How Heritage Bank helped Blanchet House rise to the challenge of serving those in need during the pandemic

Switching Banks Meet our Portland Commercial Team Lower the Risk of Payment Fraud a publication of

Banking news and stories to help you maximize the financial success of your business Q4 2022

ISSUE

IN THIS

Essential Services

“[Heritage

– Scott Kerman, Blanchet House

Expanding in the Eugene, OR Market

We’re

say hi today!

Creative

Managing

Stephanie Neurer

Contributors Bill Glasby Jeff Kister

Dominick Mobley

Rob Stewart John Stearns Cover

Business Profile: Blanchet House ............................................................... 2 Top Strategies for Growing Your Business ................................................ 6 A Faster Way to Pay Through Heritage Direct .......................................... 9 Commercial Banking Center Profile: Portland ....................................... 10 Switching to Cloud-Based Accounting and Data Storage ................... 14 The Benefits and Challenges of an SBA Loan ....................................... 20 IN EVERY ISSUE Heritage Helps 8

community involvement is part of our company’s DNA and something we’re very proud of. In this section, we highlight the good we're doing in our communities. Wealth Strategies 13, 21 Timely insights and tips from our Wealth Strategies team. PNWonderland 16 Explore the unique sights and experiences of our Pacific Northwest. Business Banking Mentor 18 How we make switching banks easy. My Heritage 22 Meet our relationship managers and learn about their heritage. Fraud Prevention 24 Take these steps to protect your business and finances from fraud. Financial Dictionary ............................ 25 Empowering you to make smart business decisions by demystifying banking terminology. Equal Housing Lender | Member FDIC Banking Business is a quarterly publication of Heritage Bank

of Marketing

Carson

Gibson

Our

Director

Shaun

Editor-In-Chief Whitney

Director

Erica Bolvin

Editor

photo Olli Tumelius, Tumelius Media, LLC 3615 Pacific Avenue Tacoma, WA 98418 800.455.6126 HeritageBankNW.com © 2022 Heritage Bank, member FDIC, Equal Housing Lender. The information in this magazine is general education or marketing in nature and is not intended to be accounting, legal, tax, investment or financial advice. Although Heritage Bank believes this information to be accurate as of the date published, it cannot ensure that it will remain accurate. Statements of individuals are their own and do not necessarily reflect the position or ideas of Heritage Bank. Contact us at 800.455.6126 or visit HeritageBankNW.com to make an appointment with one of our local experienced relationship managers to discuss your individual business banking needs. Contents 8 2 10

Bank’s]... team walks the walk, is involved in nonprofits, serves on boards of nonprofits and brings that level of dedication and service to their banking work.”

excited to announce the opening of our new commercial banking center in Eugene, Oregon. The team of highly experienced bankers is committed to providing customized solutions and a high-level of personal service that can help your business meet its strategic goals. Stop by and

Heritage Bank

Tumelius Media, Heritage Bank

Blanchet House

s we prepare to wrap up 2022, this is a great time for businesses to evaluate their market position, determine where they want to go and make adjustments so they are better positioned for the year ahead.

In this issue, we cover several topics focused on growth and what you can implement now or long-term that will help you scale your business effectively and efficiently.

Every business will have their own critical success factors to indicate how well they’re doing. It could be sales development, the number of new leads, customers retained or recurring monthly revenue. There are plenty of opportunities to expand or grow your business—requiring both foresight and action.

With proper planning, the benefits to your company could mean improved operating efficiency, greater market value, widespread brand name recognition and a chance to introduce your products or services to a larger audience. On page 6, we detail three strategies that may help you increase sales and identify new opportunities in your market.

In addition to sales and marketing, continuously improving the day-to-day operations is critical to any business’ success. One way to improve is by investing in cloud-based services (page 14), like accounting software and data storage. These services can help reduce your overhead, simplify your computing needs and provide your business with greater flexibility and security for when you need to work.

Another way to improve is by taking advantage of the tools within Heritage Direct that can help you automate routine tasks. On page 9, we discuss the benefits of ACH payments, how ACH differs from wires and other electronic payment options that are available, including the newest: same day ACH.

Thank you for reading Banking Business and for trusting us as your banking partner.

Sincerely,

Jeff Deuel CEO

A MESSAGE FROM OUR CEO

Jeff Deuel is chief executive officer at Heritage Bank. He has more than 39 years of banking experience. Prior to joining Heritage, he worked at JPMorgan Chase, WaMu, Bank United, First Union, CoreStates and First Pennsylvania Bank. Jeff is a past chair of the Washington Bankers Association. He currently serves on the board of the Oregon Bankers Association and Pacific Coast Banking School. He is an avid cyclist and has climbed to the top of Mt. Rainier.

CORPORATE CITIZENSHIP 2 022 1 Equal Housing Lender | Member FDIC HeritageBankNW.com

Heritage Bank

Scott Kerman stands outside Blanchet House’s downtown Portland meal and transitional housing building.

Scott Kerman stands outside Blanchet House’s downtown Portland meal and transitional housing building.

2 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

Tumelius Media for Heritage Bank

Portland’s Blanchet House

Helping people in need for 70 years

ARTICLE BY JOHN STEARNS

In the earliest days of the pandemic, Portland’s Blanchet (pronounced Blan-shay) House of Hospitality saw demand for its free meal service surge as other social service agencies closed, a challenge exacerbated by having to close its dining hall amid the broader health emergency.

“There was no question we had to keep serving. We literally served dinner inside on March 16, 2020, and then had to figure out how we were going to serve outside at 6:30 a.m. the next day, so that’s what we did,” said Scott Kerman, executive director of Blanchet House since August 2019. “What we didn’t know was going to happen was that we would go from 1,000 meals a day to over 2,000 meals a day, almost instantly, because nobody else was really serving.”

While a couple organizations in Portland continued to feed the hungry early in the pandemic, there was a period when most closed, he said. Not only did Kerman need all his staff to handle the extra meal demand, but he also needed to find temporary staff to help.

“I didn’t know where the money was going to come from; I didn’t know where the food was going to come from; and we suddenly needed to buy to-go packaging for every meal and beverage, plus plastic utensils and more—an unexpected $70,000 expense that first year,” he said. “What I didn’t know at the time was that there was going to be a lot of generosity in our community and people were going to donate to keep us going.”

When Blanchet House struggled to secure a Paycheck Protection Program (PPP) loan from another bank, Kerman emailed Kathy Swift, senior vice president, nonprofit development officer, at Heritage Bank in Portland, who he’s known for 15 plus years. He had a previous banking relationship with her while at other organizations and has seen her at various nonprofit events over the years.

“I felt like she snapped her fingers and it happened,” Kerman said of the PPP loan, ensuring he could manage payroll.

“I had wanted to move … a good part of our banking business over to Heritage because I just love Kathy, I love her team and I trust them. I know what a heart they have for nonprofits and the work that we do,” he said.

PPP opened that door and Heritage now handles Blanchet House’s main operational account. Heritage also assisted with a 12-month high-yield CD for a generous gift Blanchet House received.

“I always know if we have a need, I can call Kathy or someone else on their team and they’re going to pick up the phone,” Kerman said.

Blanchet House continued its to-go service for 25 months, until May 2, 2022, when diners returned indoors.

Food, clothing, shelter, support, dignity

Blanchet House says it makes a difference in people’s lives by providing food, clothing and supportive housing programs.

“We serve anyone who comes to our doors without judgment because we believe everyone deserves dignity, hope and community,” its website says.

According to its website, Blanchet House was founded in 1952 by a group of University of Portland alumni as a “House of Hospitality” like those established by the Catholic Worker Movement. The founders were rooted in the Catholic community but Blanchet House is not affiliated with any religious organization, adding its mission “derives from Catholic social teaching principles, including honoring the dignity of every person, offering aid to the poor and vulnerable, and solidarity.”

Blanchet House started by serving meals at a downtown facility and eventually added some short-term housing for men upstairs in 1958. In 1962, the founders purchased a

Visit HeritageBankNW.com

3 Equal Housing Lender | Member FDIC HeritageBankNW.com

to read more of our business profiles, then make an appointment with a banker who knows your industry.

40-acre farm in Yamhill County as a place for men struggling with addiction to escape the city’s temptations, work on the farm and pursue sobriety. The farm today is 62 acres, offering addiction recovery in a rural setting allowing men to work on the property and support each other in recovery.

Blanchet House built a larger building downtown for its meal and transitional housing program in 2012. That building is next door to the original building.

The organization only houses men but is fundraising for a women’s housing facility that it will operate with another nonprofit.

Blanchet House serves breakfast, lunch and dinner Monday through Saturday at 310 N.W. Glisan St. That’s 18 meals a week, the most by any agency in Portland, Kerman said. Not everyone who eats there is necessarily unsheltered, with some living in a shelter but looking for a nutritious meal, while others are homeless and live on the streets, in their vehicles or couch-surf.

Kerman estimated more than half the diners are over 60 and suffer from physical disabilities. Many homeless have chronic conditions like diabetes and high blood pressure, others are in wheelchairs and there seems to be an increase in amputees since the pandemic. “I’m just astounded at how these individuals survive,” he said.

Many of the homeless who eat there suffer from traumatic brain injuries, mental illness or addiction. Many abuse substances to self-medicate, he said.

“From my experience, the number one or number two reason that a person is houseless is trauma,” he said. “Trauma in their life has led them to be housing or food insecure and being homeless on the street here is, in itself, traumatizing. So, we’re dealing with an extraordinary amount of trauma and many people turn to drugs as a way of self-medicating. It’s a whirlpool that’s hard for folks to get out of.”

Two types of housing

Kerman describes Blanchet’s housing options, which include a 45-person facility downtown and 21-person facility on the Yamhill County farm, as bridge housing. Other terminology is transitional or temporary housing.

At its downtown apartments located above the dining hall, Blanchet House offers a nine-month housing program, with an option to extend that another nine months. It’s designed to give people time and support to get back on their feet. They may be couch-surfing, getting out of jail, emerging from treatment or have lost a job and are down on their luck, and likely would end up houseless without Blanchet House.

“The design of the program is: you’re here because you want to get back into the workforce and get back into stable housing,” Kerman said.

The first three months, residents must work in the kitchen or café; stabilize in the house; and meet with case managers, think about goals, work on soft skills and learn to live in the community of men. Case managers meet with them weekly to review their health, financial or legal issues, employment or education, housing and post-program maintenance.

After 90 days, residents can work outside of Blanchet House or attend school and reduce their Blanchet work hours, but they still live there. They then meet biweekly with their case manager. After nine months, some men are offered a private room for nine additional months.

The house does not allow drugs or alcohol and strictly enforces that policy.

Farm housing with addiction recovery

The farm program is similar to the downtown housing, except everyone at the farm has some kind of an addiction—from drugs and alcohol to video games. The farm runs a 12-step program with daily Alcoholics or Narcotics Anonymous meetings.

Blanchet House

4 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

Blanchet House / Julie Showers

The first three months, residents work on the farm and tend to animals, gardens and beehives. There’s also a wood shop that they can work in.

The men, many of whom unsuccessfully tried other addiction-recovery programs, enjoy working in the shop and fields as well as the complementary peer support community, Kerman said.

“The opportunity to work with our therapeutic animals, to be in a remote, beautiful, natural environment, to do work with their hands, is really therapeutic for our residents,” he said.

Housing expansion

Blanchet House has launched a $10 million capital campaign to build long-term transitional housing for women similar to its downtown program. The housing will be somewhere in the Portland metropolitan area. Blanchet House is partnering on the project with Women First, a BIPOC, women-led Portland nonprofit that works primarily with women who are, or have been, incarcerated. Some of the money raised also will help update the current Yamhill County farm housing for men.

In mid-July, Blanchet House had 22 employees, including three at the farm and the rest downtown. Its operating budget is about $2.4 million a year, which covers payroll, insurance, utilities and the like.

About 95% of Blanchet House’s food is donated. The in-kind value of that food in 2020 was nearly $2 million. It also tries to raise about $3 million annually and, with other in-kind contributions, has about $5.5 million in annual revenue. It receives no government funding.

It needs about 40 volunteers a day to serve its meals but also has some who sort clothes, which Blanchet House distributes to those in need. It accepts gently used clothing that is dignified. “We say if we wouldn’t wear it, why should they?” Kerman said.

Blanchet House also distributes hygiene kits with supplies that are also donated.

Its website, blanchethouse.org, offers links to get involved, whether individuals or companies, through time or donations.

Heritage support is broad

In addition to banking support, Heritage employees have volunteered to help assemble care kits for Blanchet House, and the bank also provided a grant this year at its annual fundraising brunch, its biggest fundraiser of the year. “They’re so people-oriented and so nonprofit-oriented,” Kerman said. “They want to provide service that is effective and efficient and allows my team to get back to what it is we’re supposed to be doing.”

That mirrors Kerman’s own background. He was active in community service at Santa Clara University where he got a degree in political science. He continued that service while in law school at the University of Virginia, where he started a community service organization. He spent summers interning with agencies helping low-income people and the homeless.

He got his law degree but wanted to do something serviceoriented first. He joined the then-new Teach For America program to teach in at-risk communities—noting that he was the first law school graduate to enter the program.

He taught in a rural North Carolina middle school for a year and loved it. He then took the bar exam and became a criminal defense lawyer, working for a prominent Houston attorney.

“There’s always been that kind of element of serving people for whom there are not a lot of people in their corner,” Kerman said of his internal compass.

After three years of law, he missed teaching and became a middle school teacher at a Catholic school in Houston, then taught in Massachusetts, then moved to Portland and added bachelor’s and master’s degrees in English. He continued to teach before moving into school leadership. He spent about 20 years in education, then opted for a new challenge.

Blanchet House had an opening.

“The move to Blanchet House didn’t feel that strange to me because that thread had always been there,” he said of the similarities between schools and nonprofits.

“Who we’re serving now … they are the people left behind and there’s a lot of pride in being there for them and sort of understanding, ‘If not us, who?’ I’m not saying there aren’t other agencies doing the same work … but collectively we are serving people who feel that they have been left behind.” Heritage’s support of that mission is special. Asked what insights he could offer others about working with Heritage, Kerman didn’t hesitate.

“They are in the banking business of supporting nonprofits. They have a rich history of supporting nonprofits as a banking and lending institution, but also, their team walks the walk, is involved in nonprofits, serves on boards of nonprofits and brings that level of dedication and service to their banking work,” he said. “They get it, they get what we do, they get how we do it and the circumstances in which we do it—and that’s not always the case with other banks.”

ABOUT BLANCHET HOUSE’S RELATIONSHIP MANAGER

KRISTEN CONNOR

Kristen has more than 16 years of experience in the commercial banking field, with expertise in business development and portfolio management for commercial and nonprofit businesses. These include some of the region’s leading nonprofits and businesses, whose missions focus on a broad range of sustainability and social justice issues.

5 Equal Housing Lender | Member FDIC HeritageBankNW.com

Top strategies for GROWING YOUR BUSINESS

If you’re ready to scale, you’ll need a plan. There are many strategies for growth but which ones suit your needs best?

Create more sales

Sell more to your present customers

Increase your levels of stock and sell more. Tempt your current customer base with incentives such as loyalty discounts, promotions and awareness.

Distribute an e-newsletter

Let your regulars know what offers you have available each week or month. Keep in frequent contact—enough to keep them interested but not too much to be annoying.

Offer complimentary goods or services

Introduce new items to your rows of goods or services that compliment those already on offer. Bundle them together as special deals to generate extra revenue. What else can you sell to customers you already have?

Promote new products or services

Keep an eye on changes in your marketplace and look for ways you can develop new products or services to keep ahead of your competition.

1 6 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

Profile your existing customers

Look for personal or professional similarities between your existing customers. Then try and find more people or businesses that have the same demographic or business characteristic.

Encourage referrals

Convince your regular customers to share their knowledge of your business with friends, family or acquaintances. Consider offering special prices for referrals.

Network

Do your own networking with like-minded business people. It can be a cost effective method of generating new leads.

Focus on advertising

Apportion some extra funds to your advertising budget, try some different channels and focus on getting your message out there.

Connect online

Set up profiles of your business on Facebook, LinkedIn and other relevant social media. You never know who might be browsing.

Pinpoint different distribution channels

Are there other avenues for you to sell your product? Consider using direct selling via the internet, various retail options and wholesale to cover a wider region.

Enter new markets

Export yourself

Is it feasible to expand your business into another territory? Make sure you first do enough research on your potential competitors, the pricing structure in the new market and what regulations you might face. If you are trading internationally, then brush up on possible foreign exchange risk.

Grow by buying others

Identify if you can buy any suppliers (to lower your costs and lock in any critical supplies) or customers (to guarantee sales).

Open more locations

Can you establish more patches in different suburbs, towns or cities? Is setting up a franchise the best way your business can grow?

Visit HeritageBankNW.com/business-banking to explore our financing options if you need extra cash to increase your advertising budget.

2 3 7 Equal Housing Lender | Member FDIC HeritageBankNW.com

Find new customers

On September 14, 2022, we closed branches and back offices across our footprint to join together in a bank-wide afternoon of volunteering. Team members participated in community service events from Bellingham to Eugene, Olympia to Yakima and everywhere in between. We painted houses, organized storerooms, packaged hygiene kits, pulled weeds, maintained trails and more.

Follow us on social media and visit HeritageBankNW.com/community to read more about how we serve our communities.

8 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

A FASTER WAY TO PAY THROUGH HERITAGE DIRECT

Beingable to make electronic payments easily and securely is critical for most business operations. It’s how you pay vendors, bills and your employees—all without the use of physical checks or cash. Plus, when you opt for electronic payments, you can reduce processing fees, increase payment security and more accurately track financial data.

One of the most prevalent types of electronic payments is ACH. It’s how your salary is automatically deposited in your bank account. It’s how you pay bills online. It’s how you set your mortgage payment to automatically withdraw from your account on a specific day of the month.

It’s used for both personal and business purposes and is one of the most top-used transaction methods around, with more than $29.11 billion payments in 2021.1

The ACH Network was established in the 1970s by the National Automated Clearing House Association (NACHA).2 This was a game-changer for most people and businesses using the internet. And while it’s still widely used today, typical ACH transactions can take up to two business days to complete.

For a business, this can make it difficult to manage day-today cash flow. That’s why NACHA eventually introduced same-day processing of ACH payments. This means that transactions are received by your customers and suppliers the same day you initiate them.

Though still not a real-time payment method, it provides an additional option for faster payments. Within Heritage Direct online or the mobile app, you can quickly initiate same day ACH* transactions.

As a Heritage Direct customer, there are several types of electronic payments you can use:

• Credit and debit cards

• ACH (direct deposit, same day ACH, vendor payments)

• Wire transfers

• Bill pay

• Payroll cards

With same day ACH, you can better track your finances with a clearer sense of your bank account balances—all while enhancing customer, supplier and employee relationships by accelerating transactions.

To learn more about payment options within Heritage Direct, call us at 800.455.6126 and ask to speak to a treasury management relationship officer.

*ACH is subject to approval.

ABOUT THE CONTRIBUTOR: DOMINICK MOBLEY

Dominick joined the bank in April 2021 and has 16 years in the industry. As the digital payments manager, he specializes in ACH and wires. He’s a NACHA Accredited ACH Professional and is also working towards a Payments Risk Accreditation. He’s been involved in several payment-related projects at the bank and looks forward to helping improve the products customers need to stay successful.

1 www.nacha.org/content/ach-network-volume-and-value-statistics

2 www.nacha.org/content/history-nacha-and-ach-network

Shutterstock 9 Equal Housing Lender | Member FDIC HeritageBankNW.com

Bringing Diversity & Equity Passion to a Broad

Range of Portland-Area Clients & Industries

Article by John Stearns

Mission matters to Emily Leach and her experienced, talented commercial banking team in Portland.

“Our team is very passionate about access to capital, and diversity, equity and inclusion are key values that inform all of our decisions, including how we spend our time,” said Leach, senior vice president-commercial banking team leader at Heritage Bank’s downtown Portland office. “We therefore end up working with clients who might need a special amount of advocacy in order to achieve their goals of buying a building or completing a complex transaction.”

The bankers are willing to take the time, sometimes years, to help historically disadvantaged clients access capital to grow their enterprises.

It was Heritage’s mission and deep sense of community that convinced Leach and four others to leave their previous bank on the same day in May 2017 to open Heritage’s new commercial office in Portland that summer. That was a big day “to make the leap together” to join Heritage, she said.

The draw of Heritage?

“What seemed to be a very authentic desire to support bankers that are truly invested in their communities,” Leach answered. “We could see where the culture would be open to the market strategies that we had used to build our book of business and the passion areas that we had would be supported.”

That includes leveling the playing field to access lending.

“We were thoroughly impressed with the quality of our management team along with the level of engagement and support,” she said. “It might have felt a little bit lonely, but we were incredibly supported by a number of different managers, and we have never looked back on our decision. It’s been rewarding to be part of opening a new market for a great bank.”

That core group of five has since grown and is passionate about supporting nonprofits and affordable housing. The team also works a lot with professional services companies— including law, architecture and property management firms— and manufacturers that are locally based and often family owned. The team has served some of its manufacturing clients for more than 10 years, with the clients following their bankers to Heritage.

Leach also takes pride in helping professional services firms, which often handle large inflow and outflow transactions for

projects they’re managing, and other business and nonprofit clients navigate the bank’s treasury management tools.

“I think that’s another key theme that differentiates our team … is that we have a large number of relationship banking officers as well as commercial banking officers,” she said of various staff dedicated to helping clients think through cash flow and look for ways to build efficiency and security.

The Portland team is comprised of about half relationship banking officers focused on deposits and cash management tools while the other half are lenders focused on loans.

A few Portland-area project highlights Leach’s team is working with a nonprofit, College Housing Northwest, whose mission is developing stable, affordable housing for college students. Heritage is funding one of their first projects at a community college, rather than a traditional university.

“Community colleges are a super important part of our community’s education ecosystem, so that’s a super exciting project for us,” Leach said. “Though affordable housing is something our team does every single year, this is our first student housing project.”

Like affordable housing, addiction treatment projects also are important to Heritage’s Portland bankers, who have helped organize financing for two nonprofit treatment facilities in the last several years.

In early August, the Portland team was preparing to close on financing for its first for-profit treatment facility. The outof-state client is opening its first Oregon facility, a 16-bed outpatient building for clients early in their detoxification journey. The company plans on securing three more facilities in the state.

“It’s a super meaningful project for us to be part of because there’s so much need in our community for addiction help,” Leach said.

Another exciting project is a refinancing deal for a customer in an industry hard hit by the pandemic: a health club. The club was referred to Heritage’s Portland team by an existing health club client who the new client trusted.

“Because of that endorsement, we had a deeper trust level with them more quickly and could better understand how their business operated in normal times so we could help them achieve their goals more effectively,” Leach said.

10 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

The bankers are willing to take the time, sometimes years, to help historically disadvantaged clients access capital

to grow their enterprises.

Sometimes,

help is a ‘warm handoff’

While Heritage’s commercial lenders do all they can to walk historically disadvantaged clients across the lending finish line and understand the metrics for traditional bank financing, not every borrower will qualify. That doesn’t mean Heritage stops helping, though.

The bank will facilitate a “warm handoff” to other funders it trusts, Leach said.

“Thankfully in Portland, there’s a very vibrant community of alternative lenders that are very supportive of minority borrowers, including Craft3, MESO (Micro Enterprise (continued next page)

BUSINESS IN PORTLAND BY THE NUMBERS

Major industries: healthcare, apparel, professional services, technology, commercial shipping, food & beverage, manufacturing

Major employers: Intel Corporation, Providence Health System, Oregon Health & Science University, Nike, Legacy Health System, Kaiser Foundation, Fred Meyer

6.2% job growth in 2021

10th fastest recovering economy among the 50 largest U.S. metro regions

#1 best place to live on the west coast in 2021-2022

2 Fortune 500 companies based in Portland

#3 best U.S. metropolitan areas for business and careers

ABOUT OUR COMMERCIAL TEAM

Combined banker experience: 278 years

Volunteer hours served in 2021: 825

Charitable giving in 2021: $70,000

11 Equal Housing Lender | Member FDIC HeritageBankNW.com

Pictured (l. to r.) Elise Bouneff, Kristin Connor, Andrew Harper, Kathy Swift, Teresa Carpenter, Thomas Shirlaw, Tamara Brown, Patrick McCarthy, Emily Leach. Not pictured: Paul van der Salm and Sherry Stewart.

Tumelius

Media for Heritage Bank

ABOUT OUR DOWNTOWN PORTLAND BRANCH

Allyson Bailey, Branch Relationship Officer

Allyson has lived in the Pacific Northwest for her entire life, growing up in the Vancouver, Washington, area. She started her banking career as a float teller and has held various positions at a branch and operations center. She works closely with the commercial banking team in Portland and focuses on property management, nonprofits and commercial businesses. Her goal is to help her customers achieve their daily financial goals now and in the future.

1000 SW Broadway, Suite 2170

Portland, OR 97205

503.306.5400

ABOUT OUR LLOYD BRANCH

Debbie Russell, Branch Relationship Officer

Debbie has been in banking for more than 40 years. She’s worked as a teller, department manager and operations manager. As branch relationship officer, she spends time building long-term relationships by assisting families and business owners reach their financial goals. She also supports a number of nonprofit organizations in her community, such as Schoolhouse Supplies, Dress For Success, Meals on Wheels, S.M.A.R.T., Oregon Food Bank, Good Neighbor Center and Junior Achievement. She served on the board the Pearl District Neighborhood Association and was the chairman of the Livability Committee in the Pearl District.

1201 NE Lloyd Blvd., Suite 290

Portland, OR 97232

503.693.2280

(continued from previous page)

Services of Oregon) and Mercy Corps Northwest, and so those organizations we have close friendships with and share a passion for serving this community together,” Leach said.

Passion comes up often in conversation with Leach, who has 22 years in the Portland-area banking industry. Her focus areas include nonprofits, law and other professional firms and businesses focused on sustainability.

Other Portland bankers and their areas of expertise include:

Kathy Swift, who wears two hats at Heritage as nonprofit development officer and senior vice president-commercial banking officer. She consults across the bank, offering nonprofit lending expertise in areas like designing independent school facility financing or capital campaign lines of credit. She offers expertise to the bank and clients, including real estate loans, lines of credit, tax-advantaged bonds and affordable housing credits.

Kristen Connor, a community development officer and senior vice president-relationship banking officer, who helps lead the bank’s social responsibility, green team and volunteerism efforts through the Heritage Helps program.

Patrick McCarthy specializes in financing solutions, including equipment, working capital lines of credit and real estate financing to the food and beverage industry.

Thomas Shirlaw is an experienced commercial lender serving health care, professional firms and manufacturing clients.

Other Portland bankers include Elise Bouneff, Tamara Brown, Teresa Carpenter, Andrew Harper, Sherry Stewart and Paul van der Salm.

Leach said Heritage’s local bankers have deep community involvement, and leadership is a strong thread running through the commercial lenders and relationship officers.

Some of their community involvement includes: Oregon Law Foundation, Jessie F. Richardson Foundation, Corporate Sustainability Collaborative, Blanchet House, Business for a Better Portland, Taste for Oregon, Earth Day Oregon, Neighborhood House, Bonneville Environmental Foundation, Commercial Real Estate Women, Future Leaders Committee, Black United Fund of Oregon, UNCF Portland, Portland State University’s Center for Real Estate, Financial Beginnings Oregon, Second Step Housing, Caring Closet, Cappella Romana, Camp Fire Columbia, Oregon Hospice & Palliative Care Association and Raphael House.

“The sense of connection to the community is very important to all of our bankers,” Leach said. “And I think it’s great to work with a bank that has that as part of the fabric of who we are and not something that goes against the grain.”

12 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

This is the fourth article in a series brought to you by Heritage Wealth Strategies. Read the previous articles in our Q1, Q2 and Q3 issues and look for the rest of the series in upcoming issues of Banking Business.

Retirement Mistakes Small Business Owners Make

(and strategies to address them)

STRATEGY #4

Get Sufficient Life Insurance Coverage

Most people are familiar with life insurance, but the role this product plays for small business owners is often more complex than for the typical individual. Of course, sufficient life insurance can help protect your family’s financial security if you were to pass away. A business owner, though, could have an extra liability: business collateral. If you take out loans to support your business, using personal assets as collateral, and you pass away, your family members may be on the hook for that debt, which could jeopardize their financial standing. However, life insurance provides an added layer of protection for your loved ones.1

Keep in mind that this article is for informational purposes only. It’s not a replacement for real-life advice, so make sure to consult your legal or tax professional before considering using personal assets as collateral.

What To Do Now

• Analyze your current life insurance coverage. Do you have the right tools? Do you have unrecognized gaps?

• Address your family’s life insurance needs. Calculate your total debts and expenses to find the amount your family would need if you were to pass away prematurely.

• Uncover the opportunities life insurance may bring to your business. Work with a professional to determine how life insurance might be able to help support both your business needs and retirement goals. Several factors will affect the cost and availability of life insurance, including age, health and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

References: 1 PolicyGenius.com, 2018

In an effort to save money, some small-business owners don’t carry any insurance at all.

Source: FitSmallBusiness.com, 2020

This material is for information purposes only and not intended as an offer or solicitation with respect to the purchase or sale of any security. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss during periods of declining values. Neither the named representative, nor the named Broker-Dealer or Registered Investment Advisor, gives tax or legal advice. Past performance does not guarantee future results. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. These are the views of FMG Suite LLC, and not necessarily those of the named representative, Broker-Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

Heritage Wealth Strategies is a marketing name of Cetera Investment Services. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/ SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 1000 SW Broadway, Suite 2170, Portland, OR 97205, (888) 360-0052.

13 Equal Housing Lender | Member FDIC HeritageBankNW.com

Vecteezy

Switching to Cloud-Based Accounting and Data Storage

Improve security and reliability while saving money and time

The last decade has brought numerous computing innovations, including cloud-based software and data storage. Data storage has evolved from magnetic tapes and storage discs to CDs, DVDs, portable hard drives and data sticks—and now, to the “cloud.”

So, what exactly is the cloud? And why should you consider moving your accounting system and data there?

WHAT IS THE CLOUD?

The cloud isn’t really a thing as much as it is a concept. Big name companies like Google, Apple, Amazon and Microsoft, along with a lot of lesser-known companies, have built enormous data centers around the world that provide computer, network and storage capacity (such as Google Gmail, Microsoft Office365, Apple iCloud, etc.) that they then “rent” to other businesses so that they can offer their own services. For example, Netflix relies almost entirely on Amazon’s AWS cloud-computing services to run most of its platform.

For companies like Intuit, NetSuite, Xero, Dropbox and Microsoft, cloud computing provides a way to offer accounting, data storage and other services vital to running your business through software that can be securely accessed from nearly anywhere in the world and from any type of device (desktop computer, cell phone, tablet, etc.).

14 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

ADVANTAGES OF CLOUD STORAGE

Storing information and using software hosted in the cloud has numerous advantages. It’s why cloud computing is taking off—particularly for small businesses that can now potentially compete with the big players in their industries by avoiding costly capital purchases of servers and software, along with the expense of employees or contractors to operate and manage that infrastructure.

Some of the advantages of cloud storage are:

• Improved business continuity: should a disaster strike (such as a fire or flood), your data is already stored offsite and remains safe. Furthermore, the data would be accessible from an alternate location with little to no effort required on your part.

• Anytime, anywhere access: business owners and staff can access the information they need from anywhere. Need to work from home a few days each week? You could easily do so when you move your business data to the cloud.

• Low-cost backup solutions: there are several cloudbased backup solutions that no longer require purchasing back-up hardware and storage media nor will you need to dedicate staff to manage your backups each day.

• Improved security: cloud data storage providers take security to a much higher level with secured data centers, encryption, multi-factor authentication and other security measures that typically don’t exist for hard drives sitting in your office.

• Integration and capacity: many solutions like Microsoft OneDrive, Apple iCloud and Google Drive offer seamless integration with your computer operating system, making storing data in the cloud as simple as storing it on your hard drive with the added benefit that expanding your storage capacity typically requires little more than a few clicks in your user account and no new equipment to purchase or install.

UNDERSTANDING CLOUD ACCOUNTING

Most accounting software providers now offer a cloud-based version of their product and in most cases for new providers, the cloud is your only option. Gone are the days of needing to install software, manage updates/upgrades and print or ship files to your CPA every month. By choosing a cloudbased accounting solution, you get the benefits of cloudbased data storage along with anywhere, anytime access to your books from virtually any device. The mobility you’ll have compared to physically being at your desk to access key information about your company can be revolutionary.

The many advantages of switching to the cloud include:

• Saving money and time

• Improved security

• Greater flexibility

• Increased reliability

• The capability to recover quickly from a disaster

If you’re still unsure about shifting to cloud-based accounting and data storage solutions, they are worth considering for your business. Cloud-based services can help reduce your overhead, simplify your network and computing needs and provide your business with greater flexibility and security for when and where you and your employees can work. With that said, the cloud is not a panacea for all business technology needs and might not be appropriate for your particular situation. When in doubt, it’s always advisable to seek professional help in assessing your needs and getting your solutions up and running and properly secured. That modest investment in getting help can open the door to vast improvements in your business operations.

ABOUT THE CONTRIBUTOR:

BILL GLASBY

Bill joined Heritage in 2017 as executive vice president chief technology officer. More than 20 years ago, Bill started in the banking industry as a teller. Since then, he’s held multiple leadership roles in product management, operational excellence and technology at Washington Mutual and JPMorgan Chase.

15 Equal Housing Lender | Member FDIC HeritageBankNW.com Shutterstock

Chopping Down Your Own Tree for the Holidays

There’s nothing better than waking up on a crisp fall day, bundling up and heading off to a local farm for some hot cocoa, apple cider donuts, corn mazes, hayrides, farm animals, pumpkin slingshots and, overall, good oldfashion fun. From November to December, hundreds of homesteads throughout Washington and Oregon open their homestead to individuals and families looking to cut down their own tree for the holiday season.

Tree Farms: A Brief History

In 1941, the very first tree farm in the United States was started in Montesano, Washington, by the Weyerhaeuser Timber Company. Since then, 22 million acres of forestland have been established and is managed by the American Tree Farm System (ATFS). Not only is ATFS the largest and oldest sustainable woodland system in the U.S., it’s also internationally recognized.1

Tree farms are privately-owned and managed for clean water, wildlife and sustainable timber production. While that was the predominate focus, many farmers have since pivoted to cultivating trees for the specific purpose of being harvested for holiday décor. Today, there are approximately 25-30 million u-pick trees sold in the U.S. every year— almost all coming from a community tree farm.

Here are some other fun facts about u-pick trees from the National Christmas Tree Association:2

• There are close to 350 million u-pick trees currently growing in the U.S. alone, all planted by farmers.

• For every u-pick tree harvested, one to three seedlings are planted the following spring.

• There are about 350,000 acres in production for growing u-pick trees in the U.S., much of it preserving green space.

• There are close to 15,000 farms growing u-pick trees in the U.S. and over 100,000 people are employed full or part-time.

• It can take as many 15 years to grow a tree of typical height (6-7 feet), but the average growing time is seven years.

• Oregon and Washington are among the top u-pick tree producing states in the U.S.

Real vs. Fake

The environment and sustainability have been hot topics in recent years. Because of this, tree farms have seen an increase in the u-pick tree business. Sure—it might seem counterintuitive that growing trees, cutting them down for limited-time use and then tossing them may seem wasteful. But when considering the benefits versus fake trees, there really is no comparison.

Fake trees are generally imported from overseas and made from metals and nonrenewable plastics (a potential source of hazardous lead). The manufacturing of these two components consume energy and create pollution. Plus, the average use of a fake tree is six to nine years before being thrown away—where it will remain in a landfill indefinitely.3

Real trees, on the other hand, absorb carbon dioxide and other harmful greenhouse gases and emit fresh oxygen into the air. In fact, these particular types of trees release more oxygen than mature forest trees. Real trees are also a renewable and recyclable resource. After the holidays, they’re chipped into biodegradable mulch, which replenishes soil in parks, schools and other public areas. Last, and most importantly, buying a real, farmgrown tree helps support American family farms and businesses—making an important economic contribution to many rural communities.

1 www.watreefarm.org/get-involved/learn/what-is-a-tree-farm-2/ 2 realchristmastrees.org/education/quick-tree-facts/ 3 www.nwchristmastrees.org/resources/real-vs-artificial/

16 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank PNWONDERLAND

FUN FACT!

Commercial banking officer, Jeff Kister, has worked on a tree farm with his family for 22 years. Check out his story on page 22.

17 Equal Housing Lender | Member FDIC HeritageBankNW.com

Shutterstock

Switching Banks: Here’s How We Make It Easy

Switching banks can seem like a daunting task. Where do you start? Who do you contact first? Will your current bank make it difficult to leave? We’ve put together some tips and tricks below to help you get started—and show you it’s not as scary as you think.

At Heritage, our job is to make switching banks as easy as possible for you. Our bankers will be here for you during the entire process, from helping open your new account to answering any questions you may have along the way.

The first step is to open your new account. We suggest visiting us in person at your local branch so we can determine the best account for your needs. But you can also open an account online at any time.

Opening a new account can take 30 minutes or longer, depending on how many services you choose. All we need to get started is a valid piece of ID, such as a driver’s license or passport, and some personal information. If you sign up for any of our checking accounts, you will also need to provide the $100 minimum opening deposit.

Next, begin moving funds from one account to the other. If it’s a smaller amount, you can simply withdraw cash (making sure your bank doesn’t require a minimum balance). If it’s a larger amount, you can request a cashier’s check from your current bank.

But you don’t want to move all of your money at once. Keep your old account open and funded enough to allow outstanding checks and automatic withdrawals to clear. Next, identify all of your direct deposits and automatic withdrawals/payments. You’ll need to contact each of these companies directly to update your account and routing numbers. And we can help! Bring all the information into the branch and we’ll walk you through making this change.

Once you’re sure all of your direct deposits, automatic withdrawals and checks are complete, you can close your old account.

YOUR SWITCH CHECKLIST

Compare checking and/ or savings accounts at HeritageBankNW.com

Open account online or in person at a branch

Update account and routing numbers for all automated and preauthorized deposits/payments

Direct deposits:

Your employer

Retirement account

Government agency

Automatic withdrawals/payments:

Mortgage

Insurance

Utilities

Gym membership

Magazine subscription Netflix

Activate debit card once it arrives in the mail (if applicable)

Order checks (if applicable)

Set up online banking

Download the Heritage Bank mobile app

Close old account(s) once all pending withdrawals have cleared

Destroy old bank materials (deposit slips, checks, debit/ATM cards, etc.)

No! This is an age-old myth. Switching banks will not affect your credit score. ?

Will switching banks affect my credit score?

18 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank BUSINESS BANKING MENTOR

Shutterstock

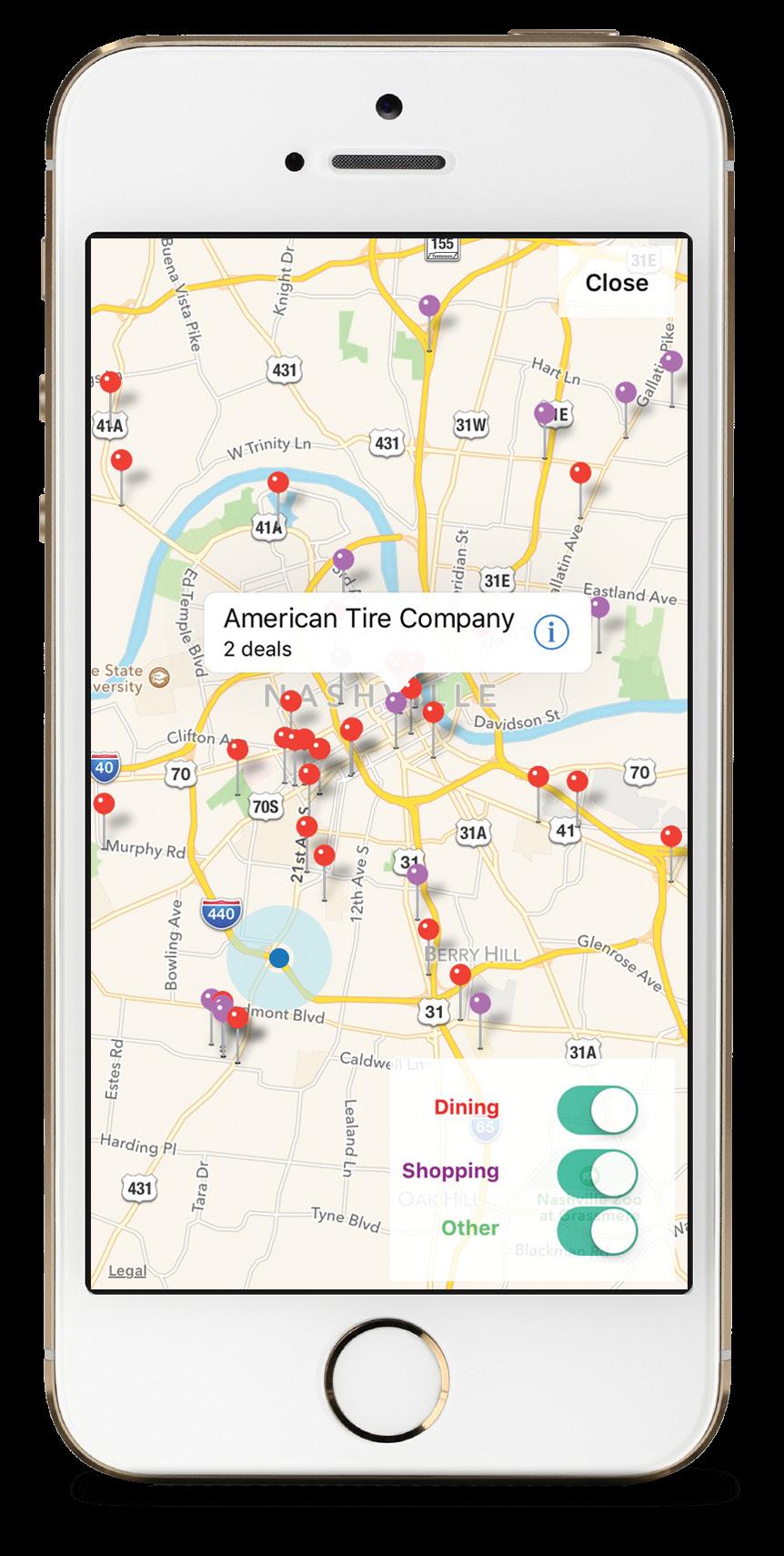

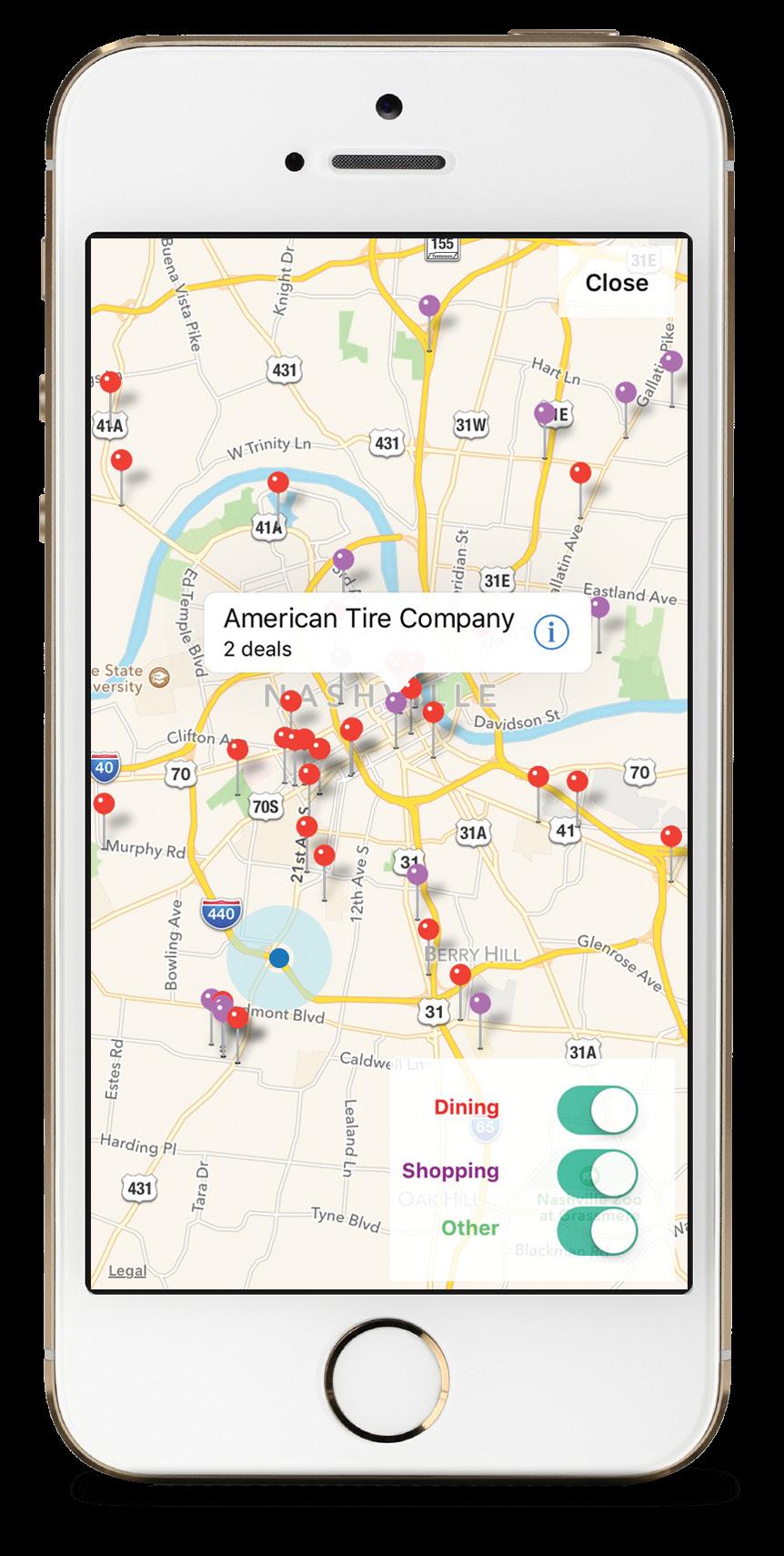

Scan this QR code to sign up online for free as a participating merchant.

Want to check out the merchant network first-hand to see how it works?

Visit BaZing.com, click Get Started, then enter your email address and temporary password: merchant.

JOIN THE BAZING MERCHANT NETWORK

It’s free exposure for you and a valuable benefit for your customers!

As a participating financial institution, customers enrolled in eligible Heritage Bank checking accounts get exclusive access to the BaZing network. BaZing offers a wide variety of discounts to over 300,000 local, regional and national merchants; identity theft aid, cell phone protection, travel accidental death coverage, roadside assistance and more.

BaZing isn’t just for our personal customers either. As a business customer, you can join the BaZing Merchant Network at no cost and start offering discounts to shoppers in your areas. This means that your business is strategically advertised in exchange for the offers you provide through the network.

What you choose to offer and the terms you set are completely flexible based on your needs and require no additional changes to your point-of-sale system. You can post multiple offers at a time as well as change them as you company evolves.

Example offers include:

• Free drink with purchase of sandwich

• $10 off $50 or more purchase

• BOGO fitness class

• 20% off VIP suite for three nights

To get started, visit BaZing.com and fill out the Merchant Network Agreement. Then log in to your account to start adding or editing your deals. Offers are automatically shown to shoppers based on their current location, but your business is also searchable by city, state and ZIP, name or category. Plus, the app sends shoppers notifications directly to their mobile device when participating businesses and offers are nearby.

*Discounts must provide a minimum savings of $1 for BaZing users. We do not allow free estimates, firsttime services, or first-time new customer offers unless they are accompanied by an exclusive, ongoing discount that is unique for BaZing customers to “shop local” at your business.

Free to participate

Advertise your business for free as part of the network in exchange for providing an ongoing, exclusive discount. Customers using BaZing are members of participating banks or credit unions that allow them access to special discount offers in the community.

A simple way to redeem

Customers use the exclusive BaZing mobile app to access discounts based on their locations. At the point of sale, they simply show a mobile coupon to receive the discount. Customers can also print a paper coupon at BaZing.com.

Control your offers anywhere, anytime

Simply log in to your online BaZing merchant account to add new discounts or edit your existing offers. This gives you the power to make the best offers for your business. You can set your own limitations, terms or exclusions to any discounts you provide.

powered by 19 Equal Housing Lender | Member FDIC HeritageBankNW.com

THE BENEFITS AND CHALLENGES OF AN SBA LOAN

U.S. Small Business Administration (SBA) loan programs are designed with specific purposes in mind so it’s important to review each of the options and decide if one of them fits your needs.

Benefits

The SBA was set up to help the U.S. economy, recognizing that small businesses are a big part of that. The main goal is to help small businesses grow and flourish. In addition to their loan programs, they also offer advice, connections, networking, training options and expertise. They want to see small businesses succeed and their loan programs are a big part of that.

So, when you’re considering applying for one of their loan programs, you’re doing so with the knowledge that they really do have the best interests of your business in mind. They also help:

– If you don’t have much in the way of start-up funds or business credit and you may not qualify for a traditional loan. Banks that offer SBA loans are more willing to work with start-ups or very small or very new businesses because their risk is reduced by the SBA guaranty. If it weren’t for the SBA, many U.S. businesses would not have gotten off the ground.

– If your business has cash flow issues, the SBA can structure loans so there are better terms, like lower monthly repayments. This helps you focus on growing your business rather than worrying about making your monthly loan payment.

– If your business has been impacted by a natural disaster, the SBA can help you to recover. If your insurance won’t cover all the damage the SBA can offer you solutions for getting through a disaster.

Apart from start-ups, SBA loans work well for businesses that want to increase their working capital, purchase equipment or real estate, expand their facilities or refinance their debt. You could have sound plans in place to grow your business but you may not have been in business long enough or not have enough collateral for your bank to agree to finance your growth plans. And that’s where the SBA can help mitigate those risks.

ABOUT THE CONTRIBUTOR: ROB STEWART

Rob’s banking career began as a file clerk and drive through teller. He’s worked in retail banking, commercial banking and was CEO of a federal credit union for nine years. Now as our director of SBA lending, Rob leads, manages and oversees all aspects of the Small Business Administration (SBA) department that offers a full suite of products and services to help small businesses succeed.

Challenges

One of the main challenges of applying for an SBA loan is the application process. You can often spend hours compiling a business plan and projections along with the application itself. However, the process is a great opportunity to consider the various aspects of running a business, such as your marketing plan, competition, supply chains, etc. The SBA, together with your local Small Business Development Centers (SBDC), can help. You may also face the following when applying for an SBA loan through your bank:

– Strict regulations. Because the SBA is governmentrun, everything from which loan program you go with to how you spend the money is strictly regulated.

– Limits. Most of the SBA loan programs have a cap, meaning you might not be able to borrow as much as you need.

– Higher interest rates. Although some SBA loans have interest rates below market value, others are a bit higher.

– Because it’s a government department and because of the paperwork required, it can take longer to get approved. Working with a commercial bank that is a preferred lender with the SBA can help expedite the process.

– Good credit requirements. If you haven’t been in business long enough to have an established credit history, the bank will put more weight on your personal finances and credit history.

Next Steps

Visit the SBA’s website, sba.gov, to compare their various loan options. If you think one fits your business needs, contact one of our SBA experts. We are a preferred SBA lender, which means we can help borrowers get the funds they need faster than a bank that does not have that classification. Our experts will spend time with you and help you understand the right solution for your business. It’s true, the SBA can be a long process, but to help your dream come true, it’s well worth the time.

20 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

Gifting Strategies this Holiday Season

Few things in life are more fulfilling than witnessing your legacy in action. These gifting strategies not only offer tax benefits but also show the fruits of a thoughtful legacy plan. Consider the following gifting strategies this holiday season.

• For adult children: The IRS allows you to gift up to $16,000 per individual free of gift or estate tax.

• For grandchildren: Make a contribution to a grandchild’s 529 Education Savings Plan. Earnings are not subject to federal tax and generally not subject to state tax when used for qualified education expenses of the designated beneficiary.1

• For the friend who has everything: Consider a taxdeductible contribution in their name to a charitable or other not-for-profit organization that they’re passionate about.

• For the charitable organizations you support: Make a taxdeductible year-end cash contribution or donate securities (such as shares of stock) or real property such as a car or boat.

• Qualified charitable distributions: These can permit a direct transfer of up to $100,000 from an IRA to a qualified charity. Note: You must be age 70 1/2 plus and subject to required minimum distributions to be eligible.

• And don’t forget to give a tax-advantaged gift to yourself: Contribute the maximum amount allowable to any 401(k), 403(b) or similar employer-sponsored retirement plans that you’re eligible to participate in by the December 31 deadline ($20,500 if you’re under age 50).

Take advantage of annual catch-up contributions ($6,500) if you’re age 50 or over, for a maximum contribution of $27,000 in your employer-sponsored plan.

If you have questions about legacy planning, charitable gifting or other wealth planning strategies, please reach out to schedule a time to talk.

1 www.irs.gov/newsroom/529-plans-questions-and-answers

Investors should consider the investment objectives, risks, charges and expenses associated with municipal fund securities before investing. This information is found in the issuer’s official statement and should be read carefully before investing.

Investors should also consider whether the investor’s or beneficiary’s home state offers any state tax or other benefits available only from that state’s 529 Plan. Any state-based benefit should be one of many appropriately weighted factors in making an investment decision. The investor should consult their financial or tax advisor before investing in any state’s 529 Plan. Distributions from traditional IRAs and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59½, may be subject to an additional 10% IRS tax penalty. This communication is designed to provide accurate and authoritative information on the subjects covered. It is not, however, intended to provide specific legal, tax, or other professional advice. For specific professional assistance, the services of an appropriate professional should be sought. These figures are representative of 2022 contribution limits.

This material is for information purposes only and not intended as an offer or solicitation with respect to the purchase or sale of any security. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss during periods of declining values. Neither the named representative, nor the named Broker-Dealer or Registered Investment Advisor, gives tax or legal advice. Past performance does not guarantee future results. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial professional for further information. These are the views of FMG Suite LLC, and not necessarily those of the named representative, Broker-Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

Heritage Wealth Strategies is a marketing name of Cetera Investment Services. Securities and insurance products are offered through Cetera Investment Services LLC (doing insurance business in CA as CFG STC Insurance Agency LLC), member FINRA/SIPC. Advisory services are offered through Cetera Investment Advisers LLC. Neither firm is affiliated with the financial institution where investment services are offered. Investments are: *Not FDIC/NCUSIF insured *May lose value *Not financial institution guaranteed *Not a deposit *Not insured by any federal government agency. 1000 SW Broadway, Suite 2170, Portland, OR 97205, (888) 360-0052.

brought to you by

21 Equal Housing Lender | Member FDIC HeritageBankNW.com

JEFF KISTER

Full-Time Banker, Part-Time Tree Farmer & Proud Dad

You might say I have two “branch” offices.

One is indoors at the new Heritage Bank Eugene, Oregon, branch, where I work as senior vice presidentcommercial banking officer. The other is outdoors at my in-laws’ Junction City, Oregon, tree farm, where each branch literally plays a supporting role (think lights and ornaments) in shaping the perfect Christmas tree.

During the holidays, I spend my weekends helping my wife’s parents, Mike and Judy Campbell, operate Campbell’s Tree Farm, which roars to life around Thanksgiving and doesn’t slow down until Christmas Day. It’s a u-pick, we-cut farm, but customers are welcome to use a handsaw to cut their own trees. Weekends are spent cutting, wrapping and loading trees for customers in all kinds of weather.

It’s hard work but people are in such a good mood. They’re appreciative and excited, especially the kids. It’s a fun industry. We have one month to achieve our annual sales goals so there’s a lot of energy expended to ensure everybody’s ready and performing to expectations.

form and I haven’t mastered that, so I leave shearing to the experts.

Campbell’s Tree Farm is a true family affair. My wife, Jody, and our three wonderful kids—daughter Jenna, 20, a junior at George Fox University; son Jaxson, 17, a senior at Junction City High School; and daughter Jordyn, 15, a sophomore at JCHS—all work during the holidays, too, making the farm a three-generation operation. My wife’s brother has younger kids who are learning about the farm, too.

Sometimes you’ll have one weekend where you sell 3,000 trees with only four or five of us working. We have a lot of fun, and you definitely sleep well those weekends. I also help occasionally other times of the year with tasks like fertilizing or replanting. I’ve tried the all-important job of pruning or shaping the trees, which is done with a machete-like tool. It’s an art

My wife, who works as a 911 dispatcher for the Eugene Police Department, introduced me to the tree-farm business 22 years ago when we were married. The farm also grows hazelnuts.

Separately, we partnered with her parents to open a wholesale plant and tree nursery 12 years ago and later expanded into retail nursery sales, a side hustle for Jody and me. But in 2021, we sold that business.

Like farming, softball is also a family affair. My father-in-law, Mike Campbell, is longtime head coach of the Junction City High School varsity softball team. The day our oldest daughter, Jenna, was born, Mike gave her a softball that he signed with a message saying that he looked forward to coaching her someday. And he did.

Jenna played for her grandfather as a pitcher at JCHS before playing two years at Montana State University

MY HERITAGE

Photos courtesy of Jeff Kister

Billings, then transferring to George Fox, where she also plans to pitch.

Before challenging batters, Jenna had her own challenge to overcome. She was born with a rare chest cavity deformity, pectus excavatum, in which her sternum and breastbone were sunken into her chest, putting pressure on her lungs and heart, making it difficult to breathe and play sports. When she was 12, Shriners Children’s Portland placed a bar in her chest for three years to correct the problem. She’s been healthy and grateful ever since.

That process was so impactful to her that the moment she became healthy again, she wanted to give back to Shriners, which paid for the surgery.

Her idea: annual softball clinics to teach skills to girls— clinics taught by Jenna, her high school and college teammates and her grandfather. The annual clinic is free but any donations from players’ families go to Shriners Children’s. Jenna has led the camp for seven years, raised $8,000 so far and deserves full credit for it, but my wife and I help with some administrative tasks.

As foster parents, an organization we support includes CASA of Lane County for the amazing work it does for children coming from difficult family environments. I’ve volunteered at CASA’s annual casino-night fundraiser, working as a dealer the past eight years.

Similarly, I’m on the finance committee for Parenting Now, a nonprofit that provides parenting education and support to families with young children.

A professional organization I chair is the EugeneSpringfield chapter of the nonprofit Risk Management Association, which helps advance sound risk principles in financial services.

Heritage Bank supports its employees’ participation in community organizations, which is a big reason why I joined Heritage in May from another bank. I started in banking in 1998, working for two larger institutions before Heritage.

My wife and I have more of a rural community connection and we’ve passed that down to our kids, to give back to our communities. It’s something that Heritage seems really focused on. The culture they represent is that their employees are part of the company, so it really is this collaborative effort. That was extremely appealing and Heritage Bank’s brand has been well represented in every conversation I’ve had with colleagues from other banks.

Banking is an industry focused on bottom line. There are different paths you can take to achieve that success for shareholders, and in contrast to other banks, it seems like Heritage Bank focuses on keeping employees happy so they can do their jobs really well.

ABOUT THE AUTHOR

Jeff has worked in banking for 24 years in both retail and commercial banking departments. This wide range of first-hand experience has enabled him to work efficiently with clients of various needs and specialties and find unique solutions to help them reach their financial goals.

23 Equal Housing Lender | Member FDIC HeritageBankNW.com

According to the 2022 AFP® Payments Fraud and Control Survey,* 71% of organizations were victims of payments fraud attacks/attempts in 2021.

* https://www.afponline.org/publications-data-tools/reports/survey-research-economic-data/Details/payments-fraud

Lower the Risk of Payment Fraud

Research suggests that a significant number of businesses each year are victims of payment fraud and that they’d suffered cash losses as a direct result.

In addition to the monetary impact, they suffered other consequences as well, like a decrease in staff morale and a negative influence on client relationships.

Payment fraud can be difficult to detect because most business owners want to assume payments for their goods or services are legitimate. Since there are several ways to commit payment fraud, it’s important that business owners are aware of them.

HOW PAYMENT FRAUD OCCURS

The most common methods of payment fraud are:

• Returned products – watch out for customers returning products they didn’t buy from you or customers who pick up products in store before walking up to the counter for a cash refund.

• Stolen credit cards – ask for photo ID if you’re suspicious of a customer and double check signatures.

• Counterfeit money – if your business accepts cash,

it’s worth learning how to spot counterfeit money, especially $100 bills. Tell your cashiers to be on the lookout. Search online for common images of counterfeit bills so they know what to look out for.

• Bad checks – they tend to bounce if they’re stolen or a customer’s account is empty. Avoid accepting checks if you can. Instead, ask for a credit card with identification or for funds to be banked online. And always ask for photo ID.

IT’S NOT JUST RETAIL

Although payment fraud tends to happen most commonly in retail businesses, they’re not the only ones vulnerable. Fraud can happen when people order products online and then don’t pay for them or they use your service and then find a reason not to pay the bill.

Online businesses often experience payment fraud when customers pay by credit card on the internet. The funds appear in your account and then you send them the goods. You should be safe, right? Not always. A common trick is that the customer will cancel the payment after three days and their bank reverses the funds.

24 Issue 7 | 2022 Q4 Banking Business a publication of Heritage Bank

Shutterstock

Learn more

Visit HeritageBankNW.com for a full list of fraud prevention tools and resources.

HOW TO PREVENT PAYMENT FRAUD

As in most cases, prevention’s always better than a cure. Tracking those who’ve tricked you is time-consuming, stressful and not always successful. It’s far better to have measures in place to prevent payment fraud from happening in the first place.

Some of the best ways to avoid payment fraud are:

• Training employees – they’re on the front line. It’s important to give them the tools and training to spot fraud at the source by regularly reviewing examples of fraud and your business policy on what to do.

• Daily finance review – keeping tabs on your bank accounts to monitor and reconcile what goes in and out on a daily basis allows you to spot inconsistencies early, before they become a problem.

• Procedures for release/transfer of funds – document everything. Identify the main types of payment fraud that could impact your business. Then, clearly outline how to prevent it from happening. Make sure your employees understand and comply with these rules as part of their employment.

• Stay informed – talk to other business owners, spend some time researching online and, in general, keep your eyes peeled for news of any recent trends that might be emerging.

In addition to the above, offering debit or credit card options, taking payments electronically using mobile payment methods, not accepting checks and ensuring your store has a good surveillance system are all good ways to prevent fraud.

CHECKS: THE MOST COMMON CRIMINAL

Checks are one of the most commonly used methods of payment fraud, even today. They’re costing businesses millions of dollars because they’re so easy for fraudsters to steal. And because there’s a delay between depositing the check and having the funds cleared into your account, customers hope to receive the goods before you’ve discovered you haven’t been paid after all.

Checks are paper based, so they’re easy to copy or forge, and they’re mailed, so they can be intercepted. This is where you, as a business owner, can be liable for payment fraud yourself if you’re using checks to pay suppliers.

Your basic rule-of-thumb here is to avoid them, both for making and receiving payments. One option is to not accept checks at all, especially when there’s a ton of online and electronic options available.

Your goal should be to protect your business from payment fraud using the most up-to-date payment options available and moving away from outdated, paperbased systems. The better the technology, the better the security will be and the harder fraudsters will find it to get around those systems.

Information provided by the FDIC

FINANCIAL DICTIONARY

ACH vs. Wire Payments

ACH and wire transfers are two of the easiest ways to move money between accounts. And while they’re both a convenient way to send funds electronically, they differ when it comes to speed and cost. The ACH (Automated Clearing House) network is made up of thousands of financial institutions and is used to process transactions like direct deposits, recurring debits, electronic funds transfers, business-to-business payments, etc. Similarly, a wire transfer allows you to move funds from one account to another and is typically the chosen method when larger amounts of money need to be moved quickly. So, what’s the difference? ACH transactions can take several days to process, while most wire transfers can be processed the same business day. But, with the expedited arrival of funds means that wires can be more costly than ACH. Both types of transfers have their benefits— and are significantly more secure than sending a paper check. Plus, you can easily initiate both using the Heritage Direct mobile app. For more information or help determining which one is best for your business, contact your treasury management relationship officer.

Check out page 9 for an overview of same day ACH, an even faster way to make payments through Heritage Direct.

25 Equal Housing Lender | Member FDIC HeritageBankNW.com

Financing For Valuable Community Development Projects

We hold the uncompromising belief that the answer to community prosperity is driven by diverse groups of people. That’s why the Heritage Bank Community Development Entity was created to encourage business expansion in economically distressed areas by providing an attractive loan program with better rates and terms and more flexibility than a traditional loan.

Our hope is that these loans will revitalize development of low-income communities, create jobs and increase the ability of goods and services.

Scan the QR code to learn more and see if your project qualifies.

HBCDE, LLC, a subsidiary of Heritage Bank, has been certified by the Community Development Financial Institutions Fund of the United States Department of Treasury as a Community Development Entity to provide loans, investments and services to low-income communities.

HeritageBankNW.com | 800.455.6126 | Equal Housing Lender | Member FDIC

Scott Kerman stands outside Blanchet House’s downtown Portland meal and transitional housing building.

Scott Kerman stands outside Blanchet House’s downtown Portland meal and transitional housing building.