3 minute read

Onions NZ Inc

ONIONS NEW ZEALAND

WINTER TOUR

Words by James Kuperus : Onions NZ Inc. chief executive

The invasive Fall Army Worm is a problem for crops across the world

Onions New Zealand has had a successful Winter Tour this July, meeting with 28 onion growing enterprises and 72 industry representatives in Christchurch, Ashburton, Hawke’s Bay and Pukekohe.

Onions NZ discussed upcoming changes, informed industry of Onion NZ’s current priorities and heard out growers’ concerns.

The following is a summary of the key updates raised during the tour:

Shipping

Shipping has been a major disruptor for the industry over the last 12 to 18 months, an issue that is likely to be an ongoing one for the coming season. Reliability of global shipping plummeted in 2020, remaining at 35–40% year to date 2021 (fig. 1). This is approximately half of what it was pre-pandemic.

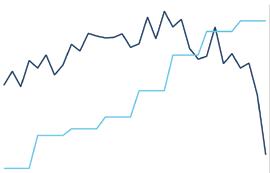

There has also been a decline in ships visiting New Zealand (fig. 2, dark blue line). This means that every time there is a blank sailing, it has a multiplying effect. i.e. Every time a ship skips a port, there is a longer wait for the next vessel and more cargo to go on that vessel. These two issues combined with climbing shipping rates, do not paint a positive outlook for shipping.

The Rise of Southeast Asia

Onions New Zealand also highlighted the rise of Southeast Asia’s importance in the New Zealand onion sector. Since 2005, onion exports (FoB) have increased from $5 million to $50 million. One particular event contributing to the increase in exports to Southeast Asia, was the signing and implementation of the ASEAN-Australia-New Zealand Free Trade Agreement (AANZFTA) in 2010 (fig. 3). The ASEAN (Association of Southeast Asian Nations) Free Trade Agreement and Southeast Asian nations are critically important for the industry and will require careful focus and care to ensure future prosperity of the sector.

90.0%

80.0%

70.0%

60.0%

50.0%

40.0%

30.0% 2018 2019 2020 2021

Source: Sea-Intelligence, GLP report issue 118

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Figure 1: Global Schedule Reliability

Number of ships per quarter 750

700

650

600

550

500

450

400 47 46 45 44 43 42 41 40 39 38 37 430 35 Tonnes ('000)

13 14 15 16 17 18 19 20

Figure 2: Number of container ships visiting New Zealand ports

$60,000,000

Free on Board Export Values $50,000,000

$40,000,000

$30,000,000

$20,000,000

$10,000,000 Southeast Asia Rise

2000 2002 2004 2006 2008 2010 2012 2014

Southeast Asia 2016 2018 2020

Figure 3: Since AANZFTA was implemented in 2010, two-way trade between New Zealand and ASEAN has grown by almost 30%

Fall Army Worm

The spread of Fall Army Worm across the globe was also discussed. Since 2016, it has spread from the Americas through Africa, Asia and into Australia in 2020. Australia is now looking at long-term management of this pest rather than eradication. Spread by the wind, this moth is likely to arrive in New Zealand within the next five years. The industry is reminded to report anything unusual through the Find-A-Pest app or by calling the Ministry for Primary Industries (MPI) pest and disease hotline 0800 80 99 66.

Changes to regulations & policies

Several upcoming regulatory changes that are likely to impact the sector were highlighted at the meetings. Due to being an export-oriented sector, we are not only exposed to domestic policies but also international ones.

The following is a summary of some upcoming regulations Onions NZ is aware of:

1 Freshwater Farm Plan System – submissions close 12 September 2021

2 Climate Change Commission

3 The Proposed Natural and Built Environment Bill –submissions close 4 August 2021

4 Biosecurity Act

5 Plant Varieties Rights Bill

6 Organics Bill

7 He Waka Eke Noa

8 European Union Green Deal

9 Commerce Commission Pricing Review

10 Fair Pay Agreements

11 Export Legislation (not yet being consulted on)

Over the coming months it will be important for industry to manage these changes and prepare for the impact that some may have.