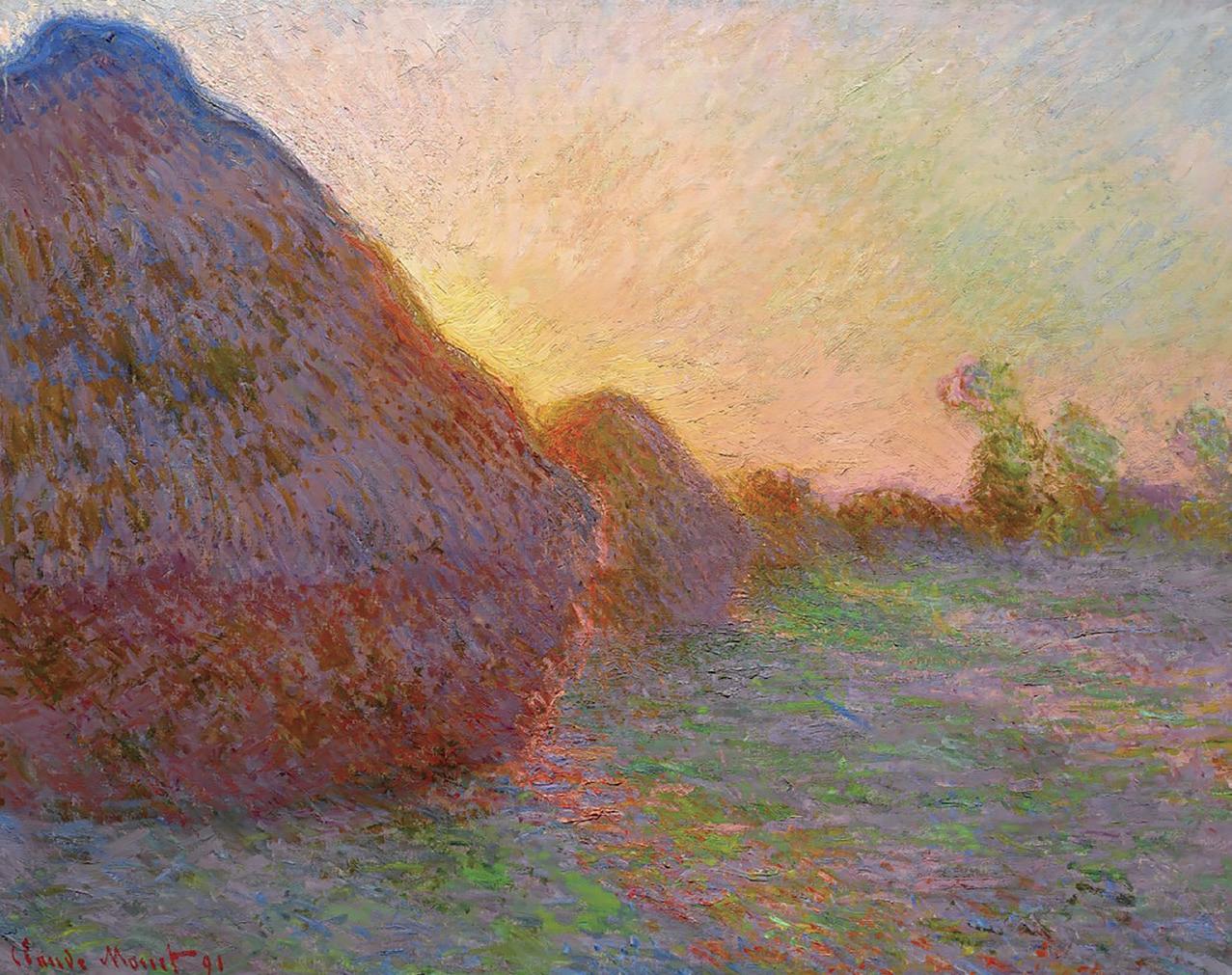

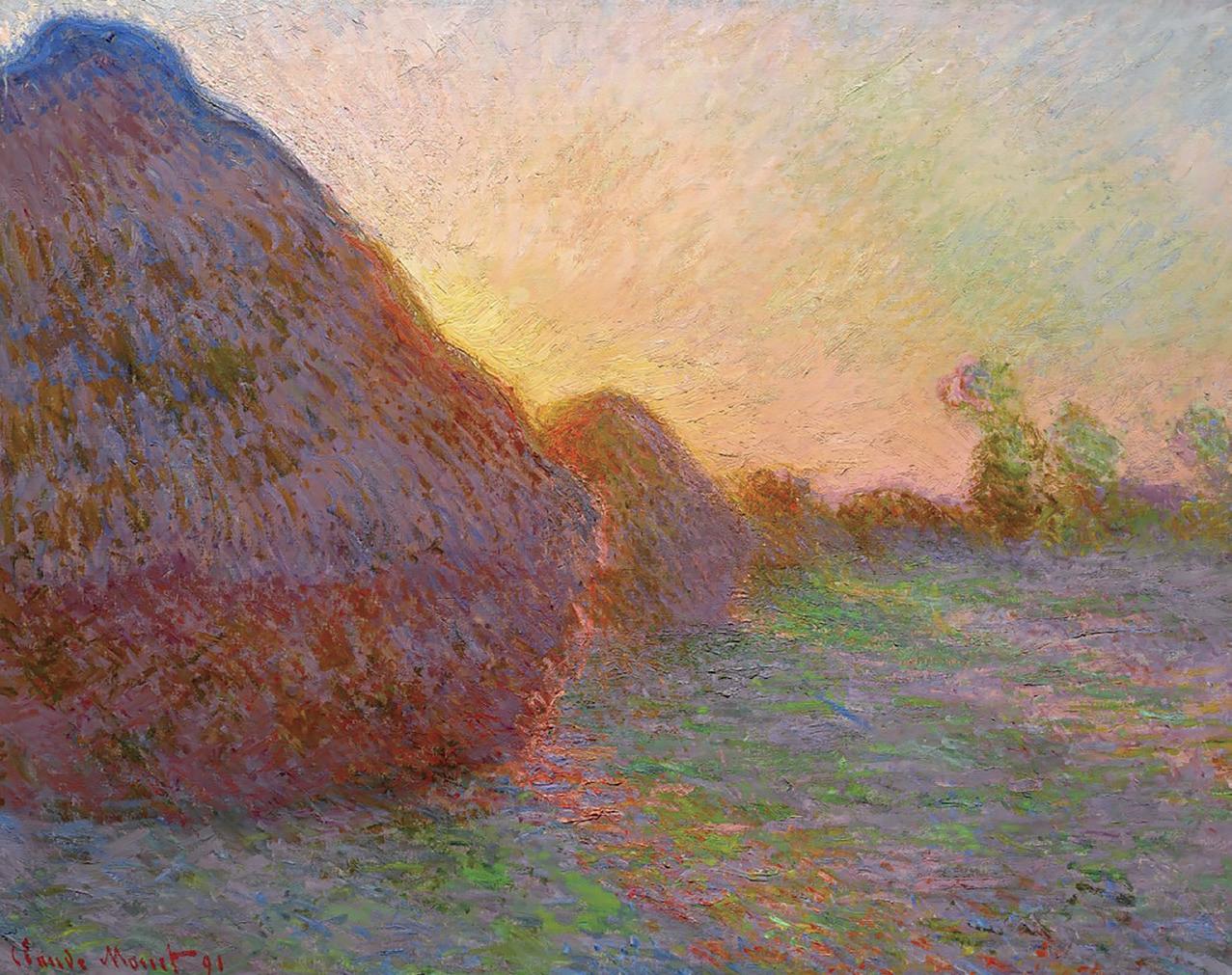

Monet – Meules sold for $110M at Sotheby’s in May 2019.

This is the new world record for any Monet sold at auction and will certainly set a new precedent for high-quality and iconic images by Monet.

This is a stunning example of an artist whose market has consistently performed incredibly well over time.

The Monet art market trajectory has strengthened over time, culminating at this extremely high price point.

Image from Sotheby’s Monet auction , May 2019

CASE STUDY:

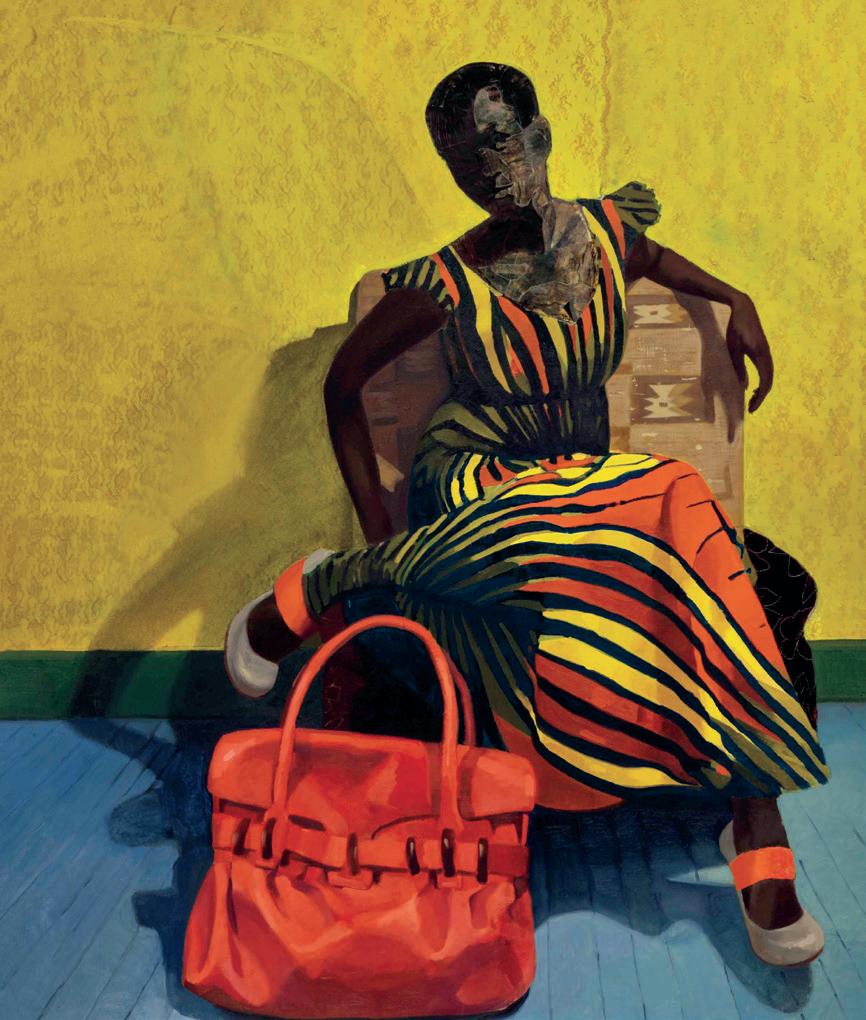

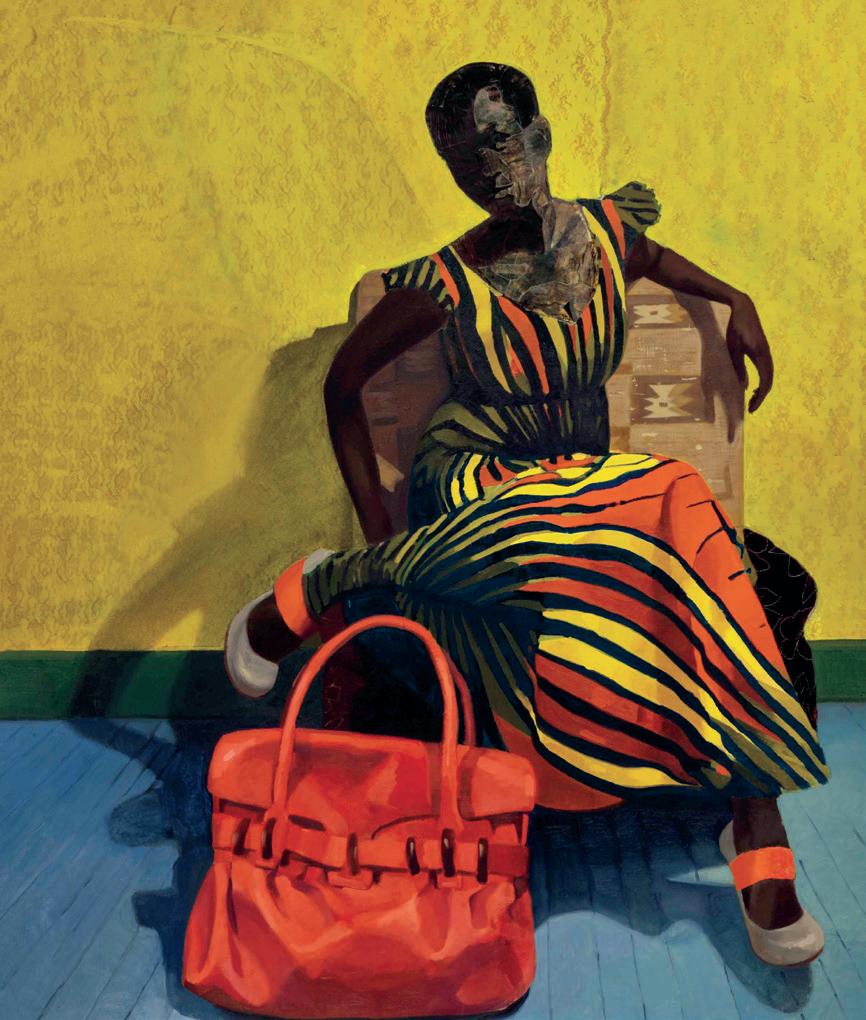

Mimetic Gestures by Njideka Crosby sold at auction on in May 2018 for $1,932,500.

Heather James Fine Art curated Njideka Crosby’s first show in 2011.

Our Senior Curator, Chip Tom, championed Crosby early in her career because he recognized her extraordinary talent.

We sold this exact piece to our client in 2011 for under $10K.

Heather James Fine Art - Palm Desert Uncommon Commencement exhibition, July 2010

BlackRock CEO Larry Fink:

BlackRock CEO Larry Fink:

Heather James Fine Art - Palm Desert gallery installation Winter 2022-2023

Heather James Fine Art - Palm Desert gallery installation Winter 2022-2023

Heather James Fine Art - Jackson Hole gallery installation Summer 2022

Heather James Fine Art - Jackson Hole gallery installation Summer 2022