Banking news and stories to help you maximize the financial success of your business Q1 2022

A RELATIONSHIP BANKING SUCCESS STORY

IN THIS ISSUE a publication of

Preparing for Tax Season Spotting Small Business Scams Permanently Affordable Homeownership

Contents

Vecteezy.com

2

13

Homestead Community Land Trust

Vibe Coffee Group, Inc.

“Heritage has always been about the person… I never felt like a number.” – Dan Ollis, Whidbey Coffee

6

Business Profile: Whidbey Coffee.................................................... 2 Heritage Direct: Setting Up Alerts.................................................... 7 Preparing for Tax Season................................................................... 9 Steps to Take for a Successful New Year....................................... 13 Scams and Your Small Business...................................................... 14

Director of Marketing Shaun Carson

IN EVERY ISSUE Heritage Helps....................................... 6 Our community involvement is part of our company’s DNA and something we’re very proud of. In this section, we highlight the good we’re doing in our communities.

Editor-In-Chief Whitney Gibson

We want to hear from you! Email us at BankingBusiness@HeritageBankNW.com with your feedback and ideas about what you'd like to read about in future issues.

PNWonderland...................................... 8 Explore the unique sights and experiences of our Pacific Northwest.

Business Banking Mentor................... 10 Increase your company's competitive advantage and profitability by improving business efficiencies.

My Heritage.......................................... 16 Meet our relationship managers and learn about their heritage.

Cybersecurity....................................... 17 Steps to protect your small business from scams.

Financial Dictionary............................. 17 Empowering you to make smart business decisions by demystifying banking terminology.

Banking Business is a quarterly publication of Heritage Bank

Tamara Brown — ALF Fellow

Congratulations to Tamara Brown, VP, relationship banking officer, for being selected by the American Leadership Forum (ALF) Oregon to participate in their Fellows Program! Of the many goals, the program hopes to help inspire leaders to a lifetime of active public engagement, acting as ongoing catalysts for addressing a range of issues that affect the state and its communities.

Creative Director Erica Bolvin

Managing Editor Stephanie Neurer Contributors Alex Pace Elizabeth Miller Brian Moore Kyle Fergusson John Stearns

3615 Pacific Avenue Tacoma, WA 98418 800.455.6126 HeritageBankNW.com © 2022 Heritage Bank, member FDIC, Equal Housing Lender. The information in this magazine is general education or marketing in nature and is not intended to be accounting, legal, tax, investment or financial advice. Although Heritage Bank believes this information to be accurate as of the date published, it cannot ensure that it will remain accurate. Statements of individuals are their own and do not necessarily reflect the position or ideas of Heritage Bank. Contact us at 800.455.6126 or visit HeritageBankNW.com to make an appointment with one of our local experienced relationship managers to discuss your individual business banking needs.

Equal Housing Lender | Member FDIC

A MESSAGE FROM OUR CEO

A

new year usually means reflecting on what worked well for your business and what could be improved upon. It also usually means setting new goals and looking at things with a fresh perspective—like your operations or sales or even your business as a whole. That’s why in our first issue of 2022, we focus on what you can do to plan for a solid year ahead.

Heritage Bank

Like many business owners, you probably have a lot you want to achieve during the year. In our featured article, Steps to Take for a Successful Year Ahead, we offer five actionable steps that can help improve your business plan and put you on track for a strong 12 months. On page 7, we go over the different Heritage Direct alerts, how to set them up and the benefits of doing so. On page 10, we talk about business efficiency and offer strategies for improving it. Even starting small, like delegating tasks, can help your business waste less time, energy and money, allowing it to run more smoothly. Taking advantage of existing technology can also help preserve resources as well as help you better manage your accounts. There’s still a lot of change occurring, and no one knows what’s in store for this year. What we do know, is we will continue to advocate for your business, tailor banking solutions to your needs and help you take advantage of every tool we have to keep your business healthy. Thank you for reading Banking Business and for trusting us as your banking partner. We look forward to serving you in the new year. Sincerely,

Jeff Deuel CEO

2021 ABA Foundation

COMMUNITY COMMITMENT

WINNER

Jeff Deuel is chief executive officer at Heritage Bank. He has more than 39 years of banking experience. Prior to joining Heritage, he worked at JPMorgan Chase, WaMu, Bank United, First Union, CoreStates and First Pennsylvania Bank. Jeff is a past chair of the Washington Bankers Association. He currently serves on the board of the Oregon Bankers Association and Pacific Coast Banking School. He is an avid cyclist and has climbed to the top of Mt. Rainier.

Equal Housing Lender | Member FDIC

HeritageBankNW.com

1

Vibe Coffee Group, Inc.

Owner of Whidbey Coffee and Victrola Coffee Roasters Values Heritage Bank Relationship Article by John Stearns

2

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

Heritage Bank

Dan Ollis has come a long way since his days selling coffee drinks from an espresso cart in 1989, just a year after graduating from South Whidbey High School on Whidbey Island. Today, he runs two coffee businesses: Whidbey Coffee and Victrola Coffee Roasters (both operating under the umbrella of Vibe Coffee Group, Inc.), with 16 north Puget Sound locations between them, 134 employees, plus wholesale and online operations. Ollis is the sole owner of Vibe. Heritage Bank has helped percolate his business growth since acquiring the parent company of Ollis’ previous bank, Whidbey Island Bank, in 2014. Whidbey Island Bank branches adopted the Heritage Bank name everywhere but on Whidbey Island, where Heritage does business under the Whidbey Island Bank name. “When the transition happened, the team from Whidbey merged with Heritage and the Heritage team just scooped me up like you would not believe,” Ollis said, including featuring him in a 2015 TV commercial still viewable online today. “They’ve done a really great job of helping me.”

Visit HeritageBankNW.com to read more of our business profiles, then make an appointment with a banker who knows your industry.

That relationship was especially important for surviving the initial onslaught of the coronavirus pandemic when statewide restrictions slashed business from pre-COVID levels. “In the midst of the everything, I had stores closing, I had one store completely shut down,” and four locations in two hospitals were basically shut down, Ollis said. His wholesale division, which sells Whidbey and Victrola coffee to offices, hotels, restaurants and other coffee shops, saw business plummet as offices shut down and travel halted. “It was incredibly frightening.” Ollis secured two rounds of Paycheck Protection Program (PPP) loans through Heritage. The loans were critical at a time when uncertainty about the future reigned. “The only saving factor in all of that was, we had access to this PPP money,” Ollis said. “We didn’t know what we didn’t know, and it was so nice to have the bank being able to basically help me sleep at night. It was incredibly efficient in getting me to that level where I…can breathe a little bit, I can adjust the sales and I can keep running the business and keep the people employed and give them some extra bonuses when it was appropriate. So having Heritage step in and facilitate that the way it was done was incredibly helpful.” The wholesale division, office clients of which include some big-name companies that had not returned many workers to offices yet, was still at about 60 percent of pre-COVID levels when Ollis spoke for this story in November. That’s significant because wholesale accounted for about 35% of the business pre-COVID but was hovering at about 5% in November. Ollis’ retail locations include 12 for Whidbey Coffee—a mix of cafes and drive-thrus numbering four on Whidbey Island, including Clinton and Freeland, two in Burlington, one on Mukilteo Speedway, one in Anacortes, three within Evergreen Hospital in Kirkland and one in Skagit Valley Hospital in Mount Vernon. Equal Housing Lender | Member FDIC

continued, next page

HeritageBankNW.com

3

Photos courtesy of Vibe Coffee Group, Inc.

Victrola Coffee Roasters, a preexisting business Ollis acquired in 2007, has four cafes in Seattle, including two in Capitol Hill, one in Beacon Hill and one at 3rd and Pine downtown in the former Macy’s building. That location was closed for a year and has since reopened, but business remains off about 75% due to the shutdown of offices in the building, he said.

Coffee ‘adventure,’ coffee ‘comfort’

Ollis describes Victrola as “the adventure in coffee,” and Whidbey as “the comfort in coffee.” Both serve pastries, snacks and other items, including sandwiches. He describes Victrola’s customer base as typically liking a single-origin coffee, wanting to know the story behind the coffee, when and where it was picked, who picked it, maybe the elevation it was grown, and someone who typically prefers a 12-ounce cup. The Whidbey customer is a little more into the 16- to 20-ounce drink, perhaps requesting a little extra chocolate, or a little extra vanilla, and maybe some whipped cream under the lid, he said. “Neither one of them are right or wrong, it’s just a difference in perspectives, and we are able to pivot for each,” Ollis said. While overseeing two different brands is challenging, it’s also beneficial to be diversified, he said. When Ollis acquired Victrola 15 years ago, he wasn’t roasting his own coffee; it was being roasted for him under a private label. He was eager to learn about roasting and his purchase of Victrola provided that opportunity. Today, he roasts in four locations, two in Mukilteo, one in Seattle and one in Burlington.

WHIDBEY COFFEE'S RELATIONSHIP MANAGER, DIANNA BODIN Dianna has 23 years of experience in the commercial banking industry and has held various positions in relationship management, special assets, commercial real estate and credit analysis. Previously, she’s mentored others in commercial banking; served on a national relationship manager committee; participated in a supplier diversity group; and lead a women’s group focused on career development.

4

Issue 4 | 2022 Q1

The Mukilteo locations are bigger and are the roasting and production workhorses, he said. Their location near the I-5 corridor also helps with shipping out product, whether for wholesale clients or online customers who can buy bags of ground or whole bean coffee, coffee pods or single-serve packets for steeped coffee, mugs and gift cards. Ollis experimented with opening a bakery in 1993 thinking it would supply the needed food items for his coffee shops. “But at that time, I only had five and there wasn’t enough volume from our own stores, so I overjumped,” he said, adding that he closed the bakery six months later.

Banking Business a publication of Heritage Bank

“Now, with 16 locations, I’m probably closer to being able to support a modified bakery, but I didn’t know what I didn’t know then, except I was challenged with getting that fresh product from suppliers to me,” Ollis said. “So that was the goal—still is the goal, by the way—of always trying to bring the best to our customers.” To that end, Ollis’ company does make some items in-house, including a few desserts, plus sandwiches, but it’s not producing one hundred percent of the stores’ food. “We are actively trying to figure out a commissary or a solution to our food,” he said. “We want to improve our food program and we know that we have to do that ourselves.” As for future growth plans, Ollis said the main focus now is returning to pre-COVID numbers. “We have growth in mind,” he said. “I’m not trying to exponentially grow the organization. I’m like a very solid, very consistent beating of the drum. If a location comes across my desk that has a story, I’m very much interested and I want to chase that, but to just open locations to open locations, that’s not for me. We want to be a part of a community. We want to be ingrained in that community. And we want to appreciate them as much as they appreciate us. And so that’s not something you do by just opening to open.”

A banking relationship of openness

Whatever Ollis considers, he’s sure to keep Heritage in the loop. Mentors told him long ago that the more the bank knows about him and his business, the better. “We really focused on communication with the bank, and I treated them like my unofficial board of directors and gave them an annual presentation and still do to this day,” Ollis said, guessing he’s done the presentation for 15 plus years, even before Heritage became his bank. “And so what that’s done is it’s improved my communications, it’s helped them and there’s full transparency there. It’s helped them and it’s helped me, and we have this common respect for one another.” Ollis began his banking relationship with Whidbey Island Bank when he was about 19, getting a loan for his coffee cart and needing a cosigner to do so. He’s gotten many loans and different variations of advice since then, he said.

Whatever Ollis considers, he’s sure to keep Heritage in the loop. Mentors told him long ago that the more the bank knows about him and his business, the better.

Asked how Heritage has played a role in his success over the years, Ollis said, “Heritage has just kind of always been there for me. It sounds a little awkward and quirky, but it’s really about the relationship and it’s about the people. I mean the banking is almost secondary to the relationship with the people, and because of the business that I’m in, the coffee business being about people, that really resonates well with us, our brand.” Vibe Coffee Group, Inc.

He and Heritage connect on that level, he said, because it’s about people as opposed to products. “I mean, I gotta have a great cup of coffee or I don’t have people, but it really boils down to my staff, it boils down to their staff and the interconnections that we have,” he said. “So, it’s really about the relationship. I realize that’s an overused word, but I truly believe that.” Added Ollis, “Heritage has always been about the person…I never felt like a number.”

Equal Housing Lender | Member FDIC

HeritageBankNW.com

5

STRENGTHENING FAMILIES & BUILDING RESILIENT COMMUNITIES THROUGH PERMANENTLY AFFORDABLE HOMEOWNERSHIP Homestead Community Land Trust to provide more affordable housing options within our communities. Homestead is a nonprofit that has been serving the Puget Sound area for 29 years. They build new homes or rehab existing ones and then sell them at subsidized prices to what would be deemed affordable for modest-income households. Buyers then agree to restrict their equity gain so they can pass on an affordable price if or when they decide to sell. The organization’s model (or the “community land trust model”) is to sell homeowners the structure of the home while retaining the land in trust. Homestead also combines housing development with counseling, education and other support activities to create a growing inventory of permanently affordable homes in the region. As a result, their rate of foreclosure is less than 1%. Homeownership is one of the most significant ways that individuals and families can build wealth. When a person achieves homeownership, they are no longer subject to displacement due to rent increases, building sales or the landlord losing the house. Their resources are no longer tied up in excessive commuting, paying high rent or serial, frequent relocation. That’s why Homestead works to build homes that will give homebuyers the hand-up they need to buy a safe, healthy, high-quality home in a neighborhood of opportunity.

Due to systemic racism and discrimination, Black, Indigenous, People of Color (BIPOC) have historically been restricted or disallowed from owning property. More recently, BIPOC families are being pushed out of their neighborhoods due to gentrification. Homestead’s homes allow these households to stabilize in a neighborhood, achieve housing security and improve their financial standing. To support their mission, we committed $50,000 over the next two years. The money will be used to expand Homestead’s capacity so they can build and maintain more affordable homes. The organization has a plan to build 100 homes over the next six years. They have five projects in active development and three more opportunities to build secured through partnerships with private landowners, other nonprofits and community partners like Heritage. Homestead has 225 homes in trust, located in areas considered most vulnerable to displacement as our region’s growth continues.

“It’s hard to explain the sense of vulnerability that working-class renters live with in this region, as we’re pushed further and further from our communities and our jobs. When we actually were selected to buy a unit…it felt like a miracle. Every day now, I wake up with a sense of relief that my family has a secure home.” – Susan, Homestead Homeowner

Their three current projects in Seattle’s Central District, Renton and Tukwila are also located in areas at risk for displacement. This next round of homes will create homes for modestincome households in additional neighborhoods of opportunity in King County. We all believe that the people who make our cities and communities great should be able to live in those same communities. Homestead Community Land Trust

Last year, we partnered with

HOMESTEAD COMMUNITY LAND TRUST RELATIONSHIP MANAGER, ALEX PACE Alex joined Heritage Bank in 2015 after eight years working as a personal banker. Now he focuses on small business customers, commercial real estate and affordable housing. He also currently serves as treasurer for Casa Latina, a nonprofit organization empowering Latino immigrants through educational and economic opportunities.

6

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

Shutterstock

Learn more about setting up alerts and other features of Heritage Direct at HeritageBankNW.com or contact us at 800.455.6126 for assistance.

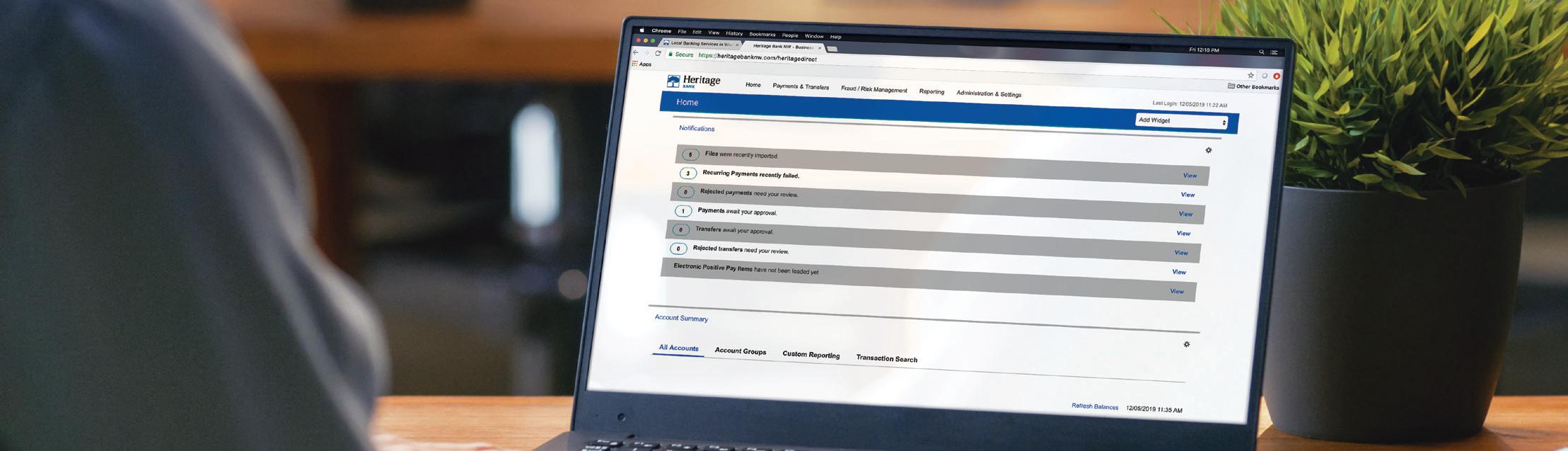

Setting Up Banking Alerts (and Why You Should Be Using Them) Remember when you had to wait for your monthly statement to arrive to know what’s going on with your bank account? Never knowing whether an account balance had fallen below a certain threshold, a large transaction occurred or there was unusual activity on your account. Now, with online and mobile banking, you can manage your finances 24/7. And as a business owner, it’s your responsibility to know what’s going on with your accounts at all times. But running a business can be time consuming—not always giving you an opportunity to stop and check on your bank accounts. That’s why alerts can be a great tool. Bank account alerts are a real-time snapshot of what’s going on with your money. They can help you keep a better eye on activities without having to log in to online banking or wait for your monthly statement. Not only can they alert you to potential fraud but they can also serve as reminders to take action with your finances.1 Heritage Direct offers a number of alert options that you can take advantage of. Alerts are sent via email by default, but you can choose to receive them by text, phone calls or a combination of all three. Whether you’re an established customer or just now signing up for business online banking, our digital banking experts can help you set up the alerts that make the most sense for you, your business and/or your employees. Some of the more common alerts our digital banking specialists see are alerts for ACH origination, online wires, check positive pay and ACH positive pay. But there are multiple alert types available in Heritage Direct. Here are a few examples.

ACH & Wires

• Payments awaiting my approval – notifies you if a payment has not been approved by a certain time. • Payment status change – notifies you when the status changes on a payment.

Check Positive Pay

• Positive pay suspect item – notifies you if there are check exception items to decision. • Positive pay cutoff time is approaching – notifies you to review your check exceptions before the noon cutoff time. • Positive pay no suspect items – notifies you if there are no check exception items to decision that day.

ACH Positive Pay

• Electronic positive pay suspect item – notifies you if there are ACH exception items to decision that day. • Electronic positive pay cutoff time approaching – notifies you to review your ACH exceptions before the noon cutoff time. • Electronic positive pay no suspect items – notifies you if there are no ACH exception items to decision that day.

Miscellaneous

• Balance – notifies you when certain account balance types have been reached (opening, closing, current ledger, etc.). • Transaction – notifies you when certain types of transactions are posting. • User actions – notifies you when a user has performed certain types of user maintenance.

SOURCES 1

www.forbes.com/advisor/banking/types-of-bank-account-alerts-to-set/

Equal Housing Lender | Member FDIC

HeritageBankNW.com

7

Shutterstock

PNWONDERLAND

Winter Wonderland Bucket List: 12 Activities to Check Off It can be rainy and cold during wintertime in the PNW. But if you happen to catch a clear day, there’s a lot to explore. There are also fun indoor activities for when the weather isn’t cooperating or you just want to stay warm. Check out these 12 PNW attractions you can check off your bucket list this winter. 1. 1 Grab your favorite companion and try snowshoeing. There are a vast number of snowy trails throughout Washington and Oregon dedicated just for snowshoeing, and they range in difficulty from beginners to longtime trekkers.

7. 7 Watch the waves crash on the Oregon coast. While storm watching has more to do with ocean conditions rather than weather conditions, if you go between November and March, you could spot a wave over 100 feet high!

2. 2 Ski or snowboard one of the PNW’s many mountain passes. Resorts offer something for just about everyone: rentals, lessons, lodging, bunny hills, expert runs, tubing—you name it! Search for a resort near you to check out what they have to offer.

8. 8 Grab your shovel and go clam digging. This is a fun activity the whole family can enjoy. Just make sure to check the shellfishing regulations before you go.

3. 3 Show your fandom at a hockey game. That could mean watching Washington’s newest NHL team, the Seattle Kraken, or rooting for a local team, like the Portland Winterhawks or Seattle Thunderbirds. 4. 4 Tour a real-life Willy Wonka. Theo’s Chocolate Factory in Seattle offers an hour-long interactive experience where you’ll learn the origins of cacao, see how they make their chocolate from scratch and sample treats along the way. 5. 5 Lace up your boots and go for a winter hike. This activity may not be for everyone, but if you like hiking, finding a trail to explore during the winter can offer spectacular views—from frozen waterfalls to snowcapped trees.

9. 9 Warm up in a hot spring. Located throughout Washington, they're a fun way to soak and relax amongst the wildlife.

10 10. Enjoy a cold one with a friend at a local beer fest. Local events happen throughout the year and all it takes is a quick internet search to find something near you.

11 11. Cozy up around a campfire. Grab the s’mores, gather

some blankets and enjoy the bright orange flicker of a winter fire.

12 12. Stay home and host your own wine or spirits tasting. If

you prefer staying in, this is a great option for you. Invite your friends, pull out the charcuterie board and sample your favorite beverages.

6. 6 Throw on your raincoat and beachcomb for treasures. Doing so after storms or during low tides can prove to be very rewarding, from polished rocks to intricate shells or even mysterious creatures from the deep. Plus, there’s no shortage of beaches in Washington and Oregon.

8

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

brought to you by

PREPARING FOR TAX SEASON

It’s never too early to start preparing to file your taxes. The best thing you can do now is gather all the paperwork you think you might need. Below is a general list of items to help you get started. Remember, always contact a tax professional or visit the IRS’ website if you need help or have questions about your taxes.

NECESSARY INFORMATION

• Social Security numbers and dates of birth for you and any family members • Estimated tax payments made during the year • Real estate and state taxes paid

HELPFUL INFORMATION

• Copy of tax return from the prior year and any supporting documents • Bank account numbers and routing numbers

Vecteezy

• Year-end statements for Individual Retirement Accounts

COMMON TAX INFORMATION

Income: • Earnings and income summary • Retirement distributions and pension payments

This communication is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 1000 SW Broadway, Suite 2170, Portland, OR 97205, (888) 360-0052.

• Property sale or exchange documentation • Interest earned • Investment portfolio consolidated forms • Rental property income and expenses (profit/loss) • Business income and expenses (profit/loss) Adjustments, deductions and credits: • Retirement contributions • Health insurance premiums • Health savings contributions and distributions • Education expenses and student loan interest • Childcare expenses • Mortgage interest and mortgage insurance • Charitable donations • Vehicle registration based on vehicle value For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Investment Services nor any of its representatives may give legal or tax advice.

Equal Housing Lender | Member FDIC

HeritageBankNW.com

9

BUSINESS BANKING MENTOR

Improve the Efficiency of Your Business IDENTIFY OPPORTUNITIES FOR SYSTEMIZATION Good business systems will make your business stronger, more efficient and easier to run. They’ll also make your business far more attractive to future buyers, because if you’ve developed clear operating and procedures manuals, the business will be seen as an independently viable unit and less dependent on you. Think, for instance, of what makes franchises so successful: they are designed so that people can buy a proven system and operate it after minimal training. They can do this because the business procedures are captured in simple, clear operating manuals. Here are five steps to better systems: • Good record-keeping and bookkeeping

Improve Productivity

From effective systems and procedures to creature comforts and progressive workplace practices, there are ways your business can improve the productivity of your staff. A progressive workplace is one that focuses on customer service, staff and technology. You’ll need to have the right balance of reinvestment in your staff, which could include: • New technologies to make work easier – like mobile devices with access to online systems and ergonomic office furniture. • Regular exercise and social activities – to take mental breaks, reward staff for their hard work and provide opportunities to know each other better. • Flexibility – many staff members have other commitments. Flexibility with work hours, to take a child to a sports match or to visit the dentist, will create an environment of give-and-take. They’ll appreciate the way their life can fit around their job.

• Good cash flow forecasting to anticipate possible problems • Good creditor and debtor controls • Set goals for your business, with specific steps on how to achieve these goals

Shutterstock

• Realistic pricing and costing

• Effective procedures for customer care – these should be clear and consistent so your staff knows exactly what to do in each situation.

Make Use of Technology

The right use of technology can give you a competitive advantage if you: • Review payment solutions • Automate tasks like newsletters and social media posts • Update client details for legal compliance and business efficiency • Remove outdated customer data that’s unlikely to be used again With the rise of online technology and increasingly fast mobile browsing, small business owners have more options than ever before to improve their business’ capabilities with online technology. There are many businesses that already run their entire operation online, while most have a web presence of some kind. Some of the tools that your business should consider adopting include:

10

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

Shutterstock

• Financial tools – software where your accounting information is stored in the cloud (like invoicing and receipt tracking tools) and card readers for mobile payments are huge leaps in technology. • Communication tools – free video conferencing software like Zoom and Webex have changed the game for meeting virtually. It’s now cheaper and easier to speak with your suppliers, partners, customers and distributors. • Tools for collaboration – online project management and content management software is abundant. Some, such as Trello, can be free while others, like ProWorkflow, require a subscription. Hosting files in cloud storage, where other staff can access and contribute to them, is also a growing trend.

Prioritize

Few people have the time to do everything so it’s important to focus on priorities. If you want to allocate your time effectively, you need to set goals and spend most of your time on activities that help you to achieve

Equal Housing Lender | Member FDIC

these goals. Base your plans on your priorities, taking into account your way of working. You might find it useful to plan first your week, then your day. • Identify which tasks will help you achieve your goals and allocate your time accordingly. • Get small, urgent tasks (for example, dealing with email) out of the way. • Delegate work if other people can do it as well, or more quickly, cheaply or effectively. • Make sure other people know what they need to achieve each day. • Divide the principal tasks for the day into achievable blocks of work.

Delegate

Trying to do everything on your own is a common mistake. Aim to delegate jobs that are routine, require no special skills or are time-consuming. Also delegate any jobs that someone is keen to take on—delegation can be good training and an opportunity for people to make progress in their careers.

HeritageBankNW.com

11

This is the first article in a series brought to you by Heritage Wealth Strategies. Look for the rest of the series in upcoming issues of Banking Business.

Vecteezy

Retirement Mistakes Small Business Owners Make (and strategies to address them) SMALL BUSINESS OWNERS are an essential component of America’s economy. In the United States, 99.7% of all firms are comprised of small businesses with 500 or fewer employees.1 Too often, however, a small business owner spends so much time and energy building their company that they neglect their personal financial future. That’s why we’ve created this four-part series on mistakes to avoid and steps to take when building the retirement you desire while managing your myriad responsibilities. Our goal is to show business owners how to maximize the value of their companies with business strategies that may also help them prepare for retirement.

STRATEGY #1: CREATE A RETIREMENT ROADMAP Building, running and growing a company is tough. Business owners have countless responsibilities and too few hours in the day. Often, in the midst of fulfilling your professional priorities, you end up putting your personal financial life on the back burner. If you haven’t prepared for your retirement, you’re not alone. Many entrepreneurs think growing a business is all they need to retire. However, just having a business does not automatically mean you have a retirement strategy in place. Without a documented roadmap—one that goes beyond the hope of simply selling your business or passing it to your family—you could end up pushing back your ability to retire. In one survey, 34% of respondents said that they have no retirement strategy, while 12% have no plans to retire at all. Both of which are likely short-sighted.2 Delaying retirement isn’t always an option though. Life often brings surprises, and you can't always control when you’ll retire. For example, you may retire early because of certain challenges, such as health problems or a disability. In 2020, only 28% of retirees were very confident in their ability to cover medical expenses during retirement.3 To help ensure that you can experience retirement on your terms, rather than reacting to what life or the business world throws your way, you need to proactively address these items…today.

One-third

of small business owners don’t have retirement strategies in place.4

WHAT TO DO NOW

• Define your ideal retirement. Clarify when you want to retire and what lifestyle you hope to enjoy. • Build strategies to address your retirement. Determine the actions needed to fill the gaps between your current assets and the income you’ll need to support your desired retirement. • Hold yourself accountable. Don’t let the busy life of business ownership keep you from staying on track toward the retirement you desire.

We know balancing your personal and professional priorities can seem overwhelming. We’re here to serve as a resource for you and your family and are happy to discuss your current financial situation and future goals. Contact a Heritage Bank Wealth Advisor to schedule an appointment today.

This material is for information purposes only and not intended as an offer or solicitation with respect to the purchase or sale of any security. For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Investment Services nor any of its representatives may give legal or tax advice. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 1000 SW Broadway, Suite 2170, Portland, OR 97205, (888) 360-0052.

REFERENCES 1 Fundera.com, April 15, 2020. 2 Forbes.com, February 23, 2020. 3 Employee Benefit Research Institute, April 23, 2020. 4 Score Association, April 9, 2020. 12

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

L

STEPS TO TAKE FOR A SUCCESSFUL YEAR AHEAD

ooking at your business plan at the start of a new year can put you on track for a strong 12 months ahead. Maybe your business is finally stabilizing after the ups and downs of the last two years or you’re just looking to revisit the strategies you currently have in place. Here are five steps you can follow to help you get started.

Step 1. Act as a new start-up

Imagine if you could start again. What parts of your business would you change to build a new, stronger business on the foundations of the old one? What would you do differently and how would the business look? You may want to: • Eliminate unprofitable product or service lines • Introduce new products or services that are experiencing growth • Evaluate parts of the business that are no longer profitable • Consider the expertise mix of employees • Invest in new research and development Determine if you can expand your products or services or take a new approach to sell to customers with a trial offer, a free sample, a special price or extra service. If you can establish one or more new opportunities in an identifiable target market, can you pivot some or all of your business to meet that demand?

Step 2. Employ low-cost marketing techniques

Bootstrap the way you promote your business by finding inexpensive ways to get in front of customers. Revisit your promotional tactics and identify what worked the best, list them from the cheapest to the most expensive, then start from the top. You may find the methods that cost very little are the best, such as: • Contacting likely customers directly • Increasing your presence on social media • Using email campaigns to your existing contact list • Asking customers to refer you to others • Using virtual meeting invites to target customers outside your normal business area of operations Many of the most successful small business marketing ideas take time rather than money.

Step 3. Sell more to existing customers

It should be easier to sell to existing customers with whom you already have a relationship. Ask if there’s anything they need and offer them an incentive (from discounts to prepayment deals to advance notice of new releases). Other tactics to sell more to existing customers include: • Using accounting software to identify and contact inactive customers Equal Housing Lender | Member FDIC

• Analyzing customer buying behavior to offer complementary products and services • Run product demos Triple check costs and pricing to ensure you’re making money from each sale. Extra revenue to existing customers that has low margin, cost overruns, extra waste or product returns isn’t going to help long term. Focus on the 20% of products and customers that generate 80% of your sales to increase the chance of success.

Step 4. Find new customers

If sales to your existing customers decline and you can’t quickly switch what you do as a business, focus on adding new customers. • Sell online by adding an online store to your website • Use third-party marketplaces like Amazon or specialist industry sites • Promote on social media to attract buyers • Form strategic alliances with complementary businesses • Prospect in the next city or state Chances are new customers will look a lot like your existing customers. Profile who your ideal prospects are (order in volume, pay on time, repeat orders, etc.) and then research where they are and the best methods to get in front of them.

Step 5. Find new business models

To get through the coming months and to keep the cash coming in, consider adjusting your business model to uncover new opportunities. For example: • Sell online if you don’t already • Target growth segments such as government, military, education and health • Set up a specialized hub to connect buyers and sellers • If you have helpful or interesting content, make money with services like Google AdSense • Sub-contract to other businesses for short-term contracts • Sell your expertise by the hour online If you do decide to shift your business model, make it a collaborative effort by including your staff, advisers, friends and family to develop your plan and seek professional advice if decisions will impact your financial well-being.

Summary

In the next 12 months, a lot can change. Be proactive by taking time to decide where best to spend your effort and money, then implement your customer, product, service or business model quickly, monitoring what works and what doesn’t.

HeritageBankNW.com

13

Scams And Your Small Business

Information courtesy of the Federal Trade Commission | business.ftc.gov

If you own a small business or are part of a nonprofit organization, you spend a lot of time and effort making sure the organization works well. But when scammers go after your organization, it can hurt your reputation and your bottom line. Your best protection? Learn the signs of scams that target businesses. Then train your employees and colleagues on what to look for so they can avoid scams.

Scammers’ Tactics

• Scammers pretend to be someone you trust. They make themselves seem believable by pretending to be connected with a company you know or a government agency. • Scammers create a sense of urgency. They rush you into making a quick decision before you look into it. • Scammers use intimidation and fear. They tell you that something terrible is about to happen to get you to send a payment before you have a chance to check out their claims. • Scammers use untraceable payment methods. They often want payment through wire transfers, reloadable cards or gift cards that are nearly impossible to reverse or track.

Be Tech-Savvy

• Don’t believe your caller ID. Imposters often fake caller ID information so you’ll be more likely to believe them when they claim to be a government agency or a vendor you trust. • Remember that email addresses and websites that look legitimate are easy for scammers to fake. Stop and think about whether it could be a scam before you click. Scammers can even hack into the social media accounts of people you trust and send you messages that appear to be from them. Don’t open attachments or download files from unexpected emails; they may have viruses that can harm your computer. • Secure your organization’s files, passwords and financial information. For more information about protecting your small business or nonprofit organization’s computer system, check out the FTC’s Small Business Computer Security Basics at FTC.gov/SmallBusiness.

Know Who You’re Dealing With

• Before doing business with a new company, search the company’s name online with the term “scam” or “complaint.” Read what others are saying about that company. • When it comes to products and services for your business, ask for recommendations from other business owners in your community. Positive word-of-mouth from trustworthy people is more reliable than any sales pitch. • Don’t pay for “free” information. You may be able to get truly free business development advice and counseling through programs like SCORE.org.

14

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

COMING IN OUR APRIL ISSUE: AVOID THESE COMMON SMALL BUSINESS SCAMS

How Can I Protect My Business? Train Your Employees

• Your best defense is an informed workforce. Explain to your staff how scams happen and share the information in this article with them. Order free copies of the brochure in English at FTC.gov/Bulkorder and in Spanish at FTC.gov/Ordenar. • Encourage people to talk with their coworkers if they spot a scam. Scammers often target multiple people in an organization, so an alert from one employee about a scam can help prevent others from being deceived. • Train employees not to send passwords or sensitive information by email, even if the email seems to come from a manager. Then stick with the program — don’t ever ask for sensitive data from employees by email.

Verify Invoices and Payments

• Check all invoices closely. Never pay unless you know the bill is for items that were actually ordered and delivered. Tell your staff to do the same. • Make sure procedures are clear for approving invoices or expenditures. To reduce the risk of a costly mistake, limit the number of people who are authorized to place orders and pay invoices. Review your procedures to make sure major spending can’t be triggered by an unexpected call, email or invoice. • Pay attention to how someone asks you to pay. Tell your staff to do the same. If you are asked to pay with a wire transfer, reloadable card or gift card, you can bet it’s a scam. In our next issue, we'll share the most common scams that target small businesses.

LEARN

REPORT

ENGAGE

For more tips on protecting your organization from scams, visit FTC.gov/SmallBusiness.

If you spot a scam, report it to FTC.gov/Complaint. Your report can help stop the scam.

Remember: Your best defense is an informed workforce.

Stay informed by signing up for scam alerts at FTC.gov/Scams.

Alert your state Attorney General. You can find contact information at NAAG.org.

Equal Housing Lender | Member FDIC

Talk to your staff about how scams happen.

HeritageBankNW.com

15

MY HERITAGE

A Country Girl at Heart

M

y heritage could be described as country girl with a twist. I grew up on a ranch in a remote area south of Tulsa, Oklahoma—not just any ranch but a boy’s ranch my father ran that was geared to rehabilitating juvenile delinquents sent there by the courts. He still runs the 100-acre ranch today. It’s now for young men 18 and older who go there voluntarily for guidance, attaining their GED, vocational training and ministry as they seek to redirect their lives. My dad’s a minister, too. I was one of six siblings, including four older brothers, so I got pushed around a little. But it also toughened me up. I like to joke my younger sister was the protected one. After high school, where my graduating class numbered about 37, I wanted to expand my horizons beyond country life. I joined the Air Force, where I got top-secret military clearance to encrypt and decrypt top-secret military messages. That work piqued my interest in fields like forensic accounting, something I thought I might like to pursue. I can spot fraud a mile away, which I think is due to my military work.

Heritage about eight months ago. My two teenage girls live with me in Fife, while my 21-year-old son stayed in Oklahoma. Before joining Heritage, I worked for another bank, starting in 2008 as a teller in a busy branch where I averaged about 450 transactions a day. That required precision accounting of money, diligence also aided by my military training. During my free time, I played roller derby for the Cast Iron Skaters out of JBLM. The women’s team included military and nonmilitary skaters. That was fun because you got anyone from smaller older ladies that are accountants who just want to get some aggression out to women in the military. As for me, I can throw an elbow! But I can also walk in heels! I was a model in high school. It helped being tall, nearly 5 feet 11 inches. I also did some radio commercials for Tulsa stations, and I played piano throughout my childhood and later taught piano before entering banking. Not surprisingly, I’m an advocate for troubled-youth programs and have also volunteered with Tacoma Rescue Mission, Emergency Food Network, Rebuilding Together South Sound and United Way. I especially enjoy helping programs that collect food for students whose food access is limited outside of school meals.

After starting at Tinker Air Force Base in Oklahoma, I was sent in 1997 to what’s now Joint Base Lewis-McChord (JBLM), and I fell in love with the Northwest. I also met my future husband and had three children. While the marriage didn’t work out, we were awesome at co-parenting until he sadly died of cancer in 2018.

While I’ve transitioned from country life to working in downtown Seattle, you can’t take the country out of me. I love the country.

I had only been with Heritage about six months at the time before I returned to Oklahoma with my children for two years for family support. I came back to Washington and rejoined

I feel like I’ve been shaped in many different ways and it’s helped me be a well-rounded person with all the different things I’ve experienced in my life.

ABOUT THE AUTHOR Elizabeth Miller, branch relationship officer, helps consumers and small businesses with account setup and support, treasury management, fraud mitigation and anything else a customer needs to achieve their financial goals.

16

Issue 4 | 2022 Q1

Banking Business a publication of Heritage Bank

FINANCIAL DICTIONARY Check Positive Pay

FRAUD MITIGATION TOOLS HERITAGE DIRECT offers a full suite of services designed to help protect your business in the digital age. Talk with your treasury management relationship officer about our fraud prevention tools and which ones might be best for your business.

Dual Control

Dual control requires approval by two users, decreasing errors and reducing the risk of fraud. This can be setup for user creation, user permissions, internal transfers, ACH origination and wire origination.

Positive Pay

Positive pay helps detect check fraud by identifying payments your business never issued or checks that don’t match those you did issue. Those with a perfect match, we will pay. Rejected items are put in an exception report that your business reviews daily. See the green box to the right for a complete definition of positive pay.

ACH Positive Pay

The system monitors ACH activity clearing your account so all authorized transactions process without delay. If there are unauthorized ACH transactions that attempt to clear your account, they’ll be flagged as an exception, and you must decide to pay or return the transaction.

Tokens

Security tokens defeat malware programs by generating a new passcode every 30 seconds. Users must enter the current passcode to access the system. Even if malicious programs capture stolen credentials, the token passcode expires within seconds. Since only the user who has the token can know the current passcode, cybercriminals are prevented from accessing the system.

Alerts

There are various alerts that can be setup within Heritage Direct that help identify payments and transfers that have been approved. You can customize who can receive the alert, how they receive it and the subject line.

i

Learn more about setting up alerts in our article on page 7.

Equal Housing Lender | Member FDIC

Check positive pay is a fraud prevention service that Heritage offers to protect against altered, forged and counterfeit checks. It’s an important banking feature for businesses because it helps eliminate a majority of the risk of losing money due to fraudulent activities on your accounts. Check positive pay matches the presented check dollar amount, check number and check date against checks that have been previously authorized by your business. If any of these items don’t match up, an exception is created and you’ll be alerted that a decision is needed. You’d then log in to online banking and make a decision to either pay or reject the item. If a decision isn’t made by noon that day, the item will automatically be paid. This stops criminals from cashing fraudulent checks using stolen account numbers. It also catches bad checks where the check amount has been altered or the check has an invalid date. Heritage also offers payee positive pay, which adds the functionality of scanning for mismatches in payee name in addition to the items listed above. Your relationship manager and treasury management relationship officer can help determine whether check positive pay or payee positive pay might be a good fit for your business. *All positive pay options are available only to Heritage Direct Corporate users. ABOUT THE AUTHOR Kyle Fergusson started in banking after graduating from the University of Washington in 2009. Since then, he’s become one of our senior treasury management relationship officers, where he helps customers choose the best products, services and pricing for their business. He also works closely with our commercial banking officers and branch teams to expand existing client relationships and bring on new prospects. Outside of work, Kyle is an avid sports fan and is currently enjoying rooting for the newly formed Seattle Kraken hockey team as an inaugural season ticket holder.

HeritageBankNW.com

17

Your business is one of a kind. We offer solutions to match.

EQUIPMENT FINANCING

Our experts will help you find the right fit for your business. Your equipment provider will likely offer financing and lease terms; before you commit, check with us. We have highly competitive financing options available when it’s time to purchase new or replace equipment. Equipment Financing* Having the right equipment is critical to the success of your business. We provide equipment financing options that suit your budget. – Up to 100% financing on new and quality used equipment – No loan origination fee – No prepayment penalty – Minimum loan size of $50,000 – Up to 7-year fixed rate available – Local decision making with rapid response

Snap a photo of the QR code with your smartphone camera to connect with a financing expert near you. * Subject to credit approval and program guidelines. Financing maximums and terms are determined by borrower qualifications and use of funds. Heritage Bank and its representatives do not provide tax advice. Consult an advisor regarding a particular financial situation. Credit products are offered by Heritage Bank.

Equal Housing Lender | Member FDIC

HeritageBankNW.com | 800.455.6126 |