TABLE OF CONTENTS

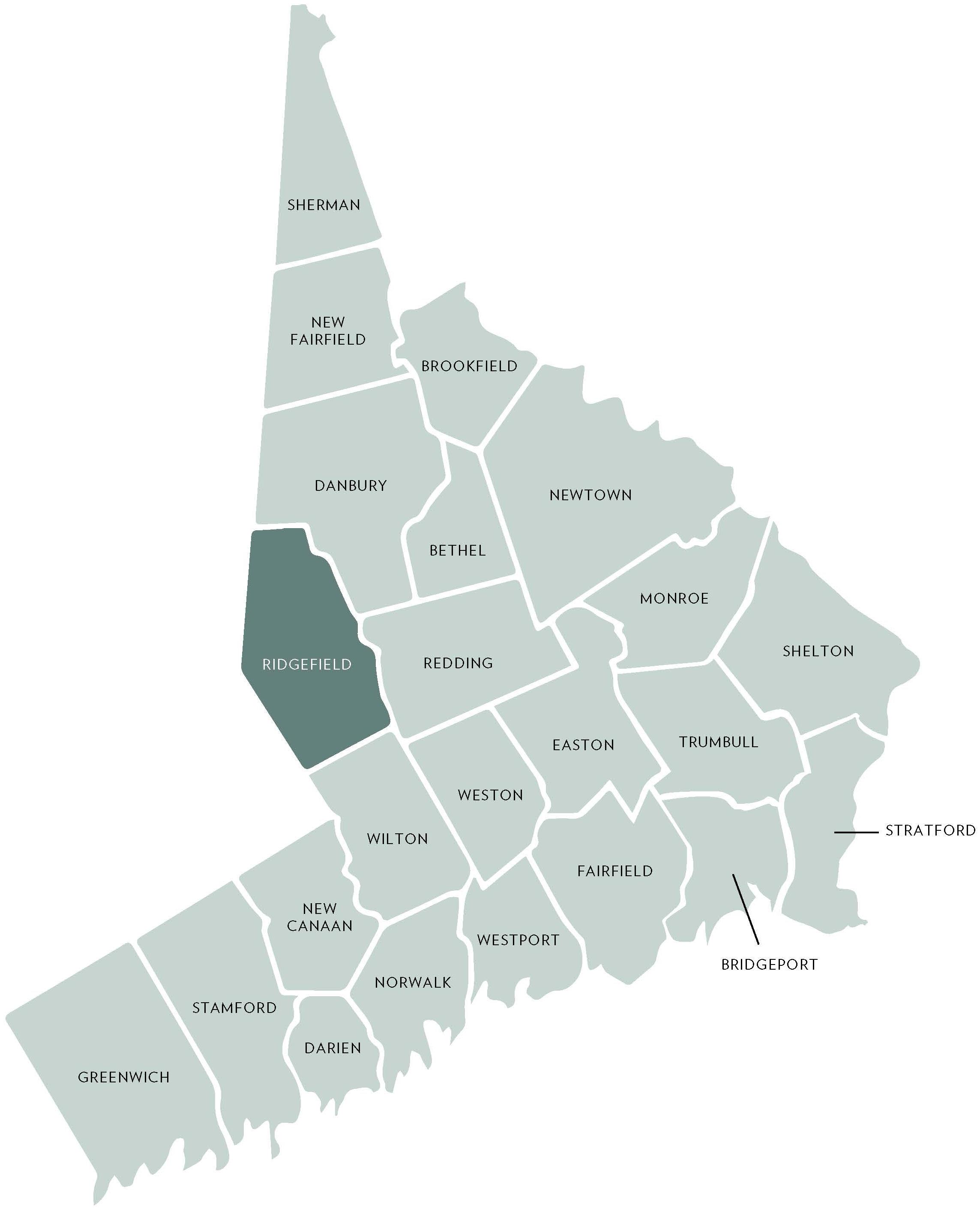

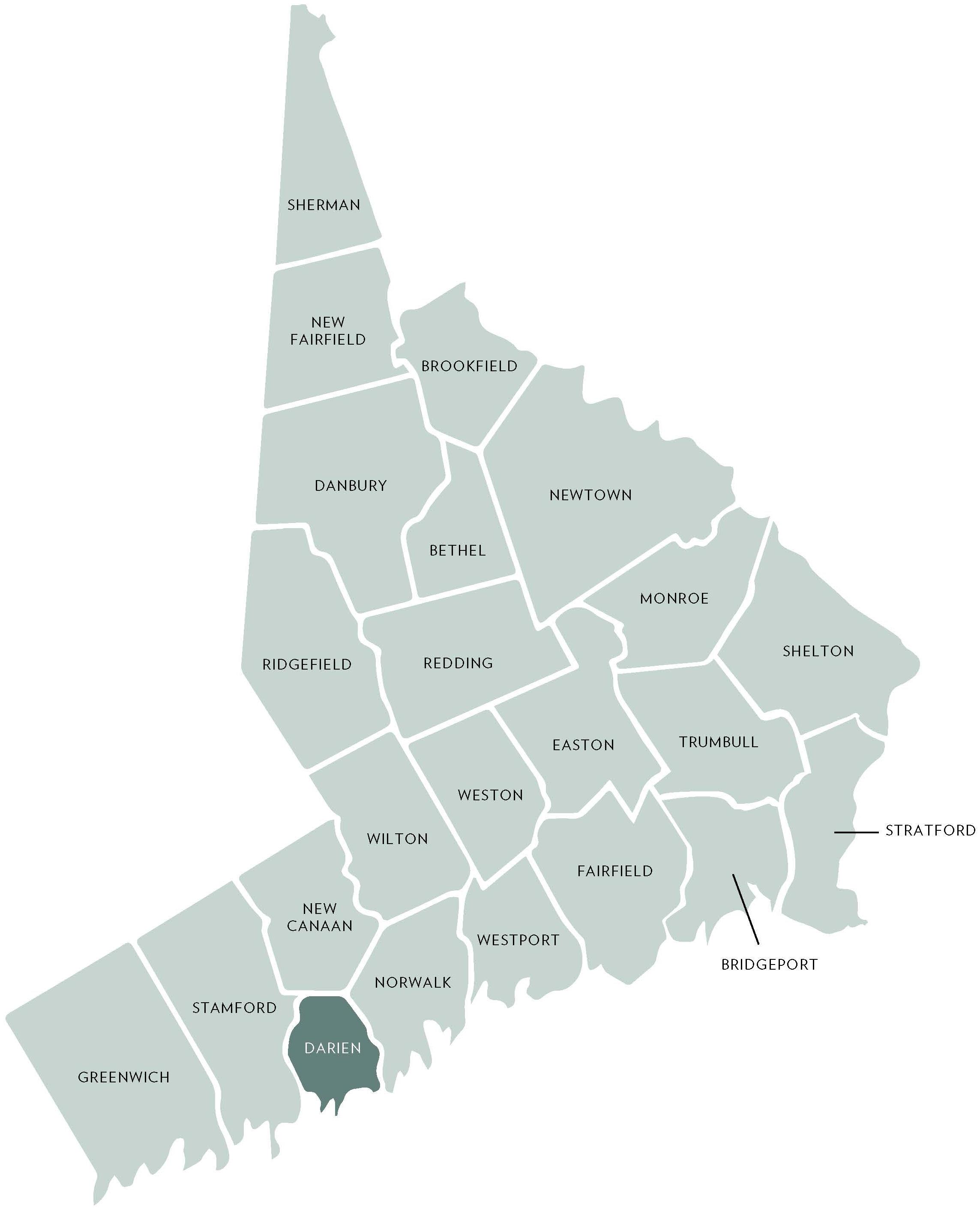

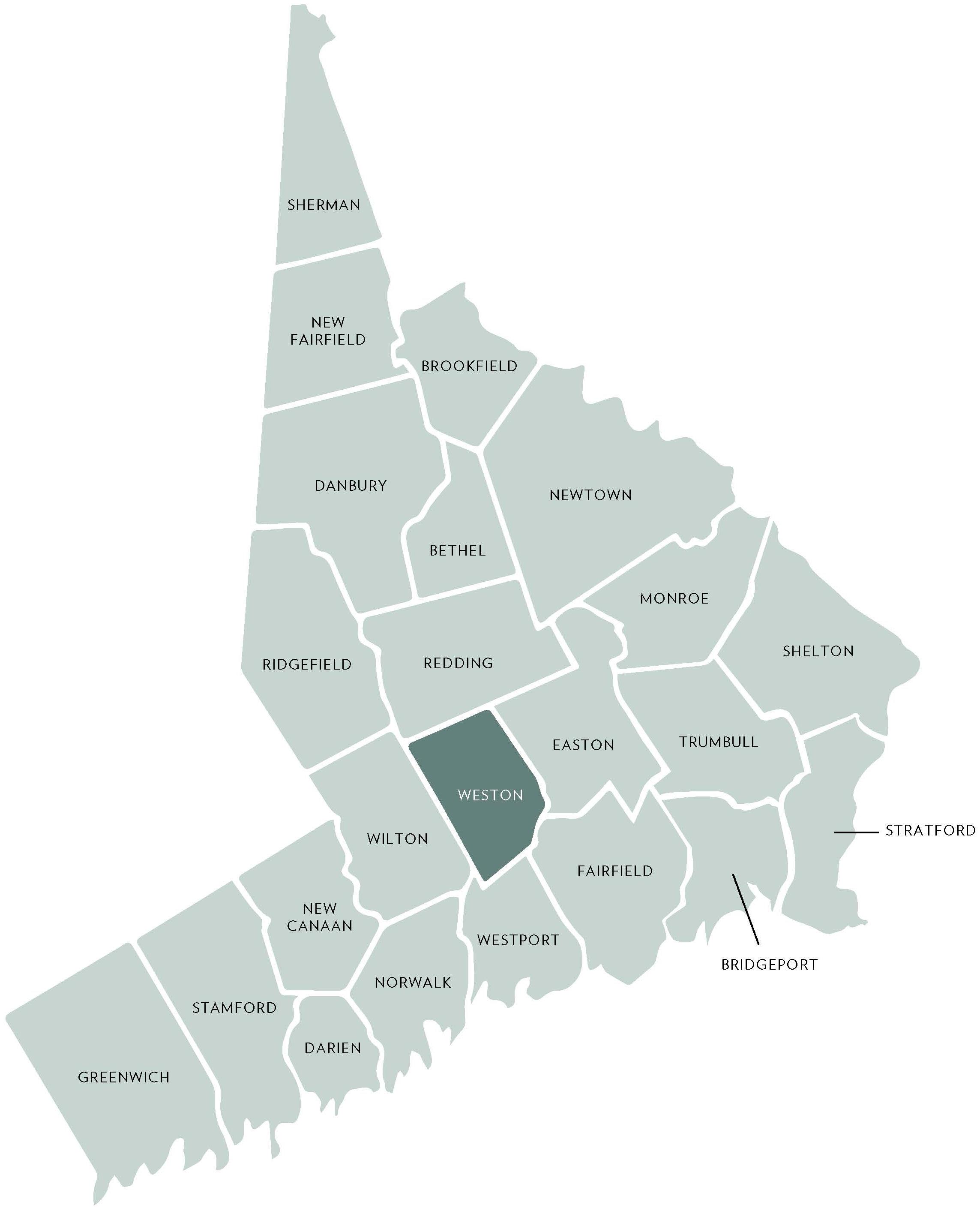

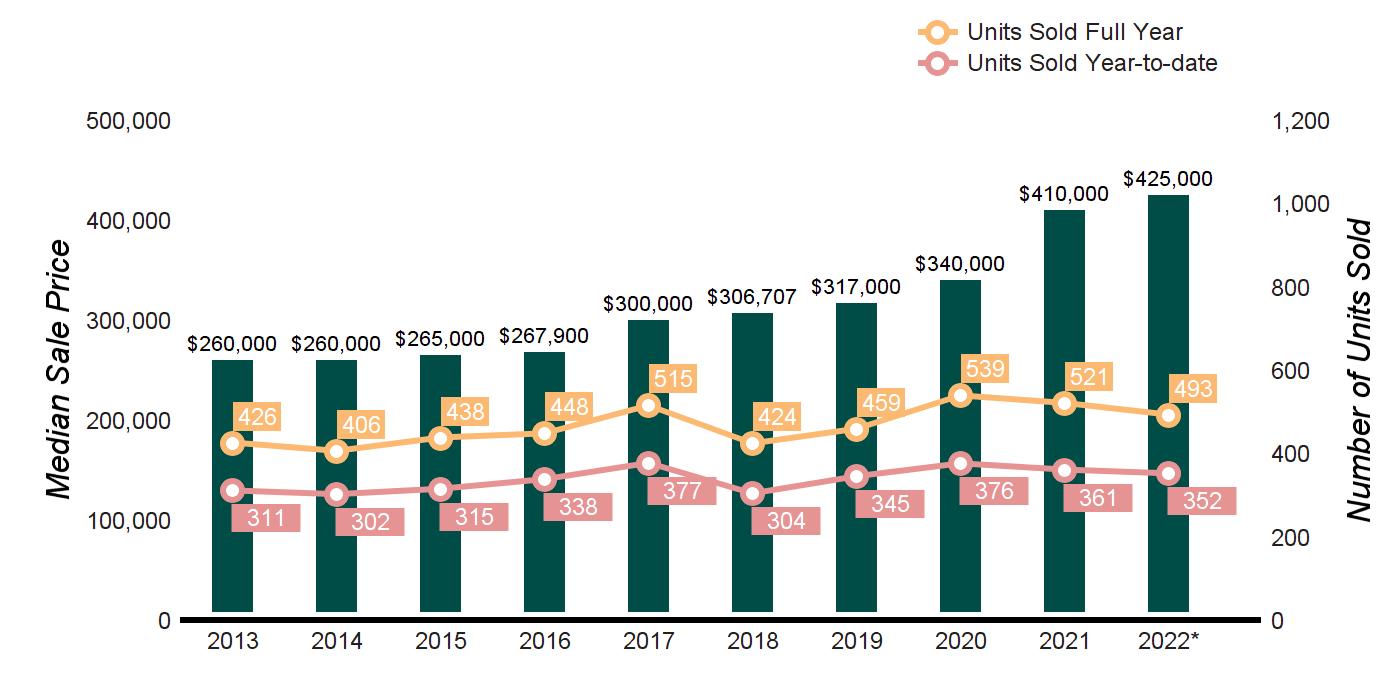

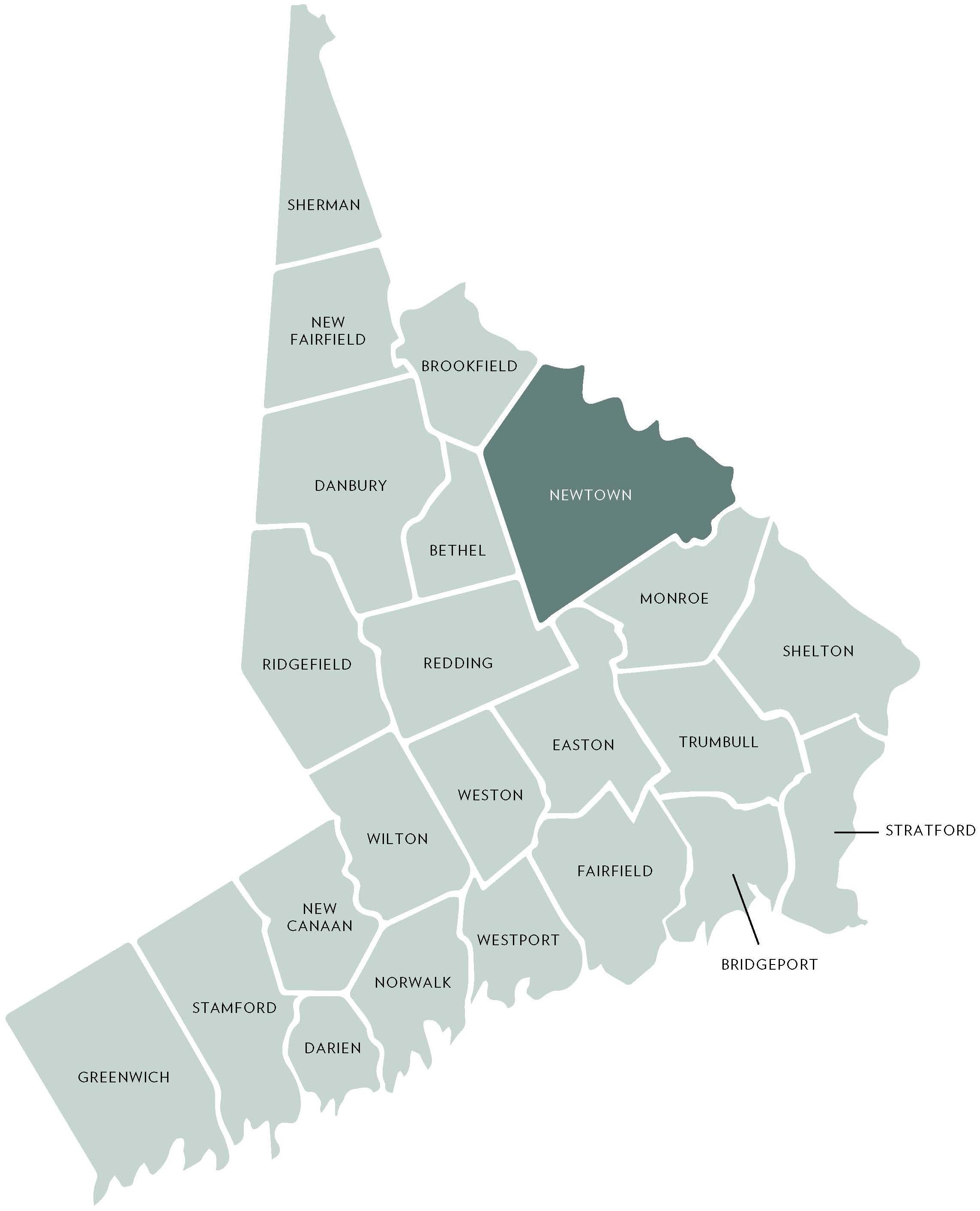

FAIRFIELD COUNTY

CANAAN

FAIRFIELD

THIRD QUARTER 2022

Single Family Homes Overview

STAMFORD DARIEN NEW

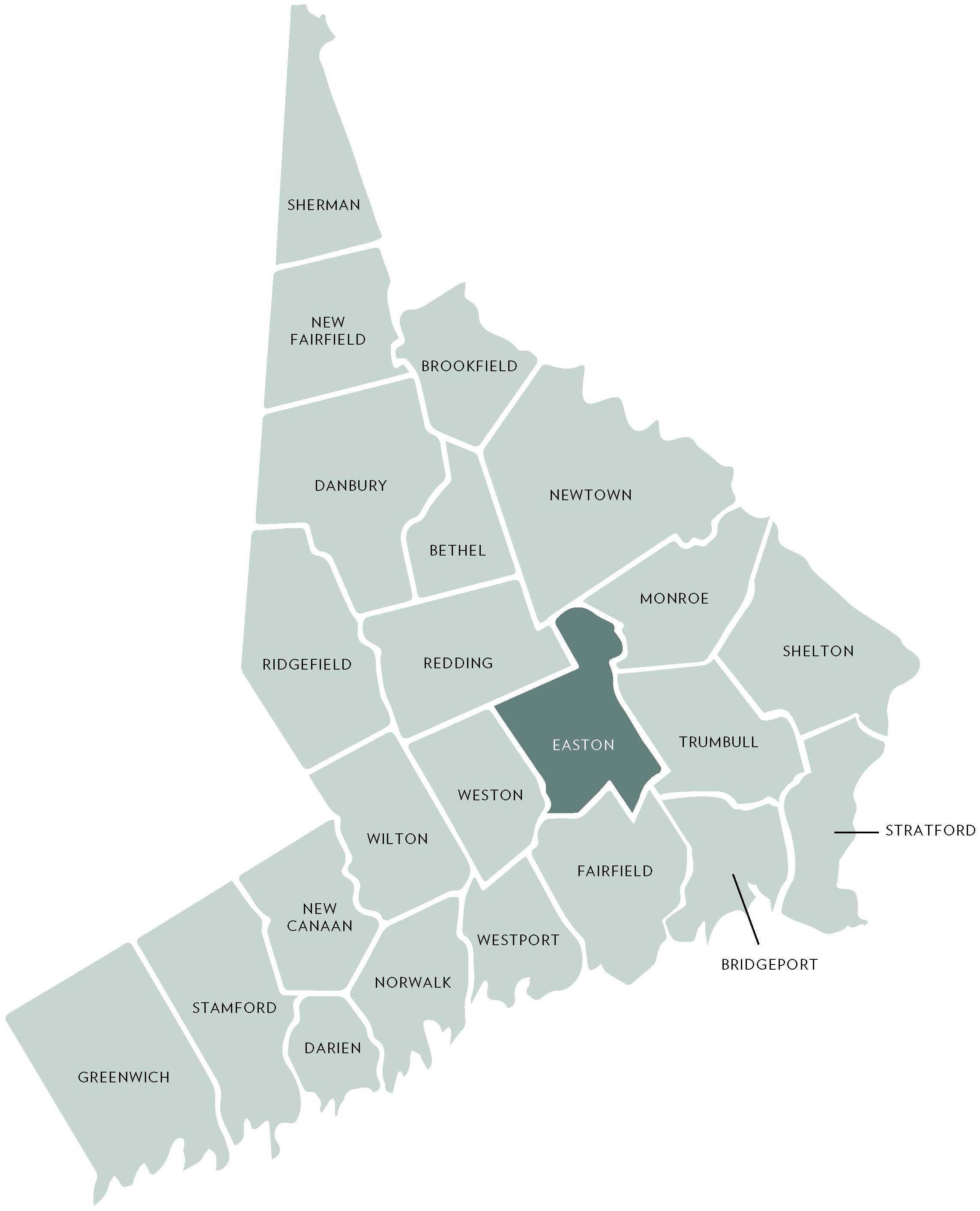

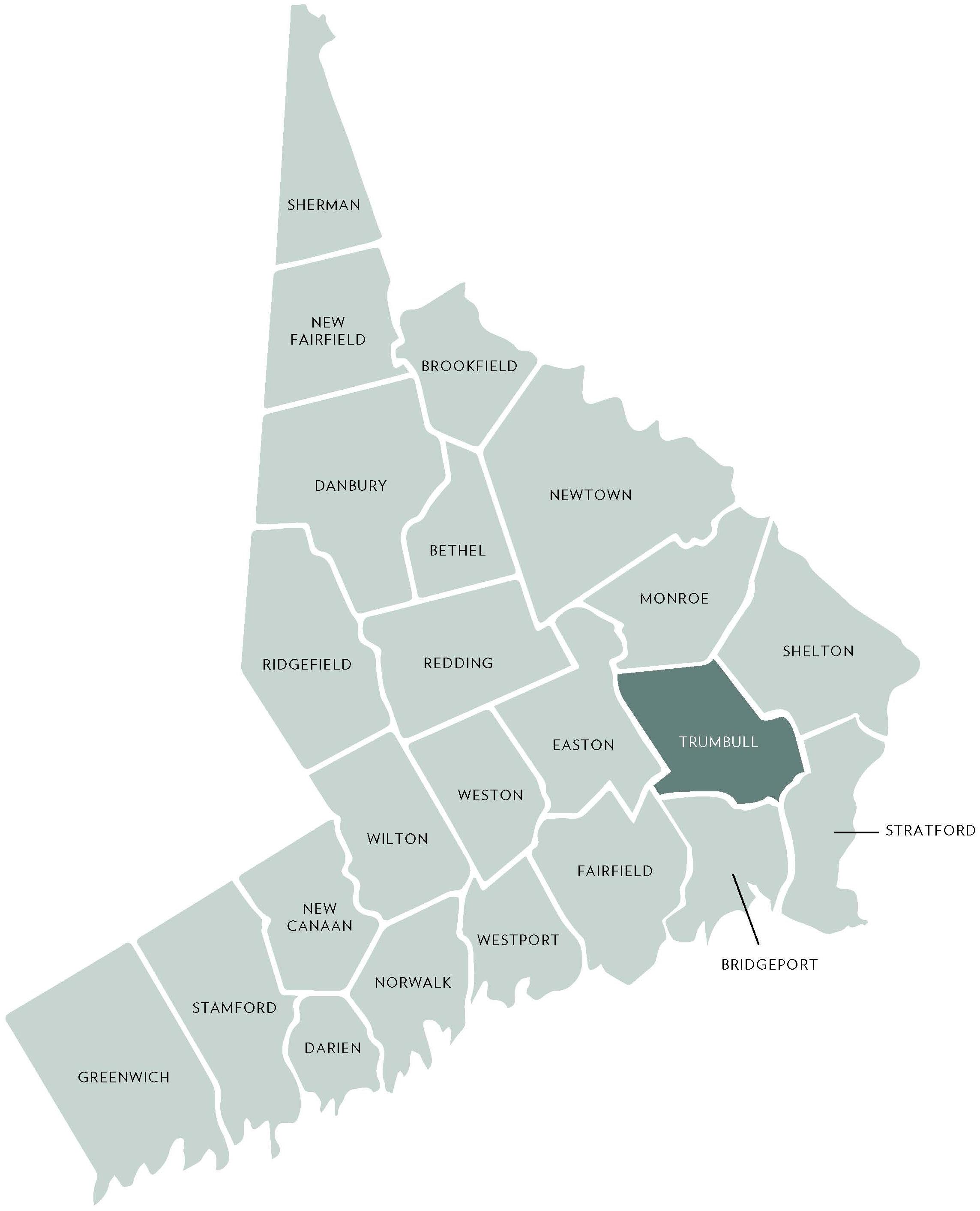

NORWALK WESTPORT FAIRFIELD BRIDGEPORT STRATFORD WILTON WESTON EASTON TRUMBULL SHELTON RIDGEFIELD REDDING MONROE DANBURY BETHEL NEWTOWN NEW

BROOKFIELD SHERMAN

QUARTERLY MARKET OVERVIEW

$2,974,497

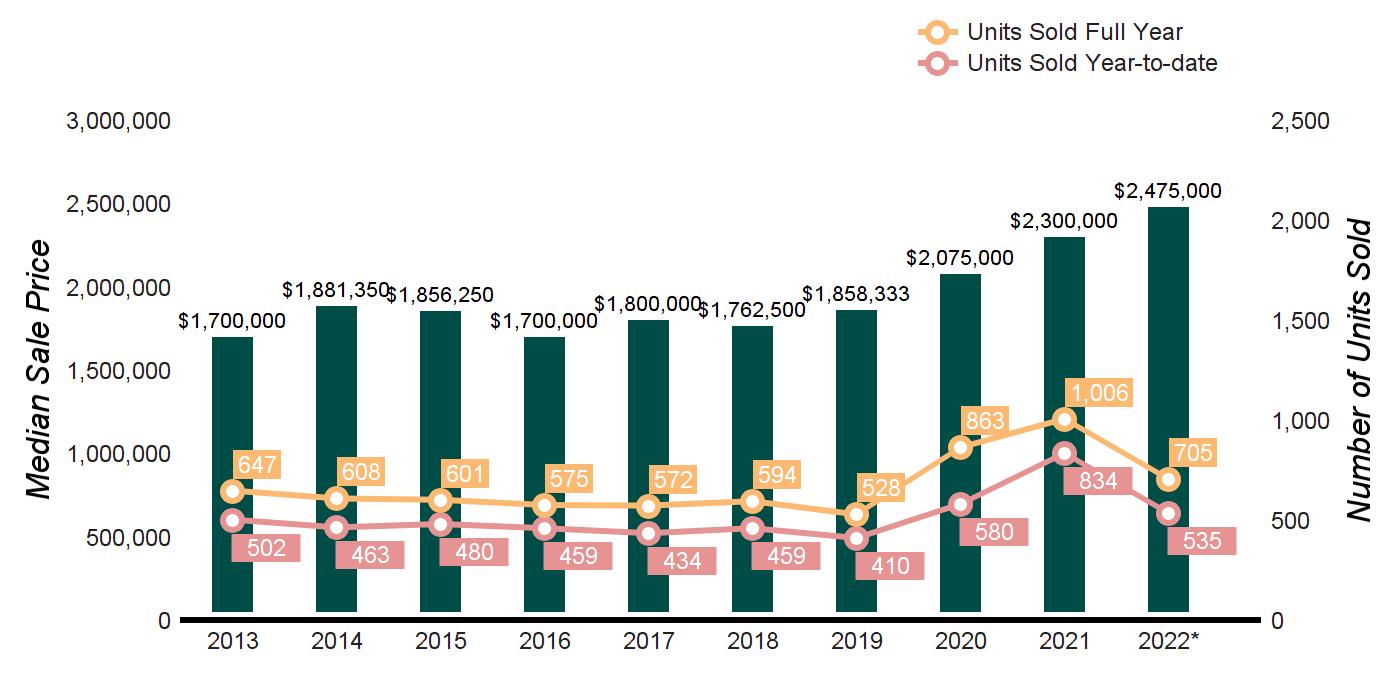

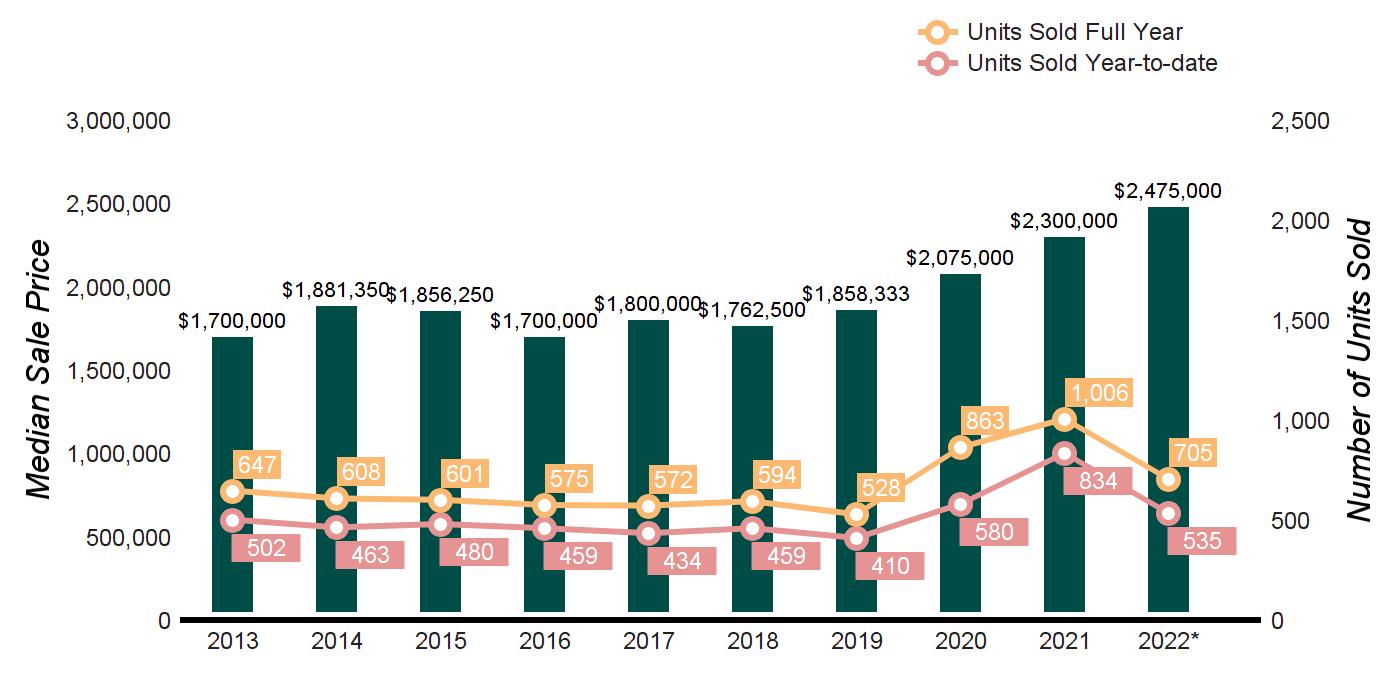

GREENWICH THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 204 320 -36.3% 535 834 -35.9% AVERAGE SALE PRICE $3,130,587 $2,940,366 6.5% $3,104,528

4.4% MEDIAN SALE PRICE $2,411,250 $2,297,500 5.0% $2,475,000 $2,300,000 7.6% AVERAGE PRICE PER SQUARE FOOT $717 $653 9.8% $694 $631 10.0% AVERAGE DAYS ON MARKET 58 83 -30.1% 79 111 -28.8% % SALE PRICE TO LIST PRICE 100.5% 98.5% 2.0% 99.8% 97.6% 2.3% TEN-YEAR MARKET HISTORY Average Sale Price $2,244,574 $2,688,907 $2,421,486 $2,203,756 $2,574,993 $2,393,006 $2,376,330 $2,667,708 $3,007,978 $3,104,528 Average Sale Price Average Price/SqFt $556 $611 $592 $564 $578 $563 $545 $557 $635 $694 Average Price/SqFt Days On Market 154 155 161 157 183 179 199 171 109 79 Days On Market %Sale Price to List Price 94.1% 93.7% 94.4% 94.1% 92.5% 93.7% 92.4% 94.4% 97.4% 99.8% %Sale Price to List Price Source : Greenwich MLS, Residential / Single Family Homes * Homes sold for 2022 are annualized based on actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $999,999

$1,000,000 - $1,999,999

$2,000,000 - $2,999,999

$3,000,000 - $3,999,999

$4,000,000 - $4,999,999

$5,000,000 - $5,999,999

$6,000,000 - $7,999,999

$8,000,000 - $9,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

vs. 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $999,999

09/30/2022

09/30/2021

2022/2021

- $1,999,999

- $2,999,999

- $3,999,999

- $4,999,999

- $5,999,999

$6,000,000 - $7,999,999

- $9,999,999

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

-42.7%

-45.8%

GREENWICH THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS % CHANGE IN PENDINGS

11 4 3 20 13 2 -45.0% -69.2%

43 11 4 57 32 2 -24.6% -65.6%

36 18 2 47 19 2 -23.4% -5.3%

27 12 2 37 14 3 -27.0% -14.3%

28 5 6 29 8 4 -3.4% -37.5%

18 7 3 18 3 6 0.0% 133.3%

17 9 2 26 9 3 -34.6% 0.0%

11 1 11 13 4 3 -15.4% -75.0% $10,000,000 and up 34 0 Not Valid 20 1 20 70.0% -100.0% MarketTotals 225 67 3 267 103 3 -15.7% -35.0% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE

10/01/2021

10/01/2020

%

$0

53 89 -40.4% 73 124 -41.1% $1,000,000

153 234 -34.6% 208 335 -37.9% $2,000,000

116 215 -46.0% 157 274

$3,000,000

70 127 -44.9% 90 166

$4,000,000

56 58 -3.4% 68 74 -8.1% $5,000,000

36 35 2.9% 44 44 0.0%

32 50 -36.0% 40 61 -34.4% $8,000,000

11 15 -26.7% 15 21 -28.6% $10,000,000 and up 8 11 -27.3% 12 18 -33.3% MarketTotals 535 834 -35.9% 707 1117 -36.7% Source : Greenwich MLS, Residential / Single Family Homes

QUARTERLY MARKET OVERVIEW

STAMFORD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 238 301 -20.9% 606 757 -19.9% AVERAGE SALE PRICE $862,154 $828,430 4.1% $882,103 $824,956 6.9% MEDIAN SALE PRICE $782,500 $715,000 9.4% $762,000 $700,000 8.9% AVERAGE PRICE PER SQUARE FOOT $312 $302 3.3% $309 $286 8.0% AVERAGE DAYS ON MARKET 41 44 -6.8% 45 59 -23.7% % SALE PRICE TO LIST PRICE 101.7% 101.5% 0.2% 102.6% 100.5% 2.1% TEN-YEAR MARKET HISTORY Average Sale Price $661,763 $689,609 $660,162 $636,893 $652,048 $648,437 $640,382 $721,185 $832,913 $882,103 Average Sale Price Average Price/SqFt $203 $222 $239 $230 $234 $230 $235 $248 $288 $309 Average Price/SqFt Days On Market 98 100 101 106 91 71 89 84 60 45 Days On Market %Sale Price to List Price 95.9% 96.0% 96.3% 96.1% 96.3% 96.7% 96.7% 97.9% 100.3% 102.6% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND

-24.2%

2021

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

$0 - $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

STAMFORD THIRD QUARTER 2022

AS

2022 vs.

SUPPLY:

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

12 8 2 27 22 1 -55.6% -63.6%

47 19 2 62 25 2

-24.0%

47 24 2 76 31 2 -38.2% -22.6%

27 19 1 27 10 3 0.0% 90.0%

8 2 4 15 7 2 -46.7% -71.4%

3 1 3 6 3 2 -50.0% -66.7%

3 1 3 2 0 Not Valid 50.0% 0.0%

4 0 Not Valid 1 1 1 300.0% -100.0% $4,000,000 and up 4 1 4 4 3 1 0.0% -66.7% MarketTotals 155 75 2 220 102 2 -29.5% -26.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

40 98 -59.2% 69 160 -56.9% $500,000

208 280 -25.7% 285 382 -25.4%

215 236 -8.9% 298 322 -7.5% $1,000,000

97 101 -4.0% 128 136 -5.9% $1,500,000

31 24 29.2% 43 34 26.5% $2,000,000

10 9 11.1% 12 13 -7.7% $2,500,000

1 2 -50.0% 2 2 0.0% $3,000,000

3 6 -50.0% 6 7 -14.3% $5,000,000 and up 1 1 0.0% 1 2 -50.0% MarketTotals 606 757 -19.9% 844 1058 -20.2% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

HOMES

AVERAGE

$1,912,084

$1,635,000 -2.1%

-48.6%

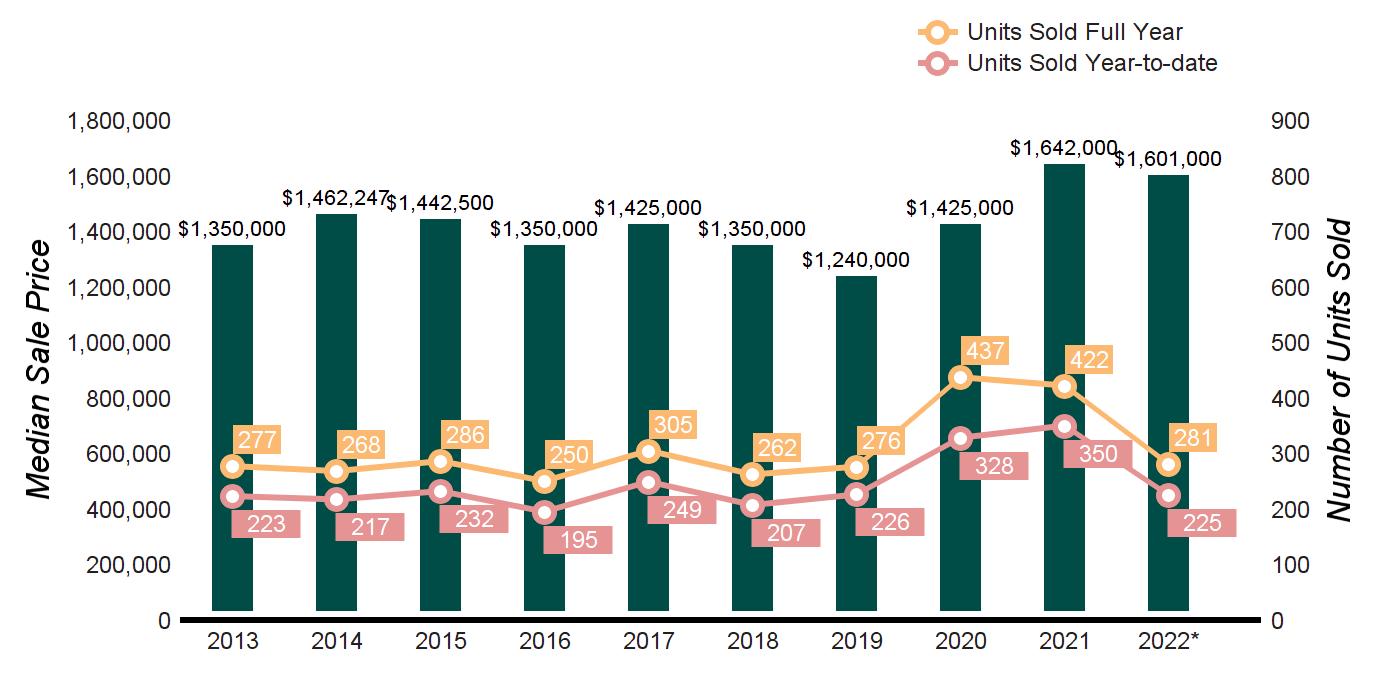

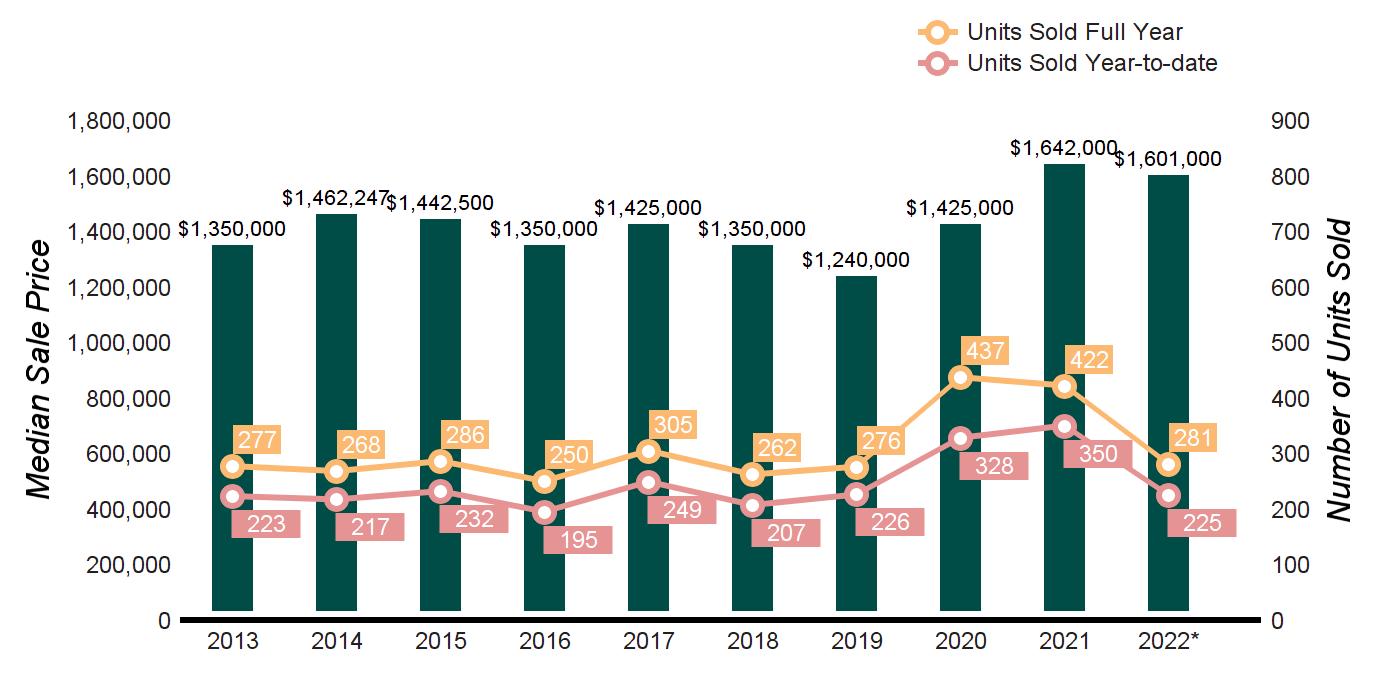

DARIEN THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

SOLD 83 119 -30.3% 225 350 -35.7%

SALE PRICE $1,932,206 $2,113,331 -8.6% $1,969,187

3.0% MEDIAN SALE PRICE $1,600,000 $1,810,000 -11.6% $1,601,000

AVERAGE PRICE PER SQUARE FOOT $559 $515 8.5% $563 $502 12.2% AVERAGE DAYS ON MARKET 30 43 -30.2% 36 70

% SALE PRICE TO LIST PRICE 103.4% 100.0% 3.4% 103.4% 99.4% 4.0% TEN-YEAR MARKET HISTORY Average Sale Price $1,618,804 $1,619,781 $1,705,978 $1,673,646 $1,676,743 $1,603,743 $1,534,435 $1,655,525 $1,929,797 $1,969,187 Average Sale Price Average Price/SqFt $467 $474 $504 $490 $476 $458 $429 $446 $505 $563 Average Price/SqFt Days On Market 123 109 105 110 126 122 147 124 70 36 Days On Market %Sale Price to List Price 96.1% 96.9% 95.6% 96.0% 95.5% 94.7% 94.0% 96.3% 99.4% 103.4% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN

-100.0%

-20.0%

SOLD PROPERTIES

YEAR-TO-DATE YEAR-OVER-YEAR

PRICE RANGE

- $499,999

- $699,999

- $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

09/30/2022

09/30/2021

-40.0%

CHANGE 2022/2021

DARIEN THIRD QUARTER 2022

% CHANGE IN LISTINGS %

PENDINGS

0 1 0 0 1 0 0.0% 0.0%

4 0 Not Valid 4 1 4 0.0%

5 2 3 12 1 12 -58.3% 100.0%

10 4 3 14 5 3 -28.6%

6 6 1 12 9 1 -50.0% -33.3%

8 6 1 8 1 8 0.0% 500.0%

5 3 2 2 5 1 150.0%

6 7 1 6 3 2 0.0% 133.3% $4,000,000 and up 10 3 3 16 2 8 -37.5% 50.0% MarketTotals 54 32 2 74 28 3 -27.0% 14.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

0 3 -100.0% 0 3 -100.0% $500,000

10 14 -28.6% 14 22 -36.4% $700,000

32 43 -25.6% 42 61 -31.1% $1,000,000

57 98 -41.8% 72 124 -41.9% $1,500,000

46 71 -35.2% 65 95 -31.6% $2,000,000

20 30 -33.3% 25 43 -41.9% $2,500,000

21 41 -48.8% 25 50 -50.0% $3,000,000

34 45 -24.4% 47 55 -14.5% $5,000,000 and up 5 5 0.0% 7 6 16.7% MarketTotals 225 350 -35.7% 297 459 -35.3% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

HOMES

-43.9%

$1,990,885

$1,725,500

$394

-37.2%

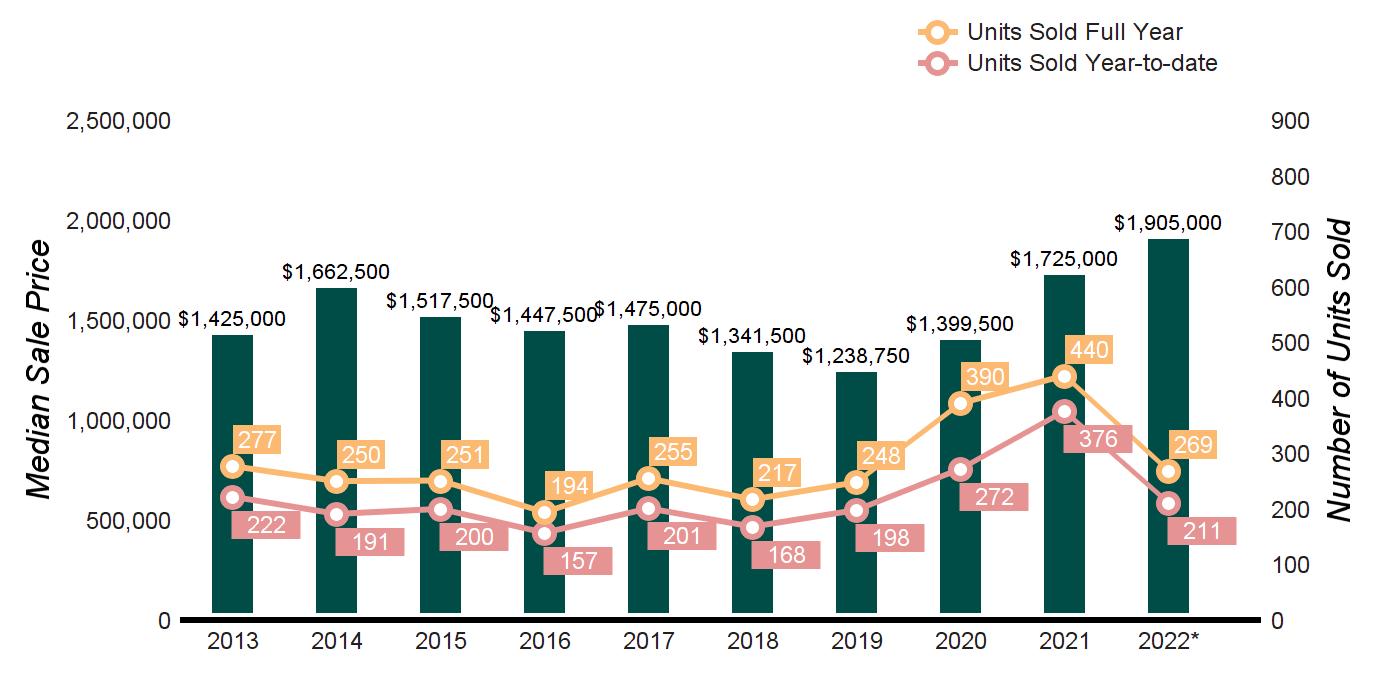

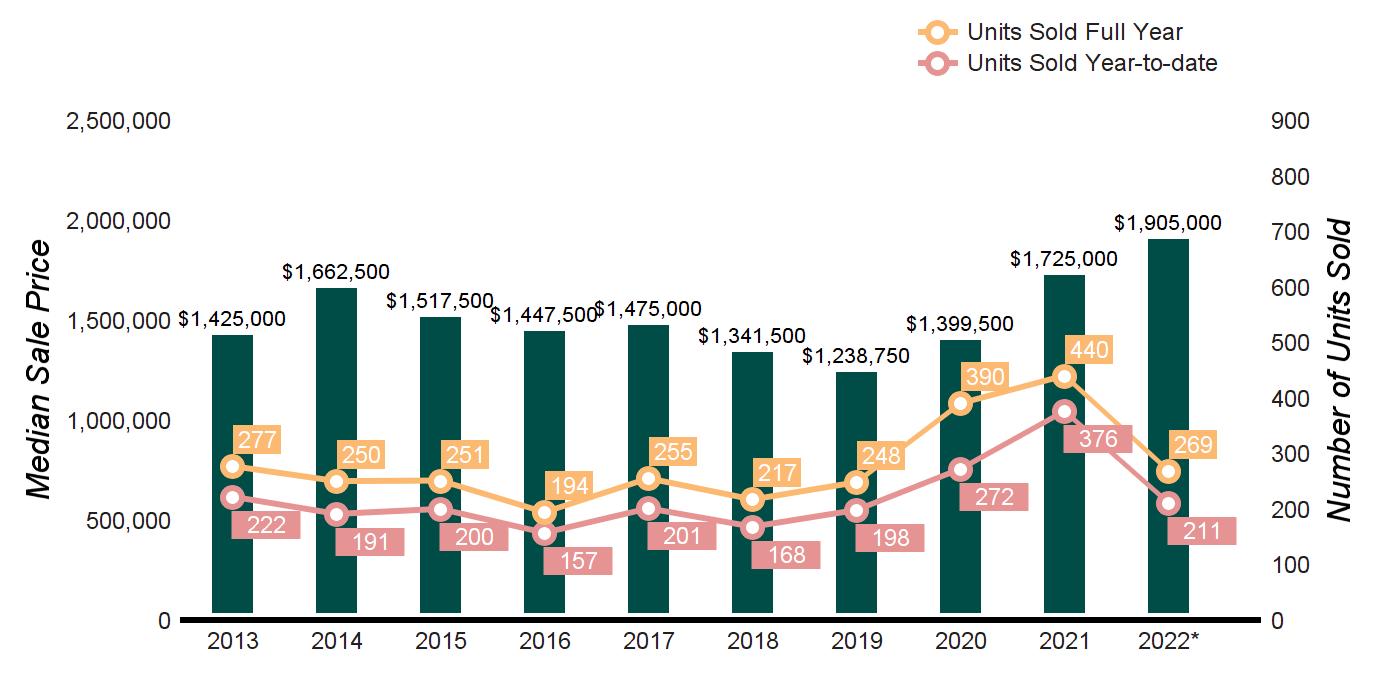

NEW CANAAN THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

SOLD 85 139 -38.8% 211 376

AVERAGE SALE PRICE $2,342,503 $1,972,061 18.8% $2,189,147

10.0% MEDIAN SALE PRICE $2,000,000 $1,720,000 16.3% $1,905,000

10.4% AVERAGE PRICE PER SQUARE FOOT $489 $399 22.6% $458

16.2% AVERAGE DAYS ON MARKET 42 63 -33.3% 54 86

% SALE PRICE TO LIST PRICE 100.4% 100.2% 0.2% 101.2% 99.3% 1.9% TEN-YEAR MARKET HISTORY Average Sale Price $1,661,172 $1,929,472 $1,783,190 $1,770,026 $1,713,201 $1,628,160 $1,424,859 $1,670,517 $1,995,193 $2,189,147 Average Sale Price Average Price/SqFt $388 $389 $406 $356 $355 $341 $316 $337 $400 $458 Average Price/SqFt Days On Market 123 122 126 148 147 138 164 138 83 54 Days On Market %Sale Price to List Price 95.0% 94.9% 95.8% 93.8% 94.0% 92.2% 92.8% 95.4% 99.1% 101.2% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

2021

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

- $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

NEW CANAAN THIRD QUARTER 2022

AS

2022 vs.

% CHANGE IN LISTINGS %

PENDINGS

0 0 Not Valid 0 0 Not Valid 0.0% 0.0%

0 0 Not Valid 1 0 Not Valid -100.0% 0.0%

8 1 8 7 1 7 14.3% 0.0%

9 5 2 24 4 6 -62.5% 25.0%

11 7 2 17 8 2 -35.3% -12.5%

8 7 1 9 4 2 -11.1% 75.0%

4 5 1 13 3 4 -69.2% 66.7%

8 5 2 16 5 3 -50.0% 0.0% $4,000,000 and up 29 2 15 23 2 12 26.1% 0.0% MarketTotals 77 32 2 110 27 4 -30.0% 18.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

0 0 Not Valid 0 0 Not Valid $500,000

4 8 -50.0% 5 10 -50.0% $700,000

14 30 -53.3% 17 45 -62.2% $1,000,000

55 97 -43.3% 74 144 -48.6% $1,500,000

37 91 -59.3% 57 117 -51.3% $2,000,000

31 61 -49.2% 36 70 -48.6% $2,500,000

35 38 -7.9% 40 45 -11.1% $3,000,000

29 48 -39.6% 39 60 -35.0% $5,000,000 and up 6 3 100.0% 7 3 133.3% MarketTotals 211 376 -43.9% 275 494 -44.3% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

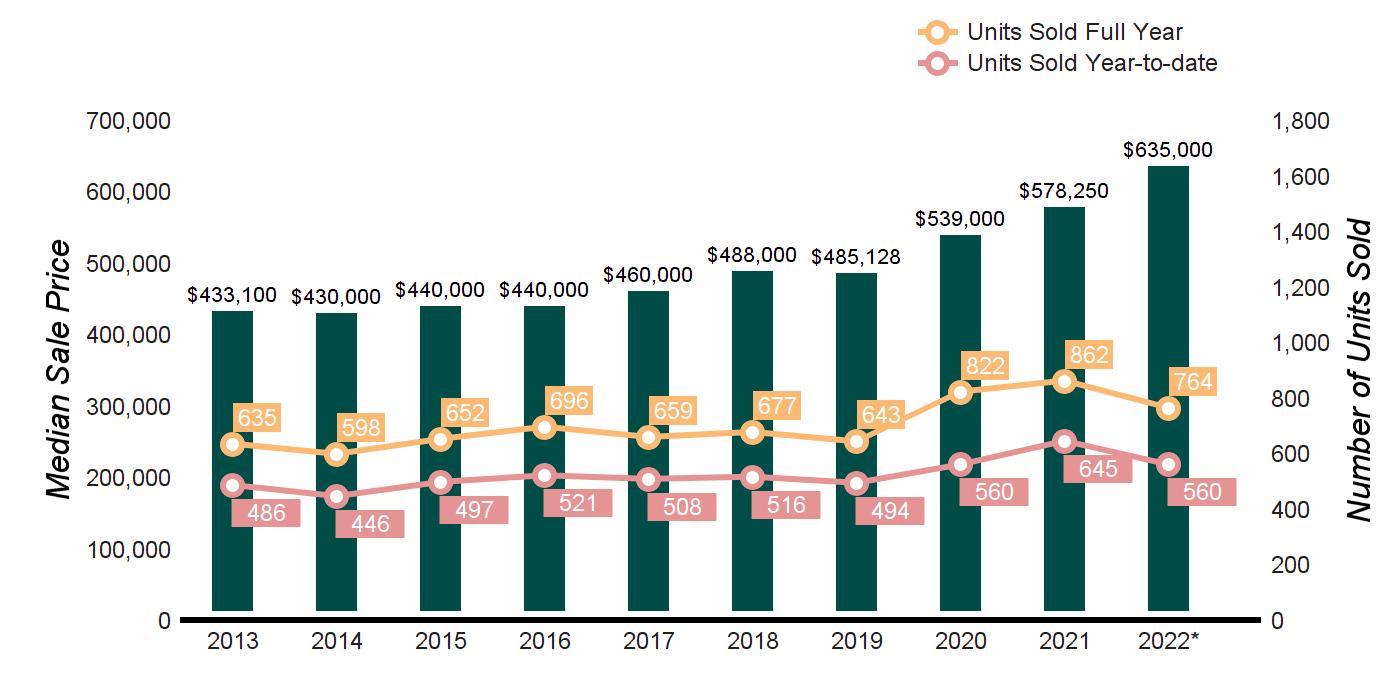

NORWALK THIRD QUARTER 2022

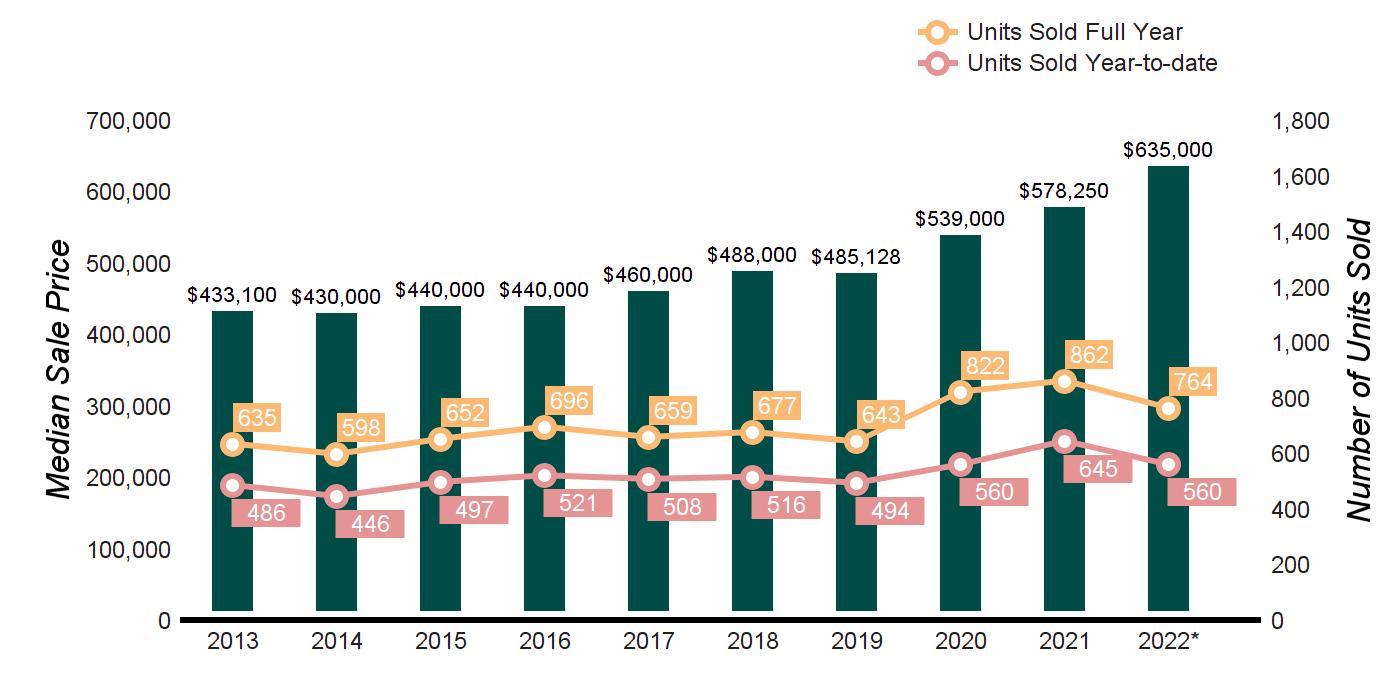

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 238 269 -11.5% 560 645 -13.2% AVERAGE SALE PRICE $916,581 $800,812 14.5% $835,662 $772,670 8.2% MEDIAN SALE PRICE $650,000 $610,000 6.6% $635,000 $580,000 9.5% AVERAGE PRICE PER SQUARE FOOT $365 $319 14.4% $351 $312 12.5% AVERAGE DAYS ON MARKET 41 51 -19.6% 43 58 -25.9% % SALE PRICE TO LIST PRICE 102.5% 101.2% 1.3% 103.7% 100.9% 2.8% TEN-YEAR MARKET HISTORY Average Sale Price $559,224 $579,016 $561,384 $589,682 $617,442 $606,739 $598,599 $692,658 $774,970 $835,662 Average Sale Price Average Price/SqFt $203 $225 $244 $255 $262 $258 $261 $289 $315 $351 Average Price/SqFt Days On Market 114 103 99 104 83 67 87 80 56 43 Days On Market %Sale Price to List Price 95.8% 96.3% 96.2% 96.2% 96.6% 96.8% 96.7% 97.8% 100.5% 103.7% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND

vs. 2021

CHANGE IN

-54.1%

-22.2% -50.0%

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

NORWALK THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

28 17 2 53 37 1 -47.2%

42 13 3 54 26 2

28 14 2 30 19 2 -6.7% -26.3%

9 14 1 6 7 1 50.0% 100.0%

9 5 2 8 0 Not Valid 12.5% 0.0%

2 0 Not Valid 4 1 4 -50.0% -100.0%

5 1 5 1 0 Not Valid 400.0% 0.0%

0 3 0 4 3 1 -100.0% 0.0% $4,000,000 and up 1 2 1 2 2 1 -50.0% 0.0% MarketTotals 124 69 2 162 95 2 -23.5% -27.4% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

127 202 -37.1% 193 299 -35.5% $500,000

206 237 -13.1% 290 320 -9.4%

111 102 8.8% 157 144 9.0% $1,000,000

60 46 30.4% 64 60 6.7% $1,500,000

32 25 28.0% 36 36 0.0% $2,000,000

9 18 -50.0% 14 25 -44.0% $2,500,000

8 6 33.3% 8 8 0.0% $3,000,000

5 8 -37.5% 11 13 -15.4% $5,000,000 and up 2 1 100.0% 4 2 100.0% MarketTotals 560 645 -13.2% 777 907 -14.3% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

HOMES

$1,850,517

$1,600,000

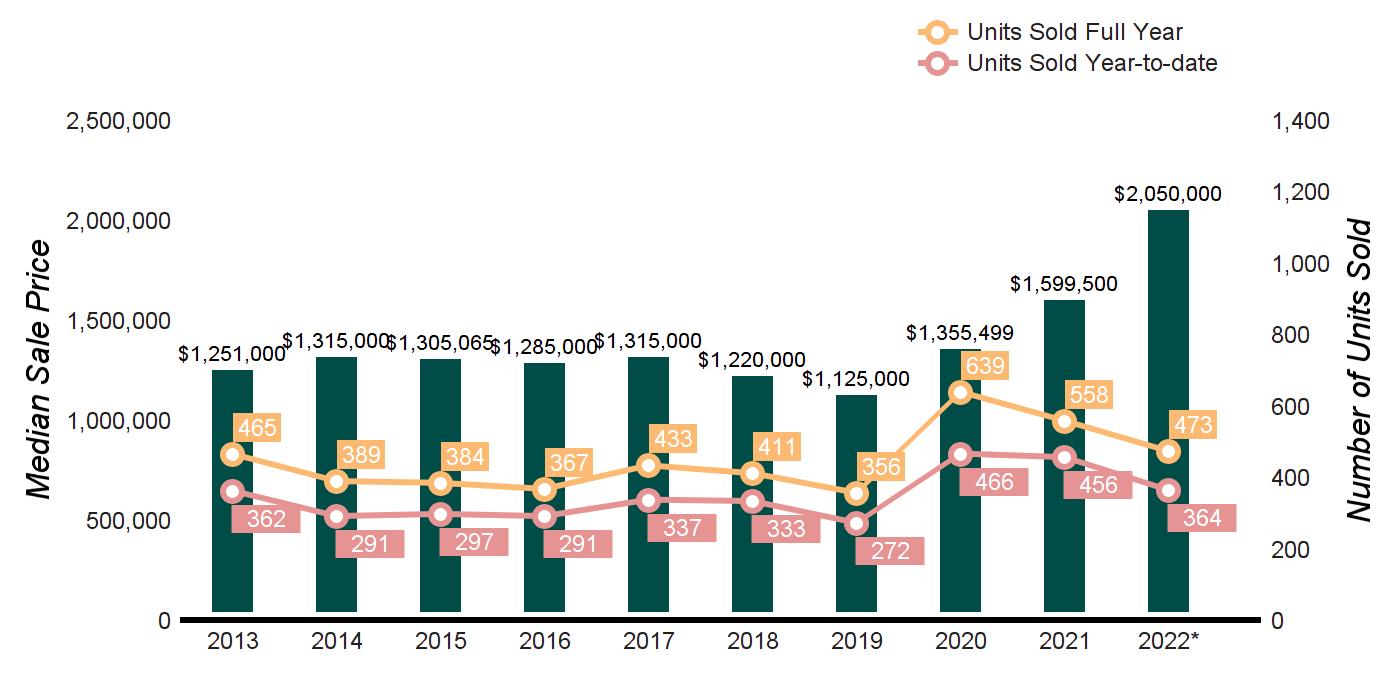

WESTPORT THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

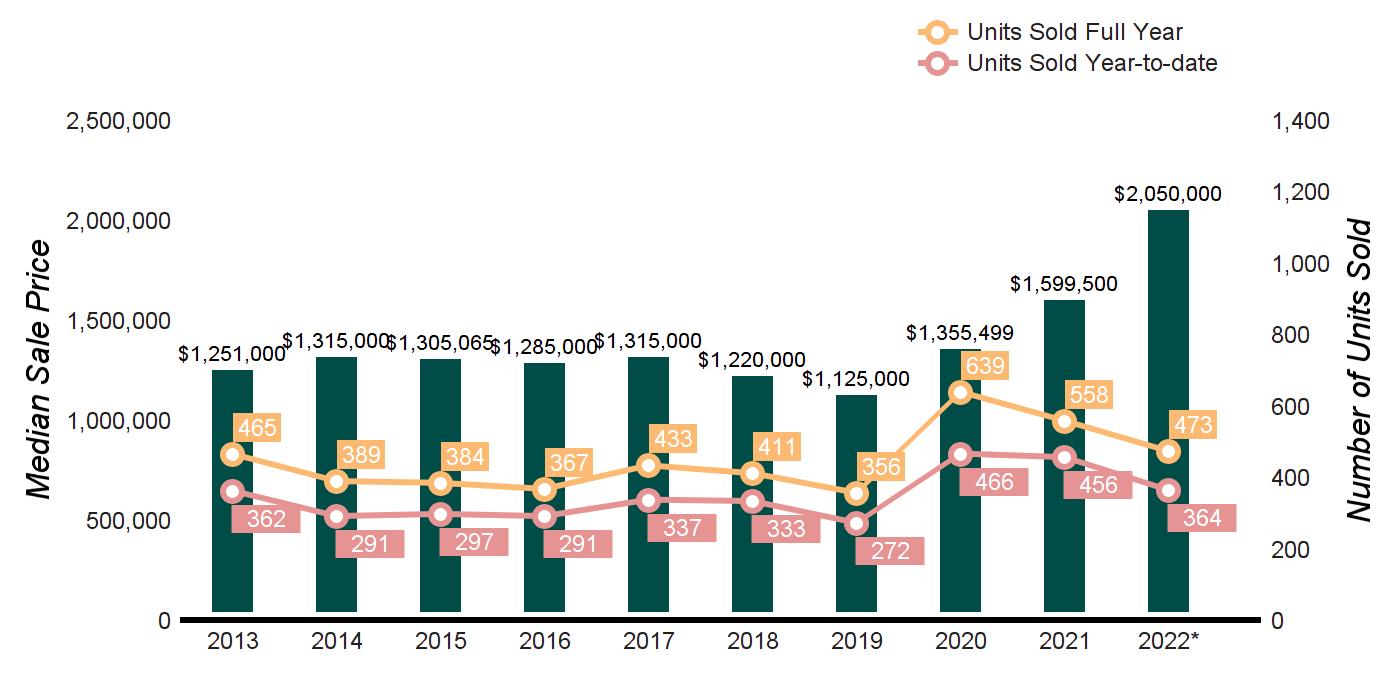

SOLD 131 189 -30.7% 364 456 -20.2% AVERAGE SALE PRICE $2,422,991 $1,852,513 30.8% $2,413,010

30.4% MEDIAN SALE PRICE $1,999,000 $1,600,000 24.9% $2,050,000

28.1% AVERAGE PRICE PER SQUARE FOOT $568 $456 24.6% $564 $453 24.5% AVERAGE DAYS ON MARKET 51 42 21.4% 54 55 -1.8% % SALE PRICE TO LIST PRICE 102.4% 101.2% 1.2% 103.2% 100.6% 2.6% TEN-YEAR MARKET HISTORY Average Sale Price $1,533,045 $1,545,200 $1,647,416 $1,527,152 $1,532,674 $1,457,544 $1,361,657 $1,595,659 $1,832,804 $2,413,010 Average Sale Price Average Price/SqFt $373 $385 $403 $376 $364 $355 $345 $375 $456 $564 Average Price/SqFt Days On Market 107 111 113 120 119 98 120 102 57 54 Days On Market %Sale Price to List Price 94.3% 96.0% 94.5% 94.9% 95.4% 95.6% 93.9% 97.1% 100.5% 103.2% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND RATIO*

vs. 2021

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

- $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

-13.3% -66.7%

-37.5%

-36.4%

09/30/2022

09/30/2021

CHANGE 2022/2021

WESTPORT THIRD QUARTER 2022

AS

2022

DEMAND:

SUPPLY/

% CHANGE IN LISTINGS %

PENDINGS

3 0 Not Valid 1 0 Not Valid 200.0% 0.0%

3 3 1 5 4 1 -40.0% -25.0%

13 3 4 15 9 2

11 5 2 22 8 3 -50.0%

18 5 4 13 11 1 38.5% -54.5%

7 8 1 18 7 3 -61.1% 14.3%

11 7 2 13 11 1 -15.4%

13 9 1 26 12 2 -50.0% -25.0% $4,000,000 and up 25 4 6 30 2 15 -16.7% 100.0% MarketTotals 104 44 2 143 64 2 -27.3% -31.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

2 6 -66.7% 4 10 -60.0% $500,000

13 14 -7.1% 20 27 -25.9% $700,000

35 80 -56.3% 52 114 -54.4% $1,000,000

58 108 -46.3% 80 152 -47.4% $1,500,000

65 88 -26.1% 80 125 -36.0% $2,000,000

57 70 -18.6% 75 84 -10.7% $2,500,000

42 35 20.0% 52 46 13.0% $3,000,000

71 45 57.8% 81 58 39.7% $5,000,000 and up 21 10 110.0% 22 13 69.2% MarketTotals 364 456 -20.2% 466 629 -25.9% Source : Smart MLS, Single Family Homes

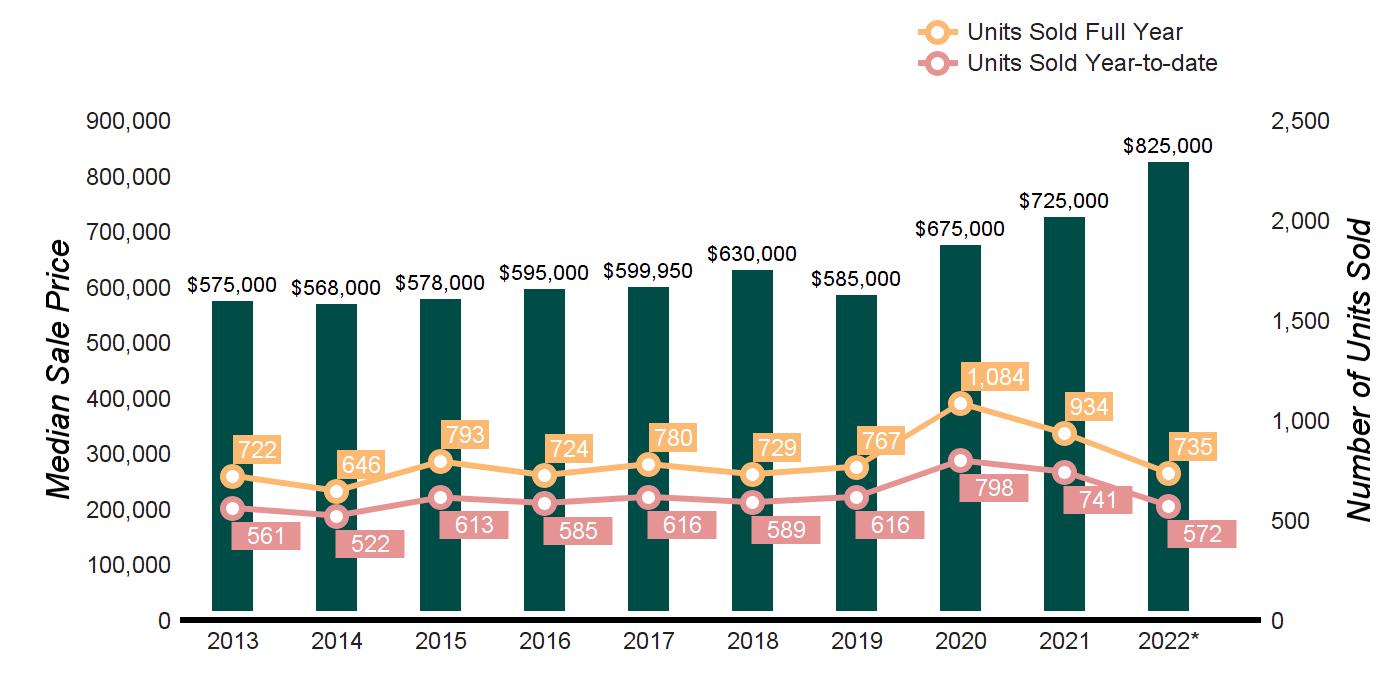

QUARTERLY MARKET OVERVIEW

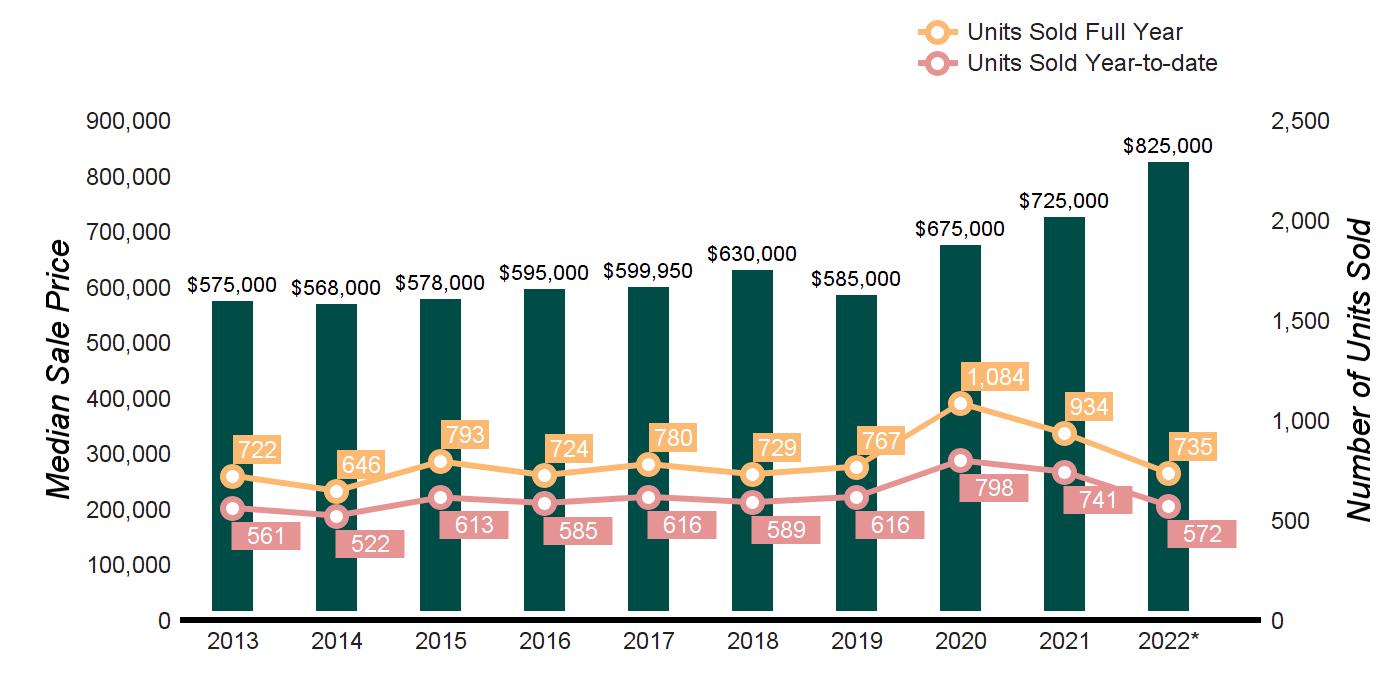

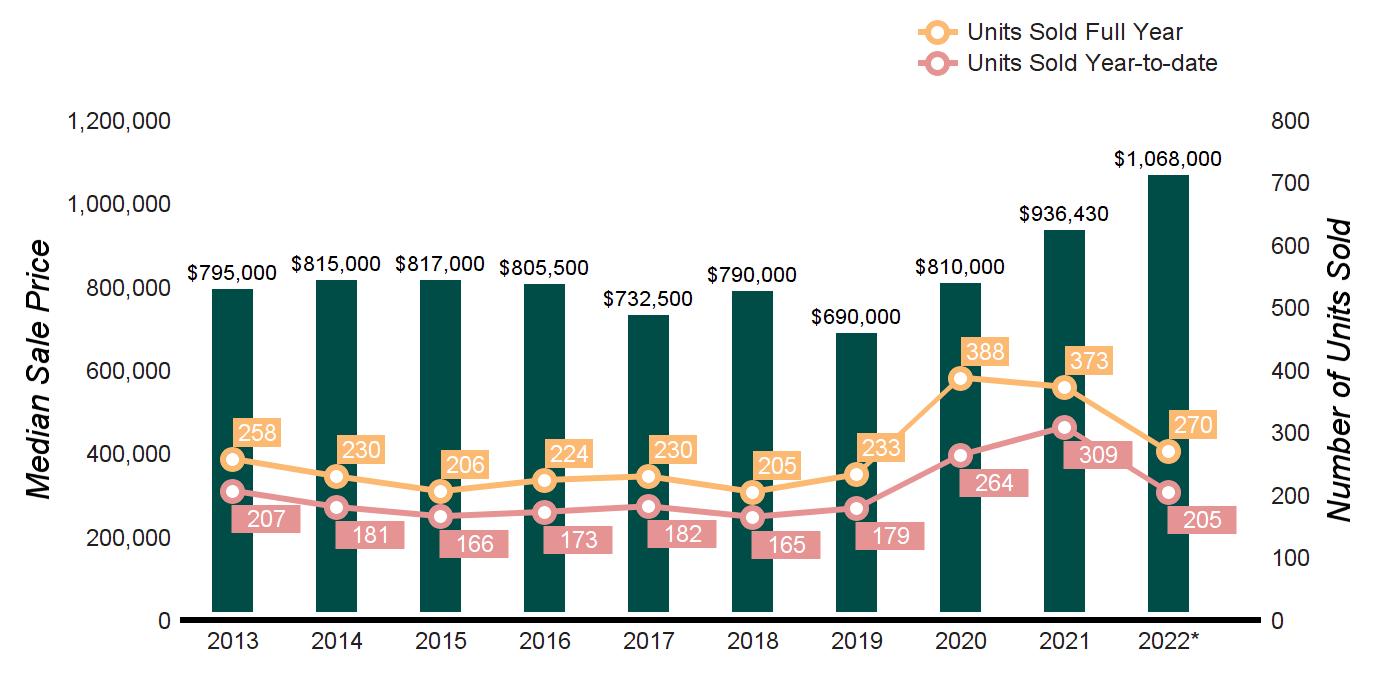

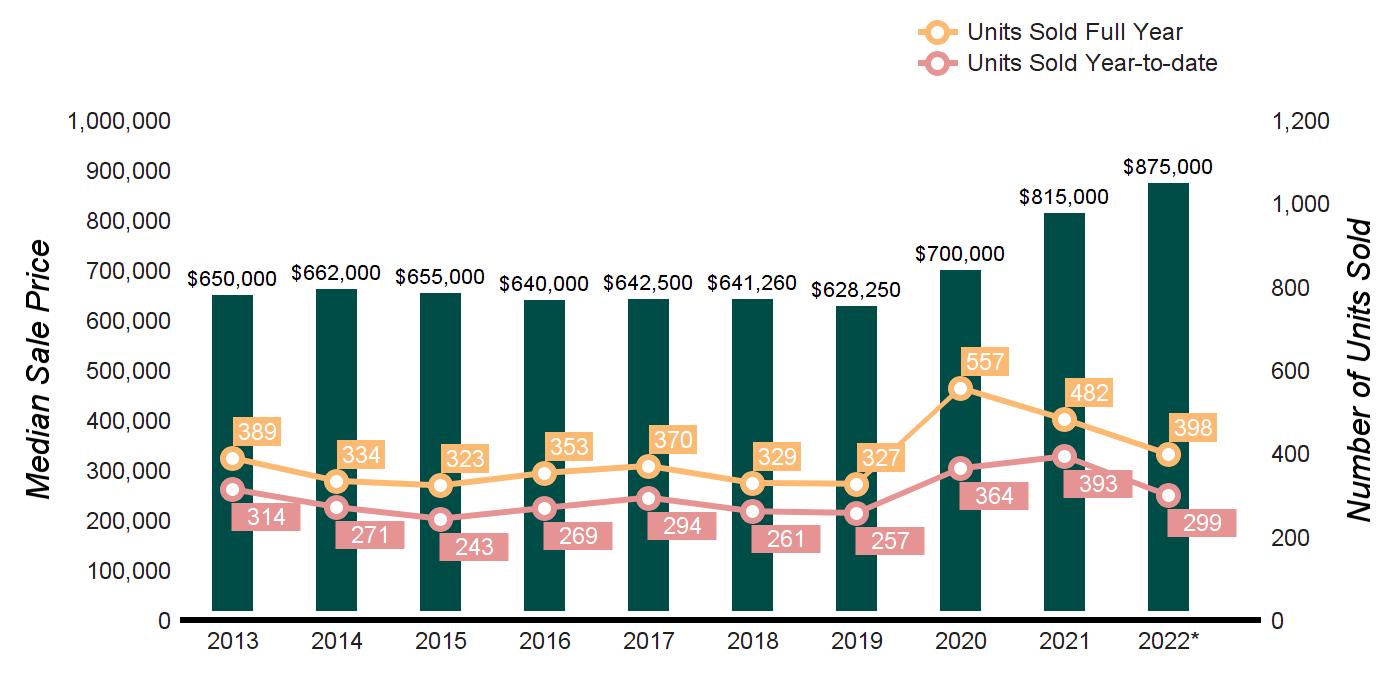

FAIRFIELD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 227 280 -18.9% 572 741 -22.8% AVERAGE SALE PRICE $1,068,810 $1,040,912 2.7% $1,077,008 $978,309 10.1% MEDIAN SALE PRICE $875,000 $763,750 14.6% $825,000 $740,000 11.5% AVERAGE PRICE PER SQUARE FOOT $400 $357 12.0% $395 $340 16.2% AVERAGE DAYS ON MARKET 41 46 -10.9% 43 56 -23.2% % SALE PRICE TO LIST PRICE 103.0% 99.7% 3.3% 102.8% 99.6% 3.2% TEN-YEAR MARKET HISTORY Average Sale Price $744,489 $722,296 $737,642 $705,408 $743,699 $776,998 $707,793 $867,030 $958,051 $1,077,008 Average Sale Price Average Price/SqFt $277 $278 $284 $279 $278 $280 $269 $293 $341 $395 Average Price/SqFt Days On Market 97 98 102 106 90 77 90 88 55 43 Days On Market %Sale Price to List Price 95.7% 95.8% 96.0% 95.8% 96.3% 95.8% 95.5% 97.2% 99.7% 102.8% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

SUPPLY/ DEMAND

vs. 2021

CHANGE

-70.8%

SOLD PROPERTIES

YEAR-TO-DATE YEAR-OVER-YEAR

PRICE RANGE

$0 - $499,999

- $699,999

- $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

09/30/2022

09/30/2021

CHANGE 2022/2021

-41.5%

-31.2%

-21.5%

-13.1%

FAIRFIELD THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

RATIO* % CHANGE IN LISTINGS %

IN PENDINGS

19 14 1 40 11 4 -52.5% 27.3%

48 7 7 39 24 2 23.1%

40 17 2 30 12 3 33.3% 41.7%

26 9 3 29 13 2 -10.3% -30.8%

14 5 3 15 4 4 -6.7% 25.0%

7 4 2 5 1 5 40.0% 300.0%

3 2 2 7 2 4 -57.1% 0.0%

5 0 Not Valid 5 1 5 0.0% -100.0% $4,000,000 and up 10 1 10 8 1 8 25.0% 0.0% MarketTotals 172 59 3 178 69 3 -3.4% -14.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

71 135 -47.4% 114 195

$500,000

135 208 -35.1% 194 282

$700,000

152 171 -11.1% 194 247

$1,000,000

104 120 -13.3% 133 153

$1,500,000

68 51 33.3% 78 75 4.0% $2,000,000

16 25 -36.0% 20 34 -41.2% $2,500,000

9 15 -40.0% 12 20 -40.0% $3,000,000

14 13 7.7% 17 18 -5.6% $5,000,000 and up 3 3 0.0% 3 3 0.0% MarketTotals 572 741 -22.8% 765 1027 -25.5% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

HOMES

AVERAGE

$292,515

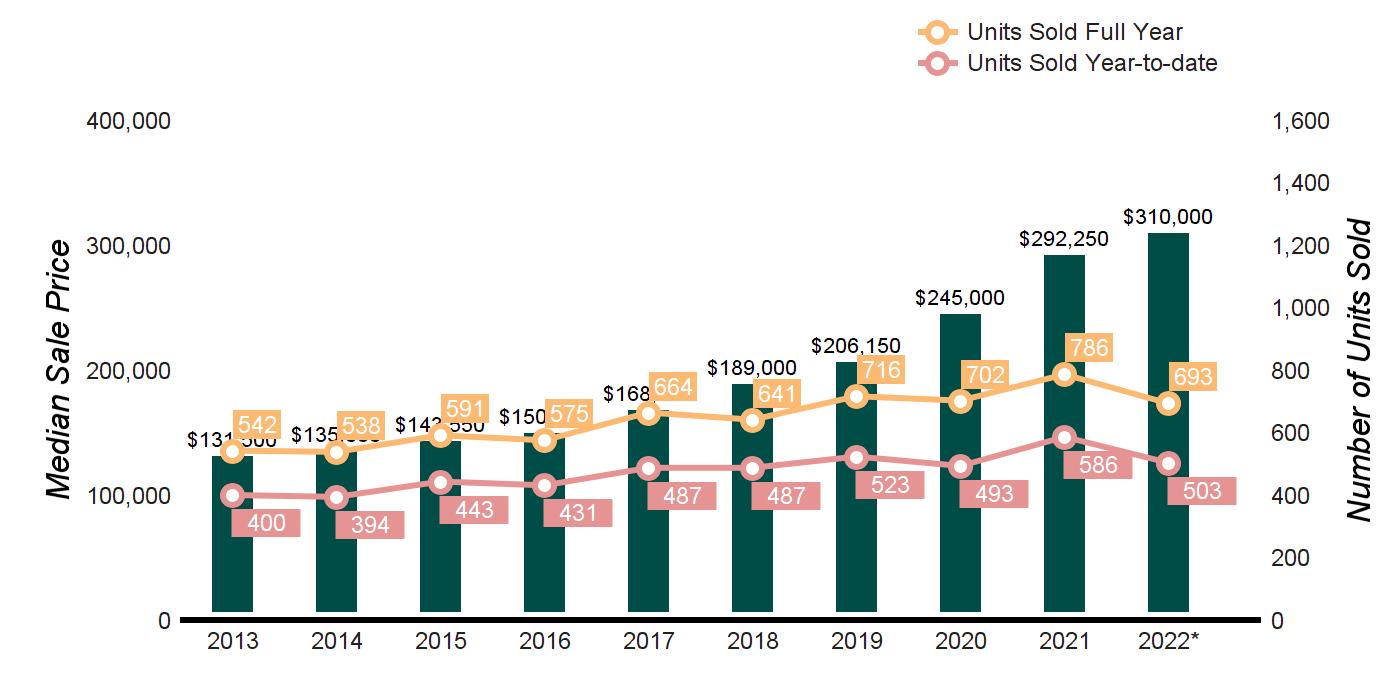

BRIDGEPORT THIRD QUARTER 2022

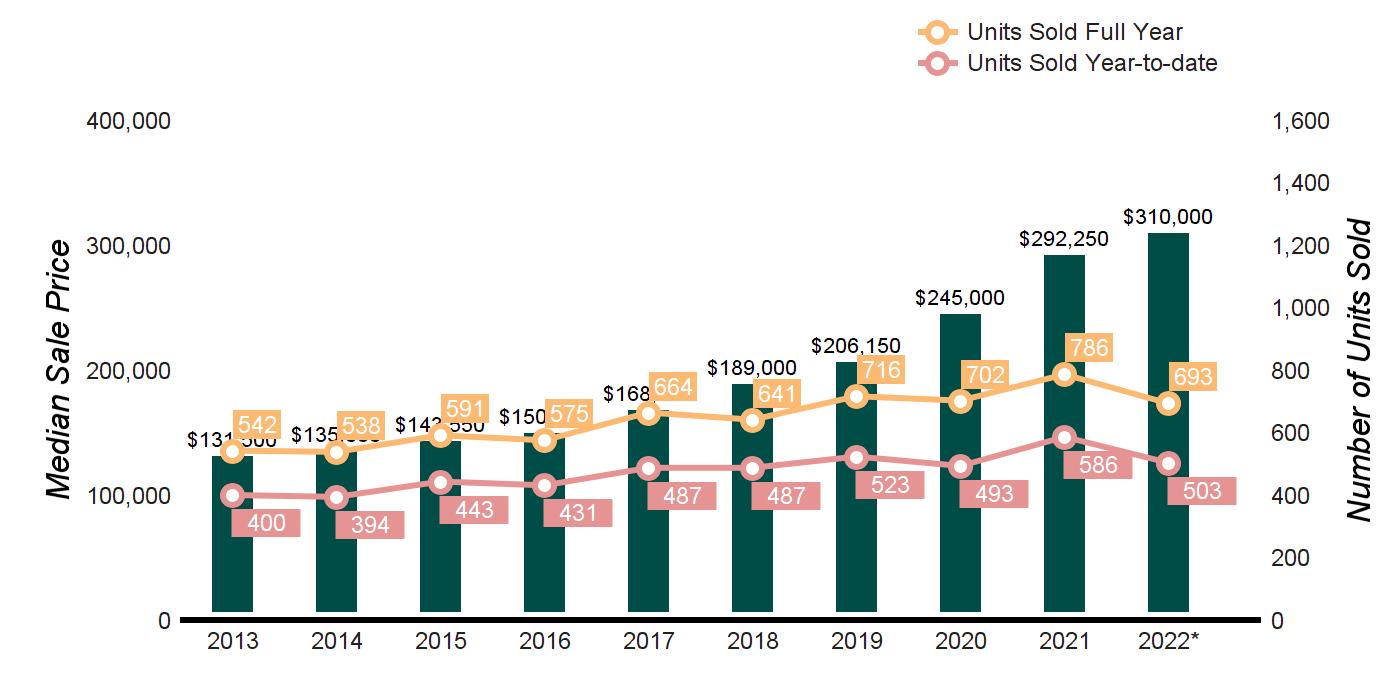

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE

SOLD 157 215 -27.0% 503 586 -14.2%

SALE PRICE $347,870 $304,445 14.3% $328,458

12.3% MEDIAN SALE PRICE $325,000 $300,000 8.3% $310,000 $290,000 6.9% AVERAGE PRICE PER SQUARE FOOT $215 $196 9.7% $206 $183 12.6% AVERAGE DAYS ON MARKET 35 45 -22.2% 42 51 -17.6% % SALE PRICE TO LIST PRICE 101.3% 101.5% -0.2% 101.4% 100.8% 0.6% TEN-YEAR MARKET HISTORY Average Sale Price $139,582 $149,196 $147,286 $150,644 $169,023 $194,259 $210,111 $248,250 $294,908 $328,458 Average Sale Price Average Price/SqFt $84 $89 $95 $98 $108 $115 $129 $154 $186 $206 Average Price/SqFt Days On Market 100 96 87 77 62 55 68 59 51 42 Days On Market %Sale Price to List Price 95.4% 95.5% 96.7% 97.0% 97.7% 98.3% 98.2% 99.5% 100.7% 101.4% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND

-28.9%

-8.0%

vs. 2021

CHANGE

SOLD

YEAR-TO-DATE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

2022/2021

BRIDGEPORT THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

IN PENDINGS

9 13 1 29 14 2 -69.0% -7.1%

59 25 2 83 50 2

-50.0%

69 38 2 75 27 3

40.7%

16 4 4 21 6 4 -23.8% -33.3%

7 2 4 1 2 1 600.0% 0.0%

0 3 0 3 0 Not Valid -100.0% 0.0%

0 0 Not Valid 1 0 Not Valid -100.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 160 85 2 213 99 2 -24.9% -14.1% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE

$0

39 95 -58.9% 62 144 -56.9% $200,000

173 221 -21.7% 246 332 -25.9%

195 220 -11.4% 270 257 5.1% $400,000

73 34 114.7% 98 38 157.9% $500,000

9 7 28.6% 11 10 10.0% $600,000

10 6 66.7% 11 9 22.2% $800,000

2 3 -33.3% 3 4 -25.0% $1,000,000

2 0 Not Valid 2 1 100.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 503 586 -14.2% 703 795 -11.6% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

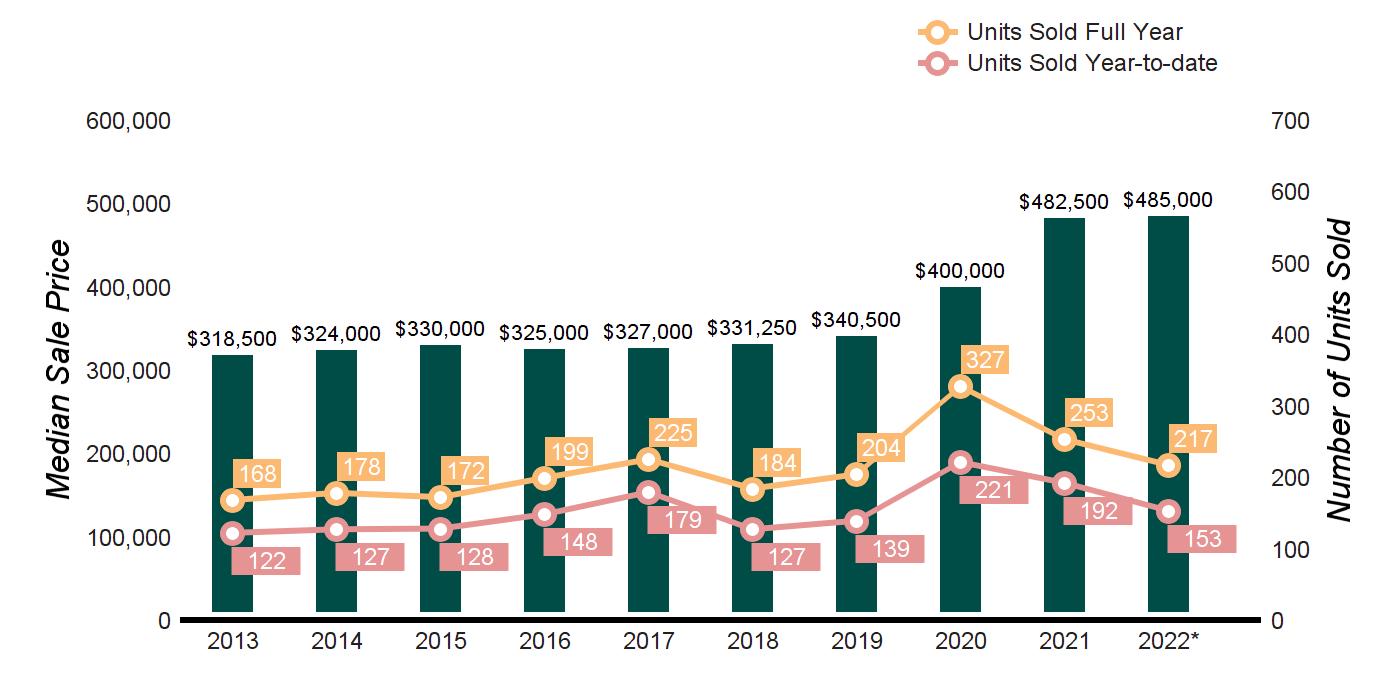

STRATFORD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 187 203 -7.9% 526 545 -3.5% AVERAGE SALE PRICE $424,968 $369,452 15.0% $398,169 $358,947 10.9% MEDIAN SALE PRICE $395,000 $360,000 9.7% $383,500 $350,000 9.6% AVERAGE PRICE PER SQUARE FOOT $237 $220 7.7% $233 $208 12.0% AVERAGE DAYS ON MARKET 34 34 0.0% 35 40 -12.5% % SALE PRICE TO LIST PRICE 102.2% 102.5% -0.3% 103.4% 102.5% 0.9% TEN-YEAR MARKET HISTORY Average Sale Price $231,705 $239,978 $235,881 $246,255 $247,072 $261,144 $259,437 $322,139 $360,812 $398,169 Average Sale Price Average Price/SqFt $136 $138 $141 $147 $147 $150 $158 $182 $210 $233 Average Price/SqFt Days On Market 94 98 93 85 74 56 69 52 41 35 Days On Market %Sale Price to List Price 95.4% 96.3% 96.0% 96.8% 97.4% 97.6% 98.0% 99.7% 102.0% 103.4% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND

-36.1%

-34.6%

vs. 2021

CHANGE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

YEAR-TO-DATE

01/01/202209/30/2022

-

YEAR-OVER-YEAR

09/30/2022

09/30/2021

STRATFORD THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

IN PENDINGS

2 1 2 11 8 1 -81.8% -87.5%

23 13 2 36 18 2

-27.8%

34 20 2 52 27 2

-25.9%

38 5 8 21 5 4 81.0% 0.0%

9 1 9 3 5 1 200.0% -80.0%

11 2 6 6 1 6 83.3% 100.0%

0 1 0 4 0 Not Valid -100.0% 0.0%

2 1 2 3 0 Not Valid -33.3% 0.0% $2,000,000 and up 1 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 120 44 3 136 64 2 -11.8% -31.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand SOLD PROPERTIES

01/01/2021

09/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE 2022/2021 $0

20 17 17.6% 30 32 -6.3% $200,000

79 116 -31.9% 123 199 -38.2%

198 265 -25.3% 270 373 -27.6% $400,000

143 101 41.6% 181 137 32.1% $500,000

49 34 44.1% 60 43 39.5% $600,000

29 10 190.0% 37 16 131.3% $800,000

6 0 Not Valid 9 0 Not Valid $1,000,000

2 2 0.0% 2 5 -60.0% $2,000,000 and up 0 0 Not Valid 0 2 -100.0% MarketTotals 526 545 -3.5% 712 807 -11.8% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

WILTON THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 84 126 -33.3% 205 309 -33.7% AVERAGE SALE PRICE $1,169,207 $1,120,485 4.3% $1,185,930 $1,067,376 11.1% MEDIAN SALE PRICE $984,500 $980,000 0.5% $1,068,000 $935,000 14.2% AVERAGE PRICE PER SQUARE FOOT $322 $287 12.2% $317 $274 15.7% AVERAGE DAYS ON MARKET 35 50 -30.0% 45 64 -29.7% % SALE PRICE TO LIST PRICE 105.0% 102.9% 2.0% 105.7% 102.1% 3.5% TEN-YEAR MARKET HISTORY Average Sale Price $919,853 $922,728 $890,707 $876,157 $825,067 $867,236 $759,135 $887,210 $1,068,607 $1,185,930 Average Sale Price Average Price/SqFt $254 $252 $260 $249 $238 $228 $214 $233 $275 $317 Average Price/SqFt Days On Market 127 118 117 132 135 102 120 107 63 45 Days On Market %Sale Price to List Price 95.7% 96.3% 96.0% 95.8% 95.4% 94.9% 95.1% 97.8% 101.5% 105.7% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

WILTON THIRD QUARTER 2022

% CHANGE IN LISTINGS %

PENDINGS

2 3 1 8 1 8 -75.0% 200.0%

6 2 3 6 2 3 0.0% 0.0%

16 5 3 19 8 2 -15.8% -37.5%

14 9 2 15 12 1 -6.7% -25.0%

8 2 4 6 6 1 33.3% -66.7%

4 1 4 5 2 3 -20.0% -50.0%

0 0 Not Valid 1 0 Not Valid -100.0% 0.0%

1 0 Not Valid 2 0 Not Valid -50.0% 0.0% $4,000,000 and up 1 0 Not Valid 1 0 Not Valid 0.0% 0.0% MarketTotals 52 22 2 63 31 2 -17.5% -29.0% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

6 15 -60.0% 10 22 -54.5% $500,000

24 40 -40.0% 34 65 -47.7%

66 122 -45.9% 88 170 -48.2% $1,000,000

67 83 -19.3% 82 119 -31.1% $1,500,000

24 31 -22.6% 33 37 -10.8% $2,000,000

11 9 22.2% 15 11 36.4% $2,500,000

7 8 -12.5% 7 8 -12.5% $3,000,000

0 1 -100.0% 0 1 -100.0% $5,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 205 309 -33.7% 269 433 -37.9% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

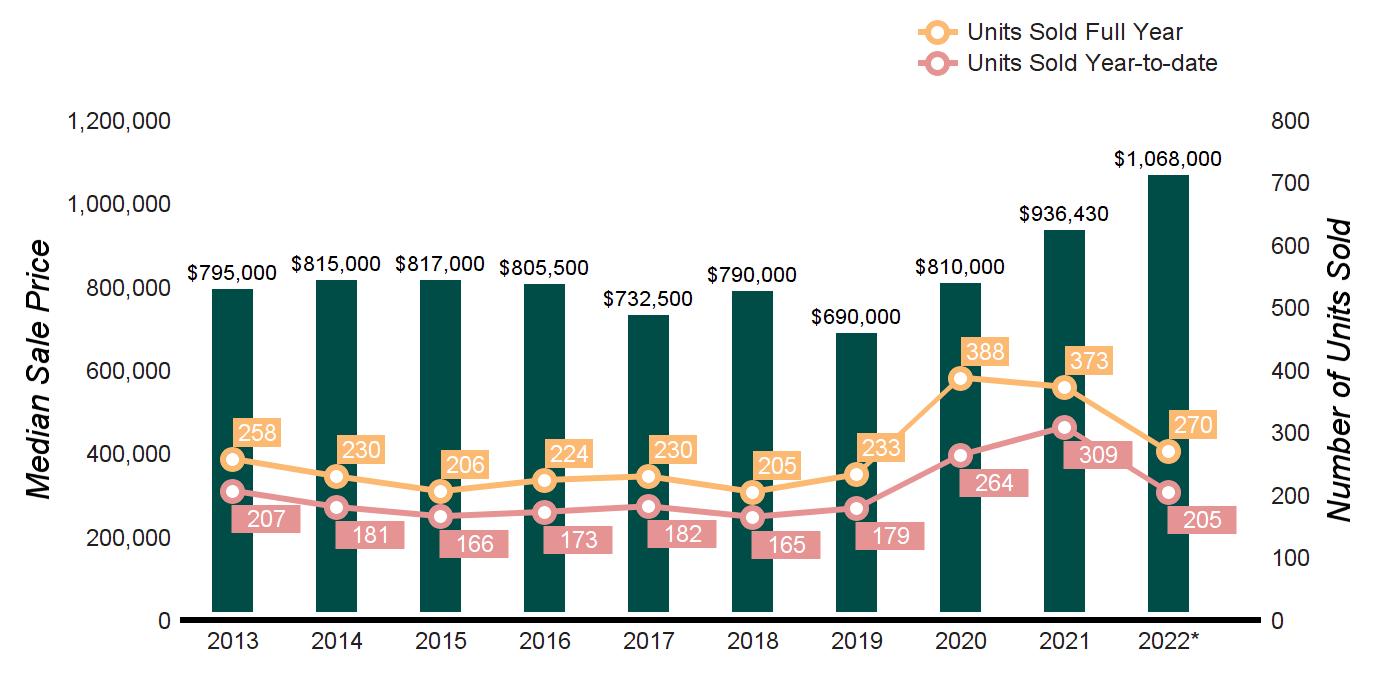

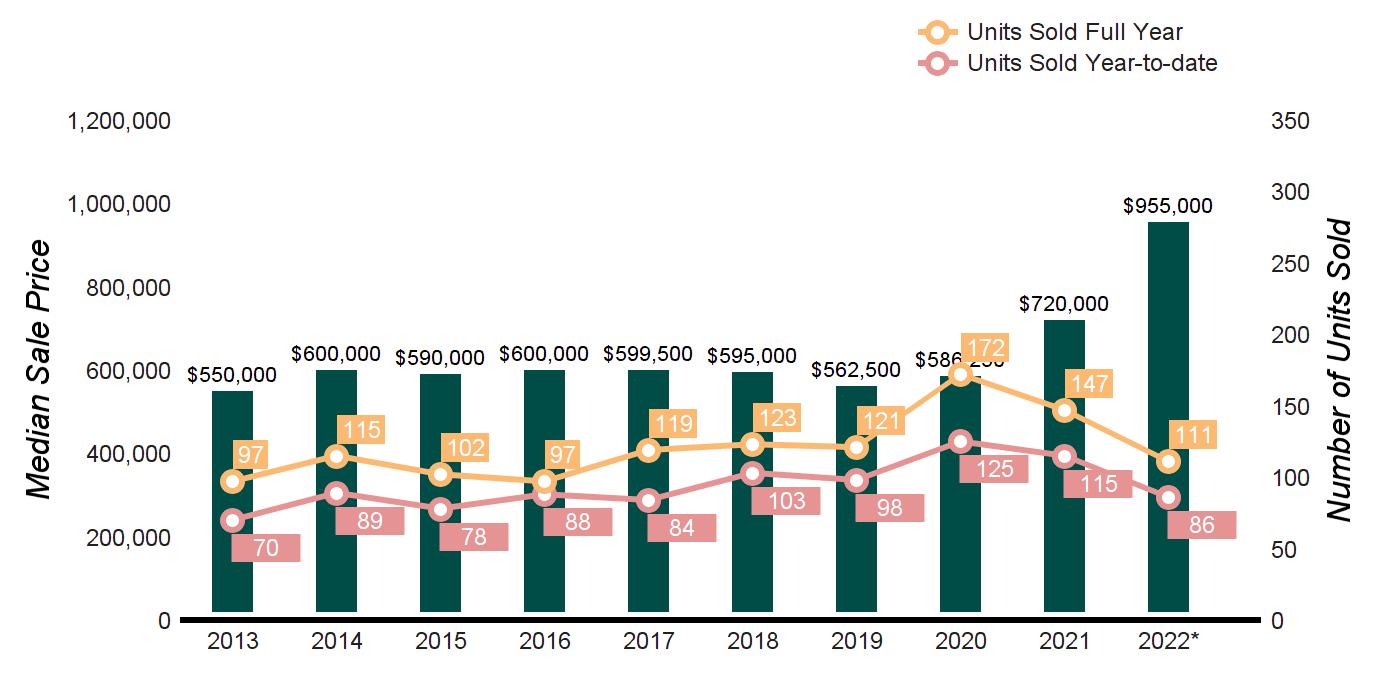

WESTON THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 71 67 6.0% 170 186 -8.6% AVERAGE SALE PRICE $1,405,516 $1,163,147 20.8% $1,349,172 $1,183,749 14.0% MEDIAN SALE PRICE $1,200,000 $1,125,000 6.7% $1,192,500 $1,112,500 7.2% AVERAGE PRICE PER SQUARE FOOT $331 $281 17.8% $317 $287 10.5% AVERAGE DAYS ON MARKET 53 48 10.4% 56 52 7.7% % SALE PRICE TO LIST PRICE 103.7% 102.7% 1.0% 104.1% 101.5% 2.6% TEN-YEAR MARKET HISTORY Average Sale Price $856,913 $892,137 $928,829 $905,162 $855,343 $810,806 $794,511 $910,457 $1,197,919 $1,349,172 Average Sale Price Average Price/SqFt $229 $233 $238 $227 $224 $216 $201 $218 $289 $317 Average Price/SqFt Days On Market 121 120 127 130 130 106 126 117 57 56 Days On Market %Sale Price to List Price 95.9% 95.4% 95.9% 95.6% 95.8% 95.6% 95.4% 97.8% 101.6% 104.1% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

-41.7%

-33.3%

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

WESTON THIRD QUARTER 2022

% CHANGE IN LISTINGS %

PENDINGS

0 0 Not Valid 3 0 Not Valid -100.0% 0.0%

7 1 7 12 2 6

-50.0%

10 3 3 15 8 2

-62.5%

9 1 9 15 8 2 -40.0% -87.5%

9 2 5 11 1 11 -18.2% 100.0%

1 2 1 7 4 2 -85.7% -50.0%

2 0 Not Valid 1 0 Not Valid 100.0% 0.0%

2 0 Not Valid 3 0 Not Valid -33.3% 0.0% $4,000,000 and up 0 0 Not Valid 1 1 1 -100.0% -100.0% MarketTotals 40 9 4 68 24 3 -41.2% -62.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

12 6 100.0% 13 12 8.3% $500,000

17 19 -10.5% 23 34 -32.4%

33 57 -42.1% 51 96 -46.9% $1,000,000

53 64 -17.2% 73 88 -17.0% $1,500,000

28 30 -6.7% 37 39 -5.1% $2,000,000

16 3 433.3% 20 3 566.7% $2,500,000

4 6 -33.3% 4 7 -42.9% $3,000,000

6 1 500.0% 7 2 250.0% $5,000,000 and up 1 0 Not Valid 1 0 Not Valid MarketTotals 170 186 -8.6% 229 281 -18.5% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

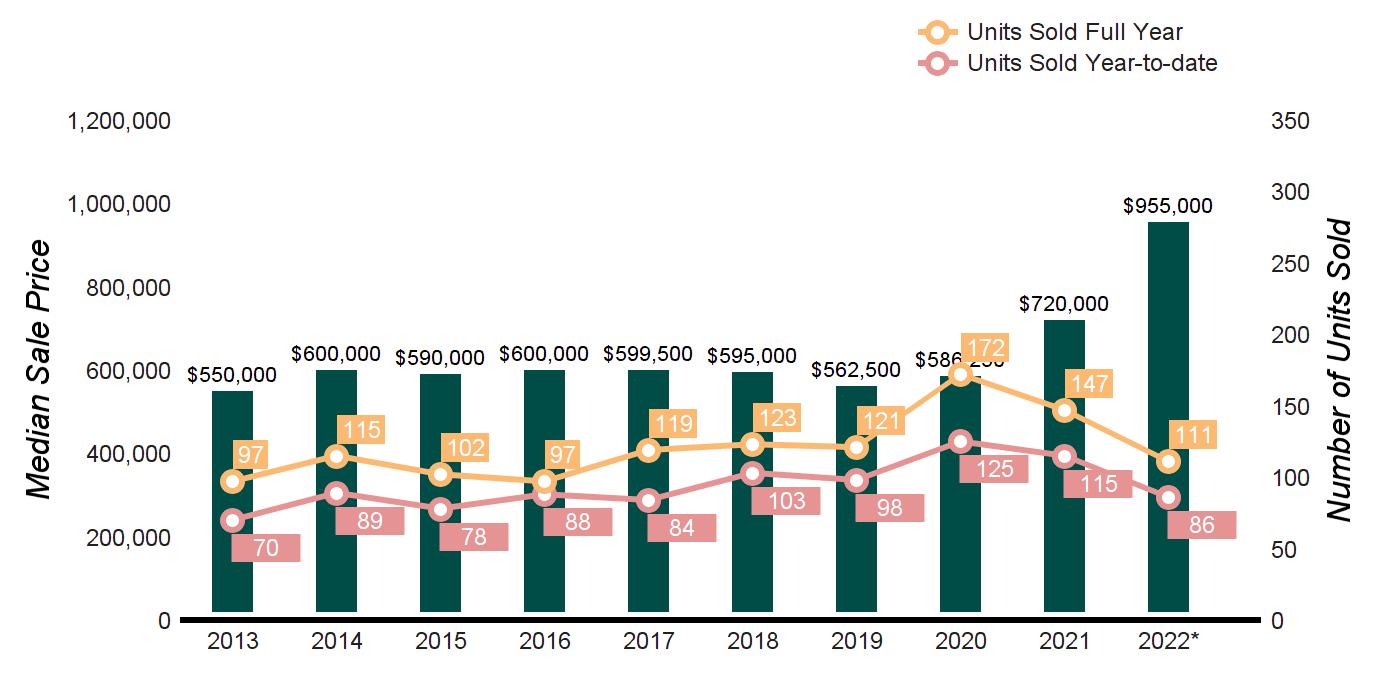

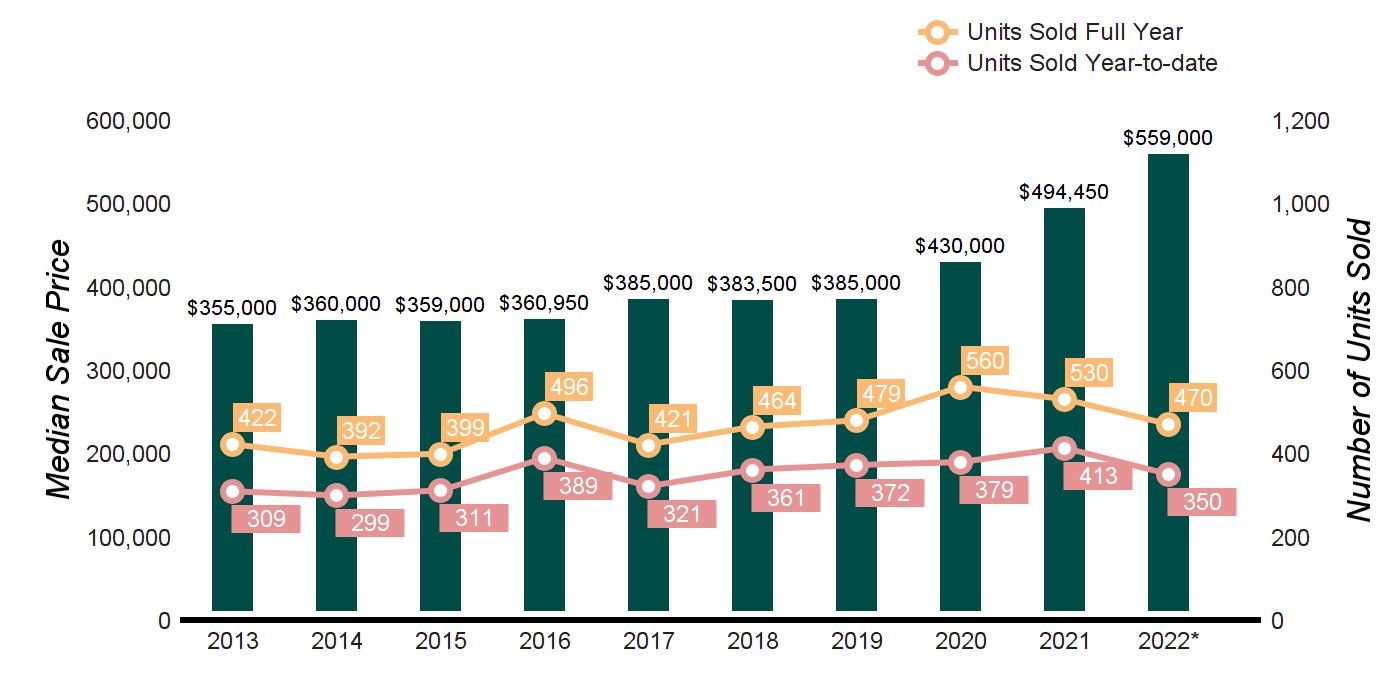

EASTON THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 28 36 -22.2% 86 115 -25.2% AVERAGE SALE PRICE $905,482 $744,647 21.6% $962,838 $787,008 22.3% MEDIAN SALE PRICE $952,500 $714,500 33.3% $955,000 $725,000 31.7% AVERAGE PRICE PER SQUARE FOOT $263 $237 11.0% $248 $226 9.7% AVERAGE DAYS ON MARKET 43 46 -6.5% 60 63 -4.8% % SALE PRICE TO LIST PRICE 102.8% 100.1% 2.7% 103.4% 99.8% 3.6% TEN-YEAR MARKET HISTORY Average Sale Price $594,917 $639,195 $611,815 $645,133 $609,615 $602,243 $604,155 $635,204 $783,457 $962,838 Average Sale Price Average Price/SqFt $159 $177 $189 $189 $184 $168 $163 $189 $227 $248 Average Price/SqFt Days On Market 133 106 123 128 107 110 127 89 67 60 Days On Market %Sale Price to List Price 93.9% 95.3% 95.6% 96.6% 94.9% 95.3% 95.7% 98.0% 99.8% 103.4% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

$2,500,000 - $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

EASTON THIRD QUARTER 2022

AS

% CHANGE IN LISTINGS %

PENDINGS

2 0 Not Valid 4 1 4 -50.0% -100.0%

9 3 3 11 2 6 -18.2% 50.0%

12 2 6 7 4 2 71.4% -50.0%

12 2 6 12 2 6 0.0% 0.0%

3 1 3 3 0 Not Valid 0.0% 0.0%

0 0 Not Valid 2 0 Not Valid -100.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $4,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 38 8 5 39 9 4 -2.6% -11.1% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

5 12 -58.3% 9 19 -52.6% $500,000

13 38 -65.8% 26 58 -55.2%

35 43 -18.6% 42 54 -22.2% $1,000,000

29 21 38.1% 36 29 24.1% $1,500,000

3 0 Not Valid 4 1 300.0% $2,000,000

1 1 0.0% 1 1 0.0%

0 0 Not Valid 0 0 Not Valid $3,000,000

0 0 Not Valid 0 0 Not Valid $5,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 86 115 -25.2% 118 162 -27.2% Source : Smart MLS, Single Family Homes

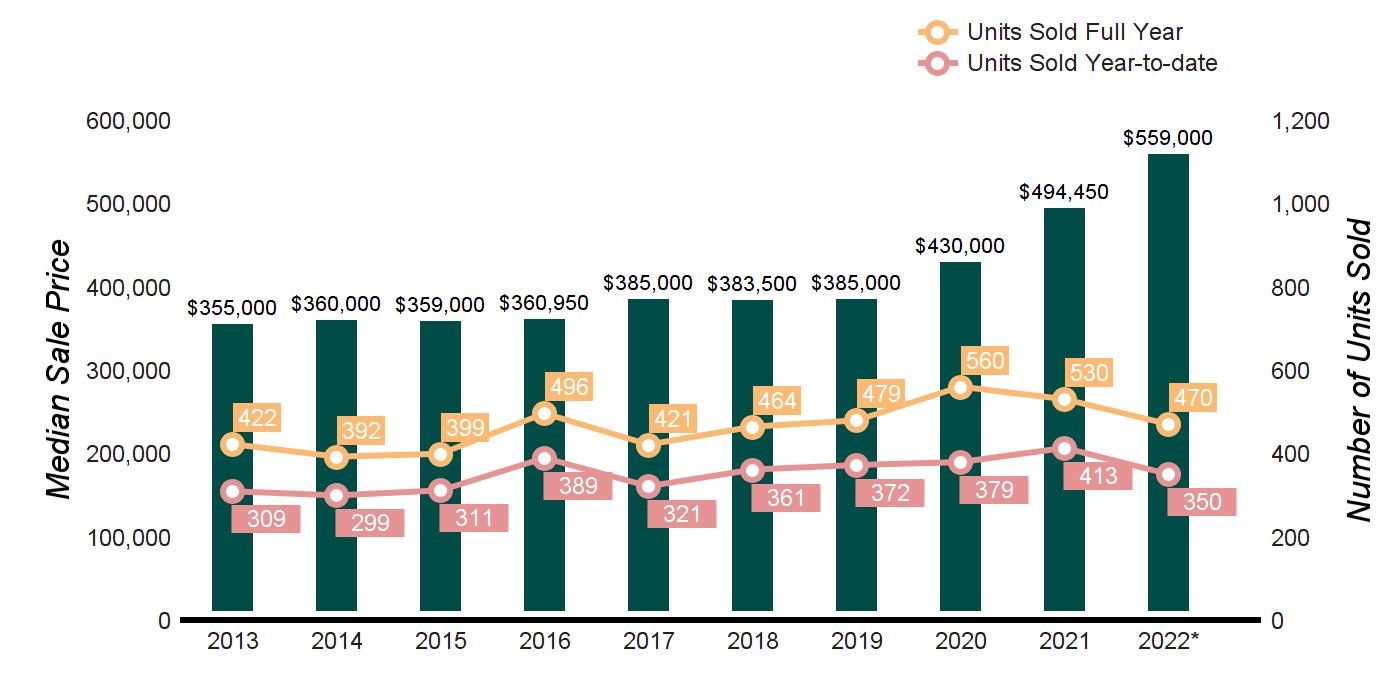

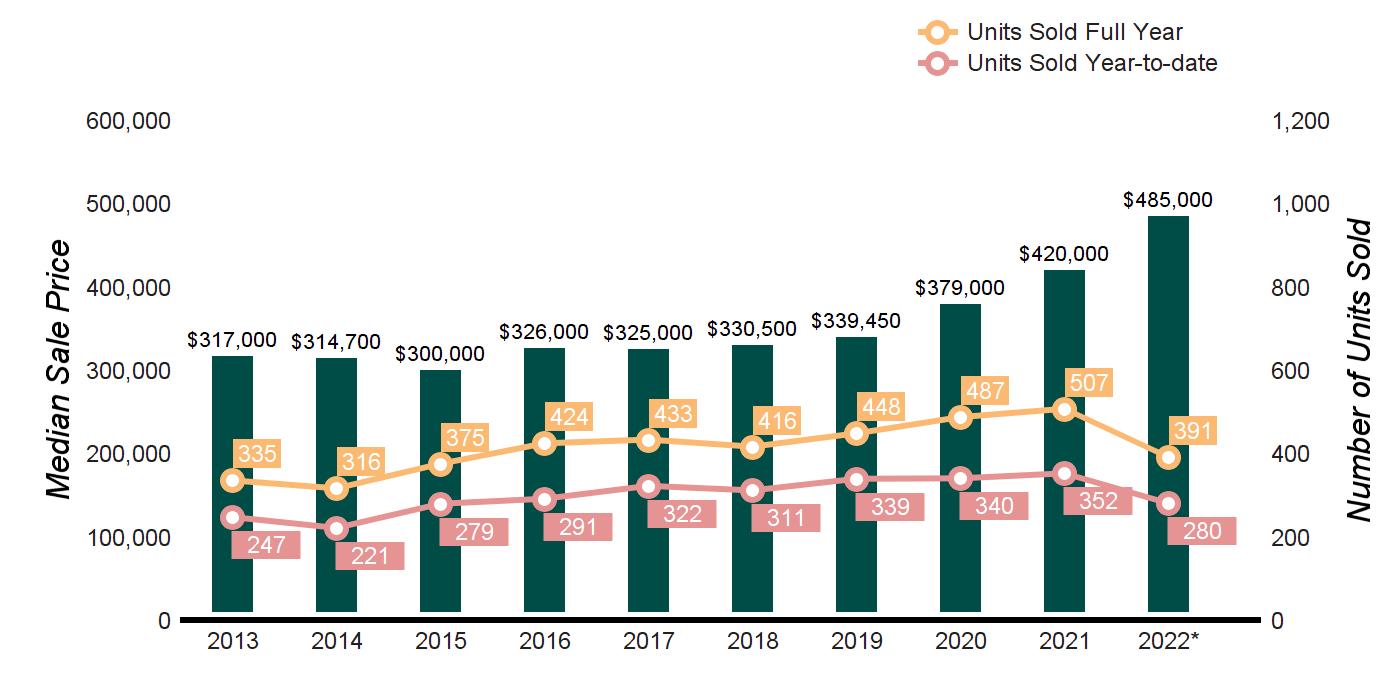

QUARTERLY MARKET OVERVIEW

TRUMBULL THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 141 171 -17.5% 350 413 -15.3% AVERAGE SALE PRICE $604,138 $549,330 10.0% $591,979 $532,855 11.1% MEDIAN SALE PRICE $560,000 $500,000 12.0% $559,000 $494,900 13.0% AVERAGE PRICE PER SQUARE FOOT $244 $226 8.0% $245 $218 12.4% AVERAGE DAYS ON MARKET 34 36 -5.6% 36 42 -14.3% % SALE PRICE TO LIST PRICE 102.5% 102.0% 0.5% 103.3% 101.5% 1.8% TEN-YEAR MARKET HISTORY Average Sale Price $376,394 $385,472 $395,498 $380,065 $407,597 $406,054 $406,195 $455,146 $534,140 $591,979 Average Sale Price Average Price/SqFt $166 $172 $175 $174 $176 $175 $175 $194 $219 $245 Average Price/SqFt Days On Market 89 79 92 94 69 57 75 58 42 36 Days On Market %Sale Price to List Price 96.5% 96.8% 96.4% 96.7% 97.6% 97.5% 97.5% 98.9% 101.5% 103.3% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND RATIO*

-50.0%

-33.3%

-13.0%

vs. 2021

CHANGE IN

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

$500,000 - $599,999

- $799,999

- $999,999

- $1,999,999

YEAR-TO-DATE

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE

TRUMBULL THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

% CHANGE IN LISTINGS %

PENDINGS

0 1 0 0 0 Not Valid 0.0% 0.0%

1 4 1 2 1 2

300.0%

6 3 2 9 14 1

-78.6%

20 12 2 23 13 2

-7.7%

11 13 1 19 5 4 -42.1% 160.0%

21 12 2 38 6 6 -44.7% 100.0%

5 2 3 1 2 1 400.0% 0.0%

3 0 Not Valid 5 2 3 -40.0% -100.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 67 47 1 97 43 2 -30.9% 9.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand SOLD PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

%

2022/2021 $0

0 0 Not Valid 0 0 Not Valid $200,000

8 10 -20.0% 10 17 -41.2%

25 67 -62.7% 44 115 -61.7% $400,000

90 133 -32.3% 128 200 -36.0%

87 98 -11.2% 111 126 -11.9% $600,000

100 78 28.2% 127 102 24.5% $800,000

21 13 61.5% 26 19 36.8% $1,000,000

19 14 35.7% 21 15 40.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 350 413 -15.3% 467 594 -21.4% Source : Smart MLS, Single Family Homes

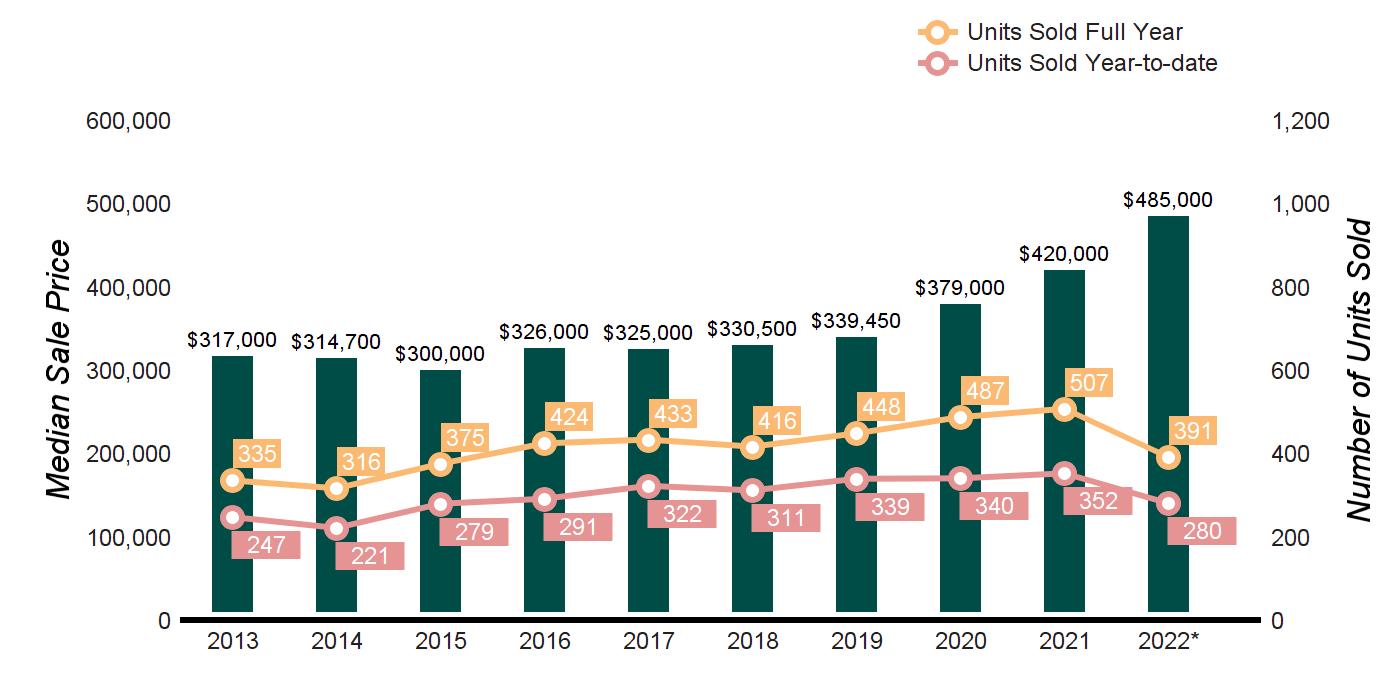

QUARTERLY MARKET OVERVIEW

AVERAGE

$449,795

SHELTON THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 121 137 -11.7% 280 352 -20.5%

SALE PRICE $522,041 $461,628 13.1% $508,606

13.1% MEDIAN SALE PRICE $485,000 $440,000 10.2% $485,000 $427,500 13.5% AVERAGE PRICE PER SQUARE FOOT $230 $207 11.1% $231 $204 13.2% AVERAGE DAYS ON MARKET 36 37 -2.7% 36 44 -18.2% % SALE PRICE TO LIST PRICE 102.4% 101.1% 1.3% 103.0% 101.7% 1.3% TEN-YEAR MARKET HISTORY Average Sale Price $346,166 $330,011 $307,625 $327,463 $343,088 $346,725 $361,234 $394,104 $445,564 $508,606 Average Sale Price Average Price/SqFt $120 $133 $145 $148 $157 $156 $162 $172 $205 $231 Average Price/SqFt Days On Market 92 92 94 87 74 69 72 58 44 36 Days On Market %Sale Price to List Price 96.4% 96.6% 96.6% 97.0% 97.8% 97.6% 97.7% 99.2% 101.2% 103.0% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

OF SEPTEMBER 30, 2021 2022 vs. 2021

ACTIVE LISTINGS

PENDING SALES

PRICE RANGE

- $199,999

- $299,999

- $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

YEAR-TO-DATE

09/30/2022

CHANGE

-50.0%

-22.2% -25.0%

-70.0% -80.0%

-24.2% -40.0%

YEAR-OVER-YEAR

09/30/2022

09/30/2021

SHELTON THIRD QUARTER 2022

AS

SUPPLY:

DEMAND:

SUPPLY/ DEMAND RATIO* % CHANGE IN LISTINGS %

IN PENDINGS

5 1 5 5 2 3 0.0%

7 3 2 9 4 2

9 4 2 30 20 2

25 6 4 33 10 3

10 1 10 13 11 1 -23.1% -90.9%

7 13 1 18 16 1 -61.1% -18.8%

7 1 7 4 0 Not Valid 75.0% 0.0%

0 1 0 0 1 0 0.0% 0.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 70 30 2 112 64 2 -37.5% -53.1% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand SOLD PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE 2022/2021 $0

6 13 -53.8% 11 18 -38.9% $200,000

25 36 -30.6% 39 56 -30.4% $300,000

43 89 -51.7% 96 135 -28.9% $400,000

75 104 -27.9% 120 141 -14.9% $500,000

56 52 7.7% 72 70 2.9% $600,000

53 49 8.2% 71 69 2.9% $800,000

20 8 150.0% 23 9 155.6% $1,000,000

2 1 100.0% 3 1 200.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 280 352 -20.5% 435 499 -12.8% Source : Smart MLS, Single Family Homes

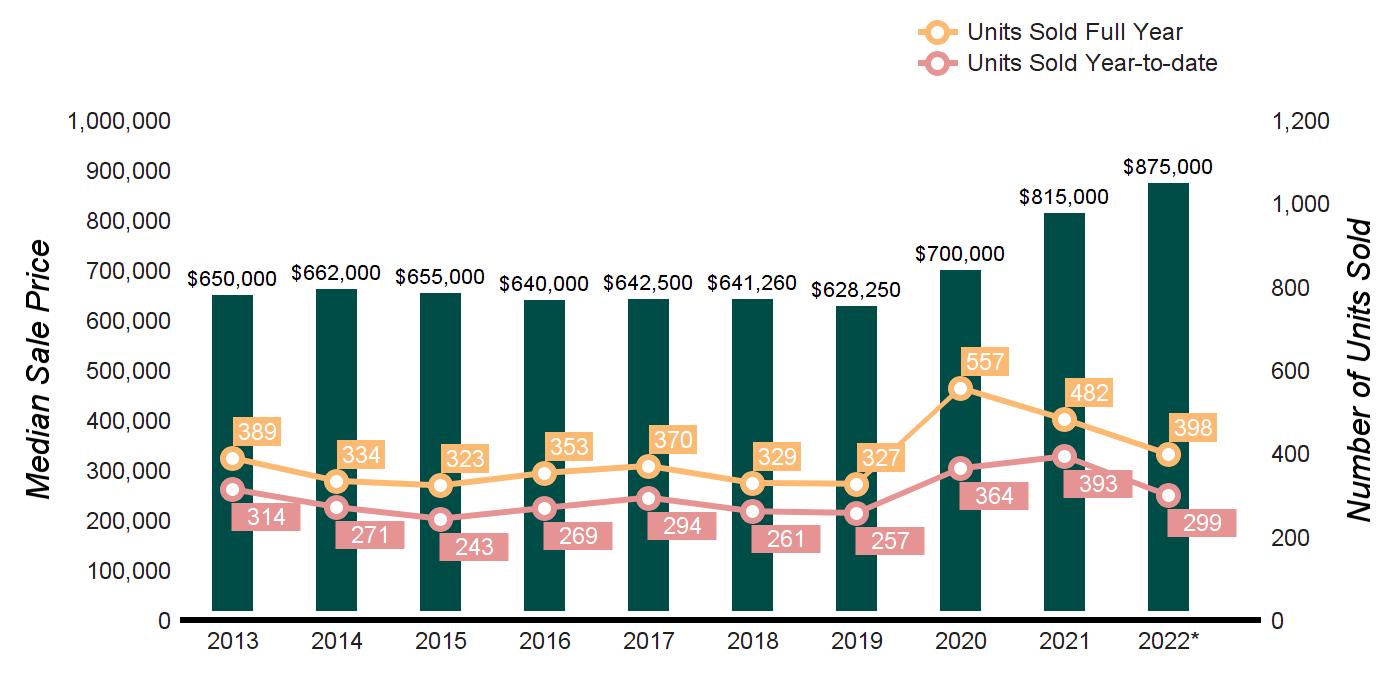

QUARTERLY MARKET OVERVIEW

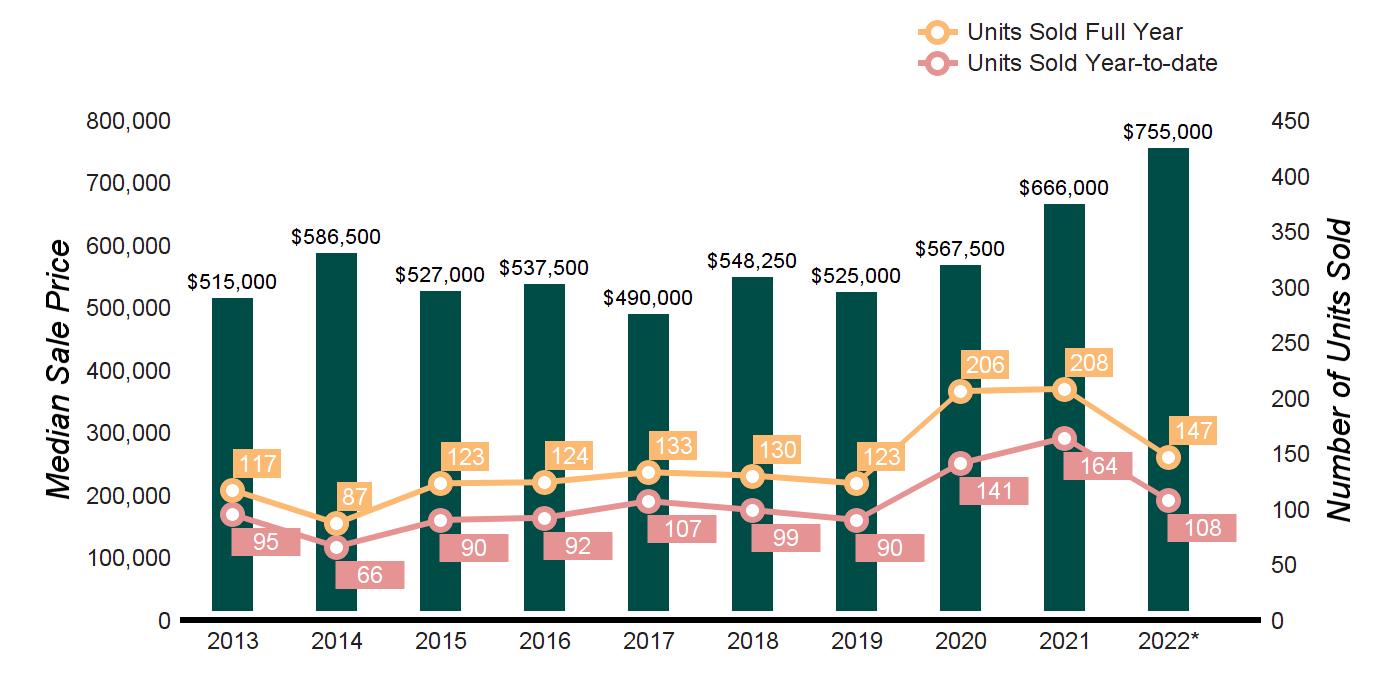

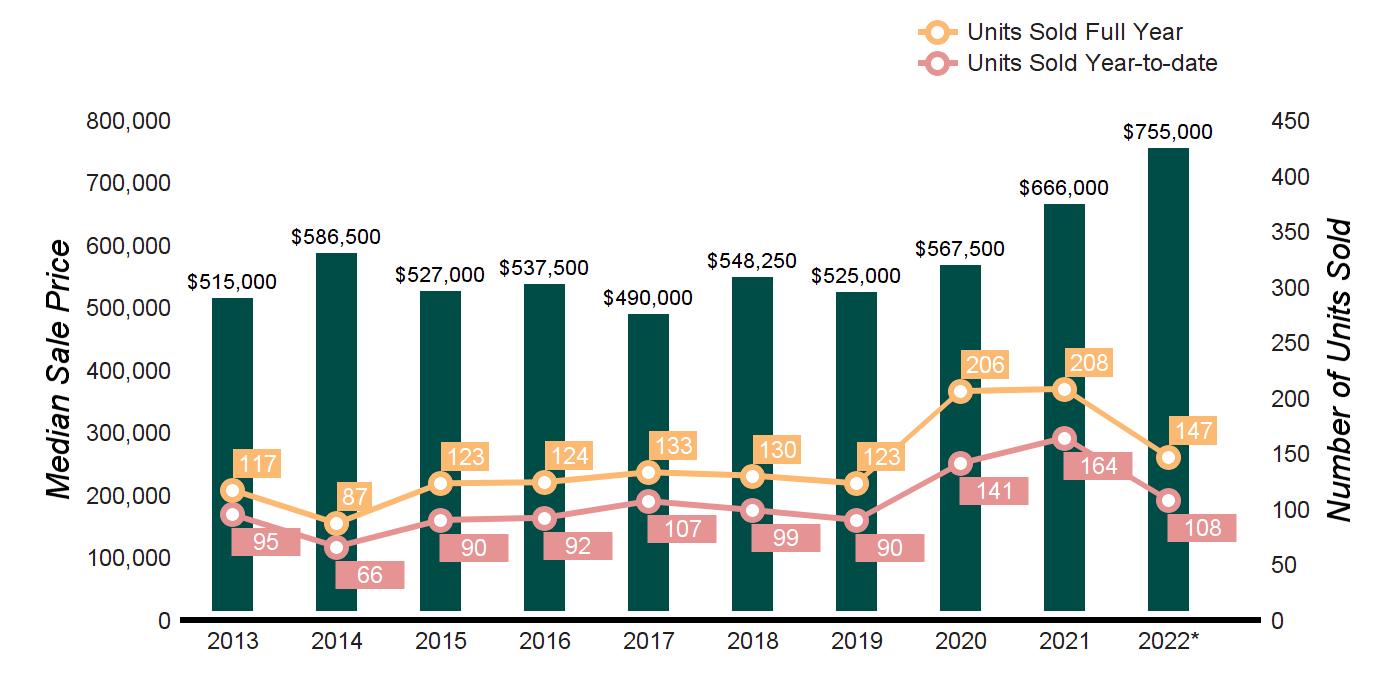

RIDGEFIELD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 132 155 -14.8% 299 393 -23.9% AVERAGE SALE PRICE $1,046,451 $926,251 13.0% $988,715 $931,726 6.1% MEDIAN SALE PRICE $914,950 $829,500 10.3% $875,000 $825,000 6.1% AVERAGE PRICE PER SQUARE FOOT $312 $278 12.2% $309 $278 11.2% AVERAGE DAYS ON MARKET 38 53 -28.3% 46 60 -23.3% % SALE PRICE TO LIST PRICE 101.6% 101.0% 0.6% 103.1% 100.5% 2.6% TEN-YEAR MARKET HISTORY Average Sale Price $771,260 $756,357 $748,817 $742,340 $738,443 $717,631 $713,699 $811,557 $937,024 $988,715 Average Sale Price Average Price/SqFt $230 $231 $228 $225 $228 $222 $223 $239 $278 $309 Average Price/SqFt Days On Market 113 111 104 113 101 83 99 99 60 46 Days On Market %Sale Price to List Price 95.6% 96.2% 95.7% 95.5% 95.1% 95.5% 95.5% 97.4% 100.4% 103.1% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

RIDGEFIELD

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

01/01/202209/30/2022

SUPPLY/ DEMAND RATIO*

AS OF SEPTEMBER 30, 2021

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

vs. 2021

CHANGE

CHANGE IN PENDINGS

-55.6% -25.0%

-50.0% -55.6%

-22.7% -33.3%

-30.8%

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

-50.0%

CHANGE 2022/2021

THIRD QUARTER 2022

2022

%

IN LISTINGS %

4 3 1 9 4 2

10 4 3 20 9 2

17 8 2 22 12 2

18 9 2 18 13 1 0.0%

5 2 3 4 1 4 25.0% 100.0%

1 1 1 1 1 1 0.0% 0.0%

0 1 0 2 2 1 -100.0%

3 1 3 5 2 3 -40.0% -50.0% $4,000,000 and up 1 0 Not Valid 2 0 Not Valid -50.0% 0.0% MarketTotals 59 29 2 83 44 2 -28.9% -34.1% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

20 38 -47.4% 33 78 -57.7% $500,000

68 103 -34.0% 89 151 -41.1%

92 131 -29.8% 118 185 -36.2% $1,000,000

85 85 0.0% 106 120 -11.7% $1,500,000

25 22 13.6% 28 33 -15.2% $2,000,000

4 10 -60.0% 4 12 -66.7% $2,500,000

3 1 200.0% 7 2 250.0% $3,000,000

2 2 0.0% 3 3 0.0% $5,000,000 and up 0 1 -100.0% 0 2 -100.0% MarketTotals 299 393 -23.9% 388 586 -33.8% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

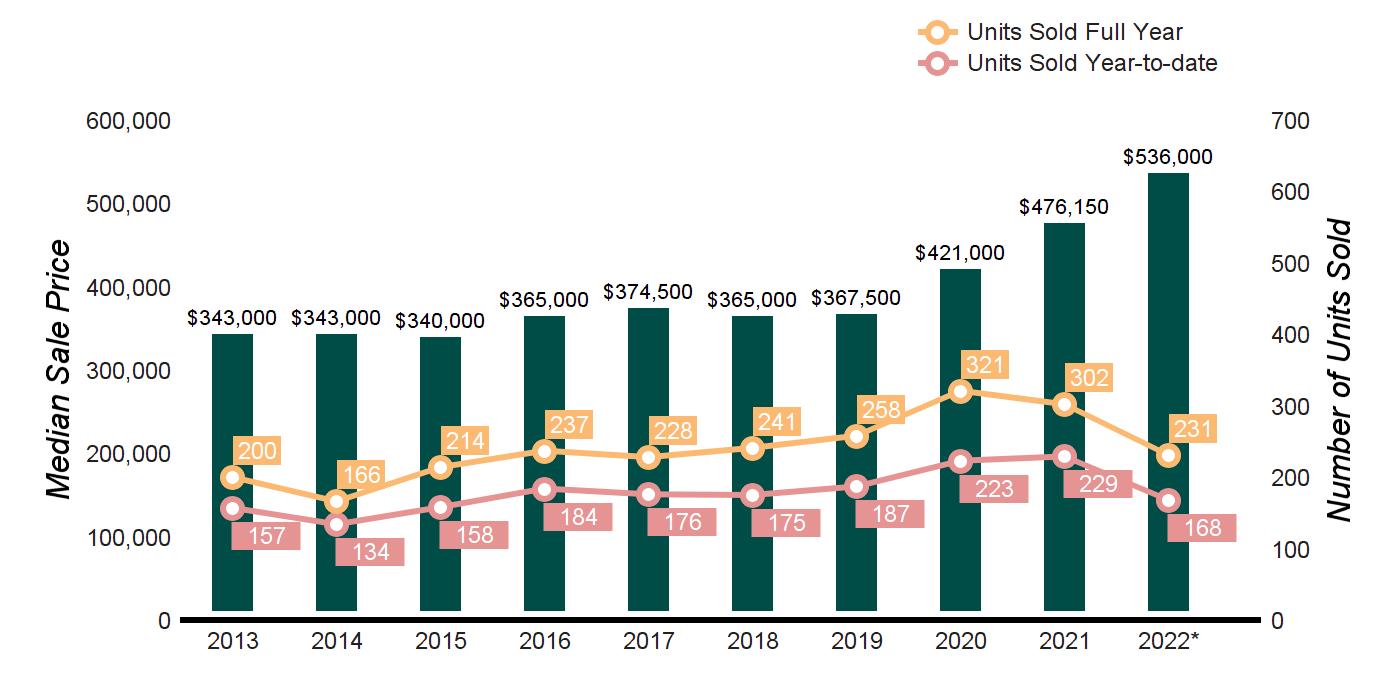

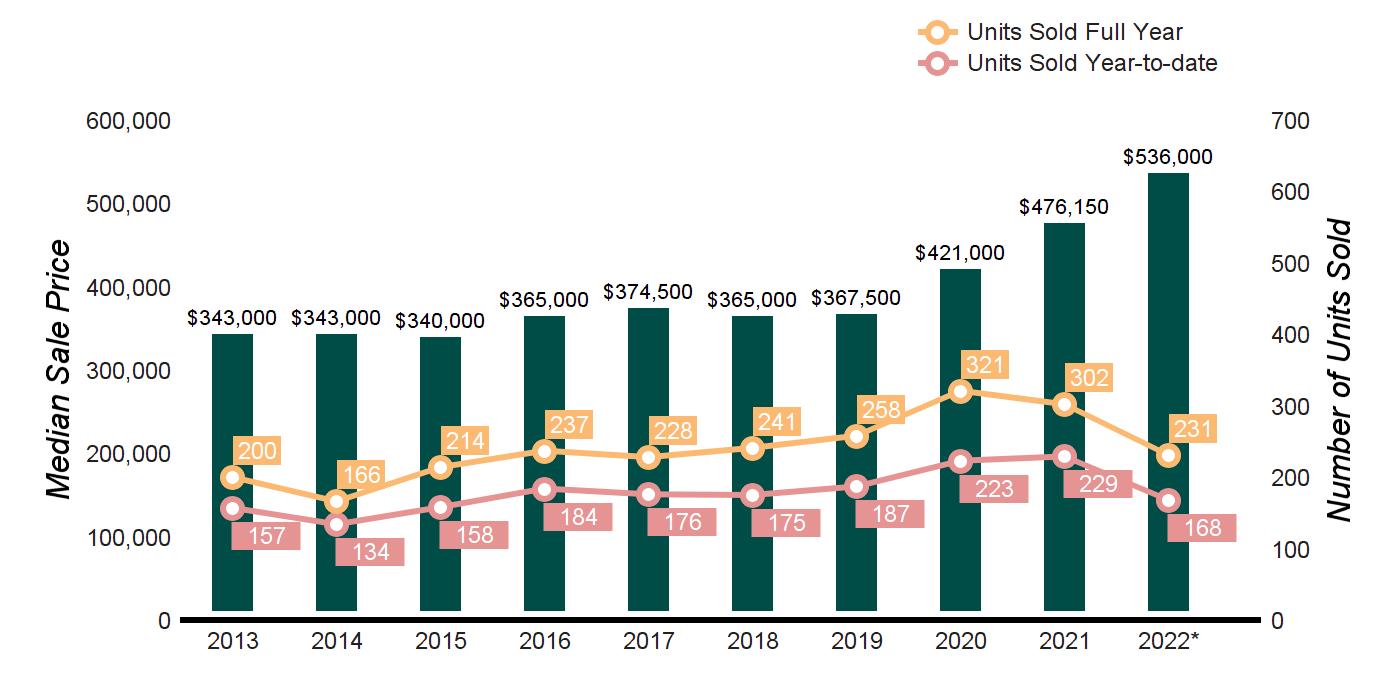

REDDING THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 50 59 -15.3% 108 164 -34.1% AVERAGE SALE PRICE $865,592 $711,705 21.6% $894,663 $760,901 17.6% MEDIAN SALE PRICE $785,000 $618,700 26.9% $755,000 $670,000 12.7% AVERAGE PRICE PER SQUARE FOOT $295 $263 12.2% $283 $253 11.9% AVERAGE DAYS ON MARKET 47 48 -2.1% 48 59 -18.6% % SALE PRICE TO LIST PRICE 101.3% 100.3% 1.0% 101.3% 100.6% 0.7% TEN-YEAR MARKET HISTORY Average Sale Price $556,489 $590,155 $555,147 $653,976 $508,769 $591,063 $543,031 $660,972 $746,957 $894,663 Average Sale Price Average Price/SqFt $187 $193 $188 $191 $186 $181 $180 $204 $251 $283 Average Price/SqFt Days On Market 136 125 156 124 117 98 138 107 59 48 Days On Market %Sale Price to List Price 94.1% 94.9% 95.6% 90.4% 93.6% 92.2% 95.8% 98.0% 100.3% 101.3% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

REDDING THIRD QUARTER 2022

% CHANGE IN LISTINGS %

PENDINGS

0 0 Not Valid 7 4 2 -100.0% -100.0%

10 3 3 13 6 2 -23.1% -50.0%

15 7 2 14 2 7 7.1% 250.0%

5 4 1 10 0 Not Valid -50.0% 0.0%

4 2 2 3 0 Not Valid 33.3% 0.0%

1 1 1 2 0 Not Valid -50.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0%

1 0 Not Valid 2 0 Not Valid -50.0% 0.0% $4,000,000 and up 2 0 Not Valid 1 0 Not Valid 100.0% 0.0% MarketTotals 38 17 2 52 12 4 -26.9% 41.7% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

15 31 -51.6% 23 50 -54.0% $500,000

32 58 -44.8% 52 76 -31.6%

31 47 -34.0% 43 64 -32.8% $1,000,000

23 21 9.5% 26 26 0.0% $1,500,000

3 3 0.0% 4 7 -42.9% $2,000,000

2 3 -33.3% 2 3 -33.3% $2,500,000

1 1 0.0% 1 3 -66.7% $3,000,000

0 0 Not Valid 0 0 Not Valid $5,000,000 and up 1 0 Not Valid 1 0 Not Valid MarketTotals 108 164 -34.1% 152 229 -33.6% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

$488,698

MONROE THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 73 102 -28.4% 168 229 -26.6% AVERAGE SALE PRICE $584,969 $505,457 15.7% $572,817

17.2% MEDIAN SALE PRICE $562,000 $490,000 14.7% $536,000 $485,000 10.5% AVERAGE PRICE PER SQUARE FOOT $229 $201 13.9% $221 $199 11.1% AVERAGE DAYS ON MARKET 36 39 -7.7% 42 43 -2.3% % SALE PRICE TO LIST PRICE 100.9% 102.0% -1.1% 102.2% 102.1% 0.1% TEN-YEAR MARKET HISTORY Average Sale Price $363,691 $363,464 $365,319 $368,491 $392,631 $379,501 $388,722 $437,275 $487,380 $572,817 Average Sale Price Average Price/SqFt $151 $155 $150 $149 $155 $153 $157 $171 $201 $221 Average Price/SqFt Days On Market 117 104 101 95 82 68 86 71 43 42 Days On Market %Sale Price to List Price 97.1% 96.6% 96.8% 96.8% 97.9% 97.2% 98.1% 99.0% 101.6% 102.2% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND RATIO*

CHANGE

-50.0%

-57.1%

CHANGE IN PENDINGS

SOLD

YEAR-TO-DATE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

MONROE THIRD QUARTER 2022

DEMAND:

SUPPLY/

%

IN LISTINGS %

0 0 Not Valid 1 2 1 -100.0% -100.0%

3 1 3 6 0 Not Valid

0.0%

6 3 2 14 10 1

-70.0%

6 5 1 13 10 1 -53.8% -50.0%

8 4 2 12 4 3 -33.3% 0.0%

5 4 1 7 6 1 -28.6% -33.3%

2 4 1 4 0 Not Valid -50.0% 0.0%

2 0 Not Valid 1 0 Not Valid 100.0% 0.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 32 21 2 58 32 2 -44.8% -34.4% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

1 2 -50.0% 4 3 33.3% $200,000

3 16 -81.3% 6 25 -76.0%

22 45 -51.1% 39 66 -40.9% $400,000

44 66 -33.3% 64 97 -34.0% $500,000

27 52 -48.1% 42 71 -40.8% $600,000

54 40 35.0% 67 54 24.1% $800,000

14 8 75.0% 15 9 66.7% $1,000,000

3 0 Not Valid 4 2 100.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 168 229 -26.6% 241 327 -26.3% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

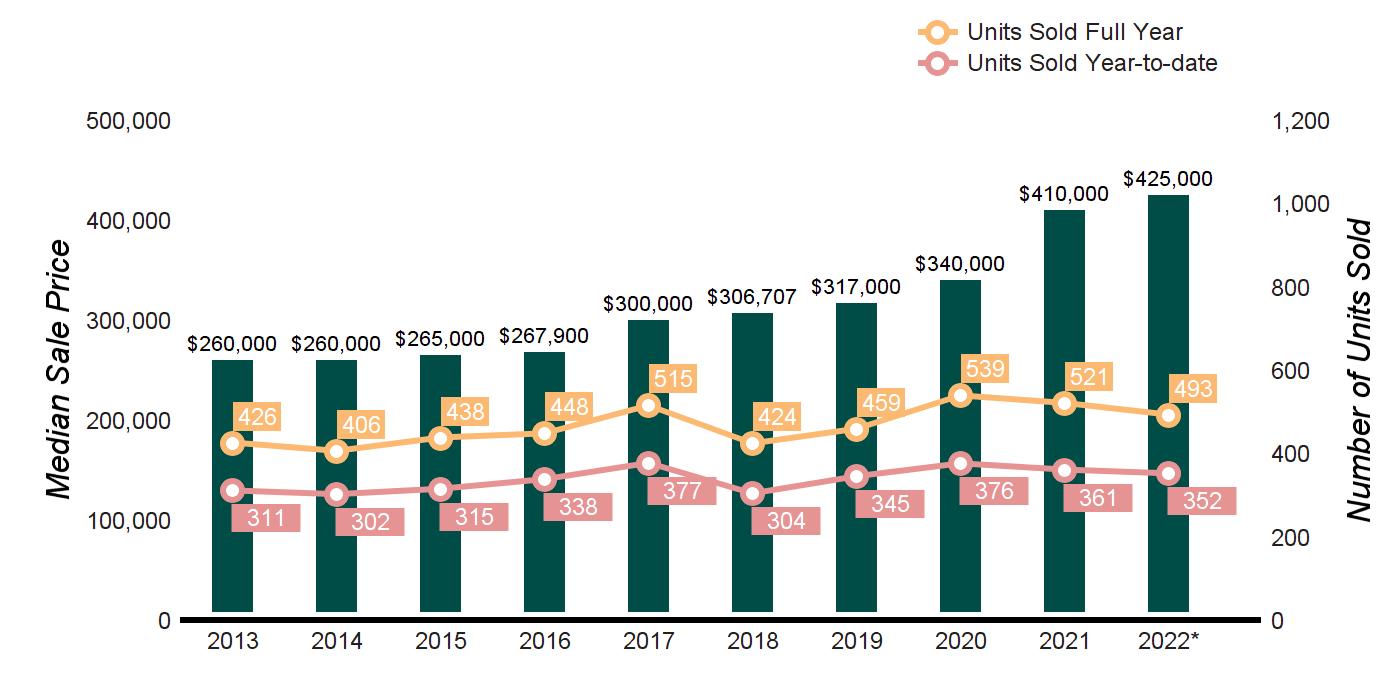

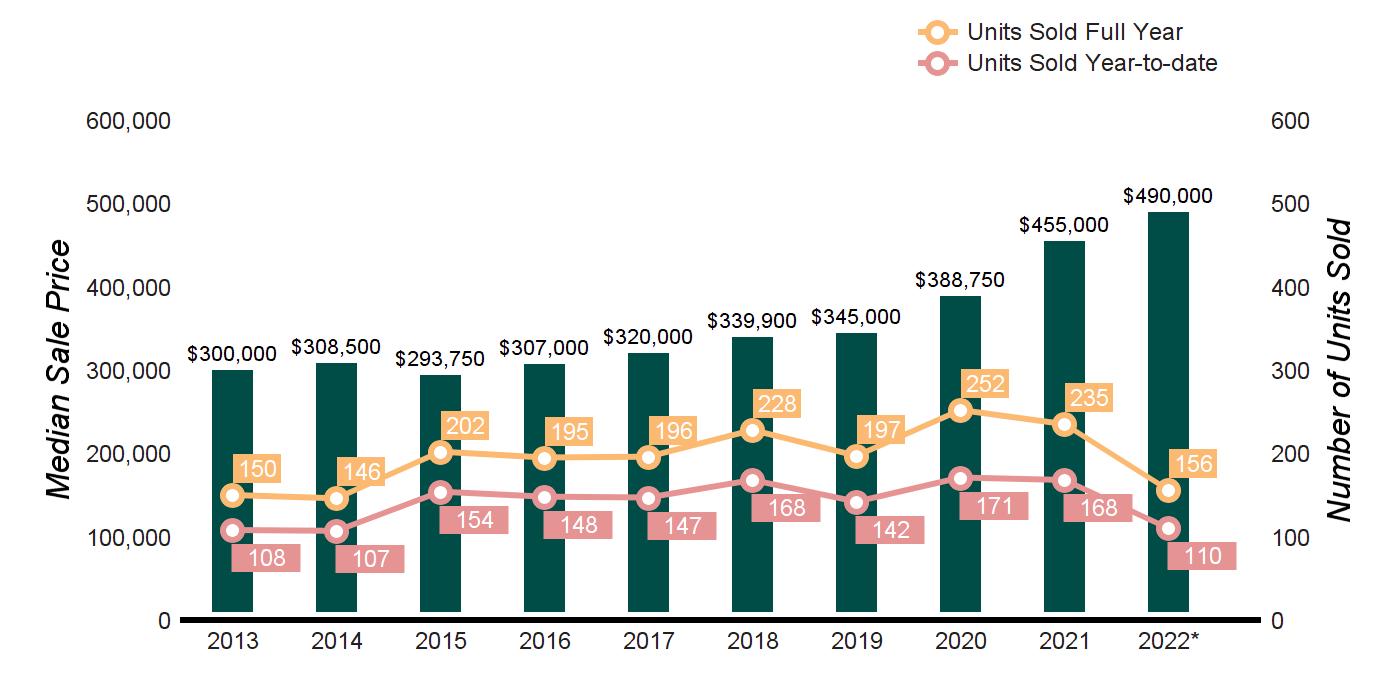

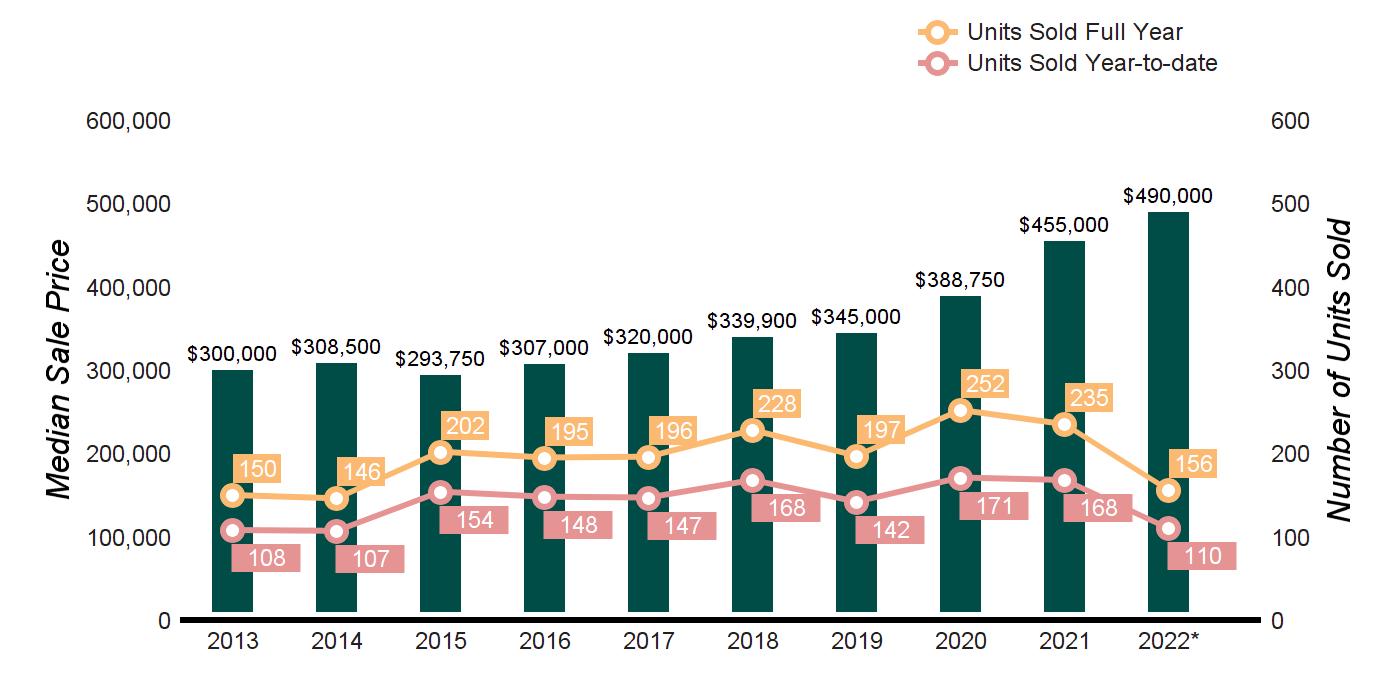

DANBURY THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 134 150 -10.7% 352 361 -2.5% AVERAGE SALE PRICE $461,936 $448,143 3.1% $465,458 $434,625 7.1% MEDIAN SALE PRICE $440,000 $420,000 4.8% $425,000 $400,000 6.3% AVERAGE PRICE PER SQUARE FOOT $242 $213 13.6% $242 $209 15.8% AVERAGE DAYS ON MARKET 44 35 25.7% 46 49 -6.1% % SALE PRICE TO LIST PRICE 101.0% 101.8% -0.8% 101.7% 101.3% 0.4% TEN-YEAR MARKET HISTORY Average Sale Price $296,519 $275,951 $282,716 $294,230 $322,357 $330,014 $327,984 $371,015 $444,951 $465,458 Average Sale Price Average Price/SqFt $145 $140 $144 $151 $158 $164 $169 $191 $212 $239 Average Price/SqFt Days On Market 107 105 92 101 76 62 71 70 49 46 Days On Market %Sale Price to List Price 95.5% 96.3% 96.5% 96.9% 97.4% 97.6% 98.5% 99.3% 100.9% 101.7% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

ACTIVE LISTINGS

PENDING SALES

DEMAND RATIO*

vs. 2021

CHANGE IN PENDINGS

-100.0%

-78.6% -33.3%

-50.0%

-63.6%

SOLD

YEAR-TO-DATE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

DANBURY THIRD QUARTER 2022

AS

2022

SUPPLY:

DEMAND:

SUPPLY/

% CHANGE IN LISTINGS %

3 0 Not Valid 4 1 4 -25.0%

3 2 2 14 3 5

27 8 3 44 16 3 -38.6%

36 8 5 35 22 2 2.9%

17 1 17 13 11 1 30.8% -90.9%

12 5 2 8 6 1 50.0% -16.7%

9 1 9 7 2 4 28.6% -50.0%

7 0 Not Valid 4 0 Not Valid 75.0% 0.0% $2,000,000 and up 2 0 Not Valid 2 2 1 0.0% -100.0% MarketTotals 116 25 5 131 63 2 -11.5% -60.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE 2022/2021 $0

8 16 -50.0% 13 21 -38.1% $200,000

29 31 -6.5% 41 59 -30.5%

99 132 -25.0% 146 204 -28.4% $400,000

106 88 20.5% 155 120 29.2% $500,000

57 56 1.8% 84 67 25.4% $600,000

40 27 48.1% 50 40 25.0% $800,000

8 2 300.0% 14 4 250.0% $1,000,000

4 8 -50.0% 7 8 -12.5% $2,000,000 and up 1 1 0.0% 2 1 100.0% MarketTotals 352 361 -2.5% 512 524 -2.3% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

BETHEL THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 45 61 -26.2% 110 168 -34.5% AVERAGE SALE PRICE $508,217 $465,731 9.1% $506,501 $465,530 8.8% MEDIAN SALE PRICE $474,000 $442,000 7.2% $490,000 $446,250 9.8% AVERAGE PRICE PER SQUARE FOOT $247 $215 14.9% $238 $208 14.4% AVERAGE DAYS ON MARKET 42 48 -12.5% 43 61 -29.5% % SALE PRICE TO LIST PRICE 102.5% 100.9% 1.6% 102.8% 101.6% 1.2% TEN-YEAR MARKET HISTORY Average Sale Price $311,961 $325,350 $312,870 $321,640 $338,778 $365,973 $374,343 $411,210 $474,559 $506,501 Average Sale Price Average Price/SqFt $141 $150 $155 $158 $157 $169 $173 $187 $209 $238 Average Price/SqFt Days On Market 120 106 103 113 80 74 88 75 57 43 Days On Market %Sale Price to List Price 95.8% 97.0% 96.9% 97.1% 97.8% 99.9% 99.6% 100.1% 101.4% 102.8% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND

-40.0%

CHANGE IN

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

YEAR-TO-DATE

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

BETHEL THIRD QUARTER 2022

AS

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

0 0 Not Valid 1 0 Not Valid -100.0% 0.0%

3 1 3 5 1 5

0.0%

9 1 9 6 5 1 50.0% -80.0%

9 2 5 17 1 17 -47.1% 100.0%

7 5 1 3 4 1 133.3% 25.0%

10 1 10 13 4 3 -23.1% -75.0%

1 1 1 3 1 3 -66.7% 0.0%

3 0 Not Valid 0 0 Not Valid 0.0% 0.0% $2,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 42 11 4 48 16 3 -12.5% -31.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand SOLD PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE 2022/2021 $0

0 1 -100.0% 1 4 -75.0% $200,000

7 8 -12.5% 10 22 -54.5%

16 48 -66.7% 28 68 -58.8% $400,000

33 49 -32.7% 57 69 -17.4% $500,000

25 36 -30.6% 36 44 -18.2% $600,000

25 23 8.7% 39 39 0.0% $800,000

4 3 33.3% 6 3 100.0% $1,000,000

0 0 Not Valid 0 0 Not Valid $2,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 110 168 -34.5% 177 249 -28.9% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

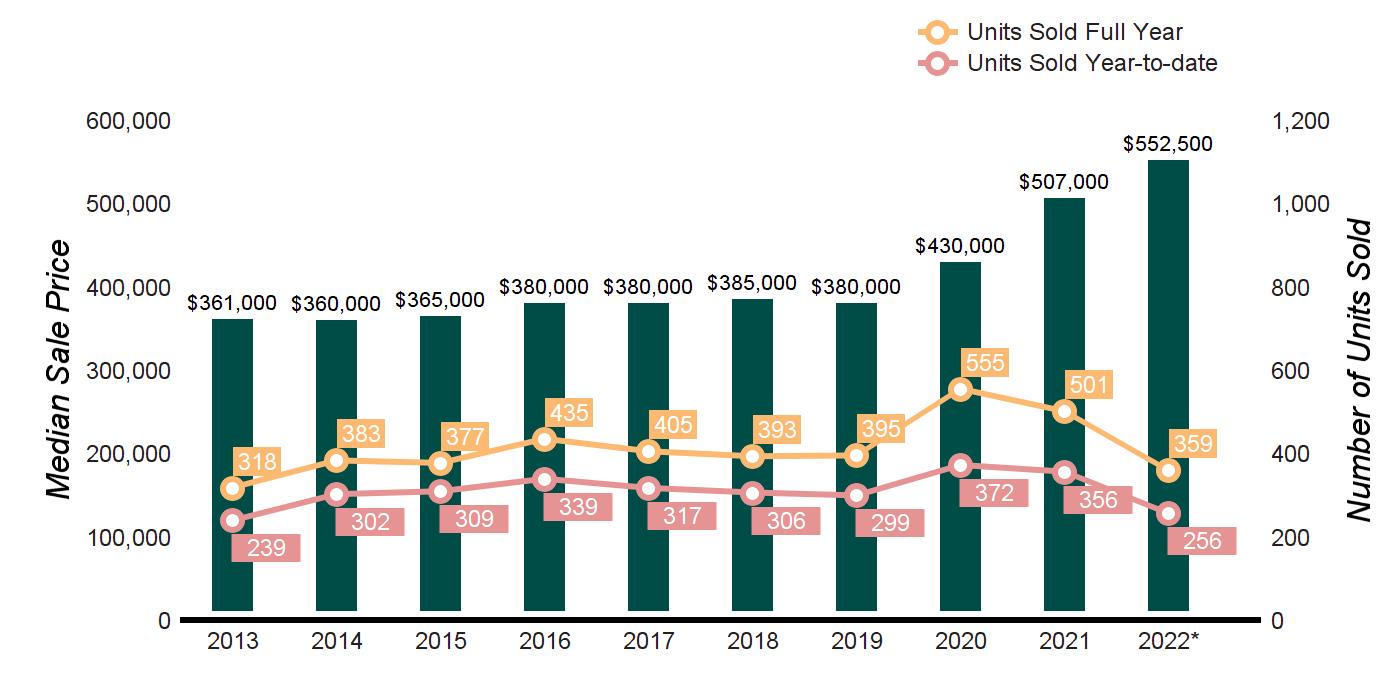

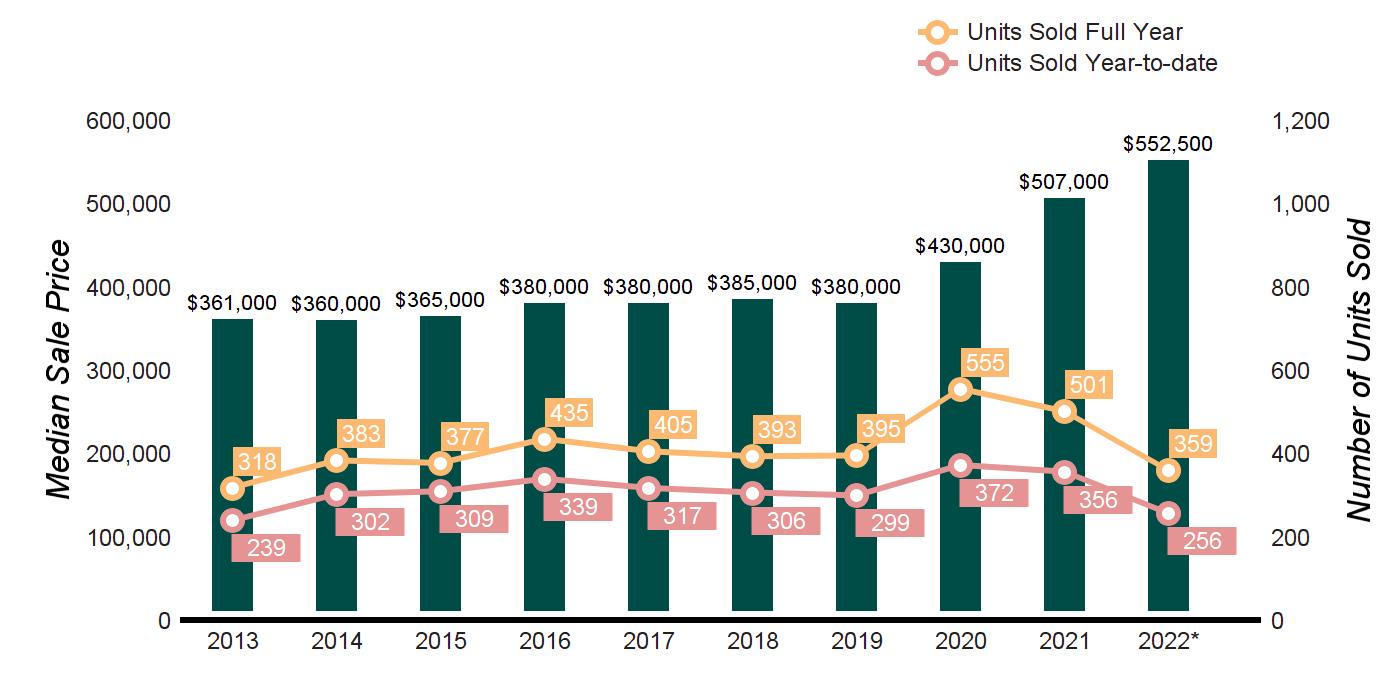

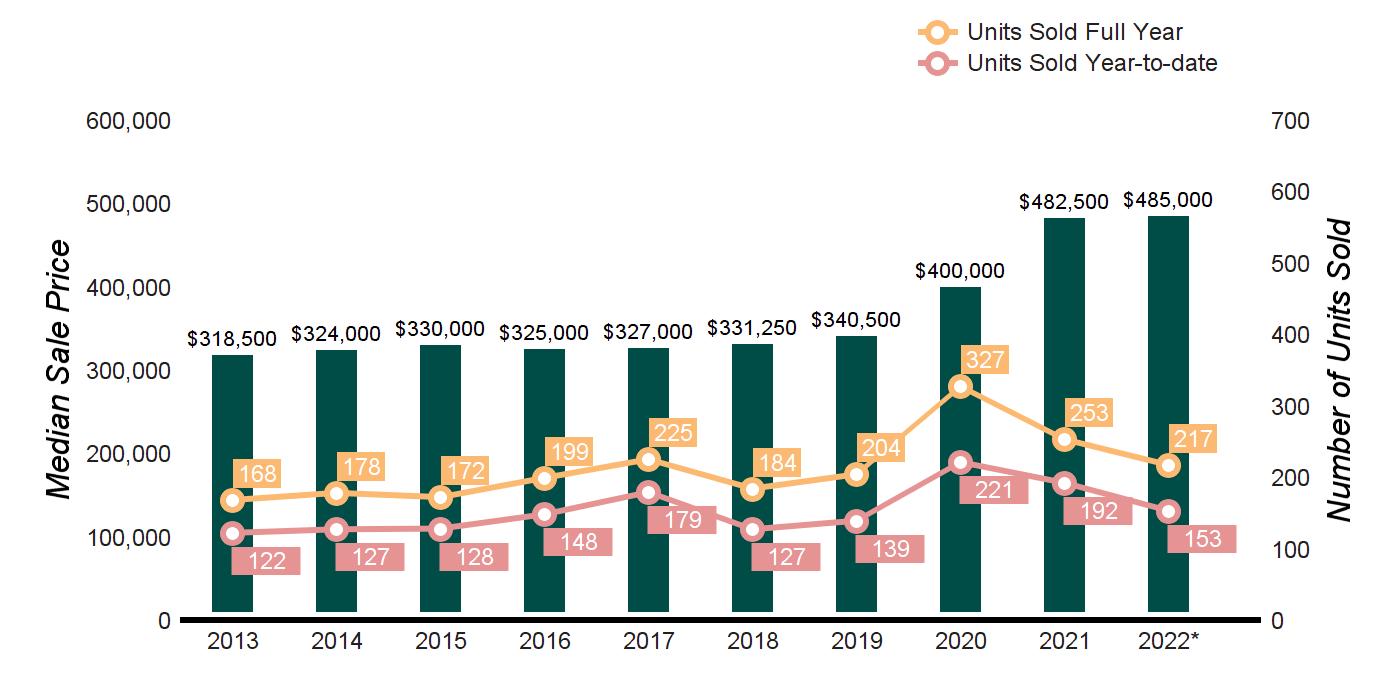

NEWTOWN THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 101 140 -27.9% 256 356 -28.1% AVERAGE SALE PRICE $549,649 $536,441 2.5% $579,589 $534,077 8.5% MEDIAN SALE PRICE $518,000 $510,000 1.6% $552,500 $510,000 8.3% AVERAGE PRICE PER SQUARE FOOT $240 $210 14.3% $233 $204 14.2% AVERAGE DAYS ON MARKET 47 47 0.0% 53 55 -3.6% % SALE PRICE TO LIST PRICE 103.2% 101.4% 1.8% 102.8% 101.1% 1.7% TEN-YEAR MARKET HISTORY Average Sale Price $395,069 $391,035 $381,332 $398,696 $397,569 $424,087 $399,444 $442,128 $538,122 $579,589 Average Sale Price Average Price/SqFt $131 $136 $151 $151 $156 $152 $156 $173 $206 $233 Average Price/SqFt Days On Market 123 126 116 125 101 72 92 80 58 53 Days On Market %Sale Price to List Price 96.0% 96.3% 96.1% 96.5% 97.1% 97.0% 97.4% 99.0% 100.9% 102.8% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

SUPPLY/ DEMAND RATIO*

OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND

-50.0%

-22.2%

-59.1%

-52.0%

CHANGE IN

SOLD

YEAR-TO-DATE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

09/30/2022

YEAR-OVER-YEAR

-47.4%

09/30/2022

09/30/2021

CHANGE

NEWTOWN THIRD QUARTER 2022

AS

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

1 2 1 2 0 Not Valid

0.0%

7 1 7 9 0 Not Valid

0.0%

9 1 9 22 12 2

-91.7%

12 6 2 25 6 4

0.0%

15 3 5 27 4 7 -44.4% -25.0%

17 8 2 26 10 3 -34.6% -20.0%

10 2 5 19 7 3

-71.4%

10 0 Not Valid 8 0 Not Valid 25.0% 0.0% $2,000,000 and up 4 1 4 1 0 Not Valid 300.0% 0.0% MarketTotals 85 24 4 139 39 4 -38.8% -38.5% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

%

2022/2021 $0

5 12 -58.3% 6 18 -66.7% $200,000

16 23 -30.4% 23 38 -39.5%

39 60 -35.0% 66 105 -37.1% $400,000

38 72 -47.2% 75 120 -37.5% $500,000

49 66 -25.8% 74 95 -22.1% $600,000

74 87 -14.9% 105 121 -13.2% $800,000

27 23 17.4% 42 29 44.8% $1,000,000

8 13 -38.5% 9 13 -30.8% $2,000,000 and up 0 0 Not Valid 1 0 Not Valid MarketTotals 256 356 -28.1% 401 539 -25.6% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

NEW FAIRFIELD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 70 74 -5.4% 153 192 -20.3% AVERAGE SALE PRICE $617,418 $584,722 5.6% $563,305 $600,964 -6.3% MEDIAN SALE PRICE $527,500 $497,500 6.0% $485,000 $480,000 1.0% AVERAGE PRICE PER SQUARE FOOT $246 $239 2.9% $244 $252 -3.2% AVERAGE DAYS ON MARKET 45 50 -10.0% 48 60 -20.0% % SALE PRICE TO LIST PRICE 100.8% 100.4% 0.4% 102.2% 98.7% 3.5% TEN-YEAR MARKET HISTORY Average Sale Price $381,667 $386,019 $381,696 $389,452 $395,612 $397,306 $410,166 $463,430 $601,804 $563,305 Average Sale Price Average Price/SqFt $170 $168 $171 $171 $186 $173 $193 $213 $256 $244 Average Price/SqFt Days On Market 117 121 121 116 88 75 95 77 57 48 Days On Market %Sale Price to List Price 94.9% 94.5% 94.1% 94.9% 95.6% 96.5% 96.1% 98.8% 99.1% 102.2% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $199,999

$200,000 - $299,999

$300,000 - $399,999

$400,000 - $499,999

$500,000 - $599,999

$600,000 - $799,999

$800,000 - $999,999

$1,000,000 - $1,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND RATIO*

-33.3%

vs. 2021

CHANGE IN PENDINGS

SOLD

YEAR-TO-DATE

PRICE RANGE

- $199,999

- $299,999

$300,000 - $399,999

- $499,999

- $599,999

- $799,999

- $999,999

- $1,999,999

09/30/2022

YEAR-OVER-YEAR

09/30/2022

09/30/2021

NEW FAIRFIELD THIRD QUARTER 2022

2022

DEMAND:

SUPPLY/

% CHANGE IN LISTINGS %

0 0 Not Valid 3 0 Not Valid -100.0% 0.0%

4 0 Not Valid 6 2 3

-100.0%

4 2 2 11 3 4 -63.6% -33.3%

5 1 5 7 6 1 -28.6% -83.3%

10 0 Not Valid 8 3 3 25.0% -100.0%

10 1 10 11 2 6 -9.1% -50.0%

3 1 3 4 1 4 -25.0% 0.0%

4 2 2 4 2 2 0.0% 0.0% $2,000,000 and up 0 0 Not Valid 2 0 Not Valid -100.0% 0.0% MarketTotals 40 7 6 56 19 3 -28.6% -63.2% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

PROPERTIES

01/01/2022

01/01/202109/30/2021 % CHANGE 2022/2021 10/01/2021

10/01/2020

% CHANGE 2022/2021 $0

6 5 20.0% 7 7 0.0% $200,000

13 17 -23.5% 18 28 -35.7%

34 34 0.0% 45 65 -30.8% $400,000

29 49 -40.8% 42 70 -40.0% $500,000

23 30 -23.3% 35 47 -25.5% $600,000

30 30 0.0% 40 44 -9.1% $800,000

9 11 -18.2% 10 16 -37.5% $1,000,000

6 12 -50.0% 13 16 -18.8% $2,000,000 and up 3 4 -25.0% 4 5 -20.0% MarketTotals 153 192 -20.3% 214 298 -28.2% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

BROOKFIELD THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 59 65 -9.2% 142 150 -5.3% AVERAGE SALE PRICE $626,561 $493,322 27.0% $692,404 $557,438 24.2% MEDIAN SALE PRICE $555,000 $450,000 23.3% $552,500 $475,000 16.3% AVERAGE PRICE PER SQUARE FOOT $255 $225 13.3% $262 $226 15.9% AVERAGE DAYS ON MARKET 52 43 20.9% 47 51 -7.8% % SALE PRICE TO LIST PRICE 100.5% 101.9% -1.4% 101.6% 101.2% 0.4% TEN-YEAR MARKET HISTORY Average Sale Price $408,626 $411,572 $419,873 $419,535 $454,929 $449,610 $450,312 $484,974 $570,545 $692,404 Average Sale Price Average Price/SqFt $165 $161 $166 $173 $174 $174 $181 $187 $223 $262 Average Price/SqFt Days On Market 104 109 119 108 105 77 86 84 52 47 Days On Market %Sale Price to List Price 95.3% 95.1% 94.6% 95.7% 96.6% 96.0% 96.7% 98.5% 100.4% 101.6% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

OF SEPTEMBER 30, 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

PENDING SALES

DEMAND

vs. 2021

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

- $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

-21.4%

09/30/2022

09/30/2021

CHANGE 2022/2021

BROOKFIELD THIRD QUARTER 2022

AS

2022

DEMAND:

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

20 4 5 26 8 3 -23.1% -50.0%

14 6 2 11 5 2 27.3% 20.0%

11 2 6 14 0 Not Valid

0.0%

2 0 Not Valid 6 0 Not Valid -66.7% 0.0%

2 0 Not Valid 1 0 Not Valid 100.0% 0.0%

2 0 Not Valid 0 0 Not Valid 0.0% 0.0%

1 0 Not Valid 1 1 1 0.0% -100.0%

1 0 Not Valid 0 0 Not Valid 0.0% 0.0% $4,000,000 and up 0 0 Not Valid 0 0 Not Valid 0.0% 0.0% MarketTotals 53 12 4 59 14 4 -10.2% -14.3% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

52 82 -36.6% 78 123 -36.6% $500,000

53 46 15.2% 76 68 11.8%

24 14 71.4% 33 18 83.3% $1,000,000

4 4 0.0% 6 5 20.0% $1,500,000

3 2 50.0% 4 5 -20.0% $2,000,000

3 0 Not Valid 3 0 Not Valid $2,500,000

1 2 -50.0% 2 3 -33.3% $3,000,000

2 0 Not Valid 2 0 Not Valid $5,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 142 150 -5.3% 204 222 -8.1% Source : Smart MLS, Single Family Homes

QUARTERLY MARKET OVERVIEW

SHERMAN THIRD QUARTER 2022

Q3 2022 Q3 2021 % CHANGE YTD 2022 YTD 2021 % CHANGE HOMES SOLD 23 25 -8.0% 53 57 -7.0% AVERAGE SALE PRICE $638,869 $739,040 -13.6% $698,838 $714,504 -2.2% MEDIAN SALE PRICE $560,000 $585,000 -4.3% $600,000 $553,000 8.5% AVERAGE PRICE PER SQUARE FOOT $265 $316 -16.1% $304 $282 7.8% AVERAGE DAYS ON MARKET 55 65 -15.4% 75 86 -12.8% % SALE PRICE TO LIST PRICE 98.6% 97.0% 1.6% 96.7% 97.4% -0.7% TEN-YEAR MARKET HISTORY Average Sale Price $472,802 $549,711 $525,489 $442,370 $624,944 $507,381 $524,542 $593,816 $697,019 $698,838 Average Sale Price Average Price/SqFt $188 $190 $224 $185 $221 $197 $230 $218 $275 $304 Average Price/SqFt Days On Market 119 170 135 106 124 122 155 137 83 75 Days On Market %Sale Price to List Price 92.8% 93.3% 93.8% 95.9% 93.9% 94.0% 92.9% 97.5% 97.7% 96.7% %Sale Price to List Price Source : Smart MLS, Single Family Homes * Homes sold for 2022 are annualized based on the actual sales year-to-date

SUPPLY/DEMAND ANALYSIS

AS OF SEPTEMBER 30, 2022

PRICE RANGE SUPPLY: ACTIVE LISTINGS

$0 - $499,999

$500,000 - $699,999

$700,000 - $999,999

$1,000,000 - $1,499,999

$1,500,000 - $1,999,999

$2,000,000 - $2,499,999

$2,500,000 - $2,999,999

$3,000,000 - $3,999,999

DEMAND: PENDING SALES

AS OF SEPTEMBER 30, 2021 2022 vs. 2021

SUPPLY/ DEMAND RATIO*

SUPPLY: ACTIVE LISTINGS

DEMAND: PENDING SALES

DEMAND

CHANGE IN

SOLD PROPERTIES

YEAR-TO-DATE

PRICE RANGE

- $499,999

- $699,999

$700,000 - $999,999

- $1,499,999

- $1,999,999

- $2,499,999

$2,500,000 - $2,999,999

- $4,999,999

09/30/2022

09/30/2021

YEAR-OVER-YEAR

09/30/2022

09/30/2021

CHANGE 2022/2021

SHERMAN THIRD QUARTER 2022

SUPPLY/

RATIO* % CHANGE IN LISTINGS %

PENDINGS

2 1 2 8 0 Not Valid -75.0% 0.0%

2 3 1 9 2 5 -77.8% 50.0%

6 3 2 6 0 Not Valid 0.0% 0.0%

3 1 3 6 2 3 -50.0% -50.0%

2 1 2 2 0 Not Valid 0.0% 0.0%

1 0 Not Valid 0 0 Not Valid 0.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0%

0 0 Not Valid 0 0 Not Valid 0.0% 0.0% $4,000,000 and up 1 0 Not Valid 1 0 Not Valid 0.0% 0.0% MarketTotals 17 9 2 32 4 8 -46.9% 125.0% *Supply Demand Ratio Key 1-4: High Demand 5-6: Balanced 7-9: Low Demand 10+: Very Low Demand

01/01/2022

01/01/2021

% CHANGE 2022/2021 10/01/2021

10/01/2020

%

$0

15 22 -31.8% 20 34 -41.2% $500,000

17 18 -5.6% 26 25 4.0%

13 8 62.5% 18 13 38.5% $1,000,000

6 6 0.0% 7 10 -30.0% $1,500,000

1 2 -50.0% 2 5 -60.0% $2,000,000

1 0 Not Valid 1 0 Not Valid

0 0 Not Valid 0 0 Not Valid $3,000,000

0 1 -100.0% 0 1 -100.0% $5,000,000 and up 0 0 Not Valid 0 0 Not Valid MarketTotals 53 57 -7.0% 74 88 -15.9% Source : Smart MLS, Single Family Homes

GLOBAL NETWORKS

COUNTRIES

CONTINENTS

Leading Real Estate Companies of the World | Luxury Portfolio International Board of Regents Luxury Real Estate

3

- REACHING 56

& 6