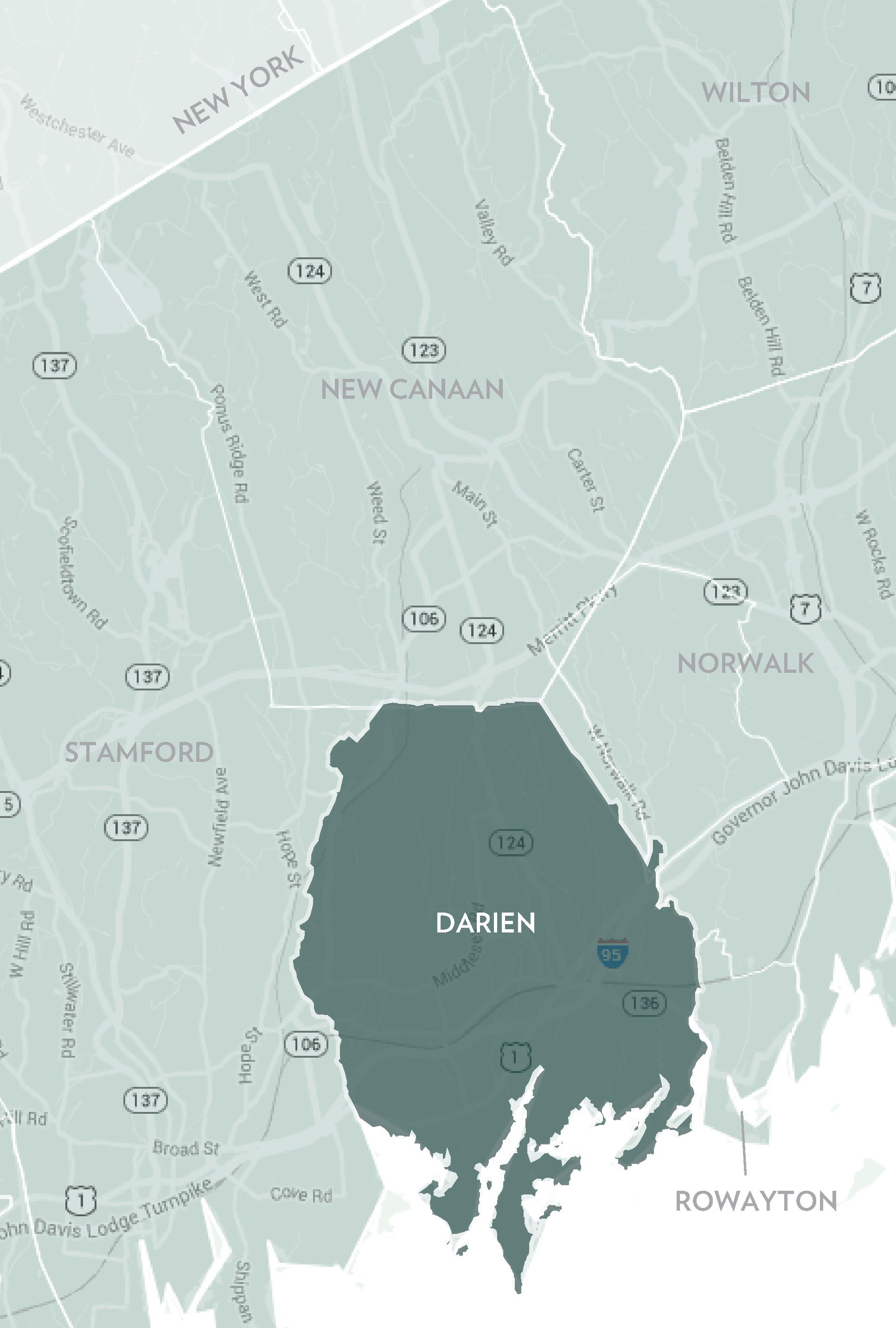

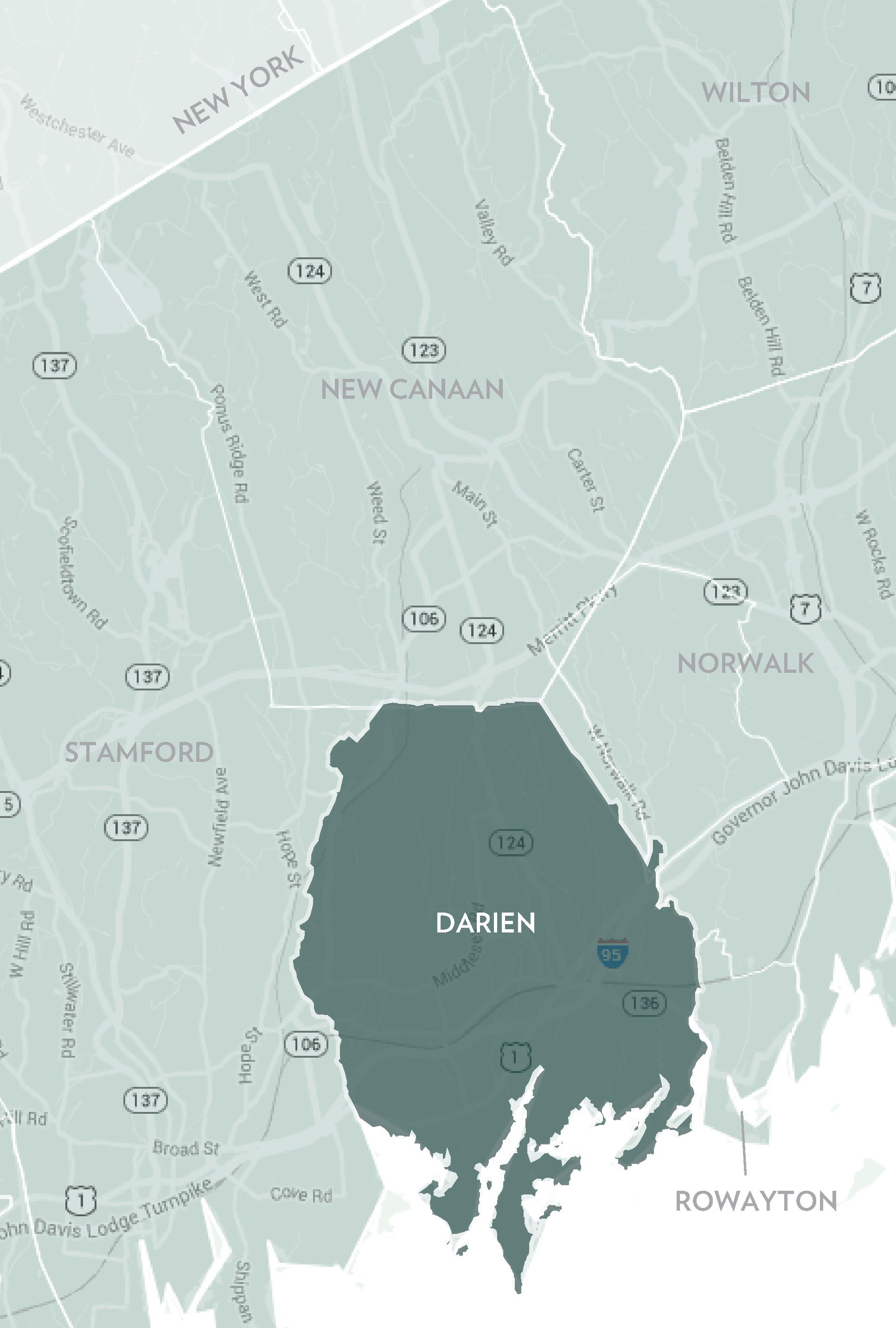

DARIEN, ROWAYTON, NEW CANAAN

Market Report

Q1-2023

914.220.7000 · HOULIHANLAWRENCE.COM LIST WITH CONFIDENCE. PUT THE POWER OF #1 TO WORK FOR YOU. PROUDLY CLOSED NEARLY $8 BILLION IN SALES AND REPRESENTED OVER 7,000 BUYERS AND SELLERS IN 2022 BROKERAGE NORTH OF NYC Source: OKMLS, MHMLS, CGNDMLS, SMARTMLS, 1/1/2022 – 12/31/2022, total dollar volume of single family homes sold by company, Westchester, Putnam, Dutchess, Columbia and Fairfield Counties combined. Source: 1/1/2022 - 12/31/2022 total sales both on and off MLS

MARKET REPORT

EXECUTIVE SUMMARY

Our local real estate markets continue to be marked by incredibly low levels of inventory for sale. While the number of homes for sale on March 31st in Darien, New Canaan and Rowayton increased slightly versus the same date last year, most of the inventory increases were in the “over $4M” category. Given how constrained our markets are by low levels of inventory, it comes as no surprise that sales totals are trending downward too. The number of homes sold during the first quarter of 2023 in Darien, New Canaan and Rowayton was down 35.8%, 42.6% and 30%, respectively, versus the same period last year.

Despite high inflation, regional bank failures and the Federal Reserve’s continued interest rate increases, demand for homes in our markets continues to outpace supply. Properly priced homes across most price points continue to attract more than one bidder, with cash buyers still active in the marketplace. Interestingly, we are noticing a decline in the number of “trade up” buyers within local markets. Seemingly, those who already own a home with a favorable mortgage rate are reluctant to trade their existing loan for a new one with a significantly higher rate.

Regardless, our persistent low supply of homes for sale should help prices remain stable in the near term. In our view, the art of pricing a home for sale will become more challenging as recent comparable transactions become scarce. The successful seller may want to take more historical sales data into account in developing a proper pricing strategy going forward.

As the #1 brokerage in Greenwich, Darien and New Canaan, Houlihan Lawrence is uniquely positioned to assist local luxury home buyers and sellers navigate this unprecedented market. We hope you find this report useful and we look forward to an opportunity to be of service to you!

With Warm Regards,

Liz Nunan President and CEO

Q1-2023

TEN-YEAR MARKET HISTORY

* Homes sold for 2023 are annualized based on actual sales year-to-date.

Q1 2023 Q1 2022 % CHANGE FULL YEAR 2022 FULL YEAR 2021 % CHANGE HOMES SOLD 34 53 -35.8% 284 422 -32.7% AVERAGE SALE PRICE $1,772,208 $2,059,352 -13.9% $2,020,720 $1,929,797 4.7% MEDIAN SALE PRICE $1,472,500 $1,568,000 -6.1% $1,690,560 $1,642,000 3.0% AVERAGE PRICE PER SQUARE FOOT $567 $544 4.2% $567 $505 12.3% AVERAGE DAYS ON MARKET 30 68 -55.9% 41 70 -41.4% % SALE PRICE TO LIST PRICE 100.8% 99.0% 1.8% 102.7% 99.4% 3.3%

DARIEN QUARTERLY MARKET OVERVIEW

Average Sale Price $1,619,781 $1,705,978 $1,673,646 $1,676,743 $1,603,743 $1,534,435 $1,655,525 $1,929,797 $2,020,720 $1,772,208 Average Sale Price Average Price/SqFt $474 $504 $490 $476 $458 $429 $446 $505 $567 $567 Average Price/SqFt Days On Market 109 105 110 126 122 147 124 70 41 30 Days On Market %Sale Price to List Price 96.9% 95.6% 96.0% 95.5% 94.7% 94.0% 96.3% 99.4% 102.7% 100.8% %Sale Price to List Price

HOULIHANLAWRENCE.COM

SUPPLY/DEMAND ANALYSIS

SOLD PROPERTIES

DARIEN

AS OF MARCH 31, 2023 AS OF MARCH 31, 2022 2023 vs. 2022 PRICE RANGE SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* % CHANGE IN LISTINGS % CHANGE IN PENDINGS $0 - $499,999 0 0 Not Valid 0 2 0 0.0% -100.0% $500,000 - $699,999 2 0 Not Valid 2 0 Not Valid 0.0% 0.0% $700,000 - $999,999 7 5 1 4 8 1 75.0% -37.5% $1,000,000 - $1,499,999 6 3 2 9 7 1 -33.3% -57.1% $1,500,000 - $1,999,999 4 10 1 7 8 1 -42.9% 25.0% $2,000,000 - $2,499,999 4 6 1 2 5 1 100.0% 20.0% $2,500,000 - $2,999,999 2 4 1 4 4 1 -50.0% 0.0% $3,000,000 - $3,999,999 9 1 9 1 3 1 800.0% -66.7% $4,000,000 and up 11 4 3 4 4 1 175.0% 0.0% MarketTotals 45 33 1 33 41 1 36.4% -19.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

YEAR-TO-DATE YEAR-OVER-YEAR PRICE RANGE 01/01/202303/31/2023 01/01/202203/31/2022 % CHANGE 2023/2022 04/01/202203/31/2023 04/01/202103/31/2022 % CHANGE 2023/2022 $0 - $499,999 1 0 Not Valid 1 2 -50.0% $500,000 - $699,999 3 3 0.0% 13 17 -23.5% $700,000 - $999,999 5 8 -37.5% 36 51 -29.4% $1,000,000 - $1,499,999 9 13 -30.8% 64 102 -37.3% $1,500,000 - $1,999,999 2 10 -80.0% 47 88 -46.6% $2,000,000 - $2,499,999 7 5 40.0% 33 35 -5.7% $2,500,000 - $2,999,999 3 2 50.0% 27 43 -37.2% $3,000,000 - $4,999,999 4 10 -60.0% 38 64 -40.6% $5,000,000 and up 0 2 -100.0% 6 9 -33.3% MarketTotals 34 53 -35.8% 265 411 -35.5%

Source: Smart MLS, Darien, Single Family Homes, Sold

QUARTERLY MARKET OVERVIEW

ROWAYTON

TEN-YEAR MARKET HISTORY

* Homes sold for 2023 are annualized based on actual sales year-to-date.

Q1 2023 Q1 2022 % CHANGE FULL YEAR 2022 FULL YEAR 2021 % CHANGE HOMES SOLD 7 10 -30.0% 77 91 -15.4% AVERAGE SALE PRICE $1,609,431 $1,280,400 25.7% $1,762,701 $1,774,299 -0.7% MEDIAN SALE PRICE $1,250,000 $934,500 33.8% $1,595,000 $1,610,000 -0.9% AVERAGE PRICE PER SQUARE FOOT $574 $576 -0.3% $615 $548 12.2% AVERAGE DAYS ON MARKET 32 57 -43.9% 37 80 -53.8% % SALE PRICE TO LIST PRICE 100.0% 101.9% -1.9% 102.7% 99.3% 3.4%

Average Sale Price $1,340,895 $1,273,026 $1,337,148 $1,379,317 $1,273,417 $1,276,696 $1,345,651 $1,774,299 $1,762,701 $1,609,431 Average Sale Price Average Price/SqFt $439 $435 $463 $459 $445 $439 $452 $548 $615 $574 Average Price/SqFt Days On Market 117 136 145 110 92 139 110 80 37 32 Days On Market %Sale Price to List Price 96.2% 94.9% 95.3% 95.0% 95.7% 95.3% 96.6% 99.3% 102.7% 100.0% %Sale Price to List Price

HOULIHANLAWRENCE.COM

SUPPLY/DEMAND ANALYSIS

SOLD PROPERTIES

ROWAYTON

AS OF MARCH 31, 2023 AS OF MARCH 31, 2022 2023 vs. 2022 PRICE RANGE SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* % CHANGE IN LISTINGS % CHANGE IN PENDINGS $0 - $499,999 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $500,000 - $699,999 1 0 Not Valid 1 1 1 0.0% -100.0% $700,000 - $999,999 1 2 1 1 2 1 0.0% 0.0% $1,000,000 - $1,499,999 2 1 2 6 2 3 -66.7% -50.0% $1,500,000 - $1,999,999 1 1 1 0 7 0 0.0% -85.7% $2,000,000 - $2,499,999 0 1 0 0 4 0 0.0% -75.0% $2,500,000 - $2,999,999 1 1 1 2 3 1 -50.0% -66.7% $3,000,000 - $3,999,999 1 0 Not Valid 1 0 Not Valid 0.0% 0.0% $4,000,000 and up 1 1 1 0 0 Not Valid 0.0% 0.0% MarketTotals 8 7 1 11 19 1 -27.3% -63.2% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

YEAR-TO-DATE YEAR-OVER-YEAR PRICE RANGE 01/01/202303/31/2023 01/01/202203/31/2022 % CHANGE 2023/2022 04/01/202203/31/2023 04/01/202103/31/2022 % CHANGE 2023/2022 $0 - $499,999 0 0 Not Valid 0 0 Not Valid $500,000 - $699,999 1 1 0.0% 6 5 20.0% $700,000 - $999,999 2 5 -60.0% 8 17 -52.9% $1,000,000 - $1,499,999 1 2 -50.0% 16 14 14.3% $1,500,000 - $1,999,999 0 1 -100.0% 21 16 31.3% $2,000,000 - $2,499,999 0 0 Not Valid 6 16 -62.5% $2,500,000 - $2,999,999 3 0 Not Valid 12 2 500.0% $3,000,000 - $4,999,999 0 1 -100.0% 4 10 -60.0% $5,000,000 and up 0 0 Not Valid 1 1 0.0% MarketTotals 7 10 -30.0% 74 81 -8.6%

Source: Smart MLS, Rowayton, Single Family Homes, Sold

QUARTERLY MARKET OVERVIEW

NEW CANAAN

TEN-YEAR MARKET HISTORY

* Homes sold for 2023 are annualized based on actual sales year-to-date.

Q1 2023 Q1 2022 % CHANGE FULL YEAR 2022 FULL YEAR 2021 % CHANGE HOMES SOLD 31 54 -42.6% 260 440 -40.9% AVERAGE SALE PRICE $2,082,951 $1,931,840 7.8% $2,177,142 $1,995,193 9.1% MEDIAN SALE PRICE $1,695,000 $1,742,500 -2.7% $1,910,876 $1,725,000 10.8% AVERAGE PRICE PER SQUARE FOOT $440 $425 3.5% $458 $400 14.5% AVERAGE DAYS ON MARKET 73 80 -8.8% 55 83 -33.7% % SALE PRICE TO LIST PRICE 98.1% 98.8% -0.7% 100.6% 99.1% 1.5%

Average Sale Price $1,929,472 $1,783,190 $1,770,026 $1,713,201 $1,628,160 $1,424,859 $1,670,517 $1,995,193 $2,177,142 $2,082,951 Average Sale Price Average Price/SqFt $389 $406 $356 $355 $341 $316 $337 $400 $458 $440 Average Price/SqFt Days On Market 122 126 148 147 138 164 137 83 55 73 Days On Market %Sale Price to List Price 94.9% 95.8% 93.8% 94.0% 92.2% 92.8% 95.4% 99.1% 100.6% 98.1% %Sale Price to List Price

HOULIHANLAWRENCE.COM

SUPPLY/DEMAND ANALYSIS

SOLD PROPERTIES

NEW CANAAN

AS OF MARCH 31, 2023 AS OF MARCH 31, 2022 2023 vs. 2022 PRICE RANGE SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* SUPPLY: ACTIVE LISTINGS DEMAND: PENDING SALES SUPPLY/ DEMAND RATIO* % CHANGE IN LISTINGS % CHANGE IN PENDINGS $0 - $499,999 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $500,000 - $699,999 1 1 1 0 1 0 0.0% 0.0% $700,000 - $999,999 4 3 1 5 2 3 -20.0% 50.0% $1,000,000 - $1,499,999 7 4 2 8 10 1 -12.5% -60.0% $1,500,000 - $1,999,999 8 9 1 4 8 1 100.0% 12.5% $2,000,000 - $2,499,999 5 7 1 3 7 1 66.7% 0.0% $2,500,000 - $2,999,999 9 2 5 6 9 1 50.0% -77.8% $3,000,000 - $3,999,999 11 5 2 11 5 2 0.0% 0.0% $4,000,000 and up 21 2 11 14 4 4 50.0% -50.0% MarketTotals 66 33 2 51 46 1 29.4% -28.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

YEAR-TO-DATE YEAR-OVER-YEAR PRICE RANGE 01/01/202303/31/2023 01/01/202203/31/2022 % CHANGE 2023/2022 04/01/202203/31/2023 04/01/202103/31/2022 % CHANGE 2023/2022 $0 - $499,999 0 0 Not Valid 0 0 Not Valid $500,000 - $699,999 0 2 -100.0% 2 8 -75.0% $700,000 - $999,999 6 5 20.0% 20 23 -13.0% $1,000,000 - $1,499,999 6 16 -62.5% 54 113 -52.2% $1,500,000 - $1,999,999 7 11 -36.4% 46 105 -56.2% $2,000,000 - $2,499,999 5 9 -44.4% 35 62 -43.5% $2,500,000 - $2,999,999 2 5 -60.0% 38 42 -9.5% $3,000,000 - $4,999,999 3 6 -50.0% 34 53 -35.8% $5,000,000 and up 2 0 Not Valid 8 4 100.0% MarketTotals 31 54 -42.6% 237 410 -42.2%

Source: Smart MLS, New Canaan, Single Family Homes, Sold

3 GLOBAL NETWORKS - REACHING 56 COUNTRIES & 6 CONTINENTS Leading Real Estate Companies of the World | Luxury Portfolio International Board of Regents Luxury Real Estate